INVESTOR PRESENTATION JULY 2024 Four Corners Property Trust NYSE: FCPT

JULY 2024 Cautionary note regarding forward-looking statements: This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding FCPT’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance, acquisition pipeline, expectations regarding the making of distributions and the payment of dividends, and the effect of pandemics on the business operations of FCPT and FCPT’s tenants and their continued ability to pay rent in a timely manner or at all. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of FCPT’s public disclosure obligations, FCPT expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in FCPT’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and FCPT can give no assurance that its expectations or the events described will occur as described. For a further discussion of these and other factors that could cause FCPT’s future results to differ materially from any forward-looking statements, see the risk factors described under the section entitled “Item 1A. Risk Factors” in FCPT’s annual report on Form 10-K for the year ended December 31, 2023 and other risks described in documents subsequently filed by FCPT from time to time with the Securities and Exchange Commission. Notice regarding non-GAAP financial measures: The information in this communication contains and refers to certain non-GAAP financial measures, including FFO and AFFO. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in the supplemental financial and operating report, which can be found in the Investors section of our website at www.fcpt.com, and on page 33 of this presentation. FORWARD LOOKING STATEMENTS AND DISCLAIMERS

3 CONSERVATIVE FINANCIAL POSITION PG 25 JULY 2024 CONTENTS 1 COMPANY OVERVIEW PG 3 2 HIGH QUALITY PORTFOLIO PG 8 4 APPENDIX PG 29 3 CONSERVATIVE FINANCIAL POSITION PG

FCPT OVERVIEW REPRESENTATIVE BRANDS SAMPLE HIGH-QUALITY PORTFOLIO Portfolio built to be e-commerce resistant, with tenants operating in-person services Strong Tenant EBITDAR / Rent Coverage, nationally established brands and low rents provide for high tenant retention and limited vacancies TRANSPARENT, ANALYTICAL, DISCIPLINED INVESTMENT PHILOSOPHY Focus on cost of capital and positive investment spread Use of proprietary, data-driven scorecard to objectively rate every property Detailed investment committee memo and unparalleled disclosure regime. FCPT makes a public press release at close for every property acquisition and disposition ACCRETIVE DIVERSIFICATION Grown from single tenant to 154 brands Established new verticals in resilient, essential retail categories of auto service and medical retail Disciplined pricing approach based on maintaining strong credit parameters and high-quality tenant base INVESTMENT GRADE BALANCE SHEET Committed to maintaining conservative 5.0x–6.0x leverage Well-laddered, predominately fixed-rate debt maturity schedule Significant liquidity, 100% unencumbered assets, high fixed charge coverage JULY 2024

JULY 2024 FINANCIAL HIGHLIGHTS AS OF Q2 2024 $0.27 Q2 2024 Net income per share $0.43 Q2 2024 AFFO per share1 $0.41 Q2 2024 FFO per share $240 million Liquidity with ample revolver capacity and cash 100% Unencumbered ABR 5.7x Net debt to adjusted EBITDAre2 4.3x Fixed charge coverage 93% Fixed rate debt 4.2 years Weighted average debt maturity BBB / Baa3 Stable Outlook Fitch / Moody’s

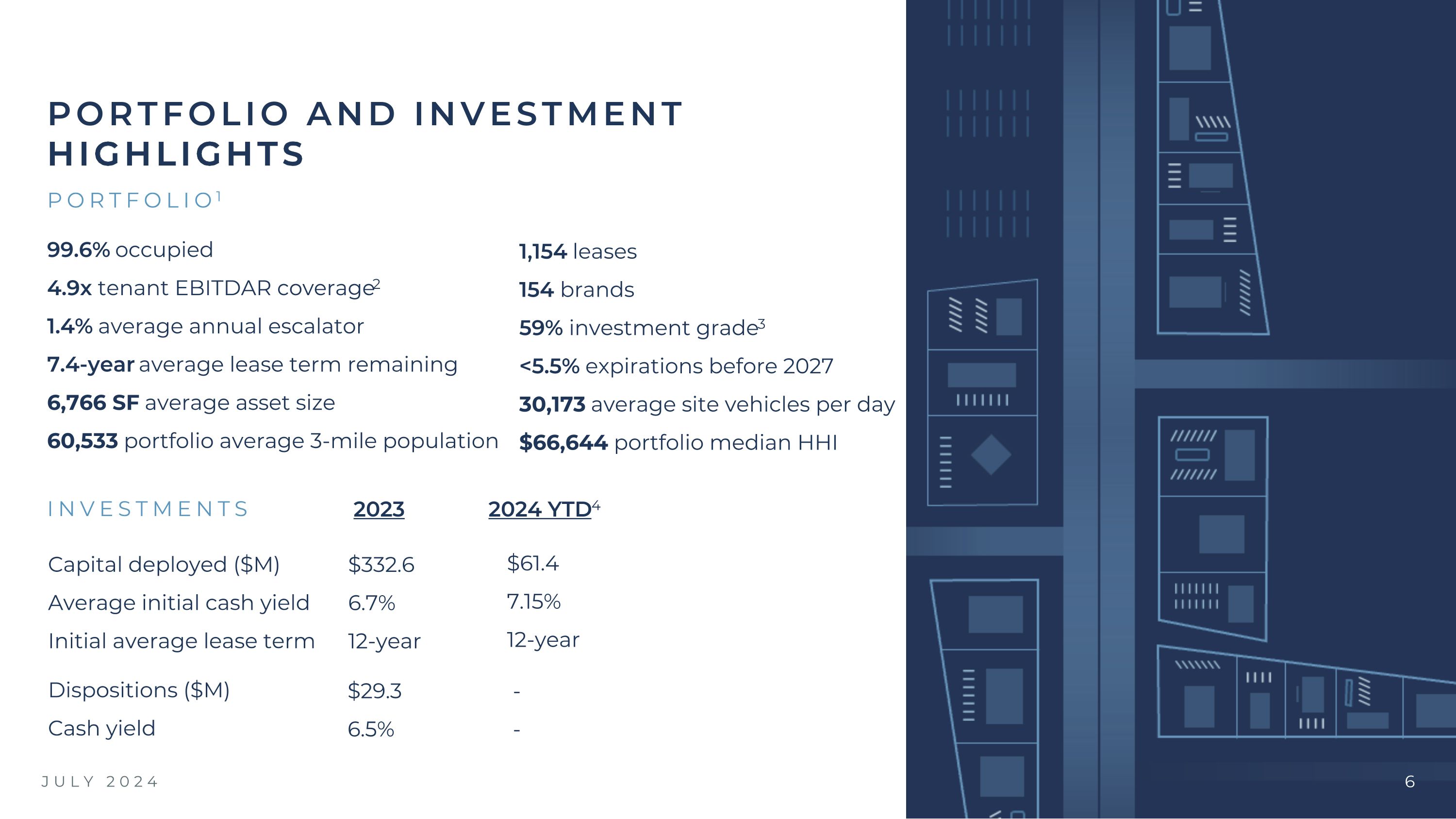

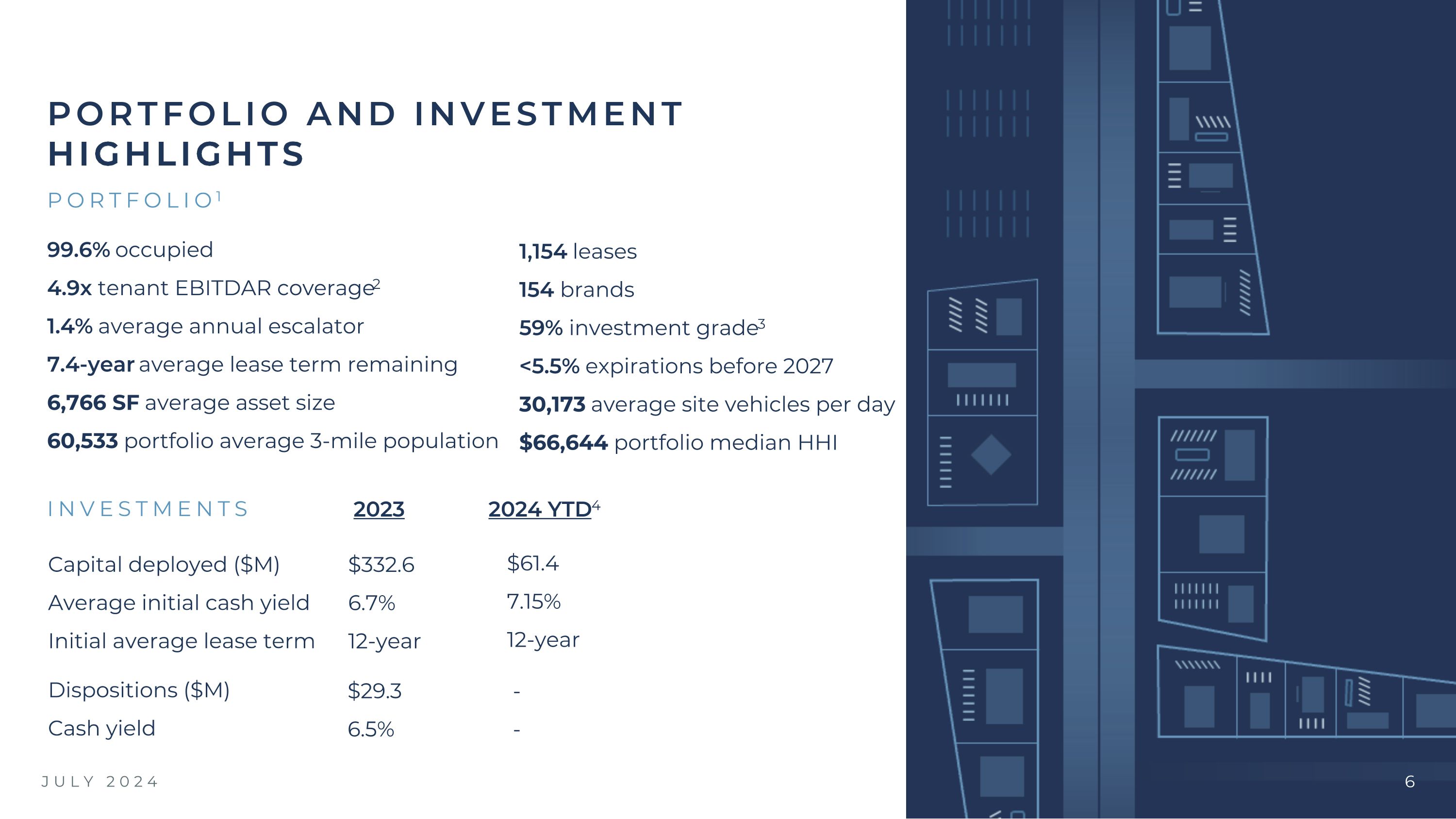

JULY 2024 INVESTMENTS 99.6% occupied 4.9x tenant EBITDAR coverage2 1.4% average annual escalator 7.4-year average lease term remaining 6,766 SF average asset size 60,533 portfolio average 3-mile population Capital deployed ($M) Average initial cash yield Initial average lease term Dispositions ($M) Cash yield PORTFOLIO AND INVESTMENT HIGHLIGHTS PORTFOLIO1 1,154 leases 154 brands 59% investment grade3 <5.5% expirations before 2027 30,173 average site vehicles per day $66,644 portfolio median HHI 2024 YTD4 $61.4 7.15% 12-year - - 2023 $332.6 6.7% 12-year $29.3 6.5%

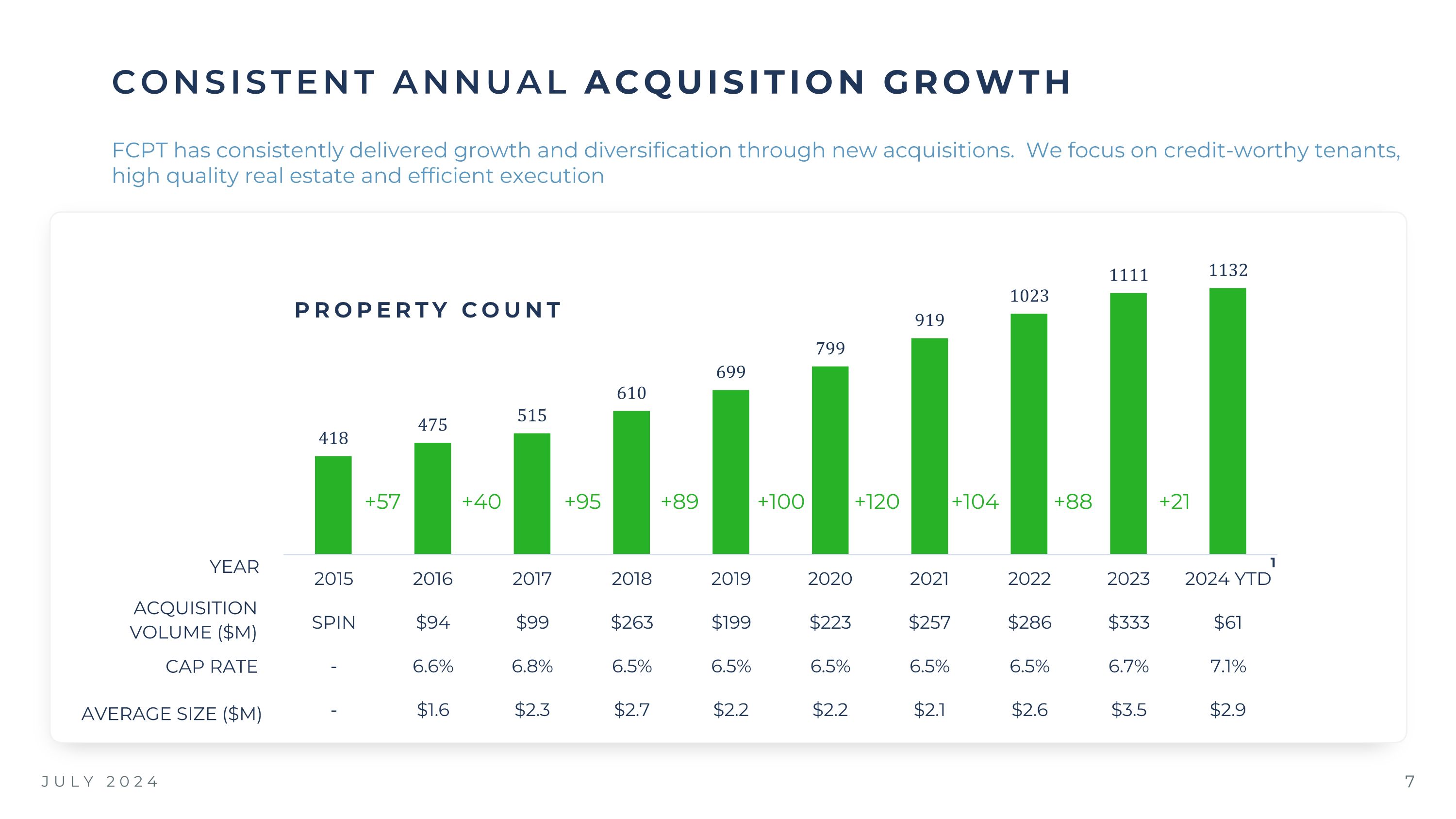

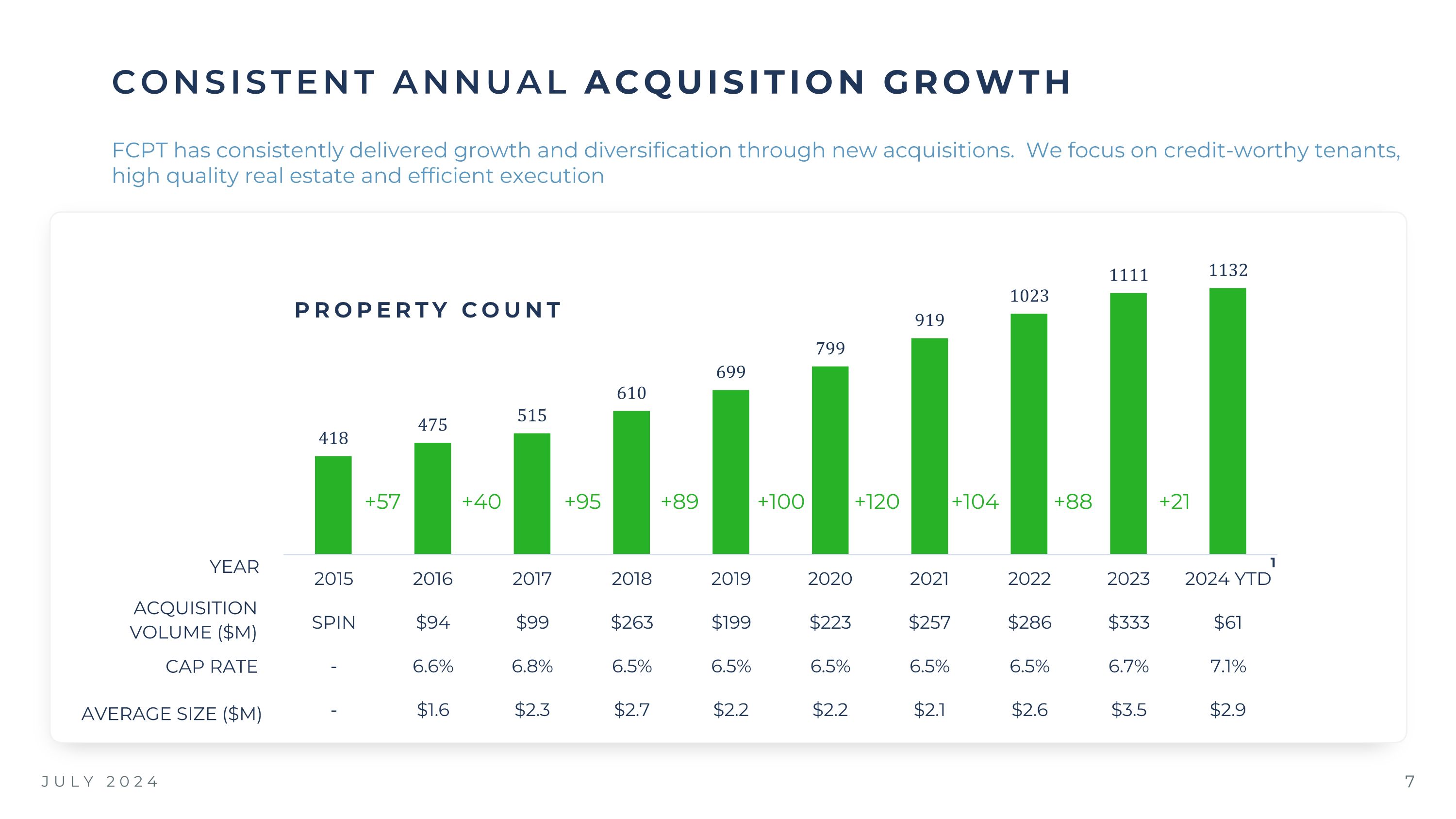

JULY 2024 CONSISTENT ANNUAL ACQUISITION GROWTH +57 +40 +95 +89 +100 +120 +104 YEAR ACQUISITION VOLUME ($M) CAP RATE +88 FCPT has consistently delivered growth and diversification through new acquisitions. We focus on credit-worthy tenants, high quality real estate and efficient execution PROPERTY COUNT 1 AVERAGE SIZE ($M) +21

CONTENTS JULY 2024 1 COMPANY OVERVIEW PG 3 2 HIGH QUALITY PORTFOLIO PG 8 4 APPENDIX PG 29 3 CONSERVATIVE FINANCIAL POSITION PG 25

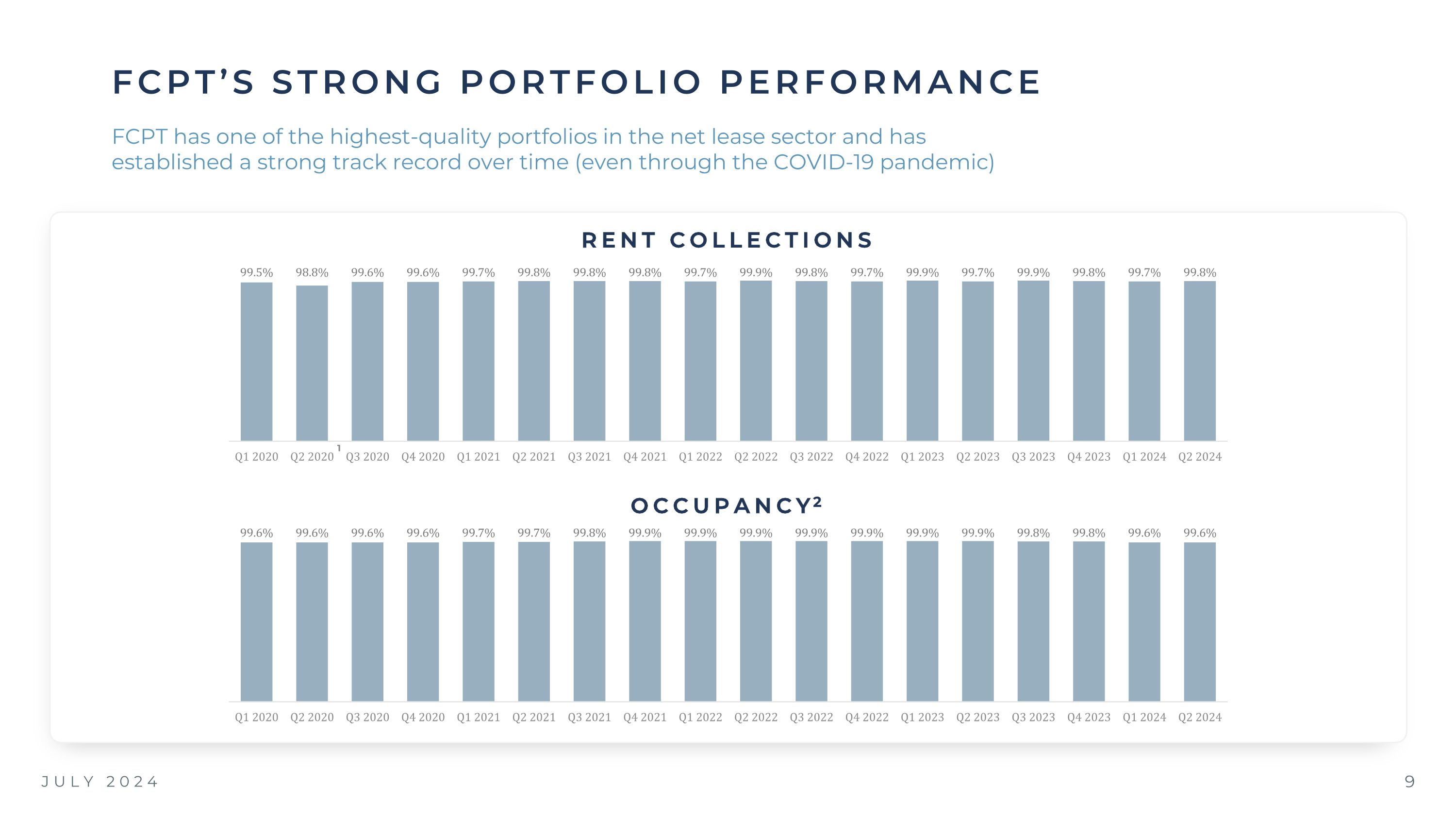

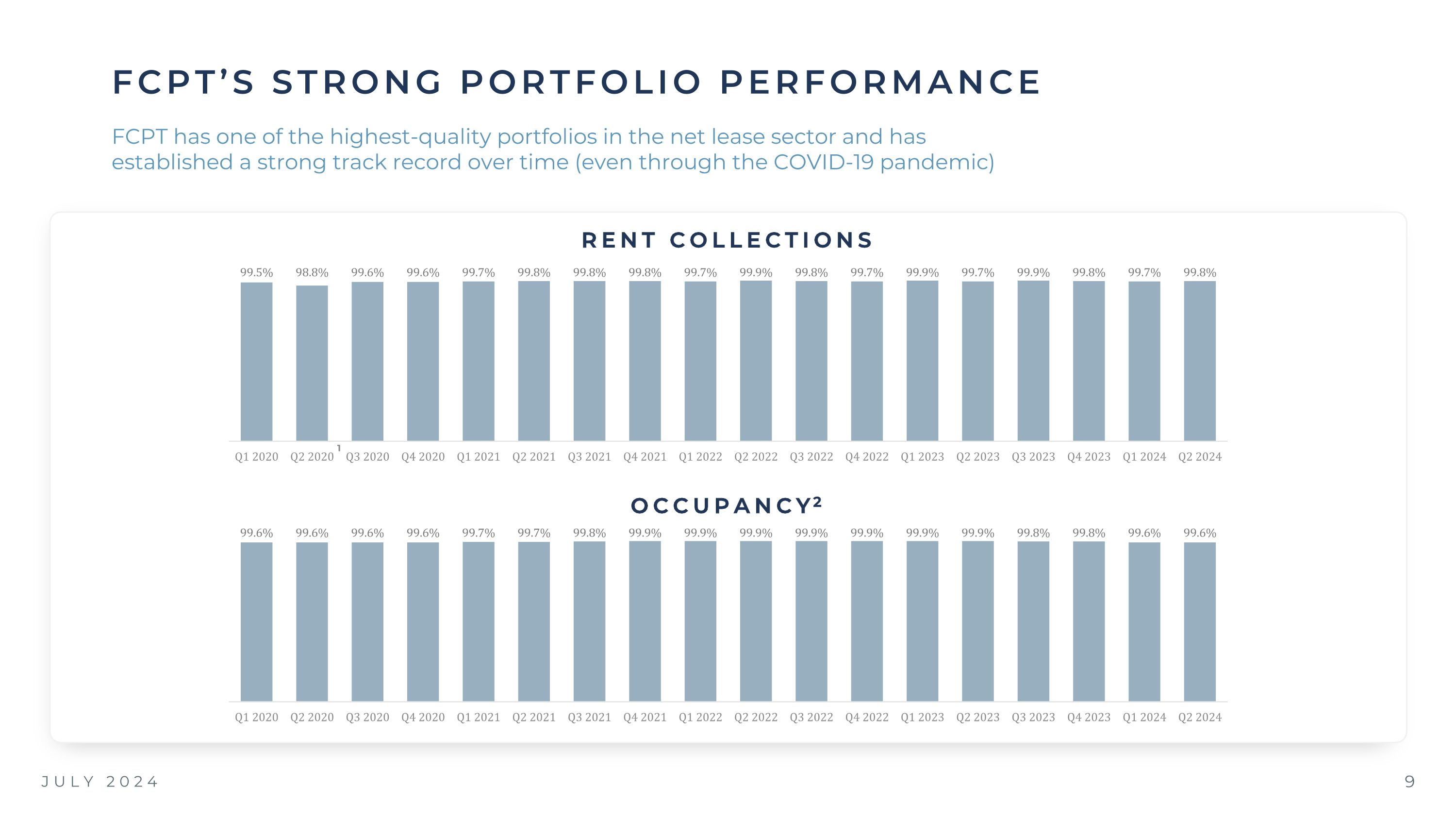

JULY 2024 FCPT’S STRONG PORTFOLIO PERFORMANCE FCPT has one of the highest-quality portfolios in the net lease sector and has established a strong track record over time (even through the COVID-19 pandemic) RENT COLLECTIONS OCCUPANCY2 1

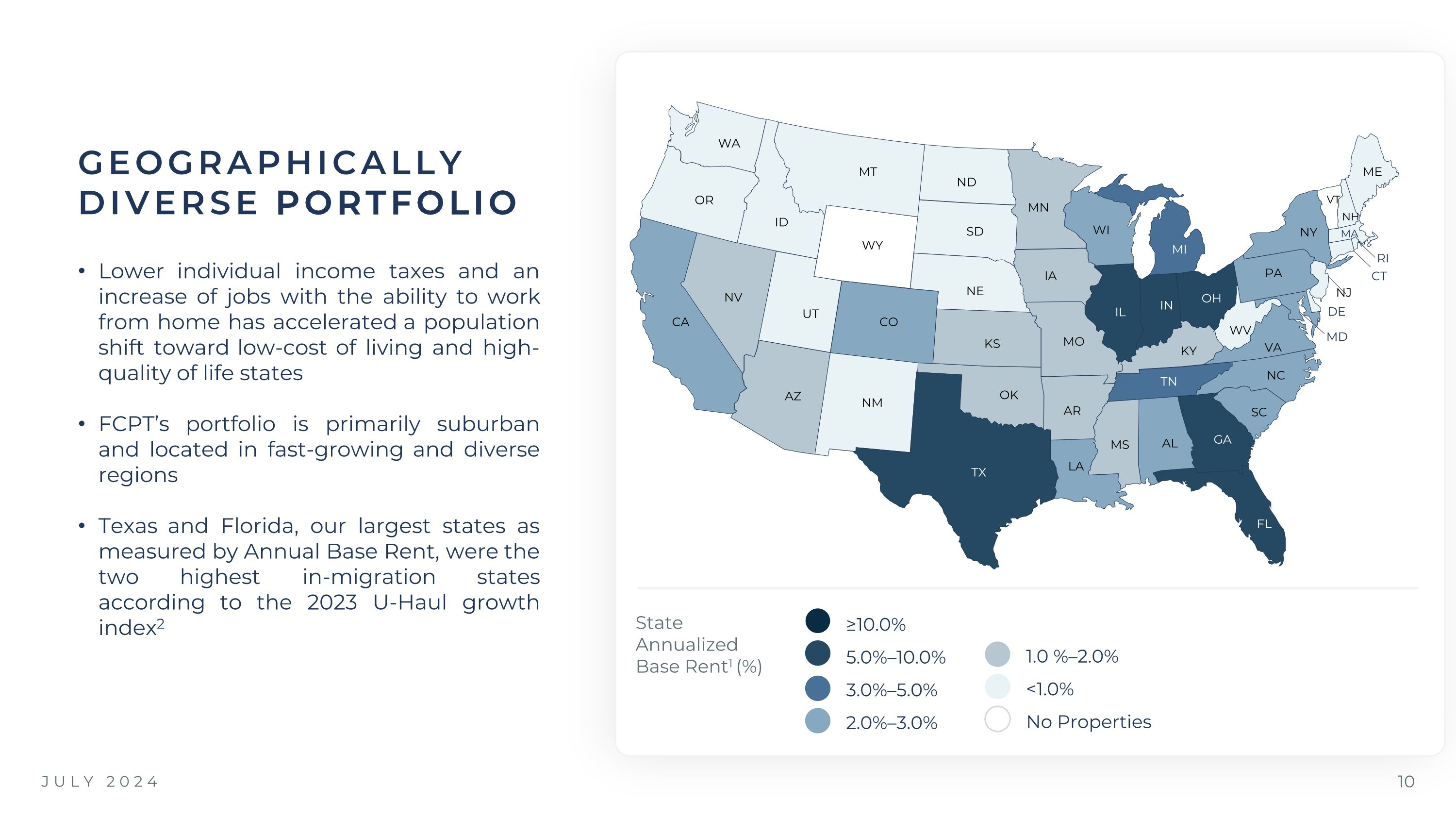

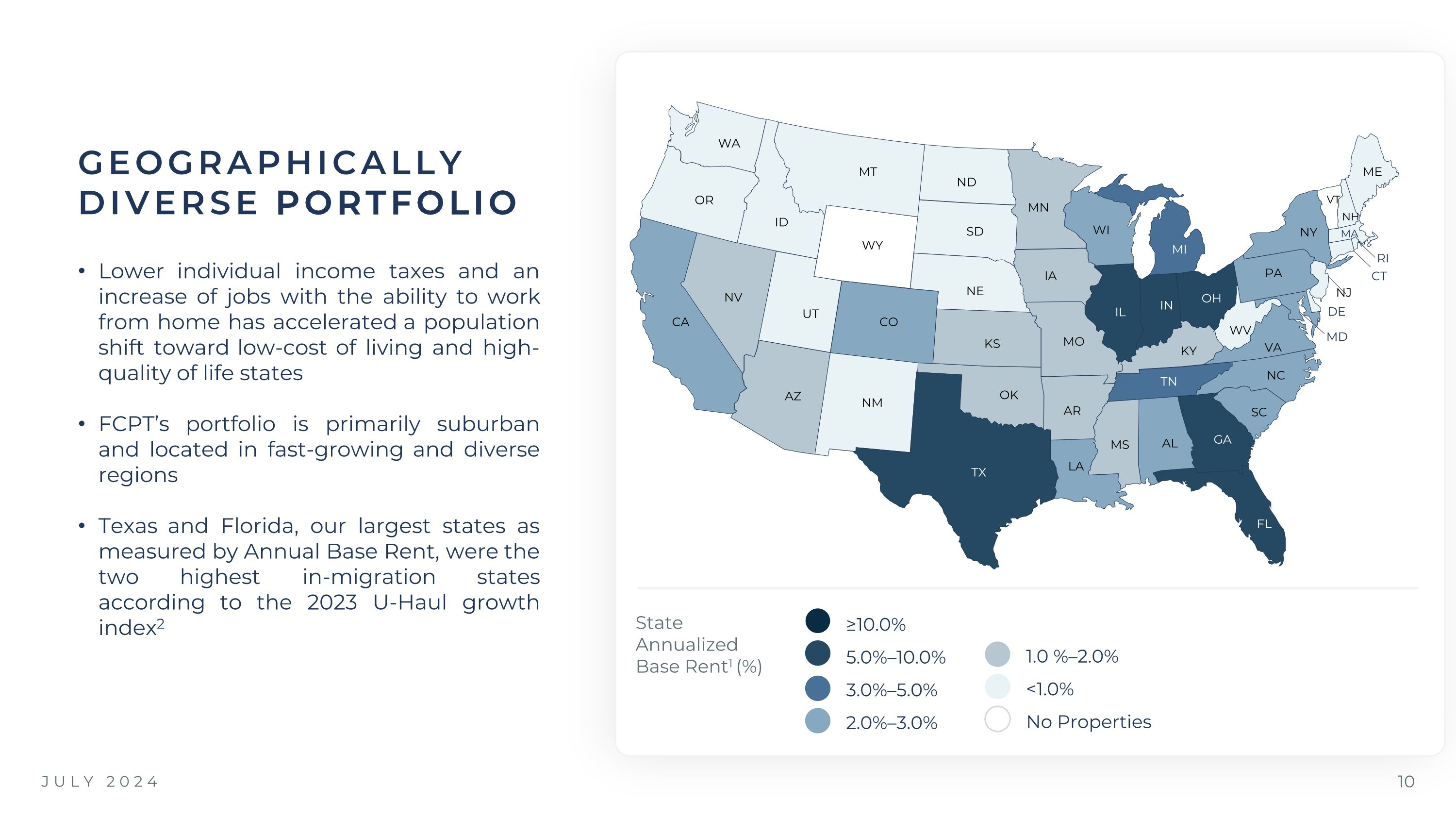

JULY 2024 GEOGRAPHICALLY DIVERSE PORTFOLIO Lower individual income taxes and an increase of jobs with the ability to work from home has accelerated a population shift toward low-cost of living and high-quality of life states FCPT’s portfolio is primarily suburban and located in fast-growing and diverse regions Texas and Florida, our largest states as measured by Annual Base Rent, were the two highest in-migration states according to the 2023 U-Haul growth index2 ≥10.0% 5.0%–10.0% 3.0%–5.0% 2.0%–3.0% State Annualized Base Rent1 (%) 1.0 %–2.0% <1.0% No Properties WA OR CA MT ID NV AZ UT WY CO NM TX OK KS NE SD ND MN IA MO AR LA MS AL GA FL SC TN NC IL WI MI OH IN KY WV VA PA NY ME VT NH NJ DE MD MA CT RI

FCPT’s high caliber portfolio benefits from strong rent coverage. Rents for the original Darden spin-off properties were purposely set at sustainable levels, and our current investment strategy and credit underwriting focuses on acquiring low rent and high rent coverage properties (including ground leases) Ground leases are characterized by low rents tied to the land value only (tenant constructed and owns the building). The ownership of buildings typically reverts to FCPT at the end of the lease. While many ground leases do not report financials, the low rent levels imply very high EBITDAR to rent coverage LOW RENT / HIGH COVERAGE PORTFOLIO FCPT TENANT RENTAL COVERAGE DETAIL1 FCPT PORTFOLIO2 Building and Ground Lease 572 Darden Spin Portfolio 410 Ground Lease 170 Average Portfolio Rent: $194 thousand Average Ground Lease Rent: $144 thousand JULY 2024

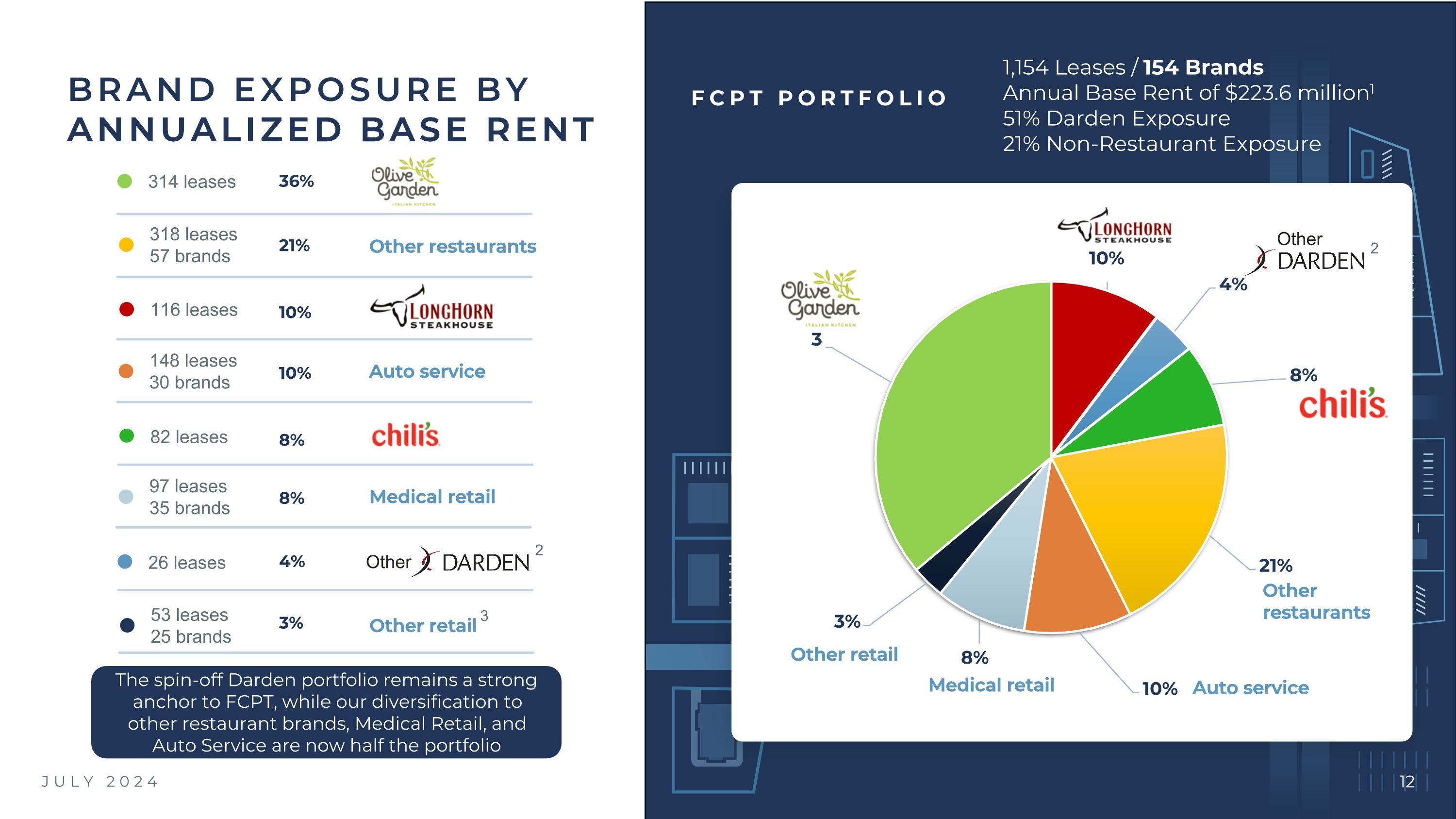

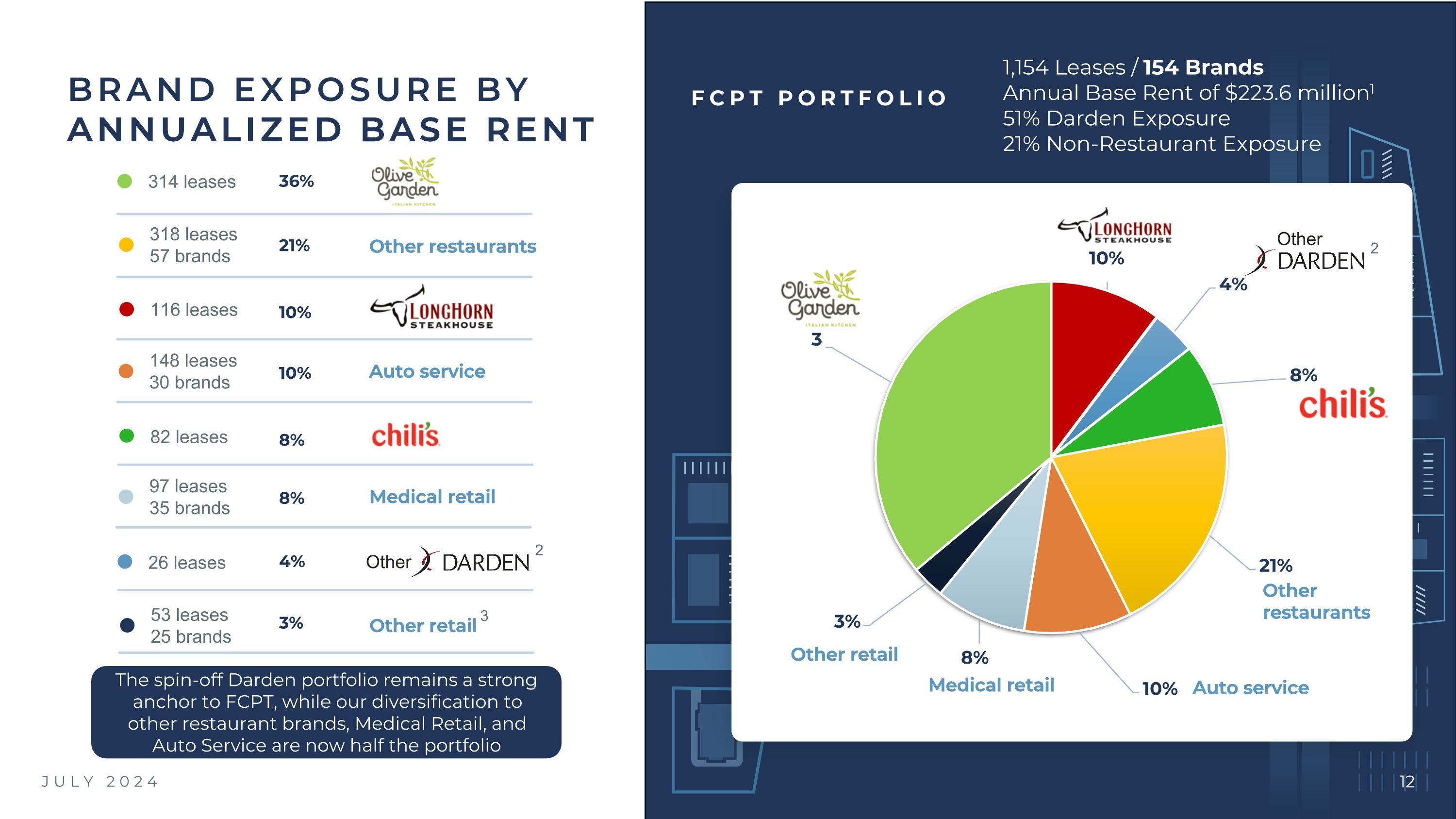

JULY 2024 BRAND EXPOSURE BY ANNUALIZED BASE RENT 314 leases 82 leases 318 leases 57 brands 26 leases 148 leases 30 brands 116 leases Other restaurants Auto service 97 leases 35 brands Medical retail 53 leases 25 brands Other retail 1,154 Leases / 154 Brands Annual Base Rent of $223.6 million1 51% Darden Exposure 21% Non-Restaurant Exposure FCPT PORTFOLIO Other restaurants Auto service Medical retail Other retail Other Other 36% 21% 10% 10% 8% 8% 4% 3% 2 2 3 The spin-off Darden portfolio remains a strong anchor to FCPT, while our diversification to other restaurant brands, Medical Retail, and Auto Service are now half the portfolio

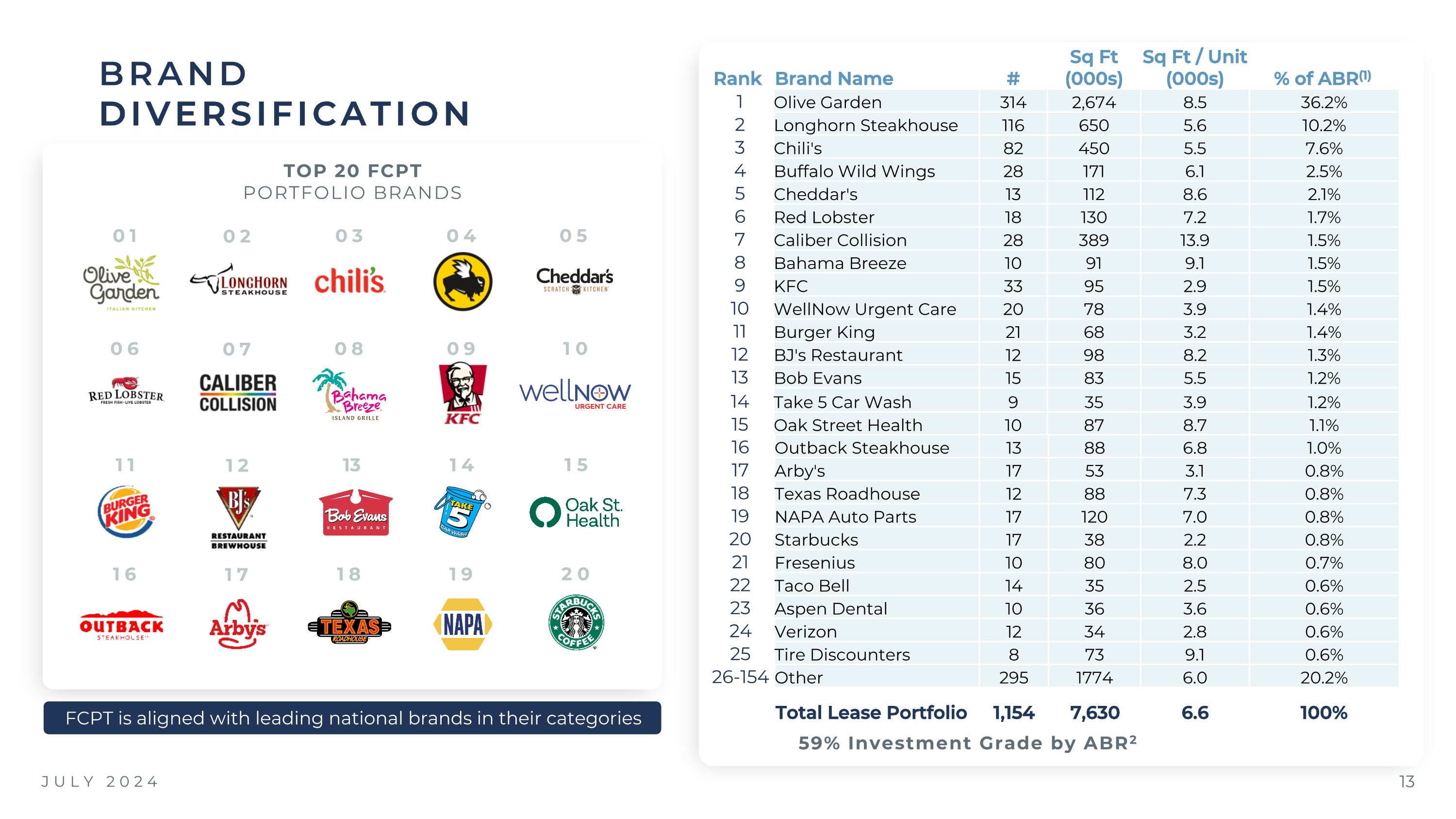

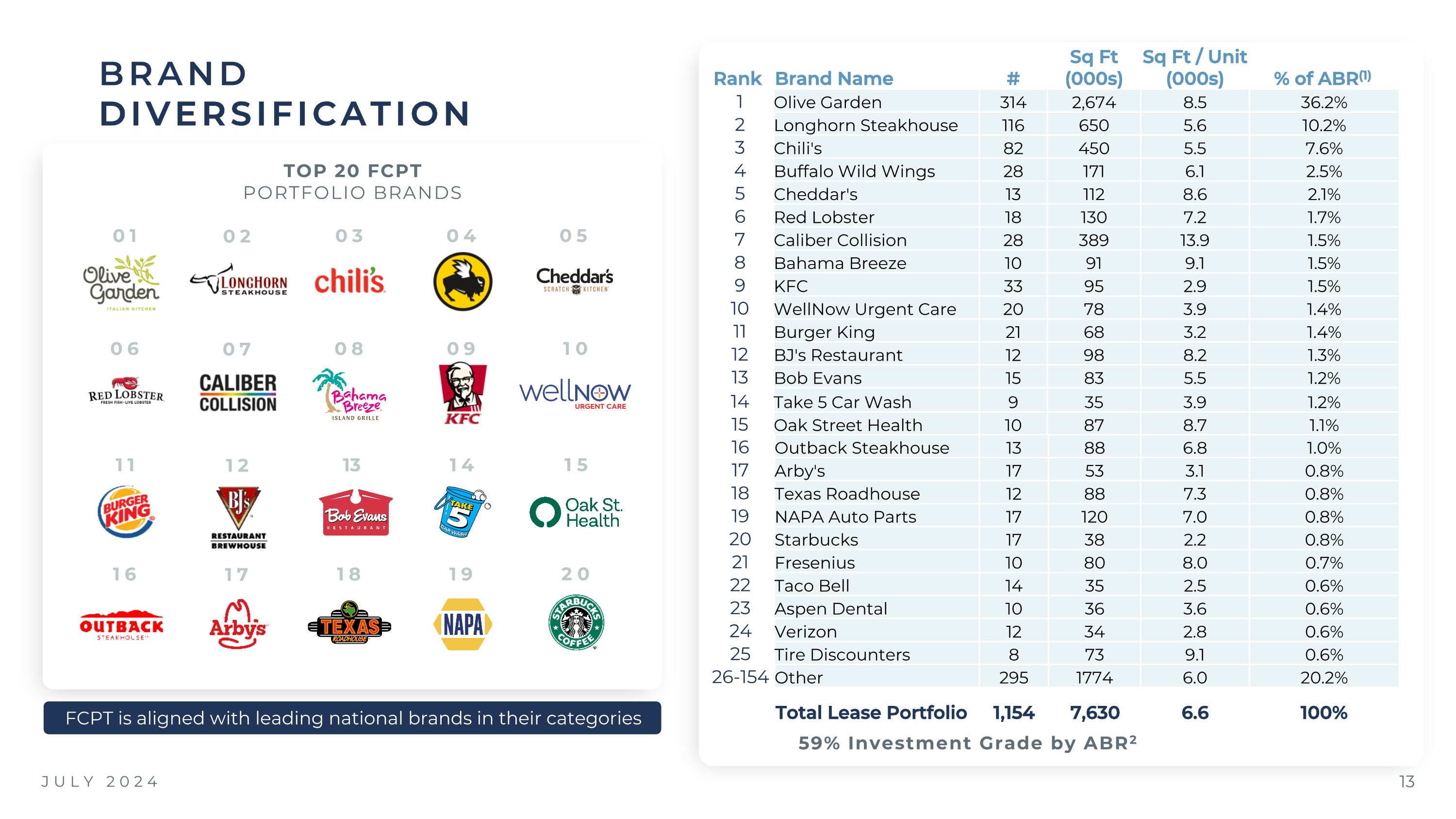

JULY 2024 BRAND DIVERSIFICATION Rank Brand Name # Sq Ft (000s) Sq Ft / Unit (000s) % of ABR(1) 1 Olive Garden 314 2,674 8.5 36.2% 2 Longhorn Steakhouse 116 650 5.6 10.2% 3 Chili's 82 450 5.5 7.6% 4 Buffalo Wild Wings 28 171 6.1 2.5% 5 Cheddar's 13 112 8.6 2.1% 6 Red Lobster 18 130 7.2 1.7% 7 Caliber Collision 28 389 13.9 1.5% 8 Bahama Breeze 10 91 9.1 1.5% 9 KFC 33 95 2.9 1.5% 10 WellNow Urgent Care 20 78 3.9 1.4% 11 Burger King 21 68 3.2 1.4% 12 BJ's Restaurant 12 98 8.2 1.3% 13 Bob Evans 15 83 5.5 1.2% 14 Take 5 Car Wash 9 35 3.9 1.2% 15 Oak Street Health 10 87 8.7 1.1% 16 Outback Steakhouse 13 88 6.8 1.0% 17 Arby's 17 53 3.1 0.8% 18 Texas Roadhouse 12 88 7.3 0.8% 19 NAPA Auto Parts 17 120 7.0 0.8% 20 Starbucks 17 38 2.2 0.8% 21 Fresenius 10 80 8.0 0.7% 22 Taco Bell 14 35 2.5 0.6% 23 Aspen Dental 10 36 3.6 0.6% 24 Verizon 12 34 2.8 0.6% 25 Tire Discounters 8 73 9.1 0.6% 26-154 Other 295 1774 6.0 20.2% Total Lease Portfolio 1,154 7,630 6.6 100% TOP 20 FCPT PORTFOLIO BRANDS 01 02 59% Investment Grade by ABR2 FCPT is aligned with leading national brands in their categories 03 04 05 06 07 08 09 1 0 11 12 13 14 1 5 16 17 18 19 2 0

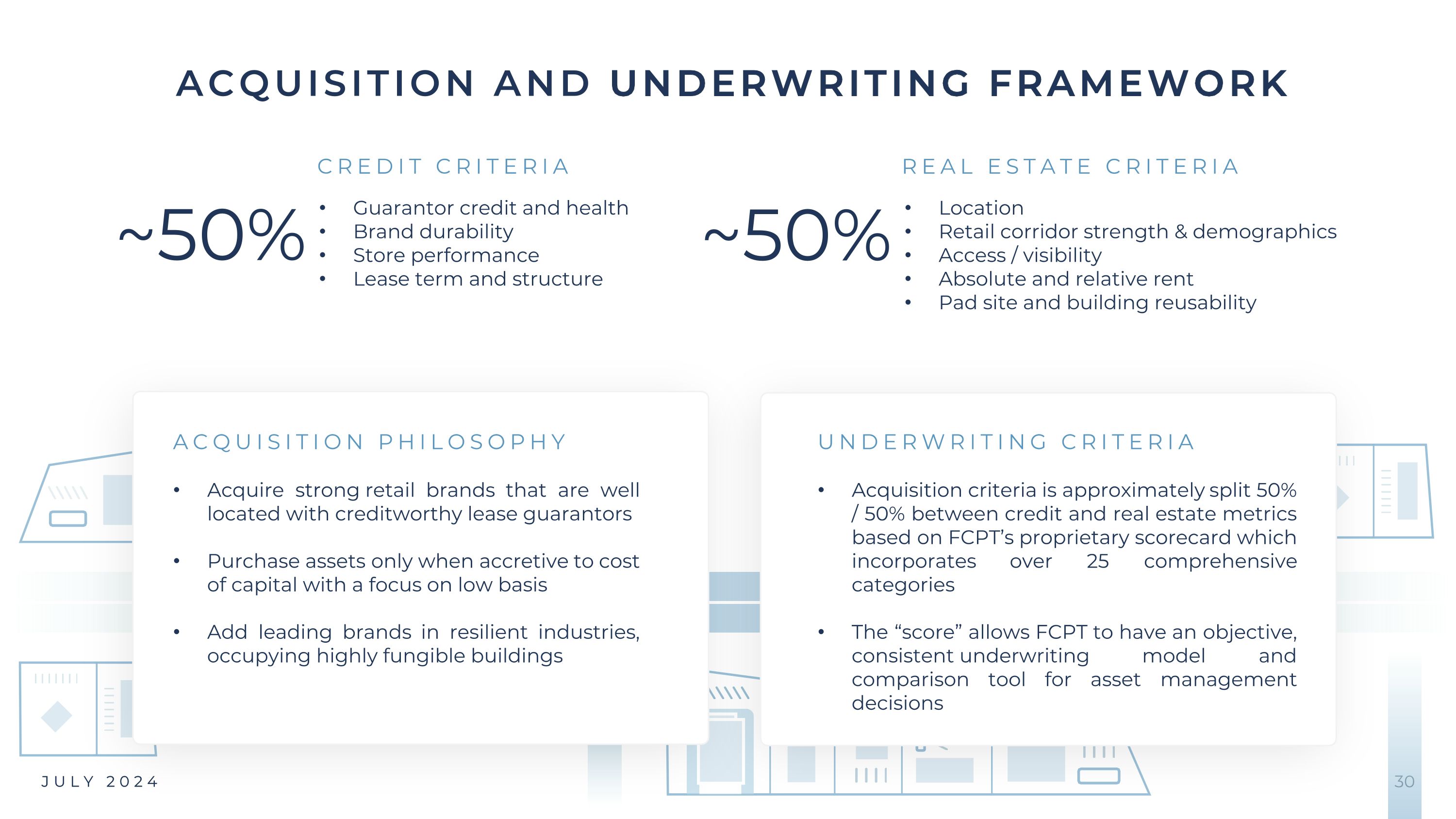

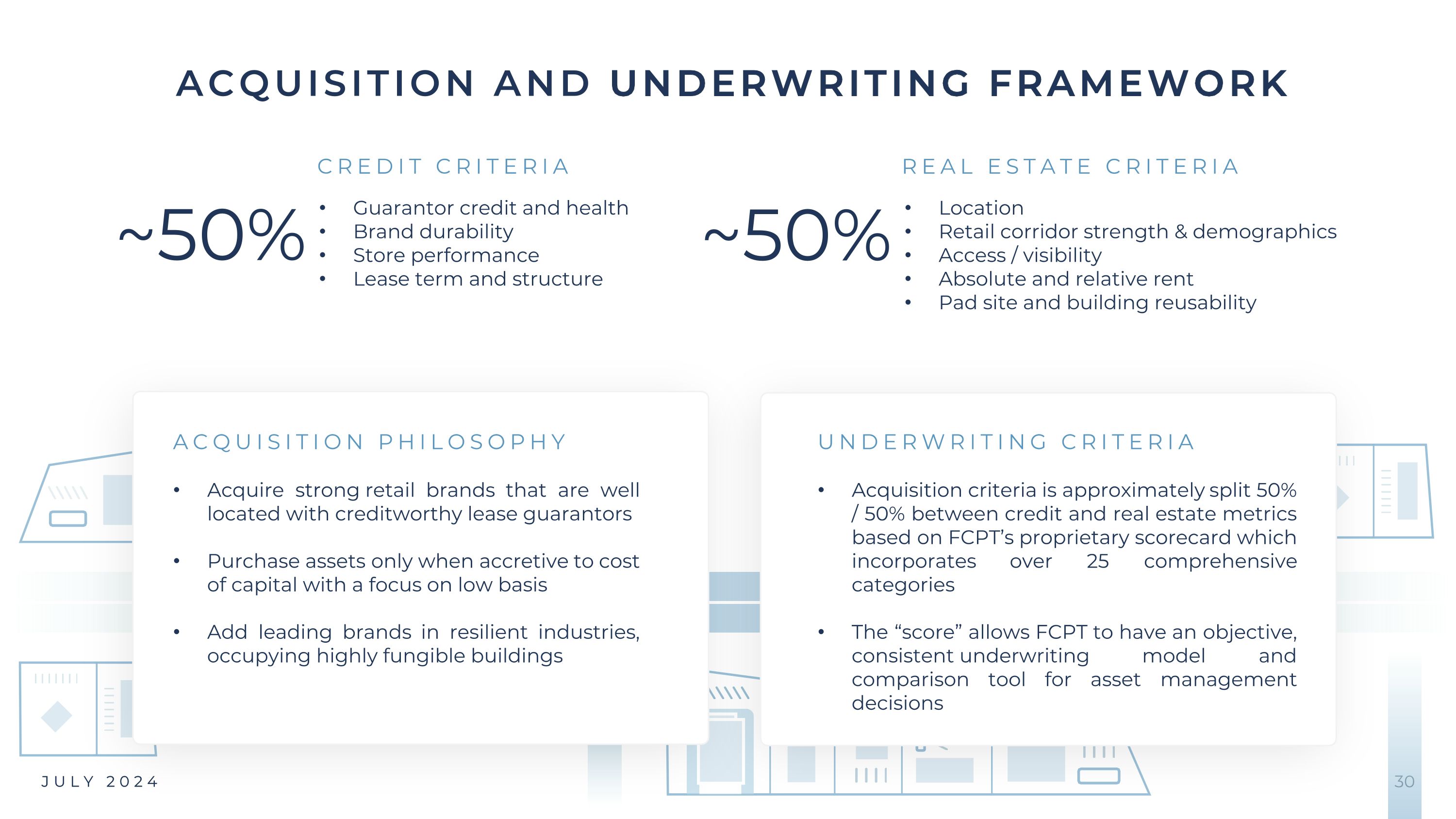

SELECTIVE APPROACH TO NET LEASE JULY 2024 FCPT’s initial portfolio was established in 2015, and so does not include properties acquired many years ago that have lost favor. We have the advantage of constructing our portfolio following the advent of online shopping Since inception, FCPT has developed a consistent underwriting process that carefully examines credit and real estate aspects of each property we consider for investment in the form of our proprietary scorecard While we have iterated and added more precision and data to the scorecard over the years, the high-level concept of balancing real estate and credit quality remains the same Our disciplined underwriting approach has ultimately led us to generally avoid allocating our time and resources to: Pharmacies: 0.0% ABR1 exposure Dollar Stores: 0.0% ABR exposure Entertainment: 0.0% ABR exposure Gyms: 0.0% ABR exposure Furniture: 0.0% ABR exposure Merchandise: 0.8% ABR exposure Car Washes: 1.3% ABR exposure FCPT owns 10 car washes, all acquired at reasonable pricing and rent levels. These sites were selected after reviewing hundreds of locations available for purchase over the years. We will remain highly selective on this sector with a focus on basis and store-level performance

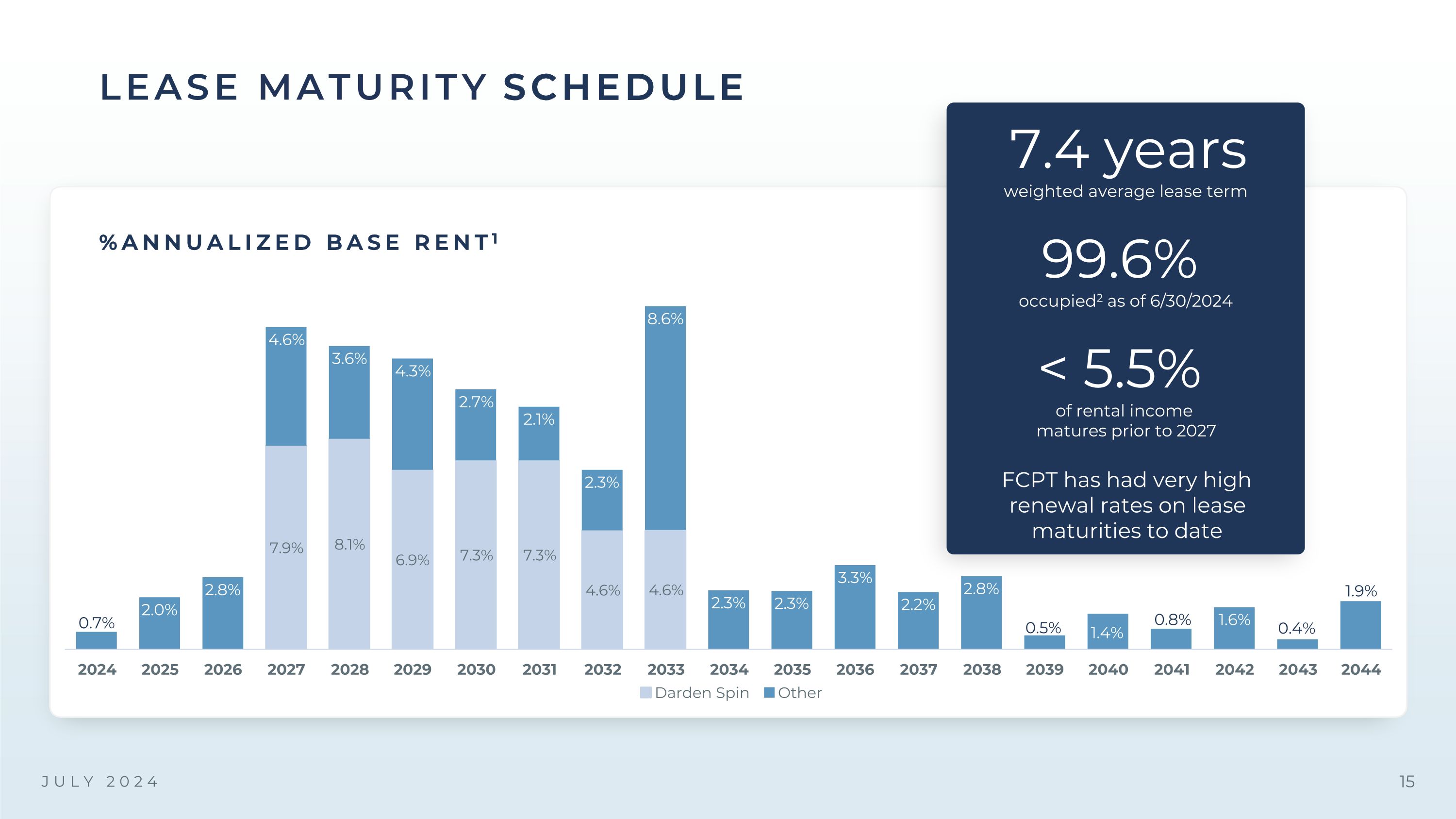

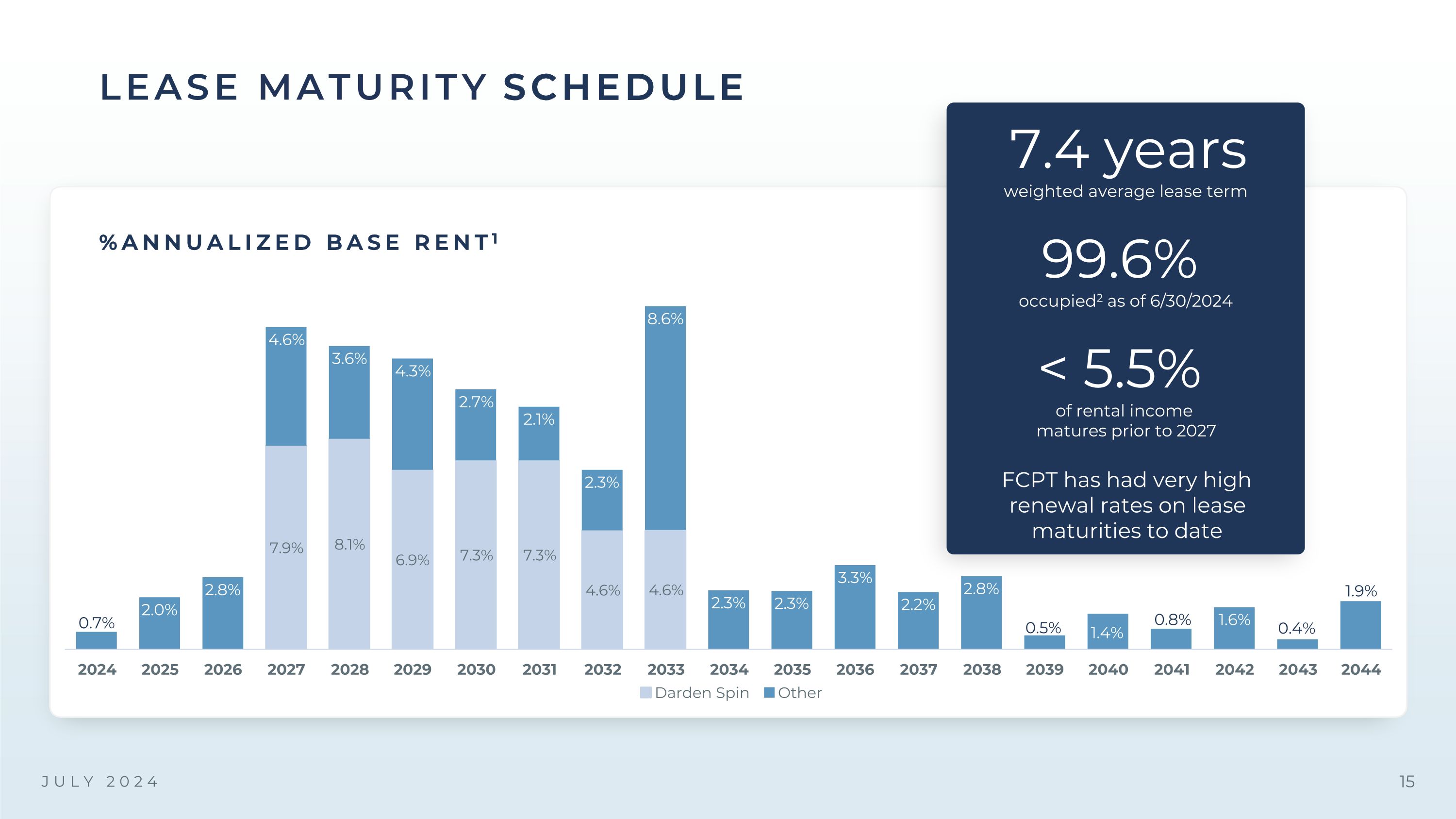

JULY 2024 %ANNUALIZED BASE RENT1 LEASE MATURITY SCHEDULE 99.6% occupied2 as of 6/30/2024 7.4 years weighted average lease term < 5.5% of rental income matures prior to 2027 FCPT has had very high renewal rates on lease maturities to date

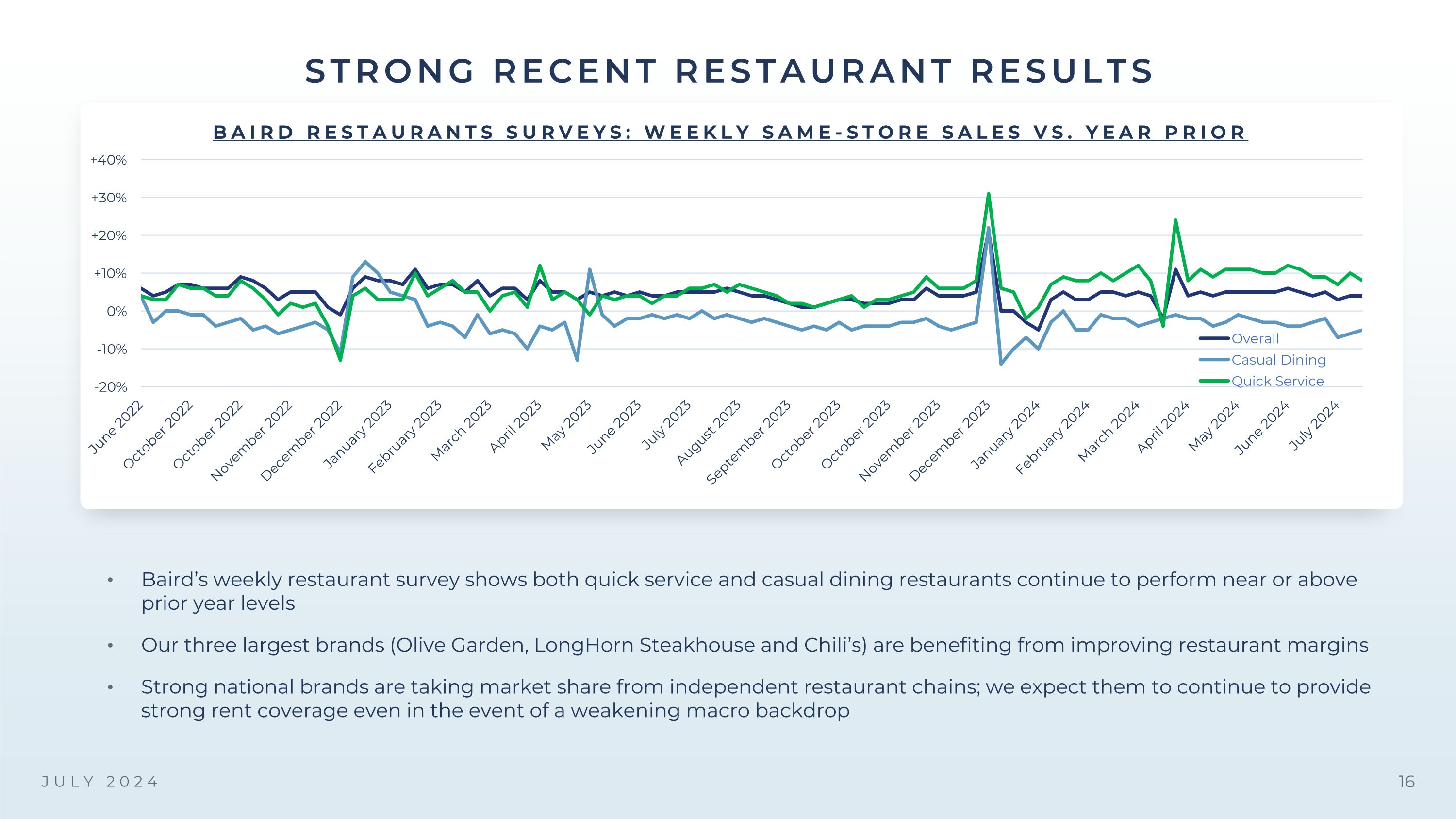

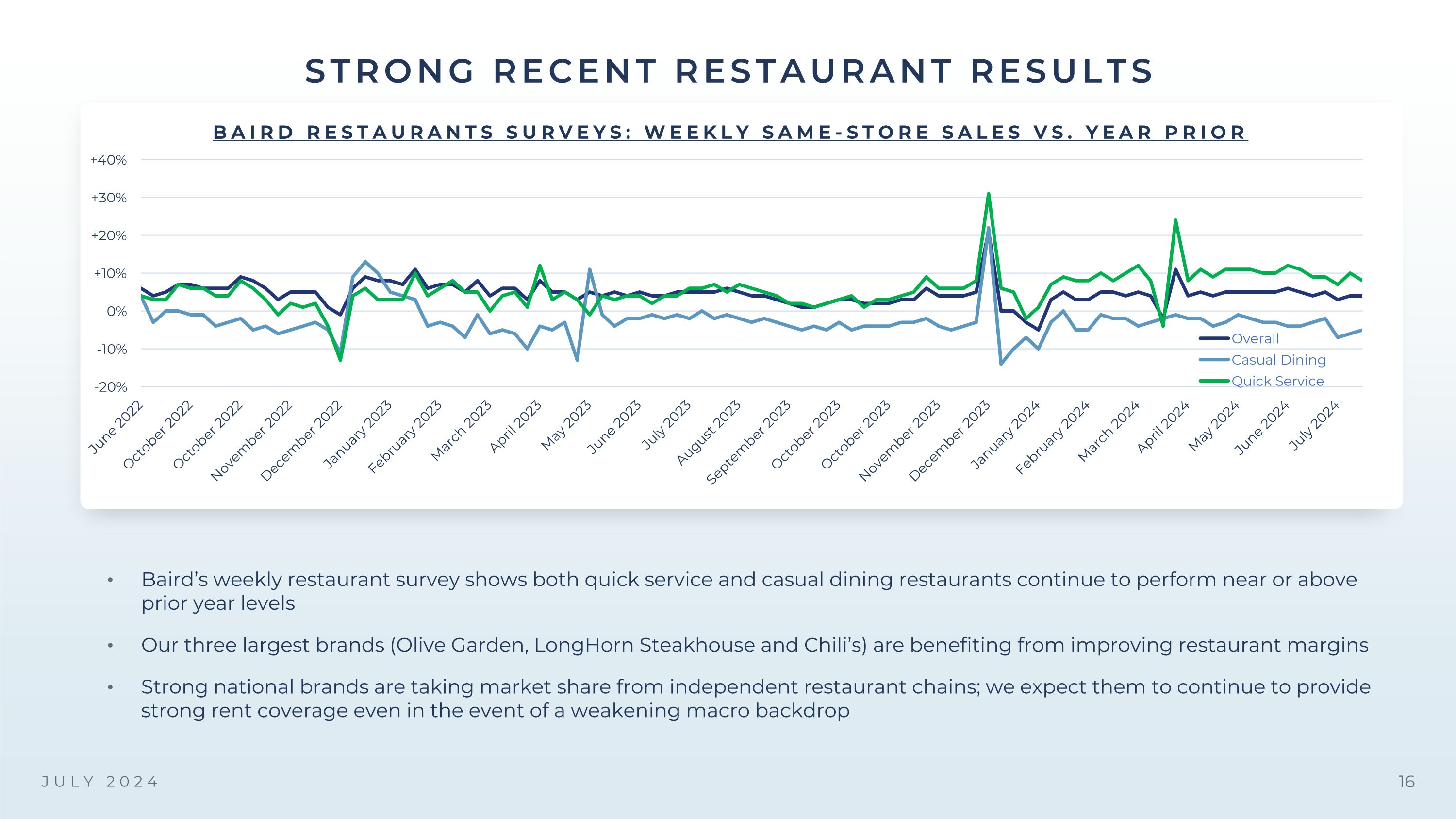

“ STRONG RECENT RESTAURANT RESULTS BAIRD RESTAURANTS SURVEYS: WEEKLY SAME-STORE SALES VS. YEAR PRIOR Baird’s weekly restaurant survey shows both quick service and casual dining restaurants continue to perform near or above prior year levels Our three largest brands (Olive Garden, LongHorn Steakhouse and Chili’s) are benefiting from improving restaurant margins Strong national brands are taking market share from independent restaurant chains; we expect them to continue to provide strong rent coverage even in the event of a weakening macro backdrop JULY 2024

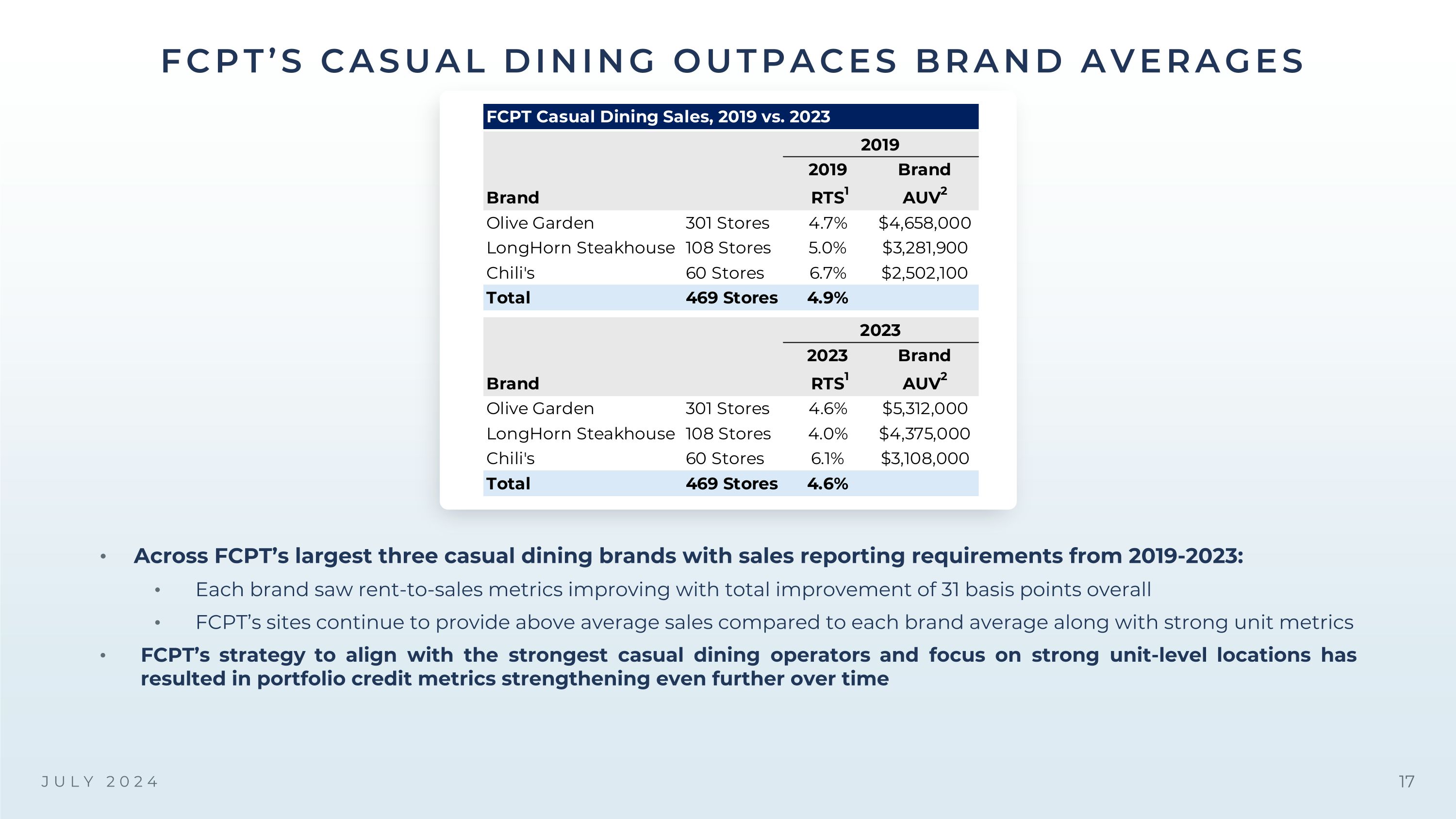

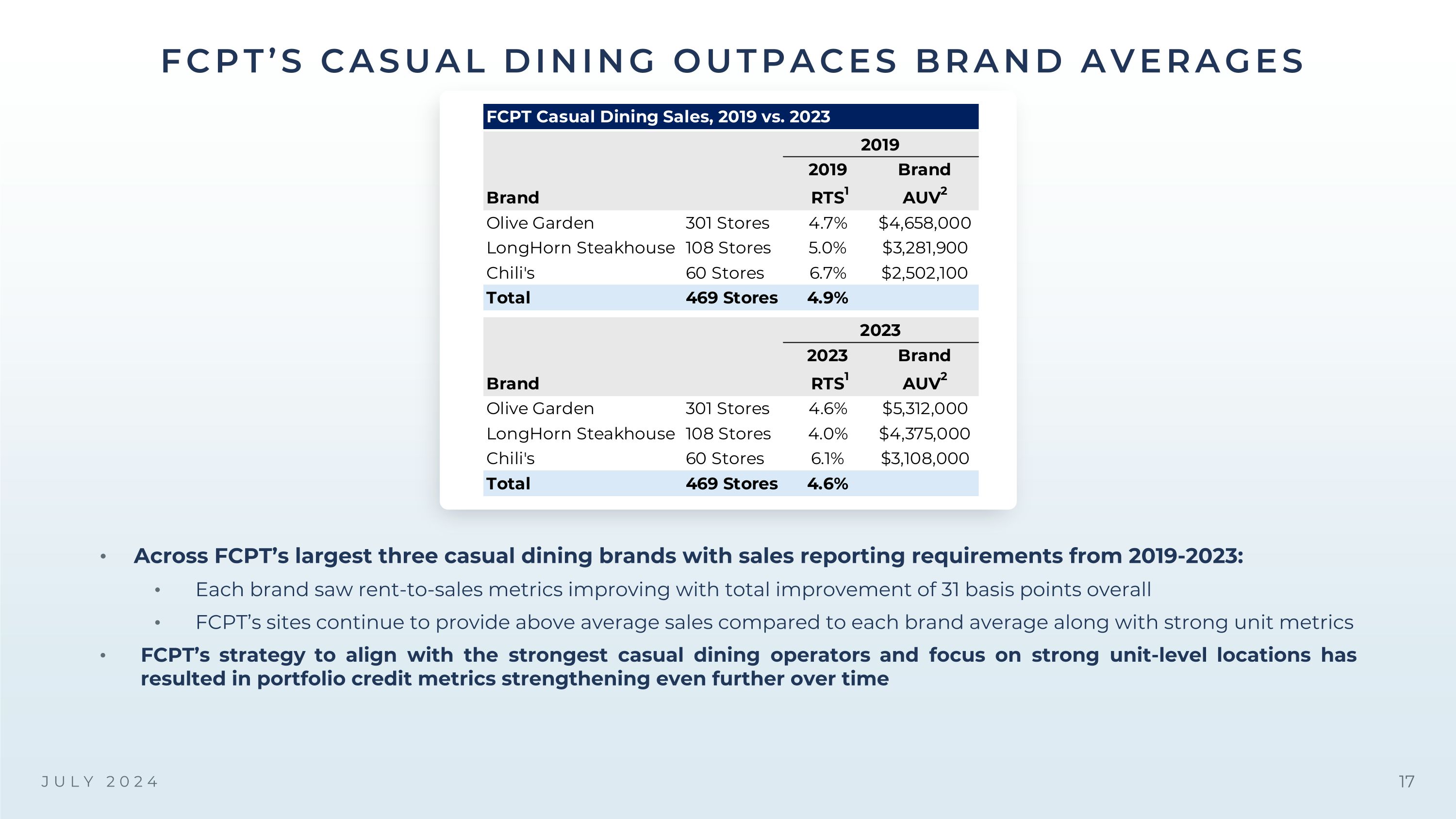

“ FCPT’S CASUAL DINING OUTPACES BRAND AVERAGES JULY 2024 Across FCPT’s largest three casual dining brands with sales reporting requirements from 2019-2023: Each brand saw rent-to-sales metrics improving with total improvement of 31 basis points overall FCPT’s sites continue to provide above average sales compared to each brand average along with strong unit metrics FCPT’s strategy to align with the strongest casual dining operators and focus on strong unit-level locations has resulted in portfolio credit metrics strengthening even further over time

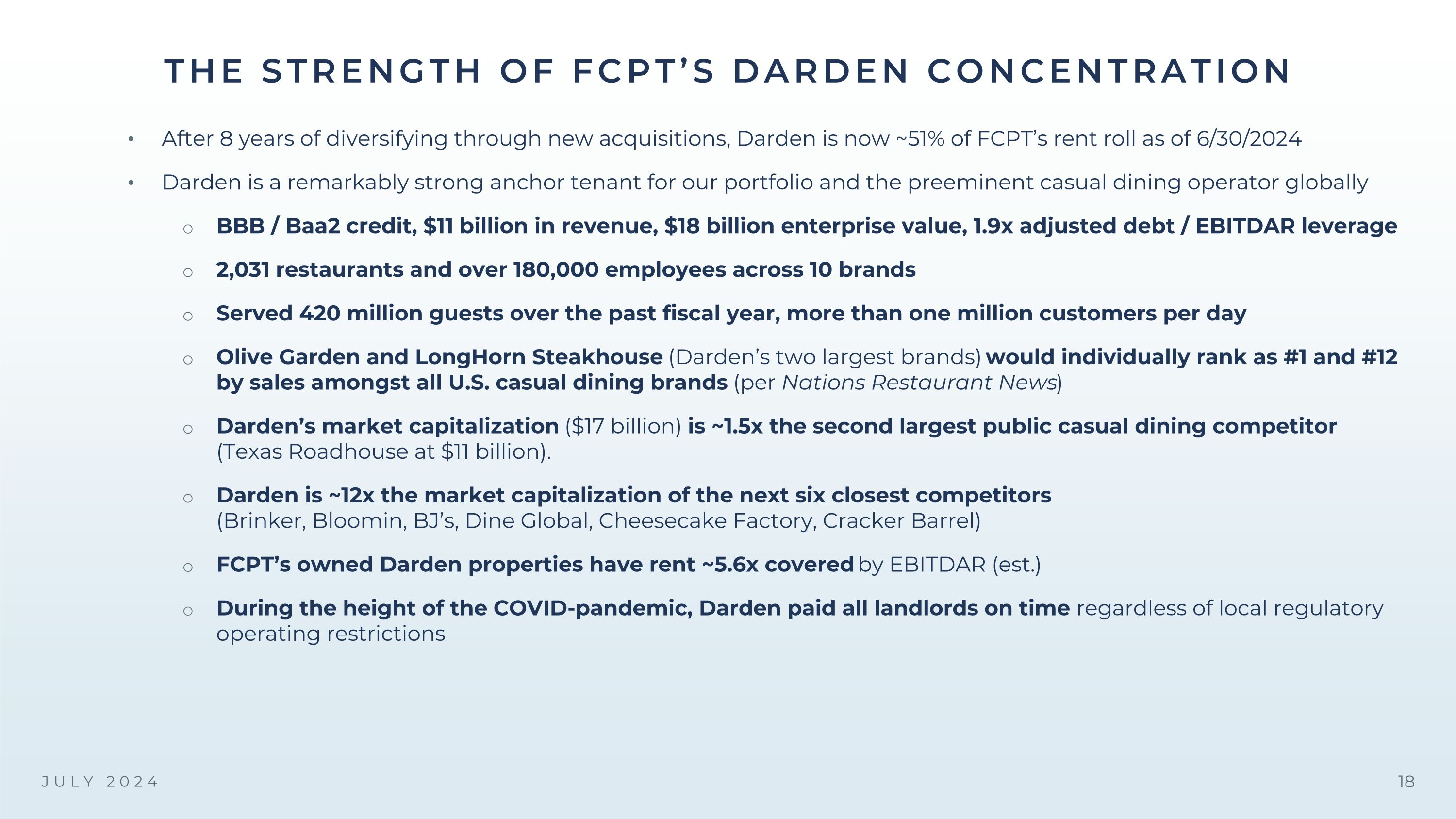

THE STRENGTH OF FCPT’S DARDEN CONCENTRATION JULY 2024 After 8 years of diversifying through new acquisitions, Darden is now ~51% of FCPT’s rent roll as of 6/30/2024 Darden is a remarkably strong anchor tenant for our portfolio and the preeminent casual dining operator globally BBB / Baa2 credit, $11 billion in revenue, $18 billion enterprise value, 1.9x adjusted debt / EBITDAR leverage 2,031 restaurants and over 180,000 employees across 10 brands Served 420 million guests over the past fiscal year, more than one million customers per day Olive Garden and LongHorn Steakhouse (Darden’s two largest brands) would individually rank as #1 and #12 by sales amongst all U.S. casual dining brands (per Nations Restaurant News) Darden’s market capitalization ($17 billion) is ~1.5x the second largest public casual dining competitor (Texas Roadhouse at $11 billion). Darden is ~12x the market capitalization of the next six closest competitors �(Brinker, Bloomin, BJ’s, Dine Global, Cheesecake Factory, Cracker Barrel) FCPT’s owned Darden properties have rent ~5.6x covered by EBITDAR (est.) During the height of the COVID-pandemic, Darden paid all landlords on time regardless of local regulatory operating restrictions

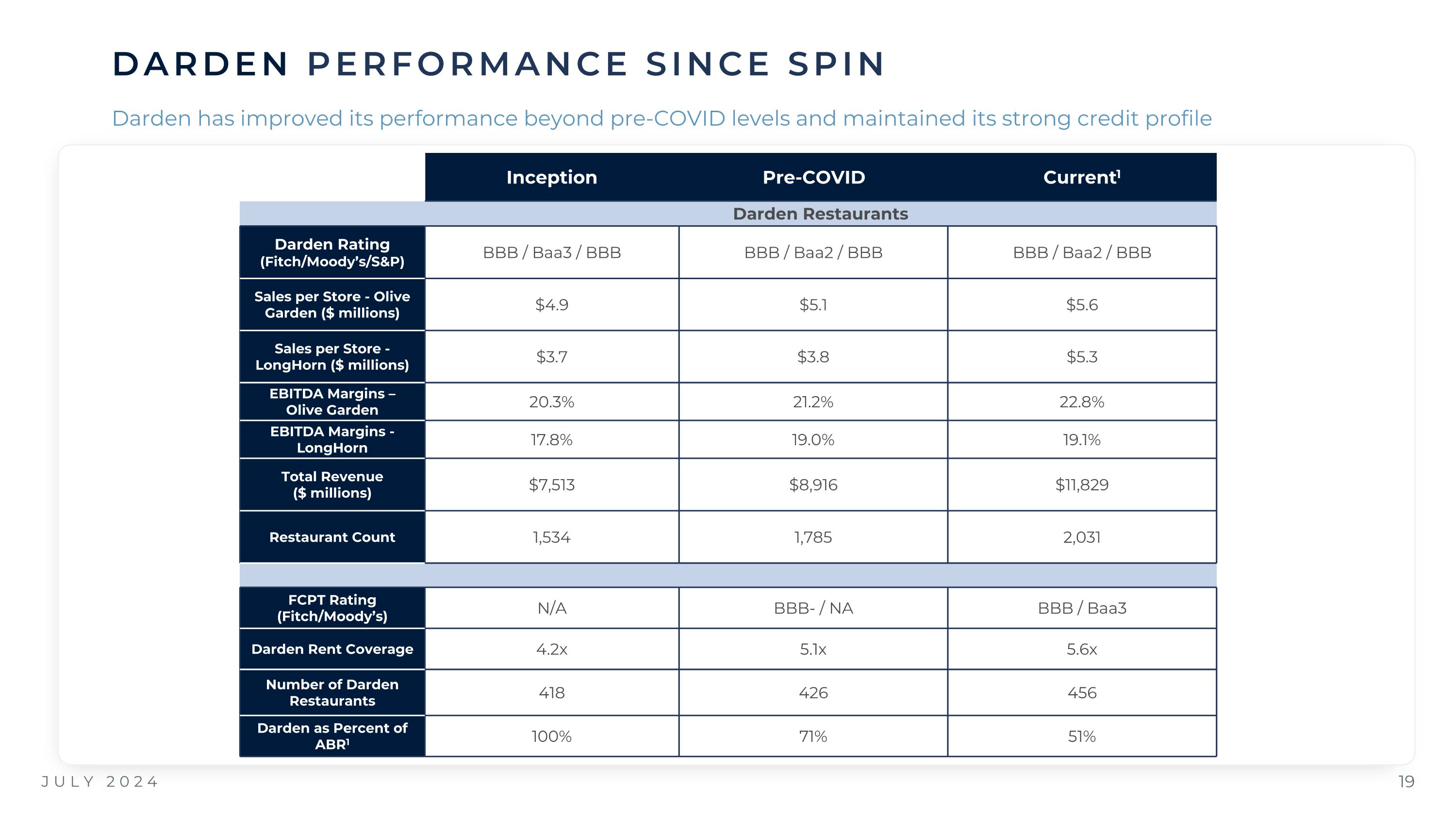

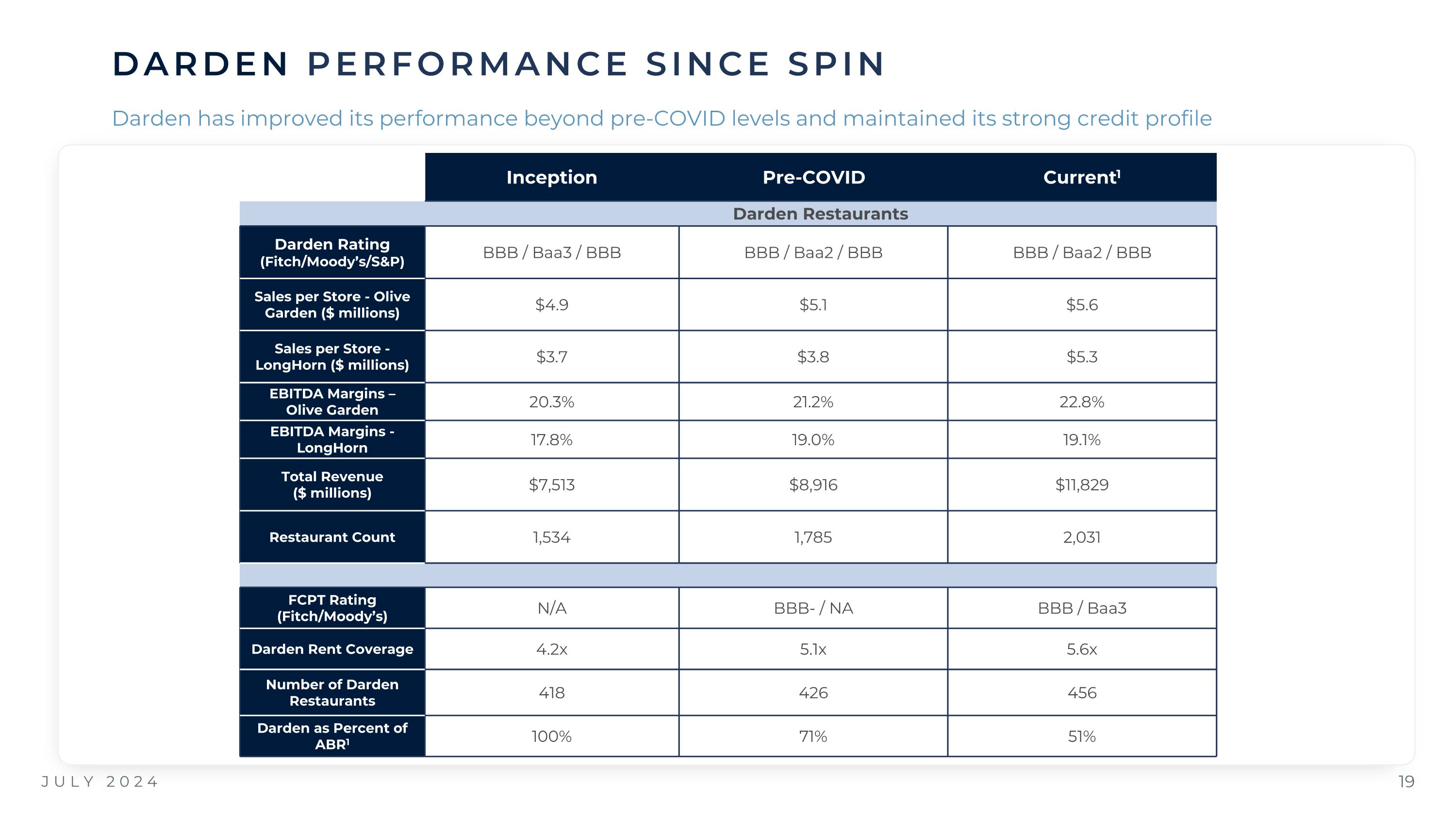

JULY 2024 DARDEN PERFORMANCE SINCE SPIN Darden has improved its performance beyond pre-COVID levels and maintained its strong credit profile Inception Pre-COVID Current1 Darden Restaurants Darden Rating (Fitch/Moody’s/S&P) BBB / Baa3 / BBB BBB / Baa2 / BBB BBB / Baa2 / BBB Sales per Store - Olive Garden ($ millions) $4.9 $5.1 $5.6 Sales per Store - LongHorn ($ millions) $3.7 $3.8 $5.3 EBITDA Margins – Olive Garden 20.3% 21.2% 22.8% EBITDA Margins - LongHorn 17.8% 19.0% 19.1% Total Revenue ($ millions) $7,513 $8,916 $11,829 Restaurant Count 1,534 1,785 2,031 FCPT FCPT Rating (Fitch/Moody’s) N/A BBB- / NA BBB / Baa3 Darden Rent Coverage 4.2x 5.1x 5.6x Number of Darden Restaurants 418 426 456 Darden as Percent of ABR1 100% 71% 51%

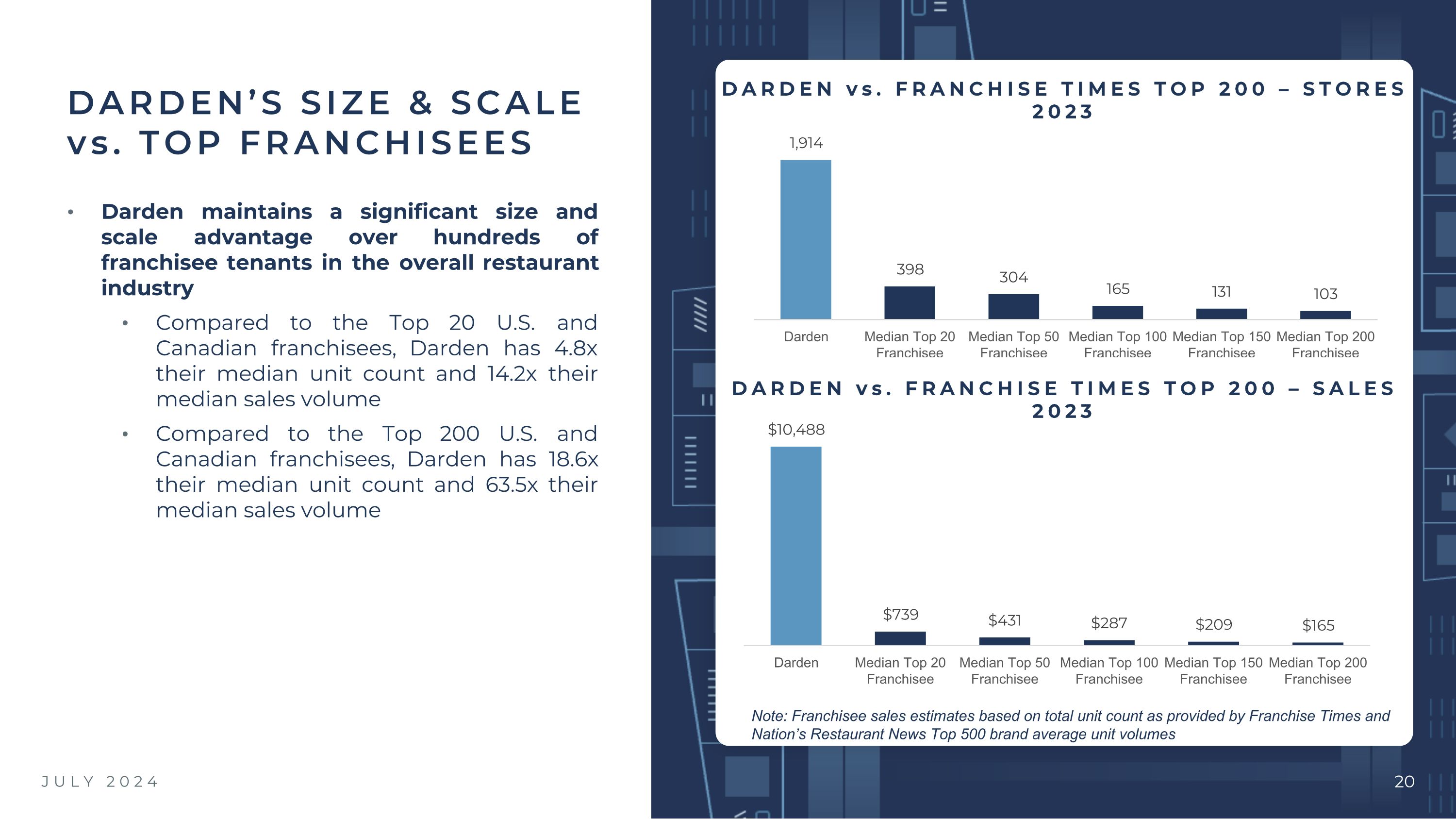

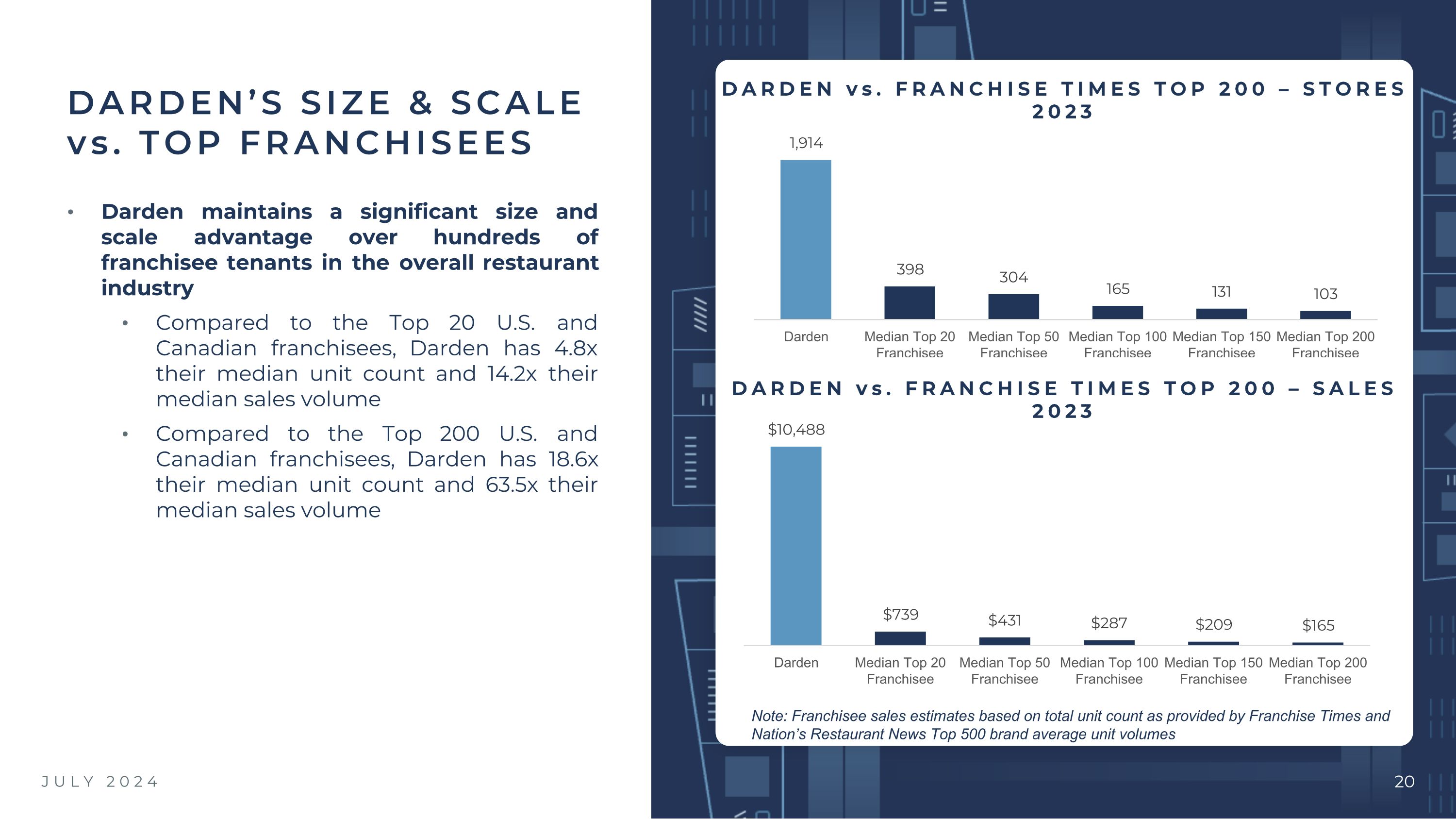

Darden maintains a significant size and scale advantage over hundreds of franchisee tenants in the overall restaurant industry Compared to the Top 20 U.S. and Canadian franchisees, Darden has 4.8x their median unit count and 14.2x their median sales volume Compared to the Top 200 U.S. and Canadian franchisees, Darden has 18.6x their median unit count and 63.5x their median sales volume DARDEN’S SIZE & SCALE vs. TOP FRANCHISEES DARDEN vs. FRANCHISE TIMES TOP 200 – STORES 2023 JULY 2024 DARDEN vs. FRANCHISE TIMES TOP 200 – SALES 2023 Note: Franchisee sales estimates based on total unit count as provided by Franchise Times and Nation’s Restaurant News Top 500 brand average unit volumes

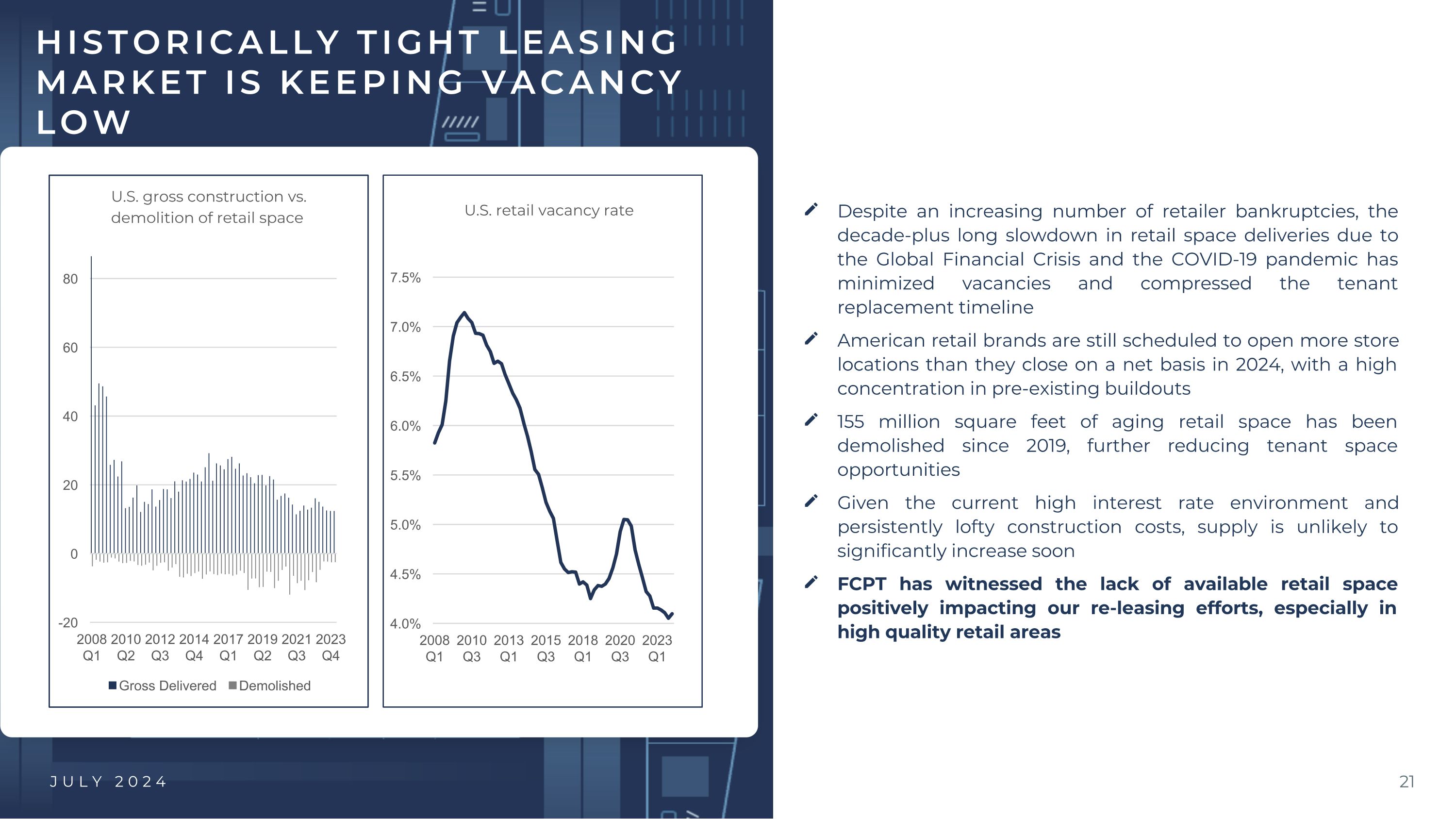

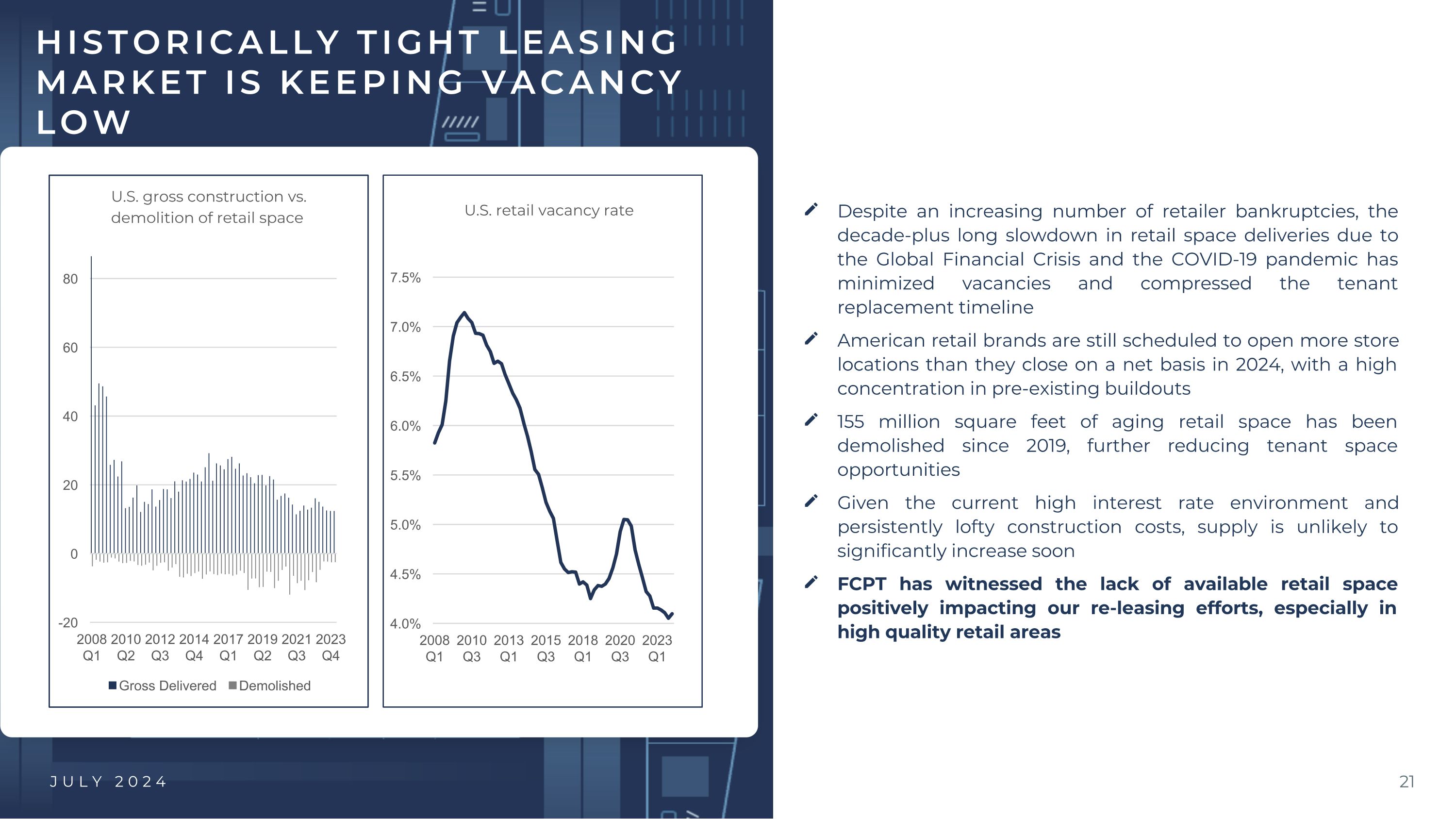

“ JULY 2024 Despite an increasing number of retailer bankruptcies, the decade-plus long slowdown in retail space deliveries due to the Global Financial Crisis and the COVID-19 pandemic has minimized vacancies and compressed the tenant replacement timeline American retail brands are still scheduled to open more store locations than they close on a net basis in 2024, with a high concentration in pre-existing buildouts 155 million square feet of aging retail space has been demolished since 2019, further reducing tenant space opportunities Given the current high interest rate environment and persistently lofty construction costs, supply is unlikely to significantly increase soon FCPT has witnessed the lack of available retail space positively impacting our re-leasing efforts, especially in high quality retail areas HISTORICALLY TIGHT LEASING MARKET IS KEEPING VACANCY LOW

148 leases 10% of annual base rent1 Principally targeting auto service centers, including collision repair and tire service leased to credit worthy operators. We have made select investments in gas stations with large format convenience stores, car wash and auto part retailers at attractive, low bases Focus is on properties that are not dependent on the internal combustion engine and will remain relevant over the longer-term with higher electric vehicle utilization Auto service is both e-commerce and recession resistant and tends to operate in high-traffic corridors with good visibility, boosting the intrinsic real estate value and long-term reuse potential More limited tenant relocation options due to zoning restrictions lead to high tenant renewal probability DIVERSIFICATION: AUTO INDUSTRY JULY 2024

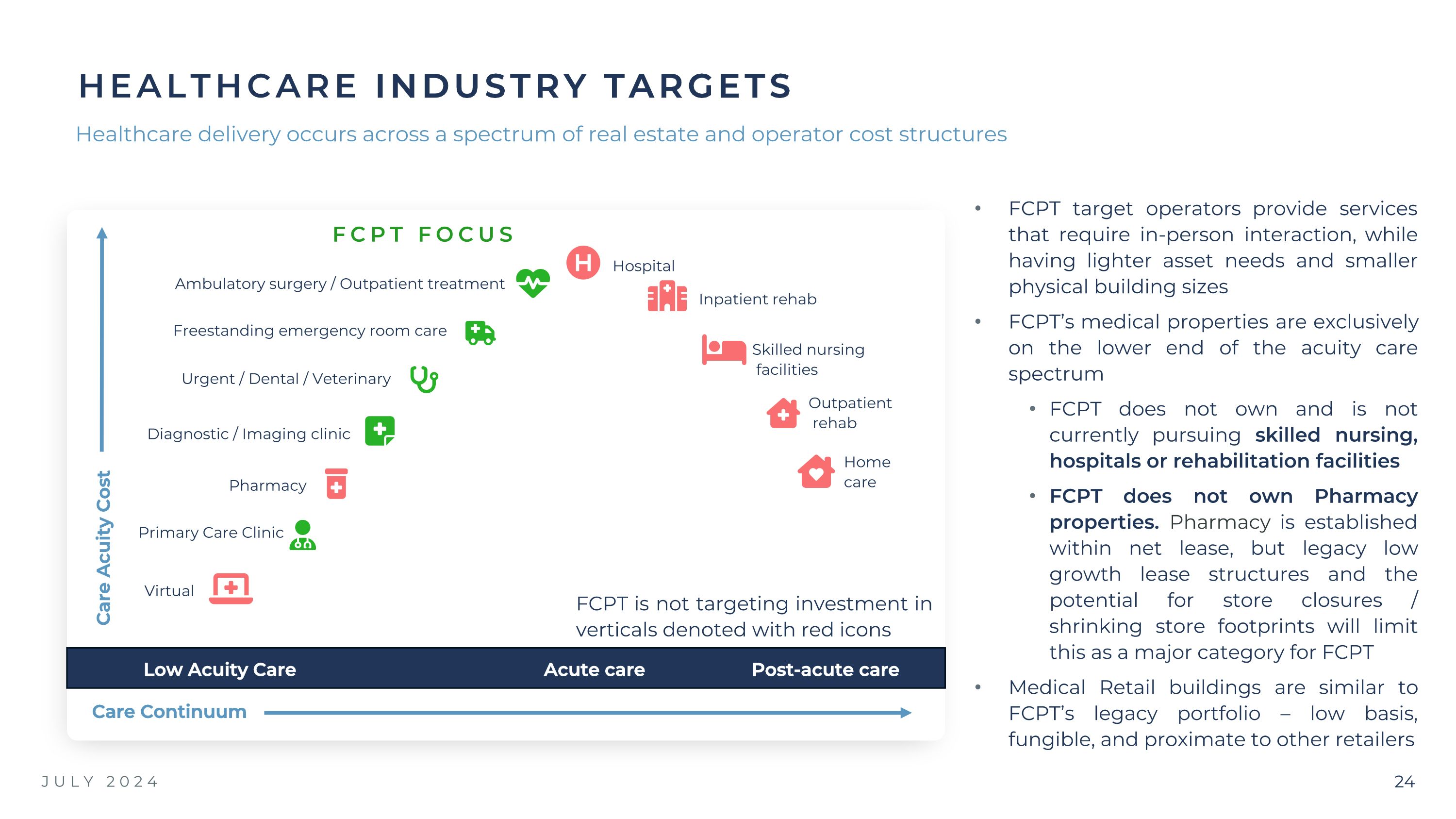

97 leases 8% of annual base rent1 DIVERSIFICATION: MEDICAL RETAIL FCPT’s largest medical retail exposures are focused on outpatient services: urgent care, dental, primary care, veterinary care, and outpatient / ambulatory surgery centers Medical retail is e-commerce and recession resistant given its service-based nature, large customer base and favorable demographic tailwinds Operator consolidation and organic growth within medical retail is improving tenant credit and scale Medical retail is emerging as an attractive property type with services moving out of hospitals and into lower-cost, retail-centric care centers JULY 2024

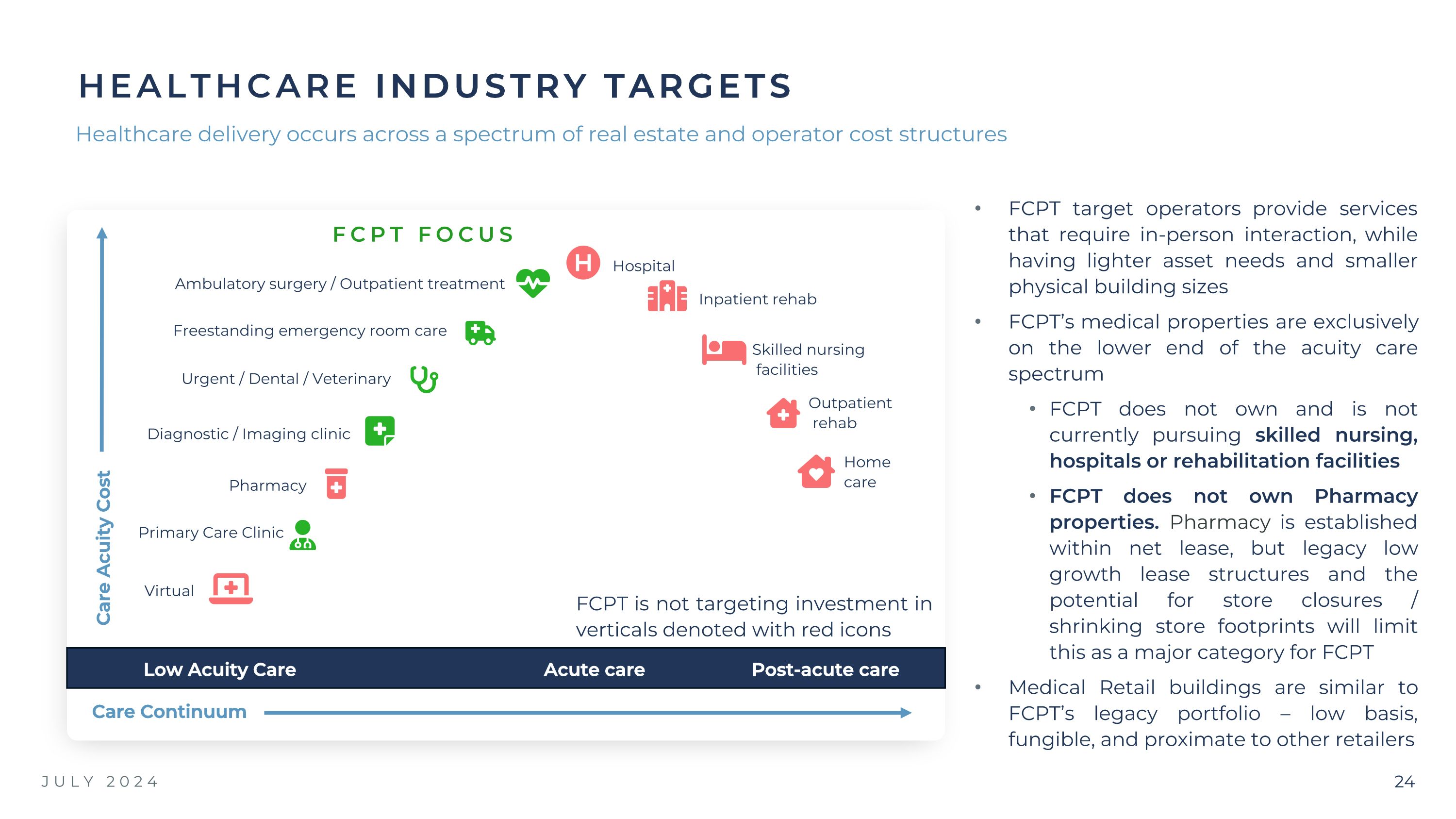

JULY 2024 Skilled nursing facilities Primary Care Clinic Pharmacy Virtual Diagnostic / Imaging clinic Hospital Urgent / Dental / Veterinary Care Acuity Cost Care Continuum Freestanding emergency room care Ambulatory surgery / Outpatient treatment Inpatient rehab Outpatient rehab Home care Low Acuity Care Acute care Post-acute care FCPT FOCUS FCPT target operators provide services that require in-person interaction, while having lighter asset needs and smaller physical building sizes FCPT’s medical properties are exclusively on the lower end of the acuity care spectrum FCPT does not own and is not currently pursuing skilled nursing, hospitals or rehabilitation facilities FCPT does not own Pharmacy properties. Pharmacy is established within net lease, but legacy low growth lease structures and the potential for store closures / shrinking store footprints will limit this as a major category for FCPT Medical Retail buildings are similar to FCPT’s legacy portfolio – low basis, fungible, and proximate to other retailers Healthcare delivery occurs across a spectrum of real estate and operator cost structures HEALTHCARE INDUSTRY TARGETS FCPT is not targeting investment in verticals denoted with red icons

JANUARY 2024 CONTENTS 1 COMPANY OVERVIEW PG 3 2 HIGH QUALITY PORTFOLIO PG 8 4 APPENDIX PG 29 3 CONSERVATIVE FINANCIAL POSITION PG 25

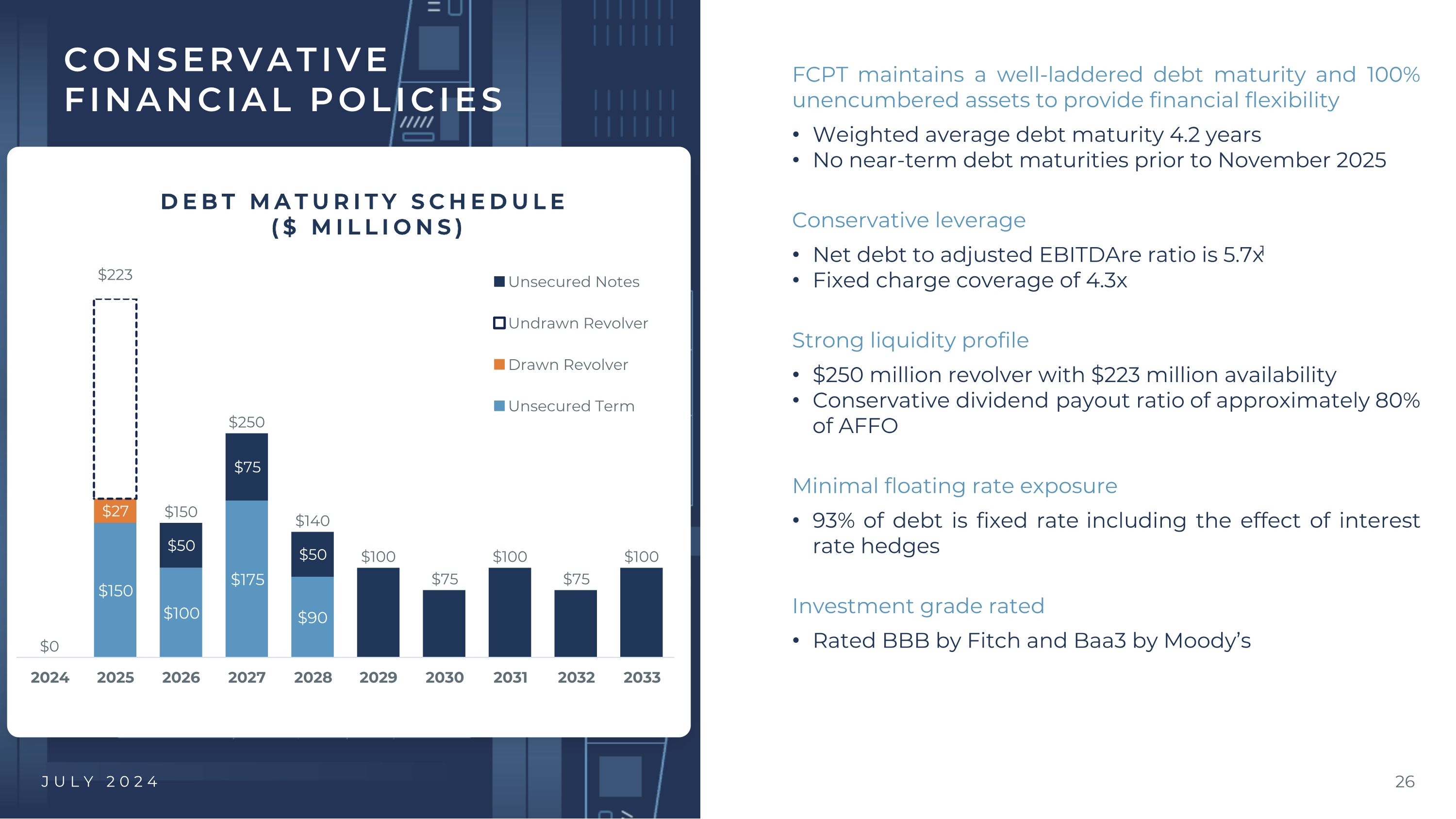

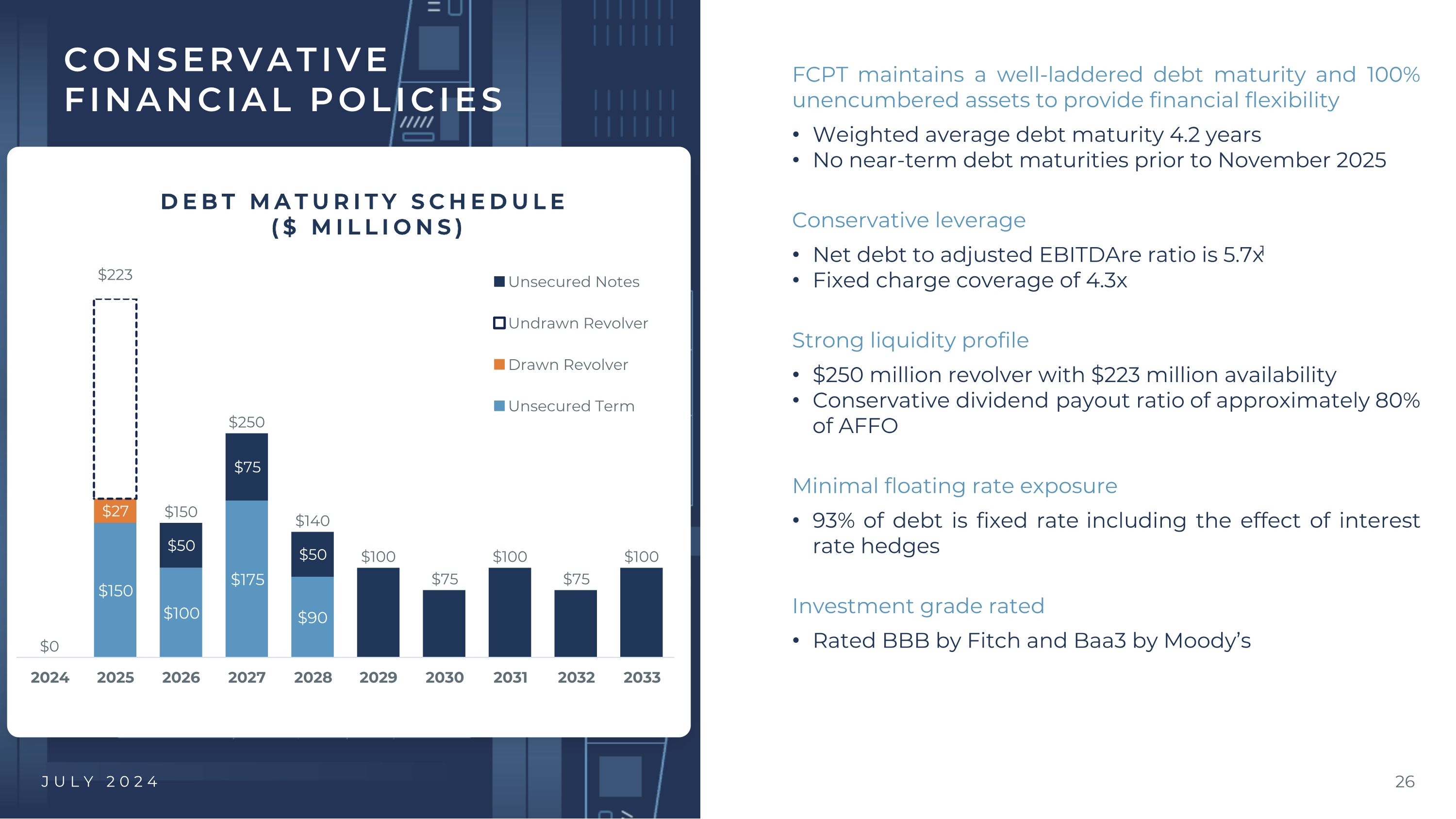

“ JULY 2024 DEBT MATURITY SCHEDULE ($ MILLIONS) FCPT maintains a well-laddered debt maturity and 100% unencumbered assets to provide financial flexibility Weighted average debt maturity 4.2 years No near-term debt maturities prior to November 2025 Conservative leverage Net debt to adjusted EBITDAre ratio is 5.7x1 Fixed charge coverage of 4.3x Strong liquidity profile $250 million revolver with $223 million availability Conservative dividend payout ratio of approximately 80% of AFFO Minimal floating rate exposure 93% of debt is fixed rate including the effect of interest rate hedges Investment grade rated Rated BBB by Fitch and Baa3 by Moody’s CONSERVATIVE FINANCIAL POLICIES

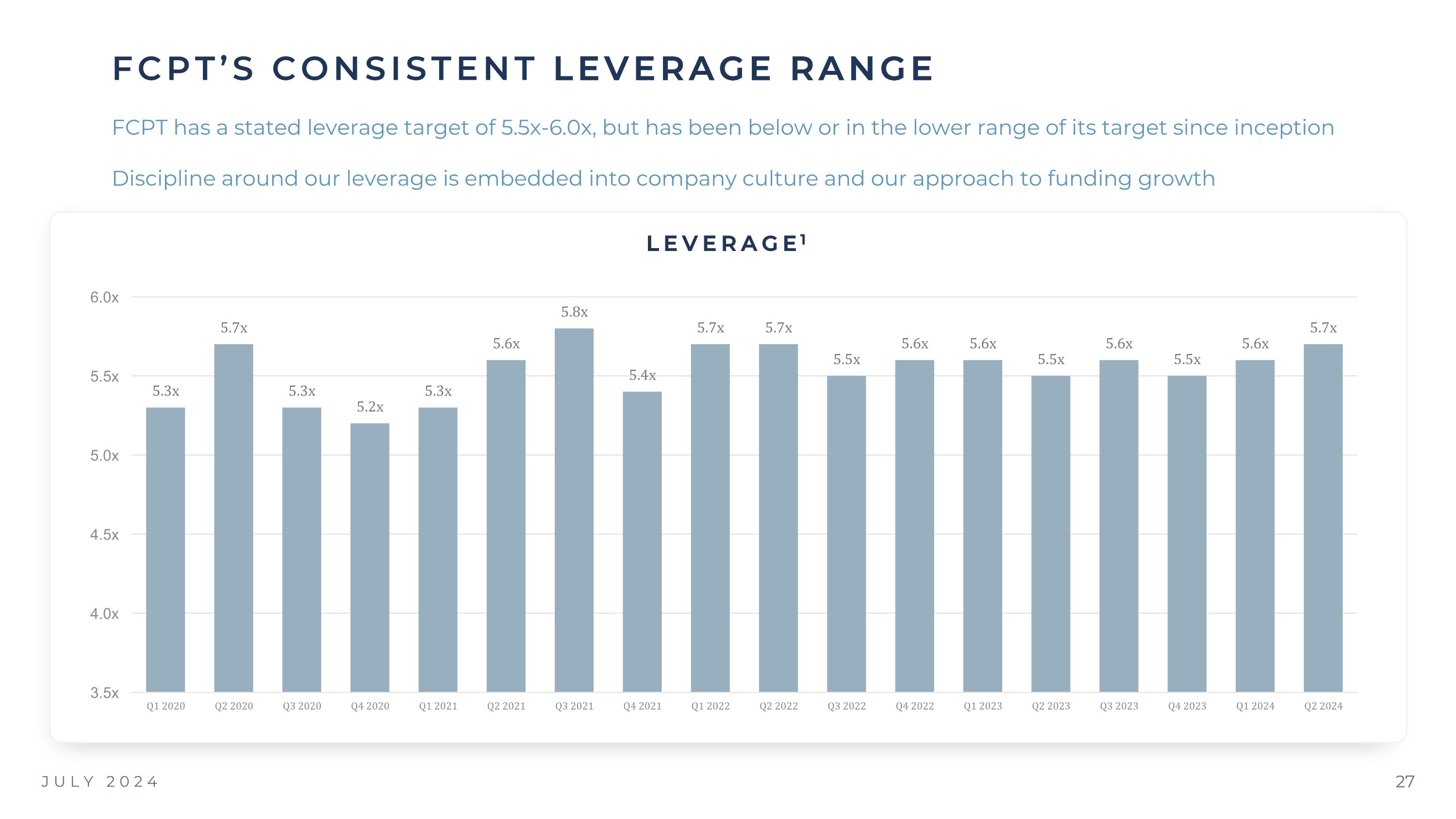

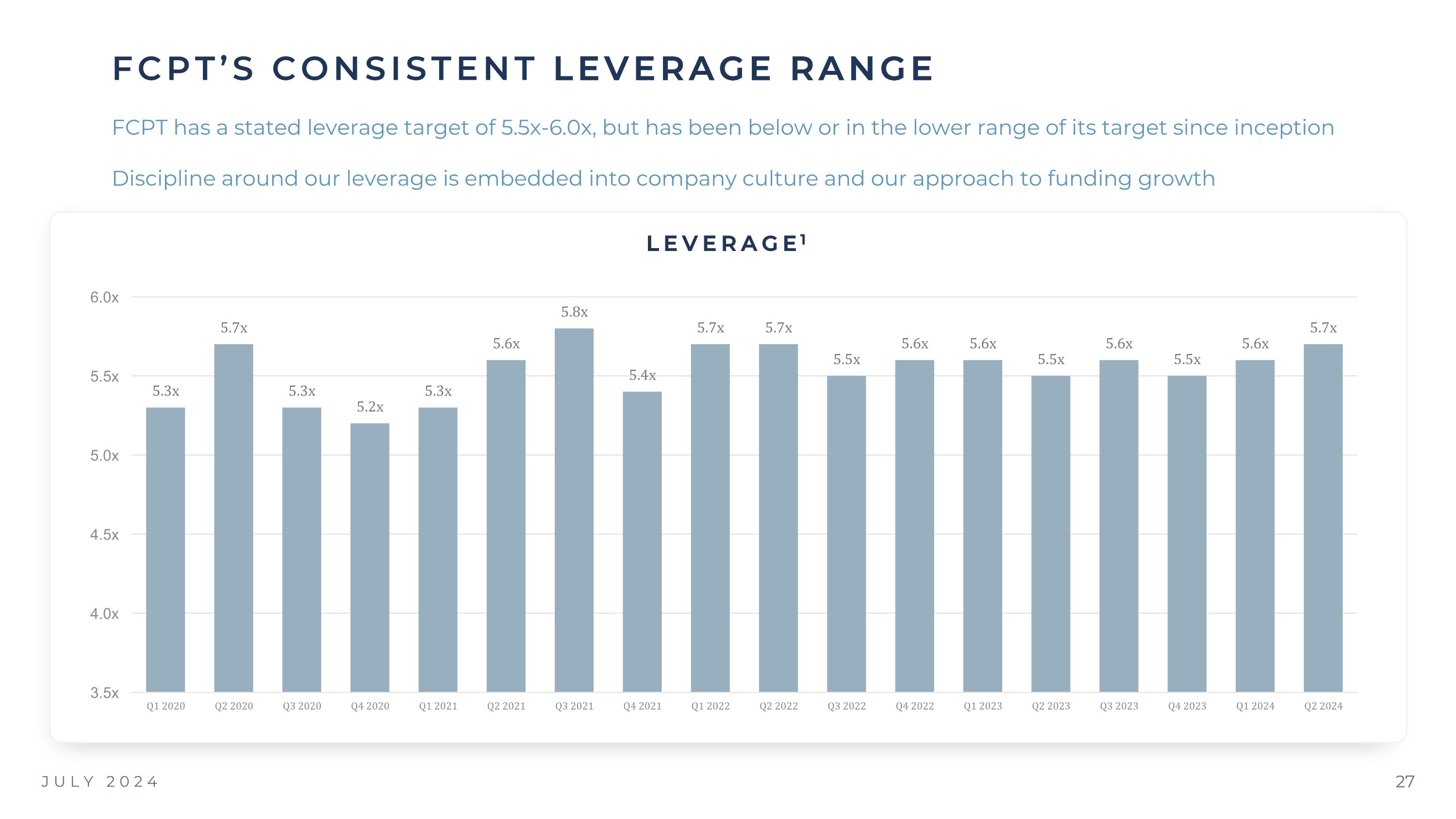

JULY 2024 FCPT’S CONSISTENT LEVERAGE RANGE FCPT has a stated leverage target of 5.5x-6.0x, but has been below or in the lower range of its target since inception Discipline around our leverage is embedded into company culture and our approach to funding growth LEVERAGE1 PAGE xx FCPT CONSISTENT LEVERAGE RANGE See page xx for reconciliation of net income to adjusted EBITDAre and page xx for non-GAAP definitions. Net debt is calculated as total debt less cash and cash equivalents. Q1 2018 and earlier are calculated as net debt to EBITDA

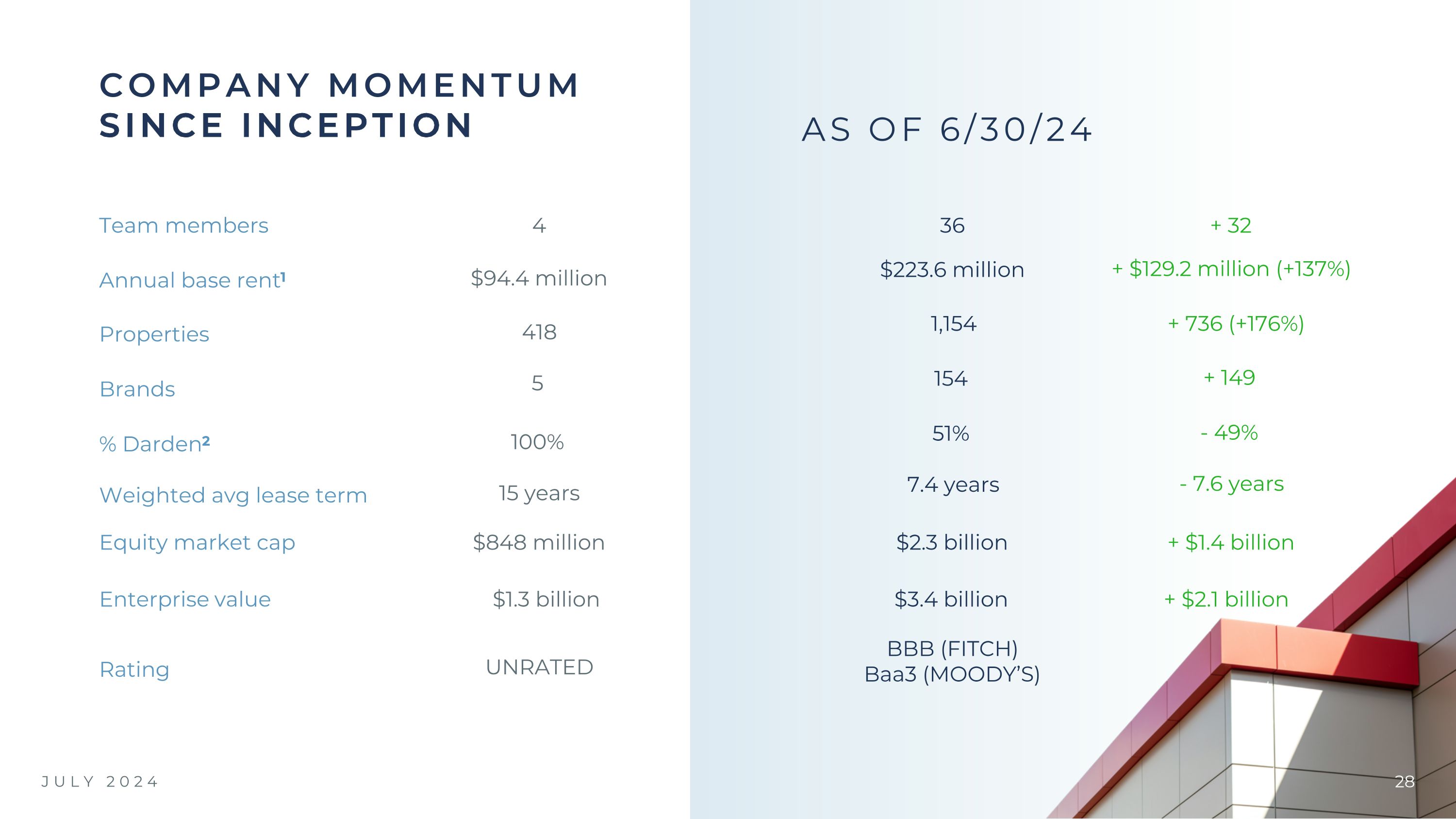

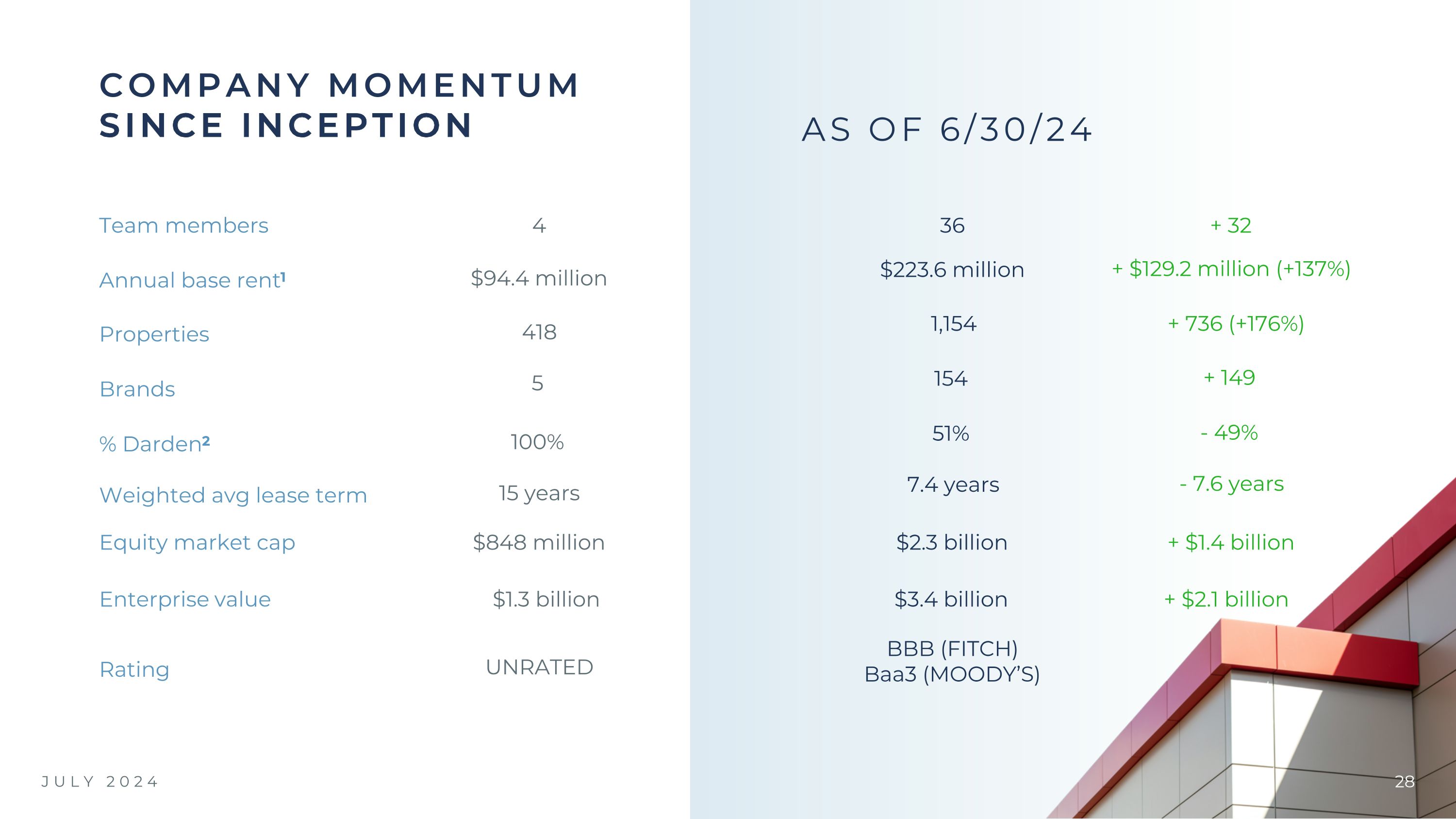

JULY 2024 COMPANY MOMENTUM SINCE INCEPTION AS OF 6/30/24 Rating UNRATED BBB (FITCH) Baa3 (MOODY’S) Team members 4 36 + 32 Annual base rent1 $94.4 million $223.6 million + $129.2 million (+137%) Properties 418 1,154 + 736 (+176%) Brands 5 154 + 149 % Darden2 100% 51% - 49% Weighted avg lease term 15 years 7.4 years - 7.6 years Equity market cap $848 million $2.3 billion + $1.4 billion Enterprise value $1.3 billion $3.4 billion + $2.1 billion

JULY 2024 CONTENTS 1 COMPANY OVERVIEW PG 3 2 HIGH QUALITY PORTFOLIO PG 8 3 CONSERVATIVE FINANCIAL POSITION PG 25 4 APPENDIX PG 29

JULY 2024 JULY 2024 ~50% CREDIT CRITERIA Guarantor credit and health Brand durability Store performance Lease term and structure Location Retail corridor strength & demographics Access / visibility Absolute and relative rent Pad site and building reusability ACQUISITION AND UNDERWRITING FRAMEWORK REAL ESTATE CRITERIA ~50% ACQUISITION PHILOSOPHY Acquire strong retail brands that are well located with creditworthy lease guarantors Purchase assets only when accretive to cost of capital with a focus on low basis Add leading brands in resilient industries, occupying highly fungible buildings UNDERWRITING CRITERIA Acquisition criteria is approximately split 50% / 50% between credit and real estate metrics based on FCPT’s proprietary scorecard which incorporates over 25 comprehensive categories The “score” allows FCPT to have an objective, consistent underwriting model and comparison tool for asset management decisions

THOUGHTFUL BRAND SELECTION FCPT focuses on national brands with strong sales volumes and market appropriate rents FCPT pursues properties within the median range of Casual Dining, Fast Casual and Quick Service; �Concepts with mid-level sales volumes provide rent support, while keeping rent at replaceable levels in case of vacancy Casual �Dining Fast �Casual Quick �Service Brand Average Sales Volume ($000s)1 JULY 2024

ENVIRONMENT SOCIAL OUR TEAM GOVERNANCE SUSTAINABILITY FRAMEWORK Our commitment to sustainability and Environmental, Social and Governance (ESG) principles creates value our shareholders. We continuously review our internal policies to advance in the areas of environmental sustainability, social responsibility, employee well-being, and governance. For more details, see the FCPT ESG Report and policies on our website https://fcpt.com/about-us/ We evaluate our business operations and the environmental risk aspects of our investment portfolio on an ongoing basis and strive to adhere to sustainable business practices We apply values-based negative screening in our underwriting process and do not transact with any tenant, buyer, or seller or acquire any properties with negative social factors. We do not process or have access to any consumer data Our culture is inclusive and team-oriented with a high retention rate. We hire for the long-term and invest in development, with a flat organization that drives employee engagement. We are a certified ‘Great Place to Work’ We aim for best-in-class corporate governance structures and compensation practices that closely align the interests of our Board and leadership with those of our stockholders. Four of our eight Board Directors are female and seven are independent, including our chairperson. Only independent Directors serve on the Board’s committees JULY 2024

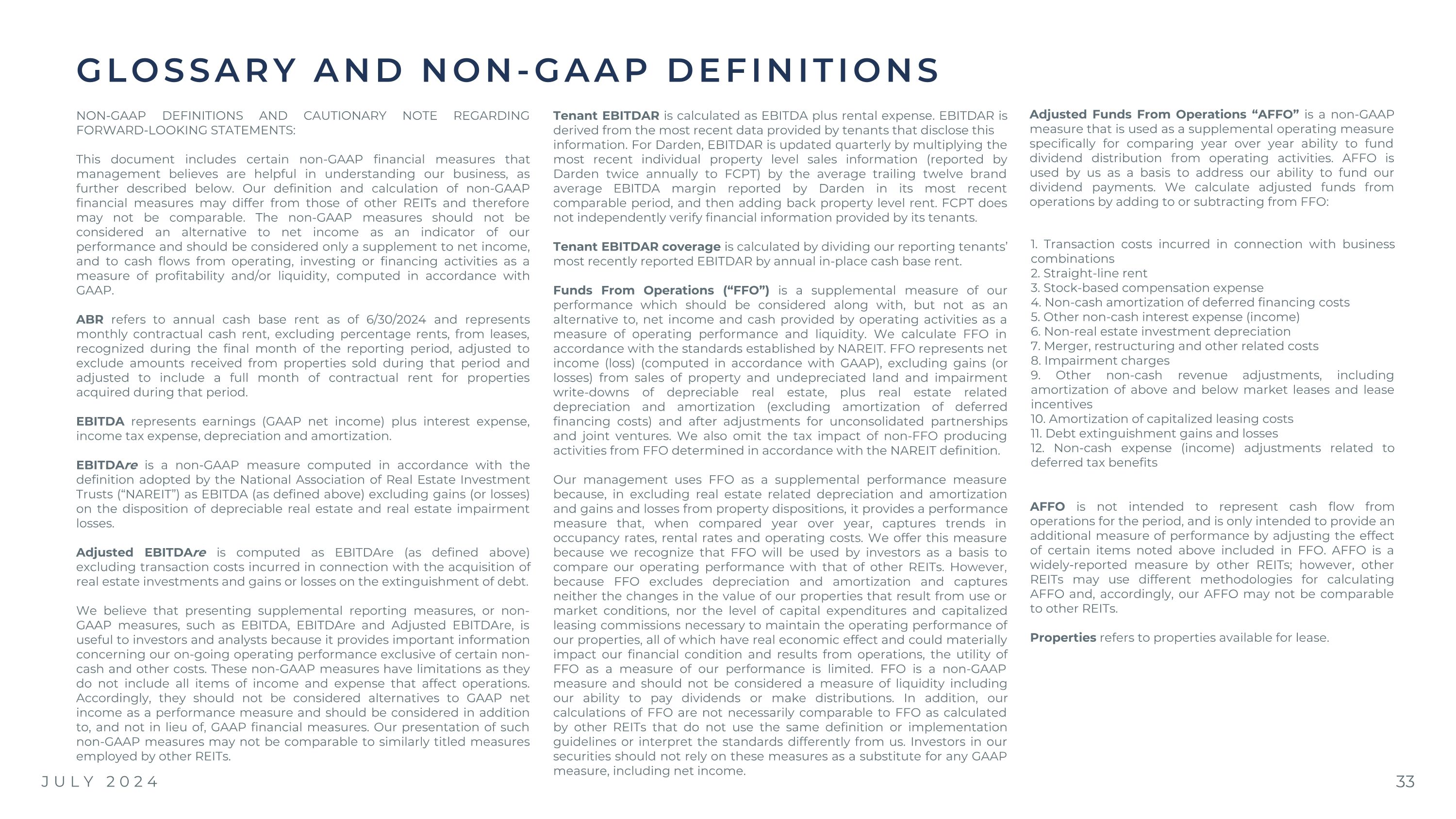

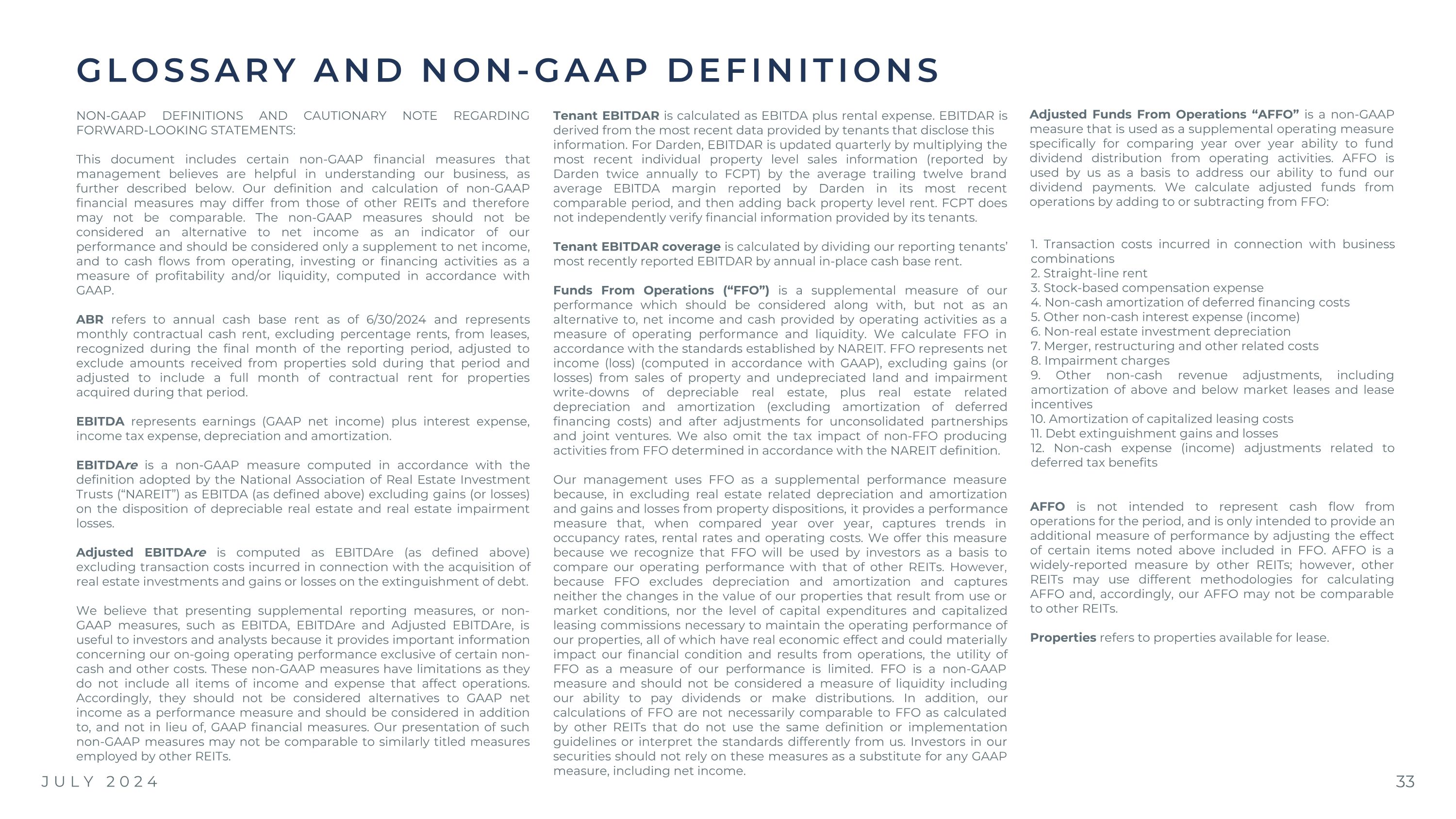

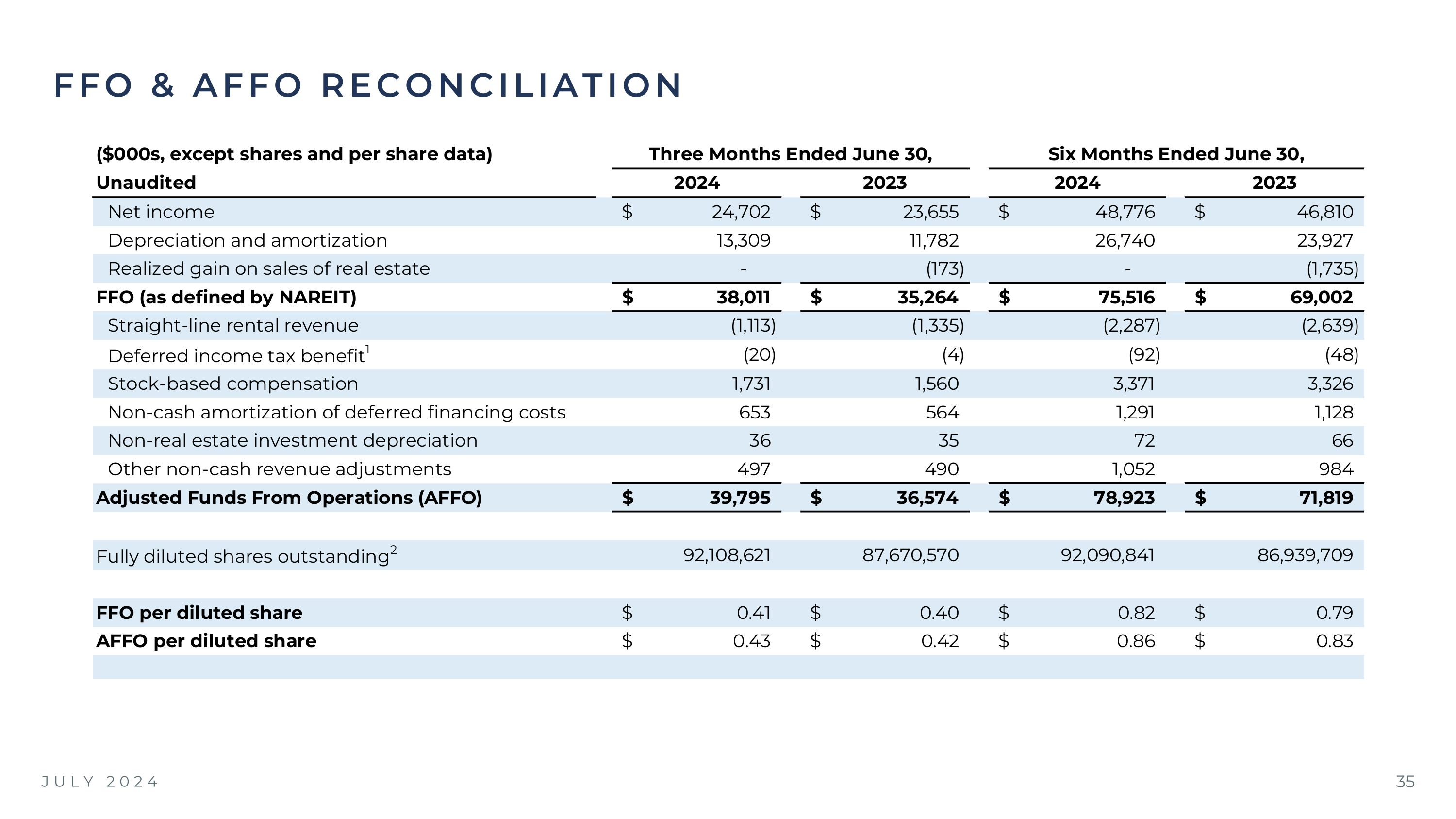

NON-GAAP DEFINITIONS AND CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This document includes certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs and therefore may not be comparable. The non-GAAP measures should not be considered an alternative to net income as an indicator of our performance and should be considered only a supplement to net income, and to cash flows from operating, investing or financing activities as a measure of profitability and/or liquidity, computed in accordance with GAAP. ABR refers to annual cash base rent as of 6/30/2024 and represents monthly contractual cash rent, excluding percentage rents, from leases, recognized during the final month of the reporting period, adjusted to exclude amounts received from properties sold during that period and adjusted to include a full month of contractual rent for properties acquired during that period. EBITDA represents earnings (GAAP net income) plus interest expense, income tax expense, depreciation and amortization. EBITDAre is a non-GAAP measure computed in accordance with the definition adopted by the National Association of Real Estate Investment Trusts (“NAREIT”) as EBITDA (as defined above) excluding gains (or losses) on the disposition of depreciable real estate and real estate impairment losses. Adjusted EBITDAre is computed as EBITDAre (as defined above) excluding transaction costs incurred in connection with the acquisition of real estate investments and gains or losses on the extinguishment of debt. We believe that presenting supplemental reporting measures, or non-GAAP measures, such as EBITDA, EBITDAre and Adjusted EBITDAre, is useful to investors and analysts because it provides important information concerning our on-going operating performance exclusive of certain non-cash and other costs. These non-GAAP measures have limitations as they do not include all items of income and expense that affect operations. Accordingly, they should not be considered alternatives to GAAP net income as a performance measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Our presentation of such non-GAAP measures may not be comparable to similarly titled measures employed by other REITs. Tenant EBITDAR is calculated as EBITDA plus rental expense. EBITDAR is derived from the most recent data provided by tenants that disclose this information. For Darden, EBITDAR is updated quarterly by multiplying the most recent individual property level sales information (reported by Darden twice annually to FCPT) by the average trailing twelve brand average EBITDA margin reported by Darden in its most recent comparable period, and then adding back property level rent. FCPT does not independently verify financial information provided by its tenants. Tenant EBITDAR coverage is calculated by dividing our reporting tenants’ most recently reported EBITDAR by annual in-place cash base rent. Funds From Operations (“FFO”) is a supplemental measure of our performance which should be considered along with, but not as an alternative to, net income and cash provided by operating activities as a measure of operating performance and liquidity. We calculate FFO in accordance with the standards established by NAREIT. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property and undepreciated land and impairment write-downs of depreciable real estate, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. We also omit the tax impact of non-FFO producing activities from FFO determined in accordance with the NAREIT definition. Our management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We offer this measure because we recognize that FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. FFO is a non-GAAP measure and should not be considered a measure of liquidity including our ability to pay dividends or make distributions. In addition, our calculations of FFO are not necessarily comparable to FFO as calculated by other REITs that do not use the same definition or implementation guidelines or interpret the standards differently from us. Investors in our securities should not rely on these measures as a substitute for any GAAP measure, including net income. Adjusted Funds From Operations “AFFO” is a non-GAAP measure that is used as a supplemental operating measure specifically for comparing year over year ability to fund dividend distribution from operating activities. AFFO is used by us as a basis to address our ability to fund our dividend payments. We calculate adjusted funds from operations by adding to or subtracting from FFO: 1. Transaction costs incurred in connection with business combinations 2. Straight-line rent 3. Stock-based compensation expense 4. Non-cash amortization of deferred financing costs 5. Other non-cash interest expense (income) 6. Non-real estate investment depreciation 7. Merger, restructuring and other related costs 8. Impairment charges 9. Other non-cash revenue adjustments, including amortization of above and below market leases and lease incentives 10. Amortization of capitalized leasing costs 11. Debt extinguishment gains and losses 12. Non-cash expense (income) adjustments related to deferred tax benefits AFFO is not intended to represent cash flow from operations for the period, and is only intended to provide an additional measure of performance by adjusting the effect of certain items noted above included in FFO. AFFO is a widely-reported measure by other REITs; however, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs. Properties refers to properties available for lease. GLOSSARY AND NON-GAAP DEFINITIONS JULY 2024

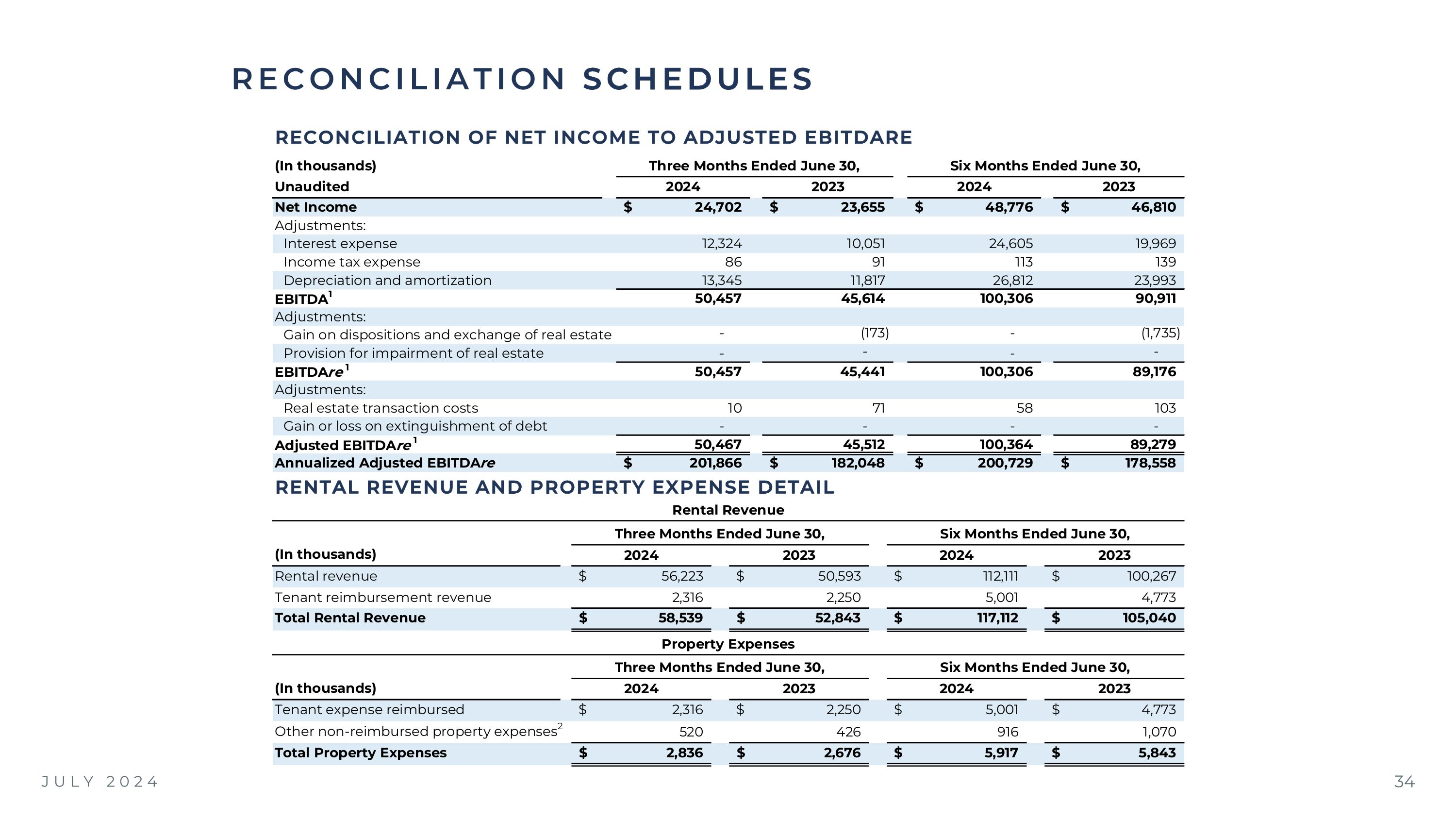

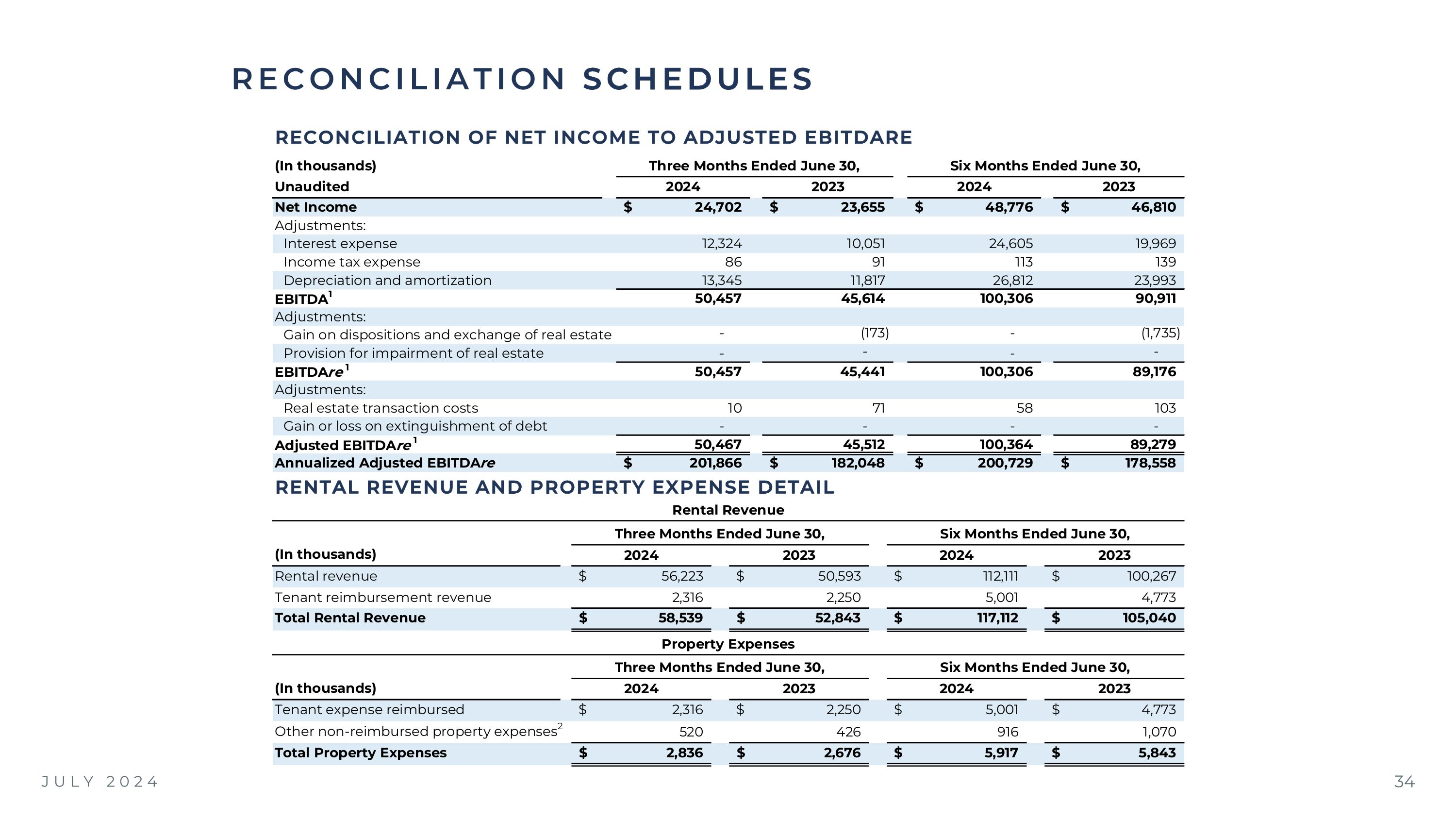

JULY 2024 RECONCILIATION SCHEDULES RECONCILIATION OF NET INCOME TO ADJUSTED EBITDARE RENTAL REVENUE AND PROPERTY EXPENSE DETAIL

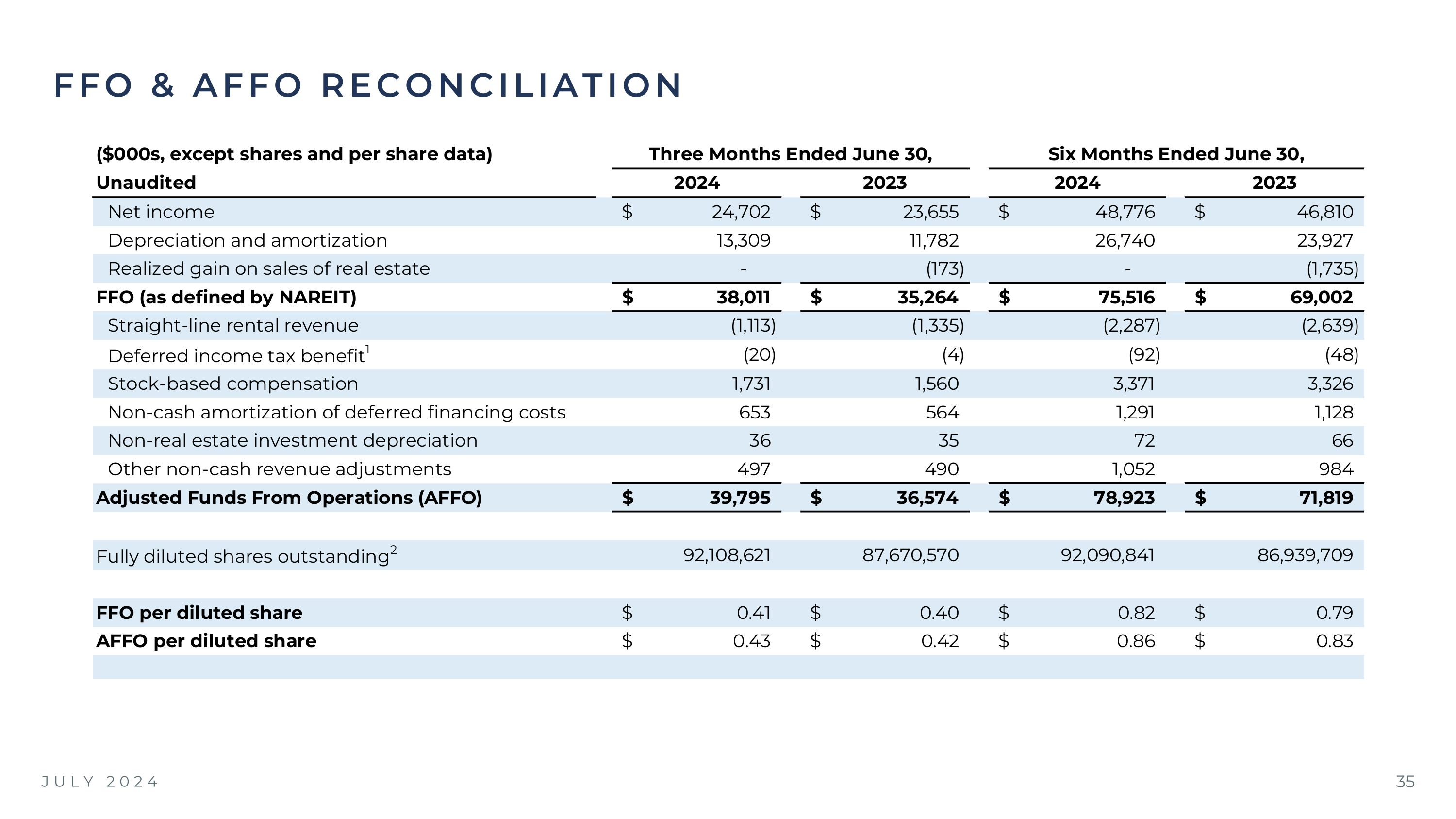

JULY 2024 FFO & AFFO RECONCILIATION

PAGE 9 FCPT STRONG PORTFOLIO PERFORMANCE FCPT reported 92% collected rent in Q2 2020, with 4% abated in return for lease modifications and 3% deferred. FCPT collected the 3% deferred rent in Q4 2020. The 98.8% number above included deferred rent that was paid and the abated rent for which FCPT received beneficial lease modifications Occupancy based on portfolio square footage JULY 2024 FOOTNOTES PAGE 6 PORTFOLIO AND INVESTMENT HIGHLIGHTS Weighted averages based on contractual Annual Cash Base Rent as defined in glossary, except for occupancy which is based on portfolio square footage. See glossary for definitions See glossary on page 33 for tenant EBITDAR and tenant EBITDAR coverage definitions: results based on tenant reporting representing 100% of Darden annual cash base rent (ABR), 53% of other restaurant ABR and 7% of non-restaurant ABR or 67% of total portfolio ABR. We have estimated Darden current EBITDAR coverage using sales results for the reported FCPT portfolio for the year ending May 2024 and updated average trailing twelve months brand average margins for the year ended May 2024 Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies from Fitch, S&P or Moody's Acquisitions through June 30, 2024. Excludes renewal options PAGE 10 GEOGRAPHICALLY DIVERSE PORTFOLIO Figures as of 6/30/2024 Annual Cash Base Rent (ABR) as defined on page 33 Source: U-Haul growth index 2023 PAGE 11 LOW RENT/ HIGH COVERAGE PORTFOLIO See glossary on page 33 for tenant EBITDAR and tenant EBITDAR coverage definitions: results based on tenant reporting representing 100% of Darden annual cash base rent (ABR), 53% of other restaurant ABR and 7% of non-restaurant ABR or 67% of total portfolio ABR. We have estimated Darden current EBITDAR coverage using sales results for the reported FCPT portfolio for the year ending May 2024 and updated average trailing twelve months brand average margins for the year ended May 2024 Represents current Annual Cash Base Rent (ABR) as of 6/30/2024 as defined on page 33 PAGE 12 BRAND EXPOSURE BY ANNUALIZED BASE RENT Represents current Annual Cash Base Rent (ABR) as of 6/30/2024 Other Darden represents Bahama Breeze, Cheddar’s, Seasons 52, and Eddie V’s branded restaurants Other retail includes properties leased to cell phone stores, bank branches, grocers amongst others. These are often below market rent leases, and many were purchased through the outparcel strategy PAGE 5 FINANCIAL HIGHLIGHTS AS OF Q2 2024 Figures as of 6/30/2024, unless otherwise noted See page 33 for non-GAAP definitions, and page 35 for reconciliation of net income to AFFO See page 34 for reconciliation of net income to adjusted EBITDAre and page 33 for non-GAAP definitions. Net debt is calculated as total debt less cash and cash equivalents PAGE 23 DIVERSIFICATION: MEDICAL RETAIL As of 6/30/2024 PAGE 22 DIVERSIFICATION: AUTO INDUSTRY As of 6/30/2024 PAGE 26 CONSERVATIVE FINANCIAL POLICIES Figures as of 6/30/2024, unless otherwise noted See page 34 for reconciliation of net income to adjusted EBITDAre and page 33 for non-GAAP definitions. Net debt is calculated as total debt less cash and cash equivalents PAGE 28 COMPANY MOMENTUM SINCE INCEPTION Annual Cash Base Rent (ABR) as defined on page 33 Based on Annual Base Rent PAGE 7 CONSISTENT ANNUAL ACQUISITION GROWTH Figures as of 6/30/2024 Note: Figures exclude capitalized transaction costs. Initial cash yield calculation excludes $2.1 million, and $2.4 million of real estate purchases in our Kerrow operating business for 2019 and 2020, respectively. 2022 initial cash yield reflects near term rent increases and rent credits given at closing; the initial cash yield with rents in place as of closing is 6.4% PAGE 34 RECONCILIATION SCHEDULES See glossary on page 33 for non-GAAP definitions Other non-reimbursed property expenses include non-reimbursed tenant expenses, vacant property expenses, abandoned deal costs, property legal costs, and franchise taxes PAGE 35 FFO & AFFO RECONCILIATION Amount represents non-cash deferred income tax (benefit) expense recognized at the Kerrow Restaurant Business Assumes the issuance of common shares for OP units held by non-controlling interest PAGE 13 BRAND DIVERSIFICATION Represents current Annual Cash Base Rent (ABR) as of 6/30/2024 as defined in glossary Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies from Fitch, S&P or Moody's PAGE 16 STRONG RECENT RESTAURANT RESULTS Note: Results shown may not be indicative of the ability or willingness of our tenants to pay rent on a timely basis or at all. Last four weeks are averaged due to a calendar shift in holidays Source: Data per The Baird Restaurant Surveys (produced by R.W. Baird & Co. Equity Research) reported 7/22/2024 PAGE 19 DARDEN PERFORMANCE SINCE SPIN Annualized Base Rent Note: Darden public SEC filing data from the fourth quarter (ended May) of each year annualized, except current results which represents Darden’s fiscal year 2024 Q4 and FY 2024 average sales per store. FCPT data is for Q4 2015, Q4 2019 and Q2 2024, respectively PAGE 31 THOUGHTFUL BRAND SELECTION Brand average sales per Nation’s Restaurant News Top 500 (2023 edition, uses 2022 sales volumes) PAGE 27 FCPT CONSISTENT LEVERAGE RANGE See page 34 for reconciliation of net income to adjusted EBITDAre and page 33 for non-GAAP definitions. Net debt is calculated as total debt less cash and cash equivalents PAGE 15 LEASE MATURITY SCHEDULE Note: Excludes renewal options. All data as of 6/30/2024 Annual cash base rent (ABR) as defined in glossary Occupancy based on portfolio square footage PAGE 21 TIGHT LEASING MARKET & LOW VACANCY Source: CoStar data as of 7/10/2024 PAGE 17 FCPT’S CASUAL DINING OUTPACES BRAND AVERAGES Rent-to-sales Per Nation’s Restaurant News Top 500 Restaurants PAGE 14 SELECTIVE APPROACH TO NET LEASE Note: All data as of 6/30/2024 Annual cash base rent (ABR) as defined in glossary

INVESTOR PRESENTATION JULY 2024