April 19, 2022 2022 First Quarter Earnings Presentation

1 Forward–Looking Statements Certain statements contained in this presentation that are not historical in nature may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding FB Financial Corporation’s (the “Company”) business operations and statements related to the Company’s future plans, results, strategies, and expectations, including expectations around the Company’s Innovations Group. These statements can generally be identified by the use of the words and phrases “may,” “will,” “should,” “could,” “would,” “goal,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target,” “aim,” “predict,” “continue,” “seek,” “project,” and other variations of such words and phrases and similar expressions. These forward-looking statements are not historical facts, and are based upon management's current expectations, estimates, and projections, many of which, by their nature, are inherently uncertain and beyond the Company’s control. The inclusion of these forward-looking statements should not be regarded as a representation by the Company or any other person that such expectations, estimates, and projections will be achieved. Accordingly, the Company cautions shareholders and investors that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements including, without limitation, (1) current and future economic conditions, including the effects of inflation, interest rate fluctuations, changes in the economy or global supply chain, supply-demand imbalances affecting local real estate prices, and high unemployment rates in the local or regional economies in which the Company operates and/or the US economy generally, (2) the ongoing effects of the COVID-19 pandemic, including the magnitude and duration of the pandemic and the emergence of new variants, and its impact on general economic and financial market conditions and on the Company’s business and the Company’s customers' business, results of operations, asset quality and financial condition, (3) ongoing public response to the vaccines that were developed against the virus as well as the decisions of governmental agencies with respect to vaccines, including recommendations related to booster shots and requirements that seek to mandate that individuals receive or employers require that their employees receive the vaccine, (4) those vaccines' efficacy against the virus, including new variants, (5) changes in government interest rate policies and its impact on the Company’s business, net interest margin, and mortgage operations, (6) the Company’s ability to effectively manage problem credits, (7) the Company’s ability to identify potential candidates for, consummate, and achieve synergies from, potential future acquisitions, (8) difficulties and delays in integrating acquired businesses or fully realizing costs savings, revenue synergies and other benefits from future and prior acquisitions, (9) the Company’s ability to successfully execute its various business strategies, (10) changes in state and federal legislation, regulations or policies applicable to banks and other financial service providers, including legislative developments, (11) the potential impact of the proposed phase-out of the London Interbank Offered Rate ("LIBOR") or other changes involving LIBOR, (12) the effectiveness of the Company’s cybersecurity controls and procedures to prevent and mitigate attempted intrusions, (13) the Company's dependence on information technology systems of third party service providers and the risk of systems failures, interruptions, or breaches of security, and (14) general competitive, economic, political, and market conditions. Further information regarding the Company and factors which could affect the forward-looking statements contained herein can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and in any of the Company’s subsequent filings with the Securities and Exchange Commission. Many of these factors are beyond the Company’s ability to control or predict. If one or more events related to these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward-looking statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date of this presentation, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the company. The Company qualifies all forward-looking statements by these cautionary statements.

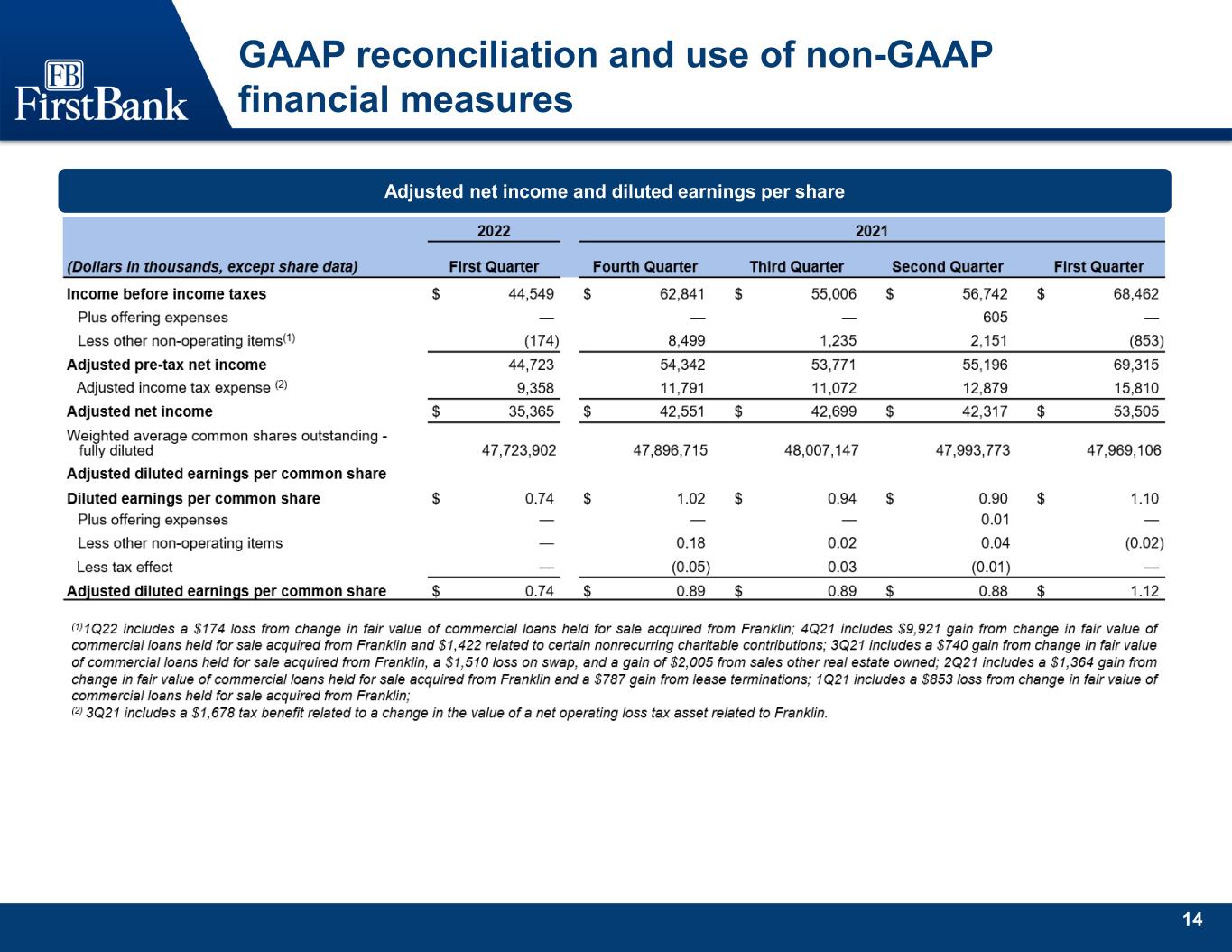

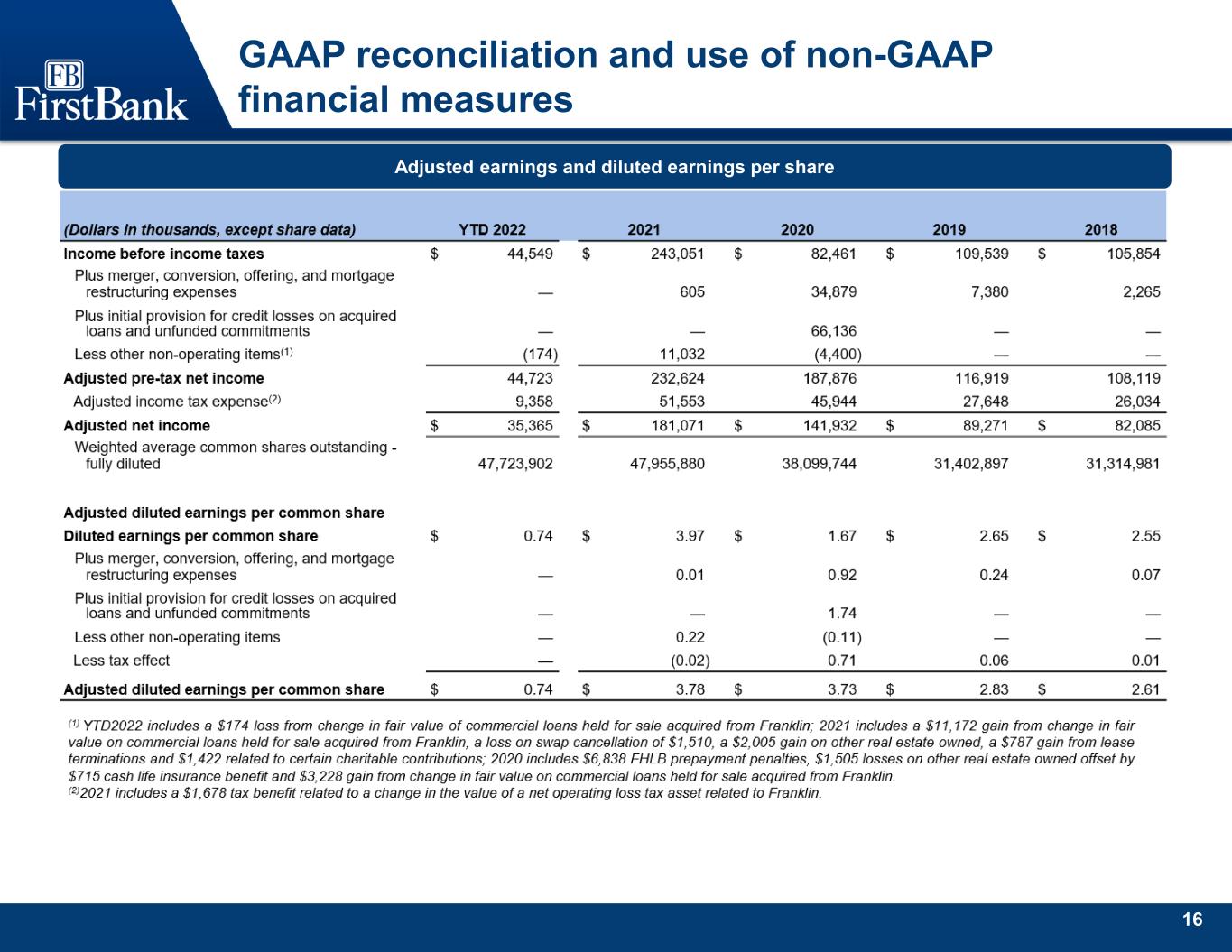

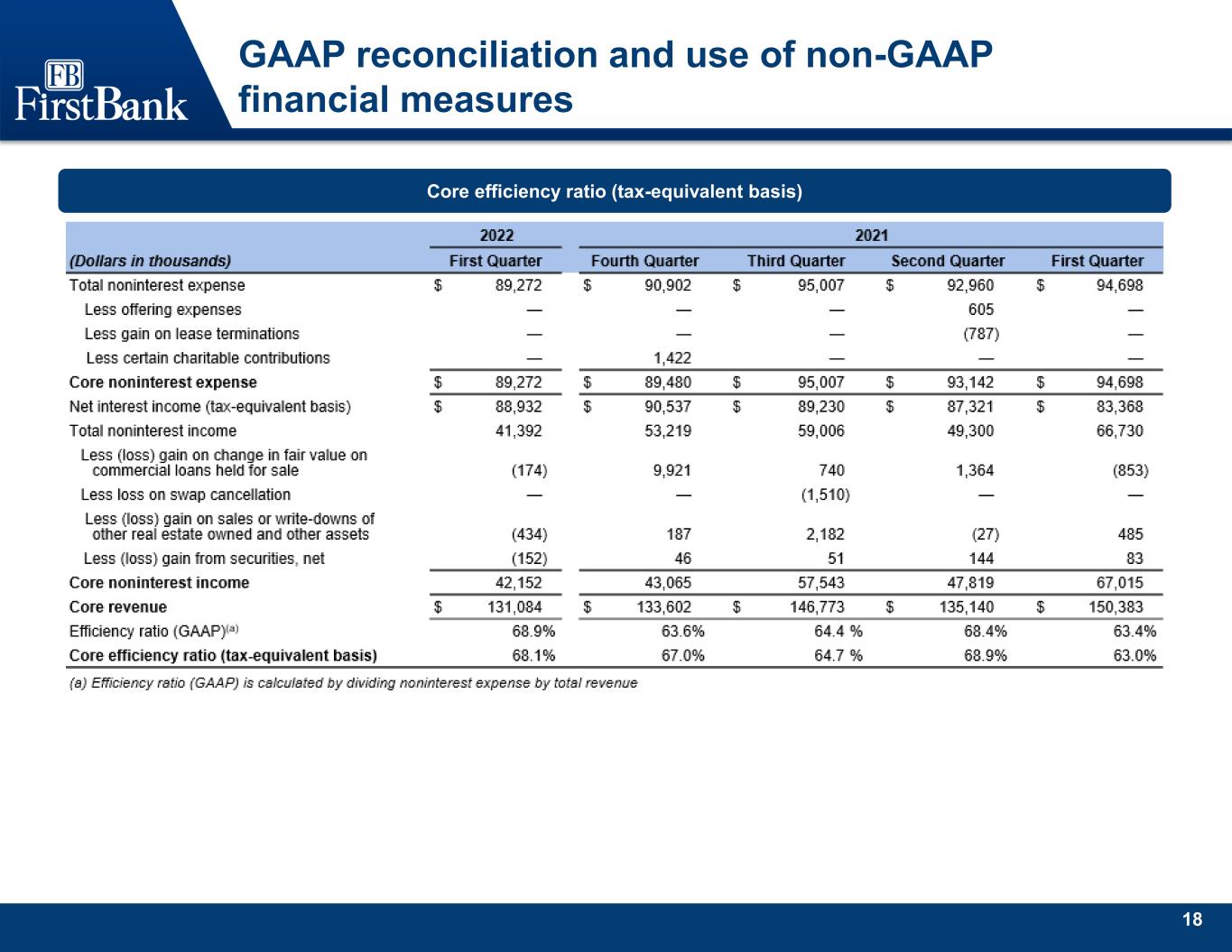

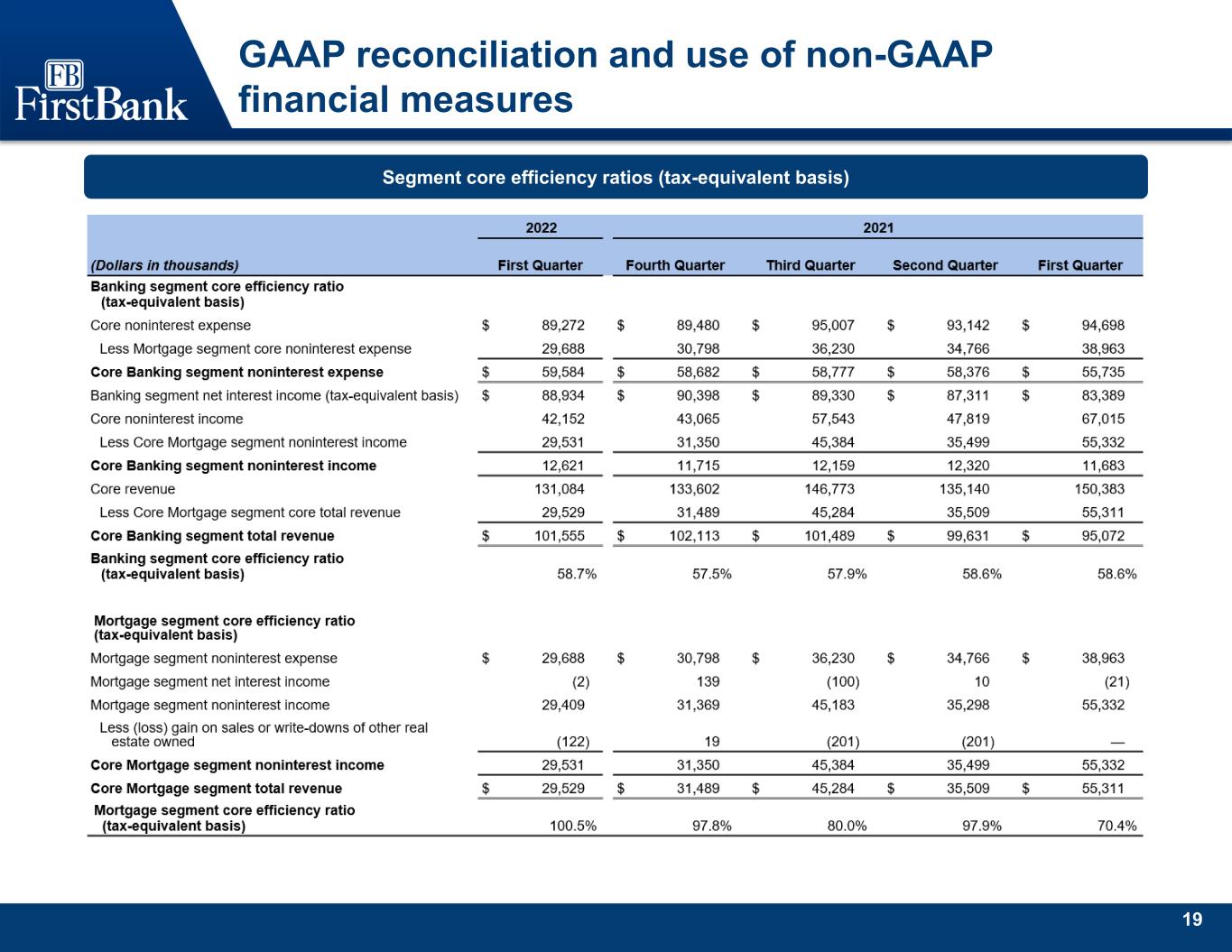

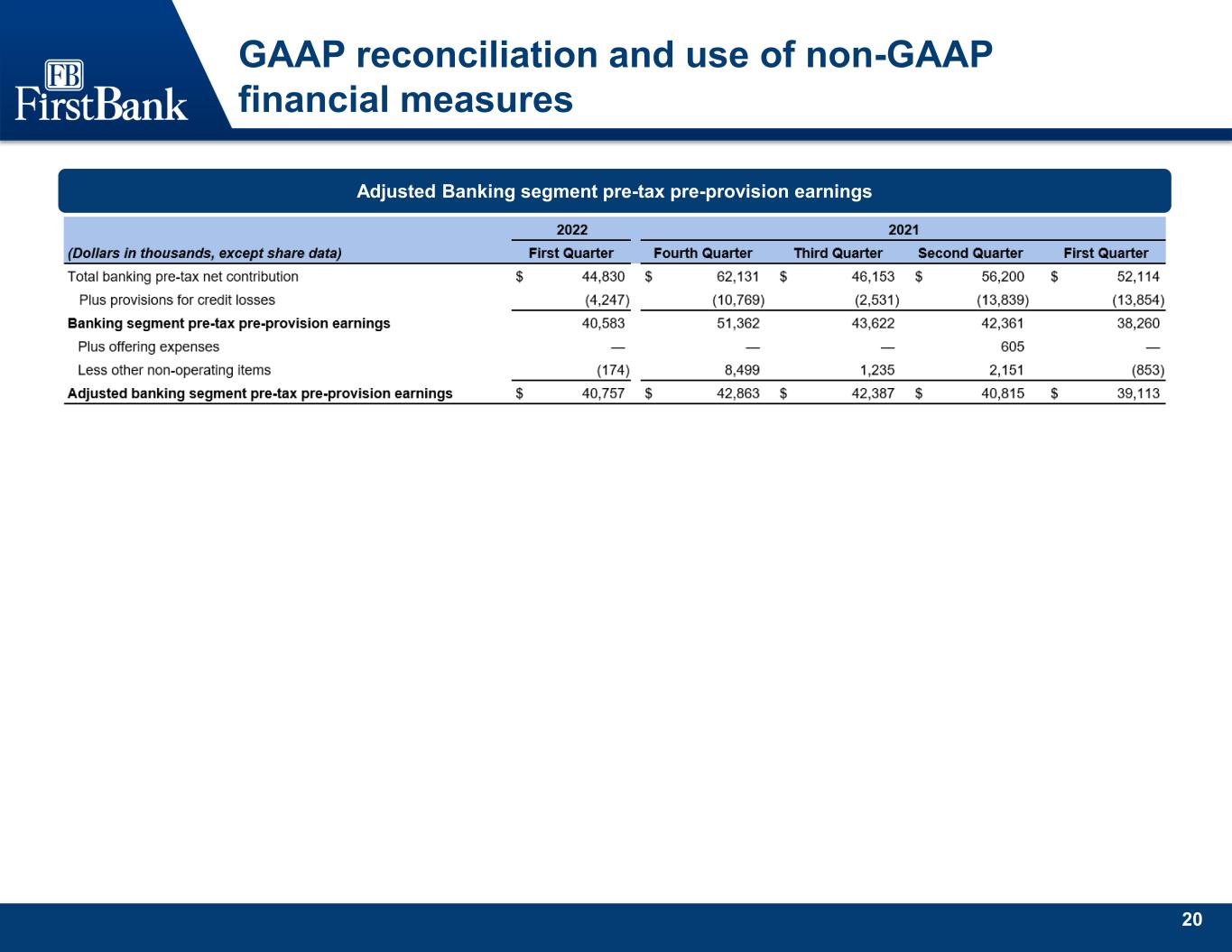

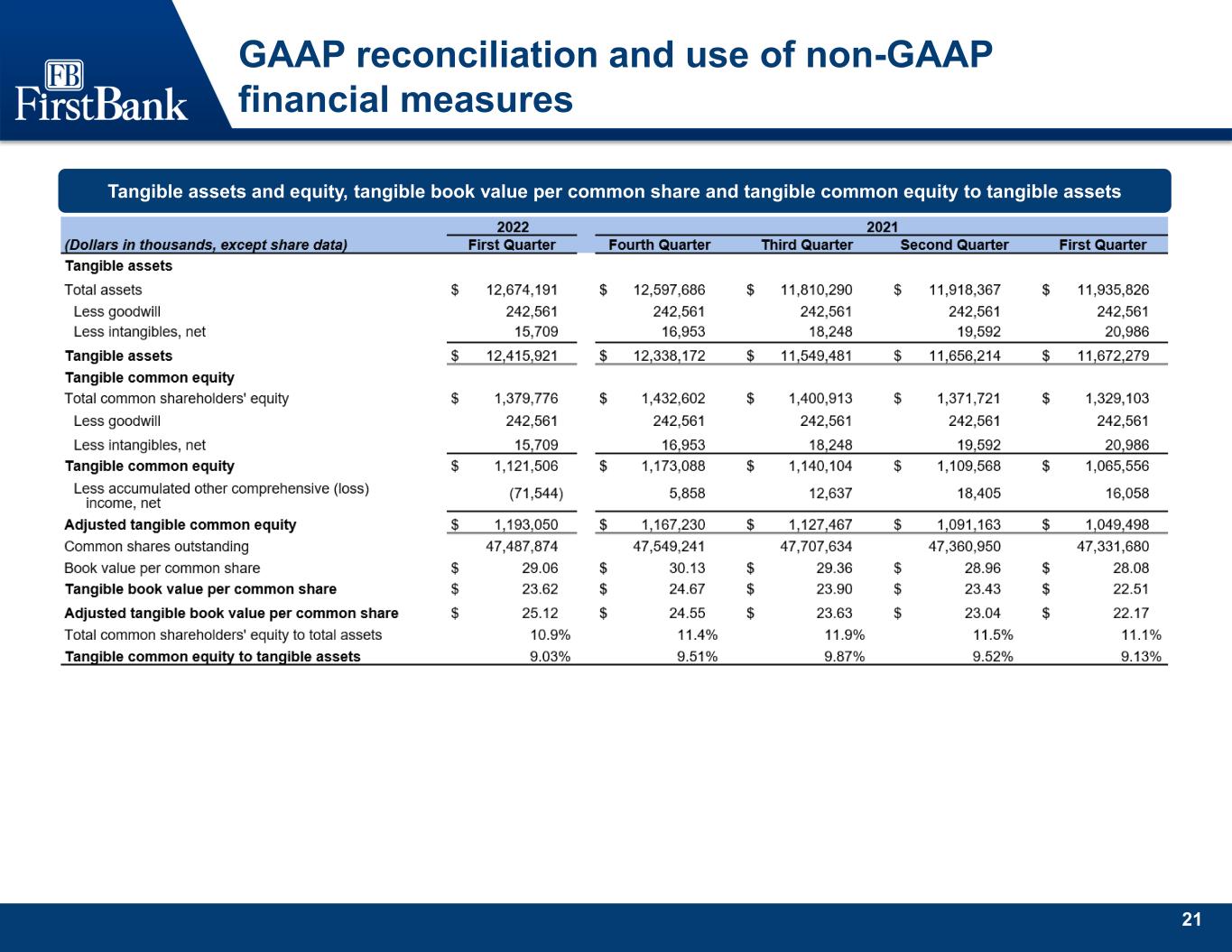

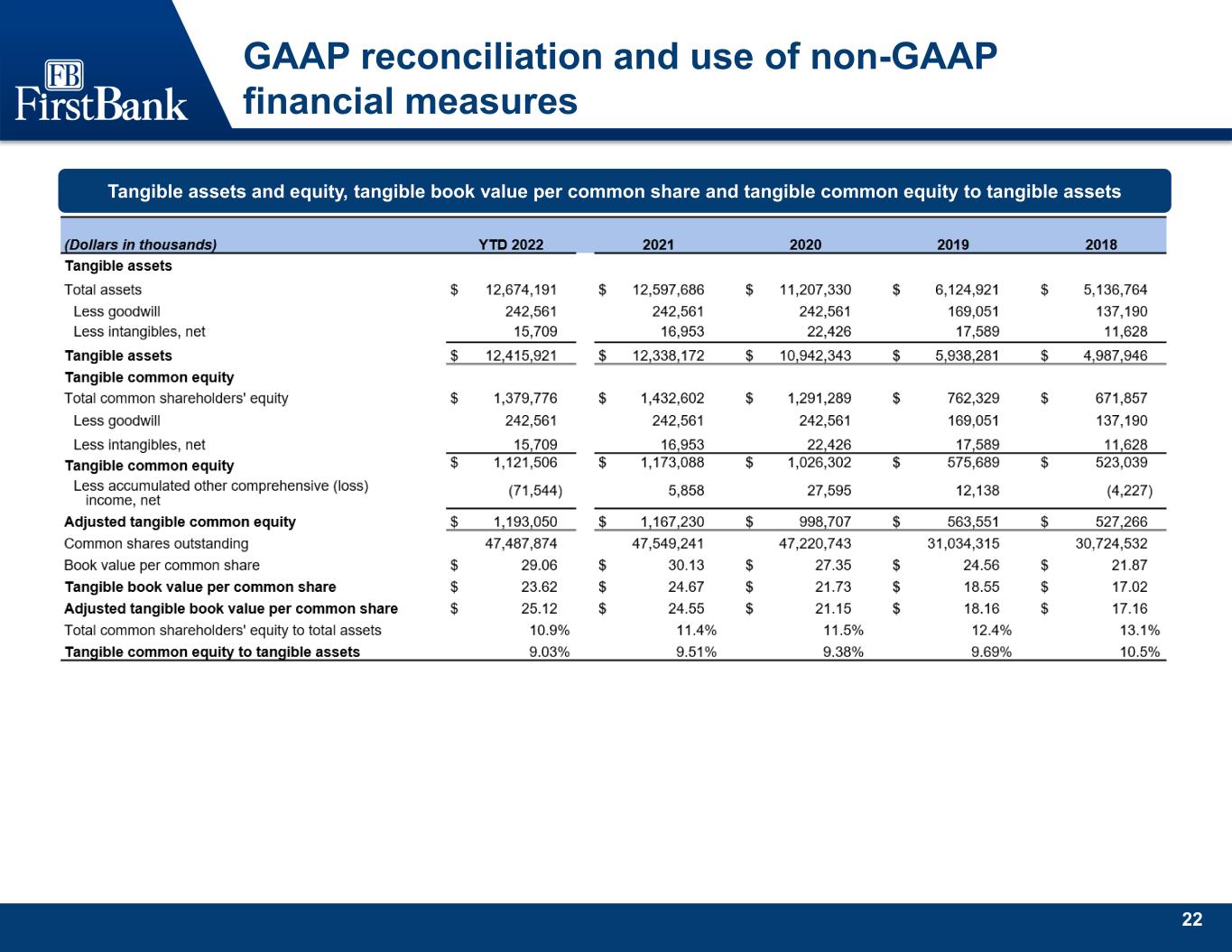

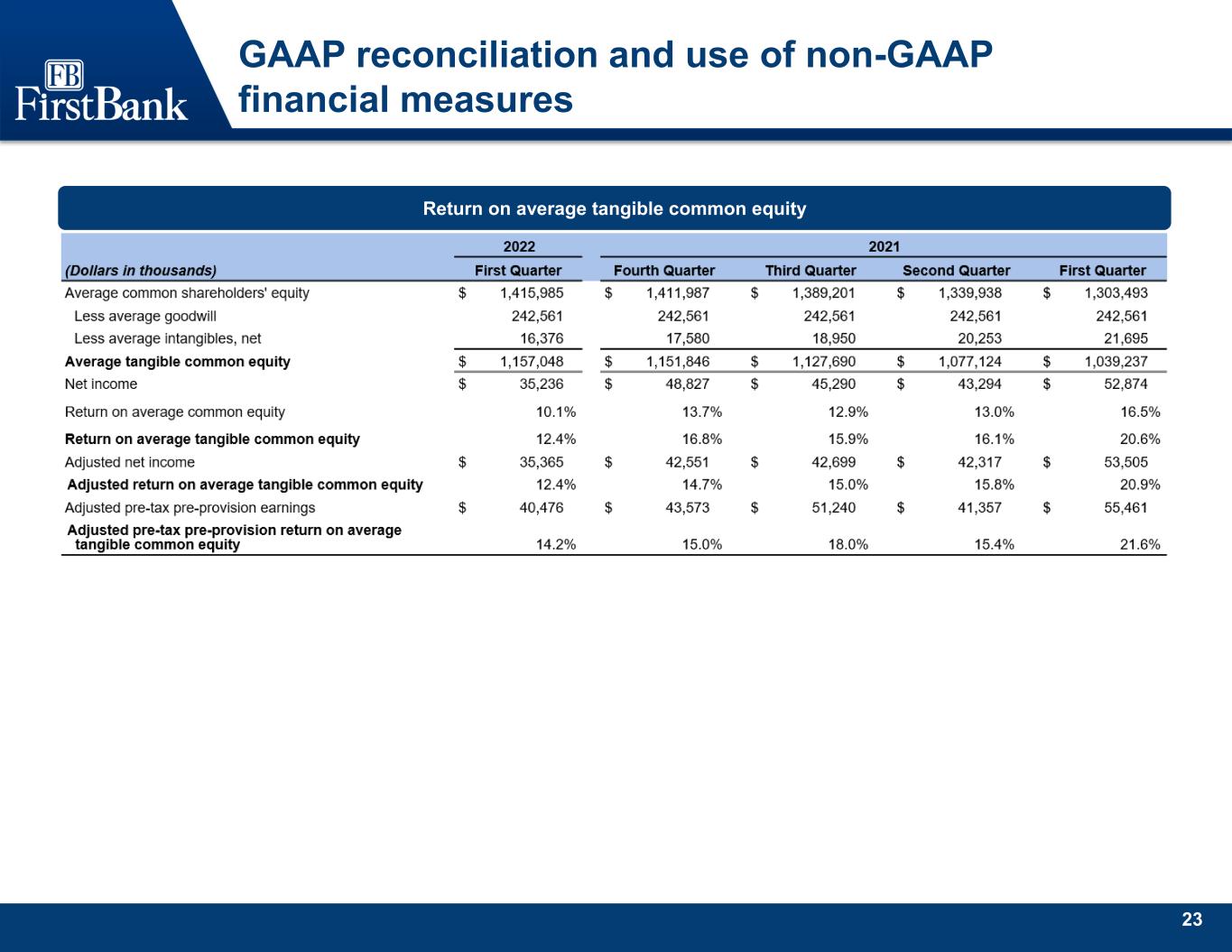

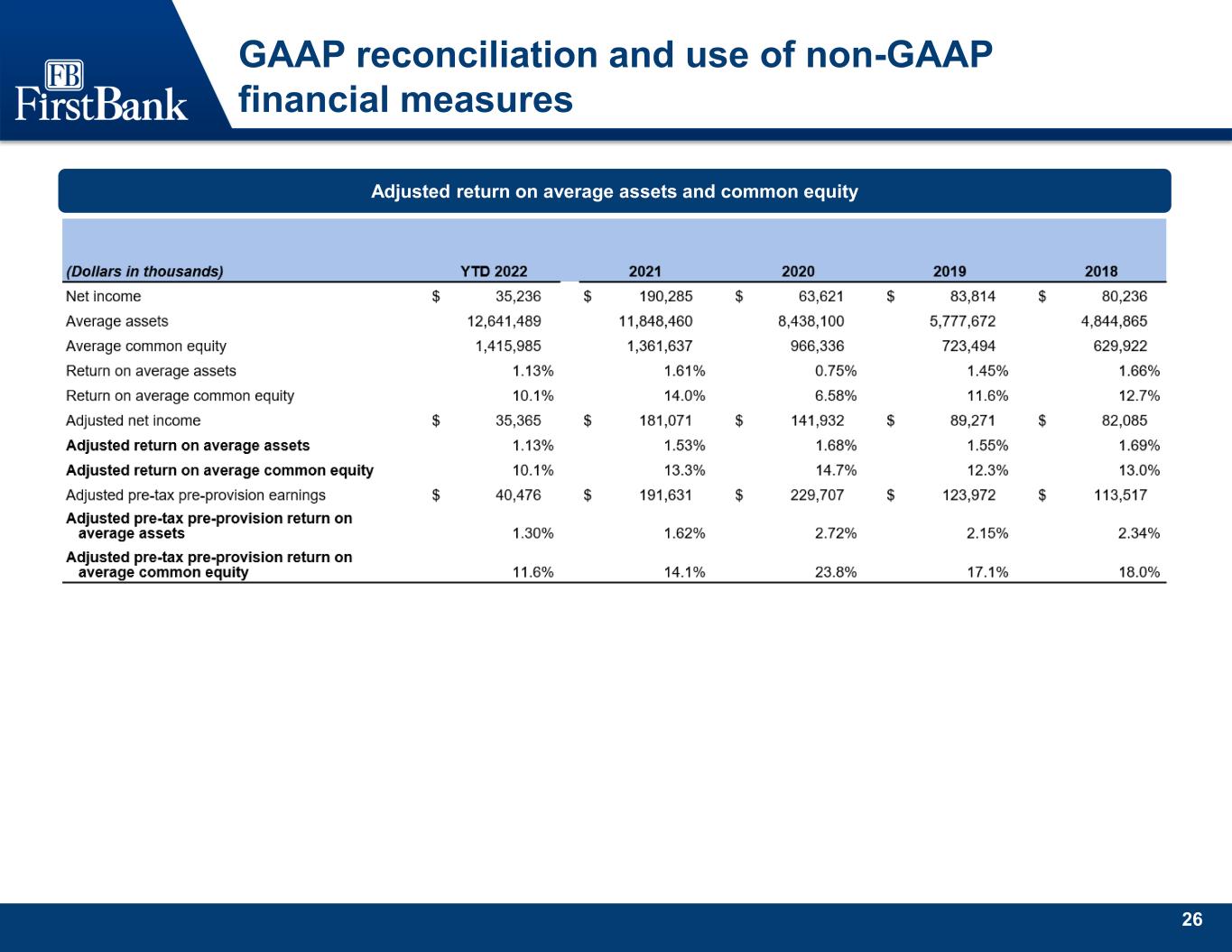

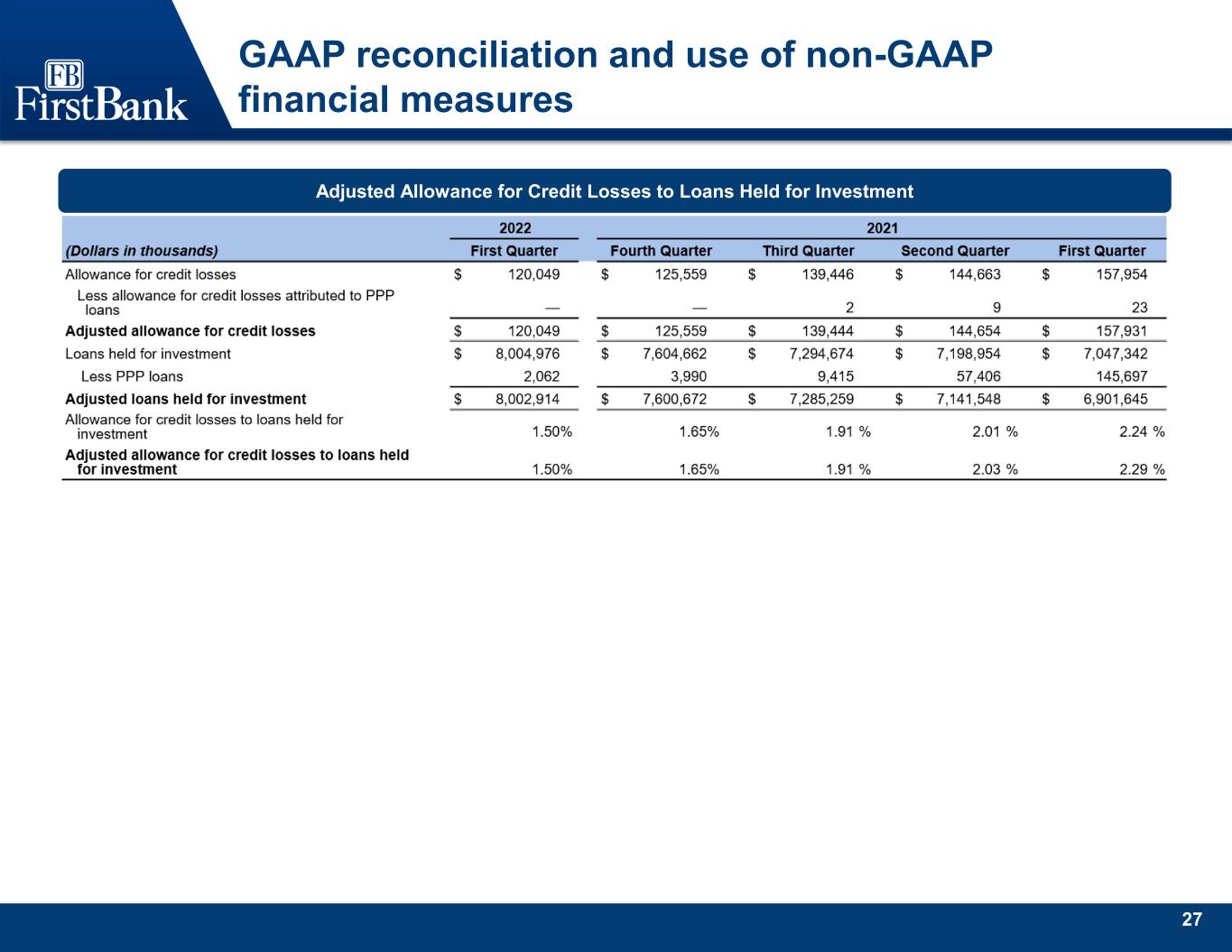

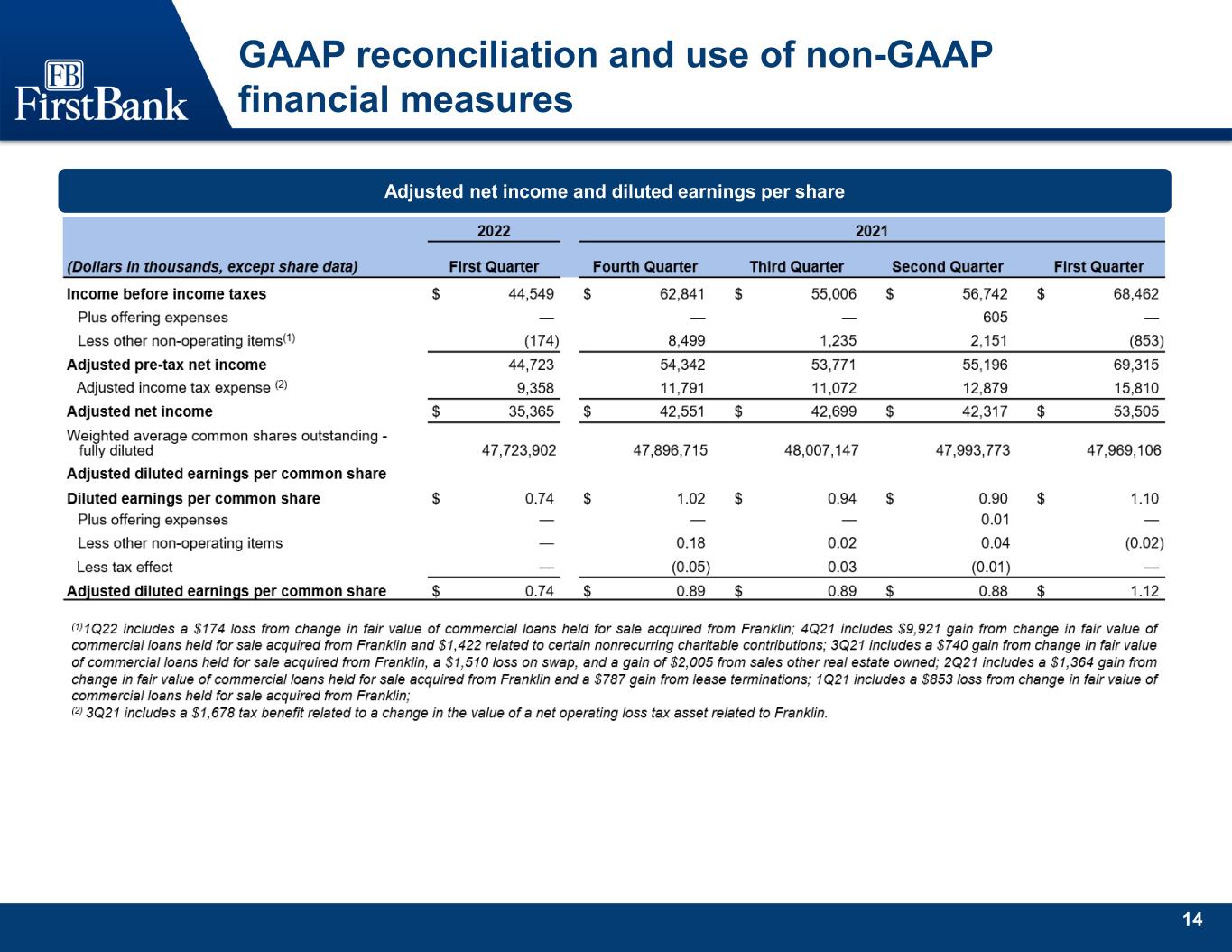

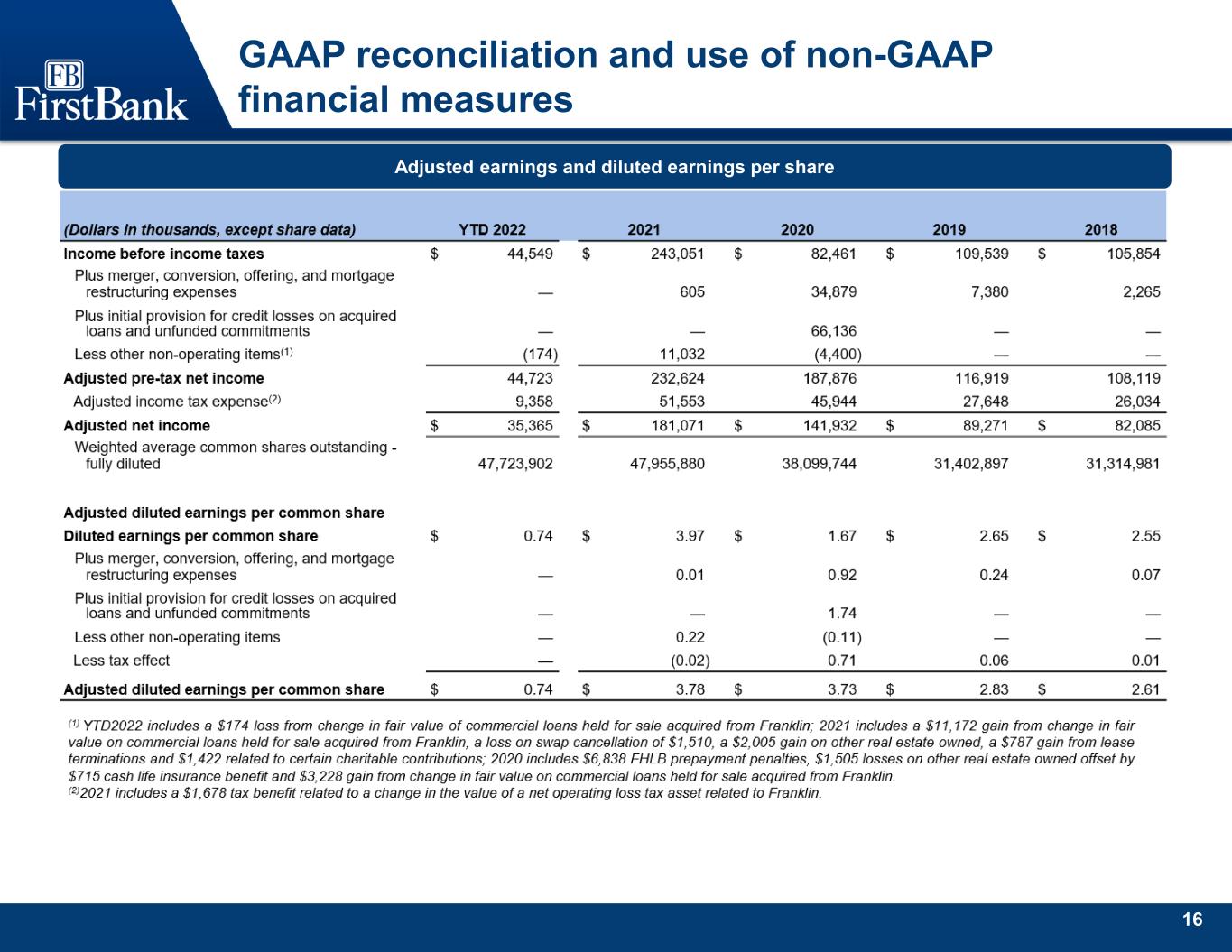

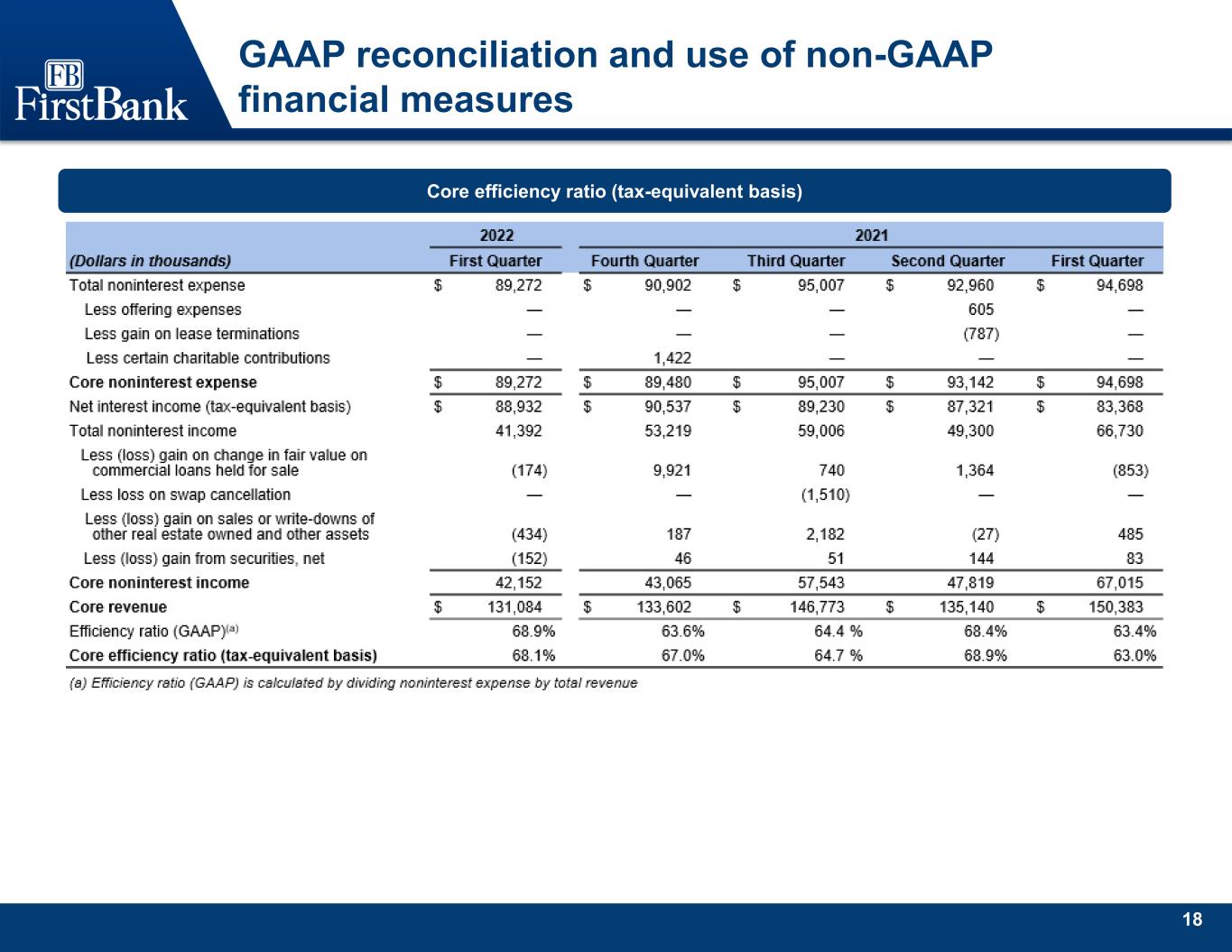

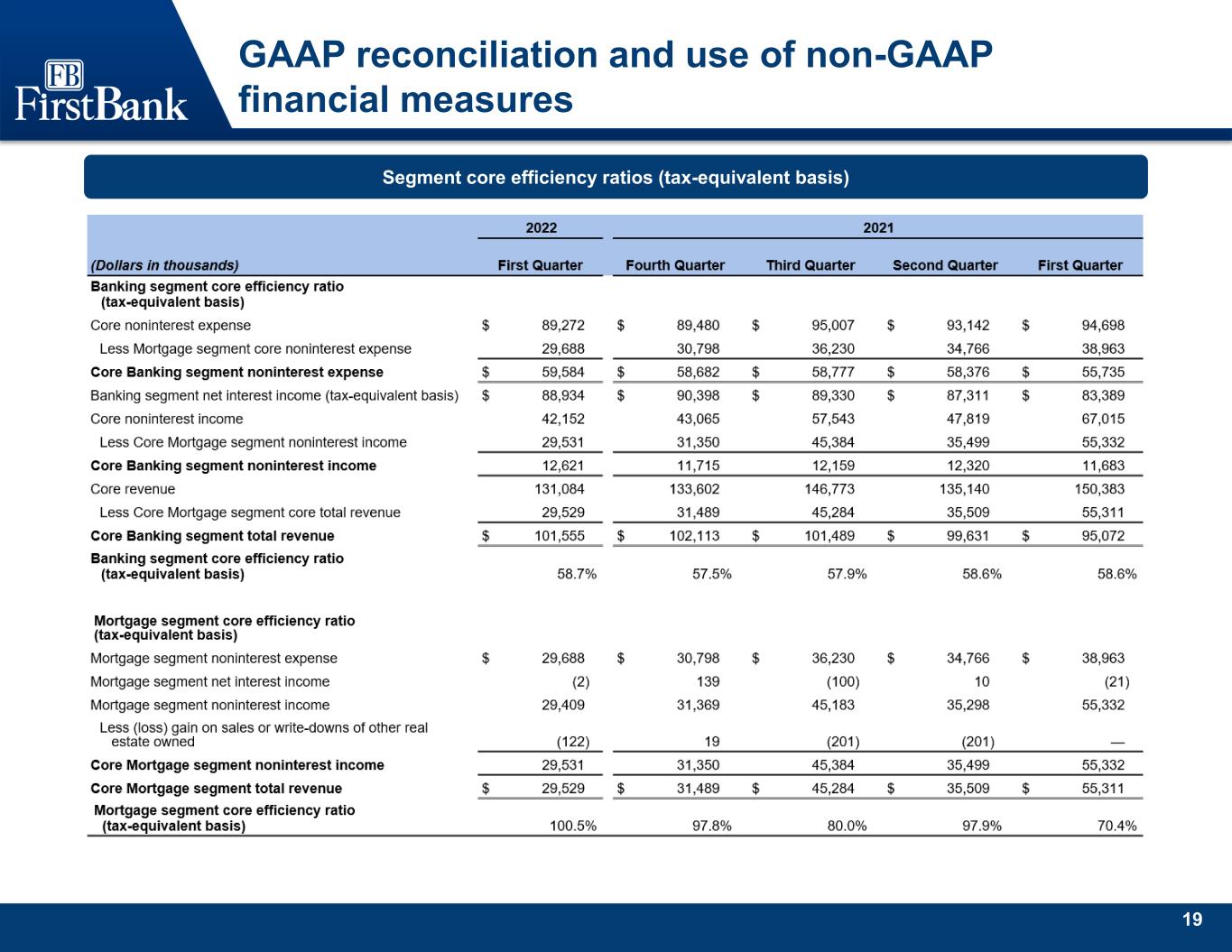

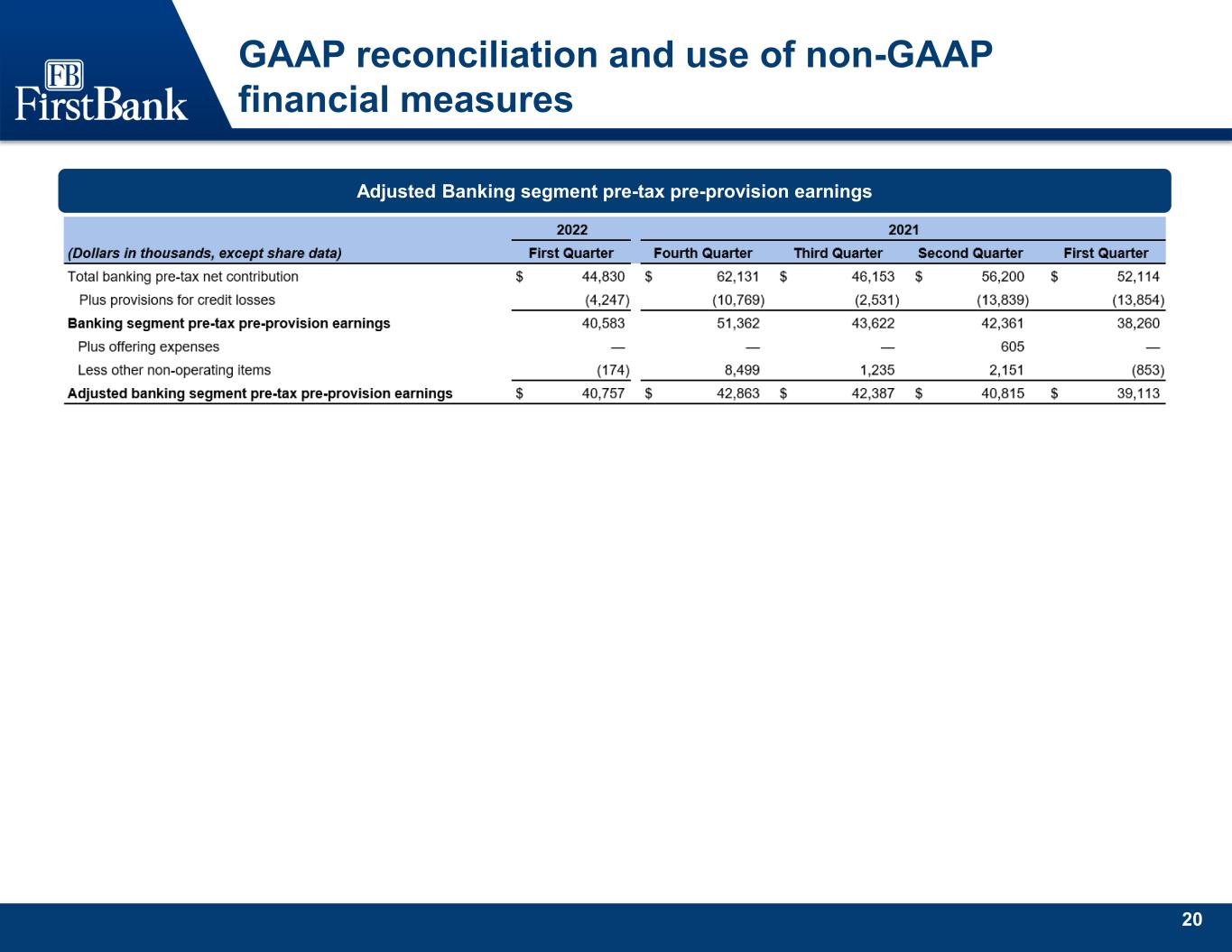

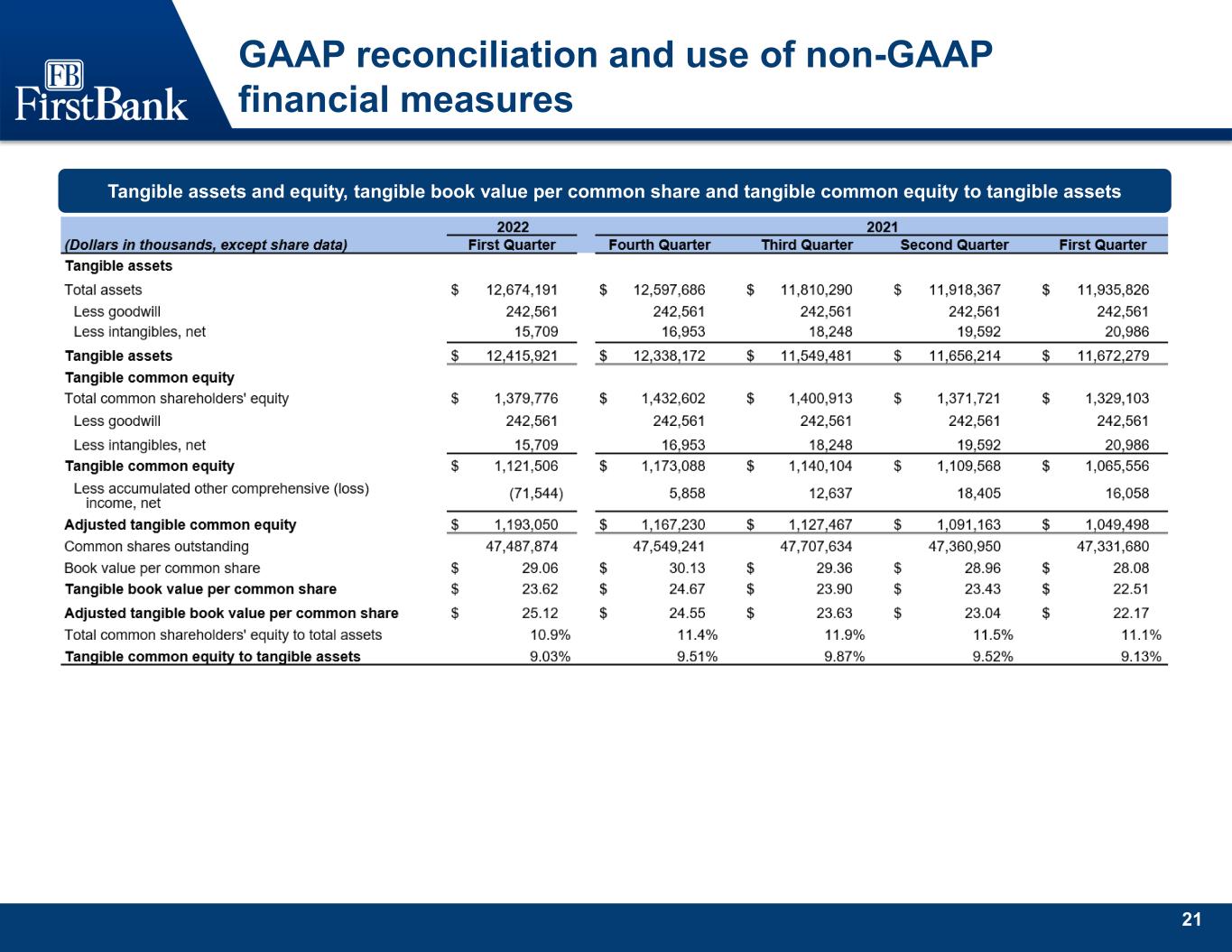

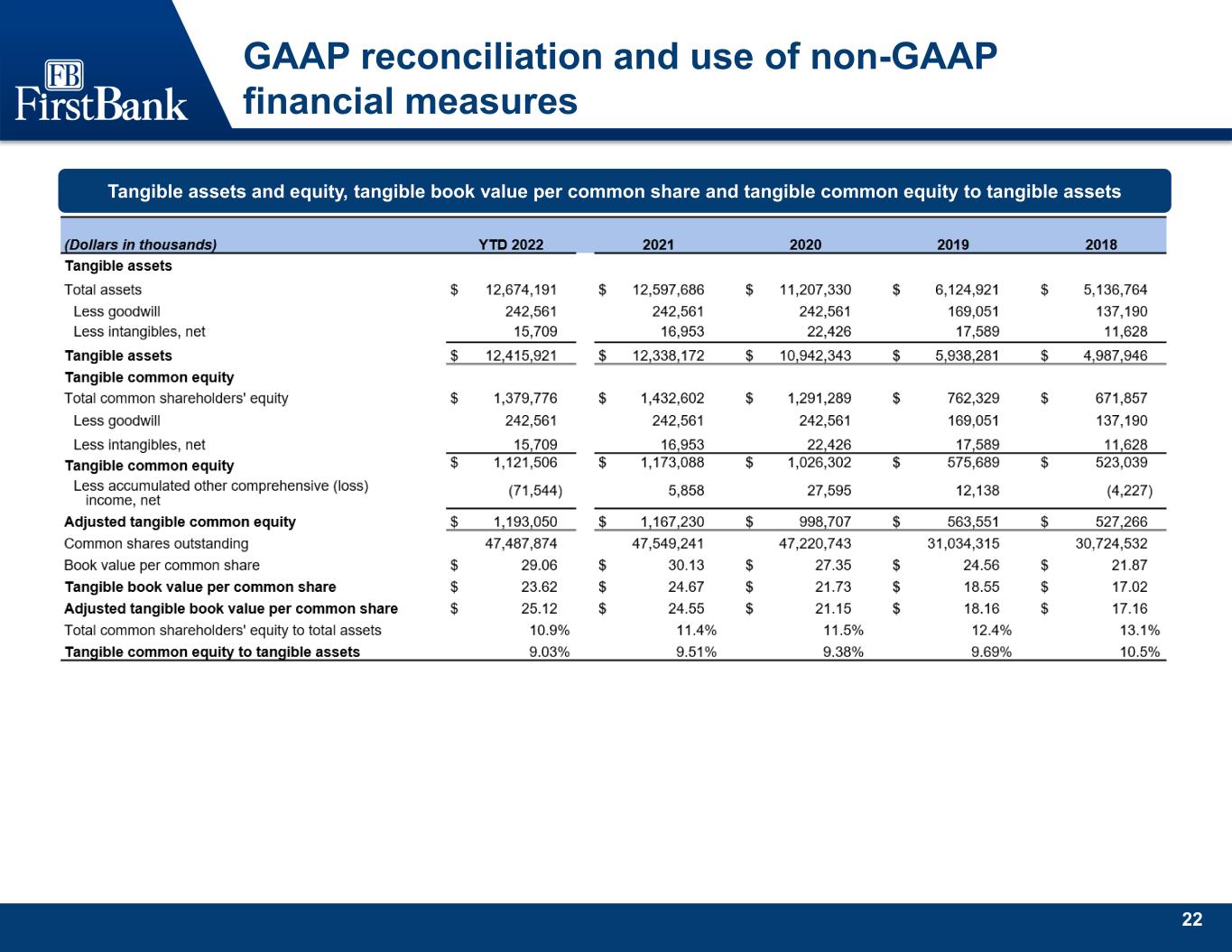

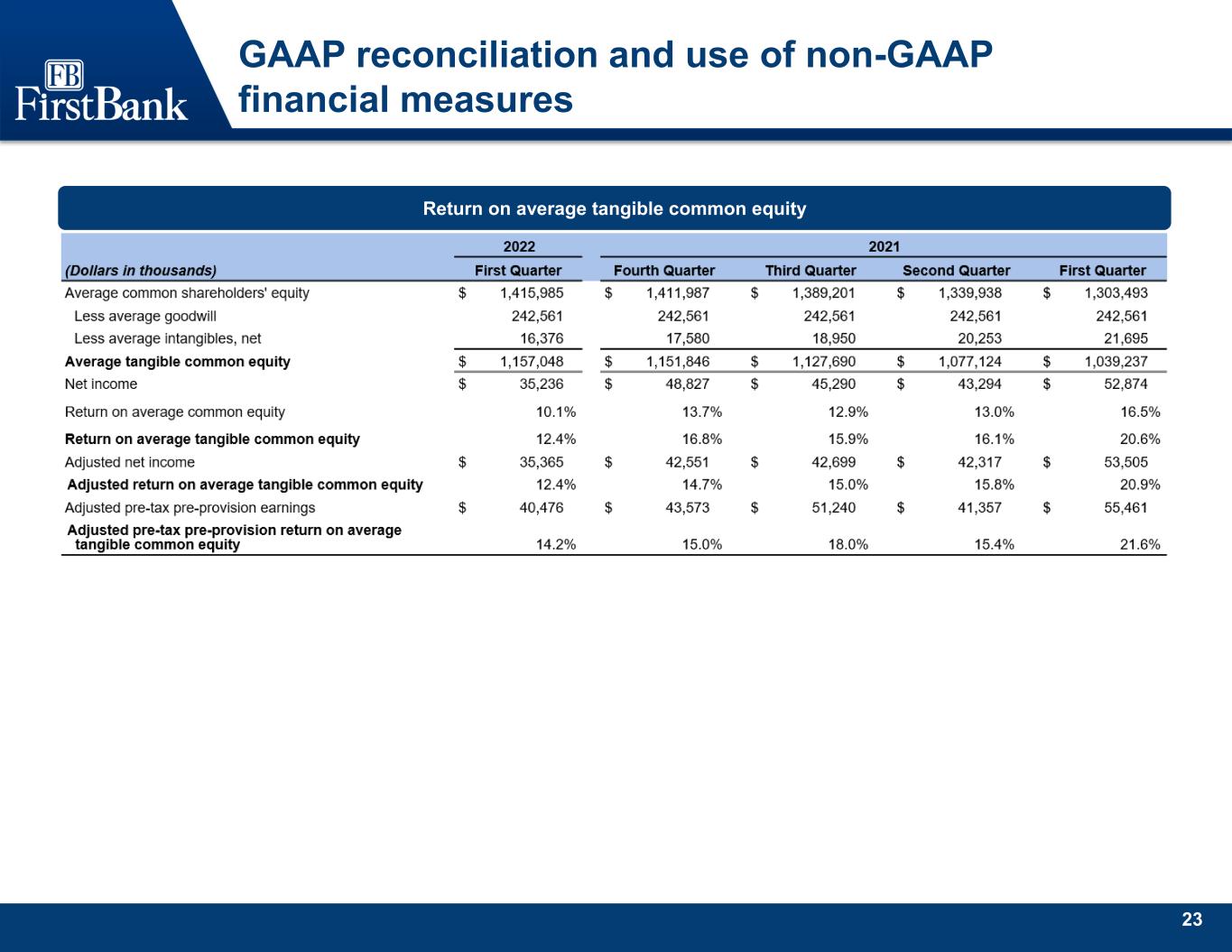

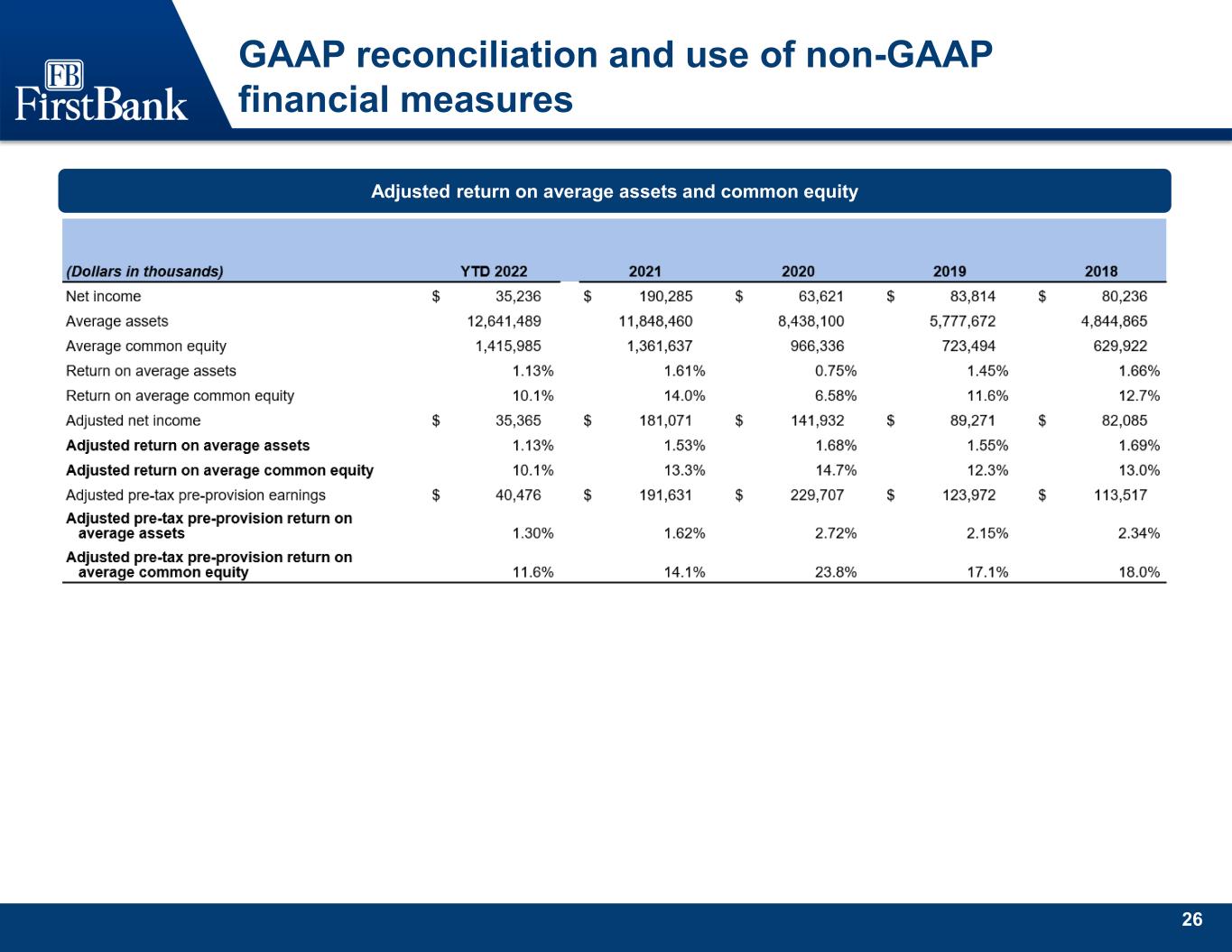

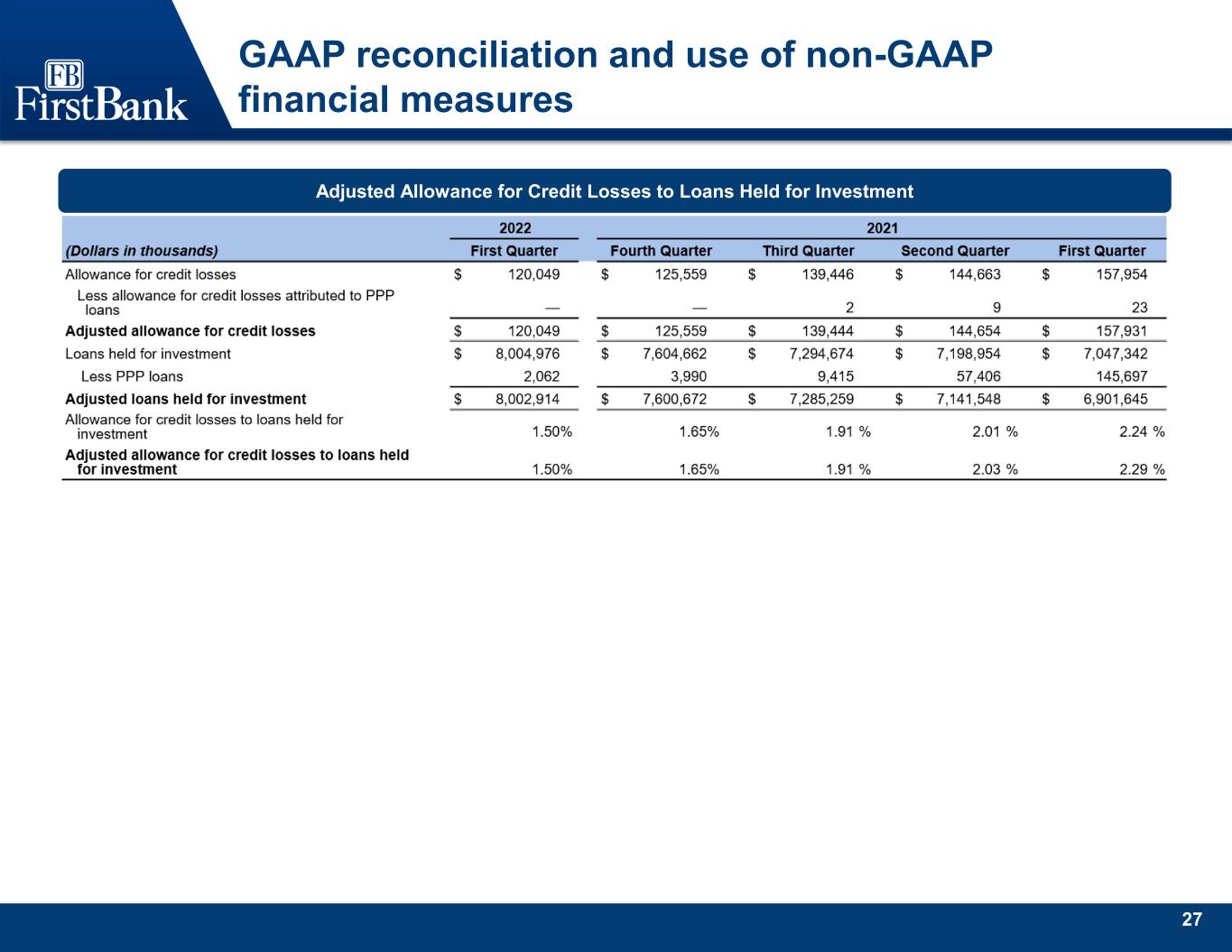

2 Use of non-GAAP financial measures This Presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. These non-GAAP financial measures may include, without limitation, adjusted net income, adjusted diluted earnings per common share, adjusted and unadjusted pre-tax pre-provision earnings, core revenue, core noninterest expense and core noninterest income, core efficiency ratio (tax equivalent basis), adjusted Banking segment pre-tax, pre-provision earnings, Banking segment core noninterest income, Mortgage segment core noninterest income, Banking segment core noninterest expense, Banking segment core revenue, Mortgage segment core revenue, Banking segment core efficiency ratio (tax equivalent basis), Mortgage segment core efficiency ratio (tax equivalent basis), adjusted return on average assets and equity, and adjusted pre-tax pre-provision return on average assets and equity. Each of these non-GAAP metrics excludes certain income and expense items that the Company’s management considers to be non-core/adjusted in nature. The Company also includes an adjusted allowance for credit losses, adjusted loans held for investment, and adjusted allowance for credit losses to loans held for investment, which all exclude the impact of PPP loans. The Company refers to these non- GAAP measures as adjusted (or core) measures. Also, the Company presents tangible assets, tangible common equity, adjusted tangible common equity, tangible book value per common share, adjusted tangible book value per common share, tangible common equity to tangible assets, return on average tangible common equity, adjusted return on average tangible common equity, and adjusted pre-tax pre-provision return on average tangible common equity. Each of these non- GAAP metrics excludes the impact of goodwill and other intangibles. Adjusted tangible common equity and adjusted tangible book value also exclude the impact of net accumulated other comprehensive (loss) income. The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations as management believes such measures facilitate period-to-period comparisons and provide meaningful indications of its operating performance as they eliminate both gains and charges that management views as non-recurring or not indicative of operating performance. Management believes that these non- GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrate the effects of significant non-core gains and charges in the current and prior periods. The Company’s management also believes that investors find these non- GAAP financial measures useful as they assist investors in understanding the Company’s underlying operating performance and in the analysis of ongoing operating trends. In addition, because intangible assets such as goodwill and other intangibles, and the other items excluded each vary extensively from company to company, the Company believes that the presentation of this information allows investors to more easily compare the Company’s results to the results of other companies. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the Company calculates the non-GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. Investors should understand how such other banking organizations calculate their financial measures similar or with names similar to the non-GAAP financial measures the Company has discussed herein when comparing such non-GAAP financial measures. The following tables in this presentation provide a reconciliation of these measures to the most directly comparable GAAP financial measures.

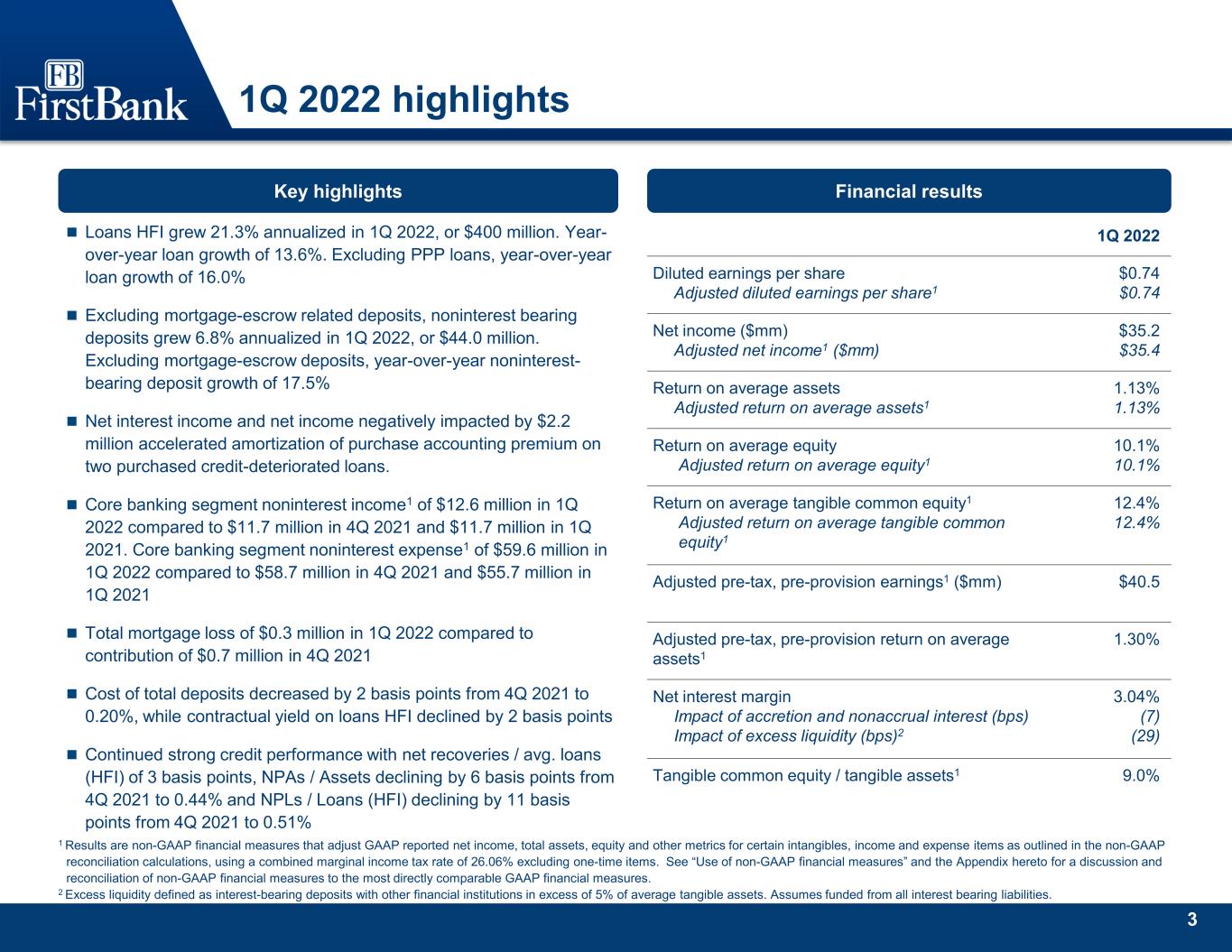

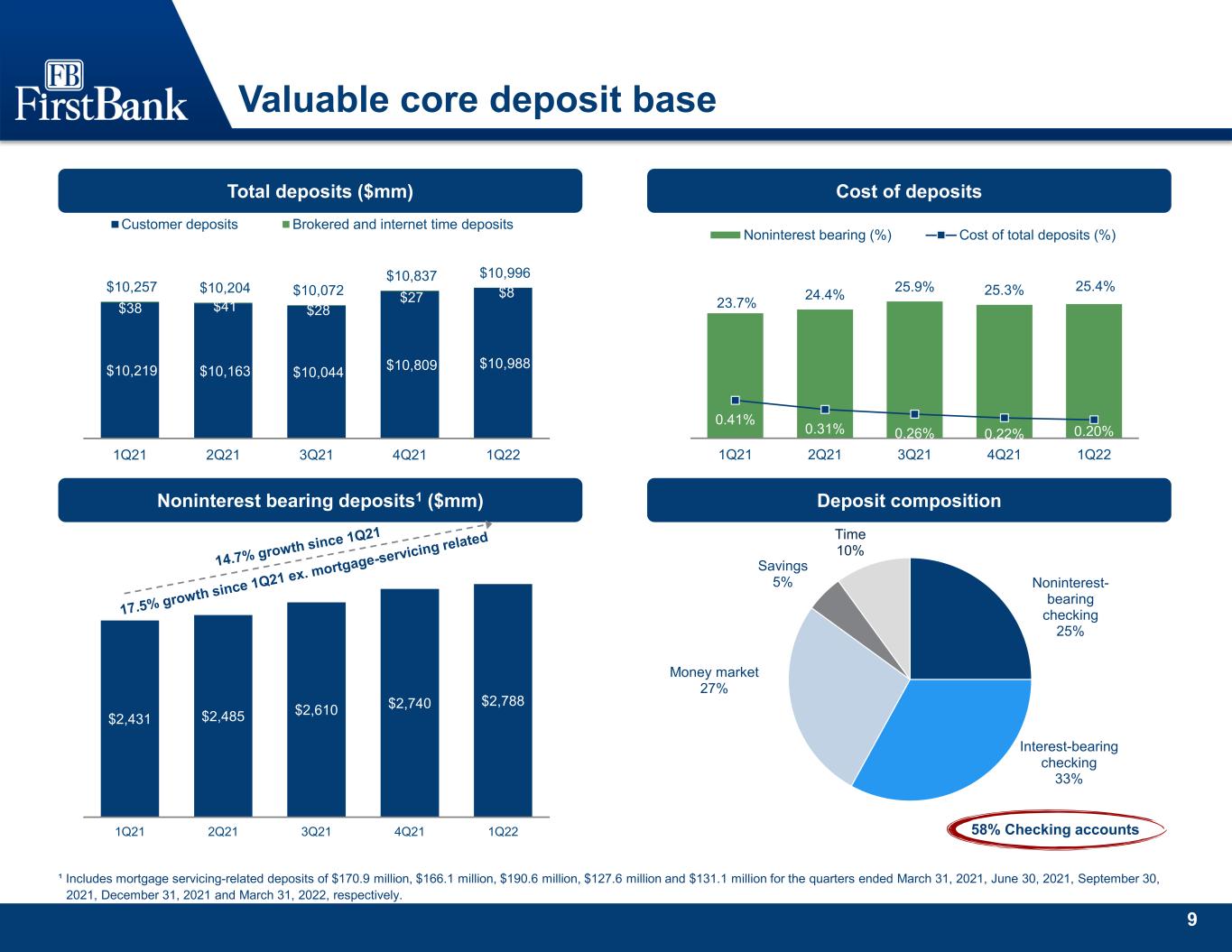

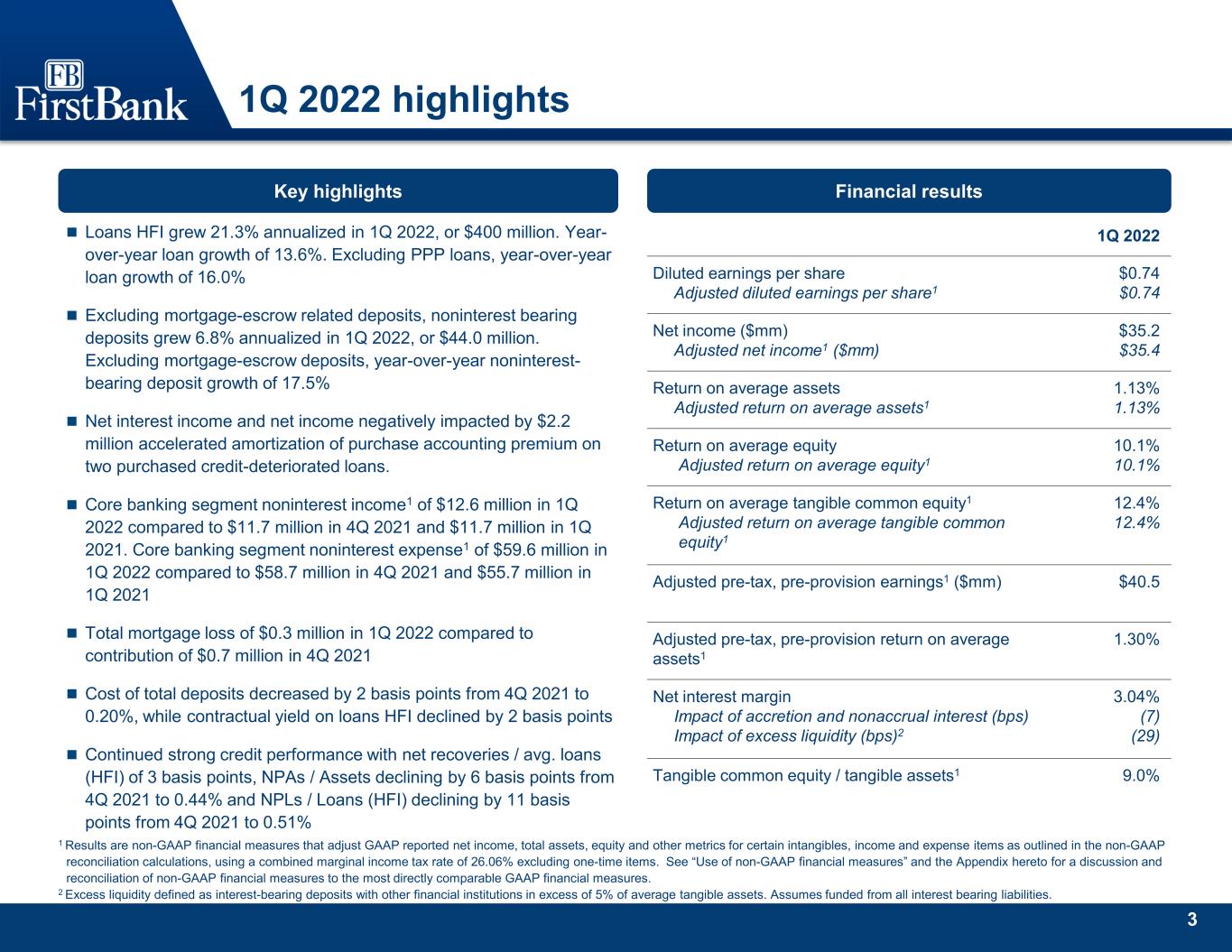

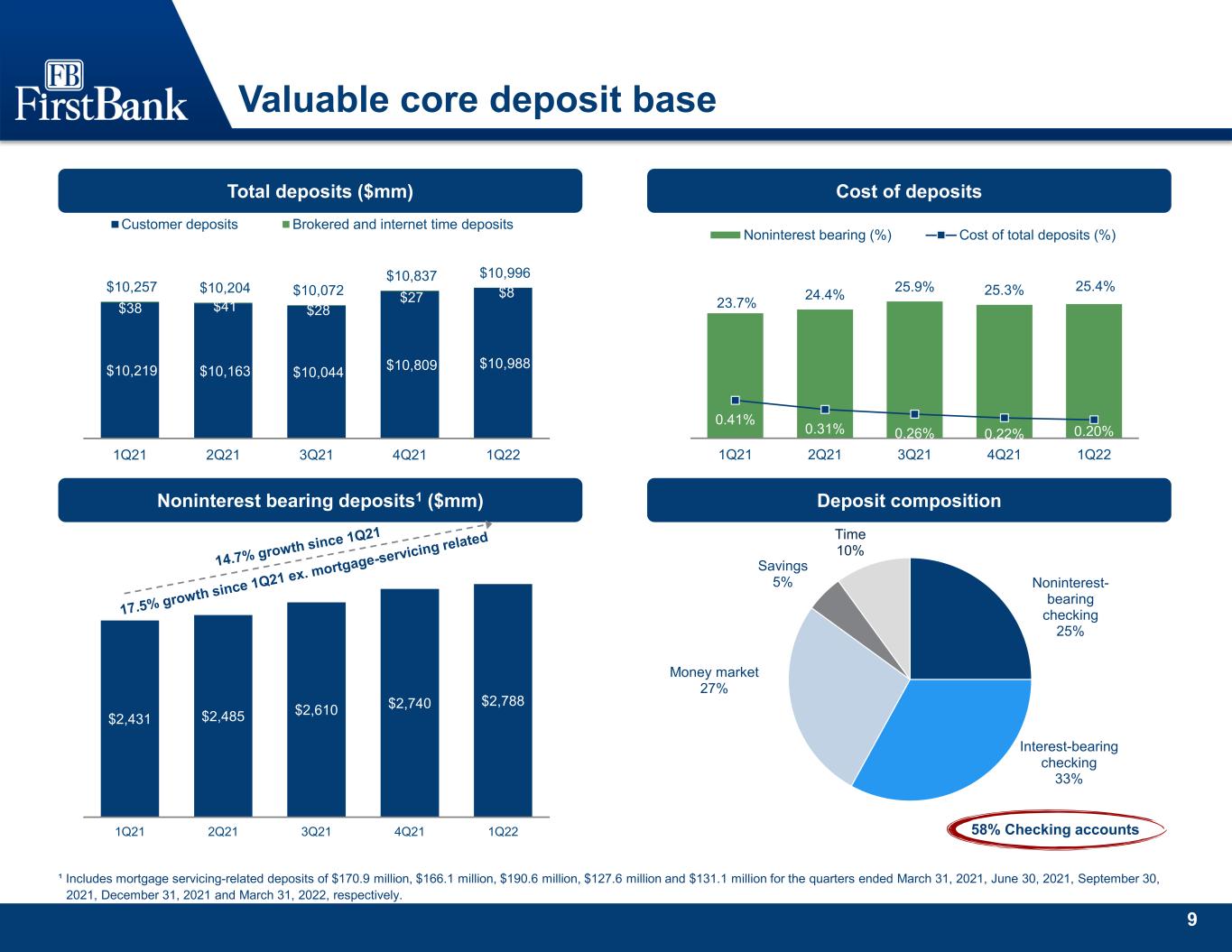

3 1Q 2022 highlights Key highlights Loans HFI grew 21.3% annualized in 1Q 2022, or $400 million. Year- over-year loan growth of 13.6%. Excluding PPP loans, year-over-year loan growth of 16.0% Excluding mortgage-escrow related deposits, noninterest bearing deposits grew 6.8% annualized in 1Q 2022, or $44.0 million. Excluding mortgage-escrow deposits, year-over-year noninterest- bearing deposit growth of 17.5% Net interest income and net income negatively impacted by $2.2 million accelerated amortization of purchase accounting premium on two purchased credit-deteriorated loans. Core banking segment noninterest income1 of $12.6 million in 1Q 2022 compared to $11.7 million in 4Q 2021 and $11.7 million in 1Q 2021. Core banking segment noninterest expense1 of $59.6 million in 1Q 2022 compared to $58.7 million in 4Q 2021 and $55.7 million in 1Q 2021 Total mortgage loss of $0.3 million in 1Q 2022 compared to contribution of $0.7 million in 4Q 2021 Cost of total deposits decreased by 2 basis points from 4Q 2021 to 0.20%, while contractual yield on loans HFI declined by 2 basis points Continued strong credit performance with net recoveries / avg. loans (HFI) of 3 basis points, NPAs / Assets declining by 6 basis points from 4Q 2021 to 0.44% and NPLs / Loans (HFI) declining by 11 basis points from 4Q 2021 to 0.51% Financial results 1 Results are non-GAAP financial measures that adjust GAAP reported net income, total assets, equity and other metrics for certain intangibles, income and expense items as outlined in the non-GAAP reconciliation calculations, using a combined marginal income tax rate of 26.06% excluding one-time items. See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. 2 Excess liquidity defined as interest-bearing deposits with other financial institutions in excess of 5% of average tangible assets. Assumes funded from all interest bearing liabilities. 1Q 2022 Diluted earnings per share Adjusted diluted earnings per share1 $0.74 $0.74 Net income ($mm) Adjusted net income1 ($mm) $35.2 $35.4 Return on average assets Adjusted return on average assets1 1.13% 1.13% Return on average equity Adjusted return on average equity1 10.1% 10.1% Return on average tangible common equity1 Adjusted return on average tangible common equity1 12.4% 12.4% Adjusted pre-tax, pre-provision earnings1 ($mm) $40.5 Adjusted pre-tax, pre-provision return on average assets1 1.30% Net interest margin Impact of accretion and nonaccrual interest (bps) Impact of excess liquidity (bps)2 3.04% (7) (29) Tangible common equity / tangible assets1 9.0%

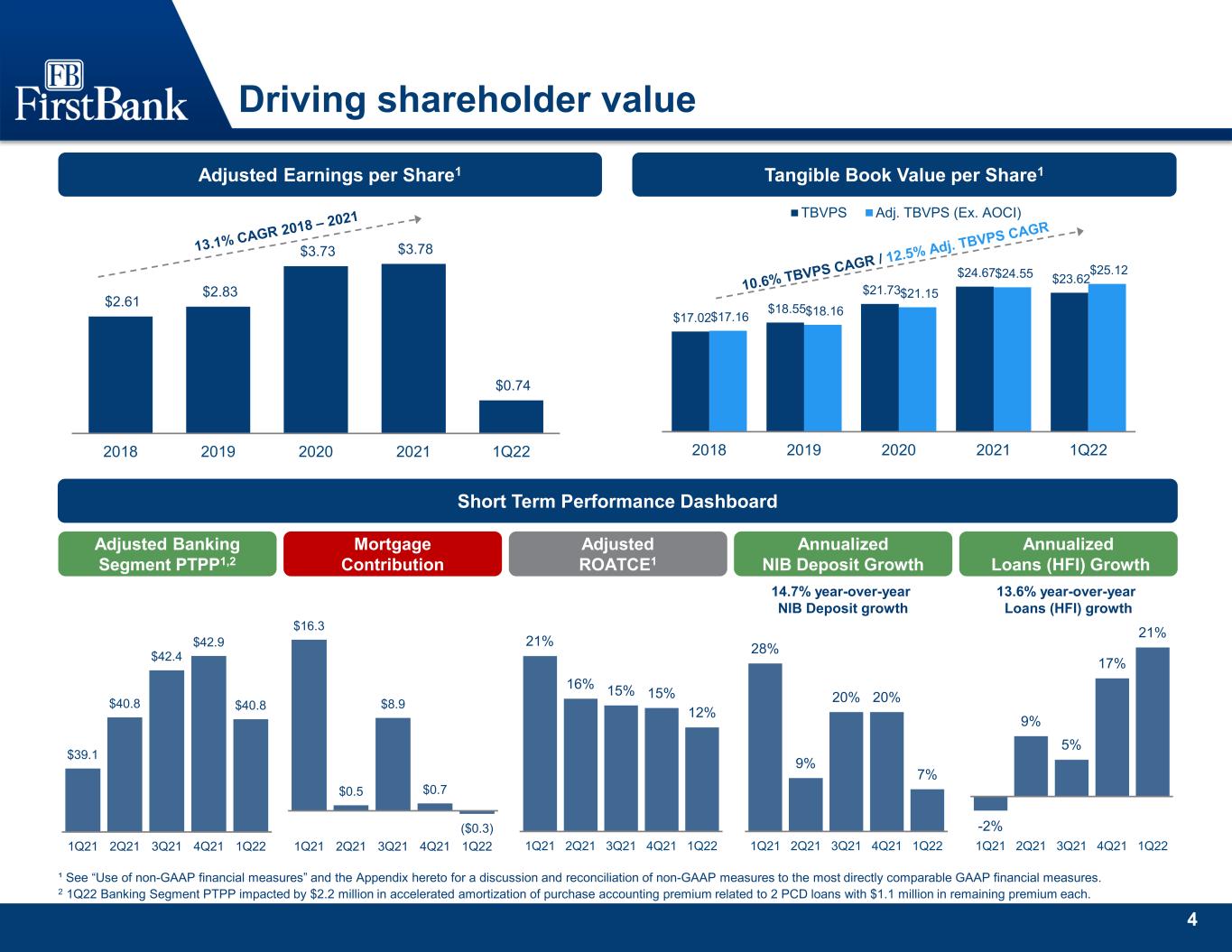

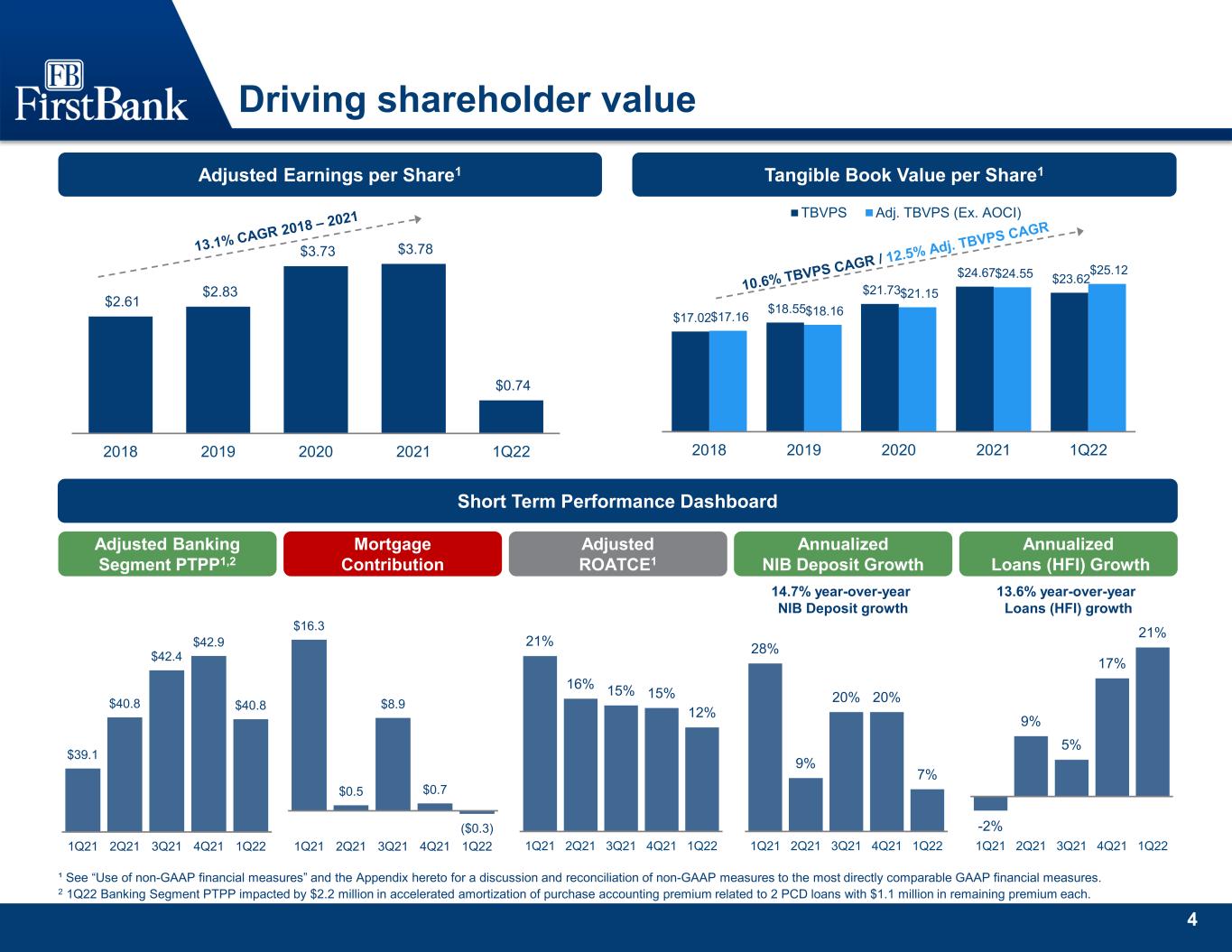

4 -2% 9% 5% 17% 21% 1Q21 2Q21 3Q21 4Q21 1Q22 Driving shareholder value ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures to the most directly comparable GAAP financial measures. 2 1Q22 Banking Segment PTPP impacted by $2.2 million in accelerated amortization of purchase accounting premium related to 2 PCD loans with $1.1 million in remaining premium each. Adjusted Earnings per Share1 $2.61 $2.83 $3.73 $3.78 $0.74 2018 2019 2020 2021 1Q22 Short Term Performance Dashboard Mortgage Contribution Annualized NIB Deposit Growth Adjusted Banking Segment PTPP1,2 Annualized Loans (HFI) Growth Tangible Book Value per Share1 $17.02 $18.55 $21.73 $24.67 $23.62 $17.16 $18.16 $21.15 $24.55 $25.12 2018 2019 2020 2021 1Q22 TBVPS Adj. TBVPS (Ex. AOCI) $16.3 $0.5 $8.9 $0.7 ($0.3) 1Q21 2Q21 3Q21 4Q21 1Q22 Adjusted ROATCE1 $39.1 $40.8 $42.4 $42.9 $40.8 1Q21 2Q21 3Q21 4Q21 1Q22 13.6% year-over-year Loans (HFI) growth 28% 9% 20% 20% 7% 1Q21 2Q21 3Q21 4Q21 1Q22 14.7% year-over-year NIB Deposit growth 21% 16% 15% 15% 12% 1Q21 2Q21 3Q21 4Q21 1Q22

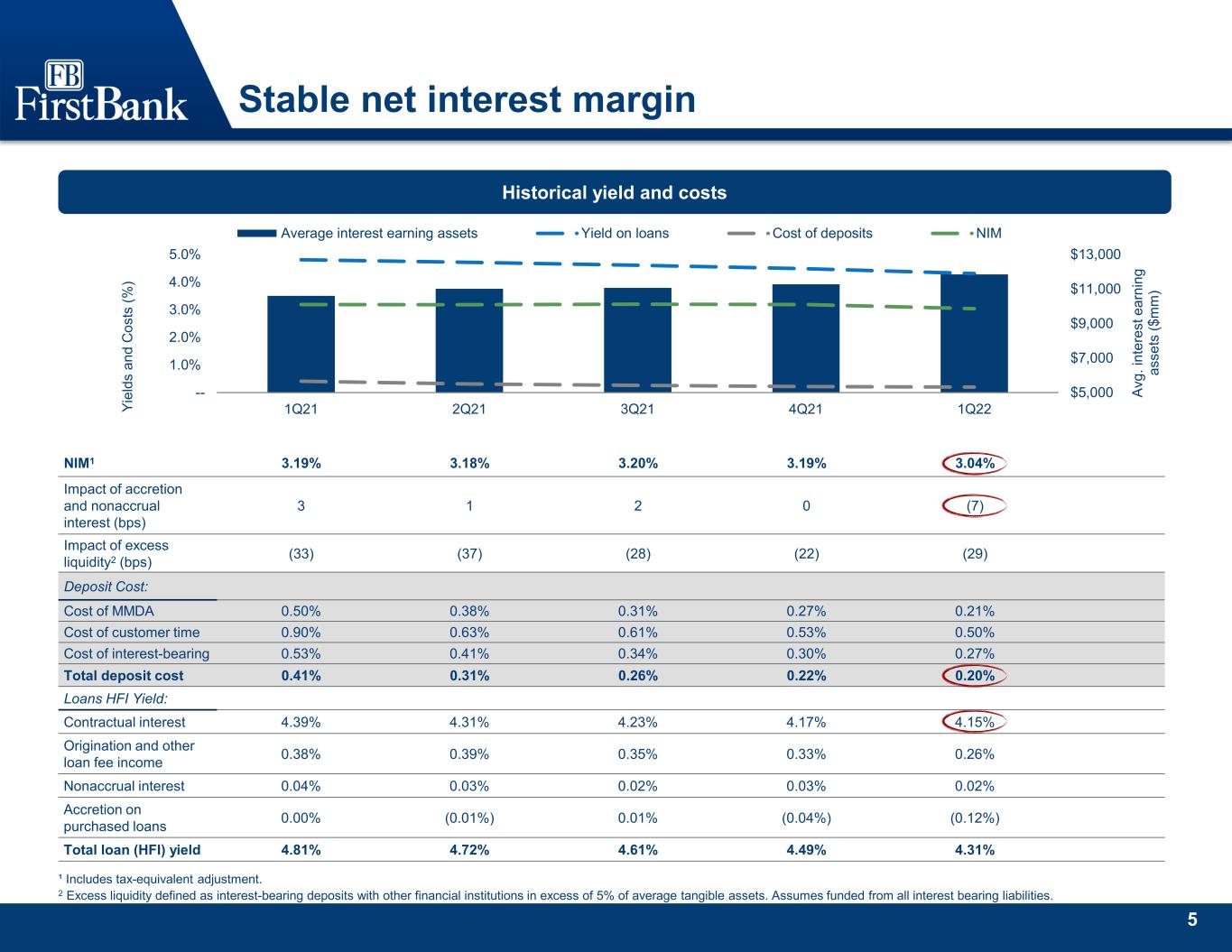

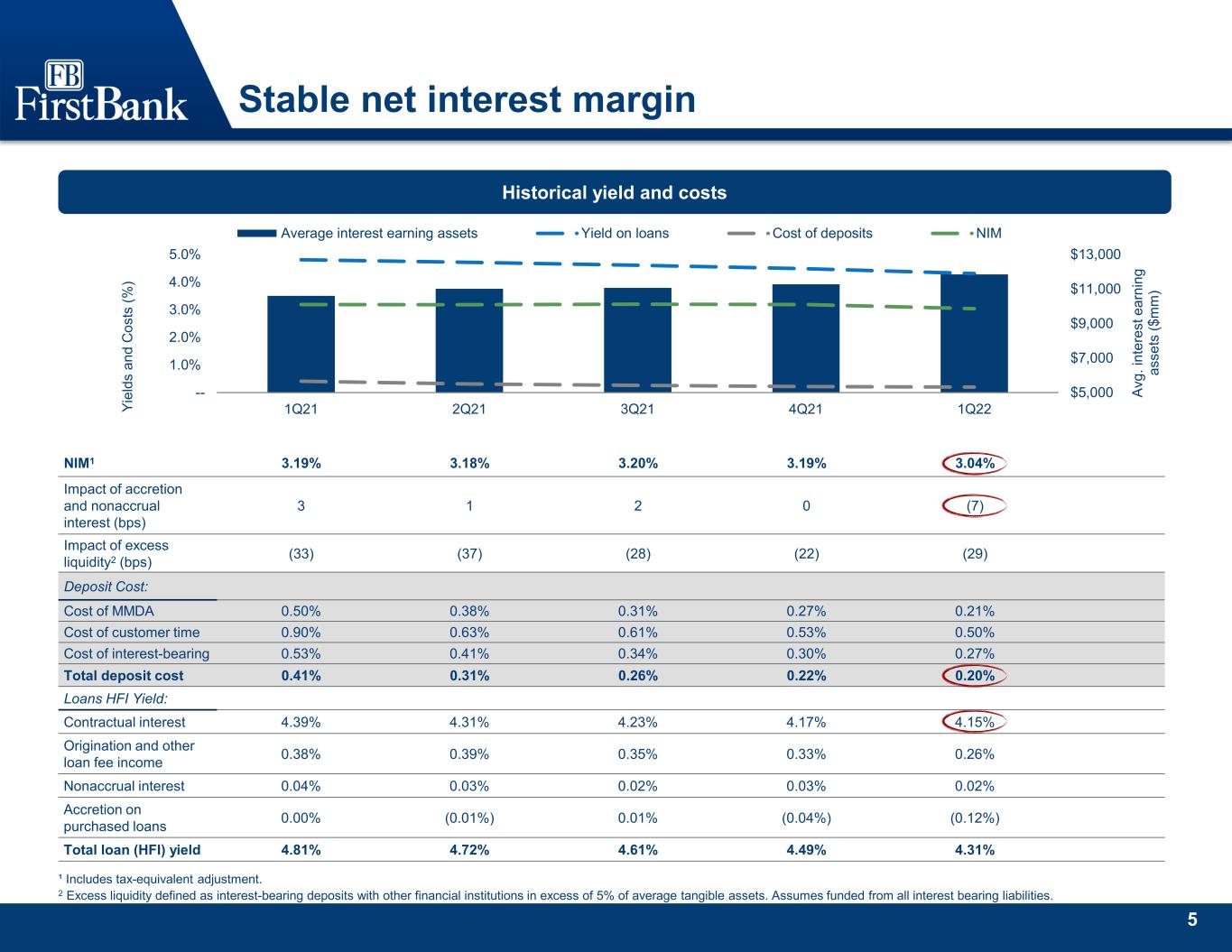

5 Stable net interest margin Historical yield and costs ¹ Includes tax-equivalent adjustment. 2 Excess liquidity defined as interest-bearing deposits with other financial institutions in excess of 5% of average tangible assets. Assumes funded from all interest bearing liabilities. $5,000 $7,000 $9,000 $11,000 $13,000 -- 1.0% 2.0% 3.0% 4.0% 5.0% 1Q21 2Q21 3Q21 4Q21 1Q22 Av g. in te re st e ar ni ng as se ts ($ m m ) Yi el ds a nd C os ts (% ) Average interest earning assets Yield on loans Cost of deposits NIM NIM1 3.19% 3.18% 3.20% 3.19% 3.04% Impact of accretion and nonaccrual interest (bps) 3 1 2 0 (7) Impact of excess liquidity2 (bps) (33) (37) (28) (22) (29) Deposit Cost: Cost of MMDA 0.50% 0.38% 0.31% 0.27% 0.21% Cost of customer time 0.90% 0.63% 0.61% 0.53% 0.50% Cost of interest-bearing 0.53% 0.41% 0.34% 0.30% 0.27% Total deposit cost 0.41% 0.31% 0.26% 0.22% 0.20% Loans HFI Yield: Contractual interest 4.39% 4.31% 4.23% 4.17% 4.15% Origination and other loan fee income 0.38% 0.39% 0.35% 0.33% 0.26% Nonaccrual interest 0.04% 0.03% 0.02% 0.03% 0.02% Accretion on purchased loans 0.00% (0.01%) 0.01% (0.04%) (0.12%) Total loan (HFI) yield 4.81% 4.72% 4.61% 4.49% 4.31%

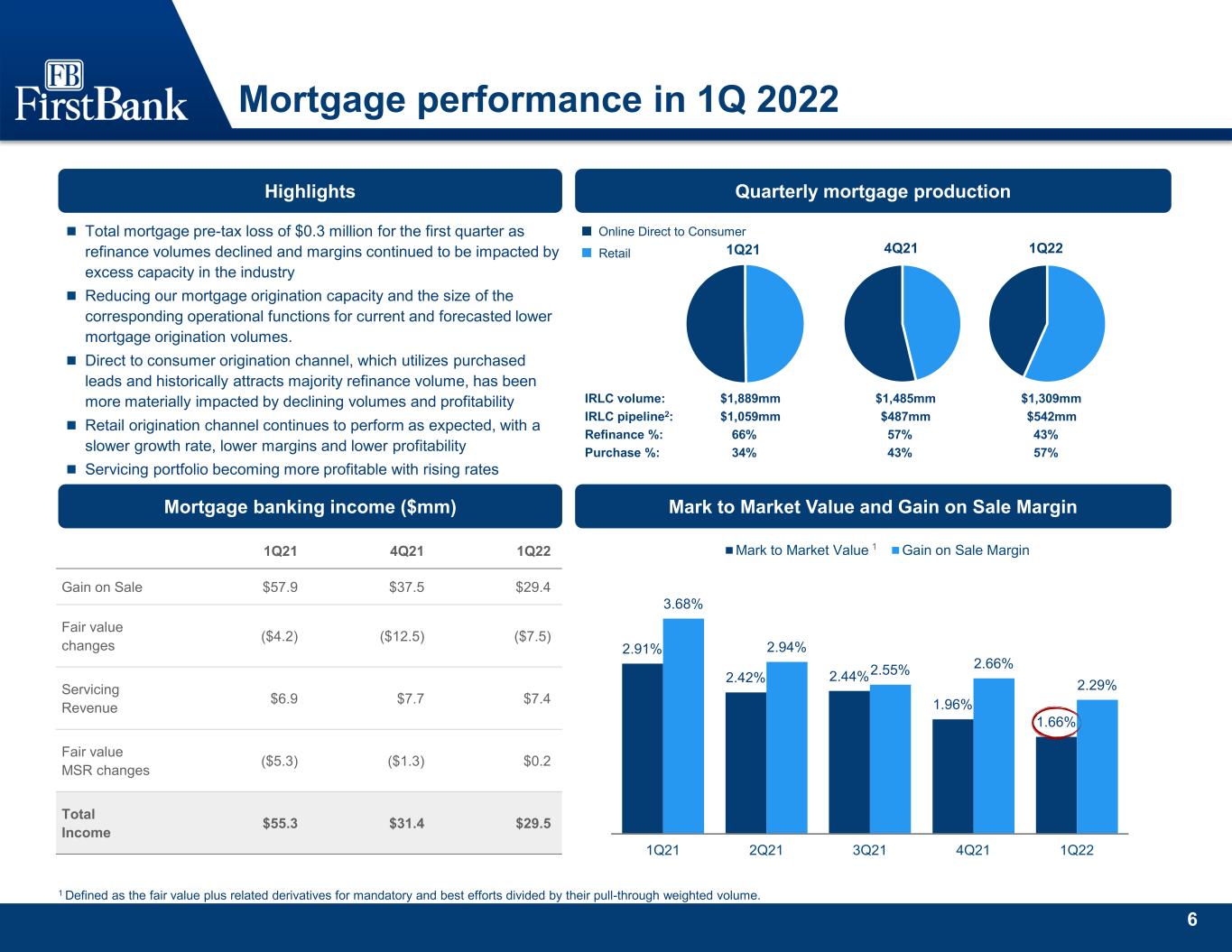

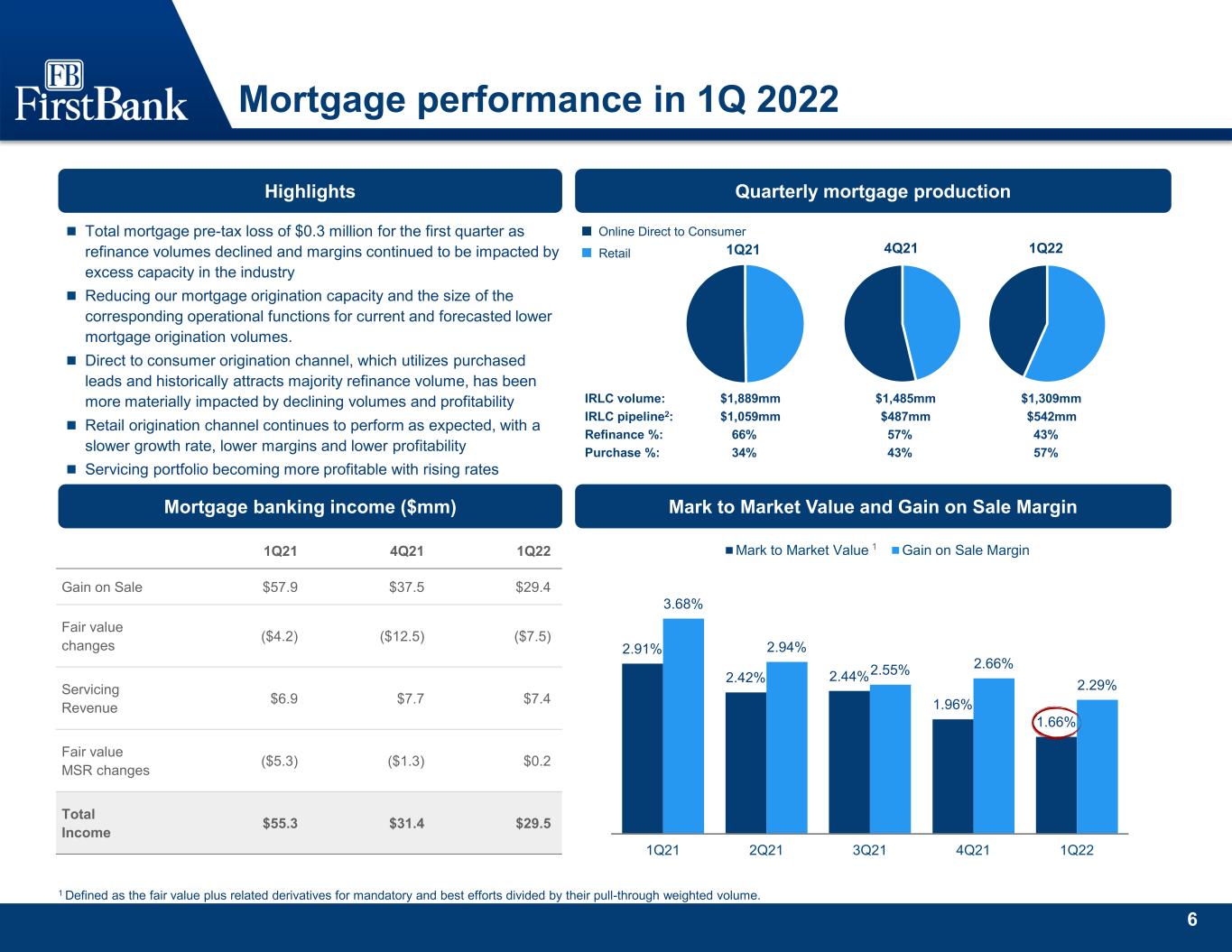

6 4Q21 Mortgage performance in 1Q 2022 Highlights Total mortgage pre-tax loss of $0.3 million for the first quarter as refinance volumes declined and margins continued to be impacted by excess capacity in the industry Reducing our mortgage origination capacity and the size of the corresponding operational functions for current and forecasted lower mortgage origination volumes. Direct to consumer origination channel, which utilizes purchased leads and historically attracts majority refinance volume, has been more materially impacted by declining volumes and profitability Retail origination channel continues to perform as expected, with a slower growth rate, lower margins and lower profitability Servicing portfolio becoming more profitable with rising rates Mortgage banking income ($mm) 1Q21 4Q21 1Q22 Gain on Sale $57.9 $37.5 $29.4 Fair value changes ($4.2) ($12.5) ($7.5) Servicing Revenue $6.9 $7.7 $7.4 Fair value MSR changes ($5.3) ($1.3) $0.2 Total Income $55.3 $31.4 $29.5 1 Defined as the fair value plus related derivatives for mandatory and best efforts divided by their pull-through weighted volume. Quarterly mortgage production Mark to Market Value and Gain on Sale Margin 1Q21 1Q22 IRLC volume: IRLC pipeline2: Refinance %: Purchase %: $1,889mm $1,485mm $1,309mm $1,059mm $487mm $542mm 66% 57% 43% 34% 43% 57% Online Direct to Consumer Retail 2.91% 2.42% 2.44% 1.96% 1.66% 3.68% 2.94% 2.55% 2.66% 2.29% 1Q21 2Q21 3Q21 4Q21 1Q22 Mark to Market Value Gain on Sale Margin1

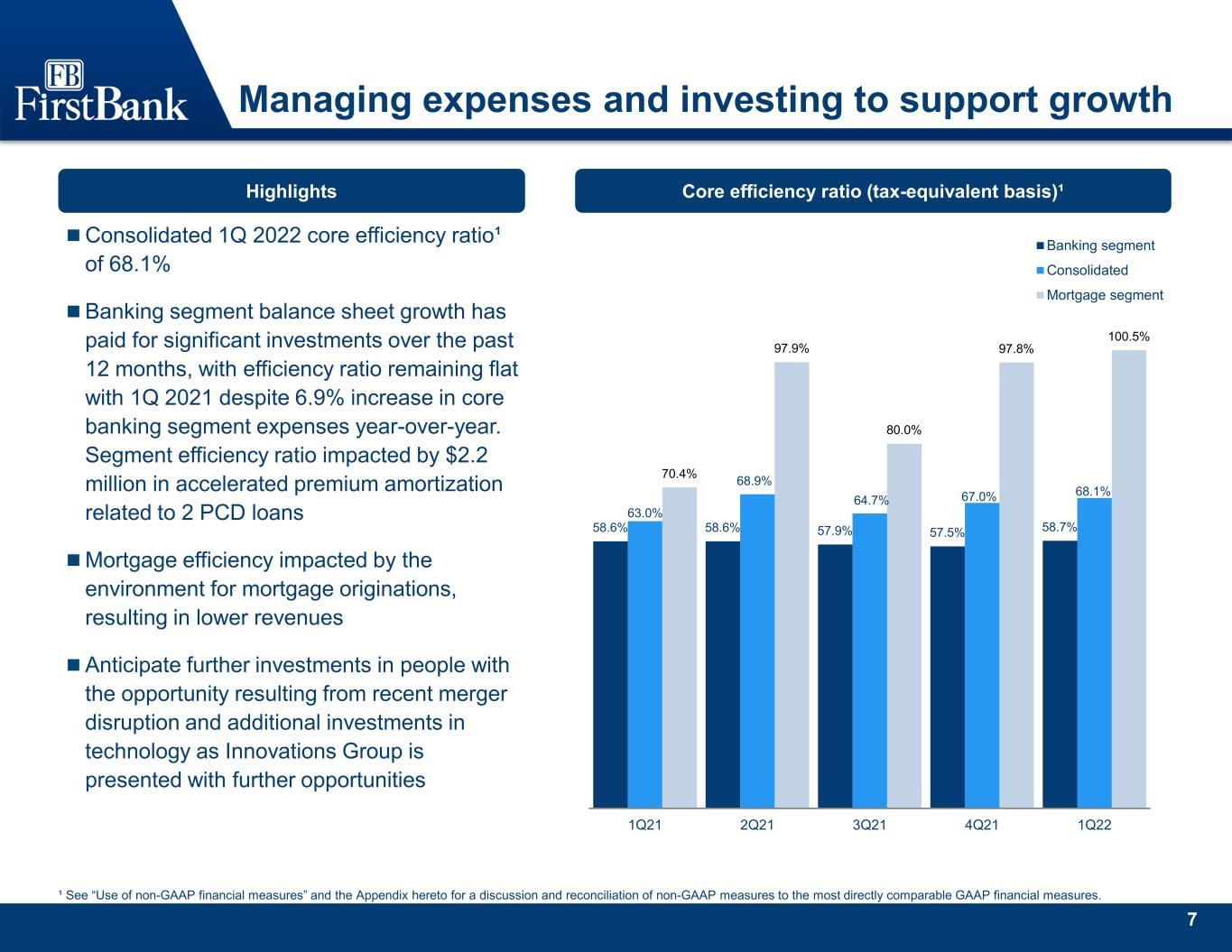

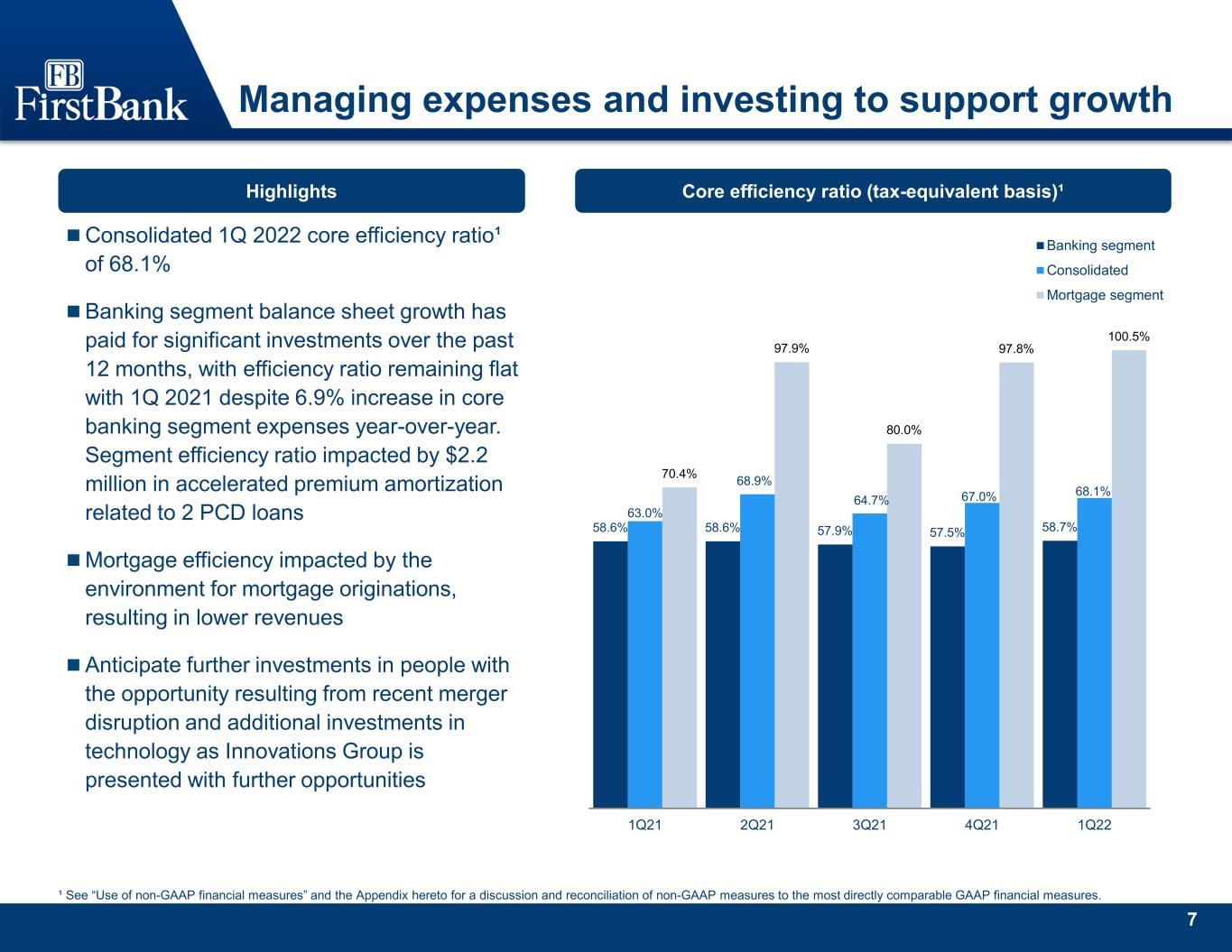

7 Managing expenses and investing to support growth Highlights Consolidated 1Q 2022 core efficiency ratio¹ of 68.1% Banking segment balance sheet growth has paid for significant investments over the past 12 months, with efficiency ratio remaining flat with 1Q 2021 despite 6.9% increase in core banking segment expenses year-over-year. Segment efficiency ratio impacted by $2.2 million in accelerated premium amortization related to 2 PCD loans Mortgage efficiency impacted by the environment for mortgage originations, resulting in lower revenues Anticipate further investments in people with the opportunity resulting from recent merger disruption and additional investments in technology as Innovations Group is presented with further opportunities ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures to the most directly comparable GAAP financial measures. Core efficiency ratio (tax-equivalent basis)¹ 58.6% 58.6% 57.9% 57.5% 58.7% 63.0% 68.9% 64.7% 67.0% 68.1% 70.4% 97.9% 80.0% 97.8% 100.5% 1Q21 2Q21 3Q21 4Q21 1Q22 Banking segment Consolidated Mortgage segment

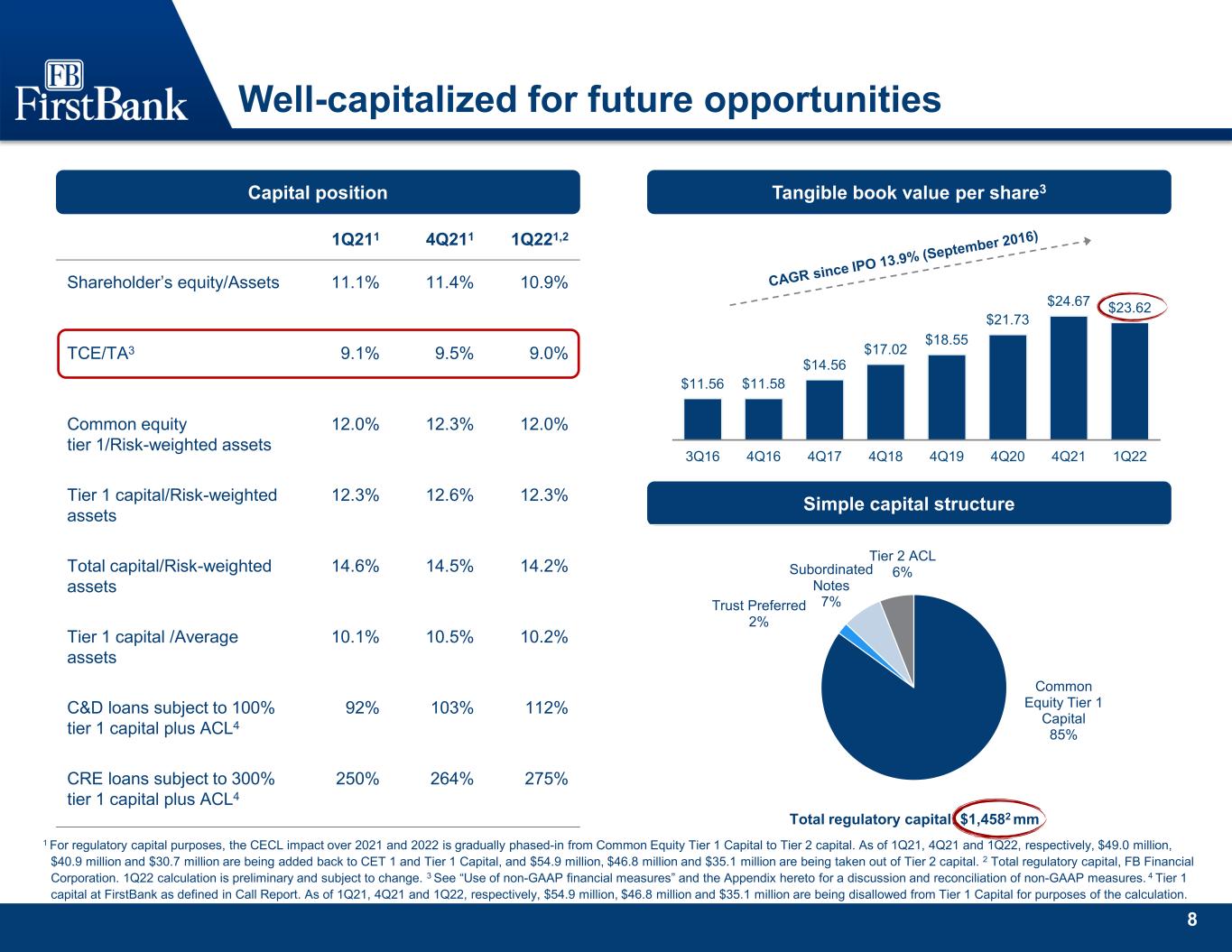

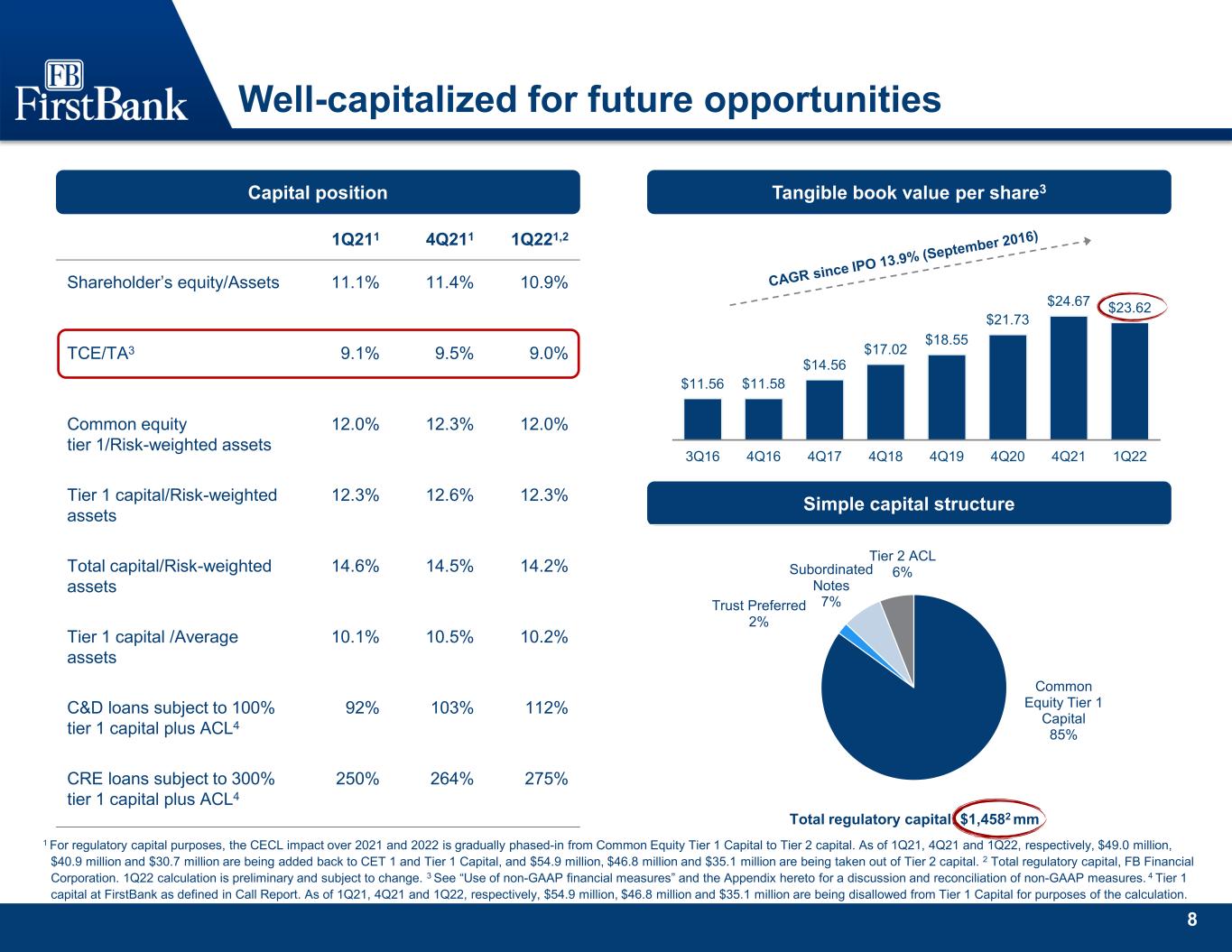

8 Well-capitalized for future opportunities Tangible book value per share3 Simple capital structure Common Equity Tier 1 Capital 85% Trust Preferred 2% Subordinated Notes 7% Tier 2 ACL 6% Total regulatory capital: $1,4582 mm $11.56 $11.58 $14.56 $17.02 $18.55 $21.73 $24.67 $23.62 3Q16 4Q16 4Q17 4Q18 4Q19 4Q20 4Q21 1Q22 1Q211 4Q211 1Q221,2 Shareholder’s equity/Assets 11.1% 11.4% 10.9% TCE/TA3 9.1% 9.5% 9.0% Common equity tier 1/Risk-weighted assets 12.0% 12.3% 12.0% Tier 1 capital/Risk-weighted assets 12.3% 12.6% 12.3% Total capital/Risk-weighted assets 14.6% 14.5% 14.2% Tier 1 capital /Average assets 10.1% 10.5% 10.2% C&D loans subject to 100% tier 1 capital plus ACL4 92% 103% 112% CRE loans subject to 300% tier 1 capital plus ACL4 250% 264% 275% Capital position 1 For regulatory capital purposes, the CECL impact over 2021 and 2022 is gradually phased-in from Common Equity Tier 1 Capital to Tier 2 capital. As of 1Q21, 4Q21 and 1Q22, respectively, $49.0 million, $40.9 million and $30.7 million are being added back to CET 1 and Tier 1 Capital, and $54.9 million, $46.8 million and $35.1 million are being taken out of Tier 2 capital. 2 Total regulatory capital, FB Financial Corporation. 1Q22 calculation is preliminary and subject to change. 3 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 4 Tier 1 capital at FirstBank as defined in Call Report. As of 1Q21, 4Q21 and 1Q22, respectively, $54.9 million, $46.8 million and $35.1 million are being disallowed from Tier 1 Capital for purposes of the calculation.

9 Noninterest- bearing checking 25% Interest-bearing checking 33% Money market 27% Savings 5% Time 10% 58% Checking accounts Valuable core deposit base ¹ Includes mortgage servicing-related deposits of $170.9 million, $166.1 million, $190.6 million, $127.6 million and $131.1 million for the quarters ended March 31, 2021, June 30, 2021, September 30, 2021, December 31, 2021 and March 31, 2022, respectively. Total deposits ($mm) Cost of deposits Noninterest bearing deposits1 ($mm) Deposit composition $10,219 $10,163 $10,044 $10,809 $10,988 $38 $41 $28 $27 $8 $10,257 $10,204 $10,072 $10,837 $10,996 1Q21 2Q21 3Q21 4Q21 1Q22 Customer deposits Brokered and internet time deposits $2,431 $2,485 $2,610 $2,740 $2,788 1Q21 2Q21 3Q21 4Q21 1Q22 23.7% 24.4% 25.9% 25.3% 25.4% 0.41% 0.31% 0.26% 0.22% 0.20%0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 1Q21 2Q21 3Q21 4Q21 1Q22 Noninterest bearing (%) Cost of total deposits (%)

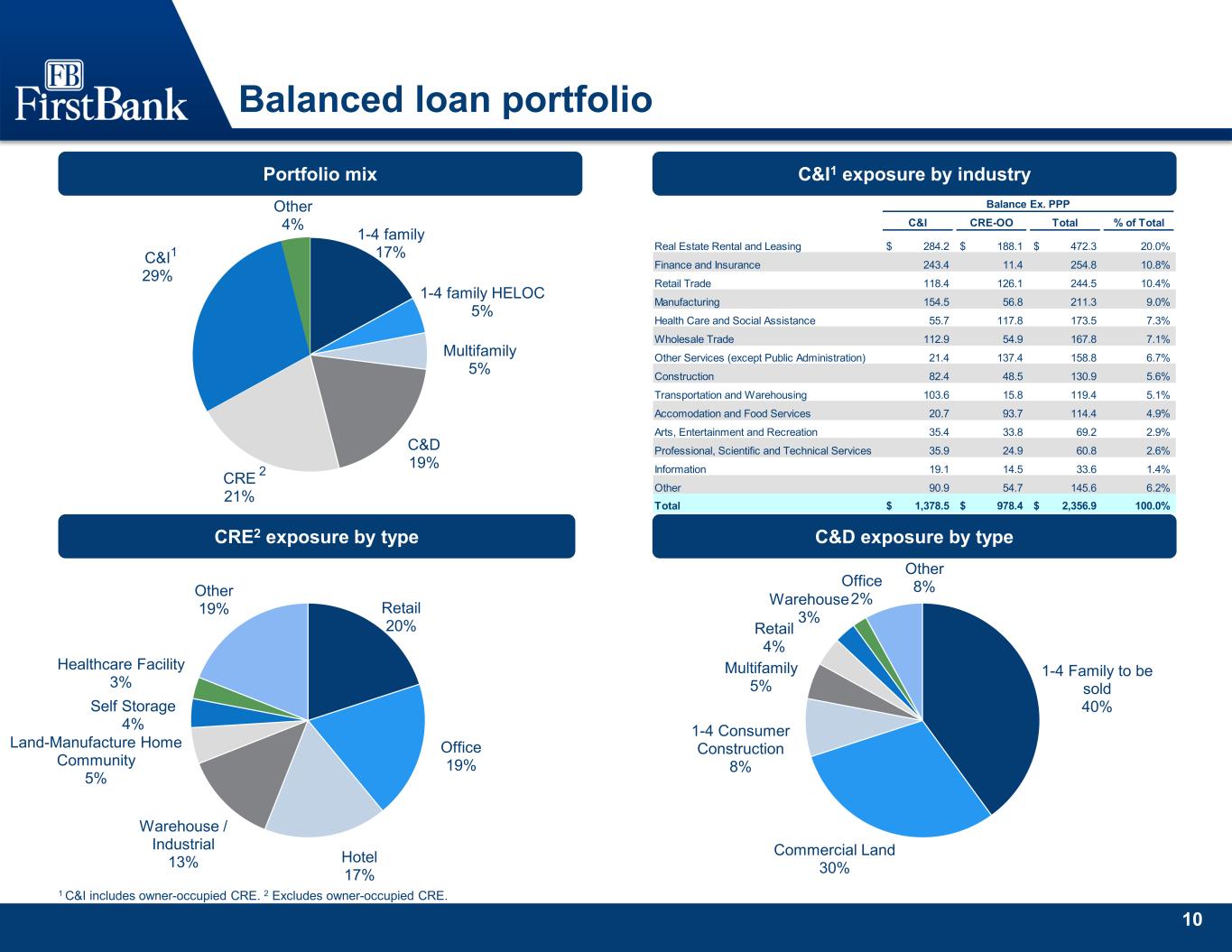

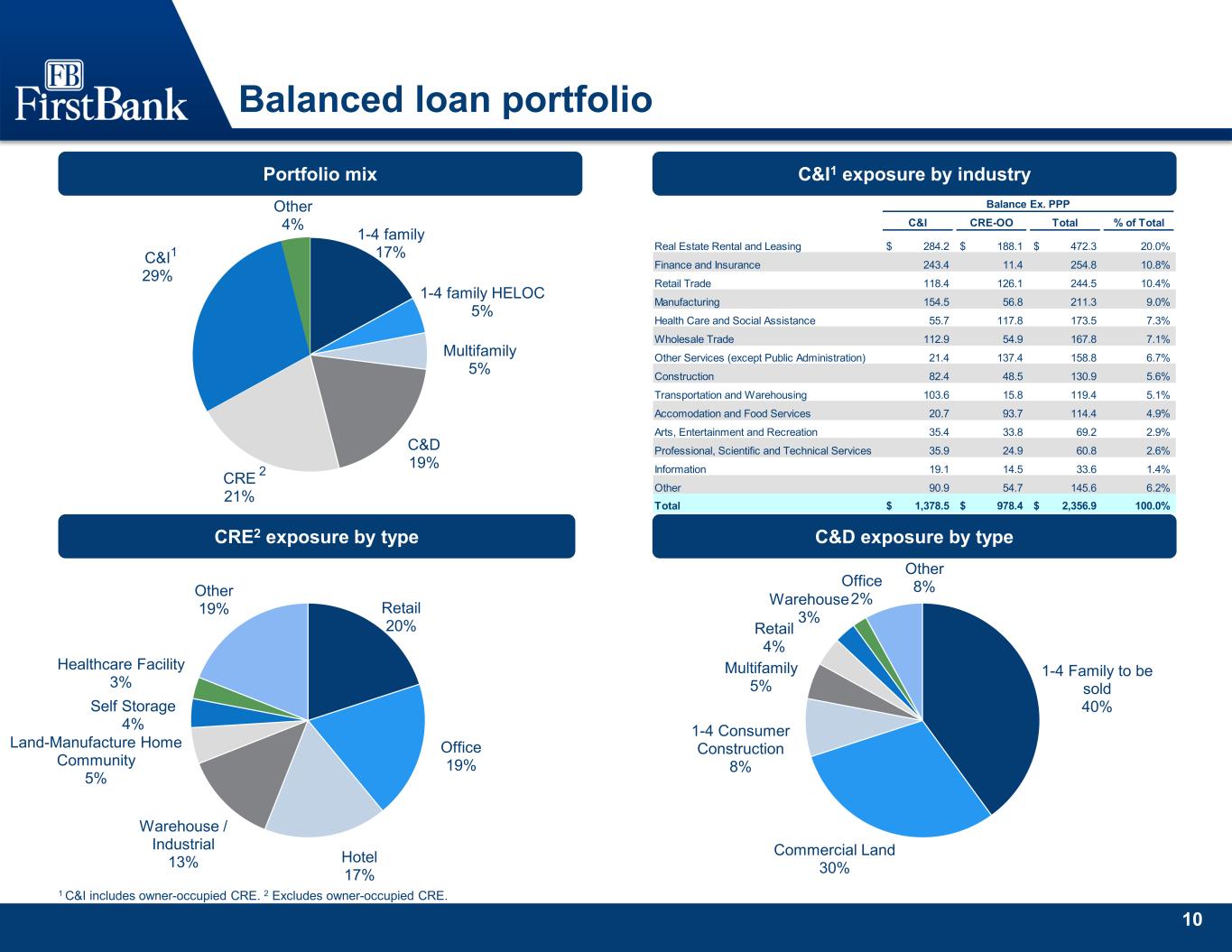

10 Retail 20% Office 19% Hotel 17% Warehouse / Industrial 13% Land-Manufacture Home Community 5% Self Storage 4% Healthcare Facility 3% Other 19% 1-4 Family to be sold 40% Commercial Land 30% 1-4 Consumer Construction 8% Multifamily 5% Retail 4% Warehouse 3% Office 2% Other 8% 1-4 family 17% 1-4 family HELOC 5% Multifamily 5% C&D 19% CRE 21% C&I 29% Other 4% Balanced loan portfolio CRE2 exposure by type Portfolio mix 1 C&I includes owner-occupied CRE. 2 Excludes owner-occupied CRE. C&I1 exposure by industry 1 2 C&D exposure by type Balance Ex. PPP C&I CRE-OO Total % of Total Real Estate Rental and Leasing 284.2$ 188.1$ 472.3$ 20.0% Finance and Insurance 243.4 11.4 254.8 10.8% Retail Trade 118.4 126.1 244.5 10.4% Manufacturing 154.5 56.8 211.3 9.0% Health Care and Social Assistance 55.7 117.8 173.5 7.3% Wholesale Trade 112.9 54.9 167.8 7.1% Other Services (except Public Administration) 21.4 137.4 158.8 6.7% Construction 82.4 48.5 130.9 5.6% Transportation and Warehousing 103.6 15.8 119.4 5.1% Accomodation and Food Services 20.7 93.7 114.4 4.9% Arts, Entertainment and Recreation 35.4 33.8 69.2 2.9% Professional, Scientific and Technical Services 35.9 24.9 60.8 2.6% Information 19.1 14.5 33.6 1.4% Other 90.9 54.7 145.6 6.2% Total 1,378.5$ 978.4$ 2,356.9$ 100.0%

11 0.77% 0.66% 0.50% 0.50% 0.44% 1Q21 2Q21 3Q21 4Q21 1Q22 2.29% 2.03% 1.91% 1.65% 1.50% 1Q21 2Q21 3Q21 4Q21 1Q22 0.05% 0.02% 0.13% 0.12% (0.03%) 1Q21 2Q21 3Q21 4Q21 1Q22 Asset quality remains solid Nonperforming Assets1 / Assets Nonperforming Loans (HFI) / Loans (HFI) LLR/loans HFI (excluding PPP loans)2 Net charge-offs (recoveries) / average loans 1 Includes acquired excess land and facilities held for sale–see page 12 of the Quarterly Financial Supplement. 2 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures to the most directly comparable GAAP financial measures. 0.94% 0.83% 0.59% 0.62% 0.51% 1Q21 2Q21 3Q21 4Q21 1Q22

12 Allowance for credit losses overview ACL / Loans HFI by Category Current Expected Credit Loss (CECL) Allowance for Credit Losses (ACL) model utilizes Moody’s model with key economic data summarized below: 1Source: Moody’s “November 2021 U.S. Macroeconomic Outlook Baseline and Alternative Scenarios”. 2 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 3 Commercial and Industrial includes Owner-Occupied CRE; excludes $2.1 million, $4.0 million and $145.7 million in PPP loans for March 31, 2022, December 31, 2021 and March 31, 2021, respectively. 32 2.29% 0.88% 3.04% 3.45% 4.29% 1.82% 2.35% 3.47% 1.65% 1.26% 1.49% 2.15% 2.14% 1.50% 1.54% 3.35% 1.50% 0.90% 1.25% 2.16% 1.60% 1.56% 1.67% 3.59% Gross Loans HFI (Ex. PPP) Commercial & Industrial Non-Owner Occ CRE Construction Multifamily 1-4 Family Mortgage 1-4 Family HELOC Consumer & Other 1Q21 4Q21 1Q22 FQE, FYE 12/31, 2Q 2022 3Q 2022 2022 2023 2024 2025 2026 GDP (bcw$) 19,875.2$ 19,866.5$ 19,869.0$ 20,142.9$ 20,742.0$ 21,287.4$ 21,866.8$ Annualized % Change 0.6% (0.2%) 2.3% 1.4% 3.0% 2.6% 2.7% Total Employment (millions) 148.9 147.8 148.5 150.3 153.0 153.5 154.0 Unemployment Rate 4.7% 5.6% 5.0% 4.6% 3.6% 3.9% 4.1% CRE Price Index 343.3 334.0 329.7 363.2 398.0 420.8 436.1 NCREIF Property Index: Rate of Return 2.3% 1.3% 2.3% 2.2% 3.2% 2.7% 2.2%

13 Appendix

14 GAAP reconciliation and use of non-GAAP financial measures Adjusted net income and diluted earnings per share

15 GAAP reconciliation and use of non-GAAP financial measures Adjusted pre-tax, pre-provision earnings

16 GAAP reconciliation and use of non-GAAP financial measures Adjusted earnings and diluted earnings per share

17 GAAP reconciliation and use of non-GAAP financial measures Adjusted pre-tax, pre-provision earnings

18 GAAP reconciliation and use of non-GAAP financial measures Core efficiency ratio (tax-equivalent basis)

19 GAAP reconciliation and use of non-GAAP financial measures Segment core efficiency ratios (tax-equivalent basis)

20 GAAP reconciliation and use of non-GAAP financial measures Adjusted Banking segment pre-tax pre-provision earnings

21 GAAP reconciliation and use of non-GAAP financial measures Tangible assets and equity, tangible book value per common share and tangible common equity to tangible assets

22 Tangible assets and equity, tangible book value per common share and tangible common equity to tangible assets GAAP reconciliation and use of non-GAAP financial measures

23 GAAP reconciliation and use of non-GAAP financial measures Return on average tangible common equity

24 GAAP reconciliation and use of non-GAAP financial measures Return on average tangible common equity

25 GAAP reconciliation and use of non-GAAP financial measures Adjusted return on average assets and common equity

26 GAAP reconciliation and use of non-GAAP financial measures Adjusted return on average assets and common equity

27 GAAP reconciliation and use of non-GAAP financial measures Adjusted Allowance for Credit Losses to Loans Held for Investment