Fourth Quarter 2020 Investor Presentation November 10, 2020

Forward–Looking Statements Certain statements contained in this presentation may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, without limitation, statements regarding the projected impact of the COVID-19 global pandemic on FB Financial business operations, statements relating to the timing, benefits, costs, and synergies of the recently completed merger with Franklin Financial Network, Inc. and Franklin Synergy Bank (collectively, “Franklin”) (the “Franklin merger”) and of the recently completed merger with FNB Financial Corp. (“FNB”) (together with the Franklin merger, the “mergers”), and FB Financial’s future plans, results, strategies, and expectations. These statements can generally be identified by the use of the words and phrases “may,” “will,” “should,” “could,” “would,” “goal,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target,” “aim,” “predict,” “continue,” “seek,” “projection,” and other variations of such words and phrases and similar expressions. These forward-looking statements are not historical facts, and are based upon current expectations, estimates, and projections, many of which, by their nature, are inherently uncertain and beyond FB Financial’s control. The inclusion of these forward-looking statements should not be regarded as a representation by FB Financial or any other person that such expectations, estimates, and projections will be achieved. Accordingly, FB Financial cautions shareholders and investors that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict. Although FB Financial believes that the expectations reflected in these forward-looking statements are reasonable as of the date of this presentation, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements including, without limitation, (1) current and future economic conditions, including the effects of declines in housing and commercial real estate prices, high unemployment rates, and any slowdown in economic growth in the local or regional economies in which we operate and/or the U.S. economy generally, (2) the effects of the COVID-19 pandemic, including the magnitude and duration of the pandemic and its impact on general economic and financial market conditions and on FB Financial’s business and FB Financial customers' businesses, results of operations, asset quality and financial condition, (3) changes in government interest rate policies, (4) our ability to effectively manage problem credits, (5) the risk that the cost savings and any revenue synergies from the mergers or another acquisition may not be realized or may take longer than anticipated to be realized, (6) disruption from the mergers with customer, supplier, or employee relationships, (7) the possibility that the costs, fees, expenses, and charges related to the mergers may be greater than anticipated, including as a result of unexpected or unknown factors, events, or liabilities, (8) the risks related to the integrations of the combined businesses following the mergers, including the risk that the integrations will be materially delayed or will be more costly or difficult than expected, (9) the diversion of management time on issues related to the mergers, (10) the ability of FB Financial to effectively manage the larger and more complex operations of the combined company following the Franklin merger, (11) the risks associated with FB Financial’s pursuit of future acquisitions, (12) reputational risk and the reaction of the parties’ respective customers to the mergers, (13) FB Financial’s ability to successfully execute its various business strategies, including its ability to execute on potential acquisition opportunities, (14) the risk of potential litigation or regulatory action related to the Franklin merger, and (15) general competitive, economic, political, and market conditions. Further information regarding FB Financial and factors that could affect the forward-looking statements contained herein can be found in FB Financial's Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020, and its other filings with the SEC. Many of these factors are beyond FB Financial’s ability to control or predict. If one or more events related to these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward-looking statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date of this presentation, and FB Financial undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for FB Financial to predict their occurrence or how they will affect the company. FB Financial qualifies all forward-looking statements by these cautionary statements. 1

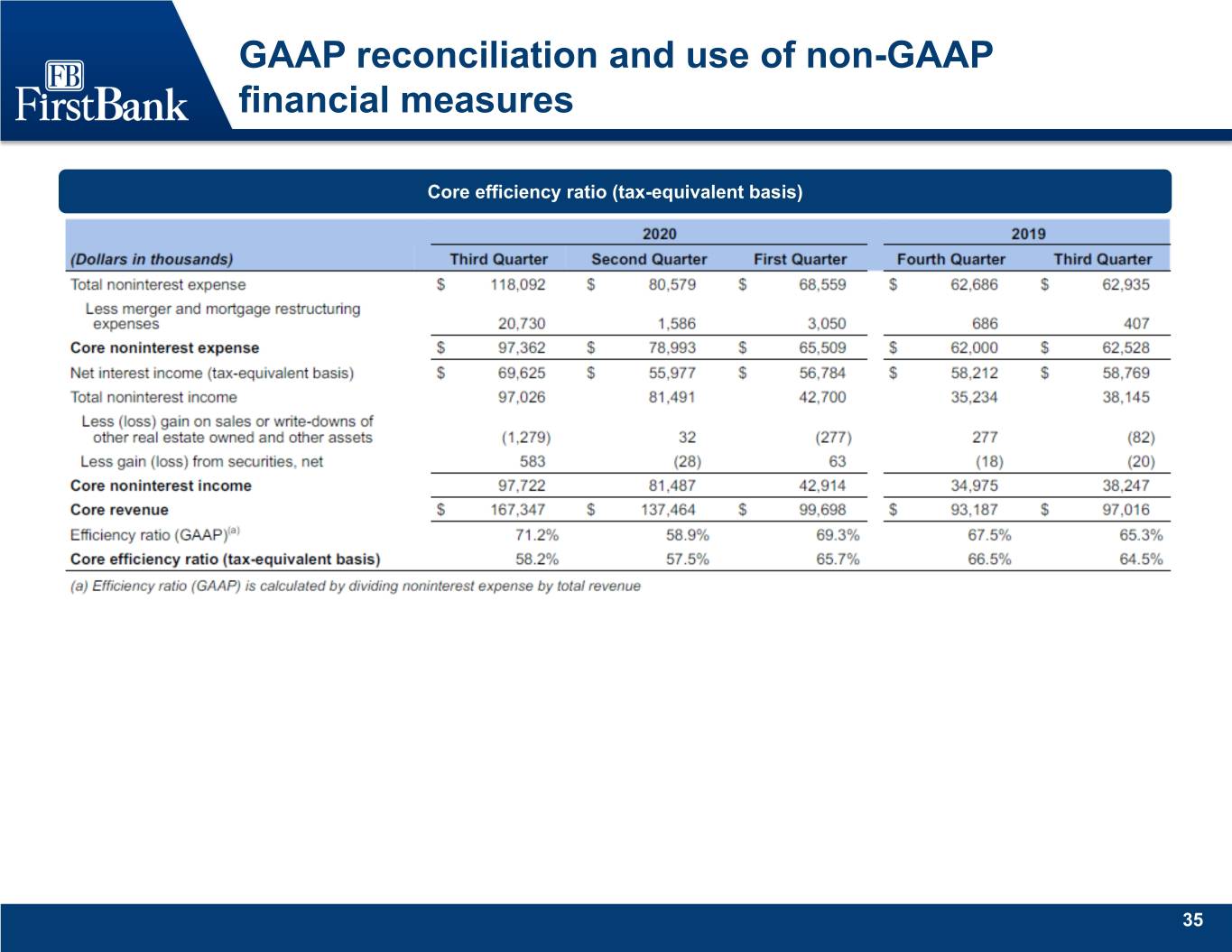

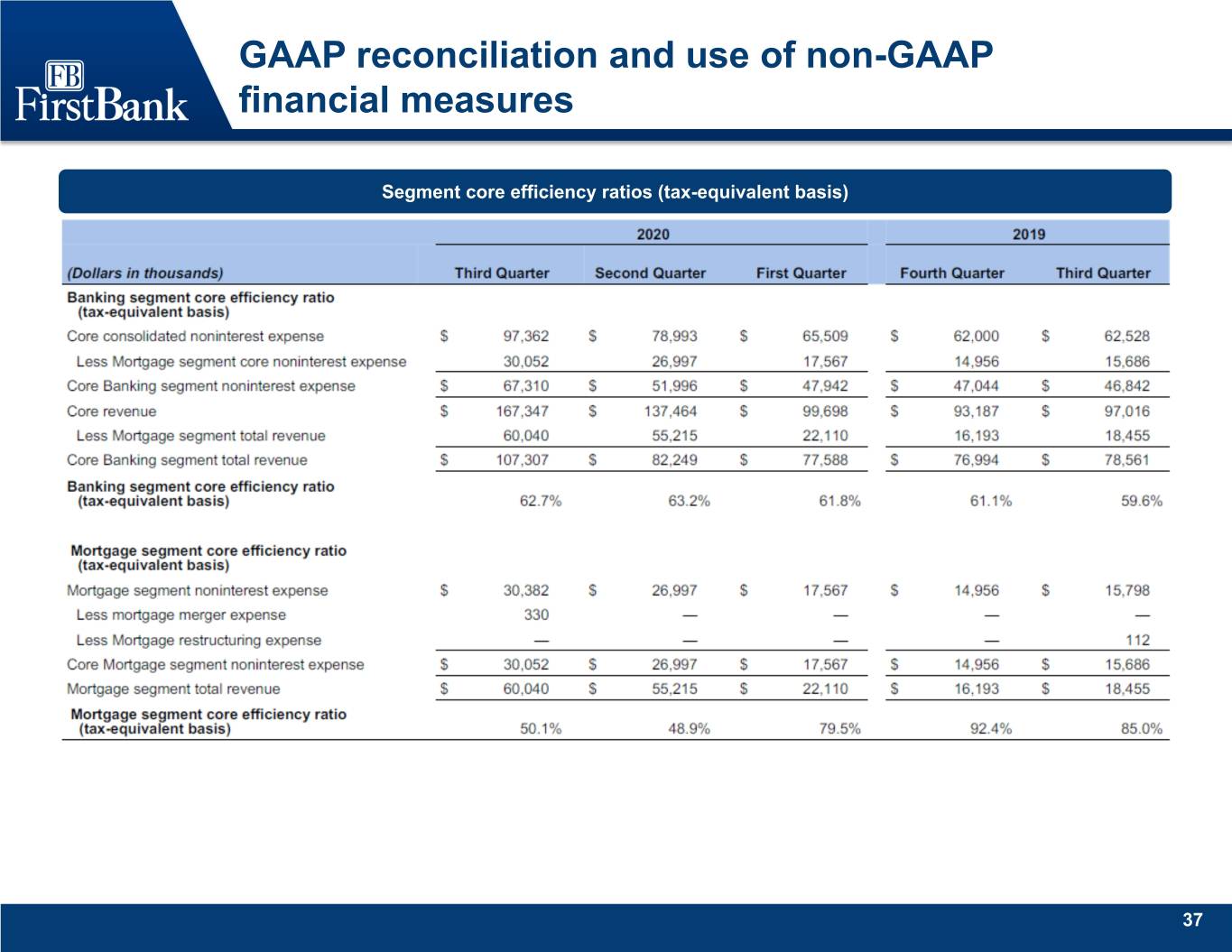

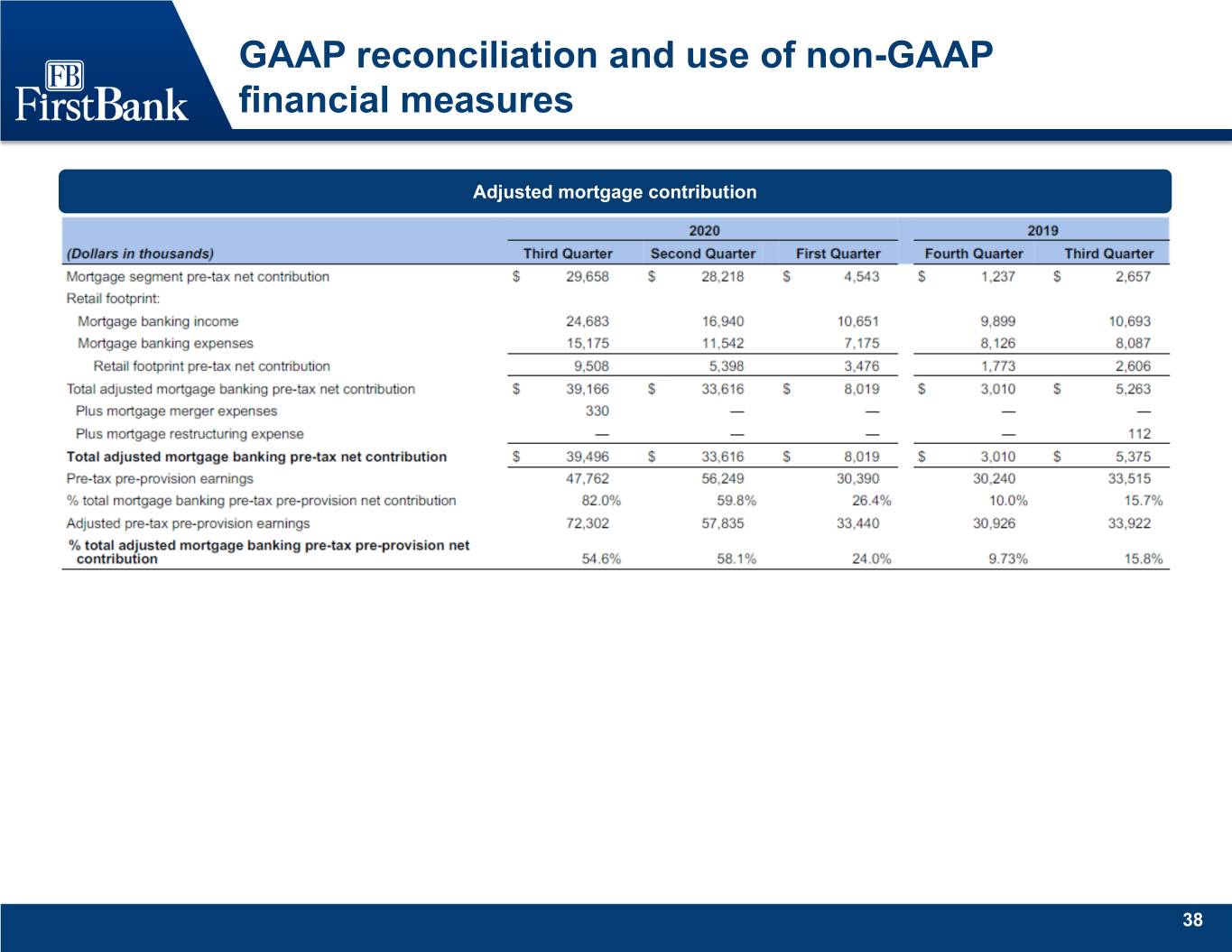

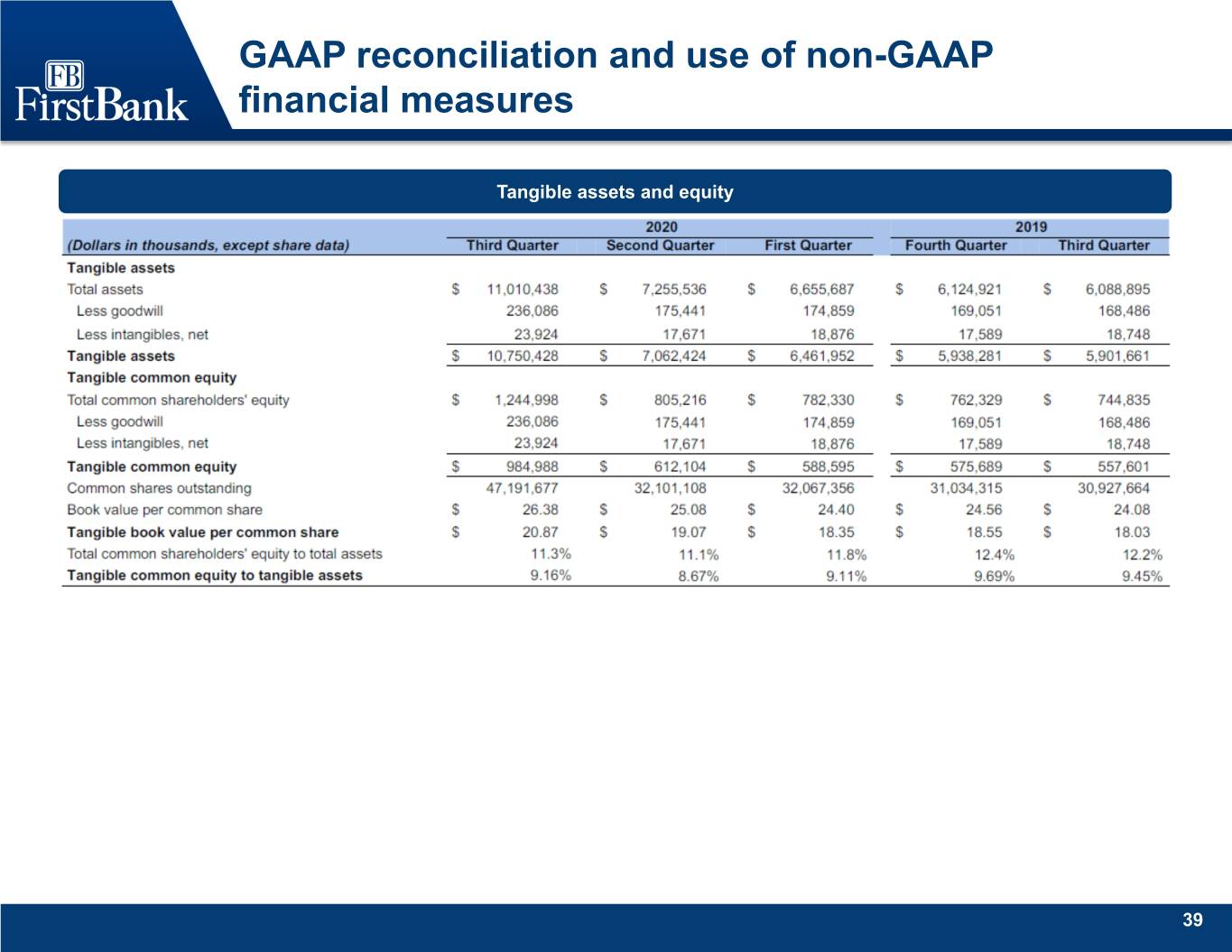

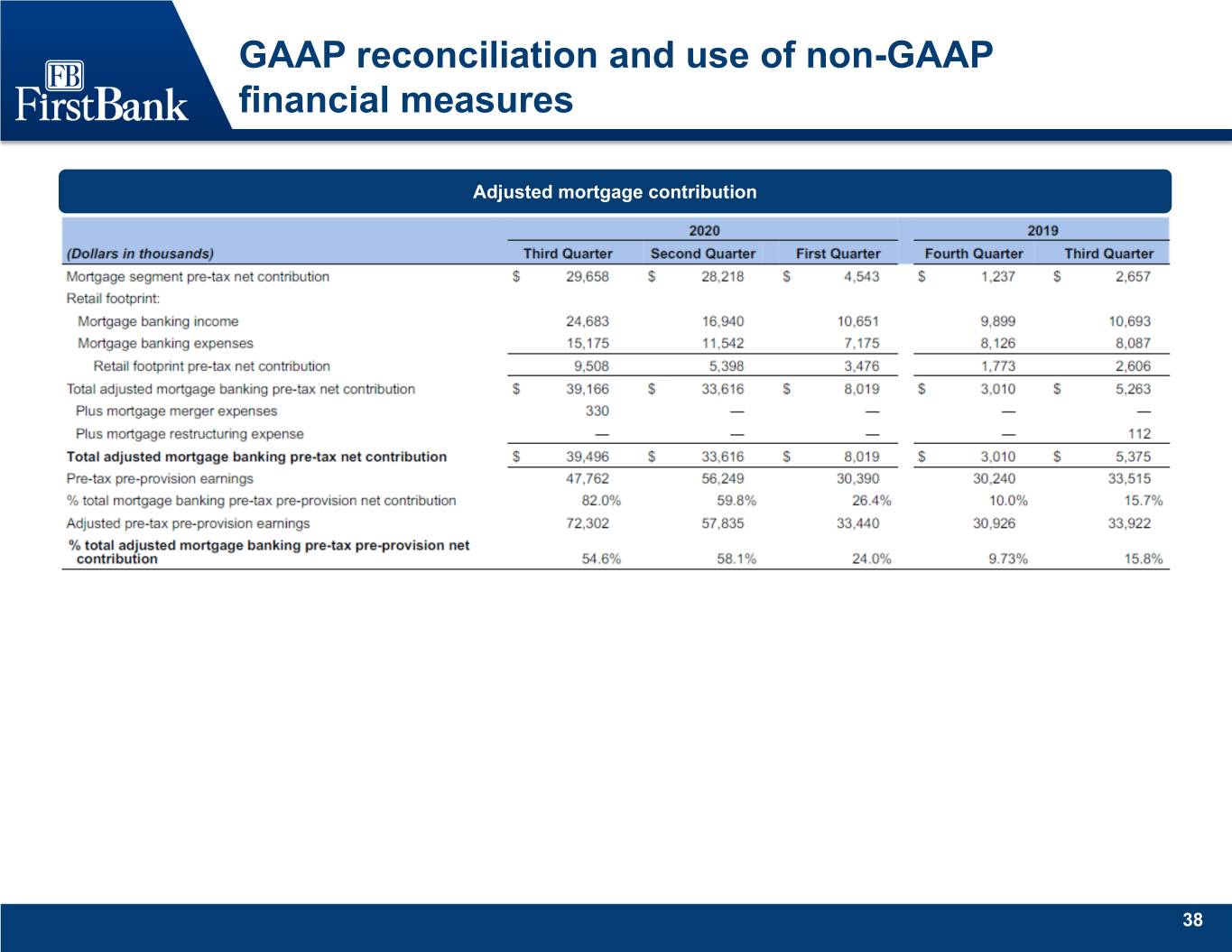

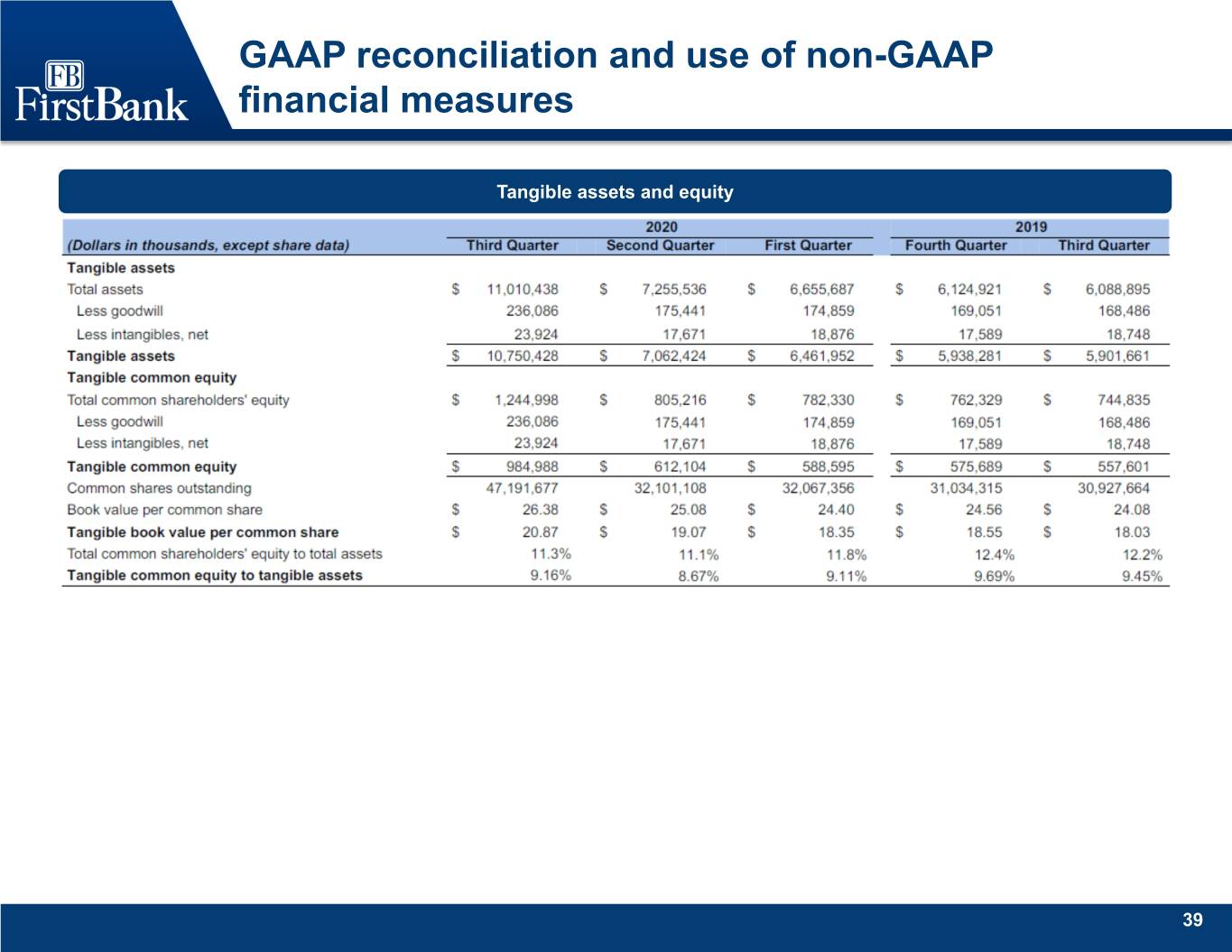

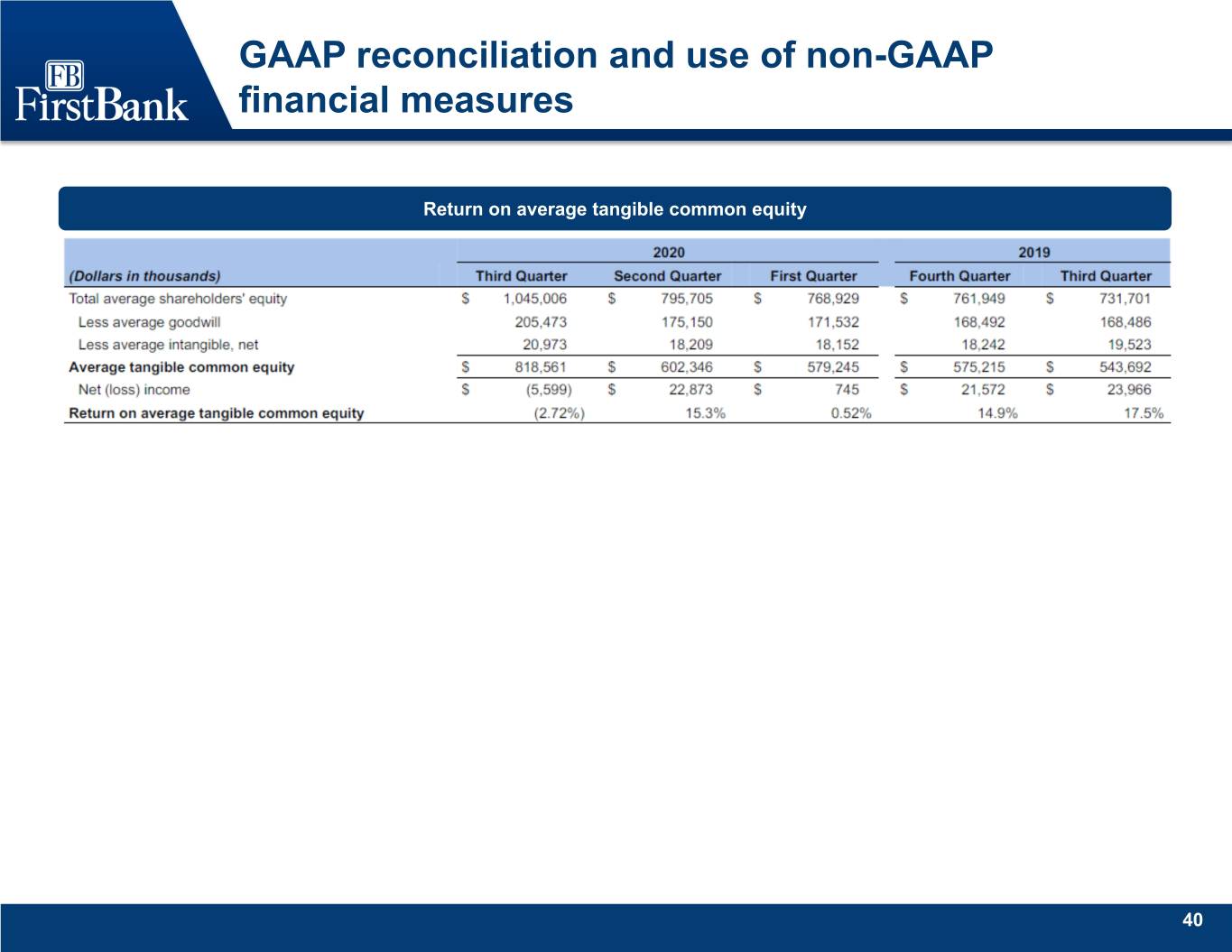

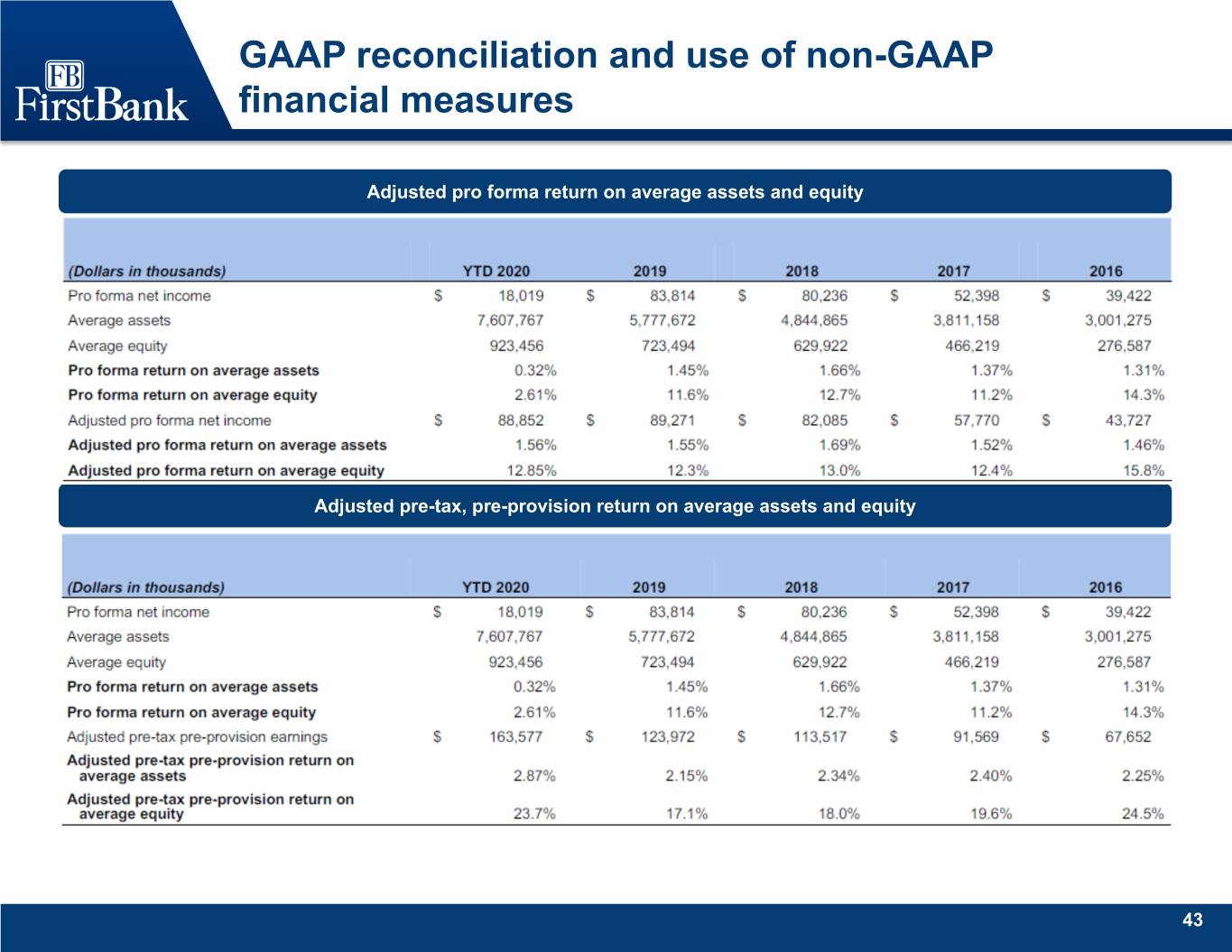

Use of non-GAAP financial measures This presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. These non‐GAAP financial measures include, without limitation, adjusted net income, adjusted diluted earnings per share, adjusted pro forma net income, adjusted pro forma diluted earnings per share, pre-tax, pre-provision earnings, adjusted pre-tax, pre- provision earnings, adjusted pre-tax, pre-provision earnings per share, core noninterest expense, core revenue, core noninterest income, core efficiency ratio (tax-equivalent basis), banking segment core efficiency ratio (tax-equivalent basis), mortgage segment core efficiency ratio (tax-efficiency basis), adjusted mortgage contribution, adjusted return on average assets and equity, pro forma return on average assets and equity, pro forma adjusted return on average assets, equity and tangible common equity and adjusted pre-tax, pre-provision return on average assets, equity and tangible common equity and adjusted allowance for credit losses to loans held for investment. Each of these non-GAAP metrics excludes certain income and expense items that FB Financial’s management considers to be non‐core/adjusted in nature. FB Financial refers to these non‐GAAP measures as adjusted or core measures. This presentation also presents tangible assets, tangible common equity, tangible book value per common share and tangible common equity to tangible assets. Each of these non-GAAP metrics excludes the impact of goodwill and other intangibles. FB Financial’s management uses these non-GAAP financial measures in their analysis of FB Financial’s performance, financial condition and the efficiency of its operations as management believes such measures facilitate period-to-period comparisons and provide meaningful indications of its operating performance as they eliminate both gains and charges that management views as non-recurring or not indicative of operating performance. Management believes that these non-GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrating the effects of significant non-core gains and charges in the current and prior periods. FB Financial’s management also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding FB Financial’s underlying operating performance and in the analysis of ongoing operating trends. In addition, because intangible assets such as goodwill and other intangibles, and the other items excluded each vary extensively from company to company, FB Financial believes that the presentation of this information allows investors to more easily compare FB Financial’s results to the results of other companies. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. FB Financial strongly encourages interested parties to review the GAAP financial measures included in this presentation and not to place undue reliance upon any single financial measure. Moreover, the manner in which FB Financial calculates the non-GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. You should understand how such other banking organizations calculate their financial measures similar or with names similar to the non-GAAP financial measures FB Financial has discussed herein when comparing such non-GAAP financial measures. The tables in the Appendix of this presentation provide a reconciliation of these measures to the most directly comparable GAAP financial measures. 2

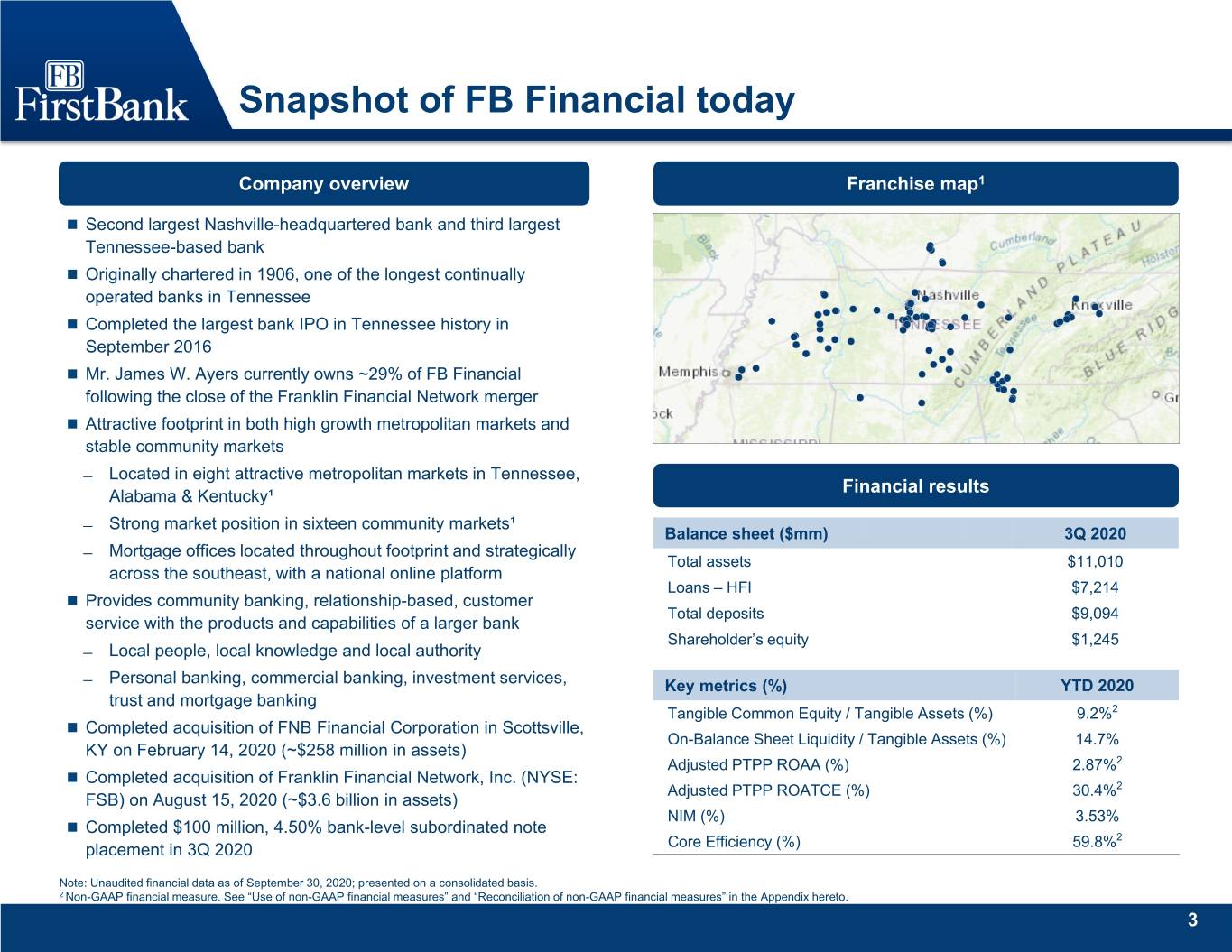

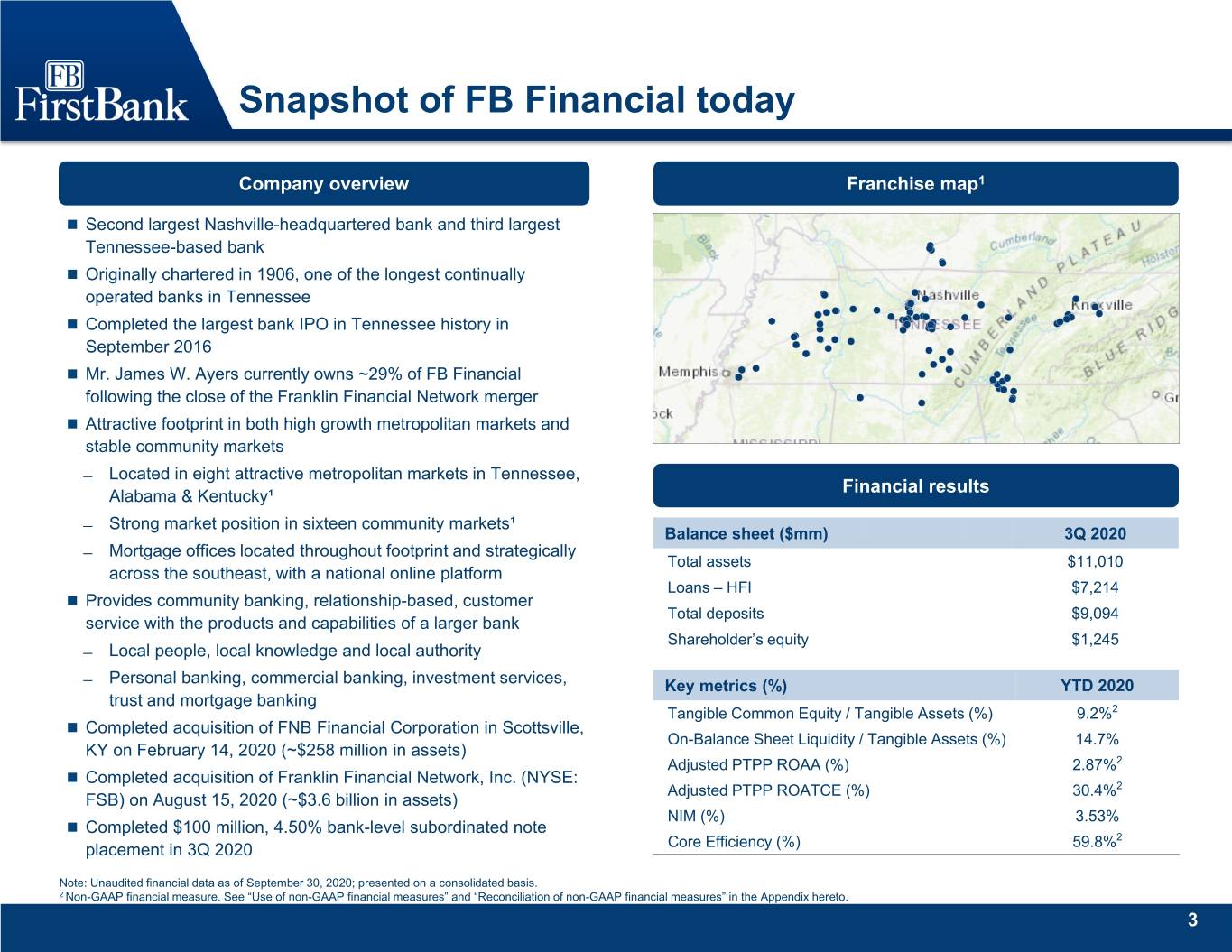

Snapshot of FB Financial today Company overview Franchise map1 Second largest Nashville-headquartered bank and third largest Tennessee-based bank Originally chartered in 1906, one of the longest continually operated banks in Tennessee 100% stockholder of FirstBank Completed the largest bank IPO in Tennessee history in September 2016 Mr. James W. Ayers currently owns ~29% of FB Financial following the close of the Franklin Financial Network merger Attractive footprint in both high growth metropolitan markets and stable community markets ̶ Located in eight attractive metropolitan markets in Tennessee, Alabama & Kentucky¹ Financial results ̶ Strong market position in sixteen community markets¹ Balance sheet ($mm) 3Q 2020 ̶ Mortgage offices located throughout footprint and strategically Total assets $11,010 across the southeast, with a national online platform Loans – HFI $7,214 Provides community banking, relationship-based, customer Total deposits $9,094 service with the products and capabilities of a larger bank Shareholder’s equity $1,245 ̶ Local people, local knowledge and local authority ̶ Personal banking, commercial banking, investment services, Key metrics (%) YTD 2020 trust and mortgage banking Tangible Common Equity / Tangible Assets (%) 9.2%2 Completed acquisition of FNB Financial Corporation in Scottsville, On-Balance Sheet Liquidity / Tangible Assets (%) 14.7% KY on February 14, 2020 (~$258 million in assets) Adjusted PTPP ROAA (%) 2.87%2 Completed acquisition of Franklin Financial Network, Inc. (NYSE: Adjusted PTPP ROATCE (%) 30.4%2 FSB) on August 15, 2020 (~$3.6 billion in assets) NIM (%) 3.53% Completed $100 million, 4.50% bank-level subordinated note 2 placement in 3Q 2020 Core Efficiency (%) 59.8% Note: Unaudited financial data as of September 30, 2020; presented on a consolidated basis. 2 Non-GAAP financial measure. See “Use of non-GAAP financial measures” and “Reconciliation of non-GAAP financial measures” in the Appendix hereto. 3

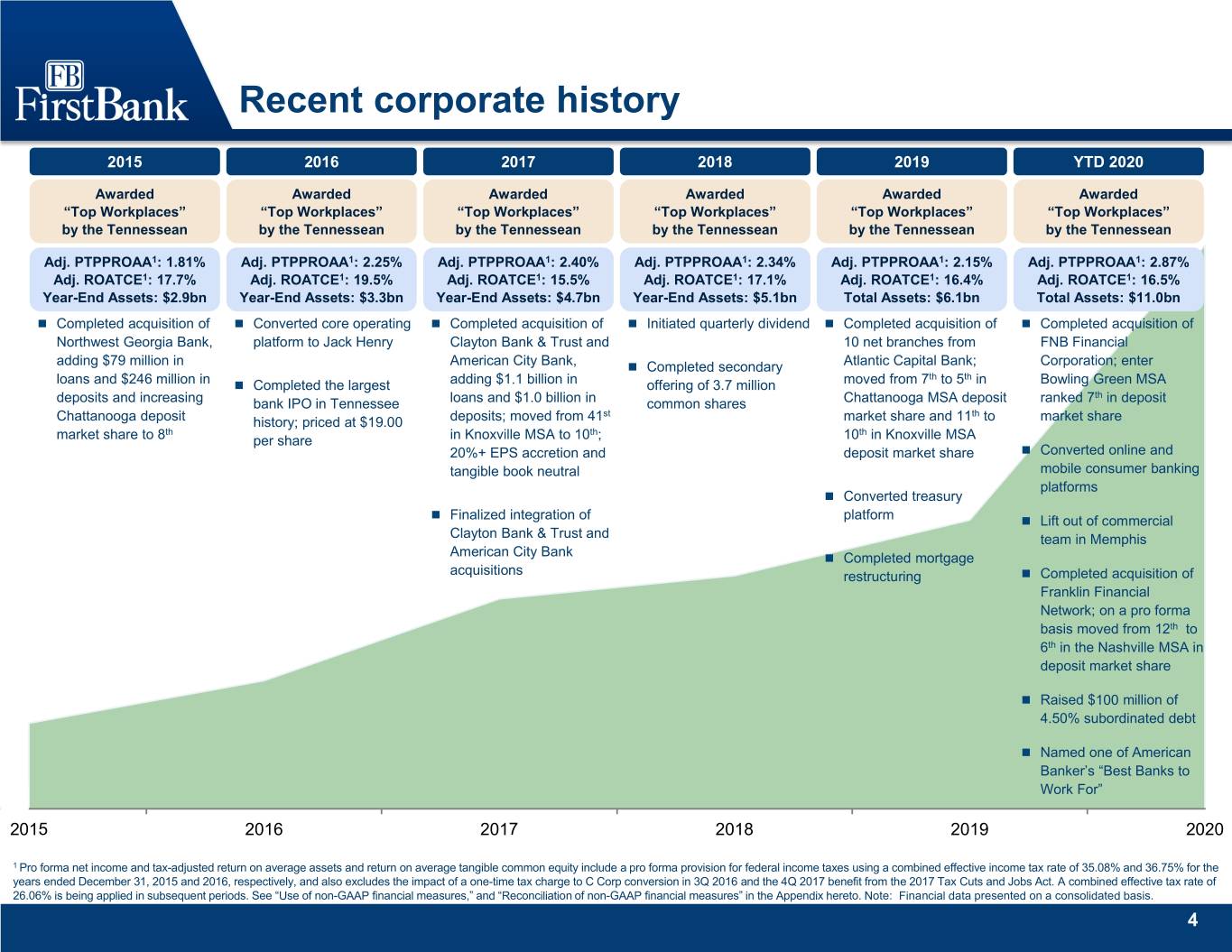

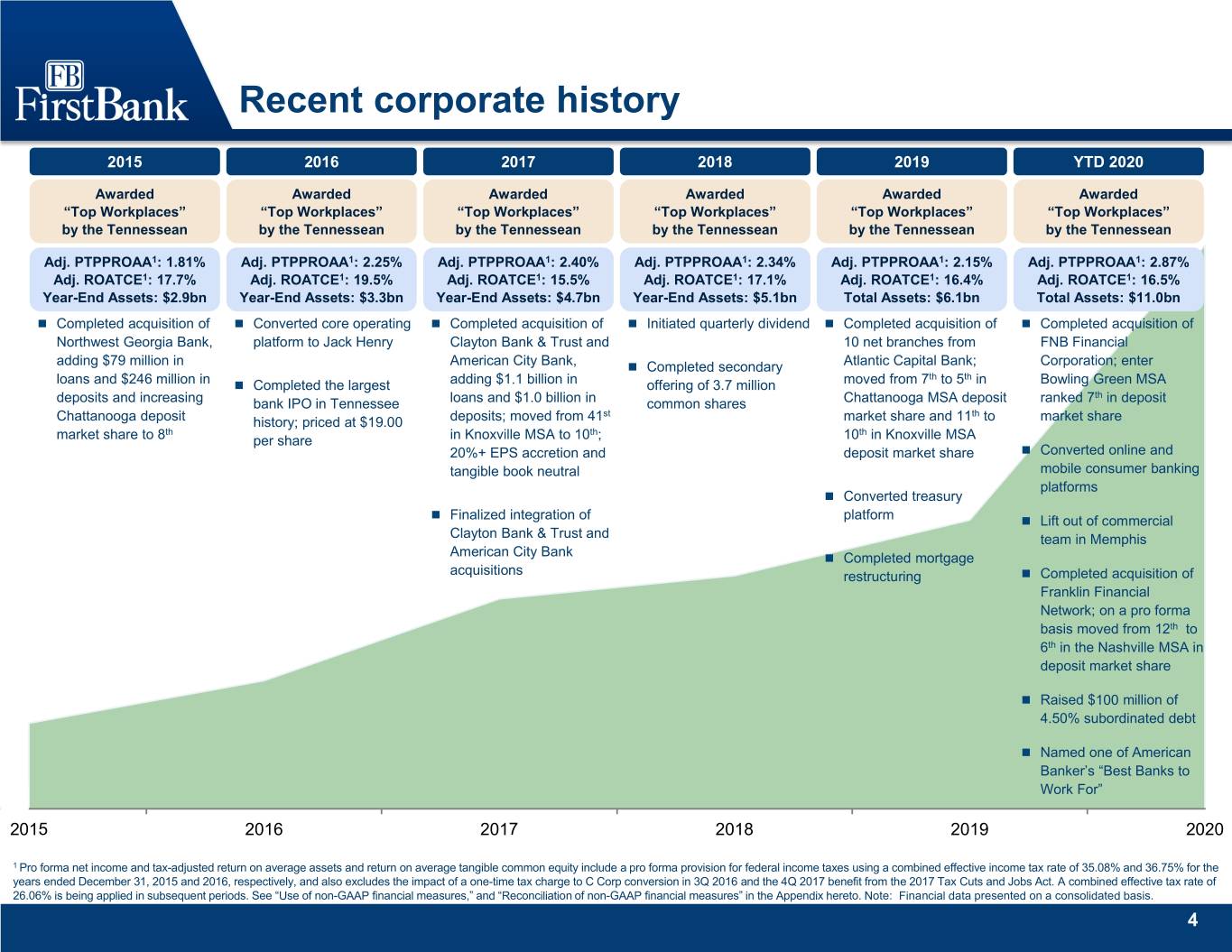

Recent corporate history 2015 2016 2017 2018 2019 YTD 2020 Awarded Awarded Awarded Awarded Awarded Awarded “Top Workplaces” “Top Workplaces” “Top Workplaces” “Top Workplaces” “Top Workplaces” “Top Workplaces” by the Tennessean by the Tennessean by the Tennessean by the Tennessean by the Tennessean by the Tennessean Adj. PTPPROAA1: 1.81% Adj. PTPPROAA1: 2.25% Adj. PTPPROAA1: 2.40% Adj. PTPPROAA1: 2.34% Adj. PTPPROAA1: 2.15% Adj. PTPPROAA1: 2.87% Adj. ROATCE1: 17.7% Adj. ROATCE1: 19.5% Adj. ROATCE1: 15.5% Adj. ROATCE1: 17.1% Adj. ROATCE1: 16.4% Adj. ROATCE1: 16.5% Year-End Assets: $2.9bn Year-End Assets: $3.3bn Year-End Assets: $4.7bn Year-End Assets: $5.1bn Total Assets: $6.1bn Total Assets: $11.0bn Completed acquisition of Converted core operating Completed acquisition of Initiated quarterly dividend Completed acquisition of Completed acquisition of Northwest Georgia Bank, platform to Jack Henry Clayton Bank & Trust and 10 net branches from FNB Financial adding $79 million in American City Bank, Completed secondary Atlantic Capital Bank; Corporation; enter th th loans and $246 million in Completed the largest adding $1.1 billion in offering of 3.7 million moved from 7 to 5 in Bowling Green MSA th deposits and increasing bank IPO in Tennessee loans and $1.0 billion in common shares Chattanooga MSA deposit ranked 7 in deposit st th Chattanooga deposit history; priced at $19.00 deposits; moved from 41 market share and 11 to market share th th th market share to 8 per share in Knoxville MSA to 10 ; 10 in Knoxville MSA 20%+ EPS accretion and deposit market share Converted online and tangible book neutral mobile consumer banking platforms Converted treasury Finalized integration of platform Lift out of commercial Clayton Bank & Trust and team in Memphis American City Bank Completed mortgage acquisitions restructuring Completed acquisition of Franklin Financial Network; on a pro forma basis moved from 12th to 6th in the Nashville MSA in deposit market share Raised $100 million of 4.50% subordinated debt Named one of American Banker’s “Best Banks to Work For” 2015 2016 2017 2018 2019 2020 1 Pro forma net income and tax-adjusted return on average assets and return on average tangible common equity include a pro forma provision for federal income taxes using a combined effective income tax rate of 35.08% and 36.75% for the years ended December 31, 2015 and 2016, respectively, and also excludes the impact of a one-time tax charge to C Corp conversion in 3Q 2016 and the 4Q 2017 benefit from the 2017 Tax Cuts and Jobs Act. A combined effective tax rate of 26.06% is being applied in subsequent periods. See “Use of non-GAAP financial measures,” and “Reconciliation of non-GAAP financial measures” in the Appendix hereto. Note: Financial data presented on a consolidated basis. 4

Strategic drivers Experienced Senior Management Team Strategic M&A and Elite Financial Capital Optimization Performance Scalable Platforms Enabled by Great Place to Work Technology Empowered Teams Across Attractive Metro and Community Markets 5

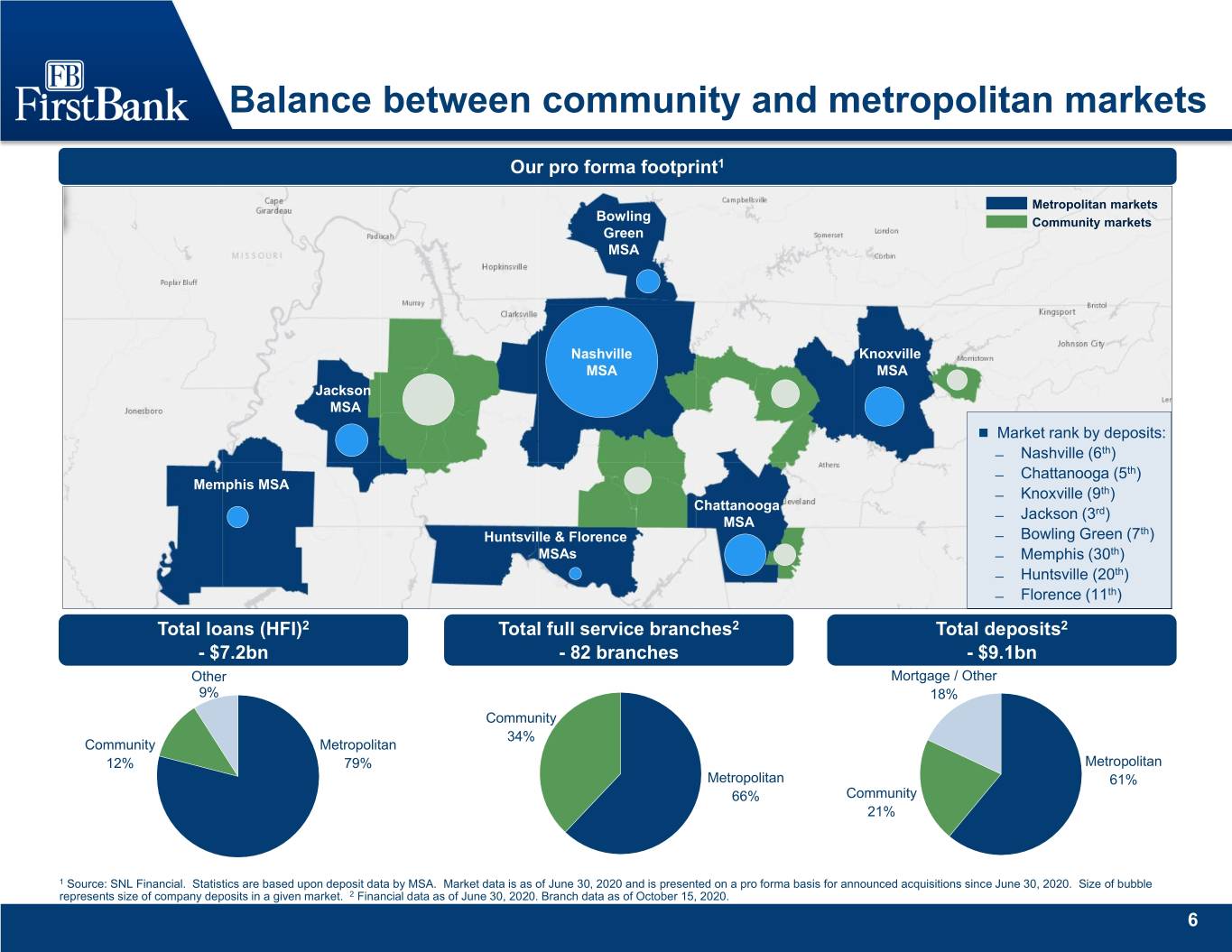

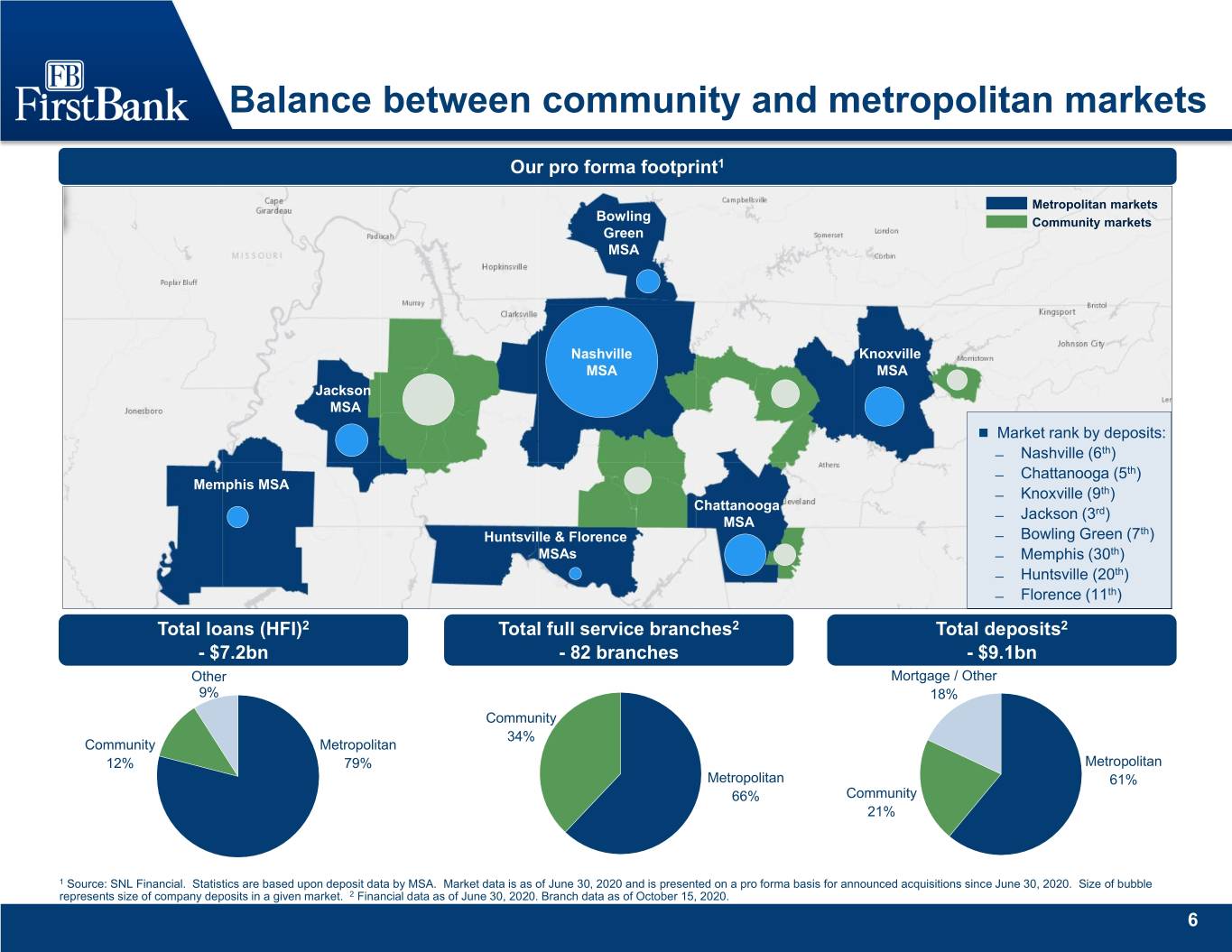

Balance between community and metropolitan markets Our pro forma footprint1 Metropolitan markets Bowling Community markets Green MSA Nashville Knoxville MSA MSA Jackson MSA Market rank by deposits: ̶ Nashville (6th) ̶ Chattanooga (5th) Memphis MSA ̶ Knoxville (9th) Chattanooga ̶ Jackson (3rd) MSA th Huntsville & Florence ̶ Bowling Green (7 ) MSAs ̶ Memphis (30th) ̶ Huntsville (20th) ̶ Florence (11th) Total loans (HFI)2 Total full service branches2 Total deposits2 - $7.2bn - 82 branches - $9.1bn Other Mortgage / Other 9% 18% Community 34% Community Metropolitan 12% 79% Metropolitan Metropolitan 61% 66% Community 21% 1 Source: SNL Financial. Statistics are based upon deposit data by MSA. Market data is as of June 30, 2020 and is presented on a pro forma basis for announced acquisitions since June 30, 2020. Size of bubble represents size of company deposits in a given market. 2 Financial data as of June 30, 2020. Branch data as of October 15, 2020. 6

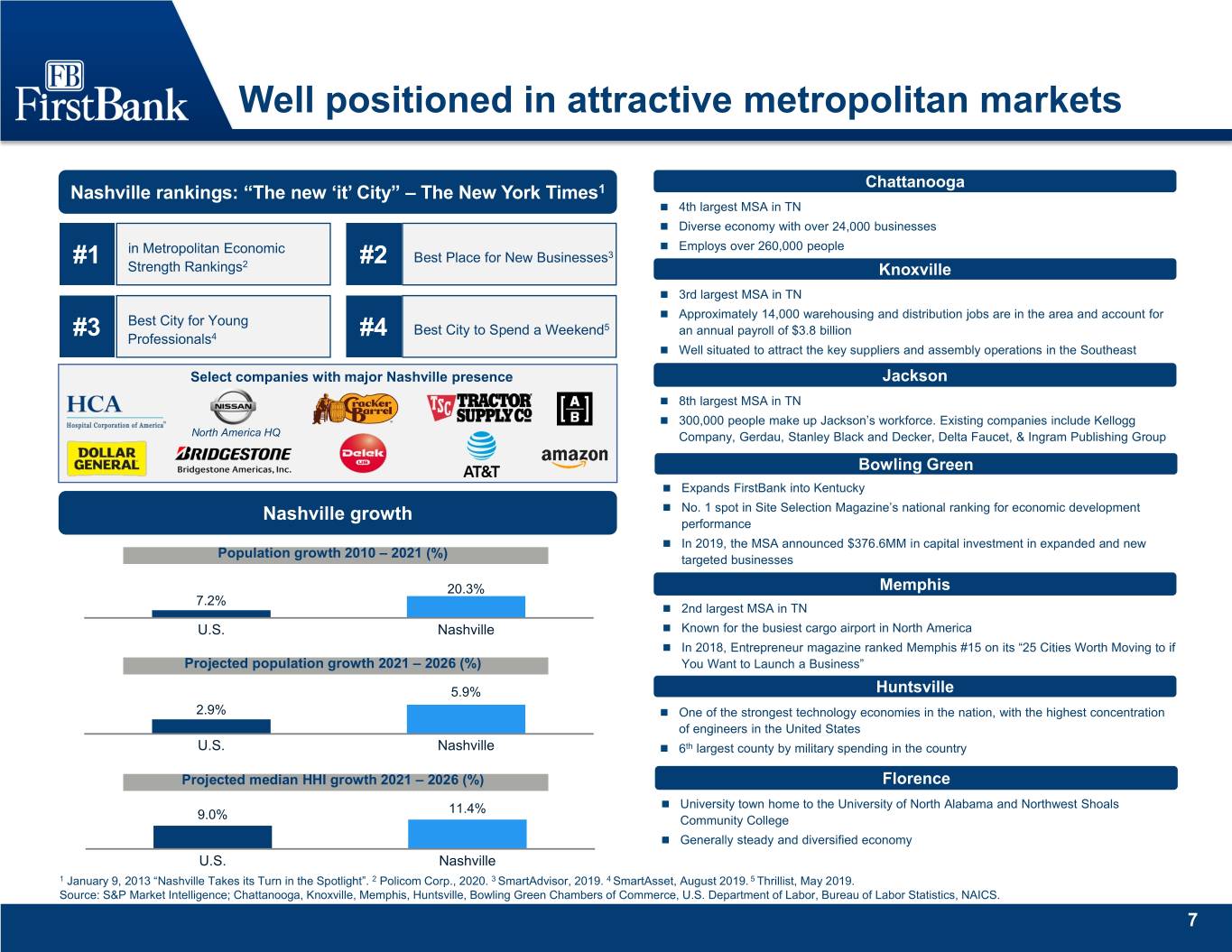

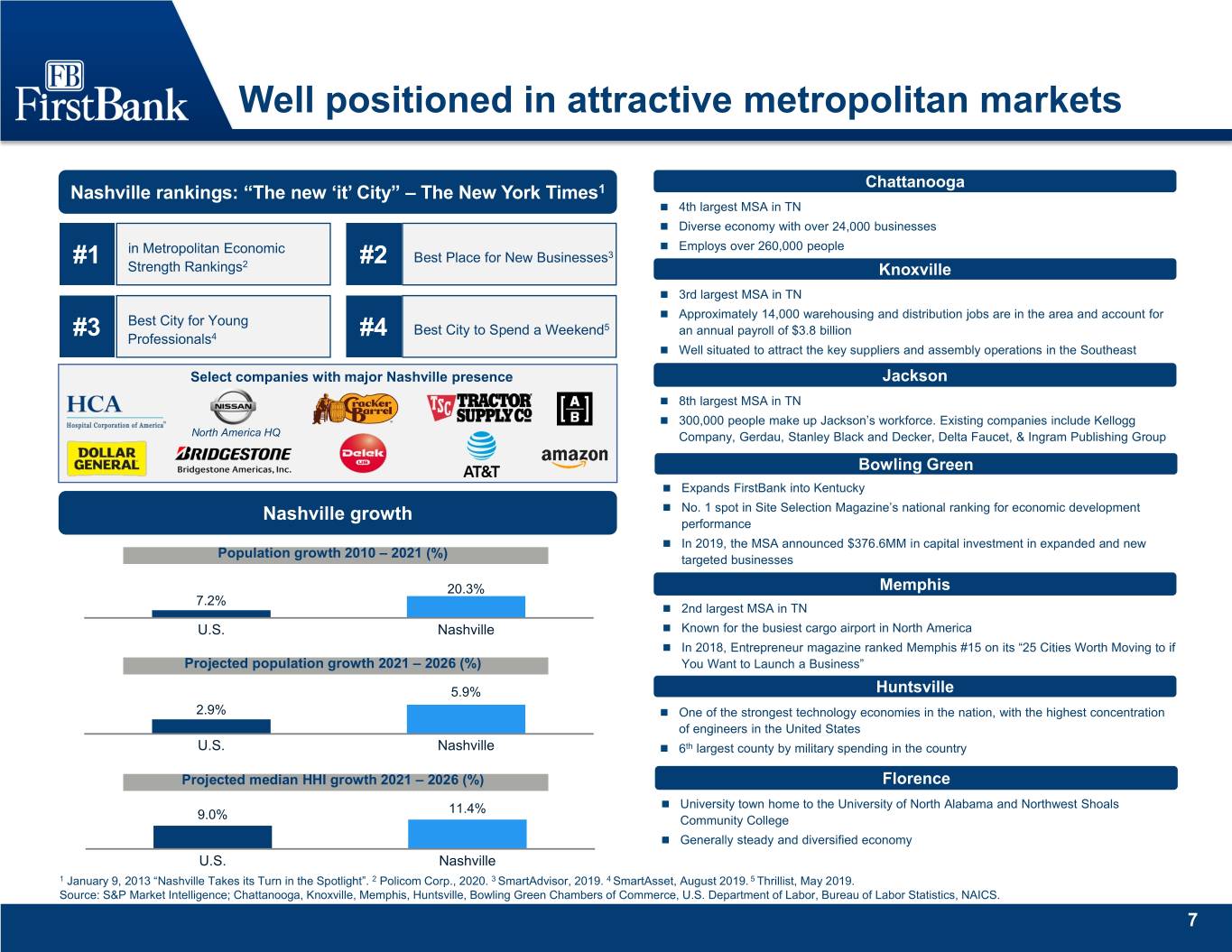

Well positioned in attractive metropolitan markets Chattanooga Nashville rankings: “The new ‘it’ City” – The New York Times1 4th largest MSA in TN Diverse economy with over 24,000 businesses in Metropolitan Economic Employs over 260,000 people Best Place for New Businesses3 #1 2 #2 Strength Rankings Knoxville 3rd largest MSA in TN Best City for Young Approximately 14,000 warehousing and distribution jobs are in the area and account for Best City to Spend a Weekend5 an annual payroll of $3.8 billion #3 Professionals4 #4 Well situated to attract the key suppliers and assembly operations in the Southeast Select companies with major Nashville presence Jackson 8th largest MSA in TN 300,000 people make up Jackson’s workforce. Existing companies include Kellogg North America HQ Company, Gerdau, Stanley Black and Decker, Delta Faucet, & Ingram Publishing Group Bowling Green Expands FirstBank into Kentucky No. 1 spot in Site Selection Magazine’s national ranking for economic development Nashville growth performance In 2019, the MSA announced $376.6MM in capital investment in expanded and new Population growth 2010 – 2021 (%) targeted businesses 20.3% Memphis 7.2% 2nd largest MSA in TN U.S. Nashville Known for the busiest cargo airport in North America In 2018, Entrepreneur magazine ranked Memphis #15 on its “25 Cities Worth Moving to if Projected population growth 2021 – 2026 (%) You Want to Launch a Business” 5.9% Huntsville 2.9% One of the strongest technology economies in the nation, with the highest concentration of engineers in the United States U.S. Nashville 6th largest county by military spending in the country Projected median HHI growth 2021 – 2026 (%) Florence 11.4% University town home to the University of North Alabama and Northwest Shoals 9.0% Community College Generally steady and diversified economy U.S. Nashville 1 January 9, 2013 “Nashville Takes its Turn in the Spotlight”. 2 Policom Corp., 2020. 3 SmartAdvisor, 2019. 4 SmartAsset, August 2019. 5 Thrillist, May 2019. Source: S&P Market Intelligence; Chattanooga, Knoxville, Memphis, Huntsville, Bowling Green Chambers of Commerce, U.S. Department of Labor, Bureau of Labor Statistics, NAICS. 7

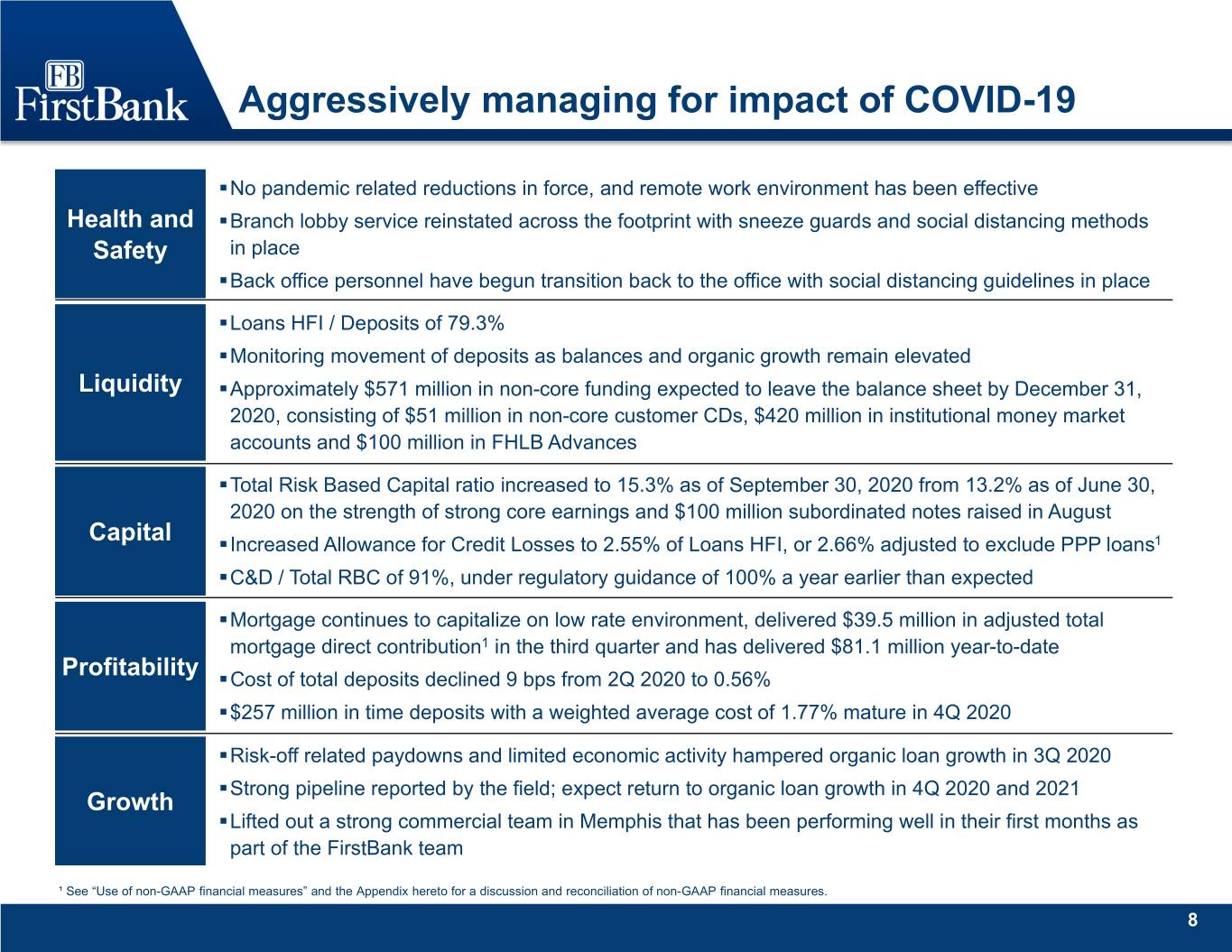

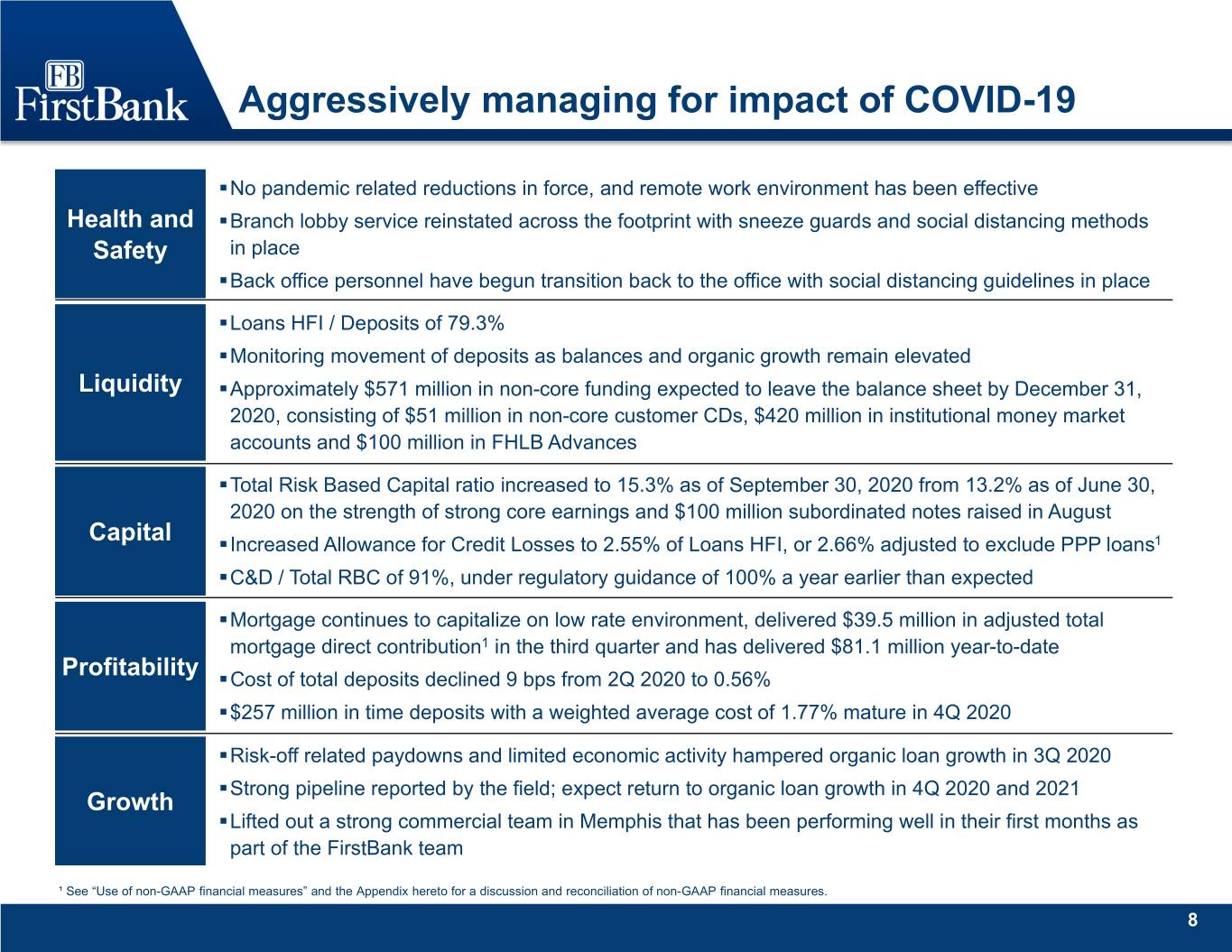

Aggressively managing for impact of COVID-19 .No pandemic related reductions in force, and remote work environment has been effective Health and .Branch lobby service reinstated across the footprint with sneeze guards and social distancing methods Safety in place .Back office personnel have begun transition back to the office with social distancing guidelines in place .Loans HFI / Deposits of 79.3% .Monitoring movement of deposits as balances and organic growth remain elevated Liquidity .Approximately $571 million in non-core funding expected to leave the balance sheet by December 31, 2020, consisting of $51 million in non-core customer CDs, $420 million in institutional money market accounts and $100 million in FHLB Advances .Total Risk Based Capital ratio increased to 15.3% as of September 30, 2020 from 13.2% as of June 30, 2020 on the strength of strong core earnings and $100 million subordinated notes raised in August Capital .Increased Allowance for Credit Losses to 2.55% of Loans HFI, or 2.66% adjusted to exclude PPP loans1 .C&D / Total RBC of 91%, under regulatory guidance of 100% a year earlier than expected .Mortgage continues to capitalize on low rate environment, delivered $39.5 million in adjusted total mortgage direct contribution1 in the third quarter and has delivered $81.1 million year-to-date Profitability .Cost of total deposits declined 9 bps from 2Q 2020 to 0.56% .$257 million in time deposits with a weighted average cost of 1.77% mature in 4Q 2020 .Risk-off related paydowns and limited economic activity hampered organic loan growth in 3Q 2020 .Strong pipeline reported by the field; expect return to organic loan growth in 4Q 2020 and 2021 Growth .Lifted out a strong commercial team in Memphis that has been performing well in their first months as part of the FirstBank team ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP financial measures. 8

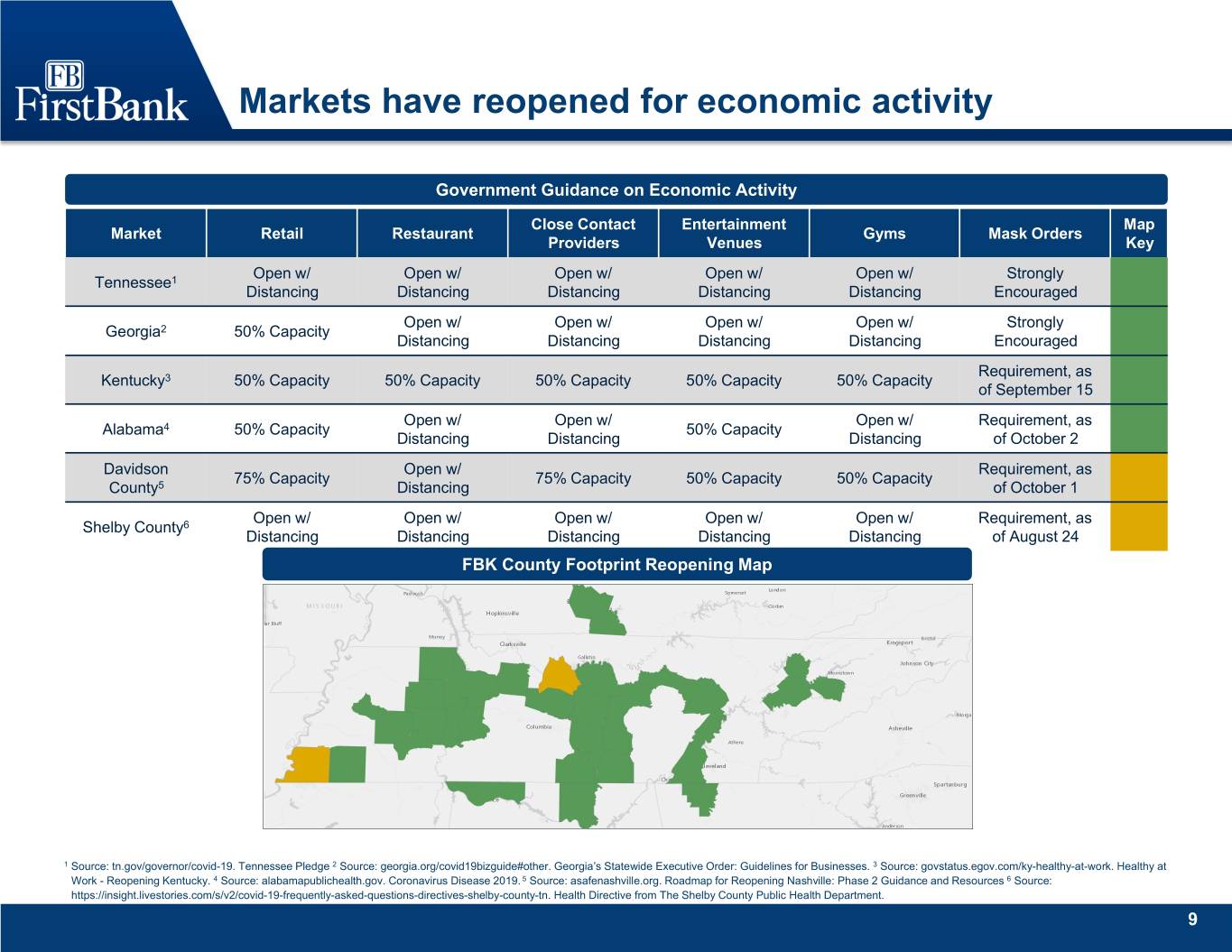

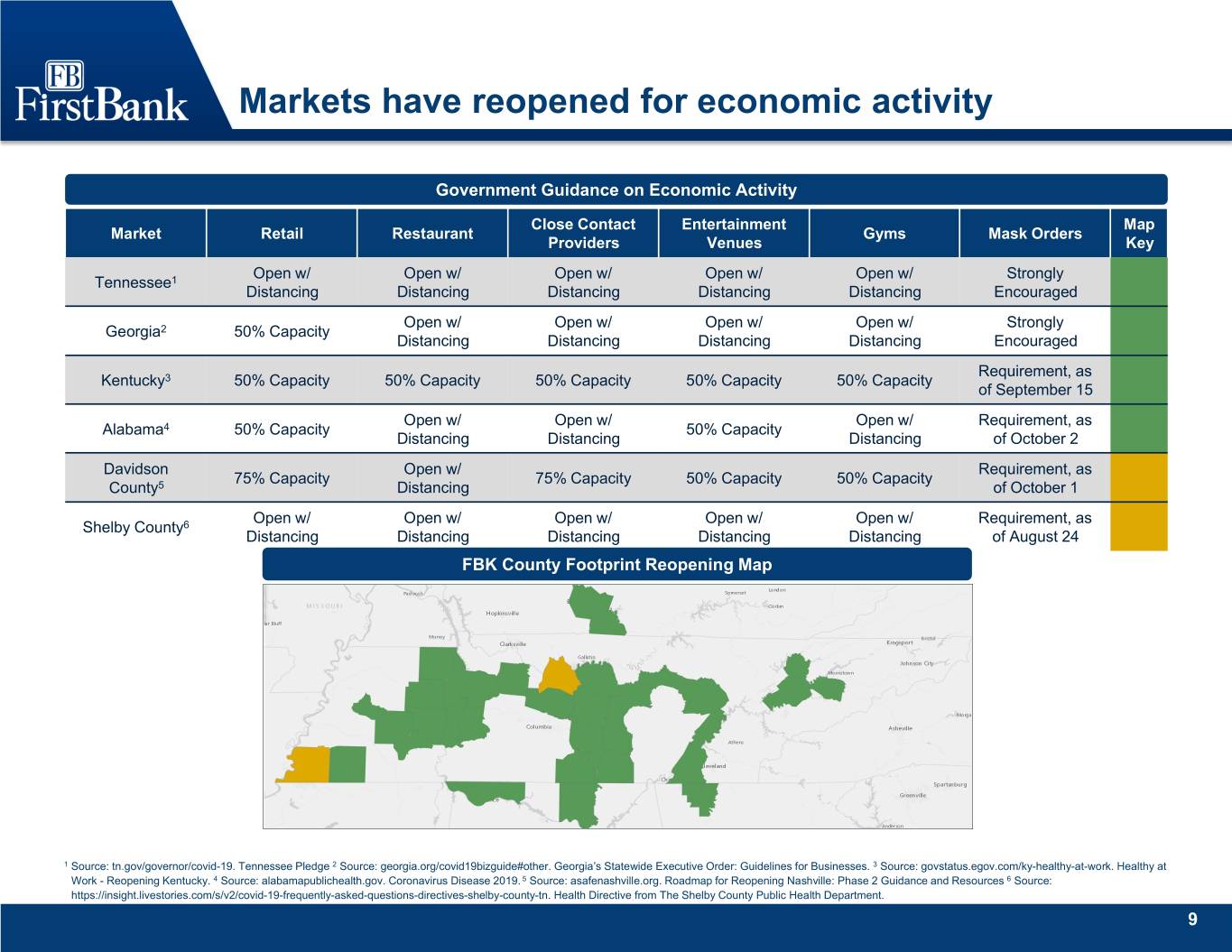

Markets have reopened for economic activity Government Guidance on Economic Activity Close Contact Entertainment Map Market Retail Restaurant Gyms Mask Orders Providers Venues Key Open w/ Open w/ Open w/ Open w/ Open w/ Strongly Tennessee1 Distancing Distancing Distancing Distancing Distancing Encouraged Open w/ Open w/ Open w/ Open w/ Strongly Georgia2 50% Capacity Distancing Distancing Distancing Distancing Encouraged Requirement, as Kentucky3 50% Capacity 50% Capacity 50% Capacity 50% Capacity 50% Capacity of September 15 Open w/ Open w/ Open w/ Requirement, as Alabama4 50% Capacity 50% Capacity Distancing Distancing Distancing of October 2 Davidson Open w/ Requirement, as 75% Capacity 75% Capacity 50% Capacity 50% Capacity County5 Distancing of October 1 Open w/ Open w/ Open w/ Open w/ Open w/ Requirement, as Shelby County6 Distancing Distancing Distancing Distancing Distancing of August 24 FBK County Footprint Reopening Map 1 Source: tn.gov/governor/covid-19. Tennessee Pledge 2 Source: georgia.org/covid19bizguide#other. Georgia’s Statewide Executive Order: Guidelines for Businesses. 3 Source: govstatus.egov.com/ky-healthy-at-work. Healthy at Work - Reopening Kentucky. 4 Source: alabamapublichealth.gov. Coronavirus Disease 2019. 5 Source: asafenashville.org. Roadmap for Reopening Nashville: Phase 2 Guidance and Resources 6 Source: https://insight.livestories.com/s/v2/covid-19-frequently-asked-questions-directives-shelby-county-tn. Health Directive from The Shelby County Public Health Department. 9

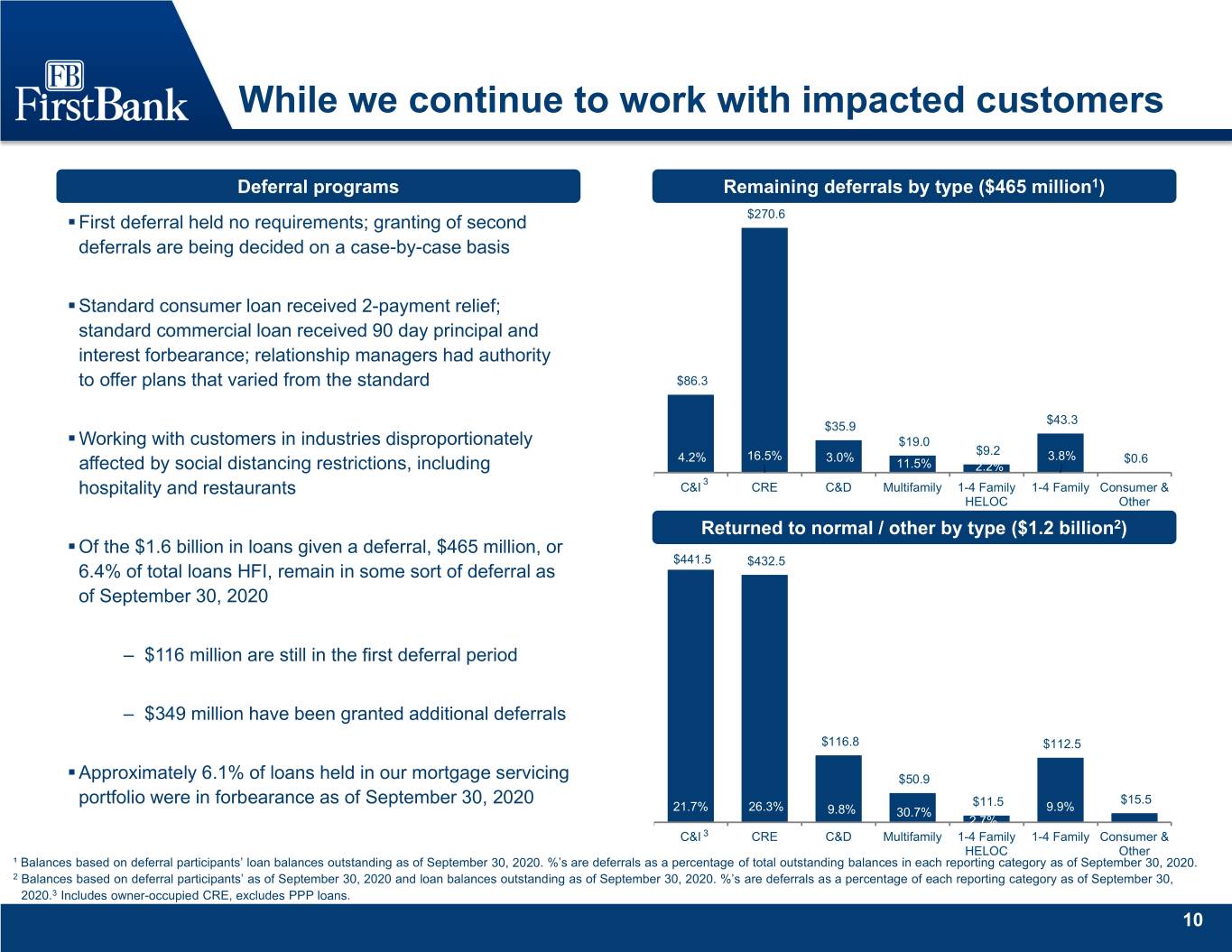

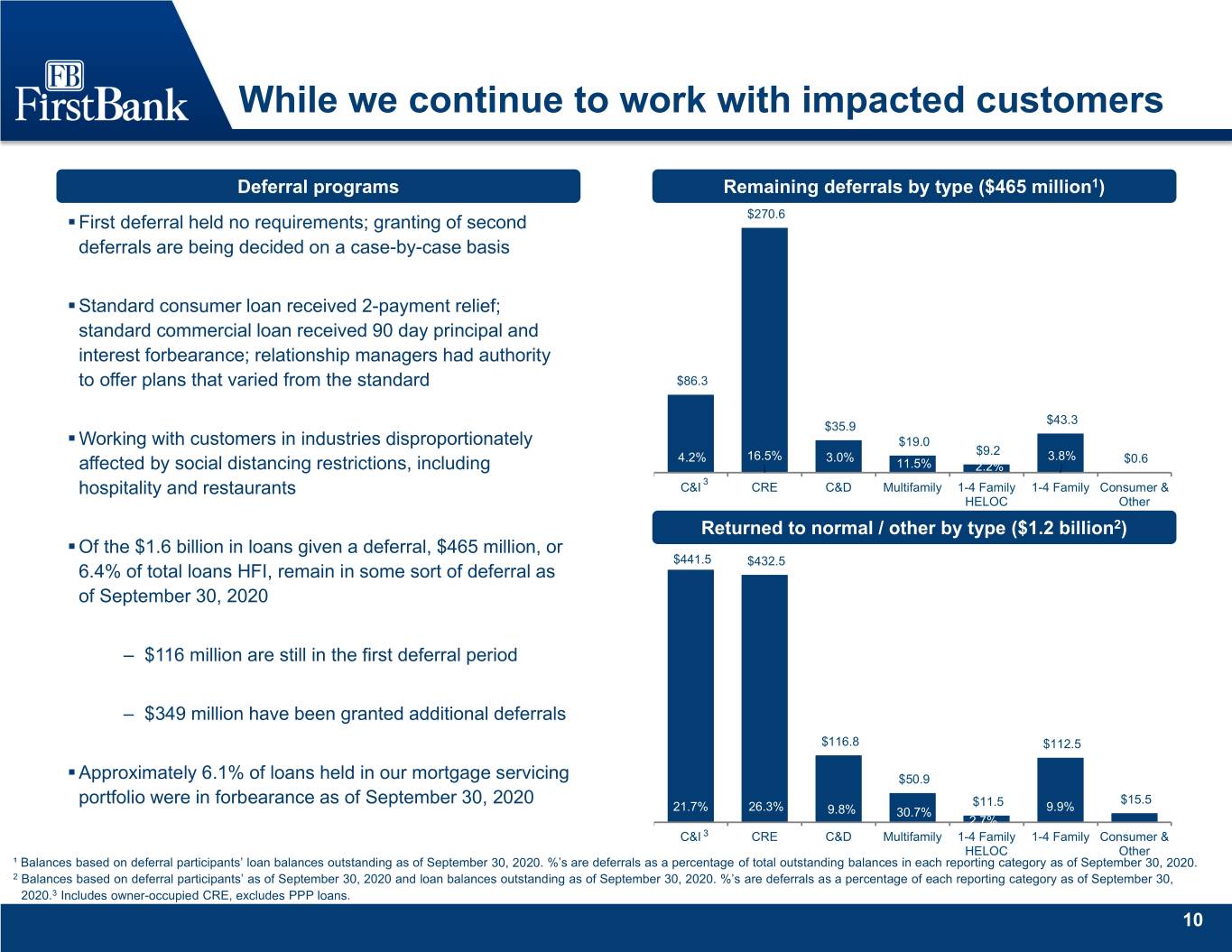

While we continue to work with impacted customers Deferral programs Remaining deferrals by type ($465 million1) . First deferral held no requirements; granting of second $270.6 deferrals are being decided on a case-by-case basis . Standard consumer loan received 2-payment relief; standard commercial loan received 90 day principal and interest forbearance; relationship managers had authority to offer plans that varied from the standard $86.3 $43.3 $35.9 . Working with customers in industries disproportionately $19.0 $9.2 4.2% 16.5% 3.0% 3.8% $0.6 affected by social distancing restrictions, including 11.5% 2.2% 3 hospitality and restaurants C&I CRE C&D Multifamily 1-4 Family 1-4 Family Consumer & HELOC Other Returned to normal / other by type ($1.2 billion2) . Of the $1.6 billion in loans given a deferral, $465 million, or $441.5 $432.5 6.4% of total loans HFI, remain in some sort of deferral as of September 30, 2020 – $116 million are still in the first deferral period – $349 million have been granted additional deferrals $116.8 $112.5 . Approximately 6.1% of loans held in our mortgage servicing $50.9 portfolio were in forbearance as of September 30, 2020 $11.5 $15.5 21.7% 26.3% 9.8% 30.7% 9.9% 2.7% C&I 3 CRE C&D Multifamily 1-4 Family 1-4 Family Consumer & HELOC Other ¹ Balances based on deferral participants’ loan balances outstanding as of September 30, 2020. %’s are deferrals as a percentage of total outstanding balances in each reporting category as of September 30, 2020. 2 Balances based on deferral participants’ as of September 30, 2020 and loan balances outstanding as of September 30, 2020. %’s are deferrals as a percentage of each reporting category as of September 30, 2020.3 Includes owner-occupied CRE, excludes PPP loans. 10

And have closed an impactful merger Transaction Highlights Recent Nashville News . Closed acquisition on August 15, 2020 . Facebook plans $800 million Gallatin data center – Nashville Post, August 12, 2020 . Successful systems conversion on October 12, 2020 . Amazon announces 2,500 new jobs in Nashville th . Deposit market share increased to 6 in the Nashville MSA – Nashville Business Journal, September 14, 2020 – 1st in Williamson County . Starwood REIT pays record rate for industrial park by – 2nd in Rutherford County Nashville International Airport – Nashville Business Journal, September 17, 2020 – 10th in Davidson County . GM reveals $2B transformation for Spring Hill plant, billed . Added 9 net branches in the Nashville MSA as the biggest expansion in state history – Nashville Business Journal, October 20, 2020 . Added over 30 relationship managers in the Nashville MSA Transaction Assumptions Announcement Close Notes Loan Marks $110 million $101 million Rate and liquidity mark moved significantly between announcement and close Total ACL and Unfunded Commitment $41 million $88 million Impacted by CECL model's ACL requirements on CRE & C&D Non-Strategic Loan Mark $34 million $24 million $22 million remaining at September 30, 2020 on $263 million in principal balances Other Fair Value Loans Marks $35 million $(11) million Heavily impacted by rate cuts between announcement and close Non-Strategic Loans Principal Balances $430 million $342 million $263 million in remaining principal balances as of September 30, 2020. Decline related to organic run-off; exploring bulk sale Core Deposit Intangible $26 million $8 million Heavily impacted by rate cuts between announcement and close Tangible Book Dilution Neutral ~0.5% Accretive Based on actuals to date and estimated remaining merger charges 11

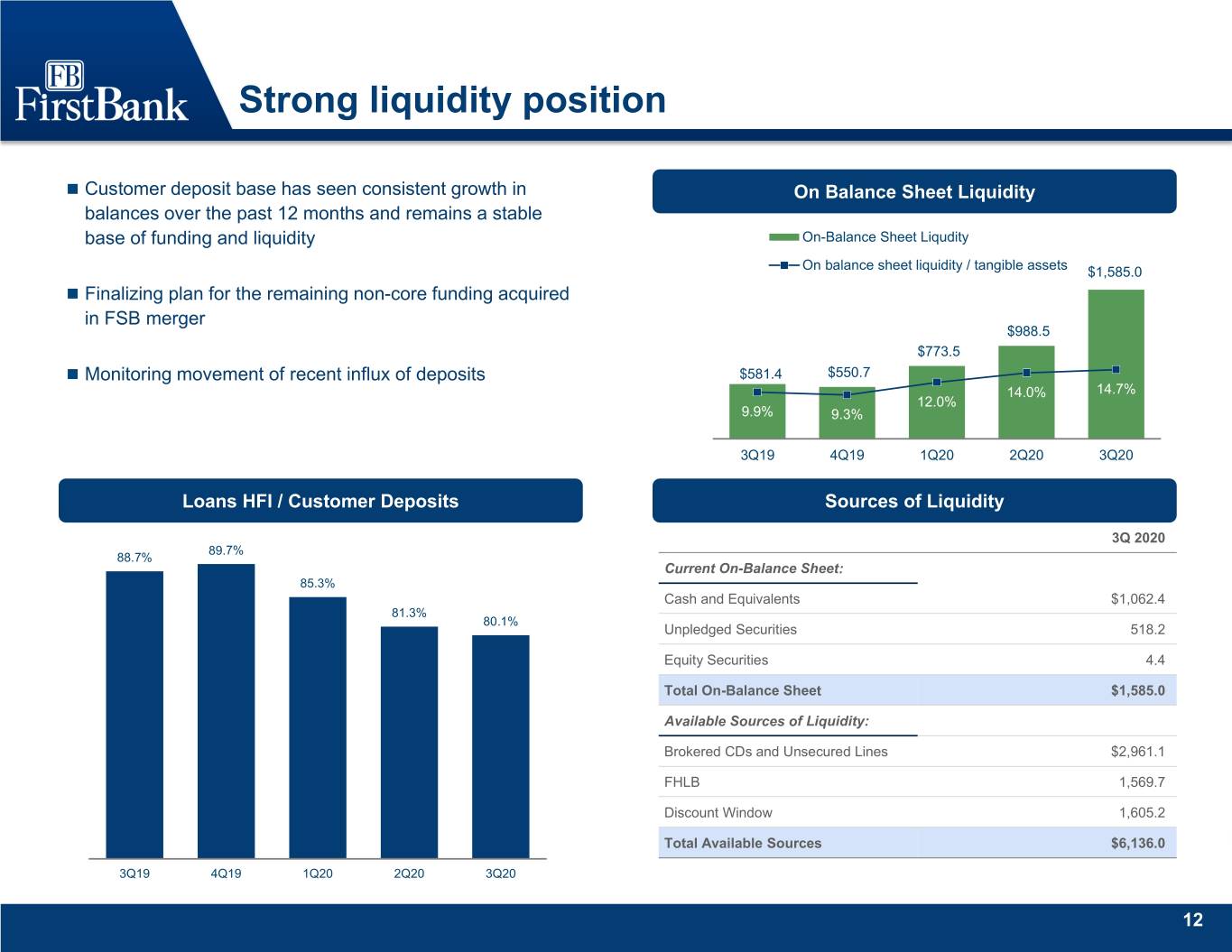

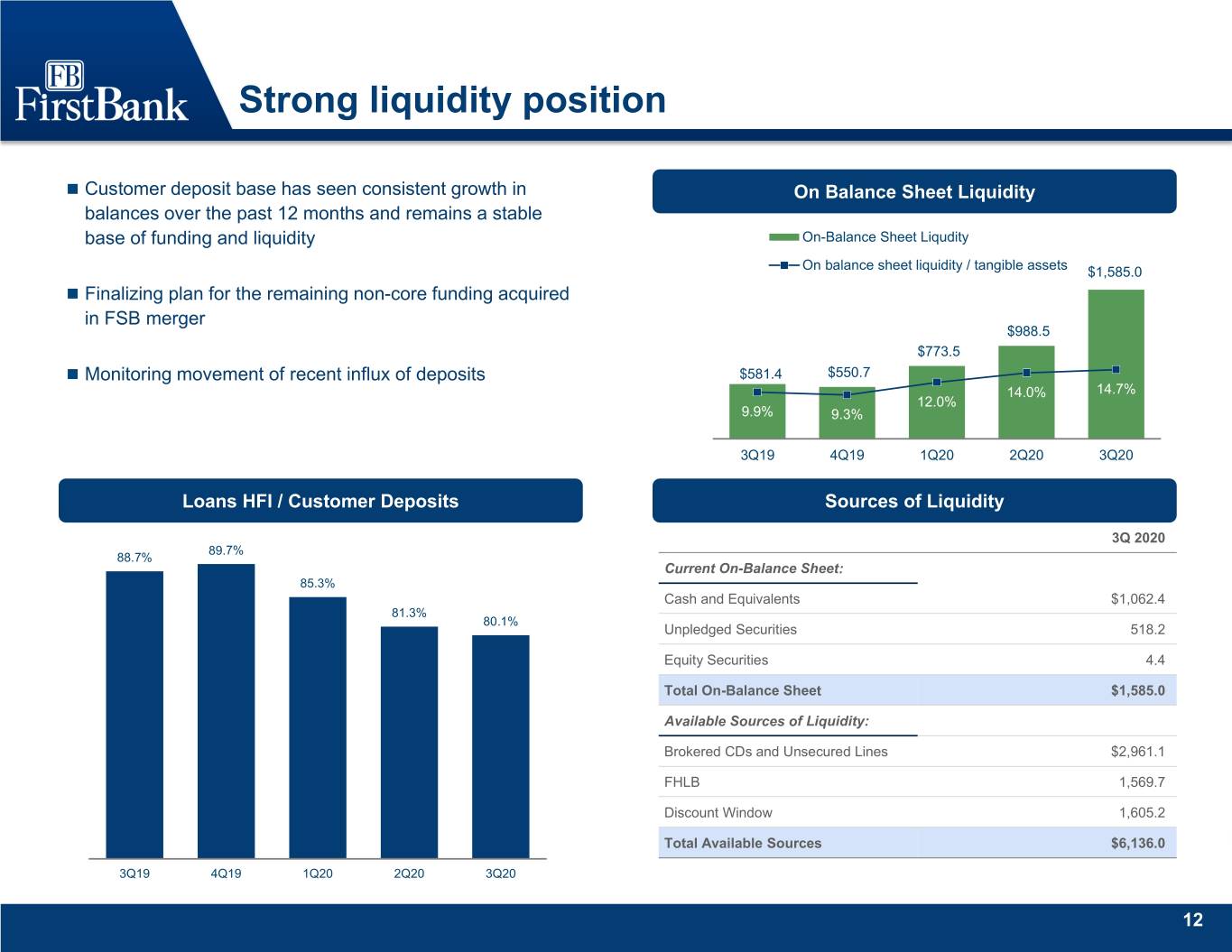

Strong liquidity position Customer deposit base has seen consistent growth in On Balance Sheet Liquidity balances over the past 12 months and remains a stable base of funding and liquidity On-Balance Sheet Liqudity On balance sheet liquidity / tangible assets $1,585.0 Finalizing plan for the remaining non-core funding acquired $1,600.0 $1,400.0 in FSB merger $1,200.0 $988.5 $1,000.0 $773.5 $800.0 $581.4 $550.7 Monitoring movement of recent influx of deposits $600.0 14.0% 14.7% $400.0 12.0% 9.9% $200.0 9.3% $- 3Q19 4Q19 1Q20 2Q20 3Q20 Loans HFI / Customer Deposits Sources of Liquidity 3Q 2020 89.7% 88.7% Current On-Balance Sheet: 85.3% Cash and Equivalents $1,062.4 81.3% 80.1% Unpledged Securities 518.2 Equity Securities 4.4 Total On-Balance Sheet $1,585.0 Available Sources of Liquidity: Brokered CDs and Unsecured Lines $2,961.1 FHLB 1,569.7 Discount Window 1,605.2 Total Available Sources $6,136.0 3Q19 4Q19 1Q20 2Q20 3Q20 12

Core deposit franchise provides stable liquidity Total deposits ($mm) Cost of deposits Customer deposits Brokered and internet time deposits Noninterest bearing (%) Cost of total deposits (%) 35.0% 29.8% 30.0% 25.2% $9,094 24.7% 24.5% 24.8% 25.0% $92 20.0% 1.11% $5,953 15.0% 1.02% $5,377 $9,002 0.94% $4,922 $4,935 $15 10.0% $20 $25 $20 0.65% $5,938 5.0% 0.56% $4,897 $4,915 $5,357 0.0% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 Noninterest bearing deposits1 ($mm) Deposit composition Time 17% Noninterest- bearing Savings checking 4% 25% $2,288 $1,775 Money market Interest-bearing checking $1,336 32% $1,214 $1,208 22% 3Q19 4Q19 1Q20 2Q20 3Q20 47% Checking accounts ¹ Includes mortgage servicing-related deposits of $194.3mm, $92.6mm, $110.1mm, $149.1mm and $177.6mm for the quarters ended September 30, 2019, December 31, 2019, March 31, 2020, June 30, 2020, and September 30, 2020 respectively. 13

Well-capitalized for future opportunities Capital position Tangible book value per share3 3Q19 2Q202 3Q201,2 Shareholder’s equity/Assets 12.2% 11.1% 11.3% $20.87 $19.07 TCE/TA² 9.4% 8.7% 9.2% $11.56 $11.58 Common equity 10.8% 11.4% 11.8% tier 1/Risk-weighted assets 3Q16 4Q16 2Q20 3Q20 Tier 1 capital/Risk-weighted 11.3% 11.9% 12.1% Simple capital structure assets Total capital/Risk-weighted 12.0% 13.2% 15.3% Tier 2 ACL 9% assets Subordinated Notes Tier 1 capital /Average 10.1% 9.7% 11.8% 12% assets Trust Preferred Common 2% Equity Tier 1 C&D loans subject to 100% 89% 75% 91% Capital risk-based capital threshold4 77% CRE loans subject to 100% 255% 215% 228% risk-based capital threshold4 Total regulatory capital: $1,3341 mm ¹ Total regulatory capital, FB Financial Corporation. 3Q 2020 calculation is preliminary and subject to change. 2 For regulatory capital purposes, the CECL impact over 2020 and 2021 is gradually phased- in from Common Equity Tier 1 Capital to Tier 2 capital. As of June 30, 2020 and September 30, 2020, respectively, $37.8 million and $55.5 million are being added back to CET 1 and Tier 1 Capital, and $43.7 million and $61.4 million are being taken out of Tier 2 capital. 3 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 4 Risk-based capital at FirstBank as defined in Call Report. 14

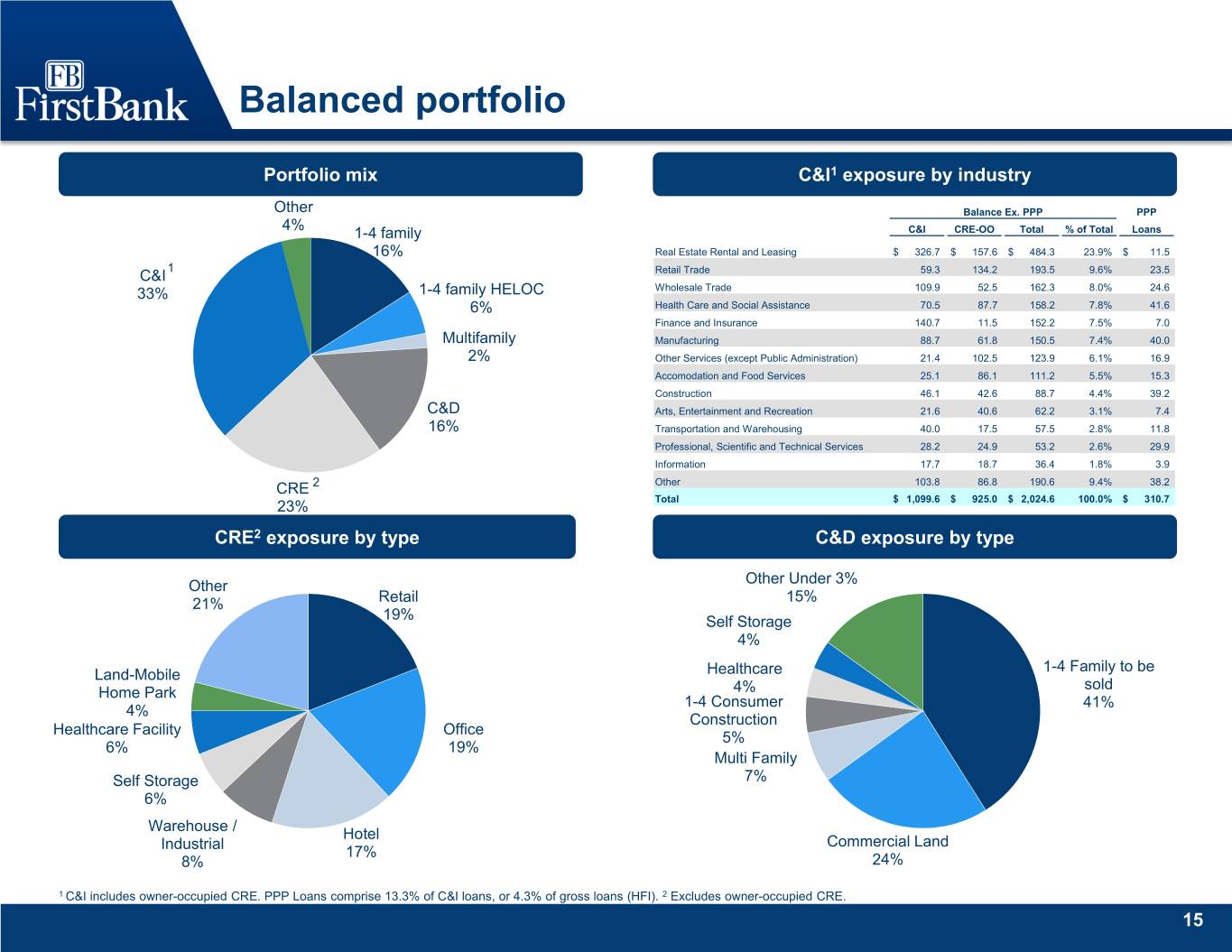

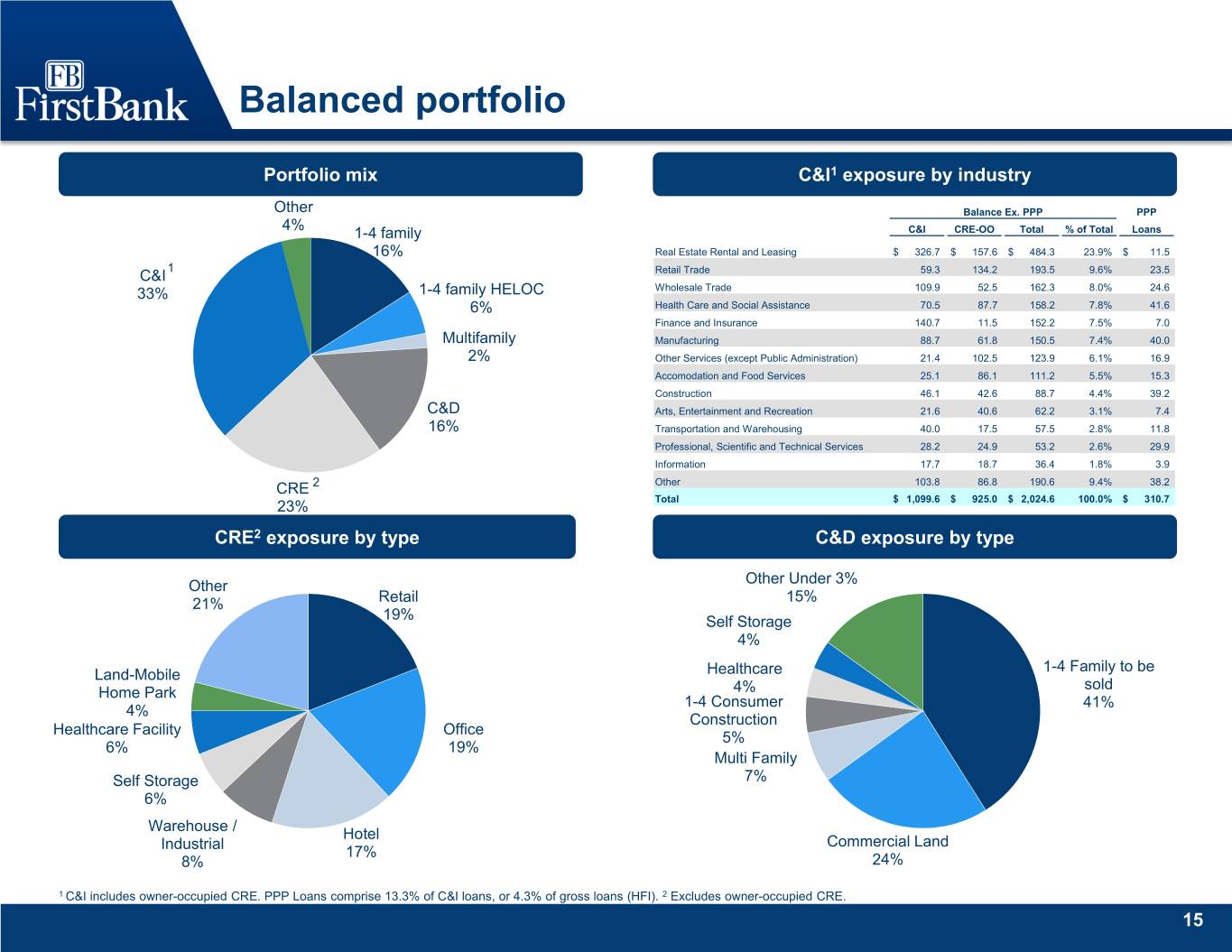

Balanced portfolio Portfolio mix C&I1 exposure by industry Other Balance Ex. PPP PPP 4% 1-4 family C&I CRE-OO Total % of Total Loans 16% Real Estate Rental and Leasing $ 326.7 $ 157.6 $ 484.3 23.9% $ 11.5 1 C&I Retail Trade 59.3 134.2 193.5 9.6% 23.5 33% 1-4 family HELOC Wholesale Trade 109.9 52.5 162.3 8.0% 24.6 6% Health Care and Social Assistance 70.5 87.7 158.2 7.8% 41.6 Finance and Insurance 140.7 11.5 152.2 7.5% 7.0 Multifamily Manufacturing 88.7 61.8 150.5 7.4% 40.0 2% Other Services (except Public Administration) 21.4 102.5 123.9 6.1% 16.9 Accomodation and Food Services 25.1 86.1 111.2 5.5% 15.3 Construction 46.1 42.6 88.7 4.4% 39.2 C&D Arts, Entertainment and Recreation 21.6 40.6 62.2 3.1% 7.4 16% Transportation and Warehousing 40.0 17.5 57.5 2.8% 11.8 Professional, Scientific and Technical Services 28.2 24.9 53.2 2.6% 29.9 Information 17.7 18.7 36.4 1.8% 3.9 CRE 2 Other 103.8 86.8 190.6 9.4% 38.2 23% Total $ 1,099.6 $ 925.0 $ 2,024.6 100.0% $ 310.7 CRE2 exposure by type C&D exposure by type Other Other Under 3% 21% Retail 15% 19% Self Storage 4% 1-4 Family to be Land-Mobile Healthcare sold Home Park 4% 1-4 Consumer 41% 4% Construction Healthcare Facility Office 5% 6% 19% Multi Family Self Storage 7% 6% Warehouse / Hotel Industrial Commercial Land 17% 8% 24% 1 C&I includes owner-occupied CRE. PPP Loans comprise 13.3% of C&I loans, or 4.3% of gross loans (HFI). 2 Excludes owner-occupied CRE. 15

Industries of concern Industries initially considered to be the most susceptible to Industry exposures / gross loans (HFI) issues associated with the pandemic 8.7% Credit quality remains satisfactory overall Optimistic regarding the group’s resiliency and ability to manage through this economy 4.7% 4.7% Significant level of initial deferrals but steady improvement and return to pre-COVID payment plans 1.9% 1.8% 1.8% Hotel business continues to face biggest challenges Retail Hotel Healthcare Restaurant Other Leisure Transportation Industries of concern credit quality Industries of concern deferral participants 92.1% $448 $242 $58 4.4% 1.4% 2.0% $9 Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 15 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. 16

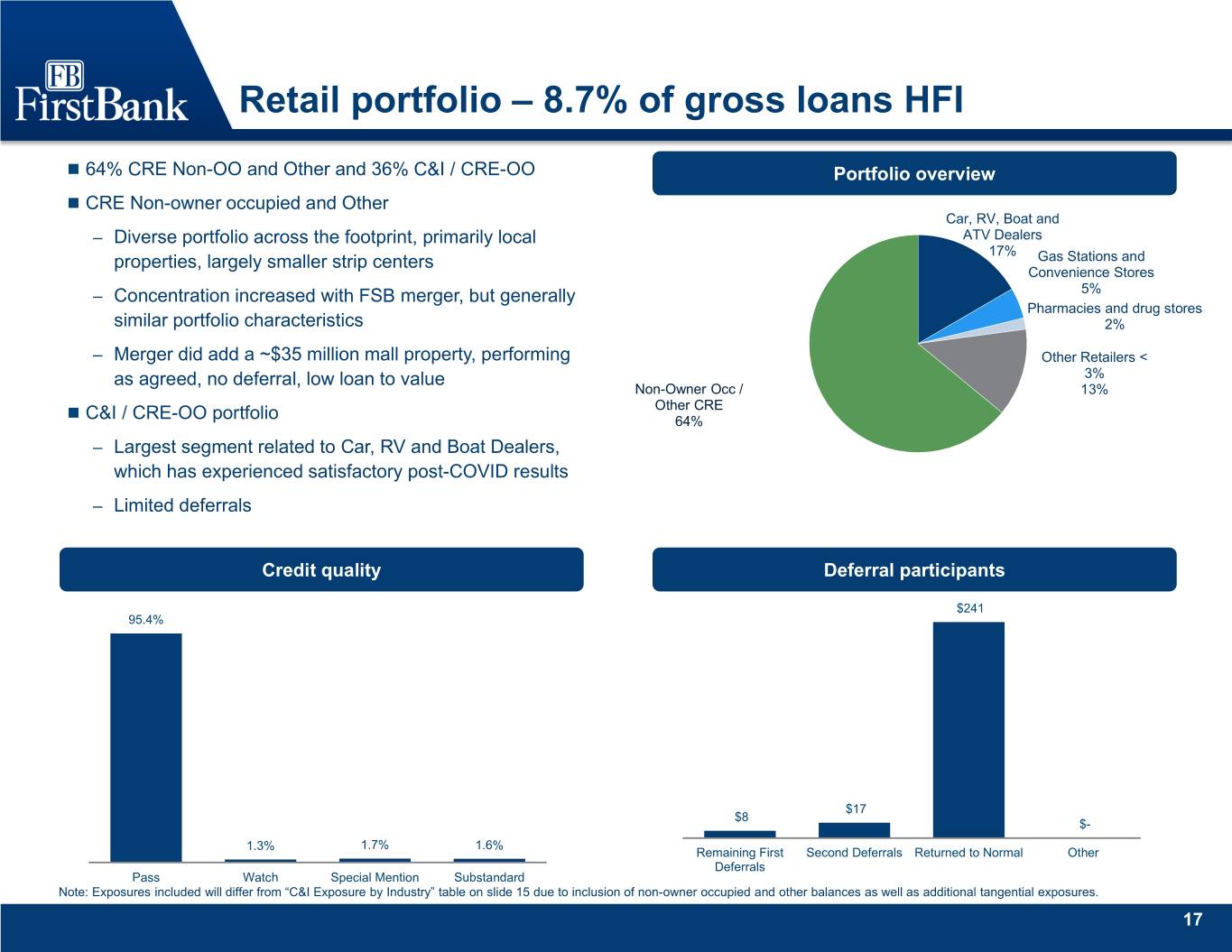

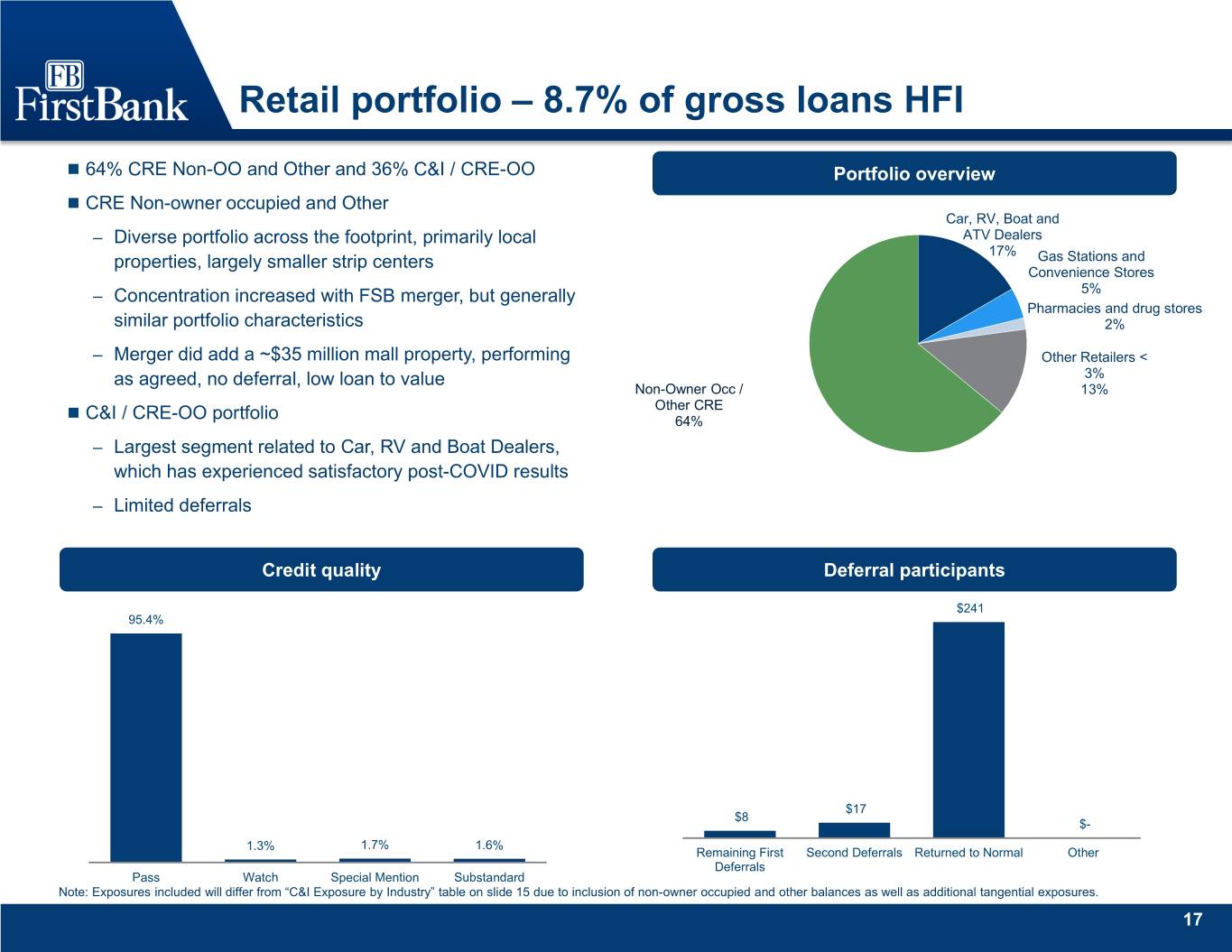

Retail portfolio – 8.7% of gross loans HFI 64% CRE Non-OO and Other and 36% C&I / CRE-OO Portfolio overview CRE Non-owner occupied and Other Car, RV, Boat and – Diverse portfolio across the footprint, primarily local ATV Dealers 17% properties, largely smaller strip centers Gas Stations and Convenience Stores – Concentration increased with FSB merger, but generally 5% Pharmacies and drug stores similar portfolio characteristics 2% – Merger did add a ~$35 million mall property, performing Other Retailers < as agreed, no deferral, low loan to value 3% Non-Owner Occ / 13% Other CRE C&I / CRE-OO portfolio 64% – Largest segment related to Car, RV and Boat Dealers, which has experienced satisfactory post-COVID results – Limited deferrals Credit quality Deferral participants $241 95.4% $17 $8 $- 1.3% 1.7% 1.6% Remaining First Second Deferrals Returned to Normal Other Deferrals Pass Watch Special Mention Substandard Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 15 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. 17

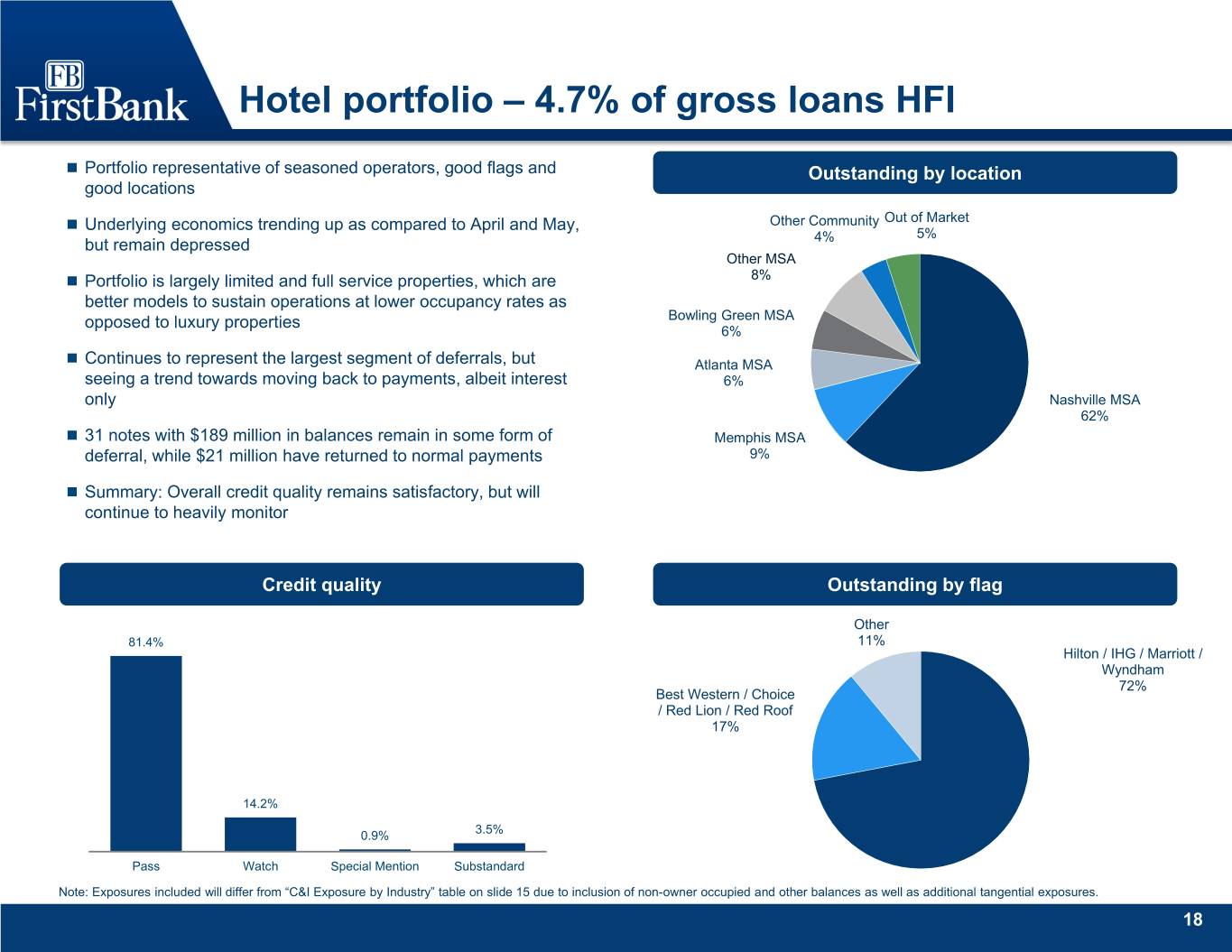

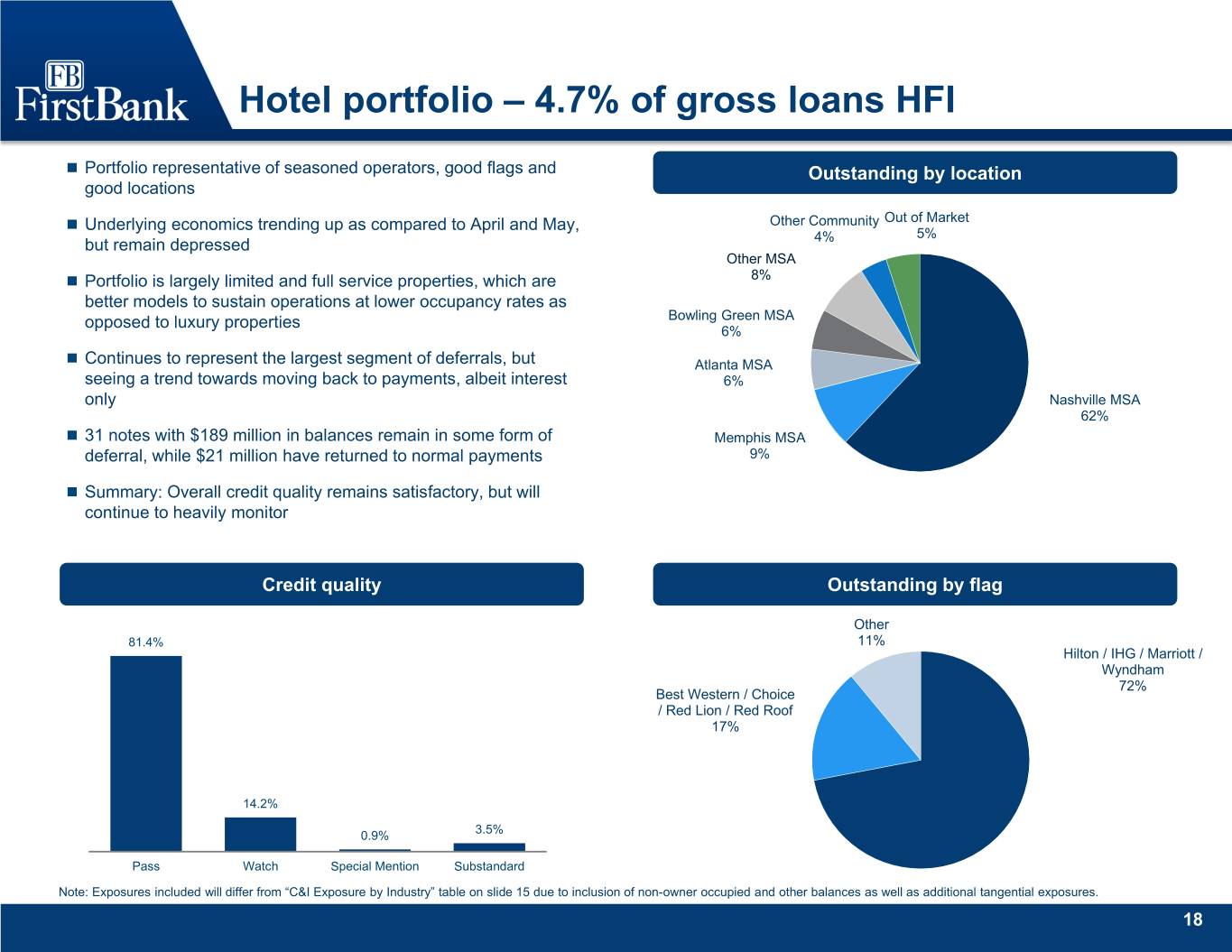

Hotel portfolio – 4.7% of gross loans HFI Portfolio representative of seasoned operators, good flags and Outstanding by location good locations Underlying economics trending up as compared to April and May, Other Community Out of Market 5% but remain depressed 4% Other MSA Portfolio is largely limited and full service properties, which are 8% better models to sustain operations at lower occupancy rates as opposed to luxury properties Bowling Green MSA 6% Continues to represent the largest segment of deferrals, but Atlanta MSA seeing a trend towards moving back to payments, albeit interest 6% only Nashville MSA 62% 31 notes with $189 million in balances remain in some form of Memphis MSA deferral, while $21 million have returned to normal payments 9% Summary: Overall credit quality remains satisfactory, but will continue to heavily monitor Credit quality Outstanding by flag Other 81.4% 11% Hilton / IHG / Marriott / Wyndham 72% Best Western / Choice / Red Lion / Red Roof 17% 14.2% 3.5% 0.9% Pass Watch Special Mention Substandard Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 15 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. 18

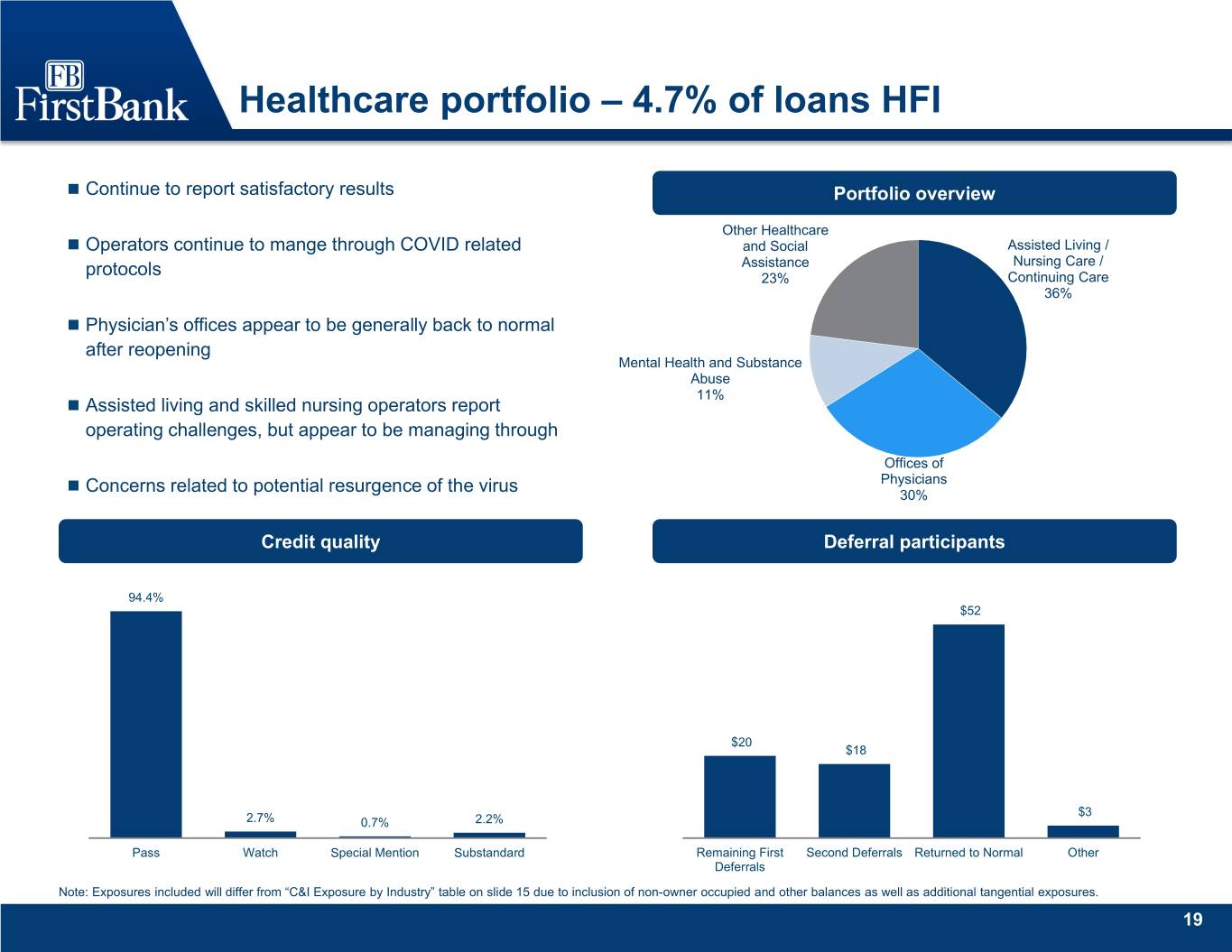

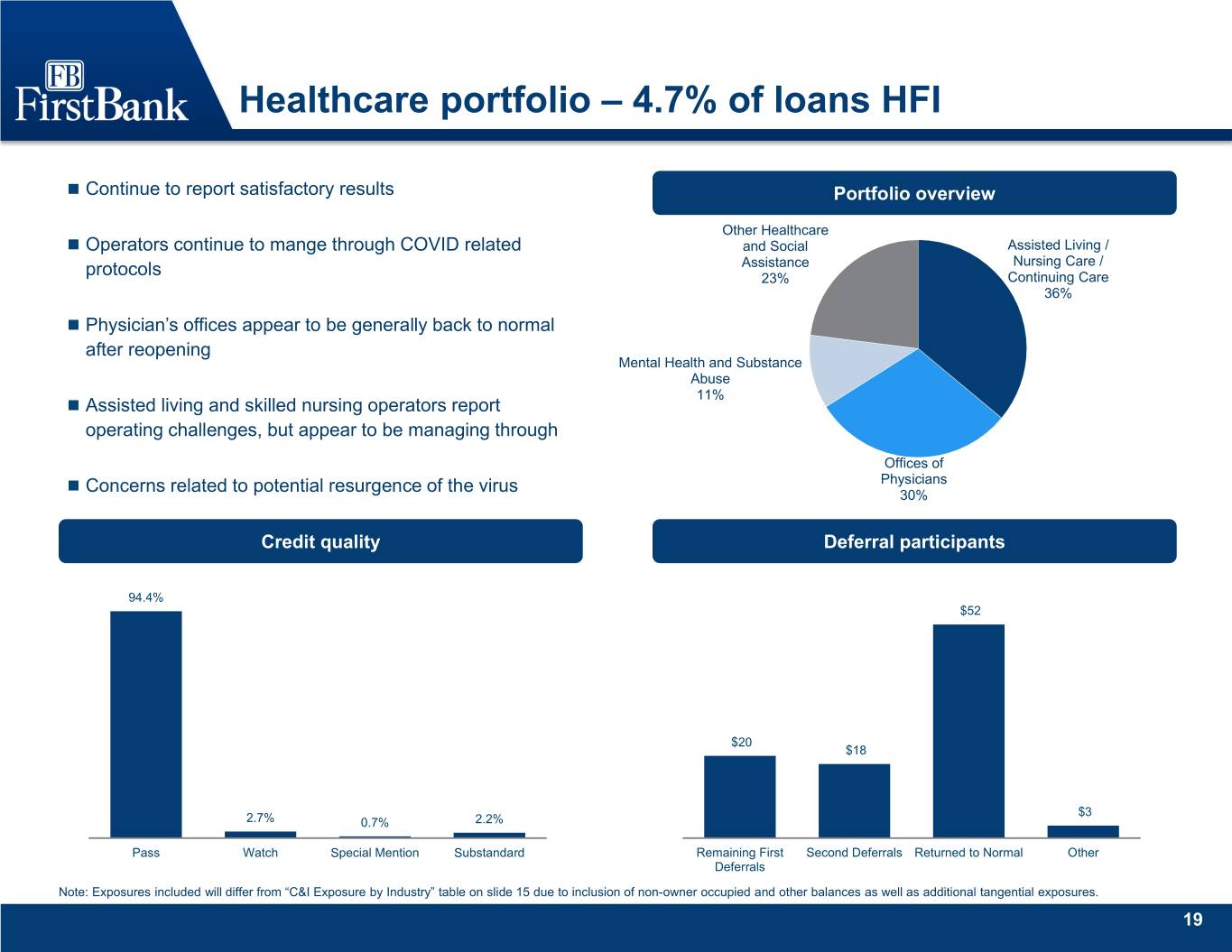

Healthcare portfolio – 4.7% of loans HFI Continue to report satisfactory results Portfolio overview Other Healthcare Operators continue to mange through COVID related and Social Assisted Living / Assistance Nursing Care / protocols 23% Continuing Care 36% Physician’s offices appear to be generally back to normal after reopening Mental Health and Substance Abuse 11% Assisted living and skilled nursing operators report operating challenges, but appear to be managing through Offices of Physicians Concerns related to potential resurgence of the virus 30% Credit quality Deferral participants 94.4% $52 $20 $18 $3 2.7% 0.7% 2.2% Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 15 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. 19

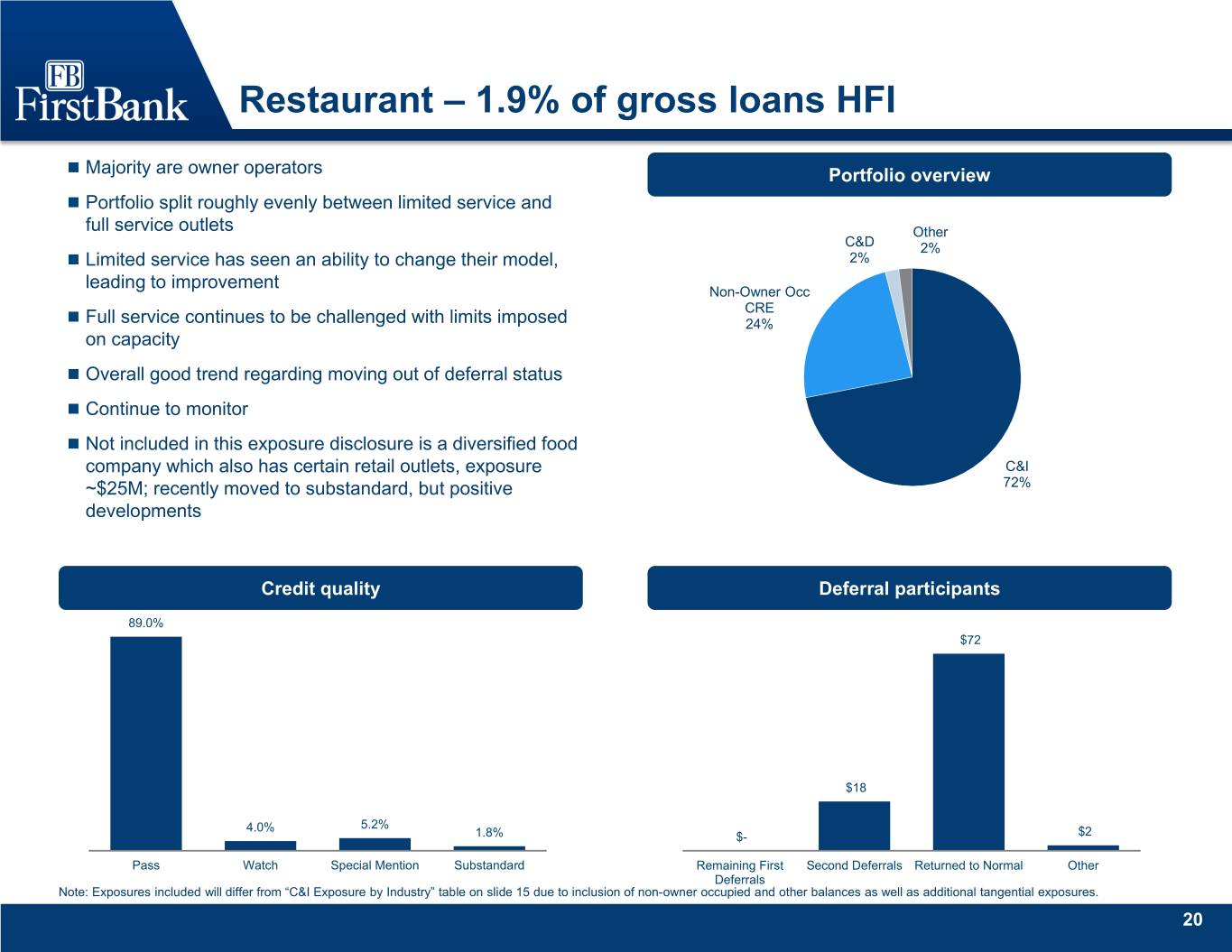

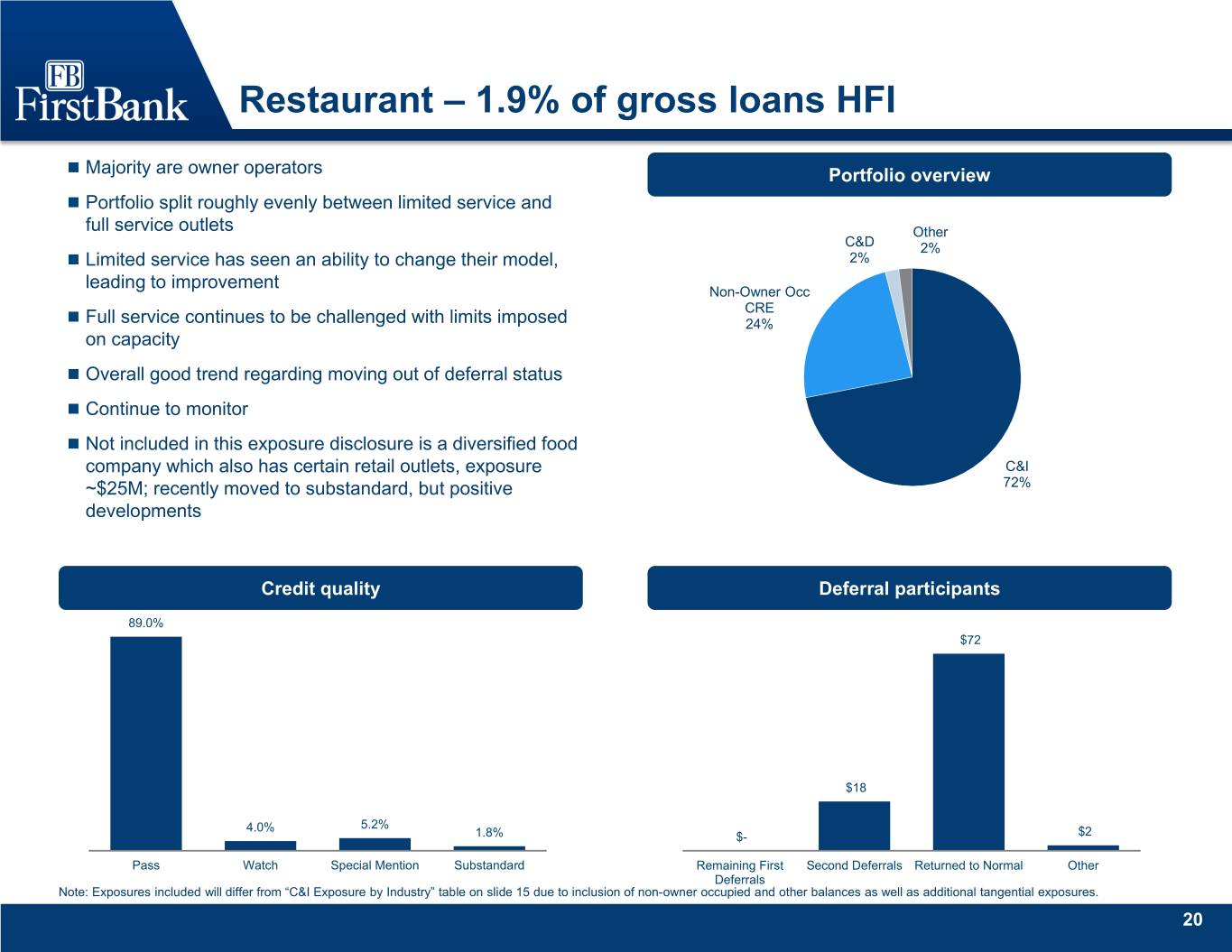

Restaurant – 1.9% of gross loans HFI Majority are owner operators Portfolio overview Portfolio split roughly evenly between limited service and full service outlets Other C&D 2% Limited service has seen an ability to change their model, 2% leading to improvement Non-Owner Occ CRE Full service continues to be challenged with limits imposed 24% on capacity Overall good trend regarding moving out of deferral status Continue to monitor Not included in this exposure disclosure is a diversified food company which also has certain retail outlets, exposure C&I ~$25M; recently moved to substandard, but positive 72% developments Credit quality Deferral participants 89.0% $72 $18 4.0% 5.2% 1.8% $- $2 Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 15 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. 20

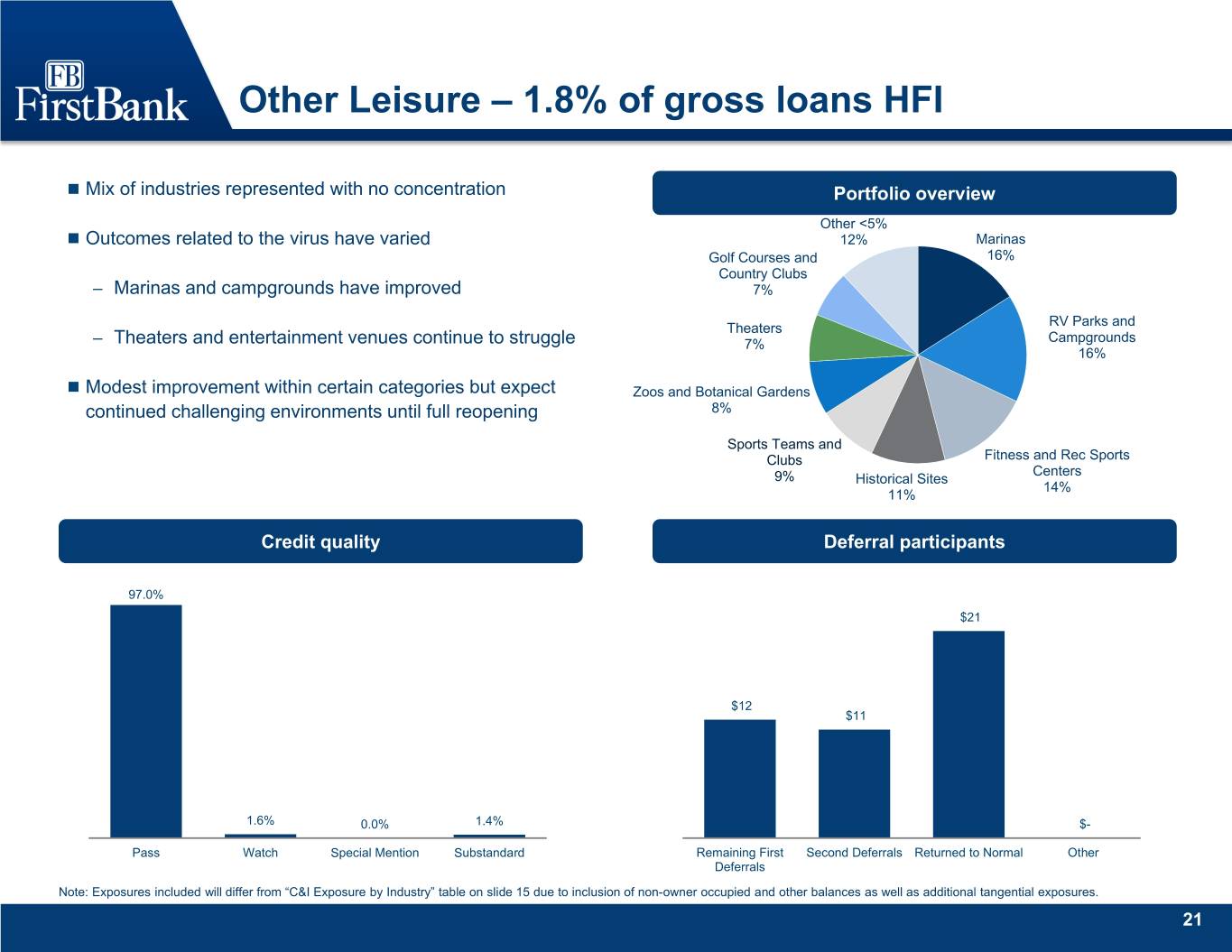

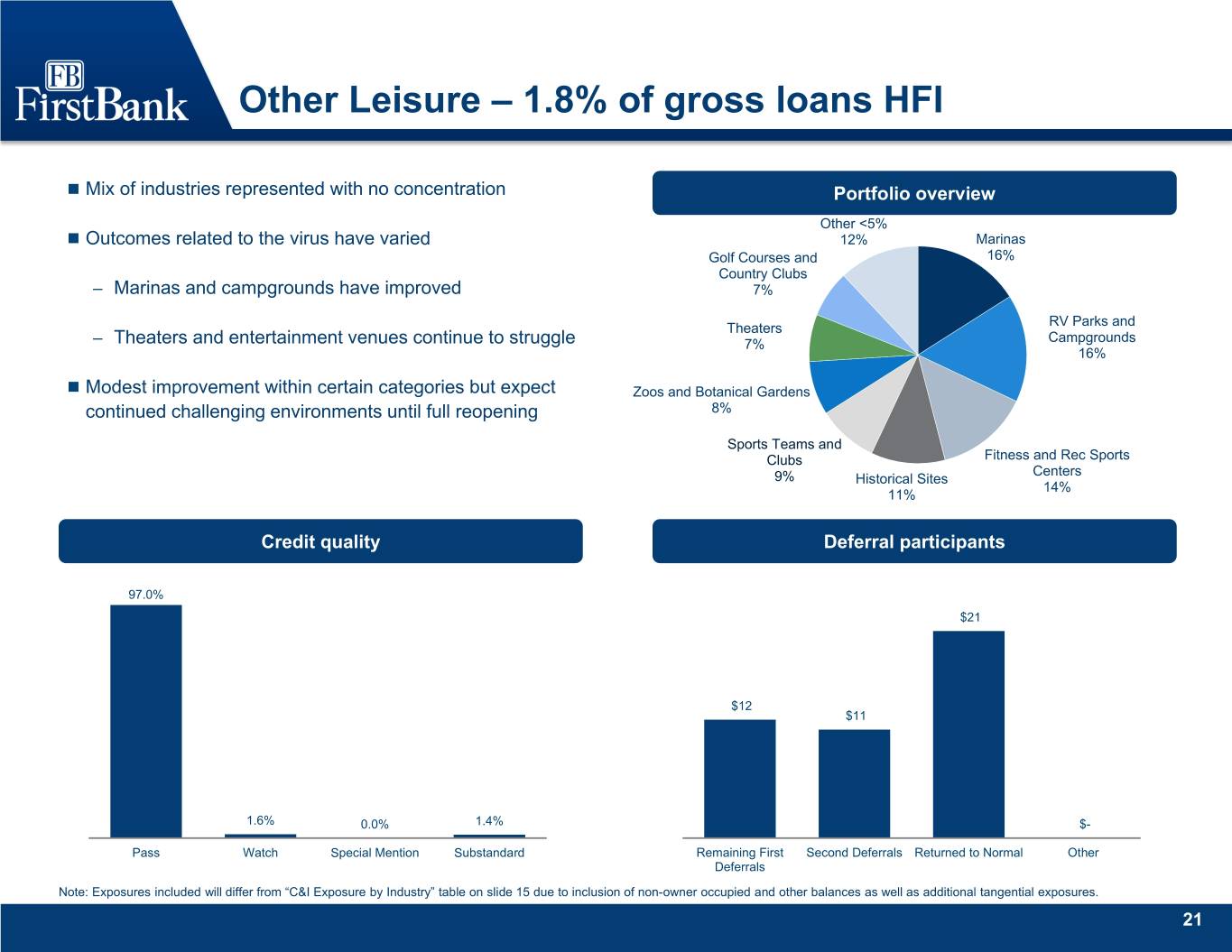

Other Leisure – 1.8% of gross loans HFI Mix of industries represented with no concentration Portfolio overview Other <5% Outcomes related to the virus have varied 12% Marinas Golf Courses and 16% Country Clubs – Marinas and campgrounds have improved 7% RV Parks and Theaters Campgrounds – Theaters and entertainment venues continue to struggle 7% 16% Modest improvement within certain categories but expect Zoos and Botanical Gardens continued challenging environments until full reopening 8% Sports Teams and Clubs Fitness and Rec Sports Centers 9% Historical Sites 14% 11% Credit quality Deferral participants 97.0% $21 $12 $11 1.6% 0.0% 1.4% $- Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 15 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. 21

Transportation and warehousing – 1.8% of gross loans HFI Portfolio continues to fare well Portfolio overview Other Trucking overall shows strength Transportation and Warehousing 18% Warehousing has benefitted from storage and distribution Trucking 37% related to online shopping Consumer Charter Transportation 10% Air travel and support segment related to engine leasing and not direct commercial passenger related Mini Warehouses and Self Storage 12% Air Travel and Support 23% Credit quality Deferral participants 97.0% $9 $7 1.3% 0.6% 0.8% $- $- Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 15 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. 22

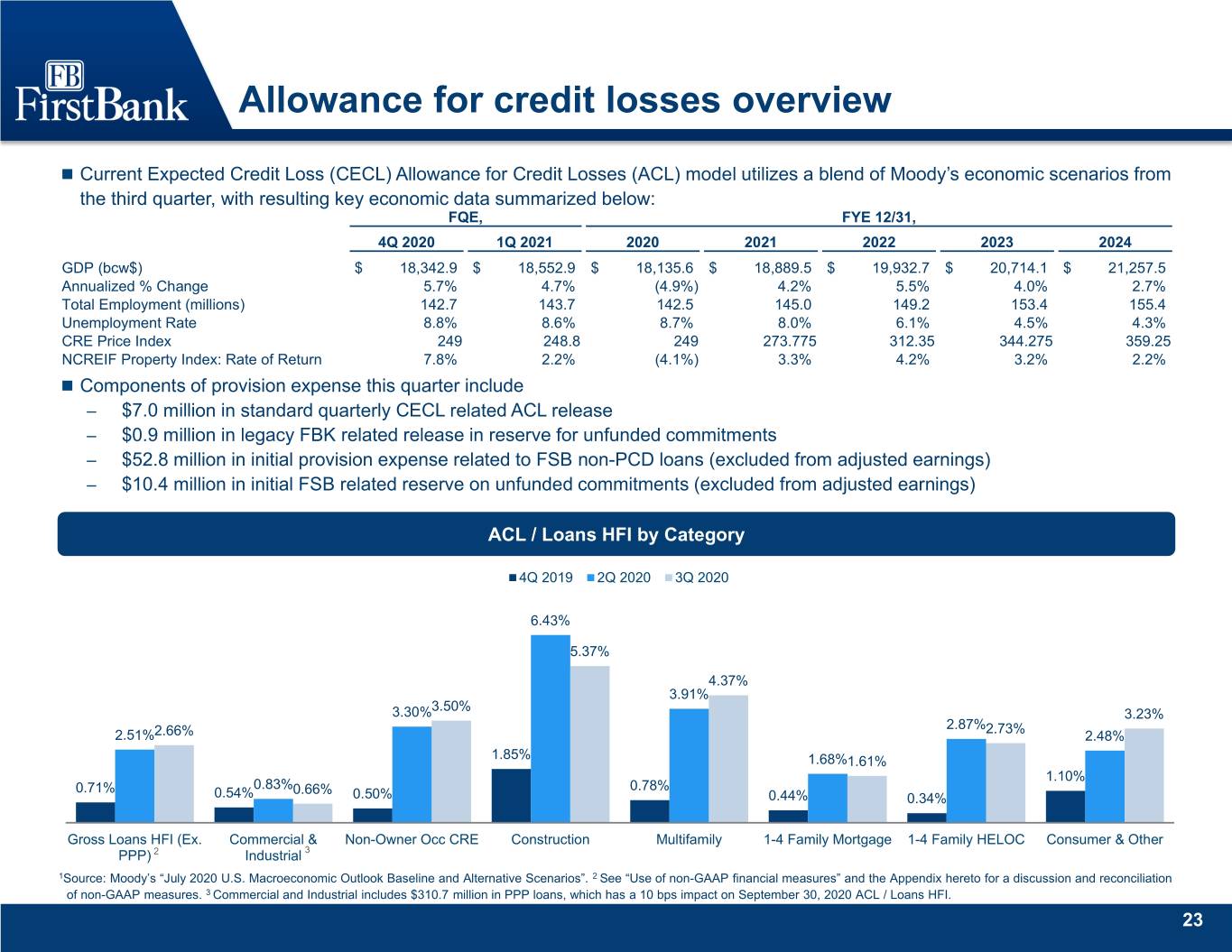

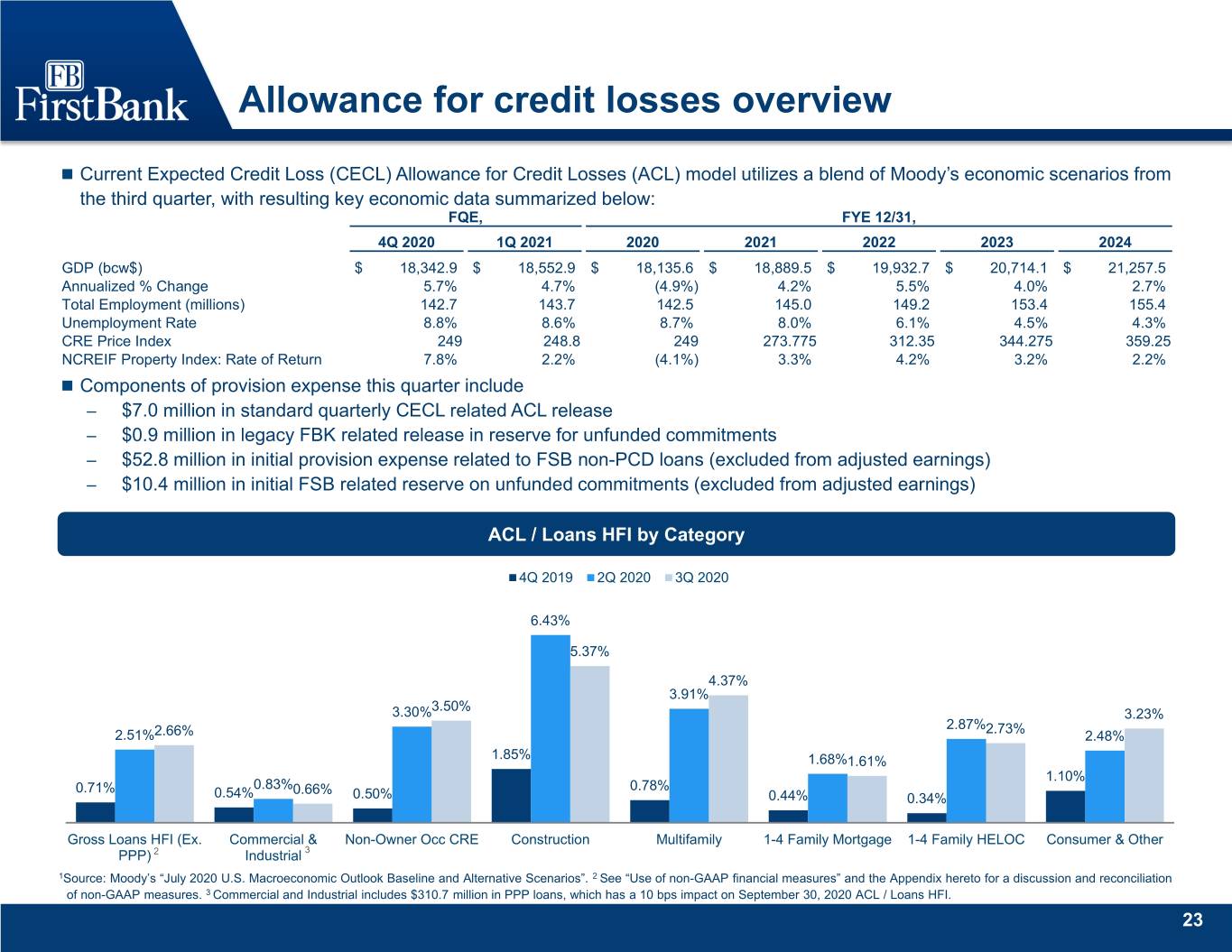

Allowance for credit losses overview Current Expected Credit Loss (CECL) Allowance for Credit Losses (ACL) model utilizes a blend of Moody’s economic scenarios from the third quarter, with resulting key economic data summarized below: FQE, FYE 12/31, 4Q 2020 1Q 2021 2020 2021 2022 2023 2024 GDP (bcw$) $ 18,342.9 $ 18,552.9 $ 18,135.6 $ 18,889.5 $ 19,932.7 $ 20,714.1 $ 21,257.5 Annualized % Change 5.7% 4.7% (4.9%) 4.2% 5.5% 4.0% 2.7% Total Employment (millions) 142.7 143.7 142.5 145.0 149.2 153.4 155.4 Unemployment Rate 8.8% 8.6% 8.7% 8.0% 6.1% 4.5% 4.3% CRE Price Index 249 248.8 249 273.775 312.35 344.275 359.25 NCREIF Property Index: Rate of Return 7.8% 2.2% (4.1%) 3.3% 4.2% 3.2% 2.2% Components of provision expense this quarter include – $7.0 million in standard quarterly CECL related ACL release – $0.9 million in legacy FBK related release in reserve for unfunded commitments – $52.8 million in initial provision expense related to FSB non-PCD loans (excluded from adjusted earnings) – $10.4 million in initial FSB related reserve on unfunded commitments (excluded from adjusted earnings) ACL / Loans HFI by Category 4Q 2019 2Q 2020 3Q 2020 6.43% 5.37% 4.37% 3.91% 3.50% 3.30% 3.23% 2.87%2.73% 2.51%2.66% 2.48% 1.85% 1.68%1.61% 1.10% 0.71% 0.83%0.66% 0.78% 0.54% 0.50% 0.44% 0.34% Gross Loans HFI (Ex. Commercial & Non-Owner Occ CRE Construction Multifamily 1-4 Family Mortgage 1-4 Family HELOC Consumer & Other PPP) 2 Industrial 3 1Source: Moody’s “July 2020 U.S. Macroeconomic Outlook Baseline and Alternative Scenarios”. 2 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 3 Commercial and Industrial includes $310.7 million in PPP loans, which has a 10 bps impact on September 30, 2020 ACL / Loans HFI. 23

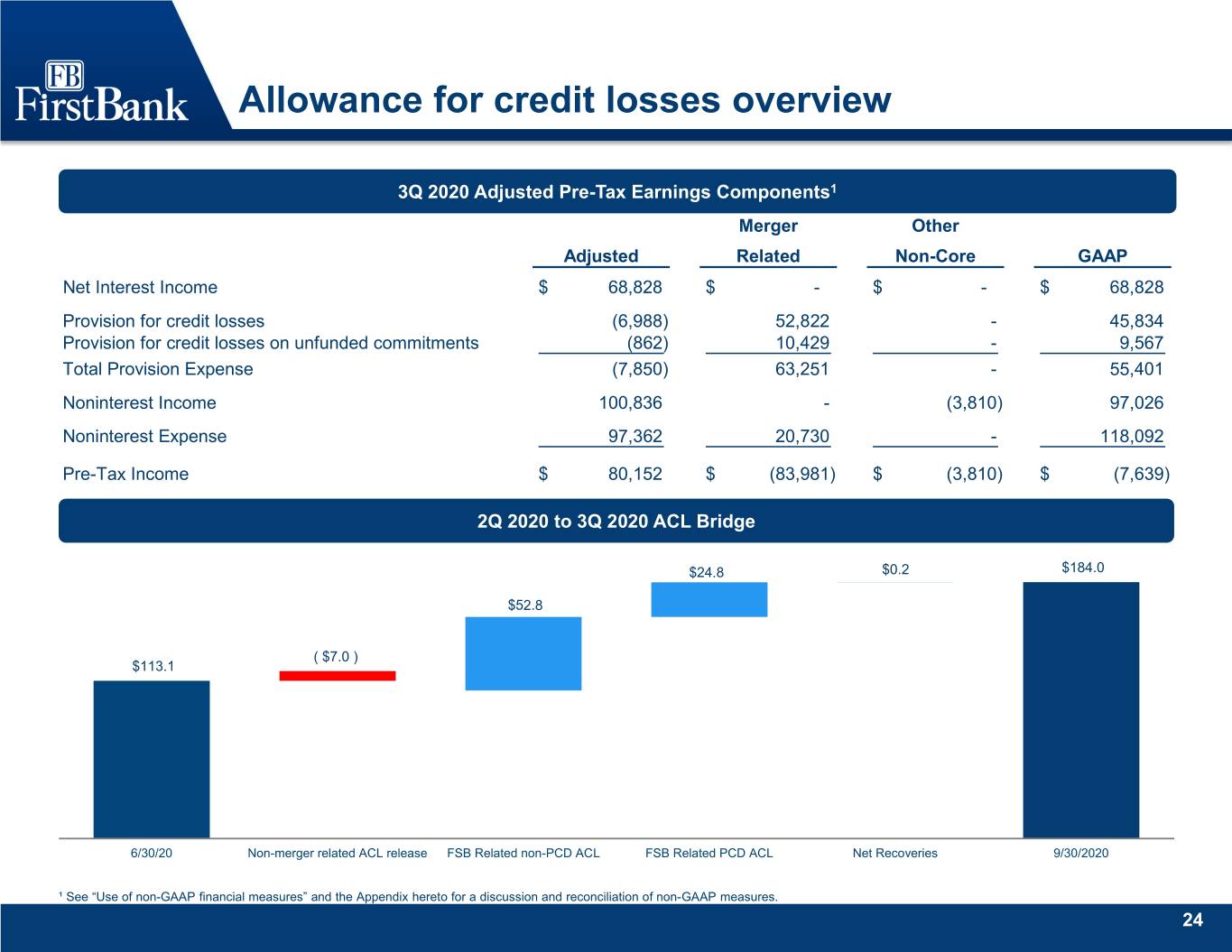

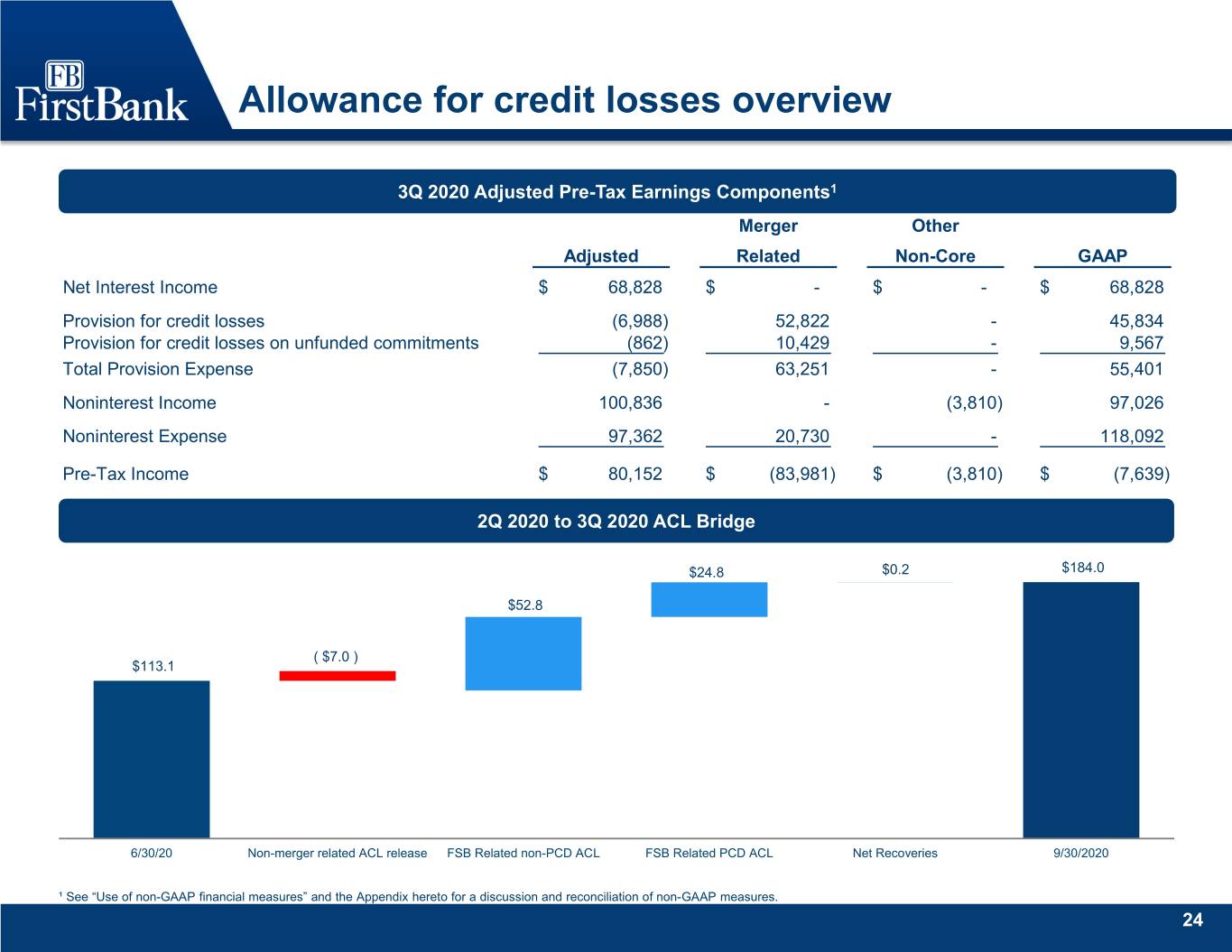

Allowance for credit losses overview 3Q 2020 Adjusted Pre-Tax Earnings Components1 Merger Other Adjusted Related Non-Core GAAP Net Interest Income $ 68,828 $ - $ - $ 68,828 Provision for credit losses (6,988) 52,822 - 45,834 Provision for credit losses on unfunded commitments (862) 10,429 - 9,567 Total Provision Expense (7,850) 63,251 - 55,401 Noninterest Income 100,836 - (3,810) 97,026 Noninterest Expense 97,362 20,730 - 118,092 Pre-Tax Income $ 80,152 $ (83,981) $ (3,810) $ (7,639) 2Q 2020 to 3Q 2020 ACL Bridge $24.8 $0.2 $184.0 $52.8 ( $7.0 ) $113.1 6/30/20 Non-merger related ACL release FSB Related non-PCD ACL FSB Related PCD ACL Net Recoveries 9/30/2020 ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 24

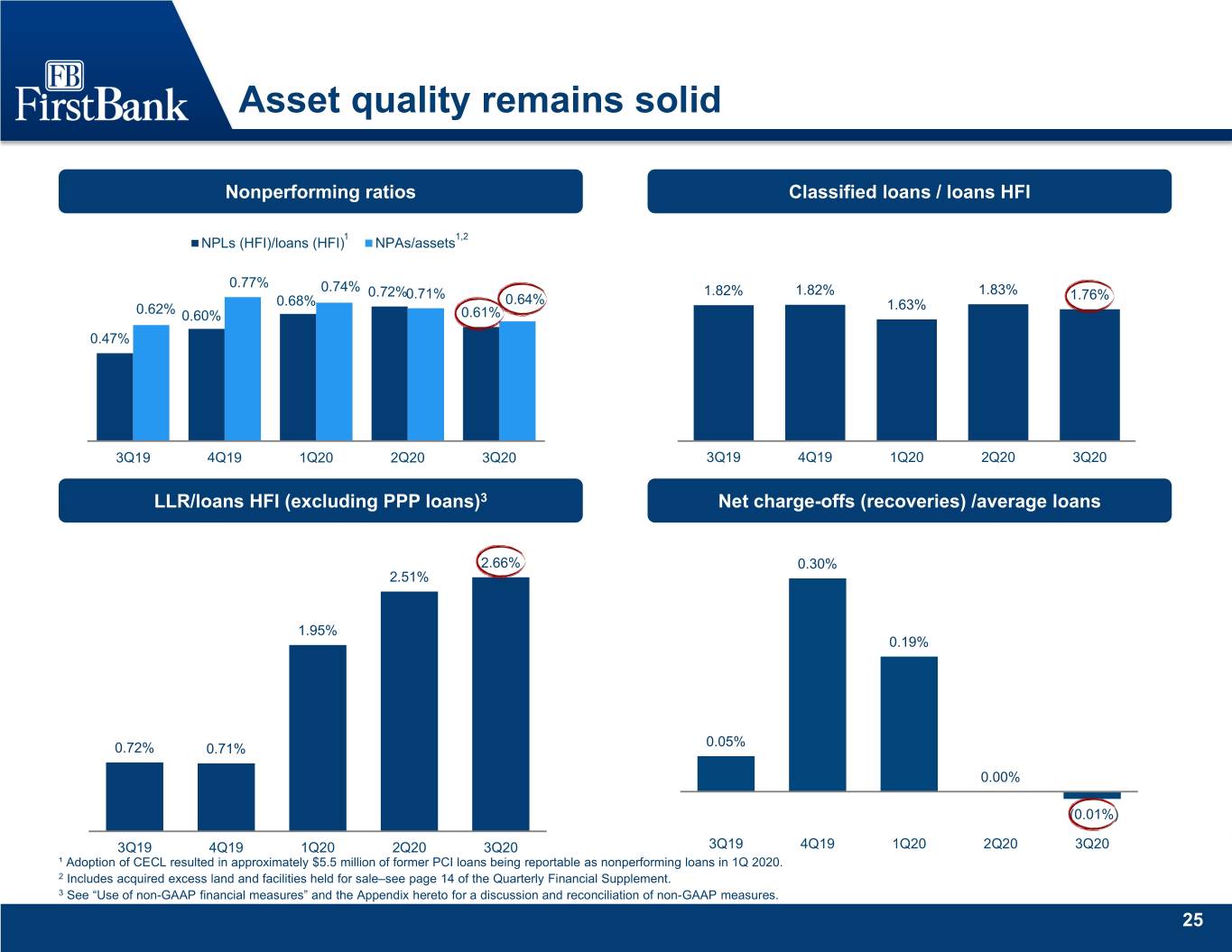

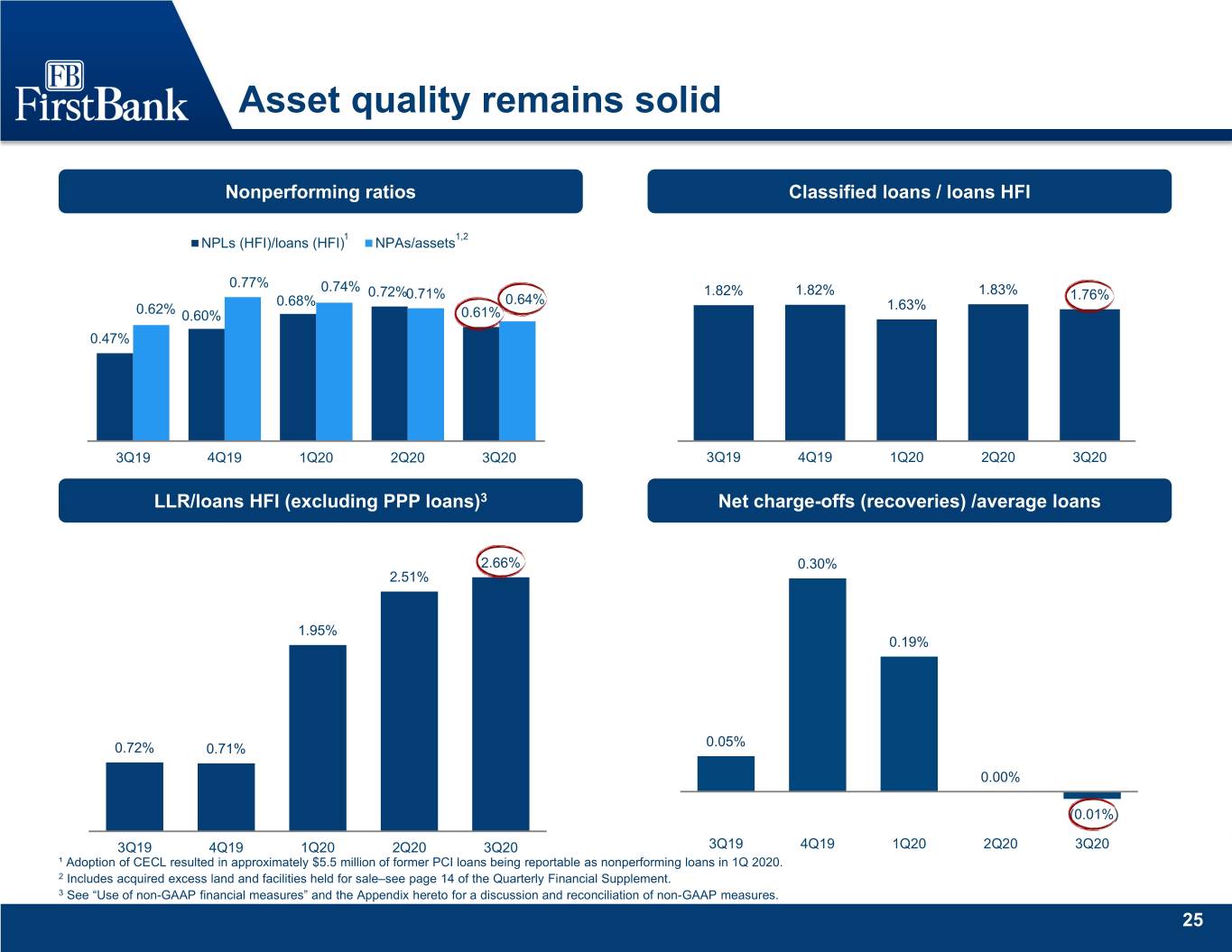

Asset quality remains solid Nonperforming ratios Classified loans / loans HFI 1 1,2 NPLs (HFI)/loans (HFI) NPAs/assets 0.77% 0.74% 0.72%0.71% 1.82% 1.82% 1.83% 1.76% 0.68% 0.64% 1.63% 0.62% 0.60% 0.61% 0.47% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 LLR/loans HFI (excluding PPP loans)3 Net charge-offs (recoveries) /average loans 2.66% 0.30% 2.51% 1.95% 0.19% 0.05% 0.72% 0.71% 0.00% (0.01%) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 ¹ Adoption of CECL resulted in approximately $5.5 million of former PCI loans being reportable as nonperforming loans in 1Q 2020. 2 Includes acquired excess land and facilities held for sale–see page 14 of the Quarterly Financial Supplement. 3 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 25

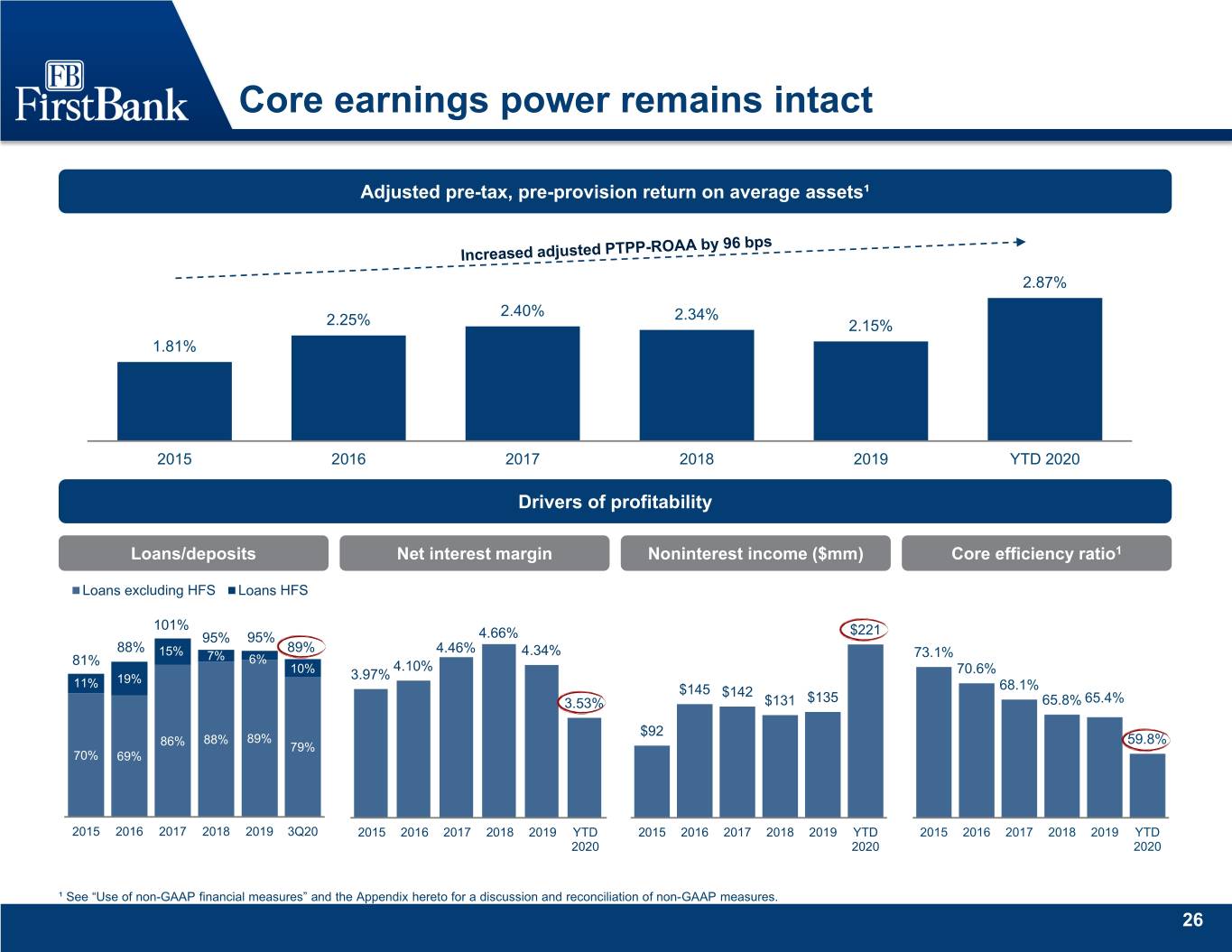

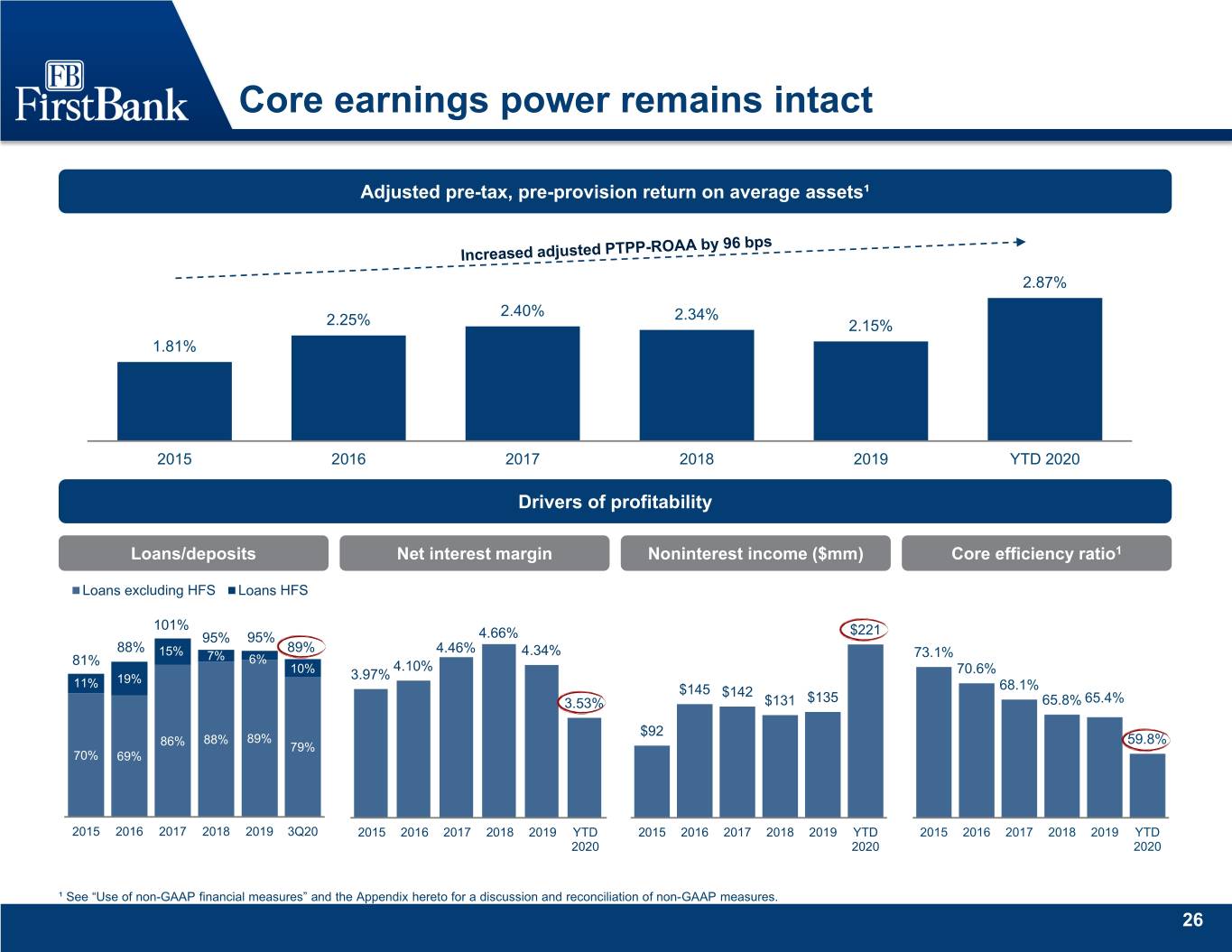

Core earnings power remains intact Adjusted pre-tax, pre-provision return on average assets¹ 2.87% 2.40% 2.34% 2.25% 2.15% 1.81% 2015 2016 2017 2018 2019 YTD 2020 Drivers of profitability Loans/deposits Net interest margin Noninterest income ($mm) Core efficiency ratio1 Loans excluding HFS Loans HFS 101% $221 95% 95% 4.66% 88% 89% 4.46% 15% 7% 4.34% 73.1% 81% 6% 4.10% 10% 3.97% 70.6% 11% 19% $145 $142 68.1% 3.53% $131 $135 65.8% 65.4% $92 88% 89% 59.8% 86% 79% 70% 69% 2015 2016 2017 2018 2019 3Q20 2015 2016 2017 2018 2019 YTD 2015 2016 2017 2018 2019 YTD 2015 2016 2017 2018 2019 YTD 2020 2020 2020 ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 26

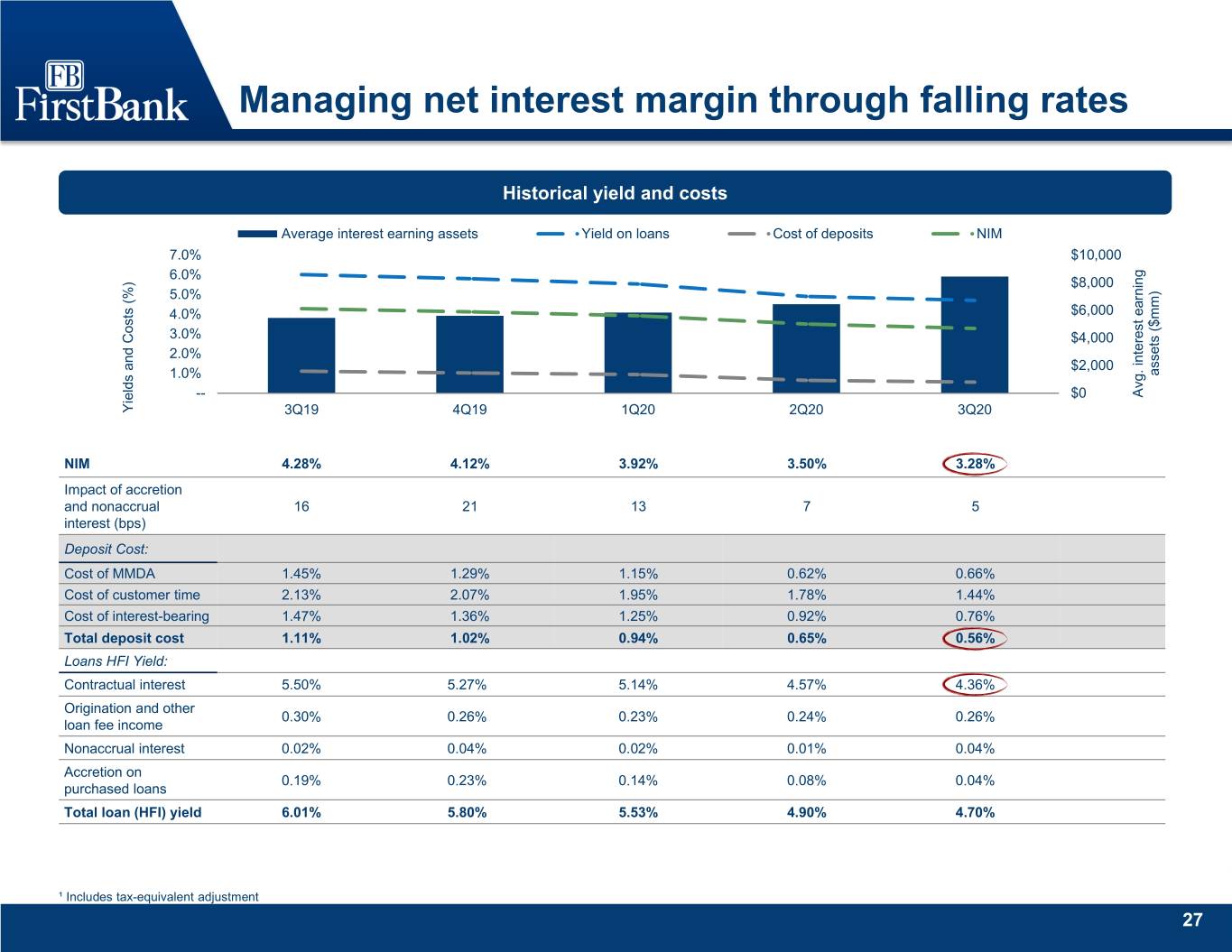

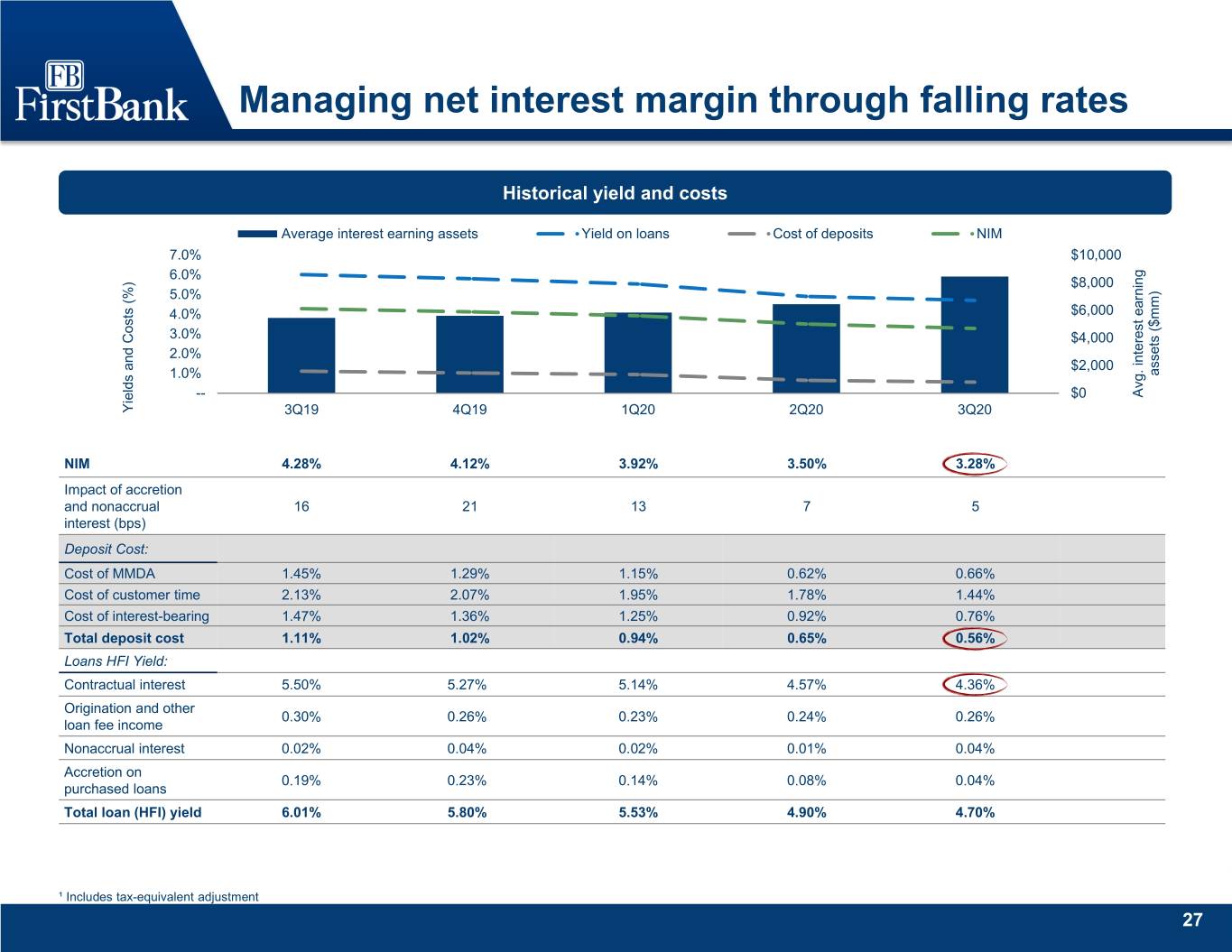

Managing net interest margin through falling rates Historical yield and costs Average interest earning assets Yield on loans Cost of deposits NIM 7.0% $10,000 6.0% $8,000 5.0% 4.0% $6,000 3.0% $4,000 2.0% $2,000 1.0% ($mm) assets -- $0 Avg. interest earning Yields and Costs(%) 3Q19 4Q19 1Q20 2Q20 3Q20 NIM 4.28% 4.12% 3.92% 3.50% 3.28% Impact of accretion and nonaccrual 16 21 13 7 5 interest (bps) Deposit Cost: Cost of MMDA 1.45% 1.29% 1.15% 0.62% 0.66% Cost of customer time 2.13% 2.07% 1.95% 1.78% 1.44% Cost of interest-bearing 1.47% 1.36% 1.25% 0.92% 0.76% Total deposit cost 1.11% 1.02% 0.94% 0.65% 0.56% Loans HFI Yield: Contractual interest 5.50% 5.27% 5.14% 4.57% 4.36% Origination and other 0.30% 0.26% 0.23% 0.24% 0.26% loan fee income Nonaccrual interest 0.02% 0.04% 0.02% 0.01% 0.04% Accretion on 0.19% 0.23% 0.14% 0.08% 0.04% purchased loans Total loan (HFI) yield 6.01% 5.80% 5.53% 4.90% 4.70% ¹ Includes tax-equivalent adjustment 27

Mortgage operations overview Highlights Quarterly mortgage production Record adjusted total mortgage pre-tax contribution1 of $39.5 Consumer Direct million for 3Q 2020 Retail 3Q19 2Q20 3Q20 Wholesale Mortgage sale margins continue to be elevated due to industry capacity constraints and low interest rates Mortgage pipeline at the end of 3Q 2020 remains robust at $1.4 billion, as compared to $0.7 billion at the end of 3Q 2019 Mortgage banking income $84.7 million, up 17.3% from 2Q IRLC volume: $1,636mm $2,239mm $2,419mm 2020 and 190.1% from 3Q 2019 IRLC pipeline2: $679mm $1,206mm $1,364mm Mortgage structure allows team to capitalize on attractive rate Refinance %: 69% 80% 76% environments while weathering downturns Purchase %: 31% 20% 24% Mortgage banking income ($mm) Mark to Market Value and Gain on Sale Margin 3Q19 2Q20 3Q20 Mark to Market Value 3 Gain on Sale Margin Gain on Sale $28.0 $45.5 $76.5 4.32% Fair value $2.3 $34.8 $10.1 3.99% changes 3.84% Servicing 2.88% 2.92% 2.85% $4.0 $5.1 $5.5 Revenue 2.20%2.29% 2.27% Fair value 1.41% $(5.1) ($13.2) ($7.4) MSR changes Total $29.2 $72.2 $84.7 Income 3Q19 4Q19 1Q20 2Q20 3Q20 ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP financial measures ² As of the respective period-end 3Defined as pipeline net of hedge plus best efforts divided by hedge weighted volume. 28

Managing operating leverage Highlights Core efficiency ratio (tax-equivalent basis)¹ Consolidated 3Q 2020 core efficiency ratio¹ Banking segment of 58.2% driven by record mortgage Consolidated contribution 92.4% Mortgage segment 85.0% 79.5% Converted Franklin Financial Network in October 2020 66.5% 65.7% 64.5% 63.2% 62.7% 61.1% 61.8% 59.6% 58.2% 57.5% Record quarterly mortgage contribution in low 48.9% 50.1% rate environment Expense control remains a focus for 2020 with margin headwinds 3Q19 4Q19 1Q20 2Q20 3Q20 ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 29

Appendix 30

GAAP reconciliation and use of non-GAAP financial measures Adjusted net income and diluted earnings per share 31

GAAP reconciliation and use of non-GAAP financial measures Pre-tax, pre-provision earnings and diluted earnings per share 32

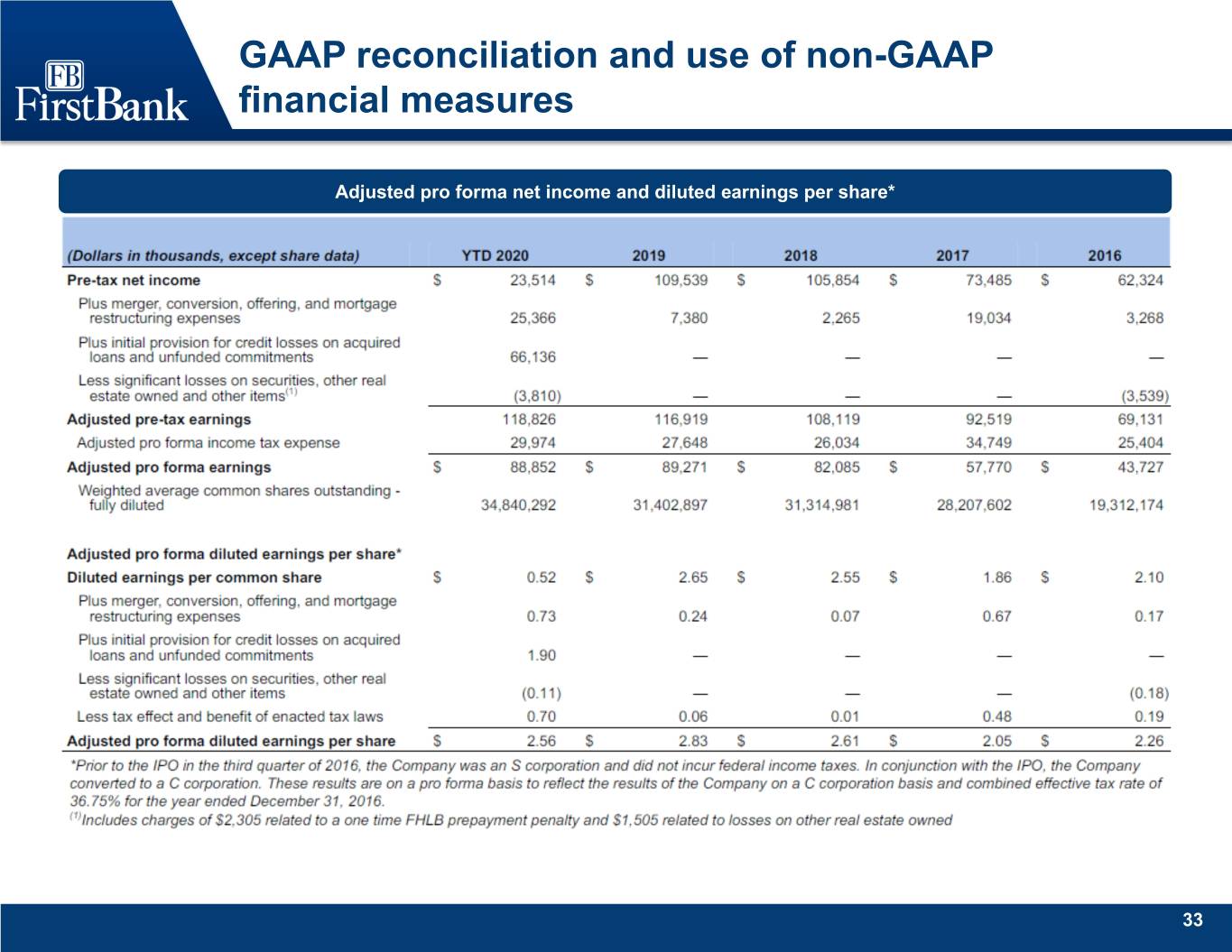

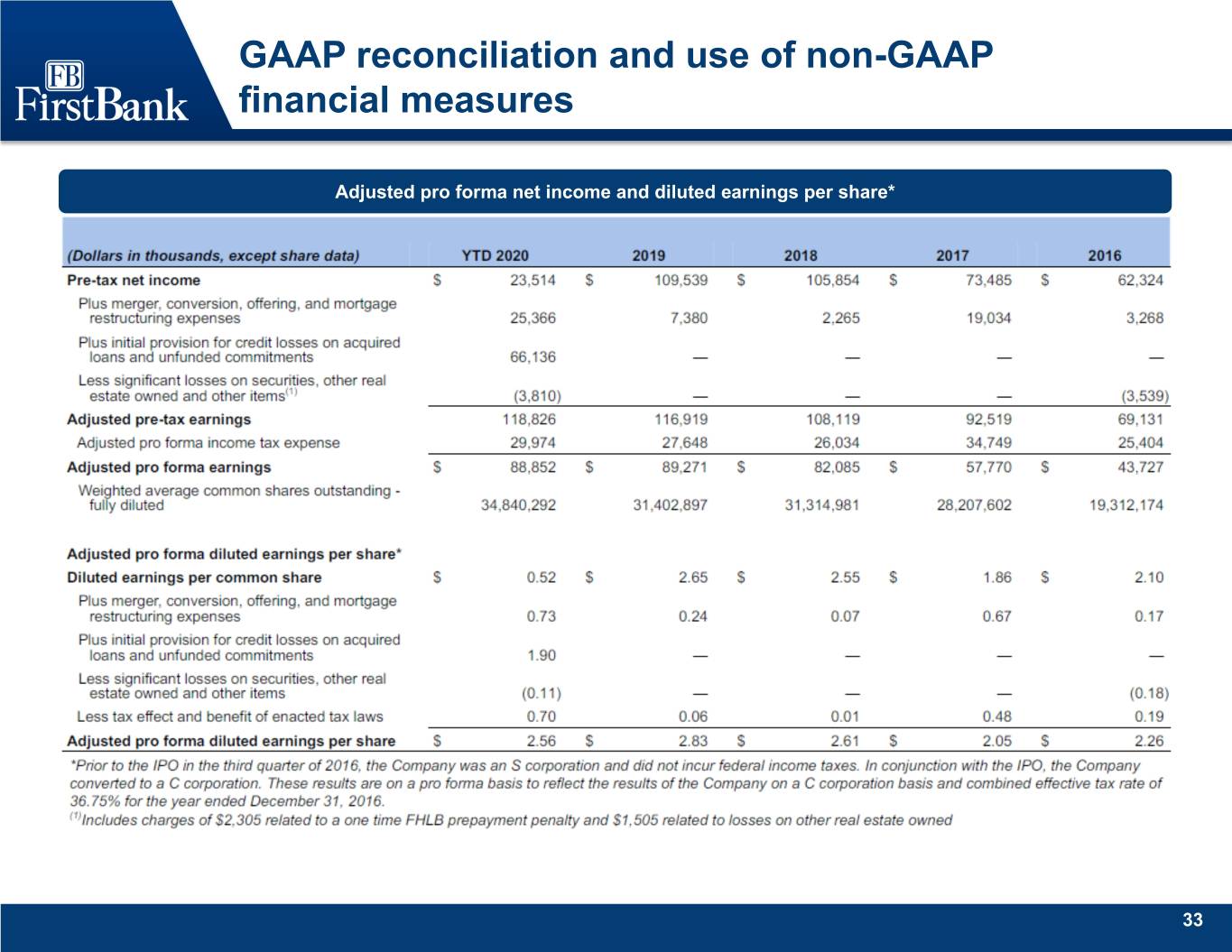

GAAP reconciliation and use of non-GAAP financial measures Adjusted pro forma net income and diluted earnings per share* 33

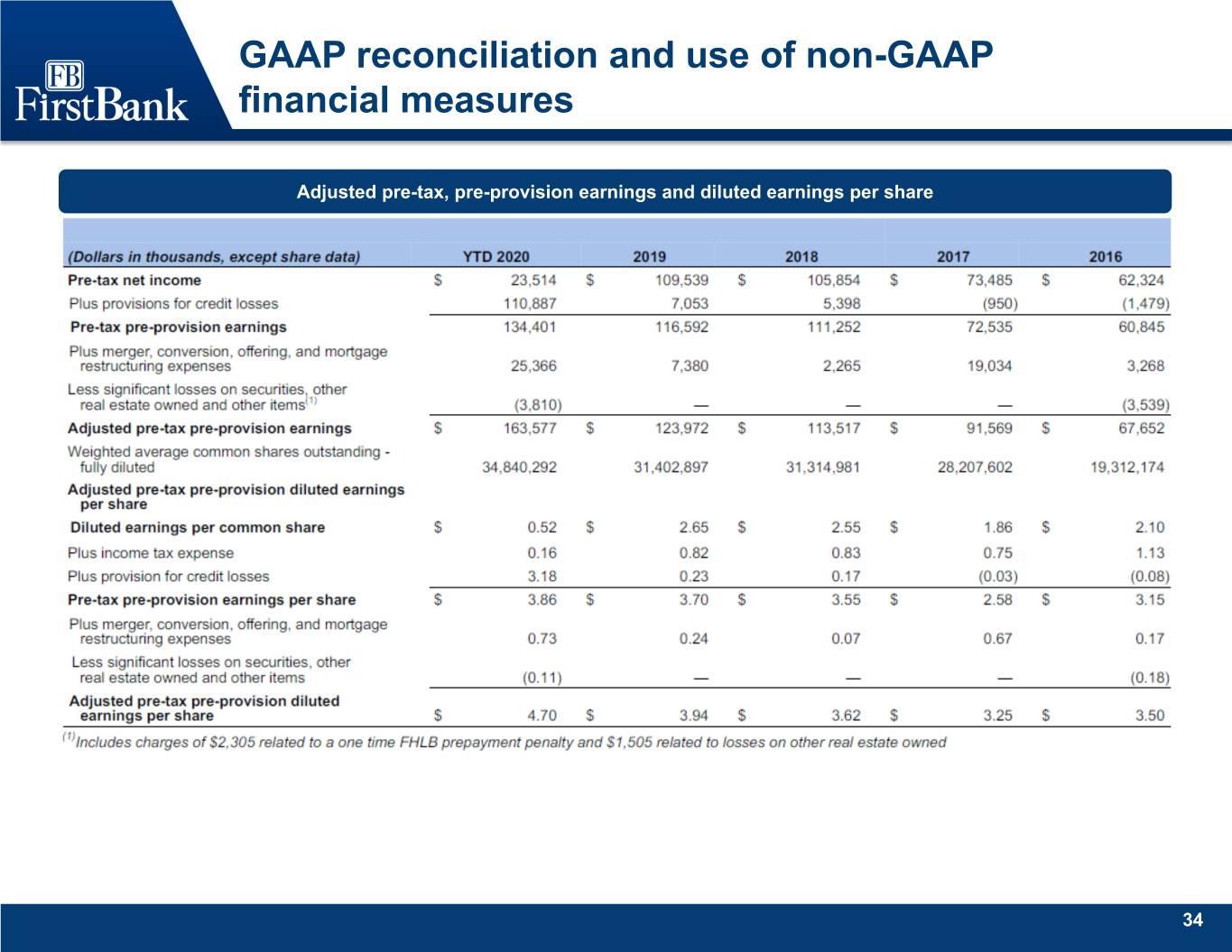

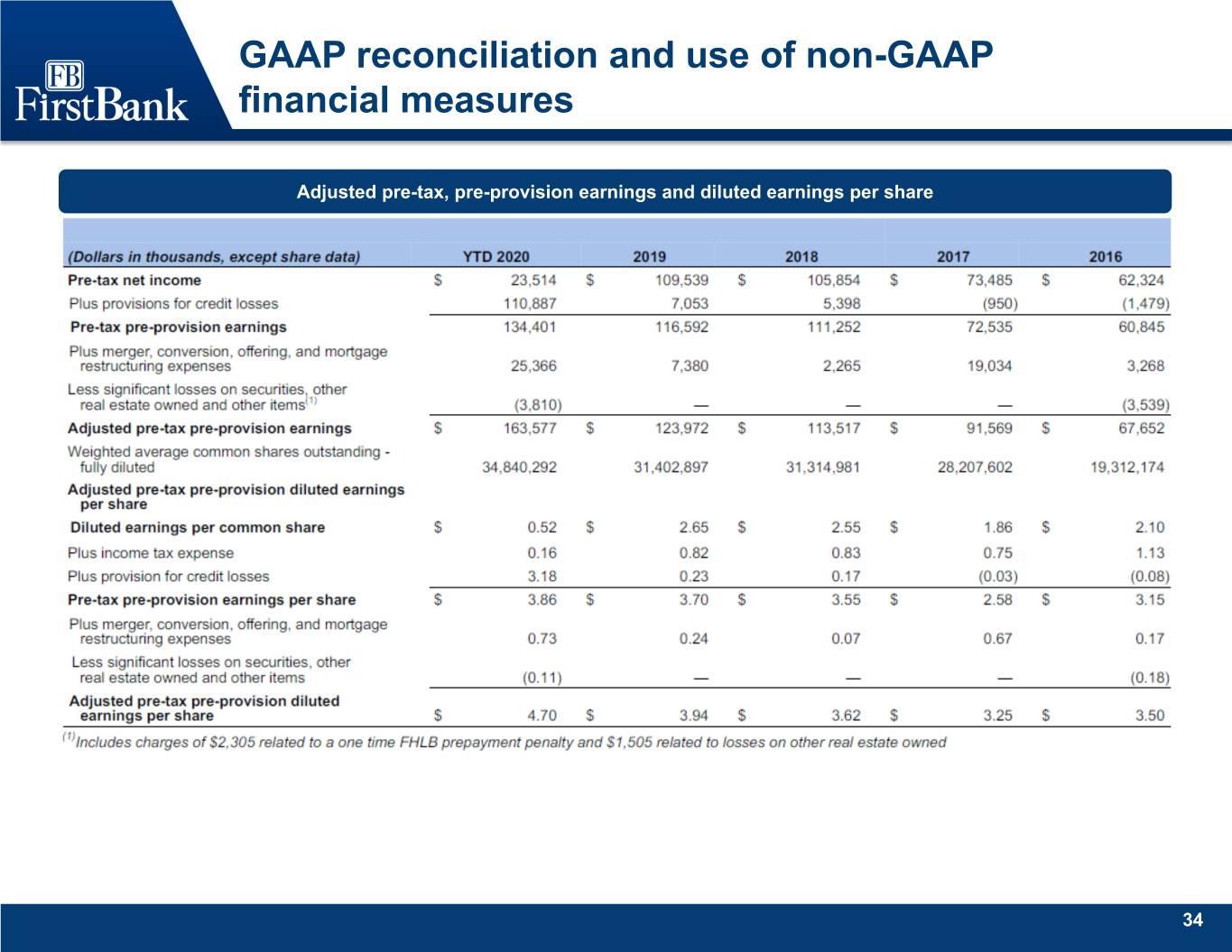

GAAP reconciliation and use of non-GAAP financial measures Adjusted pre-tax, pre-provision earnings and diluted earnings per share 34

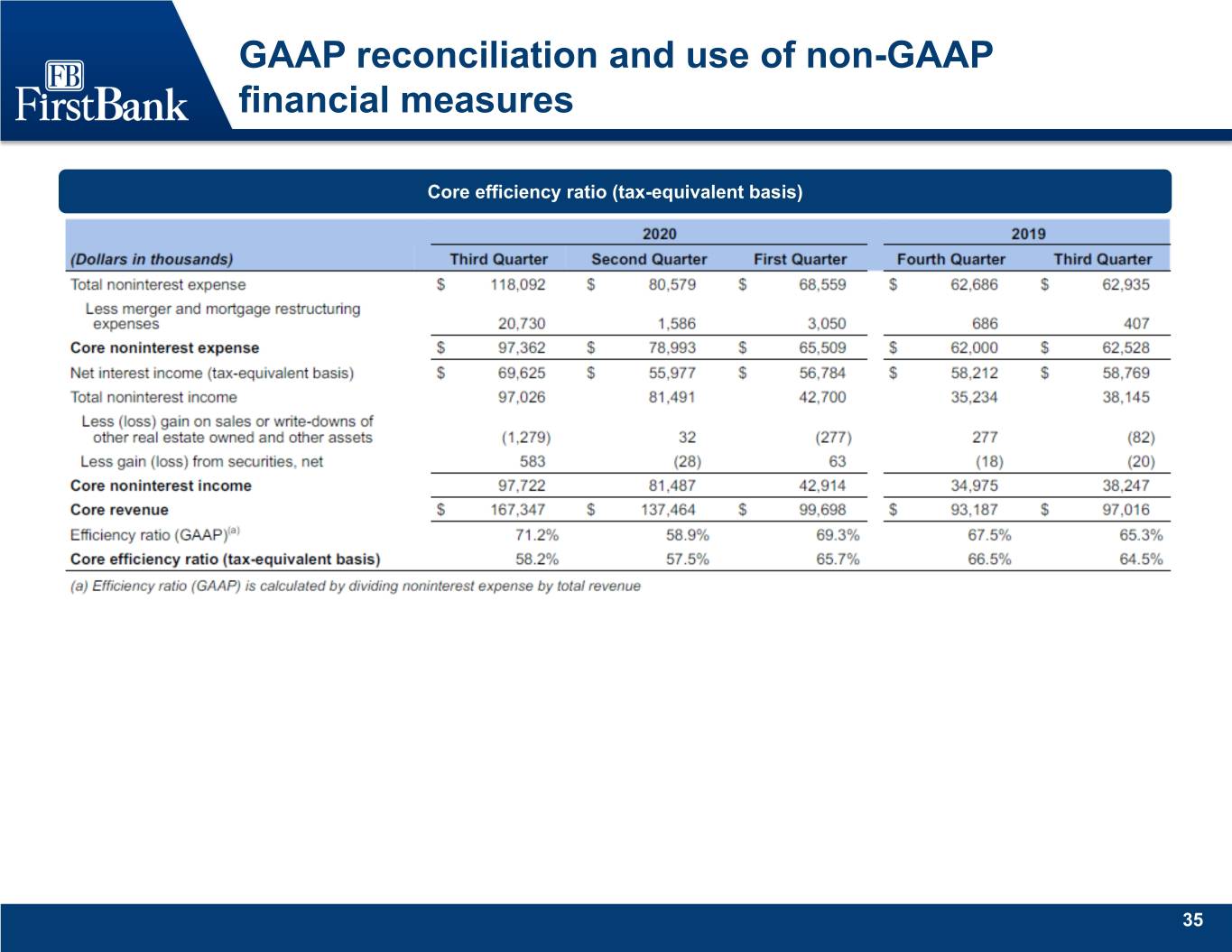

GAAP reconciliation and use of non-GAAP financial measures Core efficiency ratio (tax-equivalent basis) 35

GAAP reconciliation and use of non-GAAP financial measures Core efficiency ratio (tax-equivalent basis) 36

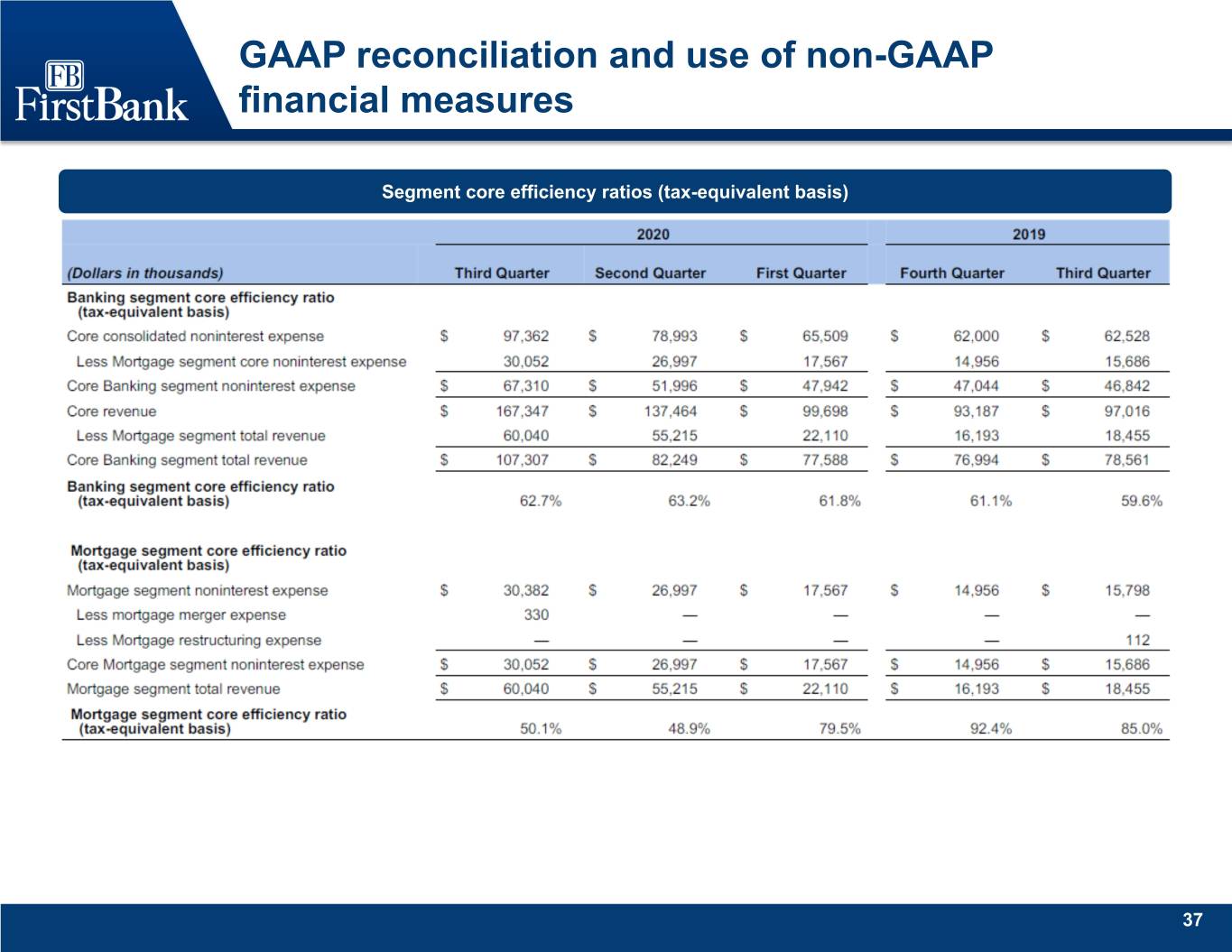

GAAP reconciliation and use of non-GAAP financial measures Segment core efficiency ratios (tax-equivalent basis) 37

GAAP reconciliation and use of non-GAAP financial measures Adjusted mortgage contribution 38

GAAP reconciliation and use of non-GAAP financial measures Tangible assets and equity 39

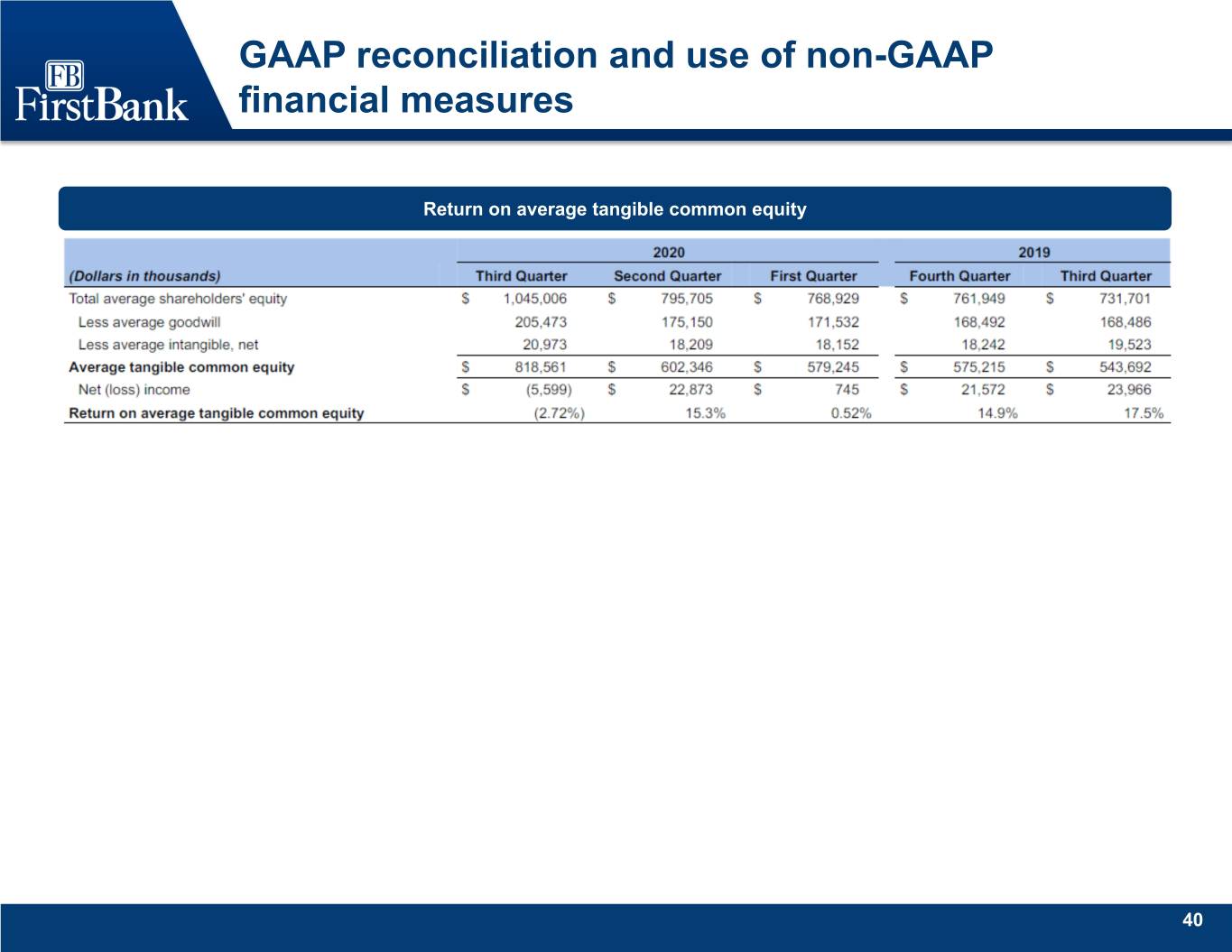

GAAP reconciliation and use of non-GAAP financial measures Return on average tangible common equity 40

GAAP reconciliation and use of non-GAAP financial measures Adjusted return on average tangible common equity Adjusted return on average assets and equity 41

GAAP reconciliation and use of non-GAAP financial measures Adjusted pre-tax, pre-provision return on average tangible common equity Adjusted pre-tax, pre-provision return on average assets and equity 42

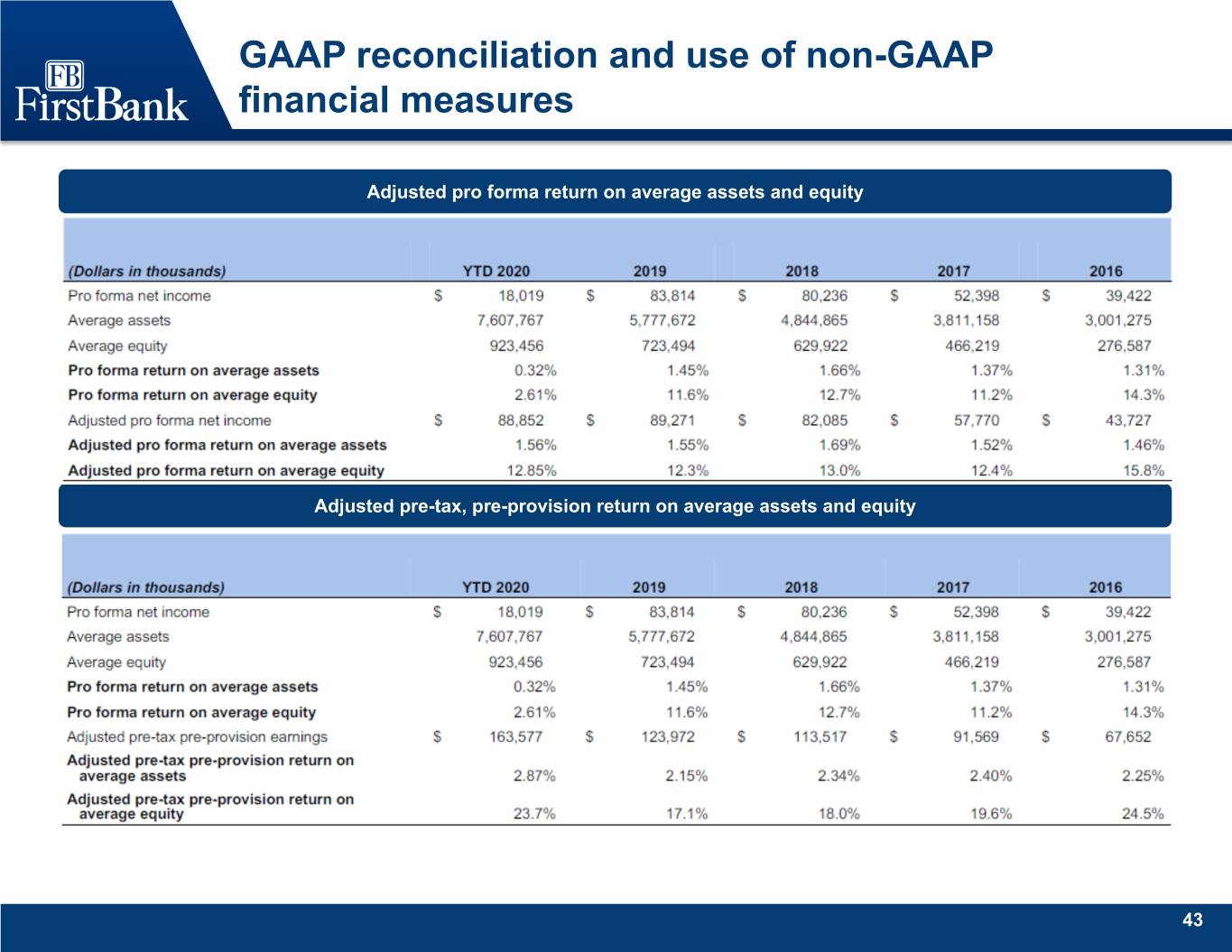

GAAP reconciliation and use of non-GAAP financial measures Adjusted pro forma return on average assets and equity Adjusted pre-tax, pre-provision return on average assets and equity 43

GAAP reconciliation and use of non-GAAP financial measures Adjusted Allowance for Credit Losses to Loans Held for Investment 44