UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934 For the month of February, 2022 Commission File Number 001-37595 SANTANDER UK GROUP HOLDINGS PLC (Translation of registrant's name into English) 2 Triton Square, Regent's Place, London NW1 3AN, England (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F . . . .X. . . . Form 40-F . . . . . . . . Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):_ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):_

Quarterly Management Statement, 31 December 2021 1 Santander UK Group Holdings plc The information contained in this report is unaudited and does not comprise statutory accounts within the meaning of section 434 of the Companies Act 2006 (‘the Act’). The statutory accounts for the year ended 31 December 2020 have been filed with the Registrar of Companies. The report of the auditor on those statutory accounts was unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under section 498(2) or (3) of the Act. This report provides a summary of the unaudited business and financial trends for the twelve months ended 31 December 2021 for Santander UK Group Holdings plc and its subsidiaries (Santander UK), including its principal subsidiary Santander UK plc. The unaudited business and financial trends in this statement only pertain to Santander UK on a statutory basis (the statutory perimeter). Unless otherwise stated, references to results in previous periods and other general statements regarding past performance refer to the business results for the same period in 2020. This report contains non-IFRS financial measures that are reviewed by management in order to measure our overall performance. These are financial measures which management believe provide useful information to investors regarding our results and are outlined as Alternative Performance Measures in Appendix 1. These measures are not a substitute for IFRS measures. Appendix 2 contains supplementary consolidated information for Santander UK plc, our principal ring-fenced bank. A list of abbreviations is included at the end of this report and a glossary of terms is available at: https://www.santander.co.uk/about-santander/investor-relations/glossary Santander UK Group Holdings plc Quarterly Management Statement for the twelve months ended 31 December 2021 Paul Sharratt Head of Investor Relations 07715 087 829 Stewart Todd Head of External Affairs 07711 776 286 Adam Williams Head of Media Relations 07711 783 118 For more information: santander.co.uk/about-santander ir@santander.co.uk

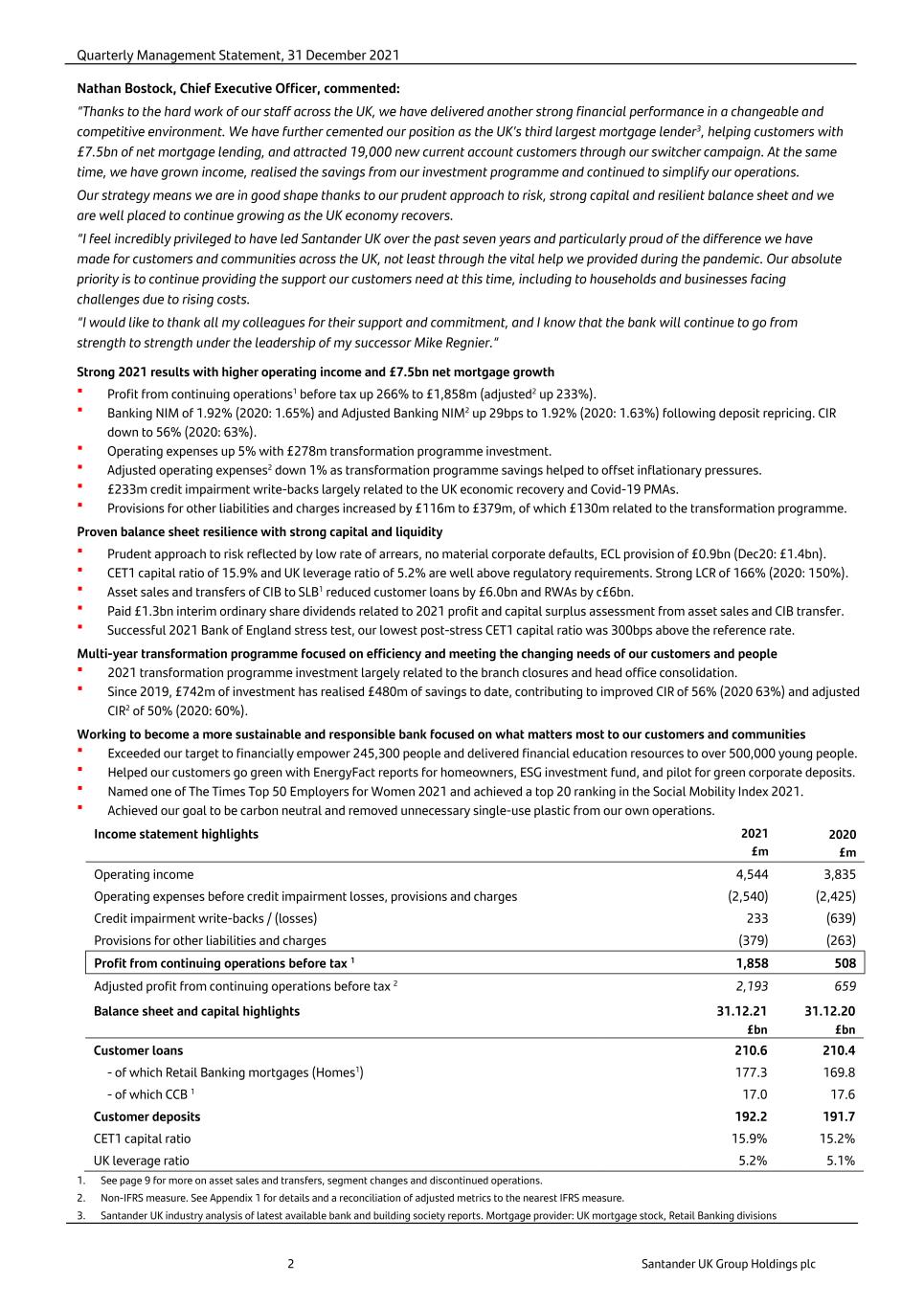

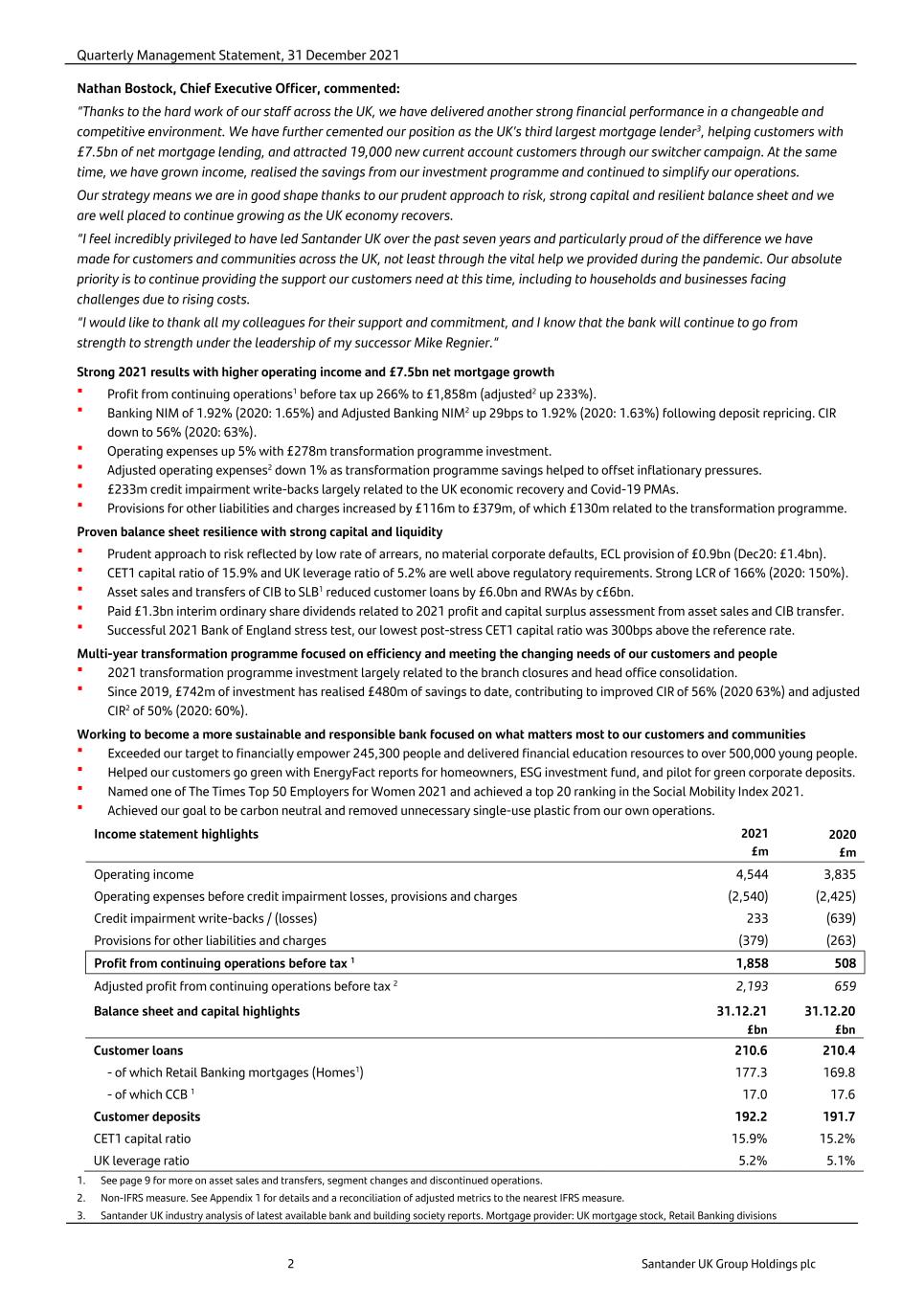

Quarterly Management Statement, 31 December 2021 2 Santander UK Group Holdings plc Nathan Bostock, Chief Executive Officer, commented: “Thanks to the hard work of our staff across the UK, we have delivered another strong financial performance in a changeable and competitive environment. We have further cemented our position as the UK’s third largest mortgage lender3, helping customers with £7.5bn of net mortgage lending, and attracted 19,000 new current account customers through our switcher campaign. At the same time, we have grown income, realised the savings from our investment programme and continued to simplify our operations. Our strategy means we are in good shape thanks to our prudent approach to risk, strong capital and resilient balance sheet and we are well placed to continue growing as the UK economy recovers. “I feel incredibly privileged to have led Santander UK over the past seven years and particularly proud of the difference we have made for customers and communities across the UK, not least through the vital help we provided during the pandemic. Our absolute priority is to continue providing the support our customers need at this time, including to households and businesses facing challenges due to rising costs. “I would like to thank all my colleagues for their support and commitment, and I know that the bank will continue to go from strength to strength under the leadership of my successor Mike Regnier.” Strong 2021 results with higher operating income and £7.5bn net mortgage growth Profit from continuing operations1 before tax up 266% to £1,858m (adjusted2 up 233%). Banking NIM of 1.92% (2020: 1.65%) and Adjusted Banking NIM2 up 29bps to 1.92% (2020: 1.63%) following deposit repricing. CIR down to 56% (2020: 63%). Operating expenses up 5% with £278m transformation programme investment. Adjusted operating expenses2 down 1% as transformation programme savings helped to offset inflationary pressures. £233m credit impairment write-backs largely related to the UK economic recovery and Covid-19 PMAs. Provisions for other liabilities and charges increased by £116m to £379m, of which £130m related to the transformation programme. Proven balance sheet resilience with strong capital and liquidity Prudent approach to risk reflected by low rate of arrears, no material corporate defaults, ECL provision of £0.9bn (Dec20: £1.4bn). CET1 capital ratio of 15.9% and UK leverage ratio of 5.2% are well above regulatory requirements. Strong LCR of 166% (2020: 150%). Asset sales and transfers of CIB to SLB1 reduced customer loans by £6.0bn and RWAs by c£6bn. Paid £1.3bn interim ordinary share dividends related to 2021 profit and capital surplus assessment from asset sales and CIB transfer. Successful 2021 Bank of England stress test, our lowest post-stress CET1 capital ratio was 300bps above the reference rate. Multi-year transformation programme focused on efficiency and meeting the changing needs of our customers and people 2021 transformation programme investment largely related to the branch closures and head office consolidation. Since 2019, £742m of investment has realised £480m of savings to date, contributing to improved CIR of 56% (2020 63%) and adjusted CIR2 of 50% (2020: 60%). Working to become a more sustainable and responsible bank focused on what matters most to our customers and communities Exceeded our target to financially empower 245,300 people and delivered financial education resources to over 500,000 young people. Helped our customers go green with EnergyFact reports for homeowners, ESG investment fund, and pilot for green corporate deposits. Named one of The Times Top 50 Employers for Women 2021 and achieved a top 20 ranking in the Social Mobility Index 2021. Achieved our goal to be carbon neutral and removed unnecessary single-use plastic from our own operations. Income statement highlights 2021 £m 2020 £m Operating income 4,544 3,835 Operating expenses before credit impairment losses, provisions and charges (2,540) (2,425) Credit impairment write-backs / (losses) 233 (639) Provisions for other liabilities and charges (379) (263) Profit from continuing operations before tax 1 1,858 508 Adjusted profit from continuing operations before tax 2 2,193 659 Balance sheet and capital highlights 31.12.21 31.12.20 £bn £bn Customer loans 210.6 210.4 - of which Retail Banking mortgages (Homes1) 177.3 169.8 - of which CCB 1 17.0 17.6 Customer deposits 192.2 191.7 CET1 capital ratio 15.9% 15.2% UK leverage ratio 5.2% 5.1% 1. See page 9 for more on asset sales and transfers, segment changes and discontinued operations. 2. Non-IFRS measure. See Appendix 1 for details and a reconciliation of adjusted metrics to the nearest IFRS measure. 3. Santander UK industry analysis of latest available bank and building society reports. Mortgage provider: UK mortgage stock, Retail Banking divisions

Quarterly Management Statement, 31 December 2021 3 Santander UK Group Holdings plc KPIs and our strategic priorities1 Our strategic priorities are aligned to Banco Santander’s OneEurope strategy, with a focus on customer loyalty, simplification, improved efficiency, and sustainable growth, while aiming to be the best bank for all our stakeholders. We are transforming the business for success to meet changing customer needs and deliver on our purpose to help people and businesses prosper. Customers are at the heart of what we do and providing them with the service they expect drives our strategy. Our KPIs for loyal customers and retail net promoter score were impacted by deposit repricing. Deposits have increased however, and overall account numbers have remained broadly stable. We have made good progress with our transformation programme in 2021 but there is more to do to deliver improved customer experience. As we continue to simplify our business, we will be able to better target our resources to invest in technology and the digitalisation of the bank to give our people the tools to support our customers across all our platforms. The transformation programme has helped to improve operational efficiency in 2021 with the cost to income ratio improving to 56% (adjusted cost-to-income ratio2 improved to 50%). This, together with higher income and credit impairment write-backs, led to increased return on ordinary shareholders’ equity of 9.9% and adjusted RoTE2 of 13.2%. We have a comprehensive strategy that supports our ambition to become a more sustainable and responsible bank. This reflects and responds to the issues that matter most to the bank and our key stakeholders, not least financial inclusion, climate change and diversity within our workplace. Over the course of the last year we have focused on supporting our customers in the wake of the pandemic and also on helping them to green their homes through new products and services. Further information on our strategy, how we measure success, and the sustainability of our business will be provided in our 2021 Annual Report and ESG Supplement due to be published in March 2022. Our ESG report will also provide more information on our Sustainability and Responsible Banking Strategy and medium-term targets. 1. Grow customer loyalty by providing an outstanding customer experience 31.12.21 31.12.20 31.12.19 Loyal customers (million) 4.4 4.4 4.6 Digital customers (million) 6.6 6.3 5.8 Retail NPS rank 7th 8th 4th Business and corporate NPS rank 1st 1st 1st 2. Simplify and digitise the business for improved efficiency and returns 31.12.21 31.12.20 31.12.19 Adjusted RoTE 2 See below See below See below Adjusted cost-to-income ratio 2 See below See below See below Cost of risk -11bps 31bps 11bps UK leverage ratio 5.2% 5.1% 4.7% 3. Invest in our people and ensure they have the skills and knowledge to thrive 31.12.21 31.12.20 31.12.19 Medium term aim to be a Top 10 company to work for3 16th n.a. n.a. 4. Further embed sustainability across our business 31.12.21 31.12.20 31.12.19 Financially empowered people (cumulative from 2019) 745,300 506,400 248,100 Return on ordinary shareholders’ equity was 9.9% (2020: 2.9%, 2019: 4.9%) and Adjusted RoTE2 was 13.2% (2020: 4.3%, 2019: 7.8%). Cost-to-income ratio (CIR) was 56% (2020: 63%, 2019: 61%) and Adjusted cost-to-income ratio 2 was 50% (2020: 60%, 2019: 59%). 2022 outlook Although growth slowed at the end of 2021 due to the impact of the Omicron variant, we expect the impact on the UK economy from this to be limited. We expect Banking NIM 2 to be adversely affected by increased competition for mortgage lending although this will be offset by the impact of rising rates. We anticipate lower operating expenses going forward driven by the investment in our transformation programme. This is expected to offset the headwinds from inflation in 2022. Although the credit environment is likely to continue to be benign going forward, we expect an increased cost of risk as the write- backs of 2021 are not repeated. 1. KPI definitions can be found in the glossary: https://www.santander.co.uk/about-santander/investor-relations/glossary. See Appendix 3 for more on NPS ranks. 2. Non-IFRS measure. See Appendix 1 for details and a reconciliation of adjusted metrics to the nearest IFRS measure. 3. We are also accredited as a Top Employer (unranked) by the Top Employers Institute

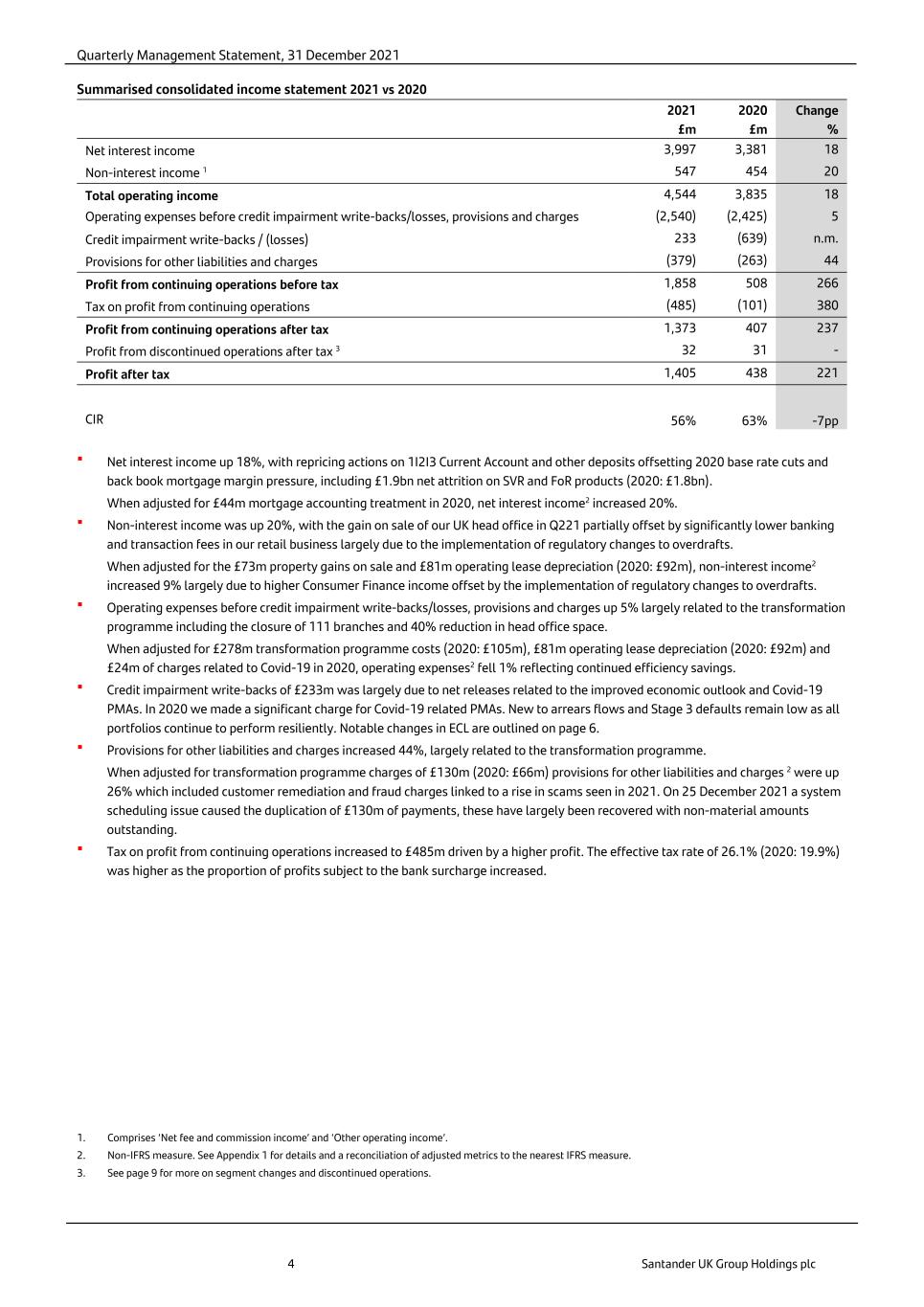

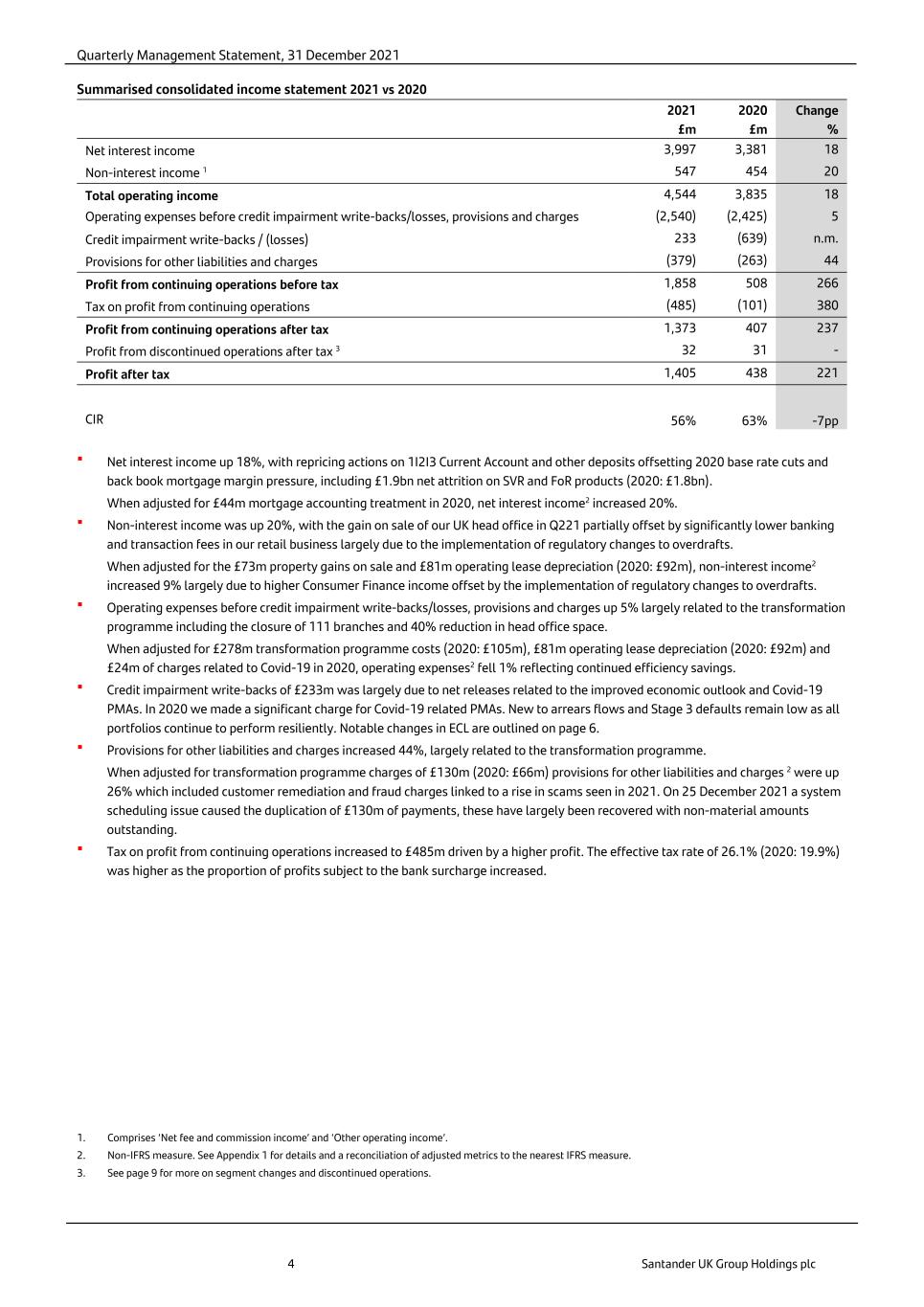

Quarterly Management Statement, 31 December 2021 4 Santander UK Group Holdings plc Summarised consolidated income statement 2021 vs 2020 2021 2020 Change £m £m % Net interest income 3,997 3,381 18 Non-interest income 1 547 454 20 Total operating income 4,544 3,835 18 Operating expenses before credit impairment write-backs/losses, provisions and charges (2,540) (2,425) 5 Credit impairment write-backs / (losses) 233 (639) n.m. Provisions for other liabilities and charges (379) (263) 44 Profit from continuing operations before tax 1,858 508 266 Tax on profit from continuing operations (485) (101) 380 Profit from continuing operations after tax 1,373 407 237 Profit from discontinued operations after tax 3 32 31 - Profit after tax 1,405 438 221 CIR 56% 63% -7pp Net interest income up 18%, with repricing actions on 1I2I3 Current Account and other deposits offsetting 2020 base rate cuts and back book mortgage margin pressure, including £1.9bn net attrition on SVR and FoR products (2020: £1.8bn). When adjusted for £44m mortgage accounting treatment in 2020, net interest income2 increased 20%. Non-interest income was up 20%, with the gain on sale of our UK head office in Q221 partially offset by significantly lower banking and transaction fees in our retail business largely due to the implementation of regulatory changes to overdrafts. When adjusted for the £73m property gains on sale and £81m operating lease depreciation (2020: £92m), non-interest income2 increased 9% largely due to higher Consumer Finance income offset by the implementation of regulatory changes to overdrafts. Operating expenses before credit impairment write-backs/losses, provisions and charges up 5% largely related to the transformation programme including the closure of 111 branches and 40% reduction in head office space. When adjusted for £278m transformation programme costs (2020: £105m), £81m operating lease depreciation (2020: £92m) and £24m of charges related to Covid-19 in 2020, operating expenses2 fell 1% reflecting continued efficiency savings. Credit impairment write-backs of £233m was largely due to net releases related to the improved economic outlook and Covid-19 PMAs. In 2020 we made a significant charge for Covid-19 related PMAs. New to arrears flows and Stage 3 defaults remain low as all portfolios continue to perform resiliently. Notable changes in ECL are outlined on page 6. Provisions for other liabilities and charges increased 44%, largely related to the transformation programme. When adjusted for transformation programme charges of £130m (2020: £66m) provisions for other liabilities and charges 2 were up 26% which included customer remediation and fraud charges linked to a rise in scams seen in 2021. On 25 December 2021 a system scheduling issue caused the duplication of £130m of payments, these have largely been recovered with non-material amounts outstanding. Tax on profit from continuing operations increased to £485m driven by a higher profit. The effective tax rate of 26.1% (2020: 19.9%) was higher as the proportion of profits subject to the bank surcharge increased. 1. Comprises ‘Net fee and commission income’ and ‘Other operating income’. 2. Non-IFRS measure. See Appendix 1 for details and a reconciliation of adjusted metrics to the nearest IFRS measure. 3. See page 9 for more on segment changes and discontinued operations.

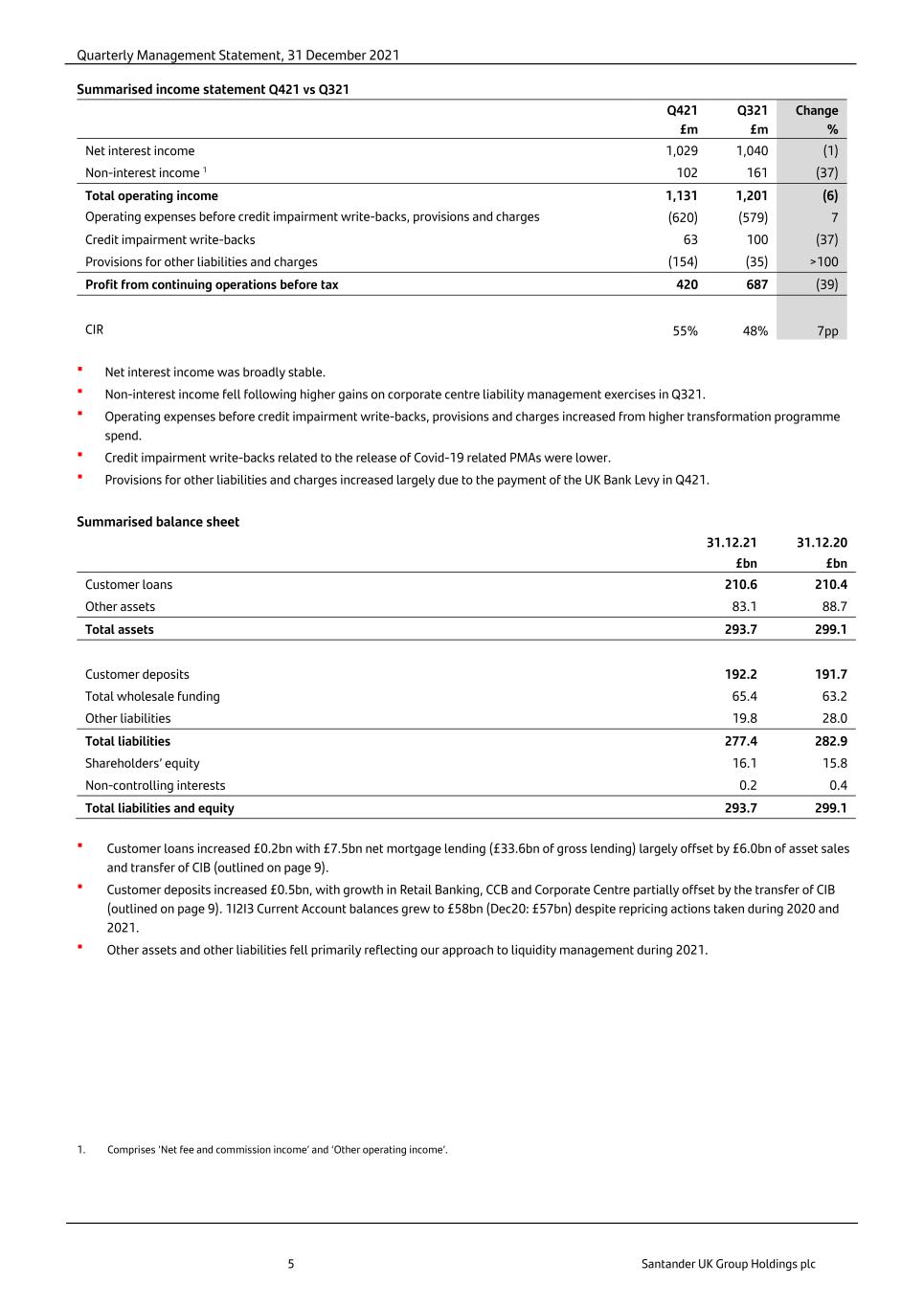

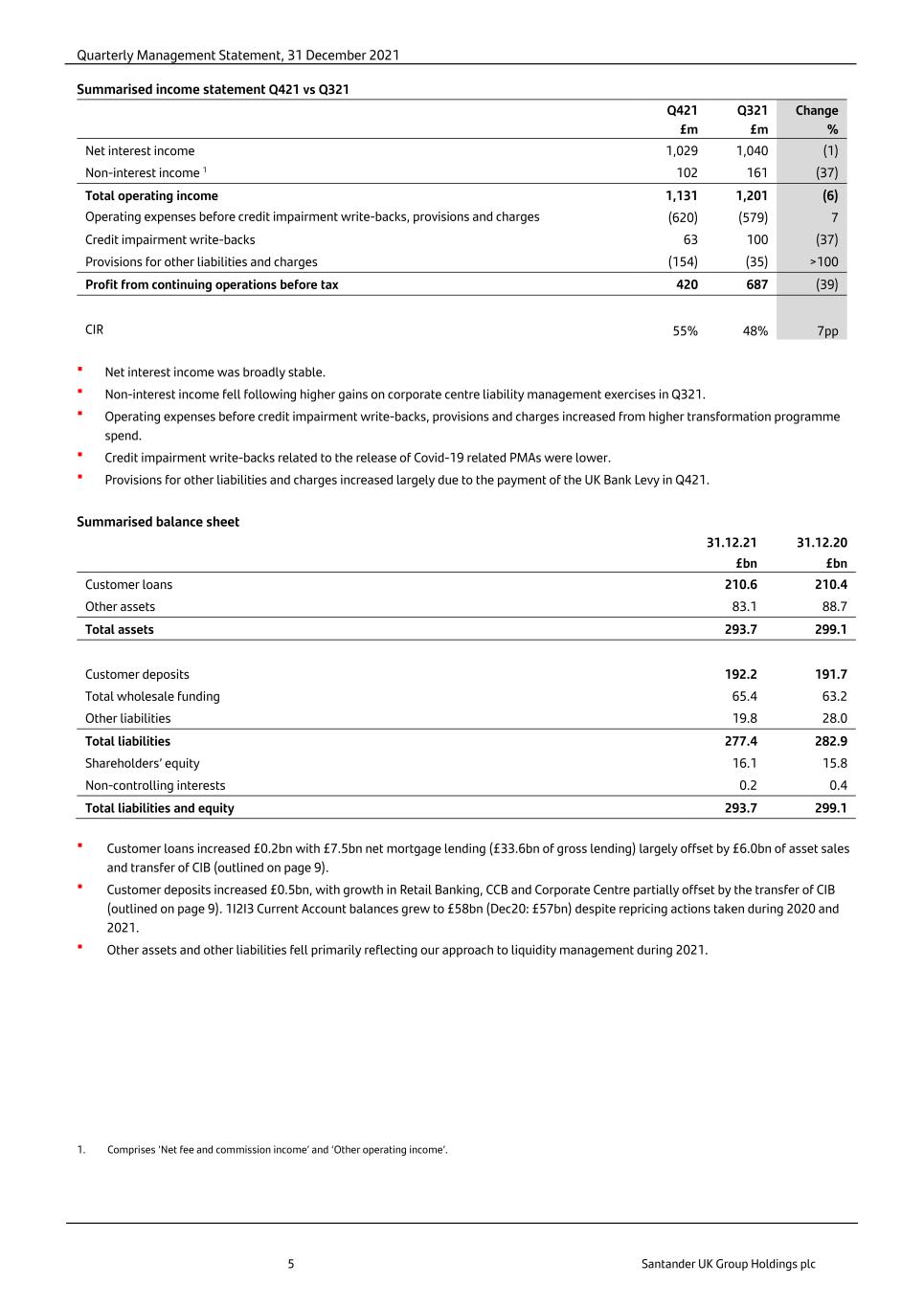

Quarterly Management Statement, 31 December 2021 5 Santander UK Group Holdings plc Summarised income statement Q421 vs Q321 Q421 Q321 Change £m £m % Net interest income 1,029 1,040 (1) Non-interest income 1 102 161 (37) Total operating income 1,131 1,201 (6) Operating expenses before credit impairment write-backs, provisions and charges (620) (579) 7 Credit impairment write-backs 63 100 (37) Provisions for other liabilities and charges (154) (35) >100 Profit from continuing operations before tax 420 687 (39) CIR 55% 48% 7pp Net interest income was broadly stable. Non-interest income fell following higher gains on corporate centre liability management exercises in Q321. Operating expenses before credit impairment write-backs, provisions and charges increased from higher transformation programme spend. Credit impairment write-backs related to the release of Covid-19 related PMAs were lower. Provisions for other liabilities and charges increased largely due to the payment of the UK Bank Levy in Q421. Summarised balance sheet 31.12.21 31.12.20 £bn £bn Customer loans 210.6 210.4 Other assets 83.1 88.7 Total assets 293.7 299.1 Customer deposits 192.2 191.7 Total wholesale funding 65.4 63.2 Other liabilities 19.8 28.0 Total liabilities 277.4 282.9 Shareholders’ equity 16.1 15.8 Non-controlling interests 0.2 0.4 Total liabilities and equity 293.7 299.1 Customer loans increased £0.2bn with £7.5bn net mortgage lending (£33.6bn of gross lending) largely offset by £6.0bn of asset sales and transfer of CIB (outlined on page 9). Customer deposits increased £0.5bn, with growth in Retail Banking, CCB and Corporate Centre partially offset by the transfer of CIB (outlined on page 9). 1I2I3 Current Account balances grew to £58bn (Dec20: £57bn) despite repricing actions taken during 2020 and 2021. Other assets and other liabilities fell primarily reflecting our approach to liquidity management during 2021. 1. Comprises ‘Net fee and commission income’ and ‘Other operating income’.

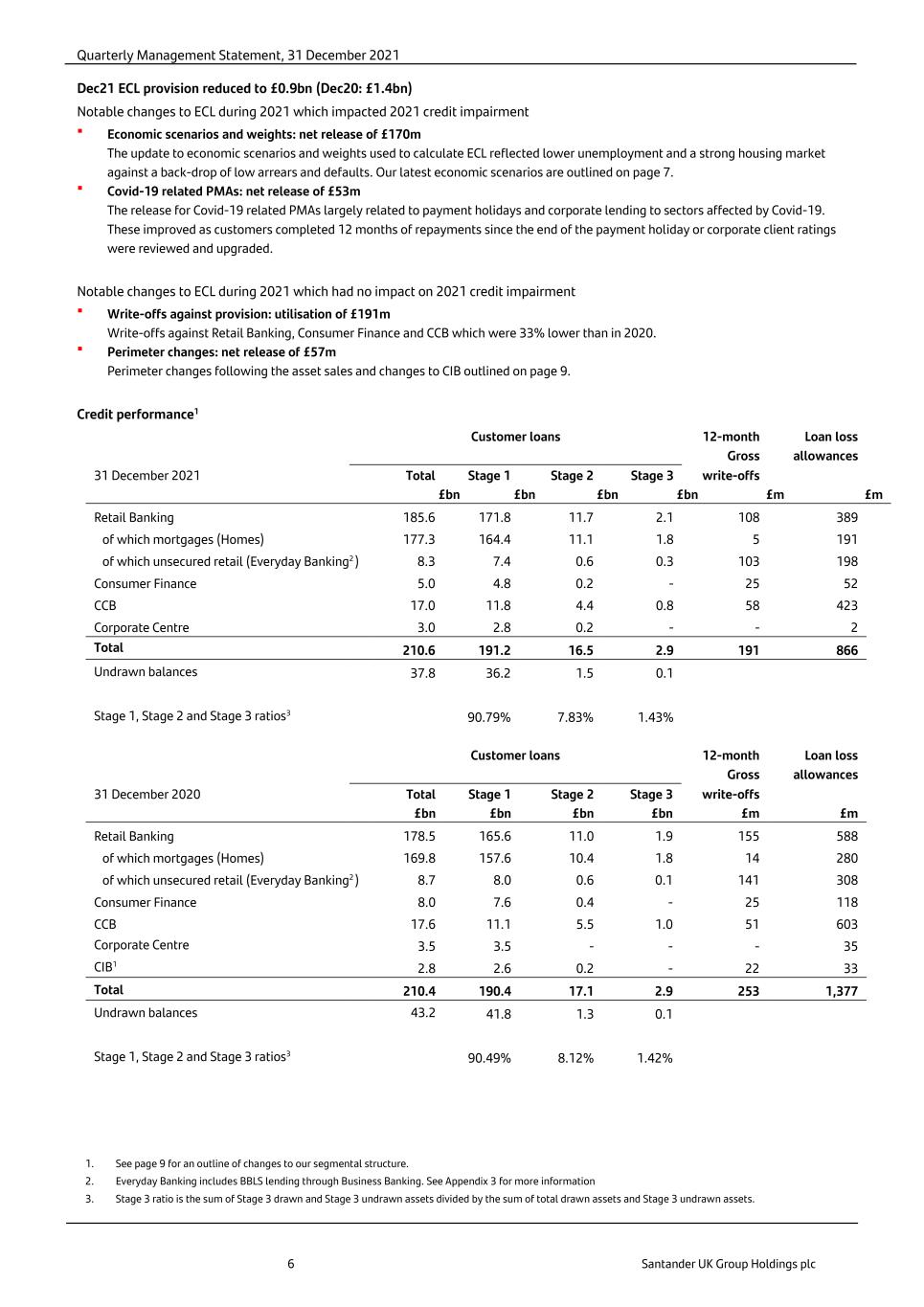

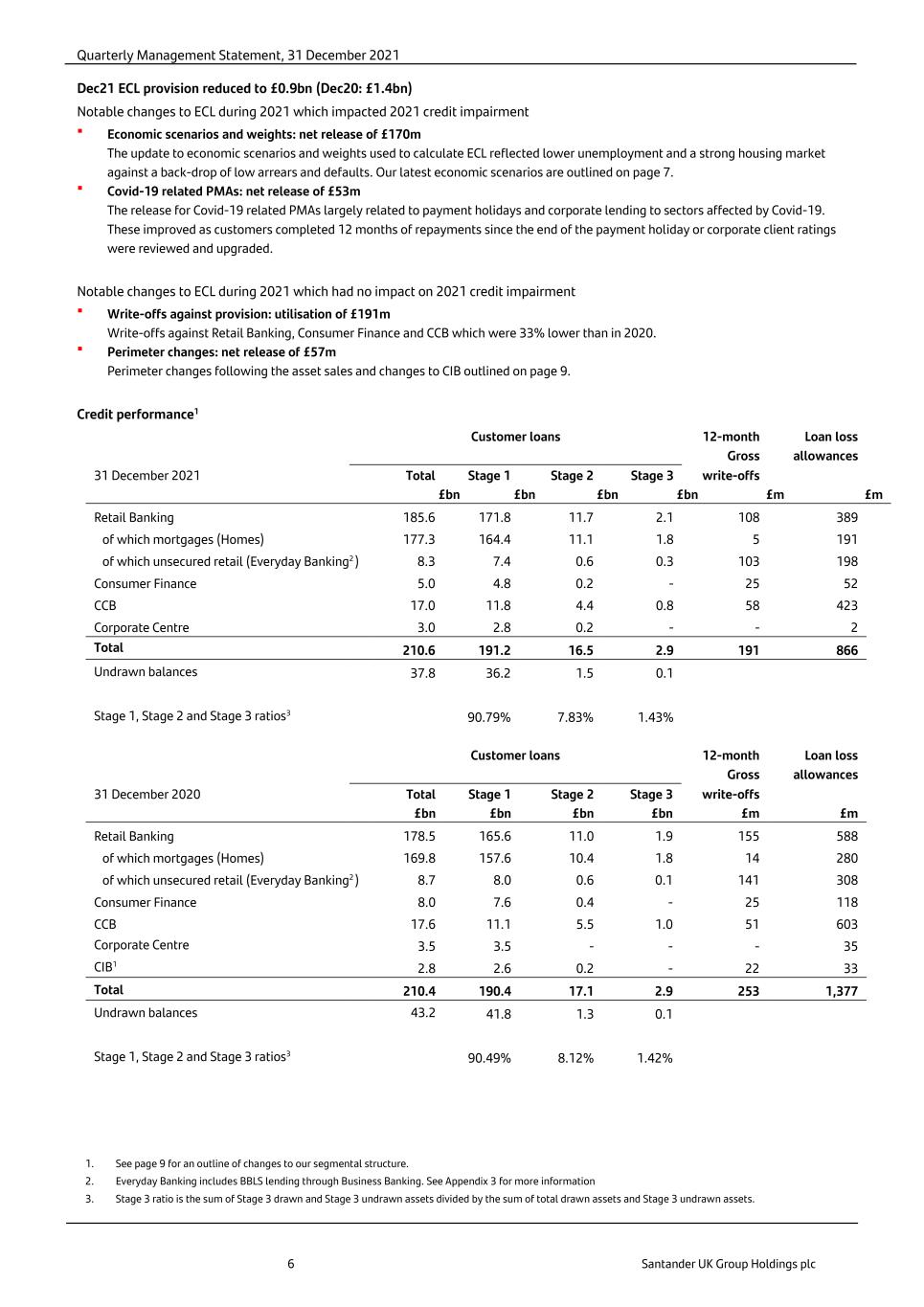

Quarterly Management Statement, 31 December 2021 6 Santander UK Group Holdings plc Dec21 ECL provision reduced to £0.9bn (Dec20: £1.4bn) Notable changes to ECL during 2021 which impacted 2021 credit impairment Economic scenarios and weights: net release of £170m The update to economic scenarios and weights used to calculate ECL reflected lower unemployment and a strong housing market against a back-drop of low arrears and defaults. Our latest economic scenarios are outlined on page 7. Covid-19 related PMAs: net release of £53m The release for Covid-19 related PMAs largely related to payment holidays and corporate lending to sectors affected by Covid-19. These improved as customers completed 12 months of repayments since the end of the payment holiday or corporate client ratings were reviewed and upgraded. Notable changes to ECL during 2021 which had no impact on 2021 credit impairment Write-offs against provision: utilisation of £191m Write-offs against Retail Banking, Consumer Finance and CCB which were 33% lower than in 2020. Perimeter changes: net release of £57m Perimeter changes following the asset sales and changes to CIB outlined on page 9. Credit performance1 Customer loans 12-month Gross Loan loss allowances 31 December 2021 Total Stage 1 Stage 2 Stage 3 write-offs £bn £bn £bn £bn £m £m Retail Banking 185.6 171.8 11.7 2.1 108 389 of which mortgages (Homes) 177.3 164.4 11.1 1.8 5 191 of which unsecured retail (Everyday Banking2 ) 8.3 7.4 0.6 0.3 103 198 Consumer Finance 5.0 4.8 0.2 - 25 52 CCB 17.0 11.8 4.4 0.8 58 423 Corporate Centre 3.0 2.8 0.2 - - 2 Total 210.6 191.2 16.5 2.9 191 866 Undrawn balances 37.8 36.2 1.5 0.1 Stage 1, Stage 2 and Stage 3 ratios3 90.79% 7.83% 1.43% Customer loans 12-month Gross Loan loss allowances 31 December 2020 Total Stage 1 Stage 2 Stage 3 write-offs £bn £bn £bn £bn £m £m Retail Banking 178.5 165.6 11.0 1.9 155 588 of which mortgages (Homes) 169.8 157.6 10.4 1.8 14 280 of which unsecured retail (Everyday Banking2 ) 8.7 8.0 0.6 0.1 141 308 Consumer Finance 8.0 7.6 0.4 - 25 118 CCB 17.6 11.1 5.5 1.0 51 603 Corporate Centre 3.5 3.5 - - - 35 CIB1 2.8 2.6 0.2 - 22 33 Total 210.4 190.4 17.1 2.9 253 1,377 Undrawn balances 43.2 41.8 1.3 0.1 Stage 1, Stage 2 and Stage 3 ratios3 90.49% 8.12% 1.42% 1. See page 9 for an outline of changes to our segmental structure. 2. Everyday Banking includes BBLS lending through Business Banking. See Appendix 3 for more information 3. Stage 3 ratio is the sum of Stage 3 drawn and Stage 3 undrawn assets divided by the sum of total drawn assets and Stage 3 undrawn assets.

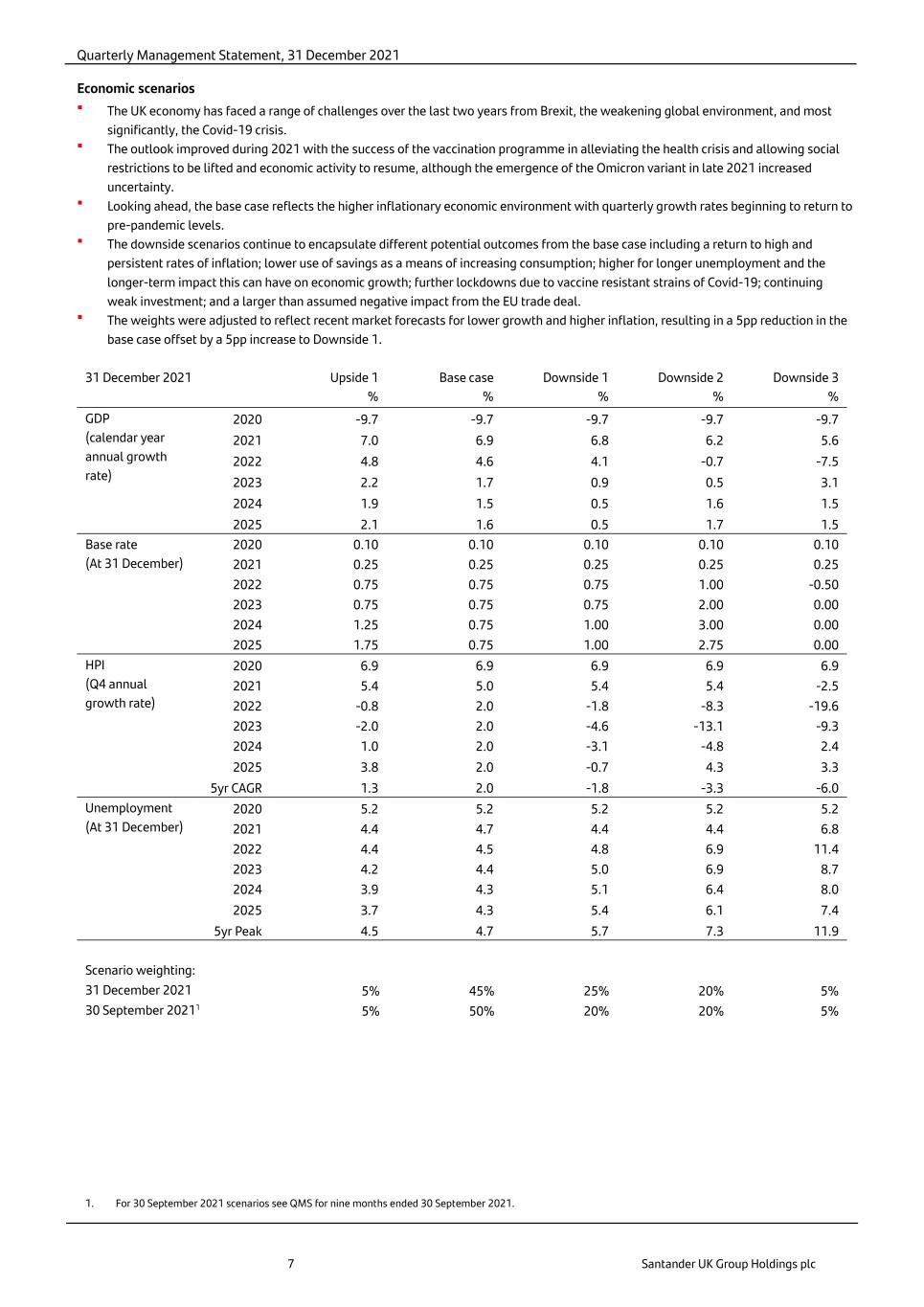

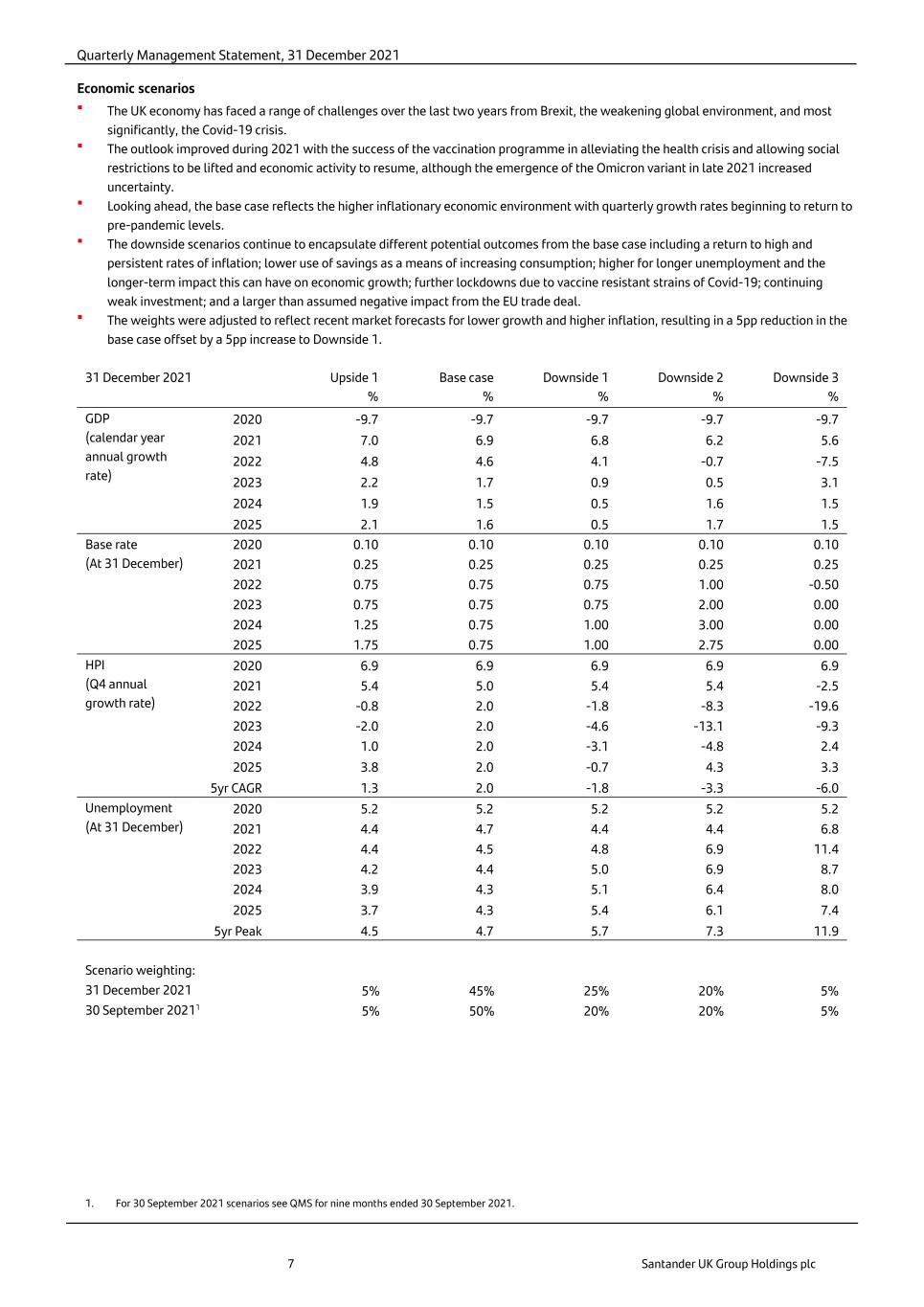

Quarterly Management Statement, 31 December 2021 7 Santander UK Group Holdings plc Economic scenarios The UK economy has faced a range of challenges over the last two years from Brexit, the weakening global environment, and most significantly, the Covid-19 crisis. The outlook improved during 2021 with the success of the vaccination programme in alleviating the health crisis and allowing social restrictions to be lifted and economic activity to resume, although the emergence of the Omicron variant in late 2021 increased uncertainty. Looking ahead, the base case reflects the higher inflationary economic environment with quarterly growth rates beginning to return to pre-pandemic levels. The downside scenarios continue to encapsulate different potential outcomes from the base case including a return to high and persistent rates of inflation; lower use of savings as a means of increasing consumption; higher for longer unemployment and the longer-term impact this can have on economic growth; further lockdowns due to vaccine resistant strains of Covid-19; continuing weak investment; and a larger than assumed negative impact from the EU trade deal. The weights were adjusted to reflect recent market forecasts for lower growth and higher inflation, resulting in a 5pp reduction in the base case offset by a 5pp increase to Downside 1. 31 December 2021 Upside 1 % Base case % Downside 1 % Downside 2 % Downside 3 % GDP (calendar year annual growth rate) 2020 -9.7 -9.7 -9.7 -9.7 -9.7 2021 7.0 6.9 6.8 6.2 5.6 2022 4.8 4.6 4.1 -0.7 -7.5 2023 2.2 1.7 0.9 0.5 3.1 2024 1.9 1.5 0.5 1.6 1.5 2025 2.1 1.6 0.5 1.7 1.5 Base rate (At 31 December) 2020 0.10 0.10 0.10 0.10 0.10 2021 0.25 0.25 0.25 0.25 0.25 2022 0.75 0.75 0.75 1.00 -0.50 2023 0.75 0.75 0.75 2.00 0.00 2024 1.25 0.75 1.00 3.00 0.00 2025 1.75 0.75 1.00 2.75 0.00 HPI (Q4 annual growth rate) 2020 6.9 6.9 6.9 6.9 6.9 2021 5.4 5.0 5.4 5.4 -2.5 2022 -0.8 2.0 -1.8 -8.3 -19.6 2023 -2.0 2.0 -4.6 -13.1 -9.3 2024 1.0 2.0 -3.1 -4.8 2.4 2025 3.8 2.0 -0.7 4.3 3.3 5yr CAGR 1.3 2.0 -1.8 -3.3 -6.0 Unemployment (At 31 December) 2020 5.2 5.2 5.2 5.2 5.2 2021 4.4 4.7 4.4 4.4 6.8 2022 4.4 4.5 4.8 6.9 11.4 2023 4.2 4.4 5.0 6.9 8.7 2024 3.9 4.3 5.1 6.4 8.0 2025 3.7 4.3 5.4 6.1 7.4 5yr Peak 4.5 4.7 5.7 7.3 11.9 Scenario weighting: 31 December 2021 5% 45% 25% 20% 5% 30 September 20211 5% 50% 20% 20% 5% 1. For 30 September 2021 scenarios see QMS for nine months ended 30 September 2021.

Quarterly Management Statement, 31 December 2021 8 Santander UK Group Holdings plc Capital, funding and liquidity 31.12.21 31.12.20 £bn £bn Capital: CET1 capital 10.8 11.1 Total qualifying regulatory capital 14.7 15.4 CET1 capital ratio 15.9% 15.2% Total capital ratio 21.6% 21.1% UK leverage ratio 5.2% 5.1% RWA 68.1 72.9 UK leverage exposure 246.3 259.0 Funding: Total wholesale funding and AT1 67.8 65.7 - of which with a residual maturity of less than one year 10.2 21.1 Liquidity: RFB DoLSub LCR 166% 150% RFB DoLSub LCR eligible liquidity pool 51.4 51.5 SFS LCR 206% 165% SFS LCR eligible liquidity pool 2.8 2.8 RWA reduced following asset sales and transfers to Banco Santander as well as a sale of a retail mortgage portfolio1 RWA reduced c£6bn following a sale of our PSA shareholding to PSA Financial Services Spain, the transfer of CIB to SLB, sale of our London head office and the sale of a £0.6bn retail mortgage portfolio. These sales and transfers reduced customer loans by £6.0bn. Dividend payments and assessment of capital surplus related to asset sales and transfer of CIB We paid £1,346m interim ordinary share dividends related to 2021 profit and an assessment of capital surpluses (2020: £103m). Dividends were paid in line with our dividend policy following review and approval by the Santander UK Board. Improved capital ratios through RWA and leverage exposure management and retained profit CET1 capital ratio increased 70bps to 15.9%, 590bps above the MDA threshold, largely due to lower RWAs and retained profit. The UK leverage ratio improved 10bps to 5.2%, 160bps above regulatory minimum, largely due to lower assets. CET1 capital ratio includes a benefit of c20bps and UK leverage ratio c5bps from the change in treatment of software assets outlined in the EBA technical standard on the prudential treatment of software assets. The PRA have outlined in Policy Statement PS17/21 on the Implementation of Basel Standards that this treatment will fall away at the start of 2022 and software assets will instead be fully deducted from CET1 capital from that date. Total capital ratio increased by 50bps to 21.6%, with lower RWA and retained profits offsetting the reduction in capital securities in issue and the increased effect from January 2021 of the CRD IV Grandfathering Cap rules that reduce the recognition of grandfathered capital instruments issued by Santander UK plc. Strong performance in the 2021 Bank of England stress test Our lowest post-stress CET1 capital ratio was modelled to be 11.2% before management actions, above the 8.2% reference rate. Our lowest post-stress Tier 1 leverage ratio was modelled to be 4.1% before management actions, above the 3.5% reference rate. The Bank of England did not require Santander UK to undertake any actions because of the exercise. Robust funding, liquidity and interest rate management We drew further on TFSME in Q421, with £31.9bn outstanding at year end. We repaid all TFS outstanding. We issued £2.8bn of MREL eligible senior unsecured securities. Wholesale funding costs improved in 2021 with buy backs and maturities being refinanced at lower cost. The RFB DoLSub LCR of 166% increased (2020: 150%) and remains significantly above regulatory requirements. Our structural hedge position remained broadly stable at c£103bn, with an average duration of c2.6 years. 1. See page 9 for more on asset sales and transfers, segment changes and discontinued operations.

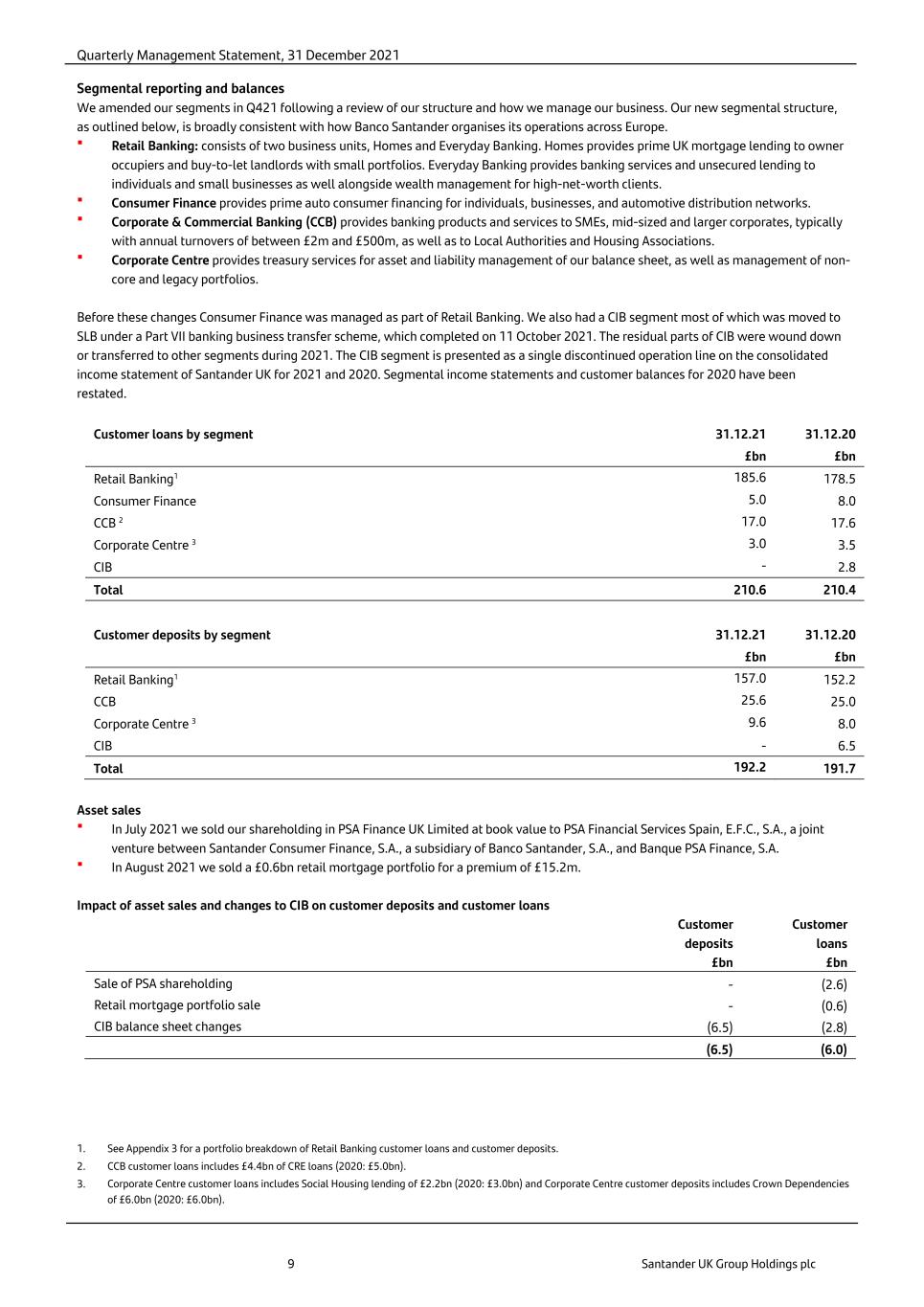

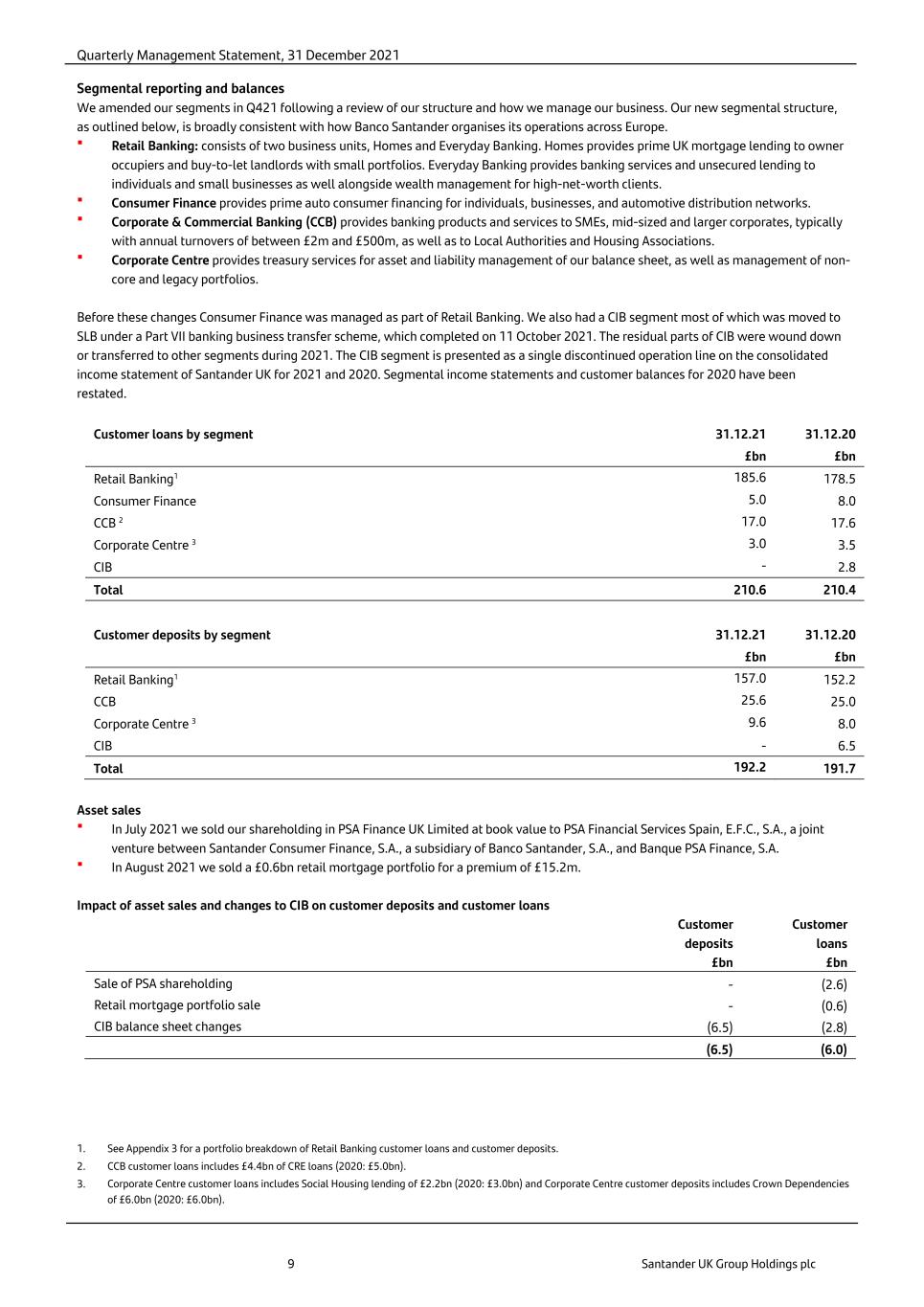

Quarterly Management Statement, 31 December 2021 9 Santander UK Group Holdings plc Segmental reporting and balances We amended our segments in Q421 following a review of our structure and how we manage our business. Our new segmental structure, as outlined below, is broadly consistent with how Banco Santander organises its operations across Europe. Retail Banking: consists of two business units, Homes and Everyday Banking. Homes provides prime UK mortgage lending to owner occupiers and buy-to-let landlords with small portfolios. Everyday Banking provides banking services and unsecured lending to individuals and small businesses as well alongside wealth management for high-net-worth clients. Consumer Finance provides prime auto consumer financing for individuals, businesses, and automotive distribution networks. Corporate & Commercial Banking (CCB) provides banking products and services to SMEs, mid-sized and larger corporates, typically with annual turnovers of between £2m and £500m, as well as to Local Authorities and Housing Associations. Corporate Centre provides treasury services for asset and liability management of our balance sheet, as well as management of non- core and legacy portfolios. Before these changes Consumer Finance was managed as part of Retail Banking. We also had a CIB segment most of which was moved to SLB under a Part VII banking business transfer scheme, which completed on 11 October 2021. The residual parts of CIB were wound down or transferred to other segments during 2021. The CIB segment is presented as a single discontinued operation line on the consolidated income statement of Santander UK for 2021 and 2020. Segmental income statements and customer balances for 2020 have been restated. Customer loans by segment 31.12.21 31.12.20 £bn £bn Retail Banking1 185.6 178.5 Consumer Finance 5.0 8.0 CCB 2 17.0 17.6 Corporate Centre 3 3.0 3.5 CIB - 2.8 Total 210.6 210.4 Customer deposits by segment 31.12.21 31.12.20 £bn £bn Retail Banking1 157.0 152.2 CCB 25.6 25.0 Corporate Centre 3 9.6 8.0 CIB - 6.5 Total 192.2 191.7 Asset sales In July 2021 we sold our shareholding in PSA Finance UK Limited at book value to PSA Financial Services Spain, E.F.C., S.A., a joint venture between Santander Consumer Finance, S.A., a subsidiary of Banco Santander, S.A., and Banque PSA Finance, S.A. In August 2021 we sold a £0.6bn retail mortgage portfolio for a premium of £15.2m. Impact of asset sales and changes to CIB on customer deposits and customer loans Customer deposits Customer loans £bn £bn Sale of PSA shareholding - (2.6) Retail mortgage portfolio sale - (0.6) CIB balance sheet changes (6.5) (2.8) (6.5) (6.0) 1. See Appendix 3 for a portfolio breakdown of Retail Banking customer loans and customer deposits. 2. CCB customer loans includes £4.4bn of CRE loans (2020: £5.0bn). 3. Corporate Centre customer loans includes Social Housing lending of £2.2bn (2020: £3.0bn) and Corporate Centre customer deposits includes Crown Dependencies of £6.0bn (2020: £6.0bn).

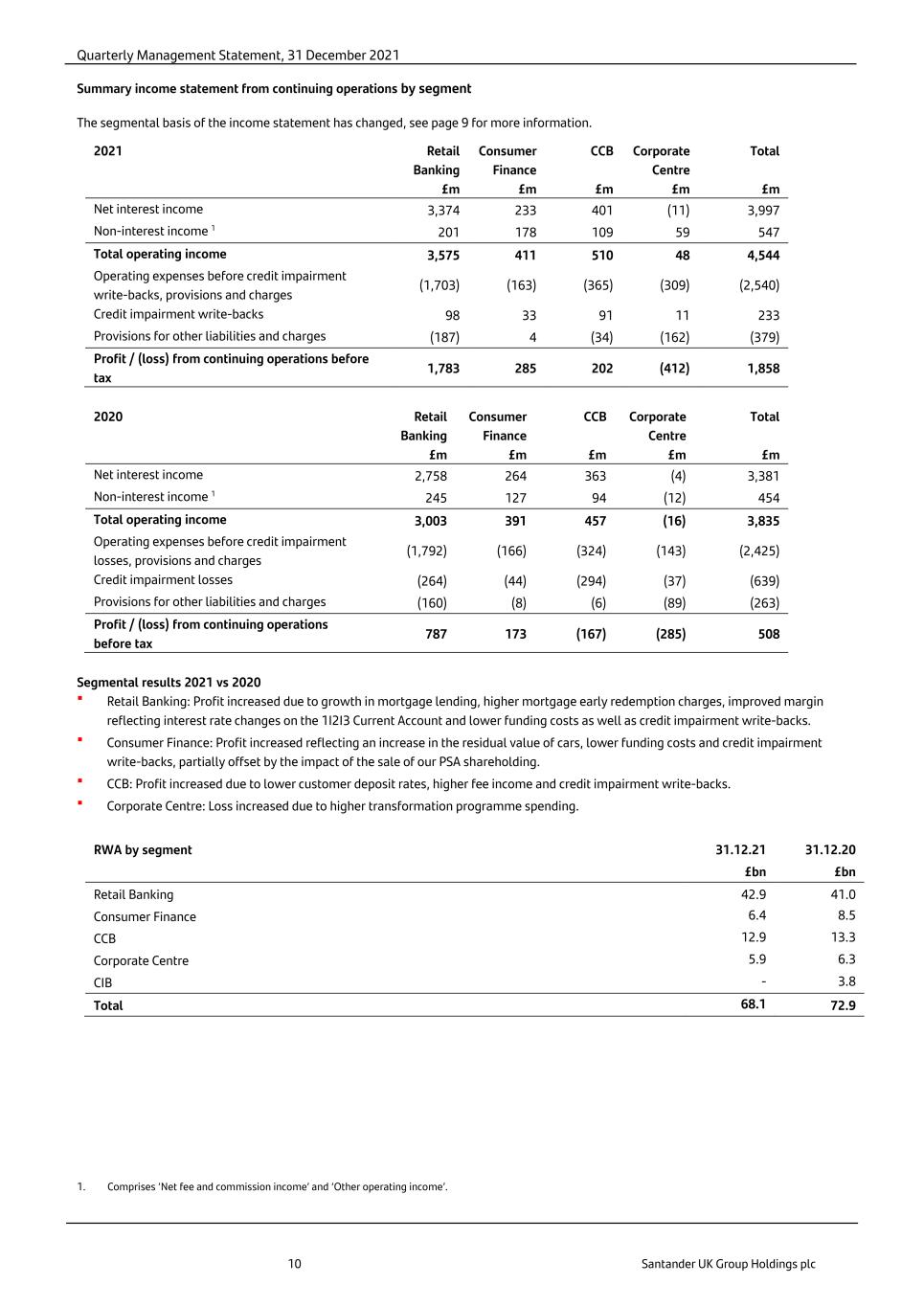

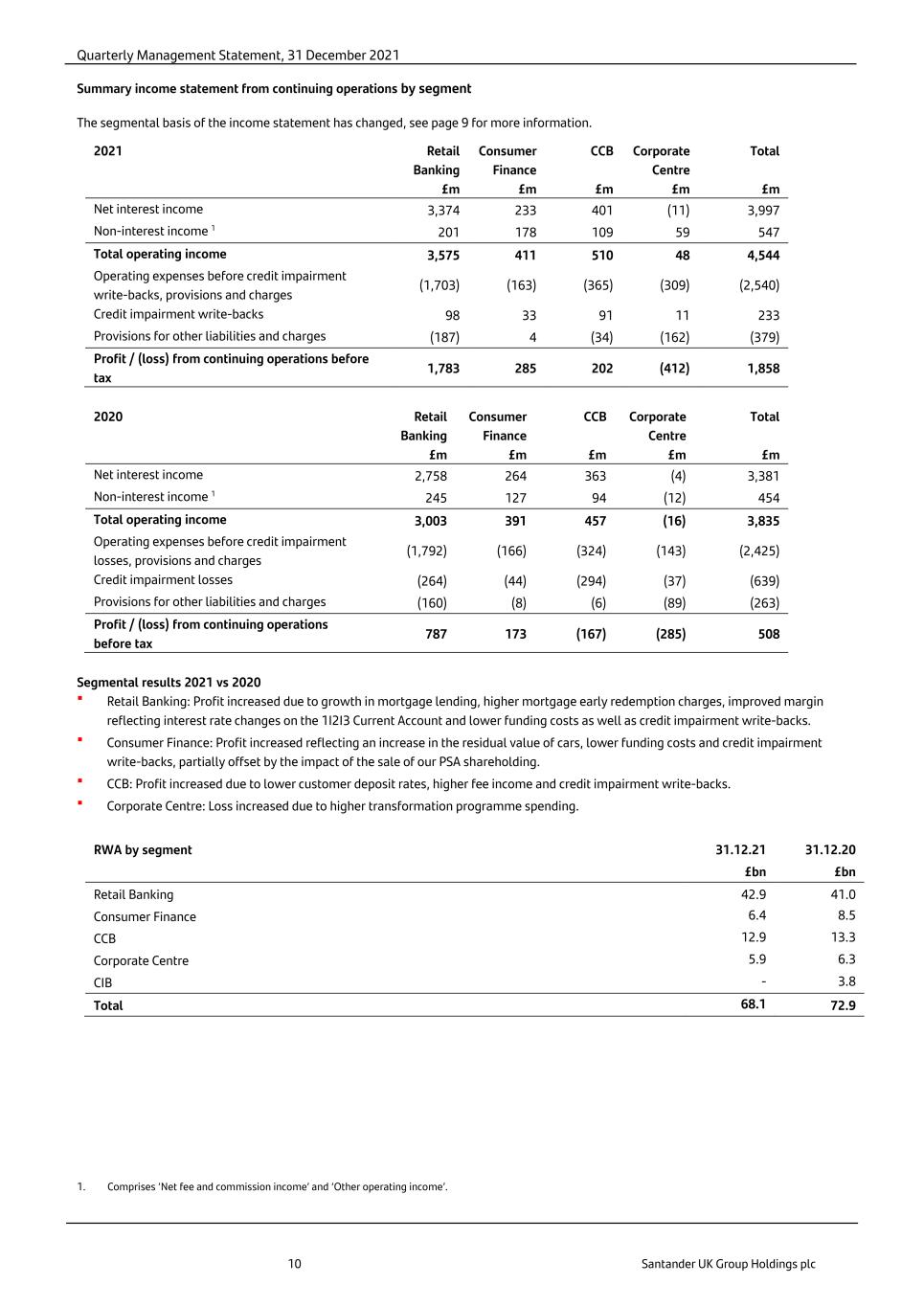

Quarterly Management Statement, 31 December 2021 10 Santander UK Group Holdings plc Summary income statement from continuing operations by segment The segmental basis of the income statement has changed, see page 9 for more information. 2021 Retail Banking Consumer Finance CCB Corporate Centre Total £m £m £m £m £m Net interest income 3,374 233 401 (11) 3,997 Non-interest income 1 201 178 109 59 547 Total operating income 3,575 411 510 48 4,544 Operating expenses before credit impairment write-backs, provisions and charges (1,703) (163) (365) (309) (2,540) Credit impairment write-backs 98 33 91 11 233 Provisions for other liabilities and charges (187) 4 (34) (162) (379) Profit / (loss) from continuing operations before tax 1,783 285 202 (412) 1,858 2020 Retail Banking Consumer Finance CCB Corporate Centre Total £m £m £m £m £m Net interest income 2,758 264 363 (4) 3,381 Non-interest income 1 245 127 94 (12) 454 Total operating income 3,003 391 457 (16) 3,835 Operating expenses before credit impairment losses, provisions and charges (1,792) (166) (324) (143) (2,425) Credit impairment losses (264) (44) (294) (37) (639) Provisions for other liabilities and charges (160) (8) (6) (89) (263) Profit / (loss) from continuing operations before tax 787 173 (167) (285) 508 Segmental results 2021 vs 2020 Retail Banking: Profit increased due to growth in mortgage lending, higher mortgage early redemption charges, improved margin reflecting interest rate changes on the 1I2I3 Current Account and lower funding costs as well as credit impairment write-backs. Consumer Finance: Profit increased reflecting an increase in the residual value of cars, lower funding costs and credit impairment write-backs, partially offset by the impact of the sale of our PSA shareholding. CCB: Profit increased due to lower customer deposit rates, higher fee income and credit impairment write-backs. Corporate Centre: Loss increased due to higher transformation programme spending. RWA by segment 31.12.21 31.12.20 £bn £bn Retail Banking 42.9 41.0 Consumer Finance 6.4 8.5 CCB 12.9 13.3 Corporate Centre 5.9 6.3 CIB - 3.8 Total 68.1 72.9 1. Comprises ‘Net fee and commission income’ and ‘Other operating income’.

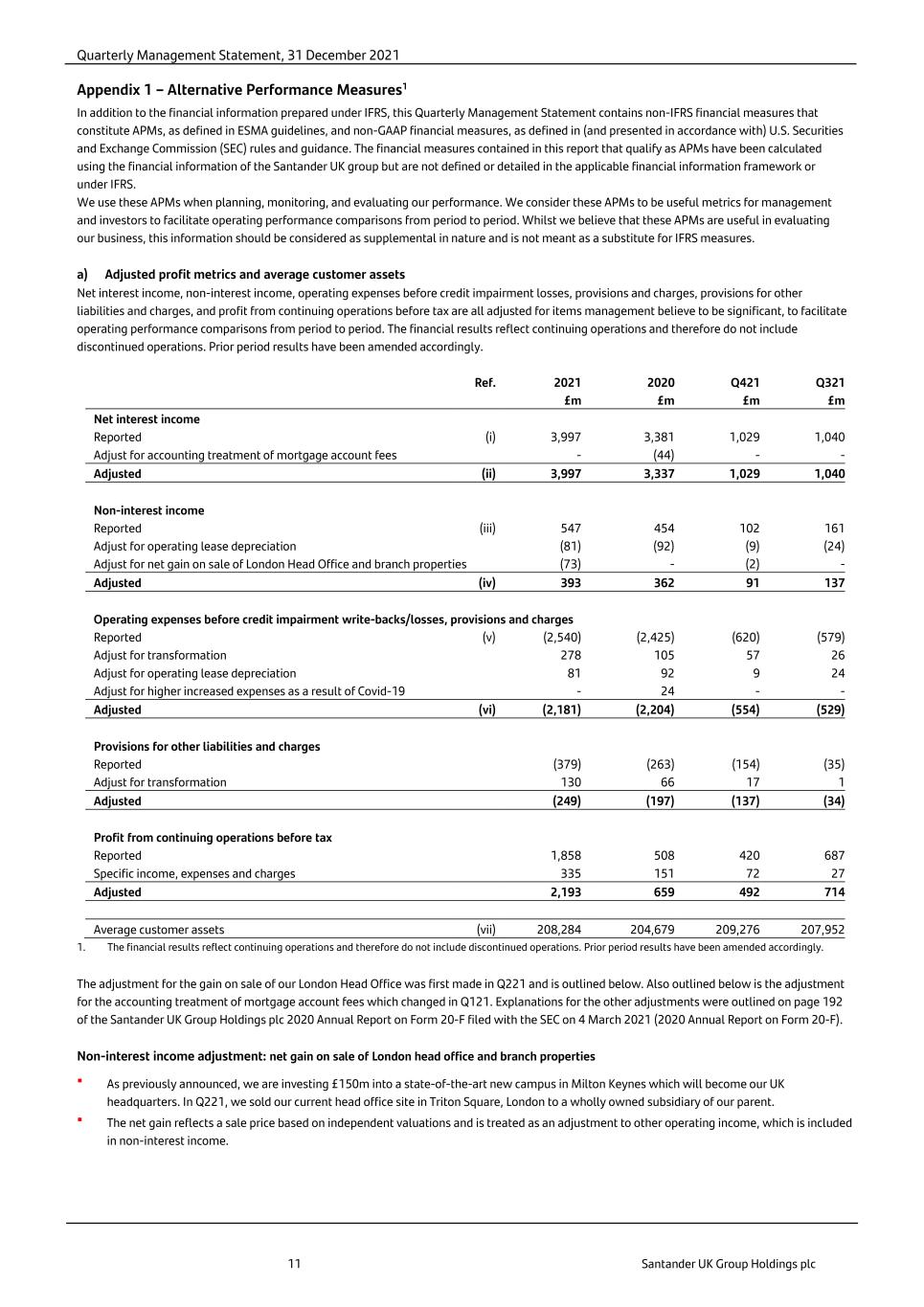

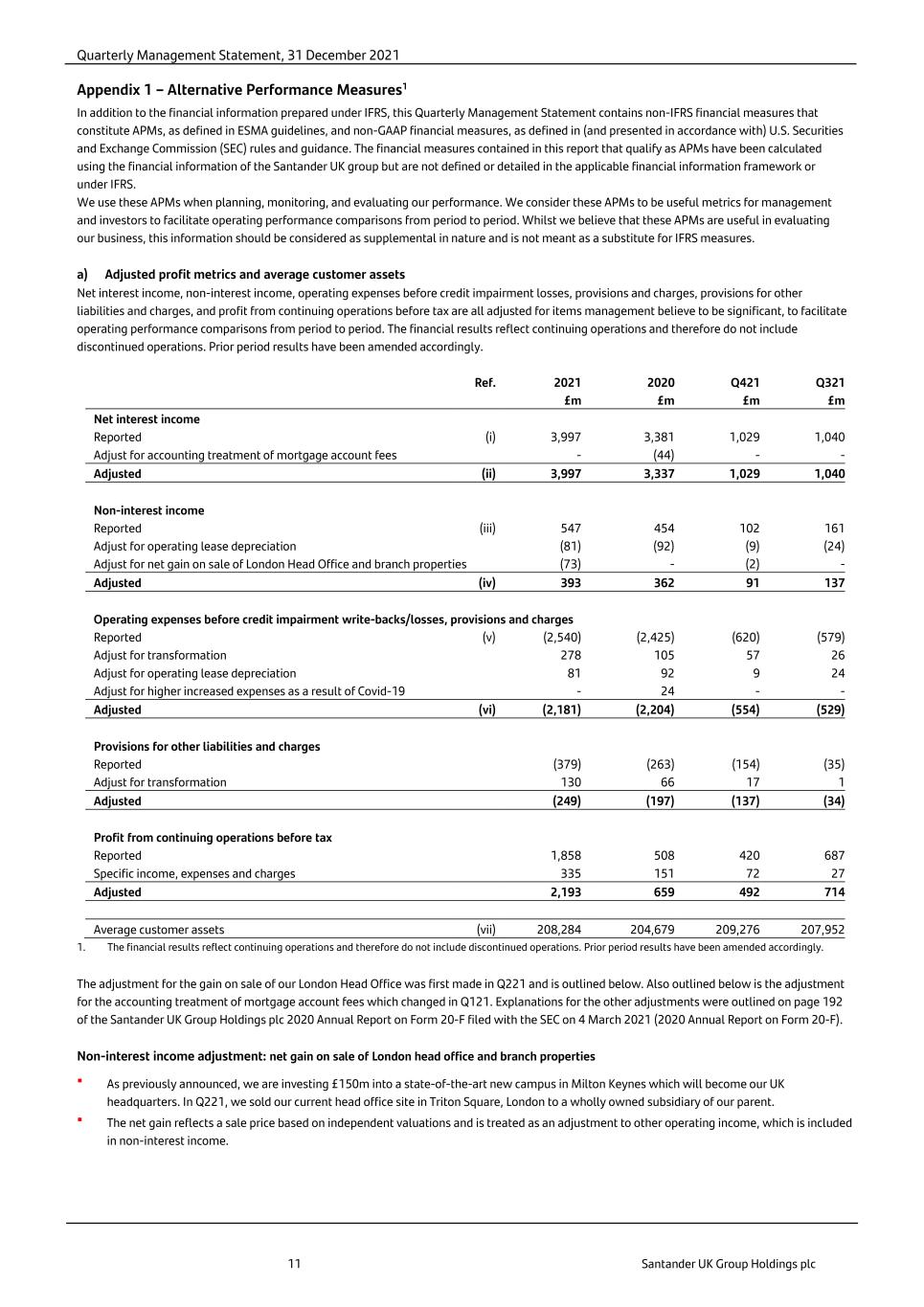

Quarterly Management Statement, 31 December 2021 11 Santander UK Group Holdings plc Appendix 1 – Alternative Performance Measures1 In addition to the financial information prepared under IFRS, this Quarterly Management Statement contains non-IFRS financial measures that constitute APMs, as defined in ESMA guidelines, and non-GAAP financial measures, as defined in (and presented in accordance with) U.S. Securities and Exchange Commission (SEC) rules and guidance. The financial measures contained in this report that qualify as APMs have been calculated using the financial information of the Santander UK group but are not defined or detailed in the applicable financial information framework or under IFRS. We use these APMs when planning, monitoring, and evaluating our performance. We consider these APMs to be useful metrics for management and investors to facilitate operating performance comparisons from period to period. Whilst we believe that these APMs are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for IFRS measures. a) Adjusted profit metrics and average customer assets Net interest income, non-interest income, operating expenses before credit impairment losses, provisions and charges, provisions for other liabilities and charges, and profit from continuing operations before tax are all adjusted for items management believe to be significant, to facilitate operating performance comparisons from period to period. The financial results reflect continuing operations and therefore do not include discontinued operations. Prior period results have been amended accordingly. Ref. 2021 2020 Q421 Q321 £m £m £m £m Net interest income Reported (i) 3,997 3,381 1,029 1,040 Adjust for accounting treatment of mortgage account fees - (44) - - Adjusted (ii) 3,997 3,337 1,029 1,040 Non-interest income Reported (iii) 547 454 102 161 Adjust for operating lease depreciation (81) (92) (9) (24) Adjust for net gain on sale of London Head Office and branch properties (73) - (2) - Adjusted (iv) 393 362 91 137 Operating expenses before credit impairment write-backs/losses, provisions and charges Reported (v) (2,540) (2,425) (620) (579) Adjust for transformation 278 105 57 26 Adjust for operating lease depreciation 81 92 9 24 Adjust for higher increased expenses as a result of Covid-19 - 24 - - Adjusted (vi) (2,181) (2,204) (554) (529) Provisions for other liabilities and charges Reported (379) (263) (154) (35) Adjust for transformation 130 66 17 1 Adjusted (249) (197) (137) (34) Profit from continuing operations before tax Reported 1,858 508 420 687 Specific income, expenses and charges 335 151 72 27 Adjusted 2,193 659 492 714 Average customer assets (vii) 208,284 204,679 209,276 207,952 1. The financial results reflect continuing operations and therefore do not include discontinued operations. Prior period results have been amended accordingly. The adjustment for the gain on sale of our London Head Office was first made in Q221 and is outlined below. Also outlined below is the adjustment for the accounting treatment of mortgage account fees which changed in Q121. Explanations for the other adjustments were outlined on page 192 of the Santander UK Group Holdings plc 2020 Annual Report on Form 20-F filed with the SEC on 4 March 2021 (2020 Annual Report on Form 20-F). Non-interest income adjustment: net gain on sale of London head office and branch properties As previously announced, we are investing £150m into a state-of-the-art new campus in Milton Keynes which will become our UK headquarters. In Q221, we sold our current head office site in Triton Square, London to a wholly owned subsidiary of our parent. The net gain reflects a sale price based on independent valuations and is treated as an adjustment to other operating income, which is included in non-interest income.

Quarterly Management Statement, 31 December 2021 12 Santander UK Group Holdings plc The adjustment for accounting treatment changed in Q121 as outlined below. Net interest income adjustment: accounting treatment of mortgage account fees During Q420, we revised the accounting treatment for certain items of mortgage income. Mortgage account fees, which are normally paid at the end of the mortgage and were previously recognised as received in fee income, are now recognised in interest income as part of the effective interest rate method throughout the life of the mortgage to better reflect the requirements of IFRS. In addition, we no longer accrue interest income relating to the period after mortgages revert to the standard variable rate (or equivalent) beyond the incentive period. This better aligns our policy to current practice. The impact of these changes was taken in Q420 with no restatement of comparatives. In Q121 comparatives were restated to reallocate the net interest income and fee income changes taken in Q420 to the quarters in 2020 to which they relate. b) Adjusted Banking NIM Calculated as adjusted net interest income as a percentage of average customer assets over the period. We consider this metric useful for management and investors as it removes the positive impact of the 2020 accounting change on net interest income, which is not expected to be repeated. Ref. 2021 2020 Q421 Q321 Reported Net Interest Income (i) £3,997m £3,381m £1,029m £1,040m Adjusted Net Interest Income (ii) £3,997m £3,337m £1,029m £1,040m Reported Net Interest Income – annualised (viii) £3,997m £3,381m £4,082m £4,126m Adjusted Net Interest Income – annualised (ix) £3,997m £3,337m £4,082m £4,126m Banking NIM (viii) divided by (vii) 1.92% 1.65% 1.95% 1.98% Adjusted Banking NIM (ix) divided by (vii) 1.92% 1.63% 1.95% 1.98% c) Adjusted CIR Calculated as adjusted total operating expenses before credit impairment write-backs/losses and provisions for other liabilities and charges as a percentage of the total of adjusted net interest income and adjusted non-interest income. We consider this metric useful for management and investors as an efficiency measure to capture the amount spent to generate income, as we invest in our multi-year transformation programme. Ref. 2021 2020 Q421 Q321 CIR (v) divided by the sum of (i) + (iii) 56% 63% 55% 48% Adjusted CIR (vi) divided by the sum of (ii) + (iv) 50% 60% 49% 45%

Quarterly Management Statement, 31 December 2021 13 Santander UK Group Holdings plc d) Adjusted RoTE Calculated as adjusted profit after tax attributable to equity holders of the parent, divided by average shareholders’ equity less non-controlling interests, other equity instruments and average goodwill and other intangible assets. We consider this adjusted measure useful for management and investors as a measure of income generation on shareholder investment, as we focus on improving returns through our multi-year transformation programme. 2021 Specific income, expenses and charges As adjusted £m £m £m Profit after tax 1,405 244 1,649 Less non-controlling interests of annual profit (36) (36) Profit due to equity holders of the parent (A) 1,369 1,613 2021 £m Equity adjustments £m As adjusted £m Average shareholders' equity 16,312 Less average Additional Tier 1 (AT1) securities (2,216) Less average non-controlling interests (316) Average ordinary shareholders' equity (B) 13,780 Average goodwill and intangible assets (1,597) Average tangible equity (C) 12,183 61 12,244 Return on ordinary shareholders' equity (A/B) 9.9% - Adjusted RoTE (A/C) - 13.2% 2020 Specific income, expenses and charges As adjusted £m £m £m Profit after tax 438 115 553 Less non-controlling interests of annual profit (36) (36) Profit due to equity holders of the parent (A) 402 517 2020 £m Equity adjustments £m As adjusted £m Average shareholders' equity 16,293 Less average Additional Tier 1 (AT1) securities (2,243) Less average non-controlling interests (398) Average ordinary shareholders' equity (B) 13,652 Average goodwill and intangible assets (1,713) Average tangible equity (C) 11,939 29 11,968 Return on ordinary shareholders' equity (A/B) 2.9% - Adjusted RoTE (A/C) - 4.3% Specific income, expenses, charges Details of these items are outlined in section a) of Appendix 1, with a total impact on profit from continuing operations before tax of £335m. The impact of these items on the taxation charge was £91m and on profit after tax was £244m. Tax is effected at the standard rate of corporation tax including the bank surcharge, except for items such as conduct provisions which are not tax deductible. Equity adjustments These adjustments are made to reflect the impact of adjustments to profit on average tangible equity.

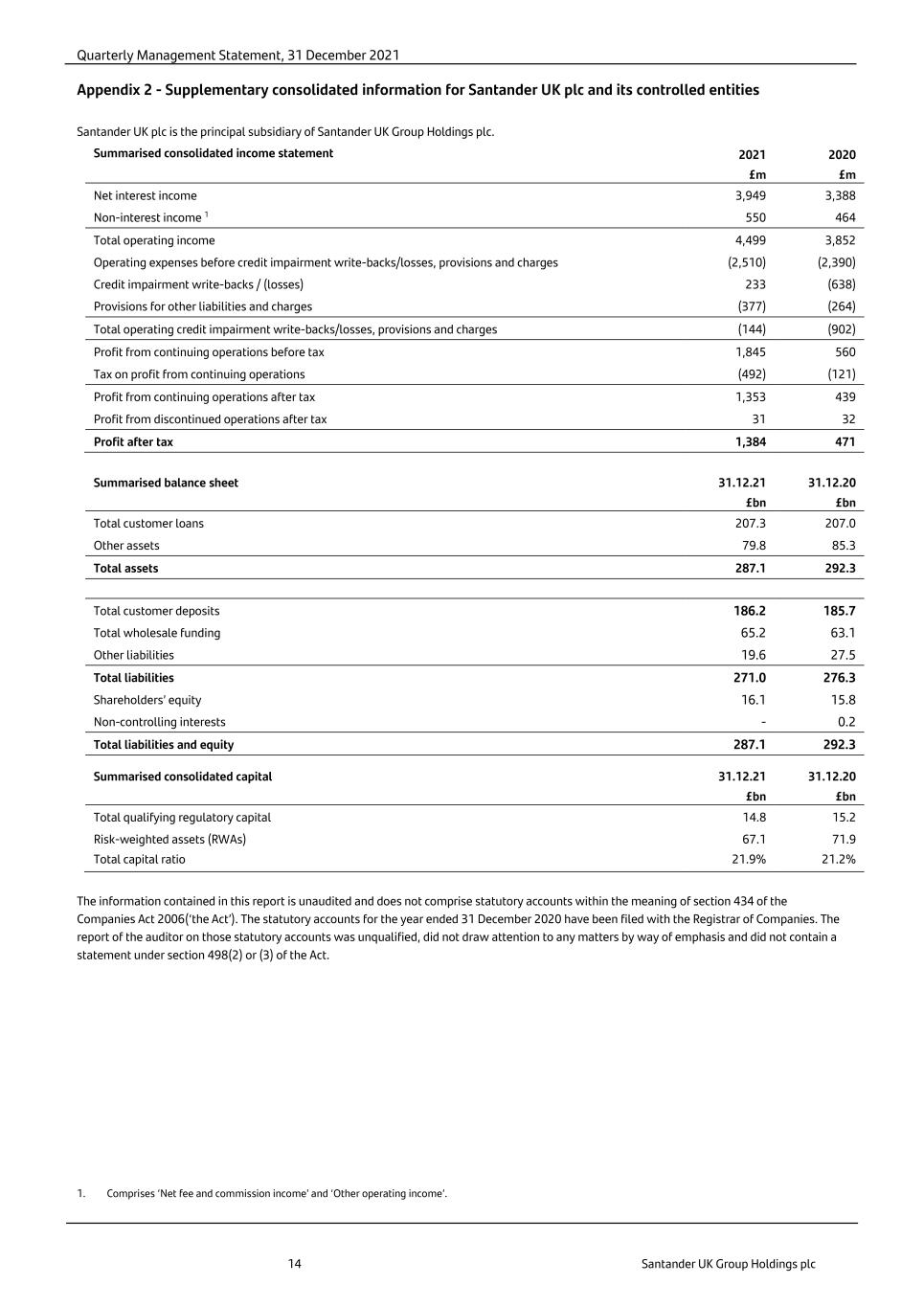

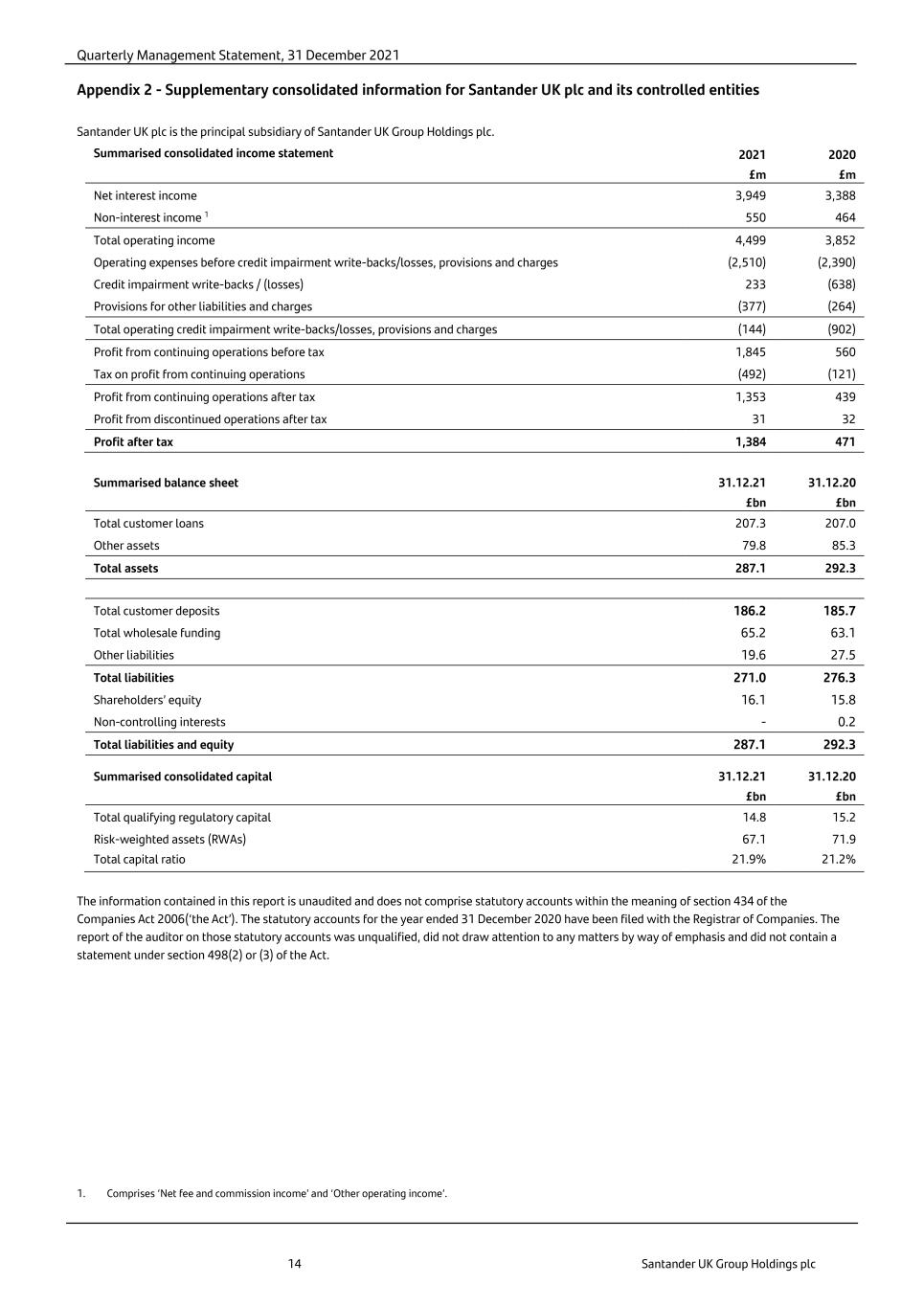

Quarterly Management Statement, 31 December 2021 14 Santander UK Group Holdings plc Appendix 2 - Supplementary consolidated information for Santander UK plc and its controlled entities Santander UK plc is the principal subsidiary of Santander UK Group Holdings plc. Summarised consolidated income statement 2021 2020 £m £m Net interest income 3,949 3,388 Non-interest income 1 550 464 Total operating income 4,499 3,852 Operating expenses before credit impairment write-backs/losses, provisions and charges (2,510) (2,390) Credit impairment write-backs / (losses) 233 (638) Provisions for other liabilities and charges (377) (264) Total operating credit impairment write-backs/losses, provisions and charges (144) (902) Profit from continuing operations before tax 1,845 560 Tax on profit from continuing operations (492) (121) Profit from continuing operations after tax 1,353 439 Profit from discontinued operations after tax 31 32 Profit after tax 1,384 471 Summarised balance sheet 31.12.21 31.12.20 £bn £bn Total customer loans 207.3 207.0 Other assets 79.8 85.3 Total assets 287.1 292.3 Total customer deposits 186.2 185.7 Total wholesale funding 65.2 63.1 Other liabilities 19.6 27.5 Total liabilities 271.0 276.3 Shareholders’ equity 16.1 15.8 Non-controlling interests - 0.2 Total liabilities and equity 287.1 292.3 Summarised consolidated capital 31.12.21 31.12.20 £bn £bn Total qualifying regulatory capital 14.8 15.2 Risk-weighted assets (RWAs) 67.1 71.9 Total capital ratio 21.9% 21.2% The information contained in this report is unaudited and does not comprise statutory accounts within the meaning of section 434 of the Companies Act 2006(‘the Act’). The statutory accounts for the year ended 31 December 2020 have been filed with the Registrar of Companies. The report of the auditor on those statutory accounts was unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under section 498(2) or (3) of the Act. 1. Comprises ‘Net fee and commission income’ and ‘Other operating income’.

Quarterly Management Statement, 31 December 2021 15 Santander UK Group Holdings plc Appendix 3 – Additional information Mortgage stock LTV distribution 2021 2020 >100% <1% <1% >85-100% 2% 4% >75-85% 8% 11% >50-75% 45% 41% Up to 50% 45% 44% Average LTV stock 41% 42% Mortgage new business LTV distribution 2021 2020 London lending 60% 60% Buy-to-let 68% 65% Average LTV new business 64% 64% Mortgage loan size 2021 2020 >£1.0m 2% 1% £0.5m to £1.0m 9% 8% £0.25m to £0.5m 30% 28% <£0.25m 59% 62% Ave. loan size (stock) £174k £165k Ave. loan size (new business) £234k £218k Mortgage borrower profile 2021 2020 Home movers 43% 42% Re-mortgagers 29% 31% First-time buyers 20% 20% BTL 8% 7% BTL balance £14.9bn £11.6bn Interest rate profile 2021 2020 Fixed rate 84% 80% Variable rate 10% 13% SVR 4% 6% FoR 2% 1%

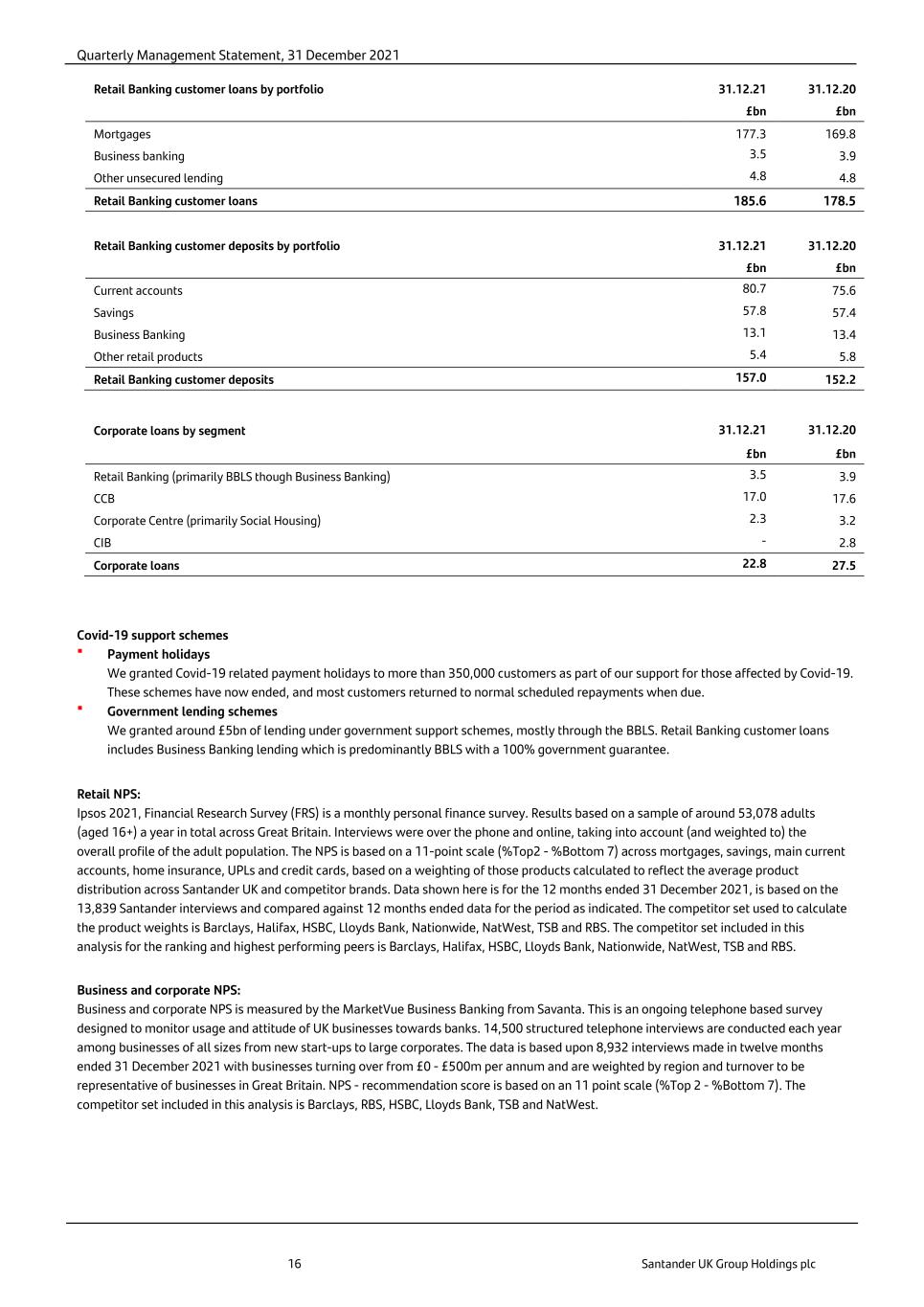

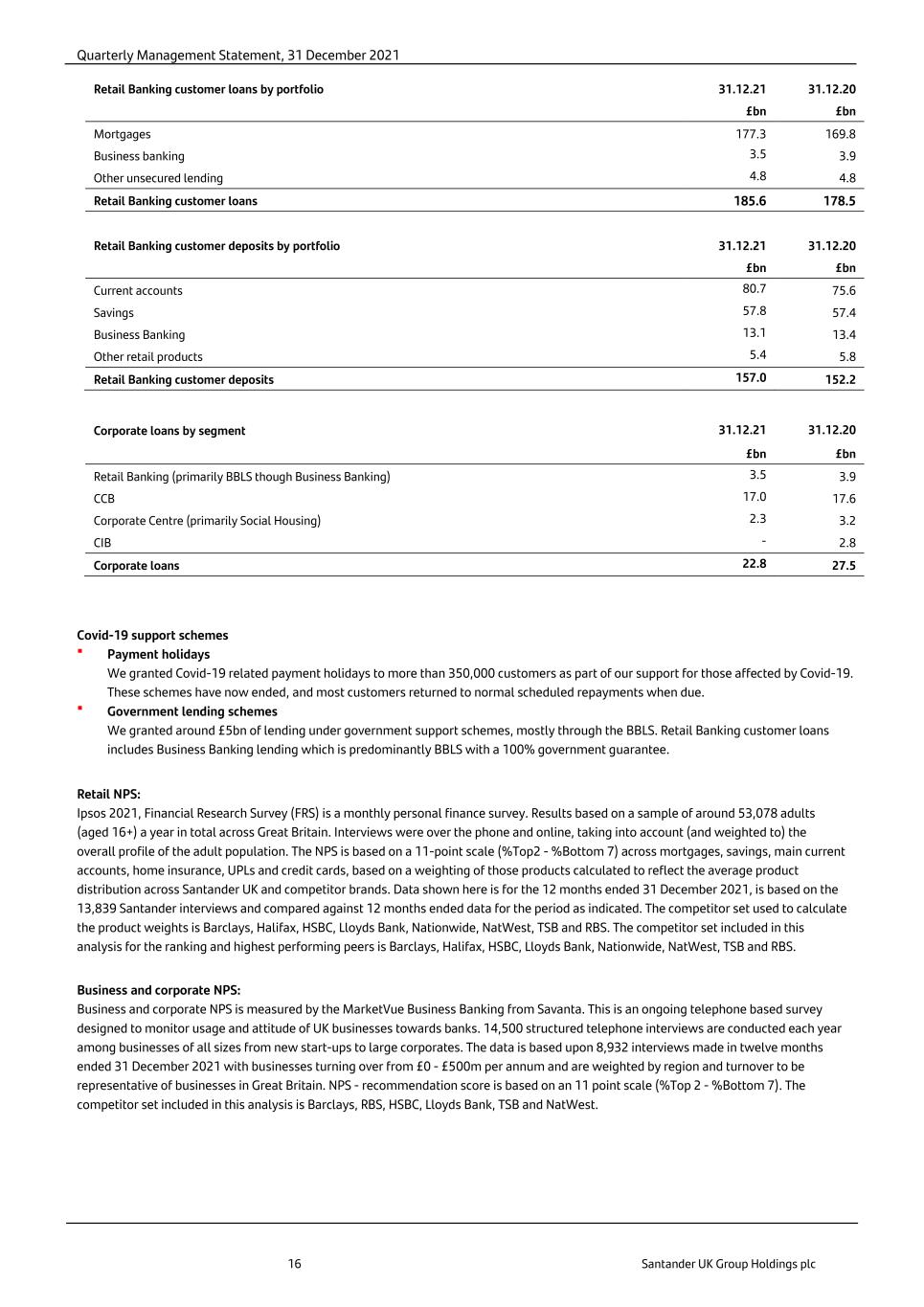

Quarterly Management Statement, 31 December 2021 16 Santander UK Group Holdings plc Retail Banking customer loans by portfolio 31.12.21 31.12.20 £bn £bn Mortgages 177.3 169.8 Business banking 3.5 3.9 Other unsecured lending 4.8 4.8 Retail Banking customer loans 185.6 178.5 Retail Banking customer deposits by portfolio 31.12.21 31.12.20 £bn £bn Current accounts 80.7 75.6 Savings 57.8 57.4 Business Banking 13.1 13.4 Other retail products 5.4 5.8 Retail Banking customer deposits 157.0 152.2 Corporate loans by segment 31.12.21 31.12.20 £bn £bn Retail Banking (primarily BBLS though Business Banking) 3.5 3.9 CCB 17.0 17.6 Corporate Centre (primarily Social Housing) 2.3 3.2 CIB - 2.8 Corporate loans 22.8 27.5 Covid-19 support schemes Payment holidays We granted Covid-19 related payment holidays to more than 350,000 customers as part of our support for those affected by Covid-19. These schemes have now ended, and most customers returned to normal scheduled repayments when due. Government lending schemes We granted around £5bn of lending under government support schemes, mostly through the BBLS. Retail Banking customer loans includes Business Banking lending which is predominantly BBLS with a 100% government guarantee. Retail NPS: Ipsos 2021, Financial Research Survey (FRS) is a monthly personal finance survey. Results based on a sample of around 53,078 adults (aged 16+) a year in total across Great Britain. Interviews were over the phone and online, taking into account (and weighted to) the overall profile of the adult population. The NPS is based on a 11-point scale (%Top2 - %Bottom 7) across mortgages, savings, main current accounts, home insurance, UPLs and credit cards, based on a weighting of those products calculated to reflect the average product distribution across Santander UK and competitor brands. Data shown here is for the 12 months ended 31 December 2021, is based on the 13,839 Santander interviews and compared against 12 months ended data for the period as indicated. The competitor set used to calculate the product weights is Barclays, Halifax, HSBC, Lloyds Bank, Nationwide, NatWest, TSB and RBS. The competitor set included in this analysis for the ranking and highest performing peers is Barclays, Halifax, HSBC, Lloyds Bank, Nationwide, NatWest, TSB and RBS. Business and corporate NPS: Business and corporate NPS is measured by the MarketVue Business Banking from Savanta. This is an ongoing telephone based survey designed to monitor usage and attitude of UK businesses towards banks. 14,500 structured telephone interviews are conducted each year among businesses of all sizes from new start-ups to large corporates. The data is based upon 8,932 interviews made in twelve months ended 31 December 2021 with businesses turning over from £0 - £500m per annum and are weighted by region and turnover to be representative of businesses in Great Britain. NPS - recommendation score is based on an 11 point scale (%Top 2 - %Bottom 7). The competitor set included in this analysis is Barclays, RBS, HSBC, Lloyds Bank, TSB and NatWest.

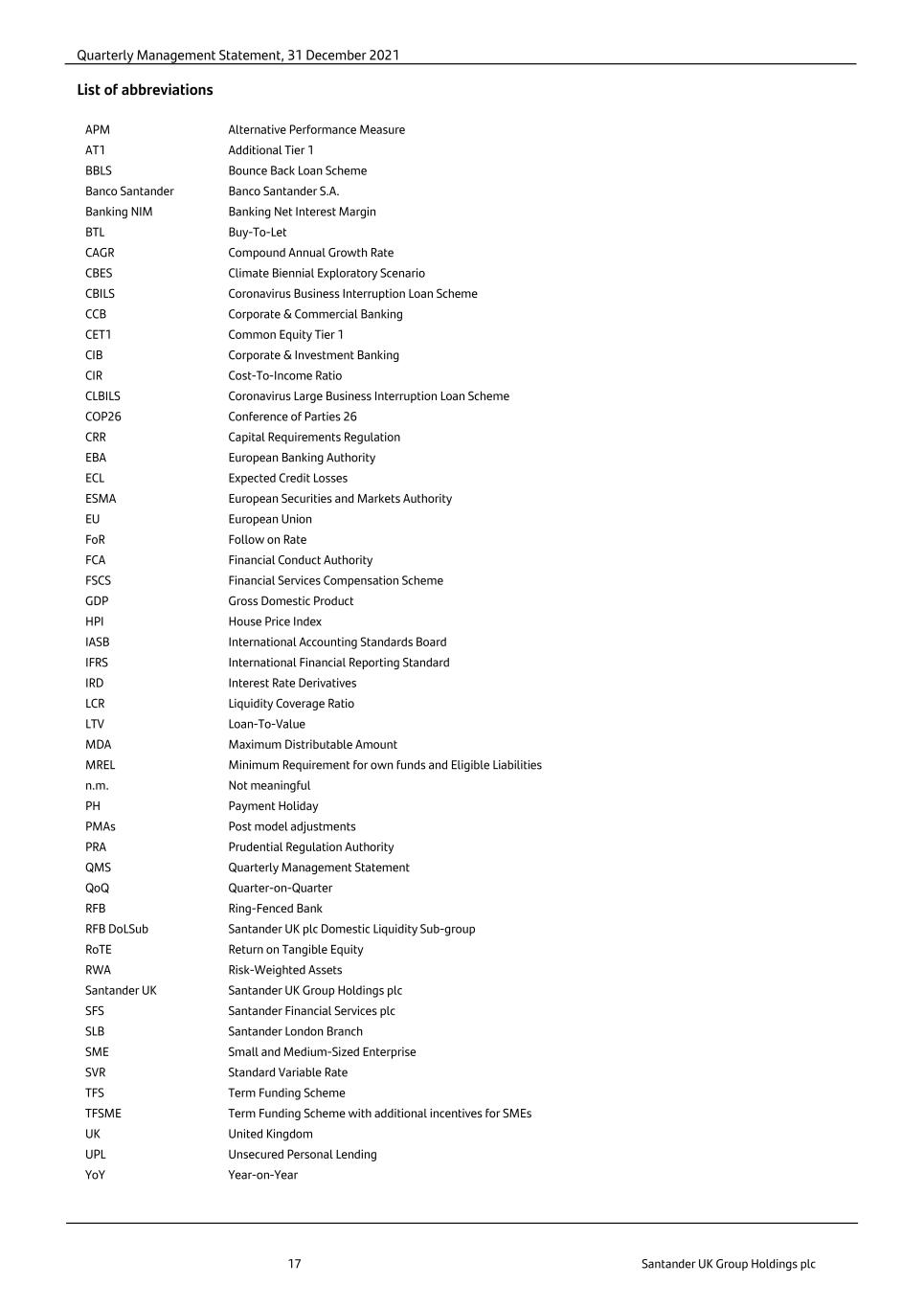

Quarterly Management Statement, 31 December 2021 17 Santander UK Group Holdings plc List of abbreviations APM Alternative Performance Measure AT1 Additional Tier 1 BBLS Bounce Back Loan Scheme Banco Santander Banco Santander S.A. Banking NIM Banking Net Interest Margin BTL Buy-To-Let CAGR Compound Annual Growth Rate CBES Climate Biennial Exploratory Scenario CBILS Coronavirus Business Interruption Loan Scheme CCB Corporate & Commercial Banking CET1 Common Equity Tier 1 CIB Corporate & Investment Banking CIR Cost-To-Income Ratio CLBILS Coronavirus Large Business Interruption Loan Scheme COP26 Conference of Parties 26 CRR Capital Requirements Regulation EBA European Banking Authority ECL Expected Credit Losses ESMA European Securities and Markets Authority EU European Union FoR Follow on Rate FCA Financial Conduct Authority FSCS Financial Services Compensation Scheme GDP Gross Domestic Product HPI House Price Index IASB International Accounting Standards Board IFRS International Financial Reporting Standard IRD Interest Rate Derivatives LCR Liquidity Coverage Ratio LTV Loan-To-Value MDA Maximum Distributable Amount MREL Minimum Requirement for own funds and Eligible Liabilities n.m. Not meaningful PH Payment Holiday PMAs Post model adjustments PRA Prudential Regulation Authority QMS Quarterly Management Statement QoQ Quarter-on-Quarter RFB Ring-Fenced Bank RFB DoLSub Santander UK plc Domestic Liquidity Sub-group RoTE Return on Tangible Equity RWA Risk-Weighted Assets Santander UK Santander UK Group Holdings plc SFS Santander Financial Services plc SLB Santander London Branch SME Small and Medium-Sized Enterprise SVR Standard Variable Rate TFS Term Funding Scheme TFSME Term Funding Scheme with additional incentives for SMEs UK United Kingdom UPL Unsecured Personal Lending YoY Year-on-Year

Quarterly Management Statement, 31 December 2021 18 Santander UK Group Holdings plc Additional information about Santander UK and Banco Santander Santander UK is a financial services provider in the UK that offers a wide range of personal and commercial financial products and services. At 31 December 2021, the bank had around 19,200 employees and serves around 14 million active customers, via a nationwide branch network, telephone, mobile and online banking. Santander UK is subject to the full supervision of the FCA and the PRA in the UK. Santander UK plc customers’ eligible deposits are protected by the FSCS in the UK. Banco Santander (SAN SM, STD US, BNC LN) is a leading retail and commercial bank, founded in 1857 and headquartered in Spain and is one of the largest banks in the world by market capitalization. Its primary segments are Europe, North America, South America and Digital Consumer Bank, backed by its secondary segments: Santander Corporate & Investment Banking (Santander CIB), Wealth Management & Insurance (WM&I) and PagoNxt. Its purpose is to help people and businesses prosper in a simple, personal and fair way. Banco Santander is building a more responsible bank and has made a number of commitments to support this objective, including raising over €120 billion in green financing between 2019 and 2025, as well as financially empowering more than 10 million people over the same period. At the end of H1 2021, Banco Santander had more than a trillion euros in total funds, 150 million customers, of which 24.2 million are loyal and 45.4 million are digital, 10,000 branches and over 190,000 employees. Banco Santander has a standard listing of its ordinary shares on the London Stock Exchange and Santander UK plc has preference shares listed on the London Stock Exchange. None of the websites referred to in this Quarterly Management Statement, including where a link is provided, nor any of the information contained on such websites is incorporated by reference in this Quarterly Management Statement. Disclaimer Santander UK Group Holdings plc (Santander UK), Santander UK plc and Banco Santander caution that this announcement may contain forward-looking statements. Such forward-looking statements are found in various places throughout this announcement. Words such as “believes”, “anticipates”, “expects”, “intends”, “aims” and “plans” and other similar expressions are intended to identify forward-looking statements, but they are not the exclusive means of identifying such statements. Forward-looking statements include, without limitation, statements concerning our future business development and economic performance. These forward-looking statements are based on management’s current expectations, estimates and projections and Santander UK, Santander UK plc and Banco Santander caution that these statements are not guarantees of future performance. We also caution readers that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. We have identified certain of these factors in the forward-looking statements on page 278 of the Santander UK Group Holdings plc 2020 Annual Report on Form 20-F and page 85 of the Santander UK Group Holdings plc 2021 Half Yearly Financial Report. Investors and others should carefully consider the foregoing factors and other uncertainties and events. Undue reliance should not be placed on forward-looking statements when making decisions with respect to Santander UK, Santander UK plc, Banco Santander and/or their securities. Such forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. Statements as to historical performance, historical share price or financial accretion are not intended to mean that future performance, future share price or future earnings for any period will necessarily match or exceed those of any prior quarter. Santander UK is a frequent issuer in the debt capital markets and regularly meets with investors via formal roadshows and other ad hoc meetings. In line with Santander UK’s usual practice, over the coming quarter it expects to meet with investors globally to discuss this Quarterly Management Statement, the results contained herein and other matters relating to Santander UK. Nothing in this announcement constitutes or should be construed as constituting a profit forecast.

SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SANTANDER UK GROUP HOLDINGS PLC Dated: 4 February 2022 By / s / Duke Dayal Duke Dayal Chief Financial Officer