UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(Rule 14c-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

| | |

| Check the appropriate box: |

| |

| ☒ | | Preliminary Information Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

| ☐ | | Definitive Information Statement |

Accenture Holdings plc

(Name of Registrant as Specified in Its Charter)

| | | | |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☐ | | No fee required. |

| |

| ☒ | | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: Ordinary shares, par value €0.000001 per share, of Accenture Holdings plc |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: 25,971,828 ordinary shares of Accenture Holdings plc |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): Solely for purposes of calculating the filing fee, the underlying value of the transaction was determined based upon the product of (i) 25,971,828, the maximum number of shares of Accenture plc Class A ordinary shares, with nominal value $0.0000225 per share (“Accenture plc Class A ordinary shares”), that may be issued to holders of Accenture Holdings plc ordinary shares (other than Accenture plc and Accenture Holdings plc itself) in the merger described in this information statement, multiplied by (ii) $146.90, the average of the high and low prices per share of the Accenture plc Class A ordinary shares, as quoted on the New York Stock Exchange on November 29, 2017. In accordance with Section 14(g) of the Securities Exchange Act of 1934, as amended, the filing fee was determined by multiplying 0.0001245 by the product of the preceding sentence. |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: $3,815,261,533.20 |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | $475,000.06 |

| | | | |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☒ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: $475,000.06 |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: PREM 14A (File No. 001-34448) |

| | | | |

| | (3) | | Filing Party: Accenture plc (CIK: 0001467373) (fee paid by Accenture plc pursuant to Exchange Act Rule 0-11(c)(3)) |

| | | | |

| | (4) | | Date Filed: December 5, 2017 |

| | | | |

ACCENTURE HOLDINGS PLC

Notice of Annual General Meeting of Shareholders

to be held on February 5, 2018

The shareholders of Accenture Holdings plc, an Irish public limited company registered with the Irish Registrar of Companies under the registration number 560222, with its registered and principal executive offices at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland (“Accenture Holdings” or the “Company”), are invited to attend the:

ANNUAL GENERAL MEETING.

The annual general meeting of all shareholders of Accenture Holdings (the “Annual General Meeting”) will be held on February 5, 2018, at 12:30 p.m., local time in Ireland, at The Dock, located at 7 Hanover Quay, Grand Canal Dock, Dublin 2, Ireland.

The boards of directors of Accenture Holdings (the “Board”) and Accenture plc have each approved a merger of Accenture Holdings with and into Accenture plc, the parent company of Accenture Holdings (the “Merger”), pursuant to which Accenture plc will be the surviving entity. In order to consummate the Merger, shareholders of Accenture Holdings will be asked to approve the Common Draft Terms of Merger entered into by Accenture Holdings and Accenture plc on December , 2017 (the “Common Draft Terms of Merger”), the form of which is attached as Annex A to the accompanying information statement, at the Annual General Meeting.

The following are the proposals to be acted upon at the Annual General Meeting:

| | 1. | approve the Common Draft Terms of Merger, whereupon and assuming the other conditions to the Merger are satisfied on the Effective Date of the Merger (which is expected to be a date in March 2018), holders of Accenture Holdings ordinary shares (other than Accenture plc and Accenture Holdings itself) will receive, on a one-for-one basis, Class A ordinary shares of Accenture plc; |

| | 2. | approve the contract pursuant to which the wholly-owned subsidiary of Accenture Holdings, Exactside Limited, will acquire ordinary shares of Accenture Holdings; |

| | 3. | grant the Board the authority to issue shares under Irish law; |

| | 4. | grant the Board the authority to opt-out of statutory pre-emption rights under Irish law; |

| | 5. | determine the price range at which Accenture Holdings can re-allot shares that it acquires as treasury shares under Irish law; and |

| | 6. | authorize Accenture International S.à r.l., a wholly owned subsidiary of Accenture Holdings, or any successor entity thereto (“Accenture International”), to purchase Accenture Holdings ordinary shares off-market. |

The second through sixth proposals are not related to the Merger. The second proposal is a specific proposal to rationalize the Accenture Holdings share capital structure, which will remain in effect irrespective of whether the Merger is consummated. Proposals three through six replace existing ordinary course authorizations until the Merger is consummated and will remain in effect in the event the Merger is not consummated. The foregoing proposals are more fully described, and the full text of each of the proposals is set forth, in the accompanying information statement.

During the Annual General Meeting, our Irish financial statements for the period from September 1, 2016 to August 31, 2017 and the reports of the Board and of the external auditors of Accenture Holdings will be available for inspection and consideration by our shareholders.

Copies of the accompanying information statement and our Irish financial statements for the period from September 1, 2016 to August 31, 2017, which include the reports of the Board and of the external auditors of Accenture Holdings on our 2017 Irish financial statements, are accessible through the Investor Relations section of the Accenture plc website (information on or accessible through the website is not incorporated herein by reference). You may also request any of these materials and information in print free of charge by making a written request to Accenture Holdings plc c/o Accenture, 161 N. Clark Street, Chicago, IL 60601, United States of America, Attention: Secretary; or at Accenture Holdings’ registered office at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland, Attention: Secretary.

The Board has fixed 11:59 p.m., local time in Ireland, on December 11, 2017 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual General Meeting. This means that only those persons who were registered holders of Accenture Holdings ordinary shares at such time on that date will be entitled to receive notice of the Annual General Meeting and to attend and vote at the meeting or at any adjournments or postponements thereof. Proof of ownership of shares as of the record date, as well as a form of personal identification, must be presented in order to be admitted to the Annual General Meeting.

The Board is not asking you for a proxy in connection with the Annual General Meeting, and you are requested not to send us a proxy. As of the record date, Accenture plc held 96% of the Accenture Holdings ordinary shares entitled to vote at the Annual General Meeting and therefore has the power, acting by itself, to approve all matters scheduled to be voted upon at the Annual General Meeting.

Availability of Documents relating to the Merger

As required by Irish law, in connection with the Merger, the Board has prepared an explanatory report that explains, among other things, the Common Draft Terms of Merger and the legal and economic grounds for, and implications of, the Common Draft Terms of Merger (the “Directors’ Explanatory Report”), the form of which is attached as Annex C to the accompanying information statement. On November 27, 2017, upon the joint application of the Company and Accenture plc, the Irish High Court appointed PricewaterhouseCoopers, an Irish firm of chartered accountants and a statutory auditor within the meaning of the Irish Companies Act (as defined herein) (“PwC”), as the joint expert acting for Accenture Holdings and Accenture plc to examine the Common Draft Terms of Merger and make a report thereon in accordance with certain requirements of the Irish Companies Act (the “Independent Expert’s Report”).

Every Accenture Holdings Shareholder is entitled to obtain on request, free of charge, full or, if so desired, partial copies of the Common Draft Terms of Merger, the Directors’ Explanatory Report, the directors’ explanatory report prepared by the board of directors of Accenture plc, the form of which is attached as Annex D to the accompanying information statement, the Independent Expert’s Report (when issued), the audited Irish financial statements of Accenture plc for Accenture plc’s preceding three financial years and/or the audited Irish financial statements of the Company for its preceding three financial years (being two full financial years of the Company and the short financial year commencing on the date of incorporation of the Company on April 10, 2015 and ending on August 31, 2015). You may request copies of any of these materials by making a written request to Accenture Holdings plc c/o Accenture, 161 N. Clark Street, Chicago, IL 60601, United States of America, Attention: Secretary; or at Accenture Holdings’ registered office at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland, Attention: Secretary. Copies of these materials are also available for inspection free of change by any Accenture Holdings Shareholder at Accenture Holdings’ registered office and will remain so available up to and including the date of the Annual General Meeting.

Important Notice Regarding the Availability of the Notice of Annual General Meeting of Shareholders and Information Statement for the Annual General Meeting To Be Held on February 5, 2018: This Notice of Annual General Meeting of Shareholders and Information Statement and our Irish financial statements, which include the reports of the Board of Directors of Accenture Holdings and of the external auditors of Accenture Holdings, are available on the Investor Relations section of the Accenture website (http://investor.accenture.com). Information on or accessible through the website is not incorporated herein by reference.

The accompanying information statement incorporates documents by reference. Please see “Where You Can Find More Information” beginning on page 80 of the accompanying information statement for a listing of documents incorporated by reference. These documents are available to any person, including any beneficial owner, without charge and upon request directed to our Investor Relations Group by telephone in the United States and Puerto Rico at +1 703-948-5150 and outside the United States and Puerto Rico at +353 1 407-8203, by e-mail at investor.relations@accenture.com, or by mail at Accenture, Investor Relations, 1345 Avenue of the Americas, New York, New York 10105, USA. To ensure timely delivery of these documents, any request should be made by January 31, 2018. The exhibits to these documents will generally not be made available unless they are specifically incorporated by reference in the accompanying information statement.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the Merger or determined if the accompanying information statement is truthful or complete. Any representation to the contrary is a criminal offense.

The accompanying information statement is dated , 2017 and is first being mailed to shareholders of Accenture Holdings on or about , 2017.

By order of the Board of Directors

Dated: , 2017

TABLE OF CONTENTS

i

ii

iii

CERTAIN TERMS

Unless otherwise specified or the context requires otherwise, as used in this information statement, the following terms have the meanings ascribed to them below:

| | • | | “Accenture” and the “Accenture group” mean Accenture plc and its direct and indirect subsidiaries. |

| | • | | “Accenture Holdings” or “Company” means Accenture Holdings plc, an Irish public limited company and a subsidiary of Accenture plc. |

| | • | | “Accenture Holdings Shareholders” means the holders of ordinary shares of Accenture Holdings. |

| | • | | “Accenture International” means Accenture International S.à r.l. or any successor entity thereto. |

| | • | | “Accenture plc” means Accenture plc, an Irish public limited company and the parent company of Accenture Holdings. |

| | • | | “Annual General Meeting” means the annual general meeting of all shareholders of Accenture Holdings to be held on February 5, 2018. |

| | • | | “Common Draft Terms of Merger” means the common draft terms of merger entered into by Accenture Holdings and Accenture plc on December , 2017, the form of which is attached as Annex A to this information statement. |

| | • | | “DTC” means the Depository Trust Company. |

| | • | | “Effective Date” means the date and time specified in the order of the Irish High Court on which the consequences of the Merger are to have effect. |

| | • | | “Exactside Limited” means Exactside Limited, an Irish private limited company and an indirect subsidiary of Accenture Holdings. |

| | • | | “Exchange Act” means the United States Securities Exchange Act of 1934, as amended. |

| | • | | “Irish Companies Act” means the Companies Act 2014 of Ireland, as amended. |

| | • | | “Irish High Court” means the High Court of Ireland. |

| | • | | “IRS” means the United States Internal Revenue Service. |

| | • | | “Merger” means the merger of Accenture Holdings with and into Accenture plc, with Accenture plc as the surviving entity. |

| | • | | “NYSE” means the New York Stock Exchange. |

| | • | | “SEC” means the United States Securities and Exchange Commission. |

| | • | | “Securities Act” means the United States Securities Act of 1933, as amended. |

| | • | | “U.S. GAAP” means generally accepted accounting principles in the United States. |

| | • | | “we,” “our company,” “our” and “us” mean Accenture Holdings and its subsidiaries prior to the Merger and Accenture plc and its subsidiaries after the Merger. |

iv

FORWARD LOOKING STATEMENTS

This information statement and the documents incorporated by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, relating to our operations, results of operations and other matters that are based on our current expectations, estimates, assumptions and projections. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “positioned,” “outlook” and similar expressions are used to identify these forward-looking statements.

Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to, the factors discussed under the section entitled “Risk Factors” in this information statement. Our forward-looking statements speak only as of the date of this information statement, the date of the applicable incorporated document or as of the date they are made, and we undertake no obligation to update them.

These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed or forecast in these forward-looking statements.

The factors that could cause actual future results to differ materially from current expectations include, but are not limited to, our ability to obtain approval of the Irish High Court for, and to satisfy the other conditions to, the Merger on the expected timeframe or at all, our ability to realize the expected benefits from the Merger, the occurrence of difficulties in connection with the Merger and any unanticipated costs in connection with the Merger.

The foregoing factors are in addition to those factors discussed under “Risk Factors” and “Proposal Number One: The Merger” and elsewhere in this information statement, as well as those in the documents that we incorporate by reference into this information statement (including, without limitation, the “Risk Factors” section of our Annual Report on Form 10-K for the year ended August 31, 2017 and subsequent filings with the SEC). There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. We expressly disclaim any obligation to update these forward-looking statements other than as required by law.

v

ACCENTURE HOLDINGS PLC

INFORMATION STATEMENT

GENERAL INFORMATION

WE ARE NOT ASKING YOU FOR A PROXY IN CONNECTION WITH THE ANNUAL GENERAL MEETING.

The Annual General Meeting

The boards of directors of Accenture Holdings and Accenture plc, the parent company of Accenture Holdings, have approved the merger of Accenture Holdings with and into Accenture plc, pursuant to which Accenture plc will be the surviving entity. In order to consummate the Merger, Accenture Holdings Shareholders will be asked to approve the Common Draft Terms of Merger at the Annual General Meeting.

At the Annual General Meeting, Accenture Holdings Shareholders will also be asked to (1) approve the contract pursuant to which Exactside Limited will acquire ordinary shares of Accenture Holdings, (2) grant the Board the authority to issue shares under Irish law, (3) grant the Board the authority to opt-out of statutory pre-emption rights under Irish law, (4) determine the price range at which Accenture Holdings can re-allot shares that it acquires as treasury shares under Irish law, and (5) authorize Accenture International to purchase ordinary shares off-market. The proposals described in clauses (1) through (5) above are not related to the Merger. The proposal described in clause (1) is a specific proposal to rationalize the Accenture Holdings share capital structure, which will remain in effect irrespective of whether the Merger is consummated. The proposals described in clauses (2) through (5) replace existing ordinary course authorizations until the Merger is consummated and will remain in effect in the event the Merger is not consummated.

Date, Time and Place of the Annual General Meeting

This information statement is provided to the shareholders of Accenture Holdings, an Irish public limited company with its registered and principal offices at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland and registered with the Irish Registrar of Companies under the registration number 560222, in connection with the Annual General Meeting to be held at 12:30 p.m. local time in Ireland, on February 5, 2018. The Annual General Meeting will be held at The Dock, located at 7 Hanover Quay, Grand Canal Dock, Dublin 2, Ireland. This information statement is first being sent to shareholders on or about , 2017.

Who Can Vote; Votes Per Share at the Annual General Meeting

All persons who were registered holders of Accenture Holdings ordinary shares at 11:59 p.m., local time in Ireland, on December 11, 2017 (the “record date”) are shareholders of record for the purposes of the Annual General Meeting and, other than Accenture Holdings and its direct and indirect subsidiaries, will be entitled to vote at the Annual General Meeting. As of such time, there were outstanding ordinary shares of Accenture Holdings held by shareholders of record (which numbers do not include Accenture Holdings ordinary shares held by Accenture Holdings and its direct and indirect subsidiaries). of those outstanding shares (or 96%) were held by Accenture plc, the controlling shareholder of Accenture Holdings. These shareholders of record will be entitled to one vote per ordinary share of Accenture Holdings on all matters submitted to a vote of shareholders, so long as those votes are represented at the Annual General Meeting. Your shares will be represented if you attend and vote at the Annual General Meeting in person or by proxy, which proxy need not be a shareholder of the Company. While we are not requesting a proxy from you and no further

1

votes are necessary to approve the matters scheduled to be voted on at the Annual General Meeting, you are entitled under Irish law to vote in person or by proxy. Any proxy, in the form prescribed by the Irish Companies Act, must be properly signed and dated and received at the Company’s registered office, located at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland, by no later than 8:00 a.m., local time in Ireland, on February 5, 2018.

Quorum and Voting Requirements; Appraisal Rights

Quorum. Under Accenture Holdings’ articles of association, no business shall be transacted at the Annual General Meeting unless a quorum is present. A quorum requires the presence of at least one person holding or representing by proxy (whether or not such holder actually exercises his or her voting rights in whole, in part or at all at the meeting) more than 50% of the total issued voting rights of ordinary shares of Accenture Holdings. The quorum requirement will be satisfied because Accenture plc, which held 96% of the aggregate outstanding Accenture Holdings ordinary shares entitled to vote as of the record date, will be present at the Annual General Meeting as required by Accenture Holdings’ articles of association.

Voting. The following table summarizes the voting requirements for each of the proposals set out in the notice of the Annual General Meeting, with each holder of Accenture Holdings ordinary shares of record and entitled to vote having one vote per share. Abstentions will not affect the voting results.

| | |

| Proposals | | Required Approval |

| | | |

| |

1. Approve the Common Draft Terms of Merger | | 75% of Votes Cast |

| |

2. Approve the Contract Pursuant to which Exactside Limited will Acquire Accenture Holdings Ordinary Shares | | 75% of Votes Cast |

| |

3. Grant Board Authority to Issue Accenture Holdings Ordinary Shares | | Majority of Votes Cast |

| |

4. Grant Board Authority to Opt-Out of Statutory Pre-emption Rights | | 75% of Votes Cast |

| |

5. Determine Price Range for the Re-Allotment of Treasury Shares | | 75% of Votes Cast |

| |

6. Authorization of Accenture International to Purchase Accenture Holdings Ordinary Shares Off-Market | | 75% of Votes Cast |

Accenture plc held 96% of the aggregate outstanding Accenture Holdings ordinary shares entitled to vote as of the record date and, therefore, has the power, acting by itself, to approve all matters scheduled to be voted upon at the Annual General Meeting. Accenture plc will vote all of the shares that it holds in favor of approving each of the proposals set out in the notice of the Annual General Meeting. Therefore, all such proposals will be passed at the Annual General Meeting.

Appraisal Rights. Any Accenture Holdings Shareholder has the right to submit a request in writing to Accenture plc, not more than 15 calendar days after the date of the Annual General Meeting, that Accenture plc acquire their Accenture Holdings ordinary shares for cash. See “Proposal Number One: The Merger—Appraisal Rights.”

2

QUESTIONS AND ANSWERS ABOUT THE ANNUAL GENERAL MEETING

We are not asking you for a proxy in connection with the Annual General Meeting.

GENERAL

| 1. | Q: Why am I receiving this information statement? |

| | A: | SEC rules require that we provide Accenture Holdings Shareholders with this information statement in connection with the approval of the proposed Merger and the other proposals included in this information statement, which will be acted upon at the upcoming Annual General Meeting. As of the record date, Accenture plc held 96% of the Accenture Holdings ordinary shares entitled to vote at the Annual General Meeting, and therefore has the power, acting by itself, to approve all matters scheduled to be voted upon at the Annual General Meeting. Accenture plc will vote all of the shares that it holds in favor of approving each of the proposals set out in the notice of the Annual General Meeting. Therefore, all proposals will be passed. |

| 2. | Q: What proposals are being voted on at the Annual General Meeting? |

| | A: | The following proposals are being voted on at the Annual General Meeting: |

| | (1) | the approval of the Common Draft Terms of Merger. Following the approval thereof, and assuming the other conditions to the Merger are satisfied, on the Effective Date of the Merger (which is expected to be a date in March 2018), Accenture Holdings Shareholders (other than Accenture plc and Accenture Holdings itself) will receive, on a one-for-one basis, Class A ordinary shares of Accenture plc; |

| | (2) | approving the contract pursuant to which Exactside Limited will acquire ordinary shares of Accenture Holdings; |

| | (3) | granting the Board the authority to issue shares under Irish law; |

| | (4) | granting the Board the authority to opt-out of statutory pre-emption rights under Irish law; |

| | (5) | to determine the price range at which Accenture Holdings can re-allot shares that it acquires as treasury shares under Irish law; and |

| | (6) | authorizing Accenture International to purchase ordinary shares off-market. |

The second through sixth proposals are not related to the Merger. The second proposal is a specific proposal to rationalize the Accenture Holdings share capital structure, which will remain in effect irrespective of whether the Merger is consummated. Proposals three through six replace existing ordinary course authorizations until the Merger is consummated and will remain in effect in the event the Merger is not consummated.

| 3. | Q: Who can vote at the Annual General Meeting? |

| | A: | All persons who were registered holders of Accenture Holdings ordinary shares at 11:59 p.m., local time in Ireland, on December 11, 2017, the record date for the Annual General Meeting, are shareholders of record for the purposes of the Annual General Meeting. Such shareholders, other than Accenture Holdings and its direct and indirect subsidiaries, will be entitled to attend and vote, in person or by a proxy (which proxy need not be a shareholder of the Company) designated by such holder, at the Annual General Meeting and any adjournments or postponements thereof. |

Each holder of Accenture Holdings ordinary shares entitled to vote will be entitled to one vote per share at the Annual General Meeting. Accenture plc held 96% of Accenture Holdings ordinary shares entitled to vote as of the record date and, therefore, has the power, acting by itself, to approve all matters scheduled to be voted upon at the Annual General Meeting.

3

VOTING AND MECHANICS

We are not asking you for a proxy in connection with the Annual General Meeting.

| | A: | You may vote your shares either by voting in person at the Annual General Meeting or by a proxy designated by you, which proxy holder need not be a shareholder of the Company. Any proxy in the form prescribed by the Irish Companies Act must be properly signed and dated and received by 8:00 a.m., local time in Ireland, on February 5, 2018 at the registered office of Accenture Holdings located at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland. You may revoke your proxy at any time prior to the commencement of the Annual General Meeting. |

Accenture plc held 96% of Accenture Holdings ordinary shares entitled to vote as of the record date and, therefore, has the power, acting by itself, to approve all matters scheduled to be voted upon at the Annual General Meeting. Accenture plc will vote all of the shares that it holds in favor of approving each of the proposals set out in the notice of the Annual General Meeting. Therefore, all proposals will be passed at the Annual General Meeting.

| 5. | Q: How do I attend the Annual General Meeting? |

| | A: | All Accenture Holdings Shareholders are invited to attend the Annual General Meeting at The Dock, located at 7 Hanover Quay, Grand Canal Dock, Dublin 2, Ireland. Proof of ownership of shares as of the record date, as well as a form of personal identification of the shareholder or the proxy designated by such holder, must be presented in order to be admitted to the Annual General Meeting. |

| 6. | Q: What quorum is required for action at the Annual General Meeting? |

| | A: | At the Annual General Meeting to approve the proposals, more than 50% of the Accenture Holdings ordinary shares issued and outstanding and entitled to vote at the Annual General Meeting as of the record date must be represented by at least one person in person or by a proxy designated by such holder (whether or not such holder actually exercises his or her voting rights in whole, in part or at all at the meeting) at the Annual General Meeting. |

The quorum requirement will be satisfied because Accenture plc, which held 96% of the aggregate outstanding Accenture Holdings ordinary shares entitled to vote as of the record date, will be present at the Annual General Meeting as required by Accenture Holdings’ articles of association. See “The Annual General Meeting—Record Date; Voting Rights; Vote Required for Approval.”

4

| 7. | Q: What vote of Accenture Holdings shareholders is required to approve the proposals? |

| | A: | The following table summarizes the voting requirements for each of the proposals set out in the notice of the Annual General Meeting, with each holder of Accenture Holdings ordinary shares of record and entitled to vote having one vote per share. Abstentions will not affect the voting results. |

| | |

| Proposals | | Required Approval |

| | | |

| |

1. Approve the Common Draft Terms of Merger | | 75% of Votes Cast |

| |

2. Approve the Contract Pursuant to which Exactside Limited will Acquire Accenture Holdings Ordinary Shares | | 75% of Votes Cast |

| |

3. Grant Board Authority to Issue Accenture Holdings Ordinary Shares | | Majority of Votes Cast |

| |

4. Grant Board Authority to Opt-Out of Statutory Pre-emption Rights | | 75% of Votes Cast |

| |

5. Determine Price Range for the Re-Allotment of Treasury Shares | | 75% of Votes Cast |

| |

6. Authorization of Accenture International to Purchase Accenture Holdings Ordinary Shares Off-Market | | 75% of Votes Cast |

Accenture plc held 96% of Accenture Holdings ordinary shares entitled to vote as of the record date and, therefore, has the power, acting by itself, to approve all matters scheduled to be voted upon at the Annual General Meeting. Accenture plc will vote all of the shares that it holds in favor of approving each of the proposals set out in the notice of the Annual General Meeting. Therefore, all proposals will be passed at the Annual General Meeting. See “The Annual General Meeting—Record Date; Voting Rights; Vote Required for Approval.”

QUESTIONS AND ANSWERS ABOUT THE MERGER

The boards of directors of Accenture Holdings and Accenture plc, have approved the merger of Accenture Holdings with and into Accenture plc. In order to consummate the Merger, Accenture Holdings Shareholders will be asked to approve the Common Draft Terms of Merger at the Annual General Meeting.

| 8. | Q: Why do you want to merge Accenture Holdings with and into Accenture plc? |

| | A. | We believe the Merger has many benefits for both Accenture and Accenture Holdings Shareholders. Simplifying and consolidating the Accenture group structure will result in economic efficiencies and reduce administrative burdens for Accenture, including no longer having to prepare financial statements and file reports with the SEC for Accenture Holdings after the Merger. In addition, the Class A ordinary shares of Accenture plc that Accenture Holdings Shareholders will receive in the Merger will be listed and tradable on the NYSE, which will make any future sales of these shares easier for such holder. Further, Accenture Holdings Shareholders, who currently may only redeem their Accenture Holdings ordinary shares for Class A ordinary shares of Accenture plc during specified trading windows, will no longer be subject to such restrictions provided they are no longer Accenture employees (or their related parties). There will be no change in how Accenture goes to market, how we manage our business or how we serve our clients. |

See “Proposal Number One: The Merger—Reasons for the Merger” and “Risk Factors.”

5

| 9. | Q: What are the steps required to effect the Merger? |

A. There are several steps required to effect the Merger:

Shareholder Approval. On February 5, 2018, we will hold the Annual General Meeting to approve, among other proposals, the Common Draft Terms of Merger. Accenture plc, which held 96% of the aggregate outstanding Accenture Holdings ordinary shares entitled to vote as of the record date, will vote all of the shares that it holds in favor of approving the Common Draft Terms of Merger. Therefore, the proposal will be passed at the Annual General Meeting. See “The Annual General Meeting.”

As a condition to the Merger, pursuant to Accenture plc’s articles of association, the holders of Accenture plc ordinary shares are also required to approve the Common Draft Terms of Merger by ordinary resolution. The holders of Accenture plc ordinary shares will consider and vote on the proposal to approve the Common Draft Terms of Merger at Accenture plc’s 2018 annual general meeting of shareholders, expected to be held on February 7, 2018.

Preliminary Irish High Court Approval. On November 27, 2017, upon the joint application of the Company and Accenture plc, the Irish High Court held a preliminary hearing and issued an order providing (1) solely to meet certain requirements of the Irish Companies Act, the appointment of PwC as the joint expert acting for Accenture Holdings and Accenture plc related to the fairness of the exchange ratio that determines the shares to be issued in the Merger and (2) that the Irish High Court would determine the fairness of the terms and conditions of the Merger, both procedurally and substantively, to all persons to whom it is proposed to issue shares of Accenture plc in connection therewith.

Final Irish High Court Approval. Shortly after the Annual General Meeting and Accenture plc’s 2018 annual general meeting, and assuming Accenture plc has obtained the necessary shareholder approval, Accenture plc and Accenture Holdings will jointly apply to the Irish High Court for an order confirming the Merger and determining the fairness of the terms and conditions of the Merger, both procedurally and substantively, to Accenture Holdings Shareholders, and setting the Effective Date of the Merger. See “Proposal Number One: The Merger—Appraisal Rights.” This Irish High Court application involves a preliminary hearing where the Irish High Court will set a date for the hearing of the substantive application. At the final hearing, the Irish High Court will be requested to make an order confirming the Merger in accordance with the Irish Companies Act, as well as make a determination of the fairness of the terms and conditions of the Merger, both procedurally and substantively, to Accenture Holdings Shareholders.

Effectiveness. If all of the conditions are satisfied (and we and Accenture plc do not abandon the Merger prior to obtaining the Irish High Court’s final order described above), the Merger will take effect on the Effective Date prescribed in such order. We currently anticipate the Effective Date to be a date in March 2018.

| 10. | Q: What happens on the Effective Date of the Merger? |

| | A: | On the Effective Date of the Merger, the following steps will occur by operation of law: |

| | 1. | Accenture Holdings will be merged with and into Accenture plc, with Accenture plc as the surviving entity (Accenture Holdings will be dissolved without going into liquidation as a result); |

| | 2. | all of the assets and liabilities of Accenture Holdings will be acquired by Accenture plc; |

| | 3. | each Accenture Holdings Shareholder (other than Accenture plc and Accenture Holdings itself) will receive one Class A ordinary share of Accenture plc for every one ordinary share of Accenture Holdings held by such shareholder; |

| | 4. | all legal proceedings pending by or against Accenture Holdings will be continued with the substitution, for Accenture Holdings, of Accenture plc as a party; and |

6

| | 5. | contracts, agreements or instruments to which Accenture Holdings is a party will be construed and have effect as if Accenture plc had been a party thereto instead of Accenture Holdings, and Accenture plc will have the same rights and be subject to the same obligations to which Accenture Holdings is subject under such contracts, agreements or instruments. |

After the Merger, the number of Class A ordinary shares you will own in Accenture plc will be the same as the number of ordinary shares you owned in Accenture Holdings immediately prior to the Merger.

In addition, on or following the Effective Date of the Merger, Accenture plc will redeem, without any action on the part of the former Accenture Holdings Shareholders, the outstanding Class X ordinary shares of Accenture plc held by the then former Accenture Holdings Shareholders (the nominal value of each Class X ordinary share is $0.0000225 per share) in accordance with Accenture plc’s articles of association. See “Proposal Number One: The Merger—Redemption of Accenture plc Class X Ordinary Shares.”

As Accenture plc and Accenture Holdings are both Irish public limited companies under the Irish Companies Act, there are many similarities between their respective memoranda and articles of association. There are, however, certain differences. These differences are summarized under “Rights of Holders of Accenture Holdings Ordinary Shares and Accenture plc Class X Ordinary Shares Compared to Rights of Holders of Accenture plc Class A Ordinary Shares.”

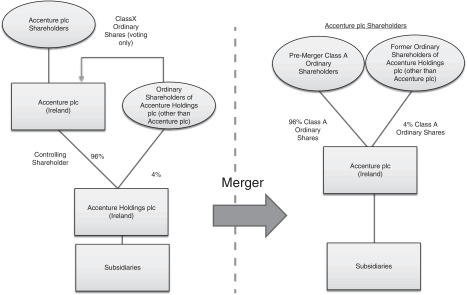

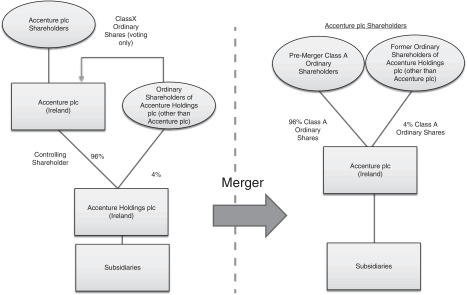

The following diagram depicts our voting power and abbreviated organizational structure before and after the Merger:

| 11. | Q: When is the Merger expected to be completed? |

| | A: | We currently expect to complete the Merger in March 2018. However, until the issuance of the order of the Irish High Court, which we need in order to complete the Merger, the Merger may be abandoned or delayed by the board of directors of Accenture Holdings and/or the board of directors of Accenture plc, even if the Merger has been approved by Accenture Holdings Shareholders and Accenture plc shareholders and all other conditions to the Merger (other than the approval of the Irish High Court) have been satisfied. |

See “Proposal Number One: The Merger—Amendment, Termination or Delay.”

7

| 12. | Q: Do I have appraisal rights with respect to the Accenture Holdings ordinary shares I own? |

| | A: | Yes. All Accenture Holdings Shareholders have the right to submit a request in writing to Accenture plc, not more than 15 calendar days after the date of the Annual General Meeting, that Accenture plc acquire their Accenture Holdings ordinary shares for cash. Where a valid request is made by an Accenture Holdings Shareholder, Accenture plc shall purchase such Accenture Holdings ordinary shares held by that shareholder at a price per share which is expected to be equal to the closing price of one Class A ordinary share of Accenture plc on the NYSE on the day before the Effective Date. See “Proposal Number One: The Merger—Appraisal Rights.” |

| 13. | Q: How will my rights as a holder of Class A ordinary shares of Accenture plc differ from my rights as a holder of ordinary shares of Accenture Holdings? |

| | A: | The economic rights and interests of holders of Class A ordinary shares of Accenture plc are similar to those of holders of ordinary shares of Accenture Holdings. However, there are differences between what your rights will be as holder of Class A ordinary shares of Accenture plc and what they currently are as a shareholder of Accenture Holdings. We discuss these differences in detail under “Description of Share Capital of Accenture plc” and “Rights of Holders of Accenture Holdings Ordinary Shares and Accenture plc Class X Ordinary Shares Compared to Rights of Holders of Accenture plc Class A Ordinary Shares.” Accenture plc is governed by Irish law, in particular by the Irish Companies Act, and its memorandum and articles of association, which is incorporated by reference herein. |

TAX MATTERS RELATED TO THE MERGER

Please refer to “Material Tax Considerations Relating to the Merger” for a description of the material U.S. federal income tax and Irish tax consequences of the Merger to Accenture plc shareholders and Accenture Holdings Shareholders. Determining the actual tax consequences of the Merger to you may be complex and will depend on your specific situation. We urge you to consult your personal tax advisors.

| 14. | Q: Is the Merger taxable to me? |

| | A: | U.S. Federal Income Tax |

U.S. Holders and Non-U.S. Holders (as defined in “Material Tax Considerations Relating to the Merger—Material U.S. Federal Income Tax Considerations”) will not recognize gain or loss for U.S. federal income tax purposes in the Merger. However, this conclusion applies only to U.S. Holders and Non-U.S. Holders who hold their Accenture Holdings ordinary shares as capital assets (as defined in “Material Tax Considerations Relating to the Merger—Material U.S. Federal Income Tax Considerations”). See “Material Tax Considerations Relating to the Merger—Material U.S. Federal Income Tax Considerations.”

Irish Tax

Non-Irish Holders (as defined in “Material Tax Considerations Relating to the Merger—Material Irish Tax Considerations”) will not be subject to Irish capital gains tax (“Irish CGT”) on the cancellation of their Accenture Holdings ordinary shares or on the receipt of Class A ordinary shares of Accenture plc, or the exercise of the appraisal rights in connection with the Merger in respect of their Accenture Holdings ordinary shares. However, this conclusion applies only to Non-Irish Holders who hold their Accenture Holdings ordinary shares as capital assets. See “Material Tax Considerations Relating to the Merger—Material Irish Tax Considerations—Irish Tax on Chargeable Gains (Irish CGT).”

Tax Residents of Other Jurisdictions

Accenture Holdings Shareholders who are tax resident in other jurisdictions should not recognize a gain or loss as a result of the Merger. However, tax laws are complex and the tax consequences in any

8

individual case may depend on the facts and circumstances. You should consult your personal tax advisors concerning the applicable tax consequences of the Merger.

| 15. | Q: Will there be any Irish withholding tax on dividends paid on Class A ordinary shares of Accenture plc? |

| | A: | As with your Accenture Holdings ordinary shares, Irish dividend withholding tax (“DWT”) (currently at a rate of 20%) will apply to dividends paid on Class A ordinary shares of Accenture plc unless shareholders qualify for an exemption. Shareholders resident in the United States, any European Union member state (other than Ireland) or any country with which Ireland has signed a tax treaty (see Annex B attached to this information statement) (together, the “Exempt Territories”) may be entitled to an exemption from DWT, provided the appropriate documentation has been timely furnished to your broker (for shares held through DTC) or Accenture plc’s transfer agent (for shares held directly). If you are a shareholder resident in the United States and you hold Accenture plc Class A ordinary shares in a brokerage account through DTC and you have a valid Form W-9 on file with your broker, you will be exempt from DWT without further action. In addition, if you already have a valid Irish DWT form on file with respect to your existing Accenture Holdings ordinary shares or any Accenture plc Class A ordinary shares held prior to the Merger, then no further action is required. Shareholders should contact their personal tax advisors or GlobeTax at +1 212-747-9100 or eCertsIreland@GlobeTax.com (please note that minor administrative fees will apply). Accenture plc shareholders that are not residents in an Exempt Territory may be subject to DWT. |

See “Material Tax Considerations Relating to the Merger—Material Irish Tax Considerations— Withholding Tax on Dividends (DWT).”

You should consult your personal tax advisors as to the tax consequences of receiving dividends on Class A ordinary shares of Accenture plc.

| 16. | Q: Will there be Irish capital acquisitions tax (“CAT”) on gifts and/or inheritances of Class A ordinary shares of Accenture plc after the Merger? |

| | A: | CAT applies to a gift or inheritance of Irish property irrespective of the place of residence, ordinary residence, or domicile of the donor or recipient. The recipient has primary liability for CAT, which is currently levied at a rate of 33% on the value of any taxable gift or inheritance, subject to any exemptions and reliefs. |

A gift or inheritance of Accenture Holdings ordinary shares may be subject to CAT. After the consummation of the Merger, while there is uncertainty surrounding the applicability of CAT, and there can be no assurance that CAT will not be due in connection with a gift or inheritance of Class A ordinary shares of Accenture plc, you will be in no worse position than you are currently. See “Material Tax Considerations Relating to the Merger—Material Irish Tax Considerations—Capital Acquisitions Tax (CAT).”

| 17. | Q: Will there be Irish stamp duty on the Merger or on the transfer of Class A ordinary shares of Accenture plc after the Merger? |

| | A: | No stamp duty will be payable by any Accenture Holdings Shareholder on the Merger. |

A transfer of Class A ordinary shares of Accenture plc effected by the transfer of a book-entry interest beneficially held through a broker or custodian (and through DTC) will not be subject to Irish stamp duty. Other transfers of Class A ordinary shares of Accenture plc may be subject to Irish stamp duty (currently levied at the rate of 1% of the price paid or the market value of the Class A ordinary shares of Accenture plc acquired, if higher) payable by the buyer.

See “Material Tax Considerations Relating to the Merger—Material Irish Tax Considerations—Stamp Duty.”

9

| 18. | Q: Is the Merger a taxable transaction for Accenture Holdings or Accenture plc? |

| | A: | No. The Merger will not be a taxable transaction for Accenture Holdings or Accenture plc. |

OTHER MATTERS RELATED TO THE MERGER

| 19. | Q: Will the Merger dilute my economic interest? |

| | A: | No. Your economic interest in Accenture plc will be essentially the same as your economic interest in Accenture Holdings prior to the Merger. |

| 20. | Q: If the Merger is approved, do I have to take any action to participate in the Merger? |

| | A: | No. Assuming the other conditions to the Merger are satisfied, on the Effective Date of the Merger (which is expected to be a date in March 2018), you will receive, on a one-for-one basis, Class A ordinary shares of Accenture plc for every Accenture Holdings ordinary share that you then hold, without any further action on your part. |

See “Proposal Number One: The Merger—No Action Required to Receive Class A ordinary shares of Accenture plc.”

| 21. | Q: How will I hold the Class A ordinary shares of Accenture plc I receive in connection with the Merger? |

| | A: | You will hold the Class A ordinary shares of Accenture plc you receive in connection with the Merger beneficially (through an account in your name with one of the Company’s brokers, Morgan Stanley or UBS Financial Services, which in turn holds those shares through DTC), and not directly as the holder of record of such shares. Cede & Co. as nominee for DTC will be the holder of record of such shares. You may opt to hold your shares directly, rather than through a broker, but there will be adverse tax consequences. If you have any questions on how the Class A ordinary shares of Accenture plc received in connection with the Merger will be held please contact us at Leadership_Holdings@Accenture.com or +1 703-948-5165. |

| 22. | Q: Will I be able to have my Accenture Holdings ordinary shares redeemed for Class A ordinary shares of Accenture plc between the date of this information statement and the Effective Date of the Merger? |

| | A: | Yes. Accenture Holdings ordinary shares will continue to be redeemable during this period, subject to the restrictions on redemption contained in Accenture Holdings’ memorandum and articles of association, Irish law and any contractual restrictions on redemption that may be applicable to a holder. Accenture Holdings ordinary shares are redeemable at the option of any holder by giving irrevocable notice of an election for redemption to Accenture Holdings. The redemption price is payable in cash or, at the election of the Board, in Class A ordinary shares of Accenture plc. |

| 23. | Q: Whom should I contact if I have questions about the Annual General Meeting or the Merger? |

| | A: | Please contact us at Leadership_Holdings@Accenture.com or +1 703-948-5165. |

IMPACT ON THE ACCENTURE GROUP

| 24. | Q: Will the Merger affect the Accenture group’s operations? |

| | A: | No. The Merger will not change how Accenture goes to market, how we manage our business or how we serve our clients. |

10

| 25. | Q: How will the Merger affect Accenture Holdings’ financial reporting? |

| | A: | On the Effective Date of the Merger, Accenture Holdings will be dissolved. As a result, it will no longer be subject to SEC reporting requirements and will no longer prepare separate financial statements or file reports on Forms 10-K, 10-Q and 8-K with the SEC. However, Accenture plc’s Class A ordinary shares are listed on the NYSE, and Accenture plc is a SEC registrant that will continue to be required to file periodic reports with the SEC on Forms 10-K, 10-Q and 8-K. Accenture plc’s financial statements consolidate the results of Accenture plc and its subsidiaries. Accenture plc is also required to prepare financial statements in accordance with Irish law and in connection with the Merger, Accenture Holdings Shareholders are entitled to inspect or request copies, free of charge, of Accenture plc’s Irish financial statements for its last three financial years. These materials are available for inspection free of charge at Accenture Holdings’ registered office. To request copies of any of these materials, Accenture Holdings Shareholders should make a written request to Accenture Holdings plc c/o Accenture, 161 N. Clark Street, Chicago, IL 60601, United States of America, Attention: Secretary; or at Accenture Holdings’ registered office at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland, Attention: Secretary. |

| 26. | Q: Will the Merger have any impact on Accenture plc’s ability to pay dividends or buy back shares? |

| | A: | No. The Merger will not negatively impact on Accenture plc’s ability to pay dividends or buy back shares. Under Irish law, dividends and buy backs of Accenture plc shares must be paid out of “profits available for distribution,” and we expect that Accenture plc will continue to have sufficient profits available for distribution to make distributions by way of dividends or buy backs. |

| 27. | Q: What effect would a failure to complete the Merger have on Accenture Holdings? |

| | A: | If the Merger is not completed, Accenture Holdings would continue to exist as a separate Irish entity. We may consider other alternatives in the event that the Merger is not completed. |

11

SUMMARY

This summary highlights selected information from this information statement. It does not contain all of the information that is important to you. To understand the proposals presented at the Annual General Meeting more fully, and for a more complete legal description of the Merger, you should read carefully the entire information statement, including the Annexes. The Common Draft Terms of Merger, the form of which is attached as Annex A to this information statement, is the legal document that governs the Merger. As is the case with Accenture Holdings, Accenture plc is governed by Irish law, in particular by the Irish Companies Act, and its memorandum and articles of association, which is incorporated by reference herein. We encourage you to read those documents carefully.

Annual General Meeting

Purpose of this Information Statement

SEC rules require that we provide the shareholders of Accenture Holdings with this information statement in connection with the approval of the proposed Merger and the other proposals included in this information statement, which will be acted upon at the upcoming Annual General Meeting. As of the record date, Accenture plc held 96% of the Accenture Holdings ordinary shares entitled to vote at the Annual General Meeting, and therefore has the power, acting by itself, to approve all matters scheduled to be voted upon at the Annual General Meeting. Accenture plc will vote all of the shares that it holds in favor of approving each of the proposals set out in the notice of the Annual General Meeting. Therefore, all proposals will be passed at the Annual General Meeting.

Time, Place, Date and Purpose of the Annual General Meeting

The Annual General Meeting is scheduled to be held at 12:30 p.m. local time in Ireland, on February 5, 2018, at The Dock, located at 7 Hanover Quay, Grand Canal Dock, Dublin 2, Ireland. At the meeting, Accenture Holdings Shareholders will vote on the following proposals to:

| | 1. | approve the Common Draft Terms of Merger. Following the approval thereof, and assuming the other conditions to the Merger are satisfied, on the Effective Date of the Merger (which is expected to be a date in March 2018), Accenture Holdings Shareholders (other than Accenture plc and Accenture Holdings itself) will receive, on a one-for-one basis, Class A ordinary shares of Accenture plc; |

| | 2. | approve the contract pursuant to which Exactside Limited will acquire ordinary shares of Accenture Holdings; |

| | 3. | grant the Board the authority to issue shares under Irish law; |

| | 4. | grant the Board the authority to opt-out of statutory pre-emption rights under Irish law; |

| | 5. | determine the price range at which Accenture Holdings can re-allot shares that it acquires as treasury shares under Irish law; and |

| | 6. | authorize Accenture International to purchase ordinary shares off-market. |

The second through sixth proposals are not related to the Merger. The second proposal is a specific proposal to rationalize the Accenture Holdings share capital structure, which will remain in effect irrespective of whether the Merger is consummated. Proposals three through six replace existing ordinary course authorizations until the Merger is consummated and will remain in effect in the event the Merger is not consummated.

Record Date

All persons who were registered Accenture Holdings Shareholders at 11:59 p.m., local time in Ireland, on December 11, 2017, the record date for the Annual General Meeting, are shareholders of record for the purposes of the Annual General Meeting and, other than Accenture Holdings and its direct and indirect subsidiaries, will

12

be entitled to attend and vote, in person or by a proxy (which proxy need not be a shareholder of the Company) designated by such holder, at the Annual General Meeting and any adjournments or postponements thereof.

Quorum

At the Annual General Meeting, the presence of one person holding or representing by proxy (whether or not such holder actually exercises his or her voting rights in whole, in part or at all at the meeting) more than 50% of the Accenture Holdings ordinary shares outstanding and entitled to vote at the Annual General Meeting as of the record date constitutes a quorum for the conduct of business at the Annual General Meeting. The quorum requirement will be satisfied because Accenture plc, which held 96% of the aggregate outstanding Accenture Holdings ordinary shares entitled to vote as of the record date, will be present at the Annual General Meeting as required by Accenture Holdings’ articles of association.

Required Vote

The following table summarizes the voting requirements for each of the proposals set out in the notice of the Annual General Meeting, with each holder of Accenture Holdings ordinary shares of record and entitled to vote having one vote per share. Abstentions will not affect the voting results.

| | |

| Proposals | | Required Approval |

| | | |

| |

1. Approve the Common Draft Terms of Merger | | 75% of Votes Cast |

| |

2. Approve the Contract Pursuant to which Exactside Limited will Acquire Accenture Holdings Ordinary Shares | | 75% of Votes Cast |

| |

3. Grant Board Authority to Issue Accenture Holdings Ordinary Shares | | Majority of Votes Cast |

| |

4. Grant Board Authority to Opt-Out of Statutory Pre-emption Rights | | 75% of Votes Cast |

| |

5. Determine Price Range for the Re-Allotment of Treasury Shares | | 75% of Votes Cast |

| |

6. Authorization of Accenture International to Purchase Accenture Holdings Ordinary Shares Off-Market | | 75% of Votes Cast |

Accenture plc held 96% of the aggregate outstanding Accenture Holdings ordinary shares entitled to vote as of the record date and, therefore, has the power, acting by itself, to approve all matters scheduled to be voted upon at the Annual General Meeting. Accenture plc will vote all of the shares that it holds in favor of approving each of the proposals set out in the notice of the Annual General Meeting. Therefore, all such proposals will be passed at the Annual General Meeting.

Summary of Proposal Number One: The Merger

Parties to the Merger

Accenture plc. Accenture plc is an Irish public limited company with no material assets other than Accenture Holdings ordinary shares. Accenture plc operates its business through subsidiaries of Accenture Holdings. Accenture plc is the parent company and controlling shareholder of Accenture Holdings and owned 96% of Accenture Holdings ordinary shares entitled to vote at the Annual General Meeting as of the record date. As the controlling shareholder of Accenture Holdings and as a result of Accenture plc’s majority voting interest in Accenture Holdings, Accenture plc controls Accenture Holdings’ management and operations and consolidates Accenture Holdings’ results in its consolidated financial statements.

13

Accenture plc, together with its consolidated subsidiaries, including Accenture Holdings, is one of the world’s leading professional services companies, providing services and solutions in strategy, consulting, digital, technology and operations to clients across a broad range of industries. Accenture employs approximately 425,000 people and has offices and operations in more than 200 cities in 53 countries. Accenture’s revenues before reimbursements were $34.9 billion for the fiscal year ended August 31, 2017.

Pursuant to the Merger, Accenture plc will be the surviving entity and on the Effective Date of the Merger will, among other things, acquire all of the assets and liabilities of Accenture Holdings and assume or take over all contractual rights and obligations of Accenture Holdings.

Accenture Holdings plc. Accenture Holdings is an Irish public limited company, having its registered office at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland. Its company registration number is 560222. Accenture Holdings is a subsidiary of Accenture plc. Following the Merger, Accenture Holdings will cease to exist.

The Merger

Accenture Holdings Shareholders are being asked to approve, among other proposals, the Common Draft Terms of Merger at the Annual General Meeting. Following the approval thereof, and assuming the other conditions to the Merger are satisfied, on the Effective Date of the Merger (which is expected to be a date in March 2018), Accenture Holdings Shareholders (other than Accenture plc and Accenture Holdings itself) will receive, on a one-for-one basis, Class A ordinary shares of Accenture plc.

There are several steps required to effect the Merger:

Shareholder Approval. On February 5, 2018, we will hold the Annual General Meeting to approve, among other proposals, the Common Draft Terms of Merger. Accenture plc, which held 96% of the aggregate outstanding Accenture Holdings ordinary shares entitled to vote as of the record date, will vote all of the shares that it holds in favor of approving the Common Draft Terms. Therefore, the proposal will be passed at the Annual General Meeting. See “The Annual General Meeting.”

As a condition to the Merger, pursuant to Accenture plc’s articles of association, the holders of Accenture plc ordinary shares are also required to approve the Common Draft Terms of Merger by ordinary resolution. The holders of Accenture plc ordinary shares will consider and vote on the proposal to approve the Common Draft Terms of Merger at Accenture plc’s 2018 annual general meeting of shareholders, expected to be held on February 7, 2018.

Preliminary Irish High Court Approval. On November 27, 2017, upon the joint application of the Company and Accenture plc, the Irish High Court held a preliminary hearing and issued an order providing (1) solely to meet certain requirements of the Irish Companies Act, the appointment of PwC as the joint expert acting for Accenture Holdings and Accenture plc related to the fairness of the exchange ratio that determines the shares of Accenture plc to be issued in the Merger and (2) that the Irish High Court would determine the fairness of the terms and conditions of the Merger, both procedurally and substantively, to all persons to whom it is proposed to issue shares of Accenture plc in connection therewith.

Final Irish High Court Approval. Shortly after the Annual General Meeting and Accenture plc’s 2018 annual general meeting, and assuming Accenture plc has obtained the necessary shareholder approval, Accenture plc and Accenture Holdings will jointly apply to the Irish High Court for an order confirming the Merger and determining the fairness of the terms and conditions of the Merger, both procedurally and substantively, to Accenture Holdings Shareholders, and setting the Effective Date of the Merger. This Irish High Court application involves a preliminary hearing where the Irish High Court will set a date for the hearing of the substantive application. At the final hearing, the Irish High Court will be requested to make an order confirming

14

the Merger in accordance with the Irish Companies Act, as well as make a determination of the fairness of the terms and conditions of the Merger, both procedurally and substantively, to Accenture Holdings Shareholders.

Effectiveness. If all of the conditions are satisfied (and we and Accenture plc do not abandon the Merger prior to obtaining the Irish High Court’s final order), the Merger will take effect on the Effective Date prescribed in the final order. We currently anticipate the Effective Date to be a date in March 2018.

On the Effective Date of the Merger, the following steps will occur by operation of law:

| | 1. | Accenture Holdings will be merged with and into Accenture plc, with Accenture plc as the surviving entity (Accenture Holdings will be dissolved without going into liquidation); |

| | 2. | all of the assets and liabilities of Accenture Holdings will be acquired by Accenture plc; |

| | 3. | each Accenture Holdings Shareholder (other than Accenture plc and Accenture Holdings itself) will receive one Class A ordinary share of Accenture plc for every one ordinary share of Accenture Holdings held by such shareholder; |

| | 4. | all legal proceedings pending by or against Accenture Holdings will be continued with the substitution, for Accenture Holdings, of Accenture plc as a party; and |

| | 5. | contracts, agreements or instruments to which Accenture Holdings is a party will be construed and have effect as if Accenture plc had been a party thereto instead of Accenture Holdings, and Accenture plc will have the same rights and be subject to the same obligations to which Accenture Holdings is subject under such contracts, agreements or instruments. |

After the Merger, the number of Class A ordinary shares you will own in Accenture plc will be the same as the number of ordinary shares you owned in Accenture Holdings immediately prior to the Merger.

In addition, on or following the Effective Date of the Merger, Accenture plc will redeem, without any action on the part of the former Accenture Holdings Shareholders, the outstanding Class X ordinary shares of Accenture plc held by the then former Accenture Holdings Shareholders (the nominal value of each Class X ordinary share is $0.0000225 per share) in accordance with Accenture plc’s articles of association.

As Accenture plc and Accenture Holdings are both Irish public limited companies under the Irish Companies Act, there are many similarities between their respective memoranda and articles of association. There are, however, certain differences. These differences are summarized under “Rights of Holders of Accenture Holdings Ordinary Shares and Accenture plc Class X Ordinary Shares Compared to Rights of Holders of Accenture plc Class A Ordinary Shares.”

Accenture plc held 96% of Accenture Holdings ordinary shares entitled to vote as of the record date and will vote in favor of approving Proposal Number One. Therefore, Proposal Number One will be passed at the Annual General Meeting.

Upon completion of the Merger, Accenture Holdings will no longer be subject to SEC reporting requirements and will no longer prepare separate financial statements or file reports on Forms 10-K, 10-Q and 8-K with the SEC. However, Accenture plc’s Class A ordinary shares are listed on the NYSE, and Accenture plc is a SEC registrant that will continue to be required to file periodic reports with the SEC on Forms 10-K, 10-Q and 8-K. Accenture plc’s financial statements consolidate the results of Accenture plc and its subsidiaries. Accenture plc is also required to prepare financial statements in accordance with Irish law and in connection with the Merger, Accenture Holdings Shareholders are entitled to inspect or request copies, free of charge, of Accenture

15

plc’s Irish financial statements for its last three financial years. You may request copies of any of these materials by making a written request to Accenture Holdings plc c/o Accenture, 161 N. Clark Street, Chicago, IL 60601, United States of America, Attention: Secretary; or at Accenture Holdings’ registered office at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland, Attention: Secretary.

Reasons for the Merger

We believe the Merger has many benefits for both Accenture and Accenture Holdings Shareholders. Simplifying and consolidating the Accenture group structure will result in economic efficiencies and reduce administrative burdens for Accenture, including no longer having to prepare financial statements and file reports with the SEC for Accenture Holdings after the Merger. In addition, the Class A ordinary shares of Accenture plc that Accenture Holdings Shareholders will receive in the Merger will be listed and tradable on the NYSE, which will make any future sales of these shares easier for the holder. Further, Accenture Holdings Shareholders, who currently may only redeem their Accenture Holdings ordinary shares for Class A ordinary shares of Accenture plc during specified trading windows, will no longer be subject to such restrictions provided they are no longer Accenture employees (or their related parties). There will be no change in how Accenture goes to market, how we manage our business or how we serve our clients.

We cannot assure you that the anticipated benefits of the Merger will be realized. In addition to the potential benefits described above, the Merger will expose us and you to some risks, including that your rights as a shareholder will change as a result of the Merger and that we may choose to abandon or delay the Merger.

See “Proposal Number One: The Merger—Reasons for the Merger” and “Risk Factors.”

The Board, which has considered both the potential advantages of the Merger and its associated risks, has approved the Common Draft Terms of Merger. The Board recommends that Accenture Holdings Shareholders vote “FOR” Proposal Number One. Accenture plc, which held 96% of the aggregate outstanding Accenture Holdings ordinary shares entitled to vote as of the record date, will vote all of the shares that it holds in favor of approving the proposal. Therefore, Proposal Number One will be passed at the Annual General Meeting.

Tax Considerations of the Merger

U.S. Federal Income Tax. U.S. Holders and Non-U.S. Holders (as defined in “Material Tax Considerations Relating to the Merger—Material U.S. Federal Income Tax Considerations”) will not recognize gain or loss for U.S. federal income tax purposes in the Merger. However, this conclusion applies only to U.S. Holders and Non-U.S. Holders who hold their Accenture Holdings ordinary shares as capital assets (as defined in “Material Tax Considerations Relating to the Merger—Material U.S. Federal Income Tax Considerations”). See “Material Tax Considerations Relating to the Merger—Material U.S. Federal Income Tax Considerations.”

Irish Tax. Non-Irish Holders (as defined in “Material Tax Considerations Relating to the Merger—Material Irish Tax Considerations”) will not be subject to Irish CGT on the cancellation of their Accenture Holdings ordinary shares or on the receipt of Class A ordinary shares of Accenture plc, or the exercise of the appraisal rights in connection with the Merger in respect of their Accenture Holdings ordinary shares. However, this conclusion applies only to Non-Irish Holders who hold their Accenture Holdings ordinary shares as capital assets. See “Material Tax Considerations Relating to the Merger—Material Irish Tax Considerations—Irish Tax on Chargeable Gains (Irish CGT).”

Tax Residents of Other Jurisdictions. Accenture Holdings Shareholders who are tax residents in other jurisdictions should not recognize a gain or loss as a result of the Merger. However, tax laws are complex and the tax consequences in any individual case may depend on the facts and circumstances. You should consult your personal tax advisors concerning the applicable tax consequences of the Merger.

16

You should consult your personal tax advisors concerning the tax consequences of receiving, holding, disposing of, and receiving dividends on Class A ordinary shares of Accenture plc received pursuant to the Merger.

Rights of Shareholders

Accenture plc and Accenture Holdings are both Irish public limited companies under the Irish Companies Act. The rights of holders of Class A ordinary shares of Accenture plc are similar to those of holders of ordinary shares of Accenture Holdings. However, there are differences between what your rights will be as a shareholder of Accenture plc and what they currently are as a shareholder of Accenture Holdings. We discuss these differences in detail under “Description of Share Capital of Accenture plc” and “Rights of Holders of Accenture Holdings Ordinary Shares and Accenture plc Class X Ordinary Shares Compared to Rights of Holders of Accenture plc Class A Ordinary Shares.” Accenture plc’s memorandum and articles of association is incorporated by reference herein.

Redemption of Accenture plc Class X Ordinary Shares

Class X ordinary shares of Accenture plc provide certain Accenture Holdings Shareholders with a vote at Accenture plc shareholder meetings that is equivalent to the voting rights held by Accenture plc Class A ordinary shareholders. Accenture plc has separately agreed with the original holders of Accenture Holdings ordinary shares not to redeem any Class X ordinary share of Accenture plc of such holder if the redemption would reduce the number of Class X ordinary shares held by that holder to a number that is less than the number of Accenture Holdings ordinary shares owned by that holder. On or following the Effective Date of the Merger, Accenture plc will redeem, without any action on the part of the former Accenture Holdings Shareholders, the outstanding Class X ordinary shares of Accenture plc held by the then former Accenture Holdings Shareholders (the nominal value of each Class X ordinary share is $0.0000225 per share) in accordance with Accenture plc’s articles of association.

Stock Exchange Listing

Accenture Holdings ordinary shares are not listed on any stock exchange. Class A ordinary shares of Accenture plc are listed on the NYSE trading under the symbol “ACN.” The Merger will not affect the stock exchange listing of Accenture plc’s shares.

Accounting Treatment of the Merger

Under U.S. GAAP, the Merger represents a transaction between entities under common control. Assets and liabilities transferred between entities under common control are accounted for at historical cost. Accordingly, the assets and liabilities of Accenture Holdings will be reflected at their carrying amounts in the consolidated group accounts of Accenture plc at the time of the Merger.

Summary of Proposal Number Two: Approve the Contract Pursuant to which Exactside Limited will Acquire Accenture Holdings Ordinary Shares

As part of an Accenture intra group transaction, we propose to authorize Exactside Limited to acquire all of the ordinary shares held in Accenture Holdings by another subsidiary of Accenture Holdings. Under Irish law, Exactside Limited, as a subsidiary of Accenture Holdings, may only acquire such ordinary shares pursuant to a contract that has been authorized by special resolution of the shareholders of Exactside Limited and Accenture Holdings before entry into the contract. The proposed contract will be approved by the sole shareholder of Exactside Limited, Accenture International, by written resolution on or before the date of the Annual General

17

Meeting. Pursuant to the proposed contract, the existing shareholder will agree to contribute the ordinary shares held by it in Accenture Holdings to Exactside Limited for no consideration in accordance with the terms of that contract. As required by Irish law, the proposed acquisition contract is available for inspection at our registered office at 1 Grand Canal Square, Grand Canal Harbour, Dublin 2, Ireland and will remain on display during business hours at our registered office up to, and including, the date of the Annual General Meeting. For further information, see “Proposal Number Two: Approve the Contract Pursuant to which Exactside Limited will Acquire Accenture Holdings Ordinary Shares.”

Summary of Proposal Number Three: To Grant the Board the Authority to Issue Shares under Irish Law

Under Irish law, directors of an Irish public limited company must have authority from its shareholders to issue any shares, including shares which are part of the company’s authorized but unissued share capital. Our current authorization, approved by Accenture Holdings Shareholders at the annual general meeting held on February 8, 2017, will expire on August 8, 2018. The authority sought under this proposal replaces our current authorization. Granting the Board this authority is a routine matter for public companies incorporated in Ireland. This authority is fundamental to our business and enables us to issue shares, including, if applicable, to facilitate share transactions between Accenture Holdings and Accenture plc and to facilitate our shareholders’ ability to redeem their Accenture Holdings shares for shares in Accenture plc prior to the Effective Date of the Merger. We are not asking you to approve an increase in our authorized share capital or to approve a specific issuance of shares. Instead, approval of this proposal will only grant the Board the authority to issue shares that are already authorized under our articles of association. For further information, see “Proposal Number Three: To Grant the Board the Authority to Issue Shares under Irish Law.”

Summary of Proposal Number Four: To Grant the Board the Authority to Opt-Out of Statutory Pre-Emption Rights under Irish Law