Exhibit 99.2

February 9, 2017 Acquisition of the Wholly-Owned Banks of Clayton HC, Inc. Knoxville, TN Tullahoma, TN

This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements in some cases through the Company’s use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the proposed acquisition, the anticipated benefits and financial impact thereof, the outlook for the Company’s future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, without limitation, statements relating to the anticipated benefits, financial impact and closing of the proposed acquisition by the Company of the Clayton Banks, including, the anticipated timing of the closing of the proposed acquisition, any expected increase in the Company’s earnings per share and any expected earn-back period related to dilution in tangible book value resulting from the proposed acquisition, acceptance by the customers of the Clayton Banks the Company’s products and services, the opportunities to enhance market share in certain markets, market acceptance of the Company generally in new markets, expectations regarding future investment in the Clayton Banks’ markets and the integration of the Clayton Banks’ operations. Forward-looking statements are based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of important factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this presentation including, without limitation, the parties’ ability to consummate the acquisition or satisfy the conditions to the completion of the acquisition, including the receipt of the shareholder approvals; the receipt of regulatory approvals required for the acquisition on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing and completion and accounting and tax treatment of the acquisition; the possibility that any of the anticipated benefits of the proposed acquisition will not be fully realized or will not be realized within the expected time period; the risk that integration of the Clayton Banks’ operations with those of the Company will be materially delayed or will be more costly or difficult than expected; the failure of the proposed acquisition to close for any other reason; the effect of the announcement of the proposed acquisition on employee and customer relationships and operating results (including, without limitation, difficulties in maintaining relationships with employees and customers); dilution caused by the Company’s issuance of additional shares of its common stock in connection with the proposed acquisition; the possibility that the proposed acquisition may be more expensive to complete than anticipated, including as a result of unexpected factors or events; general competitive, economic, political and market conditions and fluctuations; and the other factors described in the Company’s final prospectus filed pursuant to Rule 424(b)(3) under the Securities Act, as amended, filed with the U.S. Securities and Exchange Commission on September 19, 2016 (Registration No. 333-213210) under the captions “Cautionary note regarding forward-looking statements” and “Risk factors”. Many of these factors are difficult to foresee and are beyond the Company’s ability to control or predict. The Company believes the forward-looking statements contained herein are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. The Company does not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. Forward looking statements

Additional information and participants in the solicitation This presentation is for informational purposes only and does not constitute a solicitation of any vote or approval with respect to the Company’s proposed acquisition of the Clayton Banks. The issuance of the Stock Consideration in connection with the proposed acquisition of the Clayton Banks by the Company will be submitted to the shareholders of the Company for their consideration. The Company will file with the SEC a proxy statement and deliver the proxy statement to its shareholders as required by applicable law. The Company may also file other documents with the SEC regarding the proposed acquisition. This presentation is not a substitute for any proxy statement or any other document which the Company may file with the SEC in connection with the proposed acquisition. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, THE PROPOSED ACQUISITION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the proxy statement and other documents containing important information about the Company and the proposed acquisition, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. The Company makes available free of charge at www.firstbankonline.com (in the “Investor Relations” section of such website) copies of the materials it files with, or furnishes to, the SEC. The Company and certain of its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of the Company in connection with the proposed acquisition. Information about the directors and executive officers of the Company is set forth in in the Company’s final prospectus filed pursuant to Rule 424(b)(3) under the Securities Act, as amended, filed with the U.S. Securities and Exchange Commission on September 19, 2016 (Registration No. 333-213210). Such final prospectus can be obtained free of charge from the sources indicated above. Other information regarding those persons who are, under the rules of the SEC, participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

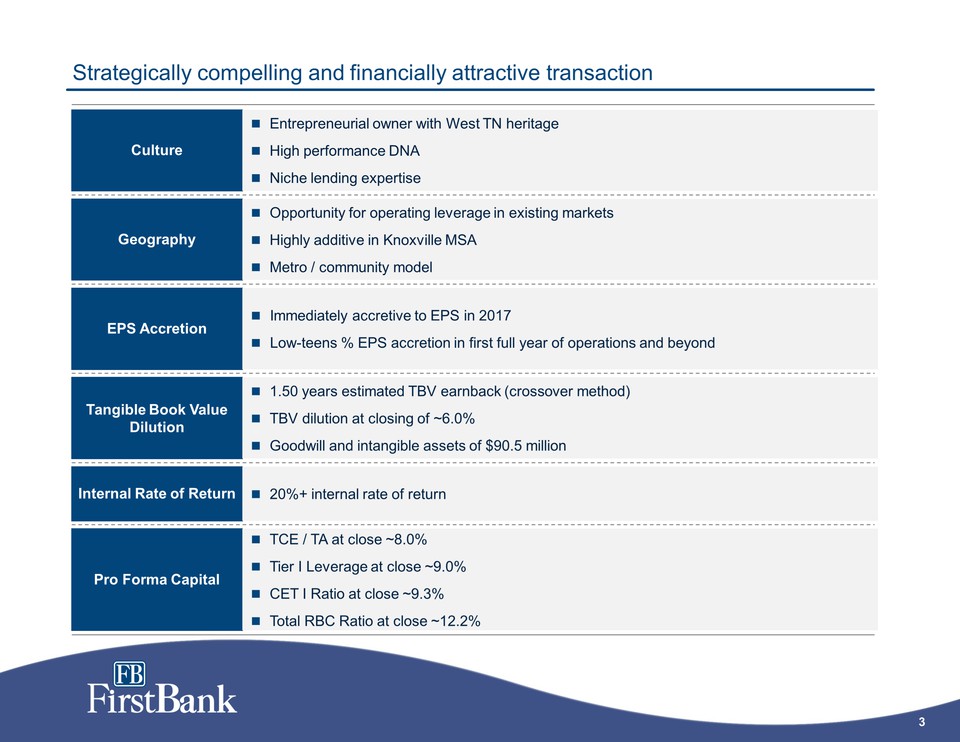

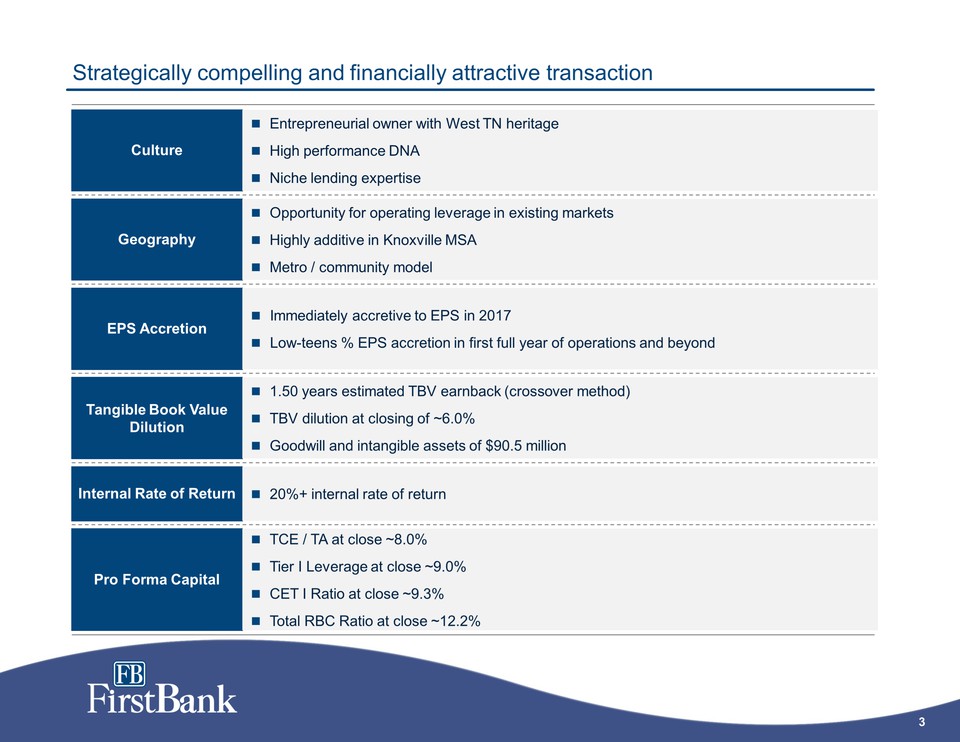

Culture EPS Accretion Geography Strategically compelling and financially attractive transaction Tangible Book Value Dilution Entrepreneurial owner with West TN heritage High performance DNA Niche lending expertise Internal Rate of Return Opportunity for operating leverage in existing markets Highly additive in Knoxville MSA Metro / community model Immediately accretive to EPS in 2017Low-teens % EPS accretion in first full year of operations and beyond 1.50 years estimated TBV earn back (crossover method)TBV dilution at closing of ~6.0%Goodwill and intangible assets of $90.5 million 20%+ internal rate of return Pro Forma Capital TCE / TA at close ~8.0%Tier I Leverage at close ~9.0%CET I Ratio at close ~9.3%Total RBC Ratio at close ~12.2%

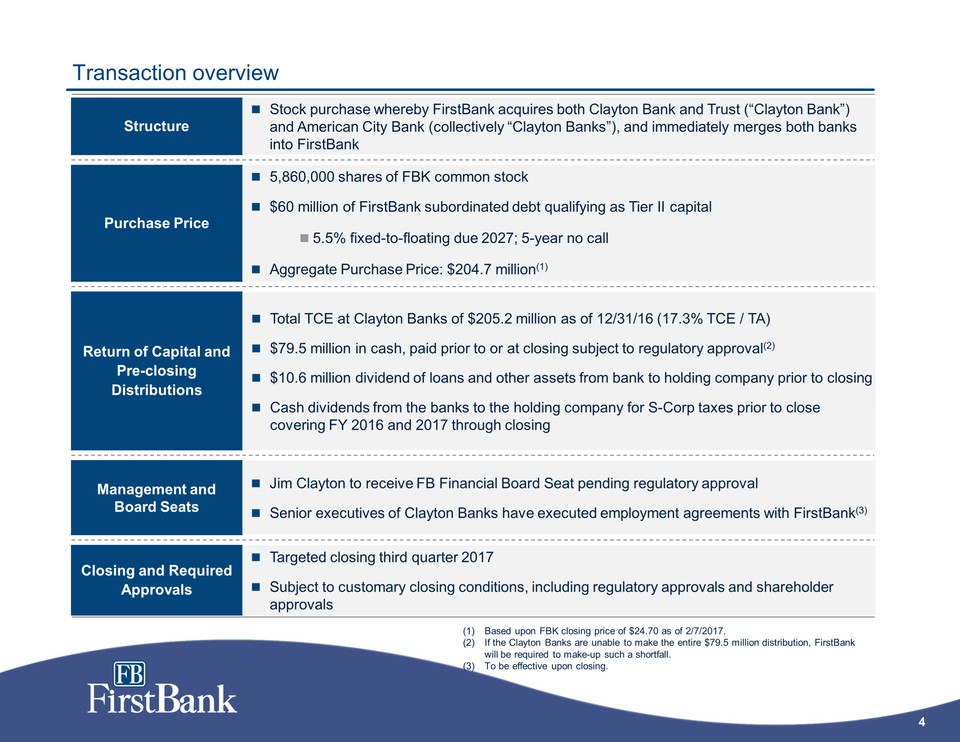

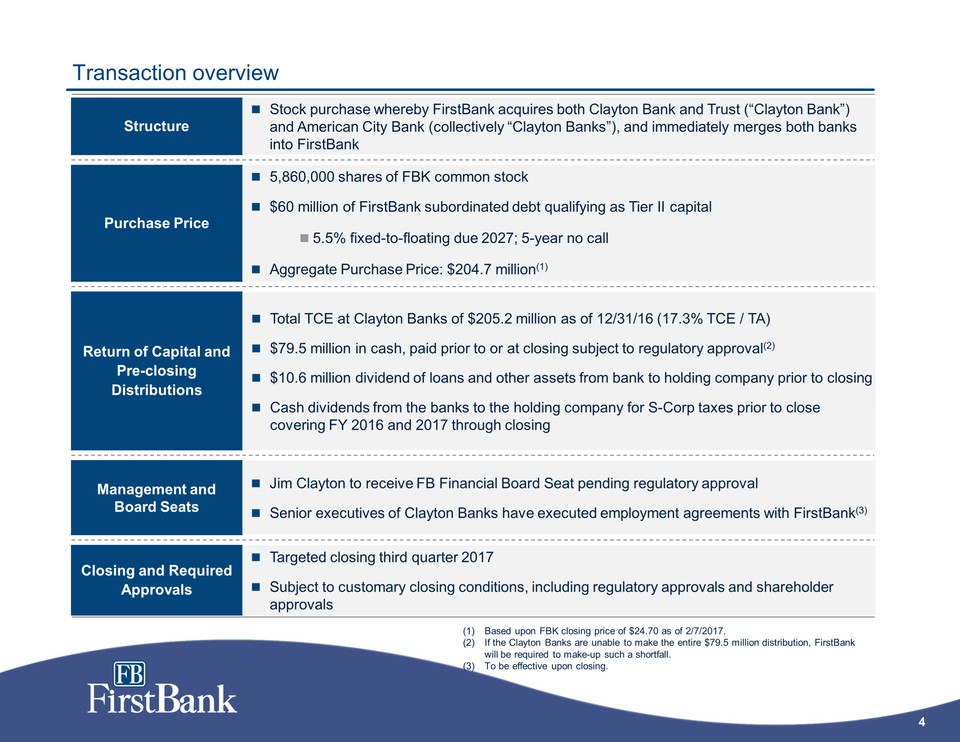

Management and Board Seats Return of Capital and Pre-closing Distributions Purchase Price Transaction overview Jim Clayton to receive FB Financial Board Seat pending regulatory approval Senior executives of Clayton Banks have executed employment agreements with First Bank(3) Structure Stock purchase whereby First Bank acquires both Clayton Bank and Trust (“Clayton Bank”) and American City Bank (collectively “Clayton Banks”), and immediately merges both banks into First Bank 5,860,000 shares of FBK common stock$60 million of First Bank subordinated debt qualifying as Tier II capital5.5% fixed-to-floating due 2027; 5-year no call Aggregate Purchase Price: $204.7 million(1) Closing and Required Approvals Targeted closing third quarter 2017Subject to customary closing conditions, including regulatory approvals and shareholder approvals Total TCE at Clayton Banks of $205.2 million as of 12/31/16 (17.3% TCE / TA)$79.5 million in cash, paid prior to or at closing subject to regulatory approval(2)$10.6 million dividend of loans and other assets from bank to holding company prior to closing Cash dividends from the banks to the holding company for S-Corp taxes prior to close covering FY 2016 and 2017 through closing Based upon FBK closing price of $24.70 as of 2/7/2017.If the Clayton Banks are unable to make the entire $79.5 million distribution, First Bank will be required to make-up such a shortfall. To be effective upon closing.

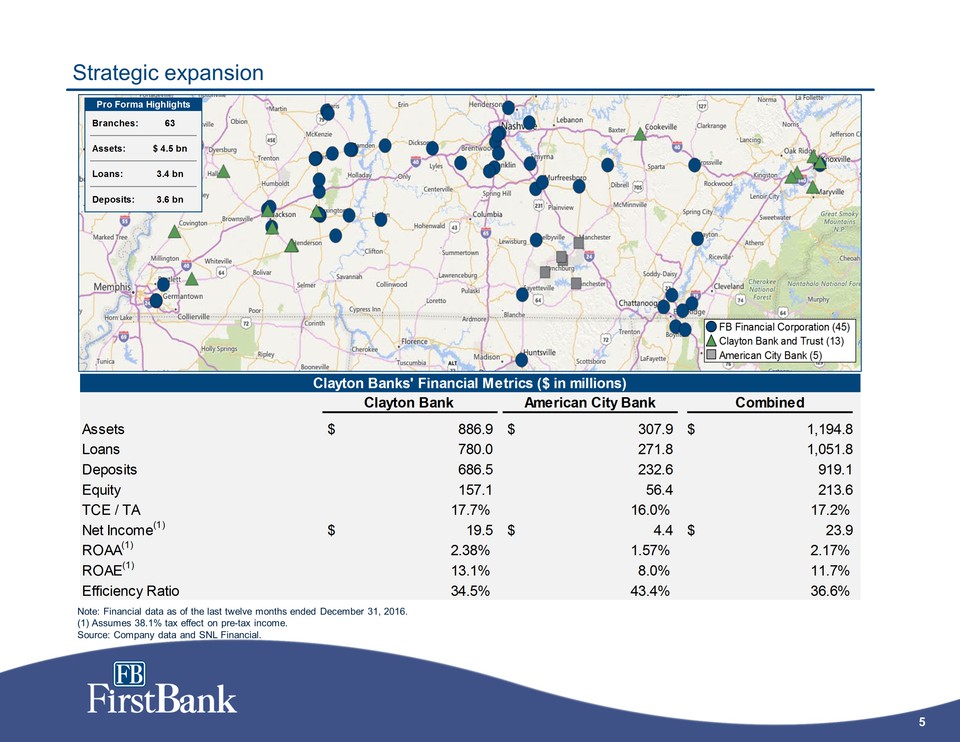

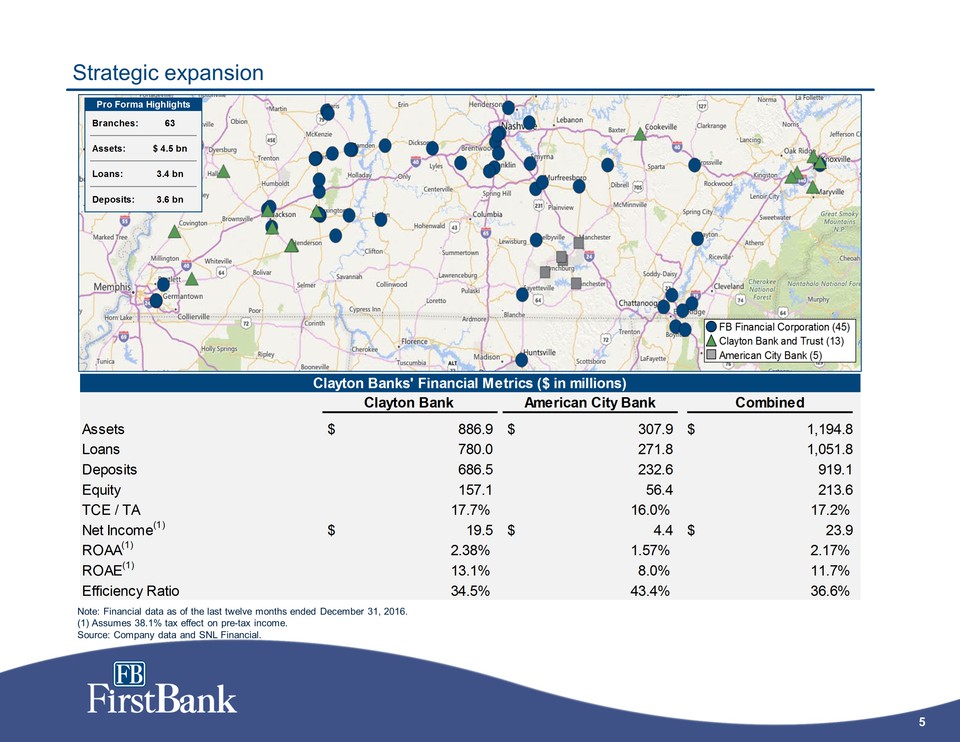

Strategic expansion Note: Financial data as of the last twelve months ended December 31, 2016.(1) Assumes 38.1% tax effect on pre-tax income. Source: Company data and SNL Financial.

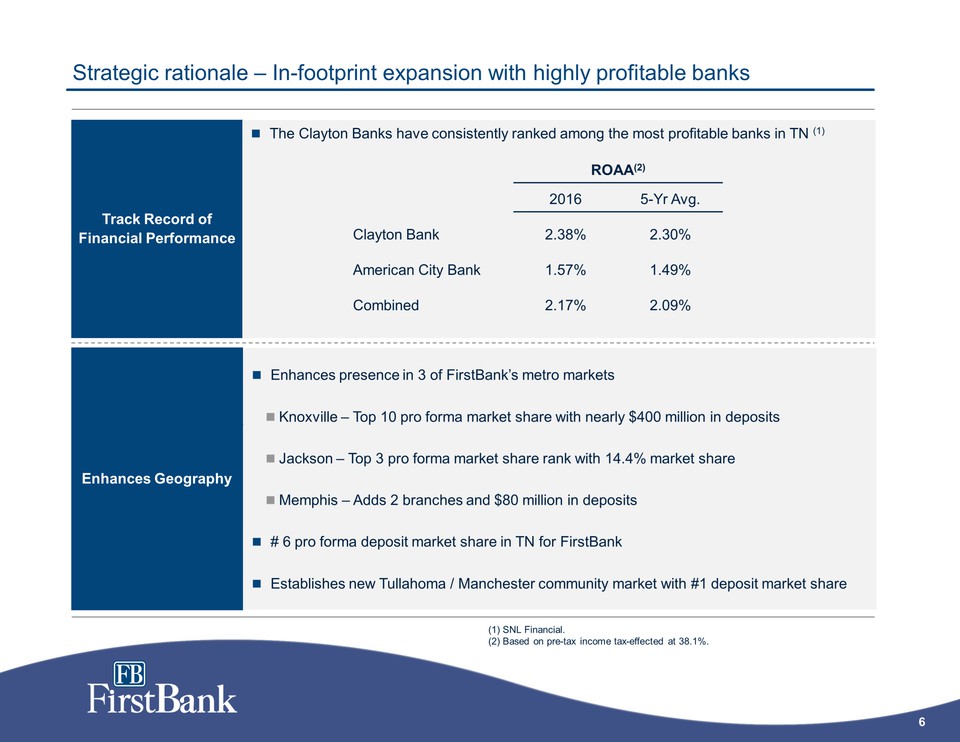

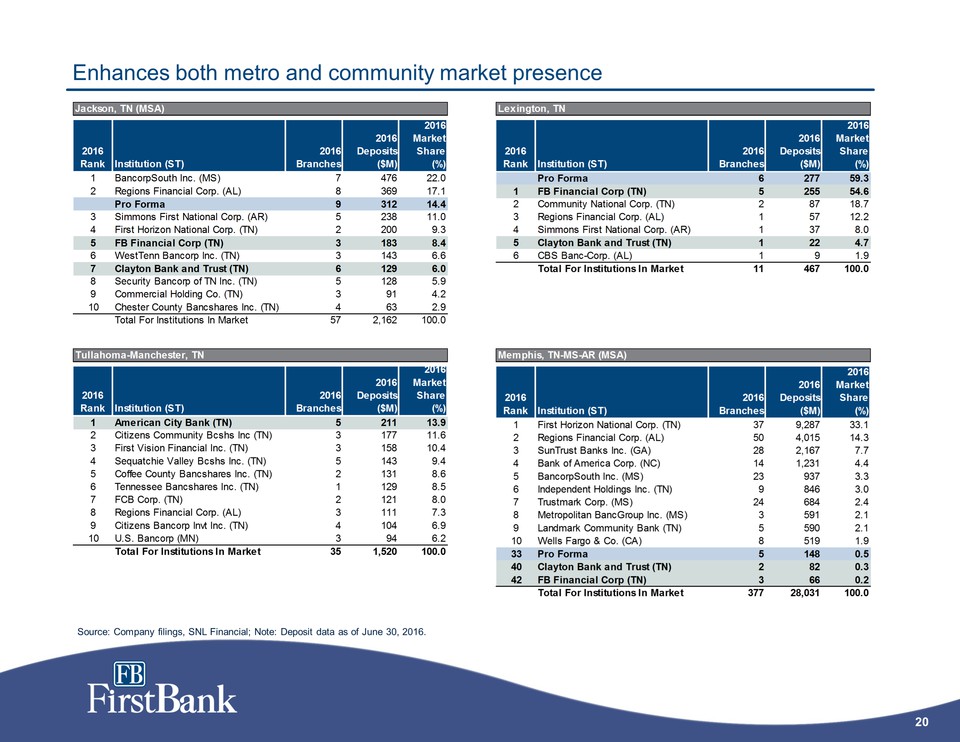

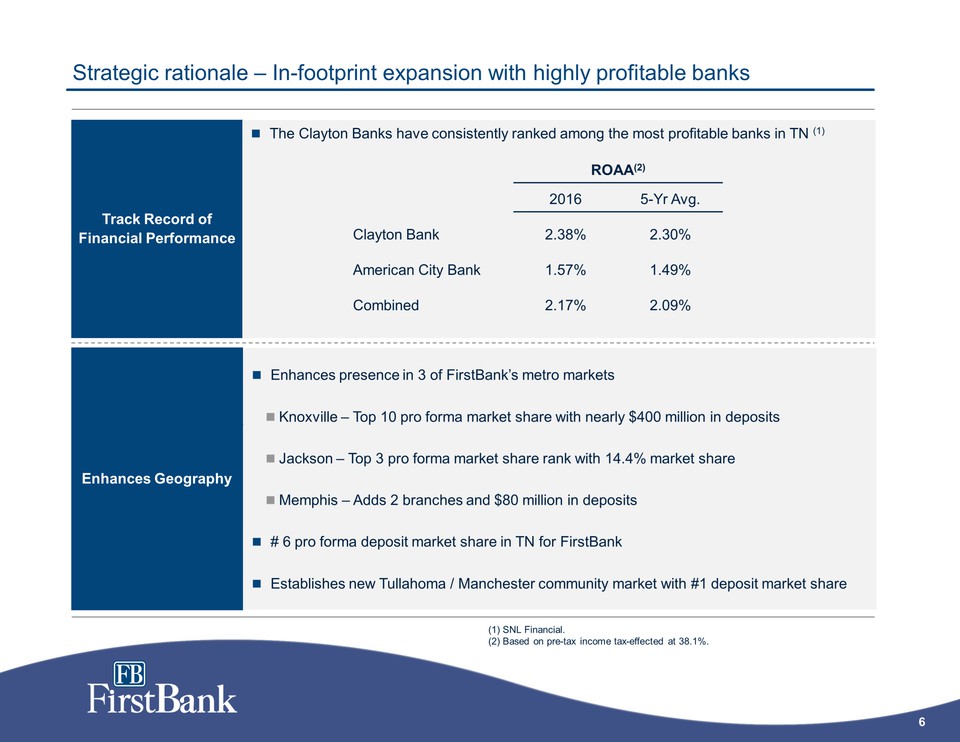

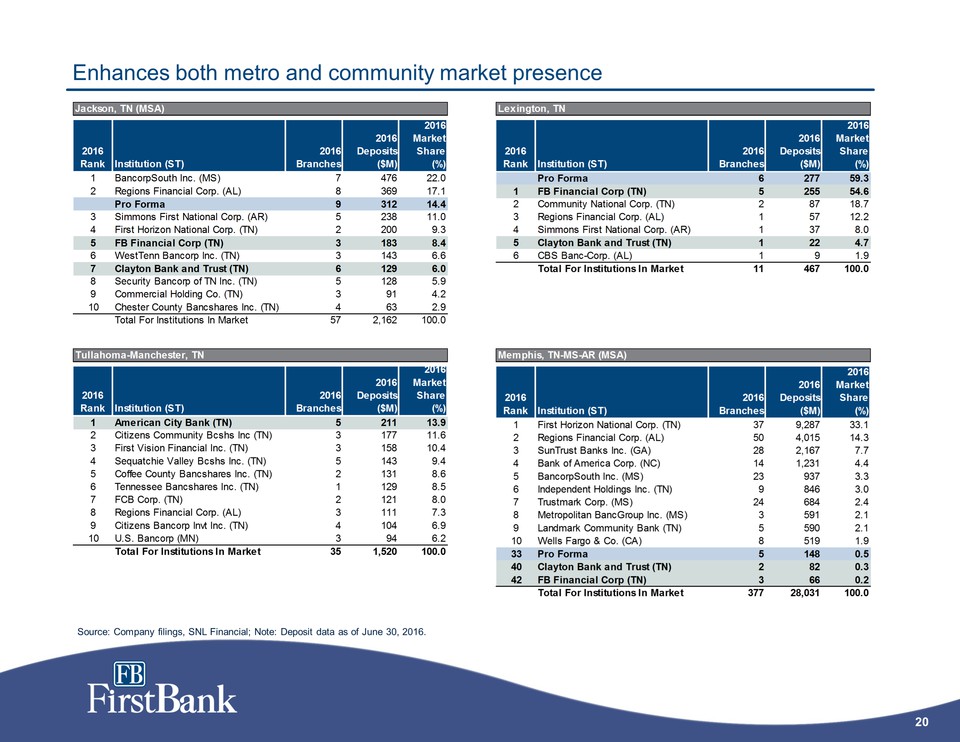

Strategic rationale – In-footprint expansion with highly profitable banks Track Record of Financial Performance The Clayton Banks have consistently ranked among the most profitable banks in TN (1) ROAA(2) 2016 5-Yr Avg. Clayton Bank 2.38% 2.30% American City Bank 1.57% 1.49% Combined 2.17% 2.09% Enhances Geography Enhances presence in 3 of First Bank’s metro markets Knoxville – Top 10 pro forma market share with nearly $400 million in deposits Jackson – Top 3 pro forma market share rank with 14.4% market share Memphis – Adds 2 branches and $80 million in deposits# 6 pro forma deposit market share in TN for First Bank Establishes new Tullahoma / Manchester community market with #1 deposit market share (1) SNL Financial. (2) Based on pre-tax income tax-effected at 38.1%.

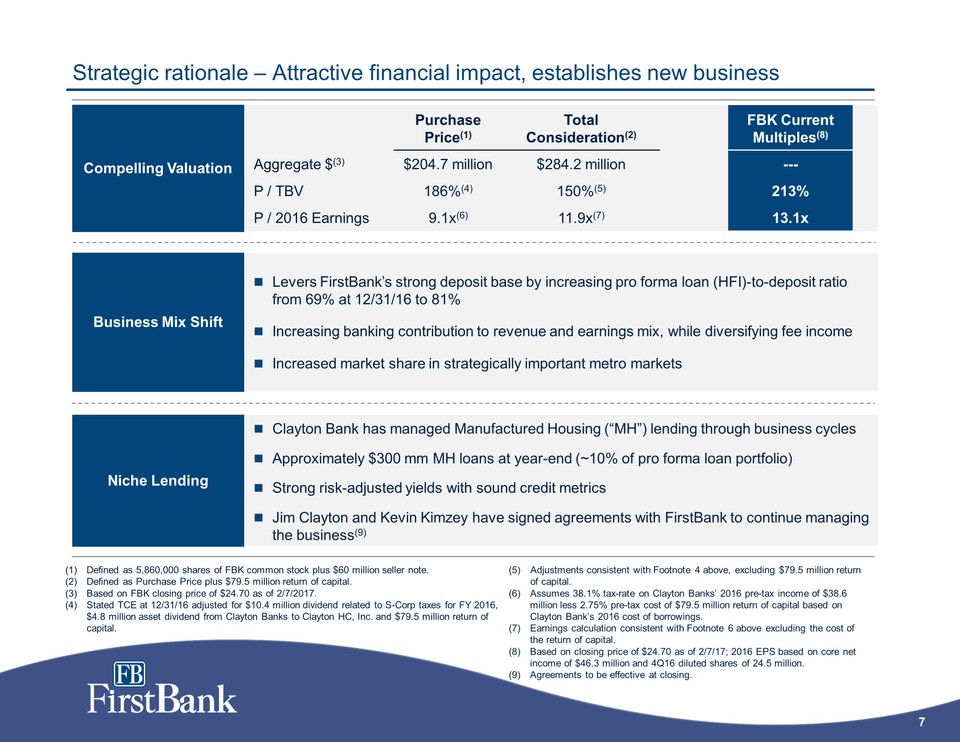

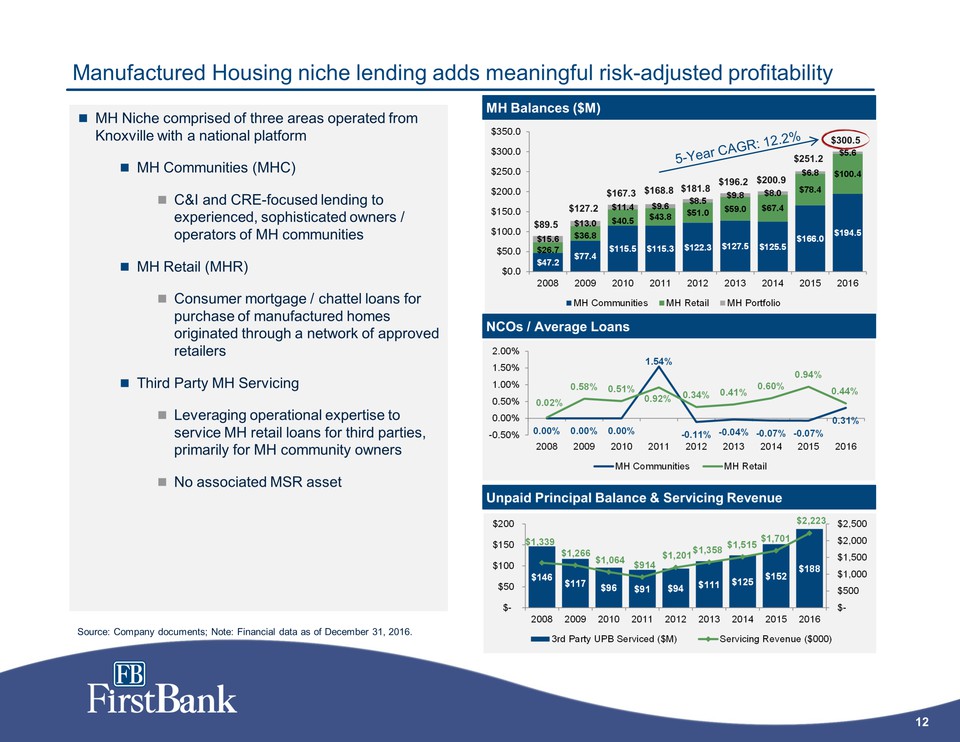

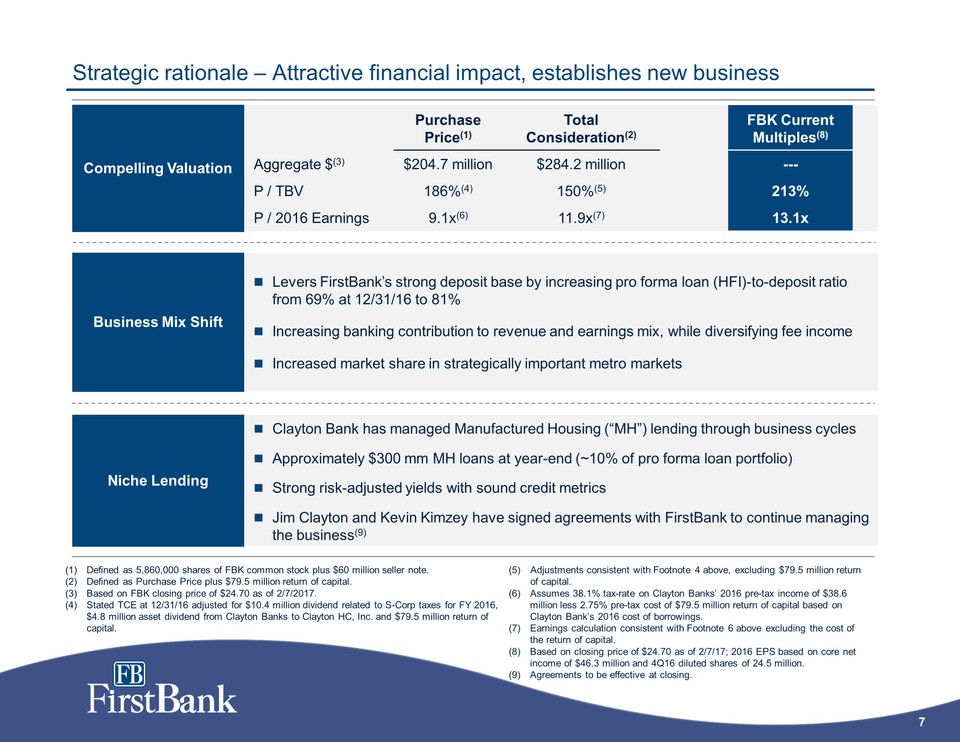

Strategic rationale – Attractive financial impact, establishes new business Niche Lending Clayton Bank has managed Manufactured Housing (“MH”) lending through business cycles Approximately $300 mm MH loans at year-end (~10% of pro forma loan portfolio)Strong risk-adjusted yields with sound credit metrics Jim Clayton and Kevin Kimzey have signed agreements with First Bank to continue managing the business(9) Adjustments consistent with Footnote 4 above, excluding $79.5 million return of capital. Assumes 38.1% tax-rate on Clayton Banks’ 2016 pre-tax income of $38.6 million less 2.75% pre-tax cost of $79.5 million return of capital based on Clayton Bank’s 2016 cost of borrowings. Earnings calculation consistent with Footnote 6 above excluding the cost of the return of capital. Based on closing price of $24.70 as of 2/7/17; 2016 EPS based on core net income of $46.3 million and 4Q16 diluted shares of 24.5 million. Agreements to be effective at closing. Business Mix Shift Levers First Bank’s strong deposit base by increasing pro forma loan (HFI)-to-deposit ratio from 69% at 12/31/16 to 81%Increasing banking contribution to revenue and earnings mix, while diversifying fee income Increased market share in strategically important metro markets Compelling Valuation Purchase Price(1) Total Consideration(2) FBK Current Multiples(8) Aggregate $(3) $204.7 million $284.2 million --- P / TBV 186%(4) 150%(5) 213% P / 2016 Earnings 9.1x(6) 11.9x(7) 13.1x Mess with footnotes Add FBK multiples somewhere Defined as 5,860,000 shares of FBK common stock plus $60 million seller note. Defined as Purchase Price plus $79.5 million return of capital. Based on FBK closing price of $24.70 as of 2/7/2017.Stated TCE at 12/31/16 adjusted for $10.4 million dividend related to S-Corp taxes for FY 2016, $4.8 million asset dividend from Clayton Banks to Clayton HC, Inc. and $79.5 million return of capital.

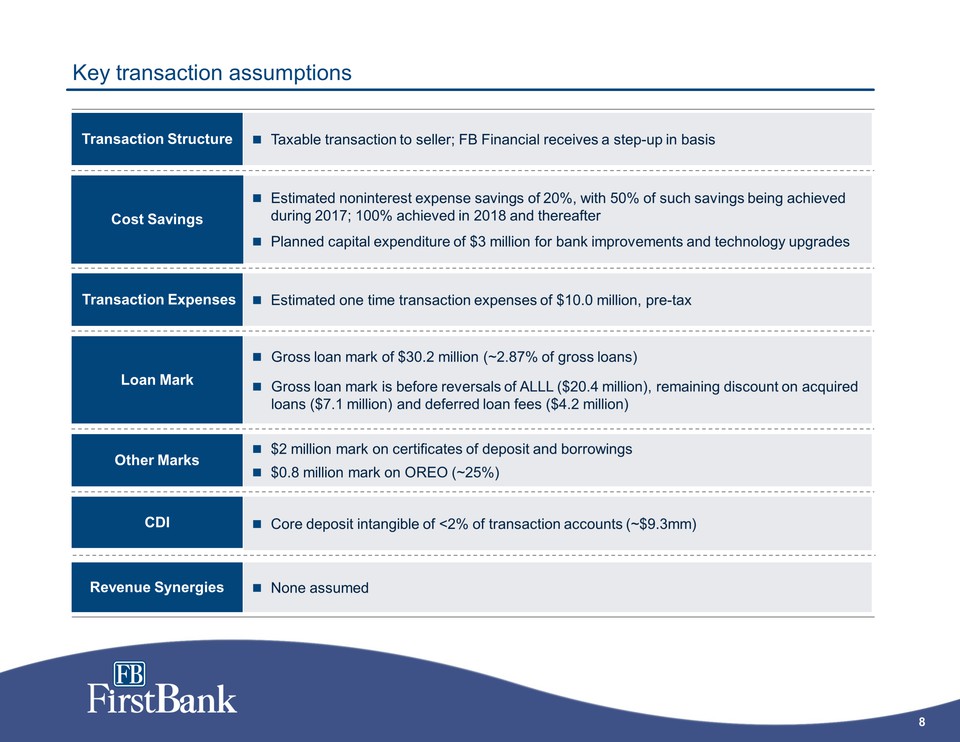

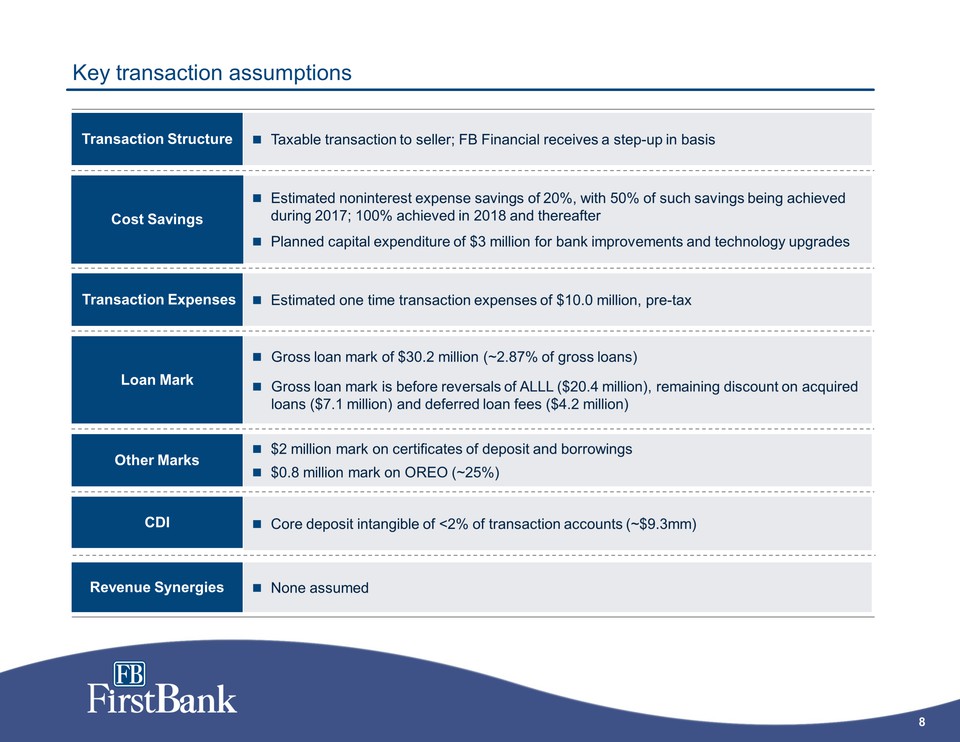

Cost Savings Transaction Expenses Estimated one time transaction expenses of $10.0 million, pre-tax Key transaction assumptions Loan Mark Gross loan mark of $30.2 million (~2.87% of gross loans)Gross loan mark is before reversals of ALLL ($20.4 million), remaining discount on acquired loans ($7.1 million) and deferred loan fees ($4.2 million) Transaction Structure Taxable transaction to seller; FB Financial receives a step-up in basis Estimated noninterest expense savings of 20%, with 50% of such savings being achieved during 2017; 100% achieved in 2018 and thereafter Planned capital expenditure of $3 million for bank improvements and technology upgrades CDI Core deposit intangible of <2% of transaction accounts (~$9.3mm) Other Marks $2 million mark on certificates of deposit and borrowings$0.8 million mark on OREO (~25%) Revenue Synergies None assumed Community investment and branding

Extensive due diligence conducted Close coordination with Clayton Banks’ management teams in all aspects of strategy and operations Risk management analysis done by First Bank’s senior management, including CEO, CFO, CRO, CCO, Operations, Human Resources, Compliance and General Counsel Comprehensive credit review of Clayton Banks’ loan portfolios, utilizing both internal and external resources Conducted detailed review, utilizing internal and external resources, with greater than 90% dollar coverage of loans $1 million and above100% coverage of Clayton Bank consumer loans via credit score refresh83% dollar coverage of MH Communities loans Thorough balance sheet and liquidity analysis Extensive review and analysis of existing IT and operational capabilities at Clayton Banks Assessment of every facility and developed a plan for future including enhancements where necessary

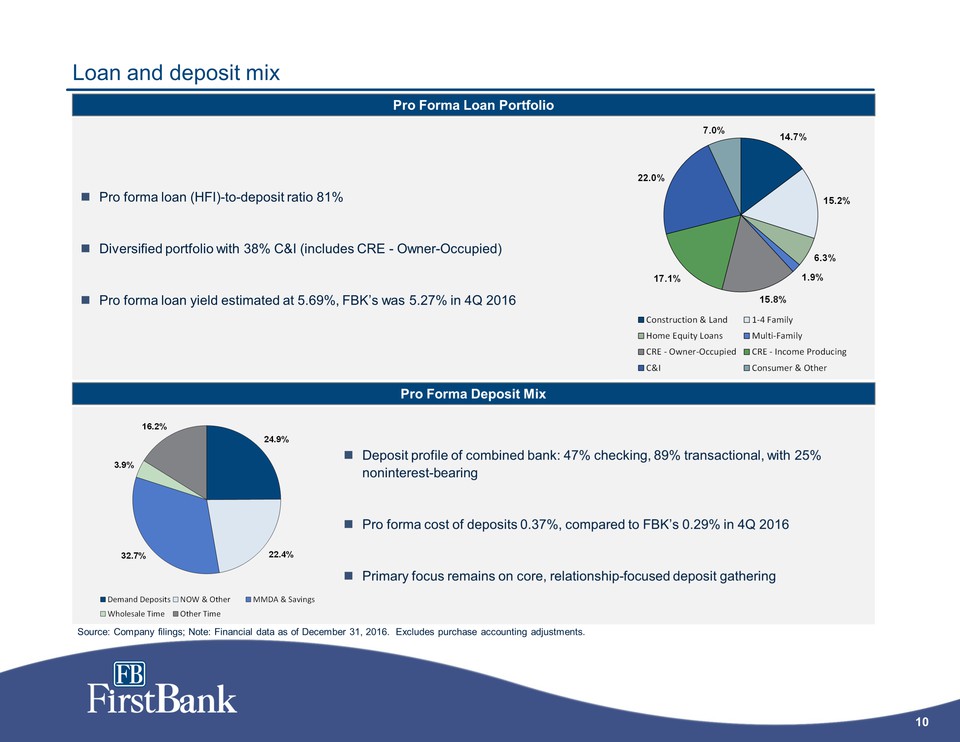

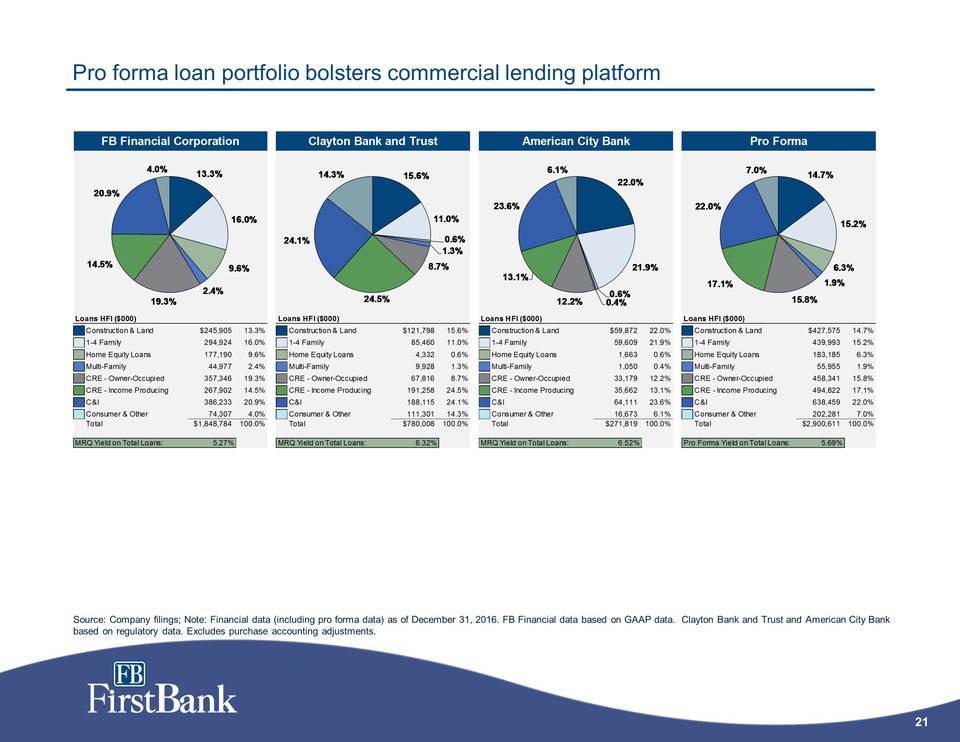

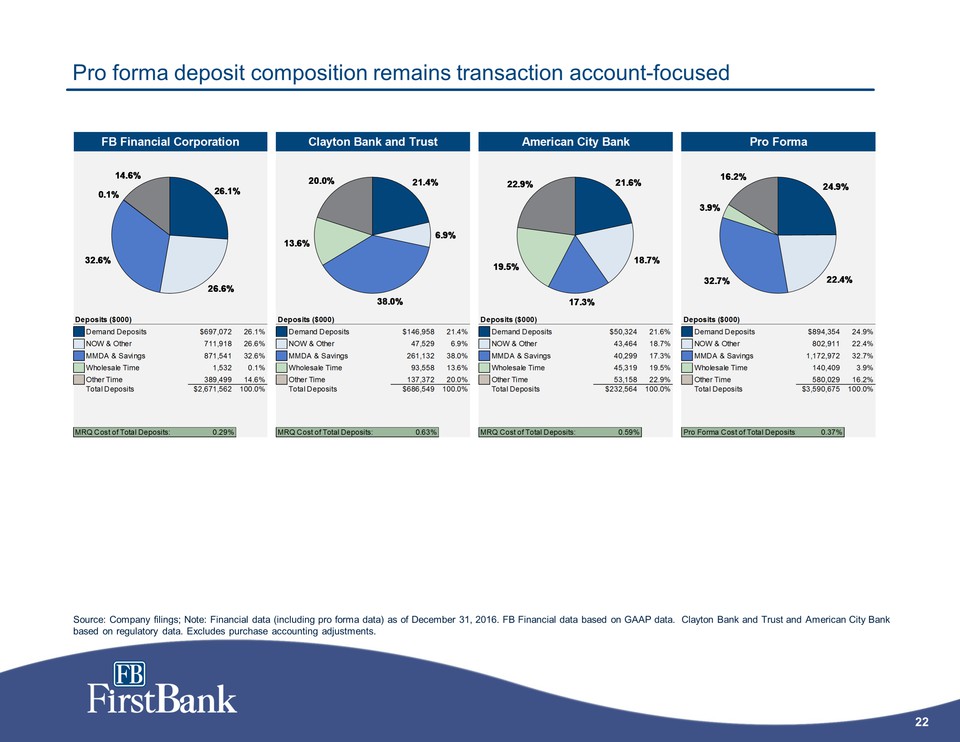

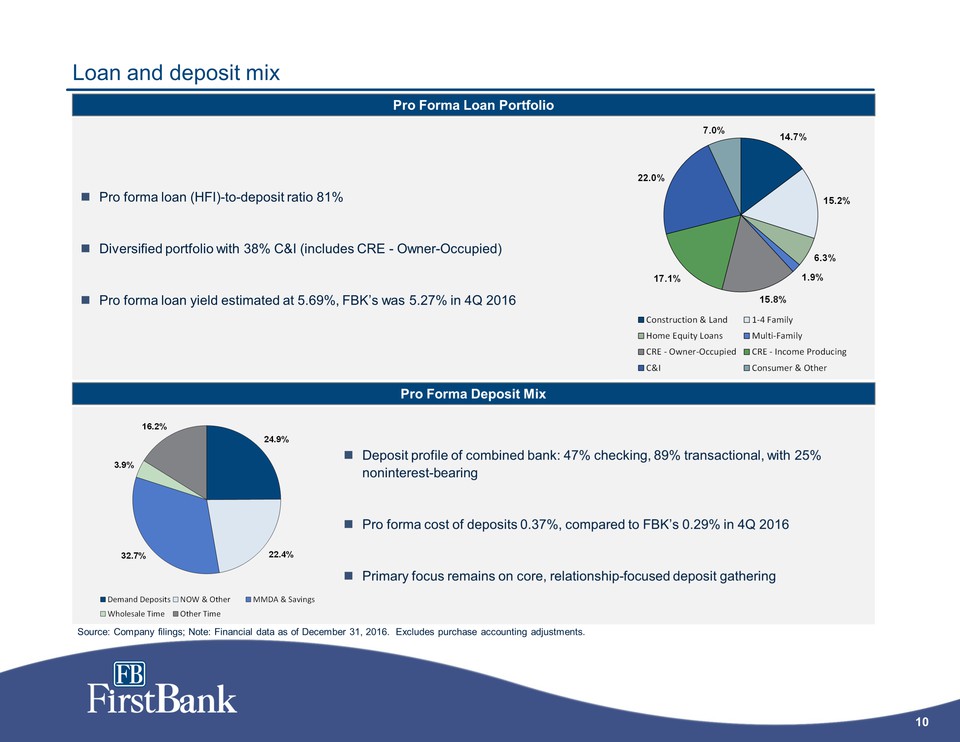

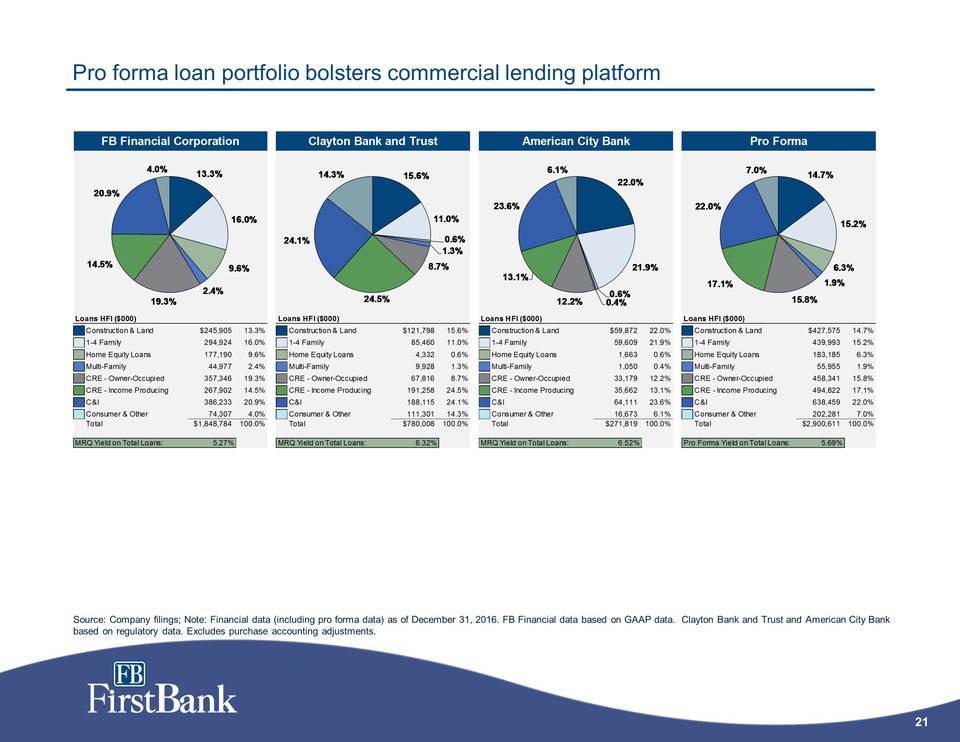

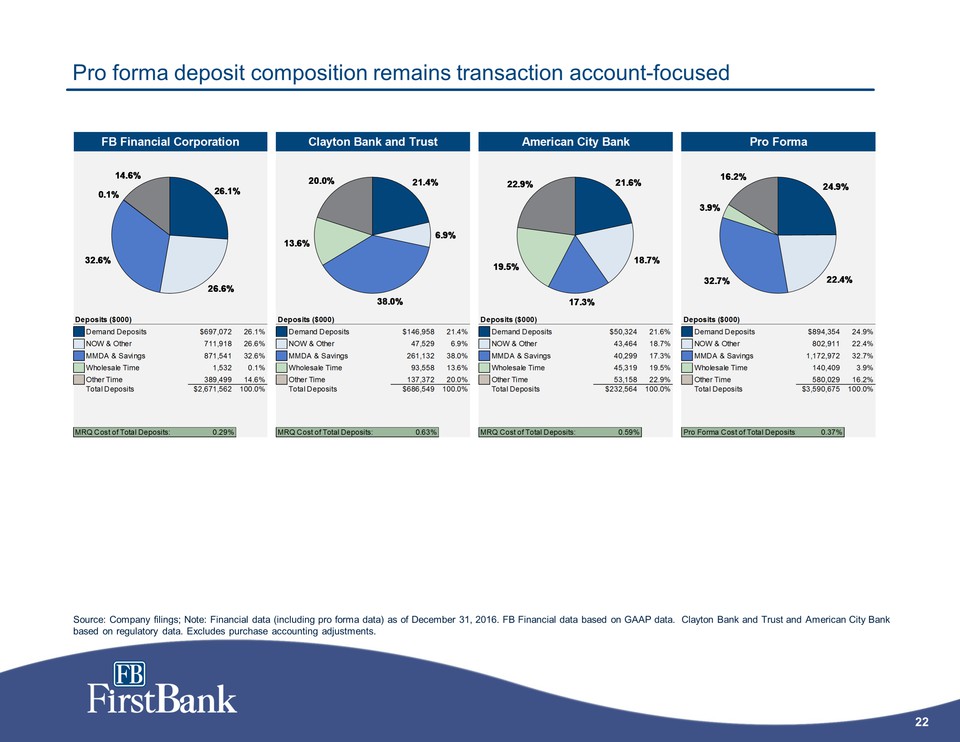

Loan and deposit mix Pro Forma Loan Portfolio Pro Forma Deposit Mix Pro forma loan (HFI)-to-deposit ratio 81%Diversified portfolio with 38% C&I (includes CRE - Owner-Occupied) Pro forma loan yield estimated at 5.69%, FBK’s was 5.27% in 4Q 2016 Deposit profile of combined bank: 47% checking, 89% transactional, with 25% noninterest-bearing Pro forma cost of deposits 0.37%, compared to FBK’s 0.29% in 4Q 2016Primary focus remains on core, relationship-focused deposit gathering Source: Company filings; Note: Financial data as of December 31, 2016. Excludes purchase accounting adjustments.

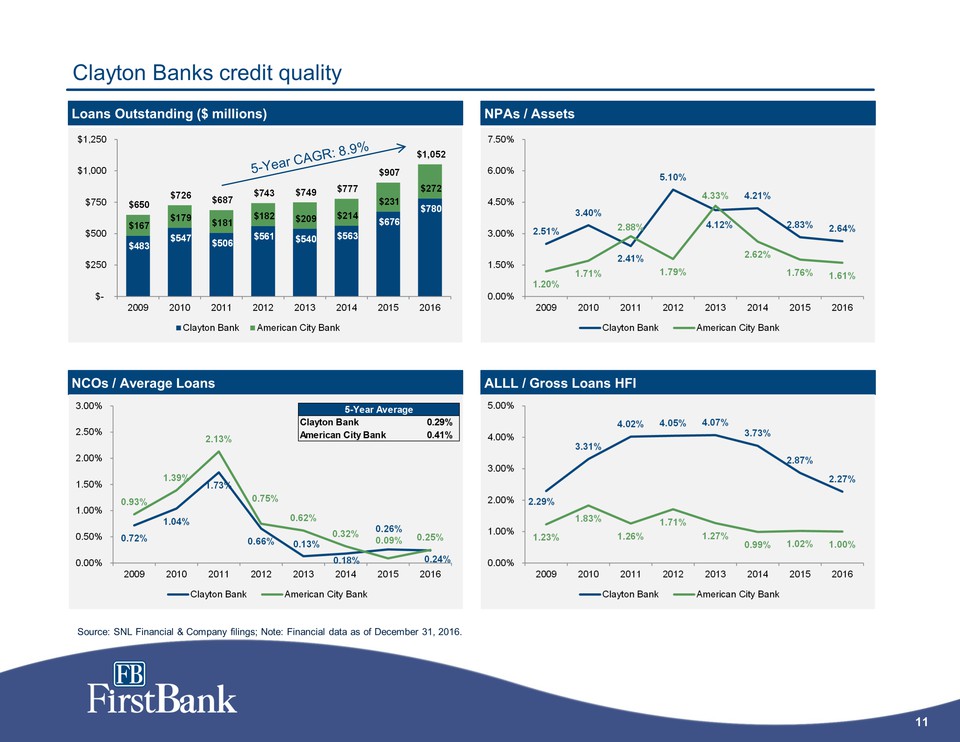

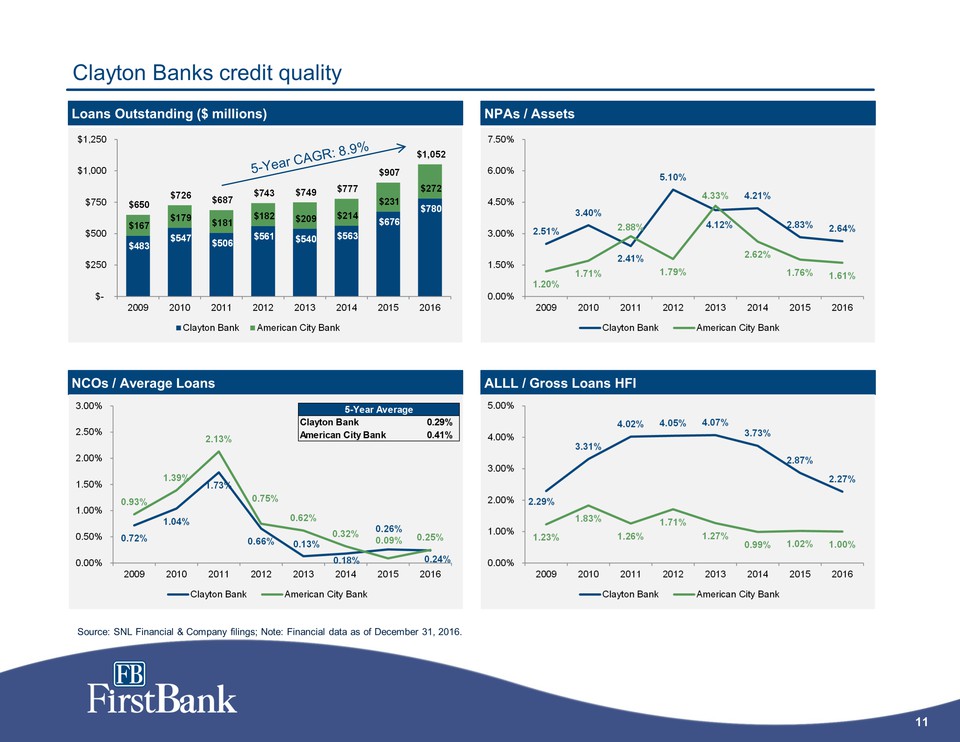

Clayton Banks credit quality Loans Outstanding ($ millions) NPAs / Assets NCOs / Average Loans ALLL / Gross Loans HFI 5-Year CAGR: 8.9% Source: SNL Financial & Company filings; Note: Financial data as of December 31, 2016.

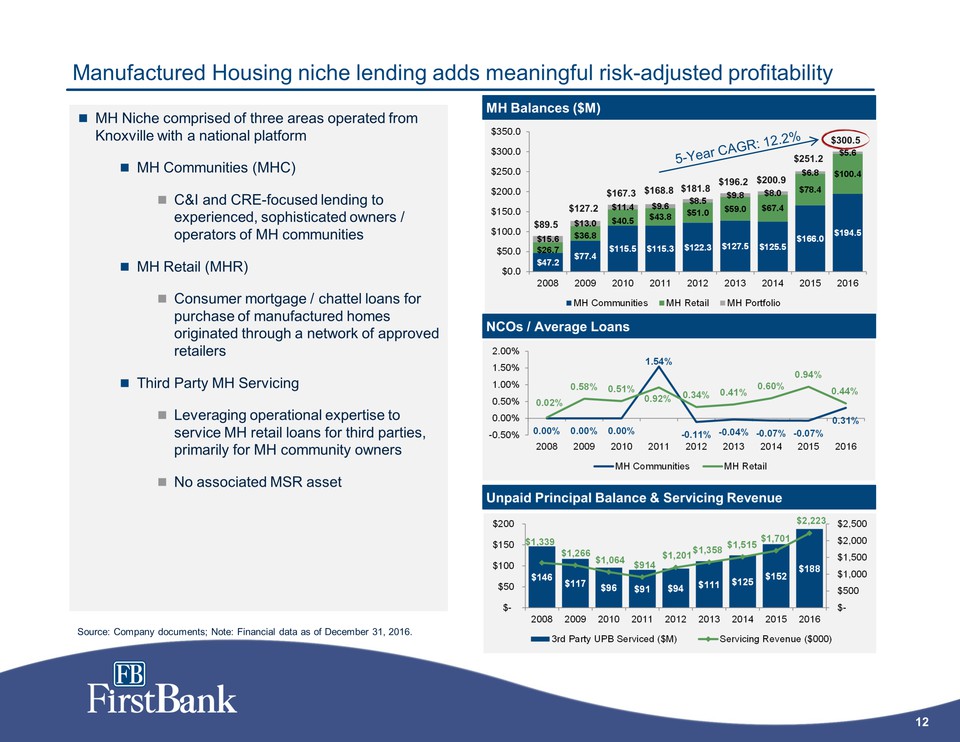

Manufactured Housing niche lending adds meaningful risk-adjusted profitability MH Balances ($M) MH Niche comprised of three areas operated from Knoxville with a national platform MH Communities (MHC) C&I and CRE-focused lending to experienced, sophisticated owners / operators of MH communities MH Retail (MHR)Consumer mortgage / chattel loans for purchase of manufactured homes originated through a network of approved retailers Third Party MH Servicing Leveraging operational expertise to service MH retail loans for third parties, primarily for MH community owners No associated MSR asset Unpaid Principal Balance & Servicing Revenue NCOs / Average Loans 5-Year CAGR: 12.2% $89.5 $127.2 $167.3 $168.8 $181.8 $196.2 $251.2 $300.5 $200.9 Source: Company documents; Note: Financial data as of December 31, 2016.

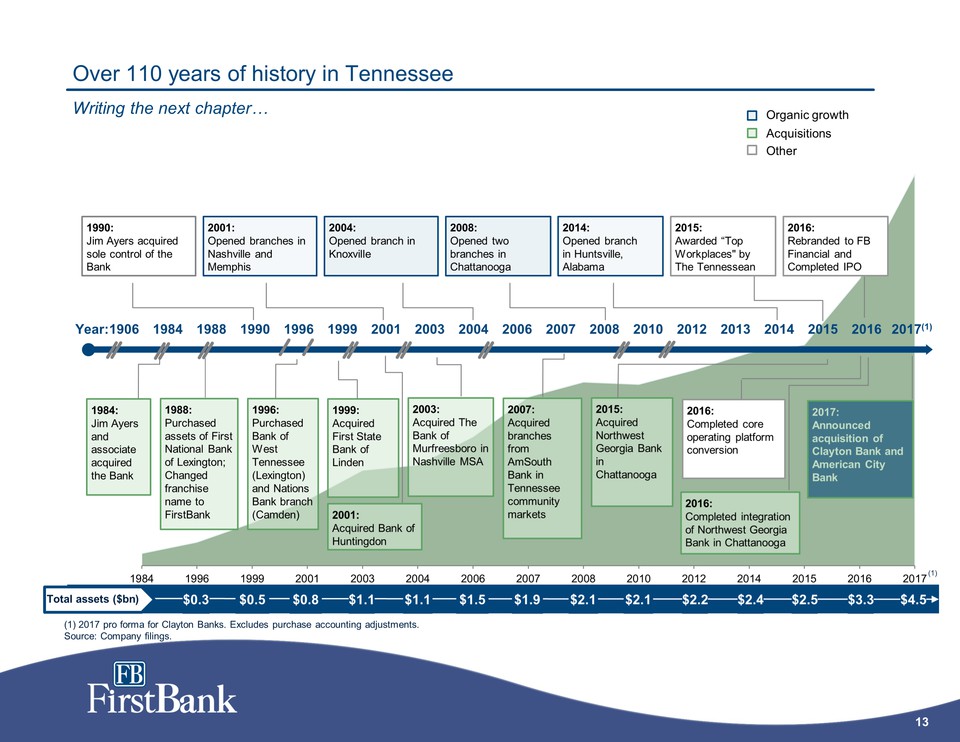

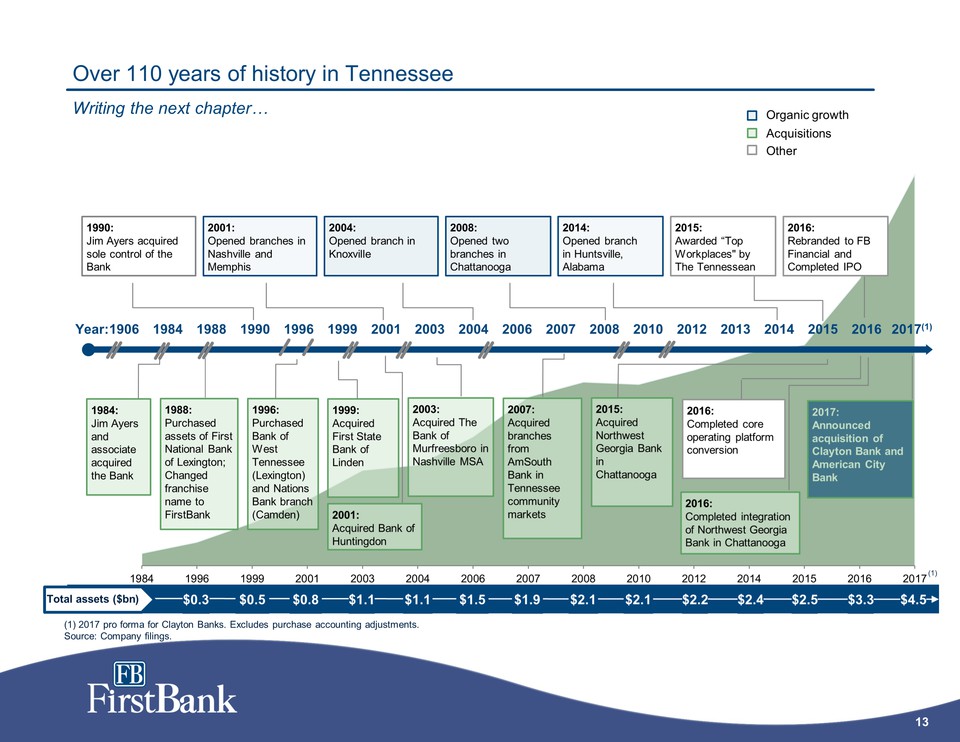

Over 110 years of history in Tennessee Writing the next chapter… 2003: Acquired The Bank of Murfreesboro in Nashville MSA 2007: Acquired branches from AmSouth Bank in Tennessee community markets 1984 1988 1996 1999 2001 2003 2004 2006 2012 2013 2015 Year: 2001: Opened branches in Nashville and Memphis 2004: Opened branch in Knoxville Acquisitions Organic growth Other (1) 2017 pro forma for Clayton Banks. Excludes purchase accounting adjustments. Source: Company filings. 1999: Acquired First State Bank of Linden 1906 2010 2007 2008 2008: Opened two branches in Chattanooga 1990 1996: Purchased Bank of West Tennessee (Lexington) and Nations Bank branch (Camden) 2001: Acquired Bank of Huntingdon 2014 2014: Opened branch in Huntsville, Alabama 1990: Jim Ayers acquired sole control of the Bank 2016 $0.3 $0.5 $0.8 $1.1 $1.1 $1.5 $2.2 $2.4 $2.5 $3.3 $1.9 $2.1 $2.1 $4.5 2016:Completed core operating platform conversion 2016:Completed integration of Northwest Georgia Bank in Chattanooga 2015: Awarded “Top Workplaces" by The Tennessean 2016:Rebranded to FB Financial and Completed IPO 1988: Purchased assets of First National Bank of Lexington; Changed franchise name to FirstBank 1984: Jim Ayers and associate acquired the Bank 2015: Acquired Northwest Georgia Bank in Chattanooga Total assets ($bn) 2017(1) 2017:Announced acquisition of Clayton Bank and American City Bank (1)

Appendix

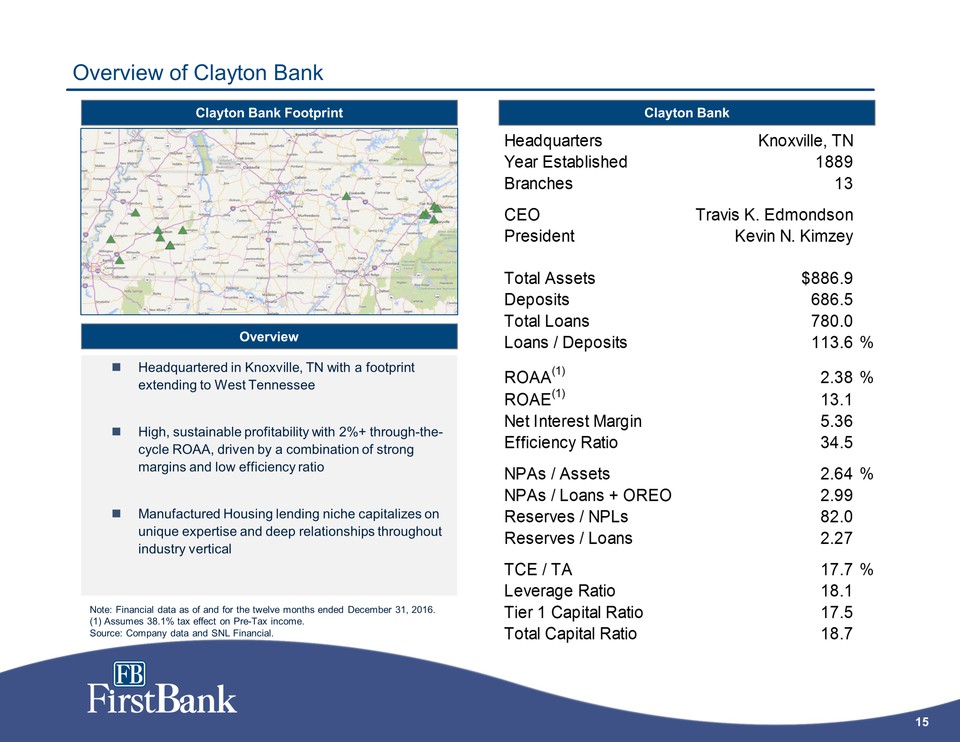

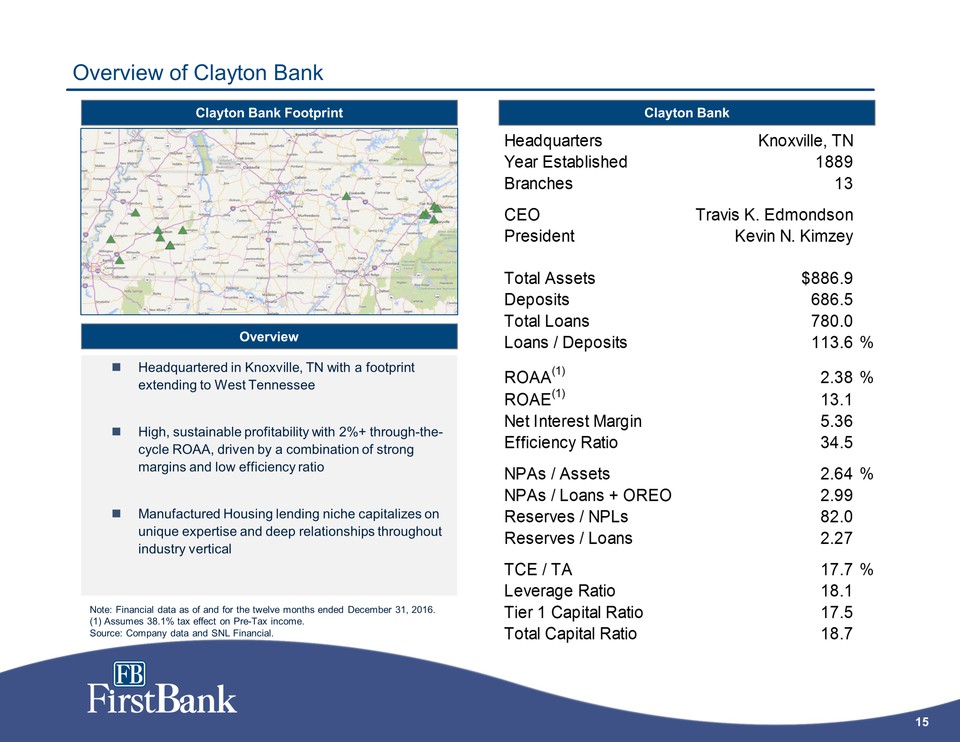

Headquartered in Knoxville, TN with a footprint extending to West Tennessee High, sustainable profitability with 2%+ through-the-cycle ROAA, driven by a combination of strong margins and low efficiency ratio Manufactured Housing lending niche capitalizes on unique expertise and deep relationships throughout industry vertical Overview of Clayton Bank Clayton Bank Footprint Overview Note: Financial data as of and for the twelve months ended December 31, 2016.(1) Assumes 38.1% tax effect on Pre-Tax income. Source: Company data and SNL Financial. Clayton Bank

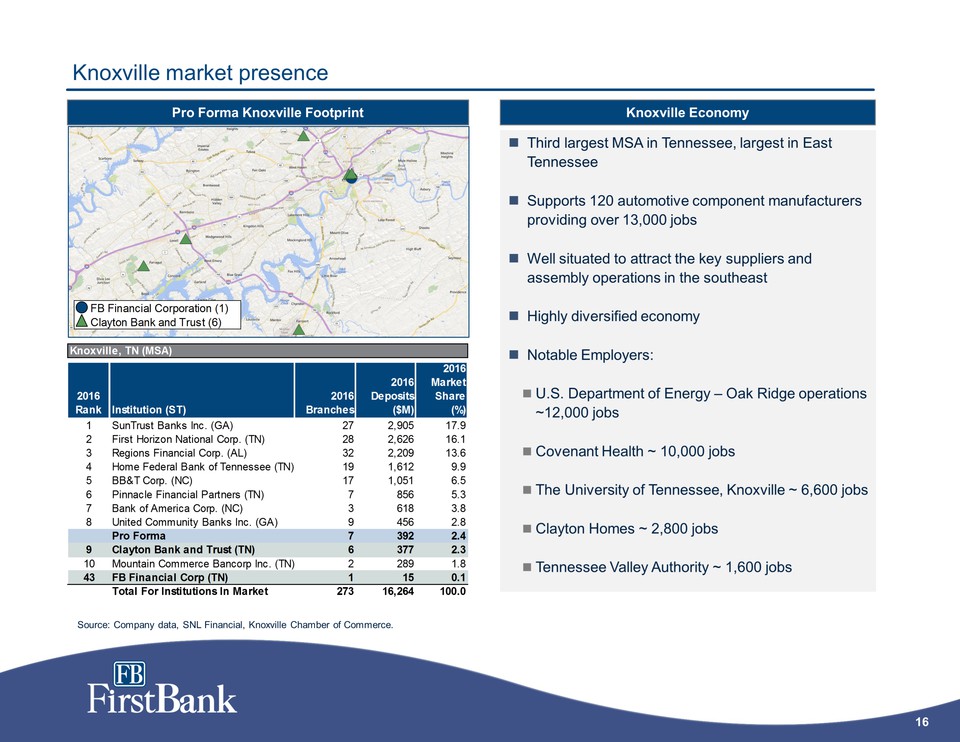

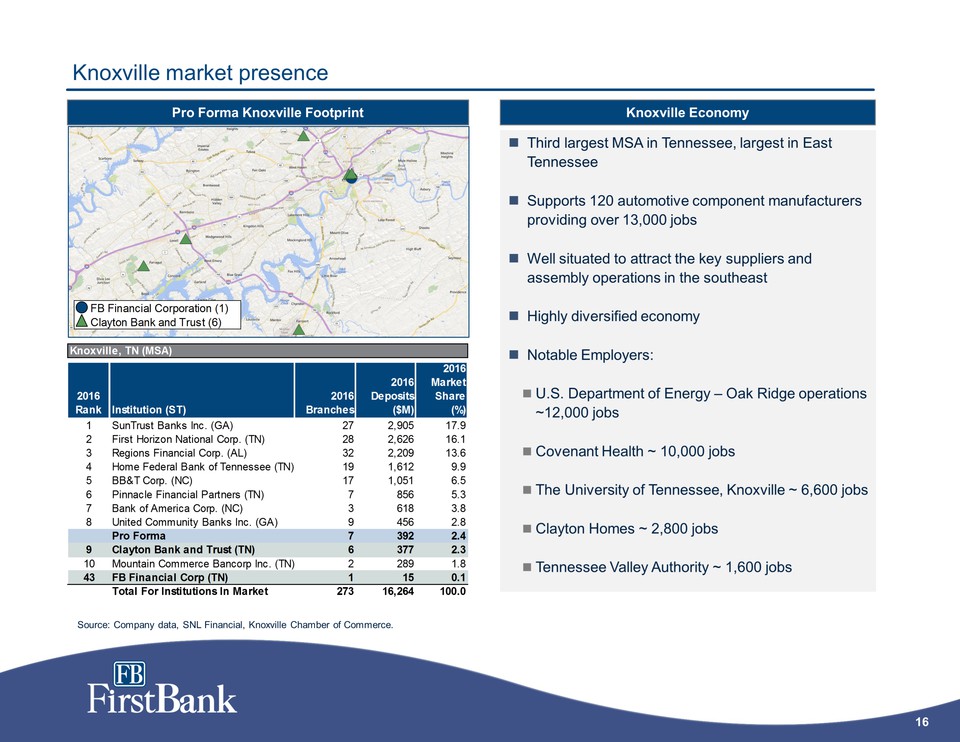

Knoxville market presence Pro Forma Knoxville Footprint Third largest MSA in Tennessee, largest in East Tennessee Supports 120 automotive component manufacturers providing over 13,000 jobs Well situated to attract the key suppliers and assembly operations in the southeast Highly diversified economy Notable Employers: U.S. Department of Energy – Oak Ridge operations ~12,000 jobs Covenant Health ~ 10,000 jobs The University of Tennessee, Knoxville ~ 6,600 jobs Clayton Homes ~ 2,800 jobs Tennessee Valley Authority ~ 1,600 jobs Knoxville Economy Source: Company data, SNL Financial, Knoxville Chamber of Commerce.

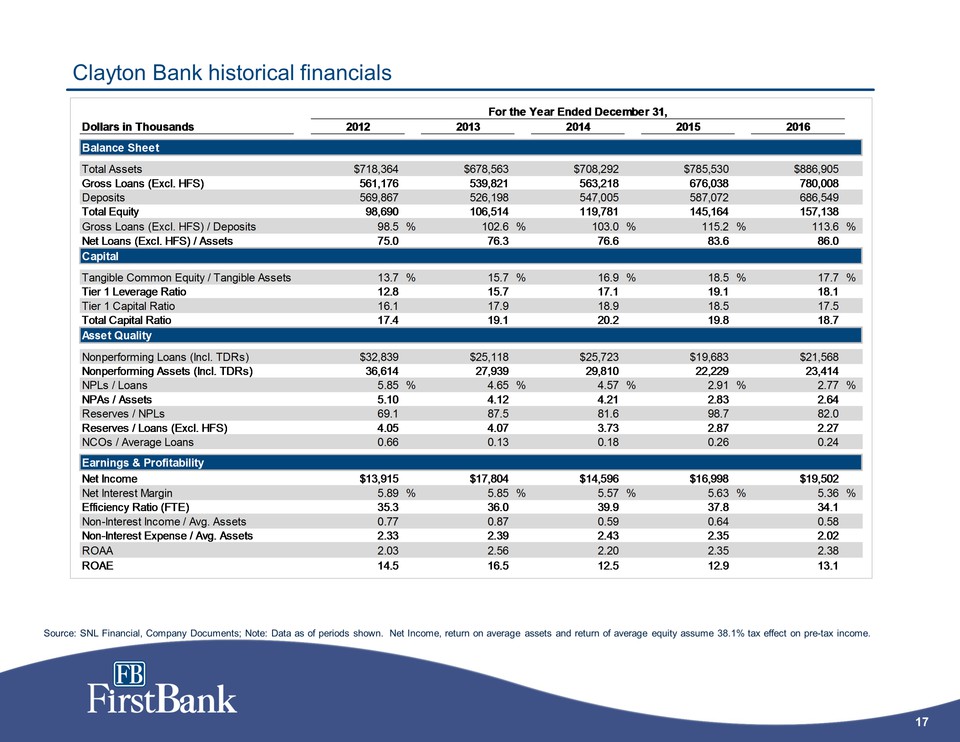

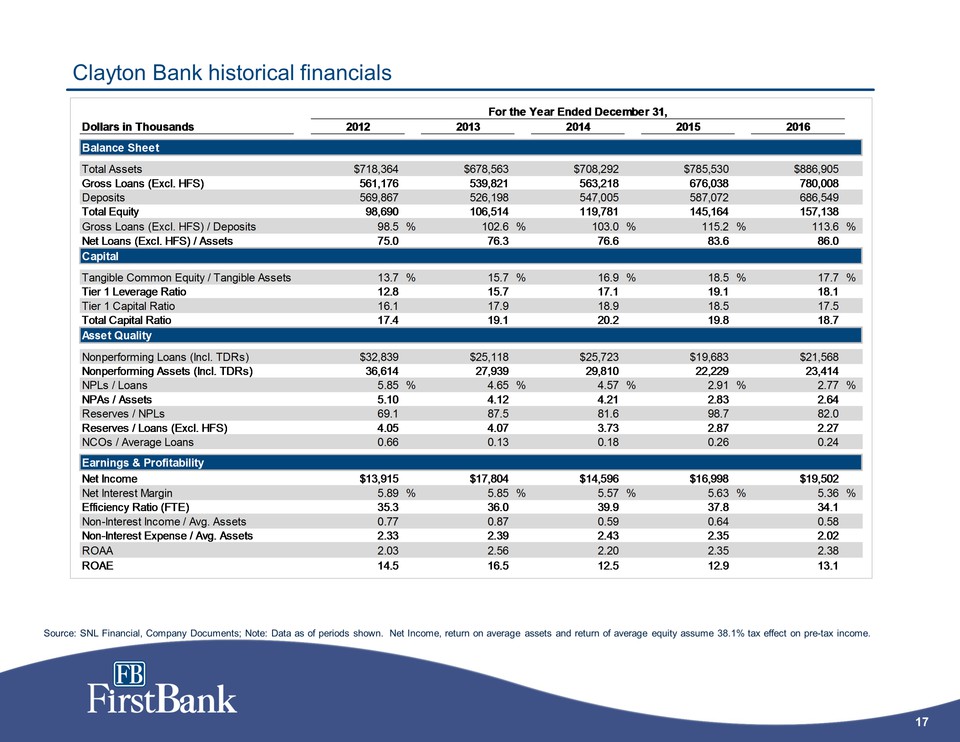

Clayton Bank historical financials Source: SNL Financial, Company Documents; Note: Data as of periods shown. Net Income, return on average assets and return of average equity assume 38.1% tax effect on pre-tax income.

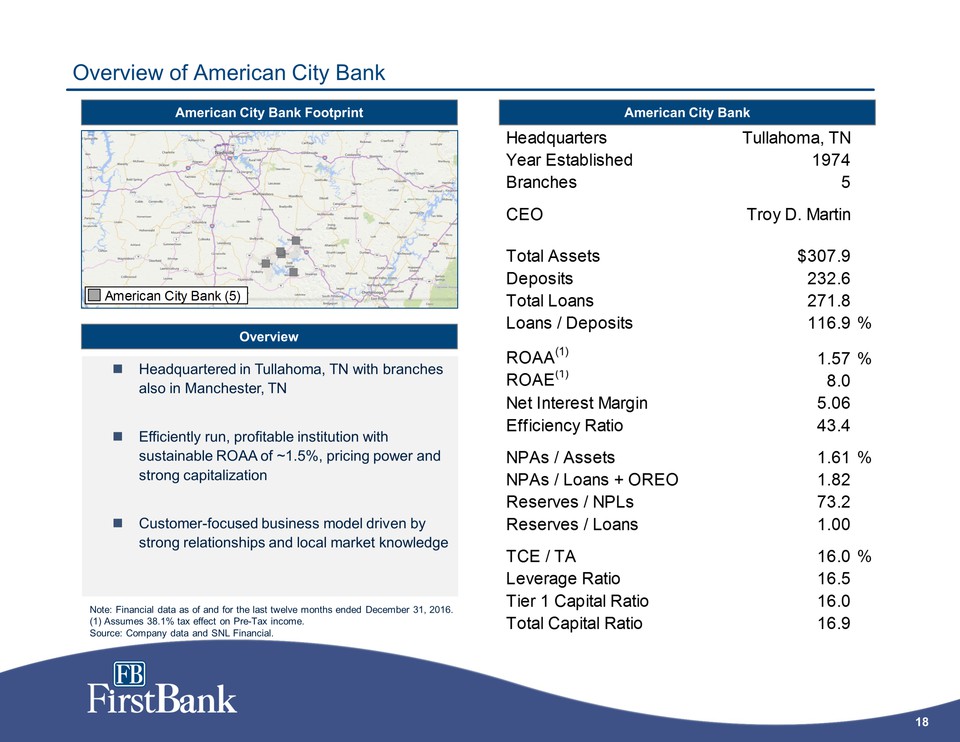

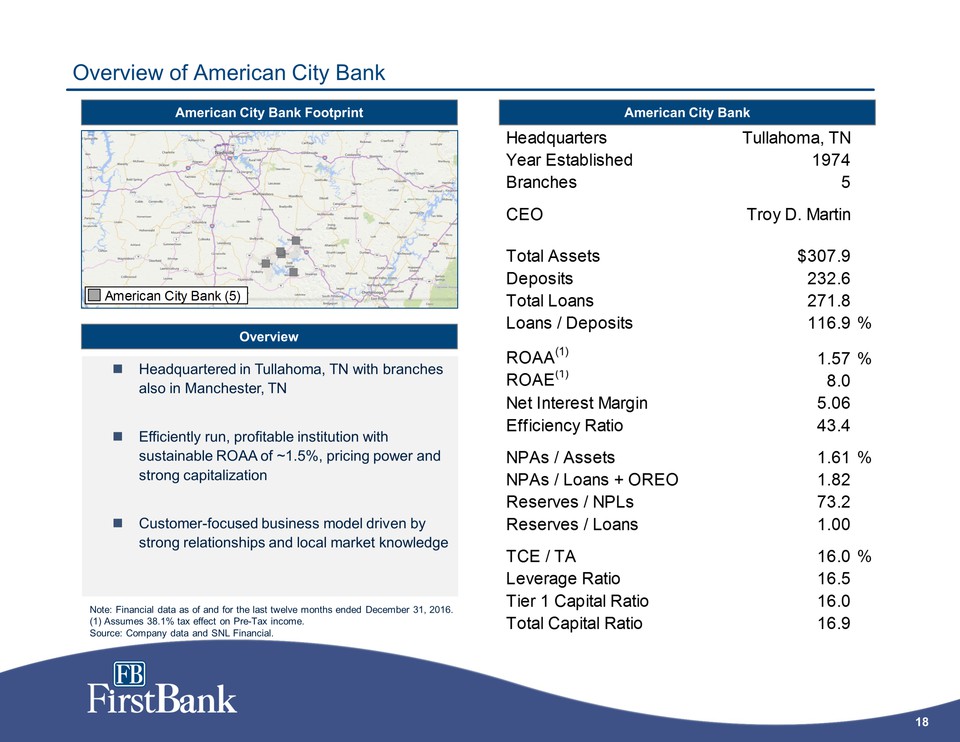

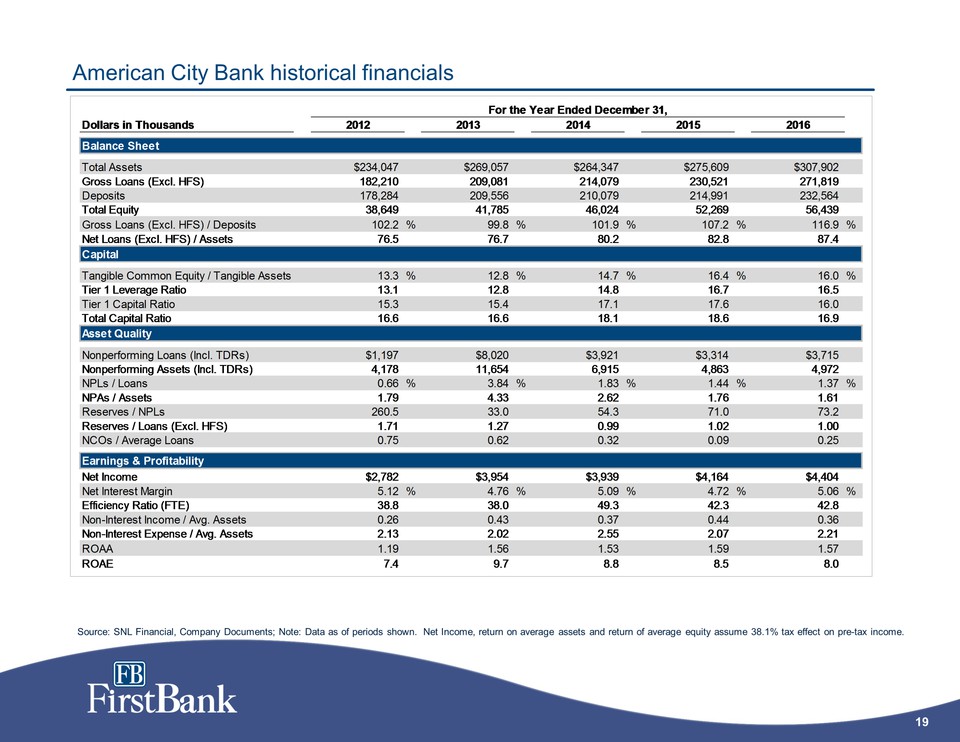

Overview of American City Bank American City Bank Footprint Overview Headquartered in Tullahoma, TN with branches also in Manchester, TN Efficiently run, profitable institution with sustainable ROAA of ~1.5%, pricing power and strong capitalization Customer-focused business model driven by strong relationships and local market knowledge American City Bank Note: Financial data as of and for the last twelve months ended December 31, 2016.(1) Assumes 38.1% tax effect on Pre-Tax income. Source: Company data and SNL Financial.

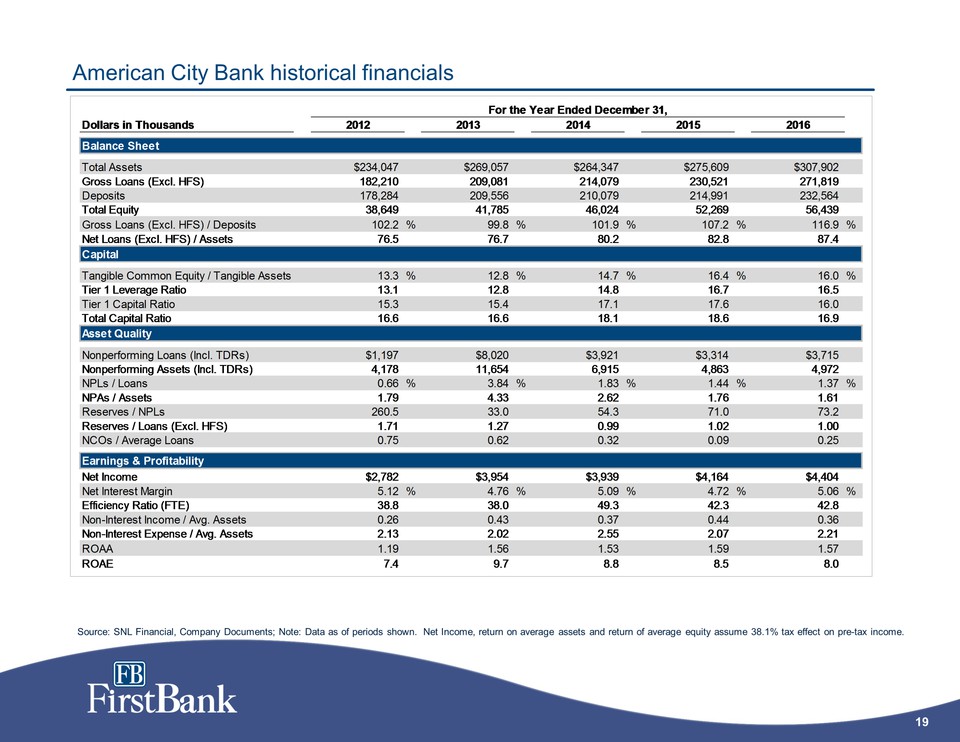

American City Bank historical financials Source: SNL Financial, Company Documents; Note: Data as of periods shown. Net Income, return on average assets and return of average equity assume 38.1% tax effect on pre-tax income.

Enhances both metro and community market presence Source: Company filings, SNL Financial; Note: Deposit data as of June 30, 2016.

Pro forma loan portfolio bolsters commercial lending platform Source: Company filings; Note: Financial data (including pro forma data) as of December 31, 2016. FB Financial data based on GAAP data. Clayton Bank and Trust and American City Bank based on regulatory data. Excludes purchase accounting adjustments.

Pro forma deposit composition remains transaction account-focused Source: Company filings; Note: Financial data (including pro forma data) as of December 31, 2016. FB Financial data based on GAAP data. Clayton Bank and Trust and American City Bank based on regulatory data. Excludes purchase accounting adjustments.