Filed Pursuant to Rule 424(b)(3)

Registration No. 333-206017

CNL HEALTHCARE PROPERTIES II, INC.

STICKER SUPPLEMENT DATED JULY 11, 2016

TO THE PROSPECTUS DATED MARCH 2, 2016

This sticker supplement is part of, and should be read in conjunction with, our prospectus dated March 2, 2016. Unless otherwise defined herein, capitalized terms used in this sticker supplement have the same meanings as prescribed to them in the prospectus.

The purpose of this sticker supplement is to disclose:

| | • | | an update to the terms of the offering reflecting a minimum offering amount for Ohio investors; |

| | • | | the status of the offering; |

| | • | | an update to the amount of shares owned by our advisor; |

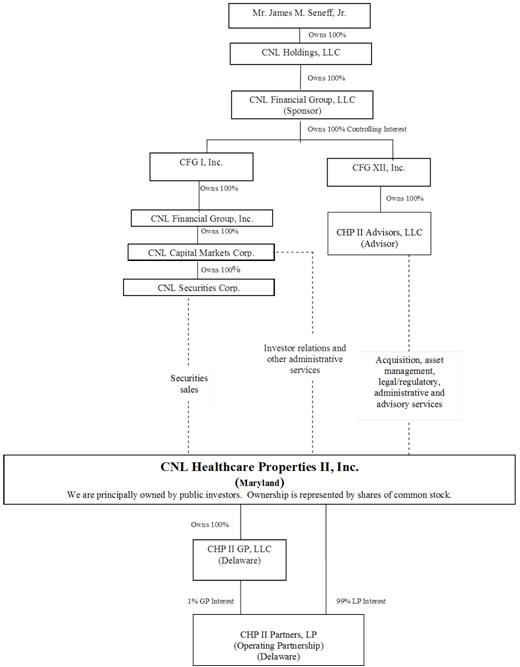

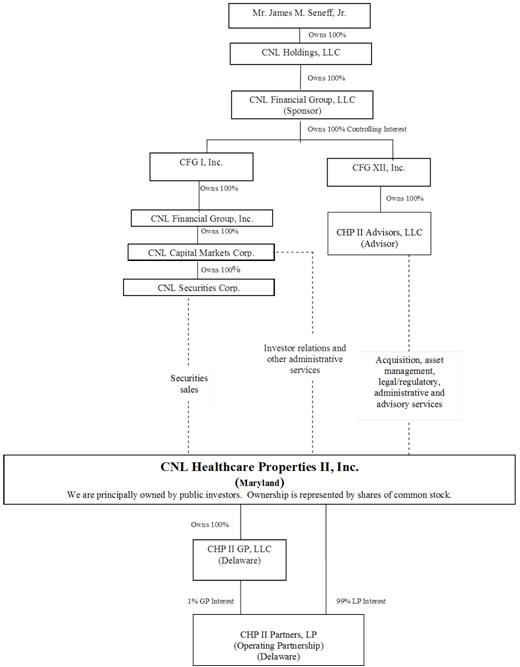

| | • | | an updated organizational chart; |

| | • | | an update to our risk factors; and |

| | • | | an update to our security ownership table. |

Terms of the Offering

The following disclosure supplements the section entitled “Plan of Distribution—Subscription Procedures” and all related disclosure throughout the prospectus.

Until we sell $20,000,000 in shares of common stock, the subscription funds of Ohio investors will be held in escrow. Ohio investors should make checks payable to “UMB Bank, N.A., Escrow Agent for CNL Healthcare Properties II, Inc.” until we have accepted subscriptions for shares totaling at least $20,000,000.

Status of the Offering

We commenced this offering of up to $2,000,000,000 in shares of Class A, Class T or Class I common stock on March 2, 2016. On July 11, 2016, we broke escrow through the sale of 250,000 Class A shares to our advisor for $2.5 million. As described in the prospectus, we do not pay selling commissions or dealer manager fees in connection with the sale of Class A shares to our advisor. As of July 11, 2016, we had received gross offering proceeds of approximately $2.5 million, which is sufficient to satisfy the minimum offering amounts in all states where we are conducting this offering except Ohio, Pennsylvania and Washington. Accordingly, we have broken escrow effective July 11, 2016 with respect to subscriptions received from all states where we are conducting this offering except Ohio, Pennsylvania and Washington, which have minimum offering amounts of $20 million, $87.5 million and $20 million, respectively.

Except with respect to subscriptions from Ohio, Pennsylvania and Washington, subscribers should make their checks payable to “CNL Healthcare Properties II, Inc.” Until we have raised $20 million, $87.5 million and $20 million, respectively, Ohio, Pennsylvania and Washington investors should continue to make their checks payable to “UMB Bank, N.A., Escrow Agent for CNL Healthcare Properties II, Inc.”

Shares Owned by Our Advisor

The following disclosure replaces the second paragraph under “The Advisor and the Advisory Agreement” and updates all similar disclosure throughout the prospectus.

Our advisor currently owns 270,000 Class A shares of our common stock. Neither our advisor, any director nor any of their affiliates may vote or consent on matters submitted to the stockholders regarding removal of our advisor, directors or any of their affiliates or any transaction between us and any of them. To the extent permitted by the MGCL, in determining the requisite percentage interest of shares of common stock necessary to approve a matter on which our advisor, our directors and any of their affiliates may not vote or consent, any shares of common stock owned by any of them will not be included.

1

Organizational Chart

The following disclosure replaces the organizational chart in the section entitled “Prospectus Summary—Conflicts of Interest.”

| (1) | Please see the disclosure below under “—Compensation of Our Advisor and Its Affiliates” for a description of the compensation, reimbursements and distributions we contemplate paying to our advisor, our dealer manager and other affiliates in exchange for services provided to us. |

2

Risk Factors

The following disclosure replaces the similar risk factor in the section entitled “Risk Factors—Company Related Risks.”

Because we rely on affiliates of CNL for advisory and dealer manager services, if these affiliates or their executive officers and other key personnel are unable to meet their obligations to us, we may be required to find alternative providers of these services, which could disrupt our business.

We have no employees and are reliant on our advisor and other affiliates of our sponsor to provide services to us. CNL, through one or more of its affiliates or subsidiaries, owns and controls our sponsor and has a controlling interest in both our advisor and CNL Securities Corp., the dealer manager of our offering. In the event that any of these affiliates are unable to meet their obligations to us, we might be required to find alternative service providers, which could disrupt our business by causing delays and/or increasing our costs.

Further, our success depends to a significant degree upon the contributions of Thomas K. Sittema, our chairman of the board and director, Stephen H. Mauldin, our vice chairman of the board, director, chief executive officer and president, and Kevin R. Maddron, our chief operating officer, chief financial officer and treasurer, each of whom would be difficult to replace. If any of these key personnel were to cease their affiliation with us or our affiliates, we may be unable to find suitable replacement personnel, and our operating results could suffer. In addition, we have entered into an advisory agreement with our advisor which contains a non-solicitation and non-hire clause prohibiting us or our operating partnership from (i) soliciting or encouraging any person to leave the employment of our advisor; or (ii) hiring on our behalf or on behalf of our operating partnership any person who has left the employment of our advisor for one year after such departure. All of our executive officers and the executive officers of our advisor are also executive officers of CNL Healthcare Properties, Inc. or its advisor, both of which are affiliates of our advisor. In the event that CNL Healthcare Properties, Inc. internalizes the management functions provided by its advisor, such executive officers may cease their employment with us and our advisor. In that case, our advisor would need to find and hire an entirely new executive management team. We believe that our future success depends, in large part, upon our advisor’s ability to hire and retain highly skilled managerial, operational and marketing personnel. Competition for such personnel is intense, and our advisor may be unsuccessful in attracting and retaining such skilled personnel. We do not maintain key person life insurance on any of our officers.

Security Ownership Table

The following disclosure replaces footnote (2) of the table in the section entitled “Security Ownership.”

| (2) | Represents shares held of record by our advisor, CHP II Advisors, LLC, which is an indirect subsidiary of CNL Financial Group, LLC, which is indirectly wholly owned by Mr. Seneff. |

3