December 21, 2017

VIA HAND DELIVERY AND EDGAR

Daniel F. Duchovny, Esq.

Special Counsel

Office of Mergers and Acquisitions

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| | | Preliminary Proxy Statement filed by Broadcom Limited and Broadcom |

| | | Filed on December 11, 2017 |

| | | Filed on December 4, 7, and 11, 2017 by Broadcom Limited and Broadcom |

Dear Mr. Duchovny:

On behalf of our clients Broadcom Limited and Broadcom Corporation (together, “Broadcom”), this letter responds to the letter from the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”), dated as of December 19, 2017, with respect to Broadcom’s preliminary Proxy Statement on Schedule 14A (the “Proxy Statement”) and the Forms 425 filed by Broadcom on December 4, 7 and 11, 2017.

U.S. Securities and Exchange Commission

December 21, 2017

Page 2

This letter and Amendment No. 1 to the Proxy Statement (“Amendment No. 1”) are being filed electronically via EDGAR today. In addition to the EDGAR filing, we are delivering a hard copy of this letter, along with six courtesy copies of Amendment No. 1 marked to indicate changes from the Proxy Statement.

For the Staff’s convenience, the text of the Staff’s comments is set forth below in bold, followed in each case by Broadcom’s response. Terms not otherwise defined in this letter shall have the meanings set forth in Amendment No. 1. All references to page numbers in these responses are to page numbers of the marked version of Amendment No. 1.

Preliminary Proxy Statement

| 1. | We note that you refer security holders to the company’s proxy statement for certain specified disclosure. You are required to provide information that will be contained in the company’s proxy statement for the annual meeting unless it is your intent to rely on Exchange Act Rule 14a-5(c). If you intend to rely on Rule 14a-5(c), please disclose that fact. Also, please be advised that we believe reliance on Rule 14a-5(c) before the company distributes the information to security holders would be inappropriate. Alternatively, if you determine to disseminate your proxy statement prior to the distribution of the company’s proxy statement, you must undertake to provide the omitted information to security holders. Please advise as to your intent in this regard. |

Response:

Broadcom respectfully advises the Staff that it has not yet determined whether to disseminate the definitive Proxy Statement prior to the distribution of Qualcomm’s proxy statement for Qualcomm’s 2018 annual meeting of stockholders. If Qualcomm has furnished the omitted information prior to the printing of the definitive Proxy Statement, such information will be included to the extent required by applicable law to be included by persons other than the registrant. If, prior to such time, Qualcomm has not furnished such information, the omitted information, other than information that persons other than the registrant are not required by applicable law to provide to security holders, will be provided in additional definitive proxy materials furnished by Broadcom.

| 2. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Provide characterize the disclosure “…a vote “For” each of the Broadcom nominees will send a clear and strong message to the Qualcomm board that it should give proper consideration to our proposal…” (Important, page iv; similar language under the caption “Reasons to vote for Broadcom nominees and bylaw proposal”) as your opinions or beliefs. |

U.S. Securities and Exchange Commission

December 21, 2017

Page 3

Response:

Broadcom acknowledges the Staff’s comment and has revised the disclosure in the cover letter and on pages ii, iv, 1, 2 and 12 of Amendment No. 1 accordingly.

Broadcom respectfully advises the Staff that Broadcom believes that the basis for its opinion is self-evident given Broadcom’s publicly disclosed proposal to acquire Qualcomm and that the platform on which the Broadcom Nominees would be seeking votes is the failure of the existing Qualcomm directors to engage in any discussions with Broadcom.

Information Regarding the Broadcom Nominees, page 13

| 3. | Please provide a business address for each of your nominees. See Item 5(b)(1)(i) of Schedule 14A. |

Response:

Broadcom respectfully advises the Staff that, as disclosed in the Proxy Statement, Mr. Elhage, Mr. Geltzeiler, Ms. Hagen, Ms. Hill, Mr. Reyes and Mr. Volpe do not currently have a business address. Item 5(b)(1)(i) of Schedule 14A requires the disclosure of a business address, but not a home address. Furthermore, in the interest of their privacy and security, providing home addresses in a document that will be distributed to a large number of Qualcomm stockholders and be publicly available on the Commission’s website could be detrimental to these individuals. Broadcom does not believe that this information would be material to a stockholder under the circumstances and believes it has clearly identified why no business addresses for these individuals are disclosed.

Form 425 filed December 4, 2017

| 4. | Please provide us support for the following statements: |

| | • | | “We have heard from many Qualcomm stockholders who have expressed their desire for Qualcomm to engage with us.” |

| | • | | “…having had initial meetings with certain relevant antitrust authorities, remain confident that any regulatory requirements necessary to complete a combination will be met in a timely manner.” |

U.S. Securities and Exchange Commission

December 21, 2017

Page 4

Response:

With respect to the first bullet, Broadcom respectfully advises the Staff that following Broadcom’s public announcement of its proposal to acquire Qualcomm, representatives of Broadcom met with representatives of many institutional stockholders of Qualcomm in one-on-one in-person meetings and through telephonic conversations, including during the weeks of November 6 and 13, 2017. During these conversations, representatives of many of Qualcomm’s institutional stockholders expressed their desire for the two companies to engage in negotiations toward a mutually agreed transaction.

With respect to the second bullet, Broadcom respectfully advises the Staff that representatives of Broadcom had in-person meetings and telephone calls with representatives of antitrust authorities in various jurisdictions. In the course of these meetings and telephone calls, representatives of Broadcom discussed with representatives of applicable antitrust authorities the nature and timing of such authorities’ review, certain aspects of Broadcom’s and Qualcomm’s businesses and the applicability of certain antitrust laws and regulations to Broadcom’s proposed acquisition of Qualcomm. The information conveyed to Broadcom and the tone and sentiments of these meetings and telephone calls provide a reasonable basis for Broadcom to “remain confident” with respect to its ability to timely meet applicable regulatory requirements.

| 5. | We note your disclosure that “The nominations give Qualcomm stockholders an opportunity to voice their disappointment with Qualcomm’s directors and their refusal to engage in discussions with us.” What is your basis to assert that Qualcomm’s shareholders are disappointed in how the Qualcomm board has handled your approach? |

Response:

Broadcom respectfully advises the Staff that representatives of certain of Qualcomm’s institutional stockholders have expressed their disappointment with Qualcomm’s directors’ refusal to engage in discussions with Broadcom regarding a transaction that would deliver compelling value to them, during the in-person and telephonic meetings referred to in response to the Staff’s comment number 4 above. Broadcom also respectfully advises the Staff that the statement noted in the comment above is not a factual assertion that Qualcomm stockholders are currently disappointed with the Qualcomm directors, but rather a description of one of a number of reasons that Qualcomm stockholders may choose to vote for the Broadcom Nominees, to express a negative view of the current behavior and approach to Broadcom’s bid by the Qualcomm directors.

U.S. Securities and Exchange Commission

December 21, 2017

Page 5

| 6. | We note your disclosure that “In light of the significant value our proposal provides for Qualcomm stockholders…” Provide support for your opinion that your proposal provides significant value for Qualcomm security holders. |

Response:

Broadcom respectfully advises the Staff that the following facts, among others, support its opinion that its proposal to acquire Qualcomm provides significant value to Qualcomm stockholders:

| | • | | the proposal represents a 28% premium over the closing price of Qualcomm common stock on the last unaffected trading day prior to media speculation regarding a potential transaction, a 33% premium to Qualcomm’s unaffected 30-day volume-weighted average price, and more value to Qualcomm stockholders than any closing market price for Qualcomm common stock since October 27, 2016; |

| | • | | the proposal provides that Qualcomm stockholders will receive a portion of the consideration in stock of the combined company, allowing them to participate in any value generated from the synergies created by the transaction and the growth of a combined enterprise that has greater scale (with pro forma fiscal 2017 revenues of approximately $51 billion, assuming Qualcomm’s acquisition of NXP Semiconductors N.V. is consummated), a more diversified product mix, a portfolio of category leading products and significant research and development resources; and |

| | • | | in addition to the equity upside described in the previous bullet, the proposal provides for cash consideration to Qualcomm stockholders of $60.00 per Qualcomm share, which on its own represents more value to Qualcomm stockholders than any closing market price for Qualcomm common stock since January 20, 2017. |

| 7. | Your disclosure that you “…believe Qualcomm stockholders would be better served by new independent, highly qualified nominees who are committed to maximizing value and acting in the best interests of Qualcomm stockholders” suggests that the current board has not sought to maximize value and act in the best interests of Qualcomm security holders. You must avoid issuing statements that directly or indirectly impugn the character, integrity or personal reputation or make charges of illegal, improper or immoral conduct without factual foundation. Please provide a factual foundation for your disclosure. In this regard, note that the factual foundation for such assertion must be reasonable. Refer to Rule 14a-9. |

U.S. Securities and Exchange Commission

December 21, 2017

Page 6

Response:

Broadcom respectfully advises the Staff that it believes it has a factual foundation for its opinion that the existing Qualcomm directors are not seeking to maximize value in the best interests of Qualcomm stockholders. As described in the Proxy Statement, the Qualcomm board of directors has repeatedly refused to engage with Broadcom despite (a) Broadcom’s proposal at a significant premium to Qualcomm’s stock price that provides compelling value to Qualcomm stockholders through a substantial cash component as well as the opportunity to share in the upside of the combined enterprise and (b) Broadcom’s repeated requests to enter into negotiations regarding the terms of the proposal. Further, the Qualcomm board of directors has continued to pursue an intellectual property licensing strategy that has exposed Qualcomm to disputes with its largest customers (such as Apple’s withholding of royalty payments and a $940 million settlement with Blackberry) and significant regulatory fines across several jurisdictions in the last five years (including approximately $2.7 billion of fines levied by regulatory authorities in Taiwan, South Korea and China in the last three years). Broadcom respectfully advises the Staff that it believes these actions provide a factual foundation for Broadcom’s belief that the Qualcomm board of directors is not acting in the best interests of Qualcomm stockholders or committed to maximizing value, which is further evidenced by a stock price that over the past five years has substantially underperformed the S&P 500 and the PHLX Semiconductor Sector index.

Forms 425 filed December 7 and 11, 2017

| 8. | We note your disclosure on each of these dates that you “continue to receive positive feedback from stockholders and customers.” Please provide us support for your disclosure on each date. |

Response:

Broadcom respectfully advises the Staff that following Broadcom’s public announcement of its proposal to acquire Qualcomm, representatives of many institutional stockholders of Qualcomm expressed support for a potential combination of Broadcom and Qualcomm, and indicated a desire for the two companies to negotiate toward a mutually agreed transaction, in one-on-one in-person meetings and through telephonic conversations, including during the weeks of December 4, 2017 and December 11, 2017. Further, in preliminary conversations between certain of Broadcom’s and Qualcomm’s customers and executives of Broadcom, as well as in ordinary course interactions between Broadcom and its customers, certain of such customers have expressed their support for Broadcom’s proposal to acquire Qualcomm. These conversations and interactions continued to occur intermittently through the first half of December 2017.

***

U.S. Securities and Exchange Commission

December 21, 2017

Page 7

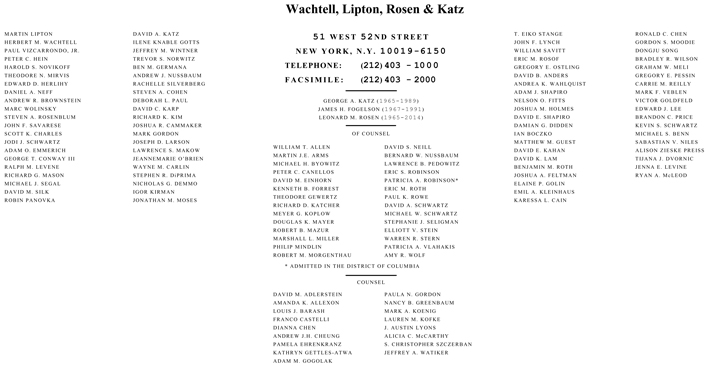

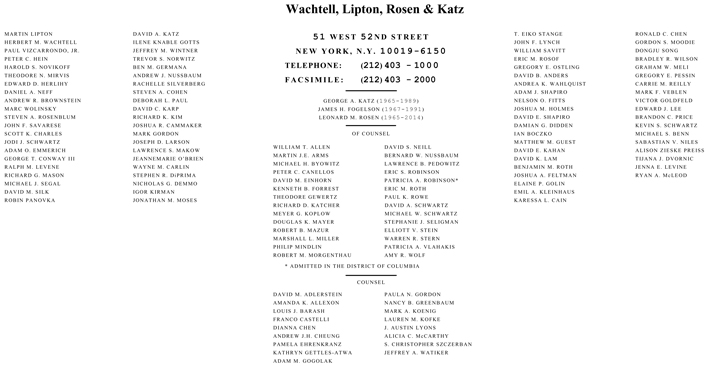

We hope that the foregoing have been responsive to the Staff’s comments. If you have any questions or comments regarding the foregoing, please do not hesitate to contact me at (212) 403-1327 or by email at dckarp@wlrk.com, or my colleagues Adam O. Emmerich at (212) 403-1234 or by email at aoemmerich@wlrk.com or Ronald C. Chen at (212) 403-1117 or by email at rcchen@wlrk.com.

Sincerely,

/s/ David C. Karp

David C. Karp

| cc: | Mark Brazeal, Esq., Chief Legal Officer, Broadcom Limited |

| | Adam O. Emmerich, Esq., Wachtell, Lipton, Rosen & Katz |

| | Ronald C. Chen, Esq., Wachtell, Lipton, Rosen & Katz |