EXHIBIT C

GUARANTY

THIS GUARANTY ("Guaranty") is made as of the 12th day of May, 2015 by Kevin Jones (as "Guarantor") for the benefit of Kevin Bentley, as resident of Fort Worth, Texas, and whose address is 12908 Portifmo Street, Fort Worth, Texas 76126 ("Bentley").

1. Definitions. As used in this Guaranty, the following terms shall have the meanings indicated below:

The term "Guaranteed Indebtedness" means (i) all principal indebtedness owing by Maybert, LLC, a Texas limited liability company (the "Company") to Bentley now existing or hereafter arising under or evidenced by that one certain Promissory Note dated May 12, 2015, in the original principal amount of Three Hundred Twelve Thousand Five Hundred Dollars ($312,500.00) made and executed by the Company and payable to the order of Bentley, as amended from time to time, (ii) all accrued but unpaid interest on any of the indebtedness described in (i) above, (iii) all costs and expenses incurred by Bentley in connection with the collection and administration of all or any part of the indebtedness and obligations described in (i) and (ii) above or the protection or preservation of, or realization upon, any collateral securing all or any part of such indebtedness and obligations, including without limitation all reasonable attorneys' fees, and (iv) all renewals, extensions, modifications and rearrangements of the indebtedness and obligations described in (i) and (ii), (iii) and above.

2. Obligations. As an inducement to Bentley to extend credit to the Company, Guarantor, for value received, does hereby unconditionally and absolutely guarantee the prompt and full payment and performance of the Guaranteed Indebtedness when due or declared to be due and at all times thereafter.

3. Character of Obligations.

(a) This is an absolute, continuing and unconditional guaranty of payment and not of collection and if at any time or from time to time there is no outstanding Guaranteed Indebtedness, the obligations of Guarantor with respect to any and all Guaranteed Indebtedness incurred thereafter shall not be affected. This Guaranty and the Guarantor's obligations hereunder are irrevocable and, in the event of Guarantor's death, shall be binding upon Guarantor's estate. All of the Guaranteed Indebtedness shall be conclusively presumed to have been made or acquired in acceptance hereof. Guarantor shall be liable, jointly and severally, with the Company and any other guarantor of all or any part of the Guaranteed Indebtedness. The obligations of Guarantor to Bentley under this Guaranty shall terminate upon the full payment and final discharge of the Guaranteed Indebtedness.

(b) Bentley may, at his sole discretion and without impairing his rights hereunder, (i) apply any payments on the Guaranteed Indebtedness that Bentley receives from the Company or any other source other than Guarantor to that portion of the Guaranteed Indebtedness, if any, not guaranteed hereunder, and (ii) apply any proceeds it receives as a result of the foreclosure or other realization on any collateral for the Guaranteed Indebtedness to that portion, if any, of the

Guaranteed Indebtedness not guaranteed hereunder or to any other indebtedness secured by such collateral.

(c) Guarantor agrees that his obligations hereunder shall not be released, diminished, impaired, reduced or affected by the existence of any other guaranty or the payment by any other guarantor of all or any part of the Guaranteed Indebtedness and, in the event Paragraph 2 above partially limits Guarantor's obligations under this Guaranty, Guarantor's obligations hereunder shall continue until Bentley has received payment in full of the Guaranteed Indebtedness.

(d) Guarantor's obligations hereunder shall not be released, diminished, impaired, reduced or affected by, nor shall any provision contained herein be deemed to be a limitation upon, the amount of credit which Bentley may extend to Company, the number of transactions between Bentley and the Company, payments by the Company to Bentley or Bentley's allocation of payments by the Company.

(e) Without further authorization from or notice to Guarantor, Bentley may compromise, accelerate, or otherwise alter the time or manner for the payment of the Guaranteed Indebtedness, increase or reduce the rate of interest thereon, or release or add any one or more guarantors or endorsers, or allow substitution of or withdrawal of collateral or other security and release collateral and other security or subordinate the same.

4. Representations and Warranties. Guarantor hereby represents and warrants the

following Bentley:

(a) This Guaranty may reasonably be expected to benefit, directly or indirectly, Guarantor; and

(b) Guarantor is familiar with, and has independently reviewed the books and records regarding, the fmancial condition of the Company and is familiar with the value of any and all collateral intended to be security for the payment of all or any part of the Guaranteed Indebtedness; provided, however, Guarantor is not relying on such financial condition or collateral as an inducement to enter into this Guaranty; and

(c) Guarantor has adequate means to obtain from the Company on a continuing basis information concerning the financial condition of the Company and Guarantor is not relying on Bentley to provide such information to Guarantor either now or in the future; and

(d) Guarantor has the power and authority to execute, deliver and perform this Guaranty and any other agreements executed by Guarantor contemporaneously herewith, and the execution, delivery and performance of this Guaranty and any other agreements executed by Guarantor contemporaneously herewith do not and will not violate (i) any agreement or instrument to which Guarantor is a party; and

(e) Neither Bentley nor any other party has made any representation, warranty or statement to Guarantor in order to induce Guarantor to execute this Guaranty; and

As of the date hereof, and after giving effect to this Guaranty and the obligations evidenced hereby, (i) Guarantor is and will be solvent, (ii) the fair saleable value of Guarantor's assets exceeds and will continue to exceed his liabilities (both fixed and contingent), and (iii) Guarantor is and will continue to be able to pay his debts as they mature.

5. Consent and Waiver.

(a) Guarantor waives (i) promptness, diligence and notice of acceptance of this Guaranty and notice of the incurring of any obligation, indebtedness or liability to which this Guaranty applies or may apply and waives presentment for payment, notice of nonpayment, protest, demand, notice of protest, notice of intent to accelerate, notice of acceleration, notice of dishonor, diligence in enforcement and indulgences of every kind, and (ii) the taking of any other action by Bentley, including without limitation giving any notice of default or any other notice to, or making any demand on, the Company, any other guarantor of all or any part of the Guaranteed Indebtedness or any other party.

(b) Guarantor waives any rights Guarantor has under, or any requirements imposed by, Chapter 34 of the Texas Business and Commerce Code, as in effect on the date of this Guaranty or as it may be amended from time to time.

(c) Bentley may at any time, without the consent of or notice to Guarantor, without incurring responsibility to Guarantor and without impairing, releasing, reducing or affecting the obligations of Guarantor hereunder: (i) change the manner, place or terms of payment of all or any part of the Guaranteed Indebtedness, or renew, extend, modify, rearrange or alter all or any part of the Guaranteed Indebtedness; (ii) change the interest rate accruing on any of the Guaranteed Indebtedness (including, without limitation, any periodic change in such interest rate that occurs because such Guaranteed Indebtedness accrues interest at a variable rate which may fluctuate from time to time); (iii) sell, exchange, release, surrender, subordinate, realize upon or otherwise deal with in any manner and in any order any collateral for all or any part of the Guaranteed Indebtedness or this Guaranty or setoff against all or any part of the Guaranteed Indebtedness; (iv) neglect, delay, omit, fail or refuse to take or prosecute any action for the collection of all or any part of the Guaranteed Indebtedness or this Guaranty; (v) exercise or refrain from exercising any rights against the Company or others, or otherwise act or refrain from acting; (vi) settle or compromise all or any part of the Guaranteed Indebtedness and subordinate the payment of all or any part of the Guaranteed Indebtedness to the payment of any obligations, indebtedness or liabilities which may be due or become due to Bentley or others; (vii) apply any deposit balance, fund, payment, collections through process of law or otherwise or other collateral of the Company to the satisfaction and liquidation of the indebtedness or obligations of the Company to Bentley not guaranteed under this Guaranty; and (viii) apply any sums paid to Bentley by Guarantor, the Company or others to the Guaranteed Indebtedness in such order and manner as Bentley, in his sole discretion, may determine.

(d) Should Bentley seek to enforce the obligations of Guarantor hereunder by action in any court or otherwise, Guarantor waives any requirement, substantive or procedural, that (i) Bentley first enforce any rights or remedies against the Company or any other person or entity liable to Bentley for all or any part of the Guaranteed Indebtedness, including without limitation that a judgment first be rendered against the Company or any other person or entity, or that the Company or any other person or entity should be joined in such cause, or (ii) Bentley first enforce rights against any collateral which shall ever have been given to secure all or any part of the Guaranteed Indebtedness or this Guaranty. Such waiver shall be without prejudice to Bentley's right, at his option, to proceed against the Company or any other person or entity, whether by separate action or by joinder.

6. Obligations Not Impaired.

(a) Guarantor agrees that his obligations hereunder shall not be released, diminished, impaired, reduced or affected by the occurrence of any one or more of the following events: (i) the death, disability or lack of corporate power of the Company, Guarantor (except as provided in Paragraph 9 herein) or any other guarantor of all or any part of the Guaranteed Indebtedness, (ii) any receivership, insolvency, bankruptcy or other proceedings affecting the Company, Guarantor or any other guarantor of all or any part of the Guaranteed Indebtedness, or any of their respective property; (iii) the partial or total release or discharge of the Company or any other guarantor of all or any part of the Guaranteed Indebtedness, or any other person or entity from the performance of any obligation contained in any instrument or agreement evidencing, governing or securing all or any part of the Guaranteed Indebtedness, whether occurring by reason of law or otherwise; (iv) the taking or accepting of any collateral for all or any part of the Guaranteed Indebtedness or this Guaranty; (v) the taking or accepting of any other guaranty for all or any part of the Guaranteed Indebtedness; (vi) any failure by Bentley to acquire, perfect or continue any lien or security interest on collateral securing all or any part of the Guaranteed Indebtedness or this Guaranty; (vii) the impairment of any collateral securing all or any part of the Guaranteed Indebtedness or this Guaranty; (viii) any failure by Bentley to sell any collateral securing all or any part of the Guaranteed Indebtedness or this Guaranty in a commercially reasonable manner or as otherwise required by law; or (ix) any other circumstance which might otherwise constitute a defense available to, or discharge of, the Company or any other guarantor of all or any part of the Guaranteed Indebtedness.

(b) This Guaranty shall continue to be effective or be reinstated, as the case may be, if at any time any payment of all or any part of the Guaranteed Indebtedness is rescinded or must otherwise be returned by Bentley upon the insolvency, bankruptcy or reorganization of the Company, Guarantor, any other guarantor of all or any part of the Guaranteed Indebtedness, or otherwise, all as though such payment had not been made.

(c) None of the following shall affect Guarantor's liability hereunder: (i) the unenforceability of all or any part of the Guaranteed Indebtedness against the Company by reason of the fact that the Guaranteed Indebtedness exceeds the amount permitted by law; (ii) the act of creating all or any part of the Guaranteed Indebtedness is ultra vires; or (iii) mangers or officers of the Company creating all or any part of the Guaranteed Indebtedness acted in excess of their authority. Guarantor hereby acknowledges that withdrawal from, or termination of, any ownership interest in the Company now or hereafter owned or held by Guarantor shall not alter, affect or in any way limit the obligations of Guarantor hereunder.

7. Actions Against Guarantor. In the event of a default in the payment or performance of all or any part of the Guaranteed Indebtedness when such Guaranteed Indebtedness becomes due, whether by its terms, by acceleration or otherwise, Guarantor shall, without notice or demand, promptly pay the amount due thereon to Bentley, in lawful money of the United States, at Bentley's address set forth in the introductory paragraph above. One or more successive or concurrent actions may be brought against Guarantor, either in the same action in which the Company is sued or in separate actions, as often as Bentley deems advisable. The exercise by Bentley of any right or remedy under this Guaranty or under any other agreement or instrument, at law, in equity or otherwise, shall not preclude concurrent or subsequent exercise of any other right or remedy. The books and records of Company shall be admissible as evidence in any action or proceeding involving this Guaranty and shall be prima facie evidence of the payments made on, and the outstanding balance of, the Guaranteed Indebtedness.

8. Payment by Guarantor. Whenever Guarantor pays any sum which is or may become due under this Guaranty, written notice must be delivered to Bentley contemporaneously with such payment. Such notice shall be effective for purposes of this paragraph when contemporaneously with such payment Bentley receives such notice either by: (a) personal delivery to the address and designated department of Bentley identified in in the introductory paragraph above, or (b) United States mail, certified or registered, return receipt requested, postage prepaid, addressed to Bentley at the address shown in the introductory paragraph above. In the absence of such notice to Bentley by Guarantor in compliance with the provisions hereof, any sum received by Bentley on account of the Guaranteed Indebtedness shall be conclusively deemed paid by the Company.

9. Death of Guarantor. In the event of the death of Guarantor, the obligations of the deceased Guarantor under this Guaranty shall continue as an obligation against his estate as to (a) all of the Guaranteed Indebtedness that is outstanding on the date of Guarantor's death, and any renewals or extensions thereof. The terms and conditions of this Guaranty, including without limitation the consents and waivers set forth in Paragraph 5 hereof, shall remain in effect with respect to the Guaranteed Indebtedness described in the preceding sentence in the same manner as if Guarantor had not died.

10. Notice of Sale. In the event that Guarantor is entitled to receive any notice under the Uniform Commercial Code, as it exists in the state governing any such notice, of the sale or other disposition of any collateral securing all or any part of the Guaranteed Indebtedness or this Guaranty, reasonable notice shall be deemed given when such notice is deposited in the United States mail, postage prepaid, at the address for Guarantor set forth in Guarantor's signature page below above, ten (10) days prior to the date of any public sale, or after which any private sale, of any such collateral is to be held; provided, however, that actual notice given in any other reasonable manner or at any other reasonable time shall be sufficient.

11. Waiver by Bentley. No delay on the part of Bentley in exercising any right hereunder or failure to exercise the same shall operate as a waiver of such right. In no event shall any waiver of the provisions of this Guaranty be effective unless the same be in writing and signed by an officer of Bentley, and then only in the specific instance and for the purpose given.

12. Successors and Assigns. This Guaranty is for the benefit of Bentley, his heirs and assigns. This Guaranty is binding upon Guarantor and Guarantor's heirs, executors, administrators, personal representatives.

13. Costs and Expenses. Guarantor shall pay on demand by Bentley all costs and expenses, including without limitation all reasonable attorneys' fees, incurred by Bentley in connection with the preparation, administration, enforcement and/or collection of this Guaranty. This covenant shall survive the payment of the Guaranteed Indebtedness.

14. Severability. If any provision of this Guaranty is held by a court of competent jurisdiction to be illegal, invalid or unenforceable under present or future laws, such provision shall be fully severable, shall not impair or invalidate the remainder of this Guaranty and the effect thereof shall be confined to the provision held to be illegal, invalid or unenforceable.

15. No Obligation. Nothing contained herein shall be construed as an obligation on the part of Bentley to extend or continue to extend credit to the Company.

16. Amendment. No modification or amendment of any provision of this Guaranty, nor consent to any departure by Guarantor therefrom, shall be effective unless the same shall be in writing and signed by an officer of Bentley, and then shall be effective only in the specific instance and for the purpose for which given.

17. Cumulative Rights. All rights and remedies of Bentley hereunder are cumulative of each other and of every other right or remedy which Bentley may otherwise have at law or in equity or under any instrument or agreement, and the exercise of one or more of such rights or remedies shall not prejudice or impair the concurrent or subsequent exercise of any other rights or remedies. This Guaranty, whether general, specific and/or limited, shall be in addition to and cumulative of, and not in substitution, novation or discharge of, any and all prior or contemporaneous guaranty agreements by Guarantor in favor of Bentley or assigned to Bentley by others.

18. Governing Law, Venue. This Guaranty is intended to be performed in the State of Texas. Except to the extent that the laws of the United States may apply to the terms hereof, the substantive laws of the State of Texas shall govern the validity, construction, enforcement and interpretation of this Guaranty. In the event of a dispute involving this Guaranty or any other instruments executed in connection herewith, the undersigned irrevocably agrees that venue for such dispute shall lie in any court of competent jurisdiction in Tarrant County, Texas.

19. Compliance with Applicable Usury Laws. Notwithstanding any other provision of this Guaranty or of any instrument or agreement evidencing, governing or securing all or any part of the Guaranteed Indebtedness, Guarantor and Bentley by its acceptance hereof agree that Guarantor

shall never be required or obligated to pay interest in excess of the maximum non-usurious interest rate as may be authorized by applicable law for the written contracts which constitute the Guaranteed Indebtedness. It is the intention of Guarantor and Bentley to conform strictly to the applicable laws which limit interest rates, and any of the aforesaid contracts for interest, if and to the extent payable by Guarantor, shall be held to be subject to reduction to the maximum non-usurious interest rate allowed under said law.

20. Gender. Within this Guaranty, words of any gender shall be held and construed to include the other gender.

21. Captions. The headings in this Guaranty are for convenience only and shall not define or limit the provisions hereof.

22. Final Agreement. THIS WRITTEN AGREEMENT REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN AGREEMENTS BETWEEN THE PARTIES.

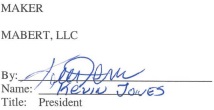

EXECUTED as of the date first above written.

| | GUARANTOR: |

| | |

| |  |