INV ES TOR P RES ENTATION FEBRUA RY 2 02 4 Four Corners Property Trust N Y S E : F C P T

F E B R U A R Y 2 0 2 4 2 Cautionary note regarding forward-looking statements: This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward- looking statements include all statements that are not historical statements of fact and those regarding FCPT’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance, acquisition pipeline, expectations regarding the making of distributions and the payment of dividends, and the effect of pandemics on the business operations of FCPT and FCPT’s tenants and their continued ability to pay rent in a timely manner or at all. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of FCPT’s public disclosure obligations, FCPT expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in FCPT’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and FCPT can give no assurance that its expectations or the events described will occur as described. For a further discussion of these and other factors that could cause FCPT’s future results to differ materially from any forward-looking statements, see the risk factors described under the section entitled “Item 1A. Risk Factors” in FCPT’s annual report on Form 10-K for the year ended December 31, 2023 and other risks described in documents subsequently filed by FCPT from time to time with the Securities and Exchange Commission. Notice regarding non-GAAP financial measures: The information in this communication contains and refers to certain non-GAAP financial measures, including FFO and AFFO. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in the supplemental financial and operating report, which can be found in the Investors section of our website at www.fcpt.com, and on page 29 of this presentation. F O R W A R D L O O K I N G S T A T E M E N T S A N D D I S C L A I M E R S

F E B R U A R Y 2 0 2 4 3 CONTENTS 1 C O M P A N Y O V E R V I E W P G 3 2 H I G H Q U A L I T Y P O R T F O L I O P G 9 3 C O N S E R V A T I V E F I N A N C I A L P O S I T I O N P G 2 3 4 A P P E N D I X P G 2 6

FCPT OVERVIEW REPRESENTATIVE BRANDS SAMPLE 4 H I G H - Q U A L I T Y P O R T F O L I O • Recently assembled, e-commerce resistant portfolio • Strong Tenant EBITDAR / Rent Coverage, nationally established brands and low rents provide for high tenant retention and limited vacancies T R A N S P A R E N T , A N A L Y T I C A L , D I S C I P L I N E D I N V E S T M E N T P H I L O S O P H Y • Focus on cost of capital and positive investment spread • Use of proprietary, data-driven scorecard to objectively rate every property • Detailed investment committee memo and public press release at close for every property acquisition A C C R E T I V E D I V E R S I F I C A T I O N • Grown from single tenant to 148 brands • Established new verticals in resilient, essential retail categories of auto service and medical retail • Disciplined pricing approach based on maintaining strong credit parameters and high-quality tenant base I N V E S T M E N T G R A D E B A L A N C E S H E E T • Committed to maintaining conservative 5.0x–6.0x leverage • Well-laddered, predominately fixed-rate debt maturity schedule • Significant liquidity, unencumbered assets, high fixed charge coverage

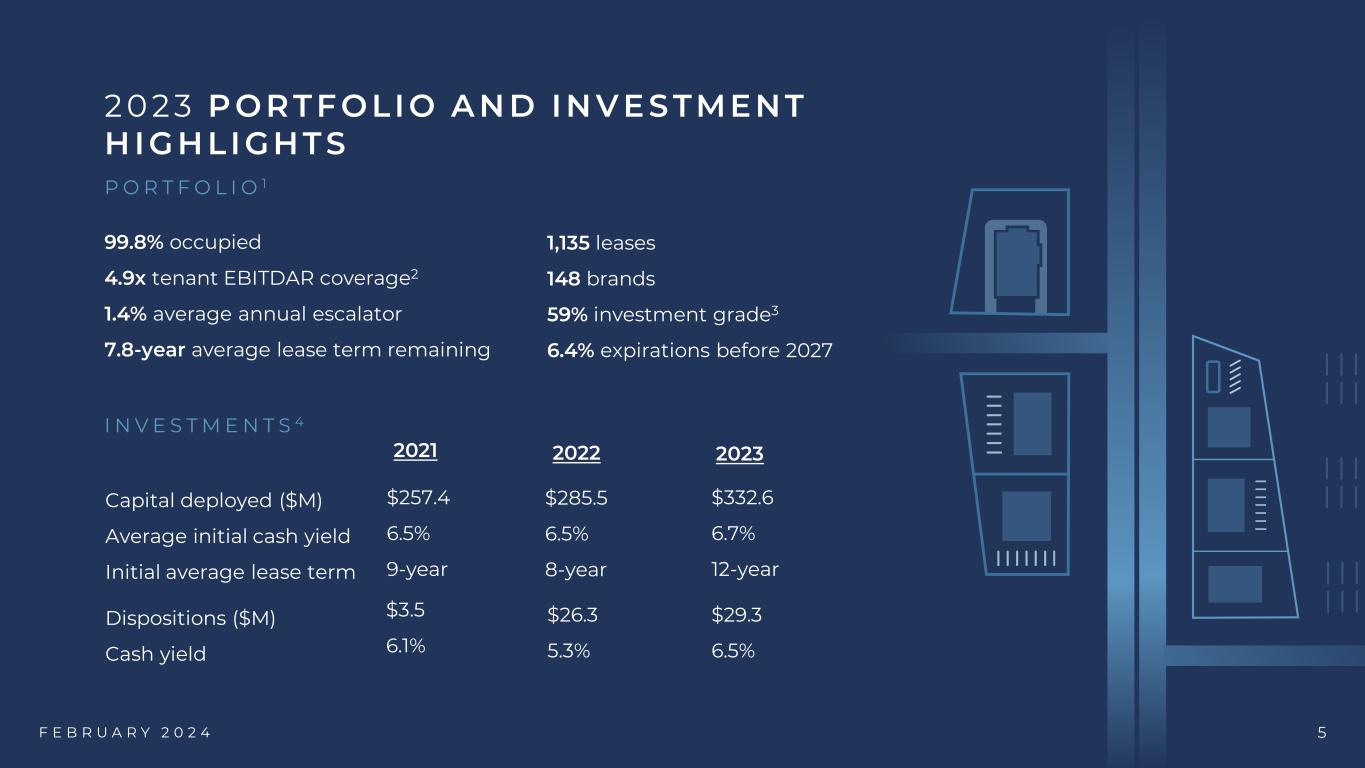

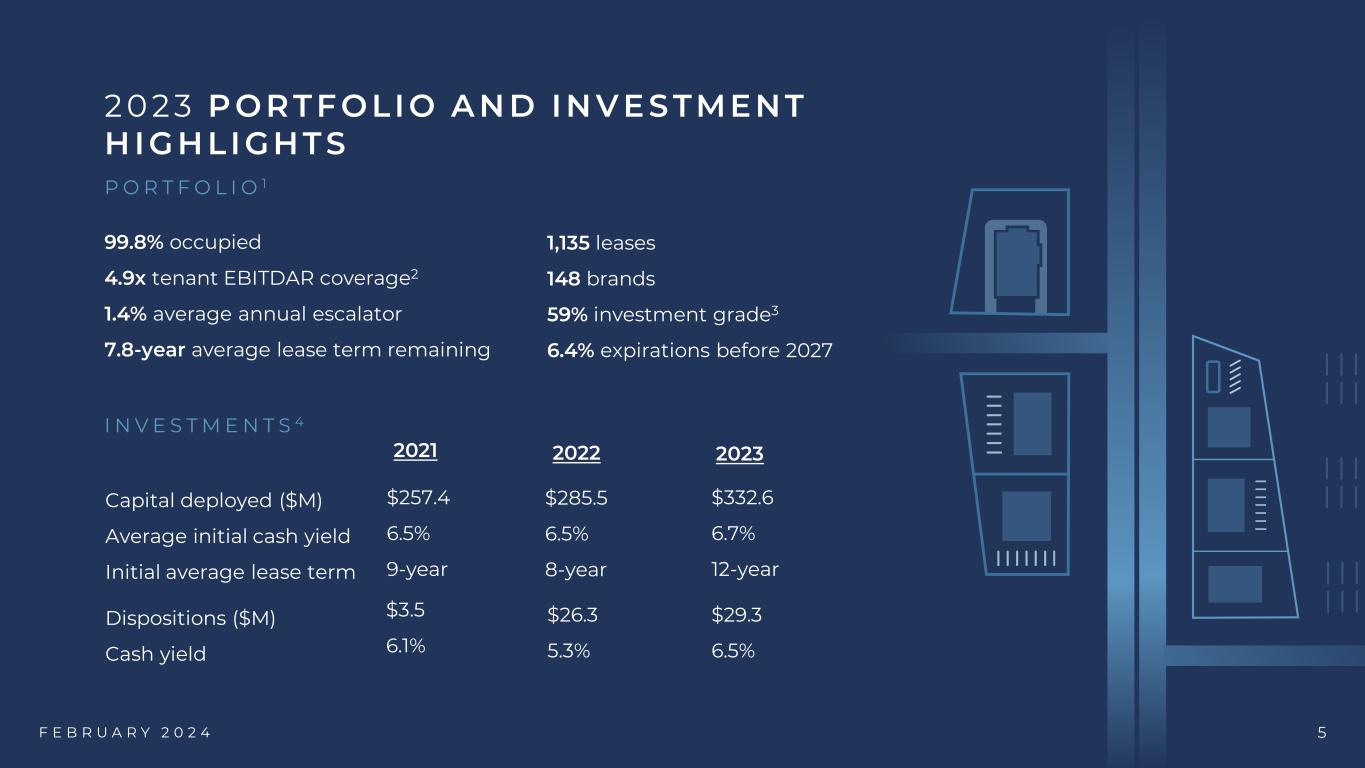

5F E B R U A R Y 2 0 2 4 I N V E S T M E N T S 4 99.8% occupied 4.9x tenant EBITDAR coverage2 1.4% average annual escalator 7.8-year average lease term remaining Capital deployed ($M) Average initial cash yield Initial average lease term Dispositions ($M) Cash yield 2 0 2 3 P OR TF OLIO A N D IN V E S TMENT H IG H LIGHTS P O R T F O L I O 1 1,135 leases 148 brands 59% investment grade3 6.4% expirations before 2027 $332.6 6.7% 12-year 20232022 $29.3 6.5% $285.5 6.5% 8-year $26.3 5.3% 2021 $257.4 6.5% 9-year $3.5 6.1%

F E B R U A R Y 2 0 2 4 6 2 0 2 3 F I N A N CI A L H IG H LIG HTS $0.27 Q4 2023 Net income per share $1.07 2023 Net income per share $0.43 Q4 2023 AFFO per share1 $1.67 2023 AFFO per share1 4.9% Growth quarter over quarter $0.41 Q4 2023 FFO per share $1.62 2023 FFO per share $259 million Liquidity with ample revolver capacity and cash 100% Unencumbered ABR 5.5x Net debt to adjusted EBITDAre2 4.4x Fixed charge coverage 94% Fixed rate debt 4.6 years Weighted average debt maturity BBB / Baa3 Stable Outlook Fitch / Moody’s

F E B R U A R Y 2 0 2 4 7 2 0 2 3 A C QU ISITION S U M MAR Y • FCPT closed $333 million of investments in 2023. The subsector split by acquisition volume was 39% restaurant, 36% medical retail, 23% auto service, and 3% other • FCPT has increased its focus on medical retail and, as such, have included several slides detailing the industry and opportunity in the High Quality Portfolio section 2023 Acquisitions by Subsector ($ millions) Volume % Total Cap Rate Quick Service $24.3 7% 6.7% Casual Dining $103.8 31% 6.4% Restaurant $128.1 39% 6.4% Auto Service $75.8 23% 7.0% Medical Retail $119.2 36% 6.8% Other $9.5 3% 6.8% Non-Restaurant $204.5 61% 6.9% Total $332.6 100% 6.7%

F E B R U A R Y 2 0 2 4 8 A C Q U I S I T I O N V O L U M E B Y Y E A R 418 475 515 610 699 799 919 1023 1111 2015 SPIN - - 2016 $94 6.6% $1.6 2017 $99 6.8% $2.3 2018 $263 6.5% $2.7 2019 $199 6.5% $2.2 2020 $223 6.5% $2.2 2021 $257 6.5% $2.1 2022 $286 6.5% $2.6 2023 $333 +6.7% $3.5 +57 +40 +95 +89 +100 +120 +104 YEAR VOLUME ($M) CAP RATE +88 FCPT has been built with a deliberate focus on consistency and efficient execution P R O P E R T Y C O U N T 1 AVERAGE SIZE ($M)

F E B R U A R Y 2 0 2 4 9 1 C O M P A N Y O V E R V I E W P G 3 2 H I G H Q U A L I T Y P O R T F O L I O P G 9 3 C O N S E R V A T I V E F I N A N C I A L P O S I T I O N P G 2 3 4 A P P E N D I X P G 2 6 CONTENTS

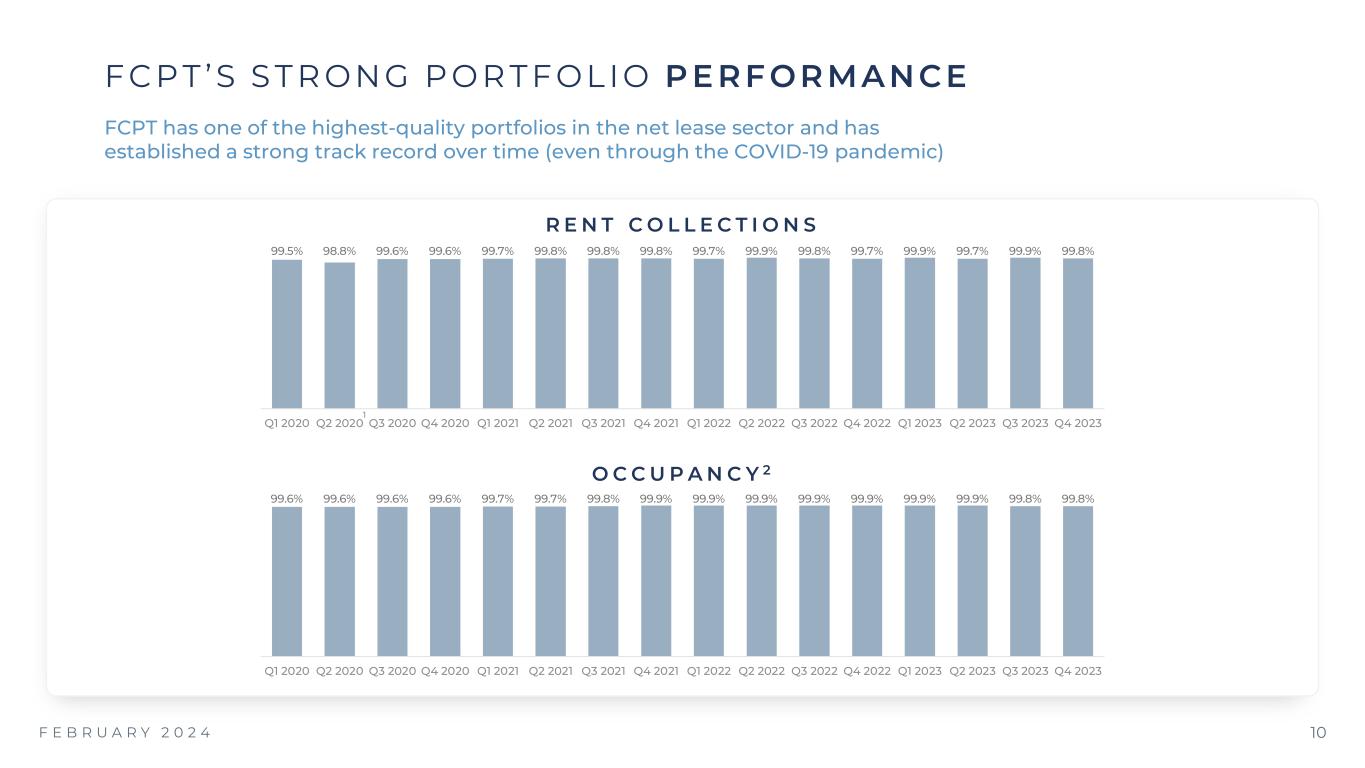

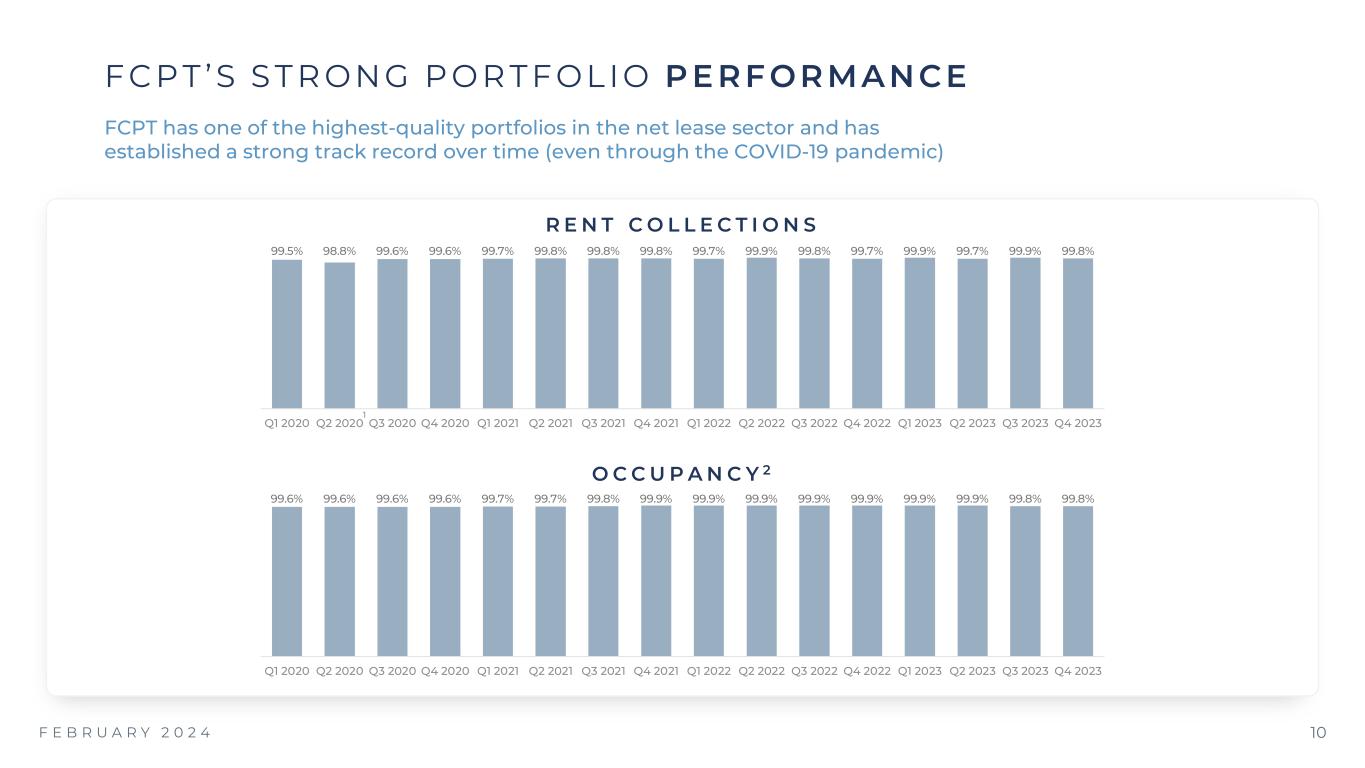

F E B R U A R Y 2 0 2 4 10 F C P T ’ S S T R ON G P O R T F OL I O P E R F OR MANCE FCPT has one of the highest-quality portfolios in the net lease sector and has established a strong track record over time (even through the COVID-19 pandemic) R E N T C O L L E C T I O N S 99.5% 98.8% 99.6% 99.6% 99.7% 99.8% 99.8% 99.8% 99.7% 99.9% 99.8% 99.7% 99.9% 99.7% 99.9% 99.8% Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 O C C U P A N C Y 2 99.6% 99.6% 99.6% 99.6% 99.7% 99.7% 99.8% 99.9% 99.9% 99.9% 99.9% 99.9% 99.9% 99.9% 99.8% 99.8% Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 1

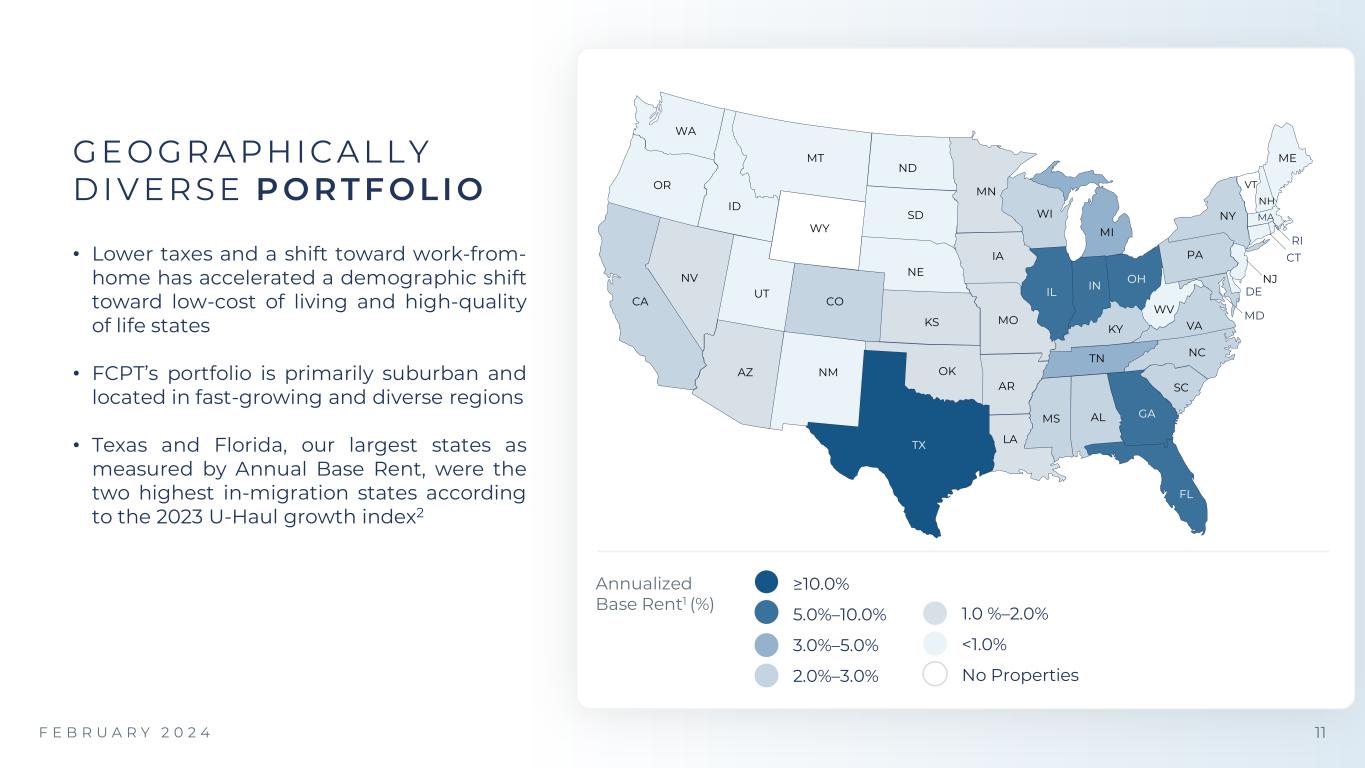

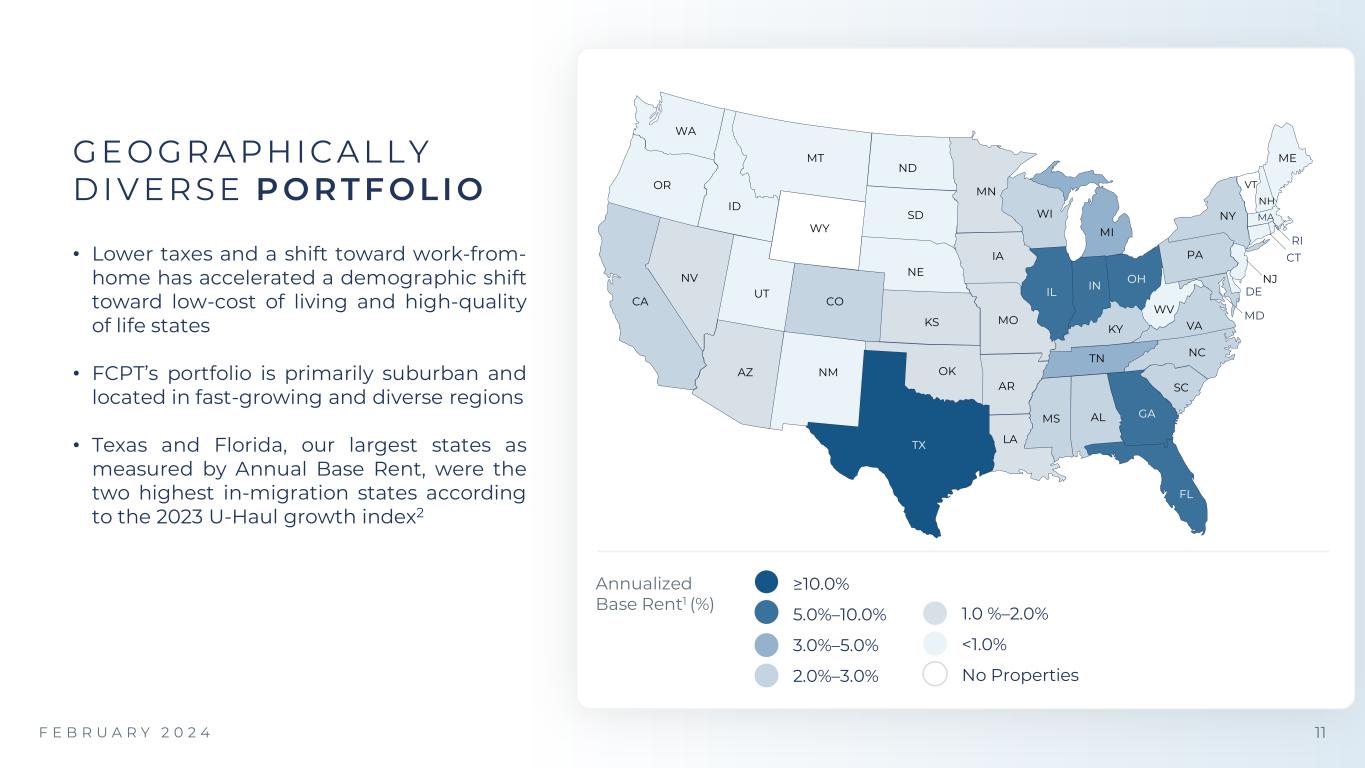

F E B R U A R Y 2 0 2 4 11 G E O G R APH I C AL LY D I V E R S E P OR TF OLIO • Lower taxes and a shift toward work-from- home has accelerated a demographic shift toward low-cost of living and high-quality of life states • FCPT’s portfolio is primarily suburban and located in fast-growing and diverse regions • Texas and Florida, our largest states as measured by Annual Base Rent, were the two highest in-migration states according to the 2023 U-Haul growth index2 WA OR CA MT ID NV AZ UT WY CO NM TX OK KS NE SD ND MN IA MO AR LA MS AL GA FL SC TN NC IL WI MI OHIN KY WV VA PA NY ME VT NH NJ DE MD MA CT RI ≥10.0% 5.0%–10.0% 3.0%–5.0% 2.0%–3.0% Annualized Base Rent1 (%) 1.0 %–2.0% <1.0% No Properties

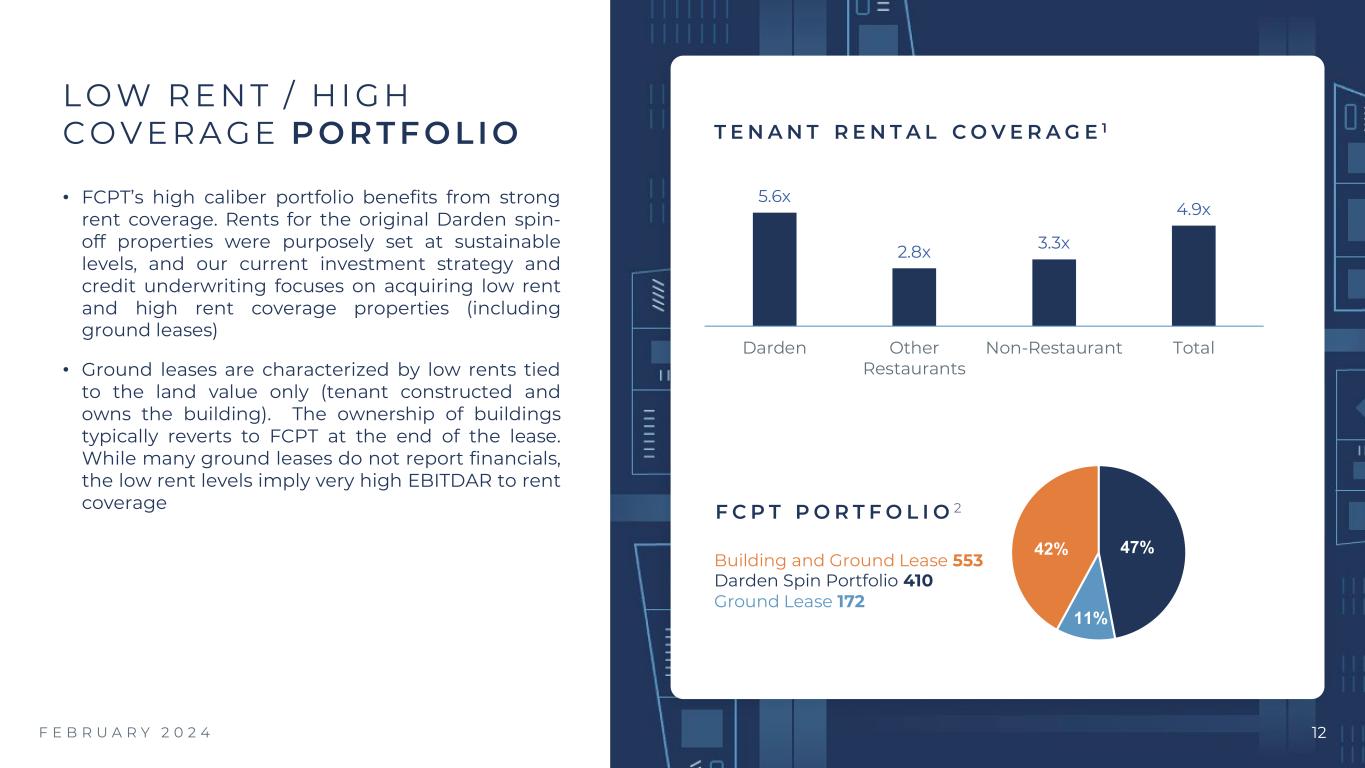

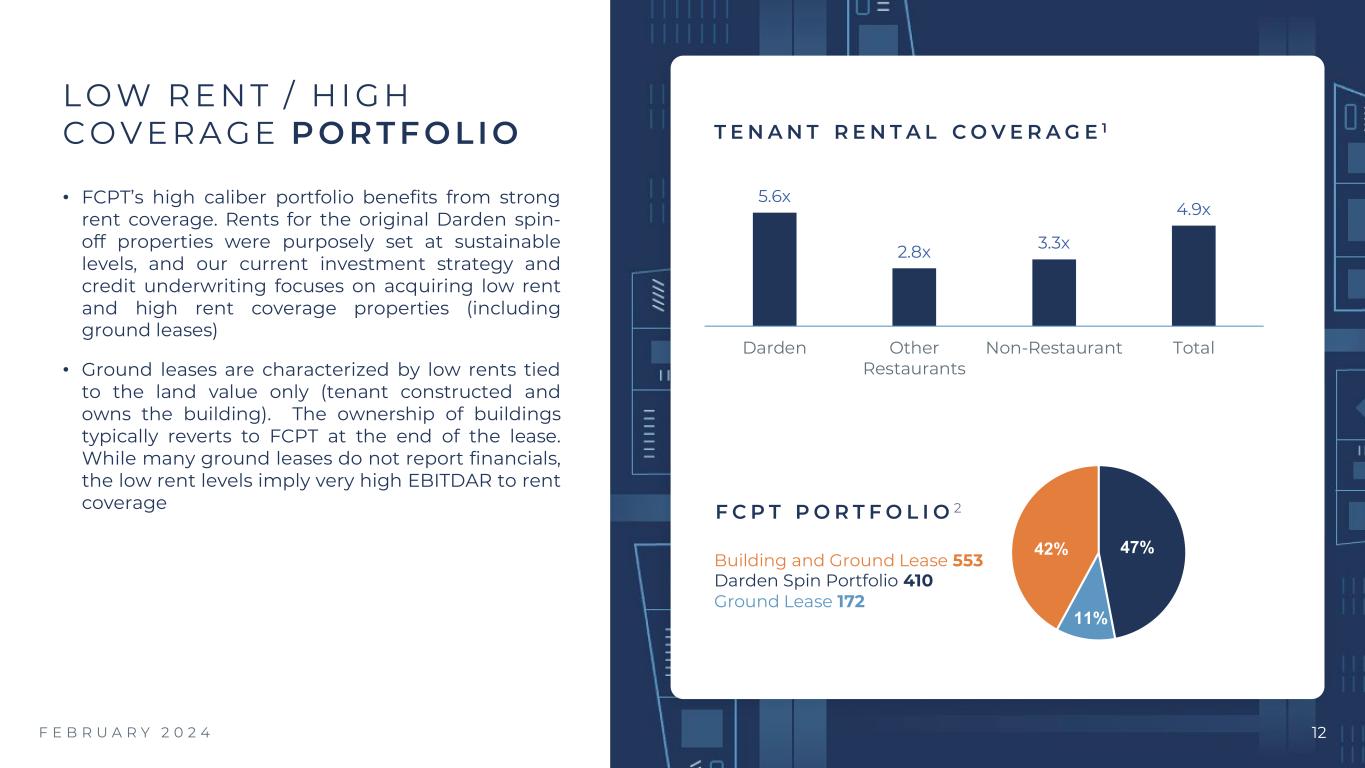

• FCPT’s high caliber portfolio benefits from strong rent coverage. Rents for the original Darden spin- off properties were purposely set at sustainable levels, and our current investment strategy and credit underwriting focuses on acquiring low rent and high rent coverage properties (including ground leases) • Ground leases are characterized by low rents tied to the land value only (tenant constructed and owns the building). The ownership of buildings typically reverts to FCPT at the end of the lease. While many ground leases do not report financials, the low rent levels imply very high EBITDAR to rent coverage L O W R E N T / H I G H C O V E R A GE P OR TF OLIO T E N A N T R E N T A L C O V E R A G E 1 47% 11% 42% F C P T P O R T F O L I O 2 Building and Ground Lease 553 Darden Spin Portfolio 410 Ground Lease 172 5.6x 2.8x 3.3x 4.9x Darden Other Restaurants Non-Restaurant Total 12F E B R U A R Y 2 0 2 4

F E B R U A R Y 2 0 2 4 13 B R A N D E X P O S U RE B Y A N N UAL IZ ED B A S E R E N T 314 leases 83 leases 319 leases 58 brands 26 leases 140 leases 29 brands 115 leases Other restaurants Auto service 85 leases 29 brands Medical retail 53 leases 25 brands Other retail 1,135 Leases / 148 Brands Annual Base Rent of $218.2 million1 52% Darden Exposure 20% Non-Restaurant Exposure F C P T P O R T F O L I O 10% 4% 8% 21% 9% 7% 3% 37% Other restaurants Auto serviceMedical retail Other retail Other Other 37% 21% 10% 9% 8% 7% 4% 3% 2 2 3

F E B R U A R Y 2 0 2 4 14 B R A N D D IV E R SIF ICATION Rank Brand Name # Sq Ft (000s) % of ABR(1) 1 Olive Garden 314 2,673 37.1% 2 Longhorn Steakhouse 115 645 10.4% 3 Chili's 83 455 7.8% 4 Buffalo Wild Wings 28 171 2.5% 5 Cheddar's 13 112 2.2% 6 Red Lobster 18 130 1.7% 7 Caliber Collision 28 390 1.6% 8 Bahama Breeze 10 92 1.5% 9 KFC 33 95 1.5% 10 WellNow Urgent Care 20 78 1.5% 11 Burger King 21 68 1.4% 12 BJ's Restaurant 12 98 1.3% 13 Take 5 Car Wash 9 35 1.3% 14 Bob Evans 15 83 1.2% 15 Oak Street Health 8 68 1.0% 16 Outback Steakhouse 13 88 1.0% 17 Arby's 17 53 0.8% 18 Texas Roadhouse 12 88 0.8% 19 NAPA Auto Parts 17 120 0.8% 20 Starbucks 17 38 0.8% 21 Fresenius 10 80 0.7% 22 Taco Bell 14 35 0.6% 23 Aspen Dental 10 36 0.6% 24 Verizon 12 34 0.6% 25 Tires Plus 11 70 0.6% 26-148 Other 275 1,632 18.7% Total Lease Portfolio 1,135 7,469 100% TOP 10 FCPT PORTFOLIO BRANDS 0 1 0 2 0 3 0 4 0 5 0 6 0 7 0 8 0 9 1 0 59% Investment Grade by ABR2

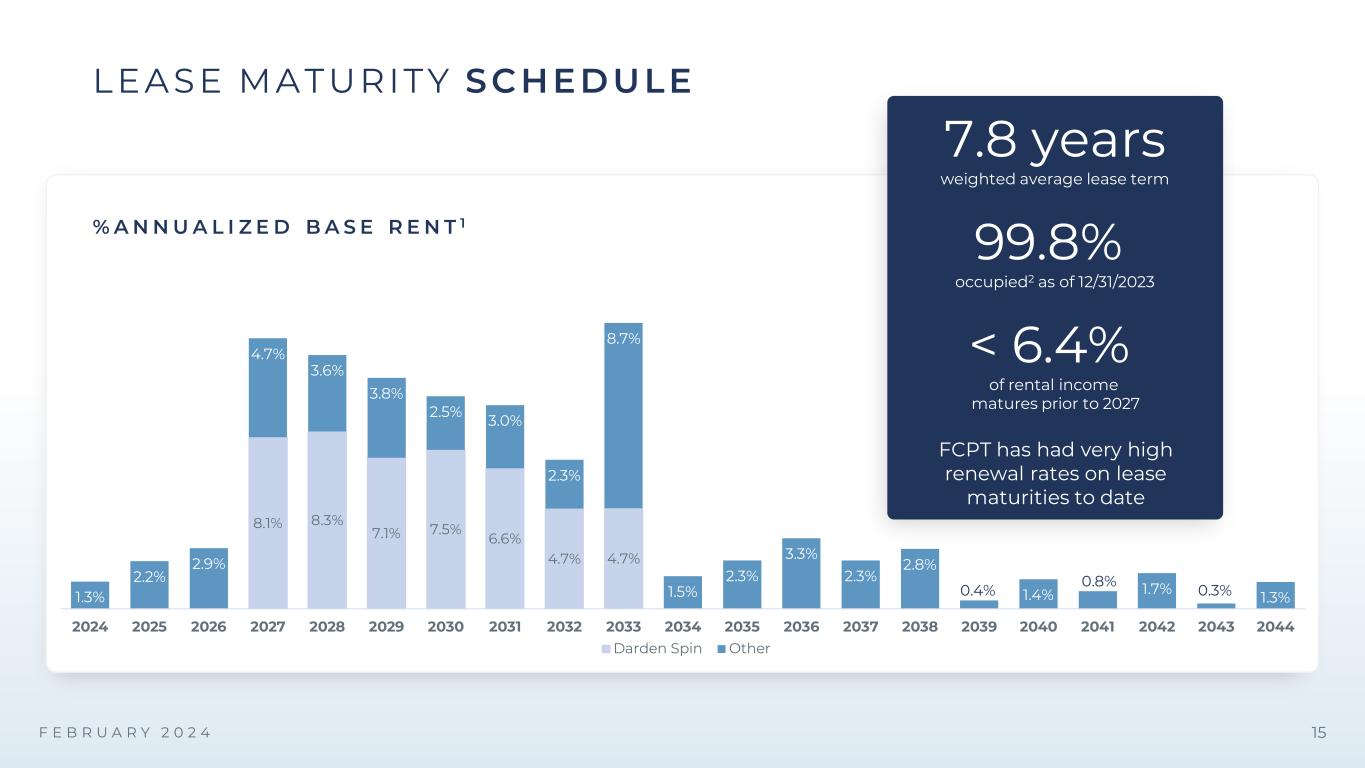

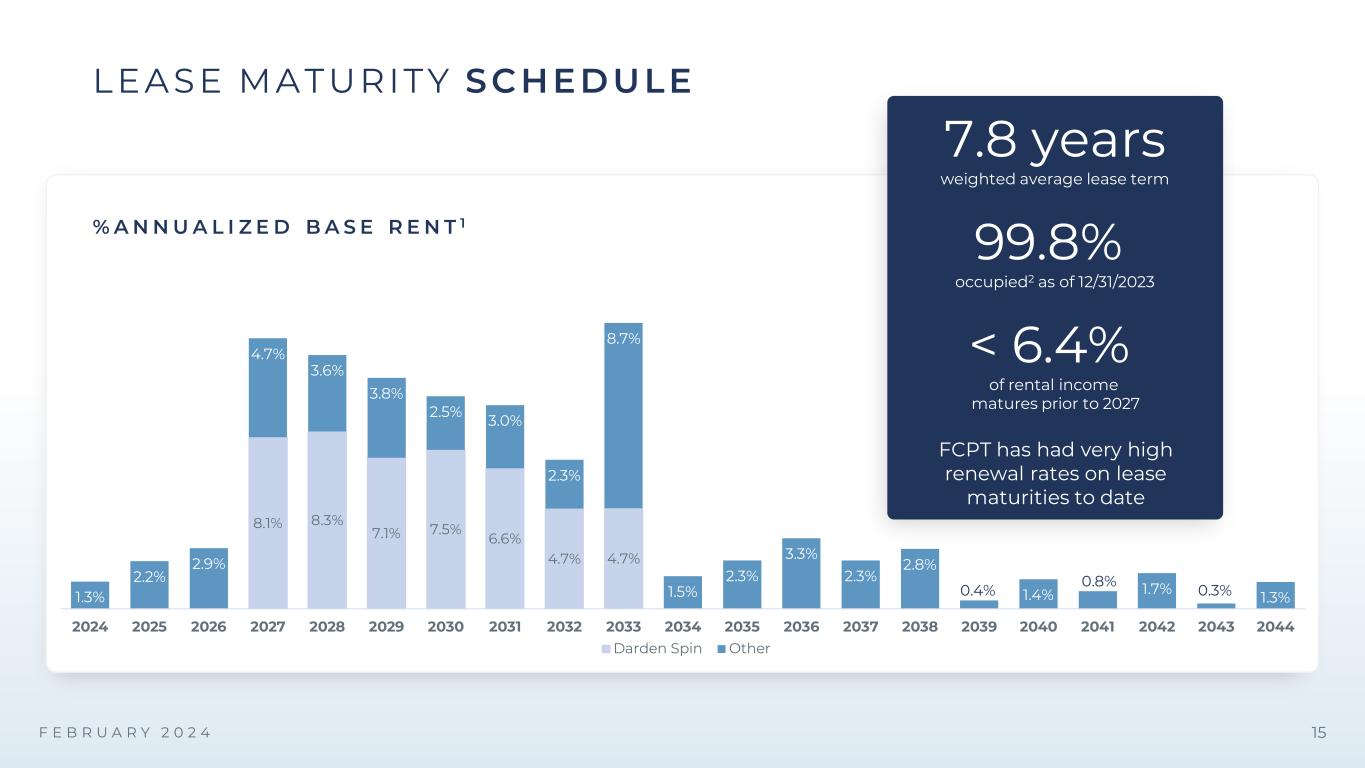

F E B R U A R Y 2 0 2 4 15 8.1% 8.3% 7.1% 7.5% 6.6% 4.7% 4.7% 1.3% 2.2% 2.9% 4.7% 3.6% 3.8% 2.5% 3.0% 2.3% 8.7% 1.5% 2.3% 3.3% 2.3% 2.8% 0.4% 1.4% 0.8% 1.7% 0.3% 1.3% 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2043 2044 Darden Spin Other % A N N U A L I Z E D B A S E R E N T 1 LE A S E M A TURITY SCHEDULE 99.8% occupied2 as of 12/31/2023 7.8 years weighted average lease term < 6.4% of rental income matures prior to 2027 FCPT has had very high renewal rates on lease maturities to date

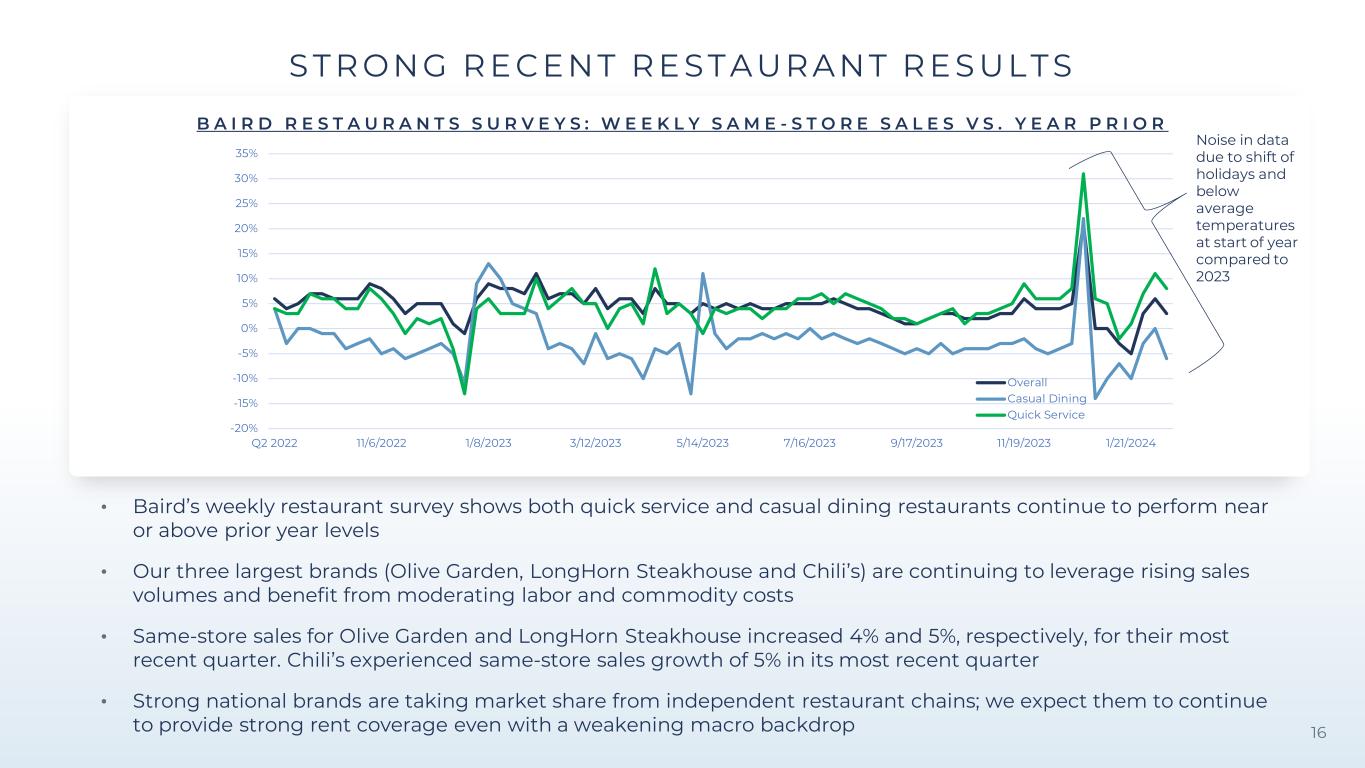

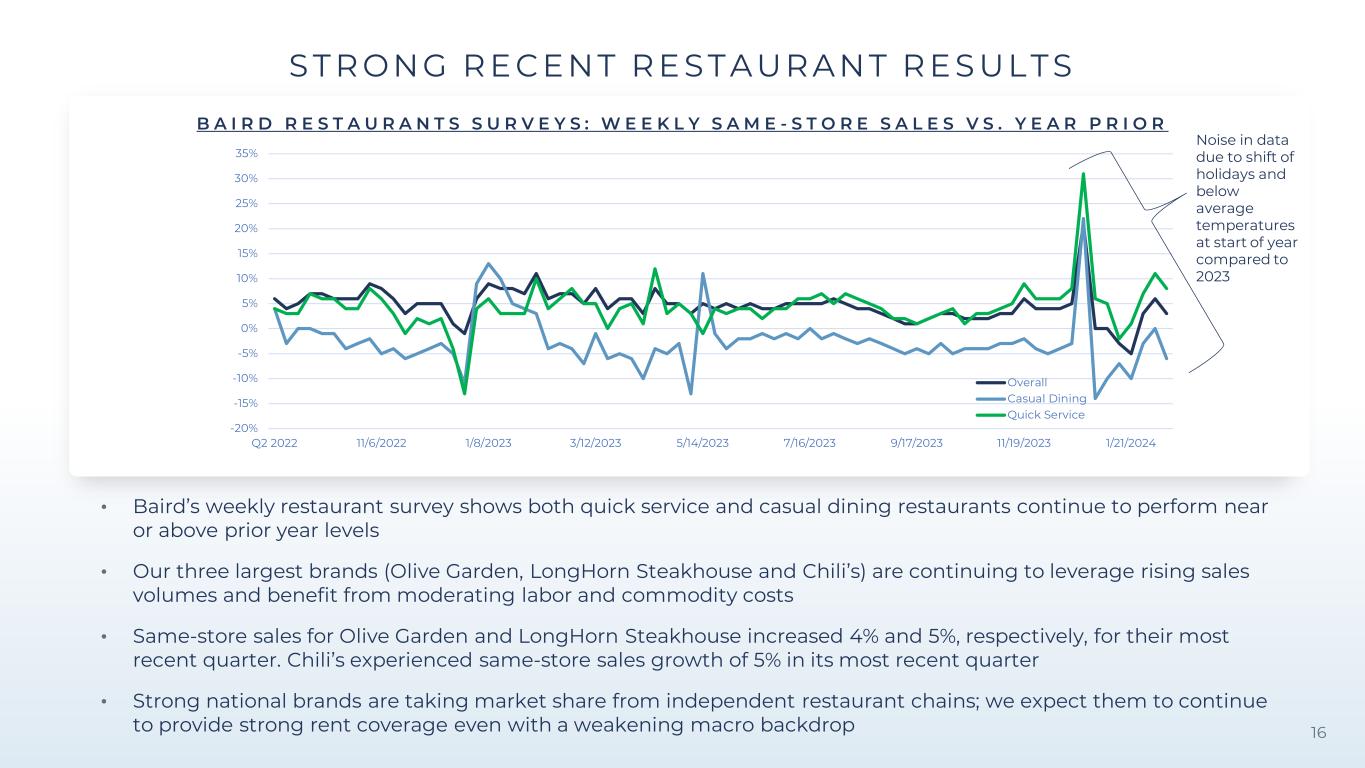

“ S T R ON G R E C E N T R E S T AU R AN T R E S U LT S B A I R D R E S T A U R A N T S S U R V E Y S : W E E K L Y S A M E - S T O R E S A L E S V S . Y E A R P R I O R 16 • Baird’s weekly restaurant survey shows both quick service and casual dining restaurants continue to perform near or above prior year levels • Our three largest brands (Olive Garden, LongHorn Steakhouse and Chili’s) are continuing to leverage rising sales volumes and benefit from moderating labor and commodity costs • Same-store sales for Olive Garden and LongHorn Steakhouse increased 4% and 5%, respectively, for their most recent quarter. Chili’s experienced same-store sales growth of 5% in its most recent quarter • Strong national brands are taking market share from independent restaurant chains; we expect them to continue to provide strong rent coverage even with a weakening macro backdrop -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 35% Q2 2022 11/6/2022 1/8/2023 3/12/2023 5/14/2023 7/16/2023 9/17/2023 11/19/2023 1/21/2024 Overall Casual Dining Quick Service Noise in data due to shift of holidays and below average temperatures at start of year compared to 2023

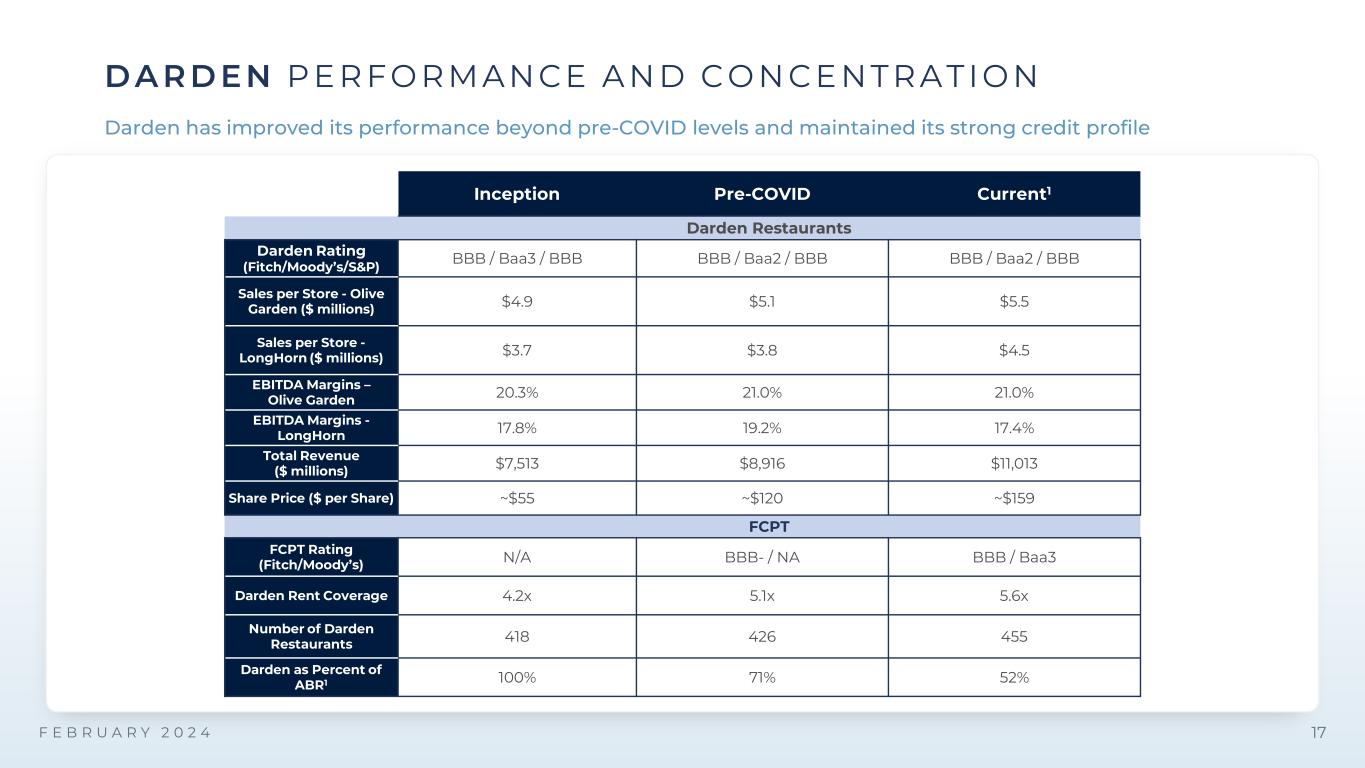

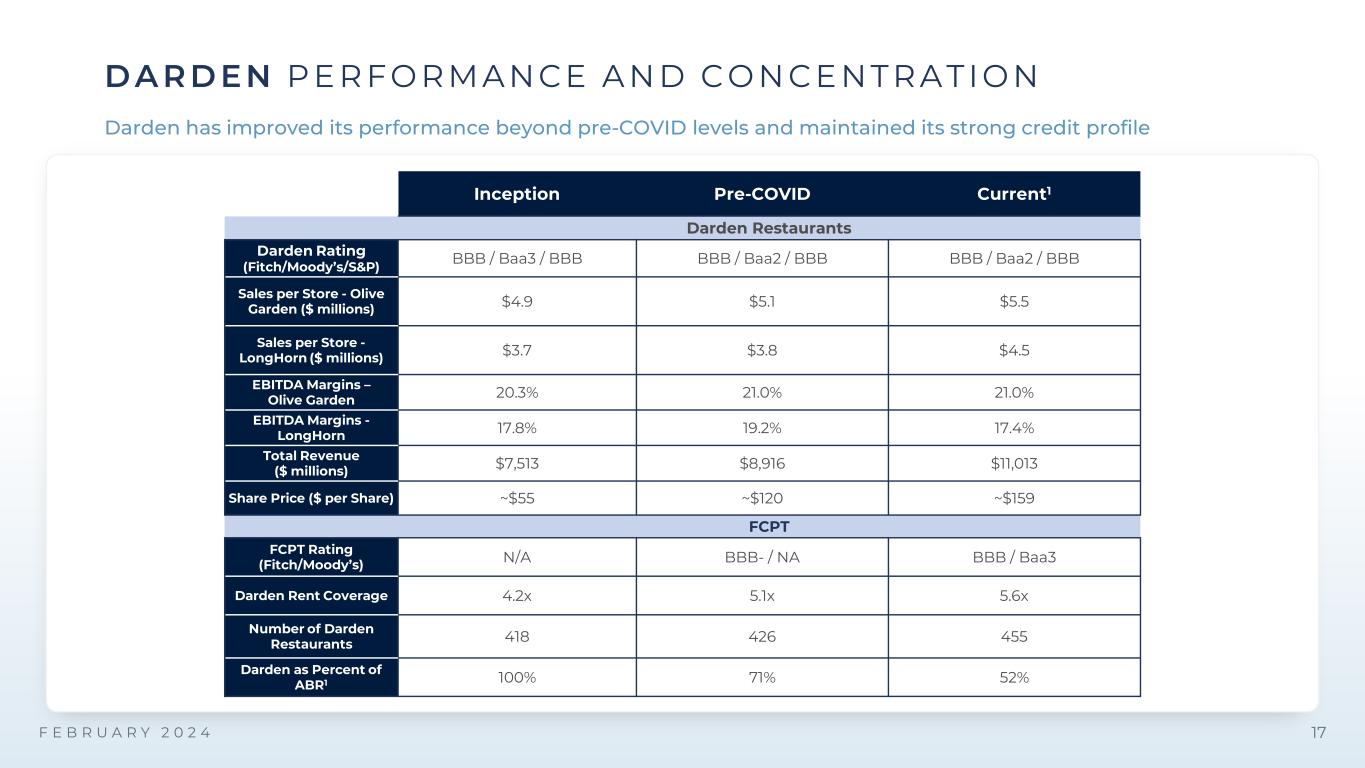

F E B R U A R Y 2 0 2 4 17 D A R D EN P E R FO R M AN CE A N D C O N C E N T R AT I O N Darden has improved its performance beyond pre-COVID levels and maintained its strong credit profile Inception Pre-COVID Current1 Darden Restaurants Darden Rating (Fitch/Moody’s/S&P) BBB / Baa3 / BBB BBB / Baa2 / BBB BBB / Baa2 / BBB Sales per Store - Olive Garden ($ millions) $4.9 $5.1 $5.5 Sales per Store - LongHorn ($ millions) $3.7 $3.8 $4.5 EBITDA Margins – Olive Garden 20.3% 21.0% 21.0% EBITDA Margins - LongHorn 17.8% 19.2% 17.4% Total Revenue ($ millions) $7,513 $8,916 $11,013 Share Price ($ per Share) ~$55 ~$120 ~$159 FCPT FCPT Rating (Fitch/Moody’s) N/A BBB- / NA BBB / Baa3 Darden Rent Coverage 4.2x 5.1x 5.6x Number of Darden Restaurants 418 426 455 Darden as Percent of ABR1 100% 71% 52%

18 140 leases 9% of annual base rent1 • Principally targeting auto service centers, including collision repair and tire service leased to credit worthy operators. We have made select investments in gas stations with large format convenience stores, car wash and auto part retailers at attractive, low bases • Focus is on properties that are not dependent on the internal combustion engine and will remain relevant over the longer-term with higher electric vehicle utilization • Auto service is both e-commerce and recession resistant and tends to operate in high-traffic corridors with good visibility, boosting the intrinsic real estate value and long-term reuse potential • More limited tenant relocation options due to zoning restrictions lead to high tenant renewal probability D I V E R S I FI CAT I ON : A U TO IN D U STR Y

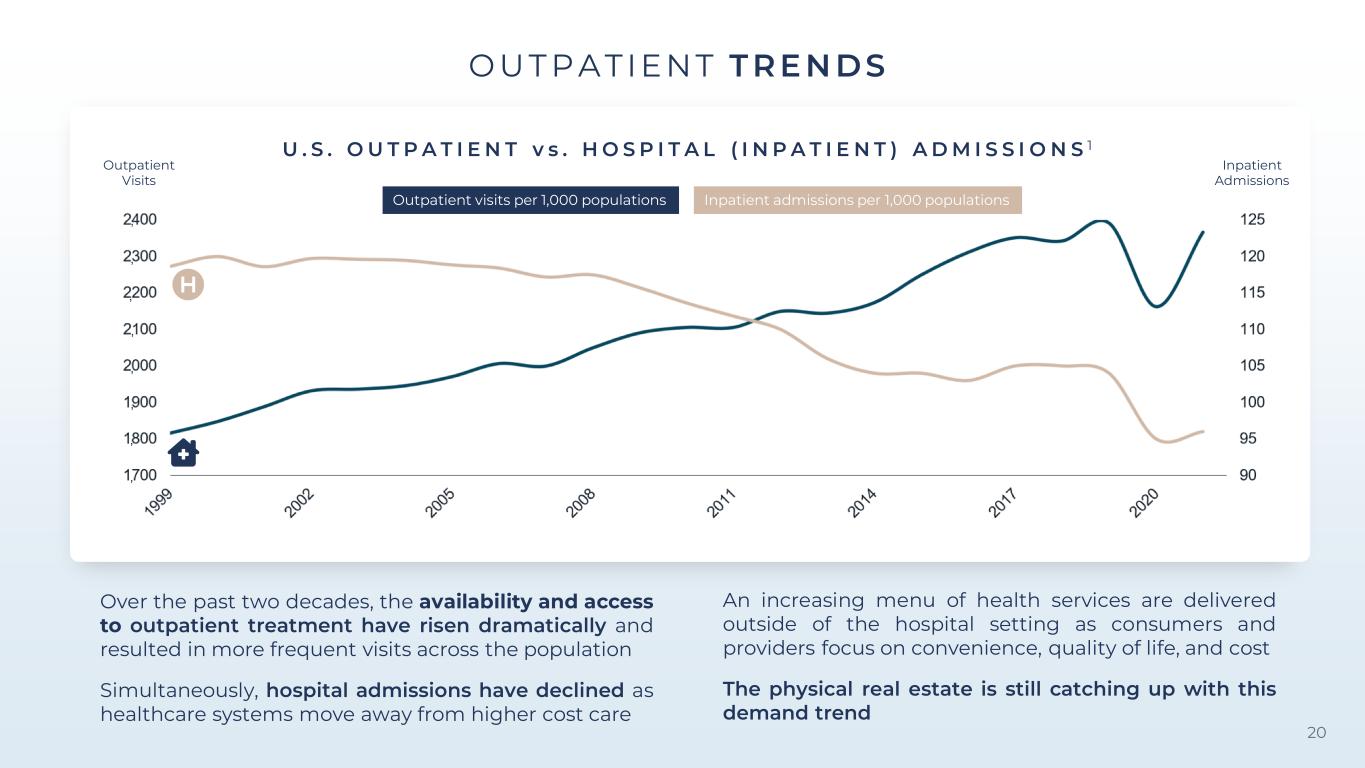

19 85 leases 7% of annual base rent1 D I V E R S I FI CAT I ON : M E D ICAL RE TA IL • FCPT’s largest medical retail exposures are focused on outpatient services: urgent care, dental, primary care, veterinary care, and outpatient / ambulatory surgery centers • Medical retail is e-commerce and recession resistant given its service-based nature, large customer base and favorable demographic tailwinds • Operator consolidation and organic growth within medical retail is improving tenant credit and scale • Medical retail is emerging as an attractive property type with services moving out of hospitals and into lower-cost, retail-centric care centers

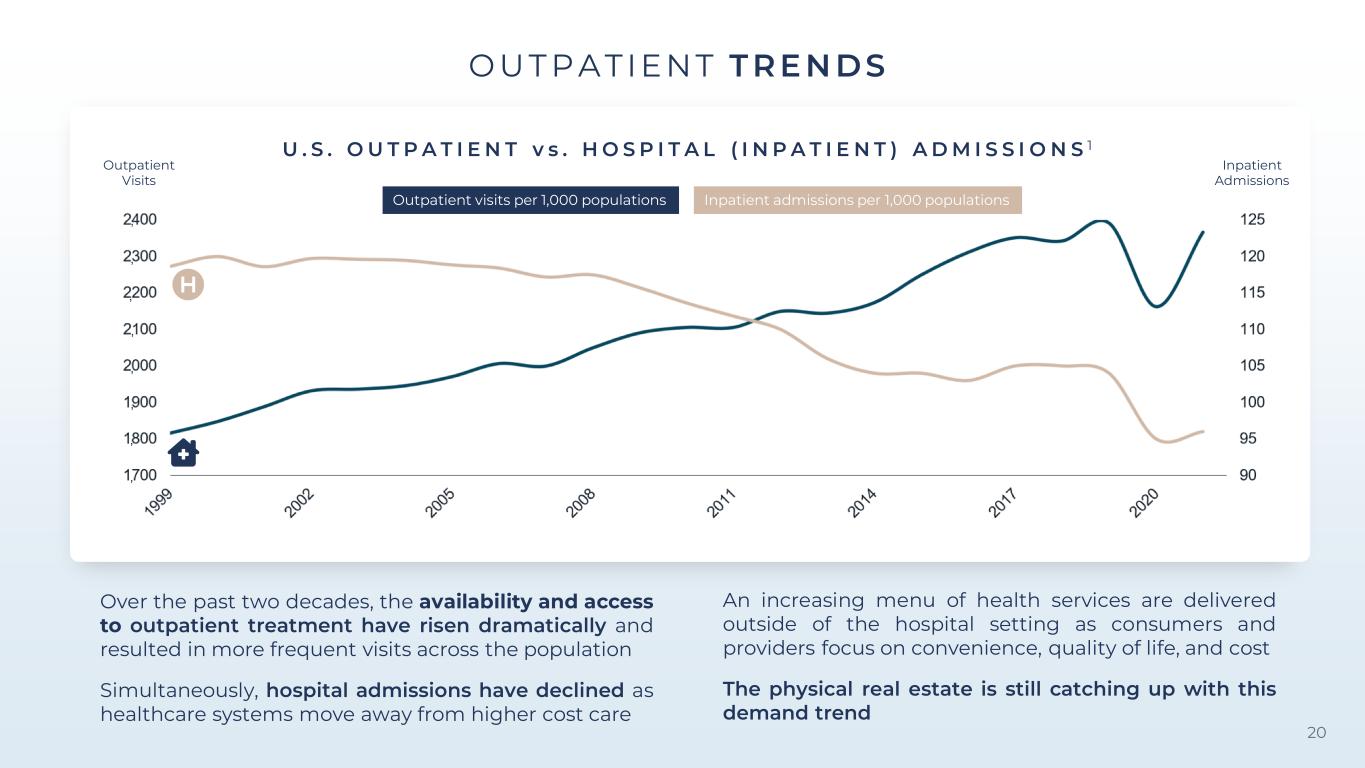

“ O U T P AT I E N T TR E N DS Outpatient Visits Inpatient Admissions Inpatient admissions per 1,000 populationsOutpatient visits per 1,000 populations U . S . O U T P A T I E N T v s . H O S P I T A L ( I N P A T I E N T ) A D M I S S I O N S 1 20 Over the past two decades, the availability and access to outpatient treatment have risen dramatically and resulted in more frequent visits across the population Simultaneously, hospital admissions have declined as healthcare systems move away from higher cost care An increasing menu of health services are delivered outside of the hospital setting as consumers and providers focus on convenience, quality of life, and cost The physical real estate is still catching up with this demand trend , , , , , , , ,

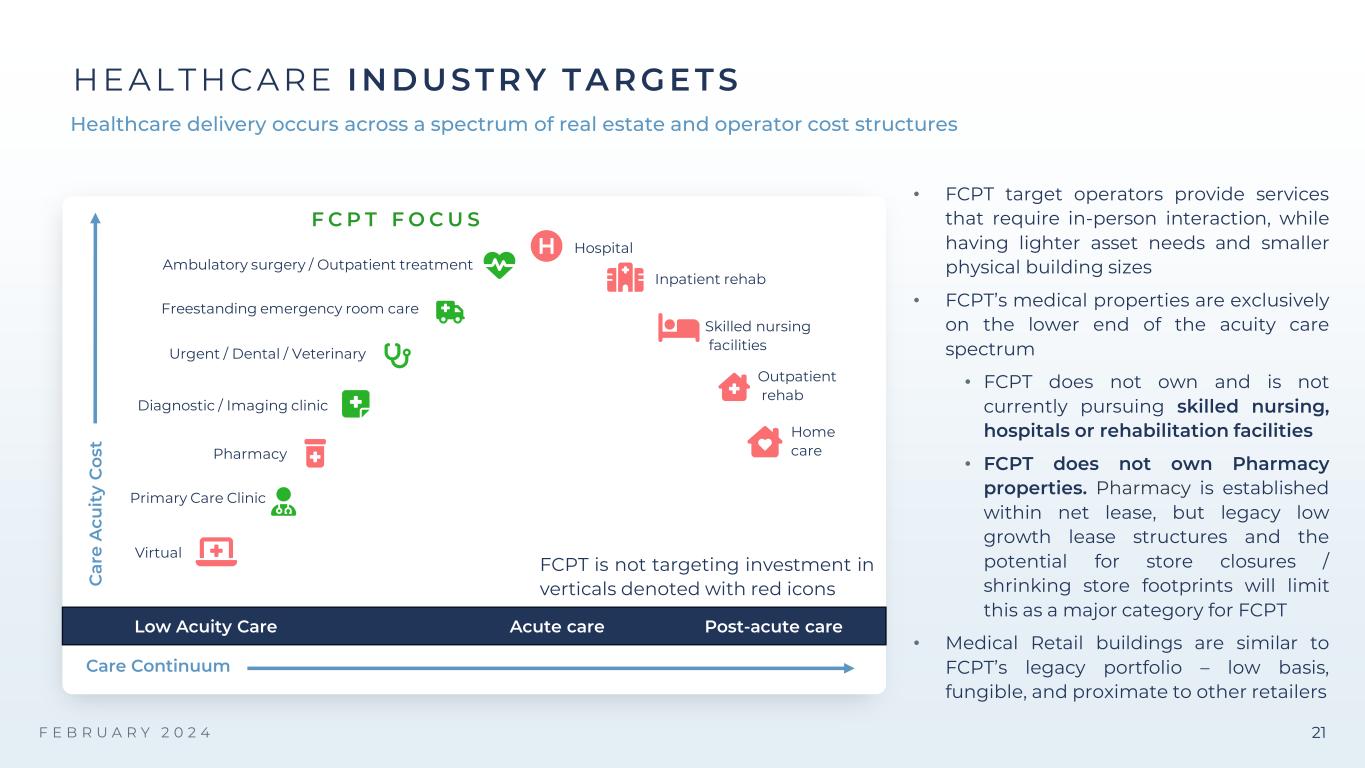

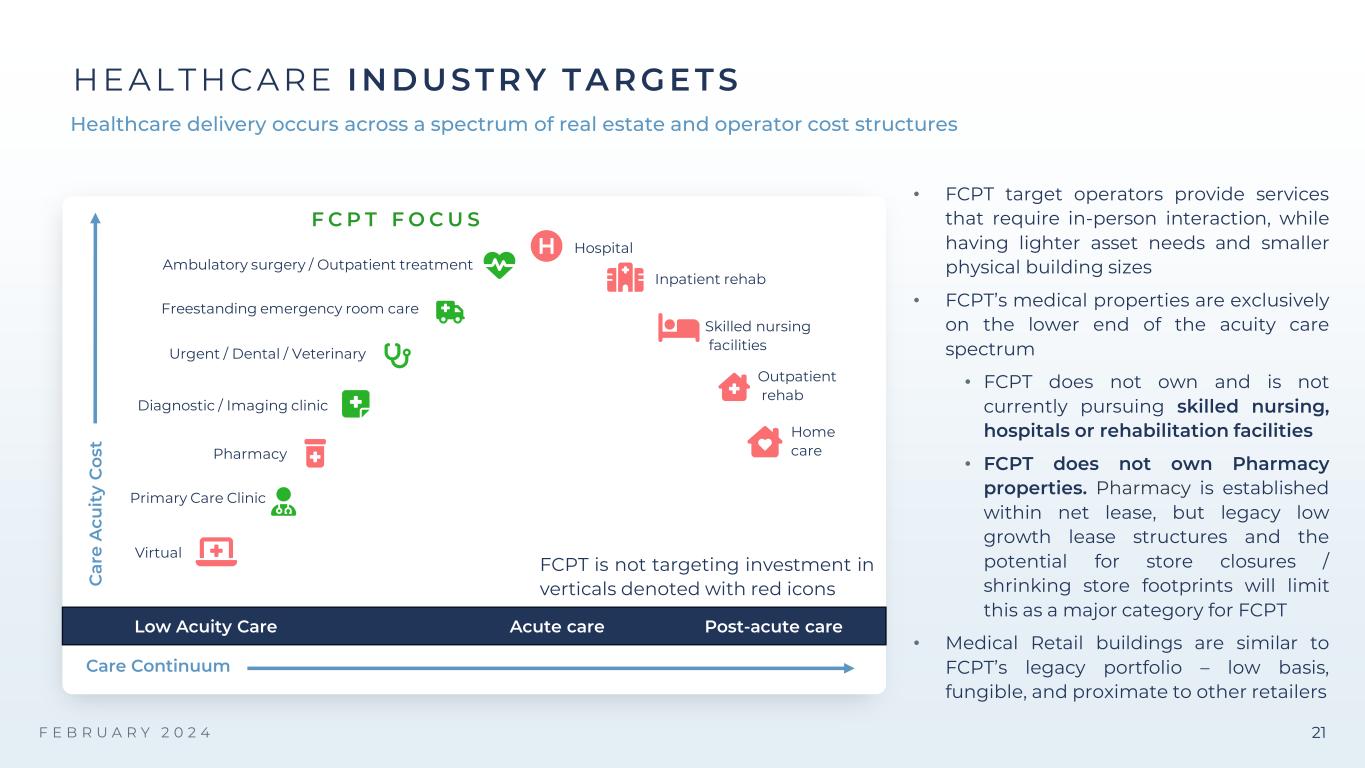

F E B R U A R Y 2 0 2 4 Skilled nursing facilities Primary Care Clinic Pharmacy Virtual Diagnostic / Imaging clinic Hospital Urgent / Dental / Veterinary C ar e A cu it y C os t Care Continuum Freestanding emergency room care Ambulatory surgery / Outpatient treatment Inpatient rehab Outpatient rehab Home care Low Acuity Care Acute care Post-acute care F C P T F O C U S • FCPT target operators provide services that require in-person interaction, while having lighter asset needs and smaller physical building sizes • FCPT’s medical properties are exclusively on the lower end of the acuity care spectrum • FCPT does not own and is not currently pursuing skilled nursing, hospitals or rehabilitation facilities • FCPT does not own Pharmacy properties. Pharmacy is established within net lease, but legacy low growth lease structures and the potential for store closures / shrinking store footprints will limit this as a major category for FCPT • Medical Retail buildings are similar to FCPT’s legacy portfolio – low basis, fungible, and proximate to other retailers Healthcare delivery occurs across a spectrum of real estate and operator cost structures 21 H E A L T H CAR E IN D US TR Y TA R G E TS FCPT is not targeting investment in verticals denoted with red icons

F E B R U A R Y 2 0 2 4 22 M E D I C AL R E T AI L INV E STMENT HIS T ORY Sector 2021 2022 2023 Total Investment Total leases % Total Medical Urgent Care $11 $20 $27 $58 24 25% Primary Care $2 $2 $39 $42 12 18% Veterinary $9 $17 $11 $37 13 16% Dialysis $10 $18 $3 $30 13 13% Dental $8 $7 $13 $28 13 12% Specialty Outpatient/ Ambulatory Surgery $1 - $14 $15 3 6% Emergency Room - - $13 $13 2 6% Other $3 $5 - $7 3 3% Diagnostic / Imaging $2 - - $2 1 1% Total Rental Revenue $46 $69 $119 $233 84 100% F C P T M E D I C A L R E T A I L I N V E S T M E N T S ( 2 0 2 1 - 2 0 2 3 ) Investments ($ Million) F C P T F O C U S % of FCPT medical retail Primary Care Clinic18% Diagnostic/Imaging clinic1% Freestanding ER care6% Urgent / Dental / Veterinary53% Dialysis / Specialty outpatient / Ambulatory surgery 19% Since 2021, FCPT has made $233 million of investments within medical retail across 84 leases. In 2023, FCPT meaningly outpaced medical retail investments in prior years

F E B R U A R Y 2 0 2 4 23 2 H I G H Q U A L I T Y P O R T F O L I O P G 9 3 C O N S E R V A T I V E F I N A N C I A L P O S I T I O N P G 2 3 4 A P P E N D I X P G 2 6 1 C O M P A N Y O V E R V I E W P G 3CONTENTS

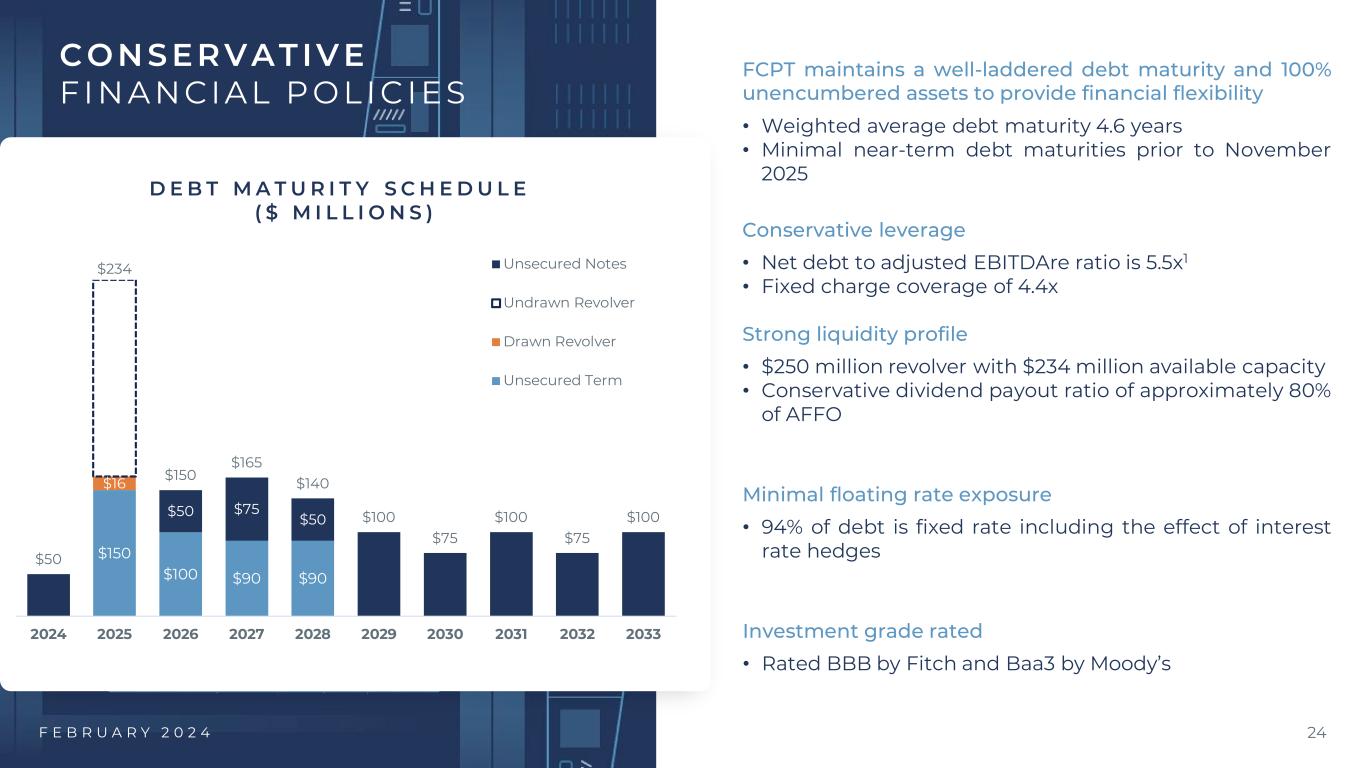

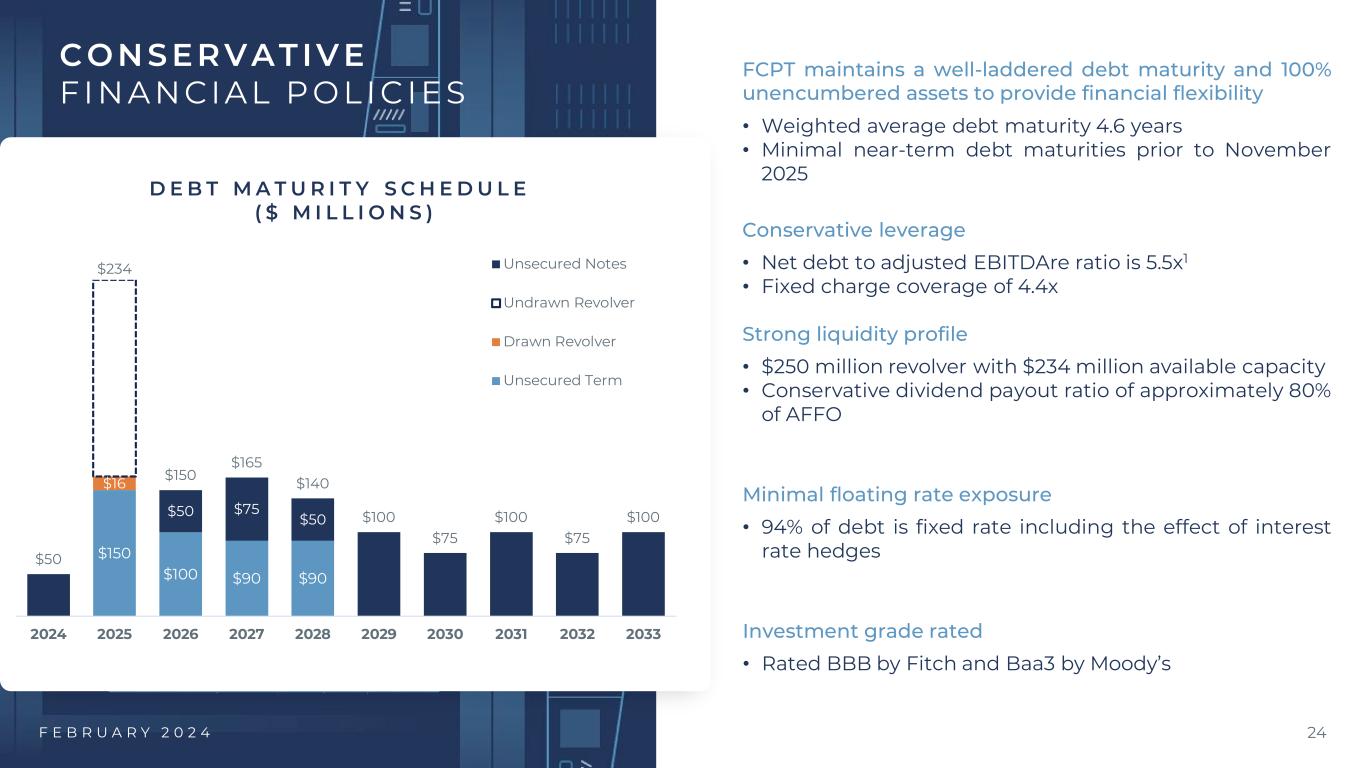

“ F E B R U A R Y 2 0 2 4 24 $150 $100 $90 $90 $16 $234 $50 $75 $50 $50 $150 $165 $140 $100 $75 $100 $75 $100 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Unsecured Notes Undrawn Revolver Drawn Revolver Unsecured Term D E B T M A T U R I T Y S C H E D U L E ( $ M I L L I O N S ) FCPT maintains a well-laddered debt maturity and 100% unencumbered assets to provide financial flexibility • Weighted average debt maturity 4.6 years • Minimal near-term debt maturities prior to November 2025 Conservative leverage • Net debt to adjusted EBITDAre ratio is 5.5x1 • Fixed charge coverage of 4.4x Strong liquidity profile • $250 million revolver with $234 million available capacity • Conservative dividend payout ratio of approximately 80% of AFFO Minimal floating rate exposure • 94% of debt is fixed rate including the effect of interest rate hedges Investment grade rated • Rated BBB by Fitch and Baa3 by Moody’s C ON S ER VATIV E F I N A N CI AL P O L I C I E S

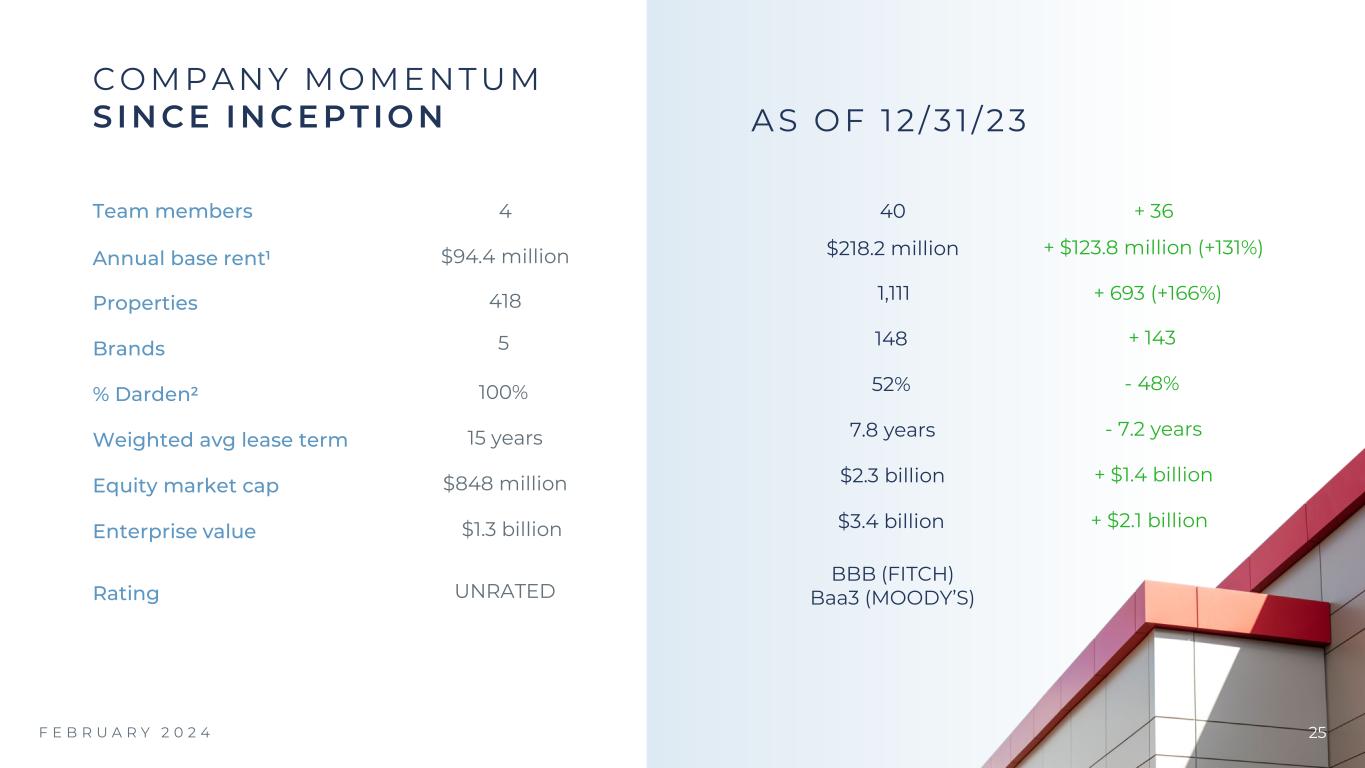

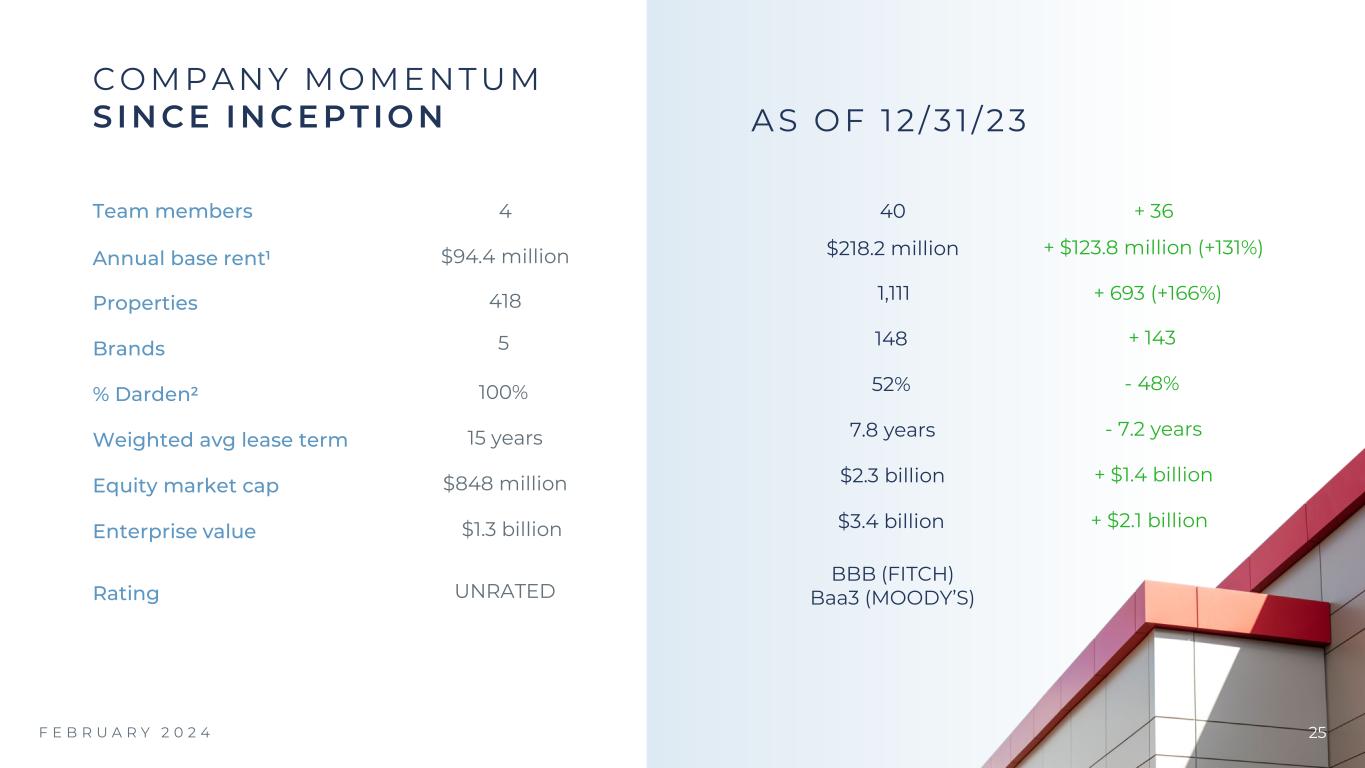

F E B R U A R Y 2 0 2 4 25 C O M P AN Y M O M E N T U M S IN C E IN C E PTION A S O F 1 2 / 3 1 / 2 3 Rating UNRATED BBB (FITCH) Baa3 (MOODY’S) Team members 4 40 + 36 Annual base rent1 $94.4 million $218.2 million + $123.8 million (+131%) Properties 418 1,111 + 693 (+166%) Brands 5 148 + 143 % Darden2 100% 52% - 48% Weighted avg lease term 15 years 7.8 years - 7.2 years Equity market cap $848 million $2.3 billion + $1.4 billion Enterprise value $1.3 billion $3.4 billion + $2.1 billion

F E B R U A R Y 2 0 2 4 26 2 H I G H Q U A L I T Y P O R T F O L I O P G 9 1 C O M P A N Y O V E R V I E W P G 3 4 A P P E N D I X P G 2 6 CONTENTS 3 C O N S E R V A T I V E F I N A N C I A L P O S I T I O N P G 2 3

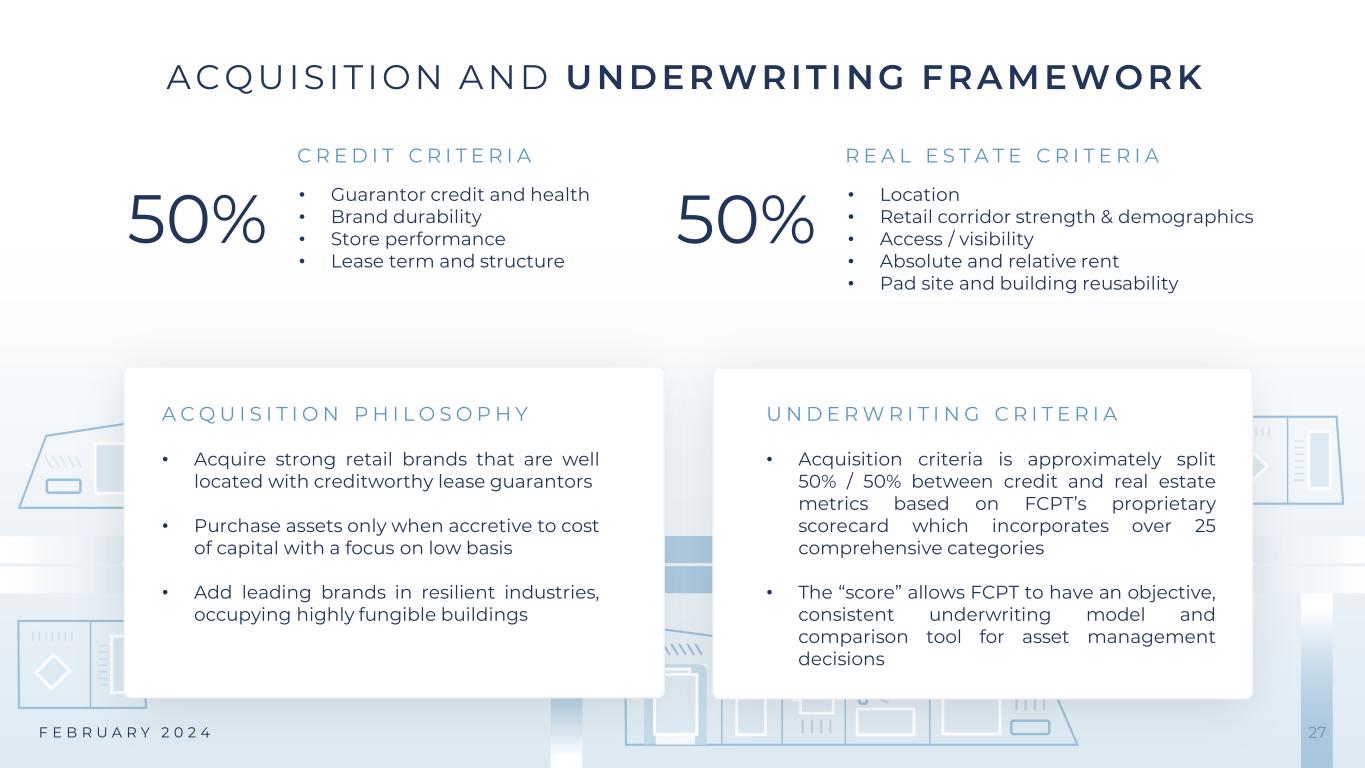

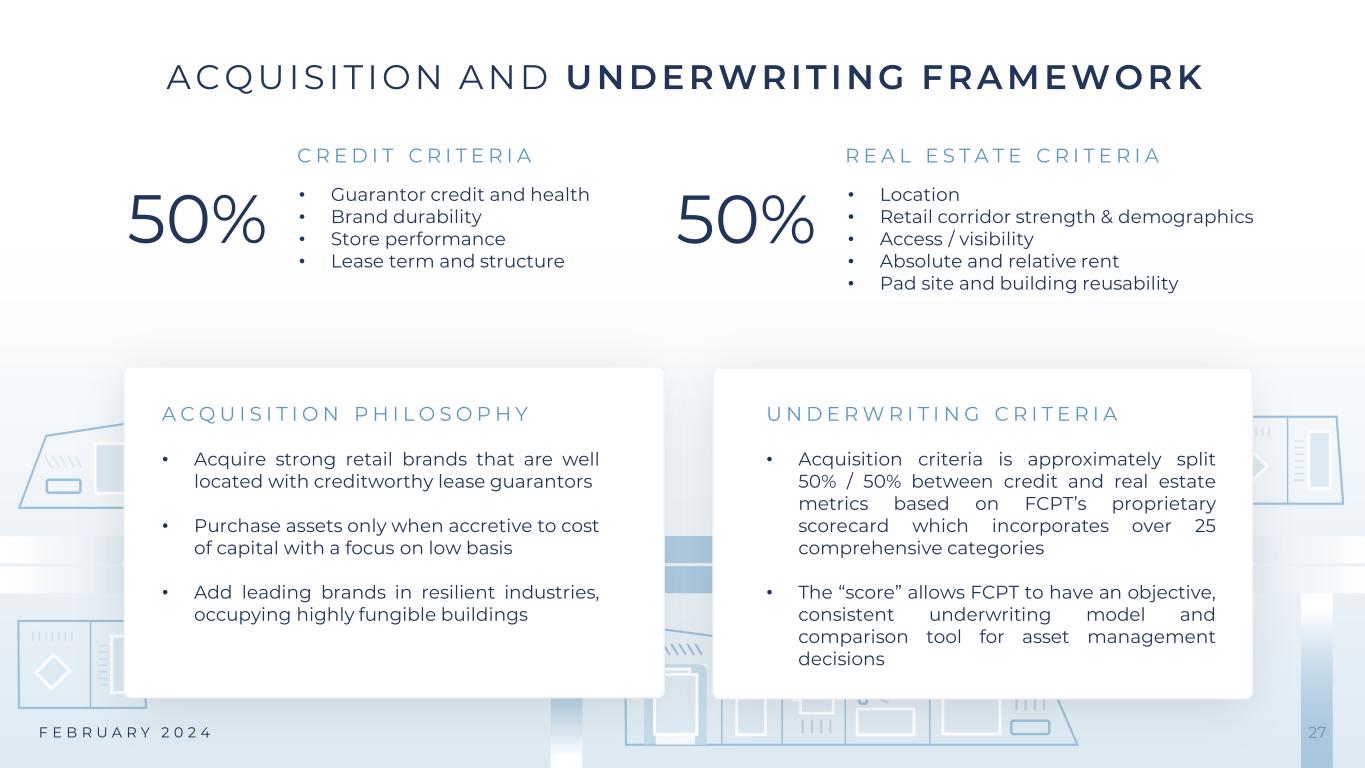

F E B R U A R Y 2 0 2 4 27 50% C R E D I T C R I T E R I A • Guarantor credit and health • Brand durability • Store performance • Lease term and structure • Location • Retail corridor strength & demographics • Access / visibility • Absolute and relative rent • Pad site and building reusability A C Q UISIT ION A ND UNDERWRITING FRAMEWORK R E A L E S T A T E C R I T E R I A 50% A C Q U I S I T I O N P H I L O S O P H Y • Acquire strong retail brands that are well located with creditworthy lease guarantors • Purchase assets only when accretive to cost of capital with a focus on low basis • Add leading brands in resilient industries, occupying highly fungible buildings U N D E R W R I T I N G C R I T E R I A • Acquisition criteria is approximately split 50% / 50% between credit and real estate metrics based on FCPT’s proprietary scorecard which incorporates over 25 comprehensive categories • The “score” allows FCPT to have an objective, consistent underwriting model and comparison tool for asset management decisions

E N V I R O N M E N T S O C I A L O U R T E A M G O V E R N A N C E S U S T AI N AB I L I T Y F R A M EWOR K Our commitment to sustainability and Environmental, Social and Governance (ESG) principles creates value our shareholders. We continuously review our internal policies to advance in the areas of environmental sustainability, social responsibility, employee well-being, and governance. For more details, see the FCPT ESG Report and policies on our website https://fcpt.com/about-us/ We evaluate our business operations and the environmental risk aspects of our investment portfolio on an ongoing basis and strive to adhere to sustainable business practices We apply values-based negative screening in our underwriting process and do not transact with any tenant, buyer, or seller or acquire any properties with negative social factors. We do not process or have access to any consumer data Our culture is inclusive and team-oriented with a high retention rate. We hire for the long-term and invest in development, with a flat organization that drives employee engagement. We are a certified ‘Great Place to Work’ We aim for best-in-class corporate governance structures and compensation practices that closely align the interests of our Board and leadership with those of our stockholders. Four of our eight Board Directors are female and seven are independent, including our chairperson. Only independent Directors serve on the Board’s committees 28F E B R U A R Y 2 0 2 4

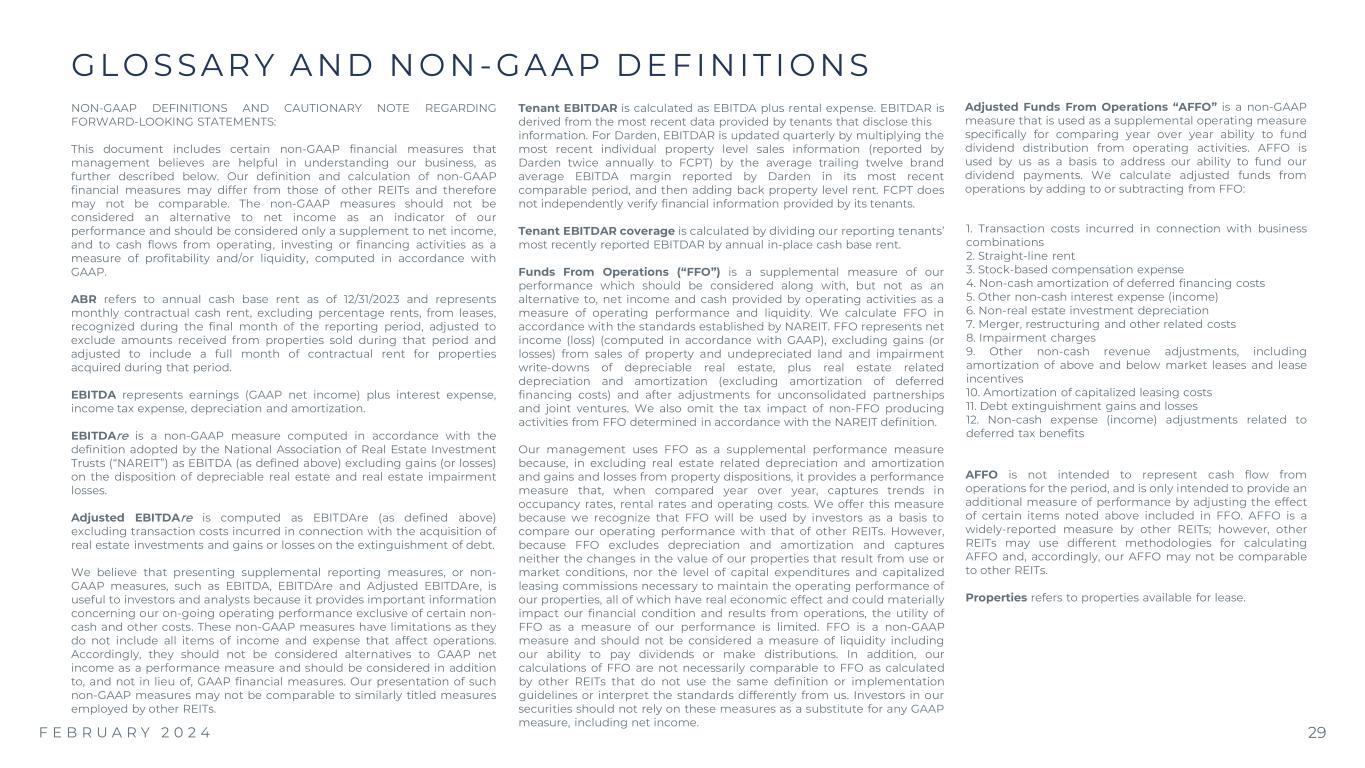

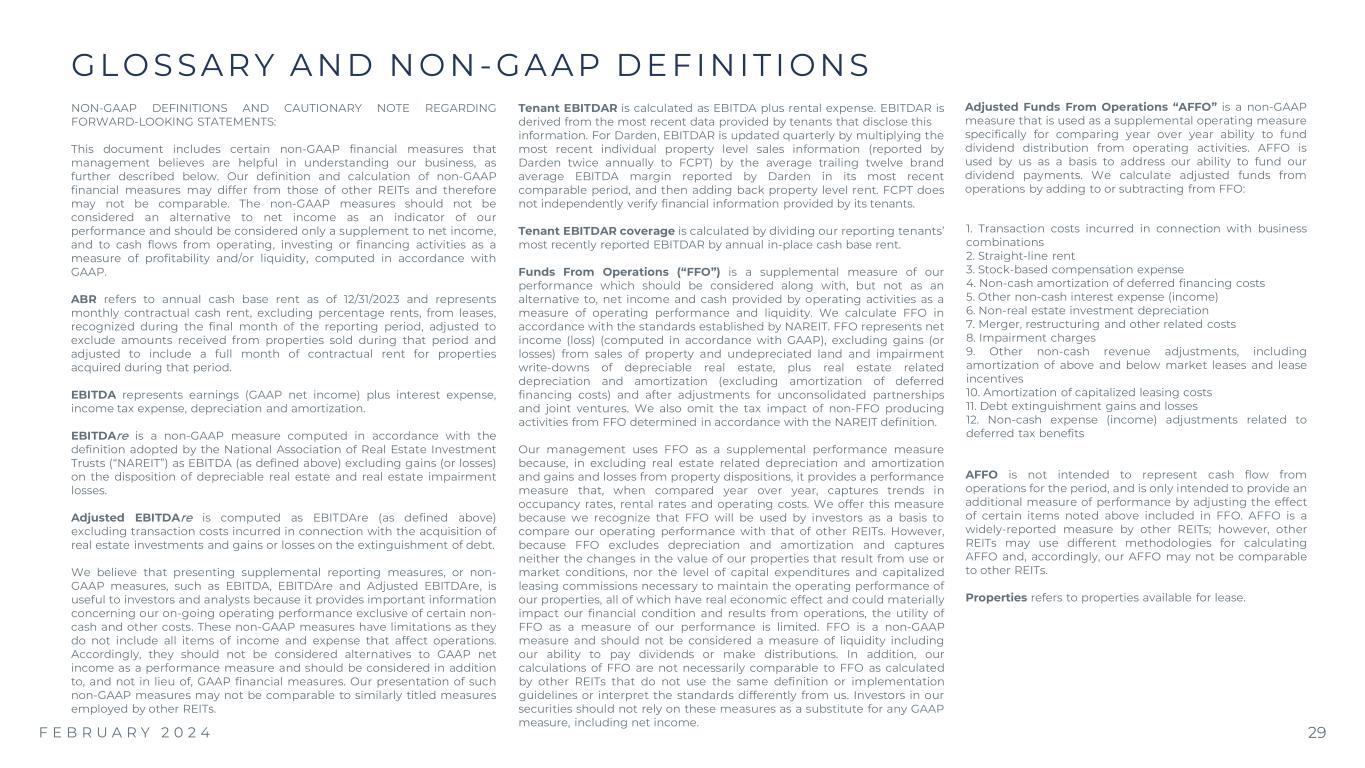

29 NON-GAAP DEFINITIONS AND CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This document includes certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs and therefore may not be comparable. The non-GAAP measures should not be considered an alternative to net income as an indicator of our performance and should be considered only a supplement to net income, and to cash flows from operating, investing or financing activities as a measure of profitability and/or liquidity, computed in accordance with GAAP. ABR refers to annual cash base rent as of 12/31/2023 and represents monthly contractual cash rent, excluding percentage rents, from leases, recognized during the final month of the reporting period, adjusted to exclude amounts received from properties sold during that period and adjusted to include a full month of contractual rent for properties acquired during that period. EBITDA represents earnings (GAAP net income) plus interest expense, income tax expense, depreciation and amortization. EBITDAre is a non-GAAP measure computed in accordance with the definition adopted by the National Association of Real Estate Investment Trusts (“NAREIT”) as EBITDA (as defined above) excluding gains (or losses) on the disposition of depreciable real estate and real estate impairment losses. Adjusted EBITDAre is computed as EBITDAre (as defined above) excluding transaction costs incurred in connection with the acquisition of real estate investments and gains or losses on the extinguishment of debt. We believe that presenting supplemental reporting measures, or non- GAAP measures, such as EBITDA, EBITDAre and Adjusted EBITDAre, is useful to investors and analysts because it provides important information concerning our on-going operating performance exclusive of certain non- cash and other costs. These non-GAAP measures have limitations as they do not include all items of income and expense that affect operations. Accordingly, they should not be considered alternatives to GAAP net income as a performance measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Our presentation of such non-GAAP measures may not be comparable to similarly titled measures employed by other REITs. Tenant EBITDAR is calculated as EBITDA plus rental expense. EBITDAR is derived from the most recent data provided by tenants that disclose this information. For Darden, EBITDAR is updated quarterly by multiplying the most recent individual property level sales information (reported by Darden twice annually to FCPT) by the average trailing twelve brand average EBITDA margin reported by Darden in its most recent comparable period, and then adding back property level rent. FCPT does not independently verify financial information provided by its tenants. Tenant EBITDAR coverage is calculated by dividing our reporting tenants’ most recently reported EBITDAR by annual in-place cash base rent. Funds From Operations (“FFO”) is a supplemental measure of our performance which should be considered along with, but not as an alternative to, net income and cash provided by operating activities as a measure of operating performance and liquidity. We calculate FFO in accordance with the standards established by NAREIT. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property and undepreciated land and impairment write-downs of depreciable real estate, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. We also omit the tax impact of non-FFO producing activities from FFO determined in accordance with the NAREIT definition. Our management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We offer this measure because we recognize that FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. FFO is a non-GAAP measure and should not be considered a measure of liquidity including our ability to pay dividends or make distributions. In addition, our calculations of FFO are not necessarily comparable to FFO as calculated by other REITs that do not use the same definition or implementation guidelines or interpret the standards differently from us. Investors in our securities should not rely on these measures as a substitute for any GAAP measure, including net income. Adjusted Funds From Operations “AFFO” is a non-GAAP measure that is used as a supplemental operating measure specifically for comparing year over year ability to fund dividend distribution from operating activities. AFFO is used by us as a basis to address our ability to fund our dividend payments. We calculate adjusted funds from operations by adding to or subtracting from FFO: 1. Transaction costs incurred in connection with business combinations 2. Straight-line rent 3. Stock-based compensation expense 4. Non-cash amortization of deferred financing costs 5. Other non-cash interest expense (income) 6. Non-real estate investment depreciation 7. Merger, restructuring and other related costs 8. Impairment charges 9. Other non-cash revenue adjustments, including amortization of above and below market leases and lease incentives 10. Amortization of capitalized leasing costs 11. Debt extinguishment gains and losses 12. Non-cash expense (income) adjustments related to deferred tax benefits AFFO is not intended to represent cash flow from operations for the period, and is only intended to provide an additional measure of performance by adjusting the effect of certain items noted above included in FFO. AFFO is a widely-reported measure by other REITs; however, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs. Properties refers to properties available for lease. G L O S S AR Y A N D N O N - GAAP D E F I N I T I ON S F E B R U A R Y 2 0 2 4

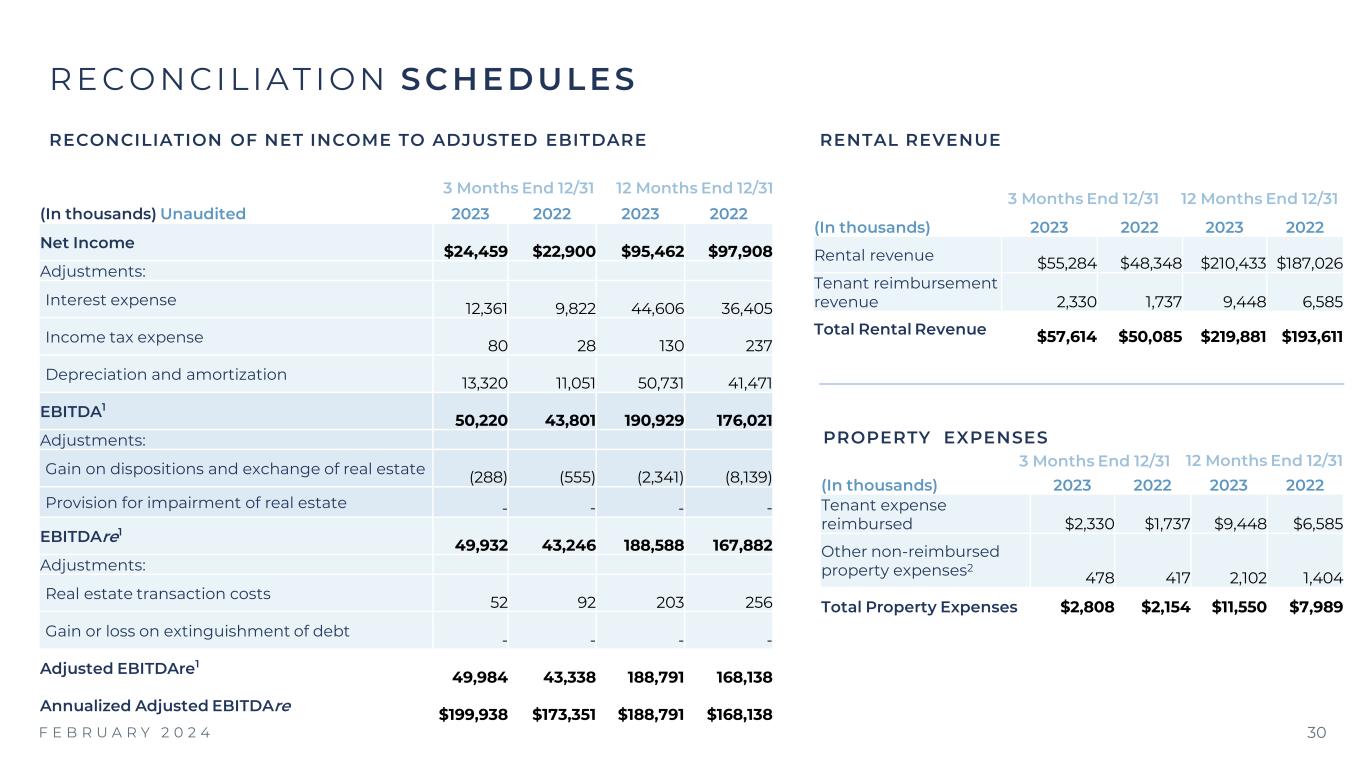

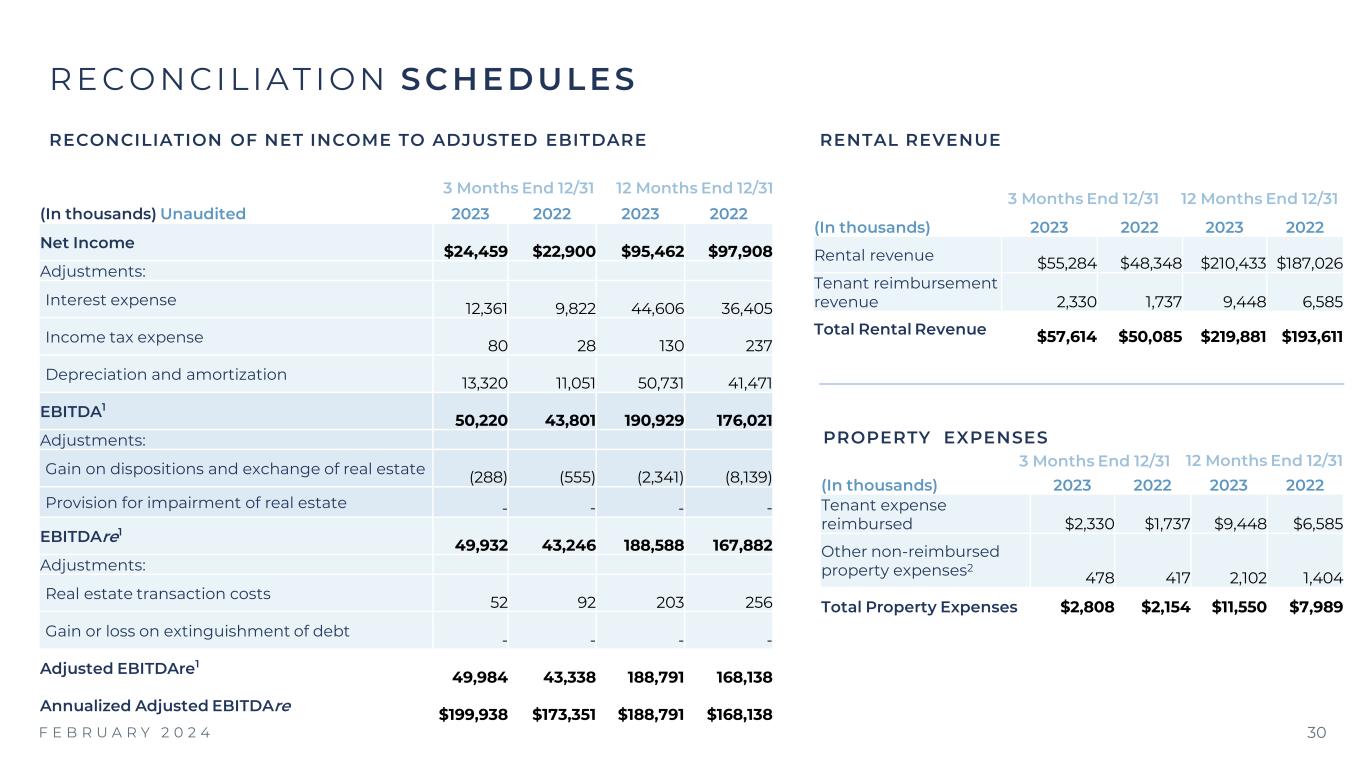

F E B R U A R Y 2 0 2 4 30 R E C O N CI LI AT I ON S C H EDULES RECONCILIATION OF NET INCOME TO ADJUSTED EBITDARE (In thousands) Unaudited 2023 2022 2023 2022 Net Income $24,459 $22,900 $95,462 $97,908 Adjustments: Interest expense 12,361 9,822 44,606 36,405 Income tax expense 80 28 130 237 Depreciation and amortization 13,320 11,051 50,731 41,471 EBITDA1 50,220 43,801 190,929 176,021 Adjustments: Gain on dispositions and exchange of real estate (288) (555) (2,341) (8,139) Provision for impairment of real estate - - - - EBITDAre1 49,932 43,246 188,588 167,882 Adjustments: Real estate transaction costs 52 92 203 256 Gain or loss on extinguishment of debt - - - - Adjusted EBITDAre1 49,984 43,338 188,791 168,138 Annualized Adjusted EBITDAre $199,938 $173,351 $188,791 $168,138 (In thousands) 2023 2022 2023 2022 Rental revenue $55,284 $48,348 $210,433 $187,026 Tenant reimbursement revenue 2,330 1,737 9,448 6,585 Total Rental Revenue $57,614 $50,085 $219,881 $193,611 RENTAL REVENUE (In thousands) 2023 2022 2023 2022 Tenant expense reimbursed $2,330 $1,737 $9,448 $6,585 Other non-reimbursed property expenses2 478 417 2,102 1,404 Total Property Expenses $2,808 $2,154 $11,550 $7,989 PROPERTY EXPENSES 3 Months End 12/31 12 Months End 12/31 3 Months End 12/31 12 Months End 12/31 3 Months End 12/31 12 Months End 12/31

F E B R U A R Y 2 0 2 4 31 F F O & A F F O R E C ONCILIATION (In thousands) Unaudited 2023 2022 2023 2022 Net income $24,459 $22,900 $95,462 $97,908 Depreciation and amortization 13,284 11,020 50,592 41,342 Realized gain on sales of real estate (288) (555) (2,341) (8,139) FFO (as defined by NAREIT) $37,455 $ 33,365 $143,713 $131,111 Straight-line rental revenue (1,165) (1,433) (5,523) (6,372) Deferred income tax benefit1 (27) (68) (259) (125) Stock-based compensation 1,473 1,239 6,271 4,978 Non-cash amortization of deferred financing costs 592 644 2,311 2,104 Non-real estate investment depreciation 36 31 139 129 Other non-cash revenue adjustments 551 551 2,061 2,151 Adjusted Funds From Operations (AFFO) $38,915 $34,329 $148,713 $133,976 Fully diluted shares outstanding2 90,817,925 84,304,767 88,861,587 81,921,624 FFO per diluted share $0.41 $0.40 $1.62 $1.60 AFFO per diluted share $0.43 $0.41 $1.67 $1.64 Twelve Months Ended December 31,Three Months Ended December 31,

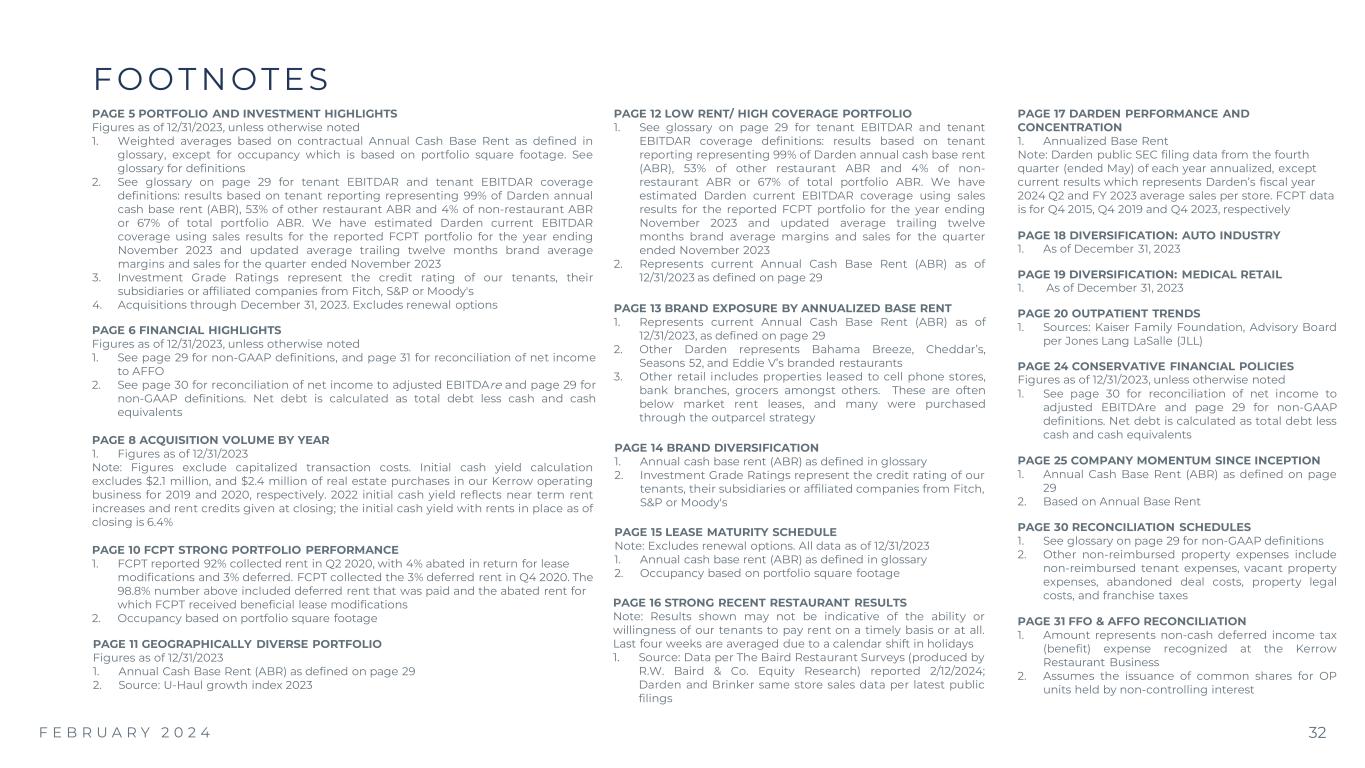

PAGE 10 FCPT STRONG PORTFOLIO PERFORMANCE 1. FCPT reported 92% collected rent in Q2 2020, with 4% abated in return for lease modifications and 3% deferred. FCPT collected the 3% deferred rent in Q4 2020. The 98.8% number above included deferred rent that was paid and the abated rent for which FCPT received beneficial lease modifications 2. Occupancy based on portfolio square footage F E B R U A R Y 2 0 2 4 32 F O O T N OT E S PAGE 5 PORTFOLIO AND INVESTMENT HIGHLIGHTS Figures as of 12/31/2023, unless otherwise noted 1. Weighted averages based on contractual Annual Cash Base Rent as defined in glossary, except for occupancy which is based on portfolio square footage. See glossary for definitions 2. See glossary on page 29 for tenant EBITDAR and tenant EBITDAR coverage definitions: results based on tenant reporting representing 99% of Darden annual cash base rent (ABR), 53% of other restaurant ABR and 4% of non-restaurant ABR or 67% of total portfolio ABR. We have estimated Darden current EBITDAR coverage using sales results for the reported FCPT portfolio for the year ending November 2023 and updated average trailing twelve months brand average margins and sales for the quarter ended November 2023 3. Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies from Fitch, S&P or Moody's 4. Acquisitions through December 31, 2023. Excludes renewal options PAGE 11 GEOGRAPHICALLY DIVERSE PORTFOLIO Figures as of 12/31/2023 1. Annual Cash Base Rent (ABR) as defined on page 29 2. Source: U-Haul growth index 2023 PAGE 12 LOW RENT/ HIGH COVERAGE PORTFOLIO 1. See glossary on page 29 for tenant EBITDAR and tenant EBITDAR coverage definitions: results based on tenant reporting representing 99% of Darden annual cash base rent (ABR), 53% of other restaurant ABR and 4% of non- restaurant ABR or 67% of total portfolio ABR. We have estimated Darden current EBITDAR coverage using sales results for the reported FCPT portfolio for the year ending November 2023 and updated average trailing twelve months brand average margins and sales for the quarter ended November 2023 2. Represents current Annual Cash Base Rent (ABR) as of 12/31/2023 as defined on page 29 PAGE 13 BRAND EXPOSURE BY ANNUALIZED BASE RENT 1. Represents current Annual Cash Base Rent (ABR) as of 12/31/2023, as defined on page 29 2. Other Darden represents Bahama Breeze, Cheddar’s, Seasons 52, and Eddie V’s branded restaurants 3. Other retail includes properties leased to cell phone stores, bank branches, grocers amongst others. These are often below market rent leases, and many were purchased through the outparcel strategy PAGE 20 OUTPATIENT TRENDS 1. Sources: Kaiser Family Foundation, Advisory Board per Jones Lang LaSalle (JLL) PAGE 6 FINANCIAL HIGHLIGHTS Figures as of 12/31/2023, unless otherwise noted 1. See page 29 for non-GAAP definitions, and page 31 for reconciliation of net income to AFFO 2. See page 30 for reconciliation of net income to adjusted EBITDAre and page 29 for non-GAAP definitions. Net debt is calculated as total debt less cash and cash equivalents PAGE 19 DIVERSIFICATION: MEDICAL RETAIL 1. As of December 31, 2023 PAGE 18 DIVERSIFICATION: AUTO INDUSTRY 1. As of December 31, 2023 PAGE 24 CONSERVATIVE FINANCIAL POLICIES Figures as of 12/31/2023, unless otherwise noted 1. See page 30 for reconciliation of net income to adjusted EBITDAre and page 29 for non-GAAP definitions. Net debt is calculated as total debt less cash and cash equivalents PAGE 25 COMPANY MOMENTUM SINCE INCEPTION 1. Annual Cash Base Rent (ABR) as defined on page 29 2. Based on Annual Base Rent PAGE 8 ACQUISITION VOLUME BY YEAR 1. Figures as of 12/31/2023 Note: Figures exclude capitalized transaction costs. Initial cash yield calculation excludes $2.1 million, and $2.4 million of real estate purchases in our Kerrow operating business for 2019 and 2020, respectively. 2022 initial cash yield reflects near term rent increases and rent credits given at closing; the initial cash yield with rents in place as of closing is 6.4% PAGE 30 RECONCILIATION SCHEDULES 1. See glossary on page 29 for non-GAAP definitions 2. Other non-reimbursed property expenses include non-reimbursed tenant expenses, vacant property expenses, abandoned deal costs, property legal costs, and franchise taxes PAGE 31 FFO & AFFO RECONCILIATION 1. Amount represents non-cash deferred income tax (benefit) expense recognized at the Kerrow Restaurant Business 2. Assumes the issuance of common shares for OP units held by non-controlling interest PAGE 14 BRAND DIVERSIFICATION 1. Annual cash base rent (ABR) as defined in glossary 2. Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies from Fitch, S&P or Moody's PAGE 15 LEASE MATURITY SCHEDULE Note: Excludes renewal options. All data as of 12/31/2023 1. Annual cash base rent (ABR) as defined in glossary 2. Occupancy based on portfolio square footage PAGE 16 STRONG RECENT RESTAURANT RESULTS Note: Results shown may not be indicative of the ability or willingness of our tenants to pay rent on a timely basis or at all. Last four weeks are averaged due to a calendar shift in holidays 1. Source: Data per The Baird Restaurant Surveys (produced by R.W. Baird & Co. Equity Research) reported 2/12/2024; Darden and Brinker same store sales data per latest public filings PAGE 17 DARDEN PERFORMANCE AND CONCENTRATION 1. Annualized Base Rent Note: Darden public SEC filing data from the fourth quarter (ended May) of each year annualized, except current results which represents Darden’s fiscal year 2024 Q2 and FY 2023 average sales per store. FCPT data is for Q4 2015, Q4 2019 and Q4 2023, respectively

Four Corners Property Trust N Y S E : F C P T THANK YOU INV ES TOR P RES ENTATION FE BRUA RY 2 02 4