Exhibit 10.15

EXECUTION COPY

RECEIVABLES PURCHASE AGREEMENT

dated

23 OCTOBER 2015

between

MAUSER-WERKE GMBH

NCG BUCHTENKIRCHEN GMBH

MAUSER BENELUX B.V.

MAUSER UK LIMITED

MAUSER FRANCE S.A.S.

MAUSER ITALIA S.P.A.

MAUSER CANADA LTD.

MAUSER USA FINANCE, LLC

NATIONAL CONTAINER GROUP FINANCE, LLC

as Originators

MAUSER-WERKE GMBH

as Master Servicer

MAUSER HOLDING SARL

as Performance Guarantor

and

ING LUXEMBOURG S.A.

as Purchaser, Transaction Administrator and Beneficiary

Baker & McKenzie

Partnerschaft von Rechtsanwälten,

Wirtschaftsprüfern und Steuerberatern mbB

Bethmannstraße 50-54

60311 Frankfurt/Main

Germany

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

TABLE OF CONTENTS

1. Definitions and Interpretation | 3 | |||

2. Sale and Purchase of Receivables | 31 | |||

3. Purchase Dates, Conditions Precedent, Etc. | 34 | |||

4. Terms and Conditions Governing Purchases | 39 | |||

5. Consequences of the Purchase | 46 | |||

6. Determination of the Purchase Price | 47 | |||

7. Initial Purchase Price and Global Initial Purchase Price | 48 | |||

8. Global Deferred Purchase Price | 49 | |||

9. Fees | 50 | |||

10. Waterfall | 50 | |||

11. Payments | 56 | |||

12. Intermediate Closing of the Current Accounts and Intermediate Payment | 68 | |||

13. Tax Gross-Up | 74 | |||

14. Representations and Warranties | 77 | |||

15. Undertakings | 83 | |||

16. Credit Enhancement Event | 96 | |||

17. Termination | 97 | |||

18. Indemnity | 102 | |||

19. Recourse | 105 | |||

20. The Transaction Administrator | 106 | |||

21. Survival of Clauses | 106 | |||

22. Sale by the Purchaser of any Global Portfolio | 106 | |||

23. Compensation | 106 | |||

24. Communications | 107 | |||

25. Confidentiality and Disclosure | 110 | |||

26. Exercise of Rights | 111 | |||

27. Amendments | 111 | |||

28. Ottawa Convention | 111 | |||

29. Election of Domicile (woonstkeuze / élection de domicile) | 111 | |||

30. Governing Law and Jurisdiction | 112 | |||

31. Partial Invalidity | 113 | |||

32. Counterparts | 113 | |||

Schedule 1 List of Originators | 114 | |||

Schedule 2 Eligibility Criteria for Purchase | 116 | |||

Schedule 3 Purchase Price | 121 | |||

I

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

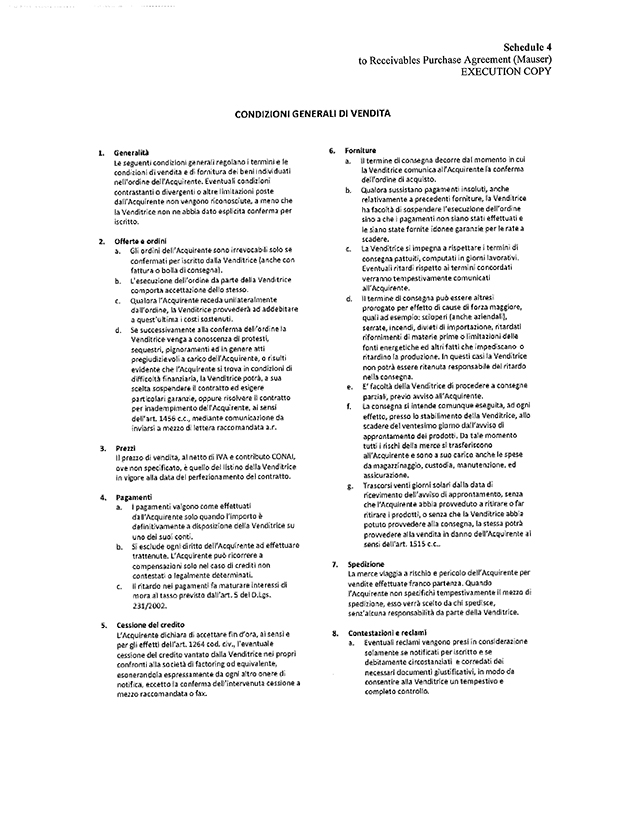

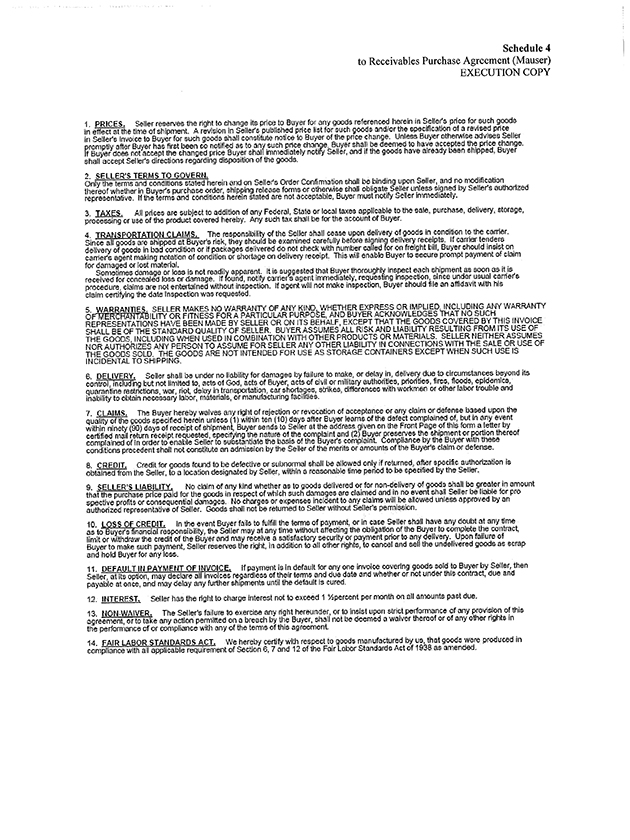

Schedule 4 Credit and Collection Policies and General Conditions of Sale | 135 | |||

Schedule 5 Charges and Expenses | 160 | |||

Schedule 6 Forms of Transfer Documents | 163 | |||

Schedule 7 List of Dedicated Collection Accounts per Originator | 173 | |||

Schedule 8 Form of Solvency Certificate | 174 | |||

Schedule 9 [Reserved] | 176 | |||

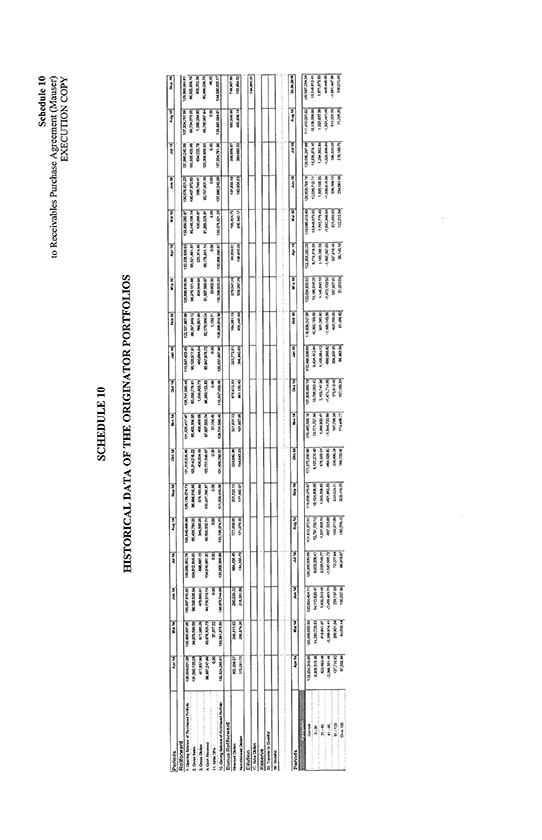

Schedule 10 Historical Data of the Originator Portfolios | 177 | |||

Schedule 11 Dedicated Collection Accounts and Security Interests | 178 | |||

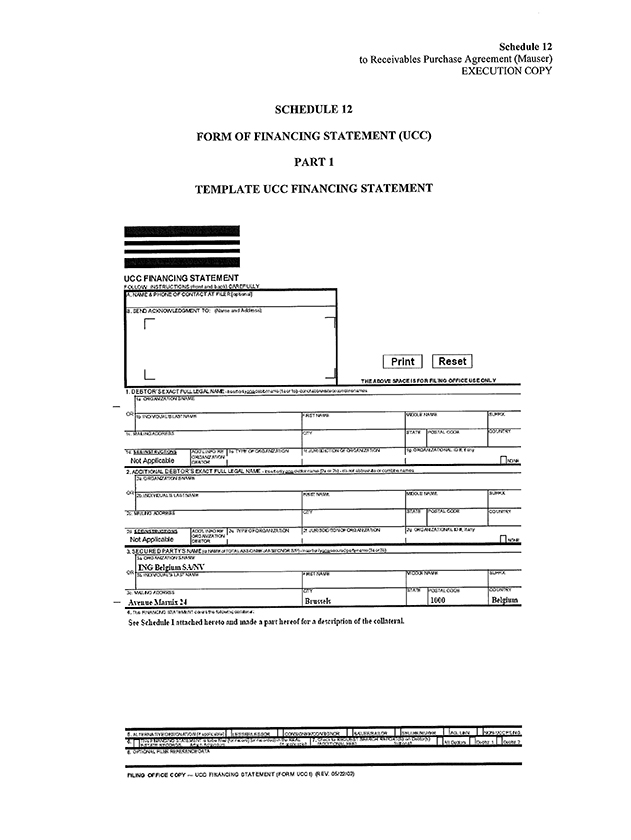

Schedule 12 Form of Financing Statement (UCC) | 179 | |||

Schedule 13 List of Obligors with Rating | 182 | |||

Schedule 14 Forms of Power of Attorney | 183 | |||

Schedule 15 Form of VAT Certificate of German Originators | 195 | |||

Schedule 16 Power of Attorney (Dutch VAT) | 196 | |||

Schedule 17 Form of French Obligor Notice | 198 | |||

Schedule 18 Calculation and Payment Report | 199 | |||

SIGNATURES | 200 | |||

II

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

RECEIVABLES PURCHASE AGREEMENT

This receivables purchase agreement (the“Agreement”) is dated 23 October 2015 and entered into

between

| 1. | MAUSER-WERKE GMBH, a German limited liability company(Gesellschaft mit beschränkter Haftung) having its office at Schildgesstraße 71-163, 50321 Brühl, Federal Republic of Germany, registered with the commercial register(Handelsregister) at the Local Court(Amtsgericht) of Cologne under registration number HRB 58469 (the“German Originator 1” and the“Master Servicer”); |

| 2. | NCG BUCHTENKIRCHEN GMBH, a German limited liability company(Gesellschaft mit beschränkter Haftung) having its office at Schildgesstraße 71-163, 50321 Brühl, Federal Republic of Germany, registered with the commercial register(Handelsregister) at the Local Court(Amtsgericht) of Cologne under registration number HRB 69927 (the“German Originator 2” and together with the German Originator 1 referred to as the“German Originators”); |

| 3. | MAUSER BENELUX B.V., a Dutch private limited liability company(besloten vennootschap met beperkte aansprakelijkheid) having its office at Souvereinstraat 1, 4903RH Oosterhout, The Netherlands, registered with the trade register of the Chamber of Commerce(Kamer van Koophandel) under registration number 20043110 (the“Dutch Originator”); |

| 4. | MAUSER UK LIMITED, a company incorporated under the laws of England and Wales with company number 05798825 and having its registered office at 100 New Bridge Street, London, EC4V 6JA, England (the“English Originator”); |

| 5. | MAUSER FRANCE S.A.S., a limited liability company(société par actions simplifiée) organised and existing under French law, having its registered office at 100 Rue Louis Blanc, 60160 Montataire, France and registered with the Registre du Commerce et des Sociétés of Compiègne under number 451 764 070 (the“French Originator”); |

| 6. | MAUSER ITALIA S.P.A., a joint stock company(società per azioni) incorporated under the laws of Italy and registered with the commercial register(registro delle imprese) under registration number and tax code 04159500968, having its office at Via Lazio 16, 20056 Grezzago (MI), Italy (the“Italian Originator”); |

| 7. | MAUSER CANADA LTD., a Canadian limited liability company incorporated in the Province of New Brunswick having its registered office at Brunswick House, 44 Chipman Hill Suite 1000, Saint John NB, E2L 4S6, Canada (the“Canadian Originator”); |

| 8. | MAUSER USA FINANCE, LLC, a limited liability company incorporated under the laws ofDelaware (United States of America) having its registered office at 2711 Centerville Road, Suite 400, Wilmington, Delaware 19808, U.S.A. (the“U.S. Originator 1”); and |

| 9. | NATIONAL CONTAINER GROUP FINANCE, LLC, a limited liability company incorporated under the laws ofDelaware (United States of America) having its registered office at 2711 Centerville Road, Suite 400, Wilmington, Delaware 19808, U.S.A. (the“U.S. Originator 2”, and together with the U.S. Originator 1 referred to as the“U.S. Originators”); |

together the“Originators”;

| 10. | MAUSER HOLDING S.A.R.L., a limited liability company(Société à responsabilité limitée) organised and existing under the laws of Luxembourg and having its office at Rue Guillaume Kroll 5, 1882 Luxembourg, Luxembourg, registered with the Luxembourg register of commerce and companies under registration number B 186.922 (the“Performance Guarantor”); |

1

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

| 11. | ING LUXEMBOURG S.A., a company incorporated under the laws of the Grand Duchy of Luxembourg as a société anonyme, with its registered office at 52, Route d’Esch, L-2965 Luxembourg and registered with the Luxembourg Register of Commerce and Companies under number B-6.041 (the“Purchaser” or the“Beneficiary”); and |

| 12. | ING LUXEMBOURG S.A., a company incorporated under the laws of the Grand Duchy of Luxembourg as a société anonyme, with its registered office at 52, Route d’Esch, L-2965 Luxembourg and registered with the Luxembourg Register of Commerce and Companies under number B-6.041 (the“Transaction Administrator”). |

The Purchaser, Beneficiary, Transaction Administrator and ING Luxembourg S.A. acting in any other capacity under any Transaction Document are together referred to as“ING Luxembourg”.

Recitals

| A. | The Originators (other than the U.S. Originators) originate trade receivables in the course of their business. Such receivables result from the delivery of products and/or provision of services. The U.S. Originators acquire such receivables originated by Mauser USA, LLC (the“U.S. Company 1”) and from National Container Group, LLC (the“U.S. Company 2” and together with the U.S. Company 1 referred to as the“U.S. Companies”), respectively, in the course of their business under the U.S. Contribution Agreements entered into with the U.S. Originators. |

| B. | The Originators and the Purchaser agree, based on the terms and conditions set out in this Agreement and pursuant to applicable local law (which includes in the case of the French Originator the provisions of article L. 313-23 et seq. of the French Code Monétaire et Financier and in case of the Italian Originator the provisions of the Italian Factoring Law (as defined below)), will sell and assign to the Purchaser on a daily basis as from the First Purchase Date, trade receivables that comply with the Eligibility Criteria (as defined herein) (the “Program”). |

| C. | Within the framework of the Program, the Master Servicer and the other Originators will, on the date hereof, also enter into a Servicing Agreement with the Purchaser and the Transaction Administrator setting out the terms and conditions upon which the Master Servicer and the other Originators will be appointed to act on behalf of the Purchaser as Servicers to service and to collect the Purchased Receivables. |

| D. | Within the framework of the Program, the Performance Guarantor will, on the date hereof, grant a guarantee as guarantee of the obligations of any Originator and any Servicer under the Transaction Documents, subject to and in accordance with the terms of the Performance Guarantee Letter. |

| E. | The Transaction Administrator will administer the Program in accordance with the terms of this Agreement. |

2

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

It is agreed as follows:

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | Definitions |

Under the Agreement, in addition to the terms defined in the recitals, unless the context otherwise requires, the following terms shall have the following meanings:

“Administration Costs” means the administration costs corresponding to the tasks and duties to be performed by the Transaction Administrator under the Program.

“Affected Originator” shall have the meaning ascribed to such term in Clause 16.3.

“Affiliate” means, in relation to any entity, a Subsidiary of that entity or a Holding Company of that entity or any other Subsidiary of that Holding Company.

“Agreement” means this receivables purchase agreement, including its annexes and schedules.

“Applicable Margin in CAD” means 210 bps per annum.

“Applicable Margin in EUR” means 190 bps per annum.

“Applicable Margin in GBP” means 210 bps per annum.

“Applicable Margin in USD” means 210 bps per annum.

“Applicable Taxes” has the meaning ascribed to such term in Clause 13 (Tax Gross-Up).

“Associated Rights” means, with respect to any Receivable, all of the relevant Originator’s rights (including accessory rights and ancillary rights), privileges, interests, benefits and claims of any nature whatsoever relating to that Receivable under the contract from which the Receivable arises (including any indemnity rights and any late payment interest that may be due), all of the Originator’s interests in any merchandise (including returned merchandise) relating to any sale giving rise to such Receivable, all guarantees, insurance or other agreements or arrangements of whatever character supporting or securing payment of such Receivables, including any Security Interest related thereto, including (without limitation):

| (a) | with respect to any English Receivable or Canadian Receivable, any right, title, interest or benefit of the relevant Originator in relation to such English Receivable or Canadian Receivable (as the case may be), including (but not limited to): |

| (i) | the right to demand, sue for, recover, receive and/or to grant a discharge in respect of the whole or part of the amounts due or to become due in connection with such English Receivable or Canadian Receivable, as the case may be (including any indemnity rights and any late payment interest that may be due); |

| (ii) | the benefit of any and all representations, warranties and undertakings relating to the relevant English Receivable or Canadian Receivable, as the case may be, given or assumed by the relevant Obligor(s); |

3

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

| (iii) | the benefit of any and all causes and rights of actions relating to the relevant English Receivable or Canadian Receivable, as the case may be, against the relevant Obligor(s); |

| (iv) | the benefit of any applicable retention of title provisions; |

| (v) | all claims for the provision of security; |

| (vi) | all indemnity claims against the relevant Obligor(s) for non-performance by such Obligor(s) of any of its (their) obligations; |

| (vii) | all restitution claims against the relevant Obligor(s) in the event that the contract from which the relevant Receivable arises is void; and |

| (viii) | any moneys or proceeds paid or payable to such Originator (in any capacity whatsoever) in respect of such Canadian Receivable (or English Receivable, as the case may be); |

| (b) | with respect to any German Receivable, including but not limited to any and all rights in relation to such Receivable which pass to the Purchaser by virtue of Section 401 of the German Civil Code; |

| (c) | with respect to any Dutch Receivable, any and all rights (including any ancillary rights(nevenrechten) and accessory rights(afhankelijke rechten) in relation to such Dutch Receivable which pass to the Purchaser by virtue of Article 6:142 of the Dutch Civil Code or otherwise pursuant to Dutch law; |

| (d) | with respect to any French Receivables, any and all rights in relation to such French Receivable which pass to the Purchaser by virtue of Article 1692 of the French Code civil and/or Article L.313-27 of the French Code monétaire et financier; |

| (e) | with respect to any Italian Receivables, any and all rights in relation to such Italian Receivable which pass to the Purchaser by virtue of Article 1263 of the Italian Civil Code; and |

| (f) | with respect to any U.S. Receivable: |

| (i) | all the right, title, interest and benefit of the relevant U.S. Originator in each such U.S. Receivable and all general intangibles related thereto, including the right to demand, sue for, recover, receive and grant receipts for all principal amounts outstanding from time to time under each such U.S. Receivable; |

| (ii) | the claim (if any) for the payment of default interest under the contract relating to each such U.S. Receivable; and |

| (iii) | all other existing and future claims and rights under, pursuant to, or in connection with each such U.S. Receivable and the underlying contract, including, but not limited to: |

| (A) | other related ancillary rights and claims, including but not limited to, independent unilateral rights as well as dependent unilateral rights by the exercise of which the relevant contract is altered, in particular the right of termination, if any, and the right of rescission, if any, but which are not of a personal nature; |

4

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

| (B) | all claims of any U.S. Originator against an Obligor pursuant to the general business conditions of the U.S. Originators in accordance with the relevant contracts; |

| (C) | all claims against insurance companies or other third Persons assigned to any U.S. Originator in accordance with the relevant contracts; |

| (D) | claims for the provision of collateral; |

| (E) | indemnity claims for non-performance; |

| (F) | restitution claims against any Obligor in the event that the underlying contract is void; |

| (G) | all other payment claims and payment intangibles under any relevant contract against an Obligor; and |

| (H) | all other related ancillary rights and claims under the relevant U.S. Contribution Agreement of the relevant U.S. Originator against the relevant U.S. Company 1 in respect of any such U.S. Receivables. |

“Available Amount in CAD” means any amount in CAD calculated and described as such in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Available Amount in EUR” means any amount in EUR calculated and described as such in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Available Amount in GBP” means any amount in GBP calculated and described as such in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Available Amount in USD” means any amount in USD calculated and described as such in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Available Cap” means the maximum liability amount under any Credit Insurance Contract after deduction of all Claim amounts, converted into EUR at the relevant Exchange Rate introduced to the Credit Insurance Company under such Credit Insurance Contract during the relevant Insurance Year.

“Backup Servicer” means any person designated as backup servicer from time to time in accordance with the Backup Servicing Agreement.

“Backup Servicing Agreement” means any backup servicing agreement from time to time between the Master Servicer, the Purchaser and the Transaction Administrator relating to the provision of back-up collection and servicing in relation to the Purchased Receivables, in form and substance satisfactory to the Purchaser.

“Backup Servicing Costs” means any costs in relation to any Backup Servicer as calculated and due and payable in accordance with the Backup Servicing Agreement.

“Base Rate in CAD” means, in relation to any Charges Period, CDOR.

“Base Rate in EUR” means in relation to any Charges Period, EURIBOR.

“Base Rate in GBP” means, in relation to any Charges Period, GBP LIBOR.

5

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Base Rate in USD” means, in relation to any Charges Period, USD LIBOR.

“Beneficiary” means the Purchaser acting in its capacity as beneficiary under any Credit Insurance Contract.

“Blocking Notice” means any notice sent by the Purchaser to a Dedicated Collection Account Bank upon the occurrence of a Credit Enhancement Event or a Termination Event in accordance with any Security Interest Agreement.

“Bribery Act” means the Bribery Act 2010 of the UK.

“Business Day” means a day (other than a Saturday or a Sunday) on which the commercial banks are open for business in Belgium, Luxembourg, The Netherlands and Brühl, Germany, and, in relation to any date for payment in EUR, CAD, GBP and USD, which is a Target Day.

“CAD” means the lawful currency of Canada.

“CAD Amount” means, in respect of any amount denominated in a currency other than CAD, an amount equal to that amount converted into CAD at the relevant Exchange Rate and, in respect of any amount denominated in CAD, that amount.

“CAD Shortfall” means the shortfall of the Available Amount in CAD in order to fully satisfy the payment obligations or internal allocations due under Clause 10.2(a)(i) up to and including 10.2(a)(vii) or Clause 10.2(b)(i) up to and including 10.2(b)(ix).

“Calculation and Payment Report” means the report for each relevant Currency, substantially in the form of Schedule 18 (Calculation and Payment Report).

“Calculation Date” means each day which is two (2) Business Days before a Settlement Date.

“Calculation Period” means any period from and excluding a Cut-off Date up to and including the immediately following Cut-off Date.

“Canadian Adverse Claim” has the meaning ascribed to “Adverse Claim” in the SecuritiesTransfer Act (Ontario).

“Canadian Assignment Agreement” means the Canadian assignment agreement executed substantially in a form as attached under Schedule 6 Part 3 (Forms of Transfer Documents).

“Canadian Deposit Account Control Agreement” means the respective deposit account control agreement entered into or about the date hereof between, among others, the Master Servicer, the relevant Canadian Originator and the credit institution mentioned therein.

“Canadian Originator(s)” has the meaning ascribed thereto above and any Originator incorporated, formed and having its principal place of business in Canada.

“Canadian Receivable” means any Receivable owned by a Canadian Originator.

“CDOR” means for a period equal to the relevant interest period, the average rate for bankers acceptances as administered by the Investment Industry Regulatory Organization of Canada (or any other Person that takes over the administration of that rate) with a tenor equal to the relevant period displayed on the appropriate page of the Reuters Monitor Service (or, in the event such rate does not appear on a Reuters page or screen, on any successor or substitute page on such screen or service that displays such rate) as of 10.15am (Toronto, Ontario time) on the relevant quotation date. In all cases, if the rate is below zero, CDOR will be deemed zero.

6

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Change of Control” has the meaning given to such term in the First Lien Credit Agreement as of the date hereof.

“Charges” means the sum of (a) the Backup Servicing Costs and (b) the Costs.

“Charges Period” means each successive period from and including a Settlement Date to (but excluding) the immediately following Settlement Date.

“Claims” means any form for claims provided for under any Credit Insurance Contract in order to initiate the indemnification procedure under such Credit Insurance Contract.

“Collections” means, with respect to any Purchased Receivable, all cash proceeds, set off, other cash proceeds or other amounts received or recovered in respect thereof, including, without limitation, any payments made by way of cheques, on any bill of exchange, promissory note or other negotiable instrument issued in respect of such Purchased Receivable to any holder thereof (whether or not issued in breach of any provisions of the Agreement), all cash proceeds from enforcement of security with respect to such Purchased Receivable, all cash proceeds distributed for the benefit of the Purchaser or for the benefit of the relevant Originator and subsequently forwarded to the Purchaser, resulting from an indemnification under a Credit Insurance Contract, and, as applicable, all recoveries of VAT from any relevant tax authority relating to any unpaid Purchased Receivable.

“Collections Transfer Date” means:

| (a) | as from one month after the First Purchase Date, each Tuesday, or if a Tuesday is not a Business Day, the immediately following Business Day; and |

| (b) | if imposed by the Purchaser in accordance with Clause 17 (Termination) or the Servicing Agreement, each Business Day. |

“Conditions Precedent Delivery Date” has the meaning ascribed thereto in Clause 3.2.

“Contractual Dilution” means, with respect to any Purchased Receivable, allowed reductions for such Purchased Receivable known as of the relevant Purchase Date, limited to reductions arising under a contract and applying at the time that such Purchased Receivable arises.

“Contractual Payment Term” has the meaning ascribed to such term in Schedule 3 Part 2 (Calculation of the Purchase Price) to this Agreement.

“Costs” means the sum of (a) the Funding Costs, (b) the Administration Costs and (c) the Servicing Costs.

“Credit and Collection Policies” means the policies described in Schedule 4 (Credit and Collection Policies and General Conditions of Sale).

“Credit Enhancement Event” means any of the events and circumstances listed in Clause 16.1.

“Credit Insurance Company” means Atradius Credit Insurance N.V., represented by its German branch(Niederlassung)Atradius Kreditversicherung and/or any other credit insurance company acceptable to the Purchaser.

7

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Credit Insurance Contract(s)” means (i) the credit insurance contract(s) entered into in connection with this transaction providing insurance cover for, amongst others, the Purchased Receivables, in form and substance satisfactory to the Purchaser, and/or (ii) each other credit insurance policy subscribed by the relevant Originator with the Credit Insurance Company(ies) in accordance with the Transaction Documents.

“Credit Insurance Required Rating Condition” means, with respect to any Credit Insurance Company, that the long term senior unsecured obligations of such Credit Insurance Company have, at all times, at least one of the Credit Insurance Required Ratings and that such rating is not withdrawn.

“Credit Insurance Required Ratings” means each of the following credit ratings: A- by Standard & Poor’s, A3 by Moody’s, A- by Fitch.

“Credit Limit” means, with respect to an Obligor (with the exception of the Obligors set out in Schedule 13 (List of Obligors with Rating)), the credit insurance limit for such Obligor, as determined in accordance with the relevant Credit Insurance Contract(s).

“Council Regulation (EC) 2271/96” means Council Regulation (EC) No. 2271/96 of 22 November 1996 protecting against the effects of the extra-territorial application of legislation adopted by a third country, and actions based thereon or resulting therefrom.

“Currency” means CAD, EUR, GBP or USD.

“Current Account” means the Current Account in EUR and/or the Current Account in CAD and/or the Current Account in GBP and/or the Current Account in USD.

“Current Account in CAD” means the current account mechanism in CAD entered into between the Purchaser and the Master Servicer, acting in its own name and in the name and on behalf of the Originators, as described in Clause 11(a).

“Current Account in EUR” means the current account mechanism in EUR entered into between the Purchaser and the Master Servicer, acting in its own name and in the name and on behalf of the Originators, as described in Clause 11(a).

“Current Account in GBP” means the current account mechanism in GBP entered into between the Purchaser and the Master Servicer, acting in its own name and in the name and on behalf of the Originators, as described in Clause 11(a).

“Current Account in USD” means the current account mechanism in USD entered into between the Purchaser and the Master Servicer, acting in its own name and in the name and on behalf of the Originators, as described in Clause 11(a).

“Current Portion of the GIPP” means the product of (i) the Outstanding Nominal Value of all receivables that are Eligible Receivables for Purchase and that are within the Contractual Payment Term and (ii) 1 minus the Total Reserve Rate.

“Cut-off Date” means the last calendar day of any calendar month, it being understood that (i) the Cut-off Date for the purpose of the determination of the Receivables that are part of the Initial Originator Portfolios (the“Initial Cut-off Date”) and (ii) the first Cut-off Date following the First Purchase Date shall be the dates as agreed separately between the Purchaser and the Master Servicer prior to the First Purchase Date.

8

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Days Sales Outstanding” or“D.S.O.” means, in relation to the Originators:

| (a) | (the Global Portfolio on the last day of the relevant Calculation Period + the Global Portfolio of the three previous months, each time as existing on the last day of the relevant Calculation Period) * 30; divided by |

| (b) | Sales of the relevant Calculation Period + Sales of the three previous Calculation Periods. |

“Dedicated Collection Account” means in respect of each Originator, the bank account(s) identified in Schedule 7 (List of Dedicated Collection Accounts per Originator) and the account(s) replacing such accounts, with the prior written consent of the Purchaser, or any further account(s) held in the name of such Originator as notified by the relevant Originator to the Purchaser in writing.

“Dedicated Collection Account Bank” means any credit institution where a Dedicated Collection Account is held and that (i) meets the Dedicated Collection Account Required Rating Condition or (ii) is a member of the ING Group.

“Dedicated Collection Account Bank Required Ratings” means BBB- by Standard & Poor’s, Baa3 (by Moody’s) and BBB- (by Fitch).

“Dedicated Collection Account Required Rating Condition” means, with respect to a Dedicated Collection Account Bank, that the long term senior unsecured obligations of such Dedicated Collection Account Bank have at least one of the Dedicated Collection Account Bank Required Ratings from time to time.

“Deemed Collections” means the Deemed Collections in CAD and/or Deemed Collections in EUR and/or Deemed Collections in GBP and/or the Deemed Collections in USD.

“Deemed Collections in CAD” has the meaning indicated in Clause 11(b) (Current Account in CAD).

“Deemed Collections in EUR” has the meaning indicated in Clause 11(b) (Current Account in EUR).

“Deemed Collections in GBP” has the meaning indicated in Clause 11(b) (Current Account in GBP).

“Deemed Collections in USD” has the meaning indicated in Clause 11(b) (Current Account in USD).

“Defaulted Receivable” means a Receivable:

| (a) | all or part of the Outstanding Nominal Value of which remains unpaid past its due date for more than 90 days; |

| (b) | that has become a Written-off Receivable; or |

| (c) | of which the Obligor has become Insolvent. |

“Deferred Purchase Price in CAD” or“CAD DPP” means that portion of the Purchase Price in CAD of the Portfolio in CAD which is payable to the Originators on a deferred basis pursuant to the terms of the Agreement and calculated in accordance with Schedule 3.

9

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Deferred Purchase Price in Euro” or“EUR DPP” means that portion of the Purchase Price in Euro of the Portfolio in Euro which is payable to the Originators on a deferred basis pursuant to the terms of the Agreement and calculated in accordance with Schedule 3.

“Deferred Purchase Price in GBP” or“GBP DPP” means that portion of the Purchase Price in GBP of the Portfolio in GBP which is payable to the Originators on a deferred basis pursuant to the terms of the Agreement and calculated in accordance with Schedule 3.

“Deferred Purchase Price in USD” or“USD DPP” means that portion of the Purchase Price in USD of the Portfolio in USD which is payable to the Originators on a deferred basis pursuant to the terms of the Agreement and calculated in accordance with Schedule 3.

“Delinquent Receivable” means a Receivable of which all or part of the Outstanding Nominal Value remains unpaid past its due date for more than 60 days.

“Dilution” means, in respect of any Receivable, the sum of any Contractual Dilution and any Non-contractual Dilution.

“Dilution Reserve Floor” has the meaning set out in Schedule 3 Part 2 (Calculation of the Purchase Price).

“Dilution Reserve Rate” has the meaning set out in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Dispute” has the meaning set out in Clause 30.9.

“Disruption Event” means either or both of:

| (a) | a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for a payment to be made in connection with the Transaction Documents which disruption is not caused by, and is beyond the control of, any of the Parties; or |

| (b) | the occurrence of any other event which results in a disruption (of a technical or system-related nature) to the treasury or payments operations of a Party preventing that Party, or any other Party: |

| (i) | from performing its payment obligations under the Transaction Documents; or |

| (ii) | from communicating with other Parties in accordance with the terms of the Transaction Documents, |

and which (in either case) is not caused by, and is beyond the control of, the Party whose operations are disrupted.

“Due Diligence” has the meaning ascribed to such term in Clause 15.2(d)(i).

“Dutch Civil Code” means the Dutch Civil Code(Burgerlijk Wetboek).

“Dutch Originator(s)” has the meaning ascribed thereto above and any Originator incorporated and having its centre of main interests (as defined pursuant to Council Regulation (EC) No 1346/2000 of 29 May 2000) in The Netherlands.

“Dutch Receivable” means any Receivable owned by a Dutch Originator.

10

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Dutch Transfer Deed” means the relevant Dutch transfer deed executed substantially in a form as attached under Schedule 6 Part 1 (Forms of Transfer Documents).

“Eligibility Criteria” means the criteria specified in Schedule 2 (Eligibility Criteria for Purchase).

“Eligible Jurisdiction” means any jurisdiction other than Greece, Cyprus, Syria, Cuba, Iran, North Korea, Myanmar and Sudan and any other jurisdictions which are embargoed by export restrictions of the relevant Originator’s jurisdiction.

“Eligible Obligor” has the meaning ascribed to such term in Schedule 2 (Eligibility Criteria for Purchase).

“Eligible Receivable for Calculation of the GIPP” or“E.R.C.G.” has the meaning ascribed thereto in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Eligible Receivables for Purchase” means any Receivables, originated by an Originator, which, on the relevant Purchase Date for such Receivables, comply with all the Eligibility Criteria set out under item 1 (Eligible Receivables) and item 2 (Eligible Obligors) of Schedule 2 (Eligibility Criteria for Purchase).

“Employee Plan” means an employee pension benefit plan within the meaning of Section 3(2) of ERISA (other than a Multiemployer Plan) subject to the provisions of Title IV or Section 302 of ERISA, or Section 412 of the U.S. Code, and in respect of which any U.S. Originator or any ERISA Affiliate is (or, if such plan were terminated, would under Section 4069 of ERISA be deemed to be) an “employer” as defined in Section 3(5) of ERISA.

“English Declaration of Trust” means each collection account declaration of trust to be declared by the English Originator over all of its rights, title, interest and benefit, present and future, in the relevant Dedicated Collection Accounts located in the United Kingdom into which amounts in respect of English Receivables originated by the English Originator are collected, in favour of the Purchaser and itself (in its capacity as a beneficiary) on the terms therein.

“English Legal Reservation” means a statutory assignment for the purpose of section 136 of the Law of Property Act 1925, being an express notice in writing to the underlying obligor.

“English Originator” has the meaning ascribed thereto above and any Originator established and having its centre of main interests in England and Wales.

“English Receivable” means any Receivable governed by the laws of England and Wales.

“ERISA” means, at any date, the U.S. Employee Retirement Income Security Act of 1974 (or any successor legislation thereto) as amended from time to time, and the regulations promulgated and rulings issued thereunder, all as the same may be in effect at such date.

“ERISA Affiliate” means any person that for purposes of Title I and Title IV of ERISA and Section 412 of the U.S. Code would be deemed at any relevant time to be a single employer with the U.S. Originator, pursuant to Section 414(b), (c), (m) or (o) of the U.S. Code or Section 4001 of ERISA.

“ERISA Event” means (i) any reportable event, as defined in Section 4043 of ERISA, with respect to an Employee Plan, as to which PBGC has not by regulation waived the requirement of Section 4043(a) of ERISA that it be notified of such event; (ii) the filing of a notice of intent to terminate any Employee Plan, if such termination would require material additional

11

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

contributions in order to be considered a standard termination within the meaning of Section 4041(b) of ERISA, the filing under Section 4041(c) of ERISA of a notice of intent to terminate any Employee Plan or the termination of any Employee Plan under Section 4041(c) of ERISA; (iii) the institution of proceedings under Section 4042 of ERISA by the PBGC for the termination of, or the appointment of a trustee to administer, any Employee Plan; (iv) any failure by any Employee Plan to satisfy the minimum funding standard (within the meaning of Section 412 of the U.S. Code or Section 302 of ERISA) applicable to such Employee Plan, in each case whether or not waived; (v) the failure to make a required contribution to any Employee Plan that would reasonably be expected to result in the imposition of an encumbrance under Section 430(k) of the U.S. Code or Section 303(k) of ERISA or a filing under Section 412(c) of the U.S. Code or Section 302(c) of ERISA, of any request for a minimum funding variance with respect to any Employee Plan or Multiemployer Plan; (vi) an engagement in a non-exempt prohibited transaction within the meaning of Section 4975 of the U.S. Code or Section 406 of ERISA; (vii) the complete or partial withdrawal of the US Originator or any ERISA Affiliate from any Employee Plan or a Multiemployer Plan; (viii) the US Originator or an ERISA Affiliate incurring any liability under Title IV of ERISA with respect to any Employee Plan (other than premiums due and not delinquent under Section 4007 of ERISA) as a result of the termination of, or the respective US Originator’s or any ERISA Affiliate’s withdrawal from, an Employee Plan or a Multiemployer Plan; (ix) the receipt by the US Originator or any of its ERISA Affiliates of any notice of the imposition of withdrawal liability relating to an Employee Plan.

“EUR Amount” means, in respect of any amount denominated in a currency other than EUR, an amount equal to that amount converted into EUR at the relevant Exchange Rate and, in respect of any amount denominated in EUR, that amount.

“EUR Shortfall”means the shortfall of the Available Amount in EUR in order to fully satisfy the payments or internal allocations due under Clause 10.1(a)(i) up to and including 10.1(a)(vii) or Clause 10.1(b)(i) up to and including 10.1(b)(ix).

“EURIBOR”means the rate for deposits in EUR for a period equal to the relevant interest period, which appears on the Reuters Index Page “Euribor 01” (or such other page on that service or such other service as may, in the Purchaser’s determination, replace it for the purposes of displaying such rate) as of 11am, Brussels time, on the relevant quotation date. If such rate does not appear on the Reuters Index page Euribor 01, the rate for that period will be determined on the basis of the rates at which deposits in EUR are offered by the reference banks at approximately 11am, Brussels time, on the relevant quotation date to prime banks in EUR-zone interbank market for a period equal to the period considered and for deposits in an amount comparable to the amounts concerned. In all cases, if the rate is below zero, EURIBOR will be deemed zero.

“Euro”,“EUR” or“€” means the single currency of the Participating Member States.

“Exchange Rate” means, where the context requires, in respect of a particular date, the exchange rate of any relevant currency against such other currency, as most recently published by the European Central Bank for such date.

“Excluded Taxes” has the meaning ascribed to such term in Clause 18.2(b)(iii).

“Expenses” has the meaning set out in Schedule 5 (Charges and Expenses).

“FATCA” means (i) sections 1471 to 1474 of the U.S. Internal Revenue Code or any associated regulations or other official guidance, (ii) any treaty, law, regulation or other official guidance enacted in any other jurisdiction, or relating to an intergovernmental

12

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

agreement between the U.S. and any other jurisdiction, which (in either case) facilitates the implementation of paragraph (i) above, or (iii) any agreement pursuant to the implementation of paragraphs (i) or (ii) above with the U.S. Internal Revenue Service, the U.S. government or any governmental or taxation authority in any other jurisdiction.

“FCPA” means the U.S. Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations promulgated thereunder.

“Financial Indebtedness” means any indebtedness for or in respect of:

| (a) | any obligation for money borrowed and debt balances at banks or other financial institutions; |

| (b) | any acceptance under any acceptance credit or bill discounting facility (or dematerialised equivalent); |

| (c) | any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; |

| (d) | the amount of any liability in respect of finance leases; |

| (e) | receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); |

| (f) | any Treasury Transaction (and, when calculating the value of that Treasury Transaction, only the marked to market value (or, if any actual amount is due as a result of the termination or close-out of that Treasury Transaction, that amount) shall be taken into account); |

| (g) | any counter-indemnity obligation in respect of a guarantee, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution in respect of (i) an underlying liability of an entity which is not a member of the Group of the Obligor which liability would fall within one of the other paragraphs of this definition or (ii) any liabilities of any member of the Group of the Obligor relating to any post-retirement benefit scheme; |

| (h) | any amount raised by the issue of redeemable shares which are redeemable (other than at the option of the issuer) before the Termination Date or are otherwise classified as borrowings; |

| (i) | any amount of any liability under an advance or deferred purchase agreement if (i) one of the primary reasons behind entering into the agreement is to raise finance or to finance the acquisition or construction of the asset or service in question or (ii) the agreement is in respect of the supply of assets or services and payment is due more than 120 days after the date of supply; |

| (j) | any amount raised under any other transaction (including any forward sale or purchase, sale and sale back or sale and leaseback agreement) having the commercial effect of a borrowing or otherwise classified as borrowings; and |

| (k) | the amount of any liability in respect of any guarantee for any of the items referred to in paragraphs (a) to (j) above. |

13

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“First Lien Credit Agreement” means the New York law governed first lien credit agreement dated 31 July 2014 amongst, inter alia, the Parent, MAUSER U.S. CORPORATE, LLC, Mauser Corporate GmbH, MAUSER HOLDING NETHERLANDS B.V., several lenders party thereto from time to time and Credit Suisse AG, as administrative agent and collateral agent.

“First Purchase Date” has the meaning provided in Clause 3.2.

“Five Largest Obligors” means, at any time and with respect to each Available Cap, the five largest Obligors or Group of Obligors (and for the purpose hereof, all Obligors belonging to the same Group are considered as one single Obligor) owing Purchased Receivables to the Originators taken as a whole, as well as to each Originator individually, and covered by such Credit Insurance Contract, but excluding the Obligors listed or whose parent is listed in Schedule 13 (List of Obligors with Rating), and such exclusion to apply only (i) for as long as such Obligors maintain at a minimum the rating set out opposite their name or (ii) if the rating requirement applies to their parent, for as long as their parent maintains at a minimum the rating and such Obligor remains a wholly owned subsidiary of the rated parent Group. For the purpose of this definition, the largest Obligors or Group of Obligors will be determined on the basis of the Outstanding Nominal Value of Receivables owing by such Obligors or Group of Obligors on the relevant determination date.

“French Eligible Receivable for Purchase” has the meaning ascribed to such term in Clause 4.5(a).

“French Obligor Notice” means a notice in the form set out in Schedule 17 (Form of French Obligor Notice) and referred to in Clause 17.3 (x).

“French Originator(s)” has the meaning ascribed thereto above and any Originator established and having its centre of main interests (as defined pursuant to Council Regulation (EC) No 1346/2000 of 29 May 2000) in France.

“French Receivable” means a Receivable governed by French law and assigned by a French Originator.

“French Transfer Document” means a transfer document substantially in the form set out in Schedule 6 Part 2 (Form of French Transfer Documents)] and complying with the provisions of articles L.313-23 et seq. of the French Code Monétaire et Financier.

“Funding Costs” means the costs of funds defined as such in Schedule 5(Charges andExpenses).

“General Conditions of Sale” means the general conditions of sale, attached in Part 2 of Schedule 4 (Credit and Collection Policies and General Conditions of Sale).

“GBP” means the lawful currency for the time being of the United Kingdom of Great Britain and Northern Ireland and shall include references to Pounds, Sterling and £.

“GBP Amount” means, in respect of any amount denominated in a currency other than GBP, an amount equal to that amount converted into GBP at the relevant Exchange Rate and, in respect of any amount denominated in GBP, that amount.

“GBP LIBOR” means the rate for deposits in GBP for a period equal to the relevant interest period, which appears on the appropriate Reuters Index Page as of 11.45am, London time, on the relevant quotation date. If such rate does not appear on the appropriate Reuters Index page, the rate for that period will be determined on the basis of the rates at which deposits in GBP are offered by the reference banks at approximately 11.45am, London time, on the relevant quotation date to prime banks in London interbank market for a period equal to the period considered and for deposits in an amount comparable to the amounts concerned. In all cases, if the rate is below zero, LIBOR will be deemed zero.

14

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“GBP Shortfall” means the shortfall of the Available Amount in GBP in order to fully satisfy the payments or internal allocations due under Clause 10.3(a)(i) up to and including 10.3(a)(vii) or Clause 10.3(b)(i) up to and including 10.3(b)(ix).

“German Civil Code” means the German Civil Code(Bürgerliches Gesetzbuch).

“German Originator(s)” has the meaning ascribed thereto above and any Originator established and having its centre of main interests in Germany.

“German Receivable” means a Receivable governed by German law.

“Global Initial Purchase Price” or“GIPP” means the sum of the EUR Amount of the Global Initial Purchase Price in CAD, the Global Initial Purchase Price in EUR, the Global Initial Purchase Price in GBP and Global Initial Purchase Price in USD.

“Global Initial Purchase Price in CAD” or“CAD GIPP” has the meaning ascribed to such term in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Global Initial Purchase Price in EUR” or“EUR GIPP” has the meaning ascribed to such term in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Global Initial Purchase Price in GBP” or“GBP GIPP” has the meaning ascribed to such term in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Global Initial Purchase Price in USD” or“USD GIPP” has the meaning ascribed to such term in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Global Portfolio” means, on any given date, the sum of the Global Portfolio in EUR and the EUR Amount of the Global Portfolio in CAD, the Global Portfolio in GBP and the Global Portfolio in USD.

“Global Portfolio in CAD” means, on any given date, the Outstanding Nominal Value in CAD of all Purchased Receivables in CAD originated by any Originator, after exclusion of the relevant Written-off Receivables in CAD on that date.

“Global Portfolio in EUR” means, on any given date, the Outstanding Nominal Value in EUR of all Purchased Receivables in EUR originated by any Originator, after exclusion of the relevant Written-off Receivables in EUR on that date.

“Global Portfolio in GBP”means, on any given date, the sum of the Outstanding Nominal Value in GBP of all Purchased Receivables in GBP originated by any Originator, after exclusion of the relevant Written-off Receivables in GBP on that date.

“Global Portfolio in USD” means, on any given date, the Outstanding Nominal Value in USD of all Purchased Receivables in USD originated by any Originator, after exclusion of the relevant Written-off Receivables in USD on that date.

“Group”means, in respect of any entity at any time, such entity and its Affiliates for the time being.

“Holding Company” means, in relation to an entity, any other entity in respect of which it is a Subsidiary.

15

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Indemnity” means any indemnity as described in Clause 18 (Indemnity).

“Ineligible Receivables for Purchase” means Receivables that, on the relevant Purchase Date for such Receivables, do not comply with all the Eligibility Criteria.

“Initial Originator Portfolio” has the meaning ascribed thereto in Clause 4.1 (Purchase of Originator Portfolios on the First Purchase Date).

“ING Group” means the companies involved in the Program and held directly or indirectly by ING Group N.V.

“ING Sweep Account” means the bank account held with ING Luxembourg S.A., the account details of which details will be notified by the Purchaser to the Master Servicer.

“Initial Purchase Price in CAD” or“CAD IPP” means that portion of the Purchase Price in CAD of the Portfolio in CAD calculated in accordance with Schedule 3 Part 1 (Calculation of the Purchase Price).

“Initial Purchase Price in Euro” or“EUR IPP” means that portion of the Purchase Price in Euro of the Portfolio in Euro calculated in accordance with Schedule 3 Part 1 (Calculation of the Purchase Price).

“Initial Purchase Price in GBP” or“GBP IPP” means that portion of the Purchase Price in Euro of the Portfolio in GBP calculated in accordance with Schedule 3 Part 1 (Calculation of the Purchase Price).

“Initial Purchase Price in USD” or“USD IPP” means that portion of the Purchase Price in USD of the Portfolio in USD calculated in accordance with Schedule 3 Part 1 (Calculation of the Purchase Price).

“Insolvency Act 1986” means the United Kingdom Insolvency Act 1986 applicable in England and Wales and Scotland.

“Insolvent” or“Insolvency” means, with respect to a person or entity, any of the following events occurring in respect of such person or entity:

| (a) | such person or entity applies for (or a third party applies in respect of it for) the opening of bankruptcy proceedings, composition proceedings or reorganisation proceedings or commences negotiations with any one or more of its creditors with a view to the general readjustment or rescheduling of its indebtedness or makes a general assignment for the benefit of or a composition with its creditors; |

| (b) | such person or entity is unable to pay its debt as they fall due; |

| (c) | such person takes any corporate action or other steps are taken or legal proceedings are started for the liquidation, insolvency, bankruptcy, winding-up, dissolution, administration, examinership or reorganisation of, for the appointment of a liquidator, provisional liquidator, receiver, receiver-manager, administrator, (whether appointed by the court or otherwise), bank administrator, bank liquidator, administrative receiver, examiner, conservator, guardian, custodian, nominee, supervisor, trustee in bankruptcy or sequestration, judicial factor or other similar officer of it or of any of all (or substantially all) of its revenues and assets; or |

16

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

| (d) | any event occurs which, under the laws of any relevant jurisdiction has a similar or analogous effect to any of those events mentioned in paragraphs (a) to (c) above and without prejudice to the foregoing, in particular (A) with respect to any person or entity formed and existing in any member state of the European Union, any insolvency proceedings in the meaning of European regulation 1346/2000 on insolvency proceedings, or European regulation 2015/848 as applicable, or (B) with respect to any English person or entity, it is unable to pay its debts within the meaning of section 123(1) of the Insolvency Act 1986 (other than subsection 123(1)(a)) or 123(2) of the Insolvency Act 1986 (or, where applicable, sections 222 to 224 of the Insolvency Act 1986), and |

| (i) | in relation to a UK person or entity, it includes (i) the making of a general assignment or trust for the benefit of creditors, (ii) the filing of a voluntary petition in bankruptcy, (iii) being adjudged bankrupt or insolvent, or having had an order entered or granted against such person for relief in any bankruptcy or insolvency proceeding or for the winding-up or dissolution or for the appointment of a liquidator, administrator, trustee, receiver, administrative receiver or similar officer in respect of it or the whole or any substantial part of its assets, (iv) the filing by such person of a petition or answer seeking reorganisation, liquidation, dissolution, administrative receivership or similar relief (including, but not limited to, presentation of a petition for an administration order, the filing of documents with the court for the appointment of an administrator, the service of a notice of intention to appoint an administrator or the taking of any steps to appoint an administrator) under any applicable law, (v) seeking, consenting to or acquiescing in the appointment of a trustee, liquidator, receiver or similar official of such person or of all or any substantial part of such person’s assets, (vi) the failure to obtain dismissal or a stay within 60 days of the commencement of or the filing by such person of an answer or other pleading admitting or failing to contest the material allegations of a petition filed against such person in any proceeding against such person seeking (A) reorganisation, liquidation, dissolution or similar relief under any applicable law or (B) the appointment of a trustee, liquidator, receiver, administrator, administrative receiver or similar official of such person or of all or any substantial part of such person’s assets, or (C) the failure by such person generally to pay its debts as such debts become due; |

| (ii) | in relation to a German person or entity, that (A) such person or entity isover-indebted(überschuldet)according to section 19 of the German Insolvency Code(Insolvenzordnung – “InsO”) or unable to pay its debts when due(zahlungsunfähig) according to section 17 InsO or that (B) a petition has been filed for the opening of insolvency proceedings(Antrag auf Eröffnung des Insolvenzverfahrens) against such person or entity by itself or a third party (in case of a filing by a third party unless such filing is obviously frivolous or vexatious and has been dismissed within 30 days after filing) or a competent court has instituted insolvency proceedings against such person or entity(Eröffnung des Insolvenzverfahrens) or the institution of an insolvency proceeding was rejected because of lack of assets(Abweisung mangels Masse); |

| (iii) | in relation to a Dutch person or entity, it includes, without limitation, being declared bankrupt(failliet verklaard), granted a preliminary suspension of payments(voorlopige surseance van betaling) and a petition being presented to or order made by a court for the bankruptcy(faillissement) or suspension of |

17

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

| payments(surseance van betaling), being subject to special measures on the basis of the Financial Institutions (Special Measures) Act, a Dutch person or entity has ceased to pay its debt(in de toestand verkeert te hebben opgehouden te betalen) pursuant to Article 1 of the Dutch Bankruptcy Act(Faillissementswet),having filed a notice under Article 36 of the Tax Collection Act of The Netherlands(Invorderingswet 1990) and a trustee(curator), administrator(bewindvoerder) or similar officer being appointed in respect of the Dutch Originator or any of its assets or a creditor of the Originator attaches all or a material part of the assets of the Originator, or a conservatory attachment(conservatoir beslag) or an executory attachment(executoriaal beslag) has been initiated; and |

| (iv) | in relation to a French person or entity, any of the following steps or proceedings: |

| (A) | a judicial order for its redressement judiciaire, liquidation judiciaire, sauvegarde, sauvegarde accélérée or sauvegarde financière accélérée under articles L.620-1 et seq. of the French Code de commerce; |

| (B) | any administrateur judiciaire, administrateur provisoire, mandataire ad hoc, conciliateur ormandataire liquidateur or any other person appointed as a result of any proceedings described in this definition of insolvency or similar officer is appointed in respect of it or any of its assets; or |

| (C) | its shareholders, directors or other officers request the appointment of a administrateur judiciaire, administrateur provisoire, mandataire ad hoc, conciliateur ormandataire liquidateur or any other person appointed as a result of any proceedings described in this definition of Insolvency or similar officer in respect of it or any of its assets; or |

| (v) | in relation to a U.S. person or entity, it includes, without limitation, (i) generally not paying its debts as such debts become due, (ii) admitting in writing its inability to pay its debts generally, (iii) making a general assignment for the benefit of creditors (or the equivalent), (iii) any proceeding being instituted by or against it seeking to adjudicate it bankrupt or insolvent (or the equivalent), (iv) seeking liquidation, winding up, reorganization, arrangement, adjustment, judicial management, protection, relief, moratorium or composition of it or its debts under the U.S. Bankruptcy Code or similar debtor relief laws of the United States or other applicable jurisdictions or any other law relating to bankruptcy, insolvency, judicial management, or reorganization or relief of debtors or the like or (v) seeking the entry of an order for relief or the appointment of a receiver, trustee, or other similar official for it or for any substantial part of its property; |

| (vi) | in respect to an Italian entity, any proceeding or corporate resolution or filing or order pertaining to any company or corporation: |

| (A) | concerning its voluntary or involuntary liquidation (other than on a solvent basis), bankruptcy, insolvency, winding-up, dissolution, reorganisation, moratorium, composition or other relief with respect to it or its debts; or |

18

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

| (B) | aimed at seeking appointment of, or taking possession by, a receiver, custodian, conservator or other similar official for it or for all or any substantial part of its assets; or |

| (C) | relating to arrangement with creditors(concordato preventivo),adjustment of creditors’ claims(concordato fallimentare),forced administrative liquidation(liquidazione coatta amministrativa)extraordinary administration of large companies in difficulty or in insolvency(amministrazione straordinaria delle grandi imprese in stato di insolvenza) or assignment for the benefit of creditors under article 1977 of the Italian Civil Code and/or any other procedure producing similar effects, piani di risanamento under article 67, paragraph 3, lett (d) of Italian Royal Decree no. 267 dated 16 March 1942, as amended and/or supplemented from time to time, accordi di ristrutturazione (including the accordi di ristrutturazione di debiti under article182-bis of Italian Royal Decree no. 267 dated 16 March 1942, as amended and/or supplemented from time to time) as well as any other procedure indicated as recovery procedure(“procedura di risanamento”) or liquidation procedure(“procedura di liquidazione”)under Legislative Decree no. 170 dated 21 May 2004 as amended and/or supplemented from time to time; and |

| (vii) | in relation to any entity which is resident in Canada, such entity admitting its inability to pay its liabilities generally as they become due, or making a general assignment for the benefit of creditors; or otherwise acknowledging its insolvency; or any proceedings being instituted by or against such entity seeking to adjudicate it as bankrupt or insolvent or seeking liquidation, winding-up, dissolution, reorganization, arrangement, adjustment, protection, relief or composition of it or its debts under any law relating to bankruptcy, insolvency, reorganization, moratorium or relief of debtors, or seeking the entry of an order for relief by the appointment of a receiver,receiver-manager, trustee, custodian or similar official for its or a substantial part of its property and, if such proceeding has been instituted against such entity, either such proceeding not being stayed or dismissed within fifteen (15) days or a receiver, receiver-manager, trustee, custodian or other similar official being appointed for it or any substantial part of its property; or such entity taking any action to authorize any of the actions described above; or a receiver being privately appointed in respect of a substantial part of such entity’s assets. |

“Insurance Cap” means each relevant cap or maximum liability amount as determined in each Credit Insurance Contract.

“Insurance Year” means with respect to each Credit Insurance Contract, the yearly period with respect to which losses are determined pursuant to such Credit Insurance Contract.

“Invoice” means, with respect to any Receivable, the invoice issued by the relevant Originator to the relevant Obligor, evidencing such Receivable.

“Italian Civil Code” means the Italian “codice civile”, the initial version of which was approved by Italian Royal Decree No. 262 of 16 March 1942.

“Italian Factoring Law” means Italian law no. 52 of 21 February 1991, as amended and/or supplemented from time to time.

19

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Italian Receivable” means any Receivable governed by Italian law and assigned by an Italian Originator.

“Largest Obligor” means, at any time and with respect to each Insurance Cap, the largest Obligor or Group of Obligors (and for the purpose hereof, all Obligors belonging to the same Group are considered as one single Obligor) owing Purchased Receivables to the Originators taken as a whole, as well as to each Originator individually, and covered by such Credit Insurance Contract, but excluding the Obligors listed or whose parent is listed in Schedule 13 (List of Obligors with Rating), and such exclusion to apply only (i) for as long as such Obligors maintain at a minimum the rating set out opposite their name or (ii) if the rating requirement applies to their parent, for as long as their parent maintains at a minimum the rating and such Obligor remains a wholly owned subsidiary of the rated parent Group. For the purpose of this definition, the largest Obligor or Group of Obligors will be determined on the basis of the Outstanding Nominal Value of Purchased Receivables owing by such Obligor or Group of Obligors on the relevant determination date.

“Legal Opinion” means any legal opinion delivered to the Purchaser under Clause 3 (Purchase Dates, Conditions Precedent, Etc) of this Agreement.

“Legal Reservations” means:

| (a) | the principle that equitable remedies may be granted or refused at the discretion of a court and the limitation of enforcement by laws relating to insolvency, reorganisation and other laws generally affecting the rights of creditors; |

| (b) | matters which are set out as qualifications or reservations as to matters of law of general application in the Legal Opinions. |

“Leverage Ratio” has the meaning given to the term “Consolidated First Lien Leverage Ratio” in the First Lien Credit Agreement, as amended in accordance with the First Lien Credit Agreement from time to time.

“Licence” means, in relation to each Originator and the Master Servicer, any licence, authorisation, consent, agreements, working permits, exemption and registrations required (a) to enable such party to enter into and perform its obligations under the Transaction Documents and (b) to ensure the legality, validity, enforceability or admissibility in evidence in its jurisdiction of incorporation or organisation, as applicable, of the Transaction Documents.

“Limited Default Reserve Rate” has the meaning set out in Schedule 3 Part 1 (Calculation of the Purchase Price).

“Local Business Day” means, in relation to any Originator, a day (other than a Saturday or a Sunday) on which the commercial banks are open for business in Belgium, Luxembourg and the jurisdiction of the Originator.

“Master Servicer” means Mauser-Werke GmbH.

“Mauser Group” means the Parent and its Subsidiaries from time to time.

“Maximum Program Amount” means EUR 100,000,000 or its equivalent in USD, CAD and GBP (such equivalent being calculated using the relevant Exchange Rate).

20

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Multiemployer Plan” means a “multiemployer plan” (as defined in Section (3)(37) of ERISA) that is subject to Title IV of ERISA that is contributed to for any employees of the U.S. Originator or any ERISA Affiliate.

“Nominal Value” means, with respect to any Receivable, the notional amount of such Receivable expressed in the currency of such Receivable, including VAT and other Taxes if any, as reflected in the books of the relevant Originator and mentioned on the Invoice evidencing such Receivable.

“Nominal Value in CAD” means the Nominal Value for any Receivable denominated in CAD.

“Nominal Value in EUR” means the Nominal Value for any Receivable denominated in EUR.

“Nominal Value in GBP” means the Nominal Value for any Receivable denominated in GBP.

“Nominal Value in USD” means the Nominal Value for any Receivable denominated in USD.

“Non-contractual Dilution” means any reduction or cancellation, in whole or in part, of the Nominal Value of any Purchased Receivable by reason of the occurrence of any of the following circumstances and excluding any Contractual Dilution:

| (a) | any credit note, rebate, discount or allowances for prompt payment, for quantity, for return of goods or as fidelity or relationship premium, invoicing error or cancellation or any other commercial adjustment, granted by the Originator in accordance with the relevant Credit and Collection Policies; |

| (b) | any change in the terms or cancellation of a contract under which the Receivable arises or the Receivable which reduces the amount payable by the Obligor or the related Receivable; |

| (c) | any set-off exercised by the relevant Obligor in respect of any claim by such Obligor as to amounts owed by it on such Receivable (whether such claim arises out of the same or a related transaction or an unrelated transaction, and whether agreed by the Originator or arising by operation of law); |

| (d) | any specifically asserted dispute, counterclaim or defence whatsoever, including without limitation, any non-payment by the relevant Obligor due to failure by any Originator to deliver any merchandise or provide any services (excluding, for the avoidance of doubt, any dispute resulting from non-payment of the Obligor due to the Obligor being Insolvent); |

| (e) | any amounts being deducted by the Obligor or the Originator or Master Servicer from the Collections, due to any Tax imposed by way of withholding or deduction on the payments to be made by such Obligor to the Originator or Master Servicer; |

| (f) | any recourse or claim of third party on such Purchased Receivable; |

| (g) | with respect to a Purchased Receivable of which the Obligor is Insolvent, any expenses saved by the Originator by the non-payment of agent’s commission,non-fulfilment of the relevant contract or otherwise; and |

21

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

| (h) | with respect to a Purchased Receivable of which the Obligor is Insolvent, any sales, VAT or other Taxes saved by the Originator due to the non-payment of that Purchased Receivable. |

“Notified Level” means, with respect to the Monthly Default Ratio, the Dilution Ratio, the Days Sales Outstanding or the Weighted Average Contractual Payment Term, the maximum percentage or the maximum number of days (as applicable) that may not be exceeded, it being understood that such percentage or number of days may be amended pursuant to Clause 3.4.

“Obligor” means an entity set out in the records of any Originator as debtor of a Receivable, obliged to make payment for the delivery of goods or provision of services evidenced by a contract for which an Invoice has been issued by the relevant Originator (or, if different, the entity so obliged, including for the avoidance of doubt, any entity that has assumed the obligation of payment of any Invoice issued by any Originator in the ordinary course of business).

“Off-Set Reduction” means the amount (in CAD, EUR, GBP or in USD) determined on the day immediately preceding the Cut-off Date equal, for each Obligor, to the lower of: (i) the aggregate of all amounts (including customer deposits) owed by the relevant Originators on such Cut-off Date to such Obligor, or (ii) the unpaid balance of such Obligor.

“Originator” means any entity defined as such above unless it has ceased to be an Originator in accordance with Clause 17 (Termination) of this Agreement.

“Originator Portfolios” means, collectively, the Initial Originator Portfolio and any Subsequent Originator Portfolio.

“Other Applicable Taxes” has the meaning ascribed to such term in Clause 13 (TaxGross-Up).

“Ottawa Convention” has the meaning set out in Clause 28 (Ottawa Convention).

“Outstanding Nominal Value” means, at any time with respect to any Receivable, its Nominal Value less (a) any Dilution in relation to such Receivable (expressed in the relevant currency) and (b) any Collection, including any indemnities from any Credit Insurance Company with respect to such Receivable (expressed in the relevant currency).

“Outstanding Nominal Value in CAD” means, the Outstanding Nominal Value for any Receivable denominated in CAD.

“Outstanding Nominal Value in EUR” means, the Outstanding Nominal Value for any Receivable denominated in EUR.

“Outstanding Nominal Value in GBP” means, the Outstanding Nominal Value for any Receivable denominated in GBP.

“Outstanding Nominal Value in USD” means, the Outstanding Nominal Value for any Receivable denominated in USD.

“Parent” means Mauser Holding S.À.R.L., a limited liability company(Société à responsabilité limitée) organised and existing under the laws of Luxembourg and having its office at Rue Guillaume Kroll 5, 1882 Luxembourg, Luxembourg, registered with the Luxembourg register of commerce and companies under registration number B 186.922.

22

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Participating Member State” means any member state of the European Community that adopts or has adopted the EUR as its lawful currency in accordance with legislation of the European Community relating to the Economic and Monetary Union.

“Performance Guarantor” means the Parent.

“Performance Guarantee Letter” means the letter agreement entered into on 23 October 2015 between the Performance Guarantor and the Purchaser pursuant to which the Performance Guarantor makes various undertakings regarding the performance by, amongst others, the Originators and the Servicers of their respective obligations under the Transaction Documents.

“PBGC” means the U.S. Pension Benefit Guaranty Corporation, or any entity succeeding to all or any of its functions under ERISA.

“Portfolio” means the sum of the Portfolio in EUR, the Portfolio in CAD, the Portfolio in GBP and the Portfolio in USD, each converted in EUR using the relevant Exchange Rate as at the immediately preceding Cut-off Date, or with respect to the Initial Originator Portfolios, as at the Initial Cut-off Date.

“Portfolio in CAD” means, for the purposes of the Calculation and Payment Report, the Outstanding Nominal Value in CAD of all the Purchased Receivables in CAD as at the relevant Purchase Date and as originated by any Originator during the Calculation Period ending on such Cut-off Date, or with respect to the Initial Originator Portfolios, as at the Initial Cut-off Date.

“Portfolio in EUR” means, for the purposes of the Calculation and Payment Report, the Outstanding Nominal Value in EUR of all the Purchased Receivables in EUR as at the relevant Purchase Date and as originated by any Originator during the Calculation Period ending on such Cut-off Date, or with respect to the Initial Originator Portfolios, as at the Initial Cut-off Date.

“Portfolio in GBP” means, for the purposes of the Calculation and Payment Report, the Outstanding Nominal Value in GBP of all the Purchased Receivables in GBP as at the relevant Purchase Date and as originated by any Originator during the Calculation Period ending on such Cut-off Date, or with respect to the Initial Originator Portfolios, as at the Initial Cut-off Date.

“Portfolio in USD” means, for the purposes of the Calculation and Payment Report, the Outstanding Nominal Value in USD of all the Purchased Receivables in USD as at the relevant Purchase Date and as originated by any Originator during the relevant Calculation Period ending on such Cut-off Date, or with respect to the Initial Originator Portfolios, as at the Initial Cut-off Date.

“Program” has the meaning ascribed to such term in recital (B).

“Purchase Date” has the meaning ascribed to such term in Clause 3.1.

“Purchase Price” means, as the case may be, the Purchase Price in CAD, the Purchase Price in EUR, the Purchase Price in GBP or the Purchase Price in USD.

“Purchase Price in CAD” means the purchase price in respect of Purchased Receivables in CAD, as described in Clause 6 (Determination of the Purchase Price), including statutory VAT, if any.

23

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Purchase Price in EUR” means the purchase price in respect of Purchased Receivables in EUR, as described in Clause 6(Determination of the Purchase Price), including statutory VAT, if any.

“Purchase Price in GBP” means the purchase price in respect of Purchased Receivables in GBP, as described in Clause 6 (Determination of the Purchase Price), including statutory VAT, if any.

“Purchase Price in USD” means the purchase price in respect of Purchased Receivables in USD, as described in Clause 6(Determination of the Purchase Price), including statutory VAT, if any.

“Purchased Receivable” means any Purchased Receivable in EUR, Purchased Receivable in CAD, Purchased Receivable in GBP or Purchased Receivable in USD.

“Purchased Receivable in CAD” means, on any given date, any Eligible Receivable for Purchase denominated in CAD and assigned, sold, transferred or purported to be assigned, sold or transferred to the Purchaser and either totally or partially unpaid on such date and funded by the Purchaser.

“Purchased Receivable in EUR” means, on any given date, any Eligible Receivable for Purchase denominated in EUR and assigned, sold, transferred or purported to be assigned, sold or transferred to the Purchaser and either totally or partially unpaid on such date and funded by the Purchaser.

“Purchased Receivable in GBP” means, on any given date, any Eligible Receivable for Purchase denominated in GBP and assigned, sold, transferred or purported to be assigned, sold or transferred to the Purchaser and either totally or partially unpaid on such date and funded by the Purchaser.

“Purchased Receivable in USD” means, on any given date, any Eligible Receivable for Purchase denominated in USD and assigned, sold, transferred or purported to be assigned, sold or transferred to the Purchaser and either totally or partially unpaid on such date and funded by the Purchaser.

“Receivable” means any indebtedness relating to principal, costs and any other amounts (including VAT, where and as applicable) owed to any Originator by an Obligor as a result (directly or indirectly) of a sale of goods or a provision of services by such Originator (other than the U.S. Originators) or a U.S. Company in its ordinary course of business.

“Receivable in CAD” means any Receivable denominated in CAD.

“Receivable in EUR” means any Receivable denominated in EUR.

“Receivable in GBP” means any Receivable denominated in GBP.

“Receivable in USD” means any Receivable denominated in USD.

“Renewal Date” means, in case of a renewal of the Program granted by the Purchaser in accordance with Clause 17.1:

| (a) | the Settlement Date occurring 24 calendar months following the First Purchase Date; or |

| (b) | the Settlement Date occurring at or immediately prior to the expiration of the Renewal Period. |

24

Receivables Purchase Agreement (ING/Mauser)

EXECUTION COPY

“Renewal Period” has the meaning ascribed to such term in paragraph (b) of Clause 17.1.