Exhibit 99.1

Supplemental Package

For the Quarter Ended December 31, 2016

Forest City Realty Trust, Inc. and Subsidiaries - Supplemental Package

Fourth Quarter 2016

Index

|

| |

| Corporate Description | |

| Selected Financial Information | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Operations | |

| Net Asset Value Components | |

| Supplemental Operating Information | |

| Occupancy Data | |

| Retail Sales Data | |

| Leasing Summary | |

| Comparable Net Operating Income (NOI) | |

| NOI Detail | |

| NOI by Product Type | |

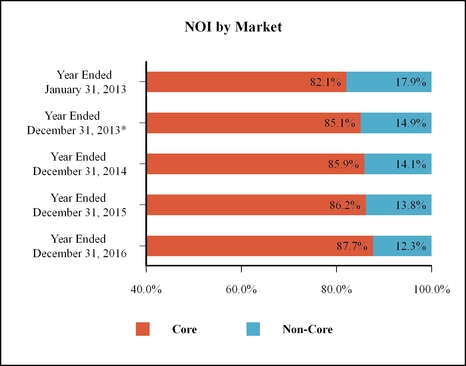

| NOI by Core Market | |

| Reconciliation of Earnings (Loss) Before Income Taxes to NOI | |

| Net Earnings | |

| Interest Expense and Capital Expenditures |

|

| Reconciliation of Net Earnings (Loss) to FFO | |

| Reconciliation of FFO to Operating FFO | |

| Reconciliation of NOI to Operating FFO | |

| Reconciliation of Net Earnings (Loss) to EBITDA | |

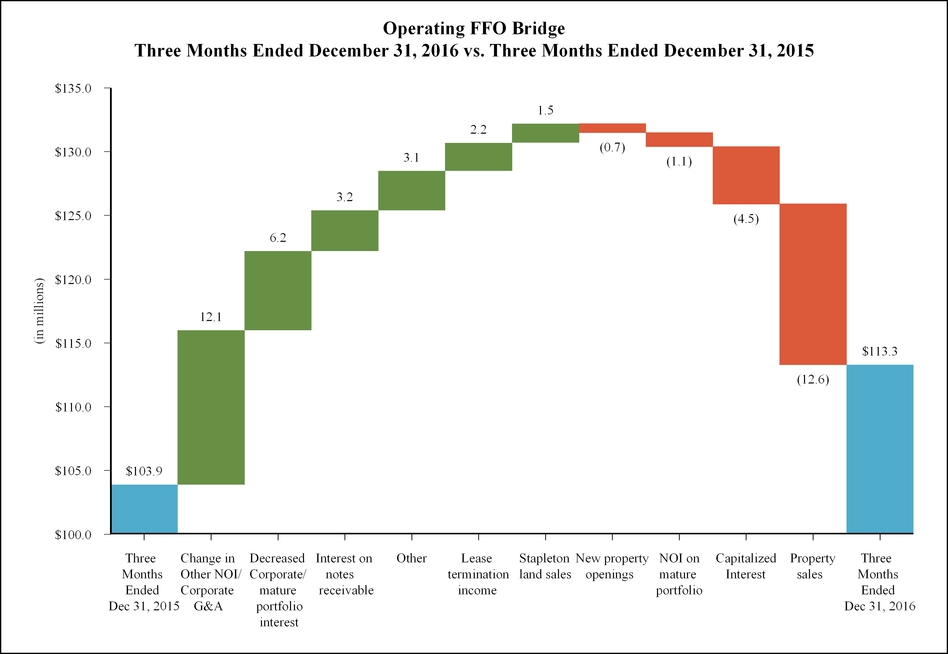

| Operating FFO Bridges | |

| Office Lease Expirations and Significant Tenants | |

| Retail Lease Expirations and Significant Tenants | |

| Historical Trends | |

| Development Pipeline | |

| Supplemental Financial Information | |

| Common Stock Data/Financial Covenants | |

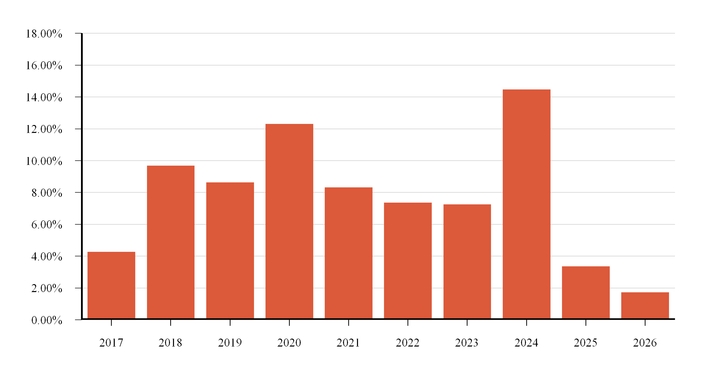

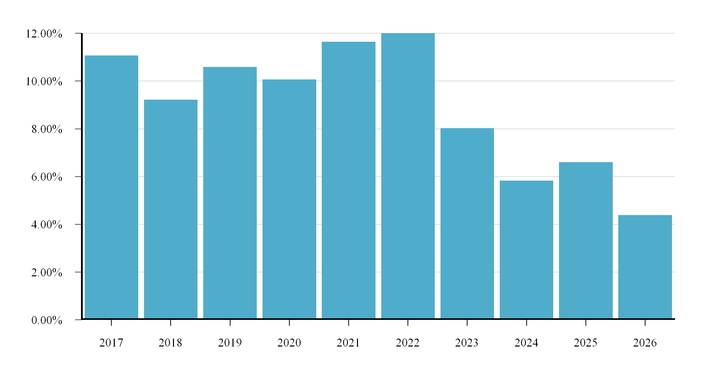

| Nonrecourse Debt Maturities Table | |

| Property Listing | |

| Appendix | |

This supplemental package, together with other statements and information publicly disseminated by us, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements reflect management’s current views with respect to financial results related to future events and are based on assumptions and expectations that may not be realized and are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, financial or otherwise, may differ, perhaps materially, from the results discussed in the forward-looking statements. Risk factors discussed in Item 1A of our Form 10-K for the year ended December 31, 2016 and other factors that might cause differences, some of which could be material, include, but are not limited to, our ability to qualify or to remain qualified as a REIT, our ability to satisfy REIT distribution requirements, the impact of issuing equity, debt or both, and selling assets to satisfy our future distributions required as a REIT or to fund capital expenditures, future growth and expansion initiatives, the impact of the amount and timing of any future distributions, the impact from complying with REIT qualification requirements limiting our flexibility or causing us to forego otherwise attractive opportunities beyond rental real estate operations, the impact of complying with the REIT requirements related to hedging, our lack of experience operating as a REIT, legislative, administrative, regulatory or other actions affecting REITs, including positions taken by the Internal Revenue Service, the possibility that our Board of Directors will unilaterally revoke our REIT election, the possibility that the anticipated benefits of qualifying as a REIT will not be realized, or will not be realized within the expected time period, the impact of current lending and capital market conditions on our liquidity, our ability to finance or refinance projects or repay our debt, the impact of the slow economic recovery on the ownership, development and management of our commercial real estate portfolio, general real estate investment and development risks, litigation risks, vacancies in our properties, risks associated with developing and managing properties in partnership with others, competition, our ability to renew leases or re-lease spaces as leases expire, illiquidity of real estate investments, our ability to identify and transact on chosen strategic alternatives for a portion of our retail portfolio, bankruptcy or defaults of tenants, anchor store consolidations or closings, the impact of terrorist acts and other armed conflicts, our substantial debt leverage and the ability to obtain and service debt, the impact of restrictions imposed by our revolving credit facility, term loan facility and senior debt, exposure to hedging agreements, the level and volatility of interest rates, the continued availability of tax-exempt government financing, our ability to receive payment on the notes receivable issued by Onexim in connection with their purchase of our interests in the Barclays Center and the Nets, the impact of credit rating downgrades, effects of uninsured or underinsured losses, effects of a downgrade or failure of our insurance carriers, environmental liabilities, competing interests of our directors and executive officers, the ability to recruit and retain key personnel, risks associated with the sale of tax credits, downturns in the housing market, the ability to maintain effective internal controls, compliance with governmental regulations, increased legislative and regulatory scrutiny of the financial services industry, changes in federal, state or local tax laws and international trade agreements, volatility in the market price of our publicly traded securities, inflation risks, cybersecurity risks, cyber incidents, shareholder activism efforts, conflicts of interest, risks related to our organizational structure including operating through our Operating Partnership and our UPREIT structure and completion of the proposed reclassification of our common stock, as well as other risks listed from time to time in our SEC filings, including but not limited to, our annual and quarterly reports. We have no obligation to revise or update any forward-looking statements, other than as imposed by law, as a result of future events or new information. Readers are cautioned not to place undue reliance on such forward-looking statements.

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Corporate Description

We principally engage in the operation, development, management and acquisition of office, retail and apartment real estate and land throughout the United States. We have approximately $8.2 billion of consolidated assets in 20 states and the District of Columbia at December 31, 2016. Our core markets include Boston, Chicago, Dallas, Denver, Los Angeles, Philadelphia and the greater metropolitan areas of New York City, San Francisco and Washington D.C. We have regional offices in Boston, Dallas, Denver, Los Angeles, New York City, San Francisco, Washington, D.C. and our corporate headquarters in Cleveland, Ohio.

We recently completed an internal reorganization and began presenting reportable segments based on this new structure for the reporting period ended September 30, 2016. The new structure is organized around our real estate operations, real estate development and corporate support service functions. Prior periods have been recast to conform to the current period’s reportable segment presentation.

Real Estate Operations represents the performance of our core rental real estate portfolio and is comprised of the following reportable operating segments:

| |

| • | Office - owns, acquires and operates office and life science buildings. |

| |

| • | Retail - owns, acquires and operates regional malls, specialty/urban retail centers and amenity retail within our mixed-use projects. |

| |

| • | Apartments - owns, acquires and operates rental properties, including upscale and middle-market apartments, adaptive re-use developments and subsidized senior housing. |

The remaining reportable operating segments consist of the following:

| |

| • | Development represents the development and construction of office and life science buildings, regional malls, specialty/urban retail centers, amenity retail, apartments, condominiums and mixed-use projects. Included in the Development segment are recently opened operating properties prior to stabilization. Development also includes the horizontal development and sale of land to residential, commercial and industrial customers primarily at our Stapleton project in Denver, Colorado. |

| |

| • | Corporate is comprised of departments providing executive oversight to the entire company and various support services for Operations, Development and Corporate employees. |

| |

| • | Other represents the operations of several non-core investments, including the Barclays Center, a sports and entertainment arena located in Brooklyn, New York (“Arena”) (sold in January 2016), our equity method investment in the Brooklyn Nets (the “Nets”)(sold in January 2016), and military housing operations (sold in February 2016). |

Segment Transfers

The Development segment includes projects in development, projects under construction along with recently opened operating properties prior to stabilization. Projects will be reported in their applicable operating segment (Office, Retail or Apartments) beginning on January 1 of the year following stabilization. Therefore, the Development segment will continue to report results from recently opened properties until the year-end following initial stabilization. We generally define stabilized properties as achieving 92% or greater occupancy or having been open and operating for one or two years, depending on the size of the project. Once a stabilized property is transferred to the applicable Operations segment on January 1, it will be considered “comparable” beginning with the next January 1, as that will be the first time the property is stabilized in both periods presented.

Segment Reclassifications

Concurrent with our internal reorganization, certain functions previously performed within our old business unit structure were centralized into our corporate segment. We analyzed the allocation methodology of these new corporate functions and our historic corporate functions and how it relates to support services provided to our new segments within our new organizational structure. As a result of this analysis, certain expenses previously recorded in the old business units and reported on the property operating and management expenses financial statement line item are recorded in the corporate segment and included in the corporate general and administrative expense financial statement line item. To conform to the current year presentation, $720,000 and $3,600,000 have been reclassed from property operating and management expenses to corporate general and administrative expenses for the three months and year ended December 31, 2015, respectively.

REIT Conversion

On January 13, 2015, the board of directors of Forest City Enterprises, Inc., our predecessor, approved a plan to pursue conversion to REIT status. On May 29, 2015, Forest City Enterprises, Inc. formed Forest City Realty Trust, Inc. (with its subsidiaries, the “Company”) as a Maryland corporation and wholly-owned subsidiary of Forest City Enterprises, Inc. On October 20, 2015, the shareholders of Forest City Enterprises, Inc. approved and adopted the merger agreement that implemented the restructuring of Forest City Enterprises, Inc. into a holding company so as to facilitate its conversion to a REIT.

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Pursuant to the merger agreement, effective as of 11:59 pm, Eastern Time, on December 31, 2015 (the “Effective Time”), (i) a wholly-owned subsidiary of the Company merged with and into Forest City Enterprises, Inc., with Forest City Enterprises, Inc. as the surviving corporation, (ii) each outstanding share of Forest City Enterprises, Inc. Class A common stock, par value $.33 1/3 per share, and Class B common stock, par value $.33 1/3 per share, automatically converted into one share of Forest City Realty Trust, Inc. Class A common stock, $.01 par value per share, and Class B common stock, $.01 par value per share, respectively, (iii) Forest City Enterprises, Inc. became a wholly-owned subsidiary of the Company and (iv) the Company became the publicly-traded New York Stock Exchange-listed parent company that succeeded to and continued to operate substantially all of the existing businesses of Forest City Enterprises, Inc. and its subsidiaries. In addition, each share of Class A common stock of Forest City Enterprises, Inc. held in treasury at December 31, 2015 ceased to be outstanding at the Effective Time of the Merger, and a corresponding adjustment was recorded to Class A common stock and additional paid-in capital. Immediately following the merger, Forest City Enterprises, Inc. converted into a Delaware limited partnership named “Forest City Enterprises, L.P.” (the “Operating Partnership”).

In this supplemental package, unless otherwise specifically stated or the context otherwise requires, all references to “the Company,” “Forest City,” “we,” “our,” “us” and similar terms refer to Forest City Enterprises, Inc. and its consolidated subsidiaries prior to the Effective Time and Forest City Realty Trust, Inc. and its consolidated subsidiaries, including the Operating Partnership, as of the Effective Time and thereafter.

Company Operations

We believe that we are organized in a manner enabling us to qualify, and intend to operate in a manner allowing us to continue to qualify, as a REIT for federal income tax purposes. As such, we intend to elect REIT status for our taxable year ended December 31, 2016, upon filing the 2016 Form 1120-REIT with the Internal Revenue Service on or before September 15, 2017.

We hold substantially all of our assets, and conduct substantially all of our business, through the Operating Partnership. We are the sole general partner of the Operating Partnership and, as of December 31, 2016, we directly or indirectly own all of the limited partnership interests in the Operating Partnership.

We hold and operate certain of our assets through one or more taxable REIT subsidiaries (“TRSs”). A TRS is a subsidiary of a REIT subject to applicable corporate income tax. Our use of TRSs enables us to continue to engage in certain businesses while complying with REIT qualification requirements and allows us to retain income generated by these businesses for reinvestment without the requirement of distributing those earnings. The primary non-REIT qualified businesses held in TRSs include 461 Dean Street, an apartment building in Brooklyn, New York, the Pacific Park Brooklyn project, land development operations, Barclays Center arena (sold in January 2016), the Nets (sold in January 2016) and military housing operations (sold in February 2016). In the future, we may elect to reorganize and transfer certain assets or operations from our TRSs to other subsidiaries, including qualified REIT subsidiaries.

Supplemental Financial and Operating Information

We recommend this supplemental package be read in conjunction with our Form 10-K for the year ended December 31, 2016. This supplemental package contains consolidated financial statements prepared in accordance with generally accepted accounting principles (“GAAP”). We also present certain financial information at total company ownership because we believe this information is useful to financial statement users as this method reflects the manner in which we operate our business. We believe financial information and other operating metrics at total company ownership including net asset value (“NAV”) components, net operating income (“NOI”), comparable NOI, Funds From Operations (“FFO”), Operating FFO, Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Net Debt to Adjusted EBITDA are necessary to understand our business and operating results, along with net earnings and other GAAP measures. Our financial statement users can use these non-GAAP measures as supplementary information to evaluate our business. Our non-GAAP measures or information shown at total company ownership are not intended to be performance measures that should be regarded as alternatives to, or more meaningful than, our GAAP measures.

This supplemental package also contains financial information of entities consolidated under GAAP (“Fully Consolidated Entities”), financial information on our partners share of entities consolidated under GAAP (“Noncontrolling Interest”) and financial information on our share of entities accounted for using the equity method accounting (“Company Share of Unconsolidated Entities”). We believe disclosing financial information on Fully Consolidated Entities, Noncontrolling Interest and Company Share of Unconsolidated Entities is essential to allow our financial statement users the ability to arrive at our Total Company ownership of all of our real estate investments, whether or not we “control” the investment under GAAP.

Financial information related to Fully Consolidated Entities, Noncontrolling Interest and Company Share of Unconsolidated Entities is included in the Appendix section of this supplemental package.

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Supplemental Operating Information

The operating information contained in this document includes: occupancy data, retail sales data, leasing summaries, comparable NOI, NOI by product type and core market, reconciliation of NOI to earnings (loss) before income taxes, reconciliation of net earnings (loss) to FFO, reconciliation of FFO to Operating FFO, reconciliation of NOI to Operating FFO, reconciliation of net earnings (loss) to EBITDA, Operating FFO bridges, office and retail lease expirations, office and retail significant tenants, historical trends and our development pipeline. We believe this information gives interested parties a better understanding and more information about our operating performance. The term “comparable,” which is used throughout this document, is generally defined as including stabilized properties open and operated in the years ended December 31, 2016 and 2015. We believe occupancy data, retail sales data, leasing spreads on office and retail properties, and other rental rate information on multi-family properties represent meaningful operating statistics about us.

Consolidation Method

In line with industry practice, we have a number of investments in which our economic ownership is less than 100% as a means of procuring opportunities and sharing risk. Under GAAP, the full consolidation method is used to report assets and liabilities at 100% if deemed to be under our control or if we are deemed to be the primary beneficiary of the variable interest entity (“VIE”), even if our ownership is not 100%.

Net Asset Value Components

We disclose components of our business relevant to calculate NAV, a non-GAAP measure. There is no directly comparable GAAP financial measure to NAV. We consider NAV to be a useful supplemental measure which assists both management and investors to estimate the fair value of our Company. The calculation of NAV involves significant estimates and can be calculated using various methods. Each individual investor must determine the specific methodology, assumptions and estimates to use to arrive at an estimated NAV of the Company. NAV components are shown at our total company ownership. We believe disclosing the components at total company ownership is essential to estimate NAV, as they represent our estimated proportionate amount of assets and liabilities the Company is entitled to.

The components of NAV do not consider the potential changes in rental and fee income streams or development platform. The components include non-GAAP financial measures, such as NOI and information related to our rental properties business at the Company’s share. Although these measures are not presented in accordance with GAAP, investors can use these non-GAAP measures as supplementary information to evaluate our business.

FFO

FFO, a non-GAAP measure, along with net earnings, provides additional information about our core operations. While property dispositions, acquisitions or other factors impact net earnings in the short-term, we believe FFO presents a more consistent view of the overall financial performance of our business from period-to-period since the core of our business is the recurring operations of our portfolio of real estate assets. Management believes that the exclusion from FFO of gains and losses from the sale of operating real estate assets allows investors and analysts to readily identify the operating results of the assets that form the core of the Company’s activity and assists in comparing those operating results between periods. Implicit in historical cost accounting for real estate assets in accordance with GAAP is the assumption that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many industry investors and analysts have considered presentations of operating results for real estate companies using historical cost accounting alone to be insufficient. Because FFO excludes depreciation and amortization of real estate assets and impairment of depreciable real estate, management believes that FFO, along with the required GAAP presentations, provides a more complete measurement of the Company’s performance relative to its competitors and a more appropriate basis on which to make decisions involving operating, financing and investing activities than the required GAAP presentations alone would provide.

The majority of our peers in the publicly traded real estate industry are REITs and report operations using FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”). Although we were not a REIT for the prior period presented, management believes it is important to publish this measure to allow for easier comparison of our performance to our peers. The major difference between us and our REIT peers is that we were a taxable entity and any taxable income we generated could have resulted in payment of federal or state income taxes. Our REIT peers typically do not pay federal or state income taxes on their qualified REIT investments, but distribute a significant portion of their taxable income to shareholders. Due to our effective tax management policies, we have not historically been a significant payer of income taxes. This has allowed us to retain our internally generated cash flows but has also resulted in large expenses for deferred taxes as required by GAAP.

FFO is defined by NAREIT as net earnings excluding the following items at our proportionate share: i) gain (loss) on full or partial disposition of rental properties, divisions and other investments (net of tax); ii) non-cash charges for real estate depreciation and

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

amortization; iii) impairment of depreciable real estate (net of tax); and iv) cumulative or retrospective effect of change in accounting principle (net of tax).

In connection with our conversion to REIT status, we were required to reverse our net deferred tax liabilities related to our subsidiaries that will be held as qualified REIT investments of $588,607,000 during the three months ended December 31, 2015, which we have excluded from our December 31, 2015 FFO calculation.

Operating FFO

In addition to reporting FFO, we report Operating FFO, a non-GAAP measure, as an additional measure of our operating performance. We believe it is appropriate to adjust FFO for significant items driven by transactional activity and factors relating to the financial and real estate markets, rather than factors specific to the on-going operating performance of our properties. We use Operating FFO as an indicator of continuing operating results in planning and executing our business strategy. Operating FFO should not be considered to be an alternative to net earnings computed under GAAP as an indicator of our operating performance and may not be directly comparable to similarly-titled measures reported by other companies.

We define Operating FFO as FFO adjusted to exclude: i) impairment of non-depreciable real estate; ii) write-offs of abandoned development projects and demolition costs; iii) income recognized on state and federal historic and other tax credits; iv) gains or losses from extinguishment of debt; v) change in fair market value of nondesignated hedges; vi) gains or losses on change in control of interests; vii) the adjustment to recognize rental revenues and rental expense using the straight-line method; viii) participation payments to ground lessors on refinancing of our properties; ix) other transactional items; x) the Nets pre-tax FFO; and xi) income taxes on FFO.

EBITDA

EBITDA, a non-GAAP measure, is defined as net earnings excluding the following items at our proportionate share: i) non-cash charges for depreciation and amortization; ii) interest expense; iii) amortization of mortgage procurement costs; and iv) income taxes. EBITDA may not be directly comparable to similarly-titled measures reported by other companies. We use EBITDA as a starting point in order to derive Adjusted EBITDA as further described below.

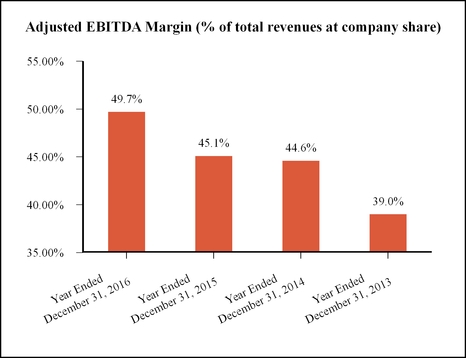

Adjusted EBITDA

We define Adjusted EBITDA, a non-GAAP measure, as EBITDA adjusted to exclude: i) impairment of real estate; ii) gains or losses from extinguishment of debt; iii) gain (loss) on full or partial disposition of rental properties, development projects and other investments; iv) gains or losses on change in control of interests; v) other transactional items, including organizational transformation and termination benefits; and vi) the Nets pre-tax EBITDA. We believe EBITDA, Adjusted EBITDA and net debt to Adjusted EBITDA provide additional information in evaluating our credit and ability to service our debt obligations. Adjusted EBITDA is used by the chief operating decision maker and management to assess operating performance and resource allocations by segment and on a consolidated basis. Management believes Adjusted EBITDA gives the investment community a more complete understanding of the Company’s operating results, including the impact of general and administrative expenses and acquisition-related expenses, before the impact of investing and financing transactions and facilitates comparisons with competitors. However, Adjusted EBITDA should not be viewed as an alternative measure of the Company’s operating performance since it excludes financing costs as well as depreciation and amortization costs which are significant economic costs that could materially impact the Company’s results of operations and liquidity. Other REITs may use different methodologies for calculating Adjusted EBITDA and, accordingly, the Company’s Adjusted EBITDA may not be comparable to other REITs.

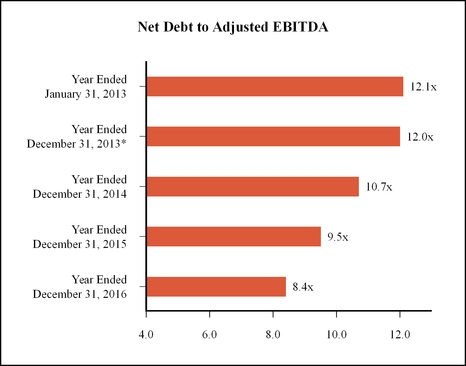

Net Debt to Adjusted EBITDA

Net Debt to Adjusted EBITDA, a non-GAAP measure, is defined as total debt, net at our proportionate share (total debt includes outstanding borrowings on our revolving credit facility, our term loan facility, convertible senior debt, net, nonrecourse mortgages and notes payable, net) less cash and equivalents, at our proportionate share, divided by Adjusted EBITDA. Net Debt to Adjusted EBITDA is a supplemental measure derived from non-GAAP financial measures that the Company uses to evaluate its capital structure and the magnitude of its debt against its operating performance. The Company believes that investors use versions of this ratio in a similar manner. The Company’s method of calculating the ratio may be different from methods used by other REITs and, accordingly, may not be comparable to other REITs.

NOI

NOI, a non-GAAP measure, reflects our share of the core operations of our rental real estate portfolio, prior to any financing activity. NOI is defined as revenues less operating expenses at our ownership within our Office, Retail, Apartments and Development segments, except for revenues and cost of sales associated with sales of land held in these segments. The activities of our Corporate and Other segments do not involve the operations of our rental property portfolio and therefore are not included in NOI.

We believe NOI provides important information about our core operations and, along with earnings before income taxes, is necessary to understand our business and operating results. Because NOI excludes general and administrative expenses, interest expense,

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

depreciation and amortization, revenues and cost of sales associated with sales of land, other non-property income and losses, and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating office, retail and apartment real estate and the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing a perspective on operations not immediately apparent from net income. We use NOI to evaluate our operating performance on a portfolio basis since NOI allows us to evaluate the impact that factors such as occupancy levels, lease structure, rental rates, and tenant mix have on our financial results. Investors can use NOI as supplementary information to evaluate our business. In addition, management believes NOI provides useful information to the investment community about our financial and operating performance when compared to other REITs since NOI is generally recognized as a standard measure of performance in the real estate industry. NOI is not intended to be a performance measure that should be regarded as an alternative to, or more meaningful than, our GAAP measures, and may not be directly comparable to similarly-titled measures reported by other companies.

Comparable NOI

We use comparable NOI as a metric to evaluate the performance of our office, retail and apartment properties. This measure provides a same-store comparison of operating results of all stabilized properties that are open and operating in all periods presented. Non-capitalizable development costs and unallocated management and service company overhead, net of service fee revenues, are not directly attributable to an individual operating property and are considered non-comparable NOI. In addition, certain income and expense items at the property level, such as lease termination income, real estate tax assessments or rebates, certain litigation expenses incurred and any related legal settlements and NOI impacts of changes in ownership percentages, are excluded from comparable NOI. Other properties and activities such as Arena, federally assisted housing, military housing, straight-line rent adjustments and participation payments as a result of refinancing transactions are not evaluated on a comparable basis and the NOI from these properties and activities is considered non-comparable NOI.

Comparable NOI is an operating statistic defined as NOI from stabilized properties operated in all periods presented. We believe comparable NOI is useful because it measures the performance of the same properties on a period-to-period basis and is used to assess operating performance and resource allocation of the operating properties. While property dispositions, acquisitions or other factors impact net earnings in the short term, we believe comparable NOI presents a more consistent view of the overall performance of our operating portfolio from period to period. A reconciliation of earnings (loss) before income taxes, the most comparable financial measure calculated in accordance with GAAP, to NOI, a reconciliation of NOI to earnings (loss) before income taxes for each operating segment and a reconciliation from NOI to comparable NOI are included in this supplemental package.

Other Reclassifications

In April 2015, the FASB issued an Accounting Standards Update to simplify the presentation of debt issuance costs. This guidance requires that third-party debt issuance costs be presented in the balance sheet as a direct deduction from the carrying value of the debt. This guidance is effective for fiscal years, and for interim reporting periods within those fiscal years, beginning after December 15, 2015. As a result of the adoption of this guidance on January 1, 2016, we reclassified mortgage procurement costs from other assets to nonrecourse mortgage debt and notes payable, net and convertible senior debt, net on the December 31, 2015 Consolidated Balance Sheet. In addition, we reclassified mortgage procurement costs from assets held for sale to liabilities held for sale on the December 31, 2015 Consolidated Balance Sheet.

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Corporate Headquarters

Forest City Realty Trust, Inc.

Terminal Tower

50 Public Square, Suite 1100

Cleveland, Ohio 44113

Annual Report on Form 10-K

A copy of the Annual Report on Form 10-K as filed with the Securities and Exchange Commission (“SEC”) for the year ended December 31, 2016, can be found on our website under SEC Filings or may be obtained without charge upon written request to:

Jeffrey B. Linton

Senior Vice President - Corporate Communication

JeffLinton@forestcity.net

Website

www.forestcity.net

The information contained on this website is not incorporated herein by reference and does not constitute a part of this supplemental package.

Investor Relations

Michael E. Lonsway

Senior Vice President - Planning

MikeLonsway@forestcity.net

Investor Presentations

Please note we periodically post updated investor presentations on the Investors page of our website at www.forestcity.net. It is possible the periodic updates may include information deemed to be material. Therefore, we encourage investors, the media, and other interested parties to review the Investors page of our website at www.forestcity.net for the most recent investor presentation.

Transfer Agent and Registrar

Wells Fargo

Shareowner Services

P.O. Box 64854

St. Paul, MN 55164-9440

(800) 468-9716

www.shareowneronline.com

NYSE Listings

FCEA - Class A Common Stock ($.01 par value)

FCEB - Class B Common Stock ($.01 par value)

Dividend Reinvestment and Stock Purchase Plan

We offer our shareholders the opportunity to purchase additional shares of common stock through the Forest City Realty Trust, Inc. Dividend Reinvestment and Stock Purchase Plan (the “Plan”). You may obtain a copy of the Plan prospectus and an enrollment card by contacting Wells Fargo Shareowner Services at (800) 468-9716 or by visiting www.shareowneronline.com.

(THIS PAGE INTENTIONALLY LEFT BLANK)

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Consolidated Balance Sheets – (Unaudited)

|

| | | | | | |

| | December 31, 2016 | December 31, 2015 |

| | (in thousands) |

| Assets | | |

| Real Estate | | |

| Completed rental properties | | |

| Office | $ | 3,603,480 |

| $ | 3,686,854 |

|

| Retail | 288,582 |

| 1,254,721 |

|

| Apartments | 2,586,720 |

| 2,442,321 |

|

| Total Operations | 6,478,782 |

| 7,383,896 |

|

| Recently-Opened Properties/Redevelopment | 622,939 |

| 299,077 |

|

| Corporate | 10,626 |

| 10,542 |

|

| Other | — |

| 556 |

|

| Total completed rental properties | 7,112,347 |

| 7,694,071 |

|

| Projects under construction | | |

| Office | 110,526 |

| 84,253 |

|

| Retail | 6,457 |

| — |

|

| Apartments | 399,332 |

| 545,574 |

|

| Total projects under construction | 516,315 |

| 629,827 |

|

| Projects under development | | |

| Operating properties | 1,637 |

| 36,152 |

|

| Office | 103,598 |

| 90,246 |

|

| Retail | — |

| 23,777 |

|

| Apartments | 113,430 |

| 109,616 |

|

| Total projects under development | 218,665 |

| 259,791 |

|

| Total projects under construction and development | 734,980 |

| 889,618 |

|

| Land inventory | 68,238 |

| 69,318 |

|

| Total Real Estate | 7,915,565 |

| 8,653,007 |

|

| Less accumulated depreciation | (1,442,006 | ) | (1,624,920 | ) |

| Real Estate, net | 6,473,559 |

| 7,028,087 |

|

| Cash and equivalents | 174,619 |

| 265,677 |

|

| Restricted cash | 149,300 |

| 161,891 |

|

| Accounts receivable, net | 208,563 |

| 221,562 |

|

| Notes receivable | 383,163 |

| 154,585 |

|

| Investments in and advances to unconsolidated entities | 564,779 |

| 678,872 |

|

| Lease procurement costs, net | 66,065 |

| 95,924 |

|

| Prepaid expenses and other deferred costs, net | 73,987 |

| 107,848 |

|

| Intangible assets, net | 134,562 |

| 198,672 |

|

| Deferred income taxes, net | — |

| 83,645 |

|

| Assets held for sale | — |

| 926,387 |

|

| Total Assets | $ | 8,228,597 |

| $ | 9,923,150 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Consolidated Balance Sheets – (Unaudited) |

| | | | | | |

| | December 31, 2016 | December 31, 2015 |

| | (in thousands) |

| Liabilities and Equity | | |

| Liabilities | | |

| Nonrecourse mortgage debt and notes payable, net | | |

| Completed rental properties | | |

| Office | $ | 1,152,425 |

| $ | 1,815,297 |

|

| Retail | 141,160 |

| 559,337 |

|

| Apartments | 1,396,088 |

| 1,281,557 |

|

| Total Operations | 2,689,673 |

| 3,656,191 |

|

| Recently-Opened Properties/Redevelopment | 292,083 |

| 196,822 |

|

| Other | — |

| — |

|

| Total completed rental properties | 2,981,756 |

| 3,853,013 |

|

| Projects under construction | | |

| Office | 37,660 |

| 20,189 |

|

| Retail | — |

| — |

|

| Apartments | 69,996 |

| 50,353 |

|

| Total projects under construction | 107,656 |

| 70,542 |

|

| Projects under development | | |

| Operating properties | — |

| — |

|

| Office | — |

| — |

|

| Retail | — |

| — |

|

| Apartments | 31,421 |

| 32,147 |

|

| Total projects under development | 31,421 |

| 32,147 |

|

| Total projects under construction and development | 139,077 |

| 102,689 |

|

| Land inventory | — |

| — |

|

| Nonrecourse mortgage debt and notes payable, net | 3,120,833 |

| 3,955,702 |

|

| Revolving credit facility | — |

| — |

|

| Term loan facility | 333,268 |

| — |

|

| Convertible senior debt, net | 112,181 |

| 267,235 |

|

| Construction payables | 137,738 |

| 166,811 |

|

| Operating accounts payable and accrued expenses | 562,784 |

| 622,327 |

|

| Accrued derivative liability | 26,202 |

| 73,679 |

|

| Total Accounts payable, accrued expenses and other liabilities | 726,724 |

| 862,817 |

|

| Cash distributions and losses in excess of investments in unconsolidated entities | 150,592 |

| 150,255 |

|

| Liabilities held for sale | — |

| 552,607 |

|

| Total Liabilities | 4,443,598 |

| 5,788,616 |

|

| Redeemable Noncontrolling Interest | — |

| 159,978 |

|

| Equity | | |

| Shareholders’ Equity | | |

| Shareholders’ equity before accumulated other comprehensive loss | 3,298,248 |

| 3,586,237 |

|

| Accumulated other comprehensive loss | (14,410 | ) | (67,905 | ) |

| Total Shareholders’ Equity | 3,283,838 |

| 3,518,332 |

|

| Noncontrolling interest | 501,161 |

| 456,224 |

|

| Total Equity | 3,784,999 |

| 3,974,556 |

|

| Total Liabilities and Equity | $ | 8,228,597 |

| $ | 9,923,150 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Consolidated Statements of Operations – (Unaudited) |

| | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Years Ended December 31, |

| | 2016 | 2015 | | 2016 | 2015 |

| | (in thousands) |

| Revenues | | | | | |

| Rental | $ | 161,937 |

| $ | 167,916 |

| | $ | 649,923 |

| $ | 625,725 |

|

| Tenant recoveries | 23,155 |

| 32,588 |

| | 117,144 |

| 133,829 |

|

| Service and management fees | 15,604 |

| 13,869 |

| | 53,824 |

| 45,263 |

|

| Parking and other | 13,432 |

| 18,732 |

| | 56,996 |

| 62,376 |

|

| Arena | — |

| — |

| | — |

| — |

|

| Land sales | 25,599 |

| 31,580 |

| | 48,078 |

| 79,169 |

|

| Subsidized Senior Housing | — |

| — |

| | — |

| — |

|

| Military Housing | — |

| 8,145 |

| | 3,518 |

| 31,869 |

|

| Total revenues | 239,727 |

| 272,830 |

| | 929,483 |

| 978,231 |

|

| Expenses | | | | | |

| Property operating and management | 79,136 |

| 100,028 |

| | 337,951 |

| 383,088 |

|

| Real estate taxes | 22,720 |

| 24,315 |

| | 90,468 |

| 91,274 |

|

| Ground rent | 3,509 |

| 1,972 |

| | 14,375 |

| 11,348 |

|

| Arena operating | — |

| — |

| | — |

| — |

|

| Cost of land sales | 8,471 |

| 15,697 |

| | 13,661 |

| 31,413 |

|

| Subsidized Senior Housing operating | — |

| — |

| | — |

| — |

|

| Military Housing operating | — |

| 1,841 |

| | 2,730 |

| 8,130 |

|

| Corporate general and administrative | 10,904 |

| 13,199 |

| | 62,683 |

| 51,974 |

|

| Organizational transformation and termination benefits | 9,215 |

| 22,627 |

| | 31,708 |

| 48,125 |

|

| | 133,955 |

| 179,679 |

| | 553,576 |

| 625,352 |

|

| Depreciation and amortization | 62,327 |

| 72,546 |

| | 250,848 |

| 252,925 |

|

| Write-offs of abandoned development projects and demolition costs | 290 |

| 3,756 |

| | 10,348 |

| 9,534 |

|

| Impairment of real estate | — |

| 25,971 |

| | 156,825 |

| 451,434 |

|

| Total expenses | 196,572 |

| 281,952 |

| | 971,597 |

| 1,339,245 |

|

| Operating earnings (loss) | 43,155 |

| (9,122 | ) | | (42,114 | ) | (361,014 | ) |

| Interest and other income | 13,564 |

| 9,762 |

| | 46,229 |

| 37,739 |

|

| Net gain on disposition of interest in unconsolidated entities | — |

| — |

| | — |

| — |

|

| Gain (loss) on change in control of interests | — |

| (1,405 | ) | | — |

| 486,279 |

|

| Interest expense | (30,311 | ) | (37,481 | ) | | (131,441 | ) | (157,166 | ) |

| Interest rate swap breakage fee | (24,635 | ) | — |

| | (24,635 | ) | — |

|

| Amortization of mortgage procurement costs | (1,324 | ) | (1,793 | ) | | (5,719 | ) | (7,549 | ) |

| Loss on extinguishment of debt | (3,876 | ) | (3,133 | ) | | (32,960 | ) | (65,086 | ) |

| Earnings (loss) before income taxes and earnings (loss) from unconsolidated entities | (3,427 | ) | (43,172 | ) | | (190,640 | ) | (66,797 | ) |

| Earnings (loss) from unconsolidated entities | 4,734 |

| (8,488 | ) | | (263,533 | ) | 28,762 |

|

| Earnings (loss) before income taxes | 1,307 |

| (51,660 | ) | | (454,173 | ) | (38,035 | ) |

| Income tax expense (benefit) of taxable REIT subsidiaries (2016) | | | | | |

| Current | 1,466 |

| (9,631 | ) | | 3,240 |

| 2,139 |

|

| Deferred | 100 |

| (595,886 | ) | | 493 |

| (583,917 | ) |

| | 1,566 |

| (605,517 | ) | | 3,733 |

| (581,778 | ) |

| Earnings (loss) before gain on disposal of real estate | (259 | ) | 553,857 |

| | (457,906 | ) | 543,743 |

|

| Net gain on disposition of interest in development project, net of tax | — |

| — |

| | 136,117 |

| — |

|

| Net gain on disposition of full or partial interests in rental properties, net of tax | 18,199 |

| — |

| | 121,284 |

| 1,067 |

|

| Earnings (loss) from continuing operations | 17,940 |

| 553,857 |

| | (200,505 | ) | 544,810 |

|

| Discontinued operations, net of tax | | | | | |

| Operating loss from rental properties | — |

| (3,058 | ) | | (1,126 | ) | (27,520 | ) |

| Gain (loss) on disposition of rental properties | (15,200 | ) | — |

| | 49,353 |

| — |

|

| Equity in earnings (loss) | — |

| (1,423 | ) | | (822 | ) | (24,952 | ) |

| | (15,200 | ) | (4,481 | ) | | 47,405 |

| (52,472 | ) |

| Net earnings (loss) | 2,740 |

| 549,376 |

| | (153,100 | ) | 492,338 |

|

| Noncontrolling interests, gross of tax | | | | | |

| Earnings from continuing operations attributable to noncontrolling interests | (915 | ) | (2,812 | ) | | (6,078 | ) | (13,258 | ) |

| Loss from discontinued operations attributable to noncontrolling interests | — |

| 2,150 |

| | 776 |

| 16,962 |

|

| | (915 | ) | (662 | ) | | (5,302 | ) | 3,704 |

|

| Net earnings (loss) attributable to Forest City Realty Trust, Inc. | $ | 1,825 |

| $ | 548,714 |

| | $ | (158,402 | ) | $ | 496,042 |

|

(THIS PAGE INTENTIONALLY LEFT BLANK)

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Net Asset Value Components – December 31, 2016

|

| | | | | | | | | | | | | | | | | | | | |

| Completed Rental Properties - Operations |

| | Q4 2016 | | Net Stabilized | | Stabilized | | Annualized | | Nonrecourse |

| (Dollars in millions at company’s share) | NOI (1) | | Adjustments (2) | | NOI | | Stabilized NOI (3) | | Debt, net (4) |

| Operations | A | | B | | =A+B | |

| | |

| Office Real Estate | | |

|

| | | |

|

| | |

| Life Science | | |

|

| | | | | | |

| Cambridge | $ | 16.9 |

| | $ | 0.6 |

| | $ | 17.5 |

| | $ | 70.0 |

| | $ | (439.3 | ) |

| Other Life Science | 4.3 |

| | (0.9 | ) | | 3.4 |

| | 13.6 |

| | (103.7 | ) |

| New York | | |

|

| | | | | | |

| Manhattan | 14.2 |

| | — |

| | 14.2 |

| | 56.8 |

| | — |

|

| Brooklyn | 23.1 |

| | — |

| | 23.1 |

| | 92.4 |

| | (410.3 | ) |

| Central Business District | 3.2 |

| | 0.3 |

| | 3.5 |

| | 14.0 |

| | (136.3 | ) |

| Suburban/Other | 3.2 |

| — |

| — |

| | 3.2 |

| | 12.8 |

| | (82.7 | ) |

| Subtotal Office | $ | 64.9 |

| | $ | — |

| | $ | 64.9 |

| | $ | 259.6 |

| | $ | (1,172.3 | ) |

| Retail Real Estate | | |

| | | | | | |

| Regional Malls | $ | 30.4 |

| | $ | (1.7 | ) | | $ | 28.7 |

| | $ | 114.8 |

| | $ | (1,024.6 | ) |

| Specialty Retail Centers | 11.8 |

| — |

| — |

| | 11.8 |

| | 47.2 |

| | (482.9 | ) |

| Subtotal Retail | $ | 42.2 |

| | $ | (1.7 | ) | | $ | 40.5 |

| | $ | 162.0 |

| | $ | (1,507.5 | ) |

| Apartment Real Estate | | |

|

| | | | | | |

| Apartments, Core Markets | $ | 33.5 |

| — |

| $ | — |

| | $ | 33.5 |

| | $ | 134.0 |

| | $ | (1,354.3 | ) |

| Apartments, Non-Core Markets | 10.7 |

| | — |

| | 10.7 |

| | 42.8 |

| | (332.0 | ) |

| Subtotal Apartment Product Type | $ | 44.2 |

| | $ | — |

| | $ | 44.2 |

| | $ | 176.8 |

| | $ | (1,686.3 | ) |

Federally Assisted Housing (5) | 4.7 |

| | 0.2 |

| | 4.9 |

| | 19.6 |

| | (143.4 | ) |

| Subtotal Apartments | $ | 48.9 |

| | $ | 0.2 |

| | $ | 49.1 |

| | $ | 196.4 |

| | $ | (1,829.7 | ) |

| Subtotal | $ | 156.0 |

| | $ | (1.5 | ) | | $ | 154.5 |

| | $ | 618.0 |

| | $ | (4,509.5 | ) |

| Straight-line rent adjustments | 1.8 |

| | — |

| | 1.8 |

| | 7.2 |

| | — |

|

| Participation payments | (0.1 | ) | | 0.1 |

| | — |

| | — |

| | — |

|

| Other Operations | 3.2 |

| | (3.3 | ) | | (0.1 | ) | | (0.4 | ) | | — |

|

| Total Operations | $ | 160.9 |

| | $ | (4.7 | ) | | $ | 156.2 |

| | $ | 624.8 |

| | $ | (4,509.5 | ) |

| |

| Development | | | | | | | | | |

| Recently-Opened Properties/Redevelopment | $ | 0.9 |

| | $ | 5.7 |

| | $ | 6.6 |

| | $ | 26.4 |

| | $ | (160.0 | ) |

| Straight-line rent adjustments | 0.4 |

| | — |

| | 0.4 |

| | 1.6 |

| | — |

|

| Other Development | (5.7 | ) | — |

| (1.0 | ) | | (6.7 | ) | | (26.8 | ) | | — |

|

| Total Development | $ | (4.4 | ) | | $ | 4.7 |

| | $ | 0.3 |

| | $ | 1.2 |

| | $ | (160.0 | ) |

| | | | | | | | Book Value (4) | | |

| Projects under construction | | $ | 575.0 |

| | $ | (156.7 | ) |

| Projects under development | | $ | 264.5 |

| | $ | (186.0 | ) |

| Land inventory: | | | | |

| Stapleton | | $ | 43.4 |

| | $ | — |

|

| Commercial Outlots | | $ | 24.2 |

| | $ | — |

|

| Other Tangible Assets |

| Cash and equivalents | | $ | 221.5 |

| | |

| Restricted cash | | $ | 251.0 |

| | |

Accounts receivable, net (6) | | $ | 254.6 |

| | |

| Notes receivable | | $ | 388.1 |

| | |

| Net investments and advances to unconsolidated entities | | $ | 42.1 |

| | |

| Prepaid expenses and other deferred costs, net | | $ | 90.3 |

| | |

| Net cash proceeds from the sale of Illinois Science and Technology Park | | $ | 15.0 |

| | |

| Recourse Debt and Other Liabilities |

| Revolving credit facility | | $ | — |

| | |

| Term loan facility | | $ | (333.3 | ) | | |

| Convertible senior debt, net | | $ | (112.2 | ) | | |

| Less: convertible debt | | $ | 112.2 |

| | |

| Construction payables | | $ | (149.7 | ) | | |

Operating accounts payable and accrued expenses (7) | | $ | (696.8 | ) | | |

Share Data (in millions) |

| Diluted weighted average number of shares for the three months ended December 31, 2016 | | 266.7 |

| | |

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Net Asset Value Components – December 31, 2016 (continued)

| |

| (1) | Q4 2016 Earnings (Loss) Before Income Taxes reconciled to NOI for the three months ended December 31, 2016 in the Supplemental Operating Information section of this supplemental package. |

| |

| (2) | The net stabilized adjustments column represents adjustments assumed to arrive at an estimated annualized stabilized NOI. We include stabilization adjustments to the Q4 2016 NOI as follows: |

| |

| a) | Due to the temporary decline in occupancy at 45/75 Sidney Street (Life Science), we have included a stabilization adjustment to the Q4 2016 NOI to arrive at our estimate of stabilized NOI. This temporary decline was due to one of our tenants relocating to 300 Massachusetts Ave (Life Science). This vacant space is currently leased and is expected to be occupied in Q1 2017. |

| |

| b) | In January 2017, we closed on the sale of Illinois Science and Technology Park (Other Life Science). As a result, we removed the NOI and nonrecourse mortgages associated with the assets. |

| |

| c) | We have removed significant Q4 2016 lease termination income from our Regional Mall portfolio. |

| |

| d) | Due to quarterly fluctuations of NOI as a result of distribution restrictions from our limited-distribution federally assisted housing properties, we have included a stabilization adjustment to the Q4 2016 NOI to arrive at our estimate of stabilized NOI. Our estimate of stabilized NOI is based on the 2016 annual NOI of $19.6 million. |

| |

| e) | Partial period NOI for recently sold properties has been removed in the Operations Segments. |

| |

| f) | For recently-opened properties currently in initial lease-up periods included in the Development Segment, NOI is reflected at 5% of the company ownership cost. This assumption does not reflect our anticipated NOI, but rather is used in order to establish a hypothetical basis for an estimated valuation of leased-up properties. The following properties are currently in their initial lease-up periods: |

|

| | | | | | | |

| | Cost at 100% | Cost at Company Share | Lease Commitment % as of |

| Property | February 20, 2017 |

| | (in millions) | |

| Office: | | | |

| 1812 Ashland Ave (Life Science) | $ | 61.2 |

| $ | 61.2 |

| 75% |

| 300 Massachusetts Ave (Life Science) | $ | 175.6 |

| $ | 91.7 |

| 99% |

| Apartments: | | | |

| NorthxNorthwest (Core Market) | $ | 115.0 |

| $ | 28.9 |

| 9% |

| 461 Dean Street (Core Market) | $ | 195.6 |

| $ | 195.6 |

| 19% |

| The Bixby (Core Market) | $ | 59.2 |

| $ | 11.8 |

| 56% |

| Blossom Plaza (Core Market) | $ | 100.6 |

| $ | 25.9 |

| 79% |

| The Yards - Arris (Core Market) | $ | 143.2 |

| $ | 37.3 |

| 82% |

| Aster Town Center North (Core Market) | $ | 23.4 |

| $ | 21.1 |

| 98% |

| | $ | 873.8 |

| $ | 473.5 |

| |

NOI attributable to Kapolei Lofts, an apartment community on land in which we lease, is not included in NOI from lease-up properties. We consolidate the land lessor, who is entitled to a preferred return that currently exceeds anticipated operating cash flow of the project, and therefore, this project is reflected at 0% for company-share purposes. In accordance with the waterfall provisions of the distribution Agreement, we expect to share in the net proceeds upon a sale of the project, which is not currently reflected on the NAV component schedule.

| |

| g) | On April 1, 2016, we closed on the creation of a joint venture with QIC, in which QIC acquired 49% of our equity ownership of Ballston Quarter (Development Segment; Recently-Opened Properties/Redevelopment). Due to the planned redevelopment, we have included a stabilization adjustment to the Q4 2016 NOI to arrive at $2.6 million, our estimate of annualized stabilized NOI following the disposition of our partial interest and the completion of our planned redevelopment. |

| |

| h) | Participation payments to ground lessors on the refinancing of our properties are sporadic and transactional in nature. As a result, these have been removed in order to arrive at a stabilized NOI. |

| |

| i) | The stabilization adjustment for Other Operations removes certain transaction-based fees and expense allocations that are not reflective of stabilized activity in this category. |

| |

| j) | In our Development Segment, we removed a $1.0 million participation payment we received on a development opportunity we sold several years prior. |

The net stabilized adjustments are not comparable to any GAAP measure and therefore do not have a reconciliation to the nearest comparable GAAP measure.

| |

| (3) | Company ownership annualized stabilized NOI is calculated by taking the Q4 2016 stabilized NOI times a multiple of four. |

| |

| (4) | Amounts represent the company’s share of each respective balance sheet line item as of December 31, 2016 and may be calculated using the financial information contained in the Appendix of this supplemental package. Due to the disposition of Illinois Science and Technology Park in January 2017, we have removed nonrecourse debt, net, of $51.0 million attributable to the assets and added the net cash proceeds received on the sale. |

| |

| (5) | Represents 47 federally assisted housing apartment communities. We recently signed a master purchase and sale agreement to dispose of this portfolio and expect to receive net proceeds of approximately $65 million. We expect the individual property dispositions to close separately beginning in Q1 2017. |

| |

| (6) | Includes $154.7 million of straight-line rent receivable (net of $9.3 million of allowance for doubtful accounts). |

| |

| (7) | Includes $63.7 million of straight-line rent payable. |

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Net Asset Value Components - Stabilized NOI - Q3 2016 vs. Q4 2016

The following represents the quarterly change in stabilized NOI used to estimate NAV, as a result of recent property openings, acquisitions or sales, as well as other portfolio changes. GAAP reconciliations for the beginning period can be found in prior supplemental packages furnished with the SEC and are available on our website at www.forestcity.net.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net Asset Value Components - Stabilized NOI |

| | | | Stabilized Adjustments | | |

| | Q3 2016 | | Property | | Property | | Property | | Portfolio | | Q4 2016 |

| (Dollars in millions at company’s share) | Stabilized NOI | | Openings | | Acquisitions | | Sales | | NOI Changes | | Stabilized NOI |

| Operations | | | | | | | | | | | |

| Office Real Estate | | | | | | | | | | | |

| Life Science | | | | | | | | | | | |

| Cambridge | $ | 18.1 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | (0.6 | ) | | $ | 17.5 |

|

| Other Life Science | 5.1 |

| | — |

| | — |

| | (1.4 | ) | | (0.3 | ) | | 3.4 |

|

| New York | | | | | | | | | | | |

| Manhattan | 14.0 |

| | — |

| | — |

| | — |

| | 0.2 |

| | 14.2 |

|

| Brooklyn | 22.6 |

| | — |

| | — |

| | — |

| | 0.5 |

| | 23.1 |

|

| Central Business District | 4.6 |

| | — |

| | — |

| | — |

| | (1.1 | ) | | 3.5 |

|

| Suburban/Other | 3.3 |

| | — |

| | — |

| | — |

| | (0.1 | ) | | 3.2 |

|

| Subtotal Office | $ | 67.7 |

| | $ | — |

| | $ | — |

| | $ | (1.4 | ) | | $ | (1.4 | ) | | $ | 64.9 |

|

| Retail Real Estate | | | | | | | | | | | |

| Regional Malls | $ | 28.2 |

| | $ | — |

| | $ | — |

| | $ | (0.8 | ) | | $ | 1.3 |

| | $ | 28.7 |

|

| Specialty Retail Centers | 12.0 |

| | — |

| | — |

| | — |

| | (0.2 | ) | | 11.8 |

|

| Subtotal Retail | $ | 40.2 |

| | $ | — |

| | $ | — |

| | $ | (0.8 | ) | | $ | 1.1 |

| | $ | 40.5 |

|

| Apartment Real Estate | | | | | | | | | | | |

| Apartments, Core Markets | $ | 34.4 |

| | $ | — |

| | $ | — |

| | $ | (0.3 | ) | | $ | (0.6 | ) | | $ | 33.5 |

|

| Apartments, Non-Core Markets | 11.4 |

| | — |

| | — |

| | — |

| | (0.7 | ) | | 10.7 |

|

| Subtotal Apartment Product Type | $ | 45.8 |

| | $ | — |

| | $ | — |

| | $ | (0.3 | ) | | $ | (1.3 | ) | | $ | 44.2 |

|

Federally Assisted Housing (5) | 4.9 |

| | — |

| | — |

| | — |

| | — |

| | 4.9 |

|

| Subtotal Apartments | $ | 50.7 |

| | $ | — |

| | $ | — |

| | $ | (0.3 | ) | | $ | (1.3 | ) | | $ | 49.1 |

|

| Subtotal | $ | 158.6 |

| | $ | — |

| | $ | — |

| | $ | (2.5 | ) | | $ | (1.6 | ) | | $ | 154.5 |

|

| Straight-line rent adjustments | 2.5 |

| | — |

| | — |

| | — |

| | (0.7 | ) | | 1.8 |

|

| Participation payments | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Other Operations | 0.5 |

| | — |

| | — |

| | — |

| | (0.6 | ) | | (0.1 | ) |

| Total Operations | $ | 161.6 |

| | $ | — |

| | $ | — |

| | $ | (2.5 | ) | | $ | (2.9 | ) | | $ | 156.2 |

|

| | | | | | | | | | | | |

| Development Pipeline | | | | | | | | | | | |

| Development | | | | | | | | | | | |

| Recently-Opened Properties/Redevelopment | $ | 6.1 |

| | $ | 0.4 |

| | $ | — |

| | $ | — |

| | $ | 0.1 |

| | $ | 6.6 |

|

| Straight-line rent adjustments | 0.3 |

| | — |

| | — |

| | — |

| | 0.1 |

| | 0.4 |

|

| Other Development | (9.6 | ) | | — |

| | — |

| | — |

| | 2.9 |

| | (6.7 | ) |

| Total Development | $ | (3.2 | ) | | $ | 0.4 |

| | $ | — |

| | $ | — |

| | $ | 3.1 |

| | $ | 0.3 |

|

| Grand Total | $ | 158.4 |

| | $ | 0.4 |

| | $ | — |

| | $ | (2.5 | ) | | $ | 0.2 |

| | $ | 156.5 |

|

(THIS PAGE INTENTIONALLY LEFT BLANK)

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Occupancy Data

Office and retail segment occupancy data represents leased occupancy at the end of the quarter. Leased occupancy percentage is calculated by dividing the sum of the total tenant occupied space under the lease and vacant space under the lease by gross leasable area (“GLA”). Occupancy data includes leases with original terms of one year or less.

|

| | |

| | Leased Occupancy |

| | As of December 31, |

| Office | 2016 | 2015 |

| Comparable | 93.2% | 96.2% |

| Total | 92.8% | 94.3% |

| Retail | | |

| Comparable | 94.3% | 94.7% |

| Total | 94.3% | 94.1% |

Apartment segment occupancy data represents economic occupancy, which is calculated by dividing the period-to-date gross potential rent less vacancy by gross potential rent. Apartment occupancy data excludes military and limited-distribution subsidized senior housing units.

|

| | |

| | Economic Occupancy |

| | Years Ended December 31, |

| Apartments | 2016 | 2015 |

| Comparable | 94.3% | 94.8% |

| Total | 94.2% | 94.7% |

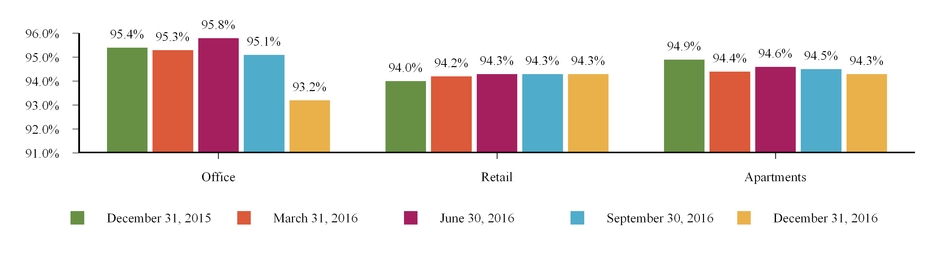

The graph below provides comparable leased and economic occupancy data as reported in previous quarters. Prior period amounts may differ from above since the properties qualifying as comparable change from period to period.

Comparable Occupancy Percentage Trend

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Retail Sales Data

The following provides retail sales data for small shop inline tenants at our regional malls. We believe this data allows investors to better understand the productivity of our small shop inline tenants.

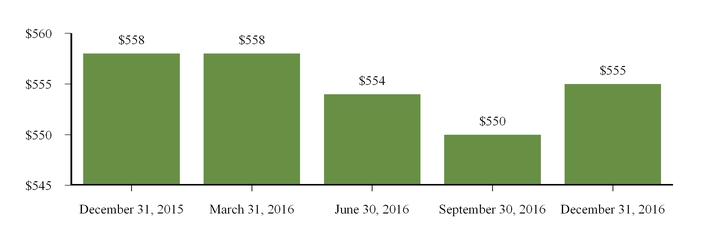

The graph below represents regional mall sales for tenants that were open and operating for the duration of each rolling 12-month period presented. Those tenants that have begun and/or ceased operations in the rolling 12-month periods shown are not included.

FCE Regional Mall Sales per Square Foot (1)

Rolling 12-month basis for periods presented

| |

| (1) | All sales data is derived from schedules provided by our tenants and is not subject to the same internal control and verification procedures applied to other data supplied in this supplemental package. |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Leasing Summary

Office Buildings

The following table represents those new leases and GLA signed on the same space in which there was a former tenant and existing tenant renewals along with all other new leases signed within the rolling 12-month period.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Same-Space Leases | | Other New Leases | | |

| Quarter | Number of Leases Signed | GLA Signed | Contractual Rent Per SF (1) | Expired Rent Per SF (1) | Cash Basis % Change over Prior Rent | | Number of Leases Signed | GLA Signed | Contractual Rent Per SF (1) | | Total GLA Signed |

| Q1 2016 | 20 |

| 244,517 |

| $ | 61.23 |

| $ | 55.51 |

| 10.3 | % | | 5 |

| 7,742 |

| $ | 19.51 |

| | 252,259 |

|

| Q2 2016 | 20 |

| 526,931 |

| $ | 34.39 |

| $ | 30.08 |

| 14.3 | % | | 4 |

| 12,503 |

| $ | 18.12 |

| | 539,434 |

|

| Q3 2016 | 9 |

| 79,348 |

| $ | 28.02 |

| $ | 26.52 |

| 5.7 | % | | 5 |

| 8,227 |

| $ | 22.71 |

| | 87,575 |

|

| Q4 2016 | 12 |

| 88,740 |

| $ | 20.36 |

| $ | 21.46 |

| (5.1 | )% | | 3 |

| 3,549 |

| $ | 25.27 |

| | 92,289 |

|

| Total | 61 |

| 939,536 |

| $ | 39.44 |

| $ | 35.53 |

| 11.0 | % | | 17 |

| 32,021 |

| $ | 20.43 |

| | 971,557 |

|

| | | | | | | | | | | | |

Retail Centers

The following tables represent those new leases and GLA signed and rent per square foot (“SF”) on the same space in which there was a former tenant and existing tenant renewals.

Regional Malls

|

| | | | | | | | | | | | | | | | | |

| Quarter | Number of Leases Signed | | GLA Signed | | Contractual Rent Per SF (1) | | Expired Rent Per SF (1) | | Cash Basis % Change over Prior Rent | |

| Q1 2016 | 28 |

| | 73,871 |

| | $ | 60.51 |

| | $ | 52.78 |

| | 14.6 | % | |

| Q2 2016 | 23 |

| | 49,196 |

| | $ | 60.15 |

| | $ | 55.57 |

| | 8.2 | % | |

| Q3 2016 | 26 |

| | 79,205 |

| | $ | 63.15 |

| | $ | 56.31 |

| | 12.1 | % | |

| Q4 2016 | 14 |

| | 53,130 |

| | $ | 153.75 |

| | $ | 137.47 |

| | 11.8 | % | |

| Total | 91 |

| | 255,402 |

| | $ | 80.65 |

| | $ | 71.99 |

| | 12.0 | % | |

| | | | | | | | | | | |

Specialty Retail Centers

|

| | | | | | | | | | | | | | | | | |

| Quarter | Number of Leases Signed | | GLA Signed | | Contractual Rent Per SF (1) | | Expired Rent Per SF (1) | | Cash Basis % Change over Prior Rent | |

| Q1 2016 | 2 |

| | 36,453 |

| | $ | 34.72 |

| | $ | 34.67 |

| | 0.1 | % | |

| Q2 2016 | 1 |

| | 1,050 |

| | $ | 40.00 |

| | $ | 33.00 |

| | 21.2 | % | |

| Q3 2016 | 2 |

| | 5,131 |

| | $ | 82.06 |

| | $ | 78.17 |

| | 5.0 | % | |

| Q4 2016 | — |

| | — |

| | $ | — |

| | $ | — |

| | 0.0 | % | |

| Total | 5 |

| | 42,634 |

| | $ | 40.55 |

| | $ | 39.87 |

| | 1.7 | % | |

| | | | | | | | | | | |

| |

| (1) | Office and Retail contractual rent per square foot includes base rent and fixed additional charges for common area maintenance and real estate taxes as of rental commencement. Retail contractual rent per square foot also includes fixed additional marketing/promotional charges. For all expiring leases, contractual rent per square foot includes any applicable escalations. |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Apartment Communities

The following tables present leasing information of our apartment communities. Prior period amounts may differ from data as reported in previous quarters since the properties that qualify as comparable change from period to period.

Quarterly Comparison

|

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | Monthly Average Apartment Rental Rates (2) | | Economic Apartment Occupancy |

| Comparable Apartment | Leasable Units | | Three Months Ended December 31, | | | Three Months Ended December 31, | |

Communities (1) | at Company % (3) | | 2016 | 2015 | % Change | | 2016 | 2015 | % Change |

| Core Markets | 8,262 |

| | $ | 1,981 |

| $ | 1,944 |

| 1.9 | % | | 94.2 | % | 94.9 | % | (0.7 | )% |

| Non-Core Markets | 7,794 |

| | $ | 982 |

| $ | 960 |

| 2.3 | % | | 92.6 | % | 91.6 | % | 1.0 | % |

| Total Comparable Apartments | 16,056 |

| | $ | 1,496 |

| $ | 1,466 |

| 2.0 | % | | 93.7 | % | 93.9 | % | (0.2 | )% |

| | | | | | | | | | |

Year-to-Date Comparison

|

| | | | | | | | | | | | | | | | | | |

| | | | Monthly Average Apartment Rental Rates (2) | | Economic Apartment Occupancy |

| Comparable Apartment | Leasable Units | | Years Ended December 31, | | | Years Ended December 31, | |

Communities (1) | at Company % (3) | | 2016 | 2015 | % Change | | 2016 | 2015 | % Change |

| Core Markets | 8,262 |

| | $ | 1,968 |

| $ | 1,914 |

| 2.8 | % | | 94.9 | % | 95.4 | % | (0.5 | )% |

| Non-Core Markets | 7,004 |

| | $ | 981 |

| $ | 953 |

| 2.9 | % | | 92.9 | % | 93.4 | % | (0.5 | )% |

| Total Comparable Apartments | 15,266 |

| | $ | 1,495 |

| $ | 1,453 |

| 2.9 | % | | 94.3 | % | 94.8 | % | (0.5 | )% |

| | | | | | | | | | |

Sequential Comparison |

| | | | | | | | | | | | | | | | | | |

| | | | Monthly Average Apartment Rental Rates (2) | | Economic Apartment Occupancy |

| | | | Three Months Ended | | | Three Months Ended | |

| Comparable Apartment | Leasable Units | | December 31, | September 30, | | | December 31, | September 30, | |

Communities (1) | at Company % (3) | | 2016 | 2016 | % Change | | 2016 | 2016 | % Change |

| Core Markets | 8,262 |

| | $ | 1,981 |

| $ | 1,982 |

| (0.1 | )% | | 94.2 | % | 94.7 | % | (0.5 | )% |

| Non-Core Markets | 7,794 |

| | $ | 982 |

| $ | 982 |

| — | % | | 92.6 | % | 93.5 | % | (0.9 | )% |

| Total Comparable Apartments | 16,056 |

| | $ | 1,496 |

| $ | 1,497 |

| (0.1 | )% | | 93.7 | % | 94.4 | % | (0.7 | )% |

| | | | | | | | | | |

| |

| (1) | Includes stabilized apartment communities completely opened and operated in the periods presented. These apartment communities include units leased at affordable apartment rates which provide a discount from average market rental rates. For the three months ended December 31, 2016, 15.6% of leasable units in core markets and 4.6% of leasable units in non-core markets were affordable housing units. Excludes all military and limited-distribution federally assisted housing units. |

| |

| (2) | Represents gross potential rent less concessions. |

| |

| (3) | Leasable units represent our share of comparable leasable units at the apartment community. |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Comparable NOI

|

| | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, 2016 | | December 31, 2016 |

| Office | (0.4 | )% | | 3.6 | % |

| Retail | (2.9 | )% | | 2.6 | % |

| Apartments | 1.1 | % | | 3.3 | % |

| Total | (0.7 | )% | | 3.2 | % |

The tables below provide the percentage change of Comparable NOI as reported in previous quarters. GAAP reconciliations for previous periods can be found in prior supplemental packages furnished with the SEC and are available on our website at www.forestcity.net.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarterly Historical Trends | | | | | Year-to-Date and Annual Historical Trends | | | |

| | Three Months Ended | | | | Years Ended | | 11 Months Ended | |

| | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 | | | | December 31, 2016 | | December 31, 2015 | | December 31, 2014 | | December 31, 2013 | |

| Office | (0.4 | )% | | (0.4 | )% | | 6.4 | % | | 12.1 | % | | 7.6 | % | | | Office | 3.6 | % | | 4.9 | % | | 6.6 | % | | (6.4 | )% | |

| Retail | (2.9 | )% | | 1.6 | % | | 2.7 | % | | 8.3 | % | | 4.2 | % | | | Retail | 2.6 | % | | 5.1 | % | | 2.6 | % | | 3.6 | % | |

| Apartments | 1.1 | % | | 1.8 | % | | 3.0 | % | | 7.8 | % | | 5.6 | % | | | Apartments | 3.3 | % | | 4.7 | % | | 4.3 | % | | 4.7 | % | |

| Total | (0.7 | )% | | 0.8 | % | | 4.3 | % | | 9.7 | % | | 5.9 | % | | | Total | 3.2 | % | | 4.9 | % | | 4.8 | % | | (0.2 | )% | |

The table below provides comparable NOI margins for our Operations segments. |

| | | | | | | | | | | | |

| Year-to-Date and Annual Historical Trends - Margins on Comparable NOI | |

| | Years Ended | |

| | December 31, 2016 | | December 31, 2015 | | December 31, 2014 | | December 31, 2013 | |

| Office | 59.0 | % | | 57.3 | % | | 57.1 | % | | 55.8 | % | |

| Retail | 59.7 | % | | 55.0 | % | | 55.6 | % | | 55.1 | % | |

| Apartments | 57.8 | % | | 56.7 | % | | 56.7 | % | | 56.0 | % | |

| Total | 58.9 | % | | 56.4 | % | | 56.6 | % | | 55.7 | % | |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

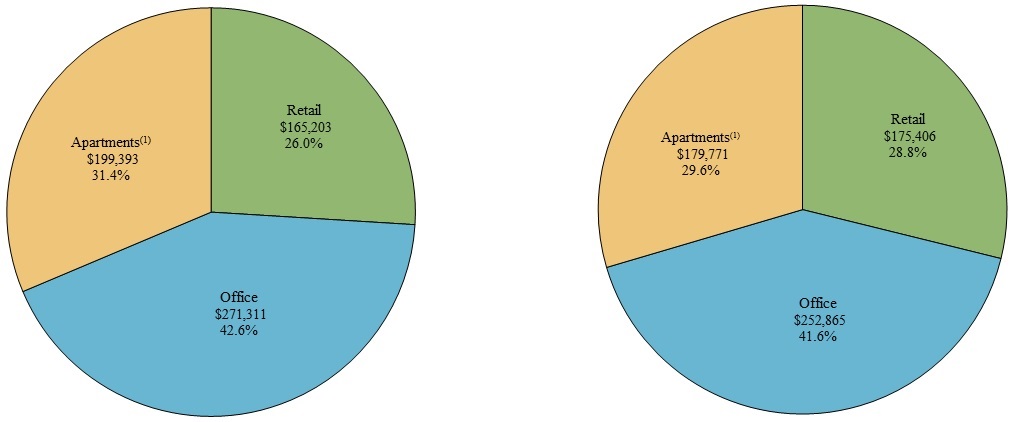

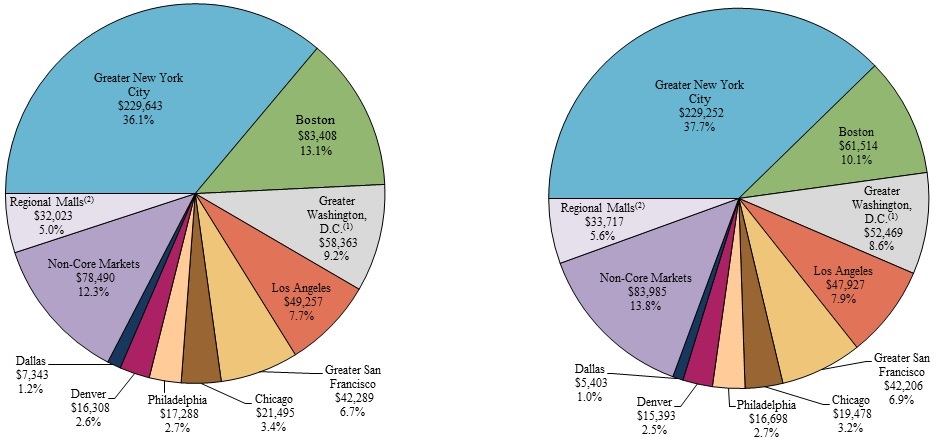

Net Operating Income (Non-GAAP) Detail (in thousands)

|

| | | | | | | | | | | | | | | | | |

| | Three Months December 31, | | | Years Ended December 31, | |

| | 2016 | 2015 | % Change | | 2016 | 2015 | % Change |

| Office Segment | | | | | | | |

| Comparable NOI | 65,274 |

| 65,563 |

| (0.4 | )% | | 254,087 |

| 245,221 |

| 3.6 | % |

| Non-Comparable NOI | (368 | ) | 1,272 |

| | | 17,224 |

| 7,644 |

| |

| Office Product Type NOI | 64,906 |

| 66,835 |

| | | 271,311 |

| 252,865 |

| |

Other NOI (1) | 2,755 |

| (309 | ) | | | 7,400 |

| (1,964 | ) | |

| Total Office Segment | 67,661 |

| 66,526 |

| | | 278,711 |

| 250,901 |

| |

| Retail Segment | | | | | | | |

| Comparable NOI | 40,528 |

| 41,744 |

| (2.9 | )% | | 162,912 |

| 158,845 |

| 2.6 | % |

| Non-Comparable NOI | 1,582 |

| 3,694 |

| | | 2,291 |

| 16,561 |

| |

| Retail Product Type NOI | 42,110 |

| 45,438 |

| | | 165,203 |

| 175,406 |

| |

Other NOI (1) | 2,532 |

| 262 |

| | | 3,785 |

| 1,986 |

| |

| Total Retail Segment | 44,642 |

| 45,700 |

| | | 168,988 |

| 177,392 |

| |

| Apartment Segment | | | | | | | |

| Comparable NOI | 41,033 |

| 40,580 |

| 1.1 | % | | 168,390 |

| 162,949 |

| 3.3 | % |

| Non-Comparable NOI | 3,185 |

| (1,476 | ) | | | 11,310 |

| (2,780 | ) | |

| Apartment Product Type NOI | 44,218 |

| 39,104 |

| | | 179,700 |

| 160,169 |

| |

| Federally Assisted Housing | 4,732 |

| 5,036 |

| | | 19,693 |

| 19,602 |

| |

Other NOI (1) | (318 | ) | (1,486 | ) | | | (2,693 | ) | (15,018 | ) | |

| Total Apartment Segment | 48,632 |

| 42,654 |

| | | 196,700 |

| 164,753 |

| |

| Operations | | | | | | | |

| Comparable NOI | 146,835 |

| 147,887 |

| (0.7 | )% | | 585,389 |

| 567,015 |

| 3.2 | % |

Non-Comparable NOI (2) | 4,399 |

| 3,490 |

| | | 30,825 |

| 21,425 |

| |

| Product Type NOI | 151,234 |

| 151,377 |

| | | 616,214 |

| 588,440 |

| |

| Federally Assisted Housing | 4,732 |

| 5,036 |

| | | 19,693 |

| 19,602 |

| |

Other NOI (1): | | | | | | | |

| Straight-line rent adjustments | 1,773 |

| 71 |

| | | 9,194 |

| 4,068 |

| |

| Participation payments | (73 | ) | (1,002 | ) | | | (73 | ) | (1,013 | ) | |

| Other Operations | 3,269 |

| (602 | ) | | | (629 | ) | (18,051 | ) | |

| 4,969 |

| (1,533 | ) | | | 8,492 |

| (14,996 | ) | |

| Total Operations | 160,935 |

| 154,880 |

| | | 644,399 |

| 593,046 |

| |

| Development Segment | | | | | | | |

| Recently-Opened Properties/Redevelopment | 939 |

| 3,987 |

| | | 3,965 |

| 10,361 |

| |

Other Development (3) | (5,331 | ) | (11,299 | ) | | | (28,676 | ) | (41,499 | ) | |

| Total Development Segment | (4,392 | ) | (7,312 | ) | | | (24,711 | ) | (31,138 | ) | |

| Other Segment | — |

| 15,518 |

| | | 2,502 |

| 47,825 |

| |

| Grand Total | $ | 156,543 |

| $ | 163,086 |

| | | $ | 622,190 |

| $ | 609,733 |

| |

| |

| (1) | Includes straight-line rent adjustments, participation payments as a result of refinancing transactions on our properties and management and service company overhead, net of service fee revenues. |

| |

| (2) | Non-comparable NOI includes lease termination income of $2,079 and $3,404 for the three months and year ended December 31, 2016, compared with $11 and $3,279 for the three months and year ended December 31, 2015. |

| |

| (3) | Includes straight-line adjustments, non-capitalizable development overhead and other costs on our development projects. |

Summary of Corporate General and Administrative and Other NOI (in thousands)