Exhibit 99.2

February 2021 Merger Transaction OverviewTo include: Cottonwood Communities, Inc. (“CCI”)Cottonwood Residential II, Inc., (“CRII”)Cottonwood Multifamily REIT I, Inc. (“CMRI”) Cottonwood Multifamily REIT II, Inc.(“CMRII”)(collectively, “the Cottonwood REITs”)

Important Disclosures ADDITIONAL INFORMATION ABOUT THE MERGERSIn connection with the proposed CMRI Merger, the CMRII Merger and the CRII Merger, CCI will prepare and file with the SEC three registration statements on Form S-4 that will include a proxy statement or information statement of CMRI, CMRII or CRII, as applicable, and will constitute a prospectus of CCI. Each Proxy Statement and Prospectus will be mailed to CMRI’s, CMRII’s and CRII’s stockholders, and each will contain important information about the applicable Merger and related matters. This communication is not a substitute for the registration statement, the Proxy Statement and Prospectus and/or the Information Statement and Prospectus or any other documents that will be made available to the stockholders of each of CMRI, CMRII and CRII. INVESTORS ARE URGED TO READ THE APPLICABLE PROXY STATEMENT AND PROSPECTUS OR INFORMATION STATEMENT AND PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED BY CCI, CMRI AND CMRII WITH THE SEC CAREFULLY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CCI, CMRI, CMRII, CRII AND THE PROPOSED MERGERS. Investors and stockholders of CCI, CMRI, CMRII and CRII may obtain free copies of the respective registration statement, the respective Proxy Statement and Prospectus or Information Statement and Prospectus, and other relevant documents filed by CCI, CMRI and CMRII with the SEC (if and when they become available) through the website maintained by the SEC at www.sec.gov. PARTICIPANTS IN SOLICITATION RELATING TO THE MERGERSCCI, CMRI, CMRII and CRII and their respective directors and officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed Mergers. Information regarding CCI’s directors and executive officers is available in its Annual Report on Form 10-K filed with the SEC on March 25, 2020 and its proxy statement filed with the SEC on August 18, 2020 in connection with its 2020 annual meeting of stockholders; information regarding CMRI’s directors and executive officers is available in its Annual Report on Form 1-K filed with the SEC on April 29, 2020; and information regarding CMRII’s directors and executive officers is available in its Annual Report on Form 1-K filed with the SEC on April 29, 2020. Certain directors and executive officers of CCI and/or CMRI and/or CMRII and/or CRII and other persons may have direct or indirect interests in the Mergers due to securities holdings, pre-existing or future indemnification arrangements and rights to severance payments and/or retention bonuses depending on the effect of the Mergers on their employment status. If and to the extent that any of the participants will receive any additional benefits in connection with the Mergers, the details of those benefits will be described in the applicable Proxy Statement and Prospectus or Information Statement and Prospectus relating to the applicable Merger. Investors and security holders may obtain additional information regarding the direct and indirect interests of CCI, CMRI, CMRII and CRII and their respective executive officers and directors in the applicable Merger by reading the applicable Proxy Statement and Prospectus or Information Statement and Prospectus when it becomes available. These documents are available free of charge on the SEC’s website and from CCI, CMRI and CMRII, as applicable, using the sources indicated above.FORWARD LOOKING STATEMENTSThis presentation contains statements that constitute “forward-looking statements,” as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. These statements are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements; no assurance can be given that these expectations will be attained. Factors that could cause actual results to differ materially from these expectations include, but are not limited to, the risk that the proposed Mergers will not be consummated within the expected time period or at all; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreements; the inability of CMRI or CMRII to obtain stockholder approval and CROP to obtain limited partner approval of the applicable proposed transaction or the failure to satisfy the other conditions to completion of the applicable Merger; risks related to disruption of management’s attention from the ongoing business operations due to the proposed Mergers; the potential adverse impact of the ongoing COVID-19 pandemic and the effect of related measures put in place to help control the spread of the virus on the operations of the REITs and their tenants, which impact remains uncertain; availability of suitable investment opportunities; changes in interest rates; the availability and terms of financing; general economic conditions; market conditions; legislative and regulatory changes that could adversely affect the business of CCI, CMRI, CMRII and CRII; and other factors, including those set forth in the Risk Factors section of CCI’s prospectus for its initial public offering, as amended and supplemented to date, as filed with the SEC, copies of which are available on the SEC’s website, www.sec.gov. CCI, CMRI and CMRII undertake no obligation to update these statements for revisions or changes after the date of this communication, except as required by law. 2

Cottonwood Communities, Inc. (or “CCI”) expects to acquire the following REITS In separate stock-for-stock transactions :Cottonwood Residential II, Inc. (or “CRII”)Cottonwood Multifamily REIT I, Inc. (or “CMRI”)Cottonwood Multifamily REIT II, Inc. (or “CMRII”) The combined company will become a $1.5 Billion multifamily REIT comprised of 34 assets across 12 statesWe believe these transactions will lead to long-term value creation for all equity holders of the combined companies. REIT exchange ratios are as follows:Each share of Cottonwood Residential II, Inc. will be converted into the right to receive 2.015 shares of Class A common stock of CCI (together with an anticipated distribution of a note receivable prior to closing)1Each share of Cottonwood Multifamily REIT I, Inc. will be converted into the right to receive 1.175 shares of Class A common stock of CCI1Each share of Cottonwood Multifamily REIT II, Inc. will be converted into the right to receive 1.072 shares of Class A common stock of CCI1 Merger Overview and Estimated Timeline 3 CCI last sold shares of its Class A common stock at $10.00 in a public offering on a best-efforts basis. CCI established the offering price of its shares on an arbitrary basis and the selling price bears no relationship to the book or asset values or to any other established criteria for valuing shares. The actual value of an investment in CCI may be less than the offering price. For more information regarding the fairness of the merger consideration, see the applicable proxy statement and prospectus or information statement and prospectus. Jan. 26, 2021 Feb./March 2021 March/April/May 2021 2nd/3rd Qtr. 2021 Merger Agreements Signed SEC Filings Shareholder Voting Process Estimated Closing of Mergers

4 Greater Scale and Diversification $1.5B Gross Asset Value multifamily REIT with assets in 12 statesOverhead cost synergies of condensing four REITs into 1 (i.e., audit, tax, legal)Greater access to equity and debt capital sourcesAsset-type diversification across the life-cycle spectrum (i.e., stabilized, development, preferred equity and debt) Institutional-Quality Property Management Internal control over operational effectiveness and efficiencySeasoned Cottonwood operations team with 200+ cumulative years of multifamily-specific experienceService provided at cost, with profit potential in growth of 3rd party management New Fee Structure/ Alignment of Ownership Advisor fees more typical of other NAV REITs:Asset Management Fee of 0.75% on Gross Asset Value, capped at 1.5% on Net Asset ValueAdvisor Performance Participation of 12.5% over a 5% Hurdle RateKey principals of Cottonwood to own 9% of the merged company equity through ownership interest in the operating partnership Expected Broadened Liquidity Options and Potential Exit Alternatives Existing classes of stock to access redemption at 100% of NAV after 5-year holding period from date of original investmentCottonwood Residential Operating Partnership (“CROP”) unitholders able to convert to CCI new common stock after 1-year lockout to access liquidityShare Repurchase Program expected to be modified to 5/20 liquidity for CCI common Increased Distributions for Common Equity Holders of Target REITs1 All target REIT shareholders expected to see an increase in distributions based on exchange ratio of each REITNo change in preferred equity distributions Key Considerations/Potential Shareholder Benefits Distributions are not guaranteed and are subject to market factors and company performance on a go-forward basis. Distributions paid by CCI through December 31, 2020, including distributions reinvested through the CCI distribution reinvestment plan have been funded in part with offering proceeds. Distributions funded from sources other than cash flow from operations will result in dilution to subsequent investors, reduced funds available for investment in assets and may reduce the overall return to stockholders. For the year ended December 31, 2019, CCI funded its total distributions paid, which includes net cash distributions and distributions reinvested by stockholders, with $384,310 prior period cash provided by operating activities and $1,619,765 of offering proceeds. For the nine months ended September 30, 2020, CCI funded its total distributions paid, which includes net cash distributions and distributions reinvested by stockholders, with $571,878 prior period cash provided by operating activities and $3,230,261 of offering proceeds.

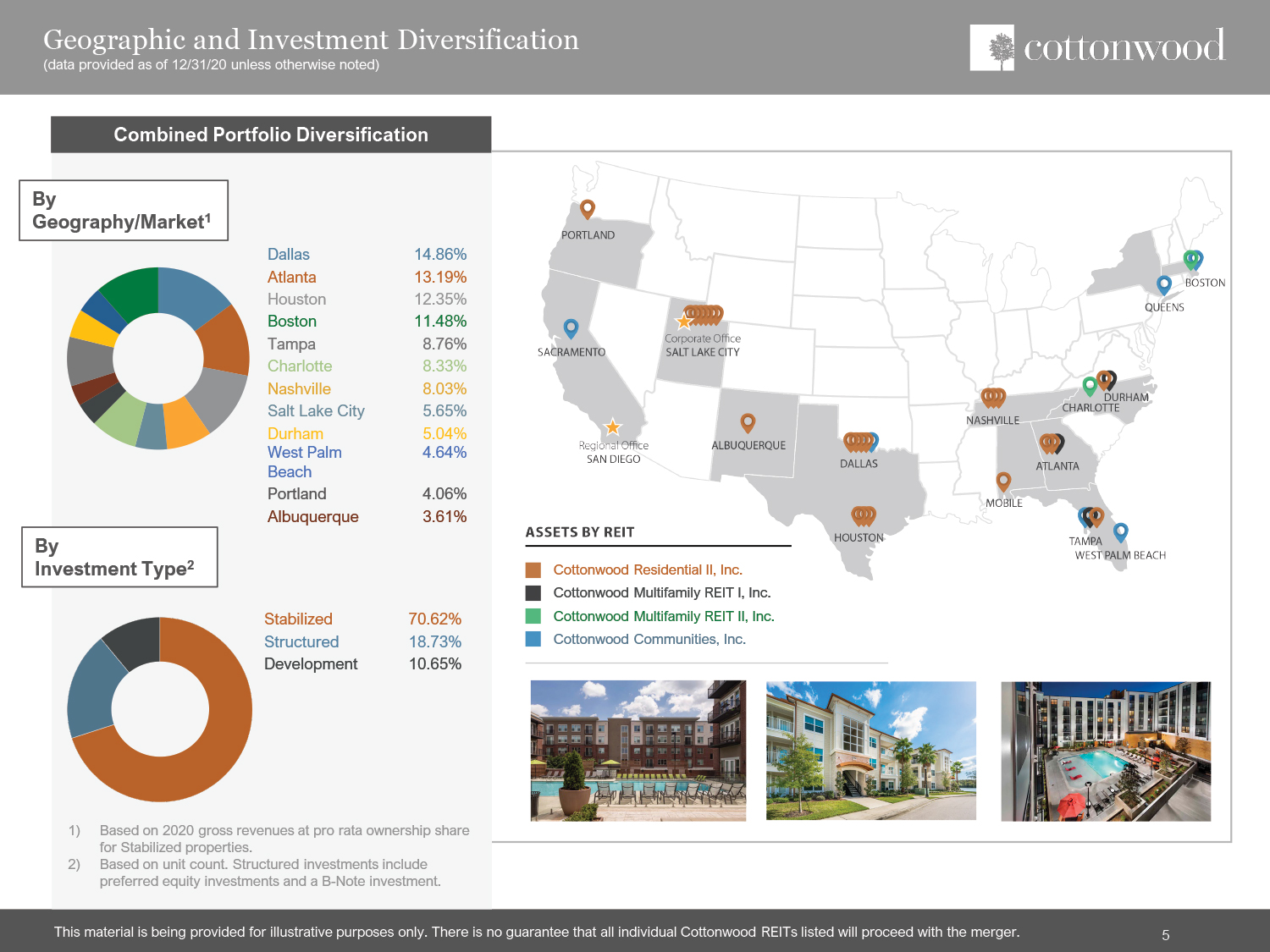

Geographic and Investment Diversification(data provided as of 12/31/20 unless otherwise noted) 5 Combined Portfolio Diversification By Geography/Market1 By Investment Type2 Cottonwood Residential II, Inc.Cottonwood Multifamily REIT I, Inc.Cottonwood Multifamily REIT II, Inc.Cottonwood Communities, Inc. Dallas 14.86% Atlanta 13.19% Houston 12.35% Boston 11.48% Tampa 8.76% Charlotte 8.33% Nashville 8.03% Salt Lake City 5.65% Durham 5.04% West Palm Beach 4.64% Portland 4.06% Albuquerque 3.61% Stabilized 70.62% Structured 18.73% Development 10.65% Based on 2020 gross revenues at pro rata ownership share for Stabilized properties.Based on unit count. Structured investments include preferred equity investments and a B-Note investment.

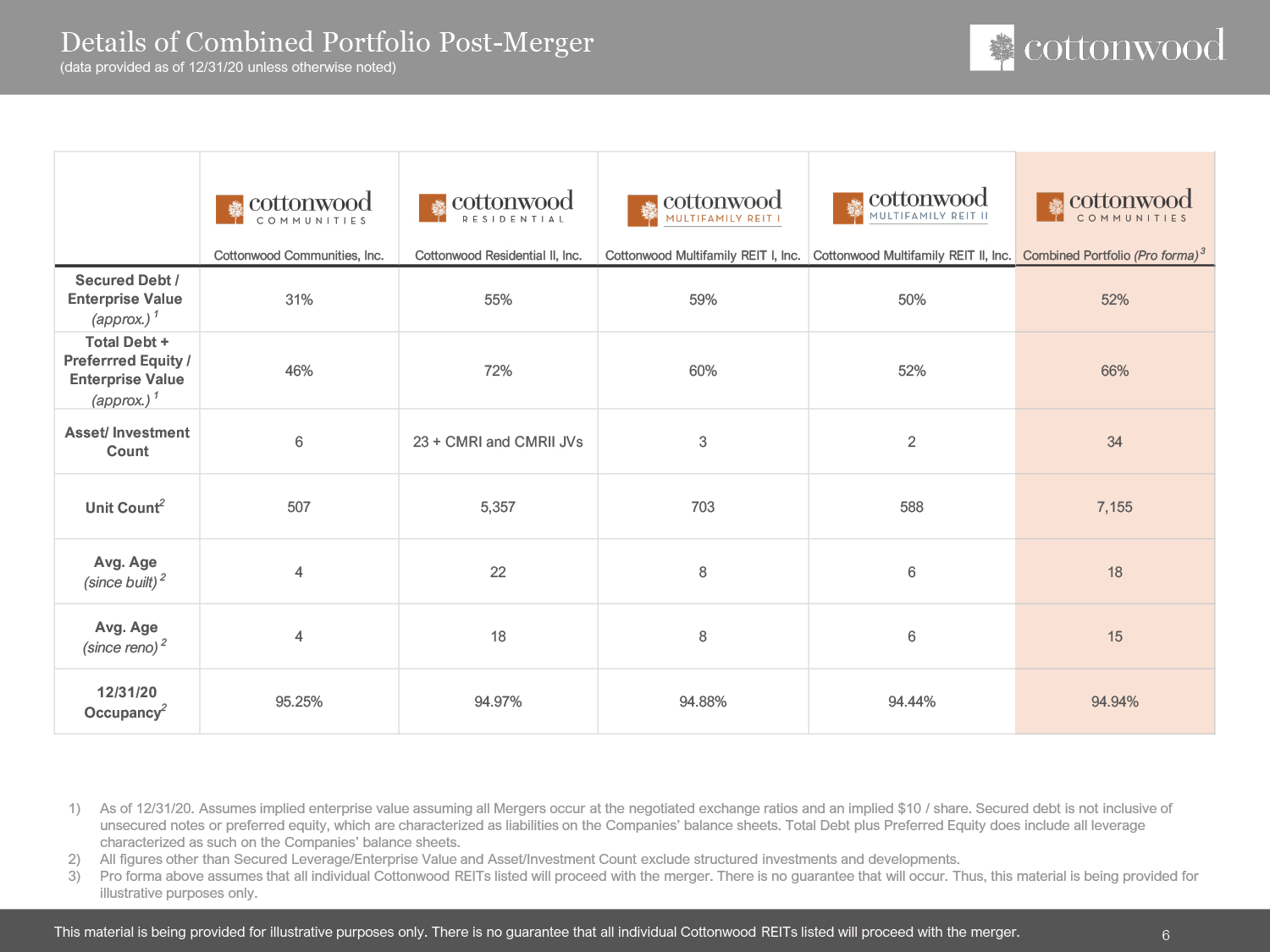

Details of Combined Portfolio Post-Merger(data provided as of 12/31/20 unless otherwise noted) As of 12/31/20. Assumes implied enterprise value assuming all Mergers occur at the negotiated exchange ratios and an implied $10 / share. Secured debt is not inclusive of unsecured notes or preferred equity, which are characterized as liabilities on the Companies’ balance sheets. Total Debt plus Preferred Equity does include all leverage characterized as such on the Companies’ balance sheets.All figures other than Secured Leverage/Enterprise Value and Asset/Investment Count exclude structured investments and developments.Pro forma above assumes that all individual Cottonwood REITs listed will proceed with the merger. There is no guarantee that will occur. Thus, this material is being provided for illustrative purposes only. 6

An Experienced Partner Dedicated Exclusively to Multifamily Focus on markets that we believe are best positioned to weather the unpredictable ups and downs of the economic cycleSome characteristics include strong demographics, sound job growth prospects, a resilient employment sector and supply constraints Enduring Locations We believe creating a balanced, comprehensive real estate portfolio for our investors involves more than just buying and managing properties – we also actively seek growth opportunities through ground-up development and structured investments A Multifaceted Approach 1) Source: National Council of Real Estate Investment Fiduciaries (“NCREIF”); information as of June 30, 2020. The NCREIF Apartment Property Index is an index of quarterly returns on an unleveraged basis reported by institutional investors on investment grade commercial properties owned by those investors. The index is used as an industry benchmark to compare an investor’s own returns against the industry average. While not a measure of non-traded REIT performance, our management feels that this index is an appropriate and accepted index for the purpose of evaluating the performance of multifamily real estate relative to the performance of other property types. The index does not reflect management fees and other investment-entity fees and expenses, to which we are subject, that lower returns. Indices are not available for direct investment. Past performance does not guarantee future results. We strive to stay ahead with innovation to best serve our tenants and communities and maintain competitive advantages with our peers – some examples include self-guided tours, simple online rent payment and lease-signing capabilities, and other features in-line with millennial habits and trends Innovation is Key 7 The multifamily sector has generally outperformed its counterparts with the least amount of volatility1 The millennial factor: high propensity to rent through delayed life decisions, significant student loan debt, general preference for a flexible lifestyle and tight credit constraints in the single-family home mortgage market Why Multifamily?

Executive Management Team 8 Gregg ChristensenChief Legal Officer Glenn RandChief Operating Officer Eric MarlinExecutive Vice President, Capital Markets Susan HallenbergChief Accounting Officer Enzio CassinisPresident Adam LarsonChief Financial Officer Daniel ShaefferChief Executive Officer Chad ChristensenExecutive Chairman Paul FredenbergChief Investment Officer Stan HanksExecutive Vice President Dedicated and Consistent Team Average of 13 years working together on the day-to-day strategy of Cottonwood, possessing time-tested knowledge and insight on the portfolioSignificant Industry Experience 200+ years of combined industry related experienceAlignment of Interests with Investors Collectively, management will own approximately 9% of the combined REIT post-merger

The Impact to Distributions (CMRI and CMRII ) 9 Note: Distributions are not guaranteed and are subject to market factors and company performance on a go-forward basis. Distributions paid by CCI through December 31, 2020, including distributions reinvested through CCI’s distribution reinvestment plan have been funded in part with offering proceeds. Distributions funded from sources other than CCI’s cash flow from operations will result in dilution to subsequent investors, reduced funds available for investment in assets and may reduce the overall return to CCI’s stockholders. For the year ended December 31, 2019, CCI funded its total distributions paid, which includes net cash distributions and distributions reinvested by stockholders, with $384,310 prior period cash provided by operating activities and $1,619,765 of offering proceeds. For the nine months ended September 30, 2020, CCI funded its total distributions paid, which includes net cash distributions and distributions reinvested by stockholders, with $571,878 prior period cash provided by operating activities and $3,230,261 of offering proceeds. Cottonwood Multifamily REIT II, Inc. (CMRII) Current Distribution (Rate per Current Common Share) INCREASE IN DISTRIBUTION due to 1.072 Exchange Ratio Cottonwood Multifamily REIT I, Inc. (CMRI) Current Distribution (Rate per Current Common Share) INCREASE IN DISTRIBUTION due to 1.175 Exchange Ratio Total Pro Forma Distribution Total Pro Forma Distribution

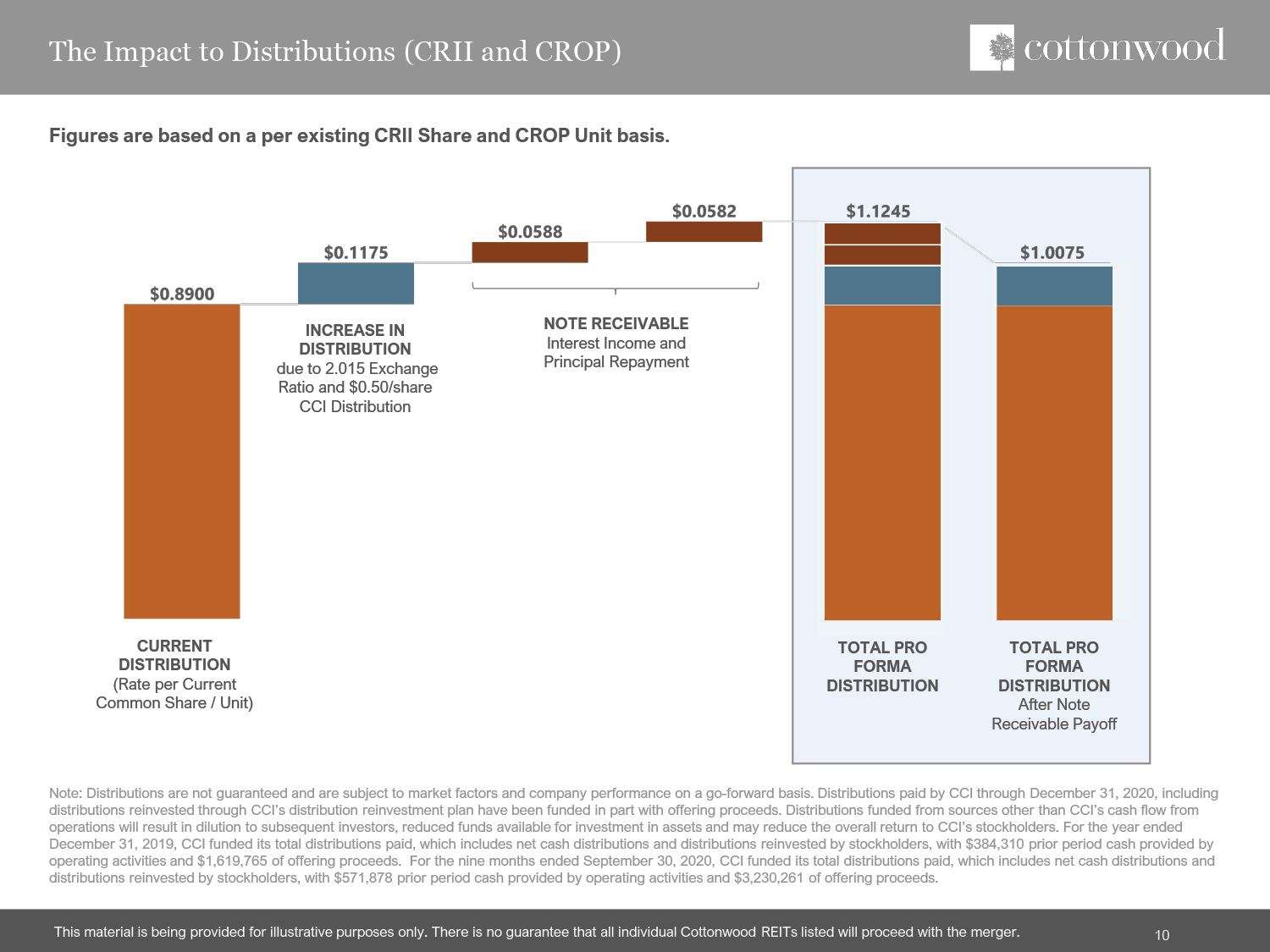

The Impact to Distributions (CRII and CROP) 10 Note: Distributions are not guaranteed and are subject to market factors and company performance on a go-forward basis. Distributions paid by CCI through December 31, 2020, including distributions reinvested through CCI’s distribution reinvestment plan have been funded in part with offering proceeds. Distributions funded from sources other than CCI’s cash flow from operations will result in dilution to subsequent investors, reduced funds available for investment in assets and may reduce the overall return to CCI’s stockholders. For the year ended December 31, 2019, CCI funded its total distributions paid, which includes net cash distributions and distributions reinvested by stockholders, with $384,310 prior period cash provided by operating activities and $1,619,765 of offering proceeds. For the nine months ended September 30, 2020, CCI funded its total distributions paid, which includes net cash distributions and distributions reinvested by stockholders, with $571,878 prior period cash provided by operating activities and $3,230,261 of offering proceeds. Figures are based on a per existing CRII Share and CROP Unit basis. Current Distribution (Rate per Current Common Share / Unit) Total Pro Forma Distribution Total Pro Forma DistributionAfter Note Receivable Payoff INCREASE IN DISTRIBUTION due to 2.015 Exchange Ratio and $0.50/share CCI Distribution Note Receivable Interest Income and Principal Repayment

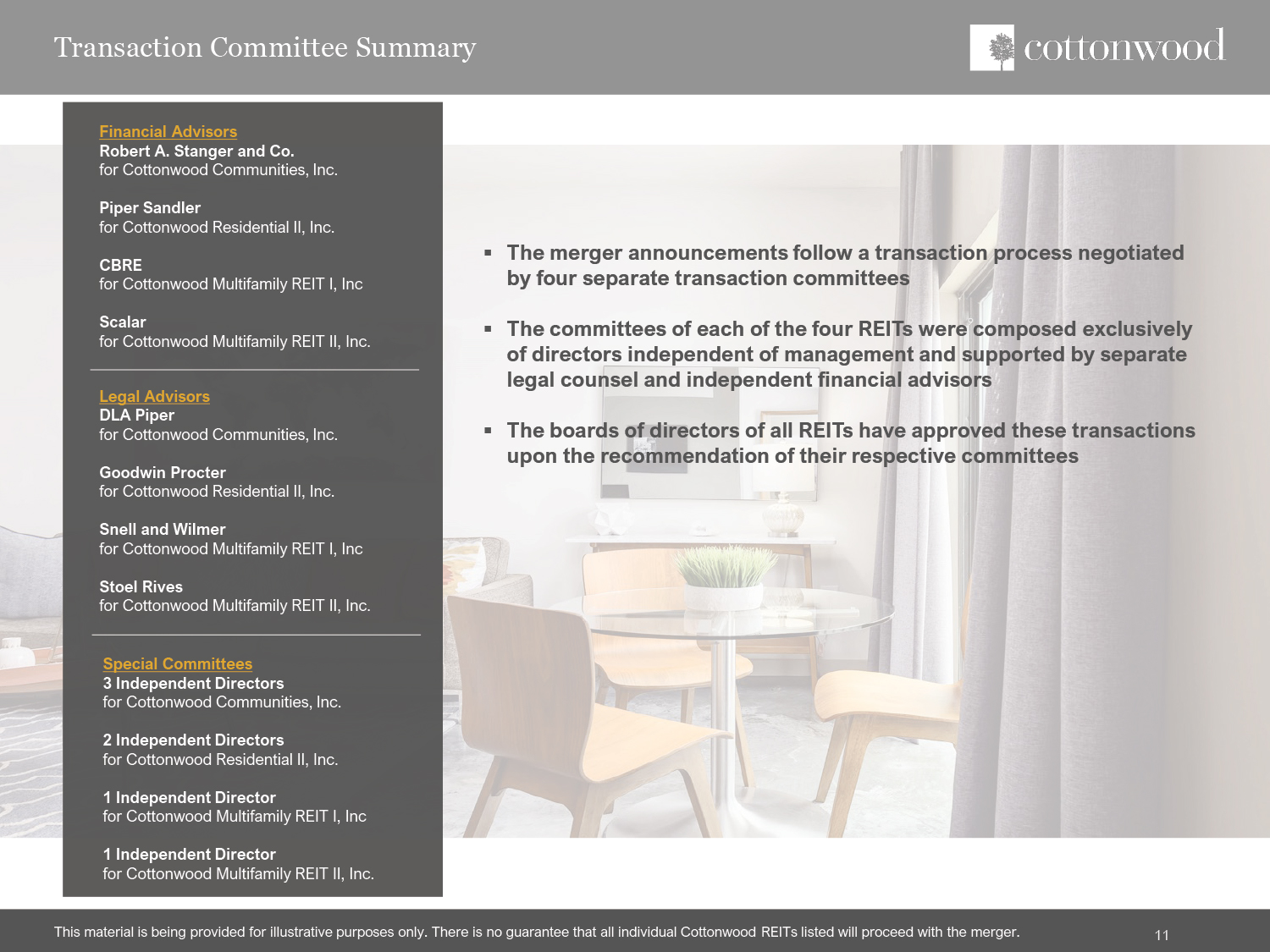

Transaction Committee Summary 11 The merger announcements follow a transaction process negotiated by four separate transaction committeesThe committees of each of the four REITs were composed exclusively of directors independent of management and supported by separate legal counsel and independent financial advisorsThe boards of directors of all REITs have approved these transactions upon the recommendation of their respective committees Financial AdvisorsRobert A. Stanger and Co. for Cottonwood Communities, Inc. Piper Sandlerfor Cottonwood Residential II, Inc. CBREfor Cottonwood Multifamily REIT I, IncScalarfor Cottonwood Multifamily REIT II, Inc. Legal AdvisorsDLA Piperfor Cottonwood Communities, Inc. Goodwin Procterfor Cottonwood Residential II, Inc. Snell and Wilmerfor Cottonwood Multifamily REIT I, IncStoel Rivesfor Cottonwood Multifamily REIT II, Inc. Special Committees3 Independent Directorsfor Cottonwood Communities, Inc. 2 Independent Directorsfor Cottonwood Residential II, Inc. 1 Independent Directorfor Cottonwood Multifamily REIT I, Inc1 Independent Directorfor Cottonwood Multifamily REIT II, Inc.

1245 Brickyard Rd., Suite 250, Salt Lake City, UT 84106 0121 | CC-1083