| FCPT | MAY 20211 INVESTOR PRESENTATION | MAY 2021 w w w. fcpt .com FOUR CORNERS PROPERTY TRUST N Y S E : F C P T

| FCPT | MAY 20212 FORWARD LOOKING STATEMENTS AND DISCLAIMERS Cautionary Note Regarding Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding FCPT’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance, acquisition pipeline, expectations regarding the making of distributions and the payment of dividends, and the effect of pandemics such as COVID-19 on the business operations of FCPT and FCPT’s tenants and their continued ability to pay rent in a timely manner or at all. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of FCPT’s public disclosure obligations, FCPT expressly disclaims any obligation to publicly release any updates or revisions to any forward- looking statements to reflect any change in FCPT’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and FCPT can give no assurance that its expectations or the events described will occur as described. For a further discussion of these and other factors that could cause FCPT’s future results to differ materially from any forward-looking statements, see the risk factors described under the section entitled “Item 1A. Risk Factors” in FCPT’s annual report on Form 10-K for the year ended December 31, 2020 and other risks described in documents subsequently filed by FCPT from time to time with the Securities and Exchange Commission Notice Regarding Non-GAAP Financial Measures: The information in this communication contains and refers to certain non-GAAP financial measures, including FFO and AFFO. These non- GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in the supplemental financial and operating report, which can be found in the Investors section of our website at www.fcpt.com, and on page 26 of this presentation.

| FCPT | MAY 20213 AGENDA Company Overview Page 3 Restaurant Industry Update Page 10 Appendix Page 16

| FCPT | MAY 20214 EXECUTIVE SUMMARY Portfolio Update1 FCPT’s portfolio of 810 properties across 85 restaurant and retail brands continues to perform well with occupancy at 99.7% Sector leading rent collection with well over 99% collected for Q1 2021 and 2020 Weighted average lease term of 10.0 years with less than 7.4% of portfolio base rent expiring before 2027 Liquidity and Capital Markets Issued $100 million of private notes in April at a weighted average interest rate of 2.70% Issued $155 million of equity since the second half of 2020 using our At-The-Market (ATM) program No near-term debt maturities and current leverage at 5.3x2 Maintains stable, investment grade rating which was reaffirmed on March 26th, 2021 (Fitch: BBB-) Acquisitions FCPT acquired $34 million of properties in the first quarter with a weighted average cap rate of 6.6% FCPT has closed over $240 million across 126 properties of outparcel transactions since October 2017 New Joint Venture with Lubert-Adler On October 5, 2020, FCPT announced a strategic joint venture with Lubert-Adler Real Estate Funds to acquire up to $150 million of vacant real estate to re-tenant with creditworthy, growing operators The total commitment will be jointly funded by Lubert-Adler ($130 million / 87%) and FCPT ($20 million / 13%) The venture has the potential to grow FCPT’s acquisition pipeline and strengthen its tenant relationships ____________________ Figures as of 3/31/2021, unless otherwise noted 1. Based on contractual Annual Base Rent as defined in glossary, except for occupancy which is based on portfolio square footage. 2. Net debt to adjusted EBITDAre leverage as of 3/31/2021, see page 27 for reconciliation of net income to adjusted EBITDAre and page 26 for non-GAAP definitions.

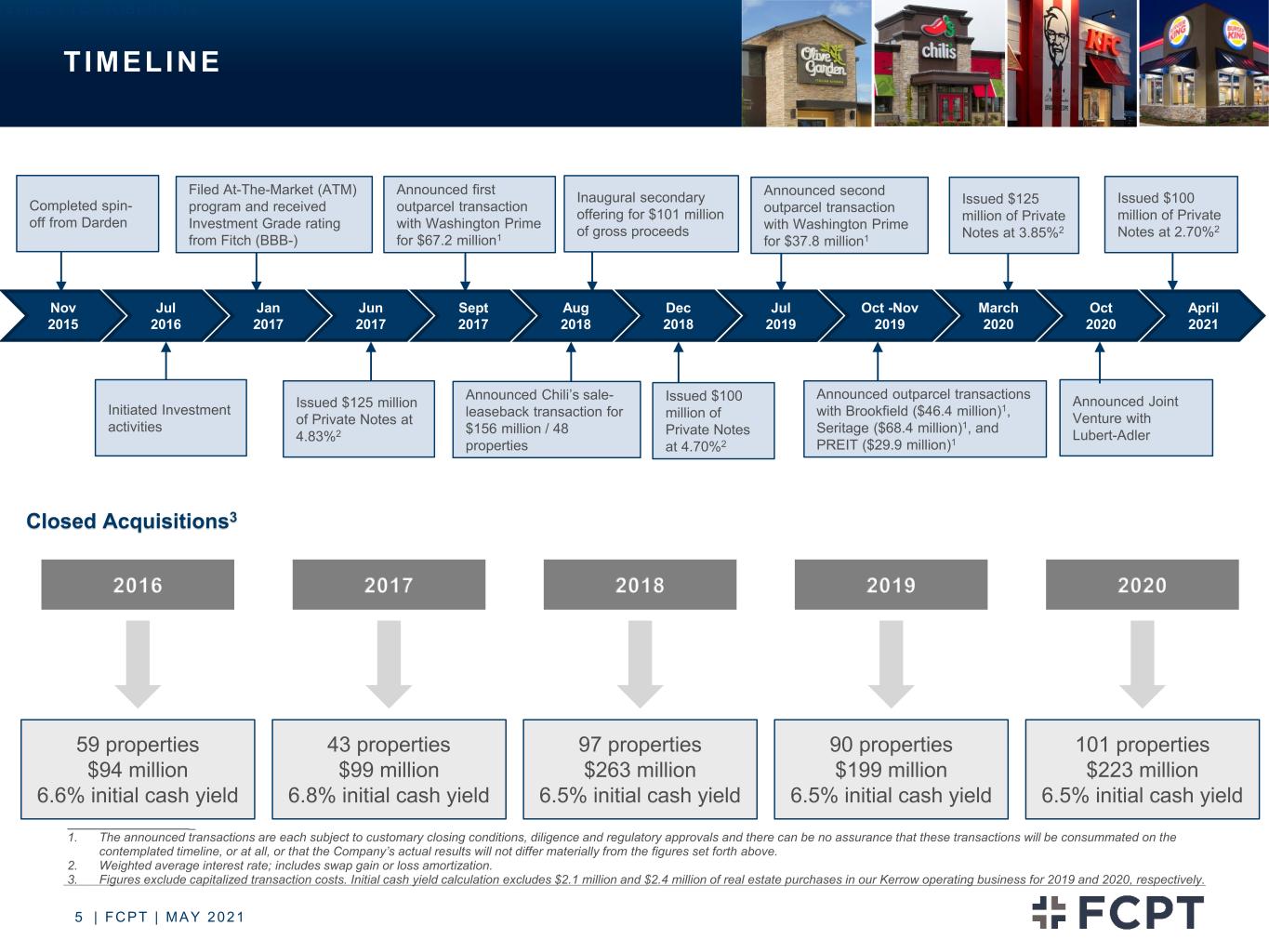

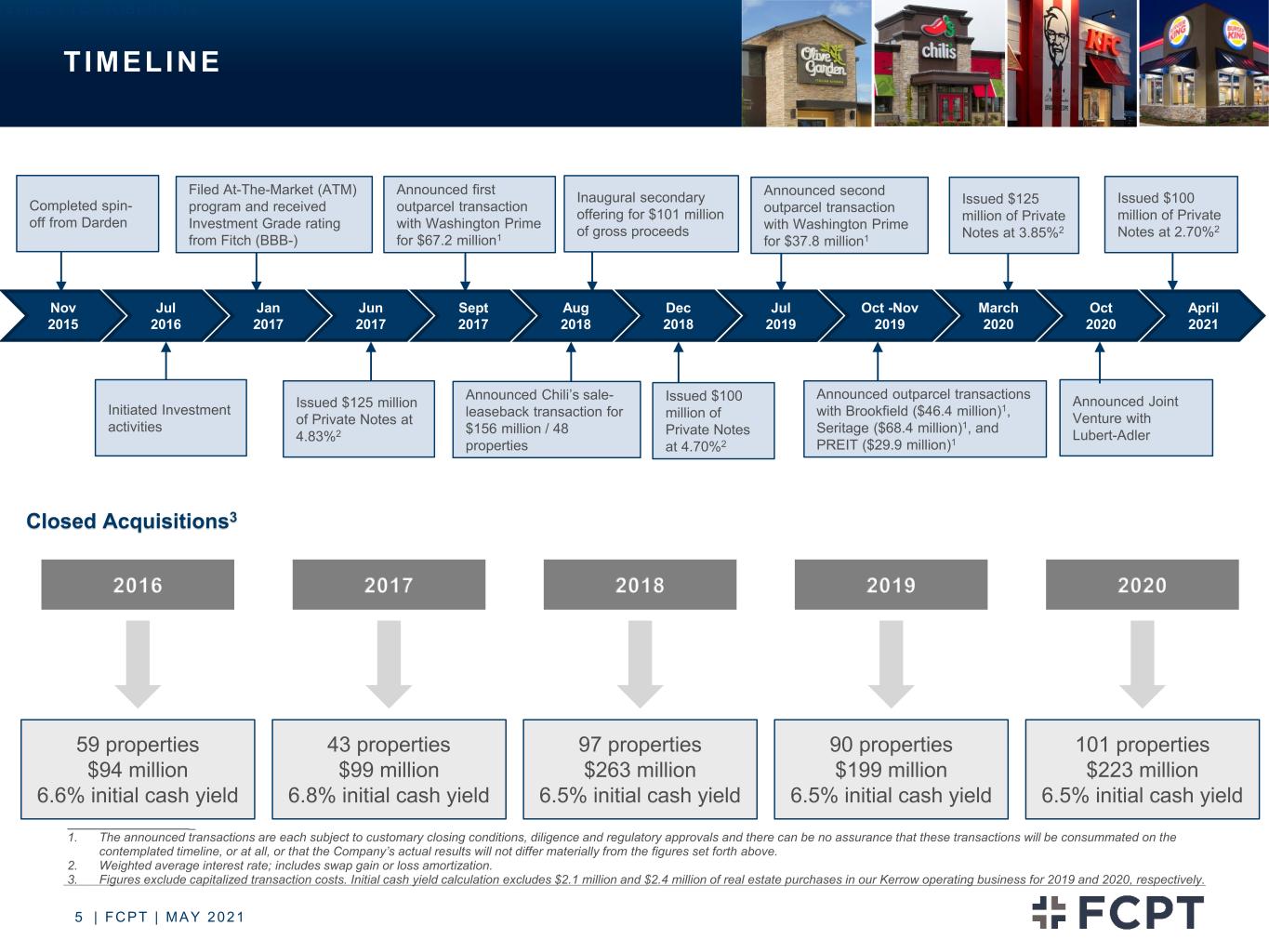

| FCPT | MAY 20215 TIMELINE 5 | FCPT | OCTOBER 2019 Completed spin- off from Darden Filed At-The-Market (ATM) program and received Investment Grade rating from Fitch (BBB-) Announced Joint Venture with Lubert-Adler Inaugural secondary offering for $101 million of gross proceeds Announced second outparcel transaction with Washington Prime for $37.8 million1 _ 1. The announced transactions are each subject to customary closing conditions, diligence and regulatory approvals and there can be no assurance that these transactions will be consummated on the contemplated timeline, or at all, or that the Company’s actual results will not differ materially from the figures set forth above. 2. Weighted average interest rate; includes swap gain or loss amortization. 3. Figures exclude capitalized transaction costs. Initial cash yield calculation excludes $2.1 million and $2.4 million of real estate purchases in our Kerrow operating business for 2019 and 2020, respectively. Closed Acquisitions3 Announced first outparcel transaction with Washington Prime for $67.2 million1 Nov 2015 Oct 2020 Jun 2017 Jan 2017 Aug 2018 March 2020 Oct -Nov 2019 Jul 2019 Jul 2016 Dec 2018 Sept 2017 Issued $125 million of Private Notes at 4.83%2 Initiated Investment activities Issued $100 million of Private Notes at 4.70%2 Issued $125 million of Private Notes at 3.85%2 Announced outparcel transactions with Brookfield ($46.4 million)1, Seritage ($68.4 million)1, and PREIT ($29.9 million)1 Announced Chili’s sale- leaseback transaction for $156 million / 48 properties 2016 2017 2018 2019 2020 59 properties $94 million 6.6% initial cash yield 43 properties $99 million 6.8% initial cash yield 97 properties $263 million 6.5% initial cash yield 90 properties $199 million 6.5% initial cash yield 101 properties $223 million 6.5% initial cash yield April 2021 Issued $100 million of Private Notes at 2.70%2

| FCPT | MAY 20216 ACQUISIT ION GROWTH Annual Cash Base Rent ($ million)1 6 | FCPT | OCTOBER 2019 Number of Properties . 94.4 94.4 94.4 95.9 101.0 102.1 105.2 105.3 108.0 109.4 109.6 120.9 125.6 126.8 129.7 130.9 139.4 142.0 144.1 147.8 156.0 158.2 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 +10% CAGR ___________________ 1. As defined on page 26. +13% CAGR 418 418 418 434 475 484 506 508 515 527 535 591 610 621 642 650 699 722 733 751 799 810 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21

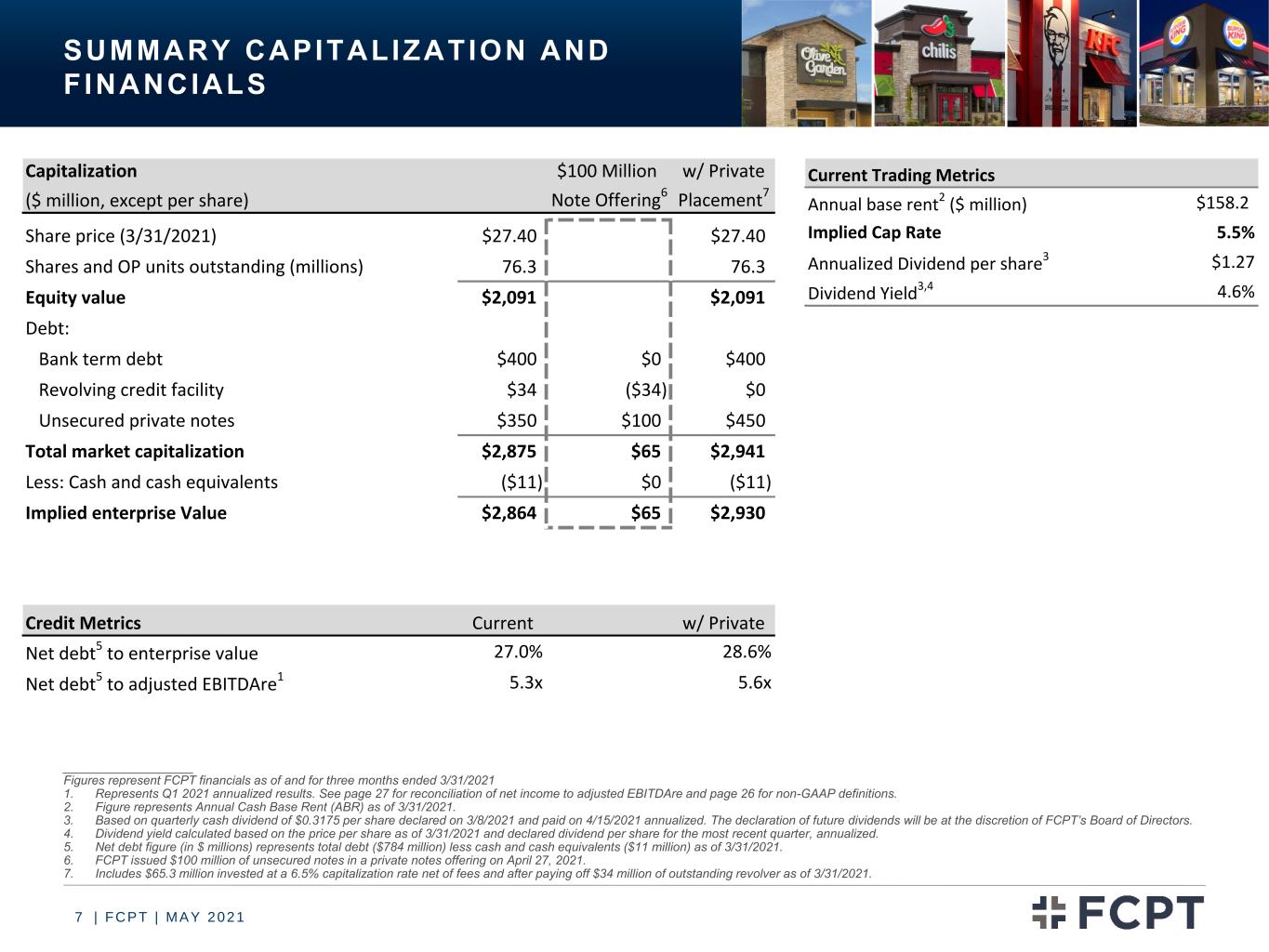

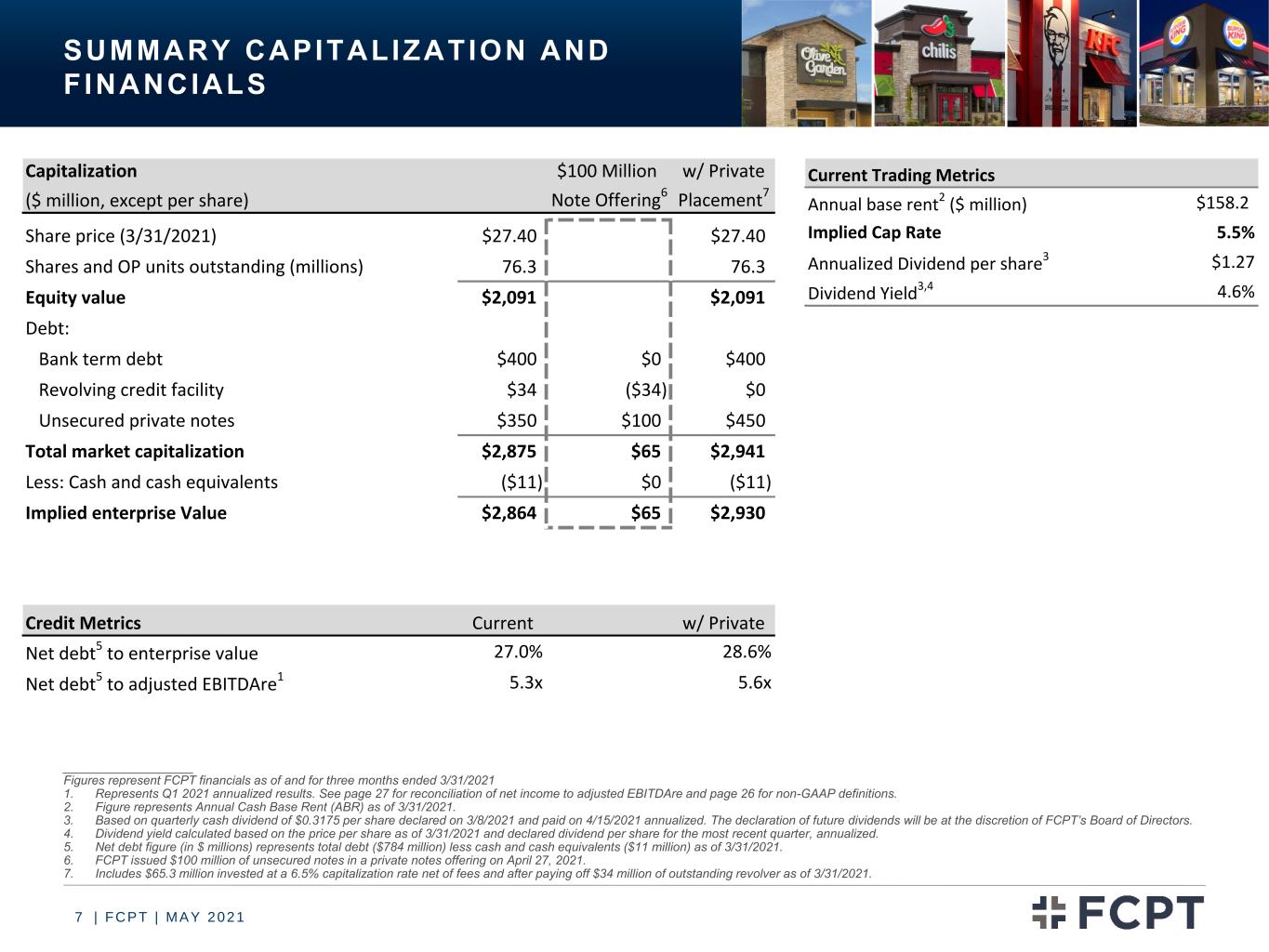

| FCPT | MAY 20217 ___________________ Figures represent FCPT financials as of and for three months ended 3/31/2021 1. Represents Q1 2021 annualized results. See page 27 for reconciliation of net income to adjusted EBITDAre and page 26 for non-GAAP definitions. 2. Figure represents Annual Cash Base Rent (ABR) as of 3/31/2021. 3. Based on quarterly cash dividend of $0.3175 per share declared on 3/8/2021 and paid on 4/15/2021 annualized. The declaration of future dividends will be at the discretion of FCPT’s Board of Directors. 4. Dividend yield calculated based on the price per share as of 3/31/2021 and declared dividend per share for the most recent quarter, annualized. 5. Net debt figure (in $ millions) represents total debt ($784 million) less cash and cash equivalents ($11 million) as of 3/31/2021. 6. FCPT issued $100 million of unsecured notes in a private notes offering on April 27, 2021. 7. Includes $65.3 million invested at a 6.5% capitalization rate net of fees and after paying off $34 million of outstanding revolver as of 3/31/2021. SUMMARY CAPITALIZATION AND FINANCIALS Current Trading Metrics Annual base rent2 ($ million) $158.2 Implied Cap Rate 5.5% Annualized Dividend per share3 $1.27 Dividend Yield3,4 4.6% Capitalization $100 Million w/ Private ($ million, except per share) Note Offering6 Placement7 Share price (3/31/2021) $27.40 $27.40 Shares and OP units outstanding (millions) 76.3 76.3 Equity value $2,091 $2,091 Debt: Bank term debt $400 $0 $400 Revolving credit facility $34 ($34) $0 Unsecured private notes $350 $100 $450 Total market capitalization $2,875 $65 $2,941 Less: Cash and cash equivalents ($11) $0 ($11) Implied enterprise Value $2,864 $65 $2,930 Credit Metrics Current w/ Private Net debt5 to enterprise value 27.0% 28.6% Net debt5 to adjusted EBITDAre1 5.3x 5.6x

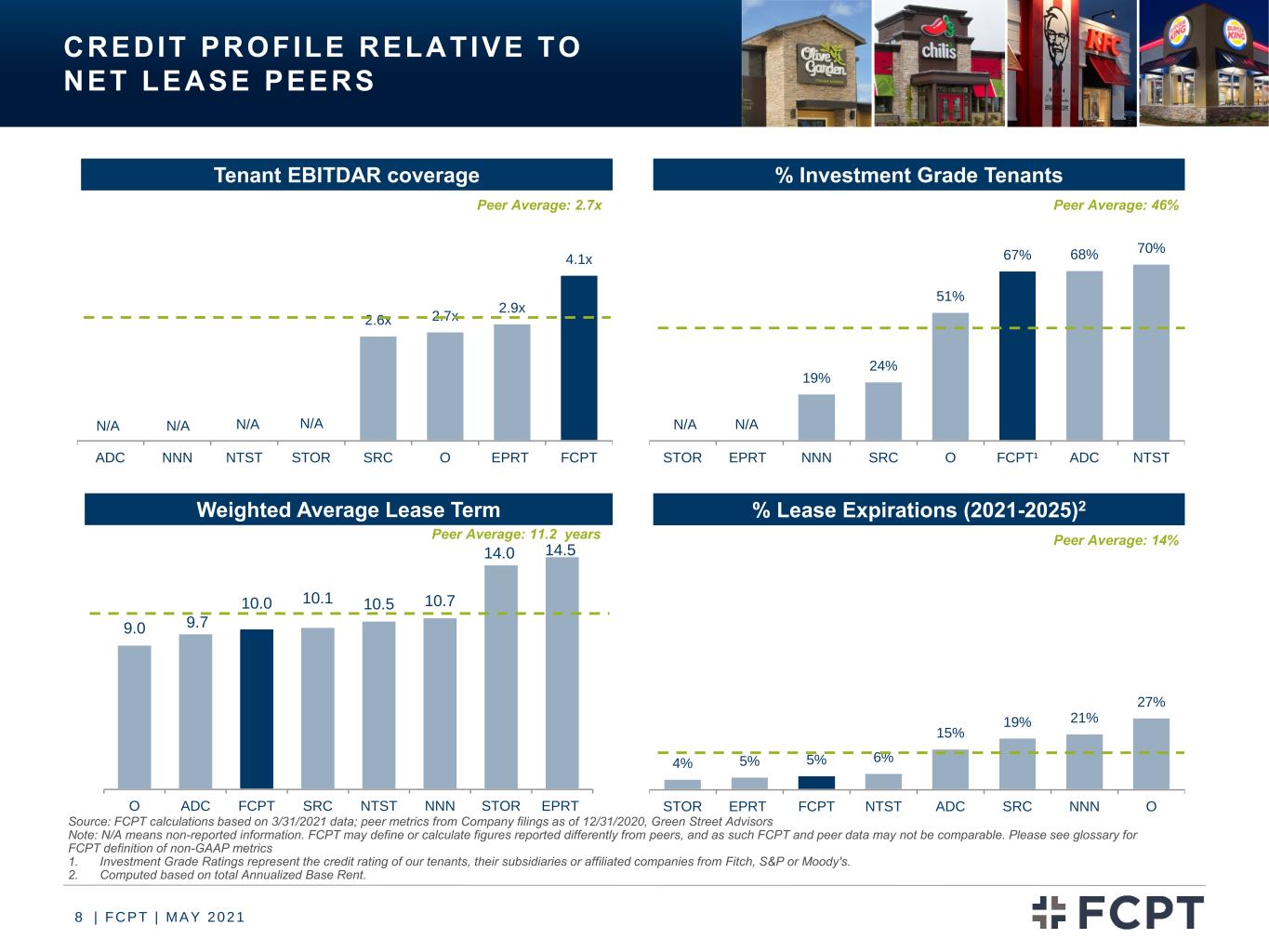

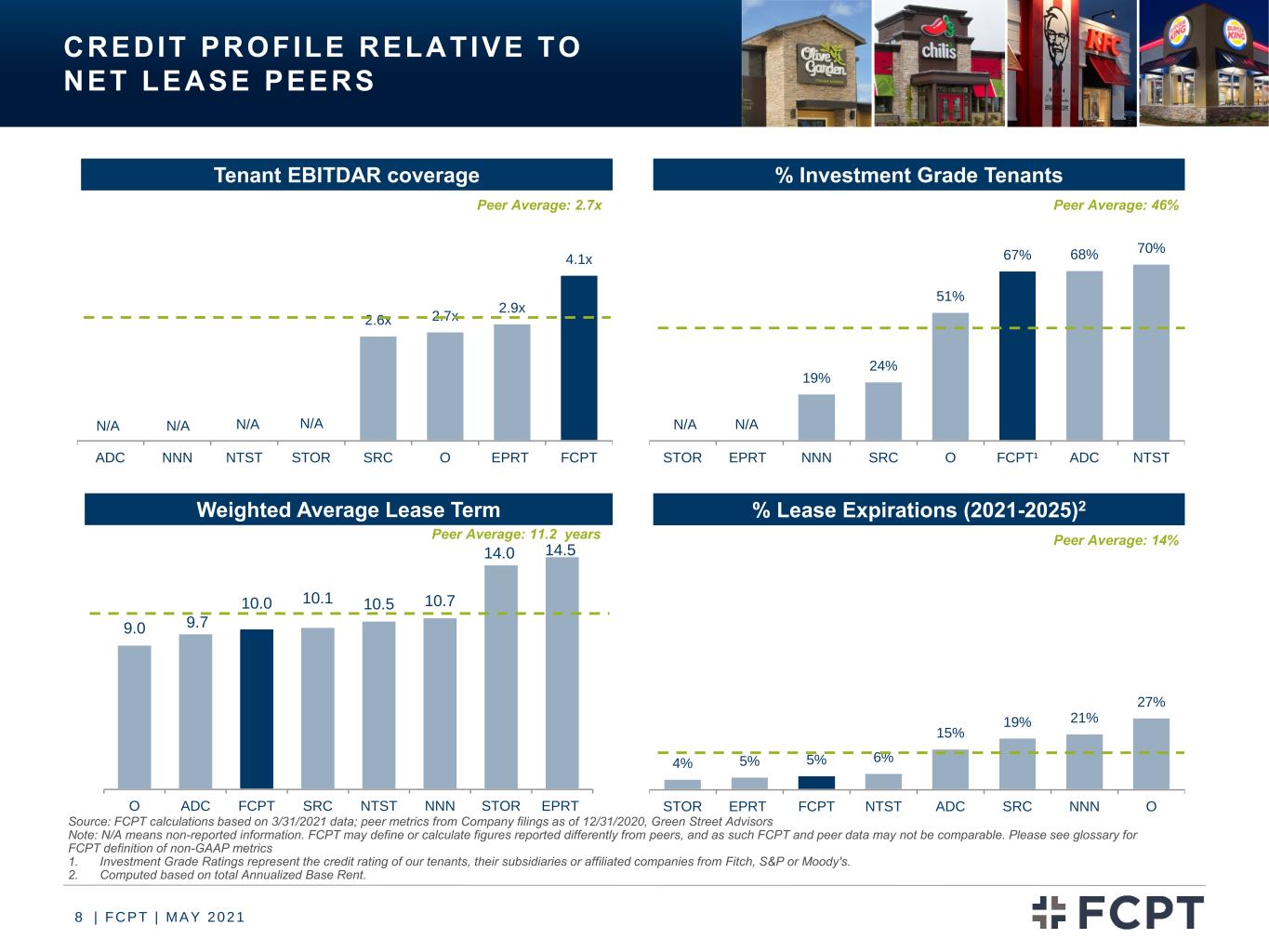

| FCPT | MAY 20218 19% 24% 51% 67% 68% 70% STOR EPRT NNN SRC O FCPT¹ ADC NTST % Investment Grade Tenants Peer Average: 46% CREDIT PROFILE RELATIVE TO NET LEASE PEERS 2.6x 2.7x 2.9x 4.1x ADC NNN NTST STOR SRC O EPRT FCPT Peer Average: 2.7x Tenant EBITDAR coverage Weighted Average Lease Term 9.0 9.7 10.0 10.1 10.5 10.7 14.0 14.5 O ADC FCPT SRC NTST NNN STOR EPRT Peer Average: 11.2 years Source: FCPT calculations based on 3/31/2021 data; peer metrics from Company filings as of 12/31/2020, Green Street Advisors Note: N/A means non-reported information. FCPT may define or calculate figures reported differently from peers, and as such FCPT and peer data may not be comparable. Please see glossary for FCPT definition of non-GAAP metrics 1. Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies from Fitch, S&P or Moody's. 2. Computed based on total Annualized Base Rent. 4% 5% 5% 6% 15% 19% 21% 27% STOR EPRT FCPT NTST ADC SRC NNN O % Lease Expirations (2021-2025)2 Peer Average: 14% N/A N/AN/A N/A N/AN/A

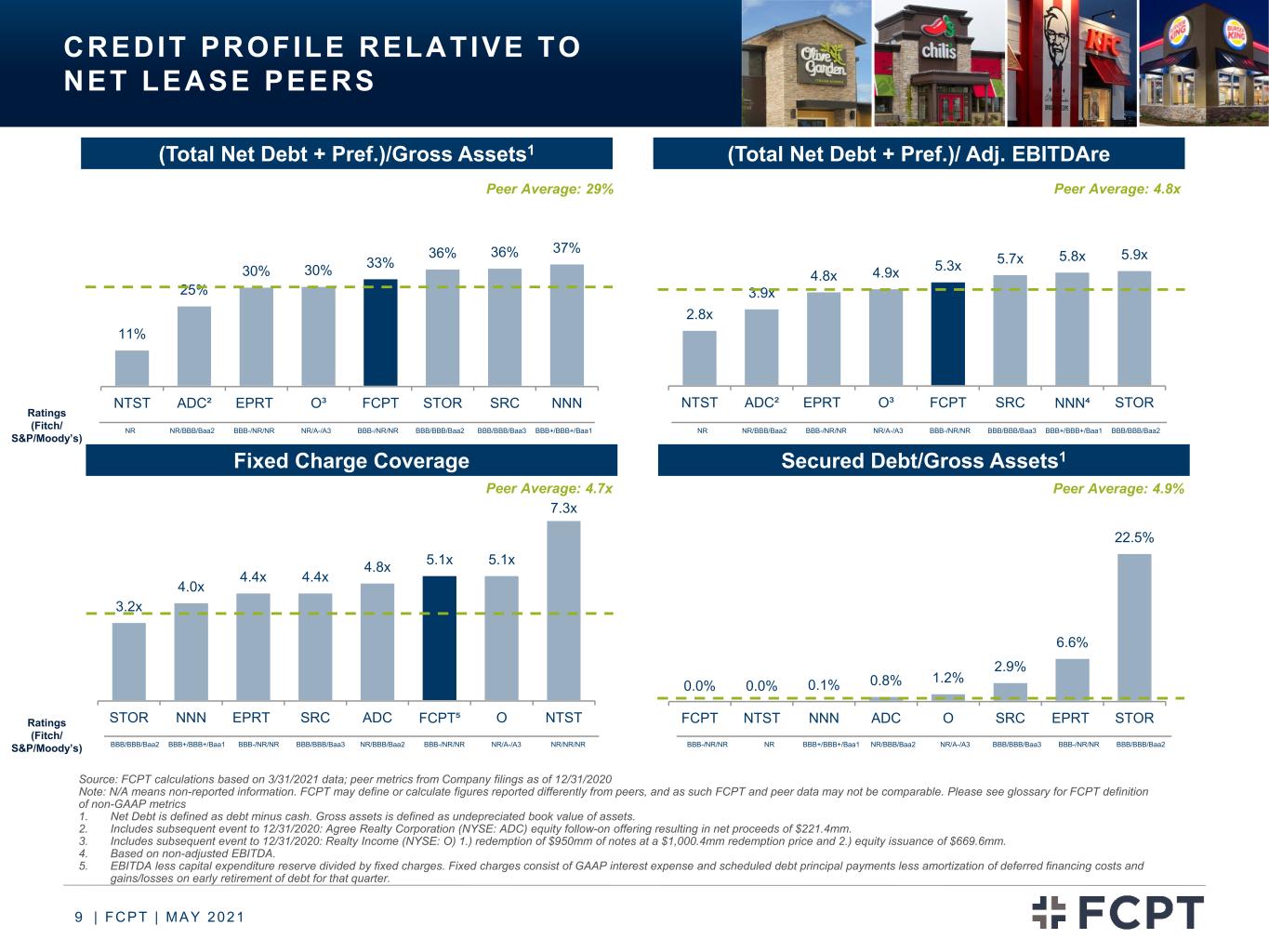

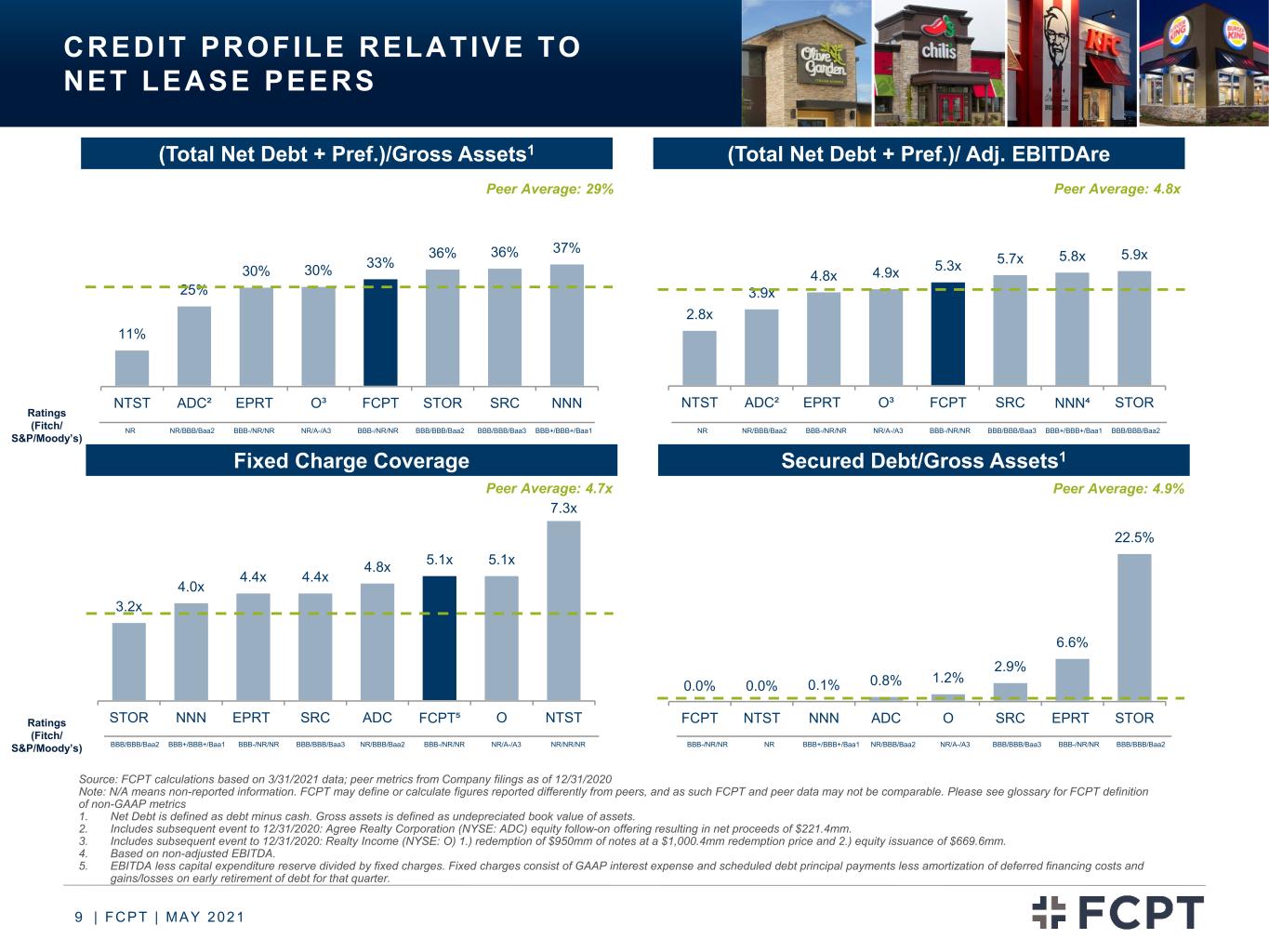

| FCPT | MAY 20219 0.0% 0.0% 0.1% 0.8% 1.2% 2.9% 6.6% 22.5% FCPT NTST NNN ADC O SRC EPRT STOR 3.2x 4.0x 4.4x 4.4x 4.8x 5.1x 5.1x 7.3x STOR NNN EPRT SRC ADC FCPT⁵ O NTST CREDIT PROFILE RELATIVE TO NET LEASE PEERS (Total Net Debt + Pref.)/Gross Assets1 2.8x 3.9x 4.8x 4.9x 5.3x 5.7x 5.8x 5.9x NTST ADC² EPRT O³ FCPT SRC NNN⁴ STOR (Total Net Debt + Pref.)/ Adj. EBITDAre Fixed Charge Coverage Secured Debt/Gross Assets1 Peer Average: 4.8x 11% 25% 30% 30% 33% 36% 36% 37% NTST ADC² EPRT O³ FCPT STOR SRC NNN Peer Average: 29% Peer Average: 4.9% NR NR/BBB/Baa2 BBB-/NR/NR NR/A-/A3 BBB-/NR/NR BBB/BBB/Baa2 BBB/BBB/Baa3 BBB+/BBB+/Baa1 Source: FCPT calculations based on 3/31/2021 data; peer metrics from Company filings as of 12/31/2020 Note: N/A means non-reported information. FCPT may define or calculate figures reported differently from peers, and as such FCPT and peer data may not be comparable. Please see glossary for FCPT definition of non-GAAP metrics 1. Net Debt is defined as debt minus cash. Gross assets is defined as undepreciated book value of assets. 2. Includes subsequent event to 12/31/2020: Agree Realty Corporation (NYSE: ADC) equity follow-on offering resulting in net proceeds of $221.4mm. 3. Includes subsequent event to 12/31/2020: Realty Income (NYSE: O) 1.) redemption of $950mm of notes at a $1,000.4mm redemption price and 2.) equity issuance of $669.6mm. 4. Based on non-adjusted EBITDA. 5. EBITDA less capital expenditure reserve divided by fixed charges. Fixed charges consist of GAAP interest expense and scheduled debt principal payments less amortization of deferred financing costs and gains/losses on early retirement of debt for that quarter. Peer Average: 4.7x Ratings (Fitch/ S&P/Moody’s) Ratings (Fitch/ S&P/Moody’s) BBB/BBB/Baa2 BBB+/BBB+/Baa1 BBB-/NR/NR BBB/BBB/Baa3 NR/BBB/Baa2 BBB-/NR/NR NR/A-/A3 NR/NR/NR NR NR/BBB/Baa2 BBB-/NR/NR NR/A-/A3 BBB-/NR/NR BBB/BBB/Baa3 BBB+/BBB+/Baa1 BBB/BBB/Baa2 BBB-/NR/NR NR BBB+/BBB+/Baa1 NR/BBB/Baa2 NR/A-/A3 BBB/BBB/Baa3 BBB-/NR/NR BBB/BBB/Baa2

| FCPT | MAY 202110 AGENDA Restaurant Industry Update Page 10 Company Overview Page 3 Appendix Page 16

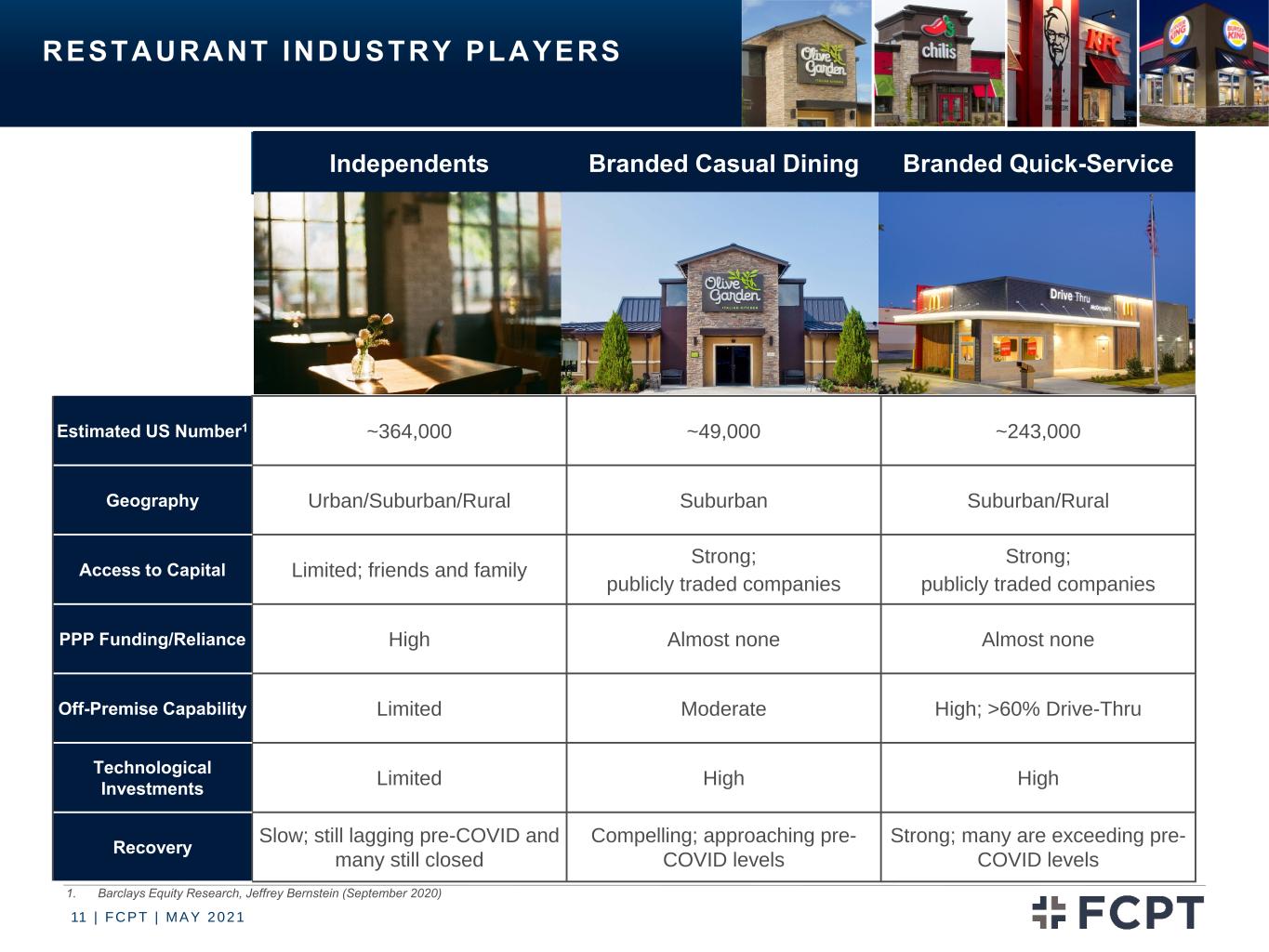

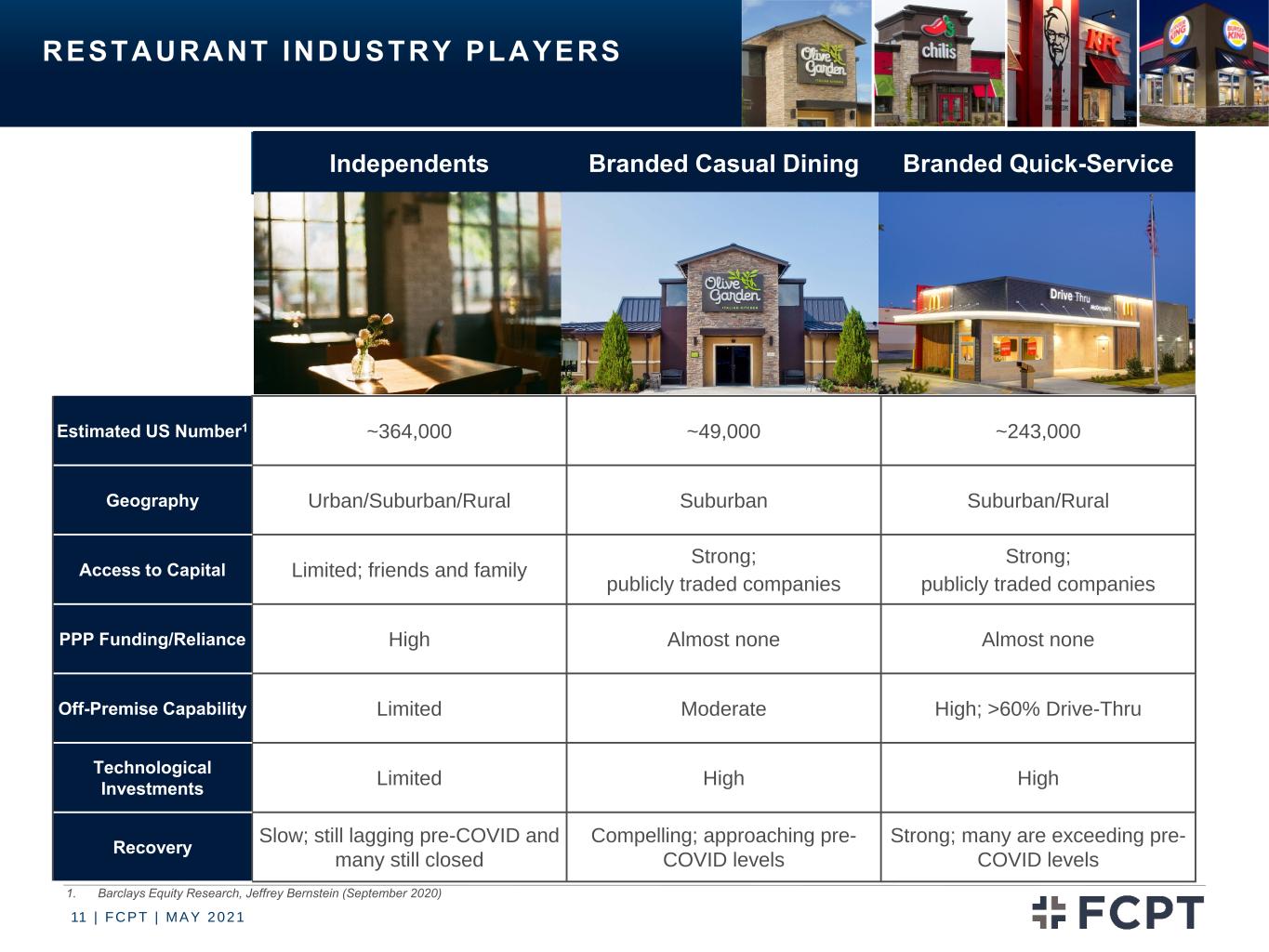

| FCPT | MAY 202111 RESTAURANT INDUSTRY PLAYERS Independents Branded Casual Dining Branded Quick-Service Estimated US Number1 ~364,000 ~49,000 ~243,000 Geography Urban/Suburban/Rural Suburban Suburban/Rural Access to Capital Limited; friends and family Strong; publicly traded companies Strong; publicly traded companies PPP Funding/Reliance High Almost none Almost none Off-Premise Capability Limited Moderate High; >60% Drive-Thru Technological Investments Limited High High Recovery Slow; still lagging pre-COVID and many still closed Compelling; approaching pre- COVID levels Strong; many are exceeding pre- COVID levels 1. Barclays Equity Research, Jeffrey Bernstein (September 2020)

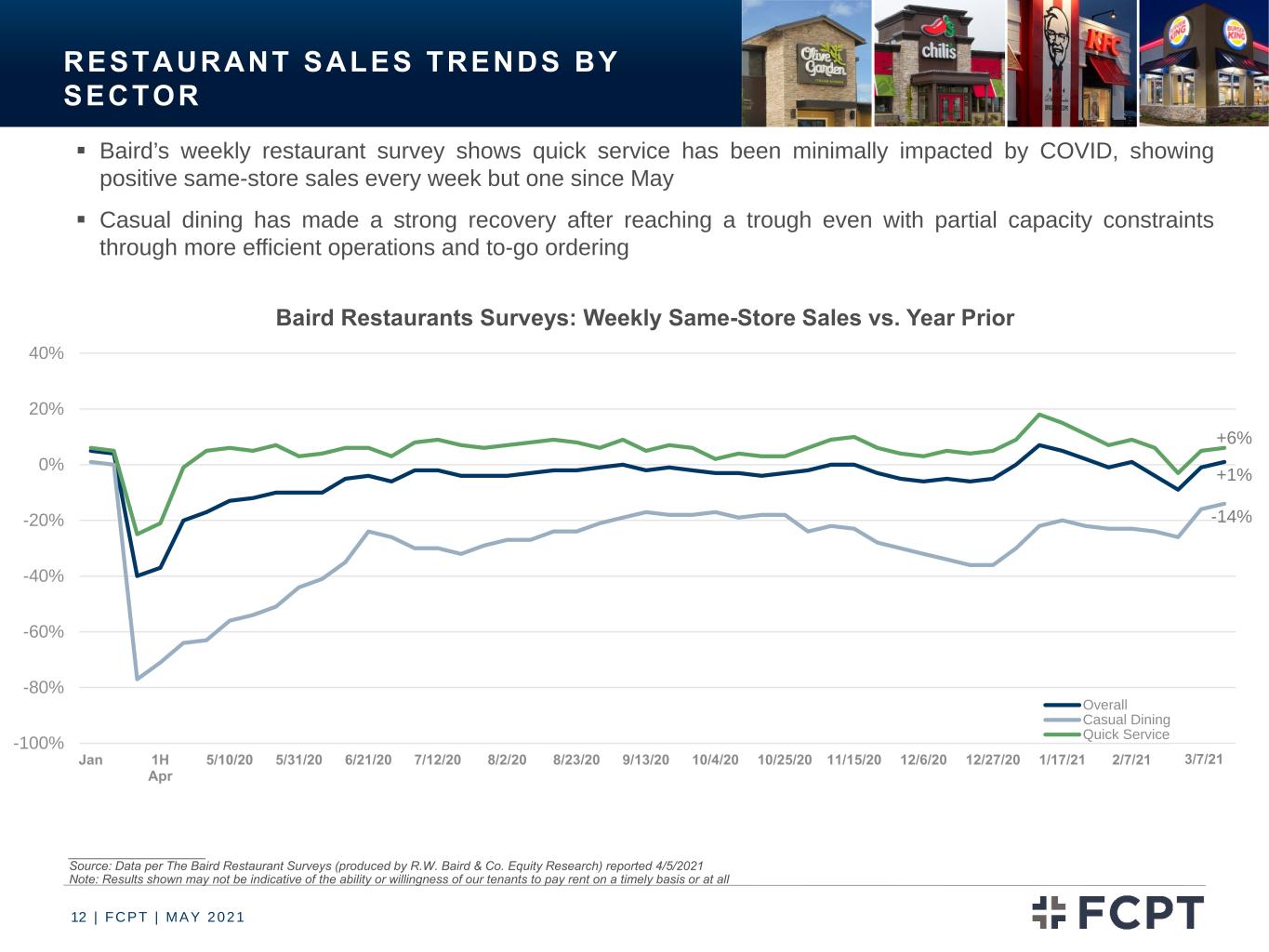

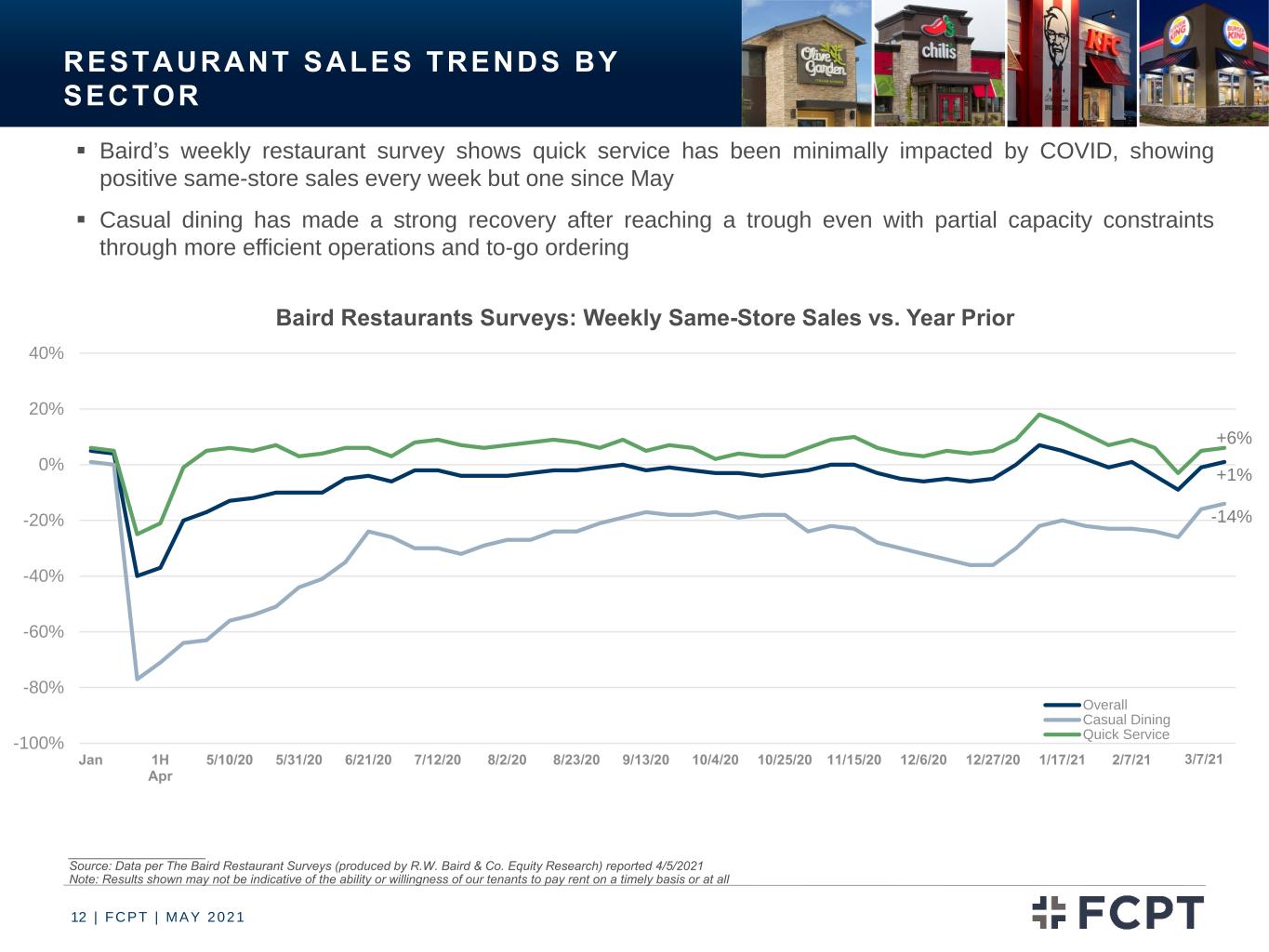

| FCPT | MAY 202112 Baird’s weekly restaurant survey shows quick service has been minimally impacted by COVID, showing positive same-store sales every week but one since May Casual dining has made a strong recovery after reaching a trough even with partial capacity constraints through more efficient operations and to-go ordering Baird Restaurants Surveys: Weekly Same-Store Sales vs. Year Prior ____________________ Source: Data per The Baird Restaurant Surveys (produced by R.W. Baird & Co. Equity Research) reported 4/5/2021 Note: Results shown may not be indicative of the ability or willingness of our tenants to pay rent on a timely basis or at all +1% -14% +6% -100% -80% -60% -40% -20% 0% 20% 40% Jan 1H Apr 5/10/20 5/31/20 6/21/20 7/12/20 8/2/20 8/23/20 9/13/20 10/4/20 10/25/20 11/15/20 12/6/20 12/27/20 1/17/21 2/7/21 2/28/21 Overall Casual Dining Quick Service RESTAURANT SALES TRENDS BY SECTOR 3/7

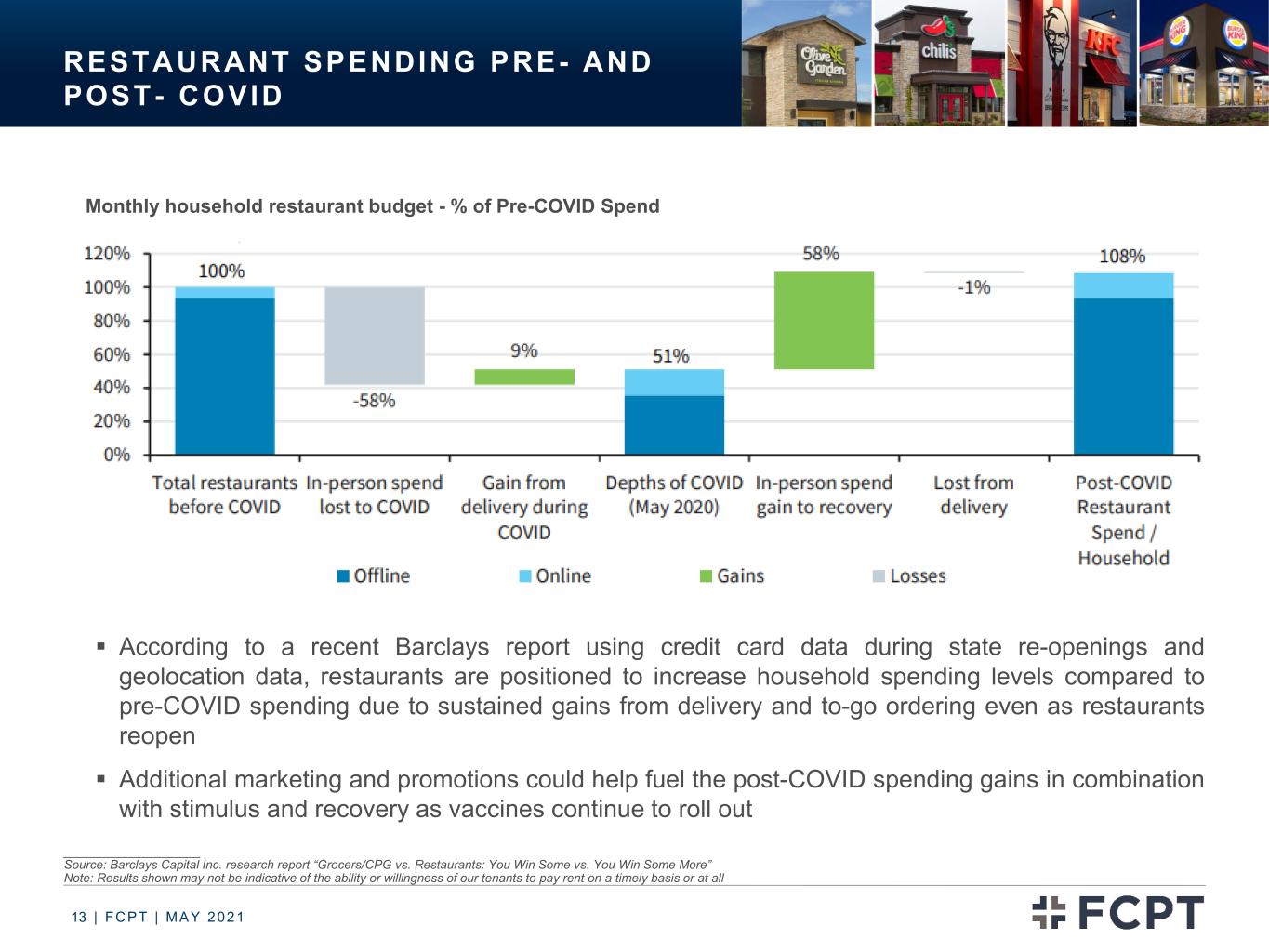

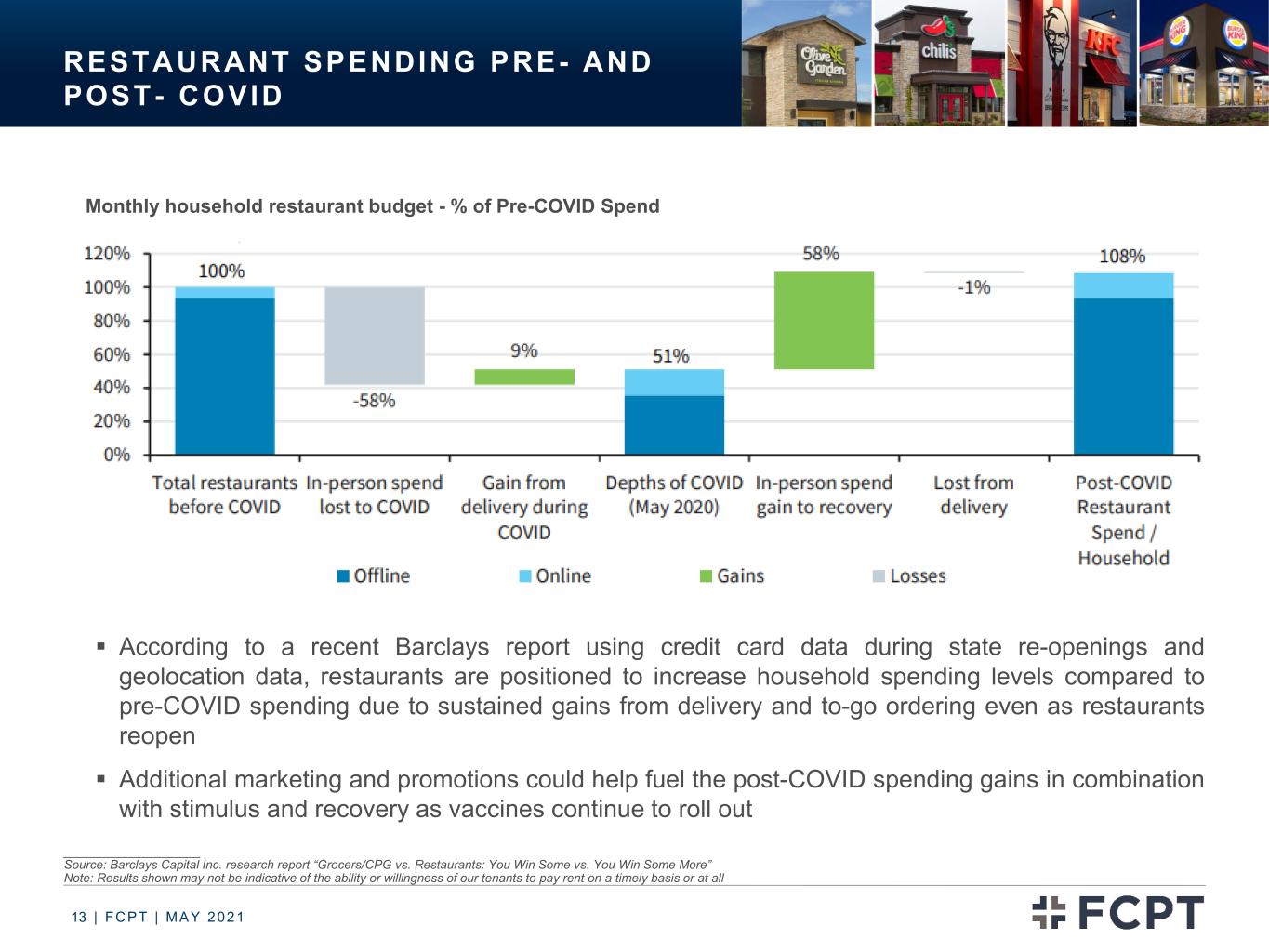

| FCPT | MAY 202113 RESTAURANT SPENDING PRE- AND POST- COVID According to a recent Barclays report using credit card data during state re-openings and geolocation data, restaurants are positioned to increase household spending levels compared to pre-COVID spending due to sustained gains from delivery and to-go ordering even as restaurants reopen Additional marketing and promotions could help fuel the post-COVID spending gains in combination with stimulus and recovery as vaccines continue to roll out Monthly household restaurant budget - % of Pre-COVID Spend ____________________ Source: Barclays Capital Inc. research report “Grocers/CPG vs. Restaurants: You Win Some vs. You Win Some More” Note: Results shown may not be indicative of the ability or willingness of our tenants to pay rent on a timely basis or at all

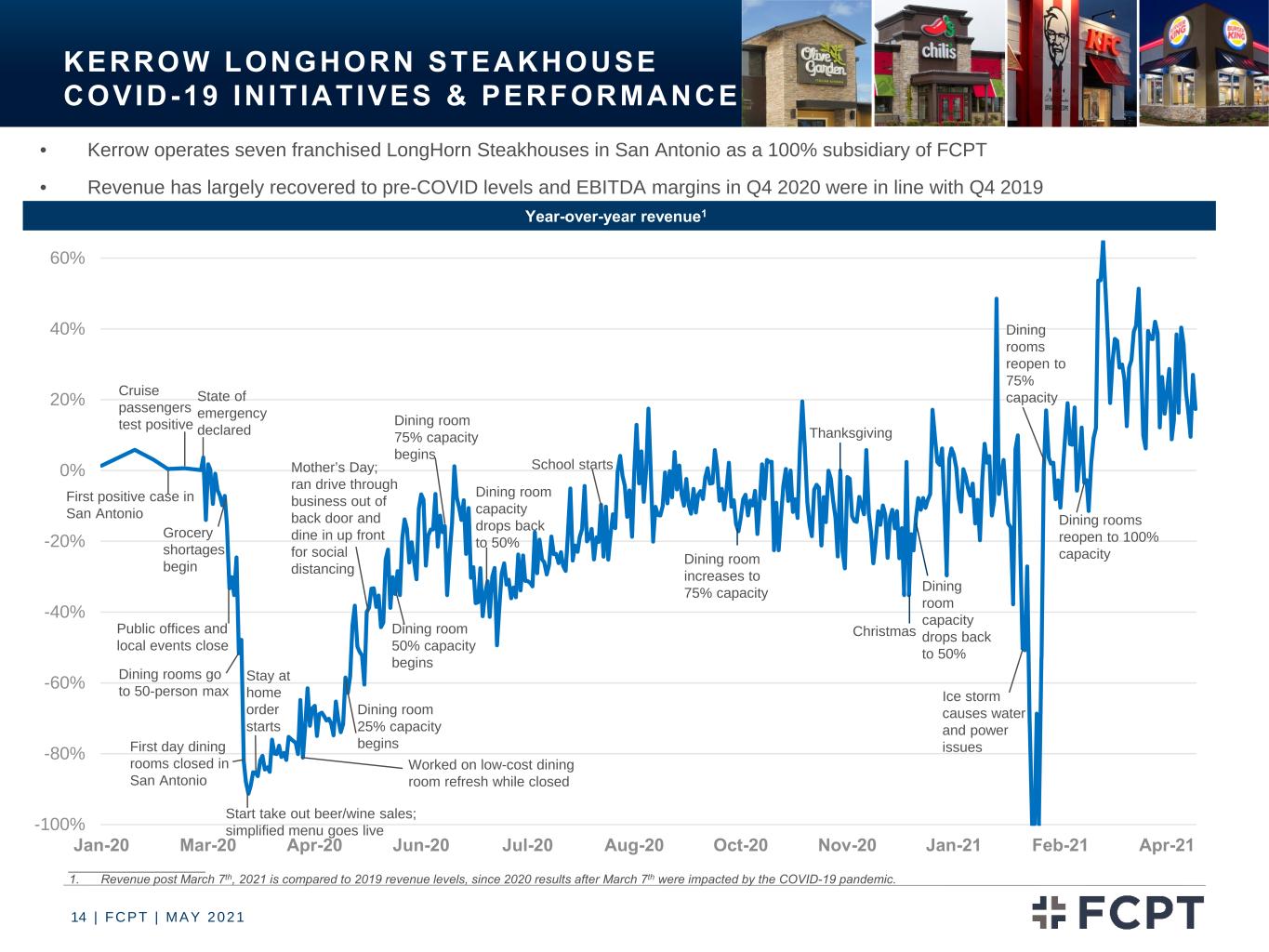

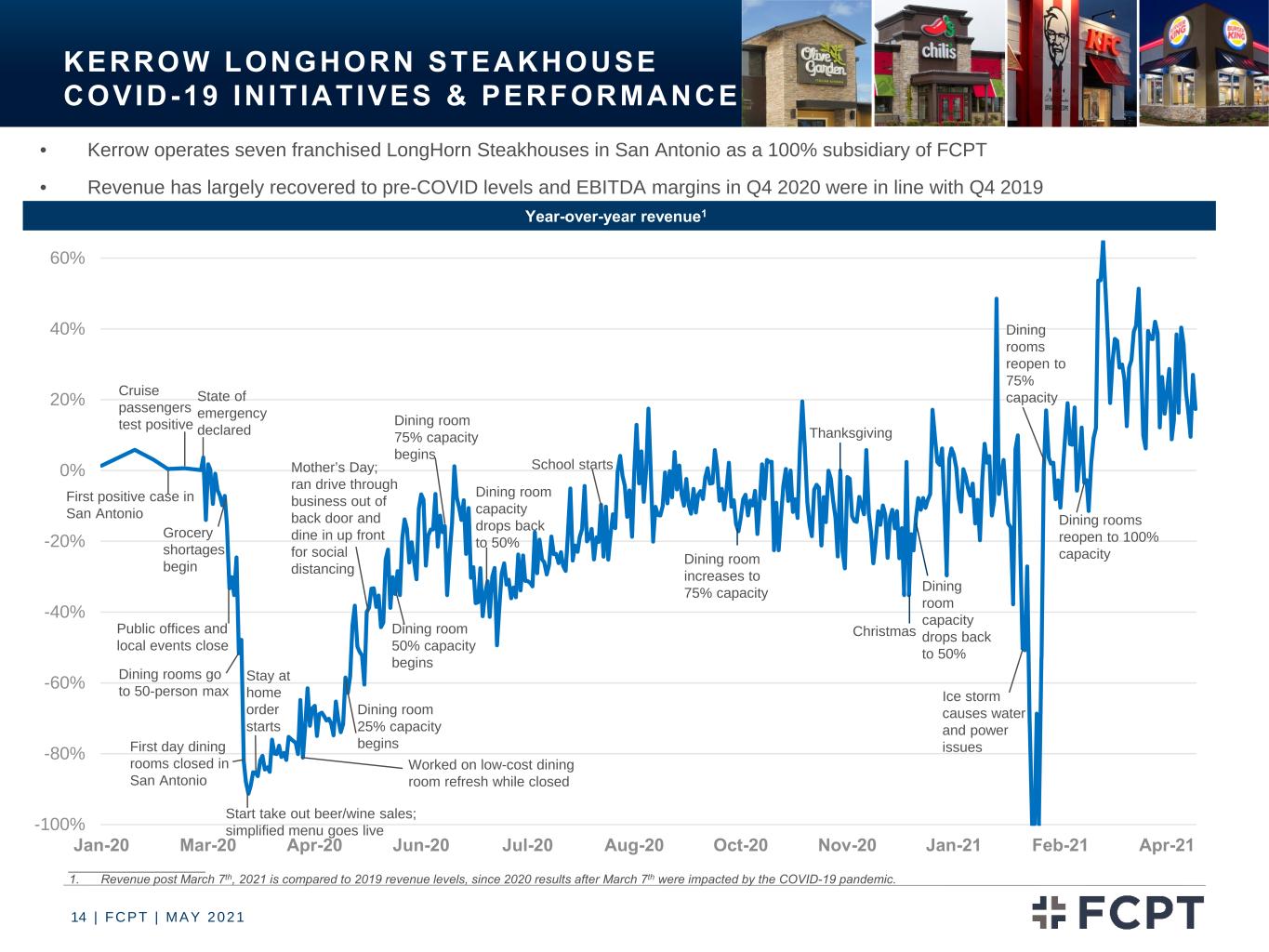

| FCPT | MAY 202114 -100% -80% -60% -40% -20% 0% 20% 40% 60% Jan-20 Mar-20 Apr-20 Jun-20 Jul-20 Aug-20 Oct-20 Nov-20 Jan-21 Feb-21 Apr-21 State of emergency declared Christmas Grocery shortages begin • Kerrow operates seven franchised LongHorn Steakhouses in San Antonio as a 100% subsidiary of FCPT • Revenue has largely recovered to pre-COVID levels and EBITDA margins in Q4 2020 were in line with Q4 2019 Dining rooms go to 50-person max Cruise passengers test positive School starts Start take out beer/wine sales; simplified menu goes live First day dining rooms closed in San Antonio Stay at home order starts Ice storm causes water and power issues Public offices and local events close Mother’s Day; ran drive through business out of back door and dine in up front for social distancing KERROW LONGHORN STEAKHOUSE COVID-19 IN IT IATIVES & PERFORMANCE First positive case in San Antonio Dining rooms reopen to 100% capacity Dining room 25% capacity begins Dining room 50% capacity begins Worked on low-cost dining room refresh while closed Year-over-year revenue1 Dining room 75% capacity begins Dining room capacity drops back to 50% Thanksgiving Dining room increases to 75% capacity Dining room capacity drops back to 50% Dining rooms reopen to 75% capacity ____________________ 1. Revenue post March 7th, 2021 is compared to 2019 revenue levels, since 2020 results after March 7th were impacted by the COVID-19 pandemic.

| FCPT | MAY 202115 MAINTAINING ACQUISIT ION PHILOSOPHY AND CRITERIA Acquisition Philosophy • Acquire strong restaurants and retail brands that are well located with creditworthy lease guarantors • Purchase assets only when accretive to cost of capital with a focus on low basis • Focused on adding concepts that are category-leaders in resilient industries—only leading brands and no theaters, fitness, or entertainment in FCPT’s portfolio or pipeline Underwriting Criteria • Acquisition criteria is approximately split 50% / 50% between credit and real estate metrics based on FCPT’s proprietary scorecard • The “score” allows FCPT to have an objective underwriting model and comparison tool for asset management as well Real Estate Criteria (~50%): − Location − Retail corridor strength and demographics − Access/visibility − Absolute and market rent − Pad site and building reusability Credit Criteria (~50%): − Guarantor credit and fitness − Brand durability − Store performance − Lease term − Lease structure

| FCPT | MAY 202116 AGENDA Appendix Page 16 Restaurant Industry Update Page 10 Company Overview Page 3

| FCPT | MAY 202117 Purpose: FCPT and Lubert-Adler will opportunistically bid, acquire and re-lease vacant restaurant properties in attractive retail corridors. The partnership will leverage existing tenant relationships and appropriate rent setting to create highly attractive and marketable net lease properties Commitment: The total commitment of up to $150 million will be jointly funded by Lubert-Adler ($130 million / 87%) and FCPT ($20 million / 13%) Take-Out: FCPT will have a right of first refusal to acquire Lubert-Adler’s stake in stabilized properties, creating a new source of future acquisition volume for our core business in those cases where market pricing matches our return thresholds In-depth knowledge of restaurant real estate Strong tenant relationships with top operators in casual dining and quick service industry Proven expertise in sustainable rent setting and property selection Industry sharpshooter in restaurant and retail underwriting Natural take-out option for stabilized properties Strong track record of re-leasing vacant properties including Toys “R” Us and ShopKo Key investor in Albertson’s Re-leased ~170 million square feet to date Tenant relationships developed through past grocery-anchored outparcel strategies Extensive ground presence for deal sourcing and investment decisions STRATEGIC JOINT VENTURE THE PARTNERSHIP

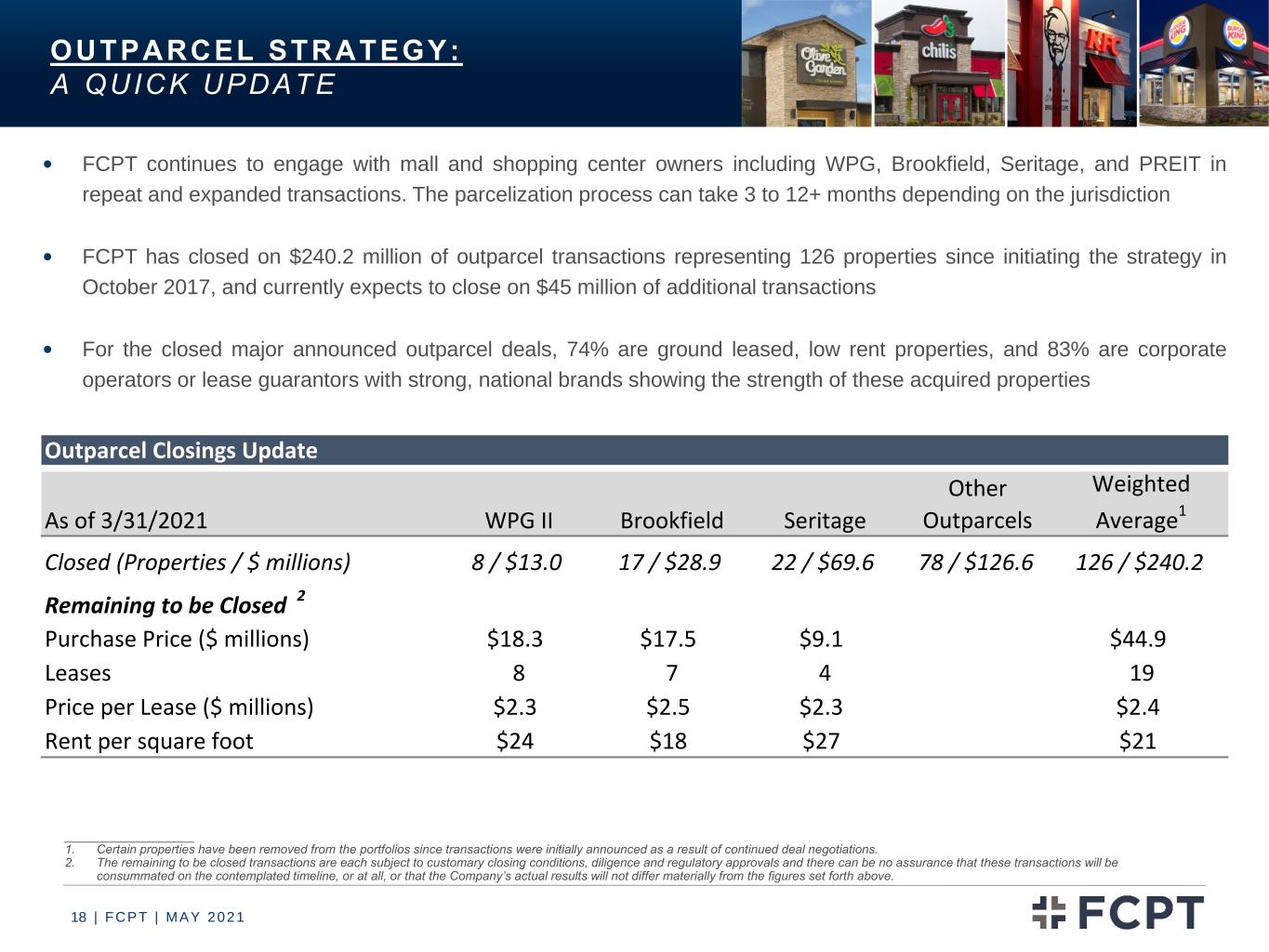

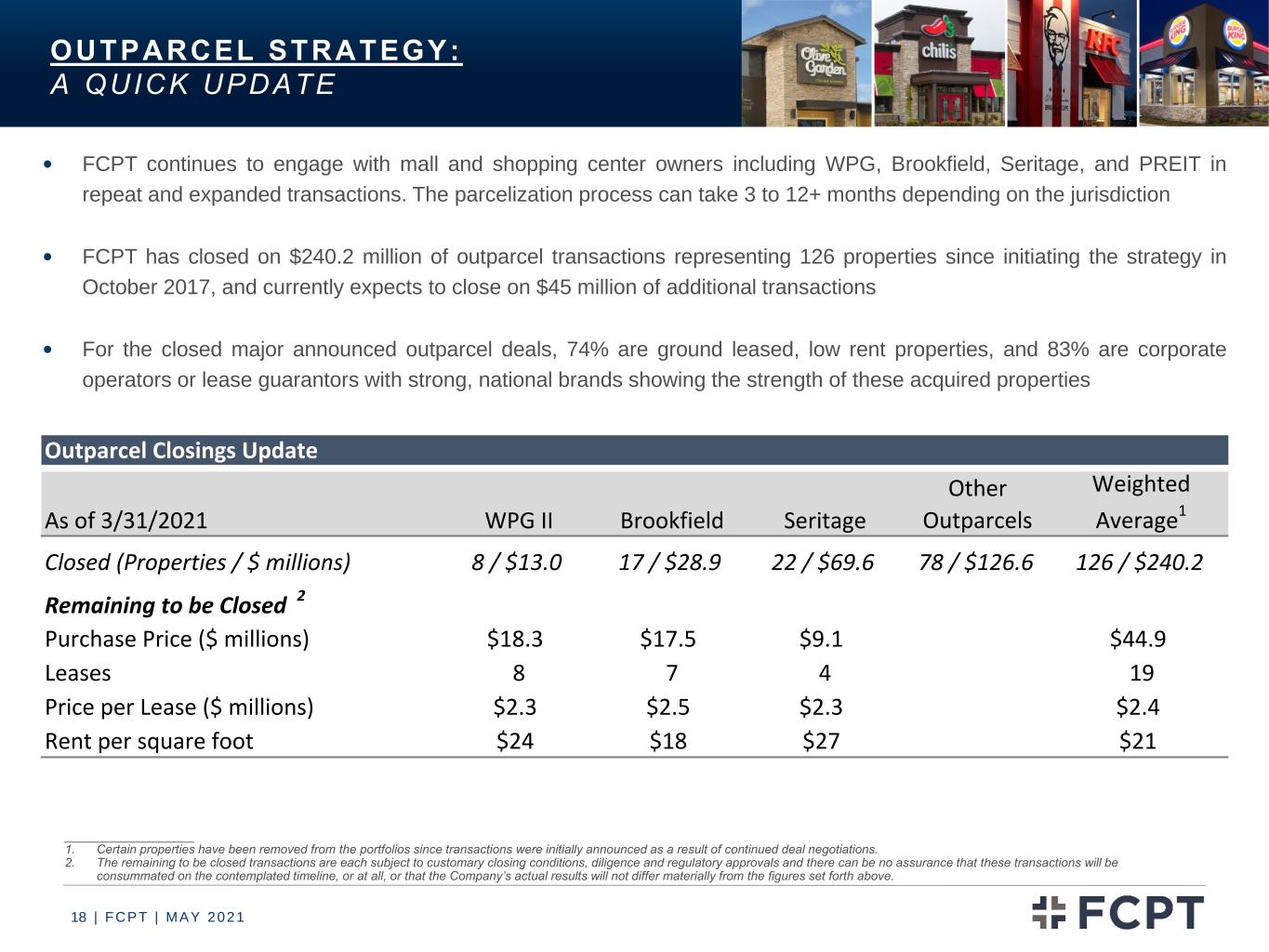

| FCPT | MAY 202118 OUTPARCEL STRATEGY: A QUICK UPDATE ___________________ 1. Certain properties have been removed from the portfolios since transactions were initially announced as a result of continued deal negotiations. 2. The remaining to be closed transactions are each subject to customary closing conditions, diligence and regulatory approvals and there can be no assurance that these transactions will be consummated on the contemplated timeline, or at all, or that the Company’s actual results will not differ materially from the figures set forth above. FCPT continues to engage with mall and shopping center owners including WPG, Brookfield, Seritage, and PREIT in repeat and expanded transactions. The parcelization process can take 3 to 12+ months depending on the jurisdiction FCPT has closed on $240.2 million of outparcel transactions representing 126 properties since initiating the strategy in October 2017, and currently expects to close on $45 million of additional transactions For the closed major announced outparcel deals, 74% are ground leased, low rent properties, and 83% are corporate operators or lease guarantors with strong, national brands showing the strength of these acquired properties Outparcel Closings Update As of 3/31/2021 WPG II Brookfield Seritage Other Outparcels Weighted Average1 Closed (Properties / $ millions) 8 / $13.0 17 / $28.9 22 / $69.6 78 / $126.6 126 / $240.2 Remaining to be Closed 2 Purchase Price ($ millions) $18.3 $17.5 $9.1 $44.9 Leases 8 7 4 19 Price per Lease ($ millions) $2.3 $2.5 $2.3 $2.4 Rent per square foot $24 $18 $27 $21

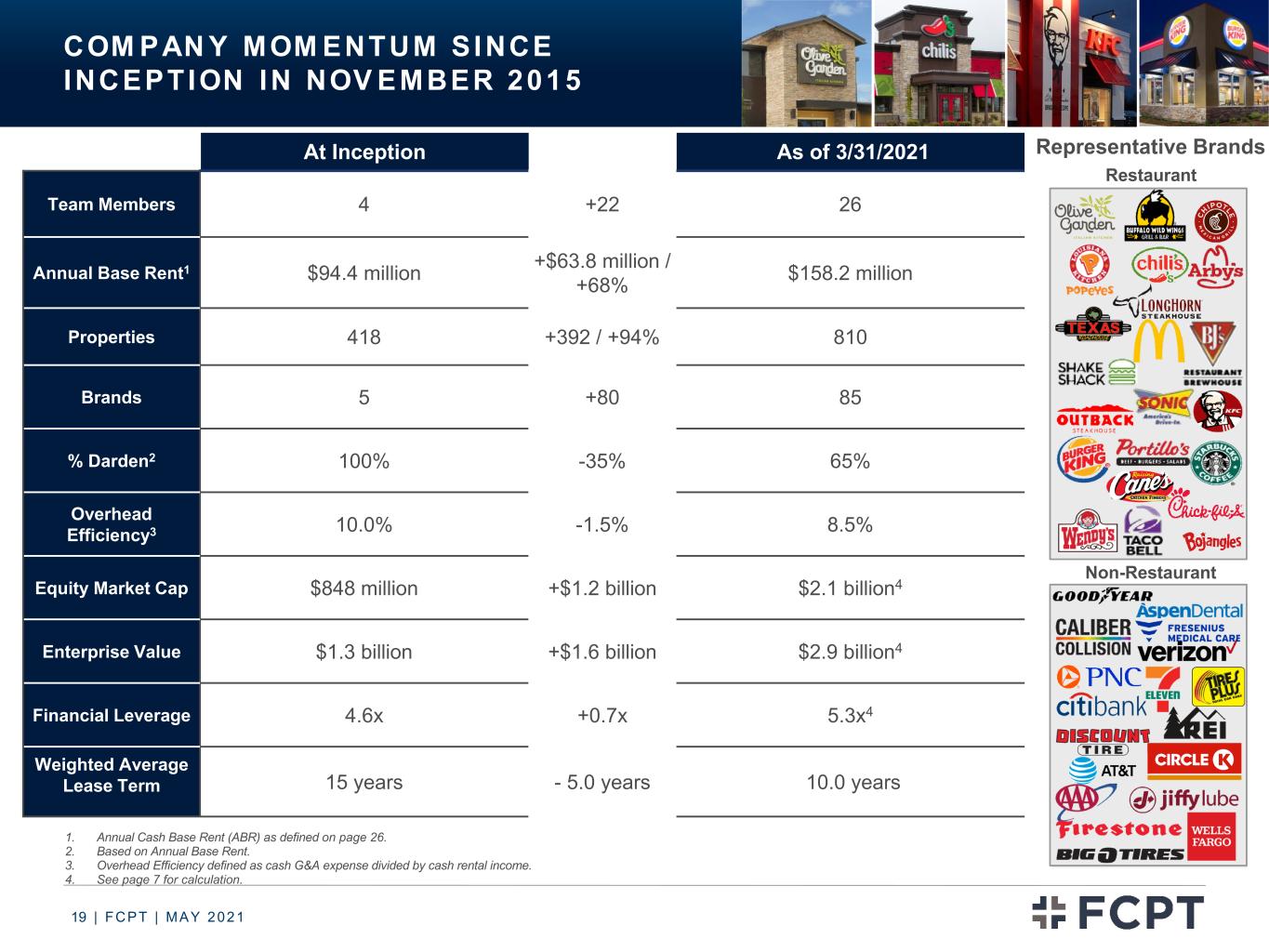

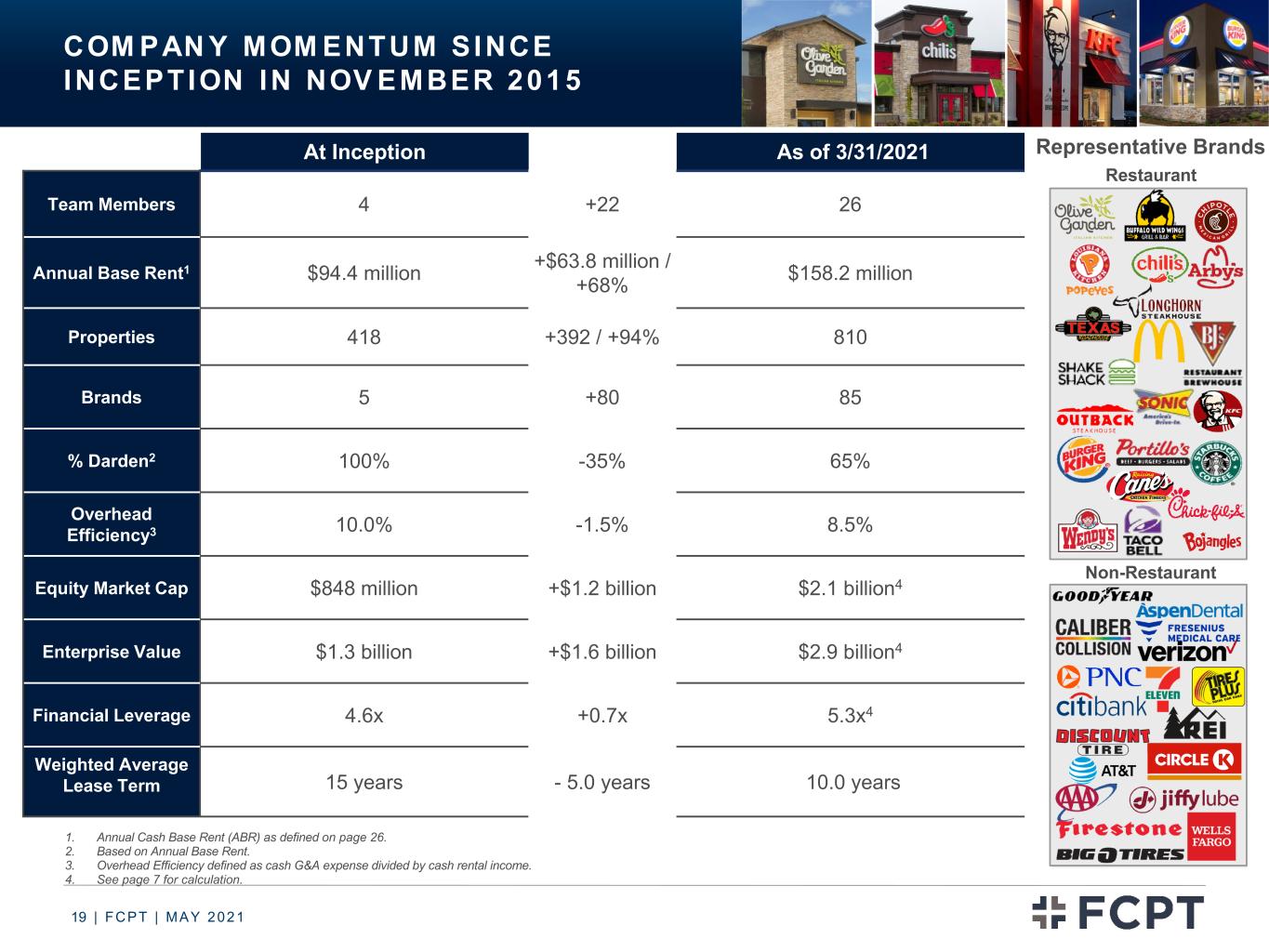

| FCPT | MAY 202119 COM PAN Y MOM ENTUM SINCE INCEPTION IN NOV EMBER 2015 Team Members 4 +22 26 Annual Base Rent1 $94.4 million +$63.8 million / +68% $158.2 million Properties 418 +392 / +94% 810 Brands 5 +80 85 % Darden2 100% -35% 65% Overhead Efficiency3 10.0% -1.5% 8.5% Equity Market Cap $848 million +$1.2 billion $2.1 billion4 Enterprise Value $1.3 billion +$1.6 billion $2.9 billion4 Financial Leverage 4.6x +0.7x 5.3x4 Weighted Average Lease Term 15 years - 5.0 years 10.0 years As of 3/31/2021 1. Annual Cash Base Rent (ABR) as defined on page 26. 2. Based on Annual Base Rent. 3. Overhead Efficiency defined as cash G&A expense divided by cash rental income. 4. See page 7 for calculation. Restaurant Non-Restaurant At Inception Representative Brands

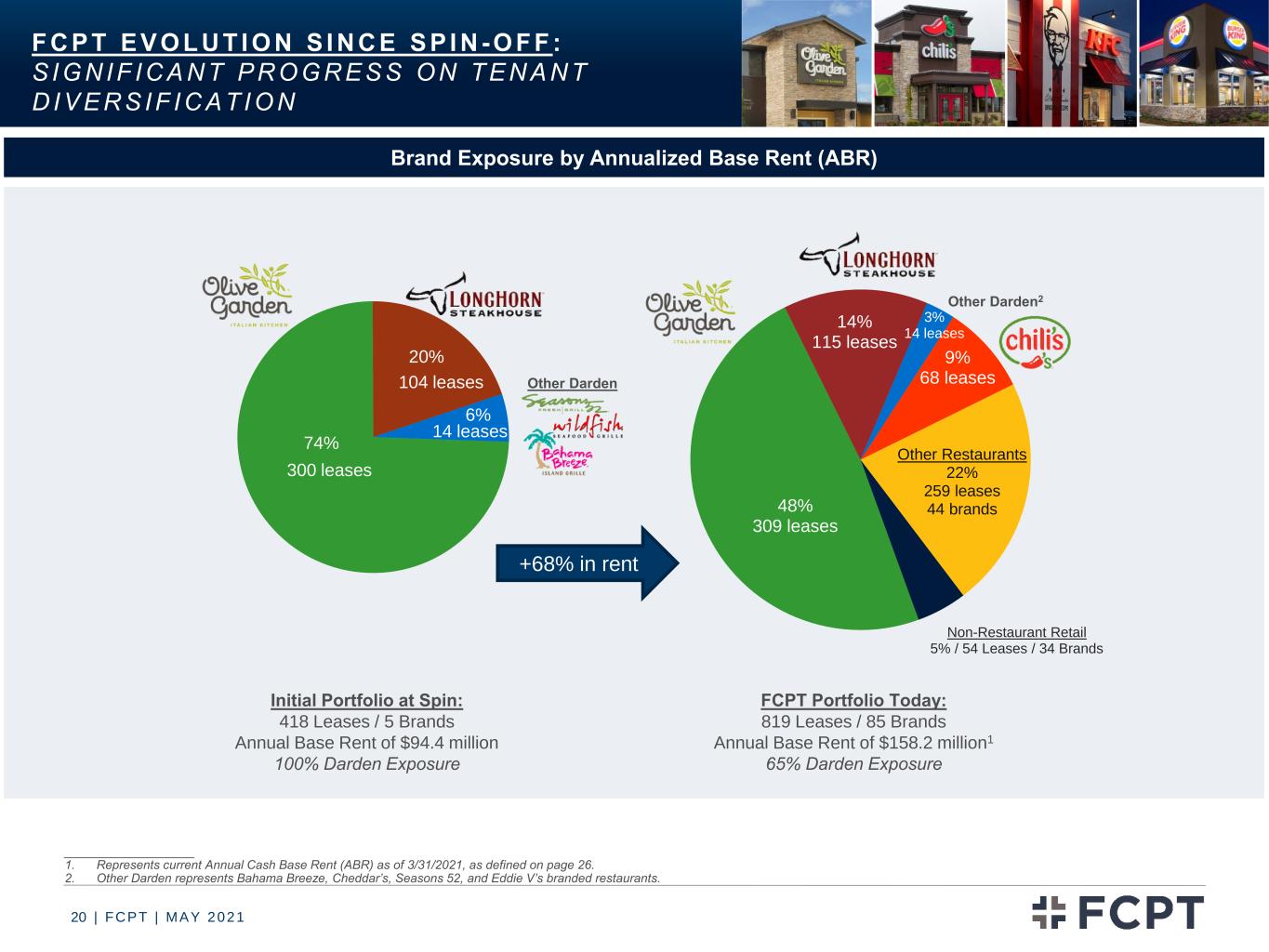

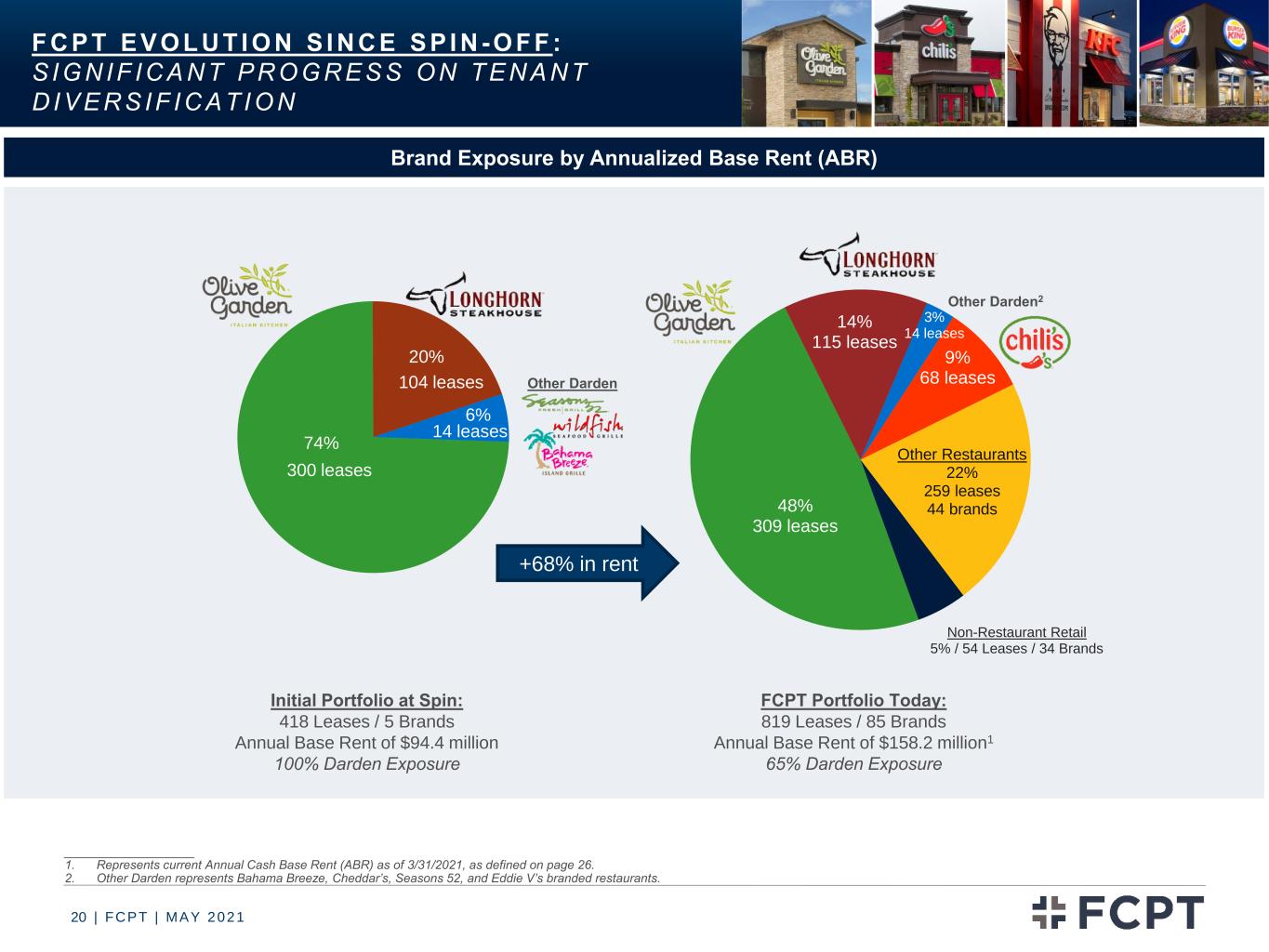

| FCPT | MAY 202120 F C P T E V O L U T I O N S I N C E S P I N - O F F : S I G N I F I C A N T P R O G R E S S O N T E N A N T D I V E R S I F I C A T I O N ___________________ 1. Represents current Annual Cash Base Rent (ABR) as of 3/31/2021, as defined on page 26. 2. Other Darden represents Bahama Breeze, Cheddar’s, Seasons 52, and Eddie V’s branded restaurants. 74% 20% 6% Initial Portfolio at Spin: 418 Leases / 5 Brands Annual Base Rent of $94.4 million 100% Darden Exposure 104 leases 300 leases 14 leases FCPT Portfolio Today: 819 Leases / 85 Brands Annual Base Rent of $158.2 million1 65% Darden Exposure +68% in rent 48% 309 leases 14% 115 leases 3% 14 leases 9% 68 leases Other Restaurants 22% 259 leases 44 brands Non-Restaurant Retail 5% / 54 Leases / 34 Brands Other Darden2 Other Darden Brand Exposure by Annualized Base Rent (ABR)

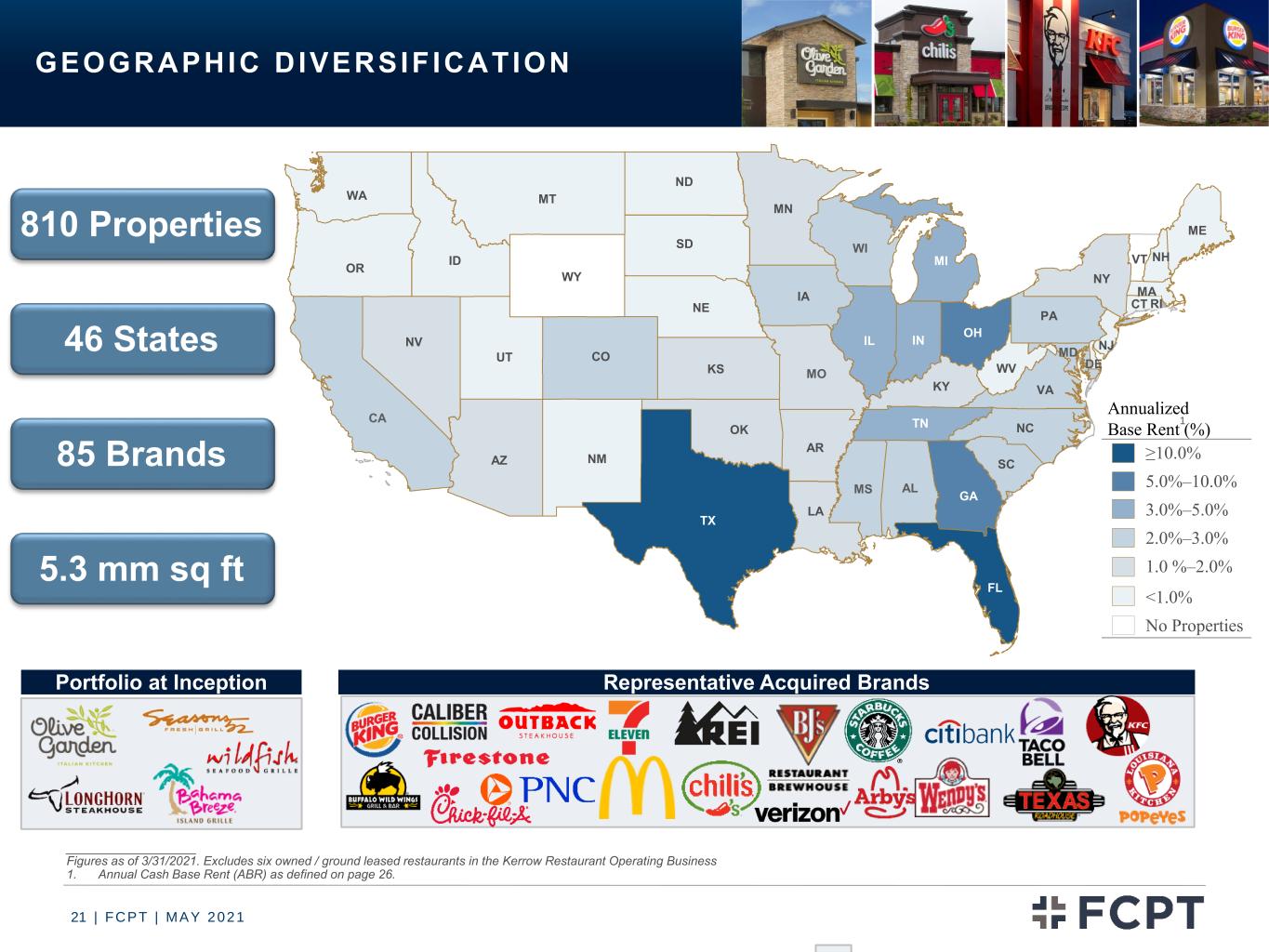

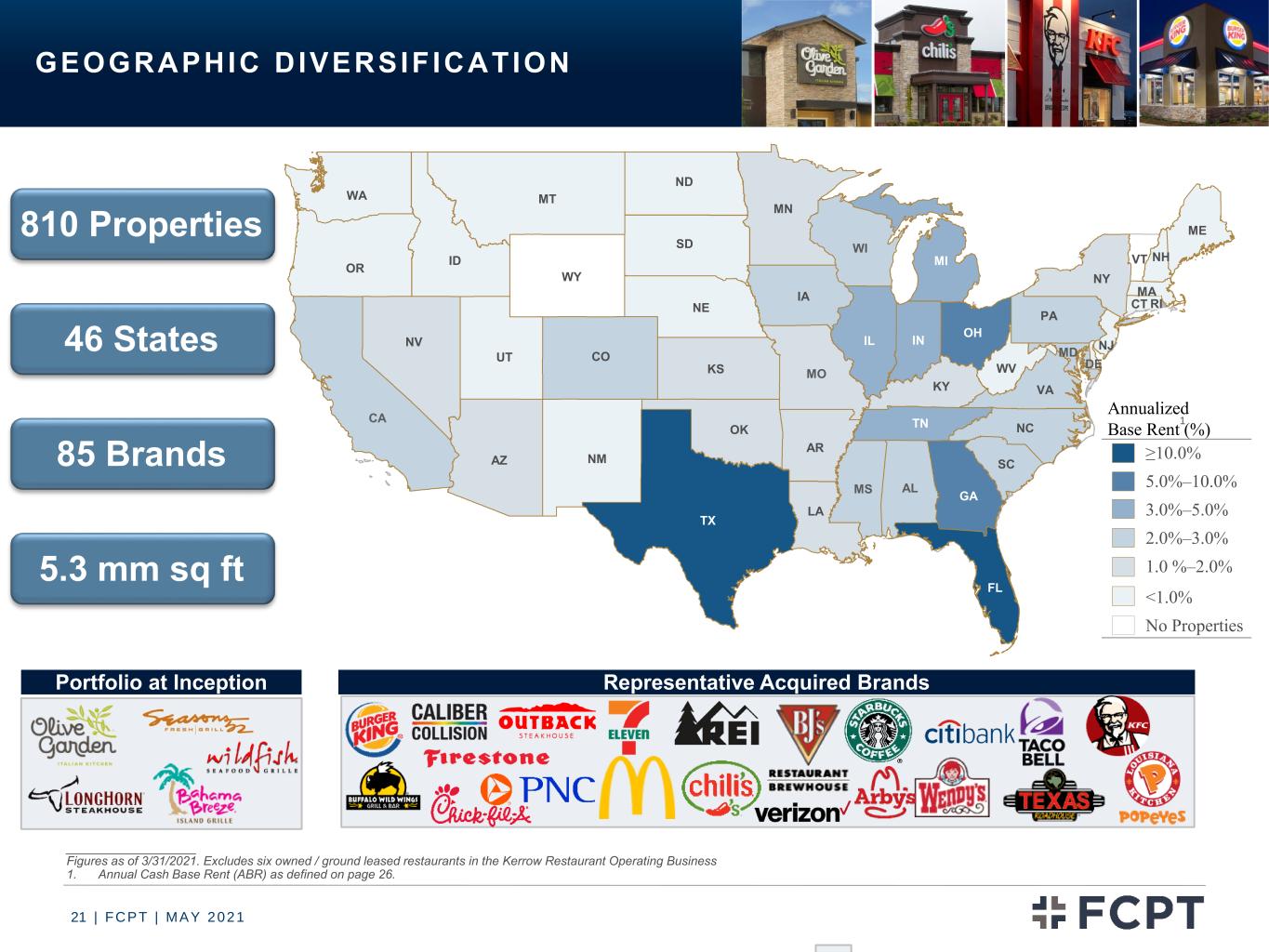

| FCPT | MAY 202121 GEOGRAPHIC DIVERSIF ICATION ___________________ Figures as of 3/31/2021. Excludes six owned / ground leased restaurants in the Kerrow Restaurant Operating Business 1. Annual Cash Base Rent (ABR) as defined on page 26. 810 Properties 46 States 85 Brands 5.3 mm sq ft Portfolio at Inception Representative Acquired Brands Annualized Base Rent (%) ≥10.0% 5.0%–10.0% 3.0%–5.0% 2.0%–3.0% 1.0 %–2.0% <1.0% No Properties 1 MN SD NJ OHINIL VT NHID AL AZ AR CA CO CT DE FL GA IA KS KY LA ME MD MA MI MS MO MT NE NV NM NY NC ND OK OR PA RI SC TN TX UT VA WA WV WI WY

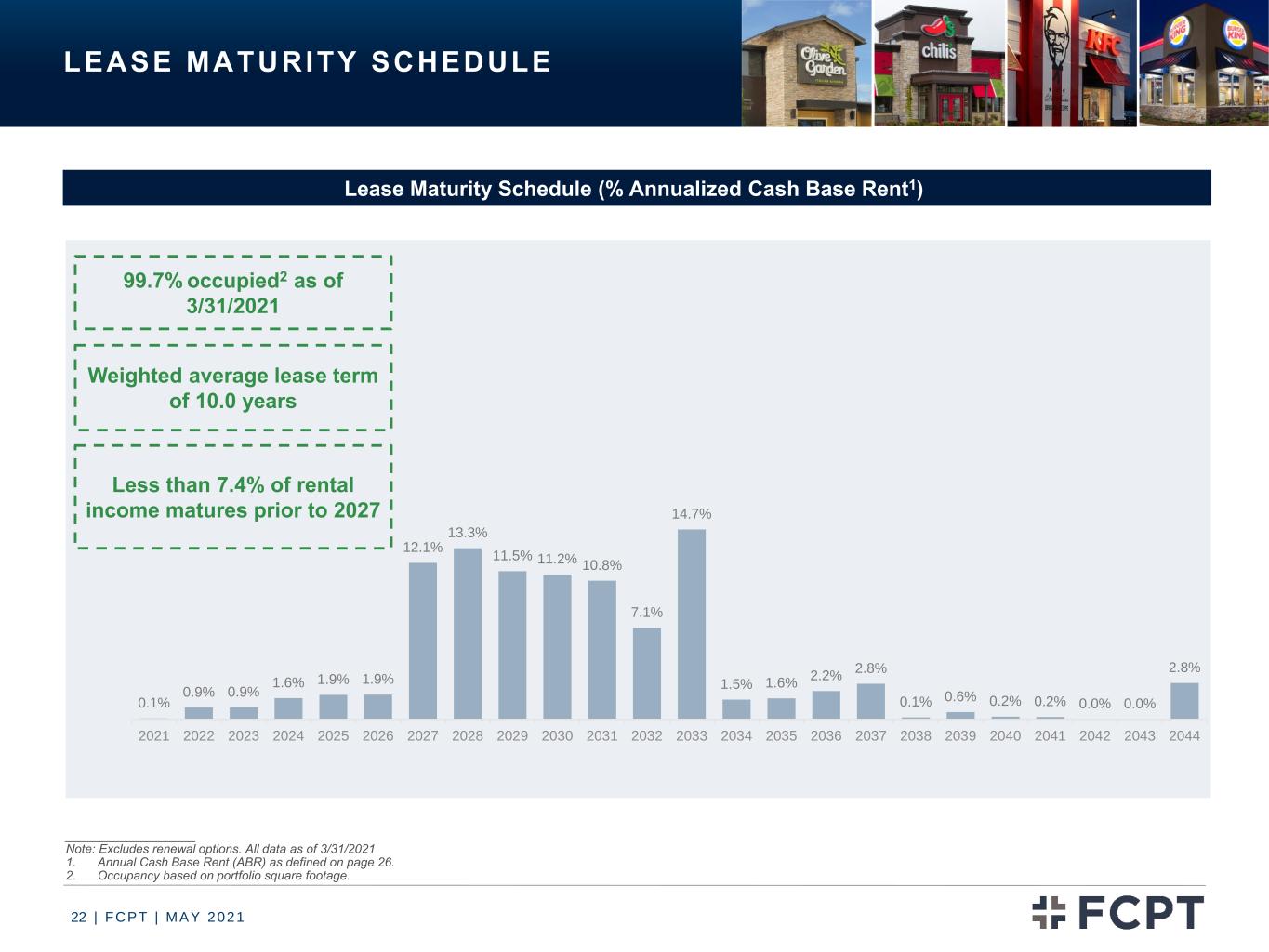

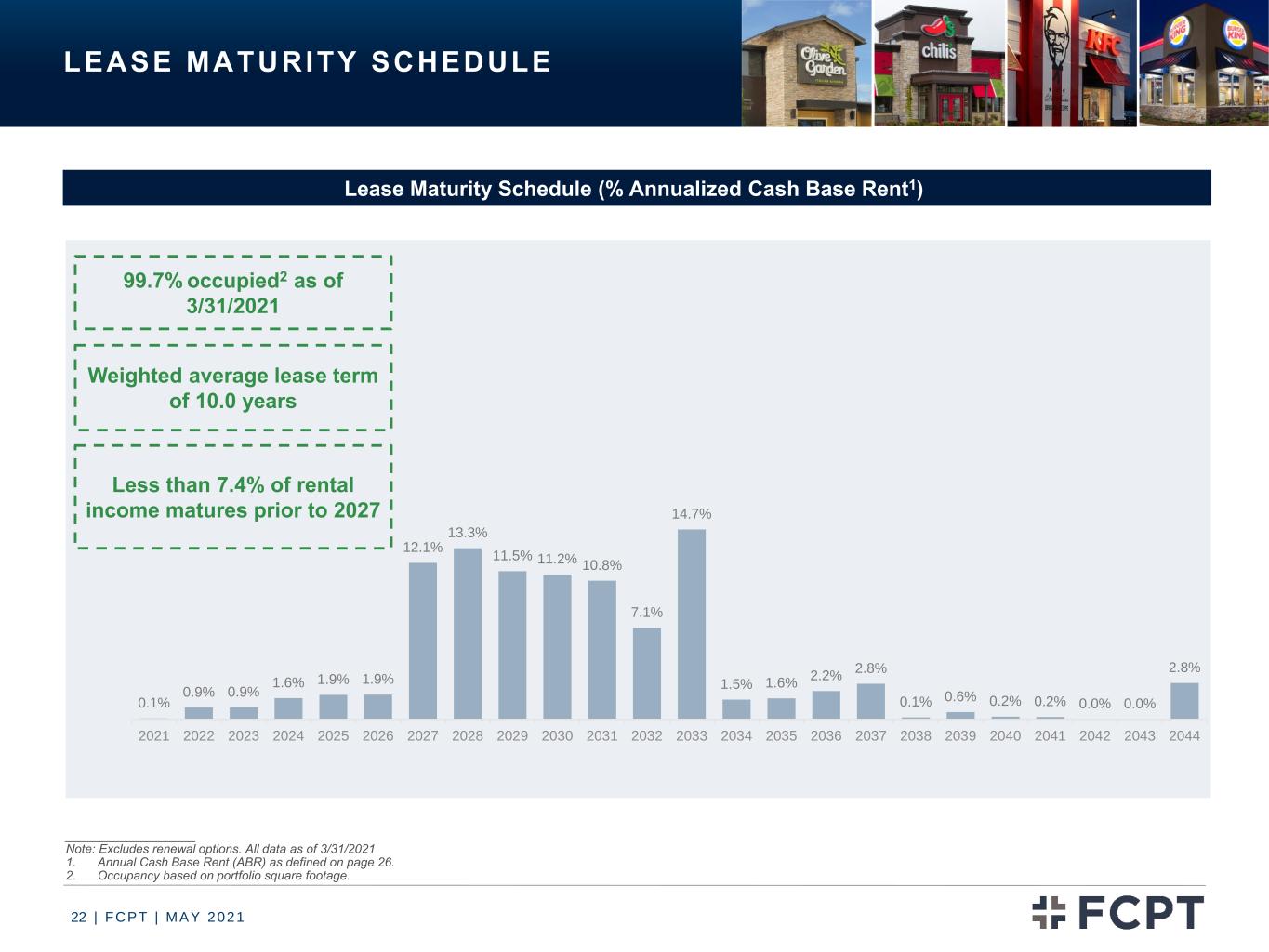

| FCPT | MAY 202122 0.1% 0.9% 0.9% 1.6% 1.9% 1.9% 12.1% 13.3% 11.5% 11.2% 10.8% 7.1% 14.7% 1.5% 1.6% 2.2% 2.8% 0.1% 0.6% 0.2% 0.2% 0.0% 0.0% 2.8% 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2043 2044 LEASE MATURITY SCHEDULE ___________________ Note: Excludes renewal options. All data as of 3/31/2021 1. Annual Cash Base Rent (ABR) as defined on page 26. 2. Occupancy based on portfolio square footage. Lease Maturity Schedule (% Annualized Cash Base Rent1) 99.7% occupied2 as of 3/31/2021 Weighted average lease term of 10.0 years Less than 7.4% of rental income matures prior to 2027

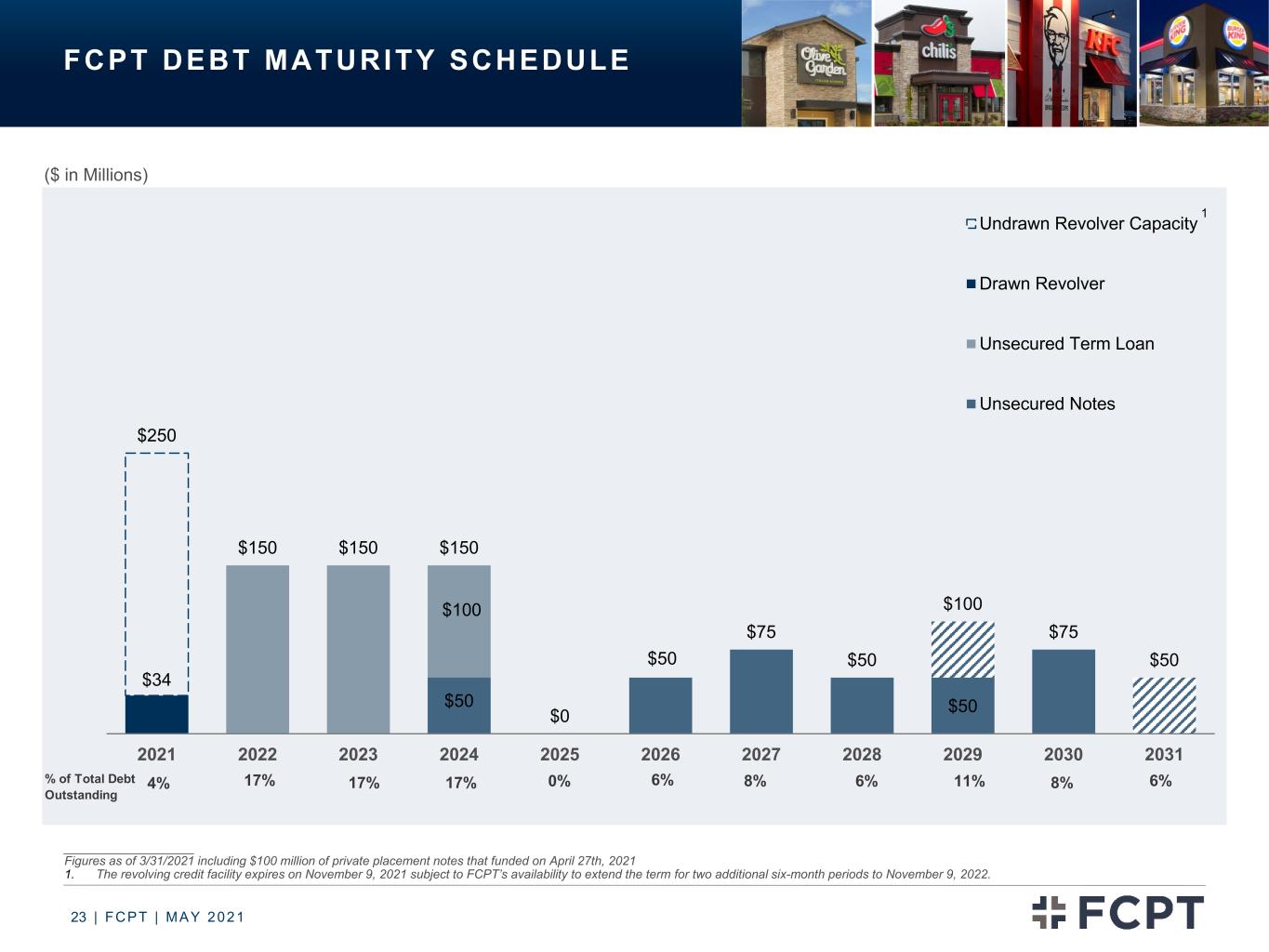

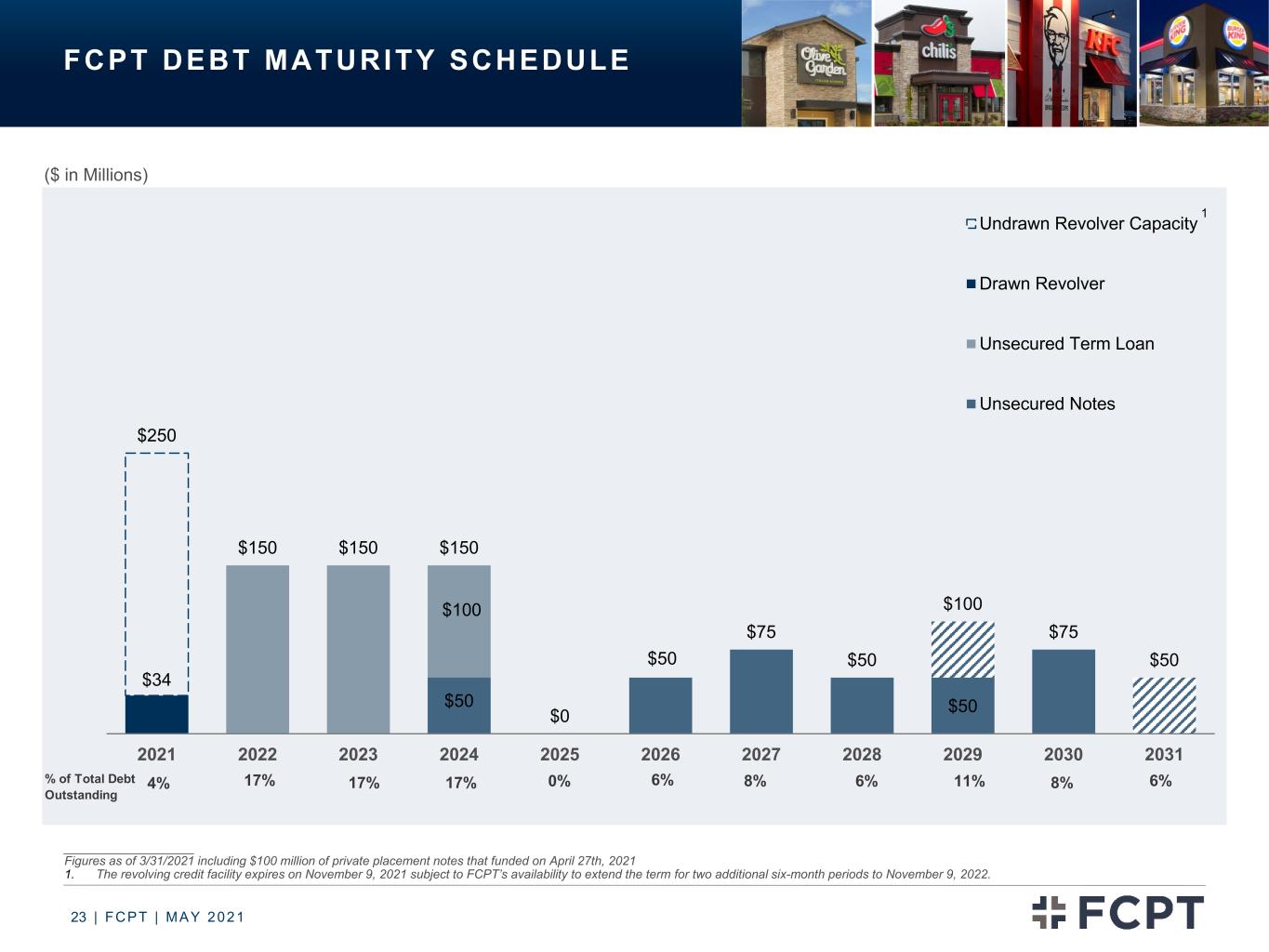

| FCPT | MAY 202123 FCPT DEBT MATURITY SCHEDULE $50 $50 $50 $34 $250 $150 $150 $150 $0 $75 $50 $100 $75 $50 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Undrawn Revolver Capacity Drawn Revolver Unsecured Term Loan Unsecured Notes $100 % of Total Debt Outstanding 1 4% 17% 17% 17% 0% 6% 11% 8%6% 8% ___________________ Figures as of 3/31/2021 including $100 million of private placement notes that funded on April 27th, 2021 1. The revolving credit facility expires on November 9, 2021 subject to FCPT’s availability to extend the term for two additional six-month periods to November 9, 2022. ($ in Millions) 6%

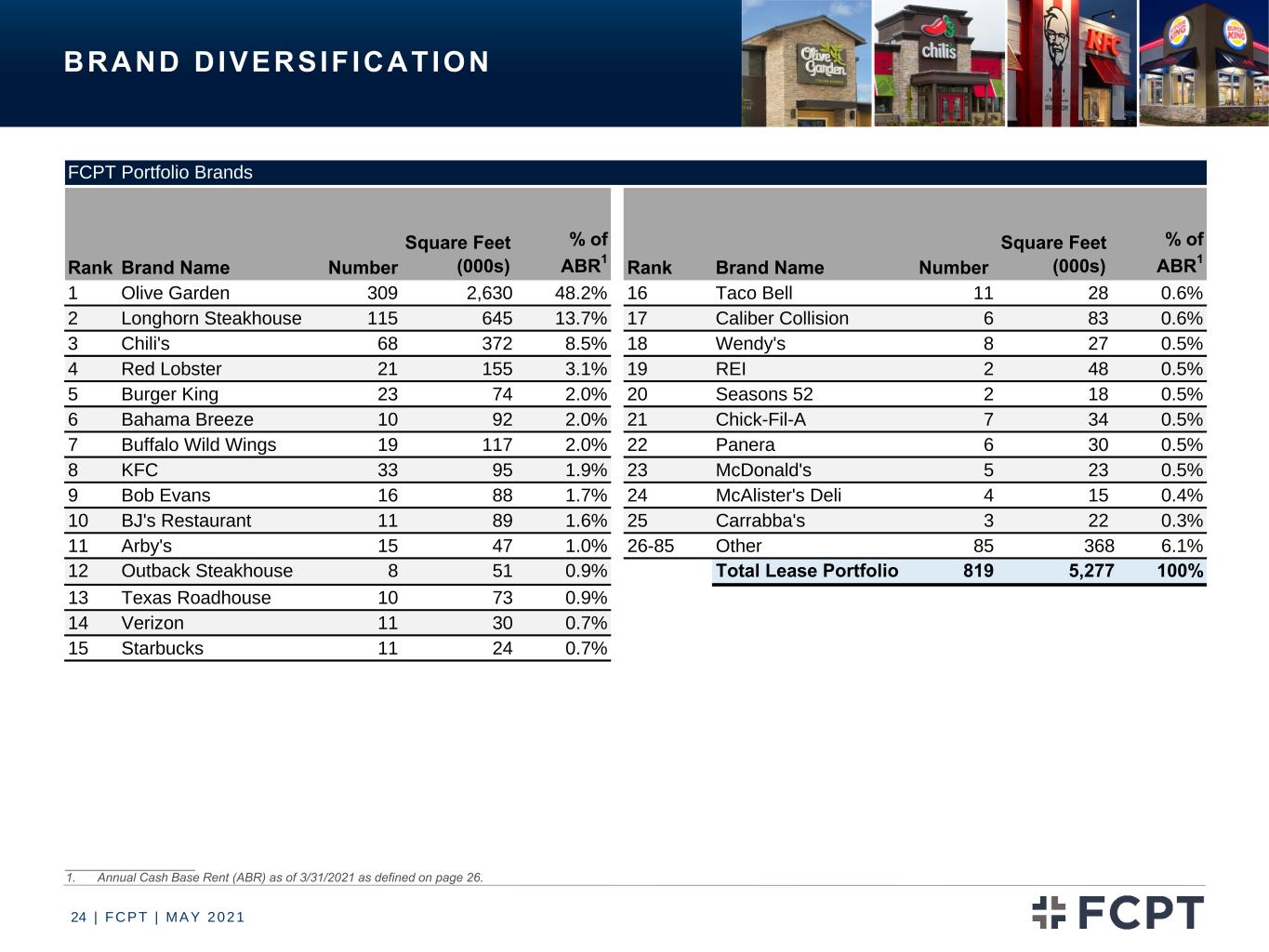

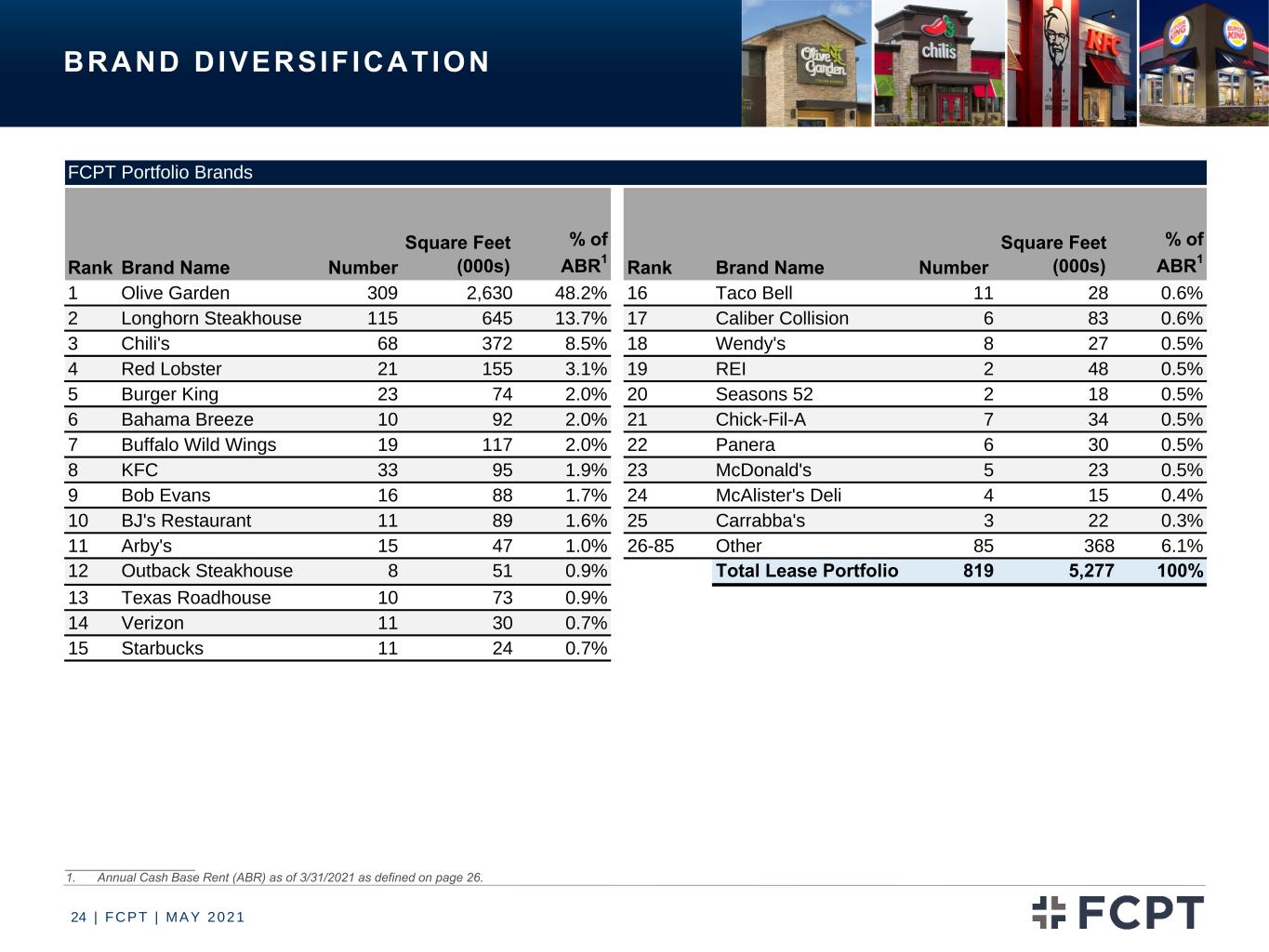

| FCPT | MAY 202124 BRAND DIVERSIF ICATION ___________________ 1. Annual Cash Base Rent (ABR) as of 3/31/2021 as defined on page 26. FCPT Portfolio Brands Rank Brand Name Number Square Feet (000s) % of ABR1 Rank Brand Name Number Square Feet (000s) % of ABR1 1 Olive Garden 309 2,630 48.2% 16 Taco Bell 11 28 0.6% 2 Longhorn Steakhouse 115 645 13.7% 17 Caliber Collision 6 83 0.6% 3 Chili's 68 372 8.5% 18 Wendy's 8 27 0.5% 4 Red Lobster 21 155 3.1% 19 REI 2 48 0.5% 5 Burger King 23 74 2.0% 20 Seasons 52 2 18 0.5% 6 Bahama Breeze 10 92 2.0% 21 Chick-Fil-A 7 34 0.5% 7 Buffalo Wild Wings 19 117 2.0% 22 Panera 6 30 0.5% 8 KFC 33 95 1.9% 23 McDonald's 5 23 0.5% 9 Bob Evans 16 88 1.7% 24 McAlister's Deli 4 15 0.4% 10 BJ's Restaurant 11 89 1.6% 25 Carrabba's 3 22 0.3% 11 Arby's 15 47 1.0% 26-85 Other 85 368 6.1% 12 Outback Steakhouse 8 51 0.9% Total Lease Portfolio 819 5,277 100% 13 Texas Roadhouse 10 73 0.9% 14 Verizon 11 30 0.7% 15 Starbucks 11 24 0.7%

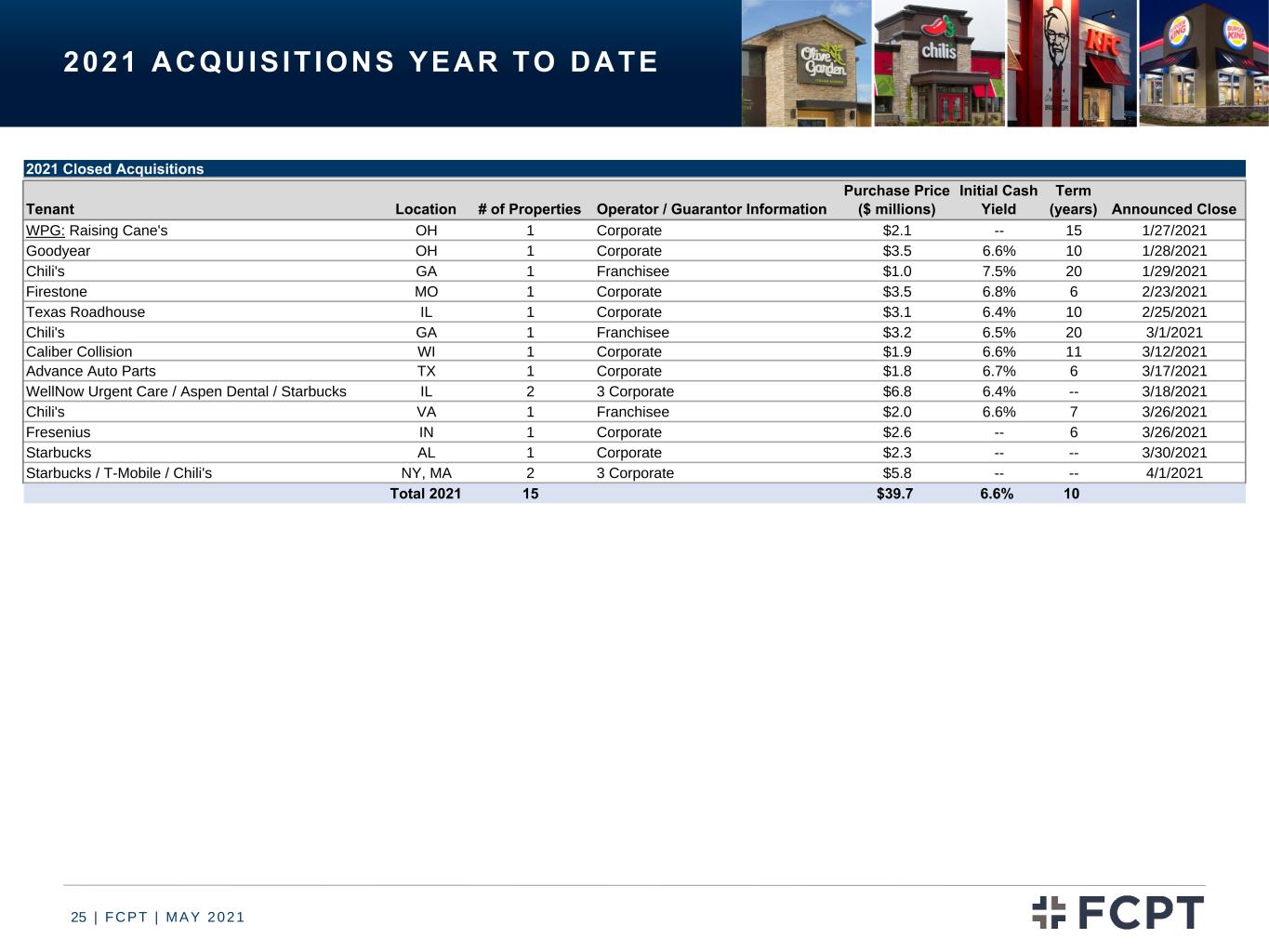

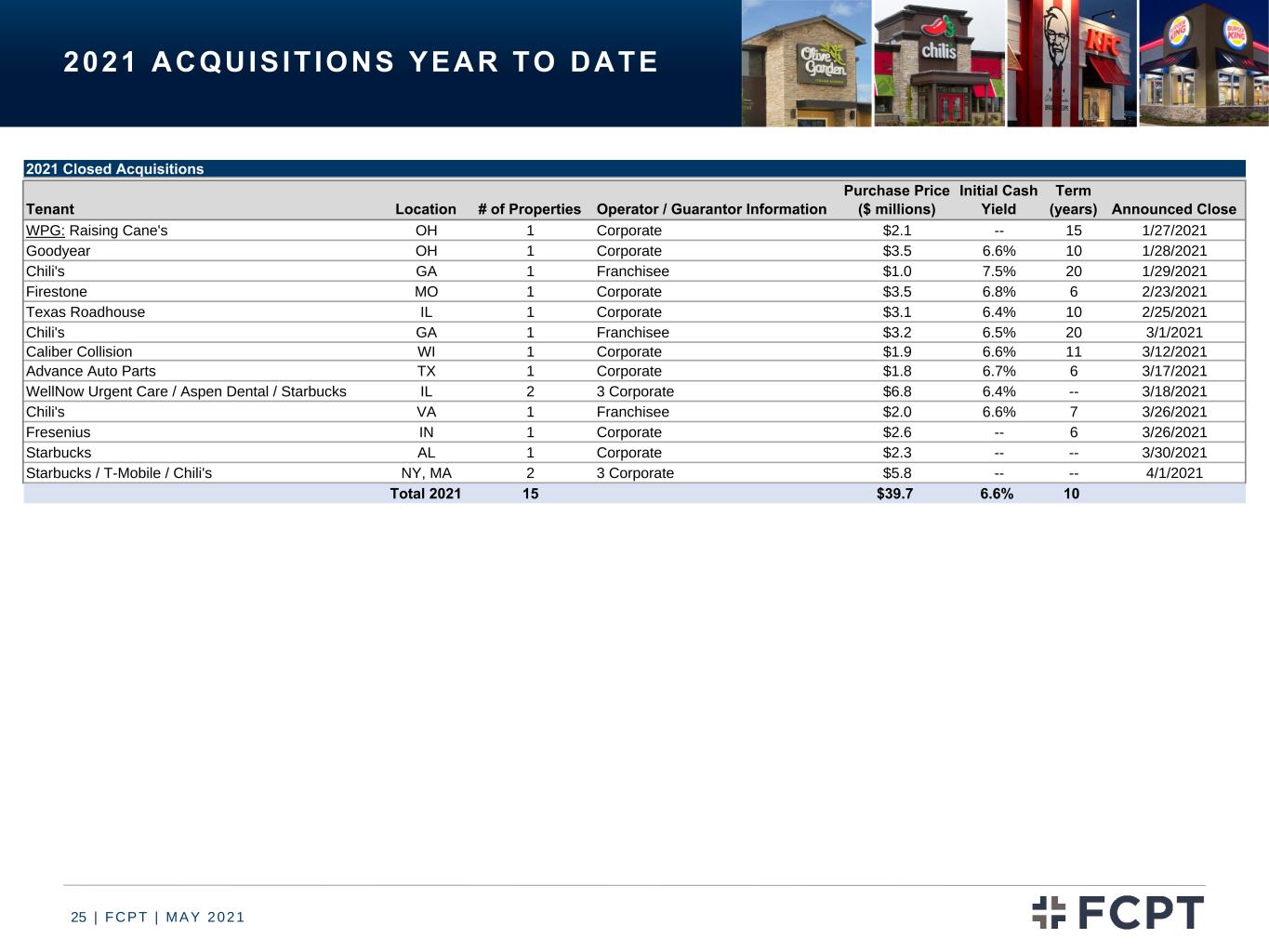

| FCPT | MAY 202125 2021 ACQUISIT IONS YEAR TO DATE 2021 Closed Acquisitions Tenant Location # of Properties Operator / Guarantor Information Purchase Price ($ millions) Initial Cash Yield Term (years) Announced Close WPG: Raising Cane's OH 1 Corporate $2.1 -- 15 1/27/2021 Goodyear OH 1 Corporate $3.5 6.6% 10 1/28/2021 Chili's GA 1 Franchisee $1.0 7.5% 20 1/29/2021 Firestone MO 1 Corporate $3.5 6.8% 6 2/23/2021 Texas Roadhouse IL 1 Corporate $3.1 6.4% 10 2/25/2021 Chili's GA 1 Franchisee $3.2 6.5% 20 3/1/2021 Caliber Collision WI 1 Corporate $1.9 6.6% 11 3/12/2021 Advance Auto Parts TX 1 Corporate $1.8 6.7% 6 3/17/2021 WellNow Urgent Care / Aspen Dental / Starbucks IL 2 3 Corporate $6.8 6.4% -- 3/18/2021 Chili's VA 1 Franchisee $2.0 6.6% 7 3/26/2021 Fresenius IN 1 Corporate $2.6 -- 6 3/26/2021 Starbucks AL 1 Corporate $2.3 -- -- 3/30/2021 Starbucks / T-Mobile / Chili's NY, MA 2 3 Corporate $5.8 -- -- 4/1/2021 Total 2021 15 $39.7 6.6% 10

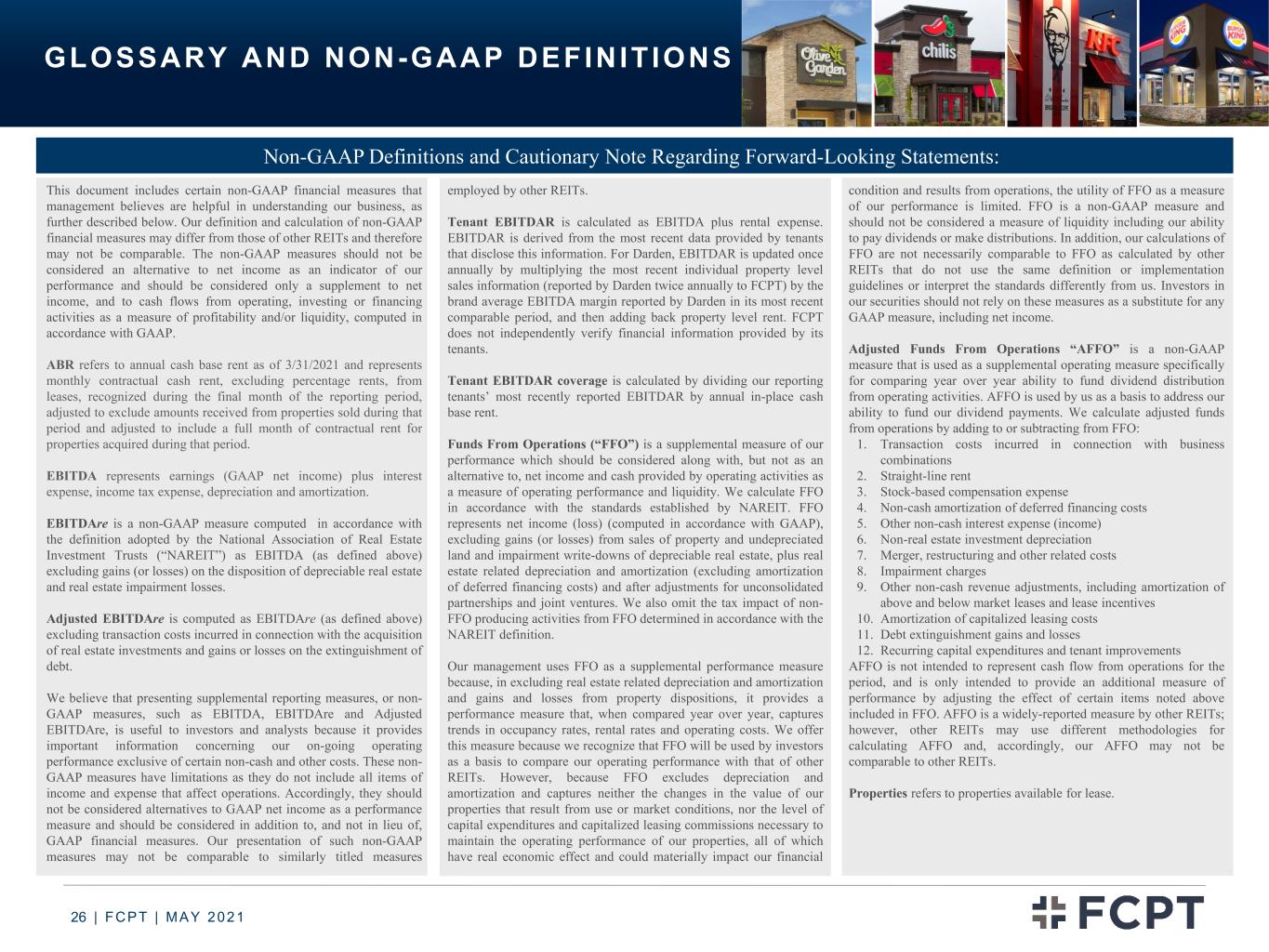

| FCPT | MAY 202126 GLOSSARY AND NON-GAAP DEFINIT IONS This document includes certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs and therefore may not be comparable. The non-GAAP measures should not be considered an alternative to net income as an indicator of our performance and should be considered only a supplement to net income, and to cash flows from operating, investing or financing activities as a measure of profitability and/or liquidity, computed in accordance with GAAP. ABR refers to annual cash base rent as of 3/31/2021 and represents monthly contractual cash rent, excluding percentage rents, from leases, recognized during the final month of the reporting period, adjusted to exclude amounts received from properties sold during that period and adjusted to include a full month of contractual rent for properties acquired during that period. EBITDA represents earnings (GAAP net income) plus interest expense, income tax expense, depreciation and amortization. EBITDAre is a non-GAAP measure computed in accordance with the definition adopted by the National Association of Real Estate Investment Trusts (“NAREIT”) as EBITDA (as defined above) excluding gains (or losses) on the disposition of depreciable real estate and real estate impairment losses. Adjusted EBITDAre is computed as EBITDAre (as defined above) excluding transaction costs incurred in connection with the acquisition of real estate investments and gains or losses on the extinguishment of debt. We believe that presenting supplemental reporting measures, or non- GAAP measures, such as EBITDA, EBITDAre and Adjusted EBITDAre, is useful to investors and analysts because it provides important information concerning our on-going operating performance exclusive of certain non-cash and other costs. These non- GAAP measures have limitations as they do not include all items of income and expense that affect operations. Accordingly, they should not be considered alternatives to GAAP net income as a performance measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Our presentation of such non-GAAP measures may not be comparable to similarly titled measures employed by other REITs. Tenant EBITDAR is calculated as EBITDA plus rental expense. EBITDAR is derived from the most recent data provided by tenants that disclose this information. For Darden, EBITDAR is updated once annually by multiplying the most recent individual property level sales information (reported by Darden twice annually to FCPT) by the brand average EBITDA margin reported by Darden in its most recent comparable period, and then adding back property level rent. FCPT does not independently verify financial information provided by its tenants. Tenant EBITDAR coverage is calculated by dividing our reporting tenants’ most recently reported EBITDAR by annual in-place cash base rent. Funds From Operations (“FFO”) is a supplemental measure of our performance which should be considered along with, but not as an alternative to, net income and cash provided by operating activities as a measure of operating performance and liquidity. We calculate FFO in accordance with the standards established by NAREIT. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property and undepreciated land and impairment write-downs of depreciable real estate, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. We also omit the tax impact of non- FFO producing activities from FFO determined in accordance with the NAREIT definition. Our management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We offer this measure because we recognize that FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. FFO is a non-GAAP measure and should not be considered a measure of liquidity including our ability to pay dividends or make distributions. In addition, our calculations of FFO are not necessarily comparable to FFO as calculated by other REITs that do not use the same definition or implementation guidelines or interpret the standards differently from us. Investors in our securities should not rely on these measures as a substitute for any GAAP measure, including net income. Adjusted Funds From Operations “AFFO” is a non-GAAP measure that is used as a supplemental operating measure specifically for comparing year over year ability to fund dividend distribution from operating activities. AFFO is used by us as a basis to address our ability to fund our dividend payments. We calculate adjusted funds from operations by adding to or subtracting from FFO: 1. Transaction costs incurred in connection with business combinations 2. Straight-line rent 3. Stock-based compensation expense 4. Non-cash amortization of deferred financing costs 5. Other non-cash interest expense (income) 6. Non-real estate investment depreciation 7. Merger, restructuring and other related costs 8. Impairment charges 9. Other non-cash revenue adjustments, including amortization of above and below market leases and lease incentives 10. Amortization of capitalized leasing costs 11. Debt extinguishment gains and losses 12. Recurring capital expenditures and tenant improvements AFFO is not intended to represent cash flow from operations for the period, and is only intended to provide an additional measure of performance by adjusting the effect of certain items noted above included in FFO. AFFO is a widely-reported measure by other REITs; however, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs. Properties refers to properties available for lease. Non-GAAP Definitions and Cautionary Note Regarding Forward-Looking Statements:

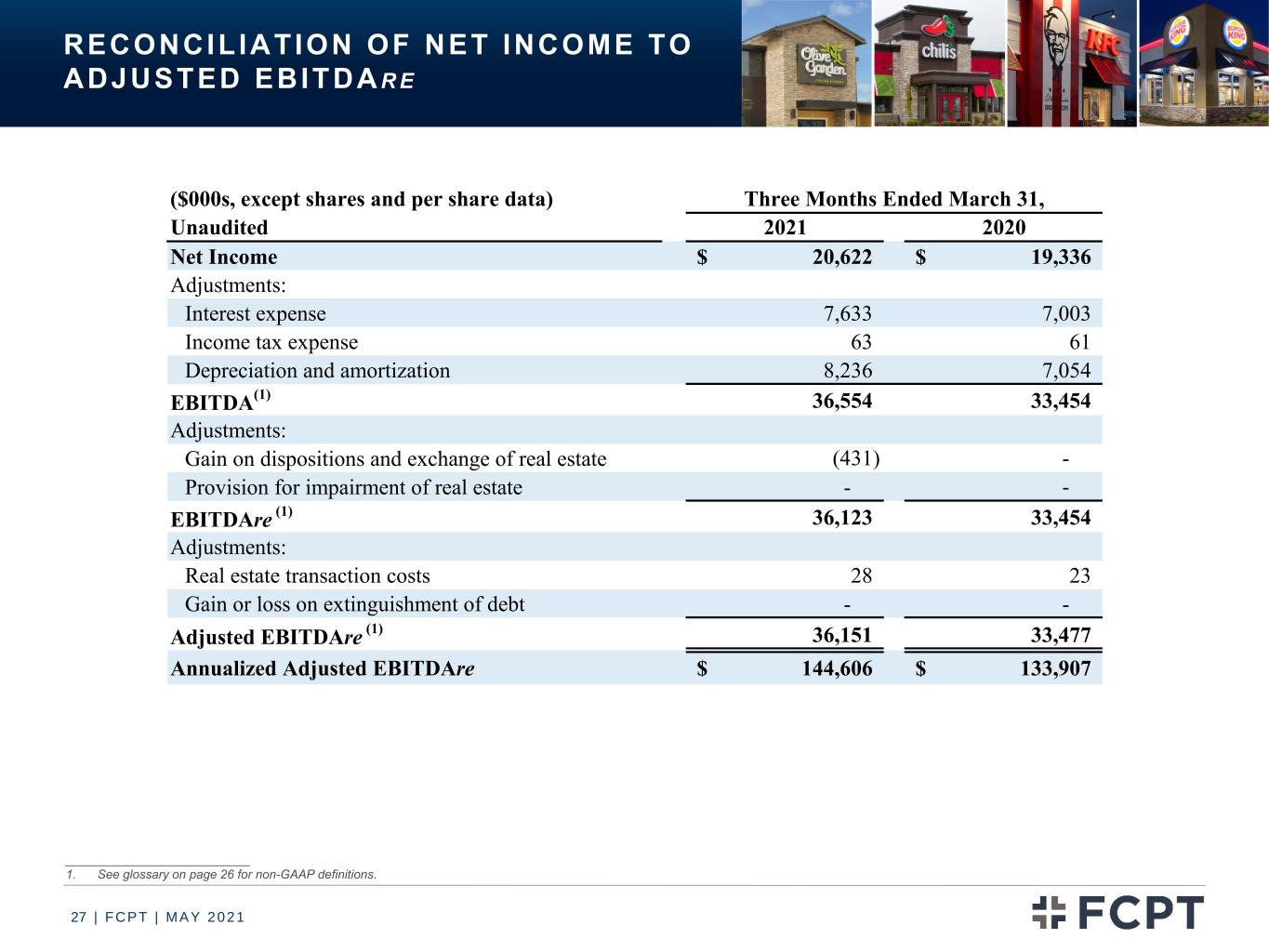

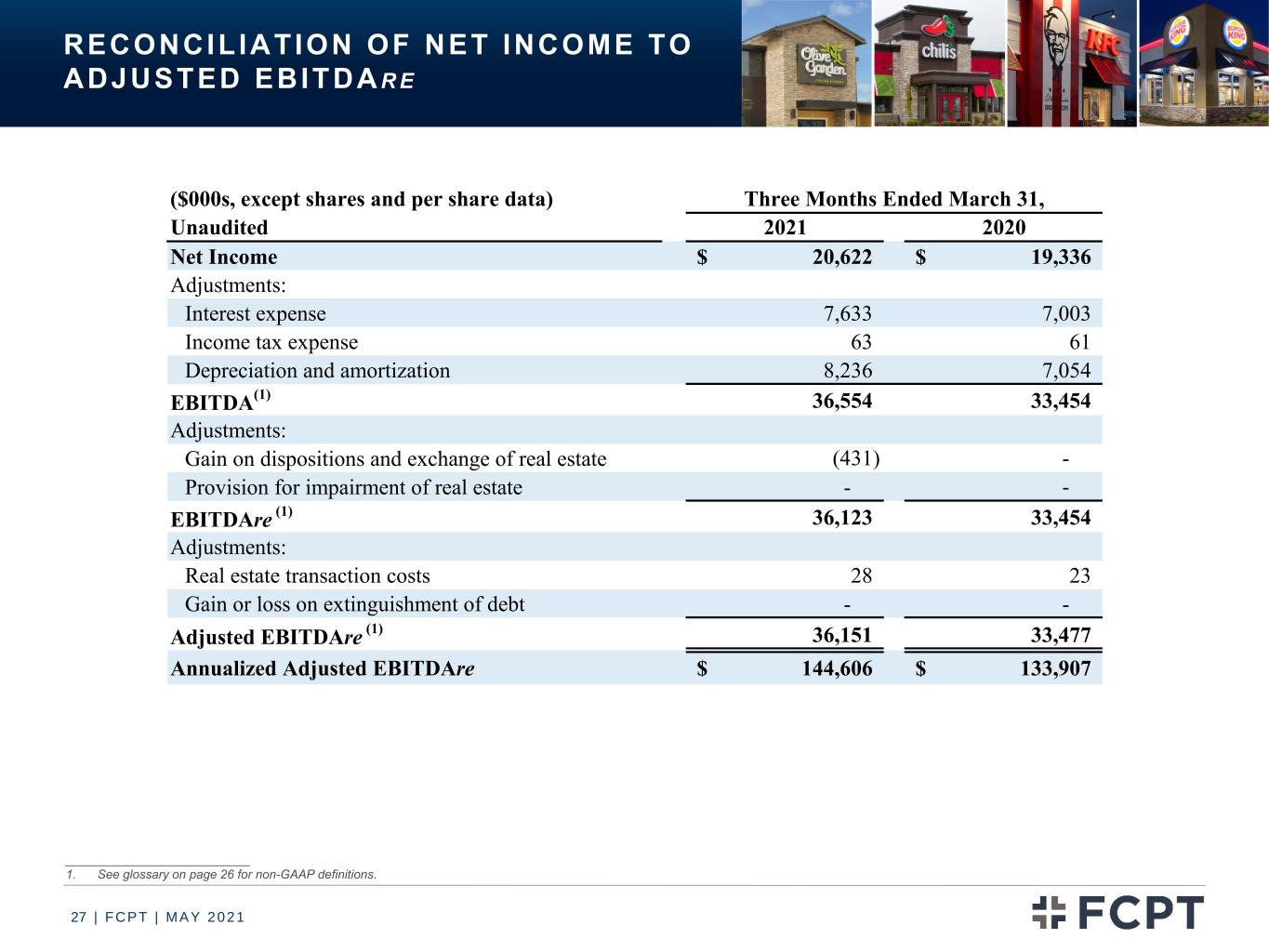

| FCPT | MAY 202127 RECONCILIATION OF NET INCOME TO ADJUSTED EBITDAR E ___________________________ 1. See glossary on page 26 for non-GAAP definitions. ($000s, except shares and per share data) Unaudited 2021 2020 Net Income 20,622$ 19,336$ Adjustments: Interest expense 7,633 7,003 Income tax expense 63 61 Depreciation and amortization 8,236 7,054 EBITDA(1) 36,554 33,454 Adjustments: Gain on dispositions and exchange of real estate (431) - Provision for impairment of real estate - - EBITDAre (1) 36,123 33,454 Adjustments: Real estate transaction costs 28 23 Gain or loss on extinguishment of debt - - Adjusted EBITDAre (1) 36,151 33,477 Annualized Adjusted EBITDAre 144,606$ 133,907$ Three Months Ended March 31,

| FCPT | MAY 202128 INVESTOR PRESENTATION | MAY 2021 w w w. fcpt .com FOUR CORNERS PROPERTY TRUST N Y S E : F C P T