BayFirst Financial Corp. Officers Meeting Q1 2022 ANNUAL MEETING OF SHAREHOLDERS BAYFIRST FINANCIAL CORP. Thursday, May 18, 2023

BARK HERE. BANK HERE.

AGENDA • WELCOME & INTRODUCTIONS • CEO’S REPORT • SHAREHOLDER Q&A Dianne Carney, VP, Director, Learning & Development & Valerie Fulbright, SVP, Community Engagement Officer • MEETING REPORT Robin L. Oliver, Chief Operating Officer and Chief Financial Officer Anthony N. Leo, Chief Executive Officer • CHAIRMAN’S REMARKS Anthony Saravanos, Chairman of the Board • BAYFIRST BILLION Valerie Fulbright, SVP, Community Engagement Officer • COMMUNITY IMPACT Thomas G. Zernick, President & Dianne Carney, VP, Director, Learning & Development

CAUTIONARY STATEMENT This presentation contains certain forward-looking statements and projections of financial performance. Such projections are, by nature, based on anticipating future events that cannot be predicted with accuracy and there is no assurance that the projections can or will be achieved. Actual results will be dependent upon a number of factors that are beyond the control of the Company. Accordingly, the projections should not be viewed as an estimate, prediction, or representation as to future results. Actual results may differ substantially. The information contained in this document is for information purposes only and based solely on information and data supplied by the Company and other third party sources. The information contained herein is not a complete analysis of every material fact respecting the Company or its subsidiary bank. While the information contained in this document is based on sources believed to be reliable, the Company has not independently verified the facts, assumptions, and estimates contained in this document. Accordingly, no representation or warranty, expressed or implied, is made to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information and opinions contained in this document. The opinions and estimates expressed herein reflect only the current judgment of the Company whose opinions and estimates are subject to change without notice. Information contained in this presentation is not an offer to sell securities or the solicitation of an offer to buy securities. Any such offer, solicitation, or sale would be unlawful prior to registration or qualification under applicable securities laws. When used in this presentation, the words “may,” “will,” “should,” “would,” “anticipate,” “expect,” “plan,” “believe,” “intend” and similar expressions identify forward looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward looking statements. These risks, uncertainties and other factors include, among other things, risks relating to changes in interest rates; risks of default on and concentration of loans within the Company’s portfolio; the possible insufficiency of the Company’s allowance for loan losses, regional economic conditions; competition; governmental regulation and supervision; failure or circumvention of our internal controls; disruption of business or dilution of shareholder value as a result of mergers or acquisitions; the Company’s ability to retain key personnel; failure or disruption of the Company’s information systems; and technological change. The Company does not undertake any obligation to revise or update these risks, uncertainties and other factors.

5 WELCOME & INTRODUCTIONS DIRECTORS Anthony Saravanos BOARD CHAIR Mark Berset CHAIR, NOMINATING & EXECUTIVE COMMITTEES Derek Berset Dennis R. DeLoach III CHAIR, COMPENSATION COMMITTEE Dr. Alex Harris CHAIR, COMPLIANCE COMMITTEE Tarek Helal CHAIR, ASSET LIABILITY COMMITTEE

6 WELCOME & INTRODUCTIONS DIRECTORS Anthony N. Leo CHIEF EXECUTIVE OFFICER; CHAIR, DIRECTORS’ CREDIT AND LOAN COMMITTEE Christos Politis CHAIR, ESG COMMITTEE Bradly Spoor Sheryl WuDunn CHAIR, TECH STRATEGY COMMITTEE Thomas G. Zernick PRESIDENT, BAYFIRST FINANCIAL CORP. Barbara Zipperian CHAIR, AUDIT & RM COMMITTEES

7 WELCOME & INTRODUCTIONS EXECUTIVE OFFICERS Robin L. Oliver CHIEF OPERATING OFFICER, CHIEF FINANCIAL OFFICER Lewis Benner CHIEF CREDIT OFFICER Brandi Jaber CHIEF PRODUCTION OFFICER John Macaluso CHIEF TECHNOLOGY OFFICER Thomas G. Quale CHIEF LENDING OFFICER, SARASOTA MARKET PRESIDENT

IN MEMORIUM George Apostolou 1951 – 2023 Director: 2011 - 2022 Friend and trusted advisor

ANNUAL MEETING REPORT Robin L. Oliver

10 SECRETARY’S REPORT The Official Meeting of Shareholders was conducted at 5:00 PM in the Tampa Room of the St. Petersburg Marriott Clearwater. The Corporate Secretary has reported that at least 2,412,325 shares, representing at least 58% of the shares outstanding of the record date, were present in person or by proxy at the meeting.

11 VOTING RESULTS PROPOSAL 1: ELECTION OF DIRECTORS At least 2,042,124 shares outstanding as of the record date, or 85% of the votes cast, voted in favor of all nominees. Therefore, all nominees have been elected.

CEO’S REMARKS Anthony N. Leo

13 A MILESTONE

14 2013 2014 2015 2016 2017 2018 2019 2020* 2021* 2022 Q1 2023 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 TOTAL ASSETS (in 000’s) ONE BILLION *Excluding PPP

A LOOK BACK AT 2022

16 2022 NET INCOME BY THE QUARTERS (in 000’s) ($13) ($282) ($1,402) $1,323 -$2,000 -$1,500 -$1,000 -$500 $0 $500 $1,000 $1,500 Q1 Q2 Q3 Q4

17 RESIDENTIAL MORTGAGE PERFORMANCE Unallocated Corporate Allocation Warehouse Interest Fully Allocated 2017 -1,813,372 - - -1,813,372 2018 -1,561,208 -1,200,000 -994,005 -3,755,213 2019 4,073,345 -1,400,000 -1,281,054 1,392,291 2020 31,732,619 -1,500,000 -1,851,608 28,381,011 2021 21,203,374 -1,787,500 -2,385,738 17,030,136 2022 -6,384,861 -2,230,000 -2,056,354 -10,671,215 1Q23 -170,236 - - -170,236 Total Pretax 47,079,661 -8,117,500 -8,568,759 30,393,402 -7,598,351 $22,795,052Estimated Net IncomeIncorporates various estimates including cost of funds, allocation of corporate expenses, and other estimates. *2017 and 2023 not allocated * * Estimated Tax

TOP 10 SBA LENDERS FY 2022 * SBA

19 SIX YEAR EARNINGS TREND (in 000’s) $3,340 -$1,205 $4,484 $12,703 $24,618 -$349 -$5,000 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 2017 2018 2019 2020 2021 2022

$2.48 ($.43) $1.27 $3.01 $5.91 ($.22) -$1.00 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 2017 2018 2019 2020 2021 2022 20 SIX YEAR EARNINGS PER SHARE TREND (Fully-diluted shares)

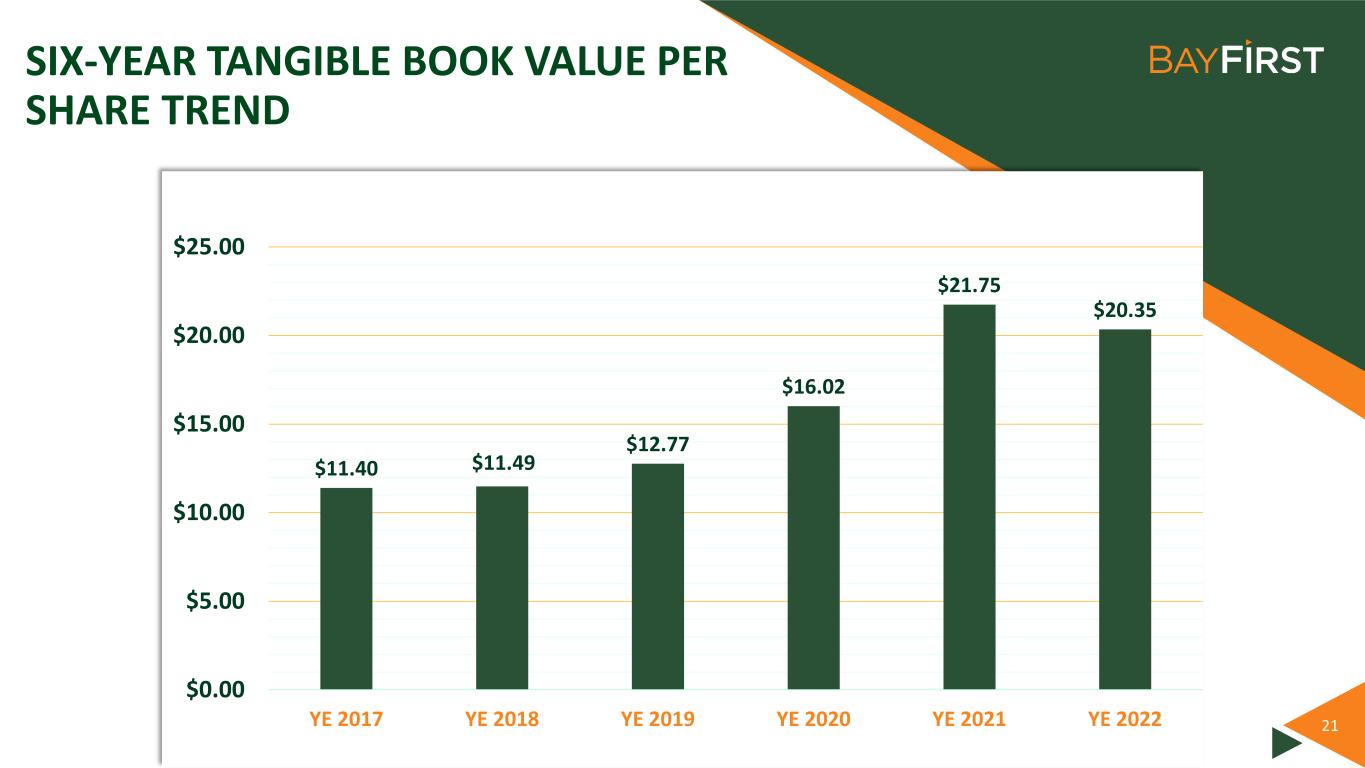

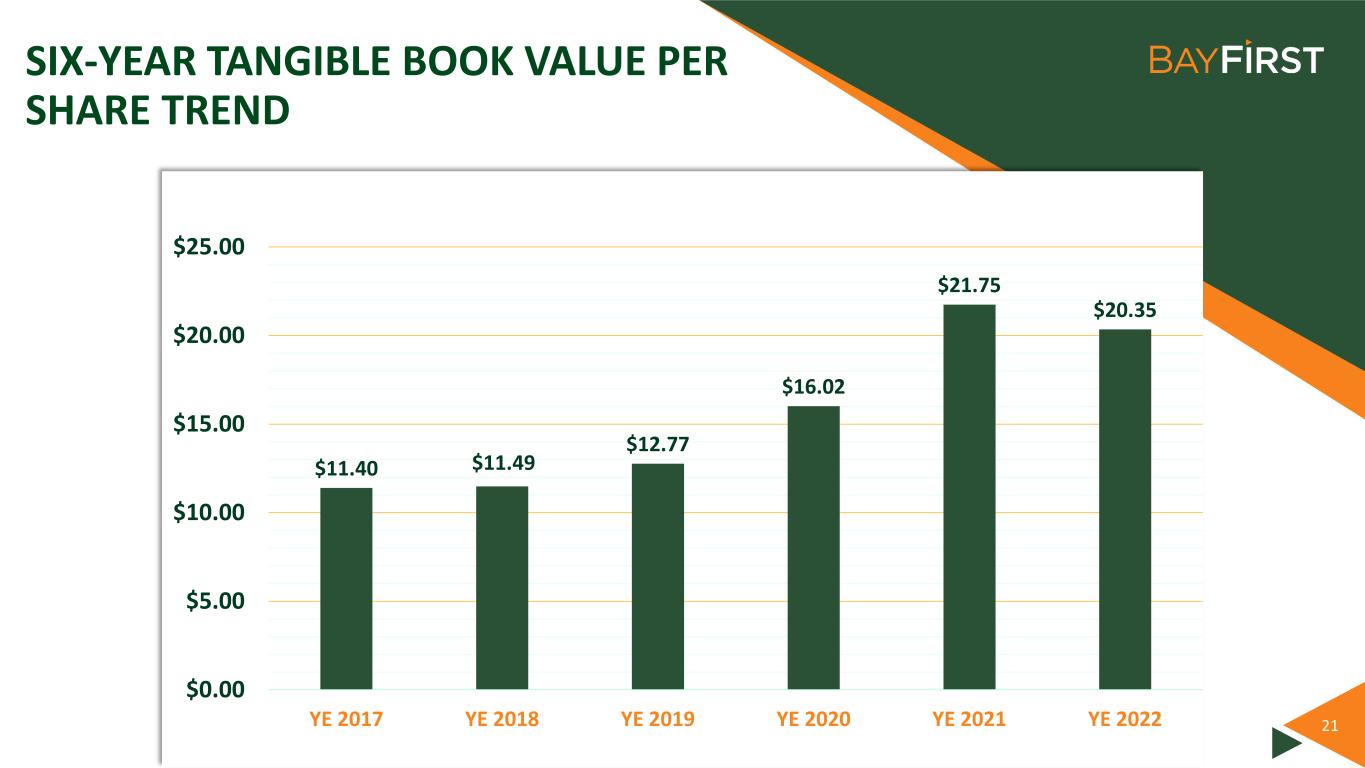

21 SIX-YEAR TANGIBLE BOOK VALUE PER SHARE TREND $11.40 $11.49 $12.77 $16.02 $21.75 $20.35 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 YE 2017 YE 2018 YE 2019 YE 2020 YE 2021 YE 2022

A QUICK LOOK AT Q1 2023

23 FIRST QUARTER HIGHLIGHTS (IN 000’S) Total Assets $1,069,839 Net Income $739 Total Loan Production $168,470 Core Deposit Growth $102,831 * *Across all loan categories ** **Exclusive of Listing Service and CDARS one-way deposits

24 INDUSTRY DEPOSIT GROWTH Q1 2023: BAYFIRST STANDS OUT! -6% -4% -2% 0% 2% 4% 6% 8% 10% 12% 14% 16% US Bank M&T CItibank Wells Truist Bank of America Chase BayFirst * * Excluding CDARS one-way deposits

THE IMPACT OF CURRENT EVENTS

CHALENGING TIMES FOR THE INDUSTRY *Charts reflect prices as of market close May 16th, 2023 BAFN

ADJUSTING TO RISING RATES Funding Beta* Asset Beta* 0.43 0.58 3/31/2022 3/31/2023 Yield on Earning Assets 3.93% 6.57% Funding Cost 0.79% 2.74% * Movement for every 100 bps change in Fed Funds rate to date

IMPACT OF UNREALIZED LOSS OF AFS SECURITIES 28 0% 10% 20% 30% 40% 50% 60% 70% 80% BayFirst Bank OZK Truist Synovus Bank of Tampa Republic Bank (PA) Unrealized loss as a % of equity capital at bank level. Does not include impact of HTM securities.

INDUSTRY INSURED DEPOSITS 29 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% SVB BMO Harris Synovus BofA Chase Republic Bank OZK BayFirst

OUR DISTINCTIVE BUSINESS MODEL BUILDS LONG-TERM VALUE

OPENING BANKING CENTERS WHEN OTHERS ARE CLOSING GROWING FOOTPRINT

EXPANDING BANKING CENTER NETWORK CURRENT BANKING CENTER LOCATIONS FUTURE BANKING CENTER LOCATIONS Seminole 1999 Pinellas Park 2005 Countryside 2018 St. Petersburg 2017 Downtown Sarasota 2018 West Tampa 2021 Belleair Bluffs 2022 West Bradenton 2022 Carrollwood 2023 Bee Ridge Sarasota 2023 S. Tamiami Trail Sarasota 2023 Lakewood Ranch TBD Newtown Sarasota 2023

UNIQUE BRAND

ADVANCING TECHNOLOGY 34

SOCIALLY RESPONSIBLE 35

DISTINCTIVE MARKETING

BUSINESS STRATEGY FOCUSED ON INDIVIDUALS, FAMILIES, AND SMALL BUSINESSES

38 TOP SBA LENDERS (As of May 2, 2023) *

WHAT’S NEXT

BUILDING THE BANK OF TAMPA BAY! 40 DISTINCTIVE BRAND! TECHNOLOGY DRIVEN! SOCIALLY FOCUSED! ENGAGED TEAM! NATIONAL LEADER IN SBA LENDING! THE PREMIER BANKING FRANCHISE IN TAMPA BAY!

COMMUNITY IMPACT Thomas G. Zernick & Dianne Carney

CHAIRMAN’S REMARKS Anthony Saravanos

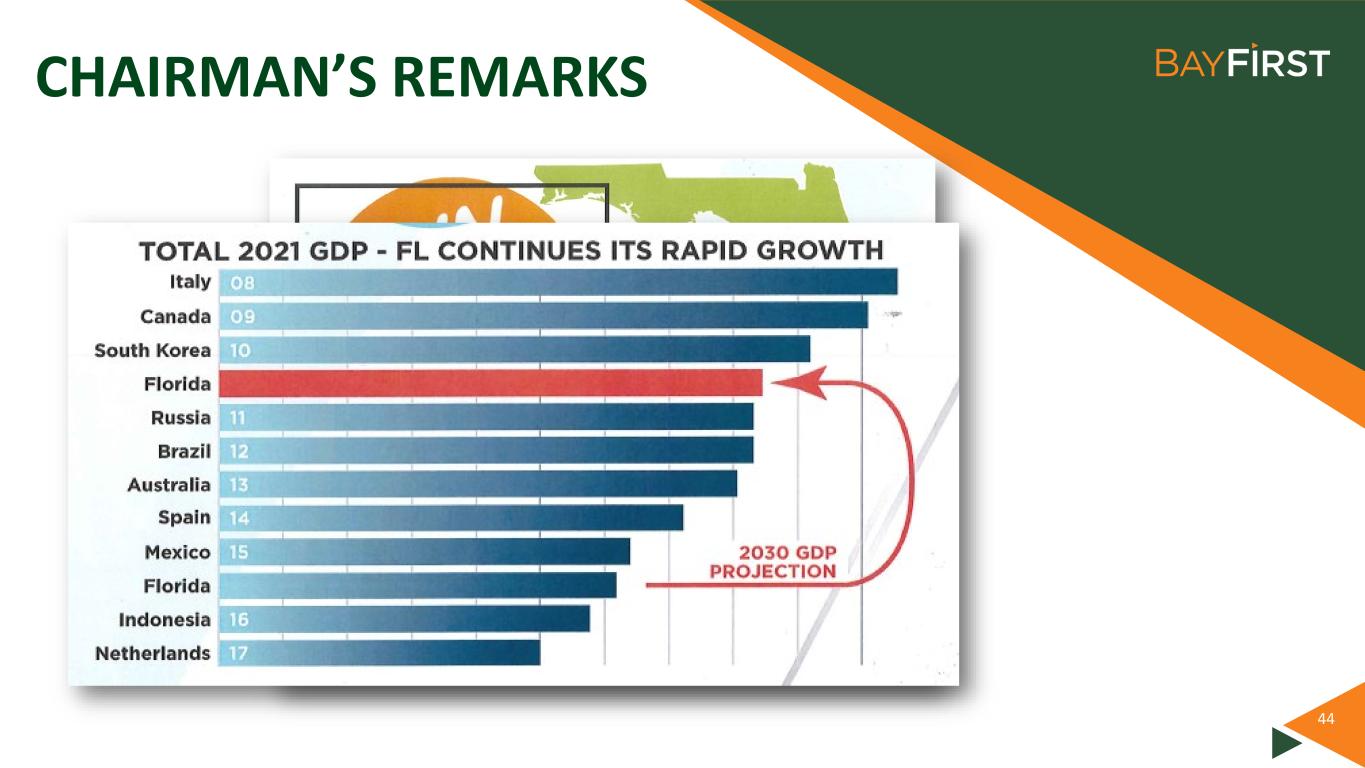

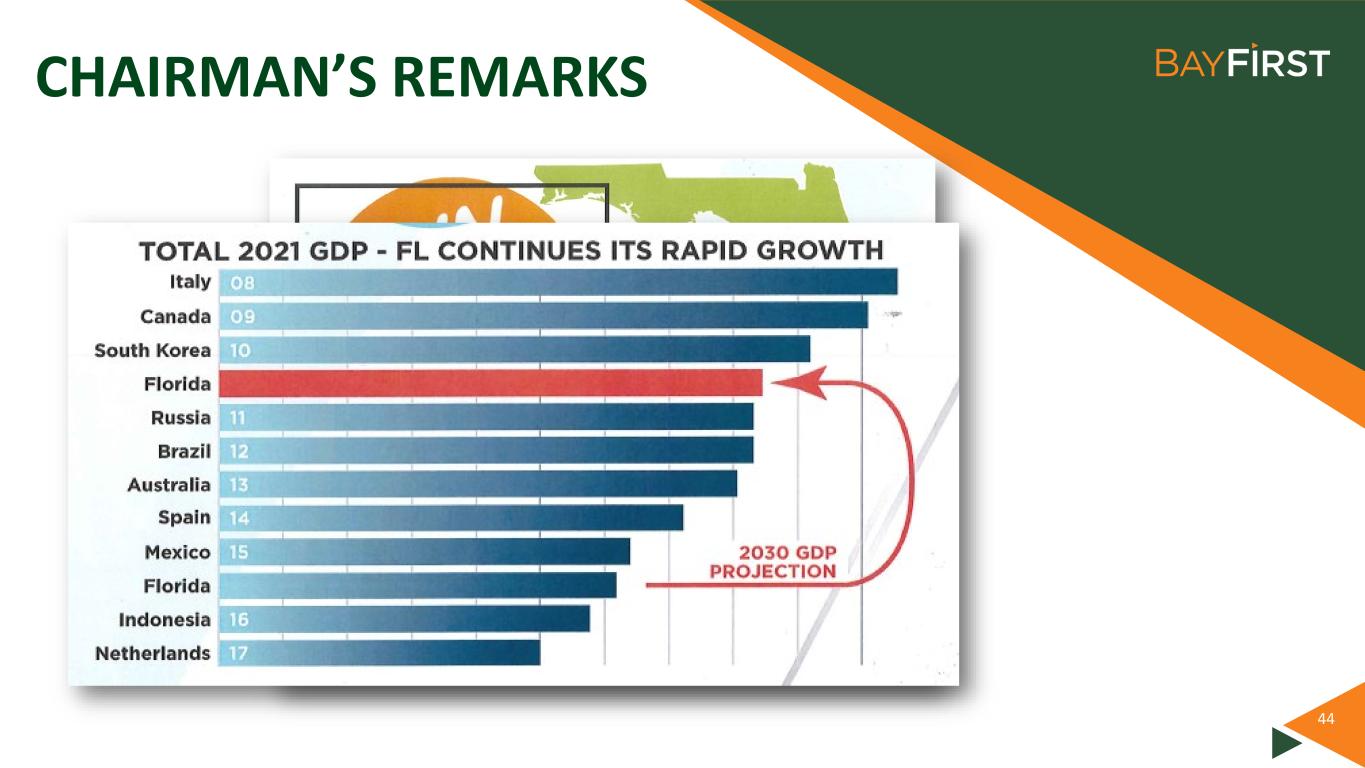

43 CHAIRMAN’S REMARKS

44 CHAIRMAN’S REMARKS

SHAREHOLDER Q&A

JOIN US FOR THE SOCIAL HOUR