Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

Table of Contents

As filed with the Securities and Exchange Commission on August 17, 2015

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CIFC LLC

(Exact Name of Registrant as Specified in its Governing Instrument)

| | | | |

Delaware

(State or Other Jurisdiction of

incorporation or Organization) | | 6199

(Primary Standard Industrial

Classification Code Number) | | 36-4814372

(I.R.S. Employer

Identification No.) |

250 Park Avenue, 4th Floor

New York, NY 10177

(212) 624-1200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Julian Weldon

General Counsel, Chief Compliance Officer and Secretary

CIFC LLC

250 Park Avenue, 4th Floor

New York, NY 10177

(212) 624-1200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

With copy to:

Joshua Ford Bonnie

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, NY 10017

(212) 455-2000

Approximate Date of Commencement of Proposed Sale of the Securities to the Public:

As soon as practicable after the effective date of this Registration Statement and upon completion of the transactions described in the enclosed proxy statement/prospectus.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filero | | Accelerated filero | | Non-accelerated filero

(Do not check if a

smaller reporting company) | | Smaller reporting companyý |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| | | | | | | | |

| |

Title of Each Class of

Securities to be Registered

| | Amount to be

Registered(1)

| | Proposed Maximum

Offering Price

per Unit(2)(3)

| | Aggregate Maximum

Offering

Price(2)(3)

| | Amount of

Registration Fee

|

|---|

| |

Shares representing limited liability company interests in CIFC LLC | | 25,372,404 | | $7.31 | | $185,472,273.24 | | $21,551.88 |

|

- (1)

- Pursuant to Rule 416, this registration statement also covers an indeterminate number of additional securities of CIFC LLC as may be issuable as a result of share splits, share distributions or similar transactions.

- (2)

- Represents the maximum number of common shares representing limited liability company interests in CIFC LLC, a Delaware limited liability company, that may be issuable pursuant to the merger of CIFC Merger Corp., a Delaware corporation, with and into CIFC Corp., a Delaware corporation, pursuant to an Agreement and Plan of Merger, as described in the proxy statement/prospectus that forms a part of this Registration Statement, or that may be issuable pursuant to outstanding options or other rights prior to the date the merger is expected to be completed, based upon the number of shares of each class of common stock, par value $0.001 per share, of CIFC Corp. issued at the close of business on August 14, 2015. Pursuant to the merger, each issued share of CIFC Corp. common stock (other than those that elect to exercise their appraisal rights) will be converted into the right to receive one common share representing a limited liability company interest in CIFC LLC.

- (3)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f) promulgated under the Securities Act of 1933, as amended. The proposed maximum aggregate offering price of the registrant's common shares representing limited liability company interests was calculated based upon the market value of shares of CIFC Corp.'s common stock (the securities to be converted in the transaction) in accordance with Rules 457(c) and 457(f) under the Securities Act as follows: (A) the product of (i) $7.31, the average of the high and low prices per share of CIFC Corp.'s common stock as reported on the NASDAQ Stock Market on August 14, 2015 and (ii) 25,372,404, the estimated maximum number of shares of CIFC Corp.'s common stock that may be converted.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

The proxy statement/prospectus that forms a part of this Registration Statement consists of (i) a proxy statement of CIFC Corp. with respect to the solicitation of proxies by CIFC Corp. for the special meeting of stockholders described herein, and (ii) a prospectus of CIFC LLC relating to the issuance by CIFC LLC of common shares representing limited liability company interests in CIFC LLC to holders of shares of common stock of CIFC Corp. in connection with the merger described herein.

Table of Contents

The information in this proxy statement/prospectus is not complete and may be changed. CIFC LLC may not offer or sell the securities being registered pursuant to this registration statement until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus is not an offer to distribute these securities and we are not soliciting offers to receive these securities in any jurisdiction where such offer or distribution is not permitted.

Subject To Completion, dated August 17, 2015

Proxy Statement/Prospectus

Reorganization Proposal—Your Vote Is Important

Dear CIFC Corp. Stockholder:

On behalf of the board of directors of CIFC Corp., you are cordially invited to attend a special meeting of our stockholders to be held on , 2015, at 9:00 a.m. (Eastern Standard Time) at the offices of CIFC Corp., 250 Park Avenue, 4th Floor, New York, NY 10177. Enclosed you will find the notice of meeting, proxy statement/prospectus and proxy card.

We are pleased to report that the board of directors of CIFC Corp. has approved a reorganization plan to cause CIFC Corp., currently a publicly-traded Delaware corporation, to become a subsidiary of a recently formed Delaware limited liability company, named CIFC LLC, that will become publicly traded as a result of the transactions described herein. We refer to this reorganization plan and certain related transactions as the "Reorganization Transaction." The recently formed Delaware limited liability company that will become publicly traded is intended to be a pass-through entity for U.S. federal income tax purposes and will maintain the existence of CIFC Corp. as a subsidiary.

The Reorganization Transaction will be implemented through a series of steps including, among other things, the merger of CIFC Merger Corp., a Delaware corporation and our indirect wholly-owned subsidiary, with and into CIFC Corp., pursuant to an agreement and plan of merger, or the "Merger Agreement." In the merger, each share of common stock of CIFC Corp. that you hold immediately prior to the merger will be converted into the right to receive one common share representing a limited liability company interest in CIFC LLC. The number of common shares of CIFC LLC you will hold following the merger will be the same as the number of shares of common stock of CIFC Corp. you hold immediately prior to the merger, and your relative economic ownership in our company will remain unchanged.

Following the merger, CIFC LLC will hold, through its subsidiaries, including CIFC Corp., the assets currently held by CIFC Corp. We expect that CIFC LLC will issue approximately common shares in the merger, based on the number of outstanding shares of common stock of CIFC Corp. as of , 2015. We will apply to have the common shares of CIFC LLC listed on the NASDAQ Stock Market under the symbol "CIFC."

At the special meeting, CIFC Corp. will ask you to adopt the agreement and plan of merger among CIFC Corp., CIFC Merger Corp. and CIFC LLC.

The board of directors of CIFC Corp. has determined that becoming a subsidiary of a limited liability company, and completing the other transactions described in this proxy statement/prospectus, is advisable and in the best interests of CIFC Corp. and its stockholders. The board of directors of CIFC Corp. believes that the Reorganization Transaction is beneficial because, among other things, conversion to a limited liability company structure will enable it to be classified as a partnership for federal tax purposes. CIFC Corp. stockholder approval is not required for the Reorganization Transaction other than the merger, and you are only being asked to vote on the adoption of the agreement and plan of merger.

We cannot complete the merger and the Reorganization Transaction unless the holders of at least a majority of the issued and outstanding shares of common stock of CIFC Corp. entitled to vote on the merger vote in favor of the merger.The board of directors of CIFC Corp. has approved the Merger Agreement, the merger and the Reorganization Transaction and determined that the Merger Agreement, the merger and the Reorganization Transaction are advisable and in the best interests of CIFC Corp. and its stockholders and recommends that you vote "FOR" the adoption of the Merger Agreement.

Whether or not you plan to attend the special meeting, please submit your proxy by completing, signing and dating the enclosed proxy card, over the Internet or via the toll-free telephone number, as described in this proxy statement/prospectus and the proxy card. Your prompt cooperation is greatly appreciated.

This proxy statement/prospectus provides you with detailed information about the merger, the Reorganization Transaction and the special meeting. We encourage you to read carefully this entire proxy statement/prospectus, including all its annexes, and we especially encourage you to read the sections entitled "Risk Factors" and "Material U.S. Federal Income Tax Considerations" of this proxy statement/prospectus.

| | | | |

| | Sincerely, | | |

| | Stephen J. Vaccaro

Co-President | | Oliver Wriedt

Co-President |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the securities or passed upon the accuracy or adequacy of the disclosures contained in this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated , 2015, and is sent or given to stockholders on or about , 2015.

Table of Contents

CIFC Corp.

250 Park Avenue, 4th Floor

New York, NY 10177

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2015

NOTICE IS HEREBY GIVEN that a special meeting of CIFC Corp. will be held at the offices of CIFC Corp. at 250 Park Avenue, 4th Floor, New York, NY 10177 on , 2015 at 9:00 a.m. (Eastern Standard Time), unless postponed or adjourned to a later date. This special meeting will be held to consider and vote on the following matters:

(1) a proposal to adopt the agreement and plan of merger, dated , 2015, among CIFC Corp., CIFC Merger Corp., a Delaware corporation, and CIFC LLC, a recently formed Delaware limited liability company, as the same may be amended from time to time, which agreement we refer to herein as the "Agreement and Plan of Merger" or the "Merger Agreement"; and

(2) to transact any other business that is properly brought before the special meeting or at any adjournments or postponements thereof.

The proposed merger is being undertaken in connection with our reorganization plan to cause CIFC Corp. to become a subsidiary of a Delaware limited liability company. CIFC Corp. reserves the right to defer or abandon the merger at any time and for any reason, even if stockholders of CIFC Corp. vote to adopt the Merger Agreement and the other conditions to the completion of the merger are satisfied or waived.

The board of directors of CIFC Corp. has approved the Merger Agreement, the merger and the Reorganization Transaction and determined that the Merger Agreement, the merger and the Reorganization Transaction are advisable and in the best interests of CIFC Corp. and its stockholders and recommends that CIFC Corp. stockholders vote "FOR" the proposal to adopt the Merger Agreement.

Whether or not you plan to attend the special meeting, please submit your proxies by completing, signing and dating the enclosed proxy card, over the Internet or via the toll-free telephone number, as described in this proxy statement / prospectus and the proxy card. Your prompt cooperation is greatly appreciated.

Any executed but unmarked proxy cards will be voted "FOR" the proposal to adopt the Merger Agreement. Stockholders may revoke their proxy in the manner described in the accompanying proxy statement/prospectus before it has been voted at the special meeting. If your broker holds your shares of common stock of CIFC Corp. in street name, you must either direct your broker on how to vote your shares or obtain a proxy from your broker to vote in person at the special meeting. Please check the voting form used by your broker for information on how to submit your instructions.

WE CANNOT COMPLETE THE MERGER AND THE REORGANIZATION TRANSACTION UNLESS THE MERGER AGREEMENT IS ADOPTED BY THE AFFIRMATIVE VOTE OF A MAJORITY OF THE OUTSTANDING SHARES OF COMMON STOCK OF CIFC CORP. ENTITLED TO VOTE ON THE MERGER.

Details concerning those matters to come before the special meeting are set forth in the accompanying proxy statement/prospectus for your inspection.

Our board of directors has fixed the close of business on , 2015 as the record date for the determination of stockholders entitled to vote at the special meeting or any meetings held upon adjournment or postponement of the special meeting. Only the holders of record of shares of common stock of CIFC Corp. as of the close of business on , 2015 are entitled to notice of and to vote at the special meeting and any adjournment or postponement thereof.

Table of Contents

Stockholders are cordially invited to attend the special meeting in person. The presence at the special meeting, in person or by proxy, of a majority of shares entitled to vote at the special meeting shall constitute a quorum. Abstentions and broker non-votes (i.e., votes not cast by a broker or other record holder in "street-name" or nominee name who has returned a properly executed proxy solely because such record holder does not have discretionary authority to vote on the matter), if any, will be counted toward the presence of a quorum.

Your vote is important, no matter how many or how few shares you own. With respect to the proposal to adopt the Merger Agreement, failure to vote will have the same effect as voting against the adoption of the Merger Agreement and the merger.

| | |

| | | By Order of the Board of Directors, |

|

|

Julian Weldon

General Counsel, Chief Compliance Officer and Secretary |

, 2015

New York, New York

Table of Contents

ADDITIONAL INFORMATION

This document, which is sometimes referred to as this proxy statement/prospectus, constitutes a proxy statement of CIFC Corp. with respect to the solicitation of proxies by CIFC Corp. for the special meeting described herein, and a prospectus of CIFC LLC relating to the issuance by CIFC LLC of common shares representing limited liability company interests in CIFC LLC to holders of shares of common stock of CIFC Corp. in connection with the merger described herein. As permitted under the rules of the Securities and Exchange Commission (the "SEC"), this proxy statement/prospectus incorporates important business and financial information about us that is contained in documents filed with the SEC that are not included in or delivered with this proxy statement/prospectus. You may obtain copies of these documents, without charge, from the web site maintained by the SEC at http://www.sec.gov, as well as other sources. See "Where You Can Find Additional Information," for additional information on documents incorporated by reference in this document. You may also obtain copies of these documents, without charge, from CIFC Corp. by writing or calling:

CIFC Corp.

250 Park Avenue, 4th Floor

New York, NY 10177

Attention: Investor Relations

(212) 624-1200

To receive timely delivery of requested documents in advance of the special meeting, you should make your request no later than , 2015.

VOTING

CIFC Corp.'s stockholders of record as of the close of business on the record date for the special meeting may submit their proxies by completing, signing and dating the enclosed proxy card, over the Internet or via the toll-free telephone number, as described in this proxy statement/prospectus and the proxy card.

If your shares are held in the name of a broker, bank or other nominee, then you are not the stockholder of record and you must obtain a proxy, executed in your favor, from the record holder. Please note that stockholders who hold their shares in "street-name" (i.e., through a bank, broker or other nominee) may also be able to provide voting instructions to their street name holders by telephone or via the Internet by following the instructions provided by such nominee. The votes entitled to be cast by the holders of shares of common stock of CIFC Corp. represented by properly authorized proxies will be cast at the special meeting as indicated or, if no instruction is given, in favor of the adoption of the Merger Agreement. Additionally, the votes entitled to be cast by the holders of such shares will be cast in the discretion of the proxy holder on any other matter that may come before the special meeting. Also, please note that if the holder of record of your shares is a broker, bank or other nominee, and you wish to vote in person at the special meeting, you must provide a legal proxy from the broker, bank or other nominee authorizing you to vote the shares.

ABOUT THIS DOCUMENT

This proxy statement/prospectus forms a part of a registration statement on Form S-4 (Registration No. 333- ) filed by CIFC LLC with the SEC. It constitutes a prospectus of CIFC LLC under the Securities Act of 1933, as amended, (the "Securities Act"), relating to the issuance by CIFC LLC of common shares representing limited liability company interests in CIFC LLC to holders of shares of common stock of CIFC Corp. in connection with the merger. It also constitutes a proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended, (the "Exchange Act") and a notice of special meeting and action to be taken with respect to the CIFC Corp. special meeting of stockholders at which CIFC Corp. stockholders will consider and vote on the proposal to adopt the Merger Agreement and to approve the transactions contemplated by the Merger Agreement, including the merger.

Table of Contents

You should rely only on the information contained in or incorporated by reference into this document. No one has been authorized to provide you with information that is different from that contained in or incorporated by reference into this document. This document is dated , 2015. You should not assume that the information contained in this document is accurate as of any date other than the date hereof. You should not assume that the information contained in any document incorporated by reference herein is accurate as of any date other than the date of such document. Any statement contained in a document incorporated or deemed to be incorporated by reference into this document will be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference into this document modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this document. Neither the mailing of this document to the stockholders of CIFC Corp. nor the taking of any actions contemplated hereby by CIFC Corp. or CIFC LLC at any time will create any implication to the contrary.

Table of Contents

TABLE OF CONTENTS

| | | | |

| | Page | |

|---|

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE REORGANIZATION TRANSACTION | | | 1 | |

SUMMARY | | | 6 | |

General | | | 7 | |

Structure of the Merger | | | 7 | |

UNAUDITED PRO FORMA FINANCIAL DATA | | | 14 | |

RISK FACTORS | | | 20 | |

Risks Related to Reorganization Transaction | | | 20 | |

Tax Risks | | | 22 | |

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS | | | 28 | |

VOTING AND PROXIES; INFORMATION ABOUT THE SPECIAL MEETING | | | 30 | |

Date, Time and Place of the Special Meeting | | | 30 | |

Matters to Be Considered | | | 30 | |

Recommendation of the Board of Directors | | | 30 | |

Who May Vote | | | 31 | |

Quorum | | | 31 | |

Vote Required | | | 31 | |

How to Vote Your Shares and Submit Your Proxies | | | 31 | |

Revocation of Proxies | | | 32 | |

Proxy Solicitation and Tabulation of Votes | | | 32 | |

Electronic Delivery | | | 32 | |

Notice Regarding Delivery of Stockholder Documents | | | 33 | |

Adjournment; Other Matters | | | 33 | |

REORGANIZATION TRANSACTION; ORGANIZATIONAL STRUCTURE | | | 33 | |

Reorganization Transaction | | | 33 | |

Treatment of Existing Indebtedness | | | 34 | |

Organizational Structure Following the Reorganization Transaction | | | 34 | |

BACKGROUND OF THE REORGANIZATION TRANSACTION AND THE MERGER | | | 34 | |

OUR REASONS FOR THE REORGANIZATION TRANSACTION AND THE MERGER | | | 36 | |

TERMS OF THE MERGER | | | 37 | |

Structure and Completion of the Merger | | | 37 | |

Exchange of Stock Certificates | | | 37 | |

Other Effects of the Merger | | | 37 | |

Conditions to Completion of the Merger | | | 38 | |

Termination of the Merger Agreement | | | 38 | |

Appraisal Rights in Connection with the Merger | | | 38 | |

Regulatory Approvals | | | 42 | |

Accounting Treatment of Reorganization Transaction | | | 43 | |

DIRECTORS AND EXECUTIVE OFFICERS | | | 44 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | 45 | |

DESCRIPTION OF SHARES OF CIFC LLC | | | 47 | |

COMPARISON OF RIGHTS OF STOCKHOLDERS OF CIFC CORP. AND SHAREHOLDERS OF CIFC LLC | | | 50 | |

LIMITATION OF LIABILITY AND INDEMNIFICATION OF DIRECTORS AND OFFICERS | | | 58 | |

SHAREHOLDERS AGREEMENT WITH DFR HOLDINGS | | | 59 | |

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS | | | 60 | |

LEGAL MATTERS | | | 83 | |

Table of Contents

| | | | |

| | Page | |

|---|

EXPERTS | | | 83 | |

FUTURE STOCKHOLDER PROPOSALS | | | 83 | |

OTHER MATTERS | | | 83 | |

WHERE YOU CAN FIND ADDITIONAL INFORMATION | | | 84 | |

Annex A—Form of Merger Agreement | | | | |

Annex B—Form of LLC Agreement | | |

| |

Annex C—Section 262 of the General Corporation Law of the State of Delaware | | |

| |

ii

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

AND THE REORGANIZATION TRANSACTION

The questions and answers below highlight only selected information from this proxy statement/prospectus. They do not contain all of the information that may be important to you. CIFC Corp.'s board of directors is soliciting proxies from its stockholders to vote at the special meeting of CIFC Corp.'s stockholders, to be held on , 2015 at 9:00 a.m. (Eastern Standard Time) at the offices of CIFC Corp. at 250 Park Avenue, 4th Floor, New York, NY 10177. You should read carefully the entire proxy statement/prospectus, including the annexes, and the additional documents incorporated by reference into this proxy statement/prospectus, to fully understand the matters to be acted upon and the voting procedures for CIFC Corp.'s special meeting. For a list of documents incorporated by reference into this document and information on how to obtain them, see the section titled "Where You Can Find More Information."

- Q:

- Why am I receiving this proxy statement/prospectus?

- A:

- The board of directors of CIFC Corp. has approved a reorganization plan to convert from a publicly-traded Delaware corporation to a publicly-traded Delaware limited liability company. We refer to this reorganization plan and certain related transactions as the "Reorganization Transaction." The Reorganization Transaction will be implemented through a series of steps including, among other things, the merger of CIFC Merger Corp., a Delaware corporation and wholly-owned indirect subsidiary of CIFC Corp., with and into CIFC Corp. In the merger, each share of common stock of CIFC Corp. that you hold immediately prior to the merger will be converted into the right to receive one common share representing a limited liability company interest in CIFC LLC. CIFC Corp. is seeking stockholder approval necessary to adopt the Merger Agreement at the special meeting. This document is a proxy statement because it is being used by the board of directors of CIFC Corp. to solicit proxies to approve the merger. It is a prospectus because CIFC LLC is offering its common shares in exchange for shares of common stock of CIFC Corp. if the merger is completed.

- Q:

- What is the purpose of the merger and the Reorganization Transaction?

- A:

- The merger is intended to change our top-level form of organization from a corporation to a limited liability company that would be taxed as a partnership, and not as a corporation, for U.S. federal income tax purposes. This change will allow us to operate in a more tax efficient manner compared to our current structure. If the Reorganization Transaction is completed, it is expected that we will be able to execute our current business strategy in a manner that will minimize entity-level taxation on investment income. In order to be treated as a partnership, CIFC LLC must satisfy the qualifying income exception, which will require that at least 90% of its gross income each taxable year consist of interest, dividends, capital gains and other types of "qualifying income." We believe that the Reorganization Transaction will enable CIFC LLC to satisfy the qualifying income exception. Under the limited liability company structure, provided that the qualifying income exception is met, you generally will have the advantages of single-layer taxation with respect to qualifying income. Upon completion of the Reorganization Transaction, we expect our structure to be more in line with that of other industry leaders. Furthermore, we anticipate that the Reorganization Transaction will result in significant tax savings that will enable us to increase distributions to shareholders and/or increase cash available for investment in our business.

- Q:

- What will be the tax treatment for CIFC LLC in the limited liability company structure and how will I be affected as a holder of CIFC LLC common shares?

- A:

- CIFC LLC will be subject to different requirements with respect to its tax status in a limited liability company structure than CIFC Corp. currently is subject to with respect to its corporate tax

1

Table of Contents

status, and provided that the qualifying income exception is met, you will be treated as owning an interest in a partnership, rather than stock in a corporation, for U.S. federal income tax purposes. As a result, you generally will be required to take into account your proportionate share of CIFC LLC's items of income, gain, loss, deduction and credit on a current basis, without regard to whether you receive a corresponding cash distribution. You are urged to read the section titled "Material U.S. Federal Income Tax Considerations" and to consult your tax advisor regarding the U.S. federal, state and local and foreign tax consequences of the Reorganization Transaction and a continuing investment in our shares.

- Q:

- What are the U.S. federal income tax consequences of the merger and the Reorganization Transaction?

- A:

- Please see "—Material U.S. Federal Income Tax Consequences of the Merger and Reorganization Transaction" and "Material U.S. Federal Income Tax Considerations—U.S. Federal Income Tax Consequences of the Merger and the Reorganization Transaction" for additional information. The tax consequences of the merger and the Reorganization Transaction to any particular holder will depend on the holder's particular tax circumstances. You are urged to consult your tax advisor regarding the specific tax consequences to you of the merger and the Reorganization Transaction in light of your particular circumstances.

- Q:

- Will CIFC's distribution policy change following the Reorganization Transaction?

- A:

- We anticipate that CIFC LLC's board of directors will reevaluate our distribution policy following the Reorganization Transaction in light of the tax savings that we expect will result from the Reorganization Transaction, the anticipated tax consequences for holders of ownership of our shares following the Reorganization Transaction and the distribution policies of other publicly-traded alternative asset managers. However, the declaration, amount and payment of any distributions on common shares of CIFC LLC will be at the sole discretion of CIFC LLC's board of directors.

- Q:

- What will I receive in connection with the merger and the Reorganization Transaction?

- A:

- If the merger is completed, each share of common stock of CIFC Corp. that you hold immediately prior to the merger will be converted into the right to receive one common share representing a limited liability company interest in CIFC LLC.

- Q:

- When do you expect to complete the Reorganization Transaction?

- A:

- We expect the Reorganization Transaction to be effective on , 2015. Although CIFC Corp.'s board of directors has approved the merger, the completion of the merger is subject to a number of conditions, and there is no assurance that all of the conditions to closing will be met and that the merger will be completed. However, CIFC Corp. reserves the right to defer or abandon the merger at any time and for any reason, even if its stockholders vote to adopt the Merger Agreement, and the other conditions to the completion of the merger are satisfied or waived. In addition, we may elect to consummate the merger prior to , 2015.

- Q:

- How will being a CIFC LLC shareholder be different from being a CIFC Corp. stockholder?

- A:

- After the merger, you will hold a number of common shares representing limited liability company interests in CIFC LLC that is equivalent to the number of shares of common stock of CIFC Corp. that you held immediately prior to the merger. You will hold common shares representing limited liability company interests in CIFC LLC, and your rights will be governed by the Delaware Limited

2

Table of Contents

Liability Company Act (the "LLC Act") and the Amended and Restated Limited Liability Company Agreement of CIFC LLC (the "LLC Agreement").

Upon the merger, the governing documents of CIFC LLC, and all of the rights and obligations of the directors and officers of CIFC LLC, will be substantially similar to those of CIFC Corp. prior to the merger. Accordingly, your rights as a shareholder of CIFC LLC will be substantially similar to your rights as a stockholder of CIFC Corp., including rights as to voting and distributions, except as described in "Description of Shares of CIFC LLC" and "Comparison of Rights of Stockholders of CIFC Corp. and Holders of Shares of CIFC LLC."

Further, as a result of CIFC LLC's limited liability company structure after the merger, provided that the qualifying income exception is met, you will be treated as owning an interest in a partnership, rather than stock in a corporation, for U.S. federal income tax purposes. See "Material U.S. Federal Income Tax Considerations."

- Q:

- Will the operations, businesses, management or capital of CIFC Corp. change as a result of the merger?

- A:

- No. After the merger, CIFC LLC will be managed by a board of directors with the same directors, and have the same officers and management personnel, as that of CIFC Corp. prior to the merger. The merger will result in no substantive changes in our operations, business, management, or total assets. CIFC LLC will have the same authorized capital and the same amount of outstanding equity interests as CIFC Corp., and there will be no change in the proportionate ownership interests in CIFC LLC after the merger as in CIFC Corp. prior to the merger (in each case, other than as a result of any common stock of CIFC Corp. subject to validly perfected appraisal rights (see "The Merger—Appraisal Rights in connection with the Merger")).

- Q:

- What other significant transactions are being contemplated as part of the Reorganization Transaction?

- A:

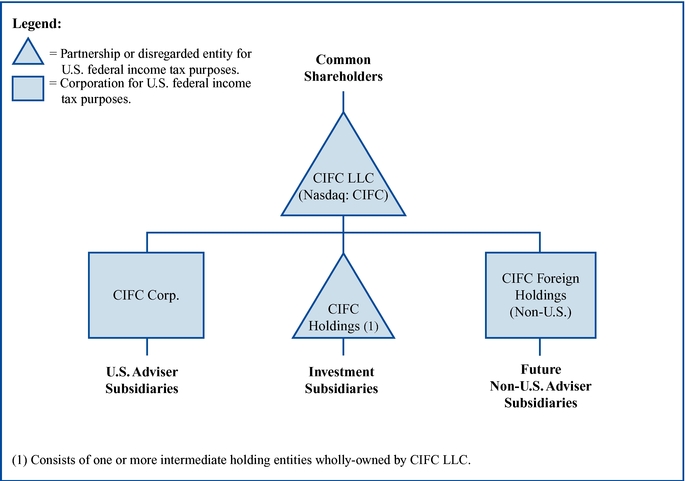

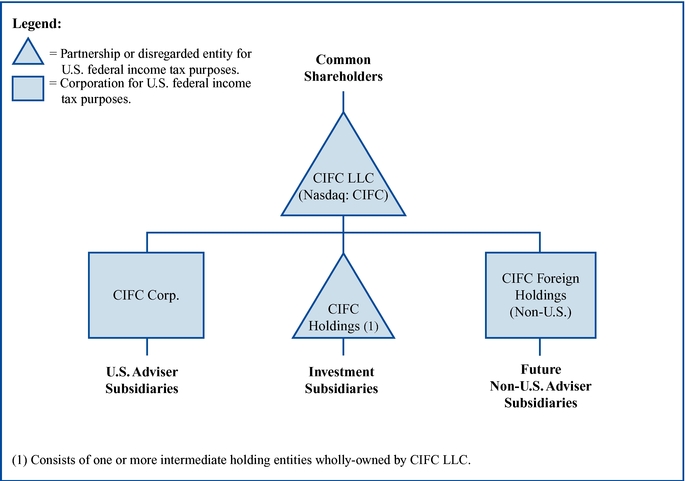

- As part of the Reorganization Transaction, we anticipate that:

- •

- CIFC Corp. will continue to hold each of our U.S. investment advisers;

- •

- CIFC Corp. will distribute ownership of one or more subsidiary entities that hold certain investment assets, including investments in CLOs and investment funds, to CIFC LLC or one or more direct or indirect wholly-owned subsidiaries thereof (collectively, "CIFC Holdings"); and

- •

- A subsidiary of CIFC LLC will be formed ("CIFC Foreign Holdings") that is anticipated to hold non-U.S. investment advisers and other non-U.S. fee-generating businesses that we may own or acquire in the future.

In addition, following the Reorganization Transaction, we anticipate that CIFC Corp. will remain the issuer and primary obligor of our outstanding $120 million aggregate principal amount of junior subordinated notes due October 30, 2035 (the "Junior Subordinated Notes") and any new indebtedness that may be incurred prior to the consummation of the Reorganization Transaction. Upon consummation of the Reorganization Transaction, we expect that CIFC LLC and certain subsidiaries of CIFC LLC will provide full and unconditional guarantees of the obligations of CIFC Corp. under the Junior Subordinated Notes and any such new indebtedness.

- Q:

- What am I being asked to vote on at the special meeting?

- A:

- You are being asked to adopt the Merger Agreement.

3

Table of Contents

- Q:

- Who can vote at the special meeting and what vote is required to adopt the Merger Agreement?

- A:

- Holders of record of shares of common stock of CIFC Corp. at the close of business on , 2015 may vote at the special meeting. The adoption of the Merger Agreement by CIFC Corp.'s stockholders requires the affirmative vote of the holders of a majority of the issued and outstanding shares of CIFC Corp.'s common stock entitled to vote on the merger. As of , 2015, the record date for the special meeting, there were shares of common stock of CIFC Corp. outstanding and entitled to vote.

DFR Holdings, LLC ("DFR Holdings"), which held approximately 74% of the outstanding shares of common stock of CIFC Corp. as of August 7, 2015, has indicated that it currently intends to vote its shares of common stock of CIFC Corp. in favor of adopting the Merger Agreement.

Votes may be cast for or against the adoption of the Merger Agreement, or you may abstain from voting. For more information about voting at the special meeting and the vote required to adopt the Merger Agreement, see "Voting and Proxies; Information About the Special Meeting."

- Q:

- How does the board of directors of CIFC Corp. recommend I vote on the proposals?

- A:

- The board of directors of CIFC Corp. believes that the merger is advisable and in the best interests of CIFC Corp. and its stockholders and recommends that you vote "FOR" the adoption of the Merger Agreement.

- Q:

- When and where is the special meeting?

- A:

- The special meeting will take place on , 2015 at 9:00 a.m. (Eastern Standard Time) at the offices of CIFC Corp. at 250 Park Avenue, 4th Floor, New York, NY 10177.

- Q:

- Can I attend the special meeting and vote my shares in person?

- A:

- Yes. All stockholders of record on , 2015 are invited to attend the special meeting. If your shares are held through a broker, bank or other nominee, then you are not the stockholder of record, and you must obtain a proxy executed in your favor from the record holder.

- Q:

- How will my proxy be voted?

- A:

- You may submit your proxy by completing, dating, signing and returning your proxy card, over the Internet or via a toll-free telephone number, as described in this proxy statement/prospectus and proxy card.

Your proxy will be voted in accordance with your instructions, so long as, in the case of a proxy card returned by mail, such card has been executed and dated. If you execute and return your proxy card by mail but provide no specific instructions in the proxy card, your shares will be voted "FOR" the proposal to adopt the Merger Agreement and in the discretion of the proxy holder on any other matters that are properly brought before the special meeting or any adjournment or postponement thereof.

- Q:

- If my shares are held in "street name" by my broker, will my broker vote my shares for me?

- A:

- If your shares are held in the name of a broker, bank or other nominee, then you are not the stockholder of record, and you must obtain a proxy executed in your favor from the record holder. Please note that stockholders who hold their shares in "street-name" (i.e., through a bank, broker or other nominee) may also be able to provide voting instructions to their street name holders by telephone or via the Internet by following the instructions provided by such nominee. The votes entitled to be cast by the holders of shares of common stock of CIFC Corp. represented by

4

Table of Contents

properly authorized proxies will be cast at the special meeting as indicated or, if no instruction is given, in favor of the merger. Additionally, the votes entitled to be cast by the holders of such shares will be cast in the discretion of the proxy holder on any other matter that may properly come before the special meeting or any adjournment or postponement thereof.

- Q:

- What do I need to do now?

- A:

- You should carefully read and consider the information contained in this proxy statement/prospectus, including its annexes. It contains important information about the special meeting and what the board of directors of CIFC Corp. considered in evaluating the Reorganization Transaction, the merger and the Merger Agreement.

You should then promptly vote by completing, signing and dating the enclosed proxy card, over the Internet or via the toll-free telephone number, as described in this proxy statement/prospectus and the proxy card. If your shares are held through a broker, bank or other nominee, you should receive a separate voting instruction form with this proxy statement/prospectus.

- Q:

- Can I change my vote after I have mailed my signed proxy card?

- A:

- Yes. You may change your vote at any time before your proxy is voted at the special meeting. If you are a stockholder of record, you can do this by giving written notice to our corporate secretary, by submitting another properly executed proxy with a later date or by attending the meeting and voting in person. Simply attending the meeting, however, will not revoke your proxy. If you are a stockholder in "street" or "nominee" name, you should consult with the bank, broker or other nominee regarding that entity's procedures for revoking your voting instructions. See "Voting and Proxies; Information About the Special Meeting."

- Q:

- Should I send in my stock certificates now?

- A:

- No. After the merger is completed, each outstanding certificate (or evidence of shares in book-entry form) representing shares of common stock of CIFC Corp. will be deemed for all purposes to represent the same number of common shares of CIFC LLC pursuant to the Merger Agreement. Holders of such outstanding certificates will not be asked to surrender them for cancellation in connection with the merger. New certificates representing common shares of CIFC LLC will be issued if (and only if) certificates representing shares of common stock of CIFC Corp. are presented for exchange or transfer after the merger. PLEASE DO NOT SEND ANY SHARE CERTIFICATES. See "The Merger Agreement—Treatment of CIFC Corp. Common Stock in the Merger."

- Q:

- Do I have appraisal rights in connection with the merger?

- A:

- Yes. As a holder of common stock of CIFC Corp, if you do not vote in favor of the adoption of the Merger Agreement, you are entitled to exercise appraisal rights under Delaware law in connection with the merger by taking certain actions and meeting certain conditions.

See "The Merger—Appraisal Rights in connection with the Merger." In addition, a copy of Section 262 of the Delaware General Corporation Law (the "DGCL") is attached to this document as Annex C.

- Q:

- Whom should I call with questions?

- A:

- If you have any questions about the special meeting or the merger, would like additional copies of the proxy statement/prospectus or need assistance with voting your shares, please call the Company at (646) 367-6633 or contact our investor relations department by email at Investor@cifc.com.

5

Table of Contents

SUMMARY

This summary highlights selected information from this proxy statement/prospectus and may not contain all of the information that is important to you. You should carefully read this entire proxy statement/prospectus and the other documents to which this proxy statement/prospectus refers in order to understand in greater detail the Reorganization Transaction, the merger and the other proposals to be considered at the special meeting. In particular, you should read the annexes attached to this proxy statement/prospectus, including the form of Merger Agreement, which is attached as Annex A. You also should read the form of LLC Agreement, which is attached as Annex B, because this document governs your rights as a holder of common shares following the merger.

The information contained in this proxy statement/prospectus, unless otherwise indicated, assumes the Reorganization Transaction and all the transactions related to the Reorganization Transaction, including the merger, will occur. When used in this proxy statement/prospectus, unless otherwise specifically stated or the context otherwise requires, the terms "Company," "CIFC," "we," "our" and "us" refer to (i) CIFC Corp. and its direct and indirect subsidiaries with respect to the period prior to the merger, and (ii) CIFC LLC and its direct and indirect subsidiaries, including CIFC Corp., with respect to the period after the merger.

The Parties

CIFC Corp.

CIFC Corp. is a Delaware corporation headquartered in New York City. We are a fundamentals-based, relative value, alternative credit manager. Our primary business is to provide investment management services for investment products. We manage assets for various types of investors, including pension funds, hedge funds, other asset management firms, banks, insurance companies and other types of institutional investors across the world.

Our assets under management are primarily comprised of collateralized loan obligations ("CLOs"). In addition, we manage credit funds, separately managed accounts and other-loan based products. We manage these credit products through opportunistic investment strategies where we seek to generate both current income and capital appreciation, primarily through senior secured corporate loan investments and, to a lesser extent, other investments. We also manage collateralized debt obligations, which we do not expect to issue in the future.

We have three primary sources of revenue: management fees, incentive fees and investment income. Management fees are generally earned based on the amount of assets managed, incentive fees are earned based on the performance of the funds and investment income is earned based on the performance of our direct investment in our products and those of third parties.

CIFC Corp. was incorporated in Delaware in November 2004. Our headquarters are located at 250 Park Avenue, 4th floor, New York, NY 10177, and our telephone number is (212) 624-1200. Our common stock is currently listed on the NASDAQ Stock Market under the symbol "CIFC".

CIFC LLC

CIFC LLC is a recently formed Delaware limited liability company. Upon completion of the merger of CIFC Merger Corp. with and into CIFC Corp., each share of common stock of CIFC Corp. outstanding immediately prior to the merger will be converted into the right to receive one common share representing a limited liability company interest, or common share, in CIFC LLC, and CIFC LLC will become a publicly-traded company. Prior to the merger, CIFC LLC will conduct no business other than that incident to the Reorganization Transaction. CIFC LLC was organized in Delaware on July 24, 2015.

6

Table of Contents

CIFC Merger Corp.

CIFC Merger Corp. is a Delaware corporation that will merge with and into CIFC Corp. CIFC LLC will be the sole stockholder of CIFC Merger Corp. Prior to the merger, CIFC Merger Corp. will conduct no business other than that incident to the Reorganization Transaction. CIFC Merger Corp. was incorporated in Delaware on , 2015.

General

The board of directors of CIFC Corp. has approved a plan to cause CIFC Corp., currently a publicly-traded Delaware corporation, to become a subsidiary of a recently formed Delaware limited liability company, CIFC LLC, that is intended to be a pass-through entity for U.S. federal income tax purposes and that will become publicly traded as a result of the transactions described herein. We refer to the merger and the related reorganization transactions described in this proxy statement/prospectus as the "Reorganization Transaction."

CIFC Corp. reserves the right to defer or abandon the merger at any time and for any reason, even if its stockholders vote to approve the merger and the other conditions to the completion of the merger are satisfied or waived.

We estimate that one-time transaction costs incurred or to be incurred in connection with the Reorganization Transaction, including, among others, financial and tax advisory fees and expenses, legal fees and printing and mailing costs associated with the preparation of this proxy statement/prospectus will be approximately $1.2 to $1.5 million.

Conversion of Shares of CIFC Corp. into Shares of CIFC LLC

If the merger is completed, each share of common stock of CIFC Corp. that you hold immediately prior to the merger will be converted into the right to receive one common share representing a limited liability company interest in CIFC LLC. See "Terms of the Merger."

Treatment of Outstanding Equity Awards

CIFC LLC will assume all obligations under the CIFC Corp. 2011 Stock Option and Incentive Plan (the "Stock Incentive Plan"). All rights of participants to acquire shares of common stock of CIFC Corp. under the Stock Incentive Plan will be converted into rights to acquire common shares in CIFC LLC in accordance with the terms of the Stock Incentive Plan. Upon the merger, the shares of common stock of CIFC Corp. that may be issuable under the Stock Incentive Plan will automatically be converted on a one-for-one basis into common shares of CIFC LLC, and the terms and conditions that are in effect immediately prior to the merger under each outstanding equity award assumed by CIFC LLC will continue in full force and effect after the merger, except that the interests issuable under each such award will be common shares of CIFC LLC. Your adoption of the Merger Agreement will be deemed to be the approval of CIFC LLC's adoption of the Stock Incentive Plan and assumption of all rights and liabilities thereunder. See "Terms of the Merger—Other Effects of the Merger."

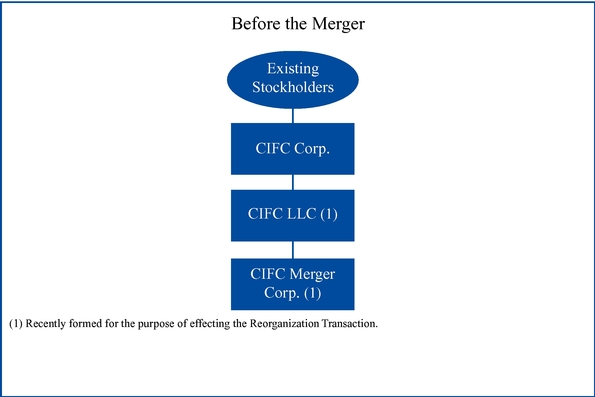

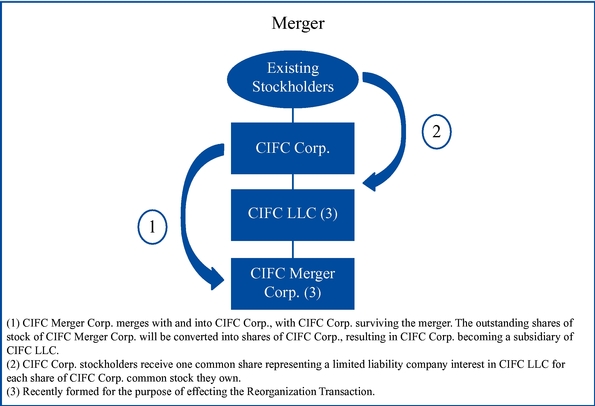

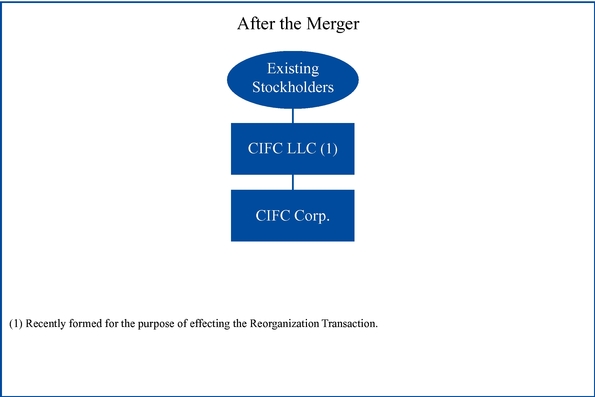

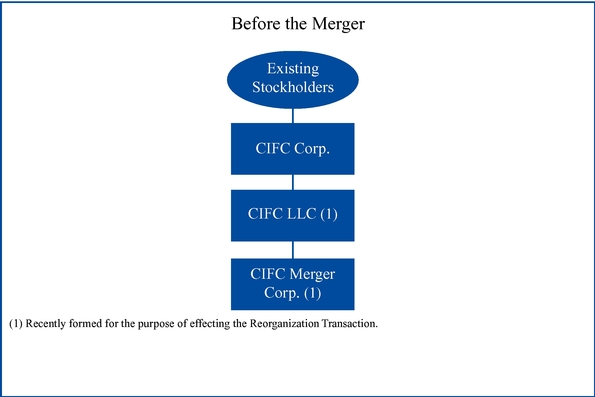

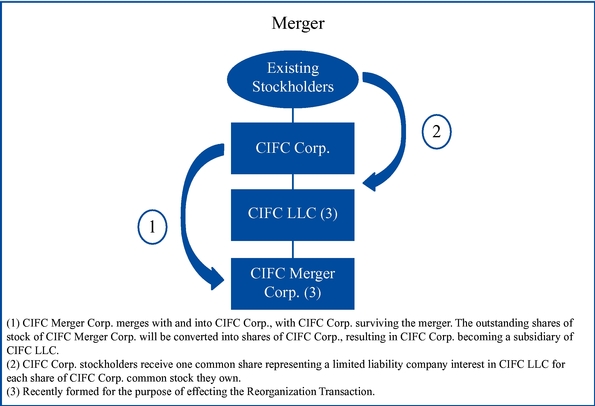

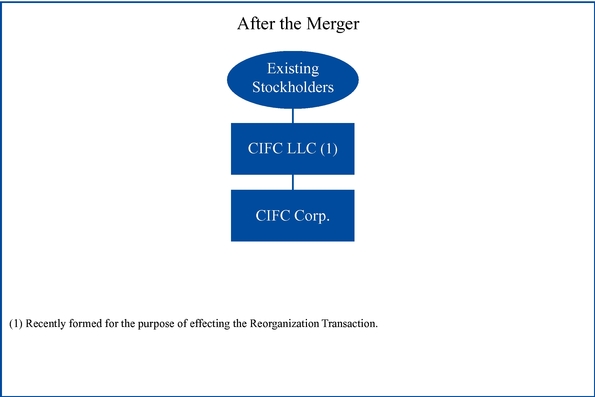

Structure of the Merger

In order to help you better understand the merger and how it will affect CIFC Corp., CIFC LLC and CIFC Merger Corp., the charts below illustrate, in simplified form, the following:

- •

- Before the Merger: the organizational structure of CIFC Corp., CIFC LLC and CIFC Merger Corp., excluding CIFC Corp.'s current operating subsidiaries, immediately before the merger;

7

Table of Contents

- •

- Merger: the steps involved in, and the effects of, the merger of CIFC Merger Corp. with and into CIFC Corp. and the exchange of shares of common stock of CIFC Corp. for the right to receive common shares of CIFC LLC; and

- •

- After the Merger: the organizational structure of CIFC LLC and CIFC Corp. immediately after the completion of the merger.

8

Table of Contents

Other Reorganization Related Transactions

As part of the Reorganization Transaction, we anticipate that:

- •

- CIFC Corp. will continue to hold each of our U.S. investment advisers;

9

Table of Contents

- •

- CIFC Corp. will distribute ownership of one or more subsidiary entities that hold certain investment assets, including investments in CLOs and investment funds, to CIFC LLC or CIFC Holdings; and

- •

- CIFC Foreign Holdings will be formed, which is anticipated to hold non-U.S. investment advisers and other non-U.S. fee-generating businesses that we may own or acquire in the future.

The distribution by CIFC Corp. to CIFC LLC will be treated as a taxable distribution to CIFC LLC equal to the fair market value of the assets distributed. CIFC Corp. will recognize taxable gain, but not loss, on the distribution to the extent the fair market value of any asset distributed exceeds its adjusted tax basis in such asset. See "Material U.S. Federal Income Tax Considerations—U.S. Federal Income Tax Consequences of the Merger and the Reorganization Transaction—U.S. Federal Income Tax Consequences of Other Aspects of the Reorganization Transaction."

In addition, following the Reorganization Transaction, we anticipate that CIFC Corp. will remain the issuer and primary obligor of our Junior Subordinated Notes and any new indebtedness that may be incurred prior to the consummation of the Reorganization Transaction. Upon consummation of the Reorganization Transaction, we expect that CIFC LLC and certain subsidiaries of CIFC LLC will provide full and unconditional guarantees of the obligations of CIFC Corp. under the Junior Subordinated Notes and any such new indebtedness.

Board of Directors CIFC LLC

The existing board of directors of CIFC Corp. will be the board of directors of CIFC LLC after the merger. See "Directors and Executive Officers."

Recommendation of the Board of Directors

The board of directors of CIFC Corp. has approved the Merger Agreement, the merger and the Reorganization Transaction, and determined that the Merger Agreement, the merger and the Reorganization Transaction are advisable and in the best interests of CIFC Corp. and its stockholders and recommends that you vote "FOR" the adoption of the Merger Agreement.

Material U.S. Federal Income Tax Consequences of the Merger and Reorganization Transaction

Although the merger is, for state law purposes, a merger of CIFC Merger Corp. with and into CIFC Corp., the merger will be treated for U.S. federal income tax purposes as a contribution by you of your common stock of CIFC Corp. to CIFC LLC in exchange for common shares of CIFC LLC. As discussed in "Material U.S. Federal Income Tax Considerations," except as described below with respect to the distribution by CIFC Corp., you will not recognize any taxable gain or loss on the exchange of common stock of CIFC Corp. for common shares of CIFC LLC in the merger. See "Material U.S. Federal Income Tax Considerations—U.S. Federal Income Tax Consequences of the Merger and the Reorganization Transaction—U.S. Federal Income Tax Consequences of the Merger to CIFC Corp. and Holders of CIFC Corp. Common Stock." Your initial U.S. federal income tax basis and holding period in the CIFC LLC shares received in the merger will reflect your tax basis and holding period in the stock of CIFC Corp. surrendered in exchange therefor.

As discussed above, as part of the Reorganization Transaction, certain assets will be distributed by CIFC Corp. to CIFC LLC. For U.S. federal income tax purposes the distribution will be treated as a taxable distribution to CIFC LLC equal to the fair market value of the assets distributed. Such distribution will be taxable as a dividend to CIFC LLC to the extent paid out of CIFC Corp.'s current or accumulated earnings and profits. Such dividend income arising from the distribution will be allocated among the CIFC LLC shareholders pro rata in accordance with their interests in CIFC LLC. If the distribution amount exceeds CIFC Corp.'s current or accumulated earnings and profits, it is

10

Table of Contents

possible that CIFC LLC will have taxable gain allocable to the CIFC LLC shareholders. The amount and allocation of such taxable gain will be determined separately for each CIFC LLC shareholder by treating that shareholder's pro rata portion of the excess distribution as (a) a nontaxable return of capital, up to that shareholder's tax basis in the CIFC Corp. stock surrendered for CIFC LLC shares, and then (b) taxable capital gain allocable to that shareholder up to the amount of any remainder (so the gain will be allocated to the CIFC LLC shareholders to reflect their relative tax bases in the CIFC Corp. stock surrendered, rather than pro rata). Shareholders of CIFC LLC may not receive a cash distribution from CIFC LLC to cover their tax liability associated with the Reorganization Transaction.

The U.S. federal income tax treatment of holders of our shares depends in some instances on determinations of fact and interpretations of complex provisions of U.S. federal income tax law for which no clear precedent or authority may be available. In addition, the tax consequences of the Reorganization Transaction and of holding our shares to any particular holder will depend on the holder's particular tax circumstances. You are urged to consult your tax advisor regarding the specific tax consequences, including the U.S. federal, state, local and foreign tax consequences, to you in light of your particular investment or tax circumstances of acquiring, holding, exchanging or otherwise disposing of our shares.

Taxation of CIFC LLC Following the Reorganization Transaction

CIFC LLC believes that it has been organized and intends to operate so that it will qualify to be treated for U.S. federal income tax purposes as a partnership, and not as an association or a publicly traded partnership taxable as a corporation. As a holder of shares, you will be required to take into account your allocable share of items of CIFC LLC's income, gain, loss, deduction and credit for the taxable year of CIFC LLC ending within or with your taxable year. As discussed in "Material U.S. Federal Income Tax Considerations," CIFC LLC's ability to qualify to be treated as a partnership will depend on its ability to satisfy certain income and other tests on an ongoing basis.

You are urged to consult your tax advisor regarding the specific tax consequences, including the U.S. federal, state, local and foreign tax consequences to you in light of your particular investment or tax circumstances, of the Reorganization Transaction and of acquiring, holding, exchanging or otherwise disposing of our shares.

Stockholders Entitled to Vote

The board of directors of CIFC Corp. has fixed the close of business on , 2015 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the special meeting. As of , 2015, there were shares of common stock of CIFC Corp. outstanding and entitled to vote. At the close of business on the record date, CIFC Corp.'s directors and executive officers as a group owned and were entitled to vote shares of common stock of CIFC Corp., representing approximately % of the outstanding voting power of the common stock of CIFC Corp. All of the directors and executive officers of CIFC Corp. that are entitled to vote at the CIFC Corp. special meeting have indicated that they currently intend to vote their shares of common stock of CIFC Corp. in favor of adopting the Merger Agreement. See "Voting and Proxies; Information about the Special Meeting—Who May Vote."

DFR Holdings, which held approximately 74% of the outstanding shares of common stock of CIFC Corp. as of August 7, 2015, has indicated that it currently intends to vote its shares of common stock of CIFC Corp. in favor of adopting the Merger Agreement.

11

Table of Contents

Vote Required

The affirmative vote of a majority of the outstanding shares of common stock of CIFC Corp. entitled to vote on the adoption of the Merger Agreement is required to approve the merger. See "Voting and Proxies; Information about the Special Meeting—Vote Required."

Appraisal Rights in Connection with the Merger

Under the General Corporation Law of the State of Delaware (the "DGCL"), CIFC Corp. stockholders who do not vote in favor of the adoption of the Merger Agreement have the right to seek appraisal in connection with the merger. Failure to strictly comply with the procedures and requirements of Section 262 of the DGCL may result in termination or waiver of such stockholder's appraisal rights. Due to the complexity of Delaware law relating to appraisal rights, if any CIFC Corp. stockholder is considering exercising his, her or its appraisal rights, such stockholder is encouraged to seek the advice of his, her or its own legal counsel. A summary of the procedures and requirements under Delaware law to exercise appraisal rights is included in the section titled "Terms of the Merger—Appraisal Rights in Connection with the Merger" and the text of Section 262 of the DGCL is included as Annex C.

Regulatory Approvals

We are not aware of any federal, state or local regulatory requirements that must be complied with, or approvals that must be obtained, prior to consummation of the merger pursuant to the Merger Agreement, other than compliance with applicable federal and state securities laws, the filing of a certificate of merger as required under the DGCL and various state governmental authorizations. See "Terms of the Merger—Regulatory Approvals."

Comparison of Rights of Stockholders of CIFC Corp. and Shareholders of CIFC LLC

In general, the rights of CIFC LLC's shareholders will be substantially similar to the rights of CIFC Corp.'s stockholders. However, there will be certain differences. See "Comparison of Rights of Stockholders of CIFC Corp. and Shareholders of CIFC LLC."

Historical Market Price of CIFC Corp. Common Stock

CIFC Corp.'s common stock is listed on the NASDAQ Stock Market under the symbol "CIFC." On August 14, 2015, the latest practicable date before the printing of this proxy statement/prospectus, the closing sale price of CIFC Corp.'s common stock on the NASDAQ Stock Market was $7.35 per share.

12

Table of Contents

The following table presents the reported high and low sale prices of CIFC Corp.'s common stock on the NASDAQ Stock Market for the periods presented and as reported by the NASDAQ Stock Market. You should obtain a current stock price quotation for CIFC Corp.'s common stock.

| | | | | | | |

| | Sales Price | |

|---|

| | High | | Low | |

|---|

Period From January 1, 2015 to August 14, 2015 | | | | | | | |

Quarter ended March 31, 2015 | | $ | 9.90 | | $ | 7.28 | |

Quarter ended June 30, 2015 | | $ | 8.35 | | $ | 7.00 | |

Period from July 1, 2015 to August 14, 2015 | | $ | 8.55 | | $ | 7.13 | |

Year Ended December 31, 2014 | | |

| | |

| |

Quarter ended December 31, 2014 | | $ | 10.09 | | $ | 7.66 | |

Quarter ended September 30, 2014 | | $ | 10.16 | | $ | 8.14 | |

Quarter ended June 30, 2014 | | $ | 9.97 | | $ | 7.30 | |

Quarter ended March 31, 2014 | | $ | 8.79 | | $ | 7.43 | |

Year Ended December 31, 2013 | | |

| | |

| |

Quarter ended December 31, 2013 | | $ | 8.30 | | $ | 7.30 | |

Quarter ended September 30, 2013 | | $ | 8.37 | | $ | 6.77 | |

Quarter ended June 30, 2013 | | $ | 8.49 | | $ | 6.60 | |

Quarter ended March 31, 2013 | | $ | 9.05 | | $ | 7.10 | |

It is expected that, upon completion of the merger, the common shares of CIFC LLC will be listed and traded on the NASDAQ Stock Market under the symbol "CIFC." The historical trading prices of CIFC Corp.'s common stock are not necessarily indicative of the future trading prices of common shares of CIFC LLC because, among other things, the current stock price of CIFC Corp. may or may not take into account the changes in CIFC Corp.'s form of organization in connection with the Reorganization Transaction.

As of August 7, 2015, CIFC Corp. had approximately 25,372,404 issued and outstanding shares of common stock.

Historical Dividends on CIFC Corp. Common Stock

The following table shows the dividends relating to CIFC Corp.'s 2015, 2014 and 2013 fiscal years:

| | | | | | |

| Record Date | | Payment Date | | Cash Dividend

Declared per Share | |

|---|

| August 28, 2015 | | September 8, 2015 | | $ | 0.10 | |

| May 25, 2015 | | June 15, 2015 | | $ | 0.10 | |

| April 2, 2015 | | April 15, 2015 | | $ | 0.10 | |

| November 25, 2014 | | December 15, 2014 | | $ | 0.10 | |

| August 25, 2014 | | September 15, 2014 | | $ | 0.10 | |

| May 25, 2014 | | June 15, 2014 | | $ | 0.10 | |

| April 4, 2014 | | April 25, 2014 | | $ | 0.10 | |

| November 25, 2013 | | December 10, 2013 | | $ | 0.10 | |

| August 27, 2013 | | September 17, 2013 | | $ | 0.10 | |

CIFC LLC is a newly formed entity and prior to the Reorganization Transaction has not paid any distributions.

13

Table of Contents

UNAUDITED PRO FORMA FINANCIAL DATA

Under generally accepted accounting principles, we expect that the Reorganization Transaction will be accounted for on an historical cost basis whereby the consolidated assets and liabilities of CIFC LLC will be recorded at the historical cost of CIFC Corp. as reflected on CIFC Corp.'s consolidated financial statements. Accordingly, the consolidated financial statements of CIFC LLC immediately following the Reorganization Transaction will be substantially similar to the consolidated financial statements of CIFC Corp. immediately prior to the Reorganization Transaction. Since the consolidated financial statements of CIFC LLC are substantially similar to those of CIFC Corp., full pro forma and comparative financial information regarding CIFC LLC and its consolidated subsidiaries giving effect to the Reorganization Transaction have not been included herein. Below we have included certain limited unaudited pro forma consolidated condensed balance sheet information that highlights those balance sheet accounts that will be adjusted due to the transactions noted above.

Unaudited Pro Forma Condensed Consolidated Balance Sheet and Statement of Operations

The unaudited pro forma condensed consolidated balance sheet of CIFC Corp. is presented as if the proposed Reorganization Transaction had occurred on June 30, 2015. The presentation of pro forma GAAP net income is presented as if the Reorganization Transaction had occurred on January 1, 2014.

Our pro forma financial information is subject to a number of estimates, assumptions and uncertainties and does not purport to reflect the financial condition that would have existed or occurred had such transactions taken place on the date indicated nor does it purport to reflect the financial condition or results of operations that will exist or occur in the future.

You should read this table together with the information under "Unaudited Pro Forma Financial Data" and "Reorganization Transaction; Organizational Structure" included elsewhere in this proxy statement/prospectus.

14

Table of Contents

Unaudited Pro Forma Condensed Balance Sheet

As of June 30, 2015

($ in thousands)

| | | | | | | | | | |

| | As of June 30, 2015 | |

|---|

| | Historical | | Reorganization

Transaction | | Pro Forma(1) | |

|---|

Assets | | | | | | | | | | |

Deferred tax assets, net | | $ | 48,050 | | $ | (2,792 | )(2) | $ | 45,258 | |

Other assets | | | 178,840 | | | | | | 178,840 | |

Total assets of Consolidated Entities | | | 13,478,988 | | | | | | 13,478,988 | |

| | | | | | | | | | | |

Total assets | | $ | 13,705,878 | | $ | (2,792 | ) | $ | 13,703,086 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Liabilities and Equity | | | | | | | | | | |

Liabilities | | |

| | |

| | |

| |

Deferred tax liability | | $ | — | | $ | | (2) | $ | — | |

Other liabilities | | | 154,901 | | | | | | 154,901 | |

Total liabilities of Consolidated Entities | | | 12,957,510 | | | | | | 12,957,510 | |

| | | | | | | | | | | |

Total liabilities | | | 13,112,411 | | | — | | | 13,112,411 | |

| | | | | | | | | | | |

Equity | | | | | | | | | | |

Stockholders' Equity | | | 180,302 | | | (2,792 | )(2) | | 177,510 | |

Non-controlling interests of Consolidated Funds and Appropriated Earnings (deficit) of Consolidated VIEs | | | 413,165 | | | | | | 413,165 | |

| | | | | | | | | | | |

Total equity | | | 593,467 | | | (2,792 | ) | | 590,675 | |

| | | | | | | | | | | |

Total liabilities and equity | | $ | 13,705,878 | | $ | (2,792 | ) | $ | 13,703,086 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- The pro forma condensed consolidated balance sheet does not include the impact of transaction costs or the realization of gains or losses, for tax purposes, related to the Reorganization Transaction.

- (2)

- Deferred tax balances reflect the transfer of investment income generating assets as part of the contemplated Reorganization Transaction and as described in "Reorganization Transaction; Organizational Structure."

15

Table of Contents

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the Six Months Ended June 30, 2015 and For the Year Ended December 31, 2014

($ in thousands, except per share)

| | | | | | | | | | |

| | Six Months Ended June 30, 2015 | |

|---|

| | Historical | | Reorganization

Transaction | | Pro Forma | |

|---|

Income (loss) before income taxes | | $ | 22,261 | | | (250 | )(1) | $ | 22,011 | |

Income tax (expense) benefit | | | (12,915 | ) | | 3,548 | (2) | | (9,367 | ) |

| | | | | | | | | | | |

Net income (loss) | | | 9,346 | | | 3,298 | | | 12,644 | |

Net (income) loss attributable to noncontrolling interest in Consolidated Entities | | | (2,815 | ) | | | | | (2,815 | ) |

| | | | | | | | | | | |

Net income (loss) attributable to CIFC Corp./CIFC LLC(3) | | $ | 6,531 | | $ | 3,298 | | $ | 9,829 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Earnings (loss) per share— | | | | | | | | | | |

Basic | | $ | 0.26 | | $ | 0.13 | | $ | 0.39 | |

Diluted | | $ | 0.25 | | $ | 0.12 | | $ | 0.37 | |

Weighted-average number of shares outstanding— | | | | | | | | | | |

Basic | | | 25,291 | | | | | | 25,291 | |

Diluted | | | 26,504 | | | | | | 26,504 | |

Outstanding Shares | | |

25,372 | | | | | |

25,372 | |

Book value per share | | $ | 7.11 | | $ | (0.11 | ) | $ | 7.00 | |

|

|

Year Ended December 31, 2014 |

|

|---|

| | Historical | | Reorganization

Transaction | | Pro Forma | |

|---|

Income (loss) before income taxes | | $ | 9,835 | | | (500 | )(1) | $ | 9,335 | |

Income tax (expense) benefit | | | (22,158 | ) | | 6,986 | (2) | | (15,172 | ) |

| | | | | | | | | | | |

Net income (loss) | | | (12,323 | ) | | 6,486 | | | (5,837 | ) |

Net (income) loss attributable to noncontrolling interest in Consolidated Entities | | | 20,704 | | | | | | 20,704 | |

| | | | | | | | | | | |

Net income (loss) attributable to CIFC Corp./CIFC LLC(3) | | $ | 8,381 | | $ | 6,486 | | $ | 14,867 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Earnings (loss) per share— | | | | | | | | | | |

Basic | | $ | 0.37 | | $ | 0.28 | | $ | 0.65 | |

Diluted | | $ | 0.35 | | $ | 0.27 | | $ | 0.62 | |

Weighted-average number of shares outstanding— | | | | | | | | | | |

Basic | | | 22,909 | | | | | | 22,909 | |

Diluted | | | 24,168 | | | | | | 24,168 | |

- (1)

- Represents additional cost of administration and compliance.

- (2)

- Estimated tax benefit to reflect the Reorganization Transaction, with the Company's top-level form of organization converted from a corporation to a limited liability company as of January 1, 2014.

- (3)

- CIFC LLC would be formed for the purpose of effecting the Reorganization Transaction.

16

Table of Contents

Non-GAAP Financial Measures

CIFC Corp. discloses financial measures that are calculated and presented on a basis of methodology other than in accordance with generally accepted accounting principles of the United States of America ("Non-GAAP") as follows:

ENI is a non-GAAP financial measure of profitability which management uses in addition to GAAP net income attributable to CIFC Corp. to measure the performance of our core business (excluding non-core products). We believe ENI reflects the nature and substance of the business, the economic results driven by management fee revenues from the management of client funds and earnings on our investments. ENI represents net income (loss) attributable to CIFC Corp. excluding (i) income taxes, (ii) merger and acquisition related items including fee-sharing arrangements, amortization and impairments of intangible assets and gain (loss) on contingent consideration for earn-outs, (iii) non-cash compensation related to profits interests granted by CIFC Parent in June 2011, (iv) revenues attributable to non-core investment products, (v) advances for fund organization expenses and (vi) certain other items as detailed.

ENI EBITDA is also a non-GAAP financial measure that management considers, in addition to net income (loss) attributable to CIFC Corp., to evaluate the CIFC Corp.'s core performance. ENI EBITDA represents ENI before corporate interest expense and depreciation of fixed assets, a non-cash item.

ENI and ENI EBITDA may not be comparable to similar measures presented by other companies, as they are non-GAAP financial measures that are not based on a comprehensive set of accounting rules or principles and therefore may be defined differently by other companies. In addition, ENI and ENI EBITDA should be considered as an addition to, not as a substitute for, or superior to, financial measures determined in accordance with GAAP.

The unaudited pro forma reconciliation of GAAP net income (loss) attributable to CIFC Corp. to ENI and ENI EBITDA are presented as if the Reorganization Transaction had occurred on January 1, 2014. Our pro forma financial information is subject to a number of estimates, assumptions and uncertainties and does not purport to reflect the financial condition that would have existed or occurred had such transactions taken place on the date indicated nor does it purport to reflect the

17

Table of Contents

financial condition or results of operations that will exist or occur in the future. Reconciliation is as follows ($ in thousands):

| | | | | | | | | | |

| | Six Months Ended June 30, 2015 | |

|---|

| | Historical | | Reorganization

Transaction | | Pro Forma | |

|---|

GAAP Net income (loss) attributable to CIFC Corp. | | $ | 6,531 | | $ | 3,298 | | $ | 9,829 | |

Income tax expense (benefit) | | | 12,915 | | | (3,548 | ) | | 9,367 | |

Amortization and impairment of intangibles | | | 4,550 | | | | | | 4,550 | |

Management fee sharing arrangement(1) | | | (3,466 | ) | | | | | (3,466 | ) |

Net (gain)/loss on contingent liabilities and other | | | 1,290 | | | | | | 1,290 | |

Employee compensation costs(2) | | | 603 | | | | | | 603 | |

Management fees attributable to non-core funds | | | (340 | ) | | | | | (340 | ) |

Advance for fund organization expenses(3) | | | (1,062 | ) | | | | | (1,062 | ) |

Other(4) | | | 1,580 | | | | | | 1,580 | |

| | | | | | | | | | | |

Total reconciling and non-recurring items | | | 16,070 | | | (3,548 | ) | | 12,522 | |

| | | | | | | | | | | |

ENI | | $ | 22,601 | | $ | (250 | ) | $ | 22,351 | |

Add: Corporate interest expense | | | 1,294 | | | | | | 1,294 | |

Add: Depreciation of fixed assets | | | 682 | | | | | | 682 | |

| | | | | | | | | | | |

ENI EBITDA | | $ | 24,577 | | $ | (250 | ) | $ | 24,327 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | |

| | Year Ended December 31, 2014 | |

|---|

| | Historical | | Reorganization

Transaction | | Pro Forma | |

|---|

GAAP Net income (loss) attributable to CIFC Corp. | | $ | 8,381 | | $ | 6,486 | | $ | 14,867 | |

Income tax expense (benefit) | | | 22,158 | | | (6,986 | ) | | 15,172 | |

Amortization and impairment of intangibles | | | 10,149 | | | | | | 10,149 | |

Management fee sharing arrangement(1) | | | (8,716 | ) | | | | | (8,716 | ) |

Net (gain)/loss on contingent liabilities and other | | | 2,932 | | | | | | 2,932 | |

Employee compensation costs(2) | | | 1,610 | | | | | | 1,610 | |

Management fees attributable to non-core funds | | | (814 | ) | | | | | (814 | ) |

Advance for fund organization expenses(3) | | | — | | | | | | — | |

Other(4) | | | 395 | | | | | | 395 | |

| | | | | | | | | | | |

Total reconciling and non-recurring items | | | 27,714 | | | (6,986 | ) | | 20,728 | |

| | | | | | | | | | | |

ENI | | $ | 36,095 | | $ | (500 | ) | $ | 35,595 | |

Add: Corporate interest expense | | | 4,236 | | | | | | 4,236 | |

Add: Depreciation of fixed assets | | | 1,272 | | | | | | 1,272 | |

| | | | | | | | | | | |

ENI EBITDA | | $ | 41,603 | | $ | (500 | ) | $ | 41,103 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- CIFC Corp. shares management fees on certain of the acquired CLOs it manages (shared with the party that sold the funds to CIFC Corp., or an affiliate thereof). Management fees are presented on a gross basis for GAAP and on a net basis for Non-GAAP ENI.

- (2)

- Employee compensation and benefits has been adjusted for non-cash compensation related to profits interests granted to CIFC Corp. employees by CIFC Parent Holdings LLC and sharing of incentive fees with certain former employees established in connection with the Company's acquisition of certain CLOs from Columbus Nova Credit Investments Management, LLC.

18

Table of Contents

- (3)

- From time to time, CIFC Corp. may temporarily incur expenses related to organizational costs on a potential fund. These costs are expensed immediately under GAAP. Generally, once a fund has been successfully launched, the Company will reverse the costs as they are absorbed by the fund.

- (4)

- For the six months ended June 30, 2015, Other includes litigation expenses and certain professional fees. For the year ended December 31, 2014, Other includes litigation expenses of $0.6 million, which was partially offset by additional gains from contingent payments collected on the 2012 sale of the Company's rights to manage Gillespie CLO PLC of $0.2 million.

19

Table of Contents

RISK FACTORS