- ACI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

Albertsons Companies (ACI) S-1/AIPO registration (amended)

Filed: 5 May 20, 4:14pm

Delaware | 5411 | 47-4376911 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

Stuart D. Freedman, Esq. Antonio L. Diaz-Albertini, Esq. Schulte Roth & Zabel LLP 919 Third Avenue New York, NY 10022 Phone: (212) 756-2000 Fax: (212) 593-5955 | William J. Miller, Esq. Cahill Gordon & Reindel LLP 80 Pine Street New York, NY 10005 Phone: (212) 701-3000 Fax: (212) 378-2500 |

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

Emerging growth company | ☐ |

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3)(4) | ||

Common Stock, par value $0.01 per share | $100,000,000 | $12,980 (7) | ||

Series A mandatory convertible preferred stock, par value $0.01 per share (5) | $100,000,000 | $12,980 (7) | ||

Common Stock, par value $0.01 per share (6) | $ | $ | ||

Total | $ | $ | ||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Includes the aggregate offering price of additional shares that the underwriters have the option to purchase from the registrant. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| (4) | An aggregate registration fee of $11,620 in respect of shares of the registrant’s common stock was previously paid on July 8, 2015 in connection with the registration statement on Form S-1 (No.333-205546). Additionally, an aggregate registration fee of $202,188 in respect of shares of the registrant’s common stock was previously paid on September 25, 2015 in connection withPre-Effective Amendment No. 2 to the registration statement on FormS-1 (No.333-205546). Additionally, an aggregate registration fee of $13,091 in respect of shares of the registrant’s common stock was previously paid on October 2, 2015 in connection withPre-Effective Amendment No. 3 to the registration statement on Form S-1 (No.333-205546). Thus, the aggregate filing fee associated with the registrant in connection with the registration statement on FormS-1 (No.333-205546) was $226,899. The registrant withdrew the registration statement on FormS-1 (No.333-205546) by filing a Form RW on April 6, 2018. The withdrawn registration statement on FormS-1 (No.333-205546) was not declared effective, and no securities were sold thereunder. Pursuant to Rule 457(p), the registrant utilized $225,641 previously paid in connection with the withdrawn registration statement on FormS-1 to offset the filing fee in respect of shares of the registrant’s common stock in connection with the registration statement on FormS-4 (No.333-224169) filed with the Securities and Exchange Commission on April 6, 2018. The registrant terminated the offering and, on August 9, 2018, filed a Post-Effective Amendment No. 1 to FormS-4 (No.333-224169), which Post-Effective Amendment No. 1 to FormS-4 was declared effective on August 14, 2018, to deregister any and all securities registered but unsold or otherwise unissued under the registration statement on FormS-4. Pursuant to Rule 457(p), the registrant hereby offsets $226,899 of the filing fee previously paid in connection with the withdrawn registration statement on FormS-1, of which $225,641 was used to offset the filing fee paid in connection with the terminated offering pursuant to the registration statement on Form S-4, against the filing fee for this registration statement on FormS-1. |

| (5) | In accordance with Rule 457(i) under the Securities Act, this registration statement also registers the shares of our common stock that are initially issuable upon conversion of the Series A preferred stock registered hereby. The number of shares of our common stock issuable upon such conversion is subject to adjustment upon the occurrence of certain events described herein and will vary based on the public offering price of the common stock registered hereby. Pursuant to Rule 416 under the Securities Act, the number of shares of our common stock to be registered includes an indeterminable number of shares of common stock that may become issuable upon conversion of the Series A preferred stock as a result of such adjustments. |

| (6) | This registration statement also registers shares of common stock that may be issued as dividends on the Series A preferred stock in accordance with the terms thereof. |

| (7) | Previously paid. |

| • | front and back cover pages, which will replace the front and back cover pages of the Common Stock Prospectus; |

| • | pages for the “Table of Contents” section, which will replace the “Table of Contents” section of the Common Stock Prospectus; |

| • | pages for the “Prospectus Summary—The Offering” section, which will replace the “Prospectus Summary—The Offering” section of the Common Stock Prospectus; |

| • | pages for the “Risk Factors—Risks Related to this Offering and Owning Our Series A Preferred Stock and Common Stock” section, which will replace the “Risk Factors—Risks Related to this Offering and Owning Our Common Stock” section of the Common Stock Prospectus; |

| • | pages for the “Description of Series A Preferred Stock” section, which will replace the “Concurrent Offering of Series A Preferred Stock” section of the Common Stock Prospectus; |

| • | pages for the “Material U.S. Federal Income Tax Consequences to Holders of Our Series A Mandatory Convertible Preferred Stock” section, which will replace the “Material U.S. Federal Income Tax Consequences to Non-U.S. Holders of Our Common Stock” section of the Common Stock Prospectus; and |

| • | pages for the “Underwriting” section, which will replace the “Underwriting” section of the Common Stock Prospectus. |

| • | references to “this offering” contained in “Explanatory Note,” “Prospectus Summary—Our Corporate Structure,” “Prospectus Summary—Our Sponsors,” “Use of Proceeds,” “Capitalization,” “Dilution,” “Management,” “Certain Relationships and Related Party Transactions,” “Principal and Selling Stockholders,” “Description of Capital Stock” and “Shares Eligible for Future Sale,” “Description of Indebtedness,” and “Where You Can Find Additional Information” of the Common Stock Prospectus will be replaced with references to “the concurrent initial public offering of our common stock” in the Series A Preferred Stock Prospectus; |

| • | references to “common stock” or “our common stock” contained in the first paragraph under “Prospectus Summary,” “Prospectus Summary—Risks Related to Our Business and This Offering,” in the first paragraph under “Risk Factors,” “Legal Matters” and “Where You Can Find Additional Information” of the Common Stock Prospectus will be replaced with a reference to “Series A preferred stock” in the Series A Preferred Stock Prospectus; |

| • | references to “on the cover page of this prospectus” contained in “Prospectus Summary—Our Corporate Structure,” “Prospectus Summary—Our Sponsors,” “Principal and Selling Stockholders,” and “Description of Capital Stock” of the Common Stock Prospectus will be replaced with references to “on the cover page of the prospectus relating to the concurrent initial public offering of our common stock” in the Series A Preferred Stock Prospectus; |

| • | references to “the offering of Series A preferred stock” or “the Series A preferred stock offering” contained in “Prospectus Summary—Our Sponsors,” “Use of Proceeds,” “Capitalization,” “Dilution,” “Certain Relationships and Related Party Transactions,” “Description of Capital Stock,” and “Shares Eligible for Future Sale” of the Common Stock Prospectus will be replaced with references to “this offering” in the Series A Preferred Stock Prospectus; |

| • | the reference to “—Risks Related to this Offering and Owning Our Common Stock—” contained in the last line of the section titled “Prospectus Summary—Our Sponsors” of the Common Stock Prospectus will be replaced with a reference to “—Risks Related to this Offering and Owning of Our Series A Preferred Stock and Common Stock—” in the Series A Preferred Stock Prospectus; |

| • | the first paragraph under “Use of Proceeds” of the Common Stock Prospectus will be removed from the Series A Preferred Stock Prospectus; |

| • | the reference to “—Risks Related to this Offering and Owning Our Common Stock—” contained in the second paragraph of “Dividend Policy” of the Common Stock Prospectus will be replaced with a reference to “—Risks Related to this Offering and Owning of Our Series A Preferred Stock and Common Stock—” in the Series A Preferred Stock Prospectus; |

| • | the section titled “Principal and Selling Stockholders” of the Common Stock Prospectus will be renamed the “Principal Stockholders” in the Series A Preferred Stock Prospectus; and |

| • | the reference to “Concurrent Offering of Series A Preferred Stock” contained in “Description of Capital Stock—Preferred Stock” of the Common Stock Prospectus will be replaced with a reference to “Description of Series A Preferred Stock” in the Series A Preferred Stock Prospectus. |

Per Share | Total | |||||||

Initial public offering price | $ | $ | ||||||

Underwriting discounts and commissions(1) | $ | $ | ||||||

Proceeds to selling stockholders(1) | $ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

BofA Securities | Goldman Sachs & Co. LLC | J.P. Morgan | Citigroup |

Credit Suisse | Morgan Stanley | Wells Fargo Securities | Barclays | Deutsche Bank Securities |

BMO Capital Markets | Evercore ISI | Guggenheim Securities | Oppenheimer & Co. | RBC Capital Markets |

Telsey Advisory Group | MUFG | Academy Securities | Blaylock Van, LLC |

vi | ||||

1 | ||||

25 | ||||

49 | ||||

51 | ||||

52 | ||||

53 | ||||

55 | ||||

56 | ||||

58 | ||||

79 | ||||

97 | ||||

108 | ||||

131 | ||||

136 | ||||

139 | ||||

143 | ||||

148 | ||||

153 | ||||

161 | ||||

165 | ||||

171 | ||||

171 | ||||

171 | ||||

F- 1 |

| • | “ACI” refers to Albertsons Companies, Inc., a Delaware corporation; |

| • | “ACI Institutional Investors” refers to Klaff Realty, L.P., Schottenstein Stores Corp., Lubert-Adler Real Estate Management Company, L.P. (“Lubert-Adler Management”) and Kimco Realty Corporation, and each of their respective controlled affiliates and investment funds; |

| • | “Albertsons” refers to Albertson’s LLC, a Delaware limited liability company and a wholly-owned subsidiary of ACI; |

| • | “Cerberus” refers to Cerberus Capital Management, L.P., a Delaware limited partnership, and investment funds and accounts managed by it and its affiliates; |

| • | “Code” refers to the Internal Revenue Code of 1986, as amended; |

| • | “Exchange Act” refers to the U.S. Securities Exchange Act of 1934, as amended; |

| • | “GAAP” refers to accounting principles generally accepted in the United States of America; |

| • | “NALP” refers to New Albertsons L.P., a Delaware limited partnership and a wholly-owned subsidiary of ACI; |

| • | “Safeway” refers to Safeway Inc., a Delaware corporation and a wholly-owned subsidiary of ACI; |

| • | “SEC” refers to the Securities and Exchange Commission; |

| • | “Securities Act” refers to the U.S. Securities Act of 1933, as amended; |

| • | “Sponsors” refers to Cerberus, the ACI Institutional Investors and their respective controlled affiliates and investment funds; and |

| • | “we,” “our” and “us” refers to ACI and its direct or indirect subsidiaries. |

| • | Non-GAAP Measures do not reflect certainone-time ornon-recurring cash costs to achieve anticipated synergies; |

| • | Non-GAAP Measures do not reflect changes in, or cash requirements for, our working capital needs; |

| • | EBITDA and Adjusted EBITDA do not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on our debt; |

| • | EBITDA and Adjusted EBITDA do not reflect income taxes or the cash payments related to income tax obligations; |

| • | Although depreciation and amortization are non-cash charges, the assets being depreciated or amortized may have to be replaced in the future, and EBITDA and Adjusted EBITDA and, with respect to acquired intangible assets, Adjusted Net Income, do not reflect any cash requirements for such replacements; |

| • | Non-GAAP Measures are adjusted for certainnon-recurring andnon-cash income or expense items that are reflected in our statements of operations; |

| • | Non-GAAP Measures do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; and |

| • | Other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures. |

| • | Easy well-thought-out initiatives underway that seek to make the Albertsons shopping experience easier and more convenient for our existing customers and appealing to new customers. We are leveraging our exceptional store footprint to provide a full suite of omni-channel offerings, including Drive Up & Go curbside pickup and home delivery. We are working to make thein-store shopping experience quicker and easier through initiatives such as faster checkout and improvedin-store navigation. These capabilities are further enhanced through targeted technology investments and partnerships like the ones we have announced with Glympse for location sharing of store pickup and home delivery orders and Takeoff Technologies for automated micro-fulfillment to support our eCommerce efforts. We also seek to simplify the many food-related choices our customers face daily by offering efficient, comprehensive solutions such as meal planning, shopping list creation and prepared foods. |

| • | Exciting best-in-class fresh offerings encompass value-added organic, local and seasonal products. Examples include dailyfresh-cut fruit and vegetables, customized meat cuts and seafood varieties, made-from-scratch bakery items, convenient prepared meal solutions, deli offerings and beautiful floral designs. In many locations, we also provide attractive specialty offerings, including curated wine selections and artisan cheese shops. We feature a localized assortment that is customized to individual markets, like our Santa Monica Seafood in Southern California and our Hatch Chile salsa in Arizona. We continue to |

| innovate with our Own Brands Own Brands O Organics Own Brands |

| • | Friendly non-customer-facing areas of our stores, freeing up our associates to do more of what they love: serving shoppers and providing a great customer experience. |

|  | |||

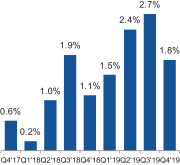

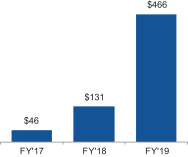

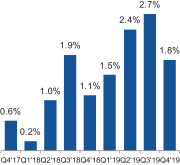

Identical Sales | Net Income ($mm) | Adj. EBITDA ($mm) | ||

|  |  | ||

|  |  | ||||||||

| • | Well-Known Banners |

| • | Prime Locations First-and-Main locations, providing our customers with exceptional convenience. Our owned and ground leased stores and distribution centers, which represent approximately 39% of our store and distribution base, have an aggregate appraised value of $11.2 billion. |

| • | Strong Market Share and Local Market Density coronavirus ( COVID-19) pandemic and the strength of our supply chain. |

| • | Highly Attractive Markets one-third of the U.S. population and approximately 45% of U.S. GDP. In 60% of the 121 MSAs in which we operate, the projected population growth over the next five years, in aggregate, exceeds the national average by over 60%. |

|  |  |  |  |

|

|

| • Currently available in approximately 650 locations, with plans to grow to 1,600 locations in the next two years• Easy-to-use mobile app• Convenient, well-signed, curbside pickup |

| • First launched home delivery services in 2001• Provide home delivery using our own “white glove” delivery service in approximately 60% of our stores• Operate over 1,000 multi-temperature delivery trucks to support home delivery growth• Successful roll out of new eCommerce website and mobile applications to all divisions |

| • Launched rush delivery in 2017 with Instacart• Delivery within one to two hours in all divisions and covering over 2,000, or nearly 90%, of our stores offered in collaboration with third parties• Partnership with Grubhub and Uber Eats adds delivery offerings for our prepared andready-to-eat options from our stores |

| • | Achieve More Identical Sales Growth From Our Stores |

| • | Merchandising Excellence Exciting re-merchandised more than 850 stores and plan to expand this successful program. |

| • | Pricing and Promotions |

| • | Operating Excellence in-store efficiency by using technology to optimize labor and improvein-stock and display execution, resulting in enhanced store productivity and customer satisfaction. A number of these initiatives are already underway. In stores where we have introduced computer-assisted ordering and production systems, for example, we have seen a meaningful uplift in sales and improved levels ofin-stocks, inventory and shrink. |

| • | Culture of Exceptional Service in-store technology to achieve labor efficiencies through the automation ofnon-customer-facing tasks. We expect this effort to provide our associates more time to better serve customers, enhancing the shopping experience and driving purchase frequency, larger basket size, customer satisfaction and retention. |

| • | Targeted Store Remodels Easy Exciting Friendly |

| • | Drive Incremental eCommerce Growth: a strong growth engine that drives incremental sales. We plan to sustain our eCommerce growth through a number of initiatives. First, we will extend our Drive Up & Go pickup service to approximately 1,600 locations in the next two years. The coronavirus (COVID-19) pandemic has driven significant eCommerce volumes that have caused us to accelerate our omni-channel investments and our Drive up & Go build out. Additionally, we are refreshing our entire digital interface to create a more personalized, easy-to-use and fully-integrated digital experience. We are improving our mobile applications to enable more personalized rewards and services like advanced basket-building tools and product, meal and recipe recommendations. We are further integrating our digital andin-store models to better drive existing customer engagement and new customer trial for our own and third-party delivery. |

| • | Accelerate Own Brand Penetration Own Brands Own Brands Own Brands |

| • | Increase Customer Engagement and Lifetime Value: just for U just for U |

| • | Enhancing Store and DC Operations: non-customer-facing tasks and drive labor productivity. For example, we are working to roll out enhanced demand forecasting and replenishment systems to improve operating efficiency, reduce product waste and optimize labor and inventory levels. We expect to scale these opportunities across the business quickly and efficiently. |

| • | Leveraging Scale to Buy Better: |

| • | Increasing Promotional Effectiveness: |

| • | Leveraging G&A: . |

| • | Customers: check-out processes and improve ourat-store pickup experience. For example, we are partnering with Adobe to provide an artificial intelligence-powered solution to personalize the website and mobile application experience. This will enable the customer to see personalized products and information as they browse homepages, categories and product detail pages. |

| • | Store Operations: forecasting and replenishment tools such as computer-assisted ordering and production systems should sharpen our ability to predict store demand and track perpetual inventory, helping us to reduce out-of-stocks, inventory, and shrink. |

|  |

| • | Merchandising |

| • | Supply Chain: |

|  |

| • | Coronavirus (COVID-19) related factors, risks and challenges, including among others, the length of time that the pandemic continues, the temporary inability of customers to shop due to illness, quarantine, or other travel restrictions or financial hardship, shifts in demand away from discretionary or higher priced products to lower priced products, or stockpiling or similar pantry-filling activities, reduced workforces which may be caused by, but not limited to, the temporary inability of the workforce to work due to illness, quarantine, or government mandates, potential shortages in supply, or temporary store closures due to reduced workforces or government mandates; |

| • | the competitive nature of the industry in which we conduct our business; |

| • | general business and economic conditions, including the rate of inflation or deflation, consumer spending levels, population, employment and job growth and/or losses in our market; |

| • | our ability to increase identical sales, expand our Own Brands |

| • | our ability to expand or grow our home delivery network and Drive Up & Go curbside pickup services; |

| • | pricing pressures and competitive factors, which could include pricing strategies, store openings, remodels or acquisitions by our competitors; |

| • | labor costs, including benefit plan costs and severance payments, or labor disputes that may arise from time to time and work stoppages that could occur in areas where certain collective bargaining agreements have expired or are on indefinite extensions or are scheduled to expire in the near future; |

| • | disruptions in our manufacturing facilities’ or distribution centers’ operations, disruption of significant supplier relationships, or disruptions to our produce or product supply chains; |

| • | results of any ongoing litigation in which we are involved or any litigation in which we may become involved; |

| • | data privacy and security, the failure of our IT systems, or maintaining, expanding or upgrading existing systems or implementing new systems; |

| • | the effects of government regulation and legislation, including healthcare reform; |

| • | our ability to raise additional capital to finance the growth of our business, including to fund acquisitions; |

| • | our ability to service our debt obligations, and restrictions in our debt agreements; |

| • | the impact of private and public third-party payers’ continued reduction in prescription drug reimbursements and the ongoing efforts to limit participation in payor networks, including through mail order; |

| • | plans for future growth and other business development activities; |

| • | our ability to realize anticipated savings from our implementation of cost reduction and productivity initiatives; |

| • | changes in tax laws or interpretations that could increase our consolidated tax liabilities; and |

| • | competitive pressures in all markets in which we operate. |

| • | Increased the frequency of how often we clean and disinfect all departments, restrooms, and other high-touch points of our stores, including check stands and service counters, and hourly disinfecting of high touch areas. This is in addition to our rigorous food safety and sanitations programs already in place. |

| • | Installed cart wipes and hand sanitizer stations in key locations within stores. |

| • | Adjusted store hours in certain stores to give store teams the time they need to rest, restock shelves and clean and disinfect. |

| • | Reserved special times for seniors and other vulnerable shoppers who must leave home to obtain their groceries. |

| • | Installed plexiglass in our checkout lanes in all stores to serve as a protective barrier at the check stand. |

| • | Secured masks and gloves for our front-line employees. |

| • | Limited store occupancy to ensure proper social distancing during all hours, and further limited occupancy during times reserved for our most vulnerable customers to improve safety. |

| • | Responded to increased demand for our eCommerce offerings by hiring additional pickers and drivers, and also simplified eCommerce offerings to focus on the products that are most in demand. |

| • | Instituted “contact-free” delivery procedures for home delivery and Drive Up & Go. |

| • | Announced a temporary increase in pay for all front-line associates of $2 per hour for every hour that they work beginning March 15, 2020 in recognition of their significant efforts. |

| • | Hired over 55,000 new associates since the beginning of fiscal 2020, partnering with more than 35 companies to help keep Americans working. |

| • | Announced a commitment of $50 million to hunger relief and previously launched a major fundraiser to help feed families in need during the coronavirus ( COVID-19 ) pandemic and to help ensure that they get the food they need. |

| Common stock outstanding | shares |

| Common stock offered by the selling stockholders | shares |

| Option to purchase additional shares of common stock | The selling stockholders have granted to the underwriters a 30-day option to purchase up to additional shares of our common stock at the initial public offering price less the underwriting discount and commissions. |

| Use of proceeds | We will not receive any net proceeds from the sale of common stock by the selling stockholders, including from any exercise by the underwriters of their option to purchase additional shares of our common stock from the selling stockholders. |

| We estimate that the net proceeds to us from the offering of our Series A preferred stock, based upon an assumed public offering price per share of our Series A preferred stock of $ , will be approximately $ (or approximately $ if the underwriters in the Series A preferred stock offering exercise their over-allotment option in full), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the anticipated net proceeds from the offering of Series A preferred stock, together with cash on hand, to repurchase approximately shares (based upon the midpoint of the estimated offering range set forth on the cover page of this prospectus) of outstanding common stock from certain Pre-IPO Stockholders (as defined herein) (the “Repurchase”). The Repurchase is conditioned upon the consummation of the offering of Series A preferred stock and the receipt of funds therefrom. See “Use of Proceeds.” |

| Dividend Policy | Effective fiscal 2020, we have established a dividend policy pursuant to which we intend to pay a dividend on our common stock in an amount of $ per share, starting with the first full quarter following completion of this offering. Our board of directors may change or eliminate the payment of future dividends to our common stockholders at its discretion, without notice to our stockholders. Any future determination relating to our dividend policy will be made at the sole discretion of our board of directors and will depend on a number of factors, including general and economic conditions, industry standards, our financial condition and operating results, our available cash and current and anticipated cash needs, restrictions under the documentation governing certain of our indebtedness, including our ABL Facility and ACI Notes (as defined herein), capital requirements, regulations, contractual, legal, tax and regulatory restrictions and implications on the payment of dividends by us to our |

Lock-Up Agreements | Prior to the closing of this offering, certain Pre-IPO Stockholders will deliver alock-up agreement to us. Pursuant to thelock-up agreements, for a period of six months after the closing of this offering such Pre-IPO Stockholders will agree, subject to certain exceptions, that they will not offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of any shares of common stock or any options or warrants to purchase common stock, or any securities convertible into, exchangeable for or that represent the right to receive common stock, owned by them (whether directly or by means of beneficial ownership) immediately prior to the closing of this offering. Thereafter, such Pre-IPO Stockholders will be permitted to sell shares of common stock subject to certain restrictions. See “Certain Relationships and Related PartyTransactions—Lock-Up Agreements.” |

| Concurrent Series A preferred stock offering | Concurrently with this offering of common stock, we are making a public offering of shares of our Series A preferred stock, and we have granted the underwriters of that offering a 30-day option to purchase up to additional shares of Series A preferred stock to cover over-allotments. Such shares of Series A preferred stock will be convertible into an aggregate of up to shares of our common stock (up to shares of our common stock if the underwriters in the Series A preferred stock offering exercise their over-allotment option in full), in each case subject to anti-dilution, make-whole and other adjustments. |

| We cannot assure you that the offering of Series A preferred stock will be completed or, if completed, on what terms it will be completed. The closing of this offering is conditioned upon the closing of the Series A preferred stock offering and the closing of our offering of Series A preferred stock is conditioned upon the closing of this offering. See “Concurrent Offering of Series A Preferred Stock” for a summary of the terms of our Series A preferred stock and a further description of the concurrent offering. |

| Risk Factors | You should carefully read and consider the information set forth in the section entitled “Risk Factors” beginning on page 25, together with all of the other information set forth in this prospectus, before deciding whether to invest in our common stock. |

| Proposed NYSE trading symbol | “ACI.” |

| Directed Share Program | At our request, the underwriters have reserved for sale, at the initial public offering price, up to 5% of the shares offered by this prospectus for sale within the United States to some of our directors, officers, employees, business associates and related persons. If these persons purchase reserved shares, it will reduce the number of shares available for sale to the general public. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same terms as the other shares offered by this prospectus. |

(dollars in millions, except per share data) | Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | Fiscal 2016 | Fiscal 2015 | |||||||||||||||

Results of Operations: | ||||||||||||||||||||

Net sales and other revenue | $ | 62,455 | $ | 60,535 | $ | 59,925 | $ | 59,678 | $ | 58,734 | ||||||||||

Gross profit | $ | 17,594 | $ | 16,895 | $ | 16,361 | $ | 16,641 | $ | 16,062 | ||||||||||

Selling and administrative expenses | 16,642 | 16,272 | 16,209 | 16,072 | 15,600 | |||||||||||||||

(Gain) loss on property dispositions and impairment losses, net | (485 | ) | (165 | ) | 67 | (39 | ) | 103 | ||||||||||||

Goodwill impairment | — | — | 142 | — | — | |||||||||||||||

Operating income (loss) | 1,437 | 788 | (57 | ) | 608 | 359 | ||||||||||||||

Interest expense, net | 698 | 831 | 875 | 1,004 | 951 | |||||||||||||||

Loss (gain) on debt extinguishment | 111 | 9 | (5 | ) | 112 | — | ||||||||||||||

Other expense (income), net | 29 | (104 | ) | (9 | ) | (44 | ) | (50 | ) | |||||||||||

Income (loss) before income taxes | 599 | 52 | (918 | ) | (464 | ) | (542 | ) | ||||||||||||

Income tax expense (benefit) | 133 | (79 | ) | (964 | ) | (90 | ) | (40 | ) | |||||||||||

| �� | ||||||||||||||||||||

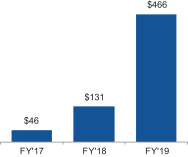

Net income (loss) | $ | 466 | $ | 131 | $ | 46 | $ | (374 | ) | $ | (502 | ) | ||||||||

Other Financial Data: | ||||||||||||||||||||

Adjusted EBITDA(1) | $ | 2,834 | $ | 2,741 | $ | 2,398 | $ | 2,817 | $ | 2,681 | ||||||||||

Adjusted Net Income(1) | 612 | 435 | 74 | 378 | 365 | |||||||||||||||

Rent expense(2)(3) | 1,023 | 864 | 844 | 806 | 781 | |||||||||||||||

Capital expenditures | 1,475 | 1,362 | 1,547 | 1,415 | 960 | |||||||||||||||

Net cash provided by operating activities | 1,904 | 1,688 | 1,019 | 1,814 | 902 | |||||||||||||||

Adjusted Free Cash Flow(1) | 1,359 | 1,379 | 851 | 1,402 | 1,721 | |||||||||||||||

Net Debt(1) | 8,244 | 9,660 | 11,206 | 11,119 | 11,646 | |||||||||||||||

(dollars in millions, except per share data) | Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | Fiscal 2016 | Fiscal 2015 | |||||||||||||||

Other Operating Data: | ||||||||||||||||||||

Identical sales(a) | 2.1 | % | 1.0 | % | (1.3 | )% | (0.4 | )% | 4.4 | % | ||||||||||

Store count (at end of fiscal period) | 2,252 | 2,269 | 2,318 | 2,324 | 2,271 | |||||||||||||||

Gross square footage (at end of fiscal period) (in millions) | 112 | 113 | 115 | 115 | 113 | |||||||||||||||

Fuel sales | $ | 3,430 | $ | 3,456 | $ | 3,105 | $ | 2,693 | $ | 2,955 | ||||||||||

Balance Sheet Data (at end of period): | ||||||||||||||||||||

Cash and equivalents | $ | 471 | $ | 926 | $ | 670 | $ | 1,219 | $ | 580 | ||||||||||

Total assets(3) | 24,735 | 20,777 | 21,812 | 23,755 | 23,770 | |||||||||||||||

Total stockholders’ / member equity(3) | 2,278 | 1,451 | 1,398 | 1,371 | 1,613 | |||||||||||||||

Total debt, including finance leases | 8,715 | 10,586 | 11,876 | 12,338 | 12,226 | |||||||||||||||

Per Share Data: | ||||||||||||||||||||

Basic and diluted net income (loss) per common share | $ | 1.67 | $ | 0.47 | $ | 0.17 | $ | (1.33 | ) | $ | (1.80 | ) | ||||||||

Pro forma net income per common share(4) | $ | |||||||||||||||||||

Weighted-average common shares outstanding (in millions): | ||||||||||||||||||||

Basic and diluted | 280 | 280 | 280 | 280 | 280 | |||||||||||||||

Pro forma weighted average common shares outstanding(4) | ||||||||||||||||||||

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | Fiscal 2016 | Fiscal 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q4’19 | Q3’19 | Q2’19 | Q1’19 | Q4’18 | Q3’18 | Q2’18 | Q1’18 | Q4’17 | Q3’17 | Q2’17 | Q1’17 | Q4’16 | Q3’16 | Q2’16 | Q1’16 | Q4’15 | Q3’15 | Q2’15 | Q1’15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) Quarterly Identical Sales | 1.8 | % | 2.7 | % | 2.4 | % | 1.5 | % | 1.1 | % | 1.9 | % | 1.0 | % | 0.2 | % | 0.6 | % | (1.8 | )% | (1.8 | )% | (2.1 | )% | (3.3 | )% | (2.1 | )% | 0.1 | % | 2.9 | % | 4.7 | % | 5.1 | % | 4.5 | % | 4.3 | % | ||||||||||||||||||||||||||||||||||||||||

| (1) | Adjusted EBITDA is a Non-GAAP Measure defined as earnings (net income (loss)) before interest, income taxes, depreciation and amortization, further adjusted to eliminate the effects of items management does not consider in assessing ongoing performance. Adjusted Net Income is aNon-GAAP Measure defined as net income (loss) adjusted to eliminate the effects of items management does not consider in assessing ongoing performance. We define Adjusted Free Cash Flow as Adjusted EBITDA less capital expenditures. Net Debt is defined as total debt (which includes finance lease obligations and is net of deferred financing costs and original issue discount) minus cash and cash equivalents. |

(dollars in millions) | Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | Fiscal 2016 | Fiscal 2015 | |||||||||||||||

Net income (loss) | $ | 466 | $ | 131 | $ | 46 | $ | (374 | ) | $ | (502 | ) | ||||||||

Adjustments: | ||||||||||||||||||||

Loss (gain) on interest rate and commodity hedges, net | 51 | (1 | ) | (6 | ) | (7 | ) | 16 | ||||||||||||

Facility closures and related transition costs(a) | 18 | 13 | 12 | 23 | 25 | |||||||||||||||

Integration costs(b) | 37 | 186 | 156 | 144 | 125 | |||||||||||||||

Acquisition-related costs(c) | 24 | 74 | 62 | 70 | 217 | |||||||||||||||

Equity-based compensation expense | 33 | 48 | 46 | 53 | 98 | |||||||||||||||

(Gain) loss on property dispositions and impairment losses, net | (485 | ) | (165 | ) | 67 | (39 | ) | 103 | ||||||||||||

Goodwill impairment | — | — | 142 | — | — | |||||||||||||||

LIFO expense (benefit) | 18 | 8 | 3 | (8 | ) | 30 | ||||||||||||||

Amortization and write-off of original issue discount, deferred financing costs and loss on extinguishment of debt | 185 | 72 | 67 | 253 | 82 | |||||||||||||||

Collington acquisition(d) | — | — | — | 79 | — | |||||||||||||||

Amortization of intangible assets resulting from acquisitions | 274 | 326 | 422 | 404 | 377 | |||||||||||||||

Other(e) | 39 | (53 | ) | 66 | 45 | 45 | ||||||||||||||

Effect of ACI Reorganization Transactions, Tax Act and reversal of valuation allowance | — | (57 | ) | (750 | ) | — | — | |||||||||||||

Tax impact of adjustments to Adjusted Net Income(f) | (48 | ) | (147 | ) | (259 | ) | (265 | ) | (251 | ) | ||||||||||

Adjusted Net Income | $ | 612 | $ | 435 | $ | 74 | $ | 378 | $ | 365 | ||||||||||

(dollars in millions) | Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | Fiscal 2016 | Fiscal 2015 | |||||||||||||||

Adjustments: | ||||||||||||||||||||

Tax impact of adjustments to Adjusted Net Income(f) | 48 | 147 | 259 | 265 | 251 | |||||||||||||||

Effect of tax restructuring, tax reform, and reversal of valuation allowance | — | 57 | 750 | — | — | |||||||||||||||

Income tax expense (benefit) | 133 | (79 | ) | (964 | ) | (90 | ) | (40 | ) | |||||||||||

Amortization and write-off of original issue discount, deferred financing costs and loss on extinguishment of debt | (185 | ) | (72 | ) | (67 | ) | (253 | ) | (82 | ) | ||||||||||

Interest expense, net | 698 | 831 | 875 | 1,004 | 951 | |||||||||||||||

Loss (gain) on debt extinguishment | 111 | 9 | (5 | ) | 112 | — | ||||||||||||||

Amortization of intangible assets resulting from acquisitions | (274 | ) | (326 | ) | (422 | ) | (404 | ) | (377 | ) | ||||||||||

Depreciation and amortization | 1,691 | 1,739 | 1,898 | 1,805 | 1,613 | |||||||||||||||

Adjusted EBITDA | $ | 2,834 | $ | 2,741 | $ | 2,398 | $ | 2,817 | $ | 2,681 | ||||||||||

Net cash provided by operating activities | $ | 1,904 | $ | 1,688 | $ | 1,019 | $ | 1,814 | $ | 902 | ||||||||||

Income tax expense (benefit) | 133 | (79 | ) | (964 | ) | (90 | ) | (40 | ) | |||||||||||

Deferred income taxes | 6 | 82 | 1,094 | 220 | 90 | |||||||||||||||

Interest expense, net | 698 | 831 | 875 | 1,004 | 951 | |||||||||||||||

Operating lease right-of-use assets amortization | (570 | ) | — | — | — | — | ||||||||||||||

Changes in operating assets and liabilities | 576 | (176 | ) | 222 | (252 | ) | 467 | |||||||||||||

Amortization and write-off of deferred financing costs | (40 | ) | (43 | ) | (56 | ) | (84 | ) | (69 | ) | ||||||||||

Pension and post-retirement (income) expense, net of contributions | 13 | 175 | 23 | (84 | ) | (7 | ) | |||||||||||||

Integration costs | 37 | 186 | 156 | 144 | 125 | |||||||||||||||

Acquisition-related costs | 24 | 74 | 62 | 70 | 217 | |||||||||||||||

Collington acquisition | — | — | — | 79 | — | |||||||||||||||

Other adjustments | 53 | 3 | (33 | ) | (4 | ) | 45 | |||||||||||||

Adjusted EBITDA | 2,834 | 2,741 | 2,398 | 2,817 | 2,681 | |||||||||||||||

Less: capital expenditures | 1,475 | 1,362 | 1,547 | 1,415 | 960 | |||||||||||||||

Adjusted Free Cash Flow | $ | 1,359 | $ | 1,379 | $ | 851 | $ | 1,402 | $ | 1,721 | ||||||||||

| (a) | Includes costs related to facility closures and the transition to our decentralized operating model. Fiscal 2019 includes closure costs related to the discontinuation of our meal kit subscription delivery operations in the third quarter. |

| (b) | Related to conversion activities and related costs associated with integrating acquired businesses, primarily the Safeway acquisition. |

| (c) | Includes expenses related to acquisition and financing activities, including management fees of $13.8 million in each year through fiscal 2019. Fiscal 2018 includes acquisition costs related to the mutually terminated merger with Rite Aid Corporation. Fiscal 2016 and fiscal 2015 include adjustments to tax indemnification assets of $12.3 million and $30.8 million, respectively. Fiscal 2015 also includes losses of $44.2 million related to acquired contingencies in connection with the Safeway acquisition. |

| (d) | Fiscal 2016 includes a charge to pension expense, net related to the settlement of a pre-existing contractual relationship and assumption of the pension plan related to the acquisition of Collington Services, LLC (“Collington”) from C&S Wholesale Grocers, Inc. during the first quarter of fiscal 2016. |

| (e) | Primarily includes non-cash lease-related adjustments and lease-related costs for surplus and closed stores. Also includes net realized and unrealized (gains) losses onnon-operating investments, certain legal and regulatory accruals and settlements, net, changes in the fair value of the contingent value rights, changes in our equity investment in Casa Ley, S.A. de C.V. (“Casa Ley”) (disposed of in the fourth quarter of fiscal 2017), foreign currency translation (losses) gains, adjustments to contingent consideration and costs related to our planned initial public offerings. |

| (f) | The tax impact was determined based on the taxable status of the subsidiary to which each of the above adjustments relate. |

| (2) | Represents rent expense on operating leases, including contingent rent expense. |

| (3) | We adopted ASU 2016-02, Leases (Topic 842), and related amendments as of February 24, 2019 under the modified retrospective approach and, therefore, have not revised comparative periods. Under Topic 842, leases historically classified as capital leases are now referred to as finance leases. |

| (4) | Fiscal 2019 pro forma net income per share reflects the effect of the dividend requirement associated with the Series A preferred stock to be issued in the concurrent offering of Series A preferred stock and the Repurchase as if they had taken place on February 24, 2019, the first day of fiscal 2019. Fiscal 2019 historical net income was reduced by $ to reflect the dividend requirement. Pro forma weighted average common shares used in computing pro forma net income per share gives effect to a repurchase of common shares (based upon the midpoint of the estimated offering range set forth on the cover page of this prospectus) from certain Pre-IPO Stockholders using the proceeds from the concurrent offering of Series A Preferred Stock. Assumes no common shares repurchased for the underwriters over-allotment option in the concurrent offering of Series A preferred stock. |

| • | transaction litigation; |

| • | a failure of our due diligence process to identify significant risks or issues; |

| • | the loss of customers of the acquired company or our Company; |

| • | negative impact on the brands or banners of the acquired company or our Company; |

| • | a failure to maintain or improve the quality of customer service; |

| • | difficulties assimilating the operations and personnel of the acquired company; |

| • | our inability to retain key personnel of the acquired company; |

| • | the incurrence of unexpected expenses and working capital requirements; |

| • | our inability to achieve the financial and strategic goals, including synergies, for the combined businesses; and |

| • | difficulty in maintaining internal controls, procedures and policies. |

| • | increase our vulnerability to general adverse economic and industry conditions; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes, including acquisitions; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | place us at a competitive disadvantage compared to our competitors that have less debt; and |

| • | limit our ability to borrow additional funds. |

| • | sales of assets; |

| • | sales of equity; or |

| • | negotiations with our lenders to restructure the applicable debt. |

| • | incur additional indebtedness or provide guarantees in respect of obligations of other persons; |

| • | pay dividends on, repurchase or make distributions to our owners or make other restricted payments or make certain investments; |

| • | prepay, redeem or repurchase debt; |

| • | make loans, investments and capital expenditures; |

| • | sell or otherwise dispose of certain assets; |

| • | incur liens; |

| • | engage in sale leaseback transactions; |

| • | restrict dividends, loans or asset transfers from our subsidiaries; |

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| • | enter into a new or different line of business; and |

| • | enter into certain transactions with our affiliates. |

| • | the failure of securities analysts to cover our common stock after this offering, or changes in financial estimates by analysts; |

| • | changes in, or investors’ perception of, the food and drug retail industry; |

| • | the activities of competitors; |

| • | future issuances and sales of our common stock, including in connection with acquisitions; |

| • | our quarterly or annual earnings or those of other companies in our industry; |

| • | the public’s reaction to our press releases, our other public announcements and our filings with the SEC; |

| • | regulatory or legal developments in the United States; |

| • | litigation involving us, our industry, or both; |

| • | general economic conditions; and |

| • | other factors described elsewhere in these “Risk Factors.” |

| • | the requirement that a majority of the board of directors consist of independent directors; |

| • | the requirement that we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| • | the requirement that we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | the requirement for an annual performance evaluation of the nominating and corporate governance and compensation committees. |

| • | from and after such date that our Sponsors and their respective Affiliates (as defined in Rule 12b-2 of the Exchange Act), or any person who is an express assignee or designee of their respective rights under our certificate of incorporation (and such assignee’s or designee’s Affiliates) ceases to own, in the aggregate, at least 50% of the then-outstanding shares of our common stock (the “50% Trigger Date”), the authorized number of our directors may be increased or decreased only by the affirmative vote oftwo-thirds of the then-outstanding shares of our common stock or by resolution of our board of directors; |

| • | prior to the 50% Trigger Date, only our board of directors and the Sponsors are expressly authorized to make, alter or repeal our bylaws and, from and after the 50% Trigger Date, our stockholders may only amend our bylaws with the approval of at least two-thirds of all of the outstanding shares of our capital stock entitled to vote; |

| • | from and after the 50% Trigger Date, the manner in which stockholders can remove directors from the board will be limited; |

| • | from and after the 50% Trigger Date, stockholder actions must be effected at a duly called stockholder meeting and actions by our stockholders by written consent will be prohibited; |

| • | from and after such date that our Sponsors and their respective Affiliates (or any person who is an express assignee or designee of our Sponsors’ respective rights under our certificate of incorporation (and such assignee’s or designee’s Affiliates)) ceases to own, in the aggregate, at least 35% of the then-outstanding shares of our common stock (the “35% Trigger Date”), advance notice requirements for stockholder proposals that can be acted on at stockholder meetings and nominations to our board of directors will be established; |

| • | limits on who may call stockholder meetings; |

| • | requirements on any stockholder (or group of stockholders acting in concert), other than, prior to the 35% Trigger Date, the Sponsors, who seeks to transact business at a meeting or nominate directors for election to submit a list of derivative interests in any of our company’s securities, including any short interests and synthetic equity interests held by such proposing stockholder; |

| • | requirements on any stockholder (or group of stockholders acting in concert) who seeks to nominate directors for election to submit a list of “related party transactions” with the proposed nominee(s) (as if such nominating person were a registrant pursuant to Item 404 of Regulation S-K, and the proposed nominee was an executive officer or director of the “registrant”); and |

| • | our board of directors is authorized to issue preferred stock without stockholder approval, which could be used to institute a “poison pill” that would work to dilute the stock ownership of a potential hostile acquiror, effectively preventing acquisitions that have not been approved by our board of directors. |

| • | investors’ anticipation of the potential resale in the market of a substantial number of additional shares of our common stock received upon conversion of the Series A preferred stock; |

| • | possible sales of our common stock by investors who view the Series A preferred stock as a more attractive means of equity participation in us than owning shares of our common stock; and |

| • | hedging or arbitrage trading activity that may develop involving the Series A preferred stock and our common stock. |

| • | Coronavirus ( COVID-19 ) related factors, risks and challenges, including among others, the length of time that the pandemic continues, the temporary inability of customers to shop due to illness, quarantine, or other travel restrictions or financial hardship, shifts in demand away from discretionary or higher priced products to lower priced products, or stockpiling or similar pantry-filling activities, reduced workforces which may be caused by, but not limited to, the temporary inability of the workforce to work due to illness, quarantine, or government mandates, potential shortages in supply, or temporary store closures due to reduced workforces or government mandates; |

| • | the competitive nature of the industry in which we conduct our business; |

| • | general business and economic conditions, including the rate of inflation or deflation, consumer spending levels, population, employment and job growth and/or losses in our market; |

| • | our ability to increase identical sales, expand our Own Brand |

| • | our ability to expand or grow our home delivery network and Drive Up & Go curbside pickup services; |

| • | pricing pressures and competitive factors, which could include pricing strategies, store openings, remodels or acquisitions by our competitors; |

| • | labor costs, including benefit plan costs and severance payments, or labor disputes that may arise from time to time and work stoppages that could occur in areas where certain collective bargaining agreements have expired or are on indefinite extensions or are scheduled to expire in the near future; |

| • | disruptions in our manufacturing facilities’ or distribution centers’ operations, disruption of significant supplier relationships, or disruptions to our produce or product supply chains; |

| • | results of any ongoing litigation in which we are involved or any litigation in which we may become involved; |

| • | data privacy and security, the failure of our IT systems, or maintaining, expanding or upgrading existing systems or implementing new systems; |

| • | the effects of government regulation and legislation, including healthcare reform; |

| • | our ability to raise additional capital to finance the growth of our business, including to fund acquisitions; |

| • | our ability to service our debt obligations, and restrictions in our debt agreements; |

| • | the impact of private and public third-party payers’ continued reduction in prescription drug reimbursements and the ongoing efforts to limit participation in payor networks, including through mail order; |

| • | plans for future growth and other business development activities; |

| • | our ability to realize anticipated savings from our implementation of new productivity initiatives, the failure of which could adversely affect our financial performance and competitive position; |

| • | changes in tax laws or interpretations that could increase our consolidated tax liabilities; and |

| • | competitive pressures in all markets in which we operate. |

As of February 29, 2020 | ||||||||

(dollars in millions) | Actual | As Adjusted | ||||||

Cash and cash equivalents(1) | $ | 471 | $ | |||||

Debt, including current maturities, net of debt discounts and deferred financing costs(2) | ||||||||

ABL Facility(3) | $ | — | $ | |||||

ACI Notes | 6,885 | |||||||

Safeway Notes(4) | 642 | |||||||

NALP Notes(5) | 466 | |||||||

Finance leases | 667 | |||||||

Other financing liabilities(6) | 37 | |||||||

Mortgage notes payable, secured | 18 | |||||||

Total Debt | $ | 8,715 | $ | |||||

Stockholders’ equity | ||||||||

Total preferred stock, $0.01 par value; 30,000,000 shares authorized, no shares issued and outstanding, actual; 100,000,000 shares authorized, shares issued and outstanding, as adjusted | $ | — | $ | |||||

Series A mandatory convertible preferred stock, $0.01 par value; no shares authorized, issued and outstanding, actual; shares authorized, shares issued and outstanding, as adjusted | — | |||||||

Undesignated preferred stock, $0.01 par value; 30,000,000 shares authorized, no shares issued and outstanding, actual; shares authorized, no shares issued and outstanding, as adjusted | — | |||||||

Common stock, $0.01 par value; 1,000,000,000 shares authorized, 279,597,312 shares issued and outstanding, actual; 1,000,000,000 shares authorized, shares issued and outstanding, as adjusted | 2.8 | |||||||

Total stockholders’ equity | $ | 2,278 | $ | |||||

Total capitalization | $ | 10,993 | $ | |||||

| (1) | On an as adjusted basis, gives effect to the proceeds received from the ABL Borrowing. See “Prospectus Summary—Coronavirus (COVID-19) Related Developments.” |

| (2) | Debt discounts and deferred financing costs totaled $41.3 million and $72.9 million, respectively, as of February 29, 2020, on an actual basis. |

| (3) | The ABL Facility provides for a $4.0 billion revolving credit facility. As of February 29, 2020, the aggregate borrowing base on the ABL Facility was approximately $3.9 billion, which was reduced by |

| $454.5 million of outstanding standby letters of credit, resulting in a net borrowing base availability of approximately $3.4 billion. As of February 29, 2020, on an as adjusted basis after giving effect to the ABL Borrowing, the aggregate borrowing base on the ABL Facility would be approximately $1.9 billion, which was reduced by $454.5 million of outstanding standby letters of credit, resulting in a net borrowing base availability of approximately $1.4 billion. See “Description of Indebtedness—ABL Facility.” |

| (4) | Consists of the 2020 Safeway Notes, 2021 Safeway Notes, 2027 Safeway Notes (as defined herein) and 2031 Safeway Notes (as defined herein). |

| (5) | Consists of the NALP Medium-Term Notes, 2026 NALP Notes, 2029 NALP Notes, 2030 NALP Notes and 2031 NALP Notes (each as defined herein). |

| (6) | Consists of other financing obligations and the ASC Notes (as defined herein). |

Initial public offering price per share of common stock (the midpoint of the estimated offering range set forth on the cover page of this prospectus) | $ | |||

Net tangible book value (deficit) per share as of , 2020 | $ | |||

Increase in tangible book (deficit) value per share attributable to investors in this offering | $ | |||

As adjusted net tangible book value (deficit) per share after this offering | $ | |||

Dilution per share to investors in this offering | $ |

(dollars in millions, except per share data) | Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | Fiscal 2016 | Fiscal 2015 | |||||||||||||||

Results of Operations | ||||||||||||||||||||

Net sales and other revenue | $ | 62,455.1 | $ | 60,534.5 | $ | 59,924.6 | $ | 59,678.2 | $ | 58,734.0 | ||||||||||

Gross Profit | 17,594.2 | 16,894.6 | 16,361.1 | 16,640.5 | 16,061.7 | |||||||||||||||

Selling and administrative expenses(1) | 16,641.9 | 16,272.3 | 16,208.7 | 16,072.1 | 15,599.3 | |||||||||||||||

(Gain) loss on property dispositions and impairment losses, net(1) | (484.8 | ) | (165.0 | ) | 66.7 | (39.2 | ) | 103.3 | ||||||||||||

Goodwill impairment | — | — | 142.3 | — | — | |||||||||||||||

Operating income (loss) | 1,437.1 | 787.3 | (56.6 | ) | 607.6 | 359.1 | ||||||||||||||

Interest expense, net | 698.0 | 830.8 | 874.8 | 1,003.8 | 950.5 | |||||||||||||||

Loss (gain) on debt extinguishment | 111.4 | 8.7 | (4.7 | ) | 111.7 | — | ||||||||||||||

Other expense (income), net | 28.5 | (104.4 | ) | (9.2 | ) | (44.3 | ) | (49.6 | ) | |||||||||||

Income (loss) before income taxes | 599.2 | 52.2 | (917.5 | ) | (463.6 | ) | (541.8 | ) | ||||||||||||

Income tax expense (benefit) | 132.8 | (78.9 | ) | (963.8 | ) | (90.3 | ) | (39.6 | ) | |||||||||||

Net income (loss) | $ | 466.4 | $ | 131.1 | $ | 46.3 | $ | (373.3 | ) | $ | (502.2 | ) | ||||||||

Balance Sheet (at end of period) | ||||||||||||||||||||

Cash and cash equivalents | $ | 470.7 | $ | 926.1 | $ | 670.3 | $ | 1,219.2 | $ | 579.7 | ||||||||||

Total assets(2) | 24,735.1 | 20,776.6 | 21,812.3 | 23,755.0 | 23,770.0 | |||||||||||||||

Total stockholders’ / member equity(2) | 2,278.1 | 1,450.7 | 1,398.2 | 1,371.2 | 1,613.2 | |||||||||||||||

Total debt, including finance leases(2) | 8,714.7 | 10,586.4 | 11,875.8 | 12,337.9 | 12,226.3 | |||||||||||||||

Net cash provided by operating activities | 1,903.9 | 1,687.9 | 1,018.8 | 1,813.5 | 901.6 | |||||||||||||||

Per Share Data | ||||||||||||||||||||

Basic and diluted net income (loss) per common share | $ | 1.67 | $ | 0.47 | $ | 0.17 | $ | (1.33 | ) | $ | (1.80 | ) | ||||||||

Pro forma net income per common share(3) | $ | |||||||||||||||||||

Weighted-average common shares outstanding (in millions): | ||||||||||||||||||||

Basic and diluted | 280 | 280 | 280 | 280 | 280 | |||||||||||||||

Pro forma weighted average common shares outstanding(3) | ||||||||||||||||||||

| (1) | Certain prior period amounts have been reclassified to conform to the current period presentation, specifically the reclassification of gains and losses from property dispositions and impairment losses from Selling and administrative expenses to (Gain) loss on property dispositions and impairment losses, net. |

| (2) | We adopted Accounting Standards Update (“ASU”) 2016-02, “Leases (Topic 842) |

| (3) | Fiscal 2019 pro forma net income per share reflects the effect of the dividend requirement associated with the Series A preferred stock to be issued in the concurrent offering of Series A preferred stock and the Repurchase as if they had taken place on February 24, 2019, the first day of fiscal 2019. Fiscal 2019 historical net income was reduced by $ to reflect the dividend requirement. Pro forma weighted average common shares used in computing pro forma net income per share gives effect to a repurchase of common shares (based upon the midpoint of the estimated offering range set forth on the cover page of this prospectus) from certain Pre-IPO Stockholders using the proceeds from the concurrent offering of Series A Preferred Stock. Assumes no common shares repurchased for the underwriters over-allotment option in the concurrent offering of Series A preferred stock. |

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | ||||||||||

Stores, beginning of period | 2,269 | 2,318 | 2,324 | |||||||||

Acquired | — | — | 5 | |||||||||

Opened | 14 | 6 | 15 | |||||||||

Closed | (31 | ) | (55 | ) | (26 | ) | ||||||

Stores, end of period | 2,252 | 2,269 | 2,318 | |||||||||

Number of Stores | Percent of Total | Retail Square Feet (1) | ||||||||||||||||||||||

Square Footage | February 29, 2020 | February 23, 2019 | February 29, 2020 | February 23, 2019 | February 29, 2020 | February 23, 2019 | ||||||||||||||||||

Less than 30,000 | 204 | 208 | 9.1 | % | 9.2 | % | 4.7 | 4.9 | ||||||||||||||||

30,000 to 50,000 | 784 | 792 | 34.8 | % | 34.9 | % | 32.9 | 33.2 | ||||||||||||||||

More than 50,000 | 1,264 | 1,269 | 56.1 | % | 55.9 | % | 74.7 | 74.9 | ||||||||||||||||

Total Stores | 2,252 | 2,269 | 100.0 | % | 100.0 | % | 112.3 | 113.0 | ||||||||||||||||

| (1) | In millions, reflects total square footage of retail stores operating at the end of the period. |

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | ||||||||||||||||||||||

Net sales and other revenue | $ | 62,455.1 | 100.0 | % | $ | 60,534.5 | 100.0 | % | $ | 59,924.6 | 100.0 | % | ||||||||||||

Cost of sales | 44,860.9 | 71.8 | 43,639.9 | 72.1 | 43,563.5 | 72.7 | ||||||||||||||||||

Gross profit | 17,594.2 | 28.2 | 16,894.6 | 27.9 | 16,361.1 | 27.3 | ||||||||||||||||||

Selling and administrative expenses | 16,641.9 | 26.6 | 16,272.3 | 26.9 | 16,208.7 | 27.0 | ||||||||||||||||||

(Gain) loss on property dispositions and impairment losses, net | (484.8 | ) | (0.7 | ) | (165.0 | ) | (0.3 | ) | 66.7 | 0.1 | ||||||||||||||

Goodwill impairment | — | — | — | — | 142.3 | 0.2 | ||||||||||||||||||

Operating income (loss) | 1,437.1 | 2.3 | 787.3 | 1.3 | (56.6 | ) | — | |||||||||||||||||

Interest expense, net | 698.0 | 1.1 | 830.8 | 1.4 | 874.8 | 1.5 | ||||||||||||||||||

Loss (gain) on debt extinguishment | 111.4 | 0.2 | 8.7 | — | (4.7 | ) | — | |||||||||||||||||

Other expense (income), net | 28.5 | — | (104.4 | ) | (0.2 | ) | (9.2 | ) | — | |||||||||||||||

Income (loss) before income taxes | 599.2 | 1.0 | 52.2 | 0.1 | (917.5 | ) | (1.5 | ) | ||||||||||||||||

Income tax expense (benefit) | 132.8 | 0.2 | (78.9 | ) | (0.1 | ) | (963.8 | ) | (1.6 | ) | ||||||||||||||

Net income | $ | 466.4 | 0.8 | % | $ | 131.1 | 0.2 | % | $ | 46.3 | 0.1 | % | ||||||||||||

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | ||||||||||

Identical sales, excluding fuel | 2.1 | % | 1.0 | % | (1.3 | )% | ||||||

Fiscal 2019 | ||||

Net sales and other revenue for fiscal 2018 | $ | 60,534.5 | ||

Identical sales increase of 2.1% | 1,160.3 | |||

Impact of 53rd week | 1,067.0 | |||

Decrease in sales due to store closures, net of new store openings | (304.6 | ) | ||

Decrease in fuel sales | (25.5 | ) | ||

Other (1) | 23.4 | |||

Net sales and other revenue for fiscal 2019 | $ | 62,455.1 | ||

| (1) | Includes changes in non-identical sales and other miscellaneous revenue. |

Fiscal 2018 | ||||

Net sales and other revenue for fiscal 2017 | $ | 59,924.6 | ||

Identical sales increase of 1.0% | 539.6 | |||

Increase in fuel sales | 351.3 | |||

Decrease in sales due to store closures, net of new store openings | (413.6 | ) | ||

Other (1) | 132.6 | |||

Net sales and other revenue for fiscal 2018 | $ | 60,534.5 | ||

| (1) | Includes changes in non-identical sales and other miscellaneous revenue. |

Fiscal 2019 vs. Fiscal 2018 | Basis point increase (decrease) | |||

Lower shrink expense | 16 | |||

Product mix, including increased penetration in Own Brands | 8 | |||

Depreciation and amortization | 7 | |||

Advertising | 5 | |||

Rent expense | (10 | ) | ||

Pharmacy reimbursement rate pressure | (8 | ) | ||

Other | 2 | |||

Total | 20 | |||

Fiscal 2018 vs. Fiscal 2017 | Basis point increase (decrease) | |||

Lower shrink expense | 31 | |||

Product mix, including increased Own Brands | 16 | |||

Advertising | 14 | |||

Acquisition synergies | 6 | |||

Other | 3 | |||

Total | 70 | |||

Fiscal 2019 vs. Fiscal 2018 | Basis point increase (decrease) | |||

Lower integration and acquisition-related costs | (32 | ) | ||

Depreciation and amortization | (11 | ) | ||

Rent expense and occupancy costs | 11 | |||

Strategic initiatives | 9 | |||

Other (1) | (7 | ) | ||

Total | (30 | ) | ||

| (1) | Includes the favorable settlement of the UFCW & Employers Midwest Pension Fund dispute. See Note 11—Employee benefit plans and collective bargaining agreements in our consolidated financial statements, included elsewhere in this prospectus, for more information. |

Fiscal 2018 vs. Fiscal 2017 | Basis point increase (decrease) | |||

Depreciation and amortization | (27 | ) | ||

Cost reduction initiatives | (18 | ) | ||

Employee wage and benefit costs (primarily incentive pay) | 28 | |||

Other (includes an increase in acquisition and integration costs) | 7 | |||

Total | (10 | ) | ||

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | ||||||||||

ABL Facility, senior secured and unsecured notes, term loans and debentures | $ | 565.3 | $ | 698.3 | $ | 701.5 | ||||||

Finance lease obligations | 79.8 | 81.8 | 96.3 | |||||||||

Deferred financing costs | 39.8 | 42.7 | 56.1 | |||||||||

Debt discounts | 34.1 | 20.3 | 16 | |||||||||

Other interest (income) expense | (21.0 | ) | (12.3 | ) | 4.9 | |||||||

Interest expense, net | $ | 698.0 | $ | 830.8 | $ | 874.8 | ||||||

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | ||||||||||

Income tax expense (benefit) at federal statutory rate | $ | 125.8 | $ | 11.0 | $ | (301.5 | ) | |||||

State income taxes, net of federal benefit | 32.3 | 0.7 | (39.8 | ) | ||||||||

Change in valuation allowance | (7.2 | ) | (3.3 | ) | (218.0 | ) | ||||||

Unrecognized tax benefits | 7.7 | (16.2 | ) | (36.5 | ) | |||||||

Member loss | — | — | 83.1 | |||||||||

Charitable donations | (6.9 | ) | (4.4 | ) | — | |||||||

Tax credits | (23.5 | ) | (10.8 | ) | (9.1 | ) | ||||||

Tax Cuts and Jobs Act | — | (56.9 | ) | (430.4 | ) | |||||||

CVR liability adjustment | — | — | (20.3 | ) | ||||||||

Reorganization of limited liability companies | — | — | 46.7 | |||||||||

Nondeductible equity-based compensation expense | 1.0 | 3.8 | 1.6 | |||||||||

Other | 3.6 | (2.8 | ) | (39.6 | ) | |||||||

Income tax expense (benefit) | $ | 132.8 | $ | (78.9 | ) | $ | (963.8 | ) | ||||

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | ||||||||||

Net income | $ | 466.4 | $ | 131.1 | $ | 46.3 | ||||||

Depreciation and amortization | 1,691.3 | 1,738.8 | 1,898.1 | |||||||||

Interest expense, net | 698.0 | 830.8 | 874.8 | |||||||||

Income tax expense (benefit) | 132.8 | (78.9 | ) | (963.8 | ) | |||||||

EBITDA | 2,988.5 | 2,621.8 | 1,855.4 | |||||||||

Loss (gain) on interest rate and commodity hedges, net | 50.6 | (1.3 | ) | (6.2 | ) | |||||||

Facility closures and related transition costs (1) | 18.3 | 13.4 | 12.4 | |||||||||

Integration costs (2) | 37.0 | 186.3 | 156.2 | |||||||||

Acquisition-related costs (3) | 23.5 | 73.4 | 61.5 | |||||||||

Loss (gain) on debt extinguishment | 111.4 | 8.7 | (4.7 | ) | ||||||||

Equity-based compensation expense | 32.8 | 47.7 | 45.9 | |||||||||

(Gain) loss on property dispositions and impairment losses, net | (484.8 | ) | (165.0 | ) | 66.7 | |||||||

Goodwill impairment | — | — | 142.3 | |||||||||

LIFO expense | 18.4 | 8.0 | 3.0 | |||||||||

Miscellaneous adjustments (4) | 38.7 | (51.7 | ) | 65.4 | ||||||||

Adjusted EBITDA (5) | $ | 2,834.4 | $ | 2,741.3 | $ | 2,397.9 | ||||||

| (1) | Includes costs related to facility closures and the transition to our decentralized operating model. Fiscal 2019 includes closure costs related to the discontinuation of our meal kit subscription delivery operations. |

| (2) | Related to conversion activities and related costs associated with integrating acquired businesses, primarily the Safeway acquisition. |

| (3) | Includes expenses related to acquisitions (including the mutually terminated merger with Rite Aid Corporation in fiscal 2018) and expenses related to management fees of $13.8 million incurred in each fiscal year in connection with acquisition and financing activities. |

| (4) | Miscellaneous adjustments include the following: |

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | ||||||||||

Non-cash lease-related adjustments | $ | 21.2 | $ | (13.7 | ) | $ | (5.9 | ) | ||||

Lease and lease-related costs for surplus and closed stores | 21.5 | 19.5 | 23.3 | |||||||||

Net realized and unrealized gain on non-operating investments | (1.1 | ) | (17.2 | ) | (5.1 | ) | ||||||

Adjustments to contingent consideration | — | (59.3 | ) | — | ||||||||

Costs related to initial public offering and reorganization transactions | 4.1 | 1.6 | 8.7 | |||||||||

Changes in our equity method investment in Casa Ley and related CVR adjustments | — | — | 53.8 | |||||||||

Certain legal and regulatory accruals and settlements, net | (22.2 | ) | 4.0 | (13.7 | ) | |||||||

Other (a) | 15.2 | 13.4 | 4.3 | |||||||||

Total miscellaneous adjustments | $ | 38.7 | $ | (51.7 | ) | $ | 65.4 | |||||

| (a) | Primarily includes adjustments for unconsolidated equity investments. |

| (5) | Fiscal 2019 includes an estimated $54 million of incremental Adjusted EBITDA due to the impact of the additional week in fiscal 2019’s 53-week annual period. |

Fiscal 2019 | Fiscal 2018 | Fiscal 2017 | ||||||||||

Net cash provided by operating activities | $ | 1,903.9 | $ | 1,687.9 | $ | 1,018.8 | ||||||

Income tax expense (benefit) | 132.8 | (78.9 | ) | (963.8 | ) | |||||||

Deferred income taxes | 5.9 | 81.5 | 1,094.1 | |||||||||

Interest expense, net | 698.0 | 830.8 | 874.8 | |||||||||

Operating lease right-of-use assets amortization | (570.3 | ) | — | — | ||||||||

Changes in operating assets and liabilities | 575.9 | (176.2 | ) | 222.1 | ||||||||

Amortization and write-off of deferred financing costs | (39.8 | ) | (42.7 | ) | (56.1 | ) | ||||||

Acquisition and integration costs | 60.5 | 259.7 | 217.7 | |||||||||

Pension and post-retirement (income) expense, net of contributions | 13.0 | 174.8 | 22.8 | |||||||||

Other adjustments | 54.5 | 4.4 | (32.5 | ) | ||||||||

Adjusted EBITDA | 2,834.4 | 2,741.3 | 2,397.9 | |||||||||

Less: capital expenditures | (1,475.1 | ) | (1,362.6 | ) | (1,547.0 | ) | ||||||

Adjusted Free Cash Flow | $ | 1,359.3 | $ | 1,378.7 | $ | 850.9 | ||||||

February 29, 2020 | February 23, 2019 | February 24, 2018 | ||||||||||

Cash and cash equivalents and restricted cash at end of period | $ | 478.9 | $ | 967.7 | $ | 680.8 | ||||||

Cash flows provided by operating activities | 1,903.9 | 1,687.9 | 1,018.8 | |||||||||

Cash flows used in investing activities | (378.5 | ) | (86.8 | ) | (469.0 | ) | ||||||

Cash flows used in financing activities | (2,014.2 | ) | (1,314.2 | ) | (1,098.1 | ) | ||||||

Projected Fiscal 2020 Capital Expenditures | ||||

New stores and remodels | $ | 550.0 | ||

IT | 375.0 | |||

Real estate and expansion capital | 100.0 | |||

Maintenance | 350.0 | |||

Supply chain | 125.0 | |||

Total | $ | 1,500.0 | ||

February 29, 2020 | ||||

Notes and debentures | $ | 7,992.6 | ||

Finance leases | 666.7 | |||

Other notes payable and mortgages | 55.4 | |||

Total debt, including finance leases | $ | 8,714.7 | ||

Payments Due Per Year | ||||||||||||||||||||

Total | 2020 | 2021-2022 | 2023-2024 | Thereafter | ||||||||||||||||

Long-term debt (2) | $ | 8,162.2 | $ | 138.0 | $ | 882.3 | $ | 1,268.4 | $ | 5,873.5 | ||||||||||

Estimated interest on long-term debt (3) | 3,145.2 | 460.0 | 908.3 | 807.6 | 969.3 | |||||||||||||||

Operating leases (4) | 9,159.4 | 891.8 | 1,795.0 | 1,504.4 | 4,968.2 | |||||||||||||||

Finance leases (4) | 1,034.0 | 136.2 | 262.1 | 212.4 | 423.3 | |||||||||||||||

Other long-term liabilities (5) | 1,247.4 | 404.0 | 380.2 | 156.0 | 307.2 | |||||||||||||||

Purchase obligations (6) | 530.5 | 152.4 | 119.2 | 107.5 | 151.4 | |||||||||||||||

Total contractual obligations | $ | 23,278.7 | $ | 2,182.4 | $ | 4,347.1 | $ | 4,056.3 | $ | 12,692.9 | ||||||||||

| (1) | The contractual obligations table excludes funding of pension and other postretirement benefit obligations, which totaled $11.0 million in fiscal 2019 and is expected to total $69.5 million in fiscal 2020. This table excludes contributions under various multiemployer pension plans, which totaled $469.3 million in fiscal 2019 and is expected to total approximately $500 million in fiscal 2020. |

| (2) | Long-term debt amounts exclude any debt discounts and deferred financing costs. See Note 7 - Long-term debt and finance lease obligations in our consolidated financial statements, included elsewhere in this prospectus, for additional information. |

| (3) | Amounts include contractual interest payments using the stated fixed interest rate as of February 29, 2020. See Note 7 - Long-term debt and finance lease obligations in our consolidated financial statements, included elsewhere in this prospectus, for additional information. |

| (4) | Represents the minimum rents payable under operating and finance leases, excluding common area maintenance, insurance or tax payments, for which we are obligated. |

| (5) | Consists of self-insurance liabilities, which have not been reduced by insurance-related receivables, deferred cash consideration related to DineInFresh, Inc. (Plated), and the $75.0 million of withdrawal liability settlement related to Safeway’s previous closure of its Dominick’s division. The table excludes the unfunded pension and postretirement benefit obligation of $793.4 million. The amount of unrecognized tax benefits of $373.8 million as of February 29, 2020 has been excluded from the contractual obligations table because a reasonably reliable estimate of the timing of future tax settlements cannot be determined. Excludes contingent consideration because the timing and settlement is uncertain. Also excludes deferred tax liabilities and certain other deferred liabilities that will not be settled in cash. |

| (6) | Purchase obligations include various obligations that have specified purchase commitments. As of February 29, 2020, future purchase obligations primarily relate to fixed asset, marketing and information technology commitments, including fixed price contracts. In addition, not included in the contractual obligations table are supply contracts to purchase product for resale to consumers which are typically of a short-term nature with limited or no purchase commitments. We also enter into supply contracts which typically include either volume commitments or fixed expiration dates, termination provisions and other customary contractual considerations. The supply contracts that are cancelable have not been included above. |

Percentage Point Change | Projected Benefit Obligation Decrease / (Increase) | Expense Decrease / (Increase) | ||||||||||

Discount rate | + /- 1.00 | % | $ | 216.1 / $(265.4) | $ | 11.2 / $(11.3) | ||||||

Expected return on assets | + /- 1.00 | % | - / - | $ | 17.3 / $(17.3) | |||||||

Fiscal 2020 | Fiscal 2021 | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 | Thereafter | Total | Fair Value | |||||||||||||||||||||||||

Long-Term Debt | ||||||||||||||||||||||||||||||||

Fixed Rate - Principal payments | $ | 138.0 | $ | 131.2 | $ | 751.1 | $ | 1.2 | $ | 1,267.2 | $ | 5,873.5 | $ | 8,162.2 | $ | 8,486.2 | ||||||||||||||||

Weighted average interest rate (1) | 3.97 | % | 4.76 | % | 3.50 | % | 5.22 | % | 6.66 | % | 5.81 | % | 5.68 | % | ||||||||||||||||||

| (1) | Excludes debt discounts and deferred financing costs. |

Pay Fixed / Receive Variable | ||||||||||||||||||||||||

Fiscal 2020 | Fiscal 2021 | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 | Thereafter | |||||||||||||||||||

Interest Rate Swaps | ||||||||||||||||||||||||

Average Notional amount outstanding | $ | 1,957.0 | $ | 1,653.0 | $ | 593.0 | $ | 49.0 | $ | — | $ | — | ||||||||||||

Average pay rate | 2.82 | % | 2.83 | % | 2.94 | % | 2.94 | % | 0.0 | % | 0.0 | % | ||||||||||||

Average receive rate | .75 | % | .75 | % | .75 | % | .75 | % | 0.0 | % | 0.0 | % | ||||||||||||

|  | |||

Identical Sales | Net Income ($mm) | Adj. EBITDA ($mm) | ||

|  |  |

|  |  |

| • | Well-Known Banners |

| • | Prime Locations First-and-Main locations, providing our customers with exceptional convenience. Our owned and ground leased stores and distribution centers, which represent approximately 39% of our store and distribution base, have an aggregate appraised value of $11.2 billion. |

| • | Strong Market Share and Local Market Density |

| • | Highly Attractive Markets one-third of the U.S. population and approximately 45% of U.S. GDP. In 60% of the 121 MSAs in which we operate, the projected population growth over the next five years, in aggregate, exceeds the national average by over 60%. |

|  |  |  |  |

|

|

| • Currently available in approximately 650 locations, with plans to grow to 1,600 locations in the next two years• Easy-to-use mobile app• Convenient, well-signed, curbside pickup |