FCPT Announces Second Quarter 2019 Financial and Operating Results MILL VALLEY, CA – July 30, 2019 / Business Wire – Four Corners Property Trust, Inc. (“FCPT” or the “Company”, NYSE: FCPT) today announced financial results for the three months and six months ended June 30, 2019. Management Comments “During the second quarter, we continued to make accretive acquisitions of quality restaurant properties that benefit from low rental rates and a high percentage of corporate operators,” said Bill Lenehan. “Last week, we also announced a $38 million follow-on acquisition with Washington Prime Group (WPG) for 12 restaurant properties and 8 properties operating in other retail sectors. We are enthusiastic to announce our first entry into the non-restaurant, retail net- lease space and look forward to continuing to build on the relationship with WPG. These non-restaurant outparcels share similar qualities as our current restaurant assets and will be great additions as we continue on the path to diversify our portfolio.” Financial Results Rental Revenue and Net Income Attributable to Common Shareholders • Rental revenue for the second quarter increased 16.3% over the prior year to $34.4 million. Rental revenue consisted of $32.2 million in cash rents and $2.2 million of straight-line and other non-cash rent adjustments. • Net income attributable to common shareholders was $17.9 million for the second quarter, or $0.26 per diluted share. These results compared to net income attributable to common shareholders of $27.4 million in the prior year, or $0.44 per diluted share, including a $10.9 million gain on the sale of a property. • Net income attributable to common shareholders was $35.4 million for the six months ended June 30, 2019, or $0.52 per diluted share. These results compared to net income attributable to common shareholders of $43.7 million, or $0.71 per diluted share, including a $10.9 million gain on the sale of a property, for the same six- month period in the prior year. Funds from Operations (FFO) • NAREIT-defined FFO per diluted share for the second quarter was $0.36, representing a $0.01 per share increase compared to the second quarter in 2018. • NAREIT-defined FFO per diluted share for the six months ended June 30, 2019 was $0.70, representing flat per share results compared to the same six-month period in the prior year. Adjusted Funds from Operations (AFFO) • AFFO per diluted share for the second quarter was $0.34, representing flat per share results compared to the second quarter in 2018. • AFFO per diluted share for the six months ended June 30, 2019 was $0.68, representing flat per share results compared to the same six-month period in the prior year. General and Administrative (G&A) Expense • G&A expense for the second quarter was $3.4 million, which included $0.8 million of stock-based compensation. These results compared to G&A expense in the second quarter of 2018 of $3.1 million, including $0.9 million of stock-based compensation.

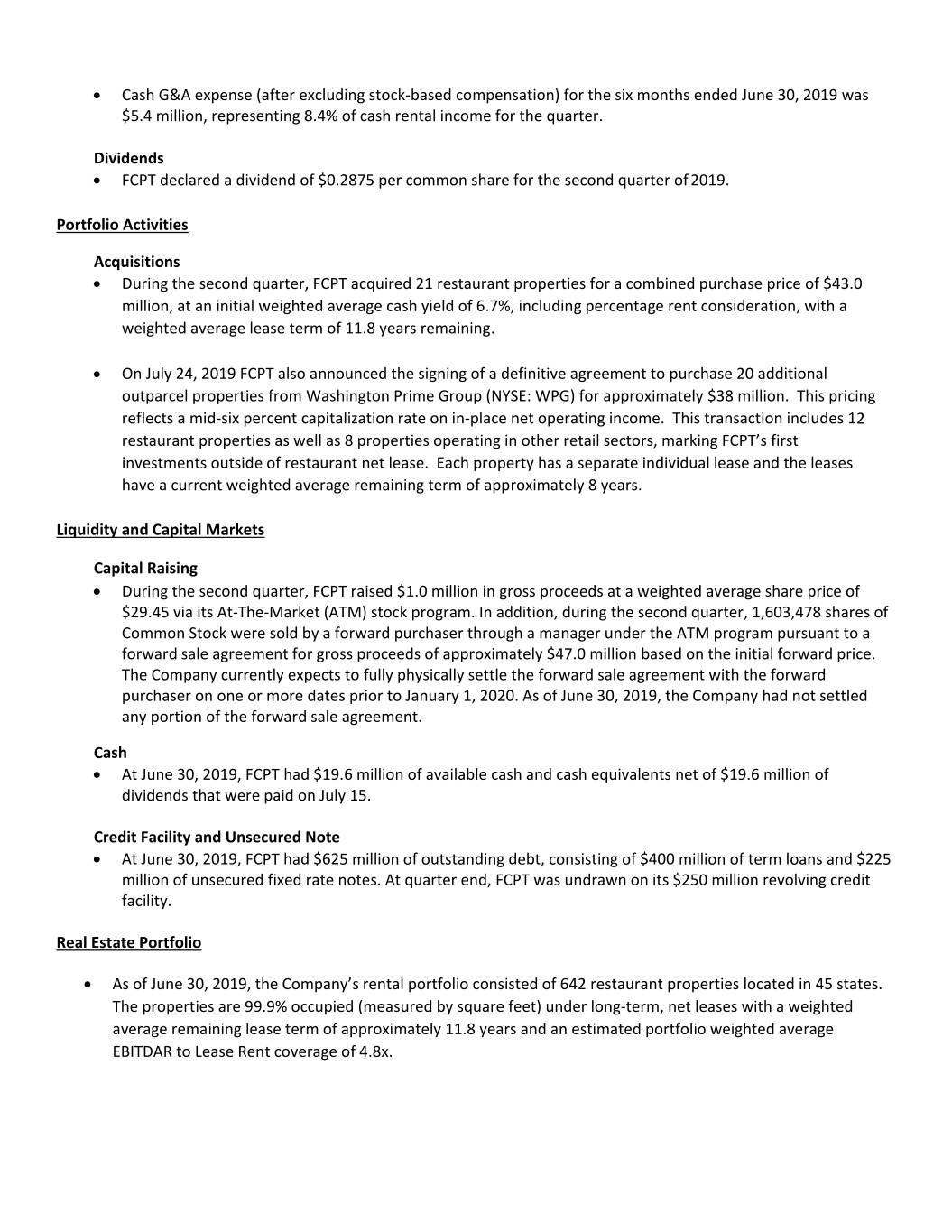

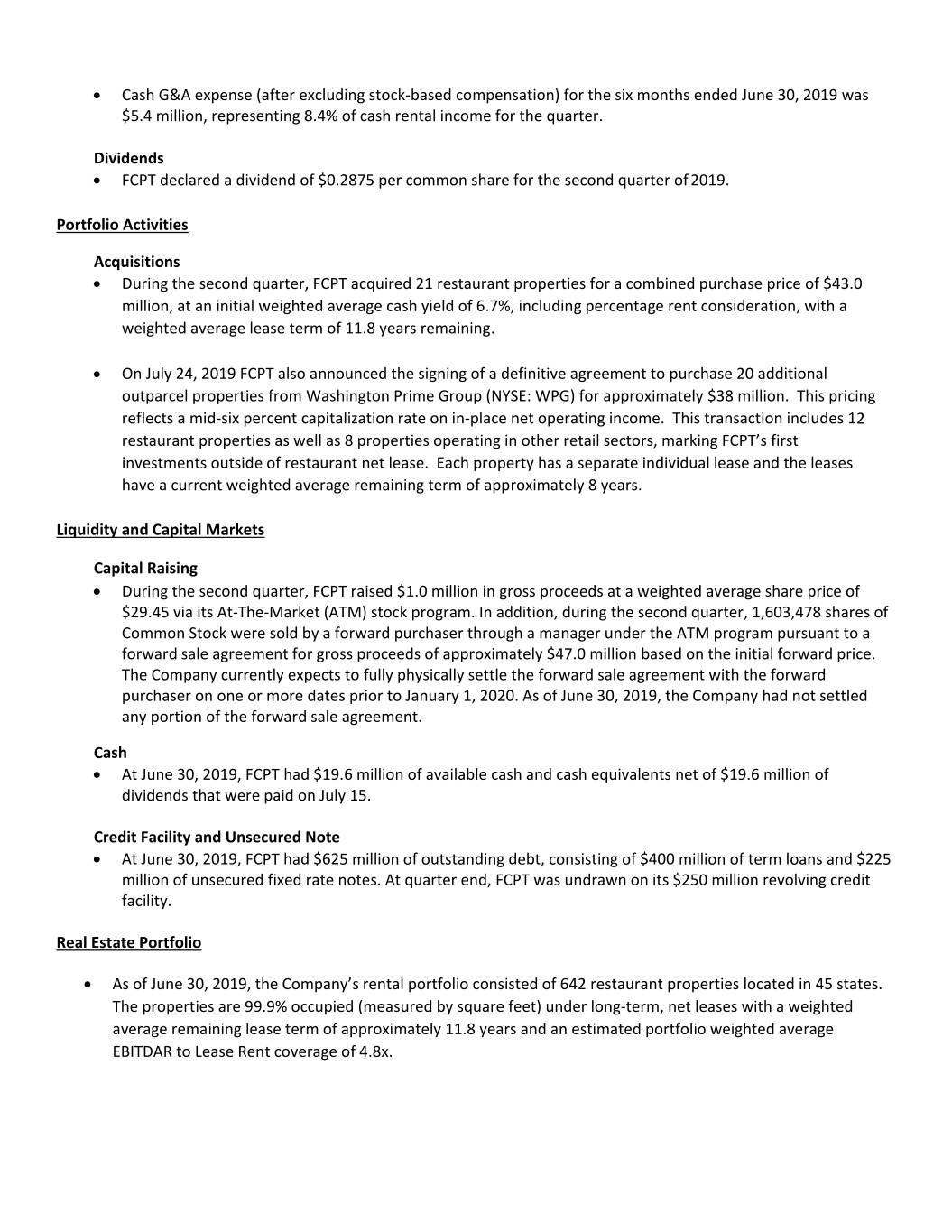

• Cash G&A expense (after excluding stock-based compensation) for the six months ended June 30, 2019 was $5.4 million, representing 8.4% of cash rental income for the quarter. Dividends • FCPT declared a dividend of $0.2875 per common share for the second quarter of 2019. Portfolio Activities Acquisitions • During the second quarter, FCPT acquired 21 restaurant properties for a combined purchase price of $43.0 million, at an initial weighted average cash yield of 6.7%, including percentage rent consideration, with a weighted average lease term of 11.8 years remaining. • On July 24, 2019 FCPT also announced the signing of a definitive agreement to purchase 20 additional outparcel properties from Washington Prime Group (NYSE: WPG) for approximately $38 million. This pricing reflects a mid-six percent capitalization rate on in-place net operating income. This transaction includes 12 restaurant properties as well as 8 properties operating in other retail sectors, marking FCPT’s first investments outside of restaurant net lease. Each property has a separate individual lease and the leases have a current weighted average remaining term of approximately 8 years. Liquidity and Capital Markets Capital Raising • During the second quarter, FCPT raised $1.0 million in gross proceeds at a weighted average share price of $29.45 via its At-The-Market (ATM) stock program. In addition, during the second quarter, 1,603,478 shares of Common Stock were sold by a forward purchaser through a manager under the ATM program pursuant to a forward sale agreement for gross proceeds of approximately $47.0 million based on the initial forward price. The Company currently expects to fully physically settle the forward sale agreement with the forward purchaser on one or more dates prior to January 1, 2020. As of June 30, 2019, the Company had not settled any portion of the forward sale agreement. Cash • At June 30, 2019, FCPT had $19.6 million of available cash and cash equivalents net of $19.6 million of dividends that were paid on July 15. Credit Facility and Unsecured Note • At June 30, 2019, FCPT had $625 million of outstanding debt, consisting of $400 million of term loans and $225 million of unsecured fixed rate notes. At quarter end, FCPT was undrawn on its $250 million revolving credit facility. Real Estate Portfolio • As of June 30, 2019, the Company’s rental portfolio consisted of 642 restaurant properties located in 45 states. The properties are 99.9% occupied (measured by square feet) under long-term, net leases with a weighted average remaining lease term of approximately 11.8 years and an estimated portfolio weighted average EBITDAR to Lease Rent coverage of 4.8x.

Conference Call Information Company management will host a conference call and audio webcast on Wednesday, July 31, 2019 at 11:00 am Eastern Time to discuss the results. Interested parties can listen to the call via the following: Internet: Go to http://dpregister.com/10133454 at least 15 minutes prior to start time of the call, in order to register and to download any necessary audio software. Please note for those that register, the dial-in number will be provided upon registration. Phone: 1-888-346-5243 (domestic) / 1-412-317-5120 (international). Participants not pre-registered must ask to be joined into the Four Corners Property Trust call. Replay: Available through October 31, 2019 by dialing 1-877-344-7529 (domestic) / 1-412-317- 0088 (international), Replay Access Code 10133454. About FCPT FCPT is a real estate investment trust primarily engaged in the acquisition and leasing of restaurant properties. The Company seeks to grow its portfolio by acquiring additional real estate to lease for use in the restaurant and retail industries.

Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements within the meaning of the federal securities laws. Forward- looking statements include all statements that are not historical statements of fact and those regarding the Company’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance; and expectations regarding the making of distributions and the payment of dividends. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of the Company’s public disclosure obligations, the Company expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and the Company can give no assurance that its expectations or the events described will occur as described. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements. For a further discussion of these and other factors that could cause the company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the company’s most recent annual report on Form 10-K, and other risks described in documents subsequently filed by the company from time to time with the Securities and Exchange Commission. Notice Regarding Non-GAAP Financial Measures: In addition to U.S. GAAP financial measures, this press release and the referenced supplemental financial and operating report contain and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in the supplemental financial and operating report, which can be found in the investor relations section of our website. Supplemental Materials and Website: Supplemental materials on the Second Quarter 2019 operating results and other information on the Company are available on the investors relations section of FCPT’s website at www.investors.fcpt.com. FCPT Bill Lenehan, 415-965-8031 CEO Gerry Morgan, 415-965-8032 CFO

Four Corners Property Trust Consolidated Statements of Income (Unaudited) (In thousands, except share and per share data) Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 Revenues: Rental revenue $ 34,415 $ 29,596 $ 68,623 $ 59,186 Restaurant revenue 5,153 5,079 10,546 10,293 Total revenues 39,568 34,675 79,169 69,479 Operating expenses: General and administrative 3,431 3,109 7,377 6,692 Depreciation and amortization 6,518 5,225 12,879 10,569 Property expenses 417 95 725 181 Restaurant expenses 4,954 4,786 9,937 9,656 Total operating expenses 15,320 13,215 30,918 27,098 Interest expense (6,557) (4,877) (13,304) (9,733) Other income, net 306 231 719 588 Realized gain on sale, net - 10,879 - 10,879 Income tax expense (61) (66) (129) (125) Net income 17,936 27,627 35,537 43,990 Net income attributable to noncontrolling interest (68) (182) (166) (291) Net Income Attributable to Common Shareholders $ 17,868 $ 27,445 $ 35,371 $ 43,699 Basic net income per share $ 0.26 $ 0.44 $ 0.52 $ 0.71 Diluted net income per share $ 0.26 $ 0.44 $ 0.52 $ 0.71 Regular dividends declared per share $ 0.2875 $ 0.2750 $ 0.5750 $ 0.5500 Weighted-average shares outstanding: Basic 68,302,395 61,751,530 68,252,947 61,511,183 Diluted 68,501,181 61,911,699 68,475,778 61,661,560

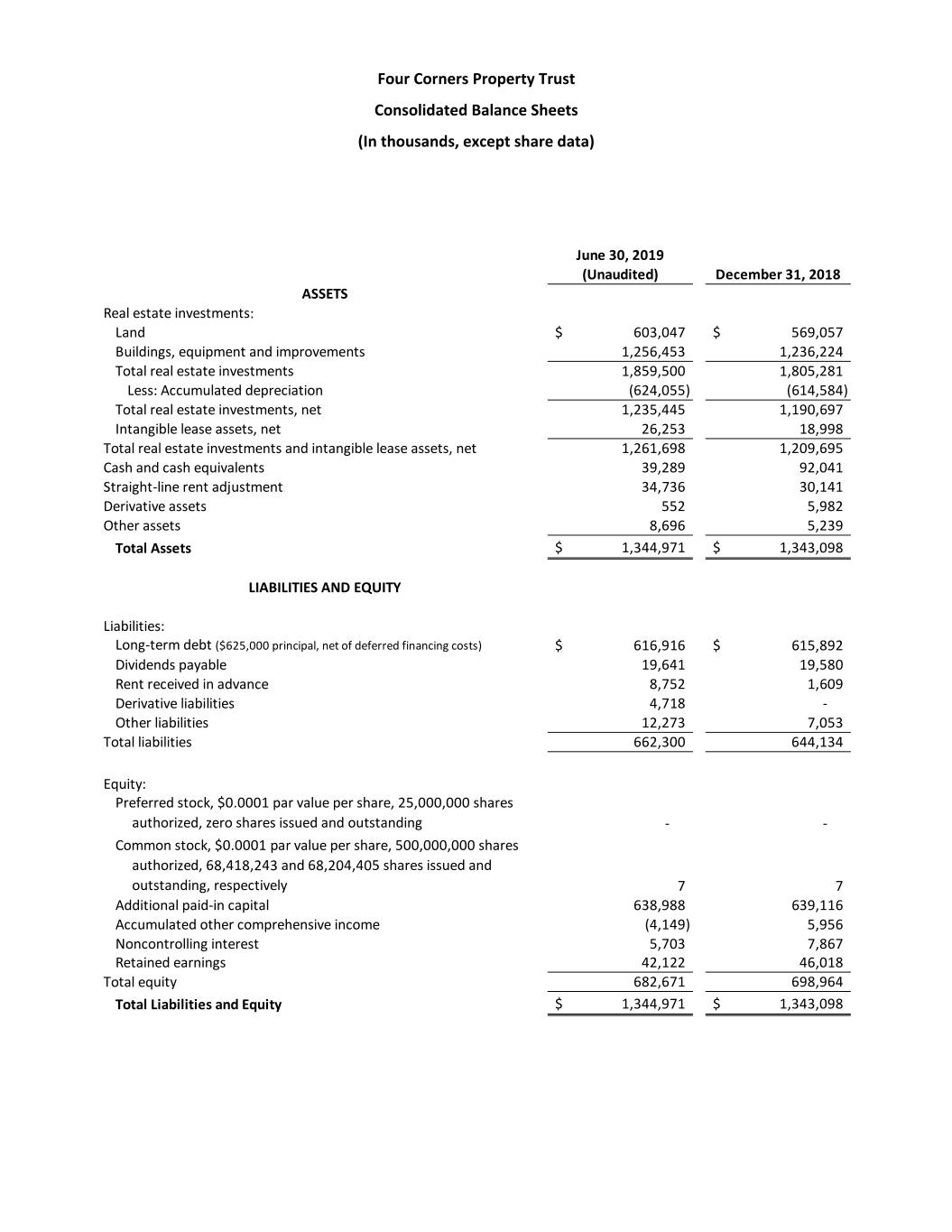

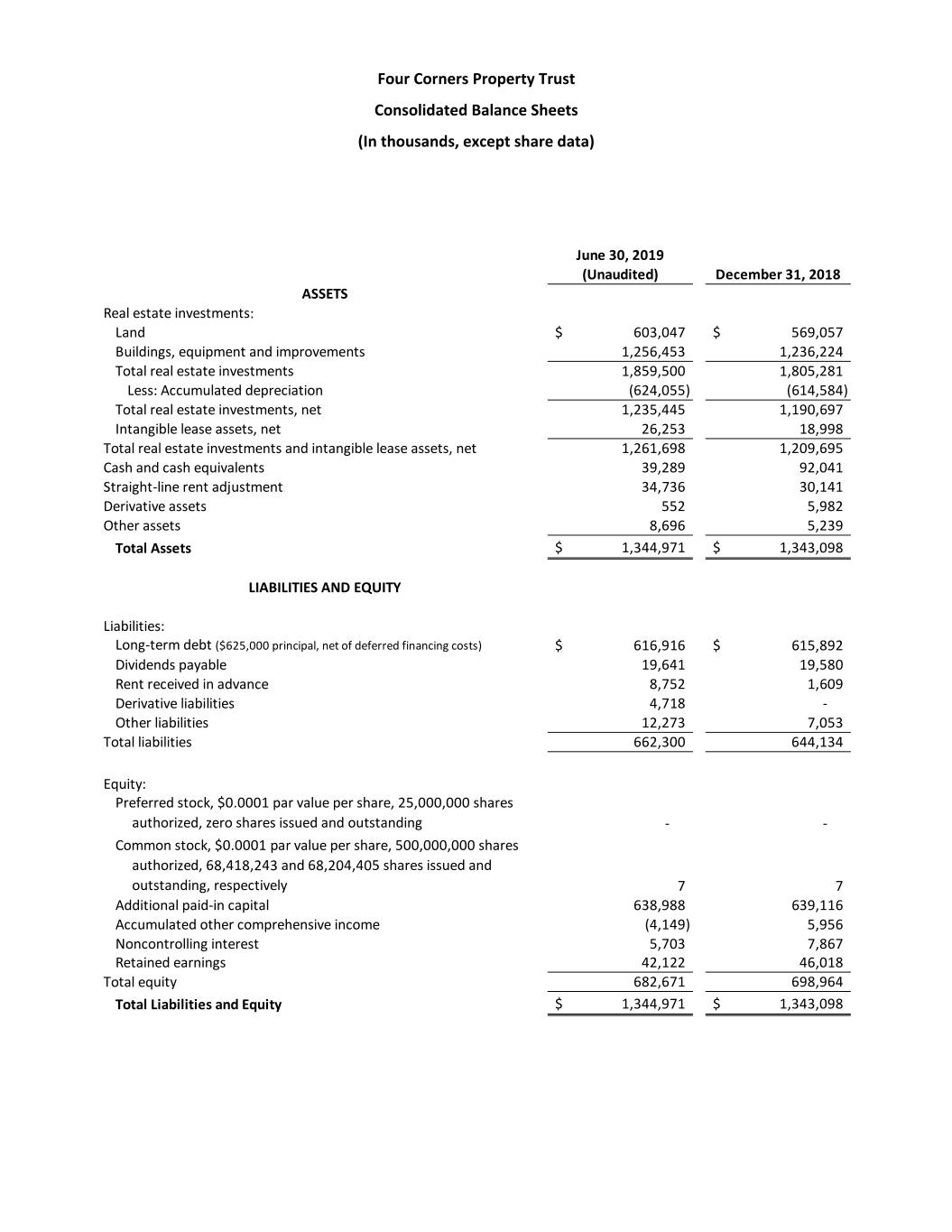

Four Corners Property Trust Consolidated Balance Sheets (In thousands, except share data) June 30, 2019 (Unaudited) December 31, 2018 ASSETS Real estate investments: Land $ 603,047 $ 569,057 Buildings, equipment and improvements 1,256,453 1,236,224 Total real estate investments 1,859,500 1,805,281 Less: Accumulated depreciation (624,055) (614,584) Total real estate investments, net 1,235,445 1,190,697 Intangible lease assets, net 26,253 18,998 Total real estate investments and intangible lease assets, net 1,261,698 1,209,695 Cash and cash equivalents 39,289 92,041 Straight-line rent adjustment 34,736 30,141 Derivative assets 552 5,982 Other assets 8,696 5,239 Total Assets $ 1,344,971 $ 1,343,098 LIABILITIES AND EQUITY Liabilities: Long-term debt ($625,000 principal, net of deferred financing costs) $ 616,916 $ 615,892 Dividends payable 19,641 19,580 Rent received in advance 8,752 1,609 Derivative liabilities 4,718 - Other liabilities 12,273 7,053 Total liabilities 662,300 644,134 Equity: Preferred stock, $0.0001 par value per share, 25,000,000 shares authorized, zero shares issued and outstanding - - Common stock, $0.0001 par value per share, 500,000,000 shares authorized, 68,418,243 and 68,204,405 shares issued and outstanding, respectively 7 7 Additional paid-in capital 638,988 639,116 Accumulated other comprehensive income (4,149) 5,956 Noncontrolling interest 5,703 7,867 Retained earnings 42,122 46,018 Total equity 682,671 698,964 Total Liabilities and Equity $ 1,344,971 $ 1,343,098

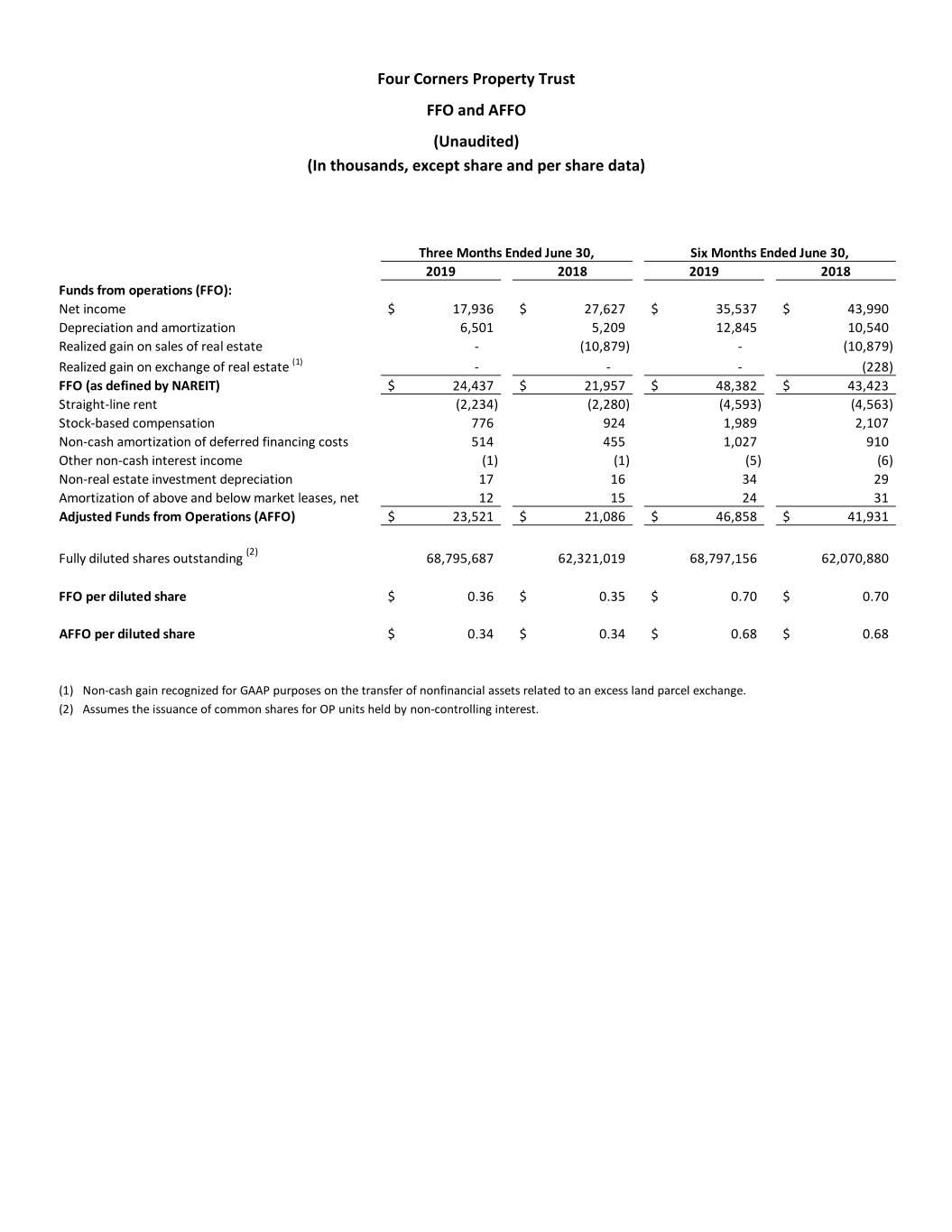

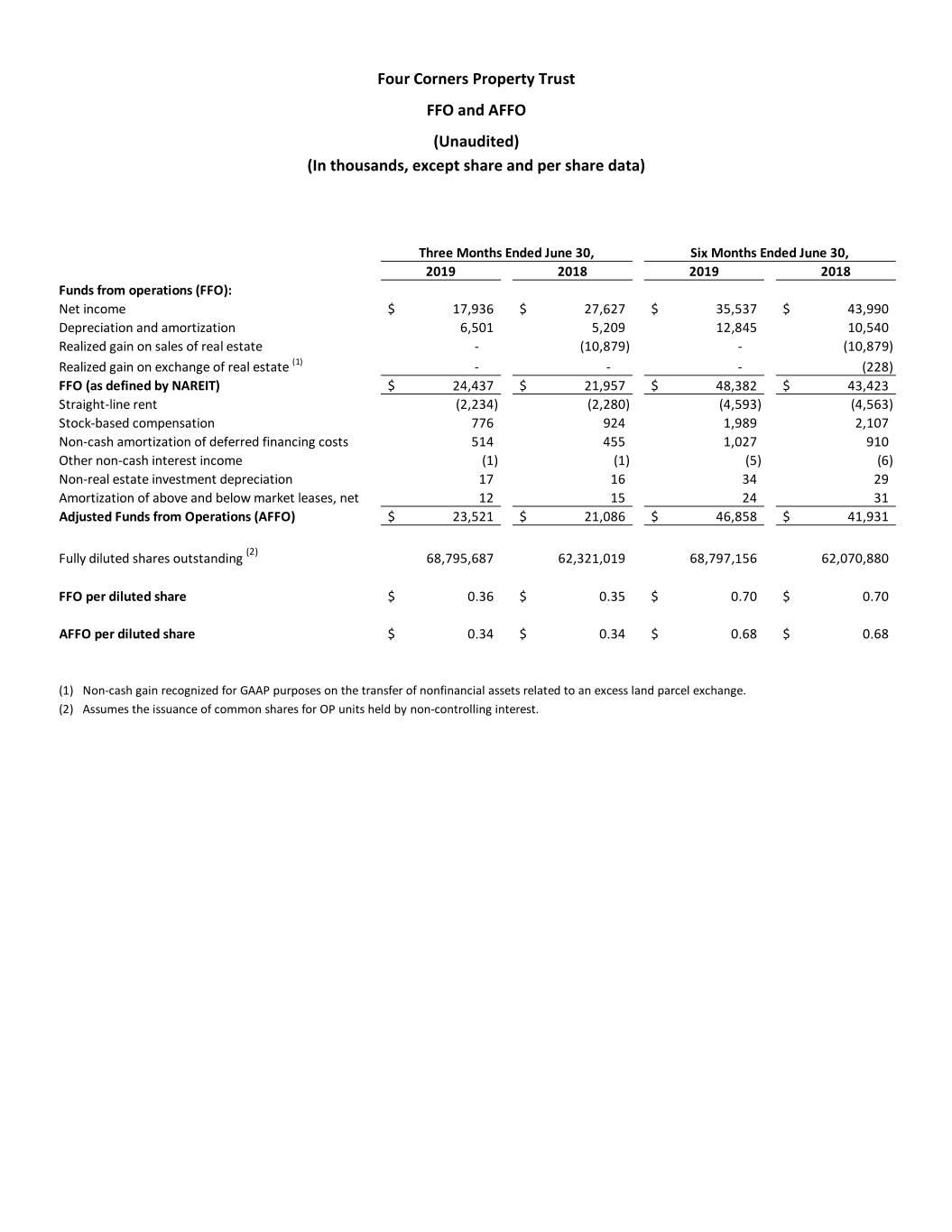

Four Corners Property Trust FFO and AFFO (Unaudited) (In thousands, except share and per share data) Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 Funds from operations (FFO): Net income $ 17,936 $ 27,627 $ 35,537 $ 43,990 Depreciation and amortization 6,501 5,209 12,845 10,540 Realized gain on sales of real estate - (10,879) - (10,879) Realized gain on exchange of real estate (1) - - - (228) FFO (as defined by NAREIT) $ 24,437 $ 21,957 $ 48,382 $ 43,423 Straight-line rent (2,234) (2,280) (4,593) (4,563) Stock-based compensation 776 924 1,989 2,107 Non-cash amortization of deferred financing costs 514 455 1,027 910 Other non-cash interest income (1) (1) (5) (6) Non-real estate investment depreciation 17 16 34 29 Amortization of above and below market leases, net 12 15 24 31 Adjusted Funds from Operations (AFFO) $ 23,521 $ 21,086 $ 46,858 $ 41,931 (2) Fully diluted shares outstanding 68,795,687 62,321,019 68,797,156 62,070,880 FFO per diluted share $ 0.36 $ 0.35 $ 0.70 $ 0.70 AFFO per diluted share $ 0.34 $ 0.34 $ 0.68 $ 0.68 (1) Non-cash gain recognized for GAAP purposes on the transfer of nonfinancial assets related to an excess land parcel exchange. (2) Assumes the issuance of common shares for OP units held by non-controlling interest.