UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23081

NorthStar Corporate Income Fund

(Exact name of registrant as specified in charter)

399 Park Avenue New York, New York (Address of principal executive offices) | | 10022 (Zip code) |

Daniel R. Gilbert

NorthStar Corporate Income Fund

399 Park Avenue

New York, New York 10022

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 547-2600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2016

Item 1. Report to Stockholders.

The semi-annual report (the “Semi-Annual Report”) of NorthStar Corporate Income Fund (the “Fund”) for the period from February 25, 2016 (commencement of operations) through June 30, 2016 transmitted to shareholders pursuant to Rule 30e-1 promulgated under the Investment Company Act of 1940, as amended (the “1940 Act”), is as follows:

2016 Semi-Annual Report NorthStar Corporate Income Fund For the period from February 25, 2016 (commencement of operations) through June 30, 2016 NorthStar Corporate Income

Table of Contents

NorthStar Corporate Income Fund

Semi-Annual Report for the period from February 25, 2016 (commencement of operations) through June 30, 2016:

NorthStar Corporate Income Fund

Unaudited Statement of Assets and Liabilities

| | | As of | |

| | | June 30, 2016 | |

| Assets | | | |

| Cash | | $ | 100,000 | |

| Total assets | | | 100,000 | |

| | | | | |

| Liabilities | | | | |

| Administrative services expense payable | | | 1,406 | |

| Accounting and administrative fee payable | | | 1,894 | |

| Accrued expenses and other liabilities | | | 2,882 | |

| Total liabilities | | | 6,182 | |

| Net assets | | $ | 93,818 | |

| | | | | |

| Commitments and Contingencies (Note 7) | | | | |

| | | | | |

| Composition of net assets | | | | |

| Common shares, par value $0.001 per share (300,000,000 shares authorized, 11,002 shares issued and outstanding at June 30, 2016) | | $ | 11 | |

| Paid-in capital in excess of par value | | | 99,989 | |

| Accumulated net investment income (loss) | | | (6,182 | ) |

| Net assets | | $ | 93,818 | |

| Net asset value per share | | $ | 8.53 | |

See notes to financial statements

NorthStar Corporate Income Fund

Unaudited Statement of Operations

| | | For the period

from February 25,

2016* through

June 30, 2016 | |

| | | | |

| Expenses: | | | | |

| Administrative services expense | | $ | 1,406 | |

| Accounting and administrative fee | | | 1,894 | |

| Other expenses | | | 2,882 | |

| Total expenses | | | 6,182 | |

| Net investment income (loss) | | | (6,182 | ) |

| | | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | (6,182 | ) |

| * | Commencement of operations |

See notes to financial statements

NorthStar Corporate Income Fund

Unaudited Statement of Changes in Net Assets

| | | For the period

from February 25,

2016* through

June 30, 2016 | |

| Increase (decrease) in net assets resulting from operations: | | | | |

| Net investment income (loss) | | $ | (6,182 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (6,182 | ) |

| | | | | |

| Capital transactions: | | | | |

| Issuance of common shares (11,002 shares) (Note 4) | | | 100,000 | |

| Net increase in net assets resulting from capital transactions | | | 100,000 | |

| Total increase (decrease) in net assets | | | 93,818 | |

| Net assets at beginning of period | | | — | |

| Net assets at end of period | | $ | 93,818 | |

| Accumulated net investment income (loss) | | $ | (6,182 | ) |

| * | Commencement of operations |

See notes to financial statements

NorthStar Corporate Income Fund

Unaudited Statement of Cash Flows

| | | For the period

from February 25,

2016* through

June 30, 2016 | |

| Cash flows from operating activities | | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | (6,182 | ) |

| | | | | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities: | | | | |

| | | | | |

| Increase (decrease) in operating assets and liabilities: | | | | |

| Increase (decrease) in administrative services expense payable | | | 1,406 | |

| Increase (decrease) in accounting and administrative fee payable | | | 1,894 | |

| Increase (decrease) in accrued expenses and other liabilities | | | 2,882 | |

| Net cash provided by (used in) operating activities | | | — | |

| | | | | |

| Cash flows from financing activities | | | | |

| Issuance of common shares (Note 4) | | | 100,000 | |

| Net cash provided by (used in) financing activities | | | 100,000 | |

| Net increase (decrease) in cash | | | 100,000 | |

| Cash, beginning of period | | | — | |

| Cash, end of period | | $ | 100,000 | |

| * | Commencement of operations |

See notes to financial statements

NORTHSTAR CORPORATE INCOME FUND

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

| 1. | Business and Organization |

NorthStar Corporate Income Fund, (the “Company”), was organized as a Delaware statutory trust on July 23, 2015. The Company’s investment objective is to offer an attractive total return while maximizing current income and capital appreciation consistent with the preservation of capital. The Company intends to invest substantially all of its net assets in NorthStar Corporate Income Master Fund and Subsidiary (the “Master Fund”). The Master Fund’s investment objective and strategies are identical to the Company’s. The Company’s unaudited financial statement should be read in conjunction with the attached unaudited consolidated financial statements for the Master Fund.

The Company commenced operations on February 25, 2016 when, together with NorthStar Corporate Income Fund-T, which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and whose principal investment strategy is to invest substantially all of its assets in the Master Fund, the Company’s registration statement was declared effective by the Securities and Exchange Commission (the “SEC”).

The Company and the Master Fund are externally managed by NSAM B-CEF Ltd, (the “Adviser”) which is a registered investment adviser under the Investment Advisers Act of 1940, as amended, (the “Advisers Act”). The Adviser is an affiliate of NorthStar Asset Management Group Inc. (“NorthStar”). The Master Fund and the Adviser engage OZ Institutional Credit Management LP (“OZ Credit Management” or the “Sub-Adviser”), which is a registered investment adviser under the Advisers Act, to serve as the Sub-Adviser. The Sub-Adviser is an affiliate of Och-Ziff Capital Management Group LLC.

In June 2016, NorthStar announced that it entered into a definitive merger agreement with NorthStar Realty Finance Corp. (“NorthStar Realty”) and Colony Capital, Inc. (“Colony”), providing for the combination of NorthStar, NorthStar Realty and Colony into a wholly-owned subsidiary of NorthStar, as the surviving publicly-traded company for the combined organization that, upon and following the effective time of the mergers, will be named Colony NorthStar, Inc. (“Colony NorthStar”). As a result of the mergers, Colony NorthStar will be an internally-managed equity REIT, with a diversified real estate and investment management platform. In addition, following the mergers, the Adviser and NorthStar Securities, LLC, the Company’s dealer manager (the “Dealer Manager”), will be subsidiaries of Colony NorthStar. This transaction is expected to close during the first quarter of 2017, subject to customary closing conditions, including regulatory approvals, and approval by the NorthStar, NorthStar Realty and Colony shareholders. There is no guarantee this transaction will close on the contemplated terms or within the anticipated timeframe, or at all.

The Company is registered under the 1940 Act, as a non-diversified, closed-end management investment company that intends to elect to be treated for federal income tax purposes, and intends to qualify annually thereafter, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

Pursuant to an administration agreement entered into by the Company and the Master Fund with State Street Bank and Trust Company (the “Administrator”), the Administrator provides the Company and the Master Fund with financial accounting and reporting, net asset value calculation, post-trade compliance, and treasury services.

NORTHSTAR CORPORATE INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

| 2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying unaudited financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair statement have been included. Operating results for the period from February 25, 2016 (commencement of operations) to June 30, 2016 are not necessarily indicative of the results that may be expected for the year ending December 31, 2016. The Company is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services – Investment Companies.

Investment in the Master Fund

The Company’s investment in the Master Fund will be recorded at fair value and will be based upon the Company’s percentage ownership of the common shares of the Master Fund. The performance of the Company will be directly affected by the performance of the Master Fund. As of June 30, 2016, the Company has not made any investment in the Master Fund.

Use of Estimates

The preparation of the Company’s unaudited financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimates.

Cash

Cash as of June 30, 2016 represents cash held at State Street Bank and Trust Company in a bank deposit account that, at times, may exceed federally insured limits.

Valuation of Portfolio Investments

The Company intends to invest substantially all of its net assets in the Master Fund. As such, the Company determines daily the net asset value (“NAV”) of its common shares of beneficial interest, or its common shares, based on the value of its interest in the Master Fund (as provided by the Master Fund). The Company calculates NAV per common share by subtracting total liabilities (including accrued expenses or distributions) from the total assets of the Company (the value of its interest in the Master Fund, plus cash or other assets, including interest and distributions accrued but not yet received) and dividing the result by the total number of outstanding common shares of the Company. See Note 2 to the consolidated financial statements of the Master Fund for information on the Master Fund’s policies regarding the valuation of its portfolio investments.

Revenue Recognition

Realized gains and losses from Master Fund transactions will be calculated on the specific identification basis. Master Fund transactions are recorded on the effective date of the subscription in or the redemption from the Master Fund. Distributions received from the Master Fund will be recorded on ex-dividend date.

NORTHSTAR CORPORATE INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Organization and Offering Costs

Organization costs include, among other things, the cost of formation, including the cost of legal services and other fees pertaining to the Company’s organization. These costs are expensed as incurred. Offering costs include, among other things, legal, accounting, printing and other costs pertaining to the preparation of the Company’s Registration Statement on Form N-2 related to the public offering of its common shares.

The Adviser and Sub-Adviser, either directly or through their affiliates, will be entitled to receive equal reimbursement for costs each has paid on behalf of the Company in connection with the offering. The Company will be obligated to reimburse the Adviser and Sub-Adviser, or their affiliates, as applicable, for organization and offering costs (“O&O costs”) to a limit of 1.0% of the aggregate proceeds from the offering, after the payment of selling commissions and dealer manager fees. The Company estimates that it will incur approximately $30.0 million of O&O costs if the maximum number of shares is sold. The Company records O&O costs each period based upon an allocation determined by the expectation of total O&O costs to be reimbursed. In addition, the Company indirectly bears its pro rata portion of O&O costs incurred by the Master Fund based on its ownership of the Master Fund shares. The offering costs incurred directly by the Company are accounted for as a deferred charge and are amortized over 12 months on a straight-line basis. As of June 30, 2016, the Adviser and Sub-Adviser incurred approximately $2.5 million of O&O costs on behalf of the Company. For the period from February 25, 2016 (commencement of operations) to June 30, 2016, there were no proceeds raised from the offering and no O&O costs were allocated to the Company.

Income Taxes

The Company intends to elect to be treated for federal income tax purposes as a RIC under Subchapter M of the Code. Because the Company will invest substantially all of its assets in the Master Fund, the Company will generally qualify as a RIC if the Master Fund qualifies as a RIC. To maintain qualification as a RIC, the Company and the Master Fund must, among other things, meet certain source-of-income and asset diversification requirements and distribute to their respective shareholders, for each taxable year, at least 90% of its “investment company taxable income” and its net tax-exempt interest income. In general, a RIC’s “investment company taxable income” for any taxable year is its taxable income, determined without regard to net capital gains and with certain other adjustments. As a RIC, the Company will not have to pay corporate-level federal income taxes on any income that it distributes to its shareholders. The Company and the Master Fund intend to distribute all or substantially all of their “investment company taxable income,” net tax-exempt interest income (if any) and net capital gains (if any) on an annual basis in order to maintain their RIC status each year and to avoid any federal income taxes on income. The Company will also be subject to nondeductible federal excise taxes if it does not distribute at least 98% of net ordinary income, 98.2% of any capital gain net income (if any).

Uncertainty in Income Taxes

The Company evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax benefits or liabilities in the financial statements. Recognition of a tax benefit or liability with respect to an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Company recognizes interest and penalties, if any, related to unrecognized tax liabilities as income tax expense in the Statement of Operations. During the period from February 25, 2016 (commencement of operations) to June 30, 2016, the Company did not incur any interest or penalties.

NORTHSTAR CORPORATE INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Class Accounting

Investment income, common expenses and realized/unrealized gain or loss on investments in the Master Fund will be allocated to various classes of the Company on the basis of net assets of each class.

Distributions

Distributions to the Company’s shareholders are recorded as of the record date. Subject to the discretion of the Company’s board of trustees (the “Board”) and applicable legal restrictions, the Company intends to authorize and declare ordinary cash distributions on a bi-monthly basis and pay such distributions on a monthly basis. Such ordinary cash distributions are expected to be paid using ordinary cash distributions received from the Master Fund, net of any Company operating expenses. From time to time, the Company intends to authorize and declare special cash distributions of net long-term capital gains, if any, and any other income, gains and dividends and other distributions not previously distributed. Such special cash distributions are expected to be paid using special cash distributions received from the Master Fund. During the period from February 25, 2016 (commencement of operations) to June 30, 2016 distributions were neither declared nor paid.

Distribution Reinvestment Plan (“DRP”)

The Company has adopted an “opt in” distribution reinvestment plan pursuant to which shareholders may elect to have the full amount of their cash distributions reinvested in additional shares. Participants in the DRP are free to elect to participate or terminate participation in the DRP within a reasonable time as specified in the DRP. If a shareholder does not elect to participate in the DRP, the shareholder will automatically receive any distributions the Company declares in cash. The Company expects to issue shares pursuant to the DRP at the bi-monthly closing conducted on the day of or immediately following each monthly distribution payment date at a price equal to the NAV per share that is used to determine the offering price of the shares on the date of such bi-monthly closing. Shares issued pursuant to the DRP will have the same voting rights as shares offered pursuant to the prospectus.

New Accounting Standards

Management does not believe any recently issued, but not yet effective, accounting standards, if currently adopted, would have a material effect on the accompanying financial statements.

In January 2016, affiliates of NorthStar and OZ Credit Management purchased shares of the Company. Refer to Note 4 for further detail.

Status of Continuous Public Offering

Since commencing its continuous public offering on February 25, 2016 (commencement of operations) through June 30, 2016, the Company has not sold any shares to the public.

Share Repurchase Program

To provide shareholders with limited liquidity, the Company intends to conduct quarterly repurchases of shares. Each repurchase offer will generally be conducted in parallel with similar repurchase offers made by the Master Fund with respect to the Master Fund shares. The first offer to repurchase shares from

NORTHSTAR CORPORATE INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

shareholders is expected to occur in the first full calendar quarter after shares are first sold to the public. In months in which the Company repurchases shares, the Company will conduct repurchases on the same date that the Company holds its first bi-monthly closing for the sale of shares in its offering. Any offer to repurchase shares will be conducted solely through written tender offer materials mailed to each shareholder (and not through this prospectus) in accordance with the requirements under Rule 13e-4 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Company’s quarterly repurchases will be conducted on such terms as may be determined by the Board in its complete and absolute discretion unless, in the judgment of the independent trustees, such repurchases would not be in the best interests of shareholders or would violate applicable law. The Board also will consider the following factors, among others, making its determination for whether the Company may offer to repurchase shares and under what terms:

| · | the effect of such repurchases on the Company’s and/or the Master Fund’s qualification as a RIC (including the consequences of any necessary asset sales); |

| · | the liquidity of the Company’s assets (including fees and costs associated with disposing of assets); |

| · | the Master Fund’s investment plans; |

| · | the Company’s and the Master Fund’s working capital requirements; |

| · | the Company’s history in repurchasing shares or portions thereof; and |

| · | the condition of the securities markets. |

The Company currently intends to limit the number of shares to be repurchased on each date of repurchase to the number of shares the Company can repurchase with, in the Board’s sole discretion, (i) the aggregate proceeds it has received from the issuance of shares pursuant to its DRP for the previous calendar quarter, and/or (ii) the aggregate proceeds it has received from the sale of shares at the previous two bi-monthly closings that occurred, or were scheduled to occur (if no proceeds were actually received), immediately prior to the date upon which the notification to repurchase shares was provided to shareholders. The Board may, in its sole discretion, determine to limit the number of shares to be repurchased to an amount that is greater than or less than the amounts described above. The Company will further limit the number of shares to be repurchased in any calendar quarter to 5.0% of the weighted average number of shares outstanding in the previous full calendar quarter prior to the date upon which the notification to repurchase shares was provided to shareholders. In addition, beginning with the Company’s second calendar year of operations, the Company will limit the number of shares to be repurchased in any calendar year to 20.0% of the weighted average number of shares outstanding in the prior calendar year. The Company will offer to repurchase such shares at a price equal to the NAV per share in effect on each date of repurchase.

The Company’s assets consist primarily of its interest in Master Fund shares. Therefore, in order to finance the repurchase of its common shares pursuant to the repurchase offers, the Company may find it necessary to liquidate all or a portion of its interest in Master Fund shares. As a result, the Company will not conduct a repurchase offer for common shares unless the Master Fund simultaneously conducts a repurchase offer for Master Fund shares. The members of the Company’s Board also serve on the Master Fund’s Board, and the Master Fund’s Board expects that the Master Fund will conduct repurchase offers for Master Fund shares as necessary to permit the Company to meet its intentions under its share repurchase program. However, there can be no assurance that the Master Fund’s Board will, in fact, decide to undertake any repurchase offers.

During the period from February 25, 2016 (commencement of operations) to June 30, 2016, there were no repurchase of the Company’s shares.

NORTHSTAR CORPORATE INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

| 4. | Related Party Transactions |

Compensation of the Adviser and Sub-Adviser

The Company will not incur a separate management fee (“Management Fee”) or incentive fee (“Incentive Fee”) under the Company’s advisory agreement (the “Advisory Agreement”) for so long as the Company has a policy to invest all or substantially all of its net assets in the Master Fund, but the Company and shareholders will be indirectly subject to the Management Fee and Incentive Fee. Pursuant to the Master Fund’s Advisory Agreement, and in consideration of the advisory services provided by the Adviser to the Master Fund, the Adviser will be entitled to a fee consisting of two components — the Management Fee and the Incentive Fee. The Management Fee will be calculated and payable quarterly in arrears at the annual rate of 2.0% of the Master Fund’s average gross assets, excluding cash and cash equivalents, at the end of the two most recently completed calendar quarters (and, in the case of the Master Fund’s first quarter, the gross assets excluding cash and cash equivalents as of such quarter-end). The Incentive Fee will be calculated and payable quarterly in arrears based upon the Master Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, measured quarterly and expressed as a rate of return on the Master Fund’s “adjusted capital” after making appropriate adjustments for subscriptions (which shall include all issuances of common shares, including issuances pursuant to the distribution reinvestment plan) and share repurchases that occurred during the quarter, equal to 1.75% per quarter (7.00% annualized), subject to a “catch-up” feature. See Note 4 to the consolidated financial statements of the Master Fund attached hereto for a detailed description of the incentive fees payable by the Master Fund to the Adviser.

The Adviser and Sub-Adviser are to each be reimbursed by the Company, as applicable, for actual costs incurred in connection with providing administrative services to the Company. Allocation of the cost of such services to the Company may be based on objective factors such as total assets, revenues and/or time allocations. The Master Fund’s sub-advisory agreement (the “Sub-Advisory Agreement”) provides that the Sub-Adviser will receive a portion of the Management Fee and Incentive Fee payable to the Adviser under the Master Fund’s Advisory Agreement.

On an annualized basis, the Sub-Adviser will be paid 50.0% of all fees payable to the Adviser under the Master Fund’s Advisory Agreement with respect to each year, and such fees are payable to the Adviser quarterly in arrears.

Selling Commissions and Dealer Manager Fees

Pursuant to a dealer manager agreement (the “Dealer Manager Agreement”) between the Company and the Dealer Manager, an affiliate of the Adviser, an investor will pay the Dealer Manager:

| (i) | selling commissions up to 6.0% and dealer manager fees up to 2.0% of the selling price of the Class A Shares for which a sale is completed, |

| (ii) | dealer manager fees up to 2.0% of the selling price of Class D Shares for which a sales is completed, but no selling commissions, and |

| (iii) | no selling commissions or dealer manager fees for the purchase of Class I Shares. |

Under the DRP, no selling commissions or dealer manager fees are payable. The selling commissions and dealer manager fees may be reduced or waived in connection with certain categories of sales, such as sales eligible for a volume discount, sales through investment advisers or banks acting as trustees or fiduciaries, and sales to affiliates of the Adviser or Sub-Adviser. For the period from February 25, 2016 (commencement of operations) to June 30, 2016 no selling commissions and dealer manager fees were paid to the Dealer Manager because there were no shares sold to the public during this period.

NORTHSTAR CORPORATE INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Distribution Support Agreement

Pursuant to a distribution support agreement (the “Distribution Support Agreement”) between the Master Fund and NorthStar Realty, a publicly-traded real estate investment trust (“REIT”) managed by an affiliate of the Adviser, and OZ Corporate Investors, LLC (“OZ Corporate”), an affiliate of the Sub-Adviser, NorthStar Realty and OZ Corporate have each agreed to purchase up to $5.0 million in Master Fund shares, totaling $10.0 million in Master Fund shares, from time to time at the current NAV per share of the Master Fund, of which $1.0 million was contributed by each to the Master Fund as seed capital investments. During any calendar month when the Distribution Support Agreement is effective, if the cash distributions exceed the net investment income for such calendar month (“Distribution Shortfall”), NorthStar Realty and OZ Corporate will each purchase 50% of any shares required in order to cover the Distribution Shortfall up to an amount equal to a 7.0% cumulative, non-compounded annual return on Master Fund’s shareholders’ invested capital prorated for such month.

Notwithstanding NorthStar Realty and OZ Corporate pursuant to the Distribution Support Agreement, the Master Fund will not be required to pay distributions to the Master Fund shareholders, including the Company, at a rate of 7.0% per annum or at all. Distributions funded from offering proceeds pursuant to the Distribution Support Agreement may constitute a return of capital. The Distribution Support Agreement expires at the earlier of: a) two years from the date on which the Company commences the offering; b) the date upon which neither the Adviser nor its affiliate is serving as the Master Fund’s Adviser; or c) the date upon which neither the Sub-Adviser nor its affiliate is serving as the Master Fund’s Sub-Adviser. For the period from February 25, 2016 (commencement of operations) to June 30, 2016, there were no distribution support provided by NorthStar Realty and OZ Corporate.

Capital Contribution by NorthStar and OZ Corporate

On January 27, 2016, affiliates of NorthStar and OZ Corporate each contributed $50,000 to purchase 5,501 common shares of Class A of the Company at a price of $9.09 per share. The related dealer manager fees and selling commissions were waived.

For the period from February 25, 2016 (commencement of operations) to June 30, 2016, distributions were neither declared nor paid.

NORTHSTAR CORPORATE INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

The following is a schedule of financial highlights for the period from February 25, 2016 (commencement of operations) to June 30, 2016:

| | | For the period from

February 25, 2016

(commencement of

operations) through | |

| | | June 30, 2016

(Unaudited) | |

| Per Share Data: | | | | |

| Net asset value, beginning of period | | $ | 9.09 | |

| Net investment income (loss)(1) | | | (0.56 | ) |

| Net realized and unrealized gain (loss) on investments | | | – | |

| Net increase (decrease) in net assets resulting from operations | | | (0.56 | ) |

| Net asset value, end of period | | $ | 8.53 | |

| Shares outstanding, end of period | | | 11,002 | |

| Total return at net asset value(2)(3) | | | (6.2 | )% |

| | | | | |

| Ratio/Supplemental Data: | | | | |

| Net assets, end of period | | $ | 93,818 | |

| Ratio of net investment income (loss) to average net assets(4) | | | (18.2 | )% |

| Ratio of total expenses to average net assets(4) | | | 18.2 | % |

| Portfolio turnover rate of the NorthStar Corporate Income Master Fund(3) | | | 29.6 | % |

| (1) | The per share data was derived by using the average number of common shares outstanding during the period from February 25, 2016 (commencement of operations) to June 30, 2016. |

| (2) | The total return is historical and is calculated by determining the percentage change in net asset value. |

| (4) | Annualized. Average daily net assets for the period from February 25, 2016 (commencement of operations) to June 30, 2016 are used for this calculation. |

| 7. | Commitments and Contingencies |

In the normal course of business the Company may enter into contracts that contain a variety of representations which provide general indemnifications. The Company’s maximum exposure under the arrangements cannot be known; however, the Company expects any risk of loss to be remote.

The management of the Company has evaluated events and transactions through August 12, 2016, the date on which the financial statements were issued, and has determined that there are no material events that would require adjustments to or disclosure in the Company’s financial statements.

NORTHSTAR CORPORATE INCOME FUND

SUPPLEMENTAL INFORMATION (UNAUDITED)

June 30, 2016

Board Consideration and Approval of Investment Advisory and Sub-Advisory Agreements

At an in-person combined meeting of the Boards of Trustees (the “Board”) of NorthStar Corporate Income Master Fund, NorthStar Corporate Income Fund (the “Multi-Class Fund”), and NorthStar Corporate Income Fund-T (“T-Fund”) (each a “Fund” and, collectively with the Master Fund, the “Funds”) held on January 15, 2016, the Board, including all of the trustees who are not “interested persons” of the Company, as that term is defined in the 1940 Act (the “Independent Trustees”), considered the approval of each Fund’s investment advisory agreement (the “Advisory Agreements”) between each Fund and NSAM B-CEF Ltd (the “Adviser”) and each Fund’s investment sub-advisory agreement (the “Sub-Advisory Agreements”) between each Fund and OZ Institutional Credit Management LP (the “Sub-Adviser”).

In its consideration of the Advisory Agreements and Sub-Advisory Agreements, the Board, including the Independent Trustees, did not identify any single factor as all-important or controlling, and the following summary does not detail all the matters considered.

Nature, Extent and Quality of Services. The Board examined the nature, extent and quality of the services to be provided by the Adviser and the Sub-Adviser to each Fund, including any administrative or other services. The Board considered a presentation regarding the Master Fund’s investment strategies. The Board discussed the nature of the Adviser’s and the Sub-Adviser’s operations, the quality of the Adviser’s and the Sub-Adviser’s compliance infrastructures and the experience of their respective fund management personnel, which for the Adviser will be made available through staffing agreements with affiliates of the Adviser’s parent company. The Board concluded that the Adviser and the Sub-Adviser have the ability to provide a level of service consistent with the Board’s expectations.

Performance. With respect to performance, the Board discussed the fact that each of the Adviser and the Sub-Adviser is a newly-formed company and had no data to provide with respect to closed-end funds managed. However, the Board discussed the background and experience of the Fund’s proposed portfolio managers and investment personnel. The Board further considered that the Sub-Adviser has previously managed strategies similar to those to be employed by the Funds in different investment vehicles. The Board also discussed the targeted performance of the Funds. The Board concluded that, based on the experience of each Fund’s proposed portfolio managers, including their extensive backgrounds in related industries, the Adviser and the Sub-Adviser each has a reasonable expectation of delivering acceptable performance to shareholders.

Fees and Expenses. The Board engaged in a lengthy discussion with the Adviser and Sub-Adviser regarding the proposed fee arrangement for the Master Fund, including a discussion regarding both the Management Fee and the Incentive Fee. The Board considered that, on an annualized basis, the Sub-Adviser would be paid 50.0% of all fees payable annually to the Adviser under the Fund’s Advisory Agreement. In addition, the Board discussed the process by which the Adviser, the Sub-Adviser or their respective affiliates will be reimbursed for certain expenses incurred in connection with providing services to the Funds, including certain administrative services as stipulated in the Advisory Agreements and the Sub-Advisory Agreements, respectively. The Board noted that neither the Multi-Class Fund nor the T-Fund would pay an advisory fee as long as each Fund continued to invest substantially all of its assets in the Master Fund. The Board also considered comparative data with respect to advisory fees or similar expenses paid by other non-traded closed-end funds with similar investment objectives.

NORTHSTAR CORPORATE INCOME FUND

SUPPLEMENTAL INFORMATION (UNAUDITED)

June 30, 2016

Economies of Scale. The Board considered whether there will be economies of scale in respect of the management of the Master Fund. It was the consensus of the Board that based on the anticipated size of the Master Fund for the initial two years of the Advisory Agreements, economies of scale was not a relevant consideration at this time.

Profitability. The Board considered the anticipated profits to be realized by the Adviser and the Sub-Adviser in connection with the operation of the Master Fund and whether the amount of profit is a fair entrepreneurial profit for the management of the Master Fund. The Board also noted that any projection of profits is speculative. The Board also considered the expected impact of the Agreement to Limit Reimbursements to the Adviser. It was noted that pursuant to a separate Agreement to Limit Reimbursements to the Adviser with each of the Funds, the Adviser contractually agreed that each Fund would only bear up to 1.0% of the organization and offering expenses, with any organization and offering expenses beyond that limitation to be equally absorbed by the Adviser and the Sub-Adviser. The Board concluded that each of the Adviser’s and the Sub-Adviser’s expected level of profitability from their respective relationships with the Master Fund was not expected to be excessive.

Conclusion. The Board approved each of the Advisory Agreements and each of the Sub-Advisory Agreements for an initial two-year term. The Board’s decision to approve each Advisory Agreement and each Sub-Advisory Agreement reflects the exercise of its business judgment to enter into such agreements.

NORTHSTAR CORPORATE INCOME FUND

SUPPLEMENTAL INFORMATION (UNAUDITED)

June 30, 2016

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

The Company has not had any changes in or disagreements with its independent registered public accounting firm on accounting or financial disclosure matters since its inception.

Form N-Q Filings

The Company files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Company’s Forms N-Q are available on the SEC’s website at http://www.sec.gov. The Company’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room located at 100 F Street, NE, Washington, DC 20549. Shareholders may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330.

Proxy Voting Policies and Procedures

The Company has delegated its proxy voting responsibility to OZ Institutional Credit Management LP, the Company’s investment sub-adviser. Shareholders may obtain a copy of OZ Institutional Credit Management LP’s proxy voting policies and procedures upon request and without charge by calling the Company toll free 877-940-8777 or on the SEC’s website at http://www.sec.gov.

Proxy Voting Record

Information regarding how OZ Institutional Credit Management LP voted proxies relating to the Company’s portfolio securities during the most recent twelve-month period ended June 30 is available upon request without charge by making a written request to the Company’s Chief Compliance Officer at NorthStar Corporate Income Fund, 399 Park Avenue, New York, New York 10022, Attn: Chief Compliance Officer, by calling the Company toll free 877-940-8777 or on the SEC’s website at http://www.sec.gov.

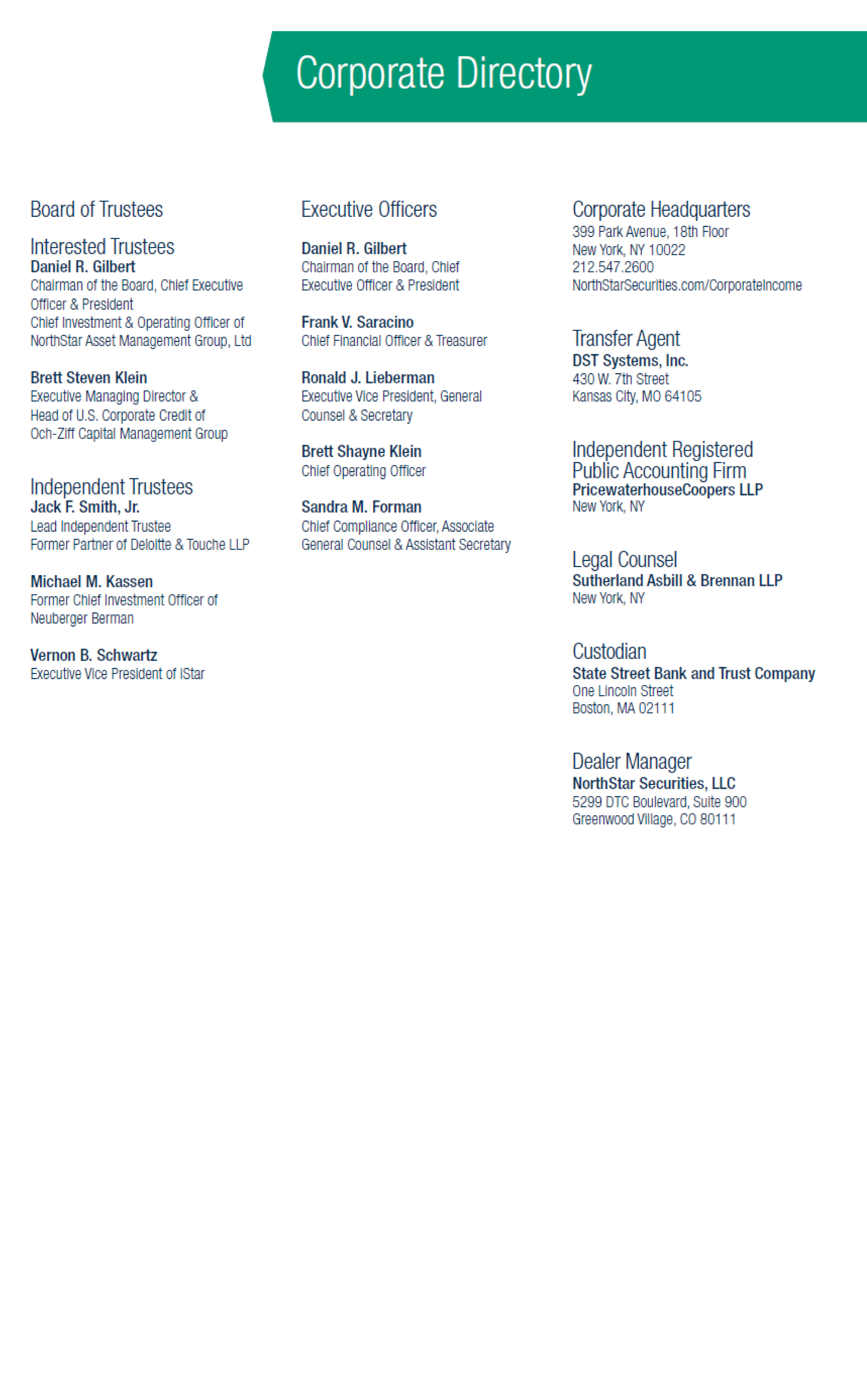

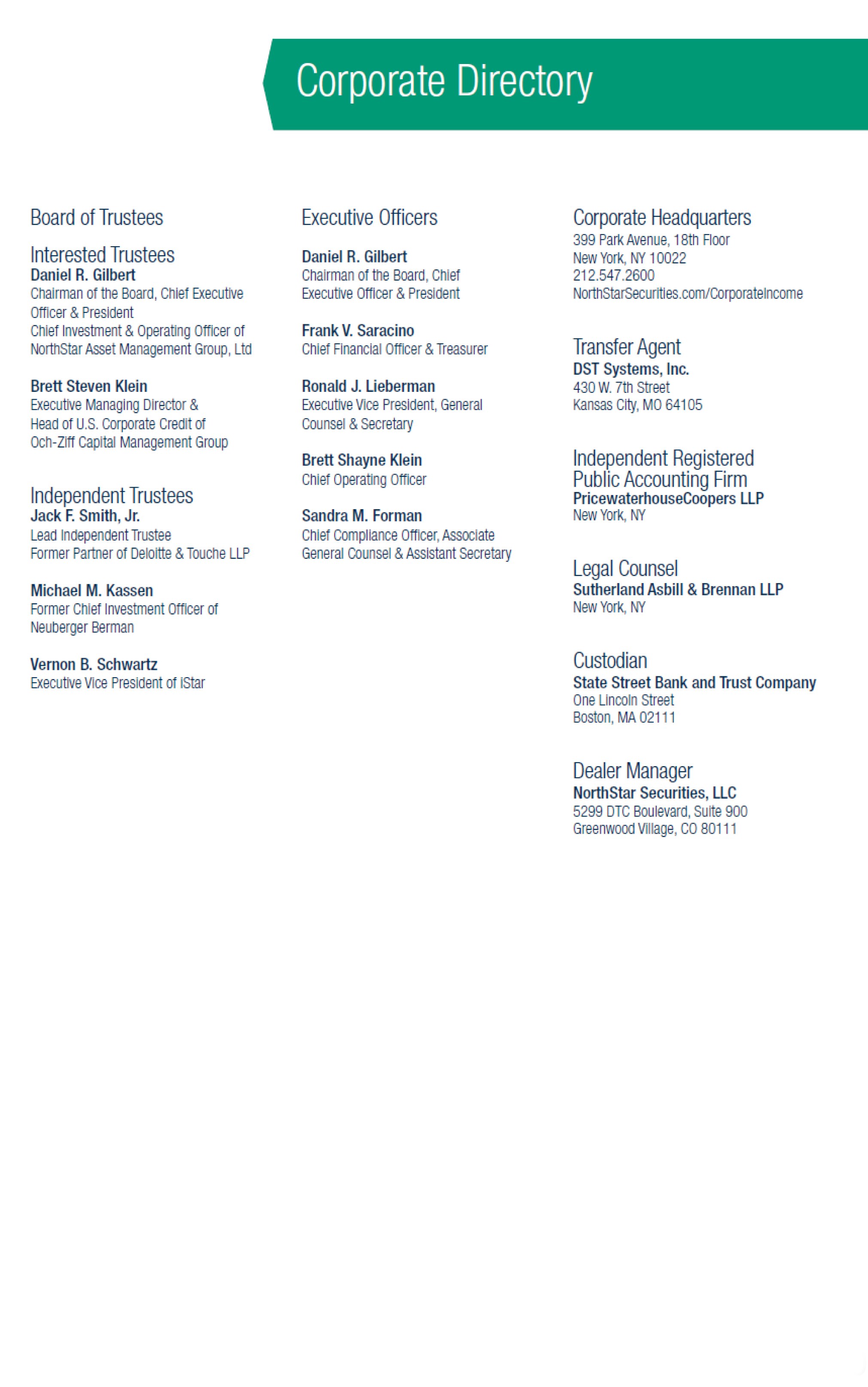

Corporate Directory Board of Trustees Interested Trustees Daniel R. Gilbert Chairman of the Board, Chief Executive Officer & President Chief Investment & Operating Officer of NorthStar Asset Management Group, Ltd Brett Steven Klein Executive Managing Director & Head of U.S. Corporate Credit of Och-Ziff Capital Management Group Independent Trustees Jack F. Smith, Jr. Lead IndependentTrustee Former Partner of Deloitte & Touche LLP Michael M. Kassen Former Chief Investment Officer of Neuberger Berman Vernon B. Schwartz Executive Vice President of IStar Executive Officers Daniel R. Gilbert Chairman of the Board, Chief Executive Officer & President Frank V. Saracino Chief Financial Officer & Treasurer Ronald J. Lieberman Executive Vice President, General Counsel & Secretary Brett Shayne Klein Chief Operating Officer Sandra M. Forman Chief Compliance Officer, Associate General Counsel & Assistant Secretary Corporate Headquarters 399 Park Avenue, 18th Floor New York, NY 10022 212.547.2600 NorthStarSecurities.com/CorporateIncome Transfer Agent DST Systems, Inc. 430 W. 7th Street Kansas City, MO 64105 Independent Registered Public Accounting Firm PricewaterhouseCoopers LLP New York, NY Legal Counsel Sutherland Asbill & Brennan LLP New York, NY Custodian State Street Bank and Trust Company One Lincoln Street Boston, MA 02111 Dealer Manager NorthStar Securities, LLC 5299 DTC Boulevard, Suite 900 Greenwood Village, CO 80111

NorthStar Corporate Income Fund 399 Park Avenue, 18th Floor New York, NY 10022 877.940.8777 Tel 303.648.5142 Fax NorthStarSecurities.com/CorporateIncome

2016 Semi-Annual Report NorthStar Corporate Income Master Fund For the period from February 25, 2016 (commencement of operations) through June 30, 2016 NorthStar Corporate Income

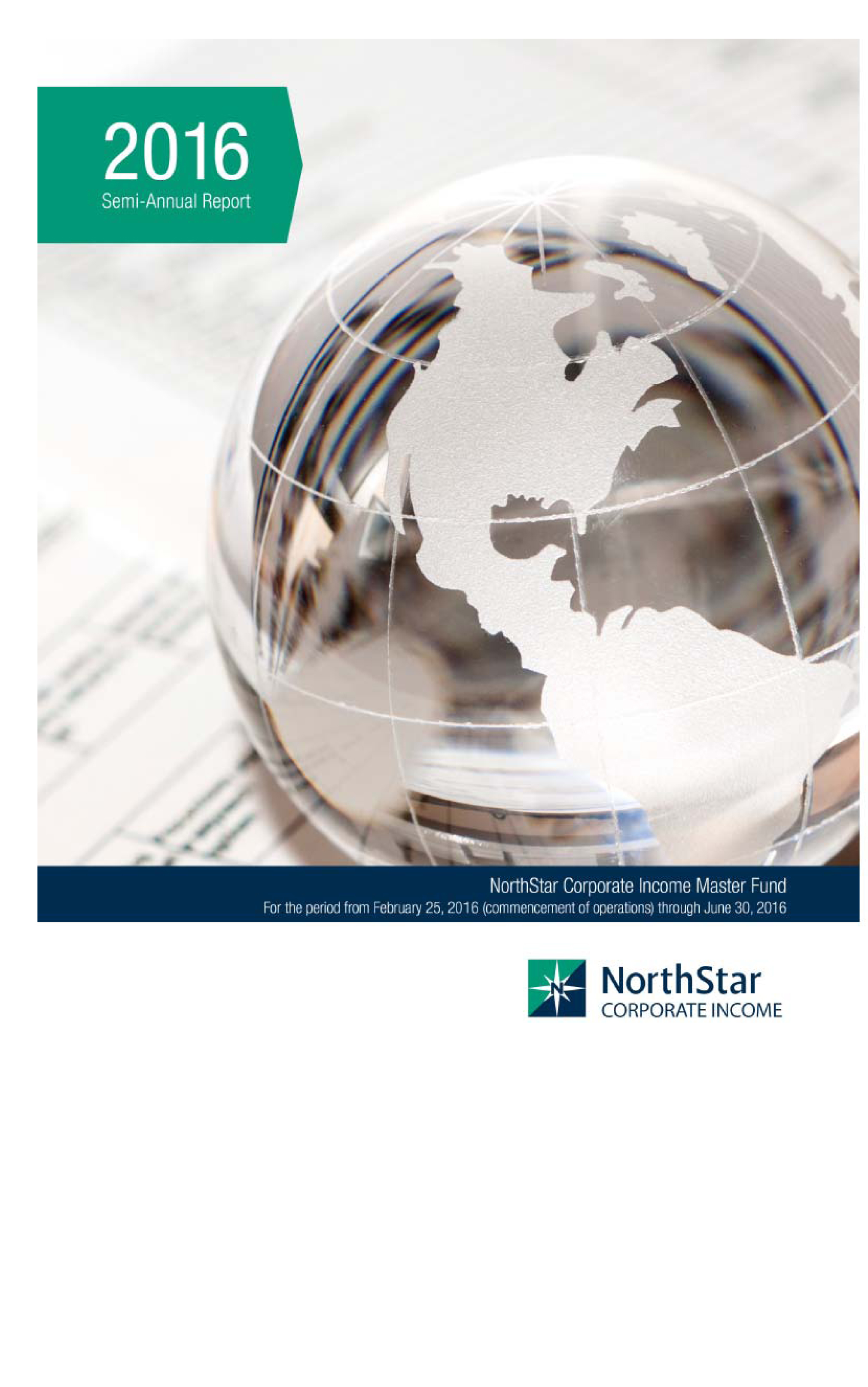

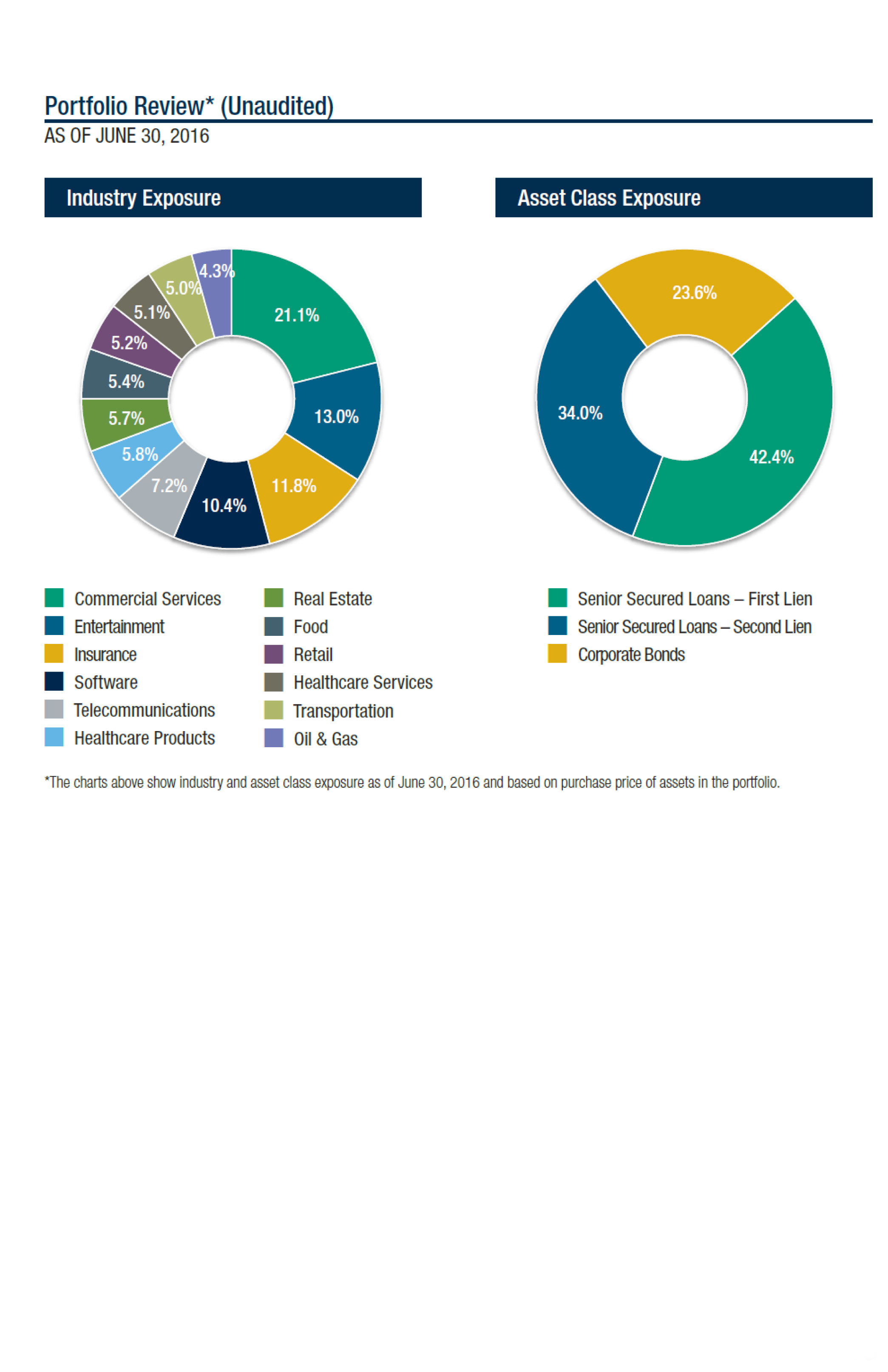

Portfolio Review* (Unaudited) AS OF JUNE 30, 2016 Industry Exposure 21.1% Commercial Services 13.0% Entertainment 11.8% Insurance 10.4% Software 7.2% Telecommunications 5.8% Healthcare Products 5.7% Real Estate 5.4% Food 5.2% Retail 5.1% Healthcare Services 5.0% Transportation 4.3% Oil & Gas Asset Class Exposure 42.4% Senior Secured Loans – First Lien 34.0% Senior Secured Loans – Second Lien 23.6% Corporate Bonds * The charts above show industry and asset class exposure as of June 30, 2016 and based on purchase price of assets in the portfolio.

Table of Contents

NorthStar Corporate Income Master Fund and Subsidiary

Semi-Annual Report for the period from February 25, 2016 (commencement of operations) through June 30, 2016:

NorthStar Corporate Income Master Fund and Subsidiary

Unaudited Consolidated Schedule of Investments

As of June 30, 2016

| | | Footnotes | | Industry (b) | | Rate(c) | | | Floor (d) | | | Stated

Maturity | | Principal

Amount | | | Amortized

Cost (e) | | | Fair Value(f) | |

| Senior Secured Loans - First Lien — 33.2% | | | | | | | | | | | | | | | | | | | | | | |

| CBAC Borrower, LLC | | (g) | | Entertainment | | | | | | | | | | 7/2/20 | | $ | 99,749 | | | $ | 96,757 | | | $ | 94,263 | |

| Cunningham Lindsey U.S. Inc. | | (g) | | Insurance | | | | | | | | | | 12/10/19 | | | 77,296 | | | | 63,382 | | | | 62,609 | |

| David's Bridal, Inc. | | (g) | | Retail | | | | | | | | | | 10/11/19 | | | 77,500 | | | | 71,106 | | | | 69,750 | |

| Laureate Education, Inc. | | (g) | | Commercial Services | | | | | | | | | | 6/15/18 | | | 77,298 | | | | 75,365 | | | | 75,108 | |

| Opal Acquisition, Inc. | | (h) | | Healthcare-Services | | | L + 400 | | | | 1.00 | % | | 11/27/20 | | | 77,483 | | | | 70,248 | | | | 68,088 | |

| Pinnacle Holdco S.a.r.l. | | (g) | | Oil & Gas Services | | | | | | | | | | 7/30/19 | | | 77,300 | | | | 58,361 | | | | 59,327 | |

| St. Georges University | | (g) | | Commercial Services | | | | | | | | | | 6/2/22 | | | 77,500 | | | | 76,338 | | | | 77,306 | |

| Syncreon Global Finance (US) Inc. | | (g) | | Transportation | | | | | | | | | | 10/28/20 | | | 77,302 | | | | 68,799 | | | | 67,253 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Senior Secured Loans - First Lien | | | | | | | | | | | | | | | | | 580,356 | | | | 573,704 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior Secured Loans - Second Lien — 26.4% | | | | | | | | | | | | | | | | | | | | | | |

| Asurion LLC | | (g) | | Insurance | | | | | | | | | | 3/3/21 | | | 100,000 | | | | 97,875 | | | | 96,700 | |

| CTI Foods Hlolding Co., LLC | | (g) | | Food | | | | | | | | | | 6/28/21 | | | 77,500 | | | | 73,625 | | | | 69,750 | |

| DTZ U.S. Borrower, LLC | | (g) | | Real Estate | | | | | | | | | | 11/4/22 | | | 77,500 | | | | 78,275 | | | | 77,855 | |

| Greenway Medical Technologies, Inc. | | (g) | | Software | | | | | | | | | | 11/4/21 | | | 77,500 | | | | 69,944 | | | | 67,425 | |

| Renaissance Learning, Inc. | | (g) | | Software | | | | | | | | | | 4/11/22 | | | 77,500 | | | | 72,850 | | | | 70,525 | |

| USAGM HoldCo LLC | | (g) | | Commercial Services | | | | | | | | | | 7/28/23 | | | 77,500 | | | | 72,850 | | | | 74,142 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Senior Secured Loans - Second Lien | | | | | | | | | | | | | | | | | 465,419 | | | | 456,397 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Bonds — 18.7% | | | | | | | | | | | | | | | | | | | | | | |

| Greatbatch Ltd. | | (i) | | Healthcare-Products | | | 9.13 | % | | | | | | 11/1/23 | | | 78,000 | | | | 79,069 | | | | 78,585 | |

| Intelsat Jackson Holdings | | (g) (i) | | Telecommunications | | | 8.00 | % | | | | | | 2/15/24 | | | 100,000 | | | | 98,000 | | | | 98,688 | |

| Monitronics International Inc. | | | | Commercial Services | | | 9.13 | % | | | | | | 4/1/20 | | | 78,000 | | | | 65,173 | | | | 64,545 | |

| Scientific Games International | | | | Entertainment | | | 10.00 | % | | | | | | 12/1/22 | | | 100,000 | | | | 82,012 | | | | 81,063 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Corporate Bonds | | | | | | | | | | | | | | | | | | | | | 324,254 | | | | 322,881 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS—78.3% | | | | | | | | | | | | | | | | $ | 1,370,029 | | | $ | 1,352,982 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES—21.7% | | | | | | | | | | | | | | | | | | | | | 374,393 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS—100.0% | | | | | | | | | | | | | | | | | | | | $ | 1,727,375 | |

| (a) | Security may be an obligation of one or more entities affiliated with the named company. |

| (b) | Industry classification information is based on the Global Industry Classification Standard (“GICS”). |

| (c) | Certain variable rate securities in NorthStar Corporate Income Master Fund and Subsidiary's (the "Master Fund") portfolio bear interest at a rate determined by a publicly disclosed base rate plus a basis point spread. As of June 30, 2016, the three-month London Interbank Offered Rate (“L” or “LIBOR”) was 0.65%. |

| (d) | Represents a minimum interest rate for respective base interest rate index when determining the total interest rate. |

| (e) | Amortized cost represents the original cost adjusted for the amortization of premiums and/or accretion of discounts, as applicable, on investments. |

| (f) | Fair value is determined by the valuation committee of the Master Fund, and approved by the Master Fund's board of trustees. For information on the Master Fund’s policy regarding valuation of investments, fair value hierarchy levels and other significant accounting policies, please refer to Note 2. |

| (g) | Position or portion thereof unsettled as of June 30, 2016. |

| (h) | The interest rate is subject to a base rate plus three-month LIBOR. As the interest rate is subject to a minimum LIBOR floor which was greater than the three-month LIBOR rate at June 30, 2016, the prevailing rate in effect as of June 30, 2016 was the base rate plus the LIBOR floor. |

| (i) | Represents a security registered under Regulation S. Bonds sold under Regulation S may not be offered, sold or delivered within the U.S., or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. |

See notes to consolidated financial statements

NorthStar Corporate Income Master Fund and Subsidiary

Unaudited Consolidated Statement of Assets and Liabilities

| | | As of

June 30, 2016

(Unaudited) | |

| Assets | | | | |

| Investments, at fair value | | | | |

| Unaffiliated issuers (amortized cost $1,370,029) | | $ | 1,352,982 | |

| Cash | | | 1,653,819 | |

| Receivable for investments sold | | | 400,031 | |

| Interest receivable | | | 7,211 | |

| Total assets | | | 3,414,043 | |

| | | | | |

| Liabilities | | | | |

| Payable for investments purchased | | | 1,473,285 | |

| Management fee payable | | | 1,635 | |

| Administrative services expense payable | | | 69,010 | |

| Trustees fee payable | | | 62,970 | |

| Accounting and administrative fee payable | | | 34,098 | |

| Accrued expenses and other liabilities | | | 45,670 | |

| Total liabilities | | | 1,686,668 | |

| Net assets | | $ | 1,727,375 | |

| | | | | |

| Commitments and Contingencies (Note 10) | | | | |

| | | | | |

| Composition of net Assets | | | | |

| Common shares, par value $0.001 per share (unlimited shares authorized, 222,222 shares issued and outstanding at June 30, 2016) | | $ | 222 | |

| Paid-in capital in excess of par value | | | 1,999,778 | |

| Accumulated net investment income (loss) | | | (257,984 | ) |

| Accumulated net realized gain (loss) on investments | | | 2,406 | |

| Net unrealized appreciation (depreciation) on investments | | | (17,047 | ) |

| Net assets | | $ | 1,727,375 | |

| Net asset value per share | | $ | 7.77 | |

See notes to consolidated financial statements

NorthStar Corporate Income Master Fund and Subsidiary

Unaudited Consolidated Statement of Operations

| | | For the period

from February 25,

2016* through

June 30, 2016

(Unaudited) | |

| Investment Income: | | | | |

| Interest income | | $ | 1,845 | |

| Total investment income | | | 1,845 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 1,635 | |

| Administrative services expense | | | 69,010 | |

| Trustees fee | | | 109,416 | |

| Accounting and administrative fee | | | 34,098 | |

| Other expenses | | | 45,670 | |

| Total expenses | | | 259,829 | |

| Net investment income (loss) | | | (257,984 | ) |

| | | | | |

| Realized and unrealized gain (loss): | | | | |

| Net realized gain (loss) from: | | | | |

| Investment transactions | | | 2,406 | |

| Net change in unrealized appreciation (depreciation) from: | | | | |

| Investments | | | (17,047 | ) |

| Net gain (loss) on investment transactions | | | (14,641 | ) |

| Net increase (decrease) in net assets resulting from operations | | $ | (272,625 | ) |

| * | Commencement of Operations |

See notes to consolidated financial statements

NorthStar Corporate Income Master Fund and Subsidiary

Unaudited Consolidated Statement of Changes in Net Assets

| | | For the period

from February 25,

2016* through

June 30, 2016

(Unaudited) | |

| Increase (decrease) in net assets resulting from operations: | | | | |

| Net investment income (loss) | | $ | (257,984 | ) |

| Net realized gain (loss) on investment transactions | | | 2,406 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (17,047 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (272,625 | ) |

| | | | | |

| Capital transactions: | | | | |

| Issuance of common shares (222,222 shares) (Note 4) | | | 2,000,000 | |

| Net increase in net assets resulting from capital transactions | | | 2,000,000 | |

| Total increase (decrease) in net assets | | | 1,727,375 | |

| Net assets at beginning of period | | | — | |

| Net assets at end of period | | $ | 1,727,375 | |

| Accumulated net investment income (loss) | | $ | (257,984 | ) |

| * | Commencement of Operations |

See notes to consolidated financial statements

NorthStar Corporate Income Master Fund and Subsidiary

Unaudited Consolidated Statement of Cash Flows

| | | For the period

from February 25,

2016* through

June 30, 2016

(Unaudited) | |

| Cash flows from operating activities | | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | (272,625 | ) |

| | | | | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities: | | | | |

| Purchases of investments | | | (1,767,589 | ) |

| Proceeds from sales of investments and principal repayments | | | 400,049 | |

| Net realized (gain) loss from investment transactions | | | (2,406 | ) |

| Net change in unrealized (appreciation) depreciation on investments | | | 17,047 | |

| Amortization of premium and accretion of discount, net | | | (83 | ) |

| | | | | |

| Increase (decrease) in operating assets and liabilities: | | | | |

| (Increase) decrease in receivable for investments sold | | | (400,031 | ) |

| (Increase) decrease in interest receivable | | | (7,211 | ) |

| Increase (decrease) in payable for investments purchased | | | 1,473,285 | |

| Increase (decrease) in management fee payable | | | 1,635 | |

| Increase (decrease) in administrative services expense payable | | | 69,010 | |

| Increase (decrease) in trustees fee payable | | | 62,970 | |

| Increase (decrease) in accounting and administrative fee payable | | | 34,098 | |

| Increase (decrease) in accrued expenses and other liabilities | | | 45,670 | |

| Net cash provided by (used in) operating activities | | | (346,181 | ) |

| | | | | |

| Cash flows from financing activities | | | | |

| Issuance of common shares (Note 4) | | | 2,000,000 | |

| Net cash provided by (used in) financing activities | | | 2,000,000 | |

| Net increase (decrease) in cash | | | 1,653,819 | |

| Cash, beginning of period | | | — | |

| Cash, end of period | | $ | 1,653,819 | |

| | | | | |

| Supplemental and non-cash financing activities | | | | |

| Net amortization of premium and accretion of discount on investments | | $ | 83 | |

| * | Commencement of Operations |

See notes to consolidated financial statements

NORTHSTAR CORPORATE INCOME MASTER FUND AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. Business and Organization

NorthStar Corporate Income Master Fund, (the “Fund”), was organized as a Delaware statutory trust on July 23, 2015. The Fund’s investment objective is to offer an attractive total return while maximizing current income and capital appreciation consistent with the preservation of capital.

The Fund commenced operations on February 25, 2016, when the registration statements of NorthStar Corporate Income Fund (the “Multi-Class Fund”), and NorthStar Corporate Income Fund-T (“T-Fund”) (collectively, the “Companies”), whose principal investment strategy is identical to the Fund’s, were declared effective by the Securities and Exchange Commission (the “SEC”).

The Fund is externally managed by NSAM B-CEF Ltd, (the “Adviser”) which is a registered investment adviser under the Investment Advisers Act of 1940, as amended, (the “Advisers Act”). The Adviser is an affiliate of NorthStar Asset Management Group Inc. (“NorthStar”). The Fund and the Adviser engage OZ Institutional Credit Management LP, (“OZ Credit Management” or the “Sub-Adviser”) which is a registered investment adviser under the Advisers Act, to serve as the Sub-Adviser. The Sub-Adviser is an affiliate of Och-Ziff Capital Management Group LLC.

In June 2016, NorthStar announced that it entered into a definitive merger agreement with NorthStar Realty Finance Corp. (“NorthStar Realty”) and Colony Capital, Inc. (“Colony”), providing for the combination of NorthStar, NorthStar Realty and Colony into a wholly-owned subsidiary of NorthStar, as the surviving publicly-traded company for the combined organization that, upon and following the effective time of the mergers, will be named Colony NorthStar, Inc. (“Colony NorthStar”). As a result of the mergers, Colony NorthStar will be an internally-managed equity REIT, with a diversified real estate and investment management platform. In addition, following the mergers, the Adviser and NorthStar Securities, LLC, the Fund’s dealer manager, will be subsidiaries of Colony NorthStar. This transaction is expected to close during the first quarter of 2017, subject to customary closing conditions, including regulatory approvals, and approval by the NorthStar, NorthStar Realty and Colony shareholders. There is no guarantee this transaction will close on the contemplated terms or within the anticipated timeframe, or at all.

The Fund is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a non-diversified, closed-end management investment company that intends to elect to be treated for federal income tax purposes, and intends to qualify annually thereafter, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

Pursuant to an administration agreement entered into by the Companies and the Master Fund with State Street Bank and Trust Company (the “Administrator”), the Administrator provides the Fund with financial accounting and reporting, net asset value calculation, post-trade compliance, and treasury services.

The Fund makes some investments through NorthStar Corporate Income Fund (Cayman) Ltd. (the “Foreign Subsidiary”). The Foreign Subsidiary was formed on January 29, 2016 as a Cayman Island exempted limited company that is a wholly owned subsidiary of the Fund. The Fund generally gains access to certain newly issued Regulation S securities through the Foreign Subsidiary. Regulation S securities are securities of U.S. and non-U.S. issuers that are issued to non-U.S. persons through offerings made pursuant to Regulation S of the Securities Act of 1933, as amended, or the Securities Act. The unaudited consolidated financial statements include the accounts of the Fund and the Foreign Subsidiary (collectively, the “Master Fund”). As of June 30, 2016, the Foreign Subsidiary has $79,772 in net assets, representing 4.62% of the Master Fund’s net assets.

NORTHSTAR CORPORATE INCOME MASTER FUND AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements of the Master Fund have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair statement have been included. Operating results for the period from February 25, 2016 (commencement of operations) through June 30, 2016 are not necessarily indicative of the results that may be expected for the year ending December 31, 2016. The Master Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services – Investment Companies.

Principles of Consolidation

The unaudited consolidated financial statements of the Master Fund include the accounts of the Fund and the Foreign Subsidiary. All intercompany transactions and balances have been eliminated in consolidation.

Use of Estimates

The preparation of the Master Fund’s unaudited financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimates.

Cash

Cash as of June 30, 2016 represents cash held at State Street Bank and Trust Company in bank deposit accounts that, at times, may exceed federally insured limits.

Valuation of Portfolio Investments

The Master Fund determines the fair value of its investment portfolio as of the close of the each regular trading session of the New York Stock Exchange. The Master Fund calculates the net asset value (“NAV”) of its common shares of beneficial interest, by subtracting total liabilities (including accrued expenses or distributions) from the total assets of the Master Fund (the value of securities, plus cash or other assets, including interest and distributions accrued but not yet received) and dividing the result by the total number of outstanding common shares of the Master Fund. The Master Fund’s assets and liabilities are valued in accordance with the principles set forth below.

The Master Fund’s board of trustees (the “Board”) has approved the Master Fund’s Valuation Policies and Procedures (the “Valuation Policies and Procedures”) and the formation of a valuation committee (the “Valuation Committee”) which consists of personnel from the Adviser and Sub-Adviser. The Valuation Committee values the Master Fund’s assets in good faith pursuant to the Valuation Policies and Procedures and applies a consistent valuation process, which was developed by the Adviser and Sub-Adviser and approved by the Board. Portfolio securities and other assets for which market quotes are readily available will be valued at market value as provided by an independent pricing source. In circumstances where market quotes are not readily available, the Board has adopted the Valuation Policies and Procedures for determining the fair value of such securities and other assets, and has delegated the responsibility for applying the valuation methods to the Valuation Committee. On a quarterly basis, the audit committee of the Board reviews the valuation

NORTHSTAR CORPORATE INCOME MASTER FUND AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

determinations made with respect to the Master Fund’s investments during the preceding quarter and evaluate whether such determinations were made in a manner consistent with the Master Fund’s Valuation Policies and Procedures. The Board reviews and ratifies such value determinations.

Accounting Standards Codification Topic 820, Fair Value Measurements and Disclosure, (“ASC Topic 820”), issued by the Financial Accounting Standards Board, (“FASB”), clarifies the definition of fair value and requires companies to expand their disclosure about the use of fair value to measure assets and liabilities in interim and annual periods subsequent to initial recognition. ASC Topic 820 defines fair value as the price that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC Topic 820 also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets; Level 2, which includes inputs such as quoted prices for similar securities in active markets and quoted prices for identical securities where there is little or no activity in the market; and Level 3, defined as unobservable inputs for which little or no market data exists, therefore requiring an entity to develop its own assumptions.

When determining the fair value of an asset or liability, the Valuation Committee seeks to determine the price that would be received from the sale of the asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, in accordance with ASC Topic 820. Fair value determinations are based upon all available inputs that the Valuation Committee deems relevant, which may include indicative dealer quotes, independent third party pricing vendors, values of like securities, recent portfolio company financial statements and forecasts, and valuations prepared by third party valuation services. However, determination of fair value involves subjective judgments and estimates. Accordingly, the notes to the Master Fund’s financial statements refer to the uncertainty with respect to the possible effect of such valuations and any change in such valuations on the Master Fund’s financial statements.

The Master Fund expects that its portfolio may consist of securities listed or traded on a recognized securities exchange or automated quotation system (“Exchange-Traded Security”) or securities traded on a privately negotiated OTC secondary market for institutional investors for which indicative dealer quotes are available, (“OTC Security”). For purposes of calculating NAV, the Valuation Committee will use the following valuation methods:

| · | The market value of each Exchange-Traded Security is the last reported sale price at the relevant valuation date on the composite tape or on the principal exchange on which such security is traded. |

| · | If no sale is reported for an Exchange-Traded Security on the valuation date or if a security is an OTC Security, the Master Fund will value such security using quotations obtained from an independent third-party pricing service, which provides prevailing bid and ask prices that are screened for validity by the service from dealers on the valuation date. For investments for which a third-party pricing service is unable to obtain quoted prices, the Master Fund obtains bid and ask prices directly from dealers who make a market in such securities. Generally, securities are valued at the mid-point of the average bid and ask prices obtained from such sources. |

| · | To the extent that the Master Fund holds investments for which no active secondary market exists and, therefore, no bid and ask prices can be readily obtained, the Master Fund will value such investments at fair value as determined in good faith by the Valuation Committee in accordance with the Master Fund’s Valuation Policies and Procedures and pursuant to authority delegated by the Master Fund’s Board as described above. In making such determination, the Valuation Committee may rely upon valuations obtained from an independent valuation firm. |

NORTHSTAR CORPORATE INCOME MASTER FUND AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

In making its determination of fair value, the Valuation Committee may use independent third-party pricing or valuation services; provided that the Valuation Committee shall not be required to determine fair value in accordance with the valuation provided by any single source, and the Valuation Committee shall retain the discretion to use any relevant data, including information obtained from any independent third-party valuation or pricing service, that the Valuation Committee deems to be reliable in determining fair value under the circumstances.

Below is a description of factors that may be considered when valuing securities for which no active secondary market exists.

Valuation of fixed income investments, such as loans and debt securities, depends upon a number of factors, including prevailing interest rates for like securities, expected volatility in future interest rates, call features, put features and other relevant terms of the debt. For investments without readily available market prices, these factors may be incorporated into discounted cash flow models to arrive at fair value. Other factors that may be considered include the borrower’s ability to adequately service its debt, the fair market value of the portfolio company in relation to the face amount of its outstanding debt and the quality of collateral securing the Master Fund’s debt investments.

The valuation of securities may consider other factors such as private merger and acquisition statistics, public trading multiples discounted for illiquidity and other factors, valuations implied by third-party investments in the portfolio companies, the acquisition price of such investment or industry practices in determining fair value. Size and scope of a portfolio company and its specific strengths and weaknesses, as well as any other factors deemed relevant in assessing fair value, may also be considered.

If the Master Fund receives warrants or other equity securities at nominal or no additional cost in connection with an investment in a debt security, the cost basis in the investment will be allocated between the debt securities and any such warrants or other equity securities received at the time the investment is made. Such warrants or other equity securities will subsequently be valued at fair value.

Portfolio securities that carry certain restrictions on sale will typically be valued at a discount from the public market value of the security, where applicable.

If events materially affecting the price of foreign portfolio securities occur between the time when their price was last determined on such foreign securities exchange or market and the time when the Master Fund’s NAV was last calculated (for example, movements in certain U.S. securities indices which demonstrate strong correlation to movements in certain foreign securities markets), fair value for such securities may be determined in good faith in accordance with procedures established by the Board. For purposes of calculating NAV, all assets and liabilities initially expressed in foreign currencies are converted into U.S. dollars at prevailing exchange rates as may be determined in good faith by Valuation Committee, under the supervision of the Board.

Revenue Recognition

Security transactions are accounted for on their trade date. The Master Fund records interest income on an accrual basis to the extent that it expects to collect such amounts. The Master Fund does not accrue a receivable for interest on loans and securities if there is reason to doubt the collectability of such income. Loan origination fees, original issue discount, and market discount (market premium) are capitalized and such amounts are accreted (amortized) as interest income (interest expense) over the respective term of the loan or security. Upon the prepayment of a loan or security, any unamortized loan origination fees and original issuance discount are recorded as income. Upfront structuring fees are recorded as income when cash is received. The

NORTHSTAR CORPORATE INCOME MASTER FUND AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Master Fund will record prepayment premiums on loans and securities as fee income when it receives such amounts.

Net Realized Gains or Losses and Net Change in Unrealized Appreciation or Depreciation

Gains or losses on the sale of investments are calculated by using the specific identification method. The Master Fund measures realized gains or losses by the difference between the net proceeds from the repayment or sale and the amortized cost basis of the investment including any unamortized upfront fees. Net change in unrealized appreciation or depreciation reflects the change in portfolio investment values during the reporting period.

Organization and Offering Costs

Organization costs include, among other things, the cost of formation, including the cost of legal services and other fees pertaining to the Master Fund’s organization. These costs are expensed as incurred. Offering costs include, among other things, legal, accounting, printing and other costs pertaining to the preparation of the Master Fund’s Registration Statement on Form N-2 related to the public offering of its common shares.

Pursuant to the Master Fund’s advisory agreement (“Advisory Agreement”), the Adviser and Sub-Adviser, either directly or through their affiliates, will be entitled to receive equal reimbursement for costs each has paid on behalf of the Master Fund in connection with the offering. The Master Fund will be obligated to reimburse the Adviser and Sub-Adviser, or their affiliates, as applicable, for organization and offering costs (“O&O costs”) to a limit of 1.0% of the aggregate proceeds from the offering. The Master Fund estimates that the O&O costs will be de minimis as Master Fund shares are not being offered directly to the public. The Master Fund records O&O costs each period based upon an allocation determined by the expectation of total O&O costs to be reimbursed. The offering costs incurred directly by the Master Fund are accounted for as a deferred charge and are amortized over 12 months on a straight-line basis. As of June 30, 2016, the Adviser and Sub-Adviser incurred approximately $163,000 of O&O costs on behalf of the Master Fund. For the period from February 25, 2016 (commencement of operations) through June 30, 2016, there were no proceeds raised from the offering and no O&O costs were allocated to the Master Fund.

Income Taxes

The Master Fund intends to elect to be treated for federal income tax purposes as a RIC under Subchapter M of the Code. To maintain qualification as a RIC, the Master Fund must, among other things, meet certain source-of-income and asset diversification requirements and distribute to their respective shareholders, for each taxable year, at least 90% of its “investment company taxable income” and its net tax-exempt interest income. In general, a RIC’s “investment company taxable income” for any taxable year is its taxable income, determined without regard to net capital gains and with certain other adjustments. As a RIC, the Master Fund will not have to pay corporate-level federal income taxes on any income that it distributes to its shareholders. The Master Fund intends to distribute all or substantially all of their “investment company taxable income,” net tax-exempt interest income (if any) and net capital gains (if any) on an annual basis in order to maintain their RIC status each year and to avoid any federal income taxes on income. The Master Fund will also be subject to nondeductible federal excise taxes if it does not distribute at least 98% of net ordinary income, 98.2% of any capital gain net income (if any).

Uncertainty in Income Taxes

The Master Fund evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax benefits or liabilities in the financial statements.

NORTHSTAR CORPORATE INCOME MASTER FUND AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Recognition of a tax benefit or liability with respect to an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Master Fund recognizes interest and penalties, if any, related to unrecognized tax liabilities as income tax expense in the Statement of Operations. During the period from February 25, 2016 (commencement of operations) through June 30, 2016, the Master Fund did not incur any interest or penalties.

Distributions

Distributions to the Master Fund’s shareholders are recorded as of the record date. Subject to the discretion of the Master Fund’s Board and applicable legal restrictions, the Master Fund intends to authorize and declare ordinary cash distributions on a bi-monthly basis and pay such distributions on a monthly basis. From time to time, the Master Fund intends to authorize and declare special cash distributions of net long-term capital gains, if any, and any other income, gains and dividends and other distributions not previously distributed. During the period from February 25, 2016 (commencement of operations) through June 30, 2016, distributions were neither declared nor paid.

New Accounting Standards

Management does not believe any recently issued, but not yet effective, accounting standards, if currently adopted, would have a material effect on the accompanying financial statements.

3. Share Transactions

In January 2016, affiliates of NorthStar and OZ Credit Management purchased 222,222 shares of the Master Fund for proceeds of $2,000,000. Refer to Note 4 for further detail.

The Master Fund will repurchase common shares held by the Multi-Class Fund and T-Fund to the extent necessary to accommodate share repurchases request under each Company’s share repurchase program. During the period from February 25, 2016 (commencement of operations) through June 30, 2016, the Master Fund did not repurchase any of its common shares in connection with the Companies’ share repurchase programs.

4. Related Party Transactions

Compensation of the Adviser and Sub-Adviser

Pursuant to the Master Fund’s Advisory Agreement, and in consideration of the advisory services provided by the Adviser to the Master Fund, the Adviser is entitled to a fee consisting of two components — the management fee (“Management Fee”) and the incentive fee (“Incentive Fee”). The Adviser will engage OZ Credit Management to act as the Master Fund’s Sub-Adviser. The Sub-Adviser is responsible for the day-to-day identification, recommendation, management and monitoring of investments for the Master Fund’s portfolio, subject to the investment criteria determined and approved from time to time by the Adviser at its sole discretion.