Via EDGAR Correspondence

May 31, 2017

Mr. Rufus Decker

Accounting Branch Chief

Office of Beverages, Apparel and Mining

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE, Mail Stop 3561

Washington, D.C. 20549

RE: Coca-Cola European Partners PLC

Form 20-F for the Year Ended December 31, 2016

Filed April 12, 2017

File No. 1-37791

Dear Mr. Decker:

Thank you for your letter dated May 17, 2017 setting forth comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) regarding the Annual Report on Form 20-F for the fiscal year ended December 31, 2016 (the “2016 Form 20-F”) of Coca-Cola European Partners plc (“CCEP” or the “Company”). The Company respectfully acknowledges the Staff’s comments. To facilitate your review of the Company’s responses, we have reproduced in italics the paragraphs of your letter and each is followed by the Company’s response.

Liquidity and Capital Management, page 19

| |

| 1. | You state adjusted EBITDA is calculated as EBITDA, before adding back certain non-recurring expense items. Please tell us how you determined that each item added back was non-recurring or revise your disclosure to remove the non-recurring characterization. Refer to Item 10(e)(1)(ii)(B) of Regulation S-K. |

Response

Adjusted EBITDA in the Company’s 2016 Form 20-F included the adjustments set forth in the bullet points below:

| |

| – | The inclusion of the financial results of Coca-Cola Enterprises, Inc (CCE), Coca-Cola Erfrischungsgetränke GmbH (CCEG) and Coca-Cola Iberian Partners S.A.U. (CCIP) as if the Merger had occurred at the beginning of the year on a basis consistent with Article 11 of Regulation S-X along with acquisition accounting for all periods presented and the additional debt financing costs incurred by CCEP in connection with the Merger. In making these adjustments, the Company reviewed and considered the guidance set forth in Sections 9220.6 and 9220.9 of the Financial Reporting Manual issued by the Division of Corporation Finance. |

| |

| – | Adjustments for items impacting the comparability of the Company’s year-over-year financial performance including merger and integration costs, inventory step-up related to acquisition accounting, restructuring charges and the out of period mark-to-market impact of commodity hedges. |

The Company made these adjustments to allow investors to better analyze the Company’s operating performance and to provide greater comparability of year-over-year results. Given the items in the first bullet point noted above are not “reasonably likely to occur within two years,” the Company believes these are “non-recurring” within the meaning of Item 10(e)(1)(ii)(B) of Regulation S-K. With regard to the adjustments noted in the second bullet point, the Company believes merger and integration costs and the inventory step-up related to acquisition accounting also meet the definition of “non-recurring” since they are “not reasonably likely to recur within two years.” With regard to restructuring charges and the out of period mark-to-market impact of commodity hedges, the Company will characterize these adjustments as items impacting comparability and not as a “non-recurring” in future SEC filings if they do not meet the definition of “non-recurring” within the meaning of Item 10(e)(1)(ii)(B) of Regulation S-K.

|

| | |

| |

| Registered in England under number 09717350 - Registered Office: Pemberton House, Bakers Road, Uxbridge, UB8 1EZ |

| |

| 2. | It appears you are using adjusted EBITDA and the resultant net debt to adjusted EBITDA measure to manage your liquidity and capital resources. If so, please reconcile adjusted EBITDA to cash flows from operating activities and provide equally prominent disclosure of your cash flows from operating, investing and financing activities. If not, please explain your basis for believing these measures are performance measures, and not liquidity ones, and reconcile adjusted EBITDA to net income, rather than operating profit. Refer to Item 10(e)(1)(i)(A) of Regulation S-K and Questions 102.06 and 103.02 of the Compliance and Disclosure Interpretations regarding Non-GAAP Measures, as revised in May 2016. |

Response

The Company has reviewed Item 10(e)(1)(i)(A) of Regulation S-K and the updated Compliance and Disclosure Interpretations issued on May 17, 2016. The Company considers Adjusted EBITDA to be a performance measure as it is intended to help investors analyze the Company’s operating performance. Adjusted EBITDA is derived directly from profit after tax adjusted for certain non-cash items and other operating items as discussed in our prior response. Adjusted EBITDA does not reflect the Company’s cash expenditures, or future requirements for capital expenditures. Further, Adjusted EBITDA does not reflect changes in, or cash requirements for, the Company’s working capital needs, and although depreciation and amortization are non-cash charges, the assets being depreciated and amortized are likely to be replaced in the future. Adjusted EBITDA does not reflect any cash requirements for such replacements. As such, the Company’s presentation of Adjusted EBITDA has limited value as a liquidity measure and the Company does not present it to investors, analysts, or credit rating agencies as a liquidity measure. In future SEC filings, the Company will ensure that Adjusted EBITDA is separately reconciled to profit after tax rather than operating profit and will augment the disclosure regarding Adjusted EBITDA to clarify that it is presented because the Company believes that it provides useful information to investors, analysts, and credit rating agencies regarding the Company’s operating performance.

Further, as noted, the Company provides a ratio that compares net debt to Adjusted EBITDA. The Company understands that the net debt to Adjusted EBITDA ratio is used by its investors and credit rating agencies to analyze the Company’s overall operating performance in the context of targeted financial leverage. As such, the Company believes this measure provides relevant and useful operating performance information to investors and other users of the Company’s financial data.

Please refer to Appendix 1 of this letter for the Company’s revised presentation of these performance measures to be included in future SEC filings. The Company believes the revised presentation satisfies the requirements of Item 10(e)(1)(i)(A) of Regulation S-K for a performance measure.

Financial Statements

Note 3. Segment Information, page 106

| |

| 3. | Please provide us with your analysis of how you determined you have one operating segment. In your response, please address the following: |

| |

| ◦ | Tell us the title and describe the role of the CODM and each of the individuals who report to the CODM. If the general managers of your various regional business units discussed on pages 169 to 170 do not report to the CODM, please also describe their role and how they fit into your organizational structure. |

Response

The Company has identified its Western Europe segment as its operating segment. In arriving at this conclusion, the Company considered the guidance presented in paragraphs 5 through 10 of IFRS 8, Operating Segments, in that its Western Europe segment: (1) engages in business activities from which it may earn revenues and incur expenses; (2) has its operating results regularly reviewed by the entity’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance; and (3) has discrete financial information available.

Identification of the Chief Operating Decision Maker (CODM)

In identifying the CODM, the Company considered paragraph 7 of IFRS 8, which defines the CODM as “a function, not necessarily a manager with a specific title. That function is to allocate resources to and assess the performance of the operating segments of an entity. Often the chief operating decision maker of an entity is its chief executive officer or chief operating officer but, for example, it may be a group of executive directors or others.”

|

| | |

| |

| Registered in England under number 09717350 - Registered Office: Pemberton House, Bakers Road, Uxbridge, UB8 1EZ |

Background of the Company and CODM Analysis

CCEP was formed on May 28, 2016 through the Merger of the legacy businesses of CCE, CCEG and CCIP. The Company operates a single business activity in Western Europe, which is selling, making and distributing non-alcoholic ready to drink (NARTD) beverages. CCEP is a public company limited by shares under the laws of England and Wales. During the year, the Company migrated from being a Company lead by a U.S. based Chief Executive Officer (CEO) to a European-based structure, Board, and leadership team. The Company’s Board structure and governance framework are set out in the “Governance and Directors Report” in the Company’s 2016 Form 20-F.

Throughout the year, the Company reviewed and discussed with the Audit Committee, the Board and the CEO the activities and responsibilities of the Board and CEO including a discussion regarding the responsibilities and involvement of the Board in key operating decisions. The Board has authority and control over key operating and strategic decisions of the Company through its involvement in the review, approval, and informational processes for significant transactions, agreements and business decisions (e.g. capital investments, restructuring activities such as production and distribution facility rationalization or route-to-market changes, pan-European or local product and package innovations, and licensing agreements). In addition to key operating decisions, the Board is responsible for capital allocation and decides whether to allocate resources to marketplace investments, optimize capital structure through debt and equity (including returning cash to shareowners), or undertake future mergers and acquisitions.

Based on the responsibilities, accountabilities, and key decisions reserved for the Board, the Board is functioning in a manner that represents the most senior executive decision-making level of the Company and, therefore, is the CODM. The Board is ultimately responsible for assessing performance and allocating resources, while the CEO is the segment manager accountable for operating results and maintains regular contact with the CODM to discuss operating activities, financial results, forecasts, or plans for the segment.

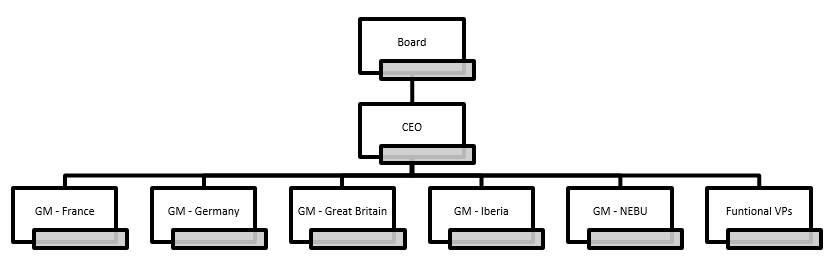

The Company’s business unit general managers report to the CEO. Please refer to the organizational chart in Appendix 2 of this letter, which reflects the current organizational structure of the Company.

| |

| ◦ | Explain the various forms of discrete financial information regularly reviewed by your CODM that is at a disaggregated or lower level than your consolidated results. Please explain the nature of any profitability information that is reviewed by your CODM at a level lower than your consolidated results and explain how often this information is provided to and reviewed by your CODM. |

The Company’s CODM reviews and utilizes information at a consolidated level to evaluate performance and allocate resources. The Company’s CODM does not regularly review discrete financial information at a disaggregated or lower level than consolidated results. The CODM does receive certain disaggregated business unit level information such as revenue and volume as part of the Company’s monthly Director’s Report. There are no measures of income or profit information regularly reviewed by the CODM at a business unit level.

The CODM also receives volume and category trends related to brands (sparkling vs still), channels (home and out-of-home), packages (cans vs PET vs glass), and consumption type (single-serve vs multi-serve). Discrete financial information (i.e. a measure of profit and loss) is not available for these categories. As such, this information is not a proxy for operating results and resource and performance decisions are not made based on this information. This information is generally provided in the Director’s Report.

| |

| ◦ | If lower level or disaggregated information is not regularly reviewed by the CODM, tell us who is responsible for allocating resources and assessing performance below the consolidated level and explain how that works. |

The Company is organized into five geographical business units in Western Europe, each with a general manager. Each of the five business unit general managers are responsible for the results of their respective business unit and report directly to the CEO, along with the global function leads of finance, IT, legal, HR, supply chain, public affairs, and strategy. The CEO, as segment manager, maintains regular contact with the CODM to discuss operating activities, financial results, forecasts, and plans for the segment.

|

| | |

| |

| Registered in England under number 09717350 - Registered Office: Pemberton House, Bakers Road, Uxbridge, UB8 1EZ |

The Company’s CEO, along with the leadership team, manage the day-to-day business of the Company and execute based on the resources allocated to them by the CODM. The leadership team holds regular meetings where performance below the consolidated level is reviewed and assessed.

| |

| ◦ | Tell us the nature of the resource allocation decisions made by the CODM and what components of the business they choose between in their allocation of resources. |

The Company’s CODM decides whether to allocate resources to marketplace investments, optimize capital structure through debt and equity (including returning cash to shareowners), or future mergers and acquisitions. With regard to marketplace investments, the CODM considers whether to allocate resources to areas such as capital investment, restructuring type activities such as production and distribution facility rationalization across geographies or route to-market changes, or pan-European or local product and package innovations.

| |

| ◦ | Explain how budgets are prepared, who approves the budget at each step of the process, the level of detail discussed at each step and the level at which the CODM makes changes to the budget |

The Company’s annual planning process has several phases as outlined below. The Company advises the Staff that the planning process in 2016 did not reflect the normal budgeting cycle given the Company was formed on May 28, 2016.

| |

| – | Long Range Plan: The Company develops a Long Range Plan (LRP) annually. The focus is on key strategic priorities to drive long-term profitable revenue growth, and investments (e.g. capital expenditure) to ensure sufficient investment in the business to support long-term growth. The Company’s proposed consolidated LRP is presented by the CEO and CFO to the Board for approval. The Board reviews and actively challenges the CEO and CFO on the Company’s proposal. The Board directs the CEO and CFO to adjust the LRP when it believes it is necessary to do so. |

| |

| – | Preliminary Consolidated Annual Plan: Business units develop their proposed budgets with key assumptions to drive revenue and profit growth. The CEO and CFO provide the Board with an update on key assumptions to be taken as part of the budgeting process. This review is an update on the LRP previously discussed with a focus on the annual plan. At this preliminary stage in the budgeting process, the Board receives supplemental information at a business unit level focused on the key initiatives and focus areas of each geography. The Board reviews the preliminary plan and directs the CEO and CFO to make adjustments when it believes it is necessary to do so. |

| |

| – | Preliminary Business Unit Budgets: Top-down targets are provided and each business unit and global function hold individual workshops to review and discuss key initiatives and proposed plans for the year. An output of this stage is a ‘bottom up’ budget proposed by the leader of each business unit and global function. These preliminary budgets are reviewed with the CEO and CFO and include key metrics such as revenue per unit case, cost of sales per unit case, gross profit, operating expenses, operating profit, and cash conversion. Commercial leaders review and discuss sources of revenue growth, investment needs, key customer strategies, and risks and opportunities. Budgets are not formally approved at this stage. |

| |

| – | Proposed Consolidated Budget: The preliminary budgets of the Company’s business units and global functions are consolidated to generate the Company’s initial preliminary proposed consolidated budget. At this stage, the Board reviews the preliminary consolidated plan presented by the CEO and CFO. The Board reviews and actively challenges the CEO and CFO on the Company’s proposed budget. In particular, the Board focuses on key drivers of growth and risks and opportunities of the plan. The Board considers the allocation of resources to key initiatives, projects, or other uses of capital. The Board directs the CEO and CFO to adjust the proposed consolidated budget when it believes it is necessary to do so. |

| |

| – | Final Approved Budgets: The Company then prepares a final proposed budget and considers key areas including pricing plans, investment choices, sources of growth, cost management plans, and executional and commercial key performance indicators. The revised final proposed consolidated budget is presented to the Board by the CEO and CFO. Subject to its satisfaction with the plan, the Board approves the proposed consolidated budget. No individual budget is considered approved until the final consolidated budget is approved by the Board. |

|

| | |

| |

| Registered in England under number 09717350 - Registered Office: Pemberton House, Bakers Road, Uxbridge, UB8 1EZ |

| |

| ◦ | Describe the level of detail communicated to the CODM when actual results differ from budgets and who is involved in the meetings with the CODM to discuss budget-to-actual variances. |

The Board, as CODM, receives the following information:

| |

| – | A monthly Director’s Report, which provides an update on business and operating performance at a consolidated level including budget to actual variances. The Director’s report is not always provided in months that correspond with a Board meeting. |

| |

| – | A quarterly CEO/CFO report at each Board meeting (five scheduled meetings each year) providing an update on operating performance and key financial performance indicators at a consolidated level. The CEO and CFO are involved in meetings with the CODM to discuss budget-to-actual variances. |

| |

| ◦ | Describe the basis for determining the compensation for each individual that reports to the CODM. |

The Board sets the compensation of the CEO. All performance-based compensation for the CEO is based upon consolidated results. Details are set out in the Directors’ Remuneration Report of the Company’s 2016 Form 20-F.

| |

| ◦ | Also, in the event you determine that you have more than one operating segment pursuant to the guidance in IFRS 8, but that these operating segments meet the aggregation criteria outlined in paragraph 12 of IFRS 8, please explain in further detail the basis for your conclusion that your operating segments are economically similar. |

As noted, the Company has identified its Western Europe segment as the only operating segment of the Company that meets the definition of an operating segment. As such, the Company has not applied the aggregation criteria of paragraph 12 of IFRS 8. The Company will reassess its conclusion should underlying facts change.

| |

| 4. | Please disclose the revenues derived from each of your principal products for each period presented. Refer to paragraph 32 of IFRS 8. |

Response

The Company derives its revenues through a single business activity, which is selling, making, and distributing NARTD beverages. The Company operates solely in developed markets in Western Europe and has a homogeneous product portfolio across its geographic territories. More than 95 percent of the products sold by the Company are products of TCCC and the Company believes it has a single principal product, which is NARTD beverages.

To help investors better understand underlying trends in the NARTD beverage market, including those tracked by external market survey organizations (e.g. AC Nielson), the Company provides certain information on brand categories. These categories include Coca-Cola trademark (e.g. Coca-Cola, Diet Coke, Coke Zero Sugar); sparkling flavors and energy (e.g. Fanta, Sprite, and Monster); juices, isotonics and other (e.g. Capri-Sun, Honest Tea, Powerade); and water (e.g. Chaudfontaine, Vio, and Smartwater). The Company has considered the guidance in paragraph 32 of IFRS 8 in determining whether these brand categories represent differing products. Given the similarity of the production processes, classes and types of customers and distribution methods across these brand categories within each geographic territory, the Company believes these categories do not represent separate principal products as defined by paragraph 32 of IFRS 8.

In future SEC filings, the Company will more clearly disclose that the Company’s revenues are derived from NARTD beverages, which is the Company’s principal product.

Note 4. Earnings Per Share, page 106

| |

| 5. | Please disclose by type of potentially dilutive security, such as stock options and restricted shares, the number of additional shares that could potentially dilute basic earnings per share in the future, but were not included in the calculation of diluted earnings per share because they were antidilutive for the periods presented. Refer to paragraph 70(c) of IAS 33. |

Response

|

| | |

| |

| Registered in England under number 09717350 - Registered Office: Pemberton House, Bakers Road, Uxbridge, UB8 1EZ |

In its 2016 Form 20-F, the Company did not make the referenced disclosure on the basis of materiality. The Company advises the Staff that for the years ended December 31, 2016, 2015, and 2014, employee share options to purchase 1.2, 1.2 and 1.0 million shares, respectively, were excluded from the diluted earnings per share calculations because the effect of including these options would be anti-dilutive. The Company will continue to monitor the materiality of this disclosure in future SEC filings.

Should you have additional questions, please do not hesitate to call or me at +44 1895 844 534 or Scott Bourgeois at +44 1895 844 055.

Sincerely,

/s/ Nik Jhangiani

Nik Jhangiani

Senior Vice President, Chief Financial Officer

cc:

Sol Daurella, Chairman of the Board

Garry Watts, Chairman of the Audit Committee

Damian Gammell, Chief Executive Officer

Clare Wardle, General Counsel and Company Secretary

Scott Bourgeois, Chief Accounting Officer and Group Controller

Karl Havers, Partner, EY United Kingdom

|

| | |

| |

| Registered in England under number 09717350 - Registered Office: Pemberton House, Bakers Road, Uxbridge, UB8 1EZ |

Appendix 1 - Adjusted EBITDA Performance Measure Presentation

|

| |

| | 2016 €m |

| Reported profit after tax | 549 |

| Taxes | 170 |

| Finance Costs, net | 123 |

| Non-Operating Items | 9 |

| Reported operating profit | 851 |

| Depreciation and amortisation | 372 |

| EBITDA | 1,223 |

| Pro forma adjustments | (64) |

| Acquisition accounting adjustments | (28) |

| Share based payment expense | 42 |

| Items impacting comparability | |

| Restructuring costs | 560 |

| Merger related costs | 168 |

| Mark to market effects | (35) |

| Inventory step up | 28 |

| Adjusted EBITDA | 1,894 |

| | |

| Total Borrowings | 6,437 |

| F/X impact of non-EUR borrowings | (57) |

| Cash and cash equivalents | (386) |

| Net Debt | 5,994 |

| | |

| Net debt to EBITDA | 4.9 |

| | |

| Net debt to Adjusted EBITDA | 3.2 |

|

| | |

| |

| Registered in England under number 09717350 - Registered Office: Pemberton House, Bakers Road, Uxbridge, UB8 1EZ |

Appendix 2 - Current Organizational Chart of the Company

|

| | |

| |

| Registered in England under number 09717350 - Registered Office: Pemberton House, Bakers Road, Uxbridge, UB8 1EZ |