UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to Section 240.14a-12 |

| | | |

| Forest City Realty Trust, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

| | | | |

| þ | No fee required. |

| | | | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | | | |

| | (5) | Total fee paid: |

| | | | | |

| o | Fee paid previously with preliminary materials. |

| | | | | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | |

| | (1) | Amount Previously Paid: |

| | | | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | | | |

| | (3) | Filing Party: |

| | | | | |

| | (4) | Date Filed: |

FOREST CITY REALTY TRUST, INC.

Notice of Annual Meeting of Shareholders

To Be Held May 25, 2016

NOTICE IS HEREBY GIVEN that the annual meeting of the shareholders of Forest City Realty Trust, Inc. (the “Company”) will be held in the 6th floor Riverview Room of the Ritz-Carlton Hotel, Tower City Center, 1515 West Third Street, Cleveland, Ohio 44113, on Wednesday, May 25, 2016 at 2:00 p.m., Eastern Daylight Time, for the purpose of considering and acting upon:

| |

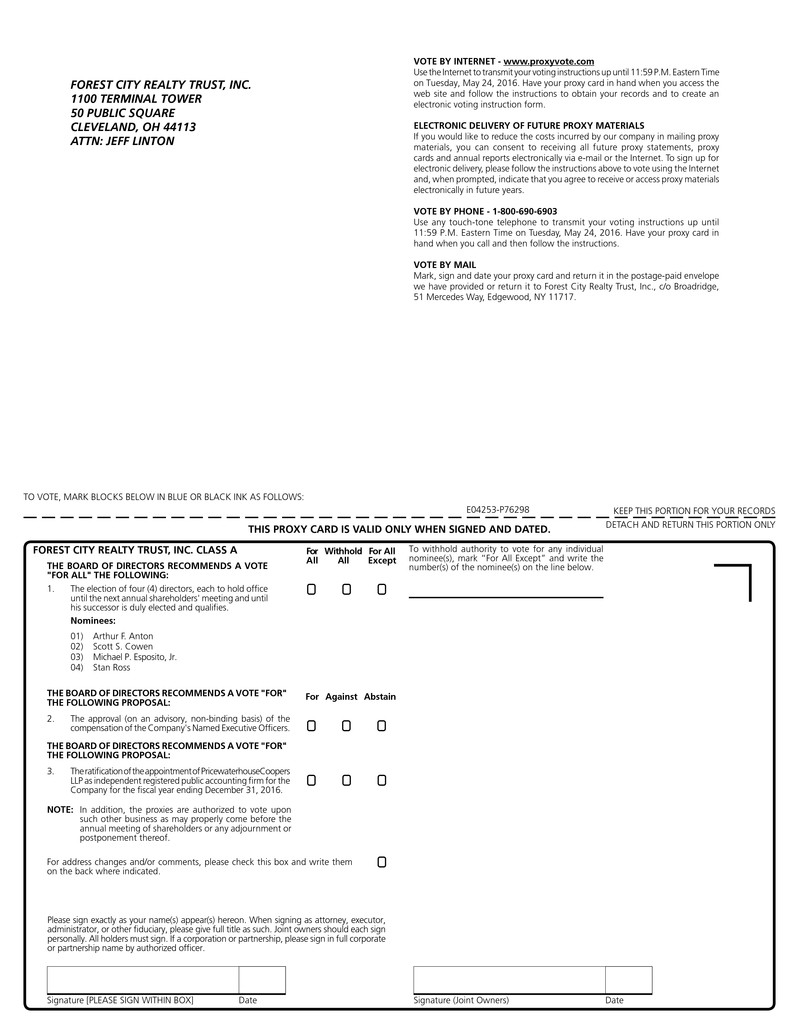

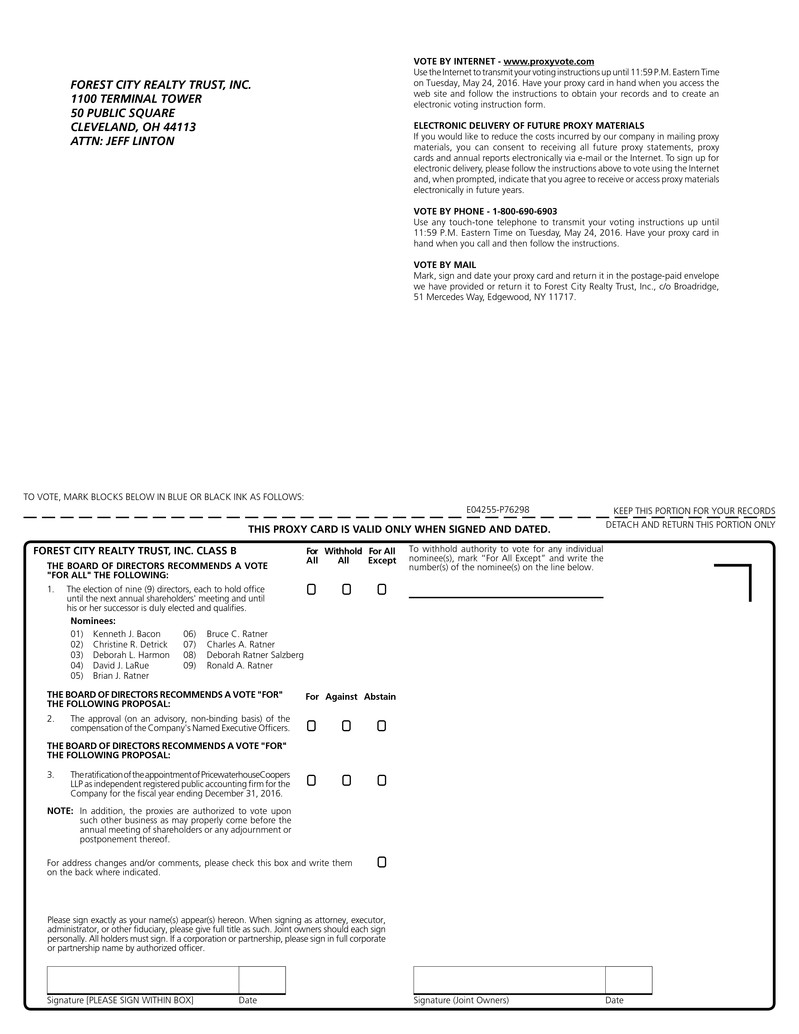

| (1) | The election of thirteen (13) directors, nominated by the Board of Directors, each to hold office until the next annual shareholders’ meeting and until a successor is duly elected and qualifies. Four (4) directors will be elected by holders of Class A Common Stock and nine (9) by holders of Class B Common Stock. |

| |

| (2) | The approval (on an advisory, non-binding basis) of the compensation of the Company’s Named Executive Officers, as described in the accompanying proxy statement. |

| |

| (3) | The ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for the Company for the year ending December 31, 2016. |

| |

| (4) | Such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Shareholders of record at the close of business on March 28, 2016 will be entitled to notice of and to vote at such annual meeting or any adjournment or postponement thereof.

BY THE ORDER OF THE BOARD OF DIRECTORS

Geralyn M. Presti, Secretary

Cleveland, Ohio

April 7, 2016

IMPORTANT: It is important that your stock be represented at the meeting. Whether or not you intend to be present, please mark, date and sign the appropriate enclosed proxy or proxies and send them by return mail in the enclosed envelope, which requires no postage if mailed in the United States.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SHAREHOLDER MEETING TO BE HELD ON MAY 25, 2016

The Proxy Statement, Proxy Card, Annual Report on Form 10-K, Summary Annual Report and Supplemental Package are available on the Investor Relations page at www.forestcity.net.

Table of Contents

|

| |

| Proxy Statement Summary | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Introduction | |

| Executive Summary | |

| |

| Executive Compensation Core Principles | |

| Target Executive Officer Pay Levels and Relevant Employment Market | |

| Components of the Executive Compensation Program | |

| Additional Executive Compensation Policies | |

| Plan Design as it Pertains to Risk | |

| Tax and Accounting Implications | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Shareholder Proposals and Director Nominations for the 2017 Annual Meeting | |

| |

| | |

| Annex A | |

| Annex B | |

| Annex C | |

| | |

| | |

| | |

| | |

| | |

| | |

Proxy Statement Summary

To further assist you in your review of the proxy statement and your consideration of matters to be voted upon at the 2016 Annual Meeting of Shareholders, we call your attention to the following information about Forest City Realty Trust, Inc. (the “Company”). As the following information is just a summary, we encourage you to read the full Annual Report and Proxy Statement before voting.

2016 Annual Meeting of Shareholders

|

| |

| Date and Time: | Record Date: |

| Wednesday, May 25, 2016 at 2:00 pm E.D.T. | March 28, 2016 |

| | |

| Place: | Webcast: |

| 6th floor Riverview Room of the Ritz-Carlton Hotel, | A webcast of the 2016 Annual Meeting will be |

| Tower City Center, 1515 West Third Street, | accessible via the investor relations page of the |

| Cleveland, Ohio 44113 | Company’s website, www.forestcity.net |

Annual Report and Proxy Materials

Available at www.proxyvote.com (for access, use the control number included on your Proxy Card or Notice of Internet Availability of Proxy Materials) or on www.forestcity.net.

Proposals to be Considered and Voted Upon and Board Recommendations

|

| | | |

| Proposal | Description | Board Recommendation | Page |

| 1 | Election of Directors. | For All | 7 |

| 2 | Approval (on an advisory, non-binding basis) of the compensation of the Company’s Named Executive Officers, as described in this proxy statement. | For | 66 |

| 3 | Ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for the Company for the year ending December 31, 2016.

| For | 71 |

Recent Corporate Actions

| |

| 1. | Successfully completed our merger, effective at 11:59 pm, Eastern Time, on December 31, 2015, in connection with our plan to convert to real estate investment trust (REIT) status commencing with the year ending December 31, 2016. |

| |

| 2. | Implemented a new organizational structure to improve efficiencies and operating margins. |

| |

| 3. | Published our Third Corporate Social Responsibility Report and achieved an MSCI ESG Rating of AA and GRESB Green Star Recognition, and gained inclusion in the MSCI Global Sustainability Index (see page 26). |

| |

| 4. | Qualified and selected for inclusion in the MSCI US REIT Index (RM2). |

| |

| 5. | Reinstituted a quarterly dividend in the first quarter of 2016. |

Election of Directors

|

| | | | | |

| Nominee | Class | Director Since | Independent | | Chairman: Charles A. Ratner Lead Director: Scott S. Cowen Director Terms: 1 Year Required Vote: Plurality of votes cast Board Meetings in 2015: 7 Standing Board Committee Meetings: Audit Committee (8); Compensation Committee (5); and Corporate Governance & Nominating Committee (5) Director Attendance: Averaged 93% and no director attended fewer than 70% of the meetings of the Board and those Committees on which the director served

|

| Arthur F. Anton | A | 2010 | Yes | |

| Scott S. Cowen | A | 1989 | Yes | |

| Michael P. Esposito, Jr. | A | 1995 | Yes | |

| Stan Ross | A | 1999 | Yes | |

| Kenneth J. Bacon | B | 2012 | Yes | |

| Christine R. Detrick | B | 2014 | Yes | |

| Deborah L. Harmon | B | 2008 | Yes | |

| David J. LaRue | B | 2011 | No | |

| Brian J. Ratner | B | 1993 | No | |

| Bruce C. Ratner | B | 2007 | No | |

| Charles A. Ratner | B | 1972 | No | |

| Deborah Ratner Salzberg | B | 1995 | No | |

| Ronald A. Ratner | B | 1985 | No | |

Executive Compensation

Our executive compensation program is intended to support our core values, drive long-term growth and value creation and reinforce our culture of accountability, integrity, responsibility, legal compliance, ethical behavior and transparency.

Key Objectives of our Executive Compensation Program:

|

| | | |

| ● | Focus senior management on key business objectives as reflected in our annual business plan and strategic plan to support our ultimate objective of maximizing long-term shareholder value. | ● | Attract and retain highly-talented employees to lead our continued growth and success and reward them for their contributions toward that success. |

| ● | Avoid unnecessary or excessive risk taking. | ● | Provide competitive pay driven by performance to increase long-term shareholder value. |

Key Components of our Executive Compensation Program:

|

| | |

| Component | Component Objective | Performance Linkage |

| Base Salary | Provide base pay commensurate with level of responsibility, experience and individual performance | Partially linked (merit increases tied to individual performance) |

| Annual Short-Term Incentives | Align pay with the achievement of short-term performance goals in support of annual business plan and strategic goals | Strongly linked |

| Long-Term Incentives | Align pay with achievement of longer-term strategic goals and shareholder value creation, enhance retention of senior management and facilitate stock ownership | Minimally to Strongly linked |

| Benefits & Perquisites | Provide for health, welfare and retirement needs at a reasonable cost | Minimally or not linked |

Results of the 2015 Say on Pay Advisory Vote:

We held our annual advisory vote on the compensation of our Named Executive Officers (“NEOs”) (“Say on Pay Vote”) at our annual meeting of shareholders on May 28, 2015. At that meeting, our shareholders overwhelmingly passed a resolution approving the compensation of our NEOs, with approximately 93.7% of the shareholders entitled to vote and present in person or by proxy at the 2015 annual meeting voting in favor of the resolution, including the negative effect of abstentions. Overall, we believe that this level of shareholder support is evidence that our executive compensation program is appropriately structured and aligned with shareholder interests.

Financial Performance Metrics that Impacted Compensation Decisions:

The following table provides comparisons of some of the key financial metrics, as previously reported in our Form 10-K and Supplemental Package for the quarter ended December 31, 2015 furnished on Form 8-K, which we use in evaluating the Company’s performance and which are considered when making compensation decisions:

|

| | | |

| Key Metric | Year Ended December 31, | Change |

| 2015 | 2014 |

Funds From Operations (“FFO”) (1) | $505,682,000 | $394,589,000 | 28.2% |

Operating FFO (“OFFO”) (1) | $337,601,000 | $248,404,000 | 35.9% |

FFO per share (on a fully-diluted basis) (1) | $1.98 | $1.75 | 13.1% |

OFFO per share (on a fully-diluted basis) (1) | $1.36 | $1.17 | 16.2% |

Comparable Net Operating Income - (Pro-Rata Consolidation) (1) | $554,490,000 | $528,443,000 | 4.9% |

| |

| (1) | These measures are financial measures not presented in accordance with Generally Accepted Accounting Principles. See pages 33-34 and Annexes A, B and C of this proxy statement for additional information on these measures. |

|

| | | | | |

| Key Metric | Stock Price December 31, | TSR |

| 2015 | 2014 | 2013 | 1-Year | 3-Year (1) |

| Total Shareholder Return (“TSR”): Class A Common Stock | $21.93 | $21.30 | $19.10 | 2.96% | 10.73% |

| |

| (1) | Represents an annualized total shareholder return ($16.15 as of 12/31/2012). |

Please see the Compensation Discussion and Analysis section beginning on page 32 of this Proxy Statement and the Executive Compensation Tables beginning on page 60 for a more detailed description of our executive compensation program and practices.

|

| |

| Forest City Realty Trust, Inc. | |

| 50 Public Square | |

| Cleveland, Ohio 44113 | |

| www.forestcity.net | April 7, 2016 |

Proxy Statement

Solicitation of Proxies

The proxy or proxies accompanying this proxy statement and relating to shares of Class A Common Stock, par value $.01 per share (the “Class A Common Stock”), and Class B Common Stock, par value $.01 per share (the “Class B Common Stock”) (collectively, “Common Stock”), are solicited on behalf of the Board of Directors of Forest City Realty Trust, Inc., a Maryland corporation, for exercise at the annual meeting of shareholders to be held on Wednesday, May 25, 2016 at 2:00 p.m., Eastern Daylight Time, in the 6th floor Riverview Room of the Ritz-Carlton Hotel, Tower City Center, 1515 West Third Street, Cleveland, Ohio 44113 (the “Annual Meeting”). This proxy statement and related form of proxy are being made first available to shareholders on or about April 7, 2016.

At 11:59 p.m., Eastern Time, on December 31, 2015 (the “Effective Time”), pursuant to an Agreement and Plan of Merger, dated as of September 15, 2015 (the “Merger Agreement”), by and among our predecessor, Forest City Enterprises, Inc., an Ohio corporation (“FCE”), Forest City Realty Trust, Inc., a Maryland corporation (“FCRT”), FCILP, LLC, a Delaware limited liability company, and FCE Merger Sub, Inc., an Ohio corporation (“Merger Sub”), Merger Sub merged with and into FCE, with FCE surviving as a wholly-owned subsidiary of FCRT (the “Merger”). The Merger was completed as part of the plan to reorganize the business operations of FCE to facilitate its qualification as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

Unless otherwise specifically stated or the context otherwise requires, all references in this proxy statement to the “Company,” “Forest City,” “we,” “our,” “us” and similar terms refer to FCE and its consolidated subsidiaries prior to the Effective Time and FCRT and its consolidated subsidiaries as of the Effective Time and thereafter.

Questions and Answers about the Proxy Materials and Annual Meeting

Q. Why am I receiving these proxy materials?

A. These proxy materials are provided in connection with the solicitation of proxies by the Board of Directors of Forest City for exercise at the Annual Meeting. You are receiving these proxy materials because you owned shares of Class A Common Stock or Class B Common Stock of Forest City, which we refer to collectively as Common Stock, at the close of business on March 28, 2016 (the “Record Date”) and that entitles you to notice of and to vote at the Annual Meeting. By use of a proxy, you can authorize your vote whether or not you attend the Annual Meeting. This proxy statement describes the matters on which we would like you to vote and provides information on those matters so that you can make an informed decision.

Q. Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of printed proxy materials?

A. Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), and in furtherance of our sustainability core value, we have elected to furnish our proxy materials to shareholders by providing access to the materials over the Internet instead of printing and mailing full sets of our proxy materials to all shareholders. Accordingly, on April 7, 2016, we sent a Notice of Internet Availability of Proxy Materials (the “Notice”) to the majority of our shareholders. We encourage you to take advantage of the availability of the proxy materials on the Internet in order to help reduce the environmental impact of the Annual Meeting.

Q. How can I get electronic access to the proxy materials?

A. The Company provides access to our proxy materials over the Internet to all shareholders. Proxy materials for the Annual Meeting, including this proxy statement and the 2016 Annual Report and Supplemental Package, are available for viewing by accessing the Investors page on the Company’s website at www.forestcity.net.

If you received the Notice, it provides you with instructions how to: access our proxy materials for the Annual Meeting on www.proxyvote.com; authorize a proxy to vote your shares after you have viewed our proxy materials; and request a printed or email copy of the proxy materials.

Whether you received the Notice only or a full set of proxy materials by mail, you may elect to receive the Company’s future proxy materials in electronic format in lieu of paper copies by following the instructions contained in the Notice or proxy card. Doing so will lower our printing and delivery costs and will further assist our efforts to reduce the environmental impact of our Annual Meeting. Your election to receive proxy materials by email will remain in effect until you terminate such election or for so long as the email address you have provided remains valid.

Q. Where and when is the Annual Meeting?

A. The Annual Meeting will be held on the 6th floor Riverview Room of the Ritz-Carlton Hotel, Tower City Center, 1515 West Third Street, Cleveland, Ohio 44113, on May 25, 2016 at 2:00 p.m., Eastern Daylight Time.

Q. Who can attend the Annual Meeting?

A. All owners of Common Stock at the close of business on the Record Date are invited to attend the Annual Meeting. Persons who are not owners of Common Stock may attend only if invited by our board of directors. If you are the beneficial owner of shares of Common Stock held in the name of your broker, bank, trust or other nominee, you must bring proof of ownership (e.g., a current brokerage statement) in order to be admitted to the Annual Meeting.

Q. Who can vote at the Annual Meeting?

A. Only shareholders of record at the close of business on the Record Date or their duly authorized proxies will be entitled to vote at the Annual Meeting. If you are not a shareholder of record but hold shares of Common Stock through your broker, bank, trust or other nominee, you may vote your shares in person only if you obtain a legal proxy from the broker, bank, trust or other nominee that holds your shares authorizing you to vote the shares. We will begin mailing or delivering this proxy statement on or about April 7, 2016 to shareholders of record at the close of business on the Record Date.

Q. How many shares of Common Stock are entitled to vote at the Annual Meeting?

A. As of the Record Date, there were 241,217,983 shares of Class A Common Stock and 18,792,687 shares of Class B Common Stock outstanding and entitled to vote at the Annual Meeting.

Q. What constitutes a quorum?

A. In order to carry out the business of the Annual Meeting, we must have a quorum. This means that the presence, in person or by proxy, of shareholders entitled to cast a majority of all the votes entitled to be cast on any matter at the Annual Meeting is required in order to carry out the business of the Annual Meeting. Broker non-votes and abstentions will be counted for purposes of determining whether a quorum is present.

Q. What will I be voting on at the Annual Meeting?

A. At the Annual Meeting, Forest City shareholders will consider and vote upon the following proposals:

| |

| • | Proposal 1: Election of Class A and Class B Directors. The holders of Class A Common Stock will be entitled as a class to elect four (4) Class A directors and the holders of Class B Common Stock will be entitled as a class to elect nine (9) Class B directors. Arthur F. Anton, Scott S. Cowen, Michael P. Esposito, Jr. and Stan Ross have been nominated for election to serve as Class A directors. Kenneth J. Bacon, Christine R. Detrick, Deborah L. Harmon, David J. LaRue, Brian J. Ratner, Bruce C. Ratner, Charles A. Ratner, Deborah Ratner Salzberg and Ronald A. Ratner have been nominated for election to serve as Class B directors. |

| |

| • | Proposal 2: Approval (on an advisory, non-binding basis) of the compensation of the Company’s Named Executive Officers, as described in this proxy statement. |

| |

| • | Proposal 3: Ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for the Company for the year ending December 31, 2016. |

Q. What vote is required to approve each of the proposals?

A. At the Annual Meeting, the required vote to approve the following proposals shall be:

| |

| • | Proposal 1: Election of Class A and Class B Directors. The nominees receiving the greatest number of votes cast at the Annual Meeting will be elected. A proxy card marked “Withhold All” or “For All Except” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Abstentions and broker non-votes, if any, will not be counted as votes cast for purposes of the election of directors and will have no effect on the result of the vote. In addition, brokers may not exercise their discretion to vote uninstructed shares for the election of directors. Therefore, if your shares are to be represented by a broker at the Annual Meeting, you must give specific instructions to your broker for your shares to be voted on the election of directors. |

| |

| • | Proposal 2: Approval (on an advisory, non-binding basis) of the compensation of the Company’s Named Executive Officers. The affirmative vote of a majority of all of the votes cast at the Annual Meeting is required for approval of this proposal. Abstentions and broker non-votes will not be counted as votes cast and, as a result, will have no effect on the result of the vote on this proposal. In addition, brokers may not exercise their discretion to vote uninstructed shares for this proposal. Therefore, if your shares are to be represented by a broker at the Annual Meeting, you must give specific instructions to your broker for your shares to be voted on Proposal 2. |

| |

| • | Proposal 3: Ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for the Company for the year ending December 31, 2016. The affirmative vote of a majority of all of the votes cast at the Annual Meeting is required for approval of this proposal. Abstentions will not be counted as votes cast and, as a result, will have no effect on the result of the vote for this proposal. |

Q. What are the board of directors’ voting recommendations?

A. Our board of directors recommends that you vote “FOR” each of the proposals, specifically:

| |

| • | “FOR” all Class A and Class B Director Nominees named in this proxy statement; |

| |

| • | “FOR” the approval of the compensation of the Company’s Named Executive Officers, as described in this proxy statement; and |

| |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for the Company for the year ending December 31, 2016. |

Q. What voting rights do I have as a shareholder?

A. At the Annual Meeting, the holders of Class A Common Stock and Class B Common Stock are entitled to one vote per share in connection with the election of Class A Directors and Class B Directors, respectively.

Except for the election of directors, the holders of Class A Common Stock and Class B Common Stock will vote together on all other matters presented at the Annual Meeting and will be entitled to one (1) vote per share of Class A Common Stock and ten (10) votes per share of Class B Common Stock held as of the close of business on the Record Date.

Q. How do I vote?

A. If you are a shareholder of record at the close of business on the Record Date, you may vote in person at the Annual Meeting or authorize a proxy to vote your shares, in which case you may:

| |

| • | Submit a proxy by Mail: sign, date and mail in your proxy card using the accompanying envelope; |

| |

| • | Submit a proxy by Telephone: submit a proxy by calling 1-800-690-6903; or |

| |

| • | Submit a proxy via the Internet: connect to the Internet site www.proxyvote.com and follow the directions provided. |

Detailed instructions for using the telephone and Internet options for voting by proxy are set forth on the proxy card accompanying this proxy statement. Because the Internet and telephone services authenticate shareholders by use of a control number, you must have the proxy card available in order to use these services to authorize a proxy to vote. Proxies submitted by telephone or Internet must be received by 11:59 p.m., Eastern Daylight Time, on May 24, 2016. If you choose to authorize a proxy to vote by telephone or Internet, you do not need to return the proxy card.

If you elect to vote by proxy, the proxy holders will vote your shares based on your directions. If you submit your proxy card but do not properly direct how your shares of Common Stock should be voted, the proxy holders will vote “FOR” all of the director nominees and “FOR” the other proposals presented in this proxy statement. The proxy holders will use their discretion on any other proposals and matters that may be brought before the Annual Meeting.

If your shares of Common Stock are held in “street name” by a broker, bank, trust or other nominee, then you are not the shareholder of record. In that case, to vote in person at the Annual Meeting, you must obtain a legal proxy from your broker, bank, trust or other nominee and present it at the Annual Meeting.

Q. If my shares are held in “street name” by my broker, bank, trust or other nominee, will my broker, bank, trust or other nominee vote my shares for me?

A. No. If your shares of Common Stock are held in “street name” by your broker, bank, trust or other nominee, you should follow the directions provided by your broker, bank, trust or other nominee. Your broker, bank, trust or other nominee will vote your shares only if you provide instructions on how you would like your shares to be voted.

Q. What do I need to do now?

A. You should carefully read and consider this proxy statement. You should then authorize a proxy to vote your shares by one of the three methods described as soon as possible so that your shares will be represented at the Annual Meeting. If your shares of Common Stock are known to us to be held by you through a broker, bank, trust or other nominee, you should receive a separate voting instruction form with this proxy statement.

Q. Can I revoke or change my vote after I submit a proxy?

A. Yes. In the event you deliver a duly executed proxy and subsequently change your mind on a matter, you may revoke your proxy prior to the close of voting at the Annual Meeting. You may revoke your proxy in any of the following five ways:

| |

| • | Connect to the website at www.proxyvote.com by 11:59 p.m,. Eastern Daylight Time, on May 24, 2016; |

| |

| • | Call 1-800-690-6903 by 11:59 p.m., Eastern Daylight Time, on May 24, 2016; |

| |

| • | Deliver a duly executed proxy bearing a later date; |

| |

| • | Deliver a written revocation to the Secretary; or |

| |

| • | Vote in person at the Annual Meeting. |

You will not revoke a proxy merely by attending the Annual Meeting. To revoke a proxy, you must take one of the actions described above.

Q. Who is paying for this proxy solicitation?

A. The expense of soliciting proxies, including the cost of preparing, assembling and mailing the notice, proxy statement and proxy, will be borne by us. In addition to solicitation by mail, we may make arrangements with brokers and other custodians, nominees and fiduciaries to send proxies and proxy materials to their principals and we may reimburse them for their expense in so doing. Our officers and other regular employees may, if necessary, request the return of proxies by telephone, email or facsimile or in person, and will not receive any special compensation for taking such actions.

Q. Can shareholders make proposals for the 2016 Annual Meeting?

A. From time to time, shareholders present proposals that may be proper subjects for inclusion in the proxy statement and for consideration at an annual meeting. To be included in the proxy statement for the Annual Meeting, the Company must have received proposals no later than December 11, 2015. To date, the Company has not received any shareholder proposals for the 2016 Annual Meeting. See “Shareholder Proposals and Director Nominations for the 2017 Annual Meeting” for a detailed discussion of the deadlines for shareholder proposals and director nominations for next year’s annual meeting of shareholders.

Q. Where can I find the voting results of the Annual Meeting?

A. We plan to announce preliminary voting results at the Annual Meeting and publish final results on a Form 8-K filed with the SEC promptly after the Annual Meeting.

Proposal 1 - Election of Directors

It is intended that proxies will be voted for the election of the nominees named below as our directors unless authority is withheld. All elected directors will serve until the next annual shareholders’ meeting and until their respective successors are duly elected and qualify. In the event any one or more of such nominees unexpectedly becomes unavailable for election, proxies will be voted in the discretion of the proxy holder. All nominees are presently our directors.

At January 31, 2016, the Ratner, Miller and Shafran families, which include members of our current Board of Directors and certain executive officers not including Bruce C. Ratner (“Family Interests”), owned 3.8% of the Class A Common Stock and 92.4% of the Class B Common Stock. RMS, Limited Partnership (“RMSLP”), which owned 68.6% of the Class B Common Stock outstanding as of the Record Date (March 28, 2016), is a limited partnership comprised of the Family Interests, with seven individual general partner positions, currently consisting of: Samuel H. Miller, Co-Chairman Emeritus; Charles A. Ratner, Chairman of the Board of Directors; Ronald A. Ratner, our Executive Vice President and Director; Brian J. Ratner, our Executive Vice President and Director; Deborah Ratner Salzberg, our Executive Vice President and Director; Joan K. Shafran, a former Director; and Abraham Miller. Charles A. Ratner, James A. Ratner and Ronald A. Ratner are brothers. Albert B. Ratner, our Co-Chairman Emeritus, is the father of Brian J. Ratner and Deborah Ratner Salzberg and is first cousin to Charles A. Ratner, James A. Ratner, Ronald A. Ratner, Bruce C. Ratner and Joan K. Shafran. Samuel H. Miller was married to Ruth Ratner Miller (now deceased), a sister of Albert B. Ratner, and is the father of Abraham Miller.

Under the partnership agreement of RMSLP, the voting power of the general partners representing a family branch is determined by dividing the interest of the family branch they represent by the aggregate interests of all family branches. The voting power of the general partner or general partners representing a family branch may not be divided or apportioned but must be voted together as a whole. If the general partners representing a family branch are unable to agree on how to vote that branch, the total voting power of the other general partners is computed without reference to the voting power otherwise available to that family branch. General partners holding 60% of the total voting power (excluding the voting power of a family branch, if any, unable to agree on how to vote on a particular matter) of RMSLP determine how to vote the Class B Common Stock held by RMSLP.

Effective December 20, 2013, the general partners of RMSLP voted to distribute five million (5,000,000) shares of Class B Common Stock to certain of its limited partners (the “Limited Partner Recipients”). The distributed shares are subject to the Ratner, Miller and Shafran Shareholder’s Agreement, dated as of December 20, 2013 (the “Shareholder Agreement”). The distribution did not change the investment intent of the Family Interests with regards to ownership of Class B Common Stock. The Shareholder Agreement contains transfer restrictions that provide a right of first refusal to the other members of the Ratner, Miller and Shafran families. In addition, the Shareholder Agreement requires the Limited Partner Recipients to vote the distributed shares consistent with the partnership agreement of RMSLP.

The following table sets forth the shares of Class B Common Stock held by RMSLP at January 31, 2016, which under the partnership agreement are voted by the general partners of RMSLP, who under Rule 13d-3 of the Securities Exchange Act of 1934, are deemed to be the beneficial owners of those shares of Class B Common Stock:

|

| | | | | |

| Family Branch | Name of General Partners | Shares of Class B Common Stock Held Through RMSLP | Percent of RMSLP’s Holdings of Class B Common Stock |

| Max Ratner | Charles A. Ratner | 6,493,853 |

| 50.4 | % |

| | Ronald A. Ratner | | |

| Albert Ratner | Brian J. Ratner | 3,552,483 |

| 27.6 | % |

| | Deborah Ratner Salzberg | | |

| Samuel H. Miller | Samuel H. Miller | 719,488 |

| 5.5 | % |

| Nathan Shafran | Joan K. Shafran | 1,355,651 |

| 10.5 | % |

| Ruth Miller | Abraham Miller | 767,118 |

| 6.0 | % |

| Total | | 12,888,593 |

| 100.0 | % |

Director Qualifications and Experience

The Corporate Governance and Nominating Committee of our Board of Directors performs an annual assessment of the skills and the experience needed to maintain a well-rounded, diverse and effective Board and summarizes such assessment in a tabular matrix. The Committee uses the matrix to assess the current composition of the Board and to identify qualifications and experience for potential nominees. When identifying nominees for the Board, the Committee conducts a targeted effort to identify and recruit individuals who have the qualifications and experience identified through this process. The following is a tabular summary of the most recently conducted matrix assessment for the full Board.

|

| | |

| Director Qualifications and Experience | | Percentage of Directors Identified as having Advanced or Good Qualifications or Experience |

Financial Expertise and Literacy is important because it assists our directors in understanding and overseeing our financial reporting and internal controls. | | 92% |

Capital Markets experience and knowledge is important in evaluating opportunities in the financial markets to raise capital. | | 100% |

Talent Management and Succession Planning experience is valuable in helping us attract, motivate and retain top candidates for positions at the Company. | | 100% |

Organizational Design and Change Management experience with organizational structure design and implementation of organizational change is important to our adaptability to industry trends. | | 92% |

Real Estate knowledge and experience is important in reviewing and understanding our business strategy. | | 85% |

Government and Government Relations experience is relevant because we operate as a publicly-traded company that is directly affected by governmental policies. | | 85% |

Political Acumen and External Relations knowledge and experience is important in aligning with issues, candidates and entities whose missions align with ours. | | 92% |

Corporate Governance experience supports our goals of strong Board and management accountability, transparency and protection of shareholder interests. | | 100% |

Legal experience and acumen provide critical thinking, analysis and understanding of the regulations applicable to us. | | 85% |

Risk Management experience is critical to the Board's role in overseeing the risks facing our business. | | 77% |

Strategic Planning experience is important to provide guidance for our strategic initiatives and oversight of the planning and implementation of our strategic plan. | | 100% |

Marketing experience is relevant as it seeks to identify and develop new real estate development and management markets. | | 85% |

Stakeholder and Community Engagement experience is important to facilitate communication and create long-term value for our stakeholders and the communities in which we operate. | | 92% |

Academic/Education experience is important because it brings perspective regarding organizational management and academic research relevant to our business and strategy. | | 85% |

Business Ethics experience is important given the critical role that ethics plays in the success of our business. | | 100% |

Business Head Administration experience is important since directors with administration experience typically possess strong leadership qualities and the ability to identify those qualities in others. | | 100% |

Business Operations experience provides a practical understanding of developing, implementing and assessing our operational plan and business strategy. | | 100% |

Director Nominee Biographies

Set forth below are each nominee’s name, age, year first elected as a director, principal occupation, professional history and public company directorships held currently and during the past five years, and detailed information about the qualifications, experience, attributes and skills that led to the conclusion that such person should serve as our director.

NOMINEES FOR ELECTION AS CLASS A DIRECTORS

|

| | |

| | Arthur F. Anton Principal Occupation and Business Experience Since 2003, Mr. Anton has been the chief executive officer of Swagelok, a privately-held domestic and international developer and provider of fluid system solutions with annual sales of approximately $1.8 billion. In addition, since October 2015, Mr. Anton has served as the Chairman of the Board of Swagelok. Prior to his current positions, Mr. Anton served Swagelok as the president and chief operating officer from 2001 to 2003, executive vice president from 2000 to 2001, and chief financial officer from 1998 to 2001. Prior to joining Swagelok, Mr. Anton was a partner at the accounting and consulting firm of Ernst & Young LLP, where he consulted with companies in the manufacturing, energy, service and other industries. He is a board member of two additional publicly-traded companies, including Olympic Steel, Inc. since 2009, a metal service center, and The Sherwin-Williams Company since 2006, a paint and building material manufacturing and distribution company. He is also a board member and chairman of the Finance Committee of University Hospitals of Cleveland. Key Experience, Attributes and Skills Mr. Anton’s leadership experience, both as a chief executive and chief financial officer, and his deep understanding of corporate strategy and vast financial acumen, make him a tremendous asset for Forest City and our Board of Directors. Through his experience serving on other public company boards, Mr. Anton is able to provide guidance on best practices, risk management and corporate governance strategies. |

Age: 58 Director Since: 2010 Independent Board Committees: -Audit -Compensation Other Current Registered Company Directorships: -Olympic Steel, Inc. -The Sherwin-Williams Company

| |

|

| | |

| | Scott S. Cowen Principal Occupation and Business Experience Dr. Cowen has been the President Emeritus and Distinguished University Chair of Tulane University since July 2014. From July 1998 to July 2014, Dr. Cowen served as the President of Tulane University. While serving as President of Tulane University, he led the school, as well as the City of New Orleans, through the aftermath of Hurricane Katrina, and developed unique and exceptional skills in crisis management. In recognition of his leadership skills, he received the Carnegie Award for Academic Leadership as well as the TIAA-CREF Hesburgh Award for Leadership Excellence in Higher Education and was named one of the “Ten Best College Presidents” in America by Time magazine. Prior to 1998, Dr. Cowen was dean at the Weatherhead School of Management at Case Western Reserve University, where he was also a professor for 23 years. Dr. Cowen is currently a board member of three additional publicly-traded companies, including Newell Rubbermaid, Inc. since 1999, a consumer products corporation, Barnes & Noble, Inc. since April 2014, a leading bookseller and content, commerce and technology company, and NACCO Industries, Inc. since May 2014, a mining, small appliances and specialty retail holding company. In addition, Mr. Cowen served as a board member of American Greetings Corporation, formerly a publicly-traded greeting card company, from 1989 to 2013. Mr. Cowen has also served as a Senior Advisor for the Boston Consulting Group since January 2015. In 2010, President Barack Obama appointed him to the White House Council for Community Solutions, which advised the president on the best ways to mobilize citizens, nonprofits, businesses and government to address community needs. Mr. Cowen recently became a member of the board of trustees of Case Western Reserve University. Key Experience, Attributes and Skills An award-winning educator and leader, Dr. Cowen has consulted for dozens of companies, from start-ups to the Fortune 100. His impressive background and service on the boards of public companies has given him expertise in strategic planning, financial management, external reporting, organizational behavior, crisis management and corporate governance. During his tenure on our Board of Directors, Dr. Cowen has contributed valuable strategic oversight and has developed an in-depth knowledge of the real-estate industry, in general, and Forest City, in particular.

|

Lead Director Age: 69 Director Since: 1989 Independent Board Committees: -Compensation (Chair) -Corporate Governance and Nominating Other Current Registered Company Directorships: -Newell Rubbermaid, Inc. -Barnes & Noble, Inc. -NACCO Industries, Inc. | |

| | |

|

| | |

| | Michael P. Esposito, Jr. Principal Occupation and Business Experience Mr. Esposito has been the non-executive chairman of Syncora Holdings Ltd., a guarantee insurance company, since 2006, and served as the non-executive chairman of Primus Guaranty Ltd., seller of credit protection, from 2002 to November 2014. In 1995, Mr. Esposito retired from The Chase Manhattan Bank, N.A. as the executive vice president, chief control, compliance and administrative officer after serving 34 years with the company in various positions, including principal accounting officer, corporate controller and chief financial officer. In 2007, he retired as the non-executive chairman of XL Capital Ltd., an insurance company. Mr. Esposito’s prior experience also included leadership positions within the Bank Administration Institute, American Bankers Association, Conference Board, and the Advisory Council to the Financial Accounting Standards Board. Key Experience, Attributes and Skills Mr. Esposito brings significant financial experience and expertise to our Board of Directors, including service with other publicly-traded companies. He provides valuable guidance on best practices in areas such as risk management, financial management, corporate governance, capital management and debt management. Mr. Esposito has chaired a strong Audit Committee of our Board of Directors, consistently receiving high ratings from proxy advisory firms relating to low Audit risk.

|

Age: 76 Director Since: 1995 Independent Board Committees: -Audit (Chair) -Compensation

| |

| | |

|

| | |

| | Stan Ross Principal Occupation and Business Experience Mr. Ross, a retired certified public accountant, holds multiple positions at the University of Southern California, including chairman of the board of the Lusk Center for Real Estate and distinguished fellow of the School of Policy, Planning & Development. He is the retired vice chairman of real estate industry services for Ernst & Young LLP, where he was a member of the firm’s management committee. Mr. Ross is a life trustee and governor of the Urban Land Institute, and trustee emeritus of his alma mater, Baruch College, from which he holds an honorary Doctor of Laws degree. He was also a member of the auditing standards board of the American Institute of Certified Public Accountants. Mr. Ross serves as senior advisor to The Irvine Company, a diversified private real estate company, and on the board of the American Jewish University. Key Experience, Attributes and Skills Mr. Ross brings substantial real estate experience and financial expertise to Forest City’s Board of Directors. As a nationally recognized real estate expert, he provides thoughtful and far-reaching insight into current economic and industry trends, domestic and global practices, and challenges facing the real estate sector. Mr. Ross’ expertise in accounting, tax and strategic planning for real estate companies has been invaluable to our Board of Directors throughout his tenure, particularly during the economic downturn.

|

Age: 80 Director Since: 1999 Independent Board Committees: -Audit -Compensation

| |

| | |

NOMINEES FOR ELECTION AS CLASS B DIRECTORS

|

| | |

| | Kenneth J. Bacon Principal Occupation and Business Experience Mr. Bacon co-founded RailField Partners, a financial advisory and asset management firm based in Washington, D.C., in 2012. Mr. Bacon began his career with Kidder Peabody and later transitioned to Morgan Stanley, where his focus was mortgage finance and related products. In 1990, he joined Resolution Trust Corporation as Director of Policy for the Oversight Board, and was later named Director of Securitization. Three years later, Mr. Bacon joined the Federal National Mortgage Association (Fannie Mae) as Senior Vice President, Northeast Region. In 1998, he was selected to lead Fannie Mae’s American Communities Fund. In 2000, he became Senior Vice President (with promotion in 2005 to Executive Vice President) of the organization’s Multifamily Division. He retired from Fannie Mae in 2012. Mr. Bacon is a board member of three additional publicly-traded companies, including Comcast Corporation since 2002, a global media and technology company, Ally Financial Inc. since February 2015, a financial service company, and Welltower Inc., a healthcare property REIT, since January 2016. He is also a board member of the National Multifamily Housing Council and serves on the advisory board of the Stanford Center on Longevity. Key Experience, Attributes and Skills Mr. Bacon brings significant financial, asset management and real estate experience to our Board of Directors. His varied professional officer roles, as well as his board service with other publicly-traded companies and real estate industry organizations, make him a tremendous asset to Forest City and to our Board. In addition, he provides recommendations on best practices in areas such as governmental affairs, the financial industry and the non-profit, educational and philanthropic communities.

|

Age: 61 Director Since: 2012 Independent Board Committees: -Audit -Corporate Governance and Nominating Other Current Registered Company Directorships: -Comcast Corporation -Ally Financial Inc. -Welltower, Inc.

| |

|

| | |

| | Christine R. Detrick Principal Occupation and Business Experience Ms. Detrick is a former Director, Head of Americas Financial Services Practice, and Senior Advisor at Bain & Company, where she served in such capacity from 2002 to 2011. Ms. Detrick began her career in the insurance industry at Progressive Corporation and Chubb Corporation, before joining McKinsey & Company in its New York office in 1984. In 1988, she was a founding partner of First Financial Partners, Inc., a venture capital firm specializing in savings and loan institutions, where she served as CEO in a turnaround setting for a failing savings and loan bank acquired by the firm. In 1992, she was recruited to the financial services practice at A.T. Kearney where she became the Global Head of Financial Services and served on the firm’s board of management and board of directors. Ms. Detrick is currently a board member of one additional publicly-traded company, Reinsurance Group of America, Incorporated, a global life reinsurance company, since 2014, and one company registered under the Investment Company Act of 1940, The Hartford Mutual Funds, Inc, a family of mutual funds, since February 2016. Key Experience, Attributes and Skills Ms. Detrick is a seasoned business executive with more than 30 years of experience leading and advising financial services companies and investors. She brings a wealth of executive-level experience in strategy, planning, governance, risk management and other areas that make her a strong, independent director and a tremendous asset to Forest City and the Board of Directors.

|

Age: 57 Director Since: November, 2014 Independent Board Committee: -Corporate Governance and Nominating Other Current Registered Company Directorships: -Reinsurance Group of America, Incorporated -The Hartford Mutual Funds, Inc.

| |

|

| | |

| | Deborah L. Harmon Principal Occupation and Business Experience Ms. Harmon is a co-founder and the Chief Executive Officer of Artemis Real Estate Partners, LLC, a real estate investment firm that manages $1.8 billion of institutional capital across the core plus, value add and opportunistic risk spectrum in a variety of real estate strategies. With over 25 years of experience in the real estate industry, she is responsible for establishing, implementing and overseeing strategic direction of Artemis. Prior to co-founding Artemis, she spent 17 years with the J.E. Robert Companies, Inc. (“JER”), a real estate investment firm where she was last President and Chief Investment Officer. Before joining JER, Ms. Harmon was a Managing Director at Bankers Trust Company in New York City where she worked in both the corporate finance and real estate groups handling a $2.0 billion portfolio of real estate developers and national corporations. Ms. Harmon currently serves on the board of Pension Real Estate Association; as a trustee of Urban Land Institute; the advisory boards of Caravel Management and BlackIvy Group; the investment committee of Sidwell Friends School; and the executive committee of the Zell/Lurie Real Estate Center at The Wharton School of the University of Pennsylvania. She also serves on the Board and Executive Committee of Women for Women International and, since 2009, as Commissioner for the White House Fellows program appointed by President Barack Obama. Ms. Harmon is a member of the Council on Foreign Relations and The Economic Club of Washington D.C. Key Experience, Attributes and Skills With more than 25 years in the management and investment of real estate funds, Ms. Harmon has extensive knowledge of the real estate investment and financial markets. She has expertise in real estate acquisition, capital markets, valuation, capital raising, strategic planning, implementation and oversight, and institutional portfolio management. She provides valuable guidance regarding the capital markets in which the Company operates, as well as the competitive environment in which we must raise capital.

|

Age: 56 Director Since: 2008 Independent Board Committee: -Corporate Governance and Nominating (Chair)

| |

| | |

|

| | |

| | David J. LaRue Principal Occupation and Business Experience Mr. LaRue has been our President and Chief Executive Officer since June 2011. He is also an officer of various subsidiaries of the Company. Prior to becoming President and Chief Executive Officer, Mr. LaRue served as Executive Vice President and Chief Operating Officer from March 2010 through June 2011. Mr. LaRue served as President and Chief Operating officer of Forest City Commercial Group, Inc. (now known as Forest City Commercial Group, LLC) from 2003 to March 2010, and as Executive Vice President of Forest City Rental Properties, Inc. (now known as Forest City Properties, LLC) from 1997 through 2003. Prior to joining Forest City in 1986, Mr. LaRue was an internal auditor and financial analyst with The Sherwin-Williams Company. Mr. LaRue served on the board of CubeSmart (formerly known as U-Store-It Trust), a publicly-traded real estate investment trust focused on self-storage facilities, from 2004 through May 2013. Mr. LaRue is a member of the NAREIT Board of Governors; a member of the Board of the Real Estate Roundtable; and a member of the Board and Executive Committee for the International Council of Shopping Centers. In addition, Mr. LaRue is a member of the Board of Trustees and Chair of the Capital Committee of the Friends of the Cleveland School of the Arts; a trustee and member of the Finance Committee of the Lawrence School; a member of the Board of Directors of St. Edward High School; and a member of the Board of Directors of the Greater Cleveland Partnership. Key Experience, Attributes and Skills Under Mr. LaRue’s leadership as our President and Chief Executive Officer, Forest City successfully executed a merger transaction in connection with its anticipated conversion to REIT status and continues to make significant progress on achieving its strategic objectives of focusing on core products in core markets, building a sustainable capital structure and achieving operational excellence. As an employee of the Company since 1986, Mr. LaRue brings vast experience in virtually every aspect of our business, along with broad strategic, operational and financial acumen to the Board of Directors.

|

Age: 54 Director Since: 2011 Forest City Executive

| |

| | |

|

| | |

| | Brian J. Ratner Principal Occupation and Business Experience Mr. Ratner has been our Executive Vice President since 2001 and is an officer and/or director of various subsidiaries of the Company. In particular, Mr. Ratner serves as President of Forest City Texas, LLC and leads our operations in Dallas, a core market for the Company. Mr. Ratner is active with numerous community, charitable, educational and professional organizations, including the Rock and Roll Hall of Fame and Museum, and membership on the board of trustees of Case Western Reserve University, the board of directors of the Jewish Federation of Greater Dallas and the board of governors of the Greater Dallas Symphony Orchestra. Key Experience, Attributes and Skills As a member of one of our founding families and a large shareholder with over 25 years of experience at Forest City, Mr. Ratner brings a depth of experience and knowledge of the real estate industry to the Board of Directors. His execution of transactions in our core market of Dallas brings regional market insight to our Board of Directors. In addition, he is a former practicing attorney and his legal experience and acumen provide critical thinking and analysis to the Board.

|

Age: 59 Director Since: 1993 Forest City Executive

| |

| | |

|

| | |

| | Bruce C. Ratner Principal Occupation and Business Experience Mr. Ratner has been our Executive Vice President since November 2006 and is Executive Chairman of Forest City Ratner Companies, the New York City subsidiary of Forest City. He also serves as an officer and/or director of various other subsidiaries of Forest City. Previously, Mr. Ratner served as Chief Executive Officer of Forest City Ratner Companies from 1987 through April 2013. Prior to joining Forest City, Mr. Ratner served as New York City’s Commissioner of Consumer Affairs during the administration of Mayor Ed Koch. He also served in the administration of former New York Mayor John Lindsay. He was also an Assistant Clinical Professor of Law at the New York University Law School. Mr. Ratner has served on many boards and is currently the Chairman of the Board of the Museum of Jewish Heritage - A Living Memorial to the Holocaust, and on the boards of the Memorial Sloan-Kettering Cancer Center and the Weill Cornell Medical College and a former board member of the Metropolitan Museum of Art. Key Experience, Attributes and Skills As a member of one of our founding families, a large shareholder, and the leader of our operations in one of our most important core markets, Mr. Ratner brings a wealth of experience in the real estate industry to the Board of Directors. His experience in city government also brings knowledge of the perspectives of major municipalities, and his legal training and acumen bring critical thinking and analysis to the Board.

|

Age: 71 Director Since: 2007 Forest City Executive

| |

| | |

|

| | |

| | Charles A. Ratner Principal Occupation and Business Experience Mr. Ratner has been the Chairman of our Board of Directors since June 2011. Previously, Mr. Ratner served as president and chief executive officer of the Company from 1995 through June 2011, and served as president and chief operating officer from 1993 to 1995. He is also an officer and/or director of various subsidiaries of Forest City. Mr. Ratner is currently a board member of one additional publicly-traded company, RPM, Inc. since 2005, a specialty coatings and sealants company. In addition, Mr. Ratner served as a board member of American Greetings Corporation, formerly a publicly-traded greeting card company, from 2000 to 2013. He is active with numerous community, charitable and professional organizations, including membership on the Board of Directors of the Cleveland Foundation and the United Jewish Communities. He also serves on the Board of Trustees of the Musical Arts Association, Mandel Associated Foundations, the Jewish Federation of Cleveland, and the David and Inez Myers Foundation and the Executive Committee of the Jewish Federation of Cleveland. Key Experience, Attributes and Skills As a member of one of our founding families, our former Chief Executive Officer and a large shareholder with over 40 years of experience at Forest City, Mr. Ratner brings a wealth of leadership experience and knowledge of the Company and the real estate industry to the Board of Directors.

|

Chairman Age: 74 Director Since: 1972 Chairman Since: 2011 Forest City Executive Other Current Registered Company Directorship: -RPM, Inc.

| |

|

| | |

| | Deborah Ratner Salzberg Principal Occupation and Business Experience Ms. Ratner Salzberg has been our Executive Vice President since June 2013 and is an officer and/or director of various subsidiaries of the Company. She also serves as president of Forest City Washington, Inc., a subsidiary of the Company, and leads our operations in the Washington D.C., metropolitan area, one of the Company’s core markets. Ms. Ratner Salzberg has been a board member of CubeSmart (formerly known as U-Store-It Trust) since 2013, a publicly-traded real estate investment trust focused on self-storage facilities. Ms. Ratner Salzberg is active with numerous District of Columbia community, charitable and professional organizations, including membership on the board of the Jewish Federation of Greater Washington, the board of trustees of Kenyon College, the board of directors of Capital Bank, N.A., the District of Columbia Building Industry Association and the Meyer Foundation. Key Experience, Attributes and Skills As a member of one of our founding families and a large shareholder with more than 30 years of experience at Forest City, Ms. Ratner Salzberg brings a wealth of experience and knowledge of the real estate industry and public-private partnerships to the Board of Directors. Her execution of transactions in our core market of the greater metropolitan area of Washington D.C. brings regional insight to our Board of Directors. In addition, her legal education provides critical thinking and analysis to the Board of Directors.

|

Age: 62 Director Since: 1995 Forest City Executive Other Current Registered Company Directorship: -CubeSmart

| |

| | |

|

| | |

| | Ronald A. Ratner Principal Occupation and Business Experience Mr. Ratner has been our Executive Vice President - Development since January 2016 and Executive Vice President since March 1988. He is also an officer and/or director of various subsidiaries of the Company. Mr. Ratner is active with numerous community, educational, charitable and professional organizations, including membership on the United States Holocaust Memorial Museum Council and the National Multi Housing Council, and the board of trustees of the Cleveland Clinic and Enterprise Community Partners. Key Experience, Attributes and Skills As a member of one of our founding families and a large shareholder with over 40 years of experience at Forest City, Mr. Ratner brings vast experience and knowledge of the real estate industry to the Board of Directors. In addition, as an architect by educational background, he brings vision and creativity to Board deliberations.

|

Age: 69 Director Since: 1985 Forest City Executive

| |

| | |

Voting

The nominees receiving the greatest number of votes cast will be elected. A proxy card marked “Withhold All” or “For All Except” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Abstentions and broker non-votes, if any, will not be counted as votes cast for purposes of the election of directors and will have no effect on the result of the vote. We have been advised that the shares owned by RMSLP and otherwise owned by the Family Interests will be voted for the election of the directors nominated. If such shares are so voted, then such vote will be sufficient to elect the nominees voted on by the Class B Common Stock shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH NOMINEE FOR DIRECTOR NAMED IN THIS PROXY STATEMENT.

CO-CHAIRMEN EMERITI

|

| | |

| | Samuel H. Miller Principal Occupation and Business Experience Mr. Miller has been our Co-Chairman Emeritus since June 2011. Mr. Miller was a Forest City director from 1960 through June 2011. He was a co-chairman of our Board from June 1995 through June 2011 and our treasurer from 1992 through June 2011. He previously served as chairman of the board from June 1993 to June 1995 and vice chairman and chief operating officer prior to June 1993. Mr. Miller was inducted into the Cleveland International Hall of Fame in 2013 and is active with numerous community, educational, charitable and professional organizations, including the Cleveland Clinic Foundation, Ashland University, Baldwin Wallace College, John Carroll University, Notre Dame College, the Catholic Diocese of Cleveland Foundation, and serves as a co-chairman emeritus and director and chair of the investment committee of Medical Mutual of Ohio. Key Experience, Attributes and Skills A large shareholder with significant experience in the real-estate industry and over 60 years of experience at Forest City, Mr. Miller provides us with leadership, experience, knowledge and vision.

|

Age: 94 Co-Chairman of the Board Service: 1995 - 2011 Director Service: 1960 - 2011

| |

| | |

|

| | |

| | Albert B. Ratner Principal Occupation and Business Experience Mr. Ratner has been our Co-Chairman Emeritus since June 2011. Mr. Ratner was a Forest City director from 1960 through June 2011. He was a co-chairman of our Board from June 1995 through June 2011. He previously served as chief executive officer from 1975 to June 1995, vice chairman from June 1993 to June 1995, and president prior to June 1993. Mr. Ratner is active with numerous community, charitable and professional organizations, including service as an executive committee member and lifetime trustee of the Jewish Community Federation of Cleveland, an honorary trustee of Shoes & Clothes for Kids, an advisory committee member of the Rock and Roll Hall of Fame and Foundation, an advisory board member of Ginn Academy, a member of the Ohio Governor’s Executive Workforce Board, and a member of the board of directors of Global Cleveland. Key Experience, Attributes and Skills As a member of one of our founding families with significant experience in the real-estate industry and over 60 years of experience at Forest City, including former service as our chief executive officer, Mr. Ratner provides us with leadership, experience, knowledge and vision.

|

Age: 88 Co-Chairman of the Board Service: 1995 - 2011 Director Service: 1960 - 2011

| |

| | |

The following table sets forth the beneficial ownership of shares of Class A and Class B Common Stock as of January 31, 2016 of each current director, nominee, and the other Named Executive Officers (as named in the Summary Compensation Table), as well as all directors and executive officers as a group.

|

| | | | | | | | | | | | | | | |

| | Number of Shares of Common Stock Beneficially Owned |

| | Class A Common | Percent of | Class A Assuming Conversion of Class B by the | Percent of | Class B Common | Percent of |

| Name | Stock(a)(c) | Class(a) | Beneficial Owner(b)(c) | Class(b) | Stock | Class |

| | | | | | | | | | |

| Arthur F. Anton | 52,507 |

| (1) | 0.02 | % | 52,507 |

| | 0.02 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| Scott S. Cowen | 78,416 |

| (2) | 0.03 | % | 78,416 |

| | 0.03 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| Michael P. Esposito, Jr. | 199,514 |

| (3) | 0.08 | % | 199,514 |

| | 0.08 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| Stan Ross | 104,492 |

| (4) | 0.04 | % | 104,492 |

| | 0.04 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| Kenneth J. Bacon | 28,443 |

| (5) | 0.01 | % | 28,443 |

| | 0.01 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| Christine R. Detrick | 11,851 |

| (6) | 0.00 | % | 11,851 |

| | 0.00 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| Deborah L. Harmon | 42,729 |

| (7) | 0.02 | % | 42,729 |

| | 0.02 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| David J. LaRue | 560,738 |

| (8) | 0.23 | % | 562,173 |

| | 0.23 | % | 1,435 |

| | 0.00 | % |

| | | | | | | | | | |

| Brian J. Ratner | 1,913,865 |

| (9) | 0.79 | % | 15,421,342 |

| (9)(10) | 6.06 | % | 13,507,477 |

| (10) | 71.83 | % |

| | | | | | | | | | |

| Bruce C. Ratner | 1,011,048 |

| (11) | 0.42 | % | 1,011,048 |

| | 0.42 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| Charles A. Ratner | 679,571 |

| (12) | 0.28 | % | 15,164,518 |

| (12)(13) | 5.93 | % | 14,484,947 |

| (13) | 77.03 | % |

| | | | | | | | | | |

| Deborah Ratner Salzberg | 2,016,047 |

| (14) | 0.84 | % | 15,797,028 |

| (14)(15) | 6.20 | % | 13,780,981 |

| (15) | 73.28 | % |

| | | | | | | | | | |

| Ronald A. Ratner | 1,019,911 |

| (16) | 0.42 | % | 15,720,193 |

| (16)(17) | 6.15 | % | 14,700,282 |

| (17) | 78.17 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| OTHER NAMED EXECUTIVE OFFICERS | | | | | | | | | |

| | | | | | | | | | |

| Robert G. O’Brien | 579,413 |

| (18) | 0.24 | % | 579,413 |

| | 0.24 | % | — |

| | 0.00 | % |

| | | | | | | | | | |

| James A. Ratner | 1,312,345 |

| (19) | 0.54 | % | 2,915,845 |

| (19)(20) | 1.20 | % | 1,603,500 |

| (20) | 8.53 | % |

| | | | | | | | | | |

ALL DIRECTORS, NOMINEES AND EXECUTIVE OFFICERS AS A GROUP (19 in number) | 7,563,440 |

| (21) | 3.11 | % | 23,936,055 |

| (21)(22) | 9.22 | % | 16,372,615 |

| (22) | 87.06 | % |

|

| |

| (1) | Includes 3,180 shares of restricted stock and 28,754 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (2) | Includes 6,361 shares of restricted stock and 32,566 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (3) | Includes 6,361 shares of restricted stock and 70,962 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (4) | Includes 3,180 shares of restricted stock and 52,617 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (5) | Includes 3,180 shares of restricted stock and 12,469 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter.

|

| | |

| (6) | Includes 2,233 shares of restricted stock and 7,060 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (7) | Includes 6,361 shares of restricted stock and 21,741 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (8) | David J. LaRue has beneficial ownership of 47,116 shares of Class A Common Stock held in a trust for which he has sole power of voting and disposition and 9,400 shares held in custodial accounts. Includes 32,900 shares of restricted stock and 263,702 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (9) | Brian J. Ratner has beneficial ownership of 1,802,029 shares of Class A Common Stock held in trusts and foundations: 1,771,229 shares for which he is trustee and has shared power of voting and disposition and 30,800 shares for which he has sole power of voting and disposition. Mr. Ratner has beneficial ownership of 25,000 shares held in trusts for which he is trust advisor and has shared power of voting and disposition. Includes 25,644 shares of restricted stock and 61,192 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

|

| |

| (10) | Brian J. Ratner has beneficial ownership of 533,172 shares of Class B Common Stock held in trusts: 497,934 shares for which he is trustee and has shared power of voting and disposition and 35,238 shares for which he has sole power of voting and disposition. Mr. Ratner has beneficial ownership of 85,712 shares held in trusts for which he is trust advisor and has shared power of voting and disposition. Mr. Ratner’s beneficial ownership of the remaining 12,888,593 shares of Class B Common Stock reflects his status as a general partner of RMSLP. Does not reflect the following shares of which Mr. Ratner disclaims beneficial ownership: 1,153,126 shares of Class B Common Stock held in trusts for which he is trustee, which shares are held in the Max Ratner Family Branch of RMSLP. See discussion of RMSLP on page 7. |

| | |

| (11) | Bruce C. Ratner and certain individuals and entities affiliated with Bruce C. Ratner hold 1,940,788 Class A Common Units (“Units”) in Forest City Master Associates III, LLC that were obtained in a transaction designed to increase Forest City’s ownership interest in 30 properties and service companies that were owned jointly by us and Bruce C. Ratner at the time of such transaction. See “Transactions With Bruce C. Ratner and His Affiliates” under the “Certain Relationships and Related Transactions” section of this proxy statement for a more detailed description of the transaction. The Units may be exchanged for an equal number of shares of our Class A Common Stock or, at our option, for cash equal to the then-current market price of our Class A Common Stock. Bruce C. Ratner claims beneficial ownership in 973,548 Units: 849,768 Units held by him and 123,780 Units held in a trust for which he is trustee. Bruce C. Ratner disclaims beneficial ownership in 748,615 Units held in trusts in which he is not trustee and 218,625 Units held directly by others. Bruce C. Ratner claims beneficial ownership of 15,000 shares of Class A Common Stock held in a custodial account. |

| | |

| (12) | Charles A. Ratner has beneficial ownership of 363,198 shares of Class A Common Stock held in trusts for which he is trustee and has shared power of voting and disposition. Mr. Ratner has beneficial ownership of 125,391 shares held in trusts for which he is trust adviser and has shared power of voting and disposition. Includes 190,982 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (13) | Charles A. Ratner has beneficial ownership of 969,393 shares of Class B Common Stock held in trusts for which he is trustee and has shared power of voting and disposition. Mr. Ratner has beneficial ownership of 626,961 shares held in trusts for which he is trust advisor and has shared power of voting and disposition. Mr. Ratner’s beneficial ownership of the remaining 12,888,593 shares of Class B Common Stock reflects his status as a general partner of RMSLP. Does not reflect the following shares of which Mr. Ratner disclaims beneficial ownership: 314,478 shares of Class B Common Stock held in trusts for which he is trustee, which shares are held in the Albert Ratner Family Branch of RMSLP. See discussion of RMSLP on page 7. |

| | |

| (14) | Deborah Ratner Salzberg has beneficial ownership of 1,900,640 shares of Class A Common Stock held in trusts and foundations: 1,348,271 shares for which she is trustee and has shared power of voting and disposition and 552,369 shares for which she has sole power of voting and disposition. Ms. Ratner Salzberg has beneficial ownership of 32,352 shares held in trusts for which she is trust advisor and has shared power of voting and disposition. Includes 21,508 shares of restricted stock and 61,547 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (15) | Deborah Ratner Salzberg has beneficial ownership of 806,676 shares of Class B Common Stock held in trusts: 369,082 shares for which she is trustee and has shared power of voting and disposition and 437,594 shares for which she has sole power of voting and disposition. Ms. Ratner Salzberg has beneficial ownership of 85,712 shares held in trusts for which she is trust advisor and has shared power of voting and disposition. Ms. Ratner Salzberg’s beneficial ownership of the remaining 12,888,593 shares of Class B Common Stock reflects her status as a general partner of RMSLP. Does not reflect the following shares of which Ms. Ratner Salzberg disclaims beneficial ownership: 1,726,930 shares of Class B Common Stock held in trusts for which she is trustee, of which 1,525,575 shares are held in the Max Ratner Family Branch of RMSLP and 201,355 shares are held in the Ruth Miller Family Branch of RMSLP. See discussion of RMSLP on page 7. |

| | |

| (16) | Ronald A. Ratner has beneficial ownership of 746,288 shares of Class A Common Stock held in trusts: 525,395 shares for which he is trustee and has shared power of voting and disposition and 220,893 shares for which he has sole power of voting and disposition. Mr. Ratner has beneficial ownership of 78,408 shares held in trusts for which he is trust advisor and has shared power of voting and disposition. Includes 13,539 shares of restricted stock and 181,676 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (17) | Ronald A. Ratner has beneficial ownership of 1,332,785 shares of Class B Common Stock held in trusts: 1,182,785 shares for which he is trustee and has shared power of voting and disposition and 150,000 shares for which he has sole power of voting and disposition. Mr. Ratner has beneficial ownership of 478,904 shares held in trusts for which he is trust advisor and has shared power of voting and disposition. Mr. Ratner’s beneficial ownership of the remaining 12,888,593 shares of Class B Common Stock reflects his status as a general partner of RMSLP. See discussion of RMSLP on page 7. |

| | |

| (18) | Robert G. O’Brien has beneficial ownership of 109,224 shares of Class A Common Stock held in trusts: 75,811 shares for which he is trustee and has sole power of voting and disposition and 33,413 shares for which he is trust advisor and has shared power of voting and disposition. Includes 120,346 shares of restricted stock and 187,017 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |

| (19) | James A. Ratner has beneficial ownership of 860,277 shares of Class A Common Stock held in trusts: 858,393 shares for which he is trustee and has shared power of voting and disposition and 1,884 shares for which he has sole power of voting and disposition. Mr. Ratner has beneficial ownership of 256,853 shares held in trusts for which he is trust advisor and has shared power of voting and disposition. Includes 13,539 shares of restricted stock and 181,676 shares that were issuable upon the exercise of stock options vested at January 31, 2016 or that will vest within 60 days thereafter. |

| | |