JULY 2017 Investor Presentation Exhibit 99.1

Disclosure Information INFORMATION RELATED TO FORWARD-LOOKING STATEMENTS Statements made in this presentation that state the Company’s or management's intentions, hopes, beliefs, expectations or predictions of the future are forward-looking statements. It is important to note that the Company's future events and actual results, financial or otherwise, could differ materially from those projected in such forward-looking statements. Additional information concerning factors that could cause future events or actual results to differ materially from those in the forward-looking statements are included in the “Risk Factors” section of the Company's SEC filings, including, but not limited to, the Company's Annual Report and quarterly reports. You are cautioned not to place undue reliance on such forward-looking statements. USE OF NON-GAAP MEASURES We frequently use the non‐GAAP measures at total company ownership of funds from operations (“FFO”), Operating FFO, Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA, Net Debt to Adjusted EBITDA, net operating income (“NOI”), net asset value (“NAV”) and comparable NOI to explain operating performance and assist investors in evaluating our business. For a more thorough discussion of FFO, Operating FFO, EBITDA, Adjusted EBITDA, Net Debt to Adjusted EBITDA, NOI, Comparable NOI, and NAV, including how we reconcile these measures to their GAAP counterparts, please refer to the supplemental package for the quarter-ended March 31, 2017, furnished to the SEC on Form 8‐K on May 4, 2017 and the supplemental package for the year-ended December 31, 2016, furnished to the SEC on Form 8‐K on February 27, 2017. Copies of our quarterly and annual supplemental packages can be found on our website at www.forestcity.net, or on the SEC’s website at www.sec.gov. Please note: We periodically post updated investor presentations on the Investors page of our website at www.forestcity.net. It is possible the periodic updates may include information deemed to be material. Therefore, we encourage investors, the media, and other interested parties to review the Investors page of our website at www.forestcity.net for the most recent investor presentation. Pictures shown on cover from left to right are Twelve12, the New York Times building and 88 Sidney Street.

Table of Contents Section Page # Our Company 1 Corporate Governance 6 Our Strategy 9 Our Portfolio 11 Capital Structure 16 Margins and Overhead 18 Appendix 22 1 2 3 4 5 6 A

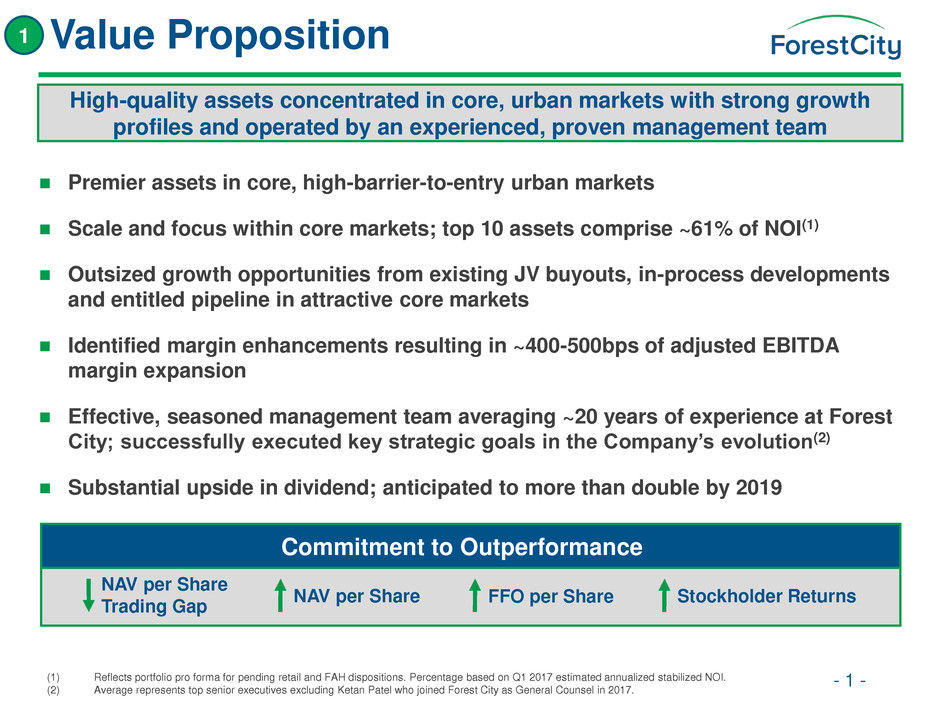

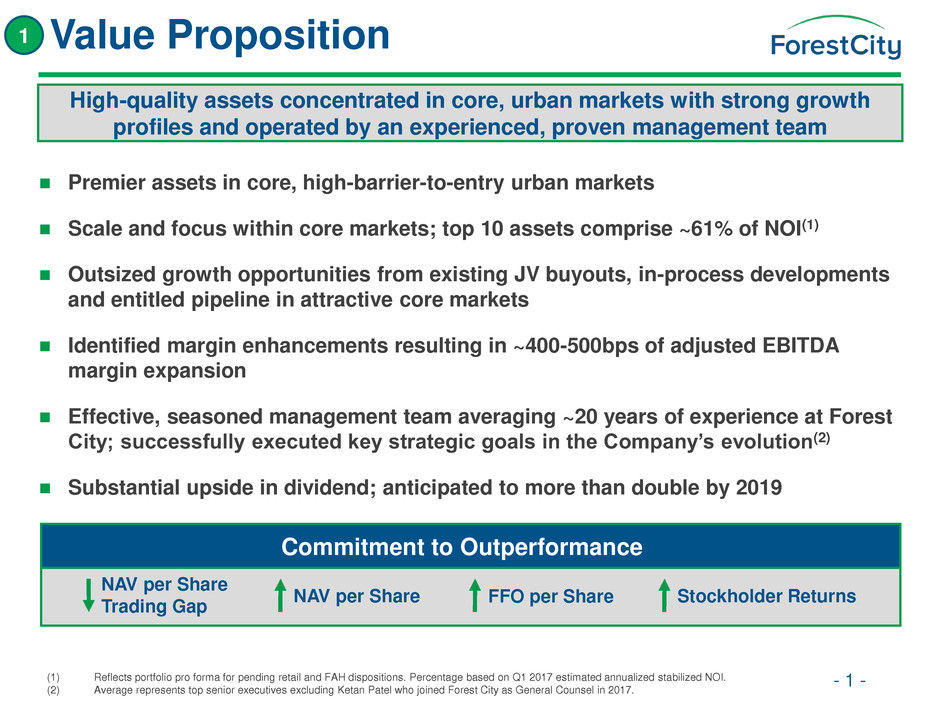

Premier assets in core, high-barrier-to-entry urban markets Scale and focus within core markets; top 10 assets comprise ~61% of NOI(1) Outsized growth opportunities from existing JV buyouts, in-process developments and entitled pipeline in attractive core markets Identified margin enhancements resulting in ~400-500bps of adjusted EBITDA margin expansion Effective, seasoned management team averaging ~20 years of experience at Forest City; successfully executed key strategic goals in the Company’s evolution(2) Substantial upside in dividend; anticipated to more than double by 2019 - 1 - Value Proposition 1 High-quality assets concentrated in core, urban markets with strong growth profiles and operated by an experienced, proven management team (1) Reflects portfolio pro forma for pending retail and FAH dispositions. Percentage based on Q1 2017 estimated annualized stabilized NOI. (2) Average represents top senior executives excluding Ketan Patel who joined Forest City as General Counsel in 2017. NAV per Share Trading Gap FFO per Share NAV per Share Stockholder Returns Commitment to Outperformance

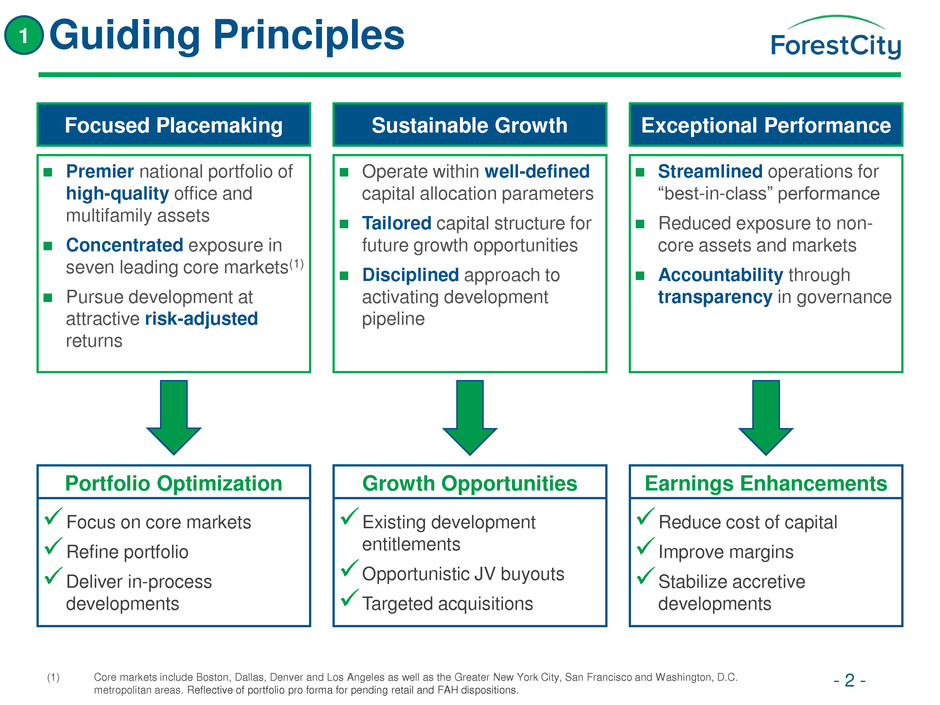

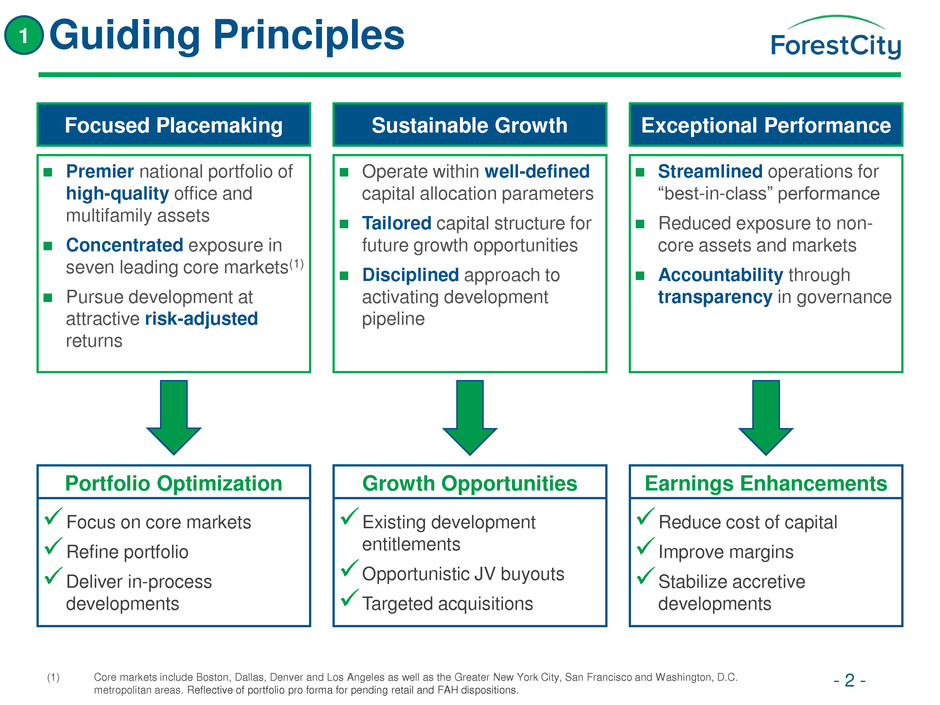

Guiding Principles - 2 - 1 (1) Core markets include Boston, Dallas, Denver and Los Angeles as well as the Greater New York City, San Francisco and Washington, D.C. metropolitan areas. Reflective of portfolio pro forma for pending retail and FAH dispositions. Focused Placemaking Premier national portfolio of high-quality office and multifamily assets Concentrated exposure in seven leading core markets(1) Pursue development at attractive risk-adjusted returns Sustainable Growth Operate within well-defined capital allocation parameters Tailored capital structure for future growth opportunities Disciplined approach to activating development pipeline Exceptional Performance Streamlined operations for “best-in-class” performance Reduced exposure to non- core assets and markets Accountability through transparency in governance Focus on core markets Refine portfolio Deliver in-process developments Portfolio Optimization Earnings Enhancements Reduce cost of capital Improve margins Stabilize accretive developments Growth Opportunities Existing development entitlements Opportunistic JV buyouts Targeted acquisitions

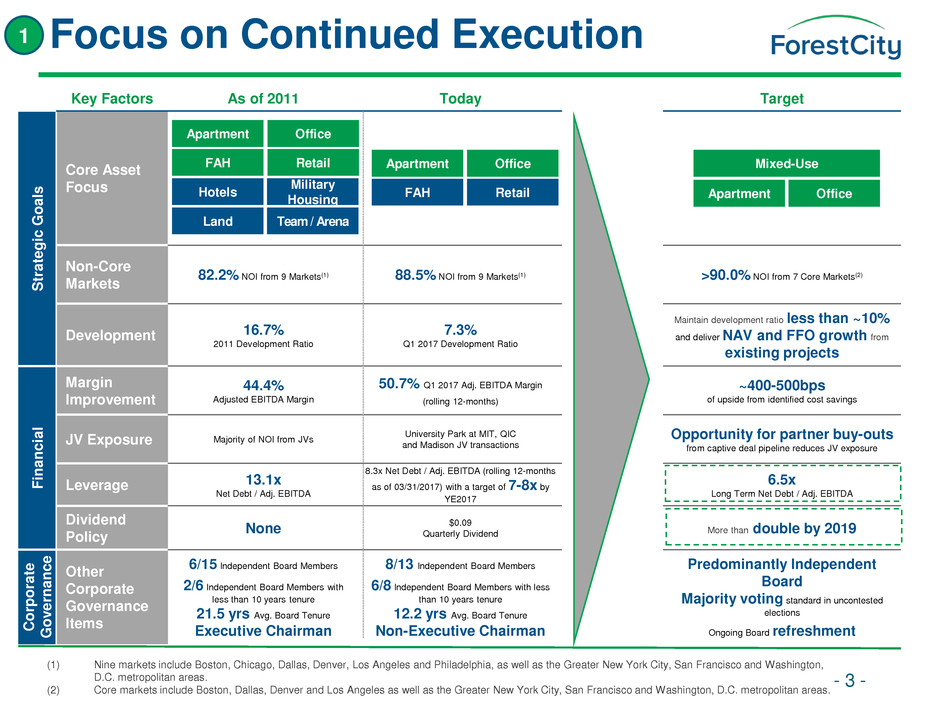

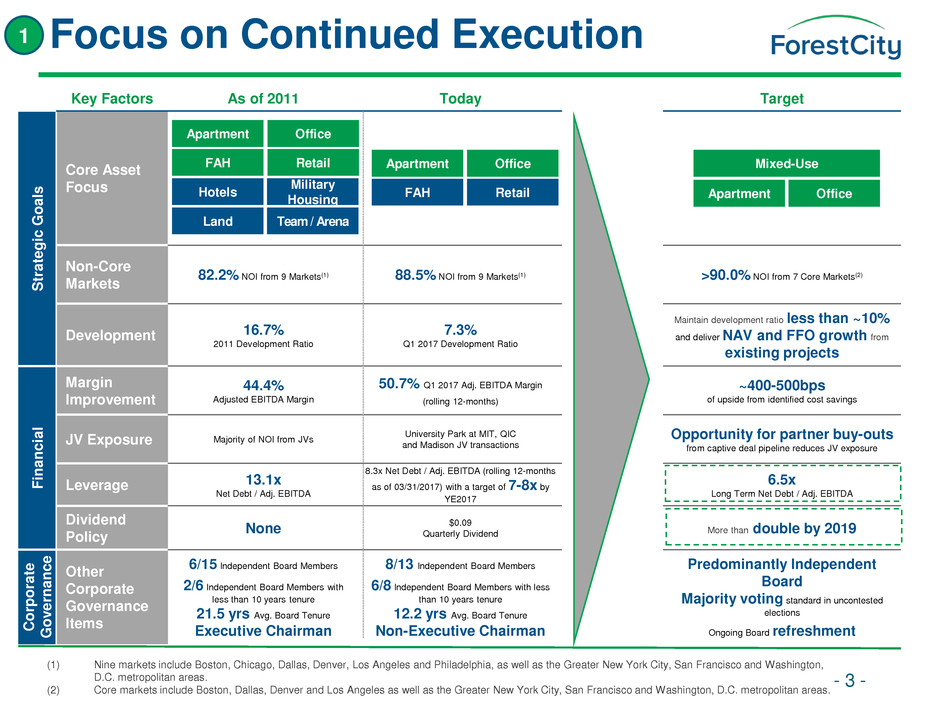

Key Factors As of 2011 Today Target S tra te g ic G o a ls Core Asset Focus Non-Core Markets 82.2% NOI from 9 Markets(1) 88.5% NOI from 9 Markets(1) >90.0% NOI from 7 Core Markets(2) Development 16.7% 2011 Development Ratio 7.3% Q1 2017 Development Ratio Maintain development ratio less than ~10% and deliver NAV and FFO growth from existing projects Fina n cia l Margin Improvement 44.4% Adjusted EBITDA Margin 50.7% Q1 2017 Adj. EBITDA Margin (rolling 12-months) ~400-500bps of upside from identified cost savings JV Exposure Majority of NOI from JVs University Park at MIT, QIC and Madison JV transactions Opportunity for partner buy-outs from captive deal pipeline reduces JV exposure Leverage 13.1x Net Debt / Adj. EBITDA 8.3x Net Debt / Adj. EBITDA (rolling 12-months as of 03/31/2017) with a target of 7-8x by YE2017 6.5x Long Term Net Debt / Adj. EBITDA Dividend Policy None $0.09 Quarterly Dividend More than double by 2019 C orp o ra te G o v ern a n c e Other Corporate Governance Items 6/15 Independent Board Members 2/6 Independent Board Members with less than 10 years tenure 21.5 yrs Avg. Board Tenure Executive Chairman 8/13 Independent Board Members 6/8 Independent Board Members with less than 10 years tenure 12.2 yrs Avg. Board Tenure Non-Executive Chairman Predominantly Independent Board Majority voting standard in uncontested elections Ongoing Board refreshment (1) Nine markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia, as well as the Greater New York City, San Francisco and Washington, D.C. metropolitan areas. (2) Core markets include Boston, Dallas, Denver and Los Angeles as well as the Greater New York City, San Francisco and Washington, D.C. metropolitan areas. Retail FAH Office Apartment - 3 - Focus on Continued Execution Office Apartment Mixed-Use 1 Retail FAH Office Apartment Hotels Military Housing Land Team / Arena

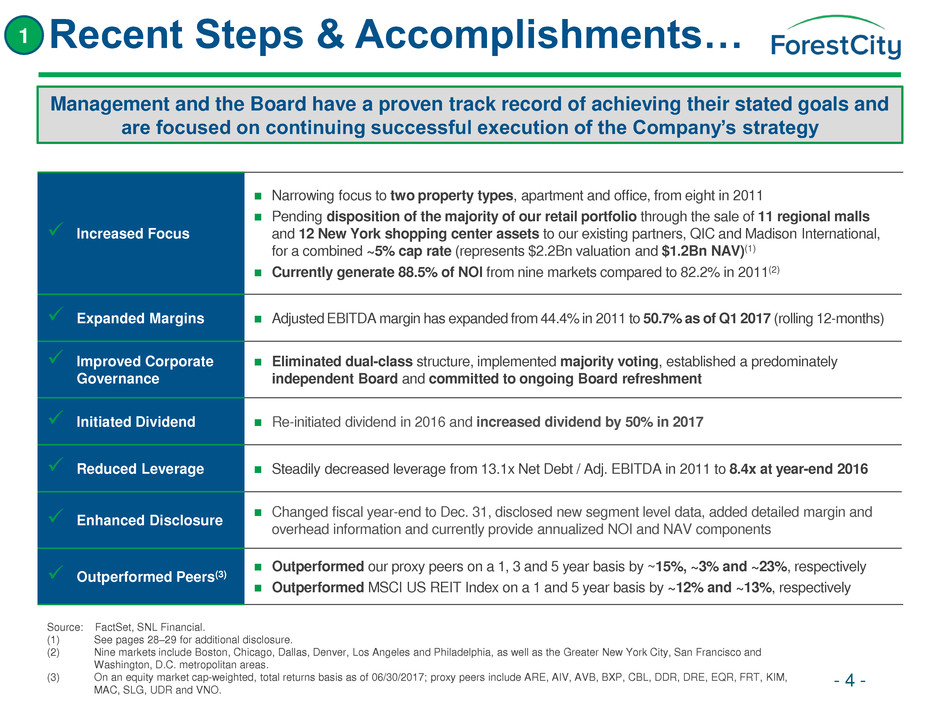

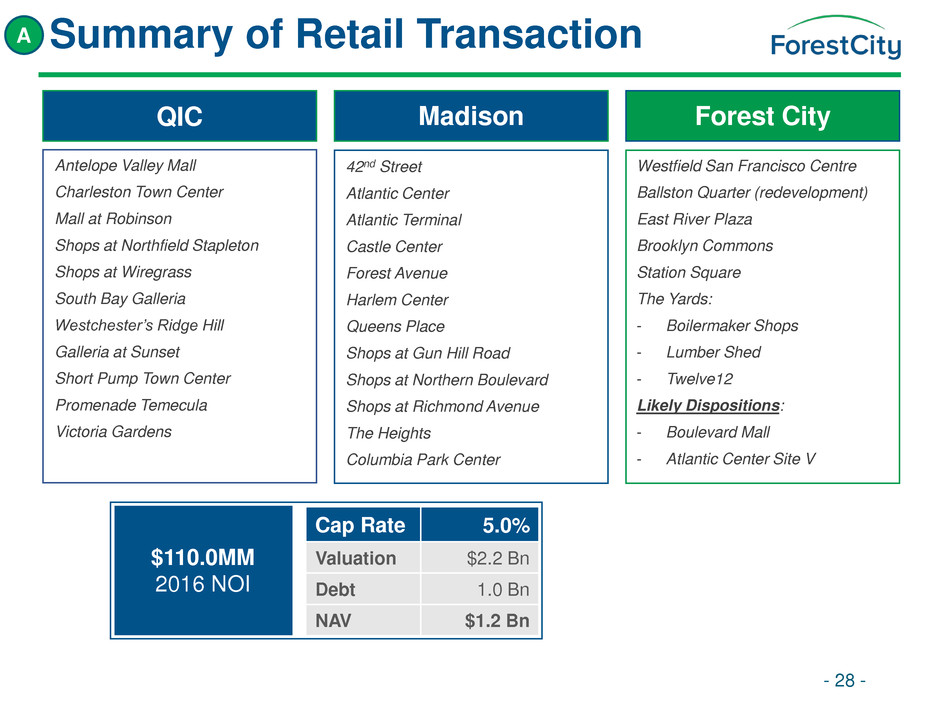

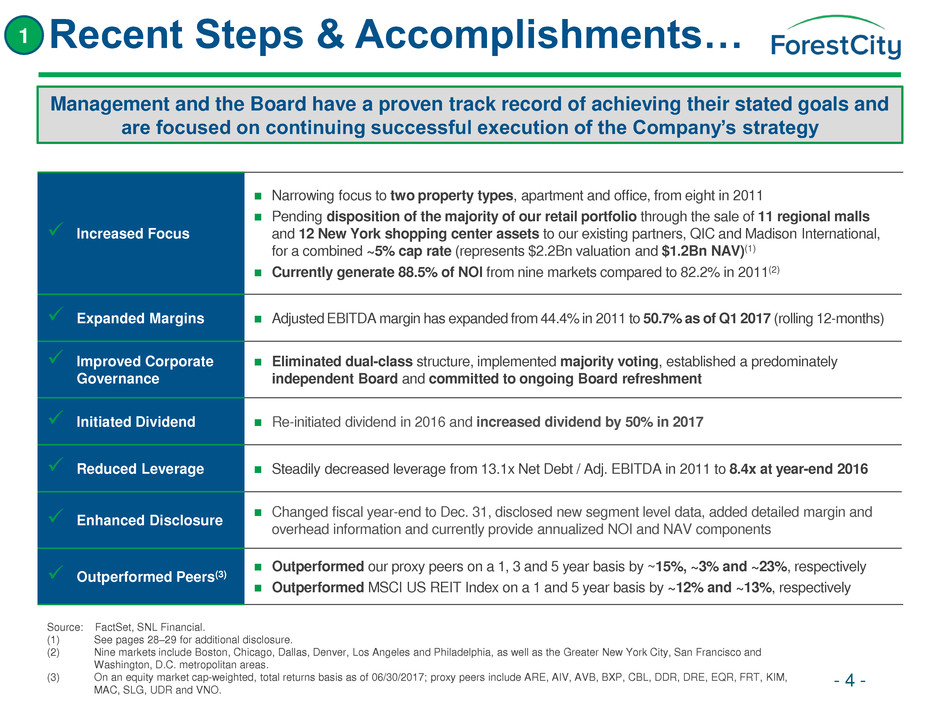

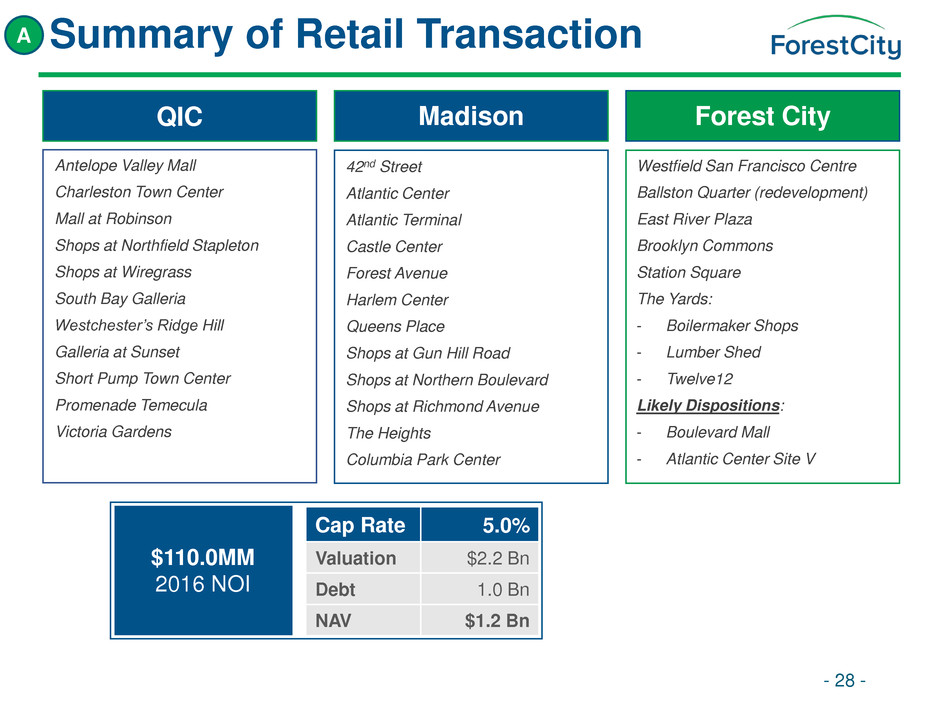

- 4 - Recent Steps & Accomplishments… 1 Management and the Board have a proven track record of achieving their stated goals and are focused on continuing successful execution of the Company’s strategy Increased Focus Narrowing focus to two property types, apartment and office, from eight in 2011 Pending disposition of the majority of our retail portfolio through the sale of 11 regional malls and 12 New York shopping center assets to our existing partners, QIC and Madison International, for a combined ~5% cap rate (represents $2.2Bn valuation and $1.2Bn NAV)(1) Currently generate 88.5% of NOI from nine markets compared to 82.2% in 2011(2) Expanded Margins Adjusted EBITDA margin has expanded from 44.4% in 2011 to 50.7% as of Q1 2017 (rolling 12-months) Improved Corporate Governance Eliminated dual-class structure, implemented majority voting, established a predominately independent Board and committed to ongoing Board refreshment Initiated Dividend Re-initiated dividend in 2016 and increased dividend by 50% in 2017 Reduced Leverage Steadily decreased leverage from 13.1x Net Debt / Adj. EBITDA in 2011 to 8.4x at year-end 2016 Enhanced Disclosure Changed fiscal year-end to Dec. 31, disclosed new segment level data, added detailed margin and overhead information and currently provide annualized NOI and NAV components Outperformed Peers(3) Outperformed our proxy peers on a 1, 3 and 5 year basis by ~15%, ~3% and ~23%, respectively Outperformed MSCI US REIT Index on a 1 and 5 year basis by ~12% and ~13%, respectively Source: FactSet, SNL Financial. (1) See pages 28–29 for additional disclosure. (2) Nine markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia, as well as the Greater New York City, San Francisco and Washington, D.C. metropolitan areas. (3) On an equity market cap-weighted, total returns basis as of 06/30/2017; proxy peers include ARE, AIV, AVB, BXP, CBL, DDR, DRE, EQR, FRT, KIM, MAC, SLG, UDR and VNO.

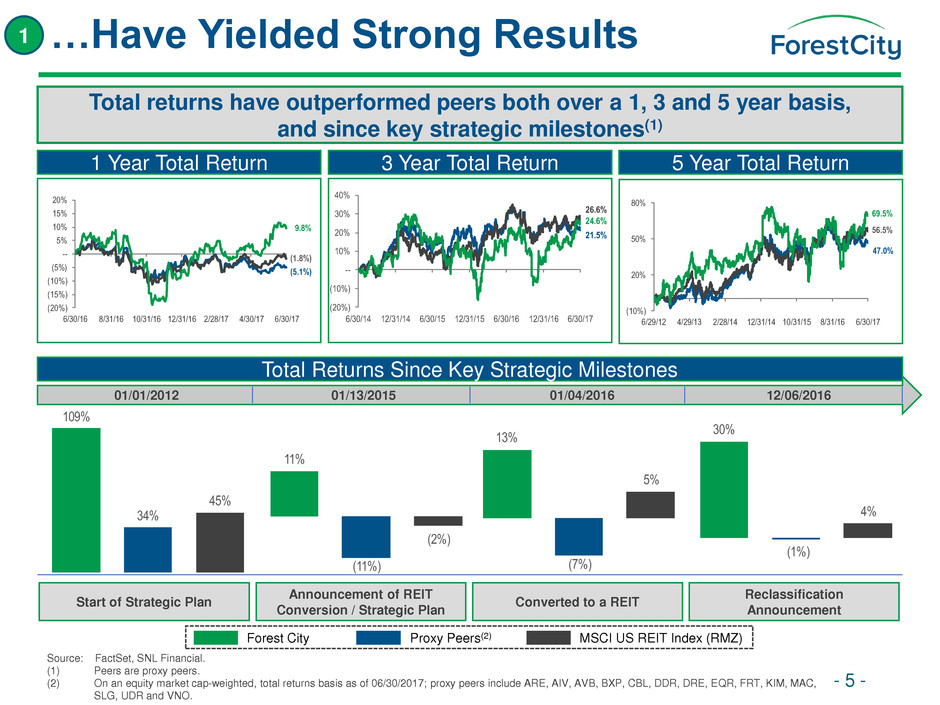

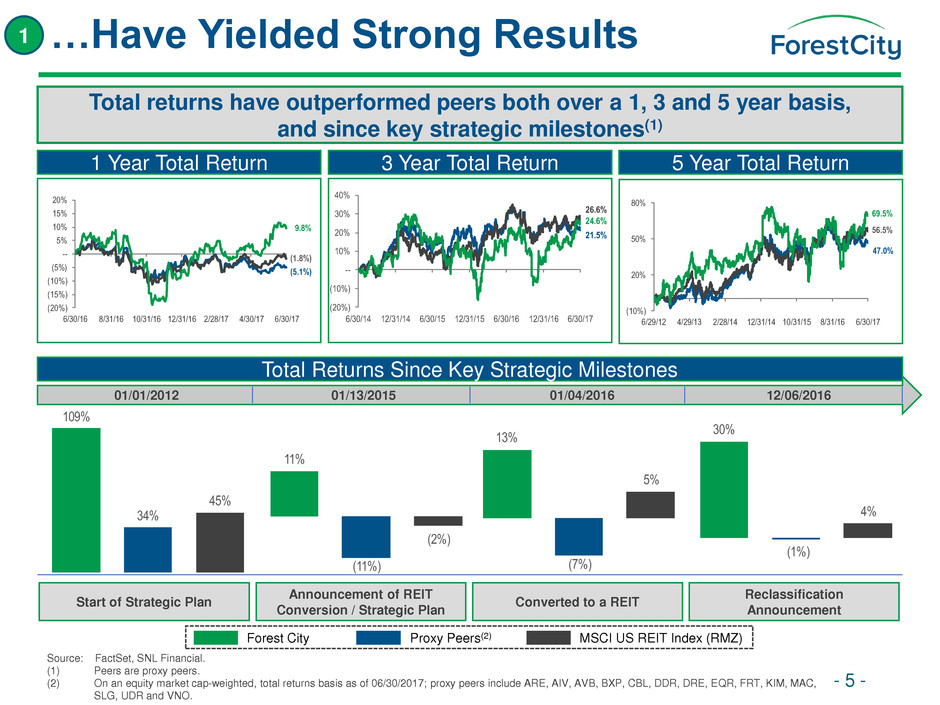

30% (1%) 4% 13% (7%) 5% 11% (11%) (2%) 109% 34% 45% (5.1%) (1.8%) 9.8% (20%) (15%) (10%) (5%) -- 5% 10% 15% 20% 6/30/16 8/31/16 10/31/16 12/31/16 2/28/17 4/30/17 6/30/17 26.6% 21.5% 24.6% (20%) (10%) -- 10% 20% 30% 40% 6/30/14 / 4 6/30/15 12/3 /15 6/30/16 12/31/16 6/30/17 47.0% 56.5% 69.5% (10%) 20% 50% 80% 6 9 2 9/ 3 2/28/14 12/31/ 4 10/31/15 8/31/16 6/30/17 - 5 - …Have Yielded Strong Results 1 1 Year Total Return 3 Year Total Return 5 Year Total Return Source: FactSet, SNL Financial. (1) Peers are proxy peers. (2) On an equity market cap-weighted, total returns basis as of 06/30/2017; proxy peers include ARE, AIV, AVB, BXP, CBL, DDR, DRE, EQR, FRT, KIM, MAC, SLG, UDR and VNO. Forest City Proxy Peers(2) MSCI US REIT Index (RMZ) Total Returns Since Key Strategic Milestones Start of Strategic Plan Converted to a REIT Reclassification Announcement Announcement of REIT Conversion / Strategic Plan 01/01/2012 01/13/2015 01/04/2016 12/06/2016 Total returns have outperformed peers both over a 1, 3 and 5 year basis, and since key strategic milestones(1)

2011 2012 2013 2014 2015 2016 2017 Jun 2011 Appointment of David LaRue as first non-founding family CEO Dec 2016 Announced collapse of dual-class structure and transition to non- executive Chairman Corporate Governance Enhancements - 6 - Dec 2013 Converted to December 31 fiscal year-end Feb 2012 Moved to majority independent Board Added Kenneth Bacon to Board Jan 2012 Improved disclosure in financial reporting including NAV, annualized NOI and FFO Nov 2014 Added Christine Detrick to Board Jan 2015 Announcement of REIT conversion and strategic plan Jun 2017 Completed collapse of dual-class structure and adoption of majority voting standard Overall ISS Quality Score upgraded from 7 to 4 Compensation plan received highest ISS Quality Score (1 out of 10) and 98% shareholder approval We have achieved significant milestones in improving corporate governance and remain committed to engaging with shareholders going forward 2 Feb 2016 Reinstated quarterly dividend May 2017 Adopted Director retirement policy Apr 2017 Appointed Jamie Behar and nominated Craig Macnab to Board, increasing independent Directors to 8 out of 13 Jan 2016 Completed REIT conversion

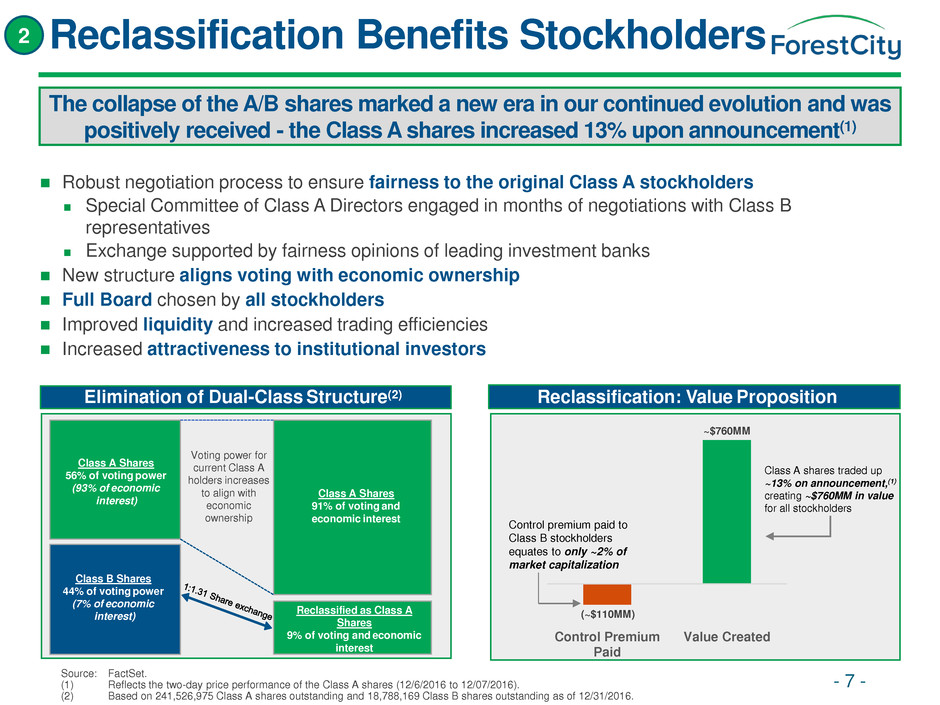

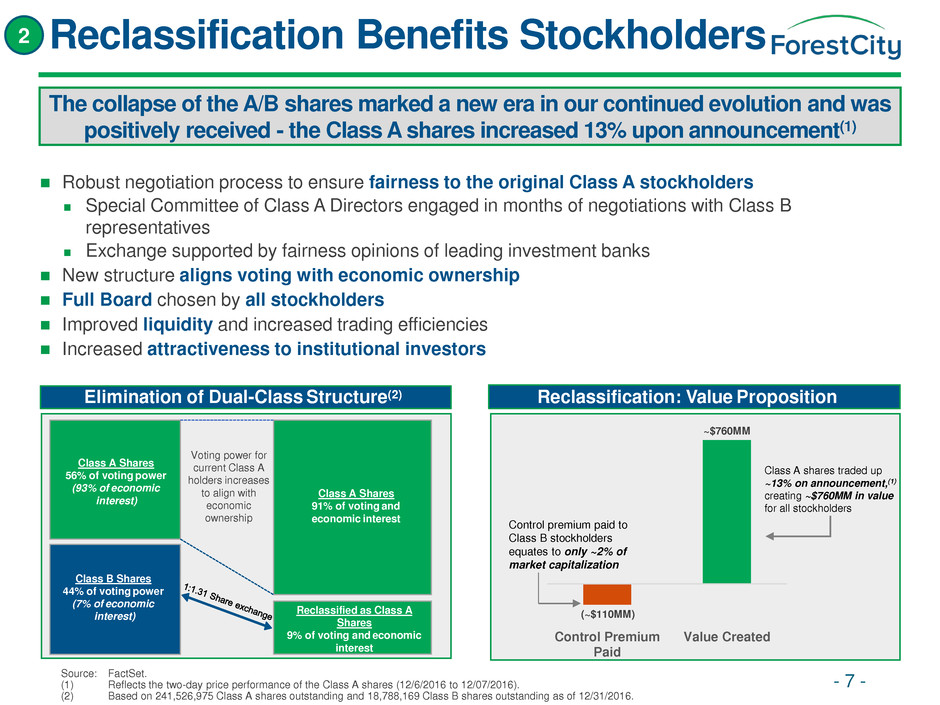

Control Premium Paid Value Created Reclassified as Class A Shares 9% of voting and economic interest Reclassification: Value Proposition Elimination of Dual-Class Structure(2) Robust negotiation process to ensure fairness to the original Class A stockholders Special Committee of Class A Directors engaged in months of negotiations with Class B representatives Exchange supported by fairness opinions of leading investment banks New structure aligns voting with economic ownership Full Board chosen by all stockholders Improved liquidity and increased trading efficiencies Increased attractiveness to institutional investors Voting power for current Class A holders increases to align with economic ownership Class A Shares 56% of voting power (93% of economic interest) Class B Shares 44% of voting power (7% of economic interest) Class A Shares 91% of voting and economic interest Control premium paid to Class B stockholders equates to only ~2% of market capitalization Class A shares traded up ~13% on announcement,(1) creating ~$760MM in value for all stockholders 2 Reclassification Benefits Stockholders Source: FactSet. (1) Reflects the two-day price performance of the Class A shares (12/6/2016 to 12/07/2016). (2) Based on 241,526,975 Class A shares outstanding and 18,788,169 Class B shares outstanding as of 12/31/2016. The collapse of the A/B shares marked a new era in our continued evolution and was positively received - the Class A shares increased 13% upon announcement(1) (~$110MM) ~$760MM - 7 -

Brings significant executive leadership experience and deep knowledge of Forest City Has served as officer and/or Director of various subsidiaries across 40+ years at Forest City, most recently as Exec. VP of Development Member of the Board at NACCO Industries, Inc. James Ratner (2016) Christine Detrick (2014) David LaRue (2011) Arthur Anton (2010) Kenneth Bacon (2012) Jamie Behar (2017) Scott Cowen (1989) Chairs the compensation committee and serves on the corporate governance and nominating committee Former Head of Americas Fin. Services Practice at Bain & Company Served as CEO of savings bank acquired by venture capital firm First Financial Partners, of which she was a founding member Has held various roles within Forest City since 1986; CEO since 2011 Former internal auditor and financial analyst with Sherwin Williams Former Director of CubeSmart, a publicly-traded REIT Member of NAREIT Board of Governors Serves on audit and compensation committees Currently the CEO of Swagelok Inc. Member of the Board of Sherwin Williams Formerly a partner at Ernst & Young LLP Serves on audit and corporate governance and nominating committees Member of the Board of Directors of Comcast Corporation Presiding Director at Ally Financial Co-founded asset management and advisory firm RailField Partners Serves on the audit committee and corporate governance and nominating committee Former Managing Director of Real Estate and Alternative Investments for GM Investment Management, managing $12Bn real estate portfolio Director at Gramercy Property Trust and Sunstone Hotel Investors Lead Independent Director; chairs corporate governance and nominating committee and serves on the compensation committee President Emeritus and Distinguished University Chair of Tulane University Member of the Board at Barnes & Noble and Newell Brands Chairs audit committee, serves on compensation committee Extensive industry knowledge in risk management, corporate governance, capital management and debt management Formerly part of advisory council to Financial Accounting Standards Board Serves on the corporate governance and nominating committee CEO of Artemis Real Estate Partners, LLC Formerly a Managing Director at Bankers Trust Company Former Director of Avis Group Holdings Serves on the corporate governance and nominating committee and the compensation committee Former Chairman and CEO at National Retail Properties, a publicly- traded REIT Director at American Tower and former Director at DDR Over 25 years of experience at Forest City, serving in current role as Executive Vice President since 2001 Leads Forest City’s operation in core Dallas market Brings significant depth of real estate experience to Board Executive Vice President of Forest City since 2013 and has served as Officer/Director of various subsidiaries within the Company Leads Forest City’s operations in core Washington, D.C. market Director at CubeSmart, a publicly-traded REIT Executive Vice President of Forest City since 1998, currently serving as Executive Vice President of Development 40 years of experience with Forest City and architecture background combine to provide vision and creativity to Board along with deep real estate knowledge and experience Michael Esposito (1995) Deborah Harmon (2008) Craig Macnab (2017) Brian Ratner (1993) Deborah Ratner Salzberg (1995) Ronald Ratner (1985) I I I I I I I I C I C Chairman (Non-Executive) Independent Director Recent Addition 2 Board of Directors Committees Composition: 100% Independent Directors - 8 -

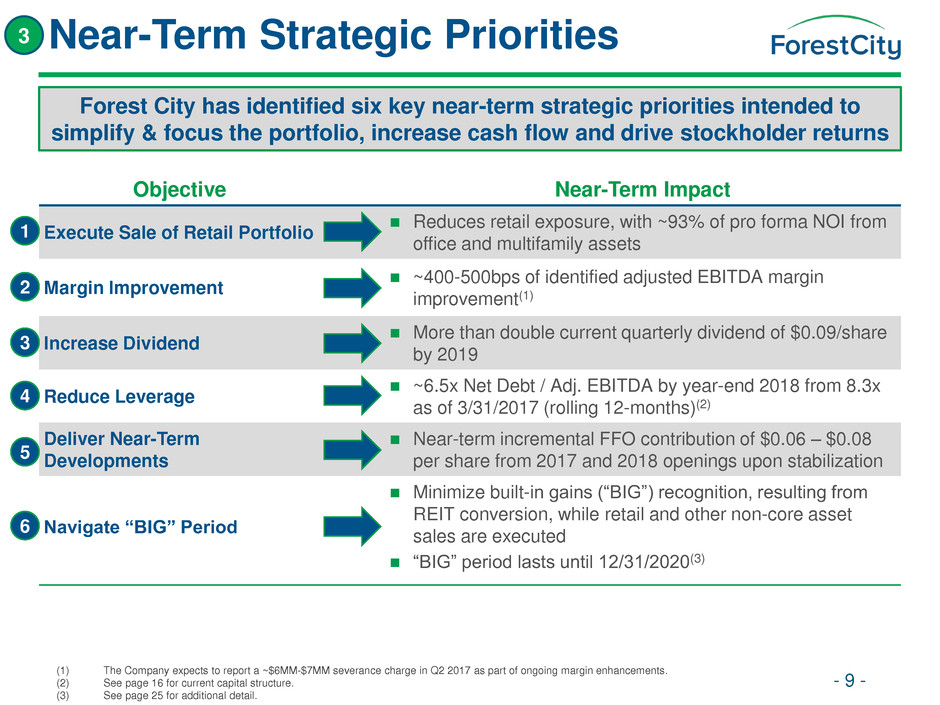

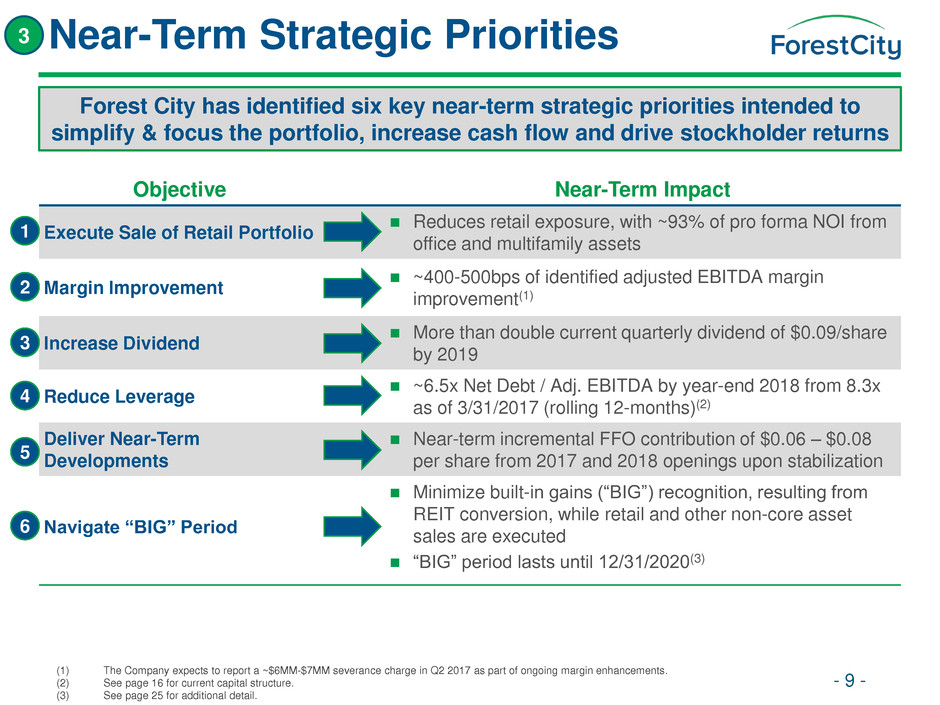

Near-Term Strategic Priorities - 9 - Objective Near-Term Impact Execute Sale of Retail Portfolio Reduces retail exposure, with ~93% of pro forma NOI from office and multifamily assets Margin Improvement ~400-500bps of identified adjusted EBITDA margin improvement(1) Increase Dividend More than double current quarterly dividend of $0.09/share by 2019 Reduce Leverage ~6.5x Net Debt / Adj. EBITDA by year-end 2018 from 8.3x as of 3/31/2017 (rolling 12-months)(2) Deliver Near-Term Developments Near-term incremental FFO contribution of $0.06 – $0.08 per share from 2017 and 2018 openings upon stabilization Navigate “BIG” Period Minimize built-in gains (“BIG”) recognition, resulting from REIT conversion, while retail and other non-core asset sales are executed “BIG” period lasts until 12/31/2020(3) (1) The Company expects to report a ~$6MM-$7MM severance charge in Q2 2017 as part of ongoing margin enhancements. (2) See page 16 for current capital structure. (3) See page 25 for additional detail. 3 Forest City has identified six key near-term strategic priorities intended to simplify & focus the portfolio, increase cash flow and drive stockholder returns 4 3 2 1 5 6

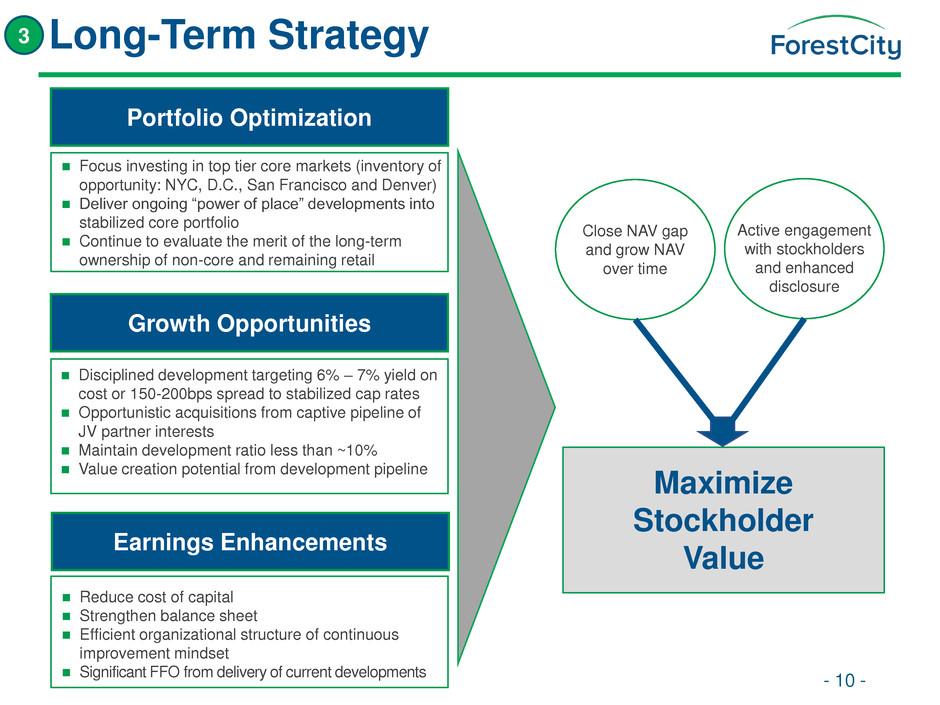

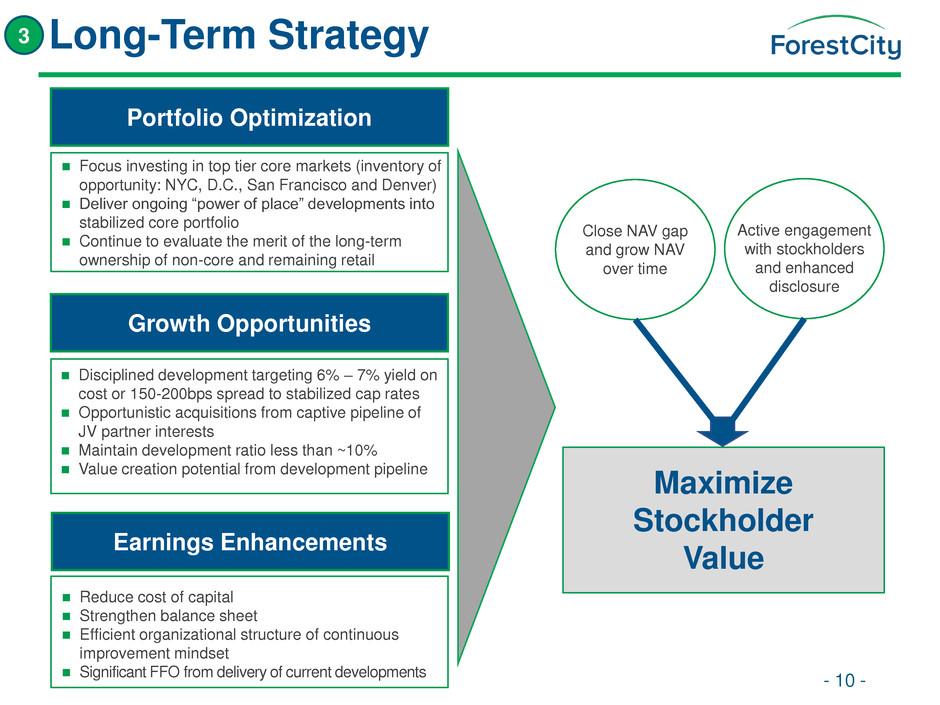

Long-Term Strategy - 10 - 3 Portfolio Optimization Focus investing in top tier core markets (inventory of opportunity: NYC, D.C., San Francisco and Denver) Deliver ongoing “power of place” developments into stabilized core portfolio Continue to evaluate the merit of the long-term ownership of non-core and remaining retail Growth Opportunities Disciplined development targeting 6% – 7% yield on cost or 150-200bps spread to stabilized cap rates Opportunistic acquisitions from captive pipeline of JV partner interests Maintain development ratio less than ~10% Value creation potential from development pipeline Earnings Enhancements Reduce cost of capital Strengthen balance sheet Efficient organizational structure of continuous improvement mindset Significant FFO from delivery of current developments Maximize Stockholder Value Close NAV gap and grow NAV over time Active engagement with stockholders and enhanced disclosure

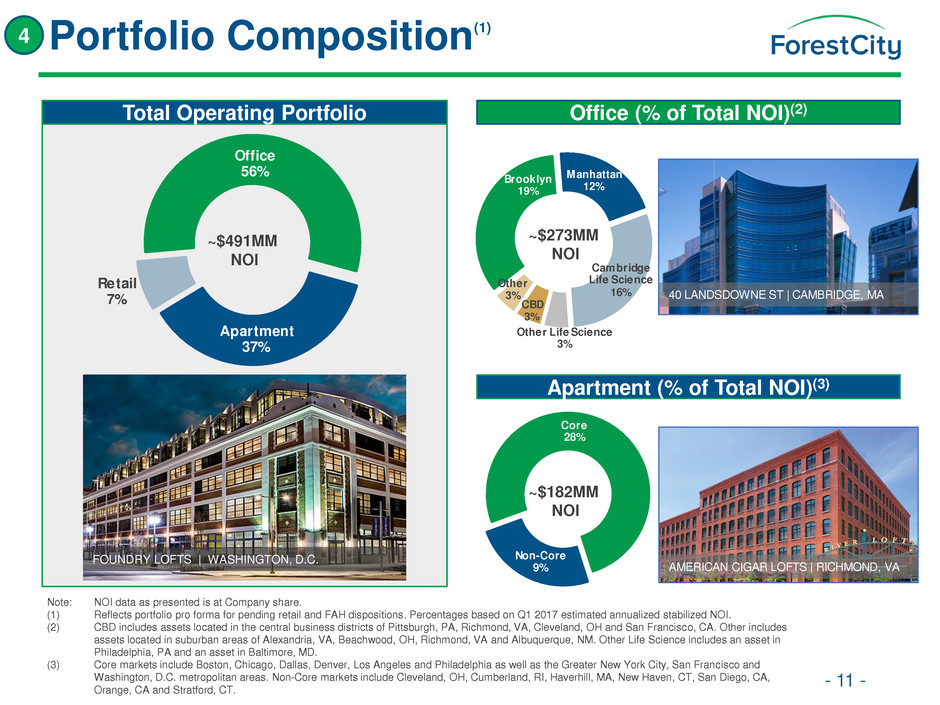

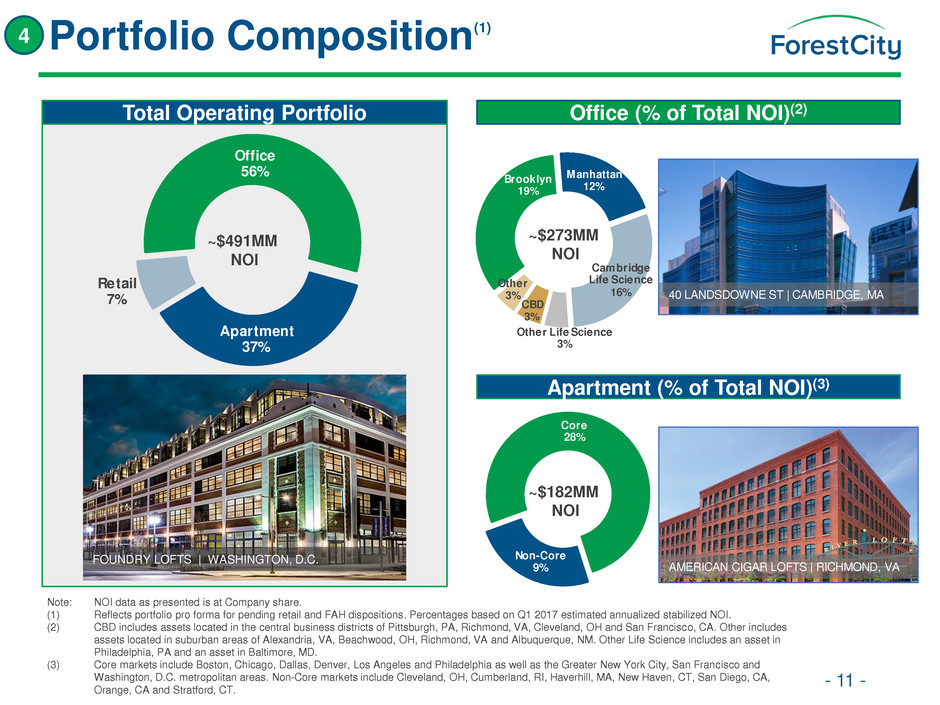

Core 28% Non-Core 9% Brooklyn 19% Manhattan 12% Cambridge Life Science 16% Other Life Science 3% CBD 3% Other 3% Portfolio Composition - 11 - Total Operating Portfolio Office (% of Total NOI)(2) Apartment (% of Total NOI)(3) ~$273MM NOI ~$182MM NOI 4 (1) Note: NOI data as presented is at Company share. (1) Reflects portfolio pro forma for pending retail and FAH dispositions. Percentages based on Q1 2017 estimated annualized stabilized NOI. (2) CBD includes assets located in the central business districts of Pittsburgh, PA, Richmond, VA, Cleveland, OH and San Francisco, CA. Other includes assets located in suburban areas of Alexandria, VA, Beachwood, OH, Richmond, VA and Albuquerque, NM. Other Life Science includes an asset in Philadelphia, PA and an asset in Baltimore, MD. (3) Core markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia as well as the Greater New York City, San Francisco and Washington, D.C. metropolitan areas. Non-Core markets include Cleveland, OH, Cumberland, RI, Haverhill, MA, New Haven, CT, San Diego, CA, Orange, CA and Stratford, CT. AMERICAN CIGAR LOFTS | RICHMOND, VA Office 56% Apartment 37% Retail 7% 40 LANDSDOWNE ST | CAMBRIDGE, MA ~$491MM NOI FOUNDRY LOFTS | WASHINGTON, D.C.

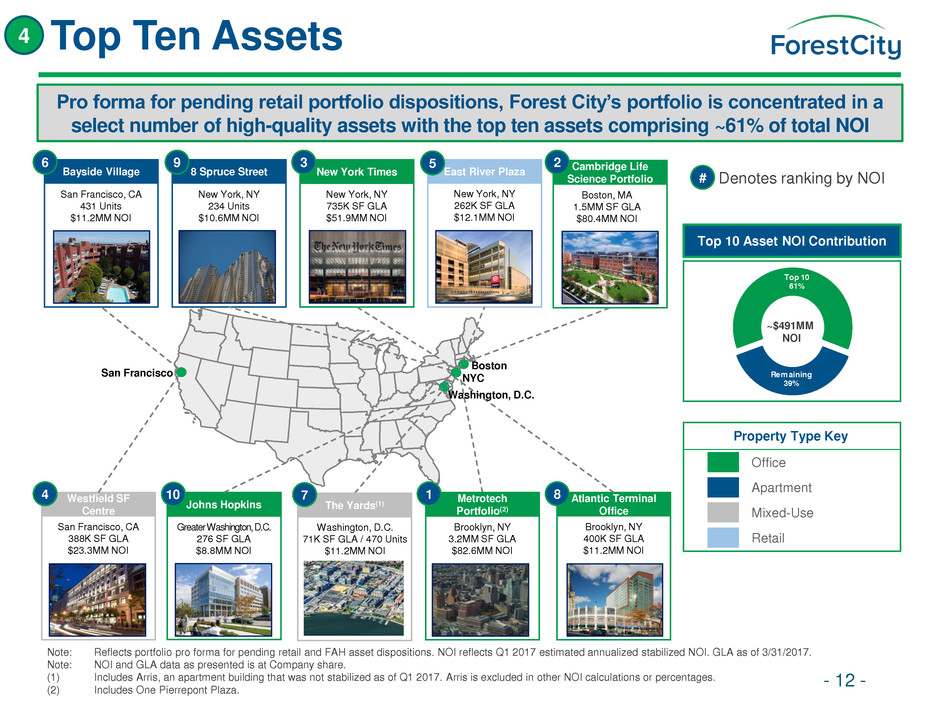

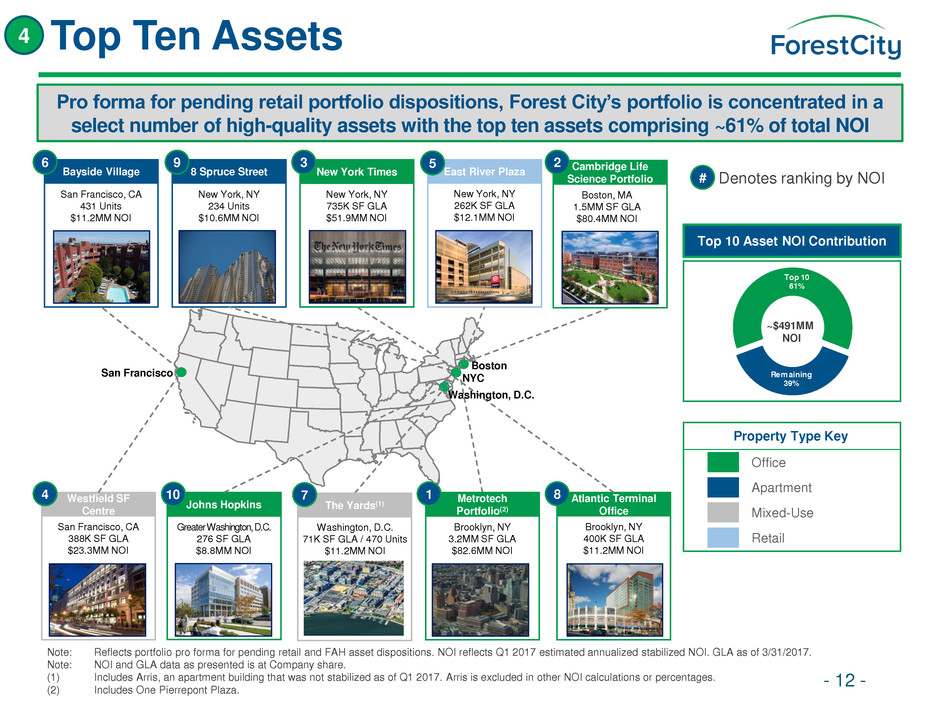

Atlantic Terminal Office Top Ten Assets - 12 - 4 Pro forma for pending retail portfolio dispositions, Forest City’s portfolio is concentrated in a select number of high-quality assets with the top ten assets comprising ~61% of total NOI Note: Reflects portfolio pro forma for pending retail and FAH asset dispositions. NOI reflects Q1 2017 estimated annualized stabilized NOI. GLA as of 3/31/2017. Note: NOI and GLA data as presented is at Company share. (1) Includes Arris, an apartment building that was not stabilized as of Q1 2017. Arris is excluded in other NOI calculations or percentages. (2) Includes One Pierrepont Plaza. Cambridge Life Science Portfolio Boston, MA 1.5MM SF GLA $80.4MM NOI 2 NYC San Francisco San Francisco, CA 388K SF GLA $23.3MM NOI Westfield SF Centre 4 Bayside Village San Francisco, CA 431 Units $11.2MM NOI Brooklyn, NY 400K SF GLA $11.2MM NOI New York, NY 735K SF GLA $51.9MM NOI New York Times 3 East River Plaza New York, NY 262K SF GLA $12.1MM NOI 6 5 8 Spruce Street New York, NY 234 Units $10.6MM NOI 9 Brooklyn, NY 3.2MM SF GLA $82.6MM NOI Metrotech Portfolio(2) 1 Boston Retail Office Apartment Mixed-Use Top 10 Asset NOI Contribution Property Type Key # Denotes ranking by NOI Greater Washington, D.C. 276 SF GLA $8.8MM NOI Johns Hopkins 8 Washington, D.C. 71K SF GLA / 470 Units $11.2MM NOI The Yards(1) 10 Top 10 61% Remaining 39% ~$491MM NOI Washington, D.C. 7

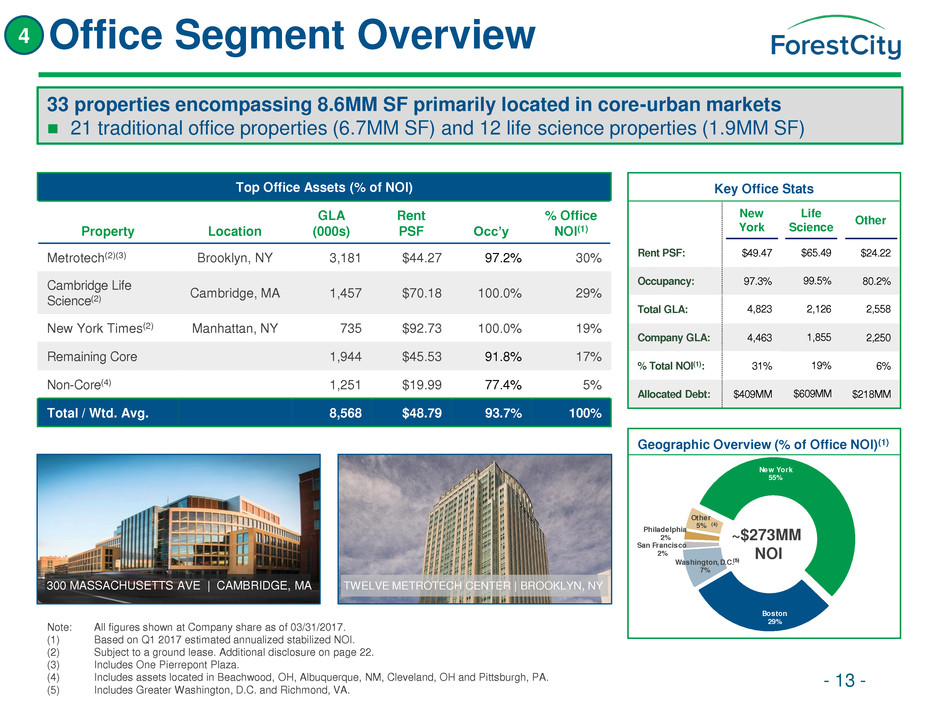

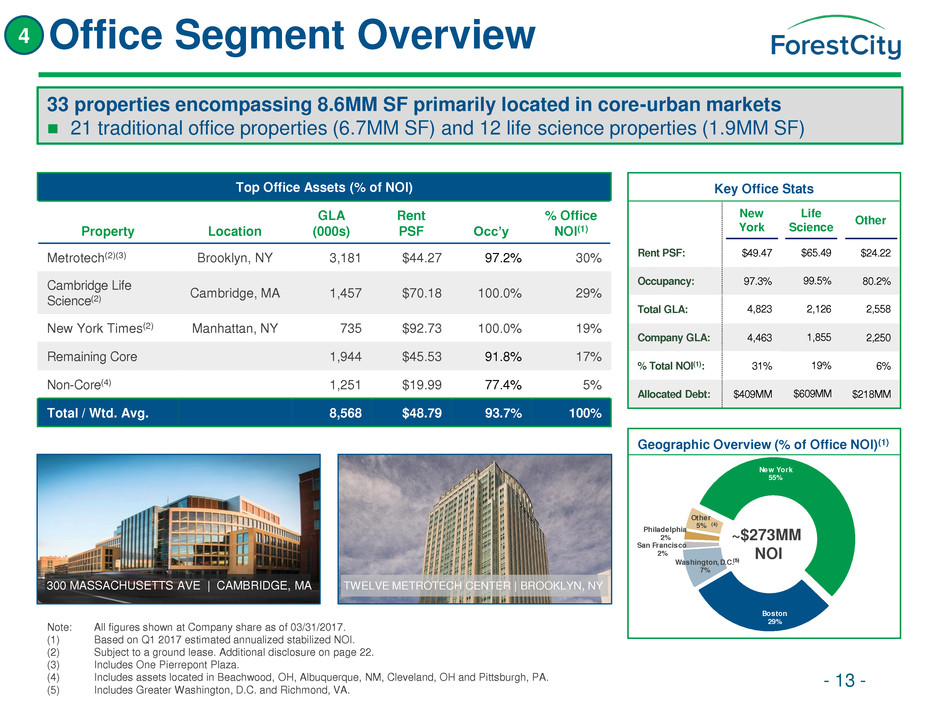

New York 55% Boston 29% Washington, D.C. 7% San Francisco 2% Philadelphia 2% Other 5% Key Office Stats New York Life Science Other Rent PSF: $49.47 $65.49 $24.22 Occupancy: 97.3% 99.5% 80.2% Total GLA: 4,823 2,126 2,558 Company GLA: 4,463 1,855 2,250 % Total NOI(1): 31% 19% 6% Allocated Debt: $409MM $609MM $218MM Office Segment Overview - 13 - Top Office Assets (% of NOI) Property Location GLA (000s) Rent PSF Occ’y % Office NOI(1) Metrotech(2)(3) Brooklyn, NY 3,181 $44.27 97.2% 30% Cambridge Life Science(2) Cambridge, MA 1,457 $70.18 100.0% 29% New York Times(2) Manhattan, NY 735 $92.73 100.0% 19% Remaining Core 1,944 $45.53 91.8% 17% Non-Core(4) 1,251 $19.99 77.4% 5% Total / Wtd. Avg. 8,568 $48.79 93.7% 100% 33 properties encompassing 8.6MM SF primarily located in core-urban markets 21 traditional office properties (6.7MM SF) and 12 life science properties (1.9MM SF) 4 Geographic Overview (% of Office NOI)(1) Note: All figures shown at Company share as of 03/31/2017. (1) Based on Q1 2017 estimated annualized stabilized NOI. (2) Subject to a ground lease. Additional disclosure on page 22. (3) Includes One Pierrepont Plaza. (4) Includes assets located in Beachwood, OH, Albuquerque, NM, Cleveland, OH and Pittsburgh, PA. (5) Includes Greater Washington, D.C. and Richmond, VA. 300 MASSACHUSETTS AVE | CAMBRIDGE, MA TWELVE METROTECH CENTER | BROOKLYN, NY (5) ~$273MM NOI (4)

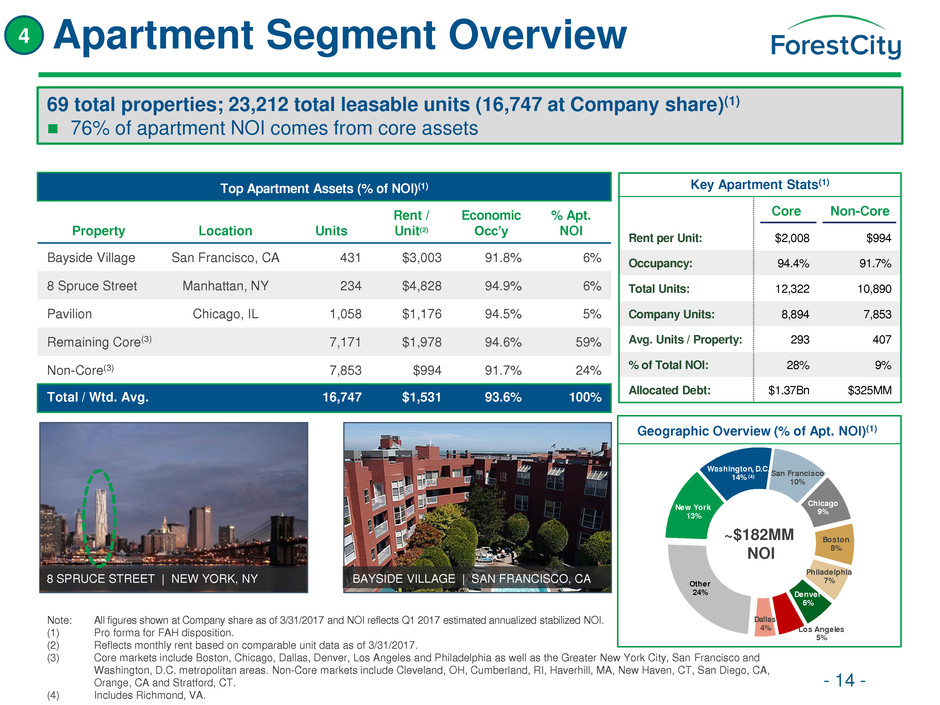

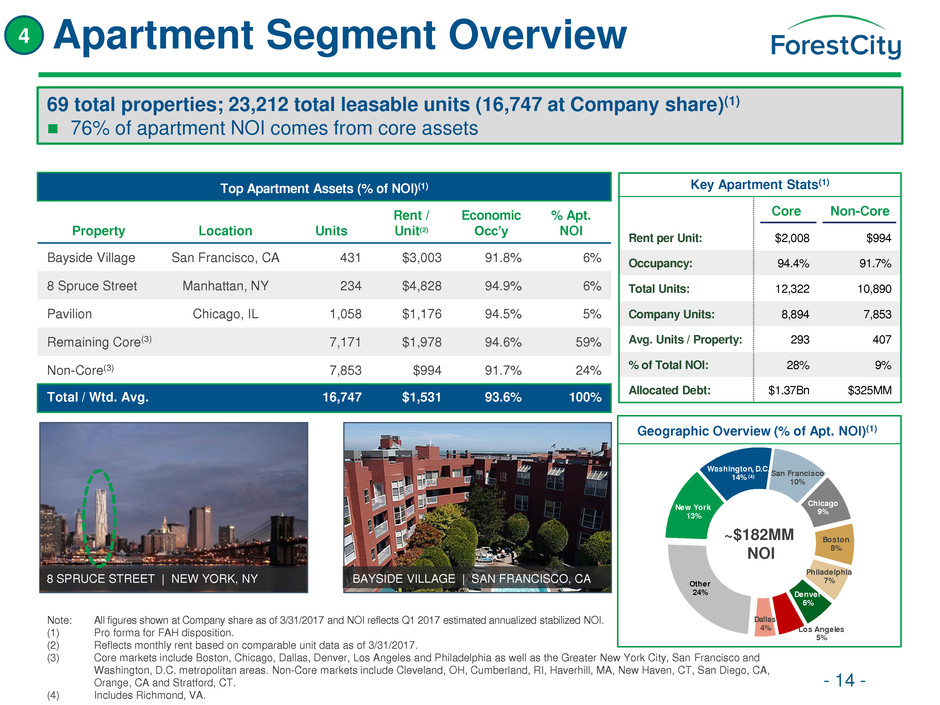

Top Apartment Assets (% of NOI)(1) Property Location Units Rent / Unit(2) Economic Occ’y % Apt. NOI Bayside Village San Francisco, CA 431 $3,003 91.8% 6% 8 Spruce Street Manhattan, NY 234 $4,828 94.9% 6% Pavilion Chicago, IL 1,058 $1,176 94.5% 5% Remaining Core 7,171 $1,978 94.6% 59% Non-Core(3) 7,853 $994 91.7% 24% Total / Wtd. Avg. 16,747 $1,531 93.6% 100% Apartment Segment Overview - 14 - 69 total properties; 23,212 total leasable units (16,747 at Company share)(1) 76% of apartment NOI comes from core assets Note: All figures shown at Company share as of 3/31/2017 and NOI reflects Q1 2017 estimated annualized stabilized NOI. (1) Pro forma for FAH disposition. (2) Reflects monthly rent based on comparable unit data as of 3/31/2017. (3) Core markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia as well as the Greater New York City, San Francisco and Washington, D.C. metropolitan areas. Non-Core markets include Cleveland, OH, Cumberland, RI, Haverhill, MA, New Haven, CT, San Diego, CA, Orange, CA and Stratford, CT. (4) Includes Richmond, VA. 4 Sky55 | CHICAGO New York 13% Washington, D.C. 14% San Francisco 10% Chicago 9% Boston 8% Philadelphia 7% Denver 6% Los Angeles 5% Dallas 4% Other 24% BAYSIDE VILLAGE | SAN FRANCISCO, CA 8 SPRUCE STREET | NEW YORK, NY (3) Key Apartment Stats(1) Core Non-Core Rent per Unit: $2,008 $994 Occupancy: 94.4% 91.7% Total Units: 12,322 10,890 Company Units: 8,894 7,853 Avg. Units / Property: 293 407 % of Total NOI: 28% 9% Allocated Debt: $1.37Bn $325MM Geographic Overview (% of Apt. NOI)(1) (4) ~$182MM NOI

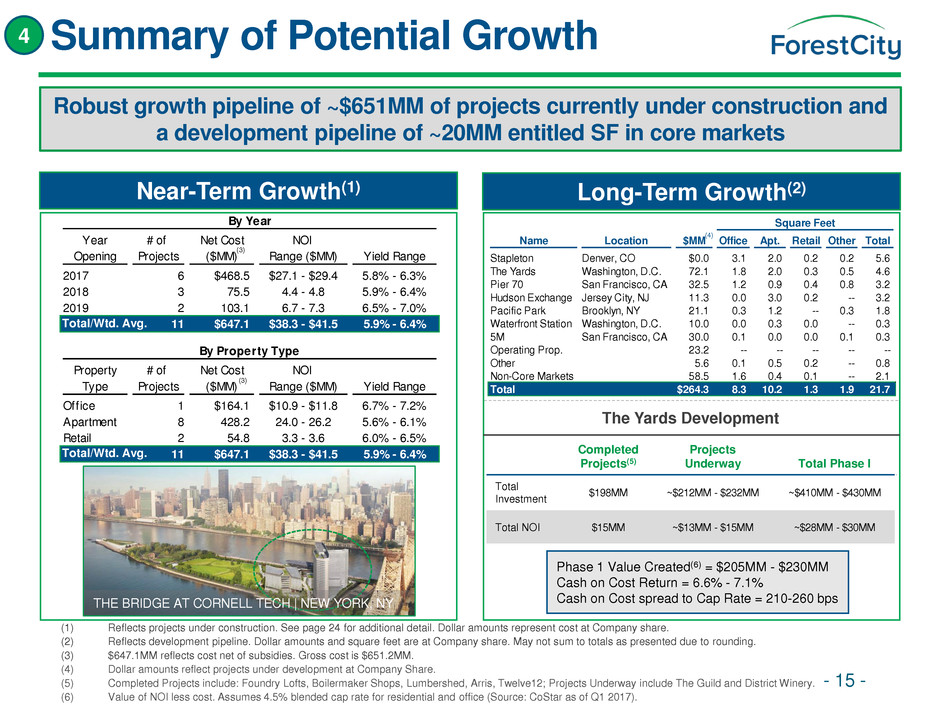

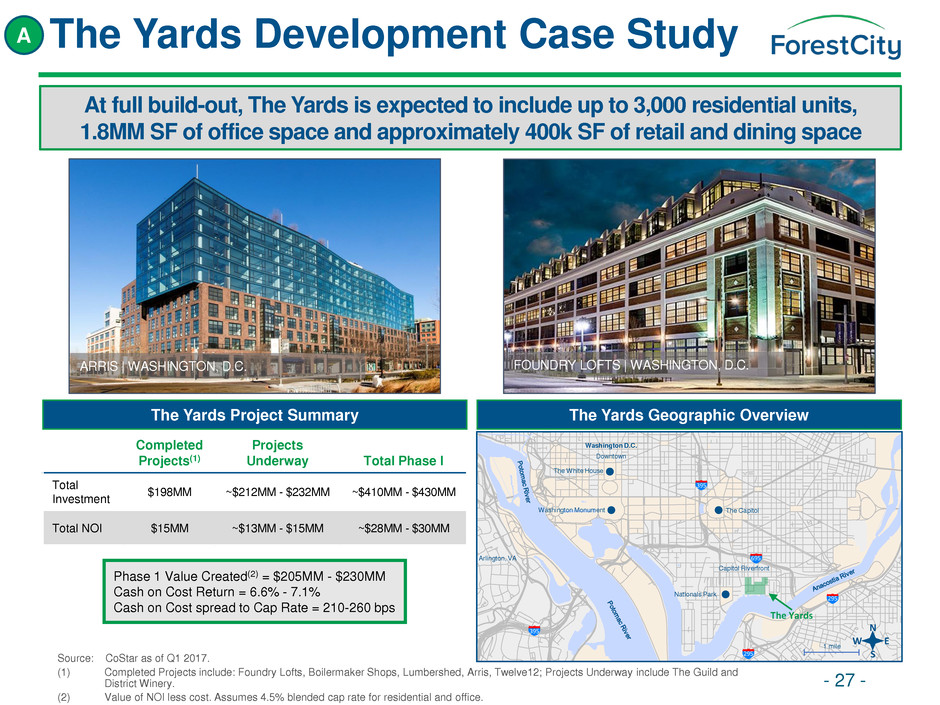

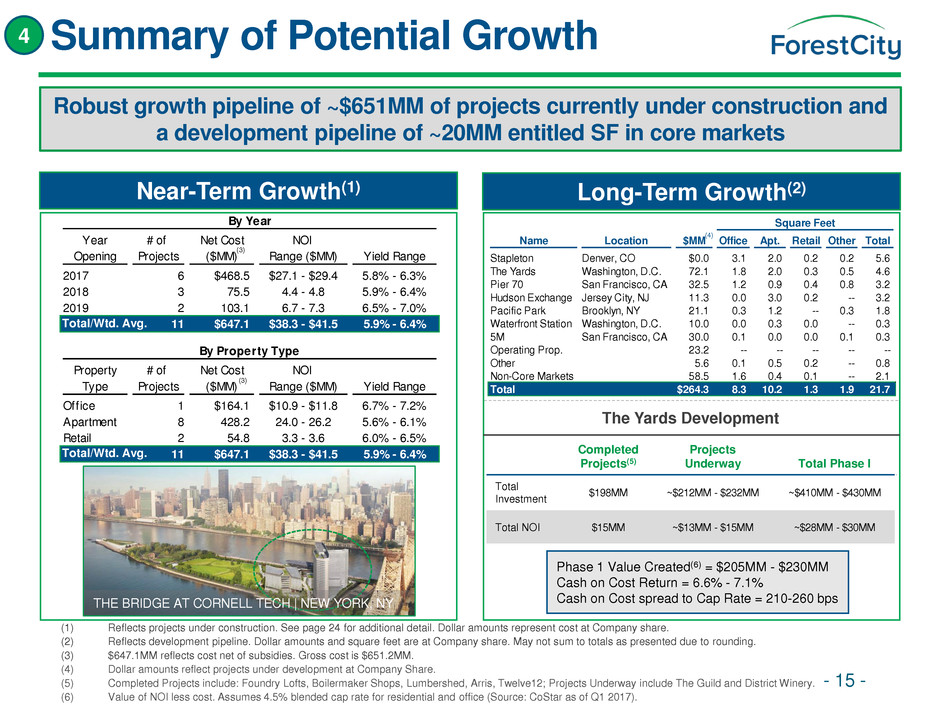

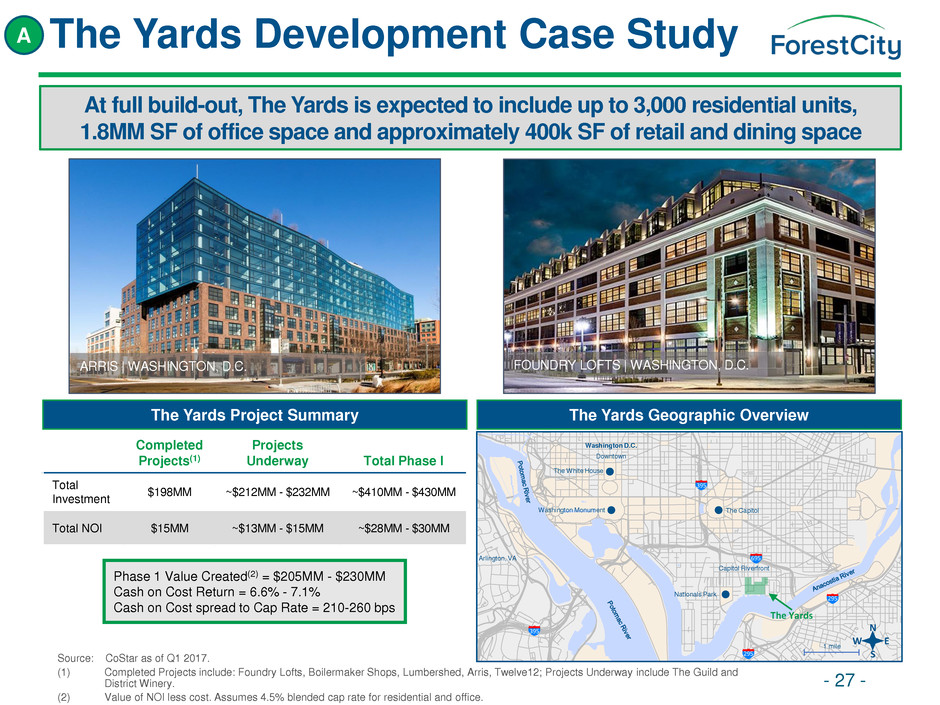

s - 15 - 4 Near-Term Growth(1) Long-Term Growth(2) Summary of Potential Growth (1) Reflects projects under construction. See page 24 for additional detail. Dollar amounts represent cost at Company share. (2) Reflects development pipeline. Dollar amounts and square feet are at Company share. May not sum to totals as presented due to rounding. (3) $647.1MM reflects cost net of subsidies. Gross cost is $651.2MM. (4) Dollar amounts reflect projects under development at Company Share. (5) Completed Projects include: Foundry Lofts, Boilermaker Shops, Lumbershed, Arris, Twelve12; Projects Underway include The Guild and District Winery. (6) Value of NOI less cost. Assumes 4.5% blended cap rate for residential and office (Source: CoStar as of Q1 2017). Robust growth pipeline of ~$651MM of projects currently under construction and a development pipeline of ~20MM entitled SF in core markets (3) The Yards Development (3) Phase 1 Value Created(6) = $205MM - $230MM Cash on Cost Return = 6.6% - 7.1% Cash on Cost spread to Cap Rate = 210-260 bps Completed Projects(5) Projects Underway Total Phase I Total Investment $198MM ~$212MM - $232MM ~$410MM - $430MM Total NOI $15MM ~$13MM - $15MM ~$28MM - $30MM THE BRIDGE AT CORNELL TECH | NEW YORK, NY By Year Year # of Net Cost NOI Opening Projects ($MM) Range ($MM) Yield Range 2017 6 $468.5 $27.1 - $29.4 5.8% - 6.3% 2018 3 75.5 4.4 - 4.8 5.9% - 6.4% 2019 2 103.1 6.7 - 7.3 6.5% - 7.0% 11 $647.1 $38.3 - $41.5 5.9% - 6.4% By P operty Type Property # of Net Cost NOI Type Projects ($MM) Range ($MM) Yield Range Office 1 $164.1 $10.9 - $11.8 6.7% - 7.2% Apartment 8 428.2 24.0 - 26.2 5.6% - 6.1% Retail 2 54.8 3.3 - 3.6 6.0% - 6.5% 11 $647.1 $38.3 - $41.5 5.9% - 6.4% Square Feet Name Location $MM Office Apt. Retail Other Total Stapleton Denver, CO $0.0 3.1 2.0 0.2 0.2 5.6 The Yards Washington, D.C. 72.1 1.8 2.0 0.3 0.5 4.6 Pier 7 San Francisco, CA 32.5 1.2 0.9 0.4 0.8 3.2 H dson Exchange Jersey City, NJ 11.3 0.0 3.0 0.2 -- 3.2 Pacific Park Brooklyn, NY 21.1 0.3 1.2 -- 0.3 1.8 Wate fr n Station Washington, D.C. 10.0 0.0 0.3 0.0 -- 0.3 5M San Francisco, CA 30.0 0.1 0.0 0.0 0.1 0.3 Operating Prop. 23.2 -- -- -- -- -- Other 5.6 0.1 0.5 0.2 -- 0.8 Non-Core Markets 58.5 1.6 0.4 0.1 -- 2.1 Total $264.3 8.3 10.2 1.3 1.9 21.7 Total/Wtd. Avg. Total/Wtd. Avg. (4)

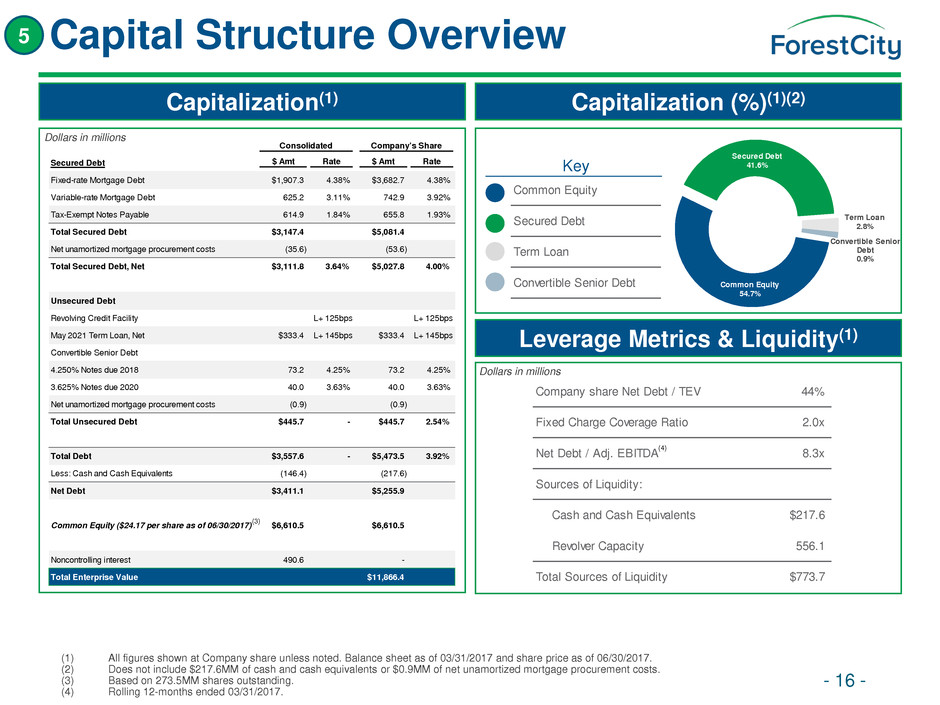

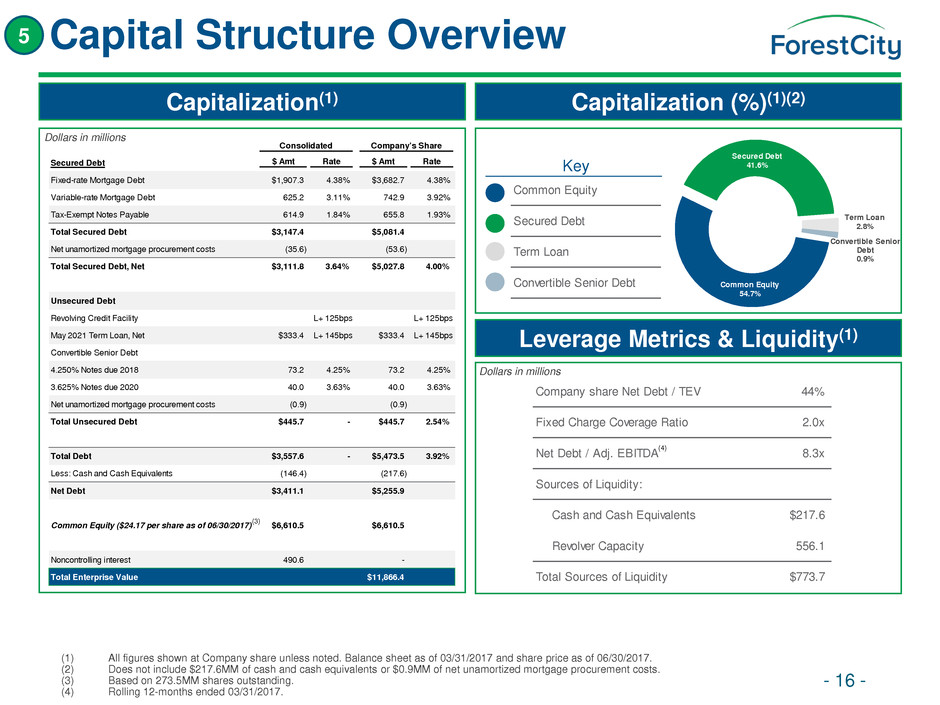

Consolidated Company's Share Secured Debt $ Amt Rate $ Amt Rate Fixed-rate Mortgage Debt $1,907.3 4.38% $3,682.7 4.38% Variable-rate Mortgage Debt 625.2 3.11% 742.9 3.92% Tax-Exempt Notes Payable 614.9 1.84% 655.8 1.93% Total Secured Debt $3,147.4 $5,081.4 Net unamortized mortgage procurement costs (35.6) (53.6) Total Secured Debt, Net $3,111.8 3.64% $5,027.8 4.00% Unsecured Debt Revolving Credit Facility L+ 125bps L+ 125bps May 2021 Term Loan, Net $333.4 L+ 145bps $333.4 L+ 145bps Convertible Senior Debt 4.250% Notes due 2018 73.2 4.25% 73.2 4.25% 3.625% Notes due 2020 40.0 3.63% 40.0 3.63% Net unamortized mortgage procurement costs (0.9) (0.9) Total Unsecured Debt $445.7 - $445.7 2.54% Total Debt $3,557.6 - $5,473.5 3.92% Less: Cash and Cash Equivalents (146.4) (217.6) Net Debt $3,411.1 $5,255.9 Common Equity ($24.17 per share as of 06/30/2017) $6,610.5 $6,610.5 Noncontrolling interest 490.6 - Total Enterprise Value $11,866.4 Company share Net Debt / TEV 44% Fixed Charge Coverage Ratio 2.0x Net Debt / Adj. EBITDA 8.3x Sources of Liquidity: Cash and Cash Equivalents $217.6 Revolver Capacity 556.1 Total Sources of Liquidity $773.7 Capital Structure Overview - 16 - Capitalization(1) Capitalization (%)(1)(2) Leverage Metrics & Liquidity(1) 5 (1) All figures shown at Company share unless noted. Balance sheet as of 03/31/2017 and share price as of 06/30/2017. (2) Does not include $217.6MM of cash and cash equivalents or $0.9MM of net unamortized mortgage procurement costs. (3) Based on 273.5MM shares outstanding. (4) Rolling 12-months ended 03/31/2017. Common Equity Secured Debt Term Loan Convertible Senior Debt Key Dollars in millions Dollars in millions (3) (4) Secured Debt 41.6% Term Loan 2.8% Convertible Senior Debt 0.9% Common Equity 54.7%

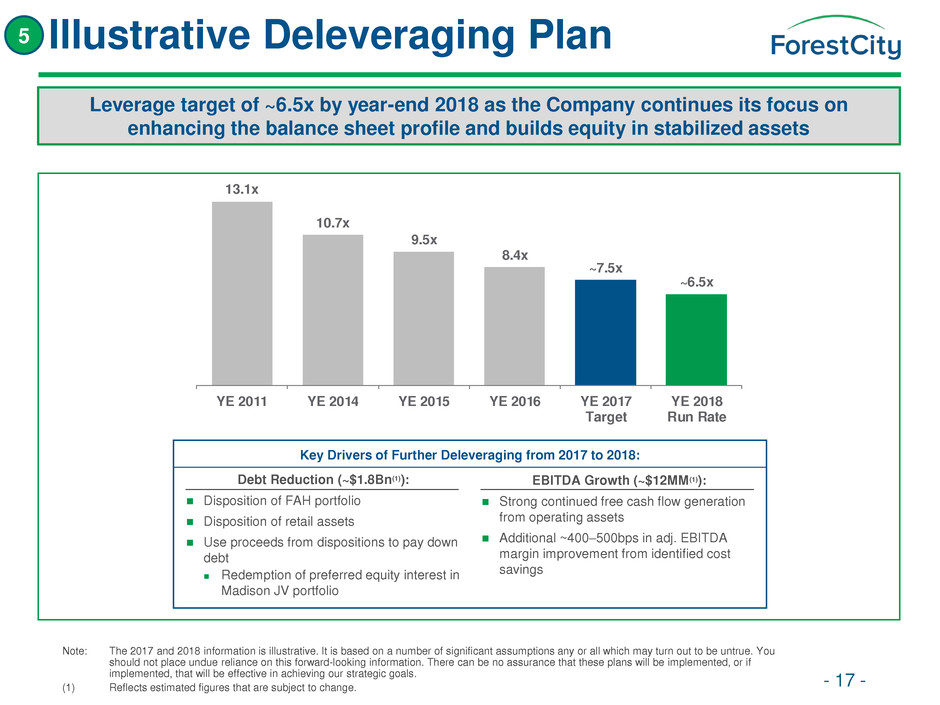

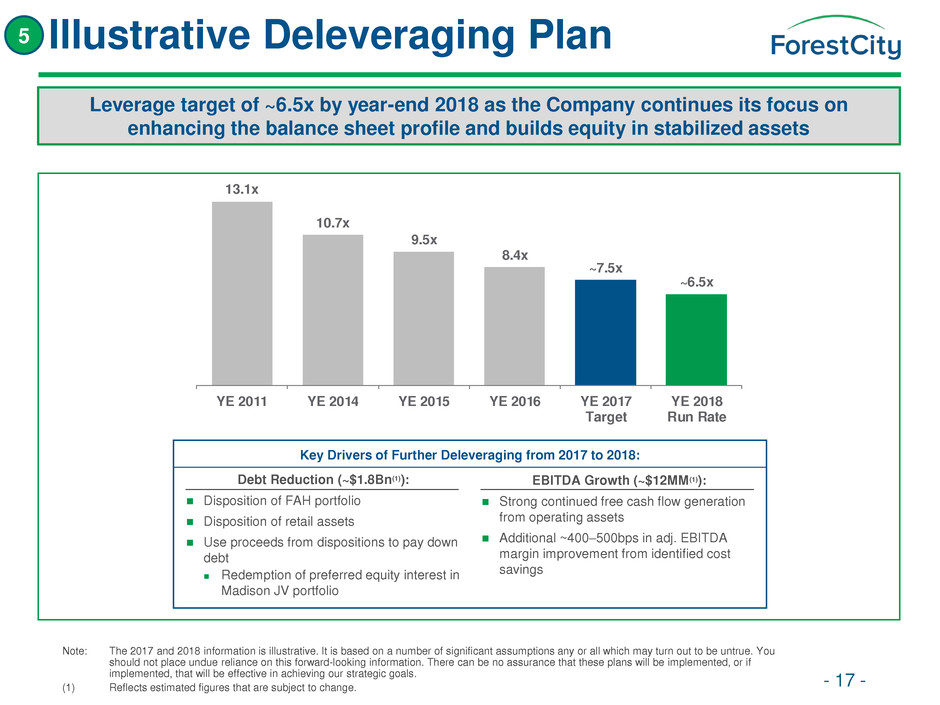

Illustrative Deleveraging Plan - 17 - Leverage target of ~6.5x by year-end 2018 as the Company continues its focus on enhancing the balance sheet profile and builds equity in stabilized assets 5 Note: The 2017 and 2018 information is illustrative. It is based on a number of significant assumptions any or all which may turn out to be untrue. You should not place undue reliance on this forward-looking information. There can be no assurance that these plans will be implemented, or if implemented, that will be effective in achieving our strategic goals. (1) Reflects estimated figures that are subject to change. 13.1x 10.7x 9.5x 8.4x ~7.5x ~6.5x YE 2011 YE 2014 YE 2015 YE 2016 YE 2017 Target YE 2018 Run Rate Key Drivers of Further Deleveraging: Debt Reduction (~$1.8Bn(1)): Disposition of FAH portfolio Disposition of retail assets Use proceeds from dispositions to pay down debt Redemption of preferred equity interest in Madison JV portfolio Key Drivers of Further Deleveraging: EBITDA Growth (~$12MM(1)): Strong continued free cash flow generation from operating assets Additional ~400–500bps in adj. EBITDA margin improvement from identified cost savings Key Drivers of Further Deleveraging from 2017 to 2018:

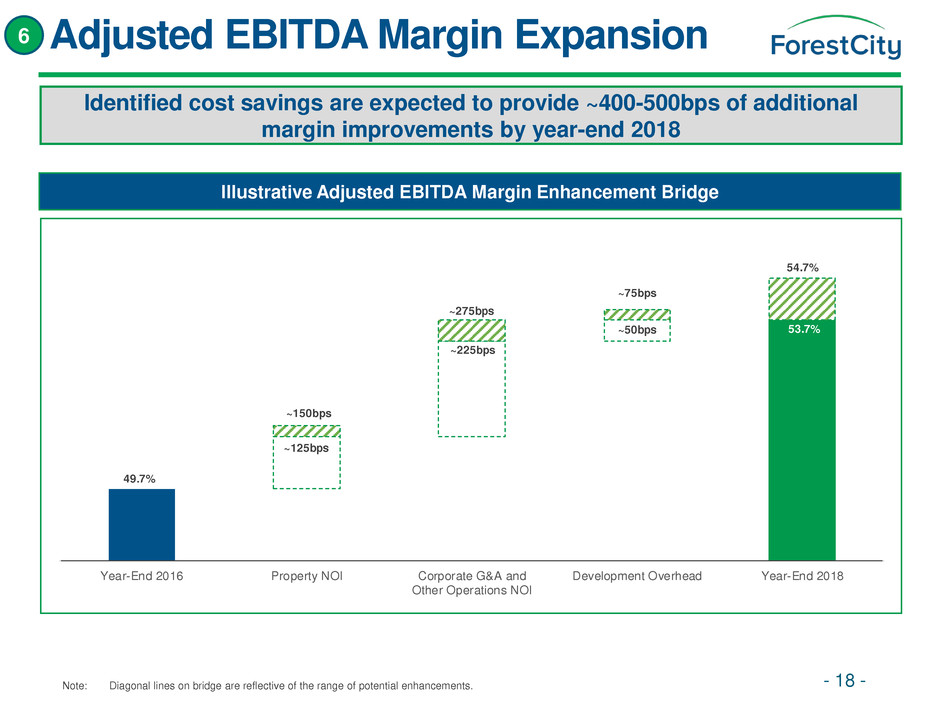

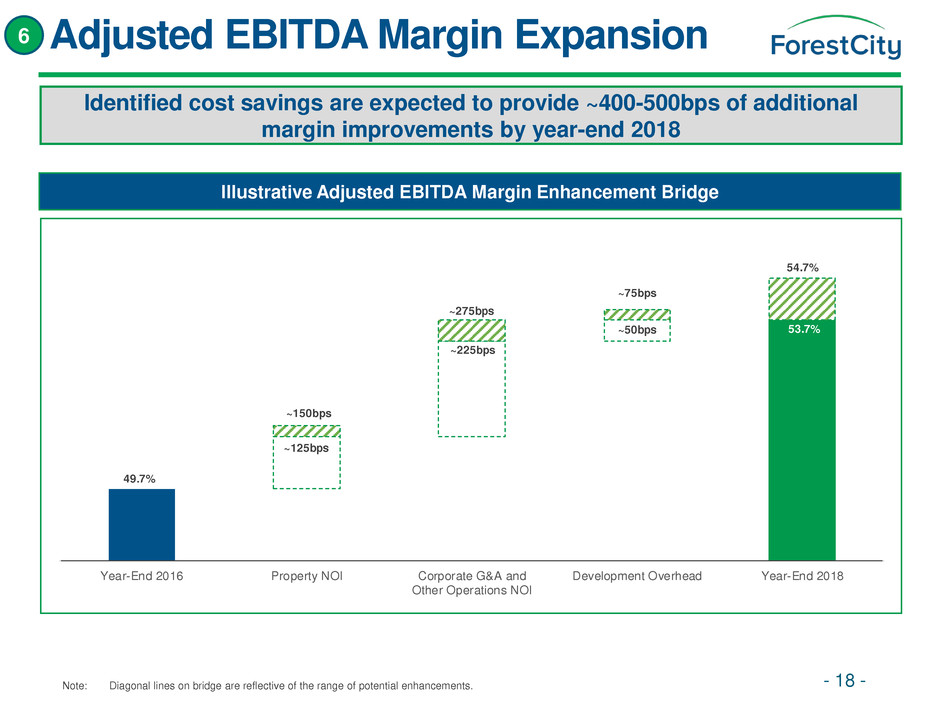

49.7% ~125bps ~150bps ~225bps ~275bps ~50bps 53.7% ~75bps 54.7% Year-End 2016 Property NOI Corporate G&A and Other Operations NOI Development Overhead Year-End 2018 Adjusted EBITDA Margin Expansion - 18 - 6 Identified cost savings are expected to provide ~400-500bps of additional margin improvements by year-end 2018 Illustrative Adjusted EBITDA Margin Enhancement Bridge Note: Diagonal lines on bridge are reflective of the range of potential enhancements.

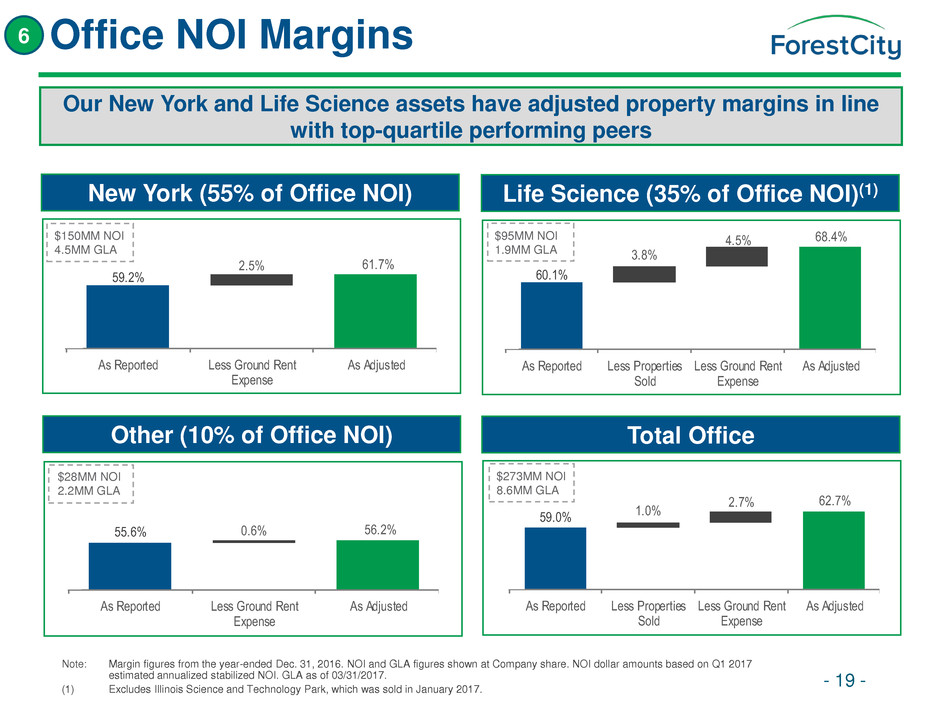

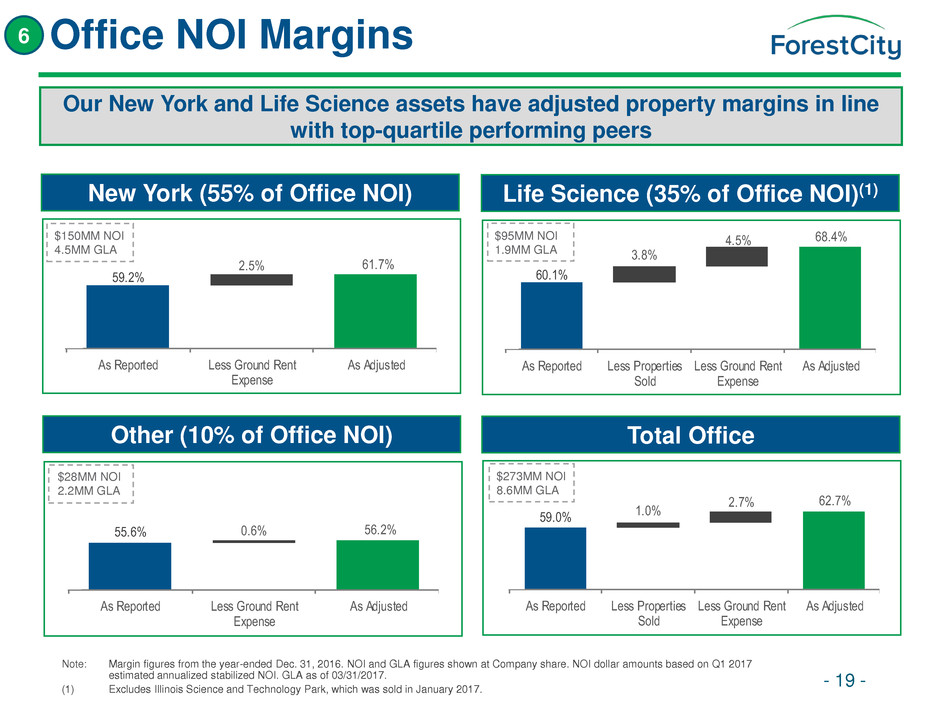

59.2% 2.5% 61.7% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% As Reported Less Ground Rent Expense As Adjusted Office NOI Margins 60.1% 3.8% 4.5% 68.4% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% As Reported Less Properties Sold Less Ground Rent Expense As Adjusted 59.0% 1.0% 2.7% 62.7% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% As Reported Less Properties Sold Less Ground Rent Expense As Adjusted 55.6% 0.6% 56.2% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% As Reported Less Ground Rent Expense As Adjusted - 19 - Total Office 6 Our New York and Life Science assets have adjusted property margins in line with top-quartile performing peers New York (55% of Office NOI) Life Science (35% of Office NOI)(1) Other (10% of Office NOI) Note: Margin figures from the year-ended Dec. 31, 2016. NOI and GLA figures shown at Company share. NOI dollar amounts based on Q1 2017 estimated annualized stabilized NOI. GLA as of 03/31/2017. (1) Excludes Illinois Science and Technology Park, which was sold in January 2017. $95MM NOI 1.9MM GLA $273MM NOI 8.6MM GLA $28MM NOI 2.2MM GLA $150MM NOI 4.5MM GLA

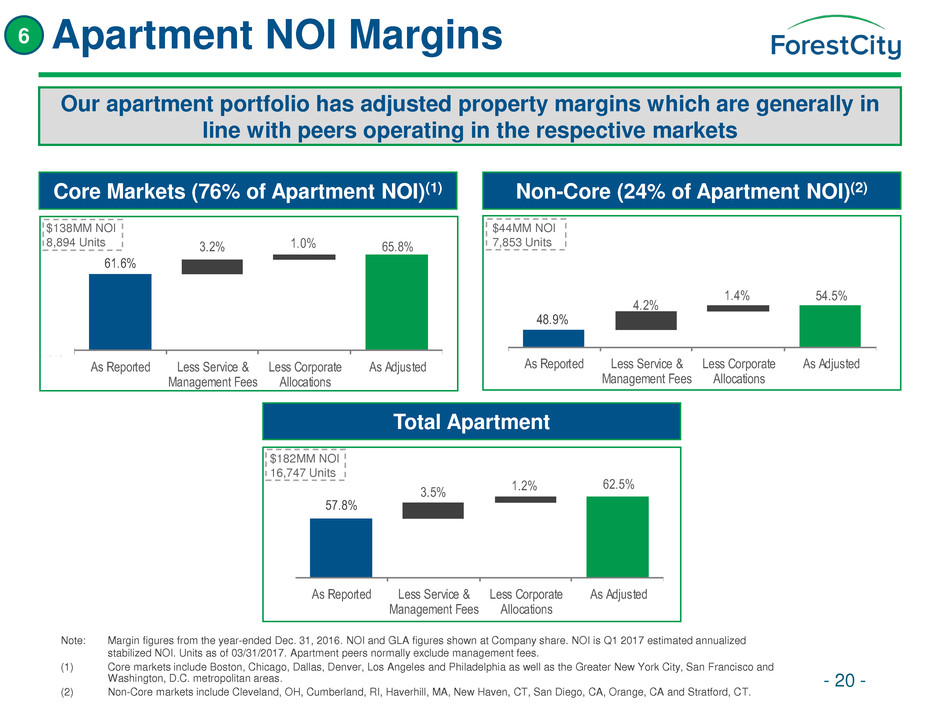

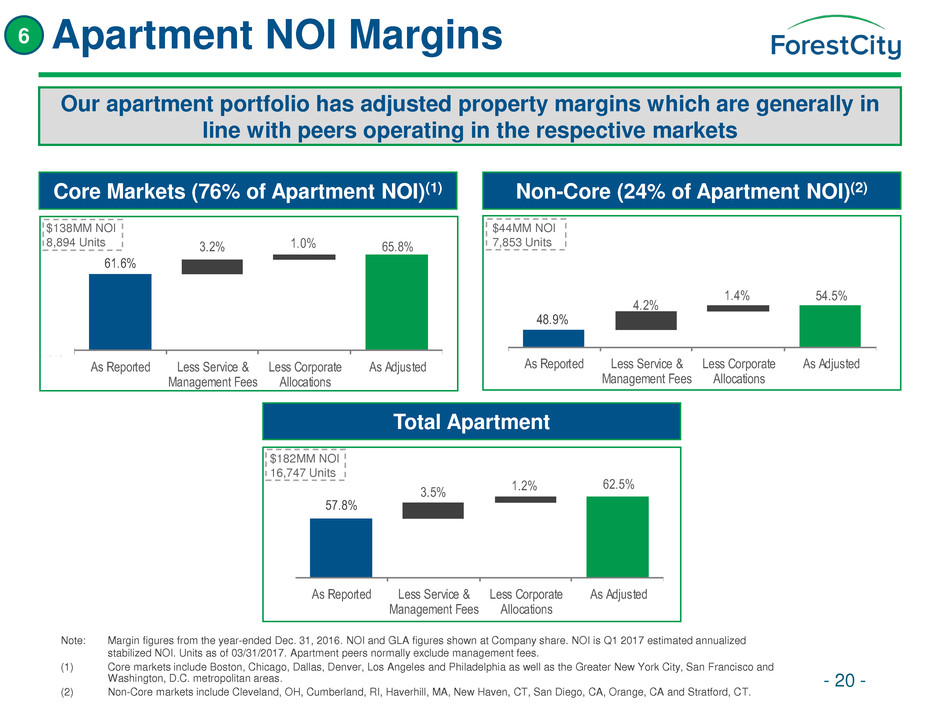

57.8% 3.5% 1.2% 62.5% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% As Reported Less Service & Management Fees Less Corporate Allocations As Adjusted 48.9% 4.2% 1.4% 54.5% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% As Reported Less Service & Management Fees Less Corporate Allocations As Adjusted 61.6% 3.2% 1.0% 65.8% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% As Reported Less Service & Management Fees Less Corporate Allocations As Adjusted Apartment NOI Margins - 20 - Total Apartment 6 Our apartment portfolio has adjusted property margins which are generally in line with peers operating in the respective markets Core Markets (76% of Apartment NOI)(1) Non-Core (24% of Apartment NOI)(2) Note: Margin figures from the year-ended Dec. 31, 2016. NOI and GLA figures shown at Company share. NOI is Q1 2017 estimated annualized stabilized NOI. Units as of 03/31/2017. Apartment peers normally exclude management fees. (1) Core markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia as well as the Greater New York City, San Francisco and Washington, D.C. metropolitan areas. (2) Non-Core markets include Cleveland, OH, Cumberland, RI, Haverhill, MA, New Haven, CT, San Diego, CA, Orange, CA and Stratford, CT. $182MM NOI 16,747 Units $44MM NOI 7,853 Units $138MM NOI 8,894 Units

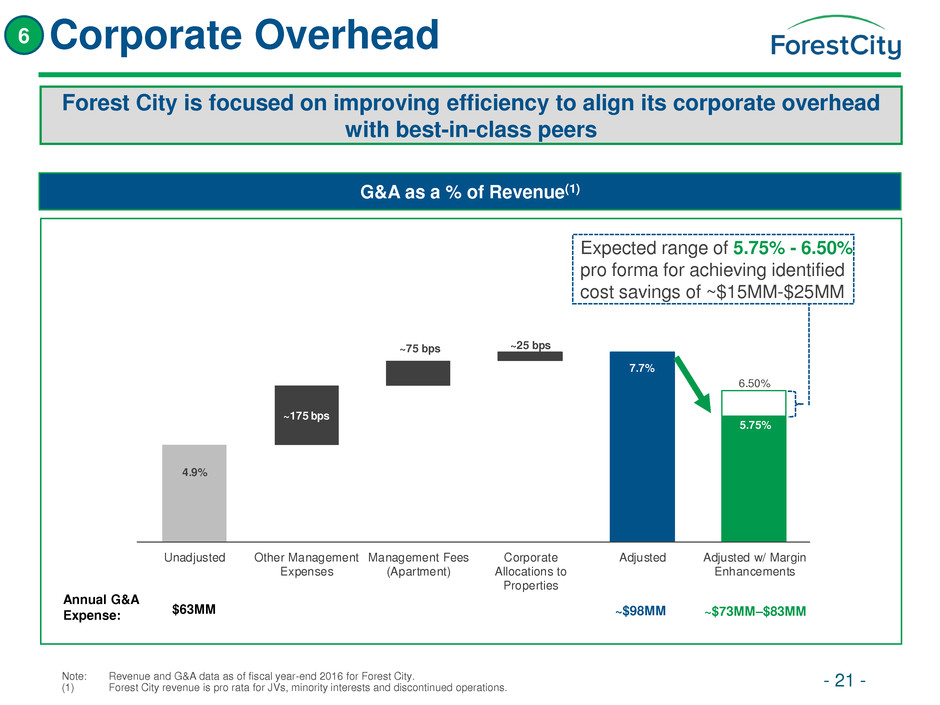

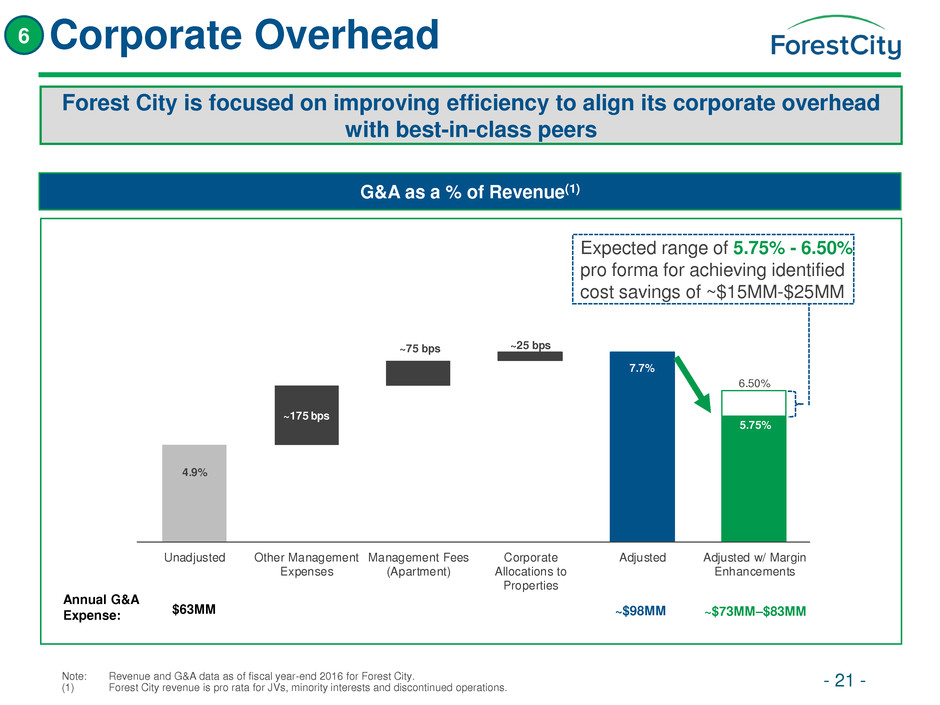

Corporate Overhead - 21 - 6 Forest City is focused on improving efficiency to align its corporate overhead with best-in-class peers G&A as a % of Revenue(1) Note: Revenue and G&A data as of fiscal year-end 2016 for Forest City. (1) Forest City revenue is pro rata for JVs, minority interests and discontinued operations. 4.9% ~175 bps ~75 bps ~25 bps 7.7% 5.75% 6.50% Unadjusted Other Management Expenses Management Fees (Apartment) Corporate Allocations to Properties Adjusted Adjusted w/ Margin Enhancements Annual G&A Expense: $63MM ~$98MM ~$73MM–$83MM Expected range of 5.75% - 6.50% pro forma for achieving identified cost savings of ~$15MM-$25MM

Appendix THE NEW YORK TIMES BUILDING | NEW YORK, NY

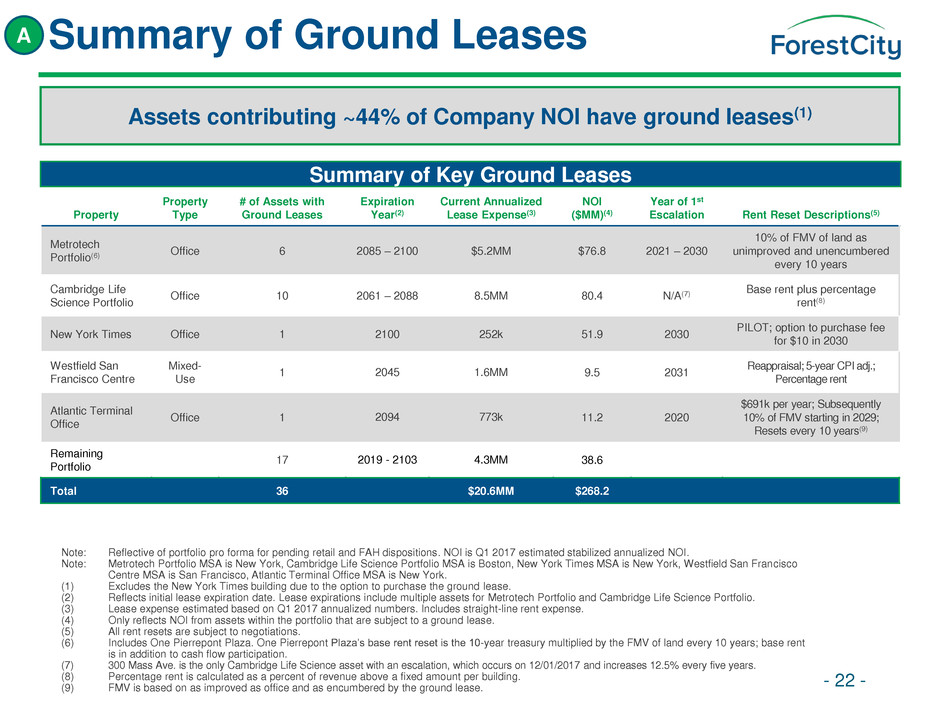

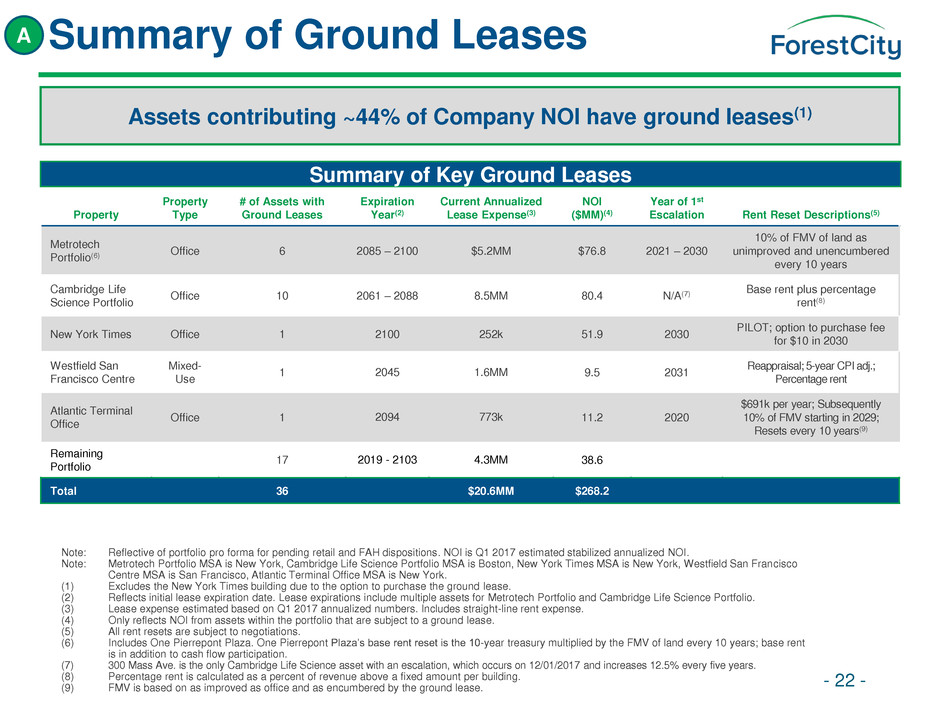

Property Property Type # of Assets with Ground Leases Expiration Year(2) Current Annualized Lease Expense(3) NOI ($MM)(4) Year of 1st Escalation Rent Reset Descriptions(5) Metrotech Portfolio(6) Office 6 2085 – 2100 $5.2MM $76.8 2021 – 2030 10% of FMV of land as unimproved and unencumbered every 10 years Cambridge Life Science Portfolio Office 10 2061 – 2088 8.5MM 80.4 N/A(7) Base rent plus percentage rent(8) New York Times Office 1 2100 252k 51.9 2030 PILOT; option to purchase fee for $10 in 2030 Westfield San Francisco Centre Mixed- Use 1 2045 1.6MM 9.5 2031 Reappraisal; 5-year CPI adj.; Percentage rent Atlantic Terminal Office Office 1 2094 773k 11.2 2020 $691k per year; Subsequently 10% of FMV starting in 2029; Resets every 10 years(9) Remaining Portfolio 17 2019 - 2103 4.3MM 38.6 Total 36 $20.6MM $268.2 Assets contributing ~44% of Company NOI have ground leases(1) Summary of Ground Leases - 22 - Note: Reflective of portfolio pro forma for pending retail and FAH dispositions. NOI is Q1 2017 estimated stabilized annualized NOI. Note: Metrotech Portfolio MSA is New York, Cambridge Life Science Portfolio MSA is Boston, New York Times MSA is New York, Westfield San Francisco Centre MSA is San Francisco, Atlantic Terminal Office MSA is New York. (1) Excludes the New York Times building due to the option to purchase the ground lease. (2) Reflects initial lease expiration date. Lease expirations include multiple assets for Metrotech Portfolio and Cambridge Life Science Portfolio. (3) Lease expense estimated based on Q1 2017 annualized numbers. Includes straight-line rent expense. (4) Only reflects NOI from assets within the portfolio that are subject to a ground lease. (5) All rent resets are subject to negotiations. (6) Includes One Pierrepont Plaza. One Pierrepont Plaza’s base rent reset is the 10-year treasury multiplied by the FMV of land every 10 years; base rent is in addition to cash flow participation. (7) 300 Mass Ave. is the only Cambridge Life Science asset with an escalation, which occurs on 12/01/2017 and increases 12.5% every five years. (8) Percentage rent is calculated as a percent of revenue above a fixed amount per building. (9) FMV is based on as improved as office and as encumbered by the ground lease. Summary of Key Ground Leases A

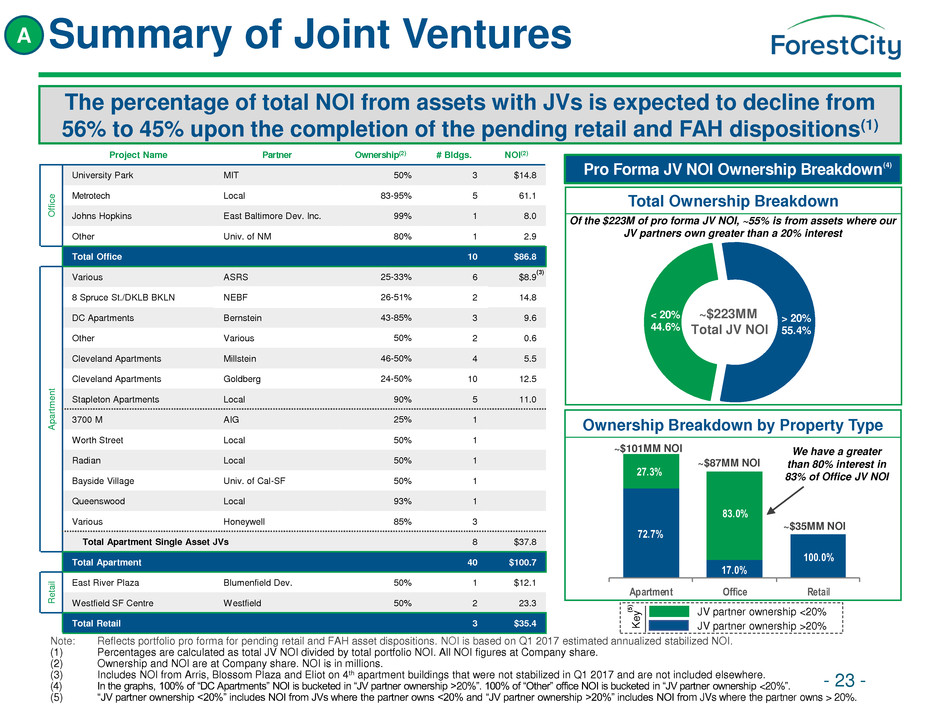

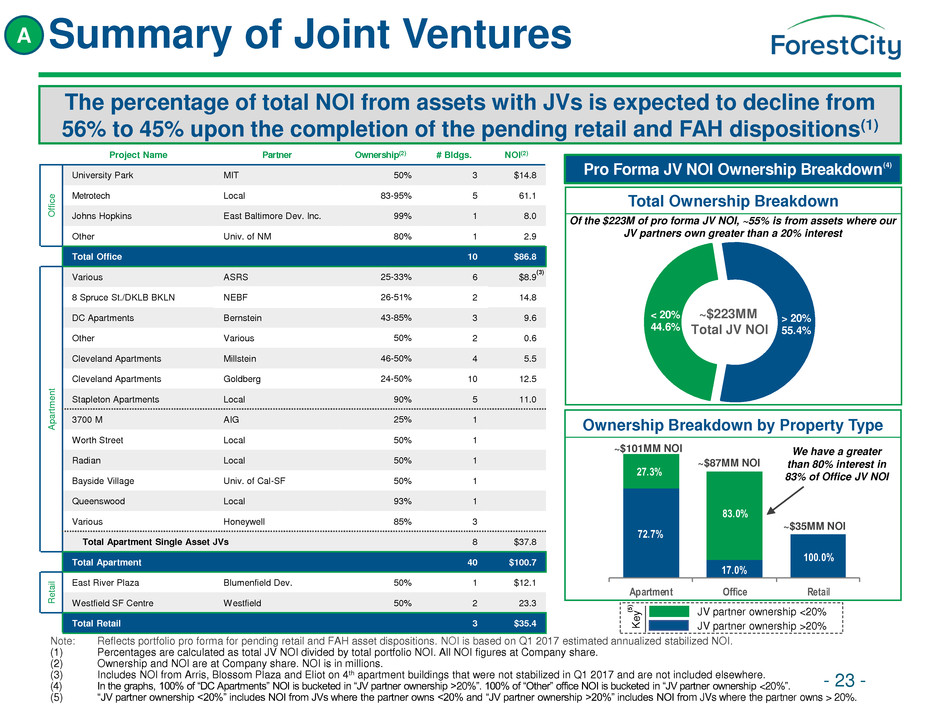

72.7% 17.0% 100.0% 27.3% 83.0% Apartment Office Retail > 20% 55.4% < 20% 44.6% Total Ownership Breakdown Ownership Breakdown by Property Type Summary of Joint Ventures - 23 - A Note: Reflects portfolio pro forma for pending retail and FAH asset dispositions. NOI is based on Q1 2017 estimated annualized stabilized NOI. (1) Percentages are calculated as total JV NOI divided by total portfolio NOI. All NOI figures at Company share. (2) Ownership and NOI are at Company share. NOI is in millions. (3) Includes NOI from Arris, Blossom Plaza and Eliot on 4th apartment buildings that were not stabilized in Q1 2017 and are not included elsewhere. (4) In the graphs, 100% of “DC Apartments” NOI is bucketed in “JV partner ownership >20%”. 100% of “Other” office NOI is bucketed in “JV partner ownership <20%”. (5) “JV partner ownership <20%” includes NOI from JVs where the partner owns <20% and “JV partner ownership >20%” includes NOI from JVs where the partner owns > 20%. Project Name Partner Ownership(2) # Bldgs. NOI(2) O ffic e University Park MIT 50% 3 $14.8 Metrotech Local 83-95% 5 61.1 Johns Hopkins East Baltimore Dev. Inc. 99% 1 8.0 Other Univ. of NM 80% 1 2.9 Total Office 10 $86.8 A p a rt m e n t Various ASRS 25-33% 6 $8.9 8 Spruce St./DKLB BKLN NEBF 26-51% 2 14.8 DC Apartments Bernstein 43-85% 3 9.6 Other Various 50% 2 0.6 Cleveland Apartments Millstein 46-50% 4 5.5 Cleveland Apartments Goldberg 24-50% 10 12.5 Stapleton Apartments Local 90% 5 11.0 3700 M AIG 25% 1 Worth Street Local 50% 1 Radian Local 50% 1 Bayside Village Univ. of Cal-SF 50% 1 Queenswood Local 93% 1 Various Honeywell 85% 3 Total Apartment Single Asset JVs 8 $37.8 Total Apartment 40 $100.7 Re ta il East River Plaza Blumenfield Dev. 50% 1 $12.1 Westfield SF Centre Westfield 50% 2 23.3 Total Retail 3 $35.4 The percentage of total NOI from assets with JVs is expected to decline from 56% to 45% upon the completion of the pending retail and FAH dispositions(1) ~$223MM Total JV NOI Pro Forma JV NOI Ownership Breakdown ~$101MM NOI ~$87MM NOI ~$35MM NOI JV partner ownership >20% JV partner ownership <20% K e y Of the $223M of pro forma JV NOI, ~55% is from assets where our JV partners own greater than a 20% interest We have a greater than 80% interest in 83% of Office JV NOI (4) (3) (5 )

Development Detail - 24 - Project Name Property Type Ownership(3) Units / SF(4) Cost Incurred(MM)(4) Expected Cost(MM)(4) Anticipated Stabilization 2017 Phased Openings 535 Carlton Apartment 30% 89 $47.5 $53.3 Q2 2018 550 Vanderbilt Condominiums 30% 83 81.9 96.8 n/a Pacific Park Parking Parking 30% n/a 1.1 4.1 Q3 2017 Projects Under Construction Axis (Broadway and Hill) Apartment 25% 98 36.2 36.3 Q1 2019 Ardan (West Village II) Apartment 25% 97 14.7 31.3 Q3 2019 38 Sixth Ave Apartment 30% 91 47.8 62.0 Q3 2018 Mint Town Center (Town Center Wrap) Apartment 95% 379 52.4 88.4 Q1 2019 VYV (Hudson Exchange) Apartment 50% 211 81.9 107.1 Q1 2019 Ballston Quarter Residential Apartment 51% 207 17.8 90.9 Q3 2020 The Yards – The Guild Apartment 0% 0 0.0 0.0 Q3 2019 Capper 769 Apartment 25% 45 3.3 18.1 Q1 2020 The Bridge at Cornell Tech Office 100% 235,000 121.1 164.1 Q1 2019 The Yards – The District Winery Retail 100% 16,150 8.2 10.6 Q4 2017 Ballston Quarter Redevelopment Retail 51% 156,570 20.8 42.4 Q3 2018 Total Projects Under Construction $404.2 $651.2 Total (Includes 2017 Openings) $534.7 $805.4 (1) Represent phased openings. (2) Pacific Park Parking costs include garages that are open/under construction as well as garages not yet under construction. (3) The Company invests in certain real estate projects through joint ventures and, at times, may provide funding at percentages that differ from the Company’s legal ownership. (4) Figures shown at Company share. (5) Opening date. A (5) (1) (1) (1)(2) (1) (1) (1) (1) (1) (1)

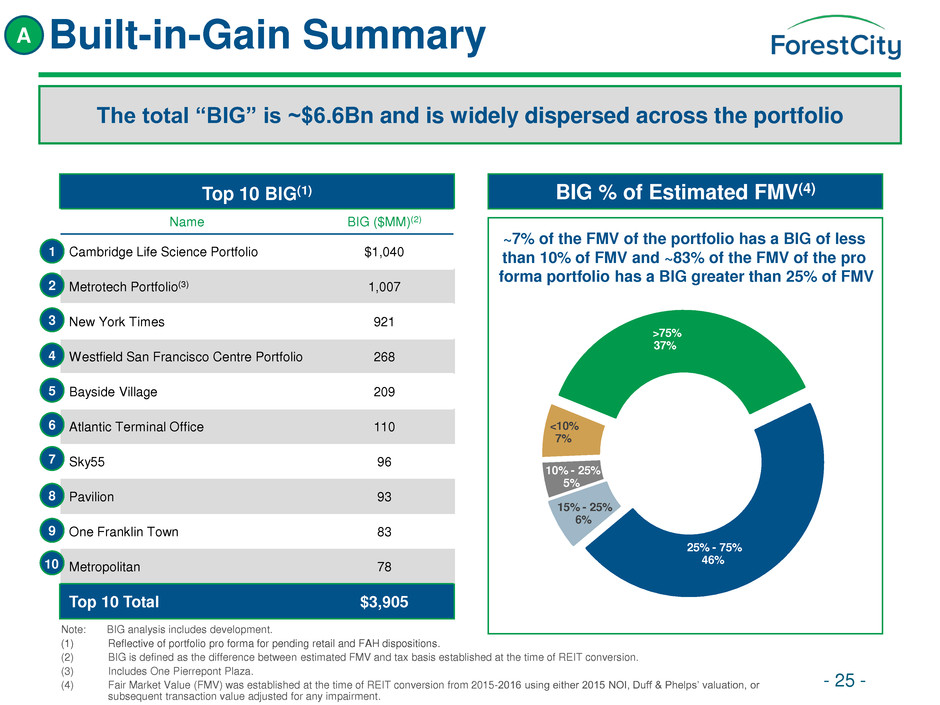

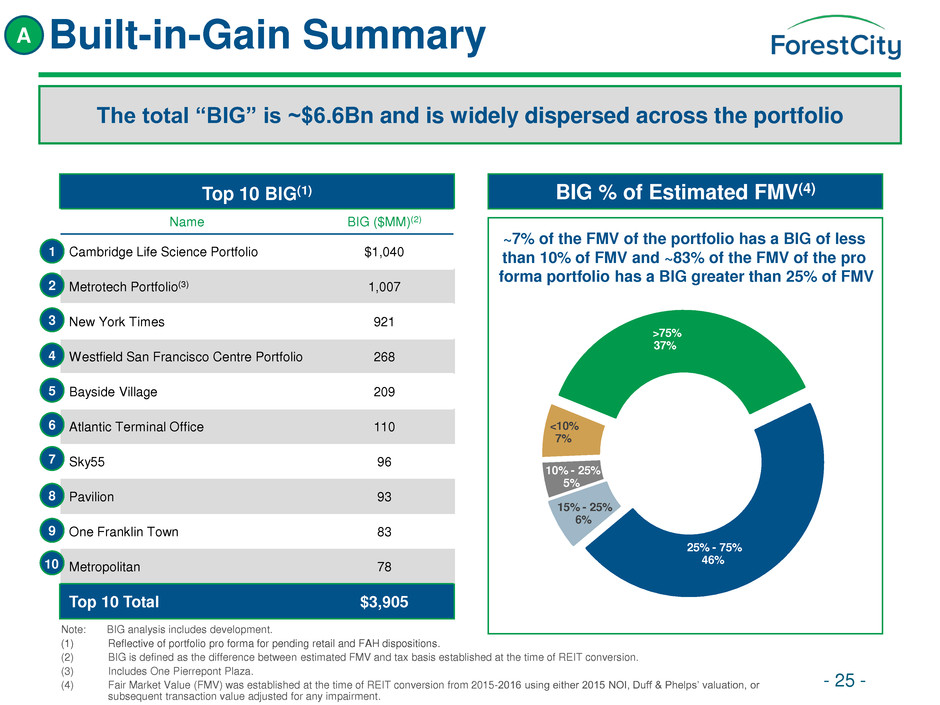

Built-in-Gain Summary - 25 - Top 10 BIG(1) Name BIG ($MM)(2) Cambridge Life Science Portfolio $1,040 Metrotech Portfolio(3) 1,007 New York Times 921 Westfield San Francisco Centre Portfolio 268 Bayside Village 209 Atlantic Terminal Office 110 Sky55 96 Pavilion 93 One Franklin Town 83 Metropolitan 78 Top 10 Total $3,905 Note: BIG analysis includes development. (1) Reflective of portfolio pro forma for pending retail and FAH dispositions. (2) BIG is defined as the difference between estimated FMV and tax basis established at the time of REIT conversion. (3) Includes One Pierrepont Plaza. (4) Fair Market Value (FMV) was established at the time of REIT conversion from 2015-2016 using either 2015 NOI, Duff & Phelps’ valuation, or subsequent transaction value adjusted for any impairment. 1 2 3 4 5 8 6 7 9 10 The total “BIG” is ~$6.6Bn and is widely dispersed across the portfolio BIG % of Estimated FMV(4) ~7% of the FMV of the portfolio has a BIG of less than 10% of FMV and ~83% of the FMV of the pro forma portfolio has a BIG greater than 25% of FMV A >75% 37% 25% - 75% 46% 15% - 25% 6% 10% - 25% 5% <10% 7%

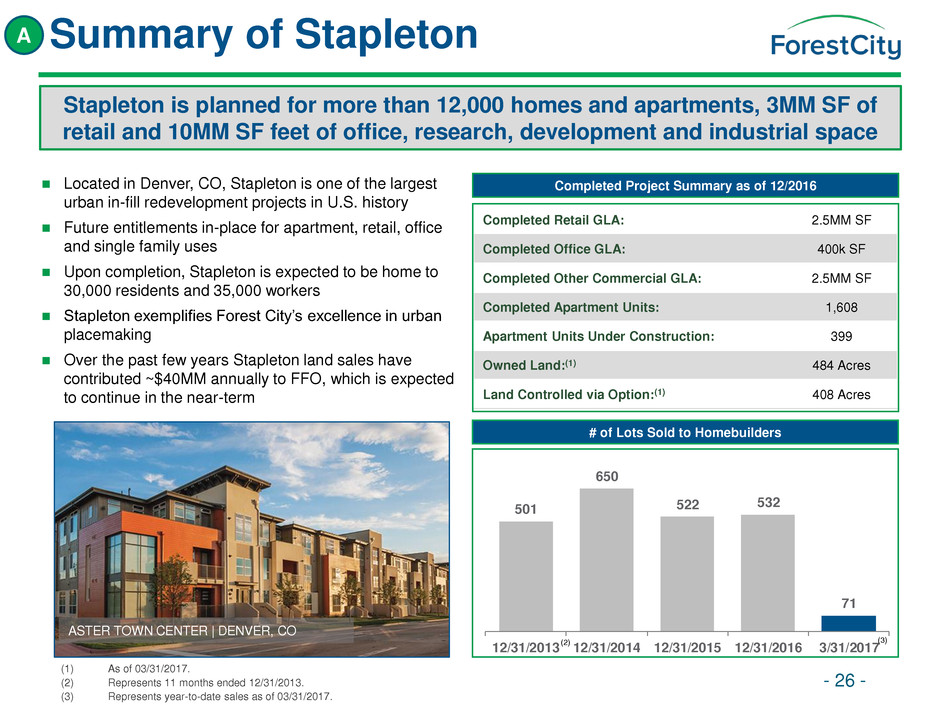

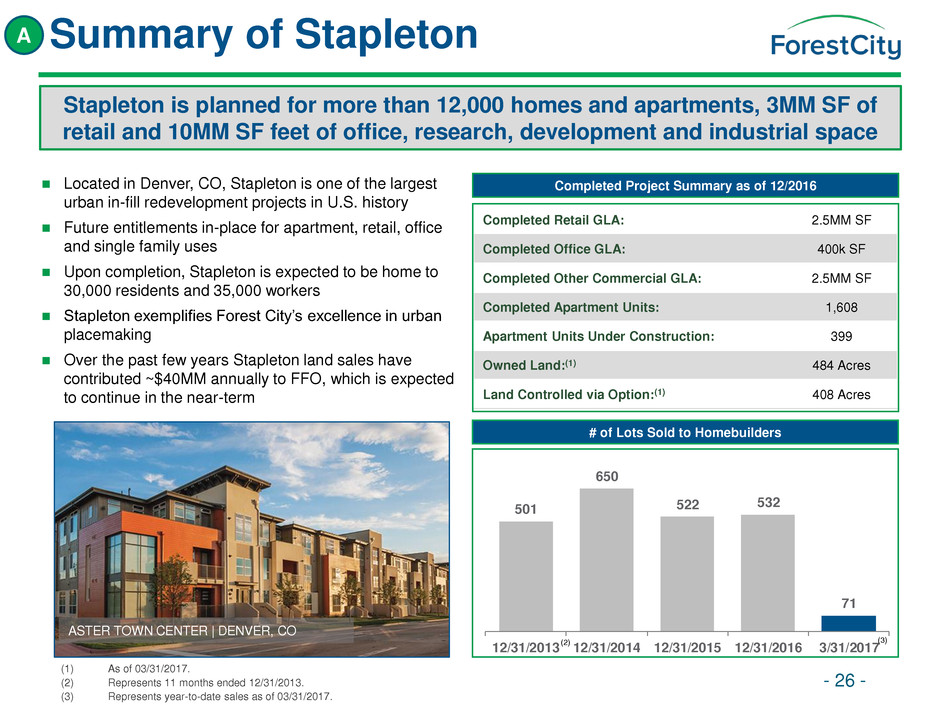

Summary of Stapleton - 26 - Stapleton is planned for more than 12,000 homes and apartments, 3MM SF of retail and 10MM SF feet of office, research, development and industrial space # of Lots Sold to Homebuilders Completed Project Summary as of 12/2016 Completed Retail GLA: 2.5MM SF Completed Office GLA: 400k SF Completed Other Commercial GLA: 2.5MM SF Completed Apartment Units: 1,608 Apartment Units Under Construction: 399 Owned Land:(1) 484 Acres Land Controlled via Option:(1) 408 Acres Located in Denver, CO, Stapleton is one of the largest urban in-fill redevelopment projects in U.S. history Future entitlements in-place for apartment, retail, office and single family uses Upon completion, Stapleton is expected to be home to 30,000 residents and 35,000 workers Stapleton exemplifies Forest City’s excellence in urban placemaking Over the past few years Stapleton land sales have contributed ~$40MM annually to FFO, which is expected to continue in the near-term ASTER TOWN CENTER | DENVER, CO A (1) As of 03/31/2017. (2) Represents 11 months ended 12/31/2013. (3) Represents year-to-date sales as of 03/31/2017. 501 650 522 532 71 12/31/2013 12/31/2014 12/31/2015 12/31/2016 3/31/2017 (2) (3)

The Yards Development Case Study - 27 - At full build-out, The Yards is expected to include up to 3,000 residential units, 1.8MM SF of office space and approximately 400k SF of retail and dining space ARRIS | WASHINGTON, D.C. A FOUNDRY LOFTS | WASHINGTON, D.C. Phase 1 Value Created(2) = $205MM - $230MM Cash on Cost Return = 6.6% - 7.1% Cash on Cost spread to Cap Rate = 210-260 bps Completed Projects(1) Projects Underway Total Phase I Total Investment $198MM ~$212MM - $232MM ~$410MM - $430MM Total NOI $15MM ~$13MM - $15MM ~$28MM - $30MM Source: CoStar as of Q1 2017. (1) Completed Projects include: Foundry Lofts, Boilermaker Shops, Lumbershed, Arris, Twelve12; Projects Underway include The Guild and District Winery. (2) Value of NOI less cost. Assumes 4.5% blended cap rate for residential and office. The Yards Project Summary The Yards Geographic Overview H:\! GRAPHICS\! MAPINFO\Porter Carbajal\2017-06-29\Yards Development.wor Downtown Capitol Riverfront The White House Washington Monument The Capitol Nationals Park E N W S Washington D.C. 695 295 395 295 395 1 mile The Yards Arlington, VA

Summary of Retail Transaction - 28 - A QIC Madison Forest City Westfield San Francisco Centre Ballston Quarter (redevelopment) East River Plaza Brooklyn Commons Station Square The Yards: - Boilermaker Shops - Lumber Shed - Twelve12 Likely Dispositions: - Boulevard Mall - Atlantic Center Site V 42nd Street Atlantic Center Atlantic Terminal Castle Center Forest Avenue Harlem Center Queens Place Shops at Gun Hill Road Shops at Northern Boulevard Shops at Richmond Avenue The Heights Columbia Park Center Antelope Valley Mall Charleston Town Center Mall at Robinson Shops at Northfield Stapleton Shops at Wiregrass South Bay Galleria Westchester’s Ridge Hill Galleria at Sunset Short Pump Town Center Promenade Temecula Victoria Gardens Cap Rate 5.0% Valuation $2.2 Bn Debt 1.0 Bn NAV $1.2 Bn $110.0MM 2016 NOI

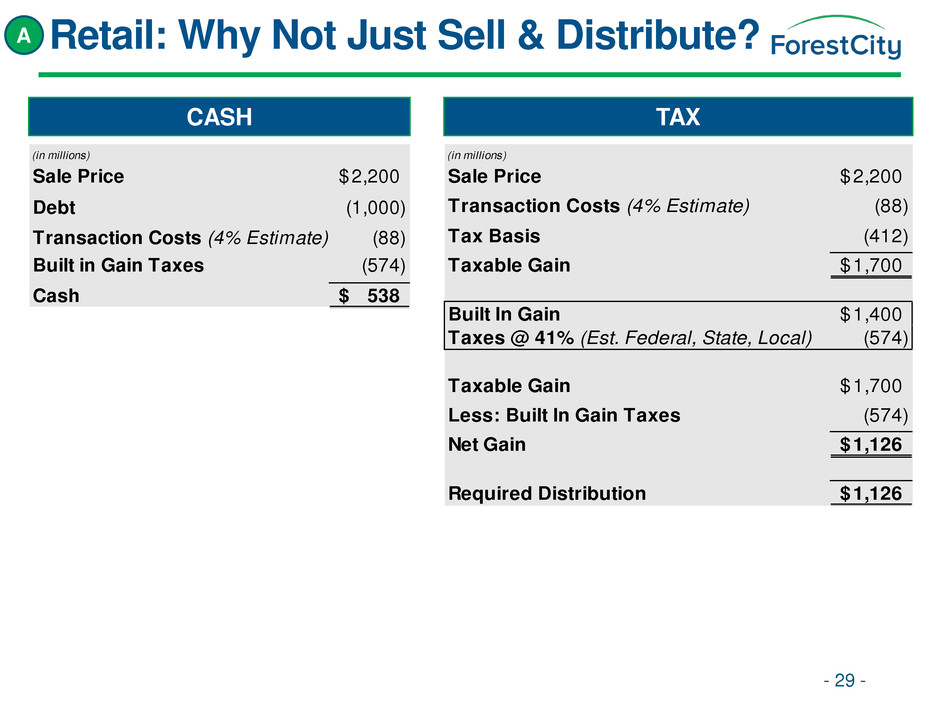

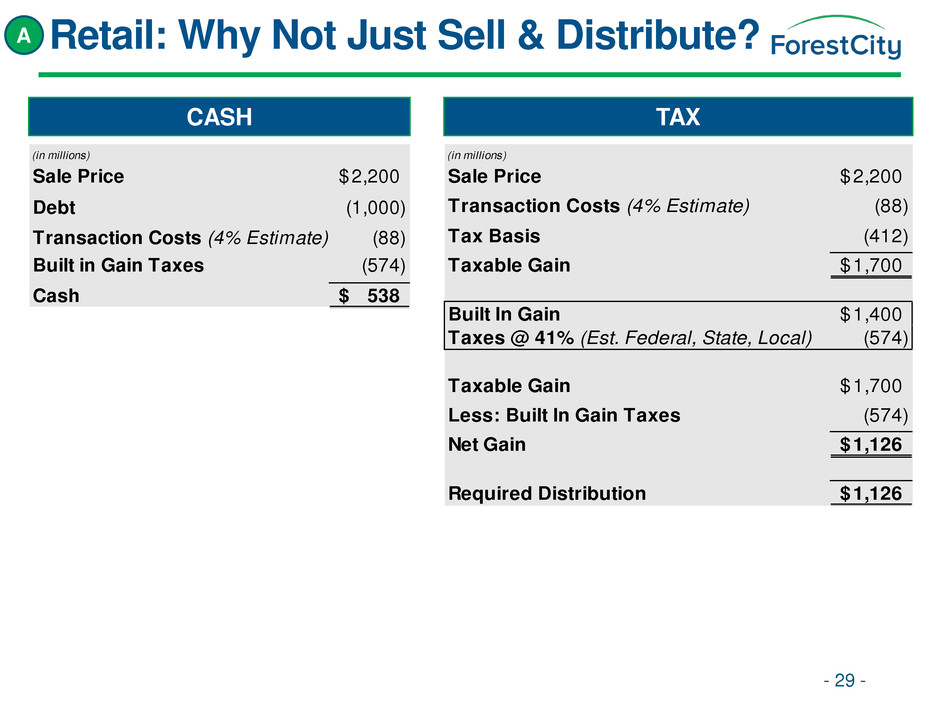

Retail: Why Not Just Sell & Distribute? - 29 - CASH TAX (in millions) Sale Price 2,200$ Transaction Costs (4% Estimate) (88) Tax Basis (412) Taxable Gain 1,700$ Built In Gain 1,400$ Taxes @ 41% (Est. Federal, State, Local) (574) Taxable Gain 1,700$ Less: Built In Gain Taxes (574) Net Gain 1,126$ Required Distribution 1,126$ (in millions) Sale Price 2,200$ Debt (1,000) Transaction Costs (4% Estimate) (88) Built in Gain Taxes (574) Cash 538$ A

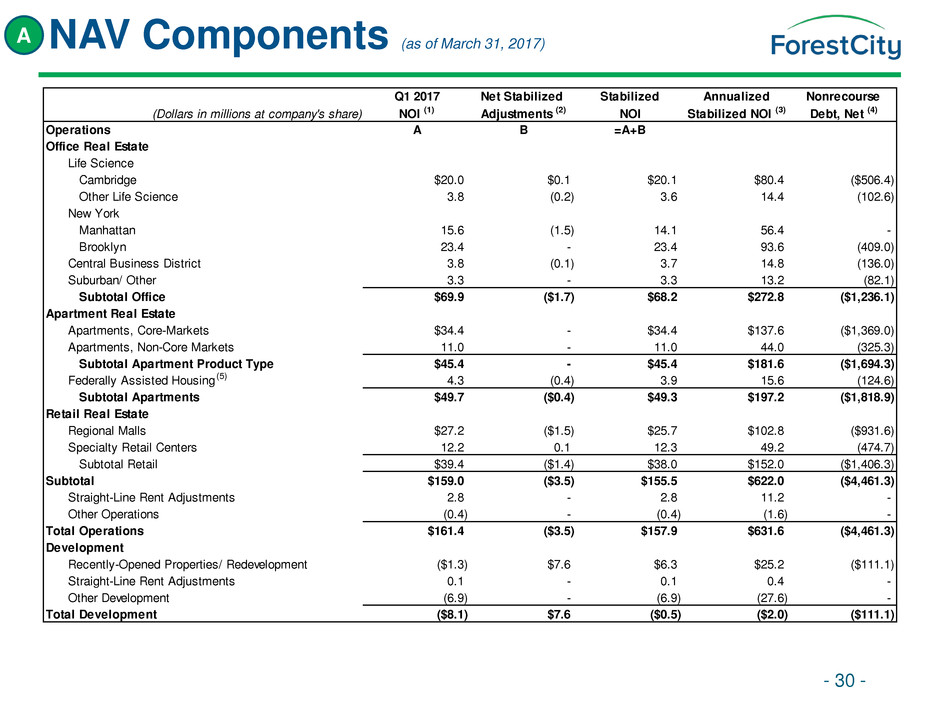

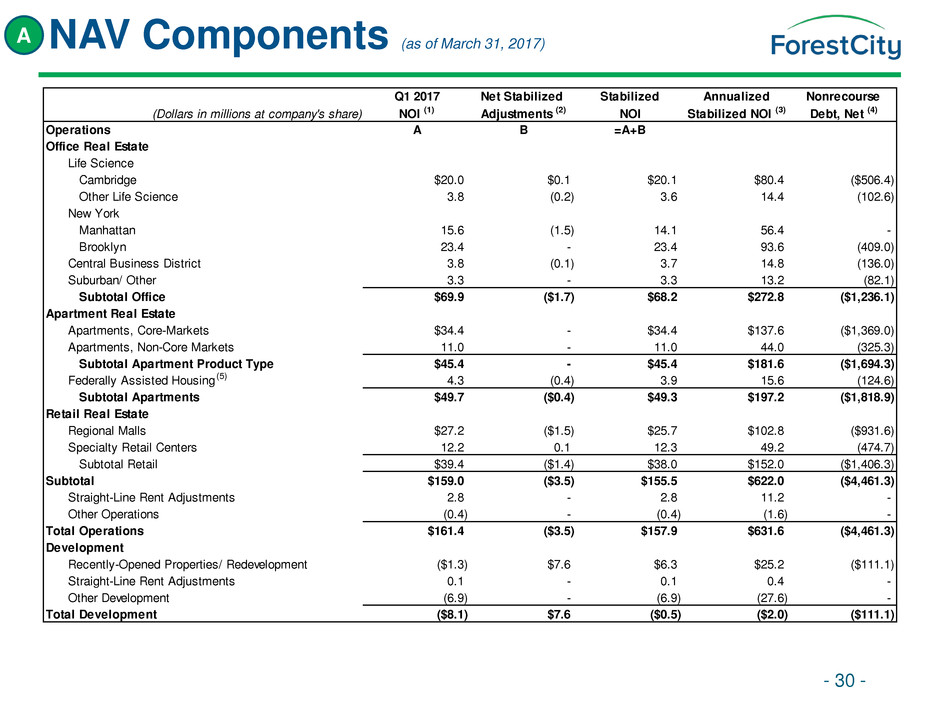

Q1 2017 Net Stabilized Stabilized Annualized Nonrecourse (Dollars in millions at company's share) NOI (1) Adjustments (2) NOI Stabilized NOI (3) Debt, Net (4) Operations A B =A+B Office Real Estate Life Science Cambridge $20.0 $0.1 $20.1 $80.4 ($506.4) Other Life Science 3.8 (0.2) 3.6 14.4 (102.6) New York Manhattan 15.6 (1.5) 14.1 56.4 - Brooklyn 23.4 - 23.4 93.6 (409.0) Central Business District 3.8 (0.1) 3.7 14.8 (136.0) Suburban/ Other 3.3 - 3.3 13.2 (82.1) Subtotal Office $69.9 ($1.7) $68.2 $272.8 ($1,236.1) Apartment Real Estate Apartments, Core-Markets $34.4 - $34.4 $137.6 ($1,369.0) Apartments, Non-Core Markets 11.0 - 11.0 44.0 (325.3) Subtotal Apartment Product Type $45.4 - $45.4 $181.6 ($1,694.3) Federally Assisted Housing 4.3 (0.4) 3.9 15.6 (124.6) Subtotal Apartments $49.7 ($0.4) $49.3 $197.2 ($1,818.9) Retail Real Estate Regional Malls $27.2 ($1.5) $25.7 $102.8 ($931.6) Specialty Retail Centers 12.2 0.1 12.3 49.2 (474.7) Subtotal Retail $39.4 ($1.4) $38.0 $152.0 ($1,406.3) Subtotal $159.0 ($3.5) $155.5 $622.0 ($4,461.3) Straight-Line Rent Adjustments 2.8 - 2.8 11.2 - Other Operations (0.4) - (0.4) (1.6) - Total Operations $161.4 ($3.5) $157.9 $631.6 ($4,461.3) Development Recently-Opened Properties/ Redevelopment ($1.3) $7.6 $6.3 $25.2 ($111.1) Straight-Line Rent Adjustments 0.1 - 0.1 0.4 - Other Development (6.9) - (6.9) (27.6) - Total Development ($8.1) $7.6 ($0.5) ($2.0) ($111.1) NAV Components (as of March 31, 2017) - 30 - A (5)

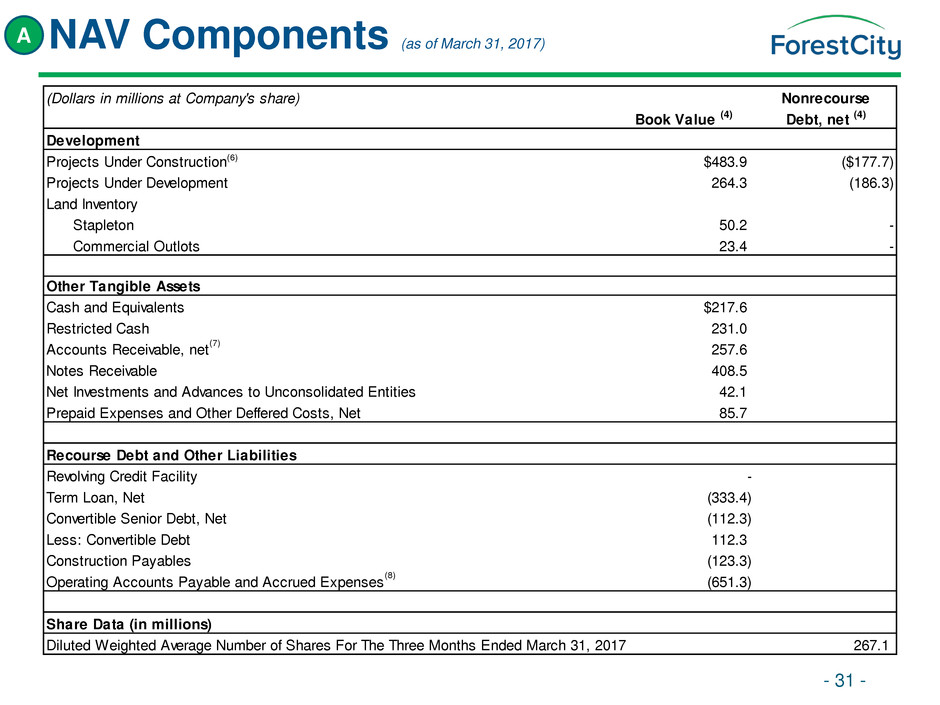

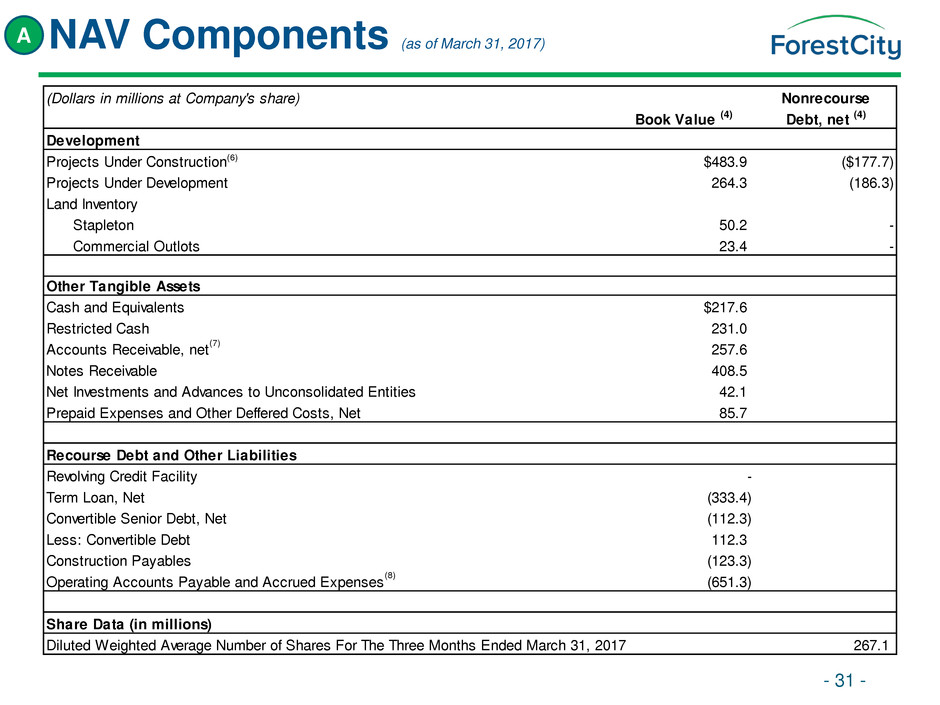

NAV Components (as of March 31, 2017) - 31 - A (Dollars in millions at Company's share) Nonrecourse Book Value (4) Debt, net (4) Development Projects Under Construction $483.9 ($177.7) Projects Under Development 264.3 (186.3) Land Inventory Stapleton 50.2 - Commercial Outlots 23.4 - Other Tangible Assets Cash and Equivalents $217.6 Restricted Cash 231.0 Accounts Receivable, net 257.6 Notes Receivable 408.5 Net Investments and Advances to Unconsolidated Entities 42.1 Prepaid Expenses and Other Deffered Costs, Net 85.7 Recourse Debt and Other Liabilities Revolving Credit Facility - Term Loan, Net (333.4) Convertible Senior Debt, Net (112.3) Less: Convertible Debt 112.3 Construction Payables (123.3) Operating Accounts Payable and Accrued Expenses (651.3) Share Data (in millions) Diluted Weighted Average Number of Shares For The Three Months Ended March 31, 2017 267.1 (6) (7) (8)

1) Q1 2017 Earnings Before Income Taxes reconciled to NOI for the three months ended March 31, 2017 in the Supplemental Operating Information section of this supplemental package, furnished to the SEC on form 8-K on May 4, 2017. 2) The net stabilized adjustments column represents adjustments assumed to arrive at an estimated annualized stabilized NOI. We include stabilization adjustments to the Q1 2017 NOI as follows: a) We have removed Q1 2017 lease termination income from our Cambridge Life Science office portfolio. b) Due to the temporary decline in occupancy at 45/75 Sidney Street (Life Science), we have included a stabilization adjustment to the Q1 2017 NOI to arrive at our estimate of stabilized NOI. This temporary decline was due to one of our tenants relocating to 300 Massachusetts Ave (Life Science). This vacant space is currently leased and is completely occupied as of March 31, 2017. c) We have removed Q1 2017 lease termination income from our Manhattan Office portfolio. d) Due to quarterly fluctuations of NOI as a result of distribution restrictions from our limited-distribution federally assisted housing properties, we have included a stabilization adjustment to the Q1 2017 NOI to arrive at our estimate of stabilized NOI. Our estimate of stabilized NOI is based on the 2016 annual NOI of $15.6 million, which excludes NOI related to 6 properties in this portfolio that were sold in Q1 2017. e) Partial period NOI for recently sold properties has been removed in the Operations Segments. f) Due to the planned transfer of Boulevard Mall (Regional Malls) to the lender in a deed-in-lieu transaction during 2017, we have removed NOI and nonrecourse debt, net, related to this property. g) For recently-opened properties currently in initial lease-up periods included in the Development Segment, NOI is reflected at 5% of the company ownership cost. This assumption does not reflect our anticipated NOI, but rather is used in order to establish a hypothetical basis for an estimated valuation of leased-up properties. The following properties are currently in their initial lease-up periods: NOI attributable to Kapolei Lofts, an apartment community on land in which we lease, is not included in NOI from lease-up properties. We consolidate the land lessor, who is entitled to a preferred return that currently exceeds anticipated operating cash flow of the project, and therefore, this project is reflected at 0% for company-share purposes. In accordance with the waterfall provisions of the distribution agreement, we expect to share in the net proceeds upon a sale of the project, which is not currently reflected on the NAV component schedule. - 32 - NAV Components-Footnotes (as of March 31, 2017) Prop rty Cost at 100% Cost at Company Share Lease Commitment % as of April 27, 2017 Office: 1812 Ashland Ave (Life Science) 61.2$ 61.2$ 75% Ap rtm n s: 535 Carlto (Cor Market) 168.1$ 53.3$ 21% Eliot o 4th (Core Market) 143.7$ 38.6$ 9% NorthxNorthw st (Core Market) 115.0$ 28.9$ 13% 461 Dean Street (Core Market) 195.6$ 195.6$ 39% The Bixby (Core Market) 59.2$ 11.8$ 77% Blossom Plaza (Core Market) 100.6$ 25.9$ 91% The Yards - Arris (Core Market) 143.2$ 37.3$ 93% 986.6$ 452.6$ (in millions) A

NAV Components-Footnotes (as of March 31, 2017) - 33 - h) Due to the planned redevelopment of Ballston Quarter (Development Segment; Recently-Opened Properties/Redevelopment), we have included a stabilization adjustment to the Q1 2017 NOI to arrive at $2.6 million, our estimate of annualized stabilized NOI following the completion of our planned redevelopment. The net stabilized adjustments are not comparable to any GAAP measure and therefore do not have a reconciliation to the nearest comparable GAAP measure. 3) Company ownership annualized stabilized NOI is calculated by taking the Q1 2017 stabilized NOI times a multiple of four. 4) Amounts represent the company’s share of each respective balance sheet line item as of March 31, 2017 and may be calculated using the financial information contained in the Appendix of this supplemental package. Due to the planned transfer of Boulevard Mall to the lender, we have removed nonrecourse debt, net, of $91.5 million related to this property. 5) Represents the remaining 41 federally assisted housing apartment communities. We recently signed a master purchase and sale agreement to dispose of this portfolio and expect to receive net proceeds of approximately $65 million. As of March 31, 2017, 6 properties have closed, representing $18.1 million in net proceeds. 6) We have removed $37.4 million of assets from projects under construction, which represents the costs on the balance sheet associated with the ongoing redevelopment of Ballston Quarter ($20.8 million) and the phased opening of 535 Carlton ($16.6 million). NOI for each of these is stabilized under Recently-Opened Properties/Redevelopment. 7) Includes $149.4 million of straight-line rent receivable (net of $9.1 million of allowance for doubtful accounts). 8) Includes $61.7 million of straight-line rent payable. A

Definitions of non-GAAP measures EBITDA EBITDA, a non-GAAP measure, is defined as net earnings excluding the following items at our company share: i) non-cash charges for depreciation and amortization; ii) interest expense; iii) amortization of mortgage procurement costs; and iv) income taxes. EBITDA may not be directly comparable to similarly-titled measures reported by other companies. We use EBITDA as the starting point in order to calculate Adjusted EBITDA as described below. Adjusted EBITDA We define Adjusted EBITDA, a non-GAAP measure, as EBITDA adjusted to exclude: i) impairment of real estate; ii) gains or losses from extinguishment of debt; iii) gain (loss) on full or partial disposition of rental properties and other investments; iv) gains or losses on change in control of interests; v) other transactional items, including organizational transformation and termination benefits; and vi) the Nets pre-tax EBITDA. We believe EBITDA, Adjusted EBITDA and net debt to Adjusted EBITDA provide additional information in evaluating our credit and ability to service our debt obligations. Adjusted EBITDA is used by the chief operating decision maker and management to assess operating performance and resource allocations by segment and on a consolidated basis. Management believes Adjusted EBITDA gives the investment community a more complete understanding of the Company’s operating results, including the impact of general and administrative expenses and acquisition-related expenses, before the impact of investing and financing transactions and facilitates comparisons with competitors. However, Adjusted EBITDA should not be viewed as an alternative measure of the Company’s operating performance since it excludes financing costs as well as depreciation and amortization costs which are significant economic costs that could materially impact the Company’s results of operations and liquidity. Other REITs may use different methodologies for calculating Adjusted EBITDA and, accordingly, the Company’s Adjusted EBITDA may not be comparable to other REITs. Net Debt to Adjusted EBITDA Net Debt to Adjusted EBITDA, a non-GAAP measure, is defined as total debt, net at our company share (total debt includes outstanding borrowings on our revolving credit facility, our term loan facility, convertible senior debt, net, nonrecourse mortgages and notes payable, net) less cash and equivalents, at our company share, divided by Adjusted EBITDA. Net Debt to Adjusted EBITDA is a supplemental measure derived from non-GAAP financial measures that the Company uses to evaluate its capital structure and the magnitude of its debt against its operating performance. The Company believes that investors use versions of this ratio in a similar manner. The Company’s method of calculating the ratio may be different from methods used by other REITs and, accordingly, may not be comparable to other REITs. Net Asset Value Components We disclose components of our business relevant to calculate NAV, a non-GAAP measure. There is no directly comparable GAAP financial measure to NAV. We consider NAV to be a useful supplemental measure which assists both management and investors to estimate the fair value of our Company. The calculation of NAV involves significant estimates and can be calculated using various methods. Each individual investor must determine the specific methodology, assumptions and estimates to use to arrive at an estimated NAV of the Company. NAV components are shown at our total company ownership. We believe disclosing the components at total company ownership is essential to estimate NAV, as they represent our estimated proportionate amount of assets and liabilities the Company is entitled to. The components of NAV do not consider the potential changes in rental and fee income streams or development platform. The components include non-GAAP financial measures, such as NOI, and information related to our rental properties business at the Company’s share. Although these measures are not presented in accordance with GAAP, investors can use these non-GAAP measures as supplementary information to evaluate our business. - 34 - A

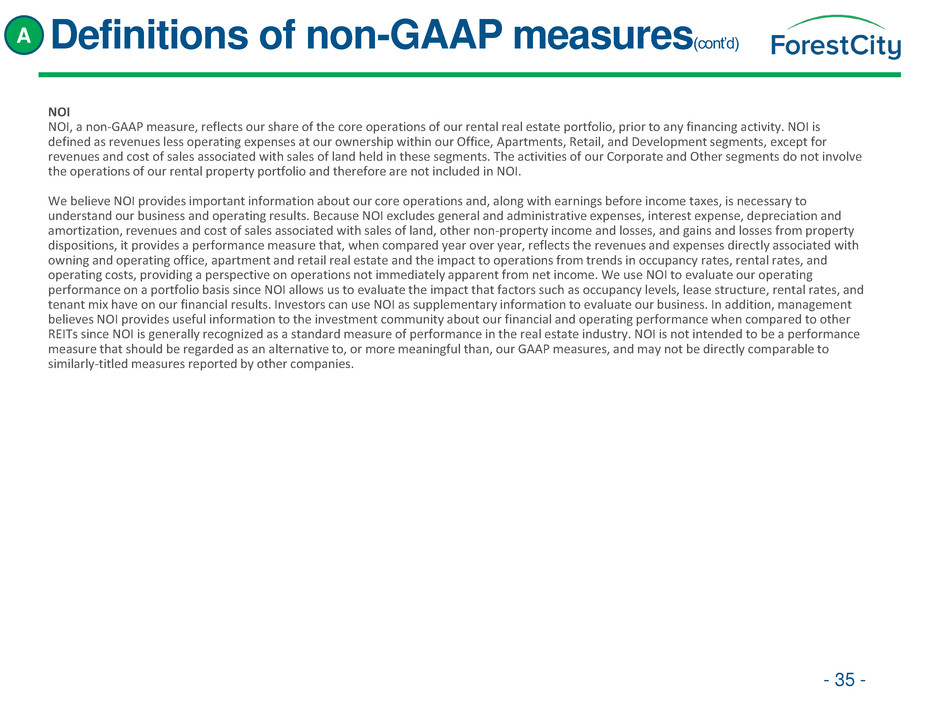

Definitions of non-GAAP measures(cont’d) NOI NOI, a non-GAAP measure, reflects our share of the core operations of our rental real estate portfolio, prior to any financing activity. NOI is defined as revenues less operating expenses at our ownership within our Office, Apartments, Retail, and Development segments, except for revenues and cost of sales associated with sales of land held in these segments. The activities of our Corporate and Other segments do not involve the operations of our rental property portfolio and therefore are not included in NOI. We believe NOI provides important information about our core operations and, along with earnings before income taxes, is necessary to understand our business and operating results. Because NOI excludes general and administrative expenses, interest expense, depreciation and amortization, revenues and cost of sales associated with sales of land, other non-property income and losses, and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating office, apartment and retail real estate and the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing a perspective on operations not immediately apparent from net income. We use NOI to evaluate our operating performance on a portfolio basis since NOI allows us to evaluate the impact that factors such as occupancy levels, lease structure, rental rates, and tenant mix have on our financial results. Investors can use NOI as supplementary information to evaluate our business. In addition, management believes NOI provides useful information to the investment community about our financial and operating performance when compared to other REITs since NOI is generally recognized as a standard measure of performance in the real estate industry. NOI is not intended to be a performance measure that should be regarded as an alternative to, or more meaningful than, our GAAP measures, and may not be directly comparable to similarly-titled measures reported by other companies. - 35 - A

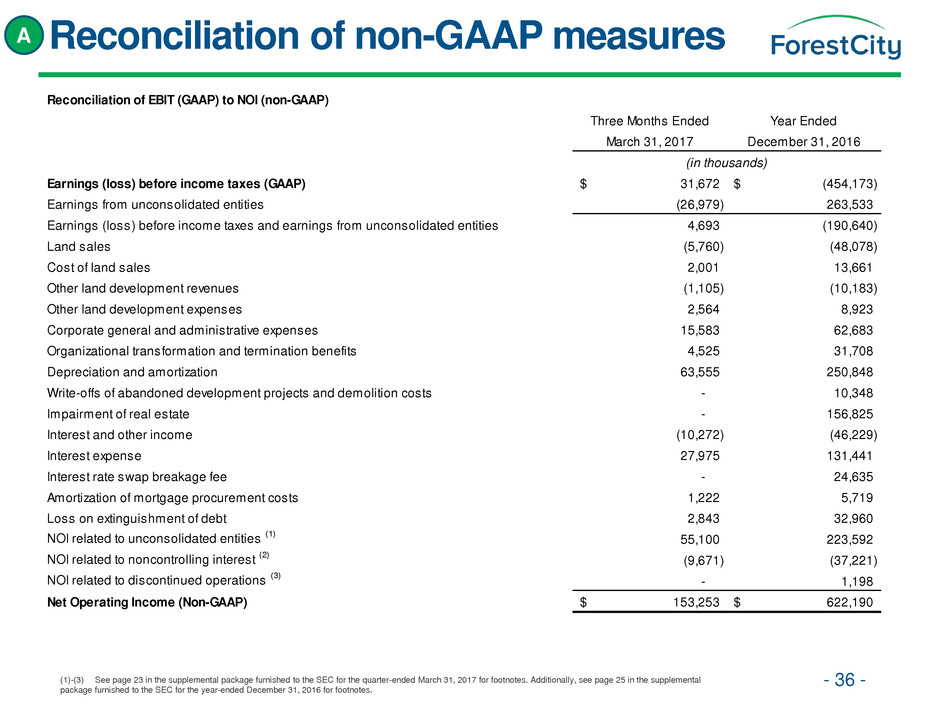

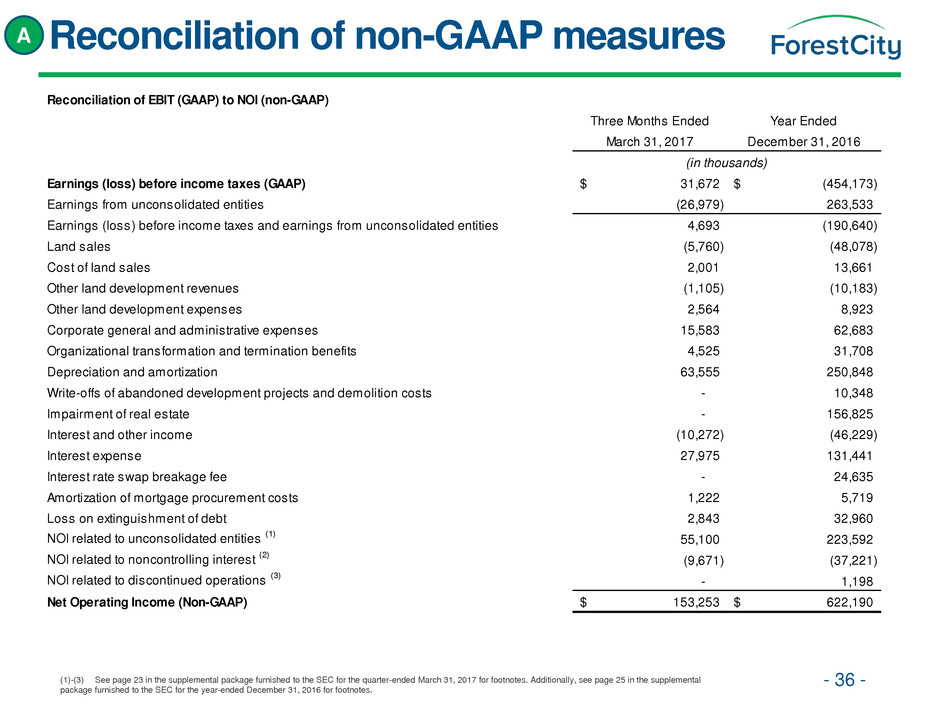

Reconciliation of non-GAAP measures (1)-(3) See page 23 in the supplemental package furnished to the SEC for the quarter-ended March 31, 2017 for footnotes. Additionally, see page 25 in the supplemental package furnished to the SEC for the year-ended December 31, 2016 for footnotes. Reconciliation of EBIT (GAAP) to NOI (non-GAAP) Three Months Ended Year Ended March 31, 2017 December 31, 2016 Earnings (loss) before income taxes (GAAP) 31,672$ (454,173)$ Earnings from unconsolidated entities (26,979) 263,533 Earnings (loss) before income taxes and earnings from unconsolidated entities 4,693 (190,640) Land sales (5,760) (48,078) Cost of land sales 2,001 13,661 Other land development revenues (1,105) (10,183) Other land development expenses 2,564 8,923 Corporate general and administrative expenses 15,583 62,683 Organizational transformation and termination benefits 4,525 31,708 Depreciation and amortization 63,555 250,848 Write-offs of abandoned development projects and demolition costs - 10,348 Impairment of real estate - 156,825 Interest and other income (10,272) (46,229) Interest expense 27,975 131,441 Interest rate swap breakage fee - 24,635 Amortization of mortgage procurement costs 1,222 5,719 Loss on extinguishment of debt 2,843 32,960 NOI related to unconsolidated entities (1) 55,100 223,592 NOI related to noncontrolling interest (2) (9,671) (37,221) NOI related to discontinued operations (3) - 1,198 Net Operating Income (Non-GAAP) 153,253$ 622,190$ (in thousands) - 36 - A

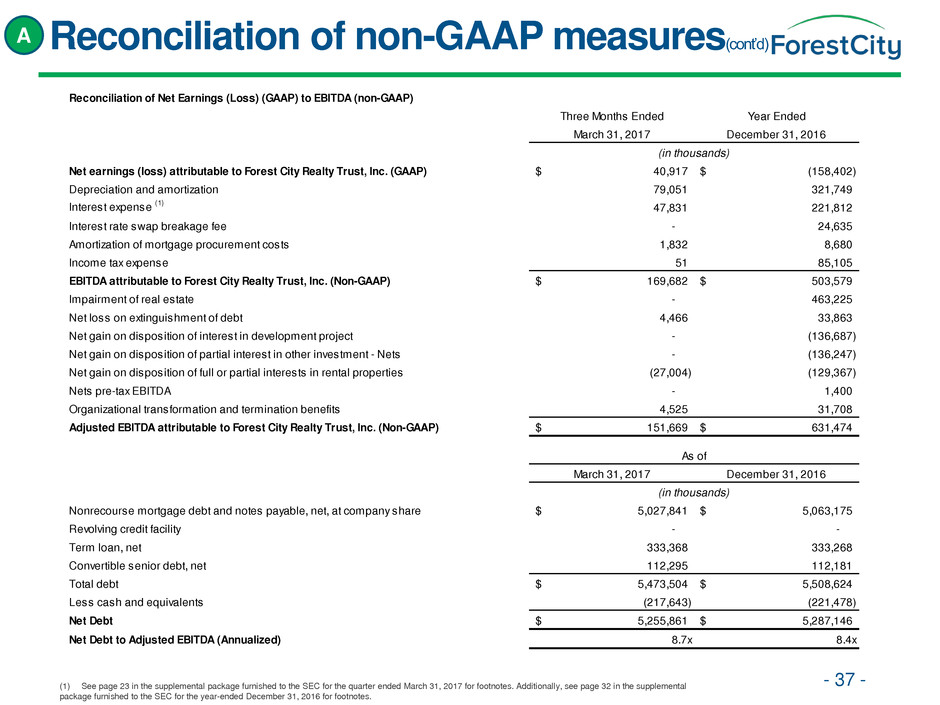

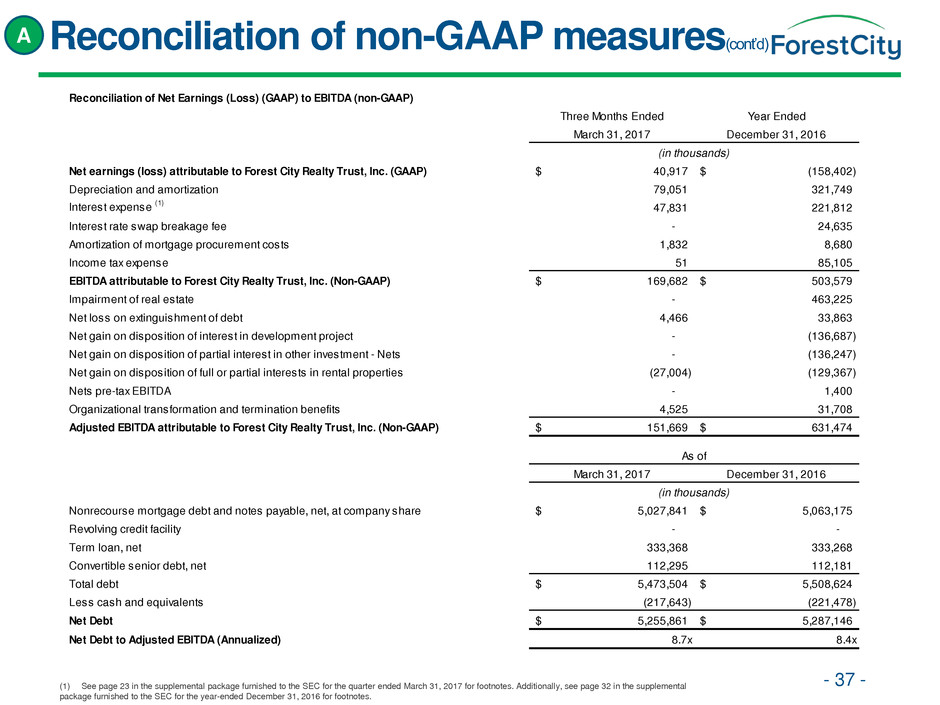

Reconciliation of non-GAAP measures(cont’d) (1) See page 23 in the supplemental package furnished to the SEC for the quarter ended March 31, 2017 for footnotes. Additionally, see page 32 in the supplemental package furnished to the SEC for the year-ended December 31, 2016 for footnotes. - 37 - Reconciliation of Net Earnings (Loss) (GAAP) to EBITDA (non-GAAP) Three Months Ended Year Ended March 31, 2017 December 31, 2016 Net earnings (loss) attributable to Forest City Realty Trust, Inc. (GAAP) 40,917$ (158,402)$ Depreciation and amortization 79,051 321,749 Interest expense (1) 47,831 221,812 Interest rate swap breakage fee - 24,635 Amortization of mortgage procurement costs 1,832 8,680 Income tax expense 51 85,105 EBITDA attributable to Forest City Realty Trust, Inc. (Non-GAAP) 169,682$ 503,579$ Impairment of real estate - 463,225 Net loss on extinguishment of debt 4,466 33,863 Net gain on disposition of interest in development project - (136,687) Net gain on disposition of partial interest in other investment - Nets - (136,247) Net gain on disposition of full or partial interests in rental properties (27,004) (129,367) Nets pre-tax EBITDA - 1,400 Organizational transformation and termination benefits 4,525 31,708 Adjusted EBITDA attributable to Forest City Realty Trust, Inc. (Non-GAAP) 151,669$ 631,474$ March 31, 2017 December 31, 2016 Nonrecourse mortgage debt and notes payable, net, at company share 5,027,841$ 5,063,175$ Revolving credit facility - - Term loan, net 333,368 333,268 Convertible senior debt, net 112,295 112,181 Total debt 5,473,504$ 5,508,624$ Less cash and equivalents (217,643) (221,478) Net Debt 5,255,861$ 5,287,146$ Net Debt to Adjusted EBITDA (Annualized) 8.7x 8.4x As of (in thousands) (in thousands) A