Confidential Treatment Requested by Albertsons Companies, Inc.

Pursuant to 17 C.F.R. Section 200.83

ITEM 15. RECENT SALES OF UNREGISTERED SECURITIES.

Set forth below is information regarding all unregistered securities sold, issued or granted by us within the past three years.

On October 17, 2016, January 5, 2017, January 23, 2017, February 26, 2017, March 1, 2017, April 19, 2017, May 11, 2017, July 19, 2017, August 3, 2017, October 23, 2017, January 11, 2018, February 28, 2018, March 1, 2018, May 21, 2018, August 28, 2018, September 11, 2018, October 10, 2018, November 9, 2018, January 2, 2019, February 24, 2019, July 1, 2019, August 19, 2019, September 11, 2019 and October 1, 2019, we granted 66,228, 16,557, 33,114, 12,176, 82,785, 82,785, 149,013, 264,912, 49,671, 140,733, 132,456, 15,720, 222,498, 75,000, 22,767, 250,000, 100,000, 1,281,416, 13,140, 35,320, 7,653, 41,907, 242,424 and 42,746 Phantom Units, respectively, to certain of our officers, executives, directors and consultants under our Phantom Unit Plan. Each Phantom Unit is generally subject to time- and performance-based vesting, and upon vesting, each Phantom Unit converts into one management incentive unit of each of Albertsons Investor and KIM ACI.

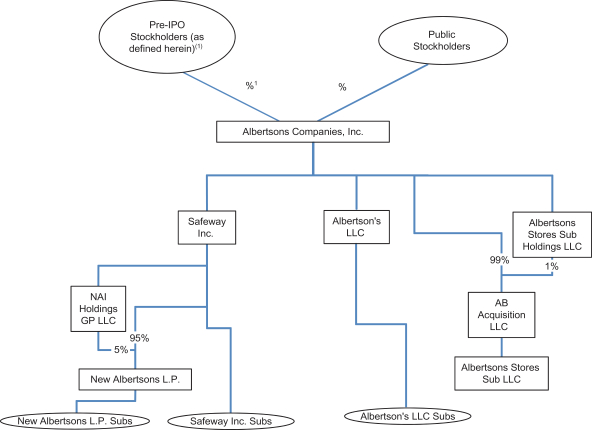

On December 3, 2017, Albertsons Companies, LLC and its parent, AB Acquisition, completed a reorganization of their legal entity structure whereby the existing equityholders of AB Acquisition each contributed their equity interests in AB Acquisition to Albertsons Investor or KIM ACI. In exchange, equityholders received a proportionate share of units in Albertsons Investor and KIM ACI, respectively. Albertsons Investor and KIM ACI then contributed all of the equity interests they received to ACI in exchange for common stock issued by ACI.

On October 21, 2019, we issued 1,547,694 shares of common stock to Albertsons Investor and 167,608 shares of common stock to KIM ACI in consideration for the issuance of Phantom Units and the settlement of Phantom Units upon vesting.

Unless otherwise stated, the sales and/or granting of the above securities were deemed to be exempt from registration under the Securities Act in reliance upon Section 4(a)(2) of the Securities Act (or Regulation D promulgated thereunder), or Rule 701 promulgated under Section 3(b) of the Securities Act as transactions by an issuer not involving any public offering or pursuant to benefit plans and contracts relating to compensation as provided under Rule 701. We did not pay or give, directly or indirectly, any commission or other remuneration, including underwriting discounts or commissions, in connection with any of the issuances of securities listed above. The recipients of the securities in each of these transactions represented their intentions to acquire the securities for investment only and not with a view to or for sale in connection with any distribution thereof. All recipients had adequate access, through their employment or other relationship with us or through other access to information provided by us, to information about us. The sales of these securities were made without any general solicitation or advertising.

ITEM 16. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES.

(a) Exhibits

The list of exhibits is set forth under “Exhibit Index” at the end of this registration statement and is incorporated herein by reference.

(b) Financial Statement Schedules

All financial statement schedules have been omitted because the required information is included in the consolidated financial statements and the notes thereto or the information therein is not applicable.

II-2