Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

congatec AG Table of Contents

congatec AG Table of Contents

As filed with the Securities and Exchange Commission on November 13, 2015

Registration No. 333-207424

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

congatec Holding AG

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

| | | | |

Federal Republic of Germany

(State or other jurisdiction of

incorporation or organization) | | 7379

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer

Identification Number) |

Auwiesenstrasse 5

94469 Deggendorf, Germany

(49) 991 2700-0

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Corporation Service Company

1090 Vermont Avenue N.W.

Washington, DC 20005

(800) 927-9800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| | |

| Copies to: |

David S. Rosenthal, Esq.

Berthold A. Hummel, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(212) 698-3500 |

|

Christopher D. Lueking, Esq.

Dr. Roland Maass, Esq.

Latham & Watkins LLP

330 North Wabash Avenue, Suite 2800

Chicago, IL 60611

(312) 876-7700 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 13, 2015

IPO PRELIMINARY PROSPECTUS

5,454,988 American Depositary Shares

Representing 1,363,747 Ordinary Shares

$ per American Depositary Share

This is the initial public offering of congatec Holding AG, a German stock corporation. We are offering 4,180,000 American Depositary Shares, or ADSs, and the selling shareholders identified in this prospectus are offering 1,274,988 ADSs. We will not receive any proceeds from the sale of ADSs by the selling shareholders. Each ADS will represent one-quarter of an ordinary share with a notional value of €1.00 per share. We anticipate that the initial public offering price will be between $10.00 and $12.00 per ADS.

We have applied to list our ADSs on the NASDAQ Global Market under the symbol "CONG."

We are an "emerging growth company" as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, will be subject to reduced public company reporting requirements for future filings. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Investing in our ADSs involves risk. See "Risk Factors" beginning on page 14.

| | | | | | | |

| | Per ADS

| | Total

| |

|---|

Initial public offering price | | $ | | | $ | | |

Underwriting discounts and commissions(1) | | $ | | | $ | | |

Proceeds, before expenses, to congatec Holding AG | | $ | | | $ | | |

Proceeds, before expenses, to the selling shareholders | | $ | | | $ | | |

- (1)

- See "Underwriting" for additional information regarding underwriting compensation.

The underwriters have a 30-day option to purchase up to 818,236 additional ADSs from the selling shareholders.

Delivery of the ADSs will be made against payment in New York, New York on or about , 2015.

Neither the Securities and Exchange Commission nor any state securities commission has approved of anyone's investment in these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

| Stifel | | Needham & Company |

Canaccord Genuity |

|

JMP Securities |

The date of this prospectus is , 2015

TABLE OF CONTENTS

| | |

| | Page |

|---|

Prospectus Summary | | 1 |

Risk Factors | | 14 |

Special Note Regarding Forward-Looking Statements | | 40 |

Exchange Rates | | 42 |

Use of Proceeds | | 43 |

Dividend Policy | | 44 |

Capitalization | | 45 |

Dilution | | 46 |

Selected Consolidated Financial Data | | 48 |

Management's Discussion and Analysis of Financial Condition and Results of Operations | | 50 |

Business | | 71 |

Management | | 93 |

Related Party Transactions | | 108 |

Principal and Selling Shareholders | | 110 |

Description of Share Capital | | 113 |

Description of American Depositary Shares | | 128 |

Shares Eligible for Future Sale | | 138 |

Exchange Controls and Limitations Affecting Shareholders | | 140 |

Taxation | | 141 |

Underwriting | | 153 |

Expenses Related to this Offering | | 159 |

Legal Matters | | 159 |

Experts | | 159 |

Service of Process and Enforcement of Civil Liabilities | | 159 |

Where You Can Find More Information | | 160 |

Index to Financial Statements | | F-1 |

You should rely only on the information contained in this prospectus or contained in any free writing prospectus we file with the Securities and Exchange Commission, or the SEC. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the SEC. We are offering to sell, and seeking offers to buy, our ADSs only in jurisdictions where offers and sales of these securities are legally permitted. The information contained in this prospectus or in any free writing prospectus we file is accurate only as of its date, regardless of the time of delivery of this prospectus or of any sale of our ADSs. Our business, financial condition, results of operation and prospects may have changed since that date.

Until 25 days after the date of this prospectus, federal securities laws may require all dealers that buy, sell or trade the ADSs, whether or not participating in this offering, to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Table of Contents

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

All references in this prospectus to "U.S. dollars" or "$" are to the legal currency of the United States, all references to "€" or "euro" are to the currency introduced at the start of the third stage of the European economic and monetary union pursuant to the treaty establishing the European Community, as amended, and all references to "TW dollars" or "TWD" are to the New Taiwan dollar.

Unless otherwise indicated, the consolidated financial statements and related notes included in this prospectus have been prepared in accordance with International Accounting Standards and also comply with International Financial Reporting Standards, or IFRS, and interpretations issued by the International Accounting Standards Board, or IASB, which differ in certain significant respects from U.S. generally accepted accounting principles, or U.S. GAAP.

INDUSTRY AND MARKET DATA

This prospectus contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this prospectus from our own research as well as from industry and general publications, surveys and studies conducted by third parties, including Gartner, Inc. ("Gartner Research") and VDC Research Group, Inc. ("VDC Research"), some of which may not be publicly available. This data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty. We caution you not to give undue weight to such projections, assumptions and estimates.

The Gartner Report(s) described herein, (the "Gartner Report(s)") represent(s) data, research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner Research, and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this prospectus) and the opinions expressed in the Gartner Report(s) are subject to change without notice.

ii

Table of Contents

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. Before investing in our ADSs, you should read this entire prospectus carefully, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and congatec AG's consolidated financial statements and related notes, for a more complete understanding of our business and this offering. Except as otherwise required by the context, references to "congatec," "Company," "we," "us" and "our" are to congatec Holding AG and its subsidiaries, including congatec AG, on a consolidated basis.

Our Company

We are a leader in the design, development and delivery of high-performance embedded computing solutions that enable computing capabilities across a variety of system-level applications and end markets, including industrial automation, medical, entertainment, transportation and test and measurement. As a technology pioneer in our industry, we have grown to become the market share leader in Europe for the computer-on-module, or COM, segment of the embedded computing market, according to our view of the market and third-party research. Our deep technical expertise, combined with longstanding customer, processor partner and supplier relationships, positions us as a trusted provider for industry standard and custom embedded computing solutions. Our participation in the design, development and bringing to market of innovative embedded computing solutions has established what we believe is a track record of innovation by integrating complex central processing units, or processors, into flexible, high-performance computer modules that reduce our customers' system development costs and design risk as well as provide valuable time-to-market advantages. Our hardware solutions are overlaid with Basic Input Output System, or BIOS, software that tailors our solutions to specific end-market, application and customer requirements, while delivering benefits such as enhanced data throughput and system security as well as seamless integration within our customers' products. We are headquartered in Germany and have established a global presence through a network of design and service centers, allowing us to provide our customers with local development, implementation and sales support while maintaining a lean and efficient fabless manufacturing model.

Our technology focus over time has evolved to encompass a broad variety of high-performance embedded computing products and solutions. Within the embedded computing market, we provide one of the industry's largest COM portfolios across a range of form factors, or module sizes and shapes, including our COM Express, Qseven, XTX and ETX product families. We further distinguish ourselves with our recently launched industrial single board computer, or Industrial SBC, product family as well as our embedded design and manufacturing, or EDM, services, which provide our customers with customized module solutions. Our engineering-driven sales force guides our customers to select the module best suited to their individual requirements based on technical specifications including size, motherboard specification, power supply and number and type of peripheral ports. Our experienced engineers focus on improving key metrics such as power consumption, temperature tolerance, processing power and system security in order to help our customers meet their product development goals. We offer our customers comprehensive services, ranging from procurement assistance to process management and support integrating our modules into their end products. This complete solution approach and our relationships with processor partners and suppliers in the embedded computing market have allowed us to develop, enhance and expand our product portfolio and consistently offer our customers a competitive advantage. We believe this, along with our broad customer base and market share position, is a strong testament to the established reputation we enjoy in our industry for innovative technology, high-quality products, differentiated technical support, a comprehensive partner network and financial strength.

1

Table of Contents

The global merchant, or outsourced, embedded computing market is large and growing. The Internet of Things, or IoT, is enabling the next generation of computing whereby objects or endpoints interact with each other and their environment. IoT combines hardware, such as processors, sensors, actuators and wireless transmitters, with software optimized for "Big Data" analytics and real-time decision making. Industry 4.0, which refers to the emerging "smart factory" trend in Europe, builds on the foundation of IoT to drive the rise of new digital industrial technology that connects sensors, machines, equipment and IT systems along the value chain beyond a single enterprise. These connected systems can interact with one another using standard Internet-based protocols and will enable data to be gathered and analyzed across machines, creating faster, more flexible and more efficient processes to produce more reliable, higher quality goods at reduced costs. Our embedded computing solutions help to facilitate both IoT and Industry 4.0.

Our end markets' demand for IoT capabilities has created numerous opportunities for us built upon key themes such as Big Data, continuous connectivity and robust computing capabilities, which are all delivered in increasingly compact form factors. As the semiconductor industry continues to test the limits of Moore's Law, which suggests that the number of transistors on an integrated circuit doubles approximately every 18 to 24 months, processor technology will continue to grow in complexity, creating challenges for systems engineers outside of traditional computing applications to implement and unlock the potential of such processors. Harnessing the power of these advanced processors is critical to the emergence of IoT and Industry 4.0. We believe that we are well positioned to capitalize on these immediate and sustainable trends impacting the embedded computing industry.

We have longstanding relationships with the world's leading processor companies, including AMD, Freescale and Intel, which allow us to provide a broad suite of embedded computing solutions to our growing customer base. As a testament to our success, Intel has advised us that we are one of its largest European embedded computing partners and the first such partner worldwide to be certified for its Gateway IoT standard. In addition, AMD recently named us an Elite Partner, the highest designation in its Embedded Partner Program. These relationships provide us early access to the technical specifications and capabilities of new processors, which better allows us to integrate the latest processor technology into our embedded computing solutions, resulting in improved performance, cost savings, time to market advantages and greater process simplicity for our customers. In return, these processor companies benefit from our integration of their processors into our customers' end products, while minimizing their direct engineering, sales and after-market support needs. Our customers' applications fall outside of the processor vendors' core computing market and require more significant engineering and software and sales support due to the nature of the applications served. This has created a challenge for our processor partners, who recognize the growth potential of these market segments but are often not organized to efficiently pursue them. We have seized the opportunity to address this gap in the market. We extend the reach of our processor partners into emerging growth opportunities they are not positioned to support without us. We enable our customers to outsource critical physical design and programming challenges for their products, allowing them to focus on their core competencies such as product definition, system architecture and branding.

We have over 400 customers worldwide in a variety of industries, including our industrial customers such as Bernecker + Rainer, or B&R, Bosch and Siemens, as well as our medical customers such as General Electric and Samsung. We maintain close proximity to our broad and diverse customer base through a multi-channel sales strategy that utilizes both direct sales and a global network of independent sales representatives and distributors. Our direct sales force and application engineers are focused on securing design wins by supporting industry-leading original equipment manufacturer, or OEM, and original design manufacturer, or ODM, customers.

We offer five product families and have shipped more than 1.6 million modules since our inception in 2004. We operate under a fabless business model, meaning we outsource all of the manufacturing, assembly and testing of our products to third parties, enabling us to maintain a flexible and capital efficient

2

Table of Contents

business model. As of June 30, 2015, we had 184 employees worldwide, of which roughly one-third were in engineering related functions (research and development, technical support and quality management). We are headquartered in Deggendorf, Germany, and have established additional research and development, or R&D, centers in the Czech Republic, Taiwan and the United States. For the six months ended June 30, 2015 and June 30, 2014 and the fiscal years ended December 31, 2014 and December 31, 2013, we recorded revenue of $46.5 million, $39.7 million, $85.0 million and $70.2 million, respectively, and net income of $2.0 million, $1.0 million, $3.6 million and $3.7 million, respectively. Our revenue by geographic region for the year ended December 31, 2014 was 68.9% in Europe, the Middle East and Africa, or EMEA, 18.7% in the Asia-Pacific region, or APAC, and 12.4% in the Americas, as compared to 67.8% in EMEA, 19.5% in APAC and 12.7% in the Americas for the same period in 2013.

Our Industry

An embedded computing solution is a special-purpose, customizable solution that performs various functions and can be configured to address a number of requirements, including temperature tolerance, ruggedness, power consumption, size and reliability. Embedded computing solutions integrate processors on standardized form factors and modules and differ from general purpose computers, which are commonly used in consumer electronics and personal computing devices. Embedded computing solutions are generally integrated into a larger machine, device or appliance and are present in many industries, including industrial automation, medical, entertainment, transportation, test and measurement, retail and digital signage.

Embedded computing solutions are proliferating due to an increasing demand for intelligent and connected systems outside of traditional computing applications. While OEMs and ODMs desire to capitalize on increased processor speed in order to deliver superior system performance, they often lack the specialized engineering talent and knowledge to properly integrate the newest processor technology into their embedded system designs in a cost-effective and timely manner. As a result, OEMs and ODMs are increasingly outsourcing their embedded computing solutions to third parties.

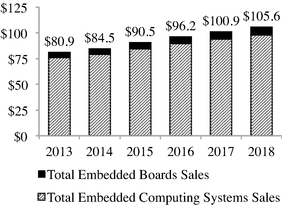

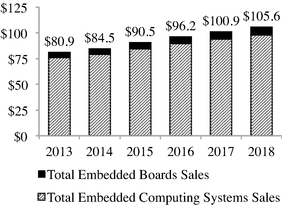

According to VDC Research and our own internal estimates, the worldwide market for embedded computing systems and boards was $80.9 billion in 2013 and is expected to grow at a compound annual growth rate, or CAGR, of more than 5% annually to $105.6 billion in 2018. According to VDC Research and our view of the market, we believe that 20% to 25% of the global embedded systems and boards market is outsourced. As a third-party provider, this outsourced portion is our addressable segment of the market.

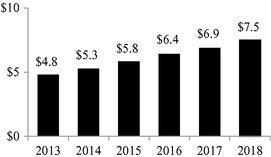

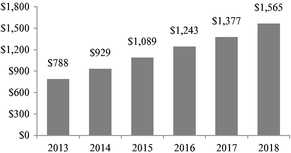

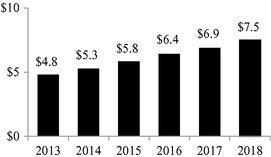

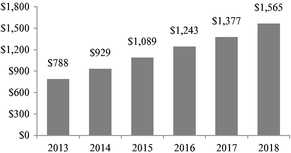

We primarily serve the COM and Industrial SBC sub-segments of the outsourced embedded market. COMs are embedded systems that incorporate the latest processor technology into industry-standard form factors such as COM Express, Qseven, XTX and ETX. Our Industrial SBCs are complete computer modules based on the xITX form factor, built on a single circuit board and that contain various features required of a fully functional computer. VDC Research estimates the COM market will grow from $788 million in 2013 to $1.6 billion in 2018, representing a CAGR of 15% while the outsourced Industrial SBC market, based on the xITX form factor, is estimated to increase from $387 million in 2013 to $839 million in 2018, representing a CAGR of 17%.

Our Competitive Strengths

We apply our strengths to enhance our position as a leading supplier of COM solutions, including our position as the market share leader in Europe, and as a new entrant to the Industrial SBC market. We consider our key strengths to include the following:

Technology leader within the embedded computing market. Our familiarity with industry standards and longstanding relationships with standard-setting consortium partners have helped us achieve a leadership position in the COM market. Our module expertise allows us to identify the best form factor, provide any

3

Table of Contents

necessary hardware or software modifications and advise on architectural improvement to our customers' systems. Our successful track record and insight into industry-shaping engineering trends have positioned us to contribute numerous advances to both the technological development and market adoption of standardized form factors within our industry.

Strategically and geographically positioned to capitalize on industry trends, including the adoption of IoT and Industry 4.0. Our solutions provide customers outside the traditional computing market with the opportunity to take advantage of advanced processing capabilities to build their own differentiated products. As IoT and Industry 4.0 continue to expand, the number of networked, heterogeneous systems in these end markets is expected to grow rapidly. Our value proposition and reputation for performance and quality position us to capitalize on this growth opportunity. In addition, Germany is a recognized global leader in industrial automation and is at the forefront of Industry 4.0 adoption, providing us a geographic advantage in addressing this emerging trend.

Broad and diversified module platform. Over the past decade, we have developed a large portfolio of COM modules and services that allow us to address diverse and evolving customer requirements and enable us to participate in a variety of attractive end markets, including industrial automation, medical, entertainment, transportation and test and measurement. In 2014, with the introduction of our Industrial SBC products, we meaningfully increased the breadth of our embedded computing portfolio, offering our customers a low-power, standalone solution that can be easily scaled and quickly integrated into their systems. Our customers depend on the high performance and reliability of our solutions for a variety of mission-critical applications.

Standardized form factor complemented by customizable software features and comprehensive service support. Our customers utilize standardized COM form factors to improve resource efficiency, limit design costs and accelerate time to market. We have been able to effectively differentiate our modules from those of our competitors by providing numerous feature sets through our application tailored BIOS software, as well as engineering services and logistical support throughout the design-in process. As part of our comprehensive solutions, we foster a collaborative engagement between our sales engineers and customers, who often rely on our expertise to unlock the potential of complex processor technology and software features for the benefit of our customers' own systems. Our skilled engineering team has helped alleviate complexity for our customers by shifting many processing requirements from hardware components to our software solutions.

Longstanding processor partner and customer relationships. We have developed key technology partnerships with the world's leading processor providers, including AMD, Freescale and Intel. Our technological advantages have allowed us to develop relationships with leading customers that rely on us to provide innovative modules, understand complex processor technology and provide critical services. We believe that leading industrial players are increasingly choosing our solutions to meet their mission-critical performance requirements because of our embedded security features that provide vital protection both within factory firewalls and on the machine level. Our solutions have been adopted by leading customers, including our industrial customers such as B&R, Bosch and Siemens, as well as our medical customers such as General Electric and Samsung.

Fabless embedded solutions provider. We operate a fabless business model with limited capital expenditures, enabling us to focus our resources on core competencies that differentiate our products. This model allows us to scale our business and enter new markets quickly, requiring less lead time to expand our operations. Since our inception, we have established several contract manufacturing relationships that have proven critical to our fabless model. These relationships provide us with high-quality, cost-effective modules that serve as the hardware backbone to our multifaceted solutions.

Experienced management and engineering teams. Our vision and direction are driven by our experienced management team and dedicated engineers. Our founders serve in senior leadership positions and

4

Table of Contents

continue to play a critical role in our development as a leading embedded computing solutions provider. The guidance of our management team and engineers continues to define and drive our competitive position in the market.

Our Growth Strategies

Our aim is to be one of the world's leading providers of embedded computing solutions. Key elements of our growth strategies include:

Continue to develop and bring to market leading products and standards. We will continue to invest in the development of high-performance embedded computing solutions that address evolving market demands for processing power, high speed connectivity, cost effectiveness, reliability, energy efficiency, security and enhanced graphics capabilities. We also intend to optimize our high-performance COM and Industrial SBC solutions for the latest processor technologies and internally developed software features, which will allow us to expand our product portfolio and address additional customer opportunities.

Continue to leverage expertise in high-growth end markets. Our hardware and software design expertise has allowed us to penetrate high-growth end markets, including industrial automation and medical. We continue to see these markets as primary drivers of our growth, particularly because they are likely to benefit from prominent technology trends, including IoT and Big Data. We have already seen these trends support our growth as Industry 4.0 has led to the demand for manufacturing equipment with advanced processing capabilities as Europe and other developed countries move toward smart factories.

Draw on expanding global footprint to catalyze growth opportunities in the United States and Asia. We are committed to continuing to grow our global footprint. Our growth to date has largely been driven by successfully executing on key opportunities in the European market, where we hold the leading market share position in COM, according to our view of the market and third-party research. While this will remain a significant focus in the future, we see an opportunity to gain market share in the United States and Asia. These markets have been key areas of investment for us for several years during which we have expanded our presence by adding key employees as well as distribution and sales representative relationships.

Continue to improve operational and financial efficiency. It is our goal to improve our operational efficiency and operating profit by leveraging our existing fixed-cost structure, increasing our purchasing power and continuing to optimize our supply chain. Leveraging manufacturing in best-cost countries has helped us drive financial efficiencies by mitigating burdensome overhead costs and preserving our financial flexibility for strategic opportunities. We also intend to increase our profitability through a higher margin product mix driven by new services and features.

Target complementary acquisitions. We may pursue acquisitions of companies, design teams and technologies to complement our existing strengths and execute on our established development goals. Any acquisitions we consider will be undertaken to supplement our broad product portfolio, increase the depth of our engineering and sales teams, expand our addressable market and improve our financial and operational metrics. We also plan to expand our presence globally, including in the United States and Asia, and may evaluate acquisition opportunities to accelerate our penetration of these international markets.

Recent Developments

Although our results for the three months ended September 30, 2015 have not yet been finalized, the following information reflects our preliminary expectations with respect to such results based on information available to us as of the date of this prospectus. For the three months ended September 30, 2015, we expect to report:

- •

- total revenue within the range of $24.5 to $25.0 million;

5

Table of Contents

- •

- gross profit within the range of $7.0 to $7.5 million;

- •

- a gross profit margin within the range of 28.5% to 30.0%;

- •

- Adjusted EBITDA within the range of $2.5 to $3.0 million; and

- •

- an Adjusted EBITDA margin within the range of 10.0% to 12.0%.

The preliminary results presented above reflect continued growth in sales to our targeted end markets. We have not identified any material change in the trends observed in our business and otherwise described in this prospectus during the three months ended September 30, 2015.

The preliminary financial data included in this prospectus has been prepared by, and is the responsibility of, congatec Holding AG's management. PricewaterhouseCoopers AG Wirtschaftsprüfungsgesellschaft has not audited, reviewed, compiled or performed any procedures with respect to accompanying preliminary financial data. Accordingly, PricewaterhouseCoopers AG Wirtschaftsprüfungsgesellschaft does not express an opinion or any other form of assurance with respect thereto. The data presented above is subject to the completion of our financial closing procedures, which have not yet been completed. This summary is not meant to be a comprehensive statement of our unaudited financial results for this period. Our actual results for this period will not be available until after this offering is completed and may differ materially from these preliminary estimates. For example, during the course of the preparation of the respective financial statements and related notes, items that would require material adjustments to be made to these preliminary estimates may be identified. Accordingly, you should not place undue reliance upon these preliminary estimates, as there can be no assurance that these estimates will be realized, and these estimates are subject to risks and uncertainties, many of which are not within our control. In addition, these estimates are not necessarily indicative of the results to be achieved for the remainder of the 2015 fiscal year or any future period. See "Risk Factors" and "Special Note Regarding Forward-Looking Statements." See "Summary Consolidated Financial and Other Data" for a reconciliation of profit for the period to Adjusted EBITDA for the year ended December 31, 2014 and our definition of Adjusted EBITDA margin.

Company History

congatec AG was founded in December 2004. congatec Holding AG was formed on June 30, 2015 and registered in the commercial register of the local court (Amtsgericht) of Munich under number HRB 219746 on July 22, 2015. Following an internal reorganization, congatec AG became a wholly owned subsidiary of congatec Holding AG (subject to the exercise of outstanding options under the existing employee stock option plan of congatec AG) and the former shareholders in congatec AG became its new shareholders, with the same pro rata participation as previously held in congatec AG. See "Description of Share Capital—Incorporation of the Company."

Our website iswww.congatec.com. This website address is included in this prospectus as an inactive textual reference only. The information and other content appearing on our website are not part of this prospectus. Our agent for service of process in the United States is Corporation Service Company, located at 1090 Vermont Avenue, N.W., Washington, DC 20005, telephone number (800) 927-9800.

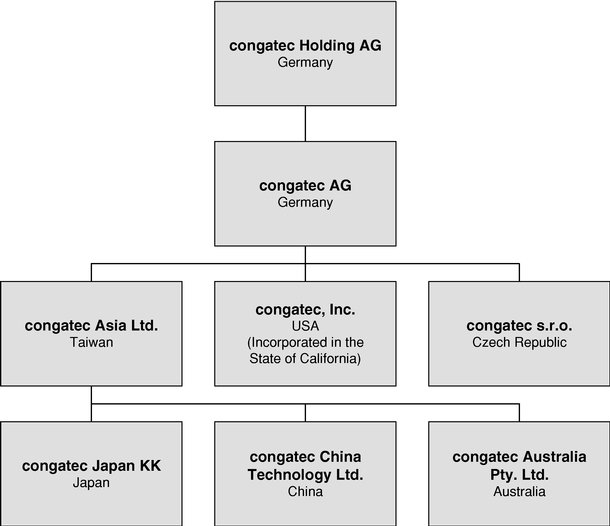

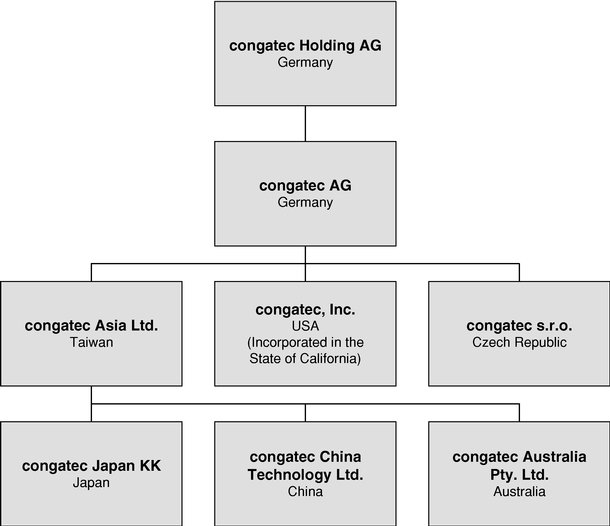

Organizational Chart

The following chart shows our organizational structure. All of the subsidiaries listed below are wholly owned by congatec Holding AG, with the exception of congatec AG, which is wholly owned subject to the exercise of

6

Table of Contents

outstanding options under the existing employee stock option plan of congatec AG. See "Management—Employee Stock Option Plans" and "Description of Share Capital—Incorporation of the Company."

Office Location

Our principal executive offices are located at Auwiesenstrasse 5, 94469 Deggendorf, Germany, and our telephone number is (49) 991 2700-0.

Our Risks and Challenges

You should carefully consider all of the information set forth in this prospectus prior to making an investment in our ADSs. Our ability to implement our business strategy is subject to numerous risks and uncertainties. Actual results could differ materially from our forward-looking statements due to a number of factors, including, without limitation, risks related to:

- •

- our dependence on the success of our customers and their sales to certain end markets;

- •

- our ability to develop and introduce new products and solutions or enhancements to existing products and solutions in line with developments in market technologies and demands;

- •

- the significant competition that we face in many aspects of our business;

- •

- our dependence upon sales to certain customers;

- •

- our dependence upon our relationship with Intel and our other processor partners;

- •

- our dependence upon the supply chain partners that procure, assemble and test our products;

7

Table of Contents

- •

- the availability of, and fluctuations in the price of, certain components and raw materials used in our products;

- •

- our ability to manage the expansion of our operations effectively in order to achieve our projected levels of growth;

- •

- our ability to retain key management or other key personnel or to recruit additional qualified personnel;

- •

- our ability to raise additional capital on attractive terms, or at all, if needed;

- •

- our ability to protect our know-how, trade secrets and other intellectual property;

- •

- the ability of our principal shareholders to exert significant influence over matters subject to shareholder approval due to their ownership of approximately 55.1% of our outstanding ordinary shares upon the consummation of this offering; and

- •

- the other risks described in the "Risk Factors" section of this prospectus and elsewhere in this prospectus.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue for our fiscal year ended December 31, 2014, we qualify as an "emerging growth company" as defined in Section 2(a) of the U.S. Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including but not limited to:

- •

- not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the SOX Act;

- •

- reduced disclosure obligations regarding executive compensation; and

- •

- not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements.

We may choose to take advantage of some or all of the available exemptions and have taken advantage of some of these exemptions in this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold shares. We do not know if some investors will find our ADSs less attractive as a result of our utilization of these or other exemptions. The result may be a less active trading market for our ADSs and increased volatility in the price of our ADSs.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We currently prepare our financial statements in accordance with IFRS, as issued by the IASB, which does not have separate provisions for publicly traded and private companies. However, in the event we convert to U.S. GAAP while we are still an emerging growth company, we may be able to take advantage of the benefits of this extended transition period.

We will remain an emerging growth company until the earliest of: (a) the last day of our fiscal year during which we had total annual gross revenue of at least $1.0 billion; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of ADSs in this offering; (c) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or (d) the date on which we are deemed to be a "large accelerated filer" under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided to emerging growth companies in the JOBS Act.

8

Table of Contents

THE OFFERING

| | |

American Depositary Shares offered: | | |

By congatec Holding AG | | 4,180,000 ADSs |

By the selling shareholders | | 1,274,988 ADSs |

ADSs to be outstanding immediately after this offering | | 5,454,988 ADSs |

Ordinary shares to be outstanding immediately after this offering | | 4,602,333 ordinary shares |

Offering price | | We currently estimate that the initial public offering price per ADS will be between $10.00 and $12.00. |

Option to purchase additional ADSs | | 818,236 ADSs from the selling shareholders |

The ADSs | | Each ADS represents one-quarter of an ordinary share. |

| | The depositary, the custodian or any of their respective nominees will hold the ordinary shares and any other rights or property underlying your ADSs. You will have rights as provided in the deposit agreement. You may cancel your ADSs and withdraw the underlying ordinary shares as provided, and pursuant to the limitations set forth in, the deposit agreement. The depositary will charge you fees for, among other acts, any such cancellation. In certain limited instances described in the deposit agreement, we may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the terms of the deposit agreement then in effect. |

| | To better understand the terms of the ADSs, you should carefully read the "Description of American Depositary Shares" section of this prospectus. You should also read the deposit agreement, which is an exhibit to the Registration Statement of which this prospectus forms a part. |

Depositary | | Citibank, N.A. |

Custodian | | Citigroup Global Markets Deutschland AG and any other custodian as may be appointed pursuant to the deposit agreement. |

Use of proceeds | | We expect to receive total net proceeds from this offering of approximately $39.0 million, after deducting the estimated underwriting discounts and commissions and estimated offering expenses (including corporate advisory fees) payable by us, assuming an initial offering price of $11.00 per ADS, the midpoint of the price range set forth on the cover page of this prospectus. We intend to use the net proceeds of this offering to expand our operations in the United States and Asia and for other general corporate purposes, including, without limitation, potential acquisitions. See "Use of Proceeds." |

9

Table of Contents

| | |

| | We will not receive any proceeds from the sale of ADSs offered by the selling shareholders. |

Dividend policy | | congatec Holding AG has never declared or paid any dividends to its shareholders and has no present intention of declaring or paying any dividends in the foreseeable future. See "Dividend Policy." |

Risk factors | | You should carefully read the information set forth in the "Risk Factors" section of this prospectus beginning on page 13 and the other information set forth in this prospectus before deciding to invest in the ADSs. |

Proposed NASDAQ Global Market Symbol | | "CONG" |

The number of our ordinary shares to be outstanding after this offering is based on the number of ordinary shares outstanding as of October 8, 2015 (the date of registration of our last capital increase prior to this offering in the commercial register) and excludes any ordinary shares that may be reserved for future issuance under a new equity incentive plan that we expect to implement subsequent to this offering. Unless otherwise indicated, all information in this prospectus assumes that the underwriters do not exercise their option to purchase additional ADSs from the selling shareholders. Estimated offering expenses payable by us presented in this prospectus do not take into account the effect of an indemnity and cost sharing agreement between us and the selling shareholders. See "Related Party Transactions."

10

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

We present below summary consolidated historical financial and other data of congatec AG, our wholly owned subsidiary (subject to the exercise of outstanding options under the existing employee stock option plan of congatec AG). The financial data as of and for the years ended December 31, 2014, 2013 and 2012 have been derived from congatec AG's audited consolidated financial statements and the related notes, which are included elsewhere in this prospectus and which have been prepared in accordance with IFRS as issued by the IASB and audited in accordance with the standards of the PCAOB. The financial data as of June 30, 2015 and 2014 and for the six months ended June 30, 2015 and 2014 have been derived from congatec AG's unaudited condensed interim consolidated financial statements and the related notes, which are included elsewhere in this prospectus.

The historical results presented below are not necessarily indicative of the financial results to be expected for any future periods. You should read this information in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Selected Consolidated Financial Data" and congatec AG's consolidated financial statements and related notes, each included elsewhere in this prospectus.

Consolidated Statement of Comprehensive Income:

| | | | | | | | | | | | | | | | |

| | Year Ended

December 31, | | Six Months Ended

June 30, | |

|---|

| | 2014 | | 2013 | | 2012 | | 2015 | | 2014 | |

|---|

| | ($ in thousands except per share data)

| |

|---|

Revenue | | $ | 85,020 | | $ | 70,175 | | $ | 60,780 | | $ | 46,533 | | $ | 39,694 | |

Cost of goods sold | | | 61,353 | | | 51,718 | | | 44,116 | | | 33,525 | | | 29,141 | |

| | | | | | | | | | | | | | | | | |

Gross profit | | | 23,667 | | | 18,457 | | | 16,664 | | | 13,008 | | | 10,553 | |

Research and development expenses (including impairment charges) | | | 4,787 | | | 4,174 | | | 2,805 | | | 2,030 | | | 2,189 | |

Selling and marketing expenses | | | 9,946 | | | 7,594 | | | 6,730 | | | 5,203 | | | 4,604 | |

General and administrative expenses | | | 4,367 | | | 4,627 | | | 3,878 | | | 2,901 | | | 2,072 | |

| | | | | | | | | | | | | | | | | |

Operating costs | | | 19,100 | | | 16,395 | | | 13,413 | | | 10,134 | | | 8,865 | |

Other operating income | | | (395 | ) | | (3,290 | ) | | (570 | ) | | (7 | ) | | (31 | ) |

Other operating expenses | | | 9 | | | 43 | | | 41 | | | 4 | | | 1 | |

Foreign exchange (gains) and losses, net | | | (293 | ) | | 121 | | | 155 | | | (12 | ) | | 146 | |

| | | | | | | | | | | | | | | | | |

Earnings before interest and taxes (EBIT) | | | 5,246 | | | 5,188 | | | 3,625 | | | 2,889 | | | 1,572 | |

Financial result(1) | | | 38 | | | 20 | | | 134 | | | (9 | ) | | (19 | ) |

| | | | | | | | | | | | | | | | | |

Earnings before taxes (EBT) | | | 5,208 | | | 5,168 | | | 3,491 | | | 2,880 | | | 1,553 | |

Income taxes | | | 1,611 | | | 1,477 | | | 1,288 | | | 879 | | | 598 | |

| | | | | | | | | | | | | | | | | |

Profit for the period | | $ | 3,597 | | $ | 3,691 | | $ | 2,203 | | $ | 2,001 | | $ | 955 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Other comprehensive income (loss) | | | 40 | | | (7 | ) | | (1 | ) | | 15 | | | (9 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total comprehensive income | | $ | 3,637 | | $ | 3,684 | | $ | 2,202 | | $ | 2,016 | | $ | 946 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Earnings per ordinary share | | | | | | | | | | | | | | | | |

Basic | | | 1.01 | | | 1.04 | | | 0.62 | | | 0.56 | | | 0.27 | |

Diluted | | | 0.99 | | | 1.02 | | | 0.61 | | | 0.55 | | | 0.26 | |

Earnings per ADS | | | | | | | | | | | | | | | | |

Basic(2) | | | 0.25 | | | 0.26 | | | 0.16 | | | 0.14 | | | 0.07 | |

Diluted(2) | | | 0.25 | | | 0.26 | | | 0.15 | | | 0.14 | | | 0.07 | |

Weighted average shares outstanding | | | | | | | | | | | | | | | | |

Basic | | | 3,557,333 | | | 3,557,333 | | | 3,557,333 | | | 3,557,333 | | | 3,557,333 | |

Diluted | | | 3,634,708 | | | 3,636,333 | | | 3,610,983 | | | 3,629,083 | | | 3,636,333 | |

- (1)

- Financial result is financial income less financial expense.

- (2)

- Each ADS represents one-quarter of an ordinary share.

11

Table of Contents

Selected Consolidated Statement of Financial Position Data:

| | | | | | | | | | | | | | | | |

| |

| |

| |

| | Six Months Ended June 30, | |

|---|

| | As of December 31, | |

|---|

| | 2015

(Actual) | | 2015

(As Adjusted)(1) | |

|---|

| | 2014 | | 2013 | | 2012 | |

|---|

| | ($ in thousands)

| |

|---|

Cash and cash equivalents | | $ | 8,184 | | $ | 6,786 | | $ | 2,753 | | $ | 6,266 | | $ | 45,277 | |

Current assets (excluding cash) | | | 16,503 | | | 12,752 | | | 10,487 | | | 20,662 | | | 20,662 | |

Intangible assets | | | 5,195 | | | 4,882 | | | 4,905 | | | 5,429 | | | 5,429 | |

Total assets | | | 31,426 | | | 25,611 | | | 19,165 | | | 34,055 | | | 73,066 | |

Debt | | | — | | | — | | | 660 | | | — | | | — | |

Total liabilities (excluding debt) | | | 13,775 | | | 9,340 | | | 6,004 | | | 14,380 | | | 14,380 | |

Shareholders' equity | | | 17,651 | | | 16,271 | | | 12,501 | | | 19,675 | | | 58,686 | |

Other Data:

| | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | Six Months Ended

June 30, | |

|---|

| | 2014 | | 2013 | | 2012 | | 2015 | | 2014 | |

|---|

| | ($ in thousands)

| |

|---|

EBITDA(2) | | $ | 7,109 | | $ | 7,235 | | $ | 5,062 | | $ | 4,004 | | $ | 2,387 | |

Adjusted EBITDA(2)(3) | | | 7,132 | | | 4,376 | | | 4,805 | | | 4,930 | | | 2,409 | |

- (1)

- Gives effect to the sale of 4,180,000 ADSs by us in this offering, assuming an initial public offering price of $11.00 per ADS, the midpoint of the price range set forth on the cover page of this prospectus.

- (2)

- Management believes that EBITDA (earnings before interest, taxes, depreciation and amortization) and Adjusted EBITDA are important supplemental measures of operating performance because they eliminate items that may have less bearing on our operating performance and highlight trends that may not otherwise be apparent when relying solely on IFRS financial measures. Management uses EBITDA and Adjusted EBITDA to evaluate our operating performance, generate future operating plans and make strategic decisions. We define EBITDA as profit for the period plus income taxes, financial result and depreciation and amortization. We define Adjusted EBITDA as EBITDA plus share-based compensation expenses plus/minus any non-recurring expenses or income. Disclosure in this prospectus of EBITDA and Adjusted EBITDA, which are non-IFRS financial measures, is intended as a supplemental measure of our performance that is not required by, or presented in accordance with, IFRS. EBITDA and Adjusted EBITDA should not be considered as an alternative to profit for the period or any other performance measure derived in accordance with IFRS. Our presentation of EBITDA and Adjusted EBITDA should not be construed to imply that our future results will be unaffected by unusual or non-recurring items.

12

Table of Contents

The following table reconciles profit for the period to EBITDA for the periods presented:

| | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | Six Months Ended

June 30, | |

|---|

| | 2014 | | 2013 | | 2012 | | 2015 | | 2014 | |

|---|

| | ($ in thousands)

| |

|---|

Profit for the period | | $ | 3,597 | | $ | 3,691 | | $ | 2,203 | | $ | 2,001 | | $ | 955 | |

Add/(deduct): | | | | | | | | | | | | | | | | |

Income tax expenses | | | 1,611 | | | 1,477 | | | 1,288 | | | 879 | | | 598 | |

Financial result | | | 38 | | | 20 | | | 134 | | | 9 | | | 19 | |

Depreciation and amortization | | | 1,863 | | | 2,047 | | | 1,437 | | | 1,115 | | | 815 | |

| | | | | | | | | | | | | | | | | |

EBITDA | | $ | 7,109 | | $ | 7,235 | | $ | 5,062 | | $ | 4,004 | | $ | 2,387 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (3)

- The following table reconciles EBITDA to Adjusted EBITDA for the periods presented:

| | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | Six Months Ended

June 30, | |

|---|

| | 2014 | | 2013 | | 2012 | | 2015 | | 2014 | |

|---|

| | ($ in thousands)

| |

|---|

EBITDA | | $ | 7,109 | | $ | 7,235 | | $ | 5,062 | | $ | 4,004 | | $ | 2,387 | |

Add/(deduct): | | | | | | | | | | | | | | | | |

Share-based compensation expenses | | | 38 | | | 86 | | | 64 | | | 8 | | | 22 | |

Non-recurring (income)/expenses(A) | | | (15 | ) | | (2,945 | ) | | (321 | ) | | 918 | | | — | |

| | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 7,132 | | $ | 4,376 | | $ | 4,805 | | $ | 4,930 | | $ | 2,409 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Adjusted EBITDA margin(B) | | | 8.4 | % | | 6.2 | % | | 7.9 | % | | 10.6 | % | | 6.0 | % |

- (A)

- Non-recurring expenses includes non-capitalized expenses of this offering and refunds from customs authorities of customs charges paid in previous years. See Note 8.4 to the consolidated financial statements of congatec AG included elsewhere in this prospectus.

- (B)

- Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by revenue.

13

Table of Contents

RISK FACTORS

Investing in our ADSs involves a high degree of risk. You should carefully consider the risks described below, which we believe are the material risks of our business, our industry, our intellectual property, the ADSs and this offering, before making an investment decision. If any of the following risks actually occurs, our business, financial condition and operating results could be harmed. In that case, the trading price of the ADSs could decline and you might lose all or part of your investment. In assessing these risks, you should also refer to the other information contained in this prospectus, including congatec AG's consolidated financial statements and the related notes thereto.

Risks Related to Our Business and Industry

We are highly dependent on the success of our customers and their sales to certain end markets.

Our customers are not the end users of our products and solutions, but rather they use our products and solutions as components within their products, which are ultimately sold to an end user. As a result, our success depends in large part on the ability of our customers to market and sell their end products that incorporate our products. If any of our customers' marketing efforts are unsuccessful or if our customers experience a decrease in demand for such products, our sales and/or profitability will be reduced. Some of the end markets in which our customers operate are characterized by intense competition, rapid technological change and economic uncertainty, and as such there is no guarantee that the revenue associated with the potential loss of a key end user will be replaced by the establishment of new business relationships by our customers. If we are unable to collaborate with and secure design wins with successful OEMs and ODMs, we may not create meaningful demand for our products. Moreover, if any of our customers choose to focus their efforts on programs and end products that do not incorporate our products and solutions, we may experience decreased demand for our products. Any of these circumstances may adversely affect our results of operations.

We also maintain strategic relationships with distributors to market certain of our products and solutions and support certain functionality. If we are unsuccessful in establishing or maintaining our strategic relationships with these distributors, our ability to compete in the marketplace, reach new customers and geographies and grow our revenue would be impaired and our operating results would suffer.

Not all new design wins lead to production, and even if they do, the timing of such production may not occur as we or our customers had estimated, or the volumes derived from such projects may not be as significant as we had estimated, which could have a substantial negative impact on our anticipated revenue and profitability.

Our product revenue expectations are highly dependent upon achieving successful design wins, moving those design wins to volume production and the market success of our customers' end products. The time between when we achieve a design win with a customer and when we begin shipping to that customer at production levels generally has been shortened with our standards-based model. However, with many new design wins, customers require us to assist them with the design process. In addition, customers may require significant time to integrate our products into their applications. The design process and the integration of customer specific applications can take six to eighteen months, and in some circumstances can take as long as 36 months. After that, there is an additional time lag from the start of production to achieving peak revenue. Not all design wins lead to production, and we may incur costs for designs that do not enter production. Even if a design win does lead to production, the volumes derived from such projects may be less than we had originally estimated. Customer projects related to design wins are sometimes canceled or delayed or can perform below original expectations, which can adversely impact anticipated revenue and profitability. In particular, the volumes and time to production associated with new design wins depend on the adoption rate of new technologies among end users. Program delays or cancellations could be more frequent during times of meaningful economic downturn or due to the

14

Table of Contents

consolidation of one or more of our customers. In addition, even if our customers are successful and sell a large number of their products to end users, their programs that involve our products may not be successful. Any of these factors could have a material adverse effect on our revenue and financial condition.

Our business depends on conditions in the end markets into which our products and solutions are sold. Demand in these markets can be volatile, and any inability to sell our products to these markets or forecast customer demand due to unfavorable or volatile market conditions could have a material adverse effect on our revenue and gross margin.

Our revenue is relatively concentrated in the industrial automation and medical end markets. Our revenue from the industrial automation end market represented 33.3%, 44.4%, 40.7%, 39.2% and 35.5% of our total revenue for the six months ended June 30, 2015 and 2014 and the years 2014, 2013 and 2012, respectively, and our revenue from the medical end market represented 11.9%, 14.8%, 14.7%, 14.2% and 13.3% of our total revenue for the six months ended June 30, 2015 and 2014 and the years 2014, 2013 and 2012, respectively. To the extent either of these end markets experiences a downturn and we, through our customers, are unable to penetrate and expand into other end markets, our results of operations may be adversely affected. Additionally, if any of these end markets develop alternatives to our customers' products that incorporate our products and solutions, it may adversely affect our results of operations.

If our customers experience adverse economic conditions in the end markets into which they sell products incorporating our products and solutions, we would expect a significant reduction in spending by these customers in addition to increased exposure to credit risk, which may limit our ability to collect our outstanding accounts receivable. In addition, customer demand for our products and solutions can be subject to significant fluctuation and volatility in certain end markets, particularly the entertainment end market. While we are expanding into additional market segments either through new product development projects with our existing customers or through new customer relationships, no assurance can be given that this strategy will be successful. If we overestimate demand, we may experience excess inventory levels. If we underestimate demand, we may miss sales opportunities and incur additional costs for labor overtime, equipment overuse and logistical complexities. Additionally, we have adverse purchase commitment liabilities pursuant to which we are contractually obligated to place a deposit with our contract manufacturer for the cost of aged or excess inventory used in the manufacture of our products and solutions for which there is no forecasted or alternative use. Unexpected decreases in customer demand or our inability to accurately forecast customer demand could result in increases in our adverse purchase commitment liability and have a material adverse effect on our gross margins and profitability.

Our failure to develop and introduce new products and solutions or enhancements to existing products and solutions on a timely basis and at competitive prices could harm our ability to attract and retain customers.

Our customers often operate in intensely competitive industries that are characterized by rapidly evolving technology, frequent product introductions and ongoing demands for greater performance and functionality. New products based on new or improved technologies or new industry standards in the end-user markets can render existing products and services of our customers obsolete and unmarketable and motivate them to seek our support in designing and manufacturing new products. We therefore must continually identify, design, develop and introduce new and updated products and solutions with improved features to remain competitive. To do this, we must:

- •

- design innovative and performance-improving features that differentiate our products and solutions from those of our competitors;

- •

- identify emerging technological trends in our target markets, including new standards for our products and solutions, in a timely manner;

- •

- accurately define and design new products and solutions to meet market needs;

- •

- anticipate changes in end-user preferences with respect to our customers' products;

15

Table of Contents

- •

- rapidly develop and produce our products and solutions at competitive prices;

- •

- anticipate and respond effectively to technological changes or product announcements by others; and

- •

- provide effective technological and post-sales support for our new products and solutions as they are deployed.

The process of developing new products and solutions and enhancing existing products and solutions is complex, lengthy, costly and uncertain. If we fail to anticipate our customers' changing needs or emerging technological trends, our market share and results of operations could materially suffer. We must make long-term investments, develop or obtain appropriate know-how and intellectual property and commit significant resources before knowing whether our predictions will accurately reflect customer demand for our products and solutions. If we are unable to adapt our products to new technological industry standards, to extend our core technologies into new applications or new platforms or to anticipate or respond to technological changes, the market's acceptance of our products and solutions could decline and our results could suffer. Additionally, any delay in the development, production, marketing or offering of a new product or application or an enhancement to an existing product or application could result in customer attrition or impede our ability to attract new customers, causing a decline in our revenue or earnings and weakening our competitive position.

Competition in the market for embedded computing solutions is intense. If we lose market share, our revenue and profitability may deteriorate.

We face competition in the design of embedded computing solutions from a number of sources globally, including our own customers, many of whom have the ability to design embedded computing solutions by utilizing their own internal resources. We believe that our customers will increase the proportion of solutions that they outsource in the coming years, but in order to continue achieving design wins and orders from these customers, we will need to continue to demonstrate the benefits of our solutions relative to similar products that could be developed in-house. We could also lose market share if customers who currently outsource to us elect to in-source all or a portion of the design process in the future. Historically, this has been influenced by customers achieving a certain volume of production. In addition, consolidation among our customers may cause material changes in their use of outsourcing.

We face competition from a large number of third-party competitors, including ADLink, Advantech, Kontron, MSC Technologies, Portwell, SECO and Technexion. The markets in which we operate are fragmented, with a few large, international companies competing both against each other and a large number of small and medium-sized companies that focus on a more select group of products and customers. Some of our current and potential competitors have a number of significant advantages over us, including:

- •

- a longer operating history;

- •

- greater name recognition and marketing power;

- •

- preferred vendor status with our existing and potential customers;

- •

- significantly greater financial, technical, personnel, sales and marketing and other resources, which allow them to respond more quickly to new or changing opportunities, technologies and customer requirements;

- •

- broader product and services offerings to provide more complete solutions; and

- •

- lower cost structures.

Consolidation among our competitors could also result in the formation of larger competitors with greater market share and greater financial and technological resources than us and further increase competition in the markets we serve.

As the market for embedded computing solutions grows, we may experience additional competition from companies that are currently our suppliers, customers and strategic partners, including electronic

16

Table of Contents

equipment manufacturers and our processor partners. As suppliers and customers operating in lower-margin end markets target new, more profitable end markets for growth opportunities, this risk will increase. New competitors may enter the market with relatively limited start-up time and capital, particularly if they employ a fabless manufacturing model. Because many of our products are based on industry standards, new competitors may be able to offer products that are similar to ours and, as a result, we may have difficulty differentiating our products from these competing products in our target markets. In addition, if a new form factor is developed, we may face significant competition from new and existing competitors if end products that we currently support are migrated to the new standard and we fail to adopt the new standard quickly or at all. Similarly, if processors that we do not currently use increase in popularity and take a larger share of the processor market, our competitors who have historically used these processor types could have a competitive advantage. If we are unable to compete effectively, this could adversely affect our revenue and financial condition.

As a result of the intense competition in the market for embedded computing solutions, we may encounter significant pricing pressure and/or suffer losses in market share. For example, our competitors have in the past and may again in the future lower prices in order to increase their market share, which would ultimately reduce the price we may realize from our customers. If we are unable to defend our market share by continually developing new products and solutions and/or reducing our own cost base, the pricing pressure exerted by competitors could cause us to lose important customers or lead to falling average selling prices, or ASPs, and declining margins. We may not be able to offset the effects of any price reductions with an increase in the number of products sold, cost reductions or otherwise, which could adversely affect our revenue and financial condition.

Because of the significant percentage of our sales to certain customers, the loss of, or a substantial decline in sales to, one of these customers could have a material adverse effect on our revenue and profitability.

During the first six months of 2015 and the years 2014, 2013 and 2012, we derived 41.5%, 41.8%, 50.3% and 52.7%, respectively, of our revenue from our five largest customers, with revenue attributable to our top customer, Bernecker + Rainer, or B&R, accounting for 16.5%, 22.0%, 21.2% and 19.3%, respectively. In addition, 11.0% of our revenue in 2013 was attributable to GAIUS Technology, one of our former distributors, while adp Gauselmann accounted for 14.4% of our revenue in the first half of 2015 and 14.4% of our revenue in 2012. GAIUS Technology and adp Gauselmann were among our five largest customers for each of 2014, 2013 and 2012. The loss of B&R or any other significant customer or a material reduction in the amount of business we undertake with B&R or any such other customer could have a material adverse effect on our revenue and profitability. There can be no assurance that our top customers will continue to purchase products from us at current levels or at all.

A change in our relationship with Intel or any of our other processor partners or the availability of state-of-the-art processors at competitive prices could materially adversely affect our business, financial condition and results of operations.

We depend on our relationships with the world's leading processor companies, including AMD, Freescale and Intel, and the suppliers from which we purchase their processors. Our relationships with these processor companies allow us to integrate their latest state-of-the-art processor technology into our products, resulting in improved performance, cost savings and process simplicity for our customers. The vast majority of processors used in our products are Intel processors. We benefit from a preferred relationship with Intel as a Platinum Member of the Intel Technology Provider program, which provides us early access to new processors and their technical specifications, enabling us to decrease the time to market for our products incorporating Intel's newest processors. We have a similar preferred relationship with AMD, recently being named as an Elite Partner in their Embedded Partner Program. If we were to lose our preferred status with AMD or Intel, our business could be materially adversely affected.

17

Table of Contents

We also depend upon the R&D efforts of our processor partners for the development of our new products. If our processor partners fail to adequately develop new products that meet the needs, specifications and expectations of the market and our customers, our revenue and profitability could be adversely affected. For example, if our processor partners cease to produce processors that are competitive from a technological and pricing standpoint, we may be unable to provide products that satisfy our customers' needs and therefore may fall behind competitors that have access to newer, more advanced processors from other sources.

As is customary in our industry, we do not have long-term supply contracts with our processor partners. Many of the framework agreements that we have with our suppliers can be terminated by either party without cause upon a short notice period. We may be unable to negotiate attractive terms with our suppliers in the future and may have difficulty establishing similar relationships with other processor suppliers. Historically, fluctuations in demand for processors have at times led to shortages in processor supply, which in turn have caused processor suppliers to allocate available processors more selectively among their customers. In the future, processor suppliers may allocate products to clients in other industries which source larger volumes, such as the automobile or consumer electronics industry, rather than to companies in the embedded computing industry. If there is an interruption in our supply of processors and we are unable to obtain suitable processors at competitive prices, we may experience delays in deliveries to our customers. We may also have delayed sales if any of these processor companies delay or cancel new technologies and products, which are often designed into our new products before they are available from our suppliers. Additionally, processor companies may choose to stop producing and selling certain processors that are used in our products and we may be unable to find other sources for the processors or adapt our products to use different processors. While it is common practice in the processor industry to provide 12 months' advance notice of such a product termination and to provide last time buy rights during the same 12 month period, industry practice may change, and our processor partners are not contractually obligated to provide notice to us. Any of these factors could have a material adverse effect on our business, results of operations and financial condition.

Because of the limited number of direct and indirect suppliers, or in some cases one supplier, for some of the components our contract manufacturers use, a loss of a supplier, a decline in the quality and/or a shortage in any of these components could have a material adverse effect on our profitability.

There are a limited number of direct and indirect suppliers, or in some cases, only one supplier, for some of the components that our contract manufacturers use in our products, and any disruption or delay in supply could adversely impact our financial performance. Because our suppliers have other customers, they may not have sufficient capacity to meet all of our needs during periods of excess demand. The recent global economic contraction has caused many of our suppliers to reduce their manufacturing capacity. As the global economy improves, our suppliers are experiencing and may continue to experience supply constraints until they expand capacity to meet increased levels of demand. These supply constraints may adversely affect the availability and lead times of components for our products. Increased lead times mean that we may have to order materials earlier and in larger quantities. Further, supply constraints will likely result in increased expediting and overall procurement costs as we attempt to meet customer demand requirements. In addition, these supply constraints may affect our ability, as well as our contract manufacturers' ability, to meet customer demand and thus result in missed sales opportunities and a loss of market share, negatively impacting revenue and our overall operating results.

We use a small number of strategically located supply chain partners to procure, assemble and test our products, and a loss or degradation in performance of our supply chain partners could have a material adverse effect on our business and financial condition.

We use a small number of strategically located supply chain partners, including EverFine Industrial Corporation Ltd., or EverFine, in Asia and Plexus Corp., or Plexus, in Europe. EverFine subcontracts the

18

Table of Contents

assembly and testing of our products and accounts for the vast majority of our purchase of goods. EverFine helps with our supply chain process primarily through their management of contract manufacturers in Taiwan. We maintain direct relationships with Intel and our other processor partners and are responsible for negotiating the pricing and other material terms for components used in our products. If any of our supply chain partners fails to adequately perform, our revenue and profitability could be adversely affected. In addition, if we are unable to replace our relationship with EverFine with a similar logistics provider or if we are unable to perform EverFine's services ourselves, our operating results could be materially affected.