Exhibit 99.1

Supplemental Package

For the Quarter Ended March 31, 2018

Forest City Realty Trust, Inc. and Subsidiaries - Supplemental Package

First Quarter 2018

Index

|

| |

| Corporate Description | |

| Selected Financial Information | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Operations | |

| Net Asset Value Components | |

| Supplemental Operating Information | |

| Occupancy Data | |

| Leasing Summary | |

| Comparable Net Operating Income (NOI) | |

| NOI Detail | |

| Summary of Corporate General and Administrative and Other NOI | |

| Core Market NOI | |

| Reconciliation of Earnings Before Income Taxes to NOI | |

| Reconciliation of Net Earnings to FFO | |

| Reconciliation of FFO to Operating FFO | |

| Reconciliation of NOI to Operating FFO | |

| Reconciliation of Net Earnings attributable to Forest City Realty Trust, Inc. to Adjusted EBITDA attributable to Forest City Realty Trust, Inc. | |

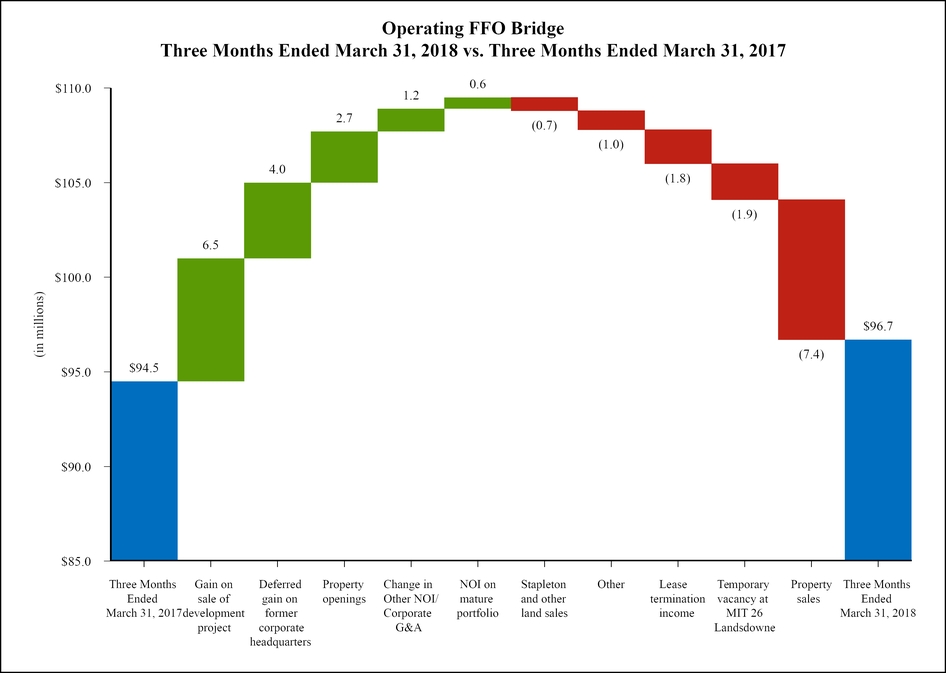

| Operating FFO Bridge | |

| Historical Trends | |

| Development Pipeline | |

| Supplemental Financial Information | |

| Financial Covenants | |

| Nonrecourse Debt Maturities Table | |

| Appendix | |

This supplemental package, together with other statements and information publicly disseminated by us, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements reflect management’s current views with respect to financial results related to future events and are based on assumptions and expectations that may not be realized and are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, financial or otherwise, may differ, perhaps materially, from the results discussed in the forward-looking statements. Risk factors discussed in Item 1A of our Form 10-K for the year ended December 31, 2017 and other factors that might cause differences, some of which could be material, include, but are not limited to, the uncertain impact, effects and results of our Board of Directors’ completed review of operating, strategic, financial and structural alternatives, our ability to carry out future transactions and strategic investments, as well as the acquisition related costs, unanticipated difficulties realizing benefits expected when entering into a transaction, our ability to qualify or to remain qualified as a REIT, our ability to satisfy REIT distribution requirements, the impact of issuing equity, debt or both, and selling assets to satisfy our future distributions required as a REIT or to fund capital expenditures, future growth and expansion initiatives, the impact of the amount and timing of any future distributions, the impact from complying with REIT qualification requirements limiting our flexibility or causing us to forego otherwise attractive opportunities beyond rental real estate operations, the impact of complying with the REIT requirements related to hedging, our lack of experience operating as a REIT, legislative, administrative, regulatory or other actions affecting REITs, including positions taken by the Internal Revenue Service, the possibility that our Board of Directors will unilaterally revoke our REIT election, the possibility that the anticipated benefits of qualifying as a REIT will not be realized, or will not be realized within the expected time period, the impact of current lending and capital market conditions on our liquidity, our ability to finance or refinance projects or repay our debt, the impact of the slow economic recovery on the ownership, development and management of our commercial real estate portfolio, general real estate investment and development risks, litigation risks, vacancies in our properties, risks associated with developing and managing properties in partnership with others, competition, our ability to renew leases or re-lease spaces as leases expire, illiquidity of real estate investments, our ability to identify and transact on chosen strategic alternatives for a portion of our retail portfolio, bankruptcy or defaults of tenants, anchor store consolidations or closings, the impact of terrorist acts and other armed conflicts, our substantial debt leverage and the ability to obtain and service debt, the impact of restrictions imposed by our revolving credit facility, term loan and senior debt, exposure to hedging agreements, the level and volatility of interest rates, the continued availability of tax-exempt government financing, our ability to receive payment on the note receivable issued by Onexim in connection with their purchase of our interests in the Barclays Center, the impact of credit rating downgrades, effects of uninsured or underinsured losses, effects of a downgrade or failure of our insurance carriers, environmental liabilities, competing interests of our directors and executive officers, the ability to recruit and retain key personnel, risks associated with the sale of tax credits, downturns in the housing market, the ability to maintain effective internal controls, compliance with governmental regulations, increased legislative and regulatory scrutiny of the financial services industry, changes in federal, state or local tax laws and international trade agreements, volatility in the market price of our publicly traded securities, inflation risks, cybersecurity risks, cyber incidents, shareholder activism efforts, conflicts of interest, risks related to our organizational structure including operating through our Operating Partnership and our UPREIT structure, as well as other risks listed from time to time in our SEC filings, including but not limited to, our annual and quarterly reports. We have no obligation to revise or update any forward-looking statements, other than as imposed by law, as a result of future events or new information. Readers are cautioned not to place undue reliance on such forward-looking statements.

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Corporate Description

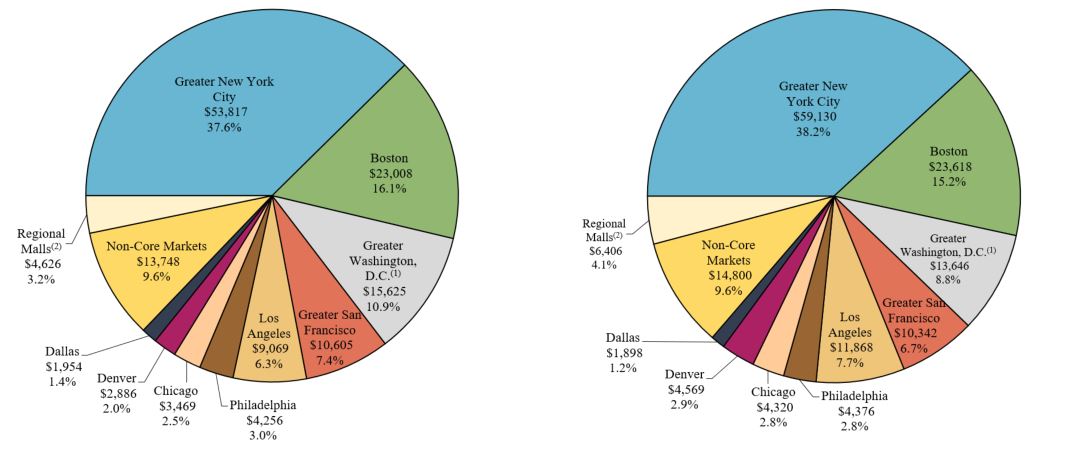

We principally engage in the operation, development, management and acquisition of office, apartment and retail real estate and land throughout the United States. We have approximately $8.0 billion of consolidated assets in 19 states and the District of Columbia at March 31, 2018. Our core markets include Boston, Chicago, Dallas, Denver, Los Angeles, Philadelphia and the greater metropolitan areas of New York City, San Francisco and Washington D.C. We have regional offices in Boston, Dallas, Denver, Los Angeles, New York City, San Francisco, Washington, D.C. and our corporate headquarters in Cleveland, Ohio.

Segments

Real Estate Operations represents the performance of our core rental real estate portfolio and is comprised of the following reportable operating segments:

| |

| • | Office - owns, acquires and operates office and life science buildings. |

| |

| • | Apartments - owns, acquires and operates upscale and middle-market apartments and adaptive re-use developments. |

| |

| • | Retail - owns, acquires and operates amenity retail within our mixed-use properties, and remaining regional malls and specialty/urban retail centers. |

The remaining reportable operating segments consist of the following:

| |

| • | Development - develops and constructs office and life science buildings, apartments, condominiums, amenity retail and mixed-use projects. The Development segment includes recently opened operating properties prior to stabilization and the horizontal development and sale of land to residential, commercial and industrial customers primarily at our Stapleton project in Denver, Colorado. |

| |

| • | Corporate - provides executive oversight to the company and various support services for Operations, Development and Corporate employees. |

Segment Transfers

The Development segment includes projects in development and projects under construction along with recently opened operating properties prior to stabilization. Projects will be reported in their applicable operating segment (Office, Apartments or Retail) beginning on January 1 of the year following stabilization. Therefore, the Development segment will continue to report results from recently opened properties until the year-end following initial stabilization. We generally define stabilized properties as achieving 92% or greater occupancy or having been open and operating for one or two years, depending on the size of the project. Once a stabilized property is transferred to the applicable Operations segment on January 1, it will be considered “comparable” beginning on the following January 1, as that will be the first time the property is stabilized in both periods presented.

Company Operations

We are organized as a Real Estate Investment Trust (“REIT”) for federal income tax purposes. We hold substantially all of our assets, and conduct substantially all of our business, through Forest City Enterprises, L.P. (“the Operating Partnership). We are the sole general partner of the Operating Partnership and directly or indirectly own all of the limited partnership interests in the Operating Partnership.

We hold and operate certain of our assets through one or more taxable REIT subsidiaries (“TRSs”). A TRS is a subsidiary of a REIT subject to applicable corporate income tax. Our use of TRSs enables us to continue to engage in certain businesses while complying with REIT qualification requirements and allows us to retain income generated by these businesses for reinvestment without the requirement of distributing those earnings. The primary businesses held in TRSs during 2018 include 461 Dean Street (sold in March 2018), an apartment building in Brooklyn, New York, Antelope Valley Mall (sold in January 2018), Mall at Robinson (sold February 2018) and Charleston Town Center, regional malls in Palmdale, California, Pittsburgh, Pennsylvania and Charleston, West Virginia, respectively, Pacific Park Brooklyn project and land development operations. In the future, we may elect to reorganize and transfer certain assets or operations from our TRSs to other subsidiaries, including qualified REIT subsidiaries.

Supplemental Financial and Operating Information

We recommend reading this supplemental package in conjunction with our Form 10-Q for the three months ended March 31, 2018. This supplemental package contains consolidated financial statements prepared in accordance with generally accepted accounting principles (“GAAP”). We also present certain financial information at total company ownership because we believe this information is useful to financial statement users as this method reflects the manner in which we operate our business. We believe financial information and other operating metrics at total company ownership including net asset value (“NAV”) components, net operating income (“NOI”), comparable NOI, comparable NOI margins, Funds From Operations (“FFO”), Operating FFO, Earnings Before Interest, Taxes, Depreciation and Amortization for real estate (“EBITDAre”), Adjusted EBITDA and Net Debt to Adjusted EBITDA are necessary to understand our business and operating results, along with net earnings and other GAAP measures. Our financial statement users can use these non-GAAP measures as supplementary information to evaluate our business. Our non-GAAP measures or information shown at total company ownership are not intended to be performance measures that should be regarded as alternatives to, or more meaningful than, our GAAP measures.

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

The operating information contained in this document includes: occupancy data, leasing summaries, comparable NOI, comparable NOI margins, core market NOI, reconciliation of earnings before income taxes to NOI, reconciliation of net earnings to FFO, reconciliation of FFO to Operating FFO, reconciliation of NOI to Operating FFO, reconciliation of net earnings attributable to Forest City Realty Trust, Inc. to Adjusted EBITDA attributable to Forest City Realty Trust, Inc., Operating FFO bridges, historical trends and our development pipeline. We believe this information gives interested parties a better understanding and more information about our operating performance. The term “comparable,” which is used throughout this document, is generally defined as including stabilized properties open and operated in the three months ended March 31, 2018 and 2017.

This supplemental package also contains financial information of entities consolidated under GAAP (“Fully Consolidated Entities”), financial information on our partners’ share of entities consolidated under GAAP (“Noncontrolling Interest”) and financial information on our share of entities accounted for using the equity method of accounting (“Company Share of Unconsolidated Entities”). We believe disclosing financial information on Fully Consolidated Entities, Noncontrolling Interest and Company Share of Unconsolidated Entities is essential to allow our financial statement users the ability to arrive at our total company ownership of all of our real estate investments, whether or not we “control” the investment under GAAP.

Financial information related to Fully Consolidated Entities, Noncontrolling Interest and Company Share of Unconsolidated Entities is included in the Appendix section of this supplemental package.

Net Asset Value Components

We disclose components of our business relevant to calculate NAV, a non-GAAP measure. There is no directly comparable GAAP financial measure to NAV. We consider NAV to be a useful supplemental measure which assists both management and investors to estimate the fair value of our Company. The calculation of NAV involves significant estimates and can be calculated using various methods. Each individual investor must determine the specific methodology, assumptions and estimates to use to arrive at an estimated NAV of the Company. NAV components are shown at our total company ownership. We believe disclosing the components at total company ownership is essential to estimate NAV, as they represent our estimated proportionate amount of assets and liabilities we are entitled to.

The components of NAV do not consider the potential changes in rental and fee income streams or development platform. The components include non-GAAP financial measures, such as NOI, and information related to our rental properties business at the Company’s share. Although these measures are not presented in accordance with GAAP, investors can use these non-GAAP measures as supplementary information to evaluate our business.

FFO

FFO, a non-GAAP measure, along with net earnings, provides additional information about our core operations. While property dispositions, acquisitions or other factors impact net earnings in the short-term, we believe FFO presents a consistent view of the overall financial performance of our business from period-to-period since the core of our business is the recurring operations of our portfolio of real estate assets. Management believes that the exclusion from FFO of gains and losses from the sale of operating real estate assets allows investors and analysts to readily identify the operating results of the Company’s core assets and assists in comparing those operating results between periods. Implicit in historical cost accounting for real estate assets in accordance with GAAP is the assumption that the value of real estate assets diminishes ratably over time. Since real estate values have historically risen or fallen with market conditions, many real estate investors and analysts have considered presentations of operating results for real estate companies using historical cost accounting alone to be insufficient. Because FFO excludes depreciation and amortization of real estate assets and impairment of depreciable real estate, management believes that FFO, along with the required GAAP presentations, provides another measurement of the Company’s performance relative to its competitors and an additional basis on which to make decisions involving operating, financing and investing activities than the required GAAP presentations alone would provide.

The majority of our peers in the publicly traded real estate industry report operations using FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”). FFO is defined by NAREIT as net earnings excluding the following items at our ownership: i) gain (loss) on full or partial disposition of rental properties, divisions and other investments (net of tax); ii) gains or losses on change in control of interests; iii) non-cash charges for real estate depreciation and amortization; iv) impairment of depreciable real estate (net of tax); and v) cumulative or retrospective effect of change in accounting principle (net of tax).

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Operating FFO

In addition to reporting FFO, we report Operating FFO, a non-GAAP measure, as an additional measure of our operating performance. We believe it is appropriate to adjust FFO for significant items driven by transactional activity and factors relating to the financial and real estate markets, rather than factors specific to the on-going operating performance of our properties. We use Operating FFO as an indicator of continuing operating results in planning and executing our business strategy. Operating FFO should not be considered to be an alternative to net earnings computed under GAAP as an indicator of our operating performance and may not be directly comparable to similarly-titled measures reported by other companies.

We define Operating FFO as FFO adjusted to exclude: i) impairment of non-depreciable real estate; ii) write-offs of abandoned development projects and demolition costs; iii) income recognized on state and federal historic and other tax credits; iv) gains or losses from extinguishment of debt; v) change in fair market value of nondesignated hedges; vi) the adjustment to recognize rental revenues and rental expense using the straight-line method; vii) participation payments to ground lessors on refinancing of our properties; viii) other transactional items; and ix) income taxes on FFO.

EBITDAre

EBITDAre, a non-GAAP measure, is defined by NAREIT as net earnings (loss), excluding the following items: i) depreciation and amortization; ii) interest expense; iii) income tax expense (benefit); iv) impairment of depreciable real estate; and v) gains and losses on the disposition of depreciable real estate, including gains and losses on change in control of interests. We further adjust EBITDAre to arrive at EBITDAre at the company’s ownership (“EBITDAre attributable to Forest City Realty Trust, Inc. (“FCRT”)). During the three months ended March 31, 2018, we began disclosing EBITDAre attributable to FCRT as a replacement to EBITDA attributable to FCRT based on recently issued NAREIT guidance. Gains and losses on the disposition of depreciable real estate, including gains and losses on change in control of interests, and impairment of depreciable real estate are also excluded from net earnings (loss) to arrive at EBITDAre attributable to FCRT as a result. The disclosure of this metric provides a more widely known and understood measure of performance in the REIT industry. We use EBITDAre attributable to FCRT as the starting point in order to calculate Adjusted EBITDA as described below.

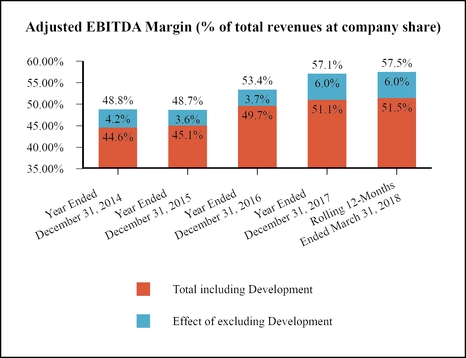

Adjusted EBITDA

We define Adjusted EBITDA, a non-GAAP measure, as EBITDAre attributable to Forest City Realty Trust, Inc. adjusted to exclude: i) impairment of non-depreciable real estate; ii) gains or losses from extinguishment of debt; and iii) other transactional items, including organizational transformation and termination benefits. We believe EBITDAre, Adjusted EBITDA and net debt to Adjusted EBITDA provide additional information in evaluating our credit and ability to service our debt obligations. Adjusted EBITDA is used by the chief operating decision maker and management to assess operating performance and resource allocations by segment and on a consolidated basis. Management believes Adjusted EBITDA gives the investment community a further understanding of the Company’s operating results, including the impact of general and administrative expenses and acquisition-related expenses, before the impact of investing and financing transactions and facilitates comparisons with competitors. However, Adjusted EBITDA should not be viewed as an alternative measure of the Company’s operating performance since it excludes financing costs as well as depreciation and amortization costs which are significant economic costs that could materially impact the Company’s results of operations and liquidity. Other REITs may use different methodologies for calculating Adjusted EBITDA and, accordingly, the Company’s Adjusted EBITDA may not be comparable to other REITs.

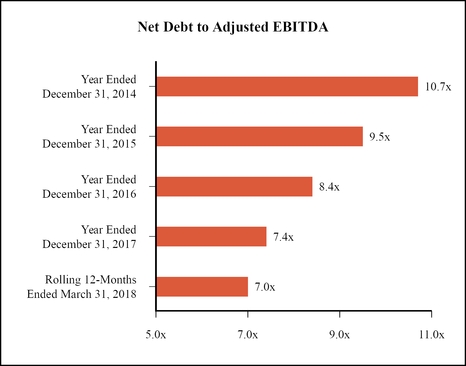

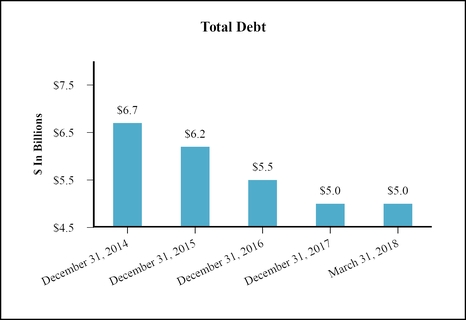

Net Debt to Adjusted EBITDA

Net Debt to Adjusted EBITDA, a non-GAAP measure, is defined as total debt, net at our company share (total debt includes outstanding borrowings on our revolving credit facility, our term loan facility, convertible senior debt, net, nonrecourse mortgages and notes payable, net) less cash and equivalents, at our company share, divided by Adjusted EBITDA. Net Debt to Adjusted EBITDA is a supplemental measure derived from non-GAAP financial measures that the Company uses to evaluate its capital structure and the magnitude of its debt against its operating performance. The Company believes that investors use versions of this ratio in a similar manner. The Company’s method of calculating the ratio may be different from methods used by other REITs and, accordingly, may not be comparable to other REITs.

NOI

NOI, a non-GAAP measure, reflects our share of the core operations of our rental real estate portfolio, prior to any financing activity. NOI is defined as revenues less operating expenses at our ownership within our Office, Apartments, Retail, and Development segments, except for revenues and cost of sales associated with sales of land held in these segments. The activities of our Corporate segment does not involve the operations of our rental property portfolio and therefore is not included in NOI.

We believe NOI provides important information about our core operations and, along with earnings before income taxes, is necessary to understand our business and operating results. Because NOI excludes general and administrative expenses, interest expense, depreciation and amortization, revenues and cost of sales associated with sales of land, other non-property income and losses, and

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

gains and losses from property dispositions, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating office, apartment and retail real estate and the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing a perspective on operations not immediately apparent from net income. We use NOI to evaluate our operating performance on a portfolio basis since NOI allows us to evaluate the impact that factors such as occupancy levels, lease structure, rental rates, and tenant mix have on our financial results. Investors can use NOI as supplementary information to evaluate our business. In addition, management believes NOI provides useful information to the investment community about our financial and operating performance when compared to other REITs since NOI is generally recognized as a standard measure of performance in the real estate industry. NOI is not intended to be a performance measure that should be regarded as an alternative to, or more meaningful than, our GAAP measures, and may not be directly comparable to similarly-titled measures reported by other companies.

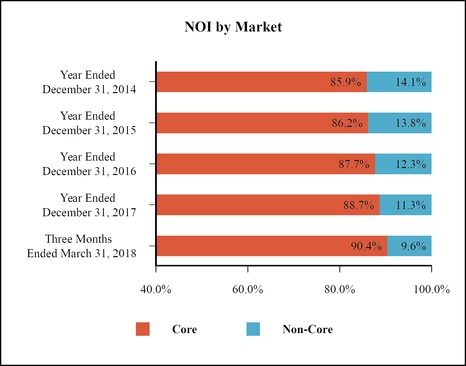

Comparable NOI

We use comparable NOI, a non-GAAP measure, as a metric to evaluate the performance of our office and apartment properties. This measure provides a same-store comparison of operating results of all stabilized properties that are open and operating in all periods presented. Non-capitalizable development costs and unallocated management and service company overhead, net of service fee revenues, are not directly attributable to an individual operating property and are considered non-comparable NOI. In addition, certain income and expense items at the property level, such as lease termination income, real estate tax assessments or rebates, certain litigation expenses incurred and any related legal settlements and NOI impacts of changes in ownership percentages, are excluded from comparable NOI. Due to the planned/ongoing disposition of substantially all of our regional mall and specialty retail portfolios, we are no longer disclosing comparable NOI for our retail properties. Other properties and activities such as federally assisted housing, straight-line rent adjustments and participation payments as a result of refinancing transactions are not evaluated on a comparable basis and the NOI from these properties and activities is considered non-comparable NOI.

Comparable NOI is an operating statistic defined as NOI from stabilized properties operated in all periods presented. We believe comparable NOI is useful because it measures the performance of the same properties on a period-to-period basis and is used to assess operating performance and resource allocation of the operating properties. While property dispositions, acquisitions or other factors impact net earnings in the short term, we believe comparable NOI presents a consistent view of the overall performance of our operating portfolio from period to period. A reconciliation of earnings before income taxes, the most comparable financial measure calculated in accordance with GAAP, to NOI, a reconciliation of NOI to earnings before income taxes for each operating segment and a reconciliation from NOI to comparable NOI are included in this supplemental package.

Comparable NOI margin information is an operating statistic derived from comparable NOI as a percentage of revenues associated with comparable NOI. We believe comparable NOI margins are useful in evaluating revenue enhancements and expense management on our comparable properties while also assessing the execution of our business strategies.

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Corporate Headquarters

Forest City Realty Trust, Inc.

Key Tower

127 Public Square, Suite 3100

Cleveland, Ohio 44114

Annual Report on Form 10-K

A copy of the Annual Report on Form 10-K as filed with the Securities and Exchange Commission (“SEC”) for the year ended December 31, 2017, can be found on our website under SEC Filings or may be obtained without charge upon written request to:

Jeffrey B. Linton

Senior Vice President - Corporate Communication

JeffLinton@forestcity.net

Website

www.forestcity.net

The information contained on this website is not incorporated herein by reference and does not constitute a part of this supplemental package.

Investor Relations

Michael E. Lonsway

Executive Vice President - Planning

MikeLonsway@forestcity.net

Investor Presentations

We periodically post updated investor presentations on the Investors page of our website at www.forestcity.net. It is possible the periodic updates may include information deemed to be material. Therefore, we encourage investors, the media, and other interested parties to review the Investors page of our website at www.forestcity.net for the most recent investor presentation.

Transfer Agent and Registrar

EQ Shareowner Services

P.O. Box 64854

St. Paul, MN 55164-9440

(800) 468-9716

www.shareowneronline.com

NYSE Listing

FCEA - Class A Common Stock ($.01 par value)

Dividend Reinvestment and Stock Purchase Plan

We offer our shareholders the opportunity to purchase additional shares of common stock through the Forest City Realty Trust, Inc. Dividend Reinvestment and Stock Purchase Plan (the “Plan”). You may obtain a copy of the Plan prospectus and an enrollment card by contacting EQ Shareowner Services at (800) 468-9716 or by visiting www.shareowneronline.com.

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Consolidated Balance Sheets – (Unaudited)

|

| | | | | | |

| | March 31, 2018 | December 31, 2017 |

| | (in thousands) |

| Assets | | |

| Real Estate | | |

| Completed rental properties | | |

| Office | $ | 3,544,451 |

| $ | 3,485,880 |

|

| Apartments | 2,461,991 |

| 2,550,072 |

|

| Retail | 112,795 |

| 103,990 |

|

| Total Operations | 6,119,237 |

| 6,139,942 |

|

| Recently-Opened Properties/Redevelopment | 438,869 |

| 990,851 |

|

| Corporate | 18,697 |

| 23,814 |

|

| Total completed rental properties | 6,576,803 |

| 7,154,607 |

|

| Projects under construction | | |

| Office | 71,968 |

| 79,976 |

|

| Apartments | 305,544 |

| 257,588 |

|

| Retail | — |

| — |

|

| Total projects under construction | 377,512 |

| 337,564 |

|

| Projects under development | | |

| Operating properties | 898 |

| 1,228 |

|

| Office | 107,589 |

| 107,260 |

|

| Apartments | 107,651 |

| 122,500 |

|

| Retail | — |

| — |

|

| Total projects under development | 216,138 |

| 230,988 |

|

| Total projects under construction and development | 593,650 |

| 568,552 |

|

| Land inventory | 58,717 |

| 57,296 |

|

| Total Real Estate | 7,229,170 |

| 7,780,455 |

|

| Less accumulated depreciation | (1,485,790 | ) | (1,484,163 | ) |

| Real Estate, net | 5,743,380 |

| 6,296,292 |

|

| Cash and equivalents | 455,447 |

| 204,260 |

|

| Restricted cash | 203,829 |

| 146,131 |

|

| Accounts receivable, net | 216,464 |

| 225,022 |

|

| Notes receivable | 459,069 |

| 398,785 |

|

| Investments in and advances to unconsolidated entities | 645,977 |

| 550,362 |

|

| Lease procurement costs, net | 58,955 |

| 59,810 |

|

| Prepaid expenses and other deferred costs, net | 72,497 |

| 75,839 |

|

| Intangible assets, net | 104,098 |

| 106,786 |

|

| Total Assets | $ | 7,959,716 |

| $ | 8,063,287 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Consolidated Balance Sheets – (Unaudited) |

| | | | | | |

| | March 31, 2018 | December 31, 2017 |

| | (in thousands) |

| Liabilities and Equity | | |

| Liabilities | | |

| Nonrecourse mortgage debt and notes payable, net | | |

| Completed rental properties | | |

| Office | $ | 1,018,293 |

| $ | 1,009,905 |

|

| Apartments | 1,428,523 |

| 1,363,784 |

|

| Retail | 46,736 |

| 47,209 |

|

| Total Operations | 2,493,552 |

| 2,420,898 |

|

| Recently-Opened Properties/Redevelopment | 343,919 |

| 524,410 |

|

| Total completed rental properties | 2,837,471 |

| 2,945,308 |

|

| Projects under construction | | |

| Office | — |

| — |

|

| Apartments | 120,145 |

| 43,696 |

|

| Retail | — |

| — |

|

| Total projects under construction | 120,145 |

| 43,696 |

|

| Projects under development | | |

| Operating properties | — |

| — |

|

| Office | — |

| — |

|

| Apartments | 9,582 |

| 9,357 |

|

| Retail | — |

| — |

|

| Total projects under development | 9,582 |

| 9,357 |

|

| Total projects under construction and development | 129,727 |

| 53,053 |

|

| Land inventory | — |

| — |

|

| Nonrecourse mortgage debt and notes payable, net | 2,967,198 |

| 2,998,361 |

|

| Revolving credit facility | — |

| — |

|

| Term loan, net | 333,768 |

| 333,668 |

|

| Convertible senior debt, net | 112,741 |

| 112,637 |

|

| Construction payables | 84,867 |

| 76,045 |

|

| Operating accounts payable and accrued expenses | 475,001 |

| 561,132 |

|

| Accrued derivative liability | 12,663 |

| 12,845 |

|

| Total Accounts payable, accrued expenses and other liabilities | 572,531 |

| 650,022 |

|

| Cash distributions and losses in excess of investments in unconsolidated entities | 120,833 |

| 123,882 |

|

| Total Liabilities | 4,107,071 |

| 4,218,570 |

|

| Equity | | |

| Stockholders’ Equity | | |

| Stockholders’ equity before accumulated other comprehensive loss | 3,587,795 |

| 3,436,997 |

|

| Accumulated other comprehensive loss | (6,143 | ) | (8,563 | ) |

| Total Stockholders’ Equity | 3,581,652 |

| 3,428,434 |

|

| Noncontrolling interest | 270,993 |

| 416,283 |

|

| Total Equity | 3,852,645 |

| 3,844,717 |

|

| Total Liabilities and Equity | $ | 7,959,716 |

| $ | 8,063,287 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Consolidated Statements of Operations – (Unaudited) |

| | | | | | |

| | Three Months Ended March 31, |

| | 2018 | 2017 |

| | (in thousands) |

| Revenues | | |

| Rental | $ | 162,547 |

| $ | 162,449 |

|

| Tenant recoveries | 28,408 |

| 25,932 |

|

| Service and management fees | 5,563 |

| 10,127 |

|

| Parking and other | 7,457 |

| 11,738 |

|

| Land sales | 5,945 |

| 5,760 |

|

| Subsidized Senior Housing | — |

| — |

|

| Total revenues | 209,920 |

| 216,006 |

|

| Expenses | | |

| Property operating and management | 71,311 |

| 78,793 |

|

| Real estate taxes | 21,031 |

| 21,200 |

|

| Ground rent | 3,685 |

| 3,888 |

|

| Cost of land sales | 2,986 |

| 2,001 |

|

| Subsidized Senior Housing operating | — |

| — |

|

| Corporate general and administrative | 12,183 |

| 15,583 |

|

| Organizational transformation and termination benefits | 15,950 |

| 4,525 |

|

| | 127,146 |

| 125,990 |

|

| Depreciation and amortization | 55,285 |

| 63,555 |

|

| Write-offs of abandoned development projects | — |

| — |

|

| Total expenses | 182,431 |

| 189,545 |

|

| Operating Income | 27,489 |

| 26,461 |

|

| Interest and other income | 10,761 |

| 10,272 |

|

| Net gain on disposition of interest in unconsolidated entities | — |

| — |

|

| Gain on change in control of interests | 117,711 |

| — |

|

| Interest expense | (26,967 | ) | (27,975 | ) |

| Amortization of mortgage procurement costs | (1,306 | ) | (1,222 | ) |

| Loss on extinguishment of debt | (2,388 | ) | (2,843 | ) |

| Earnings before income taxes and earnings from unconsolidated entities | 125,300 |

| 4,693 |

|

| Equity in earnings (loss) | (2,981 | ) | 9,278 |

|

| Net gain on disposition of interest in unconsolidated entities | 74,959 |

| 17,701 |

|

| 71,978 |

| 26,979 |

|

| Earnings before income taxes | 197,278 |

| 31,672 |

|

| Current income tax expense | 1,409 |

| 51 |

|

| Earnings before gain on disposal of real estate | 195,869 |

| 31,621 |

|

| Net gain (loss) on disposition of interest in development project, net of tax | 6,227 |

| (113 | ) |

| Net gain (loss) on disposition of full or partial interests in rental properties, net of tax | (2,534 | ) | 9,303 |

|

| Net earnings | 199,562 |

| 40,811 |

|

| Noncontrolling interests, gross of tax | | |

| Loss from continuing operations attributable to noncontrolling interests | 185 |

| 106 |

|

| Net earnings attributable to Forest City Realty Trust, Inc. | $ | 199,747 |

| $ | 40,917 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Net Asset Value Components – March 31, 2018

|

| | | | | | | | | | | | | | | | | | | |

| Completed Rental Properties - Operations |

| | Q1 2018 | | Net Stabilized | | Stabilized | | Annualized | | Nonrecourse |

| (Dollars in millions) | NOI (1) | | Adjustments (2) | | NOI | | Stabilized NOI | | Debt, net (3) |

| Operations | A | | B | | =A+B | |

| | |

| Office Real Estate | | |

|

| | | |

|

| | |

| Life Science | | |

|

| | | | | | |

| Cambridge | $ | 19.2 |

| | $ | 1.8 |

| | $ | 21.0 |

| | $ | 84.0 |

| | $ | (501.0 | ) |

| Other Life Science | 4.3 |

| | — |

| | 4.3 |

| | 17.2 |

| | (130.9 | ) |

| New York | | |

|

| | | | | | |

| Manhattan | 14.1 |

| | — |

| | 14.1 |

| | 56.4 |

| | — |

|

| Brooklyn | 23.5 |

| | — |

| | 23.5 |

| | 94.0 |

| | (351.7 | ) |

| Other Office | 6.5 |

|

| — |

| | 6.5 |

| | 26.0 |

| | (172.3 | ) |

| Subtotal Office | $ | 67.6 |

| | $ | 1.8 |

| | $ | 69.4 |

| | $ | 277.6 |

| | $ | (1,155.9 | ) |

| Apartment Real Estate | | |

|

| | | | | | |

| Apartments, Core Markets | $ | 35.0 |

|

| $ | — |

| | $ | 35.0 |

| | $ | 140.0 |

| | $ | (1,459.9 | ) |

| Apartments, Non-Core Markets | 10.9 |

| | — |

| | 10.9 |

| | 43.6 |

| | (307.2 | ) |

| Subtotal Apartment Product Type | $ | 45.9 |

| | $ | — |

| | $ | 45.9 |

| | $ | 183.6 |

| | $ | (1,767.1 | ) |

Federally Assisted Housing (4) | 0.2 |

| | 0.2 |

| | 0.4 |

| | 1.6 |

| | (13.8 | ) |

| Subtotal Apartments | $ | 46.1 |

| | $ | 0.2 |

| | $ | 46.3 |

| | $ | 185.2 |

| | $ | (1,780.9 | ) |

| Retail Real Estate | | |

| | | | | | |

| Other Retail | $ | 12.1 |

|

| $ | (1.7 | ) | | $ | 10.4 |

| | $ | 41.6 |

| | $ | (452.5 | ) |

| Subtotal | $ | 125.8 |

| | $ | 0.3 |

| | $ | 126.1 |

| | $ | 504.4 |

| | $ | (3,389.3 | ) |

| Straight-line rent adjustments | 3.3 |

| | — |

| | 3.3 |

| | 13.2 |

| | — |

|

| Other Operations | (0.7 | ) | | — |

| | (0.7 | ) | | (2.8 | ) | | — |

|

| Total Operations | $ | 128.4 |

| | $ | 0.3 |

| | $ | 128.7 |

| | $ | 514.8 |

| | $ | (3,389.3 | ) |

| |

| Development | | | | | | | | | |

| Recently-Opened Properties/Redevelopment | $ | 2.6 |

| | $ | 5.1 |

| | $ | 7.7 |

| | $ | 30.8 |

| | $ | (320.7 | ) |

| Straight-line rent adjustments | 0.4 |

| | — |

| | 0.4 |

| | 1.6 |

| | — |

|

| Other Development | (5.3 | ) |

| 1.3 |

| | (4.0 | ) | | (16.0 | ) | | — |

|

| Total Development | $ | (2.3 | ) | | $ | 6.4 |

| | $ | 4.1 |

| | $ | 16.4 |

| | $ | (320.7 | ) |

| Retail Dispositions | | | | | | | Gross Asset Value (5) | | |

| QIC | | | | | | | $ | 1,096.0 |

| | $ | (484.7 | ) |

| Madison | | | | | | | 425.0 |

| | (221.0 | ) |

| Total Retail Dispositions | | | | | | | $ | 1,521.0 |

| | $ | (705.7 | ) |

| |

| | | | | | Book Value (3) | | |

Projects under construction (6) | | $ | 144.1 |

| | $ | (48.0 | ) |

| Projects under development | | $ | 287.8 |

| | $ | (166.6 | ) |

| Land inventory: | | | | |

| Stapleton | | $ | 51.4 |

| | $ | — |

|

| Commercial Outlots | | $ | 2.4 |

| | $ | — |

|

| Other Tangible Assets |

| Cash and equivalents | | $ | 488.5 |

| | |

| Restricted cash | | $ | 190.3 |

| | |

Accounts receivable, net (7) | | $ | 255.1 |

| | |

| Notes receivable | | $ | 565.8 |

| | |

| Net investments and advances to unconsolidated entities | | $ | 22.9 |

| | |

| Prepaid expenses and other deferred costs, net | | $ | 79.4 |

| | |

| Recourse Debt and Other Liabilities |

| Revolving credit facility | | $ | — |

| | |

| Term loan, net | | $ | (333.8 | ) | | |

| Convertible senior debt, net | | $ | (112.7 | ) | | |

| Less: convertible debt | | $ | 112.7 |

| | |

| Construction payables | | $ | (108.1 | ) | | |

Operating accounts payable and accrued expenses (8) | | $ | (543.2 | ) | | |

Share Data (in millions) |

| Diluted weighted average number of shares for the three months ended March 31, 2018 | | 273.1 |

| | |

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Net Asset Value Components – March 31, 2018 (continued)

| |

| (1) | Q1 2018 Earnings Before Income Taxes is reconciled to NOI for the three months ended March 31, 2018 in the Supplemental Operating Information section of this supplemental package. Total NOI is reconciled below: |

|

| | | |

| | Q1 2018 |

| (Dollars in millions) | NOI |

| Total Operations | $ | 128.4 |

|

| Total Development | (2.3 | ) |

| QIC | 14.1 |

|

| Madison | 3.3 |

|

| Grand Total | $ | 143.5 |

|

| |

| (2) | The net stabilized adjustments column represents adjustments assumed to arrive at an estimated annualized stabilized NOI. We include stabilization adjustments to the Q1 2018 NOI as follows: |

| |

| a) | Due to the redevelopment of 26 Landsdowne Street (Life Science Office - Cambridge), we have included a stabilization adjustment to the Q1 2018 NOI to arrive at our estimate of annualized stabilized NOI prior to the commencement of our current redevelopment. |

| |

| b) | Partial period NOI for recently sold properties has been removed. |

| |

| c) | Due to the planned transfer of Charleston Town Center and Shops at Northern Boulevard (Other Retail) to the lenders in deed-in-lieu transactions, we have removed NOI and nonrecourse debt, net, related to these properties. |

| |

| d) | For recently-opened properties currently in initial lease-up periods included in the Development Segment, NOI is reflected at 5% of the company ownership cost. This assumption does not reflect our anticipated NOI, but rather is used in order to establish a hypothetical basis for an estimated valuation of leased-up properties. The following properties are currently in their initial lease-up periods: |

|

| | | | | | | |

| | Cost at 100% | Cost at Company Share | Lease Commitment % as of |

| Property | April 26, 2018 |

| | (in millions) | |

| Office: | | | |

| The Bridge at Cornell Tech (New York Office) | $ | 164.6 |

| $ | 164.6 |

| 74% |

| Apartments: | | | |

| Mint Town Center (Core Market) | $ | 94.0 |

| $ | 82.7 |

| 28% |

| Axis (Core Market) | $ | 140.4 |

| $ | 41.8 |

| 51% |

| VYV (Non-Core Market) | $ | 214.3 |

| $ | 107.1 |

| 67% |

| 38 Sixth Avenue (Core Market) | $ | 199.4 |

| $ | 49.2 |

| 47% |

| 535 Carlton (Core Market) | $ | 168.4 |

| $ | 41.9 |

| 76% |

| Eliot on 4th (Core Market) | $ | 138.3 |

| $ | 42.6 |

| 84% |

| NorthxNorthwest (Core Market) | $ | 115.0 |

| $ | 33.5 |

| 68% |

| Total Apartments | $ | 1,069.8 |

| $ | 398.8 |

| |

| Grand Total | $ | 1,234.4 |

| $ | 563.4 |

| |

| |

| e) | Due to the redevelopment of Ballston Quarter (Development Segment; Recently-Opened Properties/Redevelopment), we have included a stabilization adjustment to the Q1 2018 NOI to arrive at $2.6 million, our estimate of annualized stabilized NOI prior to the commencement of our current redevelopment. |

| |

| f) | Development Other excludes certain variable development overhead. |

The net stabilized adjustments are not comparable to any GAAP measure and therefore do not have a reconciliation to the nearest comparable GAAP measure.

| |

| (3) | Amounts represent the company’s share of each respective balance sheet line item as of March 31, 2018 and may be calculated using the financial information contained in the Appendix of this supplemental package. Due to the planned transfer of Charleston Town Center and Shops at Northern Boulevard to their lenders in deed in lieu transactions, we have removed nonrecourse debt, net, of $49.1 million and $17.3 million, respectively, related to these properties. |

| |

| (4) | Represents the remaining 8 federally assisted housing apartment communities. We previously signed a master purchase and sale agreement to dispose of this portfolio and expect to receive net proceeds of approximately $65 million. As of March 31, 2018, 39 properties have closed, representing $61.8 million in net proceeds. |

| |

| (5) | Gross asset valued related to the retail portfolio dispositions: |

| |

| a. | As a result of the signed definitive agreement to dispose of our 10 regional malls to QIC, we have calculated the remaining gross asset value based on agreed upon pricing, excluding five regional malls which closed in Q4 2017 and Q1 2018. |

| |

| b. | In accordance with the signed definitive agreement to dispose of our 11 specialty retail centers to Madison, we converted our common ownership interest in 10 assets to preferred ownership interests. The nonrecourse debt, net, associated with the 10 converted assets is approximately $182.0 million ($221.0 million, including Queens Place, the 11th specialty retail center to convert. Queens Place converted in April 2018). We have calculated the gross asset value based on agreed upon pricing. |

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

| |

| (6) | Stabilized NOI for the following properties is included under Recently-Opened Properties/Redevelopment. As such, we have removed the following from the book value of projects under construction: |

| |

| a. | $45.6 million, which represents the costs on the balance sheet associated with the ongoing redevelopment of Ballston Quarter. |

| |

| b. | $58.9 million, which represents costs on the balance sheet associated with the phased openings of Axis ($23.3 million) and Mint Town Center ($35.6 million). |

| |

| c. | $72.0 million, which represents costs on the balance sheet associated with vacant space not ready for its intended use at The Bridge at Cornell Tech. |

| |

| (7) | Includes $140.1 million of straight-line rent receivable (net of $7.2 million of allowance for doubtful accounts). |

| |

| (8) | Includes $51.7 million of straight-line rent payable. |

Forest City Realty Trust, Inc. and Subsidiaries

Selected Financial Information

Net Asset Value Components - Stabilized NOI - Q4 2017 vs. Q1 2018

The following represents the quarterly change in stabilized NOI used to estimate NAV, as a result of recent property openings and sales, as well as other portfolio changes. GAAP reconciliations for the beginning period can be found in prior supplemental packages furnished with the SEC and are available on our website at www.forestcity.net.

|

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Net Asset Value Components - Stabilized NOI |

| | | | Stabilized Adjustments | | |

| | | | | | | | | | |

| | Q4 2017 | | Property | | Property | | Portfolio | | Q1 2018 |

| (Dollars in millions) | Stabilized NOI | | Openings | | Sales | | NOI Changes | | Stabilized NOI |

| Operations | | | | | | | | | |

| Office Real Estate | | | | | | | | | |

| Life Science | | | | | | | | | |

| Cambridge | $ | 21.0 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 21.0 |

|

| Other Life Science | 3.7 |

| | — |

| | — |

| | 0.6 |

| | 4.3 |

|

| New York | | | | | | | | | |

| Manhattan | 14.0 |

| | — |

| | — |

| | 0.1 |

| | 14.1 |

|

| Brooklyn | 23.9 |

| | — |

| | — |

| | (0.4 | ) | | 23.5 |

|

| Other Office | 7.0 |

| | — |

| | — |

| | (0.5 | ) | | 6.5 |

|

| Subtotal Office | $ | 69.6 |

| | $ | — |

| | $ | — |

| | $ | (0.2 | ) | | $ | 69.4 |

|

| Apartment Real Estate | | | | | | | | | |

| Apartments, Core Markets | $ | 35.0 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 35.0 |

|

| Apartments, Non-Core Markets | 11.2 |

| | — |

| | — |

| | (0.3 | ) | | 10.9 |

|

| Subtotal Apartment Product Type | $ | 46.2 |

| | $ | — |

| | $ | — |

| | $ | (0.3 | ) | | $ | 45.9 |

|

| Federally Assisted Housing | 0.5 |

| | — |

| | (0.1 | ) | | — |

| | 0.4 |

|

| Subtotal Apartments | $ | 46.7 |

| | $ | — |

| | $ | (0.1 | ) | | $ | (0.3 | ) | | $ | 46.3 |

|

| Retail Real Estate | | | | | | | | | |

| Other Retail | 10.1 |

| | — |

| | — |

| | 0.3 |

| | 10.4 |

|

| Subtotal | $ | 126.4 |

| | $ | — |

| | $ | (0.1 | ) | | $ | (0.2 | ) | | $ | 126.1 |

|

| Straight-line rent adjustments | 2.1 |

| | — |

| | — |

| | 1.2 |

| | 3.3 |

|

| Other Operations | (0.1 | ) | | — |

| | — |

| | (0.6 | ) | | (0.7 | ) |

| Total Operations | $ | 128.4 |

| | $ | — |

| | $ | (0.1 | ) | | $ | 0.4 |

| | $ | 128.7 |

|

| | | | | | | | | | |

| Development Pipeline | | | | | | | | | |

| Development | | | | | | | | | |

| Recently-Opened Properties/Redevelopment | $ | 11.5 |

| | $ | — |

| | $ | (2.0 | ) | | $ | (1.8 | ) | | $ | 7.7 |

|

| Straight-line rent adjustments | 0.6 |

| | — |

| | — |

| | (0.2 | ) | | 0.4 |

|

| Other Development | (2.9 | ) | | — |

| | — |

| | (1.1 | ) | | (4.0 | ) |

| Total Development | $ | 9.2 |

| | $ | — |

| | $ | (2.0 | ) | | $ | (3.1 | ) | | $ | 4.1 |

|

| Grand Total | $ | 137.6 |

| | $ | — |

| | $ | (2.1 | ) | | $ | (2.7 | ) | | $ | 132.8 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Occupancy Data

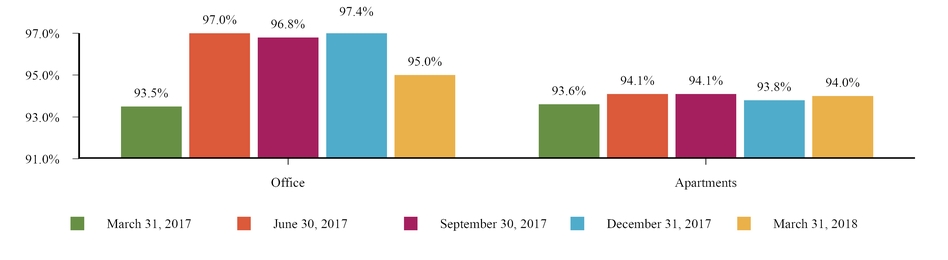

Office segment occupancy data represents leased occupancy at the end of the quarter. Leased occupancy percentage is calculated by dividing the sum of the total tenant occupied space under the lease and vacant space under the lease by gross leasable area (“GLA”).

|

| | | | |

| | Leased Occupancy |

| | As of March 31, |

| Office | 2018 | 2017 |

| Comparable | 95.0 | % | 93.7 | % |

| Total | 94.7 | % | 93.7 | % |

Apartment segment occupancy data represents economic occupancy, which is calculated by dividing the period-to-date gross potential rent less vacancy by gross potential rent. Apartment occupancy data excludes limited-distribution subsidized senior housing units.

|

| | | | |

| | Economic Occupancy |

| | Three Months Ended March 31, |

| Apartments | 2018 | 2017 |

| Comparable | 94.0 | % | 93.6 | % |

| Total | 94.0 | % | 93.6 | % |

The graph below provides comparable leased and economic occupancy data as reported in previous quarters. Prior period amounts may differ from above since the properties qualifying as comparable change from period to period.

Comparable Occupancy Percentage Trend

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Leasing Summary

Office Buildings

The following table represents those new leases and GLA signed on the same space in which there was a former tenant and existing tenant renewals along with all other new leases signed within the rolling 12-month period.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Same-Space Leases | | Other New Leases | | |

| Quarter | Number of Leases Signed | GLA Signed | Contractual Rent Per SF (1) | Expired Rent Per SF (1) | Cash Basis % Change over Prior Rent | | Number of Leases Signed | GLA Signed | Contractual Rent Per SF (1) | | Total GLA Signed |

| Q2 2017 | 20 |

| 290,759 |

| $ | 64.60 |

| $ | 57.69 |

| 12.0 | % | | 5 |

| 27,326 |

| $ | 42.07 |

| | 318,085 |

|

| Q3 2017 | 7 |

| 53,516 |

| $ | 35.23 |

| $ | 31.42 |

| 12.1 | % | | 2 |

| 6,209 |

| $ | 18.34 |

| | 59,725 |

|

| Q4 2017 | 14 |

| 340,532 |

| $ | 46.92 |

| $ | 39.39 |

| 19.1 | % | | 3 |

| 1,186 |

| $ | 57.26 |

| | 341,718 |

|

| Q1 2018 | 13 |

| 183,331 |

| $ | 73.09 |

| $ | 63.36 |

| 15.4 | % | | 3 |

| 7,172 |

| $ | 31.61 |

| | 190,503 |

|

| Total | 54 |

| 868,138 |

| $ | 57.65 |

| $ | 49.93 |

| 15.5 | % | | 13 |

| 41,893 |

| $ | 37.19 |

| | 910,031 |

|

| | | | | | | | | | | | |

| |

| (1) | Office contractual rent per square foot includes base rent and fixed additional charges for common area maintenance and real estate taxes as of rental commencement. For all expiring leases, contractual rent per square foot includes any applicable escalations. |

Apartment Communities

The following tables present leasing information of our apartment communities. Prior period amounts may differ from data as reported in previous quarters since the properties that qualify as comparable change from period to period.

Quarterly Comparison |

| | | | | | | | | | | | | | | | | | |

| | | | Monthly Average Apartment Rental Rates (2) | | Economic Apartment Occupancy |

| Comparable Apartment | Leasable Units | | Three Months Ended March 31, | | | Three Months Ended March 31, | |

Communities (1) | at Company % (3) | | 2018 | 2017 | % Change | | 2018 | 2017 | % Change |

| Core Markets | 8,857 |

| | $ | 2,020 |

| $ | 1,996 |

| 1.2 | % | | 94.6 | % | 94.4 | % | 0.2 | % |

| Non-Core Markets | 7,954 |

| | $ | 1,015 |

| $ | 994 |

| 2.1 | % | | 92.8 | % | 91.7 | % | 1.1 | % |

| Total Comparable Apartments | 16,811 |

| | $ | 1,544 |

| $ | 1,521 |

| 1.5 | % | | 94.0 | % | 93.6 | % | 0.4 | % |

| | | | | | | | | | |

Sequential Comparison |

| | | | | | | | | | | | | | | | | | |

| | | | Monthly Average Apartment Rental Rates (2) | | Economic Apartment Occupancy |

| | | | Three Months Ended | | | Three Months Ended | |

| Comparable Apartment | Leasable Units | | March 31, | December 31, | | | March 31, | December 31, | |

Communities (1) | at Company % (3) | | 2018 | 2017 | % Change | | 2018 | 2017 | % Change |

| Core Markets | 8,857 |

| | $ | 2,020 |

| $ | 2,023 |

| (0.1 | )% | | 94.6 | % | 93.6 | % | 1.0 | % |

| Non-Core Markets | 7,954 |

| | $ | 1,015 |

| $ | 1,017 |

| (0.2 | )% | | 92.8 | % | 91.6 | % | 1.2 | % |

| Total Comparable Apartments | 16,811 |

| | $ | 1,544 |

| $ | 1,547 |

| (0.2 | )% | | 94.0 | % | 93.0 | % | 1.0 | % |

| | | | | | | | | | |

| |

| (1) | Includes stabilized apartment communities completely opened and operated in the periods presented. These apartment communities include units leased at affordable apartment rates which provide a discount from average market rental rates. For the three months ended March 31, 2018, 14.7% of leasable units in core markets and 4.9% of leasable units in non-core markets were affordable housing units. Excludes limited-distribution federally assisted housing units. |

| |

| (2) | Represents gross potential rent less concessions. |

| |

| (3) | Leasable units represent our share of comparable leasable units at the apartment community. |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Comparable NOI

|

| | |

| | Three Months Ended |

| | March 31, 2018 |

| Office | 1.2 | % |

| Apartments | (0.4 | )% |

| Total | 0.6 | % |

The tables below provide the percentage change of Comparable NOI as reported in previous quarters. GAAP reconciliations for previous periods can be found in prior supplemental packages furnished to the SEC and are available on our website at www.forestcity.net.

|

| | | | | | | | | | | | | | | |

| Quarterly Historical Trends | | | |

| | Three Months Ended | |

| | March 31, 2018 | | December 31, 2017 | | September 30, 2017 | | June 30, 2017 | | March 31, 2017 | |

| Office | 1.2 | % | | 6.4 | % | | 4.3 | % | | 1.4 | % | | (1.4 | )% | |

| Apartments | (0.4 | )% | | 5.6 | % | | 5.0 | % | | 2.3 | % | | (0.3 | )% | |

| Total | 0.6 | % | | 6.1 | % | | 4.6 | % | | 1.8 | % | | (0.9 | )% | |

|

| | | | | | | | | | | | |

| Annual Historical Trends | | | |

| | Years Ended | |

| | December 31, 2017 | | December 31, 2016 | | December 31, 2015 | | December 31, 2014 | |

| Office | 2.9 | % | | 3.6 | % | | 4.9 | % | | 6.6 | % | |

| Apartments | 3.3 | % | | 3.3 | % | | 4.7 | % | | 4.3 | % | |

| Total | 3.1 | % | | 3.5 | % | | 4.9 | % | | 5.7 | % | |

The table below provides comparable NOI margins for our Operations segments. Properties included in prior periods may differ from the current year since properties qualifying as comparable change from period to period. |

| | | | | | | | | | | | |

| Year-to-Date and Annual Historical Trends - Margins on Comparable NOI | |

| | Three Months Ended | | Years Ended | |

| | March 31, 2018 | | December 31, 2017 | | December 31, 2016 | | December 31, 2015 | |

| Office Segment | | | | | | | | |

| Life Science | 68.5 | % | | 68.6 | % | | 60.1 | % | | 58.7 | % | |

| New York | | | | | | | | |

| Manhattan | 73.5 | % | | 73.9 | % | | 73.5 | % | | 72.1 | % | |

| Brooklyn | 51.9 | % | | 52.8 | % | | 53.0 | % | | 51.4 | % | |

| Other Office | 63.5 | % | | 63.7 | % | | 55.6 | % | | 53.8 | % | |

| Total Office Segment | 62.0 | % | | 62.2 | % | | 59.0 | % | | 57.3 | % | |

| Apartment Segment | | | | | | | | |

| Core Markets | 59.4 | % | | 62.3 | % | | 61.6 | % | | 60.8 | % | |

| Non-Core Markets | 45.6 | % | | 49.7 | % | | 48.9 | % | | 46.3 | % | |

| Total Apartment Segment | 55.4 | % | | 58.6 | % | | 57.8 | % | | 56.7 | % | |

| Total | 59.1 | % | | 60.6 | % | | 58.5 | % | | 57.1 | % | |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

NOI (Non-GAAP) Detail (in thousands)

|

| | | | | | | | |

| | Three Months Ended March 31, | |

| | 2018 | 2017 | % Change |

| Office Segment | | | |

| Comparable NOI | 66,985 |

| 66,166 |

| 1.2 | % |

| Non-Comparable NOI | 569 |

| 3,780 |

| |

| Office Product Type NOI | 67,554 |

| 69,946 |

| |

Other NOI (1) | 2,364 |

| 3,454 |

| |

| Total Office Segment | 69,918 |

| 73,400 |

| |

| Apartment Segment | | | |

| Comparable NOI | 45,267 |

| 45,458 |

| (0.4 | )% |

| Non-Comparable NOI | 632 |

| (54 | ) | |

| Apartment Product Type NOI | 45,899 |

| 45,404 |

| |

| Federally Assisted Housing | 167 |

| 4,285 |

| |

Other NOI (1) | (1,170 | ) | (732 | ) | |

| Total Apartment Segment | 44,896 |

| 48,957 |

| |

| Retail Segment | | | |

| Retail NOI | 27,299 |

| 39,623 |

| |

| Madison Preferred Return | 2,311 |

| — |

| |

| Retail Product Type NOI | 29,610 |

| 39,623 |

| |

Other NOI (1) | 1,389 |

| (598 | ) | |

| Total Retail Segment | 30,999 |

| 39,025 |

| |

| Operations | | | |

| Comparable NOI | 112,252 |

| 111,624 |

| 0.6 | % |

| Retail NOI | 29,610 |

| 39,623 |

| |

Non-Comparable NOI (2) | 1,201 |

| 3,726 |

| |

| Product Type NOI | 143,063 |

| 154,973 |

| |

| Federally Assisted Housing | 167 |

| 4,285 |

| |

Other NOI (1): | | | |

| Straight-line rent adjustments | 3,292 |

| 2,798 |

| |

| Other Operations | (709 | ) | (674 | ) | |

| 2,583 |

| 2,124 |

| |

| Total Operations | 145,813 |

| 161,382 |

| |

| Development Segment | | | |

| Recently-Opened Properties/Redevelopment | 2,636 |

| (1,393 | ) | |

Other Development (3) | (4,905 | ) | (6,736 | ) | |

| Total Development Segment | (2,269 | ) | (8,129 | ) | |

| Grand Total | $ | 143,544 |

| $ | 153,253 |

| |

| |

| (1) | Includes straight-line rent adjustments, participation payments as a result of refinancing transactions on our properties and management and service company overhead, net of service fee revenues. |

| |

| (2) | Non-comparable NOI includes lease termination income of $291 for the three months ended March 31, 2018, compared with $2,140 for the three months ended March 31, 2017. |

| |

| (3) | Includes straight-line adjustments, non-capitalizable development overhead and other costs on our development projects. |

Percentage of NOI by Product Type (dollars in thousands)

|

| | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2018 | 2017 |

| | NOI | % of Total | NOI | % of Total |

| Office Segment | $ | 67,554 |

| 47.2 | % | $ | 69,946 |

| 45.1 | % |

| Apartment Segment | 45,899 |

| 32.1 | % | 45,404 |

| 29.3 | % |

| Retail Segment | 29,610 |

| 20.7 | % | 39,623 |

| 25.6 | % |

| Total Product Type NOI | $ | 143,063 |

| | $ | 154,973 |

| |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Summary of Corporate General and Administrative and Other NOI (in thousands)

|

| | | | | | | | | |

| | Three Months Ended March 31, | |

| | 2018 | 2017 | Change |

| Corporate General and Administrative | $ | (16,801 | ) | $ | (16,243 | ) | $ | (558 | ) |

| Other Operations NOI | (709 | ) | (674 | ) | (35 | ) |

| Other Development NOI | (4,905 | ) | (6,736 | ) | 1,831 |

|

| | $ | (22,415 | ) | $ | (23,653 | ) | $ | 1,238 |

|

Deferred gain (1) | 4,618 |

| 660 |

| 3,958 |

|

| Total | $ | (17,797 | ) | $ | (22,993 | ) | $ | 5,196 |

|

Year-to-Date and Annual Historical Trends

GAAP reconciliations for previous periods can be found in prior supplemental packages furnished to the SEC and are available on our website at www.forestcity.net.

|

| | | | | | | | | |

| | Three Months Ended | Years Ended |

| | March 31, 2018 | December 31, 2017 | December 31, 2016 |

| | (in thousands) |

| Corporate General and Administrative | $ | (16,801 | ) | $ | (64,788 | ) | $ | (63,343 | ) |

| Other Operations NOI | (709 | ) | (3,203 | ) | (1,593 | ) |

| Other Development NOI | (4,905 | ) | (18,611 | ) | (33,391 | ) |

| | $ | (22,415 | ) | $ | (86,602 | ) | $ | (98,327 | ) |

Deferred gain (1) | 4,618 |

| 2,639 |

| 660 |

|

| Ballston Quarter development fee | — |

| — |

| 5,500 |

|

| Total | $ | (17,797 | ) | $ | (83,963 | ) | $ | (92,167 | ) |

| |

| (1) | Deferred gain relates to a 2016 leaseback transaction at Terminal Tower, the Company’s former headquarters in Cleveland, Ohio. Upon vacating these premises in March 2018, the remaining deferred gain was recorded as a reduction to rent expense in accordance with GAAP. |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Core Market NOI

(dollars in thousands)

|

| | |

| Three Months Ended March 31, 2018 | | Three Months Ended March 31, 2017 |

|

| | | | | | | | |

| Product Type NOI | $ | 143,063 |

| | Product Type NOI | $ | 154,973 |

|

| Federally Assisted Housing | 167 |

| | Federally Assisted Housing | 4,285 |

|

Other NOI (3): | | | Other NOI (3): | |

| Straight-line rent adjustments | 3,292 |

| | Straight-line rent adjustments | 2,798 |

|

| Other Operations | (709 | ) | | Other Operations | (674 | ) |

| | 2,583 |

| | | 2,124 |

|

| Recently-Opened Properties/Redevelopment | 2,636 |

| | Recently-Opened Properties/Redevelopment | (1,393 | ) |

Development Segment (4) | (4,905 | ) | | Development Segment (4) | (6,736 | ) |

| Grand Total NOI | $ | 143,544 |

| | Grand Total NOI | $ | 153,253 |

|

| |

| (1) | Includes Richmond, Virginia. |

| |

| (2) | Represents Regional Malls located in Non-Core Markets. Regional Malls located in Core Markets are included in their applicable Core Markets. |

| |

| (3) | Includes straight-line rent adjustments, participation payments as a result of refinancing transactions on our properties and management and service company overhead, net of service fee revenues. |

| |

| (4) | Includes straight-line adjustments, non-capitalizable development overhead and other costs on our development projects. |

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Reconciliation of Earnings Before Income Taxes (GAAP) to Net Operating Income (non-GAAP) (in thousands):

|

| | | | | | |

| | Three Months Ended March 31, |

| | 2018 | 2017 |

| Earnings before income taxes (GAAP) | $ | 197,278 |

| $ | 31,672 |

|

| Earnings from unconsolidated entities | (71,978 | ) | (26,979 | ) |

| Earnings before income taxes and earnings from unconsolidated entities | 125,300 |

| 4,693 |

|

| Land sales | (5,945 | ) | (5,760 | ) |

| Cost of land sales | 2,986 |

| 2,001 |

|

| Other land development revenues | (2,193 | ) | (1,105 | ) |

| Other land development expenses | 3,072 |

| 2,564 |

|

| Corporate general and administrative expenses | 12,183 |

| 15,583 |

|

| Organizational transformation and termination benefits | 15,950 |

| 4,525 |

|

| Depreciation and amortization | 55,285 |

| 63,555 |

|

| Interest and other income | (10,761 | ) | (10,272 | ) |

| Gains on change in control of interests | (117,711 | ) | — |

|

| Interest expense | 26,967 |

| 27,975 |

|

| Amortization of mortgage procurement costs | 1,306 |

| 1,222 |

|

| Loss on extinguishment of debt | 2,388 |

| 2,843 |

|

NOI related to noncontrolling interest (1) | (10,939 | ) | (9,671 | ) |

NOI related to unconsolidated entities (2) | 45,656 |

| 55,100 |

|

| Net Operating Income (Non-GAAP) | $ | 143,544 |

| $ | 153,253 |

|

| | | |

| (1) NOI related to noncontrolling interest: | | |

| Loss from continuing operations attributable to noncontrolling interests (GAAP) | $ | 185 |

| $ | 106 |

|

| Exclude non-NOI activity from noncontrolling interests: | | |

| Land and non-rental activity, net | 153 |

| 246 |

|

| Interest and other income | 370 |

| 524 |

|

| Depreciation and amortization | (6,539 | ) | (6,696 | ) |

| Amortization of mortgage procurement costs | (325 | ) | (287 | ) |

| Interest expense and extinguishment of debt | (5,135 | ) | (3,564 | ) |

| Gain on disposition of full or partial interests in rental properties and interest in unconsolidated entities | 352 |

| — |

|

| NOI related to noncontrolling interest | $ | (10,939 | ) | $ | (9,671 | ) |

| (2) NOI related to unconsolidated entities: | | |

| Equity in earnings (loss) (GAAP) | $ | (2,981 | ) | $ | 9,278 |

|

| Exclude non-NOI activity from unconsolidated entities: | | |

| Land and non-rental activity, net | (887 | ) | (1,136 | ) |

| Interest and other income | (192 | ) | (1,525 | ) |

| Write offs of abandoned development projects and demolition costs | 6,218 |

| 351 |

|

| Depreciation and amortization | 21,675 |

| 22,192 |

|

| Amortization of mortgage procurement costs | 656 |

| 897 |

|

| Interest expense and extinguishment of debt | 21,167 |

| 25,043 |

|

| NOI related to unconsolidated entities | $ | 45,656 |

| $ | 55,100 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Reconciliation of Net Earnings (GAAP) to FFO (non-GAAP)

The table below reconciles net earnings, the most comparable GAAP measure, to FFO, a non-GAAP measure. |

| | | | | | |

| | Three Months Ended March 31, |

| | 2018 | 2017 |

| | (in thousands) |

| Net earnings attributable to Forest City Realty Trust, Inc. (GAAP) | $ | 199,747 |

| $ | 40,917 |

|

Depreciation and Amortization—real estate (1) | 69,767 |

| 78,349 |

|

| Gain on change in control of interests | (117,711 | ) | — |

|

| Gain on disposition of full or partial interests in rental properties | (72,203 | ) | (27,004 | ) |

| Income tax expense adjustment: | | |

| Gain on disposition of full or partial interests in rental properties | 1,711 |

| — |

|

| FFO attributable to Forest City Realty Trust, Inc. (Non-GAAP) | $ | 81,311 |

| $ | 92,262 |

|

| FFO Per Share - Diluted | | |

Numerator (in thousands): | | |

| FFO attributable to Forest City Realty Trust, Inc. | $ | 81,311 |

| $ | 92,262 |

|

| If-Converted Method (adjustments for interest): | | |

| 4.250% Notes due 2018 | 778 |

| 778 |

|

| 3.625% Notes due 2020 | 363 |

| 363 |

|

| FFO for per share data | $ | 82,452 |

| $ | 93,403 |

|

| Denominator: | | |

| Weighted average shares outstanding—Basic | 265,440,763 |

| 258,797,277 |

|

| Effect of stock options, restricted stock and performance shares | 1,380,471 |

| 1,320,911 |

|

| Effect of convertible debt | 5,213,392 |

| 5,031,753 |

|

| Effect of convertible 2006 Class A Common Units | 1,111,044 |

| 1,910,625 |

|

| Weighted average shares outstanding - Diluted | 273,145,670 |

| 267,060,566 |

|

| FFO Per Share - Diluted | $ | 0.30 |

| $ | 0.35 |

|

| |

| (1) | The following table provides detail of depreciation and amortization: |

|

| | | | | | |

| | Three Months Ended March 31, |

| | 2018 | 2017 |

| | (in thousands) |

| Full Consolidation | $ | 55,285 |

| $ | 63,555 |

|

| Non-Real Estate | (654 | ) | (702 | ) |

| Real Estate Full Consolidation | 54,631 |

| 62,853 |

|

| Real Estate related to noncontrolling interest | (6,539 | ) | (6,696 | ) |

| Real Estate Unconsolidated | 21,675 |

| 22,192 |

|

| Real Estate at Company share | $ | 69,767 |

| $ | 78,349 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Reconciliation of FFO to Operating FFO

|

| | | | | | | |

| Three Months Ended March 31, | |

| | 2018 | 2017 | % Change |

| | (in thousands) | |

| FFO attributable to Forest City Realty Trust, Inc. | $ | 81,311 |

| $ | 92,262 |

| |

| Write-offs of abandoned development projects and demolition costs | 6,218 |

| 351 |

| |

| Tax credit income | (3,275 | ) | (2,691 | ) | |

| Loss on extinguishment of debt | 2,269 |

| 4,466 |

| |

| Change in fair market value of nondesignated hedges | (2,148 | ) | (1,502 | ) | |

| Straight-line rent adjustments | (3,693 | ) | (2,942 | ) | |

| Organizational transformation and termination benefits | 15,950 |

| 4,525 |

| |

| Income tax expense on FFO | 113 |

| 51 |

| |

| Operating FFO attributable to Forest City Realty Trust, Inc. | $ | 96,745 |

| $ | 94,520 |

| 2.4% |

| | | | |

If-Converted Method (adjustments for interest) (in thousands): | | | |

| 4.250% Notes due 2018 | 778 |

| 778 |

| |

| 3.625% Notes due 2020 | 363 |

| 363 |

| |

| Operating FFO attributable to Forest City Realty Trust, Inc. (If-Converted) | $ | 97,886 |

| $ | 95,661 |

| |

| Weighted average shares outstanding - Diluted | 273,145,670 |

| 267,060,566 |

| |

| Operating FFO per share - Diluted | $ | 0.36 |

| $ | 0.36 |

| 0.0% |

Reconciliation of NOI to Operating FFO |

| | | | | | |

| | Three Months Ended March 31, |

| | 2018 | 2017 |

| | |

| NOI attributable to Forest City Realty Trust, Inc. | $ | 143,544 |

| $ | 153,253 |

|

| Land sales | 12,288 |

| 8,082 |

|

| Other land development revenues | 2,338 |

| 1,389 |

|

| Cost of land sales | (9,063 | ) | (3,910 | ) |

| Other land development expenses | (2,749 | ) | (2,371 | ) |

| Corporate general and administrative expenses | (12,183 | ) | (15,583 | ) |

| Interest and other income | 10,583 |

| 11,273 |

|

| Interest expense | (43,118 | ) | (47,831 | ) |

| Amortization of mortgage procurement costs | (1,637 | ) | (1,832 | ) |

| Non-real estate depreciation and amortization | (654 | ) | (702 | ) |

| Tax credit income | (3,275 | ) | (2,691 | ) |

| Change in fair market value of nondesignated hedges | (2,148 | ) | (1,502 | ) |

| Straight-line rent adjustments | (3,693 | ) | (2,942 | ) |

| Net gain (loss) on sale of development project | 6,512 |

| (113 | ) |

| Operating FFO attributable to Forest City Realty Trust, Inc. | $ | 96,745 |

| $ | 94,520 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Reconciliation of Net Earnings attributable to FCRT (GAAP) to Adjusted EBITDA attributable to FCRT (non-GAAP)

|

| | | | | | |

| | Three Months Ended March 31, |

| | 2018 | 2017 |

| | (in thousands) |

| Net earnings attributable to Forest City Realty Trust, Inc. (GAAP) | $ | 199,747 |

| $ | 40,917 |

|

| Depreciation and amortization | 70,421 |

| 79,051 |

|

Interest expense (1) | 43,118 |

| 47,831 |

|

| Amortization of mortgage procurement costs | 1,637 |

| 1,832 |

|

| Income tax expense | 1,824 |

| 51 |

|

| Net gain on disposition of full or partial interests in rental properties | (72,203 | ) | (27,004 | ) |

| Gains on change in control of interests | (117,711 | ) | — |

|

| EBITDAre attributable to Forest City Realty Trust, Inc. (Non-GAAP) | $ | 126,833 |

| $ | 142,678 |

|

| Net loss on extinguishment of debt | 2,269 |

| 4,466 |

|

| Organizational transformation and termination benefits | 15,950 |

| 4,525 |

|

| Adjusted EBITDA (Non-GAAP) | $ | 145,052 |

| $ | 151,669 |

|

| | As of March 31, |

| | 2018 | 2017 |

| | (in thousands) |

| Nonrecourse mortgage debt and notes payable, net | $ | 4,514,733 |

| $ | 5,027,841 |

|

| Revolving credit facility | — |

| — |

|

| Term loan, net | 333,768 |

| 333,368 |

|

| Convertible senior debt, net | 112,741 |

| 112,295 |

|

| Total debt | $ | 4,961,242 |

| $ | 5,473,504 |

|

| Less cash and cash equivalents | (488,500 | ) | (217,643 | ) |

| Net Debt | $ | 4,472,742 |

| $ | 5,255,861 |

|

| Net Debt to Adjusted EBITDA (Annualized) | 7.7 | x | 8.7 | x |

| |

| (1) | The following table provides detail of interest expense: |

|

| | | | | | |

| | Three Months Ended March 31, |

| | 2018 | 2017 |

| | (in thousands) |

| Full consolidation | $ | 26,967 |

| $ | 27,975 |

|

| Noncontrolling interest | (5,016 | ) | (3,564 | ) |

| Unconsolidated entities at Company share | 21,167 |

| 23,420 |

|

| Company share | $ | 43,118 |

| $ | 47,831 |

|

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information

Forest City Realty Trust, Inc. and Subsidiaries

Supplemental Operating Information