Exhibit 99.1

|

| |

| CIFC LLC | Investor Relations |

| 250 Park Avenue | Investor@cifc.com |

| New York, NY 10177 | (646) 367-6633 |

NASDAQ: CIFC

| |

CIFC LLC Announces Third Quarter 2016 Results

NEW YORK, November 3, 2016 - CIFC LLC (NASDAQ: CIFC) (“CIFC” or the “Company”) today announced its results for the third quarter ended September 30, 2016.

Highlights

| |

| • | On August 19, 2016, CIFC entered into a definitive Agreement and Plan of Merger (the "Merger Agreement") with F.A.B. Holdings I LP, a limited partnership organized and existing under the laws of Delaware ("Parent") and CIFC Acquisition, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Parent ("Merger Sub") (referred to as the "Strategic Transaction"). If the transactions contemplated by the Merger Agreement are completed, CIFC shareholders will be entitled to receive $11.36 in cash, without interest and subject to any withholding of taxes required by applicable law, for each common share, par value $0.001 (unless the shareholder has properly exercised their appraisal rights with respect to such shares). Under the Merger Agreement, Merger Sub will merge with and into CIFC with CIFC surviving as a direct wholly owned subsidiary of Parent. |

| |

| • | GAAP net income (loss) for the nine months was $39.8 million as compared to $8.0 million for the same period in the prior year. GAAP net income (loss) for the quarter was $17.7 million as compared to $1.5 million for the same period in the prior year. |

| |

| • | Economic Net Income "ENI," a non-GAAP measure, for the nine months was $47.5 million as compared to $27.1 million for the same period in the prior year. ENI for the quarter was $19.8 million as compared to $4.5 million for the same period in the prior year. |

| |

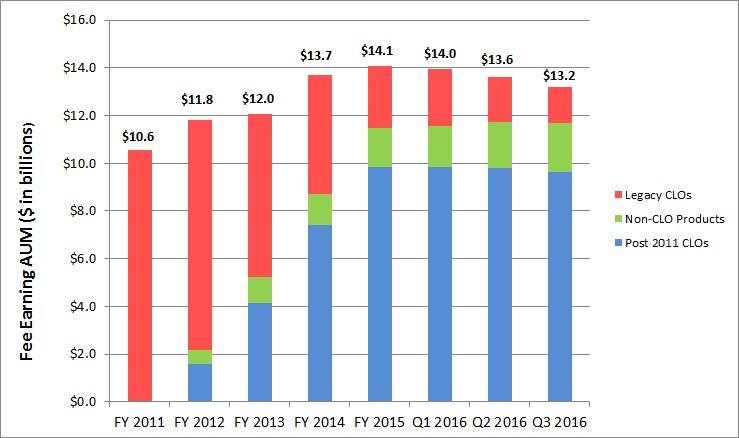

| • | Fee Earning Assets Under Management ("AUM") was $13.2 billion as of September 30, 2016, as compared to $14.1 billion as of December 31, 2015. |

| |

| • | On August 19, 2016, CIFC's board of directors declared a cash distribution of $0.10 per share which was paid on September 12, 2016 to shareholders of record as of the close of business on August 31, 2016. |

Executive Overview

Strong performance in credit assets continued in the third quarter driven by an increased appetite for risk from investors. The U.S. leveraged loan market posted a 3.08% return over the quarter for a 7.72% return year-to-date (source: S&P/LSTA Leveraged Loan Index). Net investment income was $22.1 million and $42.3 million for the third quarter and year to date, respectively. Our Credit Funds continued to see inflows, pushing Credit Fund AUM to $1.5 billion. Fee income related to Credit Funds increased by 53% to $4.4 million for the year. As expected, the new issue Collateralized Loan Obligation ("CLO") market improved during the third quarter with $19.9 billion of new issuance. We are managing two warehouses and expect to issue two CLOs in the near future. We continue to be well capitalized to issue risk retention compliant CLOs in the future.

Selected Financial Metrics

(In thousands, except per share data)

|

| | | | | | | | | | | | | | |

| SELECTED GAAP RESULTS | 3Q'16 | 3Q'15 | % Change vs. 3Q'15 | YTD'16 | YTD'15 | % Change vs. YTD'15 |

| Total net revenues (1) | $ | 40,707 |

| $ | 24,512 |

| 66% | $ | 127,693 |

| $ | 77,349 |

| 65% |

| Total expenses (1) | $ | 35,098 |

| $ | 27,348 |

| 28% | $ | 94,901 |

| $ | 64,481 |

| 47% |

| Income tax expense (benefit) - Current | $ | (1,448 | ) | $ | 655 |

| (321)% | $ | (142 | ) | $ | 6,145 |

| (102)% |

| Income tax expense (benefit) - Deferred | $ | 181 |

| $ | (129 | ) | (240)% | $ | 3,021 |

| $ | 7,296 |

| (59)% |

| Net income (loss) attributable to CIFC LLC | $ | 17,671 |

| $ | 1,469 |

| 1,103% | $ | 39,760 |

| $ | 8,000 |

| 397% |

| Earnings (loss) per share - basic | $ | 0.75 |

| $ | 0.06 |

| 1,150% | $ | 1.63 |

| $ | 0.32 |

| 409% |

| Earnings (loss) per share - diluted | $ | 0.67 |

| $ | 0.06 |

| 1,017% | $ | 1.52 |

| $ | 0.30 |

| 407% |

| Distributions declared per share | $ | 0.10 |

| $ | 0.10 |

| —% | $ | 0.69 |

| $ | 0.30 |

| 130% |

| Weighted average shares outstanding - basic | 23,620 |

| 25,368 |

| (7)% | 24,354 |

| 25,317 |

| (4)% |

| Weighted average shares outstanding - diluted | 26,201 |

| 26,465 |

| (1)% | 26,088 |

| 26,494 |

| (2)% |

|

| | | | | | | | | | | | | | |

| NON-GAAP FINANCIAL MEASURES (2) | 3Q'16 | 3Q'15 | % Change vs. 3Q'15 | YTD'16 | YTD'15 | % Change vs. YTD'15 |

| Management Fees from CLOs | 13,033 |

| 14,407 |

| (10)% | 40,711 |

| 43,347 |

| (6)% |

| Management Fees from Non-CLO products | 1,770 |

| 1,069 |

| 66% | 4,440 |

| 2,907 |

| 53% |

| Total Management Fees | 14,803 |

| 15,476 |

| (4)% | 45,151 |

| 46,254 |

| (2)% |

| Incentive Fees | 1,964 |

| 3,101 |

| (37)% | 14,108 |

| 11,167 |

| 26% |

| Net Investment Income | 22,074 |

| 58 |

| 37,959% | 42,258 |

| 11,908 |

| 255% |

| Total ENI Revenues | 38,841 |

| 18,635 |

| 108% | 101,517 |

| 69,329 |

| 46% |

| Employee compensation and benefits | 10,472 |

| 7,309 |

| 43% | 27,965 |

| 22,780 |

| 23% |

| Share-based compensation (3) | 1,498 |

| 1,146 |

| 31% | 5,642 |

| 3,775 |

| 49% |

| Other operating expenses | 5,049 |

| 4,743 |

| 6% | 14,487 |

| 13,441 |

| 8% |

| Corporate interest expense | 2,004 |

| 962 |

| 108% | 5,960 |

| 2,256 |

| 164% |

| Total ENI Expenses | 19,023 |

| 14,160 |

| 34% | 54,054 |

| 42,252 |

| 28% |

| ENI (2) | $ | 19,818 |

| $ | 4,475 |

| 343% | $ | 47,463 |

| $ | 27,077 |

| 75% |

| ENI per share - basic (4) | $ | 0.84 |

| $ | 0.18 |

| 367% | $ | 1.95 |

| $ | 1.07 |

| 82% |

| ENI per share - diluted (4) | $ | 0.76 |

| $ | 0.17 |

| 347% | $ | 1.82 |

| $ | 1.02 |

| 78% |

|

| | | | | | | | | | | | | | |

| NON-GAAP FINANCIAL MEASURES (2) | 3Q'16 | 3Q'15 | % Change vs. 3Q'15 | YTD'16 | YTD'15 | % Change vs. YTD'15 |

| ENI EBITDA (5) | $ | 22,199 |

| $ | 5,784 |

| 284% | $ | 54,534 |

| $ | 30,362 |

| 80% |

| ENI EBITDA Margin (6) | 57 | % | 31 | % | 26% | 54 | % | 44 | % | 10% |

| ENI Margin (6) | 51 | % | 24 | % | 27% | 47 | % | 39 | % | 8% |

|

| | | | | |

| NON-GAAP FINANCIAL MEASURE - AUM | 9/30/2016 | 12/31/2015 | % Change vs. 12/31/15 | 9/30/2015 | % Change vs. 9/30/15 |

| Fee Earning AUM from loan-based products (7) | $13,207,464 | $14,055,487 | (6)% | $14,216,216 | (7)% |

Explanatory Notes:

| |

| (1) | Prior year amounts have been re-presented to conform to current period presentation. |

| |

| (2) | See Appendix for a detailed description of these non-GAAP measures and reconciliations from GAAP net income (loss) attributable to the Company to non-GAAP measures. |

| |

| (3) | Share-based compensation includes equity award amortization expense for both employees and directors of the Company. |

| |

| (4) | GAAP weighted average shares outstanding is used to calculate ENI per share - basic and diluted. |

| |

| (5) | ENI EBITDA is ENI before corporate interest expense and depreciation of fixed assets. See Appendix. |

| |

| (6) | ENI EBITDA Margin is ENI EBITDA divided by Total ENI Revenue. ENI Margin is ENI divided by Total ENI Revenue. |

| |

| (7) | Amount excludes Fee Earning AUM attributable to non-core products of $500.1 million, $592.8 million and $621.9 million as of September 30, 2016, December 31, 2015 and September 30, 2015, respectively. Fee Earning AUM attributable to non-core products is expected to continue to decline as these funds run-off per their contractual terms. |

Third Quarter Overview

CIFC reported GAAP net income attributable to the Company of $17.7 million for the third quarter of 2016, as compared to net income of $1.5 million in the same period of the prior year. GAAP operating results increased quarter over quarter by $16.2 million, primarily due to higher revenues from realized and unrealized gains of $14.9 million as the Company held more investments period over period and the market value of loans and CLO securities was higher period over period. In addition, (i) income tax expenses decreased by $1.8 million primarily related to a tax benefit as a result of the Company being taxed as a partnership in 2016 and (ii) amortization and impairment of intangible assets decreased by $1.3 million as a result of write-offs in previous years. Offsetting these increases were (i) higher accrued employee compensation expenses as a result of better performance year over year, (ii) lower management fees due to lower CLO AUM as we did not issue any new CLOs for the first nine months of 2016 due to market conditions and the Strategic Transaction to offset the run-off in certain Legacy CLOs, (iii) lower incentive fees period over period due to timing of legacy CLOs being called and (iv) higher corporate interest expense predominately related to the issuance of $40.0 million unsecured senior notes in November 2015.

CIFC reported ENI of $19.8 million for the third quarter of 2016, as compared to $4.5 million for the same period in the prior year. ENI increased quarter over quarter by $15.3 million, or 343%, primarily due to $16.2 million GAAP increase noted above. In addition, ENI excludes the quarter over quarter (i) decrease of $1.8 million in income tax expense as a result of the Company being taxed as a partnership in 2016 and (ii) decrease of $1.3 million in amortization and impairment of intangible assets from write-offs in previous years. These decreases were slightly offset by the quarter over quarter increase of $2.1 million in professional fees related to the Strategic Transaction announced in January 2016. See the Non-GAAP Financial Measures section of the Appendix for a reconciliation between GAAP and Non-GAAP ENI.

Fee Earning AUM

The following table summarizes Fee Earning AUM for the Company's loan-based products:

|

| | | | | | | | | | | | | | | | | | | | | |

| | | September 30, 2016 | | December 31, 2015 | | September 30, 2015 |

| (in thousands, except # of Accounts) (1)(2) | | # of Accounts | | Fee Earning AUM | | # of Accounts | | Fee Earning AUM | | # of Accounts | | Fee Earning AUM |

| Post 2011 CLOs | | 18 |

| | $ | 9,612,489 |

| | 18 |

| | $ | 9,860,519 |

| | 17 |

| | $ | 9,388,022 |

|

| Legacy CLOs (3) | | 9 |

| | 1,528,631 |

| | 10 |

| | 2,559,066 |

| | 14 |

| | 3,253,869 |

|

| Total CLOs | | 27 |

| | 11,141,120 |

| | 28 |

| | 12,419,585 |

| | 31 |

| | 12,641,891 |

|

| Credit Funds (4) | | 16 |

| | 1,537,501 |

| | 12 |

| | 1,062,712 |

| | 10 |

| | 941,035 |

|

| Other Loan-Based Products (4) | | 2 |

| | 528,843 |

| | 2 |

| | 573,190 |

| | 2 |

| | 633,290 |

|

| Total Non-CLOs (4) | | 18 |

| | $ | 2,066,344 |

| | 14 |

| | $ | 1,635,902 |

| | 12 |

| | $ | 1,574,325 |

|

| AUM from loan-based products | | 45 |

| | $ | 13,207,464 |

| | 42 |

| | $ | 14,055,487 |

| | 43 |

| | $ | 14,216,216 |

|

Explanatory Notes:

| |

| (1) | Table excludes Fee Earning AUM attributable to non-core products of $500.1 million, $592.8 million and $621.9 million as of September 30, 2016, December 31, 2015 and September 30, 2015, respectively. Fee Earning AUM attributable to non-core products is expected to continue to decline as these funds run-off per their contractual terms. |

| |

| (2) | Fee Earning AUM is based on the latest available monthly report issued by the trustee or fund administrator prior to the end of the period, and may not tie back to the Consolidated GAAP financial statements. |

| |

| (3) | Legacy CLOs represent all managed CLOs issued prior to 2011, including CLOs acquired since 2011 but issued prior to 2011. |

| |

| (4) | Management fees for Non-CLO products vary by fund and may not be similar to a CLO. |

Since 2012, CIFC has raised $11.6 billion of new AUM through organic growth (i.e. excluding mergers and acquisition related transactions) which has more than offset the run-off from Legacy CLOs (including acquired CLOs). Our Legacy CLO AUM of $1.5 billion is approximately a tenth of our total loan-based AUM of $13.2 billion, and we anticipate it will run off over the next two years.

Total loan-based Fee Earning AUM activity for the periods below are as follows ($ in thousands):

|

| | | | | | | | | | | | |

| | | 3Q'16 | | YTD'16 | | LTM 3Q'16 |

| Opening AUM Balance | | $ | 13,617,299 |

| | $ | 14,055,487 |

| | $ | 14,216,216 |

|

| CLO New Issuances | | — |

| | — |

| | 498,360 |

|

| CLO Paydowns | | (570,796 | ) | | (1,280,765 | ) | | (2,006,984 | ) |

| Net Subscriptions to Credit Funds | | 94,382 |

| | 361,691 |

| | 488,505 |

|

| Net Redemptions from Other Loan-Based Products | | (13,397 | ) | | (44,346 | ) | | (104,446 | ) |

| Other (1) | | 79,976 |

| | 115,397 |

| | 115,813 |

|

| Ending AUM Balance | | $ | 13,207,464 |

| | $ | 13,207,464 |

| | $ | 13,207,464 |

|

Explanatory Note:

| |

| (1) | Includes changes in collateral balances of CLOs between periods and market value or portfolio value changes in certain Non-CLO products. |

Balance Sheet Highlights

|

| | | | | | | | | | | | | | | | |

| ($ in thousands) | | As of September 30, 2016

| | As of December 31, 2015

|

| Cash and Cash Equivalents | | | | $ | 38,843 |

| | | | $ | 57,968 |

|

| | | | | | | | | |

| Investments (1) | | | | | | | | |

| CIFC CLO Equity | | $ | 73,473 |

| | | | $ | 53,912 |

| | |

| Warehouses | | 68,635 |

| | | | — |

| | |

| Fund Coinvestments | | 34,837 |

| | | | 41,401 |

| | |

| CLO Debt | | 6,232 |

| | | | 32,140 |

| | |

| Other (2) | | 28,297 |

| | | | 24,946 |

| | |

| Total Investments | | | | $ | 211,474 |

| | | | $ | 152,399 |

|

| Total Cash and Investments | | | | 250,317 |

| | | | 210,367 |

|

| | | | | | | | | |

| Long Term Debt (Par) | | | | | | | | |

| Junior Subordinated Notes due 2035 | | $ | 120,000 |

| | | | $ | 120,000 |

| | |

| Senior Notes due 2025 | | 40,000 |

| | | | 40,000 |

| | |

| Total Long Term Debt (Par) | | | | 160,000 |

| | | | 160,000 |

|

| Net Cash and Investments | | | | $ | 90,317 |

| | | | $ | 50,367 |

|

Explanatory Notes:

| |

| (1) | Pursuant to GAAP, investments in consolidated CLOs, warehouses and certain Non-CLO products are eliminated from "Investments" on our Consolidated Balance Sheets. |

| |

| (2) | Primarily includes investment in a consolidated Fund, which may be redeemed with 60 days' notice on the last day of each calendar quarter. |

Appendix

Non-GAAP Financial Measures

The Company discloses financial measures that are calculated and presented on a basis of methodology other than in accordance with generally accepted accounting principles of the United States of America (“Non-GAAP”) as follows:

ENI and ENI EBITDA are non-GAAP financial measures of performance that management uses in addition to GAAP Net income (loss) attributable to CIFC to measure the performance of our core business (excluding non-core products). We believe ENI and ENI EBITDA are helpful to investors as they reflect the nature and substance of the business, the economic results achieved by management fee revenues from the management of client funds and earnings on our investments.

ENI represents GAAP Net income (loss) attributable to CIFC , prior to the consolidation of Funds (or the "Management Company") as required under Accounting Standard Codification ASC Topic 810, Consolidation, excluding (i) current and deferred income taxes, (ii) merger and acquisition related items, including fee-sharing arrangements, amortization and impairments of intangible assets and gain (loss) on contingent consideration for earn-outs, (iii) non-cash compensation related to profits interests granted by CIFC Parent Holdings LLC in June 2011, (iv) revenues attributable to non-core investment products, (v) advances for fund organizational expenses and (vi) certain other items as detailed.

In addition to the pre-consolidation impact, the following adjustments were made to arrive at ENI Revenues and ENI Expenses (Refer to Summary of Reconciliation of GAAP to Net Income (loss) attributable to CIFC to Non-GAAP Measures for more details):

| |

| • | ENI Revenues represent GAAP revenues excluding management fee sharing arrangements and fees attributable to non-core investment products. Further GAAP net (gain)/loss on contingent liabilities and other have been reclassed to ENI Revenues. |

| |

| • | ENI Expenses represent GAAP expenses excluding amortization and impairment of intangibles, employee compensation costs from non-cash compensation related to profits interests granted by CIFC Parent Holdings LLC in June 2011, other (such as advances for fund organizational expenses and certain other items as detailed), and current and deferred income taxes. |

Further ENI EBITDA represents ENI before corporate interest expense and depreciation of fixed assets, a non-cash item.

ENI and ENI EBITDA may not be comparable to similar measures presented by other companies, as they are non-GAAP financial measures that are not based on a comprehensive set of accounting rules or principles and therefore may be defined differently by other companies. In addition, ENI and ENI EBITDA should be considered as an addition to, not as a substitute for, or superior to, financial measures determined in accordance with GAAP.

A detailed calculation of ENI and ENI EBITDA and a reconciliation to the most comparable GAAP financial measure is included in the Appendix.

Fee Earning AUM refers to the assets managed by the Company on which we receive management fees and/or incentive based fees. Generally, with respect to CLOs, management fees are paid to the Company based on the aggregate collateral balance at par plus principal cash, and with respect to Non-CLO funds, the value of the assets in such funds. We believe this measure is useful to investors as it is an additional performance measure providing insight into the overall investment activities of the Company's managed Funds (or core business).

[Financial Tables to Follow in Appendix]

About CIFC

Founded in 2005, CIFC is a private debt manager specializing in secured U.S. corporate loan strategies. Headquartered in New York, CIFC is a SEC registered investment adviser and a publicly traded company (NASDAQ: CIFC). Serving institutional investors globally, CIFC is one of the largest managers of senior secured corporate credit. For more information, please visit CIFC’s website at www.cifc.com.

Forward-Looking Statements

This release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 which reflect CIFC's current views with respect to, among other things, CIFC's operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. CIFC believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as such factors may be updated from time to time in its periodic filings with the Securities and Exchange Commission, which are accessible on the SEC's website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in the filings. CIFC undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

Summary Reconciliation of GAAP Net income (loss) attributable to CIFC LLC to Non-GAAP Measures

|

| | | | | | | | | | | | | | | | |

| (In thousands) | | 3Q'16 | | 3Q'15 | | YTD'16 | | YTD'15 |

| GAAP Net income (loss) attributable to CIFC LLC | | $ | 17,671 |

| | $ | 1,469 |

| | $ | 39,760 |

| | $ | 8,000 |

|

| Income tax expense (benefit) - current and deferred (1) | | (1,267 | ) | | 526 |

| | 2,879 |

| | 13,441 |

|

| Amortization and impairment of intangibles | | 540 |

| | 1,884 |

| | 2,715 |

| | 6,433 |

|

| Management fee sharing arrangements (2) | | (223 | ) | | (898 | ) | | (2,537 | ) | | (4,364 | ) |

| Net (gain)/loss on contingent liabilities and other | | 237 |

| | 502 |

| | 452 |

| | 1,792 |

|

| Employee compensation costs (3) | | 6 |

| | 224 |

| | 1,472 |

| | 827 |

|

| Management fees attributable to non-core funds | | (127 | ) | | (163 | ) | | (372 | ) | | (503 | ) |

| Other (4) | | 2,981 |

| | 931 |

| | 3,094 |

| | 1,451 |

|

| Total reconciling and other items | | 2,147 |

| | 3,006 |

| | 7,703 |

| | 19,077 |

|

| ENI | | $ | 19,818 |

| | $ | 4,475 |

| | $ | 47,463 |

| | $ | 27,077 |

|

| Add: Corporate interest expense | | 2,004 |

| | 962 |

| | 5,960 |

| | 2,256 |

|

| Add: Depreciation of fixed assets | | 377 |

| | 347 |

| | 1,111 |

| | 1,029 |

|

| ENI EBITDA | | $ | 22,199 |

| | $ | 5,784 |

| | $ | 54,534 |

| | $ | 30,362 |

|

Explanatory Notes:

| |

| (1) | Includes current taxes of $(1.4) million and $(0.1) million for the three and nine months ended September 30, 2016 respectively, and $0.7 million and $6.1 million for the three and nine months ended September 30, 2015, respectively, and deferred taxes of $0.2 million and $3.0 million for the three and nine months ended September 30, 2016, respectively, and $(0.1) million and $7.3 million for the three and nine months ended September 30, 2015, respectively. |

| |

| (2) | The Company shares management fees on certain of the acquired CLOs it manages with the party that sold the funds to CIFC, or an affiliate thereof. Management fees are presented on a gross basis for GAAP and on a net basis for ENI. |

| |

| (3) | Employee compensation and benefits has been adjusted for sharing of incentive fees with certain former employees in connection with the Company's acquisition of certain CLOs from CNCIM and non-cash compensation related to profits interests granted to CIFC employees by CIFC Parent Holdings LLC. |

| |

| (4) | In 2016, Other primarily represents professional services and general and administrative fees incurred in relation to the Strategic Transaction. In 2015, Other primarily represents professional services in relation to the Reorganization Transaction and litigation expenses. |

Condensed Consolidated Statement of Operations

The Consolidated Condensed Financial Statements include the financial statements of CIFC LLC & Subsidiaries, or the Company’s core asset management business ("Management Company") and certain managed Funds ("Consolidated Entities"). The supplemental financial information provided below illustrates the consolidating effects of the Management Company, and the Consolidated Entities which we are required to consolidate under ASC 810. Further, management internally views and manages the business as one reportable segment. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3Q'16 | | 3Q'15 |

| (In thousands) | | Management Company | | Consolidated Entities | | Eliminations | | CIFC LLC Consolidated | | Management Company | | Consolidated Entities | | Eliminations | | CIFC LLC Consolidated |

| Total net revenues | | $ | 21,693 |

| | $ | 24,799 |

| | $ | (5,785 | ) | | $ | 40,707 |

| | $ | 22,853 |

| | $ | 4,143 |

| | $ | (2,484 | ) | | $ | 24,512 |

|

| Total expenses | | (22,560 | ) | | (15,046 | ) | | 2,508 |

| | (35,098 | ) | | (17,196 | ) | | (10,553 | ) | | 401 |

| | (27,348 | ) |

| Net other income (expense) and gain (loss) | | 17,271 |

| | (7,738 | ) | — |

| 1,617 |

| — |

| 11,150 |

| | (3,662 | ) | | 6,158 |

| | 2,151 |

| | 4,647 |

|

| Income (loss) before income taxes | | 16,404 |

| | 2,015 |

| — |

| (1,660 | ) | — |

| 16,759 |

| | 1,995 |

| | (252 | ) | — |

| 68 |

| — |

| 1,811 |

|

| Income tax (expense) benefit | | 1,267 |

| | — |

| | — |

| | 1,267 |

| | (526 | ) | | — |

| | — |

| | (526 | ) |

| Net income (loss) | | 17,671 |

| | 2,015 |

| | (1,660 | ) | | 18,026 |

| | 1,469 |

| | (252 | ) | — |

| 68 |

| — |

| 1,285 |

|

| Net (income) loss attributable to noncontrolling interest in Consolidated Entities | | — |

| | (2,015 | ) | | 1,660 |

| | (355 | ) | | — |

| | 252 |

| | (68 | ) | | 184 |

|

| Net income (loss) attributable to CIFC LLC | | $ | 17,671 |

| | $ | — |

| — |

| $ | — |

| — |

| $ | 17,671 |

| | $ | 1,469 |

| | $ | — |

| — |

| $ | — |

| — |

| $ | 1,469 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | YTD'16 | | YTD'15 |

| (In thousands) | | Management Company | | Consolidated Entities | | Eliminations | | CIFC LLC Consolidated | | Management Company | | Consolidated Entities | | Eliminations | | CIFC LLC Consolidated |

| Total net revenues | | $ | 73,519 |

| | $ | 68,598 |

| | $ | (14,424 | ) | | $ | 127,693 |

| | $ | 70,342 |

| | $ | 9,934 |

| | $ | (2,927 | ) | | $ | 77,349 |

|

| Total expenses | | (61,344 | ) | | (40,222 | ) | | 6,665 |

| | (94,901 | ) | | (50,959 | ) | | (14,361 | ) | | 839 |

| | (64,481 | ) |

| Net other income (expense) and gain (loss) | | 30,464 |

| | (24,234 | ) | — |

| 4,296 |

| — |

| 10,526 |

| | 2,058 |

| | 7,088 |

| | 60 |

| | 9,206 |

|

| Income (loss) before income taxes | | 42,639 |

| | 4,142 |

| — |

| (3,463 | ) | — |

| 43,318 |

| | 21,441 |

| | 2,661 |

| — |

| (2,028 | ) | — |

| 22,074 |

|

| Income tax (expense) benefit | | (2,879 | ) | | — |

| | — |

| | (2,879 | ) | | (13,441 | ) | | — |

| | — |

| | (13,441 | ) |

| Net income (loss) | | 39,760 |

| | 4,142 |

| | (3,463 | ) | | 40,439 |

| | 8,000 |

| | 2,661 |

| — |

| (2,028 | ) | — |

| 8,633 |

|

| Net (income) loss attributable to noncontrolling interest in Consolidated Entities | | — |

| | (4,142 | ) | | 3,463 |

| | (679 | ) | | — |

| | (1,289 | ) | | 656 |

| | (633 | ) |

| Net income (loss) attributable to CIFC LLC | | $ | 39,760 |

| | $ | — |

| — |

| $ | — |

| — |

| $ | 39,760 |

| | $ | 8,000 |

| | $ | 1,372 |

| | $ | (1,372 | ) | — |

| $ | 8,000 |

|