Oakhurst Strategic Defined Risk Fund

Institutional Class OASDX

ANNUAL REPORT

April 30, 2024

(This Page Intentionally Left Blank.)

June 18, 2024

Dear Shareholders:

From October 31, 2023, through April 30, 2024, the Oakhurst Strategic Defined Risk Fund (the “Fund” or “OASDX”) performed in line with expectations versus its index while meeting its stated risk objective. For this 6-month period ending April 30, 2024, the Fund posted a gain of 13.91% versus a gain of 20.07% for the S&P 500® Index over the same period, representing an upside returns capture of 69.3%. For the full year between April 30, 2023, and April 30, 2024, the Fund posted a gain of 15.56 % versus a gain of 20.78% for the S&P 500® Index, representing an upside capture of 74.9%, again while maintaining the significant downside protection provided by the Fund’s hedging strategies.

The Fund’s Objective: Capital appreciation while attempting to limit short term risk.

Analysis

Fund Allocation (As of 4/30/2024):

Throughout 2022 and 2023, the US Federal Reserve implemented one of its most rapid tightening cycles in history to combat inflation, resulting in significant volatility in the bond markets. Equities have adjusted to the higher interest rate regime in 2023 and into 2024 as headline inflation figures have come down from mid-2022 levels and expectations of a pause in future rate hikes get priced into the markets.

Lido Advisors, LLC | 1875 Century Park East, Suite 950, Los Angeles, CA 90067

The Oakhurst Strategic Defined Risk Fund is distributed by Quasar Distributors, LLC and Lido Advisors, LLC is the investment adviser.

Currently, we are focused on three major economic themes: the Fed Funds rate, consumer spending, and commercial real estate.

Fed Funds Rate: The most recent inflation prints have shown a bumpy but downward trend, with the market forecasting two possible rate cuts in 2024. Declining inflation, combined with a resilient labor market, has also increased the chances of a soft-landing scenario.

Consumer: While spending is still healthy, savings rates are at record lows and consumer delinquencies are ticking up. Disinflation and a healthy labor market however are tailwinds for the consumer, supporting the argument for a slow growth but non-recessionary environment.

Commercial Real Estate: The economy’s strength is helping commercial real estate (CRE) portfolios withstand defaults and losses. However, questions persist about whether CRE can adapt to higher funding costs without causing significant financial distress for borrowers, especially since rate cuts keep being delayed.

Going Forward

The Fund is well positioned with a mix of short, intermediate, and longer-term trades with significant levels of protection. During the last 6 months, we have exited several trades placed at lower levels on the S&P 500® Index and have taken the opportunity to move up our protective hedges closer to the current levels of the Index as US equities have appreciated. While options implied volatility has continued to be muted throughout 2024, the relative pricing of protection versus participation remains attractive. Paired with the higher and more stabilized interest rate environment, we believe that the current portfolio is well prepared to meet the Fund’s investment objectives over the next calendar year and beyond.

Thank you,

Jeff Garden, CFA®

Portfolio Manager, Lido Advisors, LLC

Michael J. Reis, CMT

Portfolio Manager, Lido Advisors, LLC

Lido Advisors, LLC | 1875 Century Park East, Suite 950, Los Angeles, CA 90067

The Oakhurst Strategic Defined Risk Fund is distributed by Quasar Distributors, LLC and Lido Advisors, LLC is the investment adviser.

Past performance is not a guarantee of future results.

The S&P 500® Index is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Investors cannot invest directly in an index or benchmark.

Upside Capture is the appreciation in value of an investment, in percentage terms, compared to an index or benchmark.

The outlook, views, and opinions presented are those of the Adviser as of April 30, 2024. These are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

Must be preceded or accompanied by a prospectus.

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of portfolio holdings, please refer the Schedule of Investments and Schedule of Written Options provided in this report.

The Fund’s investments in other investment companies, including ETFs, will be subject to substantially the same risks as those associated with the direct ownership of the securities comprising the portfolio of such investment companies and the value of the Fund’s investment will fluctuate in response to the performance of such portfolio. These risks apply to the Fund, as well as the underlying funds, which may themselves invest in other investment companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Fund in lower- rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks. Depending on the characteristics of the particular derivative, it could become illiquid.

Lido Advisors, LLC | 1875 Century Park East, Suite 950, Los Angeles, CA 90067

The Oakhurst Strategic Defined Risk Fund is distributed by Quasar Distributors, LLC and Lido Advisors, LLC is the investment adviser.

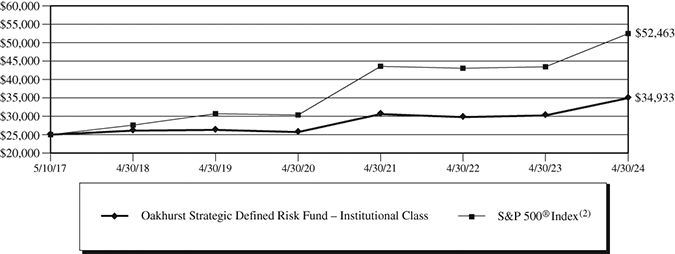

Value of $25,000 Investment (Unaudited)

The chart assumes an initial investment of $25,000. Performance reflects waivers of fees and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-625-4778. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return (%) – As of April 30, 2024

| | One Year | Five Year | Since Inception(1) |

| Oakhurst Strategic Defined Risk Fund – Institutional Class | 15.56% | 5.85% | 4.92% |

S&P 500® Index(2) | 20.78% | 11.32% | 11.22% |

(1) | Commencement date of the Fund was May 10, 2017. |

(2) | The S&P 500® Index is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Investors cannot invest directly in an index or benchmark. |

The following is expense information for the Oakhurst Strategic Defined Risk Fund as disclosed in the Fund’s most recent prospectus dated August 28, 2023:

Gross Expenses: 1.53%; Net Expenses: 1.53%. Lido Advisors, LLC (the “Adviser”) has contractually agreed to waive a portion or all of its management fees and reimburse Fund expenses (excluding front-end or contingent deferred sales loads, Rule 12b-1 fees, shareholder servicing plan fees, acquired fund fees and expenses, taxes, leverage/borrowing interest, interest expense, dividends on securities sold short, brokerage and other transactional expenses, expenses incurred in connection with any merger or reorganization, or extraordinary expenses) in order to limit the Total Annual Fund Operating Expenses to 1.50% of the average daily net assets of the Fund (the “Expense Cap”). The Expense Cap will remain in effect through at least August 28, 2024, and may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or by the Fund’s Adviser. The Adviser may request recoupment of previously waived fees and reimbursed expenses from the Fund for three years from the date they were waived or reimbursed, provided that after payment of the recoupment, the Total Annual Fund Operating Expenses do not exceed the lesser of the Expense Cap: (i) in effect at the time of the waiver or reimbursement; or (ii) in effect at the time of recoupment.

Expense Example (Unaudited)

April 30, 2024

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including broker commissions on the purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund specific expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2023 – April 30, 2024).

ACTUAL EXPENSES

The first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs may have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (11/1/2023) | (4/30/2024) | (11/1/2023 to 4/30/2024) |

| Institutional Class | | | |

Actual(2) | $1,000.00 | $1,139.10 | $7.55 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,017.80 | $7.12 |

(1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.42%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

(2) | Based on the actual return for the six-month period ended April 30, 2024 of 13.91%. |

Allocation of Portfolio(1) (% of Investments) (Unaudited)

April 30, 2024

(1) | Data expressed excludes written option contracts and other liabilities in excess of assets. Please refer to the Schedule of Investments and Schedule of Written Options for more details on the Fund’s individual holdings. |

Schedule of Investments

April 30, 2024

| | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS – 82.44% | | | | | | |

Invesco BulletShares 2024 Corporate Bond ETF(a) | | | 1,290,442 | | | $ | 27,112,187 | |

| Invesco BulletShares 2025 Corporate Bond ETF | | | 154,280 | | | | 3,147,312 | |

Invesco BulletShares 2026 Corporate Bond ETF(a) | | | 1,415,839 | | | | 27,021,287 | |

SPDR S&P 500 ETF(b) | | | 17,800 | | | | 8,935,244 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $63,803,691) | | | | | | | 66,216,030 | |

| | | | | | Notional | | | | |

| | | Contracts(d) | | | Amount | | | | |

PURCHASED OPTIONS – 15.56%(c) | | | | | | | | | |

| | | | | | | | | | |

| Purchased Call Options – 15.04% | | | | | | | | | |

S&P 500® Index | | | | | | | | | |

| Exercise Price: $4,100.00, Expiration: 12/19/2025 | | | 5 | | | $ | 2,517,845 | | | | 639,475 | |

SPDR S&P 500 ETF(b) | | | | | | | | | | | | |

| Exercise Price: $410.00, Expiration: 12/20/2024 | | | 67 | | | | 3,363,266 | | | | 716,364 | |

| Exercise Price: $425.00, Expiration: 12/20/2024 | | | 136 | | | | 6,826,928 | | | | 1,274,320 | |

| Exercise Price: $435.00, Expiration: 12/20/2024 | | | 100 | | | | 5,019,800 | | | | 848,900 | |

| Exercise Price: $445.00, Expiration: 12/20/2024 | | | 270 | | | | 13,553,460 | | | | 2,057,670 | |

| Exercise Price: $450.00, Expiration: 12/20/2024 | | | 111 | | | | 5,571,978 | | | | 798,645 | |

| Exercise Price: $390.00, Expiration: 12/19/2025 | | | 60 | | | | 3,011,880 | | | | 866,190 | |

| Exercise Price: $500.00, Expiration: 12/18/2026 | | | 200 | | | | 10,039,600 | | | | 1,706,000 | |

| Exercise Price: $510.00, Expiration: 12/18/2026 | | | 127 | | | | 6,375,146 | | | | 990,600 | |

| Exercise Price: $515.00, Expiration: 12/18/2026 | | | 157 | | | | 7,881,086 | | | | 1,177,500 | |

| Exercise Price: $520.00, Expiration: 12/18/2026 | | | 139 | | | | 6,977,522 | | | | 1,004,275 | |

| | | | | | | | | | | | 12,079,939 | |

| Purchased Put Options – 0.52% | | | | | | | | | | | | |

| SPDR S&P 500 ETF | | | | | | | | | | | | |

| Exercise Price: $390.00, Expiration: 06/21/2024 | | | 38 | | | | 1,907,524 | | | | 1,140 | |

| Exercise Price: $410.00, Expiration: 12/20/2024 | | | 20 | | | | 1,003,960 | | | | 7,970 | |

| Exercise Price: $485.00, Expiration: 03/21/2025 | | | 55 | | | | 2,760,890 | | | | 99,632 | |

| Exercise Price: $495.00, Expiration: 06/20/2025 | | | 65 | | | | 3,262,870 | | | | 154,895 | |

| Exercise Price: $490.00, Expiration: 12/18/2026 | | | 45 | | | | 2,258,910 | | | | 157,500 | |

| | | | | | | | | | | | 421,137 | |

| Total Purchased Options | | | | | | | | | | | | |

| (Cost $10,695,026) | | | | | | | | | | | 12,501,076 | |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments – Continued

April 30, 2024

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS – 5.16% | | | | | | |

| | | | | | | |

| Money Market Funds – 5.16% | | | | | | |

Fidelity Government Portfolio, Class Institutional, 5.20%(e)(f) | | | 3,425,562 | | | $ | 3,425,562 | |

First American Government Obligations Fund, Class X, 5.23%(f) | | | 720,451 | | | | 720,451 | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $4,146,013) | | | | | | | 4,146,013 | |

| Total Investments | | | | | | | | |

| (Cost $78,644,730) – 103.16% | | | | | | | 82,863,119 | |

| Liabilities in Excess of Other Assets – (3.16)% | | | | | | | (2,537,847 | ) |

| Total Net Assets – 100.00% | | | | | | $ | 80,325,272 | |

ETF – Exchange Traded Fund

| (a) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at https://www.sec.gov/. |

| (b) | Held in connection with written option contracts. See Schedule of Written Options for further information. |

| (c) | Non-income producing security. |

| (d) | 100 shares per contract. |

| (e) | All or portion of this security has been committed as collateral for open written option contracts. The total value of assets committed as collateral as of April 30, 2024 is $3,425,562. |

| (f) | The rate quoted is the annualized seven-day effective yield as of April 30, 2024. |

The accompanying notes are an integral part of these financial statements.

Schedule of Written Options

April 30, 2024

| | | | | | Notional | | | | |

| | | Contracts(a) | | | Amount | | | Value | |

WRITTEN OPTIONS(b) | | | | | | | | | |

| | | | | | | | | | |

| Written Call Options | | | | | | | | | |

| SPDR S&P 500 ETF | | | | | | | | | |

| Exercise Price: $470.00, Expiration: 06/21/2024 | | | (38 | ) | | $ | (1,907,524 | ) | | $ | (144,400 | ) |

| Exercise Price: $490.00, Expiration: 12/20/2024 | | | (87 | ) | | | (4,367,226 | ) | | | (355,569 | ) |

| Exercise Price: $500.00, Expiration: 12/20/2024 | | | (136 | ) | | | (6,826,928 | ) | | | (463,080 | ) |

| Exercise Price: $520.00, Expiration: 12/20/2024 | | | (100 | ) | | | (5,019,800 | ) | | | (219,800 | ) |

| Exercise Price: $600.00, Expiration: 03/21/2025 | | | (55 | ) | | | (2,760,890 | ) | | | (19,058 | ) |

| Exercise Price: $630.00, Expiration: 06/20/2025 | | | (65 | ) | | | (3,262,870 | ) | | | (18,915 | ) |

| Exercise Price: $485.00, Expiration: 12/19/2025 | | | (60 | ) | | | (3,011,880 | ) | | | (434,220 | ) |

| | | | | | | | | | | | (1,655,042 | ) |

| Written Put Options | | | | | | | | | | | | |

S&P 500® Index | | | | | | | | | | | | |

| Exercise Price: $2,800.00, Expiration: 12/19/2025 | | | (5 | ) | | | (2,517,845 | ) | | | (12,900 | ) |

| SPDR S&P 500 ETF | | | | | | | | | | | | |

| Exercise Price: $310.00, Expiration: 06/21/2024 | | | (38 | ) | | | (1,907,524 | ) | | | (323 | ) |

| Exercise Price: $300.00, Expiration: 12/20/2024 | | | (136 | ) | | | (6,826,928 | ) | | | (13,668 | ) |

| Exercise Price: $305.00, Expiration: 12/20/2024 | | | (67 | ) | | | (3,363,266 | ) | | | (7,169 | ) |

| Exercise Price: $330.00, Expiration: 12/20/2024 | | | (20 | ) | | | (1,003,960 | ) | | | (2,850 | ) |

| Exercise Price: $350.00, Expiration: 12/20/2024 | | | (100 | ) | | | (5,019,800 | ) | | | (17,950 | ) |

| Exercise Price: $355.00, Expiration: 12/20/2024 | | | (381 | ) | | | (19,125,438 | ) | | | (72,771 | ) |

| Exercise Price: $370.00, Expiration: 03/21/2025 | | | (55 | ) | | | (2,760,890 | ) | | | (19,030 | ) |

| Exercise Price: $390.00, Expiration: 06/20/2025 | | | (65 | ) | | | (3,262,870 | ) | | | (38,805 | ) |

| Exercise Price: $315.00, Expiration: 12/19/2025 | | | (40 | ) | | | (2,007,920 | ) | | | (15,280 | ) |

| Exercise Price: $360.00, Expiration: 12/18/2026 | | | (200 | ) | | | (10,039,600 | ) | | | (218,000 | ) |

| Exercise Price: $410.00, Expiration: 12/18/2026 | | | (45 | ) | | | (2,258,910 | ) | | | (74,250 | ) |

| Exercise Price: $415.00, Expiration: 12/18/2026 | | | (284 | ) | | | (14,256,232 | ) | | | (482,800 | ) |

| Exercise Price: $420.00, Expiration: 12/18/2026 | | | (85 | ) | | | (4,266,830 | ) | | | (144,117 | ) |

| Exercise Price: $520.00, Expiration: 12/18/2026 | | | (45 | ) | | | (2,258,910 | ) | | | (204,750 | ) |

| | | | | | | | | | | | (1,324,663 | ) |

| Total Written Options | | | | | | | | | | | | |

| (Premiums received $3,572,722) | | | | | | | | | | $ | (2,979,705 | ) |

ETF – Exchange Traded Fund

| (a) | 100 shares per contract. |

| (b) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

Statement of Assets and Liabilities

April 30, 2024

| ASSETS: | | | |

| Investments, at value (Cost $78,644,730) | | $ | 82,863,119 | |

| Deposits at brokers for written option contracts | | | 501,486 | |

| Receivable for Fund shares sold | | | 84,980 | |

| Interest receivable | | | 26,564 | |

| Prepaid expenses and other receivables | | | 19,951 | |

| Total assets | | | 83,496,100 | |

| | | | | |

| LIABILITIES: | | | | |

| Written option contracts, at value (Premiums received $3,572,722) | | | 2,979,705 | |

| Payable to Adviser | | | 64,936 | |

| Payable for shareholder servicing fees – Institutional Class | | | 66,036 | |

| Payable for administration and fund accounting fees | | | 19,166 | |

| Payable for transfer agent fees | | | 7,735 | |

| Payable for compliance fees | | | 3,078 | |

| Payable for custody fees | | | 1,377 | |

| Accrued expenses and other liabilities | | | 28,795 | |

| Total liabilities | | | 3,170,828 | |

| | | | | |

| NET ASSETS | | $ | 80,325,272 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 74,623,185 | |

| Total distributable earnings | | | 5,702,087 | |

| Net assets | | $ | 80,325,272 | |

| | | | | |

| | | Institutional | |

| | | Class Shares | |

Shares issued and outstanding(1) | | | 6,934,773 | |

| Net asset value | | $ | 11.58 | |

(1) | Unlimited shares authorized without par value. |

The accompanying notes are an integral part of these financial statements.

Statement of Operations

For the Year Ended April 30, 2024

| INVESTMENT INCOME: | | | |

| Dividend income | | $ | 1,800,914 | |

| Interest income | | | 506,670 | |

| Total investment income | | | 2,307,584 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (See Note 3) | | | 803,899 | |

| Administration and fund accounting fees (See Note 3) | | | 113,383 | |

| Shareholder servicing fees – Institutional Class (See Note 5) | | | 74,884 | |

| Transfer agent fees (See Note 3) | | | 45,189 | |

| Federal and state registration fees | | | 27,629 | |

| Audit fees | | | 20,052 | |

| Compliance fees (See Note 3) | | | 18,513 | |

| Legal fees | | | 18,015 | |

| Trustees’ fees (See Note 3) | | | 11,085 | |

| Insurance fees | | | 7,375 | |

| Custody fees (See Note 3) | | | 6,546 | |

| Reports to shareholders | | | 3,207 | |

| Broker interest expense | | | 20 | |

| Other | | | 3,040 | |

| Total expenses | | | 1,152,837 | |

| NET INVESTMENT INCOME | | | 1,154,747 | |

| | | | | |

| REALIZED AND CHANGE IN UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | |

| Net realized gain on: | | | | |

| Investments | | | 3,387,286 | |

| Written option contracts expired or closed | | | 2,354,210 | |

| Net realized gain | | | 5,741,496 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 6,455,250 | |

| Written option contracts | | | (1,770,532 | ) |

| Net change in unrealized appreciation (depreciation) | | | 4,684,718 | |

| Net realized and change in unrealized gain on investments | | | 10,426,214 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 11,580,961 | |

The accompanying notes are an integral part of these financial statements.

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | April 30, 2024 | | | April 30, 2023 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 1,154,747 | | | $ | 668,523 | |

| Net realized gain (loss) on investments and | | | | | | | | |

| written option contracts expired or closed | | | 5,741,496 | | | | (251,892 | ) |

| Net change in unrealized appreciation (depreciation) | | | | | | | | |

| on investments and written option contracts | | | 4,684,718 | | | | 656,421 | |

| Net increase in net assets resulting from operations | | | 11,580,961 | | | | 1,073,052 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Net decrease in net assets | | | | | | | | |

resulting from capital share transactions(1) | | | (12,529,083 | ) | | | (16,781,768 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Institutional Class (See Note 4) | | | (2,617,774 | ) | | | (4,634,754 | ) |

| | | | | | | | | |

| NET DECREASE IN NET ASSETS | | | (3,565,896 | ) | | | (20,343,470 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 83,891,168 | | | | 104,234,638 | |

| End of year | | $ | 80,325,272 | | | $ | 83,891,168 | |

(1) A summary of capital share transactions is as follows:

| | | For the Year Ended | | | For the Year Ended | |

| | | April 30, 2024 | | | April 30, 2023 | |

| SHARE TRANSACTIONS: | | Shares | | | Dollar Amount | | | Shares | | | Dollar Amount | |

| Issued | | | 865,573 | | | $ | 9,629,907 | | | | 829,225 | | | $ | 8,656,019 | |

| Issued to holders in | | | | | | | | | | | | | | | | |

| reinvestment of dividends | | | 206,203 | | | | 2,288,851 | | | | 422,825 | | | | 4,139,458 | |

| Redeemed | | | (2,242,056 | ) | | | (24,447,841 | ) | | | (2,831,105 | ) | | | (29,577,245 | ) |

| Net decrease in shares outstanding | | | (1,170,280 | ) | | $ | (12,529,083 | ) | | | (1,579,055 | ) | | $ | (16,781,768 | ) |

The accompanying notes are an integral part of these financial statements.

Financial Highlights

For a Fund share outstanding throughout each year.

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | April 30, | | | April 30, | | | April 30, | | | April 30, | | | April 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Institutional Class | | | | | | | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 10.35 | | | $ | 10.76 | | | $ | 11.64 | | | $ | 9.78 | | | $ | 10.24 | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1)(2) | | | 0.16 | | | | 0.08 | | | | (0.05 | ) | | | (0.04 | ) | | | 0.01 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

gains (loss) on investments(3) | | | 1.43 | | | | 0.06 | | | | (0.21 | ) | | | 1.90 | | | | (0.23 | ) |

| Total from investment operations | | | 1.59 | | | | 0.14 | | | | (0.26 | ) | | | 1.86 | | | | (0.22 | ) |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.18 | ) | | | — | | | | — | | | | — | | | | — | |

| From net realized gains | | | (0.18 | ) | | | (0.55 | ) | | | (0.62 | ) | | | — | | | | (0.24 | ) |

| Total distributions | | | (0.36 | ) | | | (0.55 | ) | | | (0.62 | ) | | | — | | | | (0.24 | ) |

| Net asset value, end of year | | $ | 11.58 | | | $ | 10.35 | | | $ | 10.76 | | | $ | 11.64 | | | $ | 9.78 | |

| TOTAL RETURN | | | 15.56 | % | | | 1.58 | % | | | -2.70 | % | | | 19.02 | % | | | -2.24 | % |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 80,325 | | | $ | 83,891 | | | $ | 104,235 | | | $ | 105,370 | | | $ | 30,875 | |

| Ratio of gross expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

Before expense waiver/recoupment(4) | | | 1.43 | % | | | 1.44 | % | | | 1.39 | % | | | 1.56 | % | | | 2.12 | % |

After expense waiver/recoupment(4) | | | 1.43 | % | | | 1.47 | % | | | 1.60 | % | | | 1.60 | % | | | 1.66 | % |

| Ratio of broker interest expense to average net assets | | | 0.00 | %(6) | | | 0.01 | % | | | 0.00 | %(6) | | | 0.00 | %(6) | | | 0.06 | % |

| Ratio of operating expenses to average | | | | | | | | | | | | | | | | | | | | |

| net assets excluding broker interest expense | | | | | | | | | | | | | | | | | | | | |

(after expense waiver/recoupment)(4) | | | 1.43 | % | | | 1.46 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

to average net assets(4) | | | 1.44 | % | | | 0.72 | % | | | (0.45 | )% | | | (0.34 | )% | | | 0.06 | % |

Portfolio turnover rate(5) | | | 73 | % | | | 69 | % | | | 98 | % | | | 71 | % | | | 214 | % |

(1) | Calculated based on average shares outstanding during the year. |

(2) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

(3) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net assets value per share for the year, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the year. |

(4) | These ratios exclude the impact of expenses of the underlying funds as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying funds in which the Fund invests. |

(5) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short-term investments and short-term options). The denominator includes the average fair value of long positions throughout each year. |

(6) | Less than 0.005%. |

The accompanying notes are an integral part of these financial statements.

Notes to the Financial Statements

April 30, 2024

1. ORGANIZATION

Series Portfolios Trust (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated July 27, 2015. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Oakhurst Strategic Defined Risk Fund (the “Fund”) is a diversified series with its own investment objectives and policies within the Trust. The primary investment objective of the Fund is to seek capital appreciation while seeking to limit short-term risk. The Fund commenced operations on May 10, 2017. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (the “Codification”) Topic 946, Financial Services – Investment Companies. The Fund does not hold itself out as related to any other series of the Trust for purposes of investment and investor services, nor does it share the same investment adviser with any other series of the Trust.

The Fund offers two share classes, Institutional Class and Advisor Class. Institutional Class shares have no front end sales load, no deferred sales charge, and no redemption fee. Advisor Class shares have a front end sales load of 5.75%, a deferred sales charge of 1.00%, and no redemption fee. Advisor Class shares are subject to a 0.25% distribution fee and a shareholder servicing fee of up to 0.10% of average daily net assets. As of April 30, 2024, Advisor Class shares are not available. Institutional Class shares are not subject to a distribution fee, and are subject to a shareholder servicing fee of up to 0.10% of average daily net assets.

The Fund may issue an unlimited number of shares of beneficial interest, with no par value. All shares of the Fund have equal rights and privileges except with respect to distribution fees and voting rights on matters affecting a single share class.

Effective May 20, 2019, the Fund changed its principal investment strategy. Under this new strategy, the Fund invests in a portfolio of equity securities of companies that are representative of the S&P 500® Index (the “Index”) or ETFs that are designed to replicate the performance of the Index or whose holdings are representative of the Index. The Fund will simultaneously use options on ETFs in which the Fund may invest and will invest in U.S. Treasury securities to enhance the Fund’s potential returns during up markets while seeking to limit losses during down markets. The performance of the Fund is not intended to match the performance of the Index.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

A. Investment Valuation – The following is a summary of the Fund’s pricing procedures. It is intended to be a general discussion and may not necessarily reflect all the pricing procedures followed by the Fund. Equity securities, including common stocks, preferred stocks, and real estate investment trusts (“REITS”) that are traded on a national securities exchange, except those listed on the Nasdaq Global Market®, Nasdaq Global Select Market® and the Nasdaq Capital Market® exchanges (collectively “Nasdaq”), are valued at the last reported sale price on that exchange on which the security is principally traded. Securities traded on Nasdaq will be valued at the Nasdaq Official Closing Price (“NOCP”). If, on a particular day, an exchange traded or Nasdaq security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non-exchanged traded equity security does not

Notes to the Financial Statements – Continued

April 30, 2024

trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Investments in registered open-end investment companies (including money market funds) are typically valued at their reported net asset value (“NAV”) per share. To the extent these securities are valued at their NAV per share, they are categorized in Level 1 of the fair value hierarchy.

Exchange traded funds are valued at the last reported sale price on the exchange on which the security is principally traded. If, on a particular day, an exchange-traded fund does not trade, then the mean between the most recent quote bid and asked prices will be used. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Exchange traded options are valued at the composite mean price, which calculates the mean of the highest bid price and lowest ask prices across the exchanges where the options are principally traded. If the composite mean price is not available, last sale or settlement price may be used. For non-exchange traded options, models such as Black- Scholes can be used to value the options. On the last trading day prior to expiration, expiring options may be priced at intrinsic value. These securities are categorized in Level 2 of the fair value hierarchy.

Fixed income securities, including short-term debt instruments having a maturity less than 60 days, are valued at the evaluated mean price supplied by an approved independent third-party pricing service (“Pricing Service”). These securities are categorized in Level 2 of the fair value hierarchy.

The Board of Trustees (the “Board”) has adopted a pricing and valuation policy for use by the Fund and its Valuation Designee (as defined below) in calculating the Fund’s NAV. Pursuant to Rule 2a-5 under the 1940 Act, the Fund has designated Lido Advisers, LLC (the “Adviser”) as its “Valuation Designee” to perform all of the fair value determinations as well as to perform all of the responsibilities that may be performed by the Valuation Designee in accordance with Rule 2a-5. The Valuation Designee is authorized to make all necessary determinations of the fair values of the portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are unreliable.

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation Levels for major security types. These inputs are summarized in the three broad Levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Notes to the Financial Statements – Continued

April 30, 2024

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s securities by Level within the fair value hierarchy as of April 30, 2024:

Investments at Fair Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Exchange Traded Funds | | $ | 66,216,030 | | | $ | — | | | $ | — | | | $ | 66,216,030 | |

| Purchased Options | | | — | | | | 12,501,076 | | | | — | | | | 12,501,076 | |

| Money Market Funds | | | 4,146,013 | | | | — | | | | — | | | | 4,146,013 | |

| | | $ | 70,362,043 | | | $ | 12,501,076 | | | $ | — | | | $ | 82,863,119 | |

| Liabilities | | | | | | | | | | | | | | | | |

| Written Options | | $ | — | | | $ | (2,979,705 | ) | | $ | — | | | $ | (2,979,705 | ) |

| | | $ | — | | | $ | (2,979,705 | ) | | $ | — | | | $ | (2,979,705 | ) |

As of April 30, 2024, the Fund did not hold any Level 3 securities, nor were there any transfers into or out of Level 3. Refer to the Fund’s Schedule of Investments for further information on the classification of investments.

B. Transactions with Brokers – The Fund’s written options contracts’ cash deposits are monitored daily by the Adviser and counterparty. Cash deposits by the Fund are presented as deposits at broker for written option contracts on the Statement of Assets and Liabilities. These transactions may involve market risk in excess of the assets or liabilities reflected on the Statement of Assets and Liabilities.

C. Written Option Contracts – The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund will write call or put options. Under normal circumstances, the Fund will write or purchase options on ETFs that are designed to replicate the performance of the Index or whose holdings are representative of the Index. The use of options may give rise to leverage. Leverage is investment exposure which exceeds the initial amount invested. Leverage can cause the Fund to lose more than the principal amount invested. When a Fund writes (sells) an option, an amount equal to the premium received by the Fund is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently priced daily to reflect the current value of the option written. Refer to Note 2 A. for a pricing description. By writing an option, a Fund may become obligated during the term of the option to deliver or purchase the securities underlying the option at the exercise price if the option is exercised. These contracts may involve market risk in excess of the amounts receivable or payable reflected on the Statement of Assets and Liabilities. Refer to Note 2 M. for further derivative disclosures and Note 2 J. for further counterparty risk disclosure.

When an option expires on its stipulated expiration date or the Fund enters into a closing purchase transaction, the Fund realizes gains or losses if the cost of the closing purchase transaction differs from the premium received when the option was sold without regard to any unrealized appreciation or depreciation on the underlying security, and the liability related to such an option is eliminated. When a written call option is exercised, the premium originally received decreases the cost basis of the security and the Fund realizes gains or losses from the sale of the underlying security. When a written put option is exercised, the cost of the security acquired is decreased by the premium received for the put.

Notes to the Financial Statements – Continued

April 30, 2024

D. Purchased Option Contracts – The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund will purchase call or put options. In connection with the Fund’s written option contracts, the Fund will simultaneously use options on ETFs. When the Fund purchases an option contract, an amount equal to the premiums paid is included in the Statement of Assets and Liabilities as Investments at value, and is subsequently priced daily to reflect the value of the purchased option contract. Refer to Note 2 A. for a pricing description. Refer to Note 2 M. for further derivative disclosures and Note 2 J. for further counterparty risk disclosure. When option contracts expire or are closed, realized gains or losses are recognized without regard to any unrealized appreciation or depreciation on the underlying securities that may be held by the Fund. If the Fund exercises a call option, the cost of the security acquired is increased by the premium paid for the call. If the Fund exercises a put option, the premium paid for the put option increases the cost of the underlying security and a gain or loss is realized from the sale of the underlying security.

E. Cash and Cash Equivalents – The Fund considers highly liquid short-term fixed income investments purchased with an original maturity of less than three months to be cash equivalents. Cash equivalents are included in short- term investments on the Schedule of Investments as well as in investments on the Statement of Assets and Liabilities. Any temporary cash overdrafts by the Fund are reported as a payable to the custodian.

F. Guarantees and Indemnifications – In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

G. Security Transactions, Income and Expenses – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income and expense is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities. Interest income is accounted for on the accrual basis and includes amortization of premiums and accretion of discounts on the effective interest method.

H. Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. 12b-1 fees are expensed at 0.25% of average daily net assets of Advisor Class shares (See Note 5). Shareholder servicing fees are expensed at an annual rate of up to 0.10% of average daily net assets of each class of shares (See Note 5). Trust Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between the funds of the Trust, or by other equitable means.

I. Share Valuation – The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on days which the New York Stock Exchange (“NYSE”) is closed for trading.

J. Counterparty Risk – The Fund helps manage counterparty credit risk by entering into agreements only with counterparties the Adviser believes have the financial resources to honor its obligations. The Adviser considers the credit worthiness of each counterparty to a contract in evaluating potential credit risk. All of the Fund’s written and

Notes to the Financial Statements – Continued

April 30, 2024

purchased options are held with one counterparty. Written and purchased option contracts sold on an exchange have minimal counterparty risk; the exchange’s clearinghouse guarantees the options against counterparty nonperformance. Over-the-counter options counterparty risk includes the risk of loss of the full amount of any net unrealized appreciation.

K. Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

L. Statement of Cash Flows – Pursuant to the Cash Flows topic of the Codification, the Fund qualifies for an exemption from the requirement to provide a statement of cash flows and have elected not to provide a statement of cash flows.

M. Derivatives – The Fund may utilize derivative instruments such as options and other instruments with similar characteristics to the extent that they are consistent with the Fund’s respective investment objectives and limitations. The use of these instruments may involve additional investment risks, including the possibility of illiquid markets or imperfect correlation between the value of the instruments and the underlying securities. Derivatives also may create leverage which will amplify the effect of their performance on the Fund and may produce significant losses. Refer to Note 8 for further derivative disclosure.

The Fund writes call options with strike prices and expiration dates designed to reduce the volatility of the Fund’s investment portfolio and to earn premiums. A call option gives the holder (buyer) the right to purchase a security at a specified price (the exercise price) at any time until a certain date (the expiration date). The Fund will use cash or U.S. Treasury securities to cover the written call options. The Fund may utilize put options to lower the overall volatility of the Fund’s investment portfolio, to “hedge” or limit the exposure of the Fund’s position. The Fund will also invest in U.S. Treasury securities.

The Fund has adopted authoritative standards regarding disclosure about derivatives and hedging activities and how they affect the Fund’s Statement of Assets and Liabilities and Statement of Operations. For the year ended April 30, 2024, the Fund’s monthly average quantity and notional value are described below:

| | | Average | | | Average | |

| | | Quantity | | | Notional Amount | |

| Purchased Option Contracts | | | 1,632 | | | $ | 81,282,542 | |

| Written Option Contracts | | | 2,114 | | | $ | 103,433,879 | |

Notes to the Financial Statements – Continued

April 30, 2024

Statement of Assets and Liabilities

Fair values of derivative instruments as of April 30, 2024:

| | |

| Statement of Assets and | | Fair Value | |

| | | | Liabilities Location | | Assets | | | Liabilities | |

| Purchased Option Contracts: | | Investments, | | | | | | |

| Equity | | at value | | $ | 12,501,076 | | | $ | — | |

| Written Option Contracts: | | Written option contracts, | | | | | | | | |

| Equity | | at value | | | — | | | | 2,979,705 | |

| Total fair values of derivative instruments | | | | $ | 12,501,076 | | | $ | 2,979,705 | |

Statement of Operations

The effect of derivative instruments on the Statement of Operations for the year ended April 30, 2024:

| | | Net Realized Gain (Loss) on Derivatives | |

| | | Purchased Option | | | Written Option | | | | |

Derivatives | | Contracts* | | | Contracts | | | Total | |

| Equity Contracts | | $ | 4,026,706 | | | $ | 2,354,210 | | | $ | 6,380,916 | |

| Total | | $ | 4,026,706 | | | $ | 2,354,210 | | | $ | 6,380,916 | |

| | | | | | | | | | | | | |

| | Net Change in Unrealized Appreciation (Depreciation) on Derivatives |

| | | Purchased Option | | | Written Option | | | | | |

Derivatives | | Contracts** | | | Contracts | | | Total | |

| Equity Contracts | | $ | 3,647,108 | | | $ | (1,770,532 | ) | | $ | 1,876,576 | |

| Total | | $ | 3,647,108 | | | $ | (1,770,532 | ) | | $ | 1,876,576 | |

| * | | The amounts disclosed are included in the realized gain (loss) on investments. |

| ** | | The amounts disclosed are included in the change in unrealized appreciation (depreciation) on investments. |

3. RELATED PARTY TRANSACTIONS

The Trust has an agreement with the Adviser to furnish investment advisory services to the Fund. Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is entitled to receive, on a monthly basis, an annual advisory fee equal to 1.00% of the Fund’s average daily net assets.

The Fund’s Adviser has contractually agreed to reduce its management fees and/or absorb expenses of the Fund to ensure that total annual operating expenses after fee waiver and/or expense reimbursement (excluding any front-end or contingent deferred loads, Rule 12b-1 fees – Advisor Class (See Note 5), shareholder servicing plan fees (See Note 5), taxes, leverage/borrowing interest (including interest incurred in connection with bank and custody overdrafts), interest expense, dividends paid on short sales, brokerage and other transaction expenses, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, or extraordinary expenses, including but not limited to litigation expenses and judgements and indemnification expenses) do not exceed 1.50% of each class’ average daily net asset value. As of April 30, 2024, Advisor Class shares are not available. The Adviser may request recoupment of previously waived fees and reimbursed Fund expenses from the Fund for three years from the date they were waived or reimbursed, provided that, after payment of the recoupment, the Total Annual Fund

Notes to the Financial Statements – Continued

April 30, 2024

Operating Expenses do not exceed the lesser of the Expense Cap: (i) in effect at the time of the waiver or reimbursement; or (ii) in effect at the time of recoupment. The Operating Expenses Limitation Agreement is intended to be continual in nature and cannot be terminated within a year after the effective date of the Fund’s prospectus and subject thereafter to termination at any time upon 60 days written notice and approval by the Trust’s Board or the Adviser, with consent of the Board. There were no waived fees, reimbursed expenses or recoupment by the Adviser for the year ended April 30, 2024.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or the “Administrator”) acts as the Fund’s Administrator, transfer agent, and fund accountant. U.S. Bank N.A. (the “Custodian”) serves as the custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. The officers of the Trust, including the Chief Compliance Officer, are employees of the Administrator. A trustee of the Trust is an officer of the Administrator. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees paid by the Fund for administration and accounting, transfer agency, custody and compliance services for the year ended April 30, 2024 are disclosed in the Statement of Operations.

Quasar Distributors, LLC is the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with the Adviser, Fund Services, or its affiliated companies.

4. TAX FOOTNOTE

Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income or excise tax provision is required. As of and during the year ended April 30, 2024, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority and did not have liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. The Fund is not subject to examination by U.S. tax authorities for tax years prior to the year ended April 30, 2021.

At April 30, 2024, the components of accumulated loss on a tax basis were as follows:

| Tax cost of investments | | $ | 75,326,783 | |

| Gross tax unrealized appreciation | | $ | 5,695,204 | |

| Gross tax unrealized depreciation | | | (1,457,637 | ) |

| Net tax unrealized appreciation (depreciation) | | | 4,237,567 | |

| Undistributed ordinary income | | | 3,021,416 | |

| Undistributed long-term capital gains | | | 2,042,333 | |

| Distributable earnings | | | 5,063,749 | |

| Other accumulated loss* | | | (3,599,229 | ) |

| Total distributable earnings | | $ | 5,702,087 | |

* Any wash sale or straddle loss deferrals are temporary book to tax differences.

Notes to the Financial Statements – Continued

April 30, 2024

For the year ending April 30, 2024 the Fund utilized short-term capital loss carryovers of $1,644,022 and long-term carryovers of $63,572. As of April 30, 2024, the Fund had no capital loss carryovers. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31 and December 31, respectively. For the taxable year ended April 30, 2024, the Fund did not defer, on a tax basis, any qualified late year losses.

Distributions to Shareholders – The Fund distributes substantially all net investment income, if any, and net realized capital gains, if any, annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For the year ended April 30, 2024, the Fund did not have any reclassifications to the components of net assets for federal income tax purposes.

The tax character of distributions paid for the years ended April 30, 2024, and April 30, 2023, are as follows:

| | Ordinary Income* | Long-Term Capital Gain | Total Distributions Paid |

| 4/30/2024 | $1,618,189 | $999,585 | $2,617,774 |

| 4/30/2023 | $4,372,306 | $262,448 | $4,634,754 |

| * | For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions. |

5. DISTRIBUTION & SHAREHOLDER SERVICING FEES

The Fund has adopted a Distribution Plan pursuant to Rule 12b-1 (the “Plan”) for the Advisor Class. The Plan permits the Fund to pay for distribution and related expenses at an annual rate of 0.25% average daily net assets of the Advisor Class. The expenses covered by the Plan may include the cost of preparing and distributing prospectuses and other sales material, advertising and public relations expenses, payments to financial intermediaries and compensation of personnel involved in selling shares of the Fund. Payments made pursuant to the Plan will represent reimbursement for distribution and service activities. As of April 30, 2024, Advisor Class shares are not available.

In addition, pursuant to a Shareholder Service Plan (the “Shareholder Servicing Plan”) adopted by the Trust on behalf of the Fund, the Advisor is authorized to engage financial institutions, securities dealers and other industry professionals (“Shareholder Servicing Agent”) to provide personal shareholder services relating to the servicing and maintenance of shareholder accounts not otherwise provided to the Fund. Payments made pursuant to the Shareholder Servicing Plan shall not exceed 0.10% of the average daily net asset value of the Institutional Class or the Advisor Class. For the year ended April 30, 2024, the Institutional Class incurred expenses of $74,884 to the plan. As of April 30, 2024, the Advisor Class shares were not available for purchase. Payments made under the Shareholder Servicing Plan shall be used to compensate Shareholder Servicing Agents for providing general shareholder liaison services, including, but not limited to: (i) answering inquiries from shareholders regarding account status and history, the manner in which purchases and redemptions of the Fund shares may be effected, and other matters pertaining to the Fund; (ii) assisting shareholders in designating and changing dividend options, account designations and addresses; (iii) arranging for wiring of funds and

Notes to the Financial Statements – Continued

April 30, 2024

transmitting and receiving funds in connection with orders to purchase or redeem Fund shares; (iv) verifying and guaranteeing shareholder signatures in connection with orders to purchase or redeem Fund shares; (v) providing such other similar services related to the maintenance of shareholder accounts; and (vi) providing necessary personnel and facilities to conduct the activities described above.

6. INVESTMENT TRANSACTIONS

The aggregate purchases and sales, excluding short-term investments, by the Fund for the year ended April 30, 2024, were as follows:

| | | Purchases | | | Sales | |

| U.S. Government Securities | | $ | — | | | $ | 7,745,619 | |

| Other Securities | | $ | 55,152,011 | | | $ | 60,881,606 | |

7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of April 30, 2024, National Financial Services, for the benefit of its customers, owned 82.46% of the outstanding shares of the Fund.

8. OFFSETTING ASSETS AND LIABILITIES

The Fund is subject to various Master Netting Arrangements, which govern the terms of certain transactions with select counterparties. The Master Netting Arrangements allow the Fund to close out and net its total exposure to a counterparty in the event of a default with respect to all the transactions governed under a single agreement with a counterparty. The Master Netting Arrangements also specify collateral posting arrangements at pre-arranged exposure levels. Under the Master Netting Arrangements, collateral is routinely transferred if the total net exposure to certain transactions (net of existing collateral already in place) governed under the relevant Master Netting Arrangement with a counterparty in a given account exceeds a specified threshold depending on the counterparty and the type of Master Netting Arrangement. Interactive Brokers is the prime broker for the Fund’s exchange traded derivatives. Refer to Note 2 M. for further derivative disclosure.

| | | | | | | Gross | | | Net Amounts | | | Gross Amounts not offset in the Statement of Assets and Liabilities | | | | | |

| | | Gross | | | Amounts | | | Presented | | | | | | | |

| | | Amounts of | | | Offset in the | | | in the | | |

| | | | |

| | | Recognized | | | Statement of | | | Statement | | | | | | | Collateral | | | | | |

| | | Assets/ | | | Assets and | | | of Assets | | | Financial | | | Received/ | | | Net | |

| | | Liabilities | | | Liabilities | | | and Liabilities | | | Instruments | | | Pledged* | | | Amount | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | | | | | | | | | | | | | | | | | | | | | | | |

| Written Option Contracts** | | $ | 2,979,705 | | | $ | — | | | $ | 2,979,705 | | | $ | 2,979,705 | | | $ | — | | | $ | — | |

| | | $ | 2,979,705 | | | $ | — | | | $ | 2,979,705 | | | $ | 2,979,705 | | | $ | — | | | $ | — | |

| * | | In some instances, the actual collateral pledged/received may be more than the amount shown. |

| ** | | Interactive Brokers, LLC is the prime brokers for all written option contracts held by the Fund as of April 30, 2024. |

Notes to the Financial Statements – Continued

April 30, 2024

9. OTHER REGULATORY MATTERS

In October 2022, the Securities and Exchange Commission (the “SEC”) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements. The rule and form amendments will, among other things, require the Funds to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendment.

Report of Independent Registered Public Accounting Firm

To the Shareholders of Oakhurst Strategic Defined Risk Fund and

Board of Trustees of Series Portfolios Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedules of investments and written options, of Oakhurst Strategic Defined Risk Fund (the “Fund”), a series of Series Portfolios Trust, as of April 30, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2024, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2024, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2017.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

June 27, 2024

Additional Information (Unaudited)

April 30, 2024

TRUSTEES AND EXECUTIVE OFFICERS

The Board oversees the management and operations of the Trust. The Board, in turn, elects the officers of the Trust, who are responsible for the day-to-day operations of the Trust and its separate series. The current Trustees and officers of the Trust, their year of birth, positions with the Trust, terms of office with the Trust and length of time served, principal occupations during the past five years and other directorships are set forth in the table below. Unless noted otherwise, the principal business address of each Trustee is c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202.

| | | | | Number of | |

| | | | | Portfolios | |

| | | | | in Fund | Other |

| | Positions | Term of Office | | Complex(2) | Directorships |

| Name and | with | and Length of | Principal Occupations | Overseen | Held During |

Year of Birth | the Trust | Time Served | During Past Five Years | by Trustees | Past Five Years |

Independent Trustees(1) | | | | | |

| | | | | | |

| Koji Felton | Trustee | Indefinite Term; | Retired. | 1 | Independent |

| (born 1961) | | Since | | | Trustee, Listed |

| | | September | | | Funds Trust |

| | | 2015. | | | (55 portfolios) |

| | | | | | (Since 2019). |

| | | | | | |

| Debra McGinty-Poteet | Trustee | Indefinite Term; | Retired. | 1 | Independent |

| (born 1956) | | Since | | | Trustee, F/m |

| | | September | | | Funds Trust |

| | | 2015. | | | (4 portfolios) |

| | | | | | (2015 – 2023). |

| | | | | | |

| Daniel B. Willey | Trustee | Indefinite Term; | Retired. | 1 | None |

| (born 1955) | | Since | | | |

| | | September | | | |

| | | 2015. | | | |

| | | | | | |

| Interested Trustee | | | | | |

| | | | | | |

Elaine E. Richards(3) | Chair, | Indefinite Term; | Senior Vice President, | 1 | None |

| (born 1968) | Trustee | Since | U.S. Bancorp Fund | | |

| | | July | Services, LLC (since 2007). | | |

| | | 2021. | | | |

| | | | | | |

| Officers | | | | | |

| | | | | | |

| Ryan L. Roell | President and | Indefinite Term; | Vice President, | Not | Not |

| (born 1973) | Principal | Since | U.S. Bancorp Fund | Applicable | Applicable |

| | Executive | July | Services, LLC (since 2005). | | |

| | Officer | 2019. | | | |

| | | | | | |

| Douglas Schafer | Vice | Indefinite Term; | Assistant Vice President, | Not | Not |

| (born 1970) | President, | Since | U.S. Bancorp Fund | Applicable | Applicable |

| | Treasurer and | November | Services, LLC (since 2002). | | |

| | Principal | 2023. | | | |

| | Financial | | | | |

| | Officer | | | | |

Additional Information (Unaudited) – Continued

April 30, 2024

| | | | | Number of | |

| | | | | Portfolios | |

| | | | | in Fund | Other |

| | Positions | Term of Office | | Complex(2) | Directorships |

| Name and | with | and Length of | Principal Occupations | Overseen | Held During |

Year of Birth | the Trust | Time Served | During Past Five Years | by Trustees | Past Five Years |

| Donna Barrette | Vice | Indefinite Term; | Senior Vice President | Not | Not |

| (born 1966) | President, | Since | and Compliance Officer, | Applicable | Applicable |

| | Chief | November | U.S. Bancorp Fund | | |

| | Compliance | 2019. | Services, LLC | | |

| | Officer and | | (since 2004). | | |

| | Anti-Money | | | | |

| | Laundering | | | | |

| | Officer | | | | |

| | | | | | |

| Adam W. Smith | Secretary | Indefinite Term; | Vice President, | Not | Not |

| (born 1981) | | Since | U.S. Bancorp Fund | Applicable | Applicable |

| | | June | Services, LLC | | |

| | | 2019. | (since 2012). | | |

| | | | | | |

| Richard E. Grange | Assistant | Indefinite Term; | Officer, | Not | Not |

| (born 1982) | Treasurer | Since | U.S. Bancorp Fund | Applicable | Applicable |

| | | October | Services, LLC | | |

| | | 2022. | (since 2017). | | |

| | | | | | |

| Leone Logan | Assistant | Indefinite Term; | Officer, | Not | Not |

| (born 1986) | Treasurer | Since | U.S. Bancorp Fund | Applicable | Applicable |

| | | November | Services, LLC | | |

| | | 2023. | (since 2022); Senior | | |

| | | | Financial Reporting Analyst, | | |

| | | | BNY Mellon (2014 – 2022). | | |

| (1) | The Trustees of the Trust who are not “interested persons” of the Trust as defined under the 1940 Act (“Independent Trustees”). |

| (2) | As of April 30, 2024, the Trust was comprised of 14 portfolios (including the Fund) managed by unaffiliated investment advisers. The term “Fund Complex” applies only to the Fund. The Fund does not hold itself out as related to any other series within the Trust for investment purposes, nor does it share the same investment adviser with any other series within the Trust. |

| (3) | Ms. Richards, as a result of her employment with U.S. Bancorp Fund Services, LLC, which acts as transfer agent, administrator, and fund accountant to the Trust, is considered to be an “interested person” of the Trust, as defined by the 1940 Act. |

Additional Information (Unaudited) – Continued

April 30, 2024

AVAILABILITY OF FUND PORTFOLIO INFORMATION

The Fund files complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form N-PORT, which is available on the SEC’s website at https://www.sec.gov/. The Fund’s Part F of Form N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. For information on the Public Reference Room call 1-800-SEC-0330. In addition, the Fund’s Part F of Form N-PORT is available without charge upon request by calling 1-844-625-4778.

AVAILABILITY OF PROXY VOTING INFORMATION

A description of the Fund’s Proxy Voting Policies and Procedures is available without charge, upon request, by calling 1-844-625-4778. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent period ended June 30, is available (1) without charge, upon request, by calling 1-844-625-4778, or on the SEC’s website at https://www.sec.gov/.

QUALIFIED DIVIDEND INCOME/DIVIDENDS RECEIVED DEDUCTION

For the fiscal year ended April 30, 2024, certain dividends paid by the Fund may be reported as qualified dividend income and may be eligible for taxation at capital gain rates. The percentage of dividends declared from ordinary income designated as qualified dividend income was 8.11% for the Fund. For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the year ended April 30, 2024 was 0.79% for the Fund. The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(c) was 19.27% for the Fund.

Privacy Notice (Unaudited)

The Fund collects non-public information about you from the following sources:

• Information the Fund receives about you on applications or other forms;

• Information you give the Fund orally; and/or

• Information about your transactions with the Fund or others

The Fund does not disclose any non-public personal information about its customers or former customers without the customer’s authorization, except as permitted by law. The Fund may share information with affiliated and unaffiliated third parties with whom it has contracts for servicing the Fund. The Fund will provide unaffiliated third parties with only the information necessary to carry out their assigned responsibilities. The Fund maintains physical, electronic and procedural safeguards to guard your personal information and require third parties to treat your personal information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a brokerdealer, bank, or trust company, the privacy policy of your financial intermediary would govern how your non- public personal information would be shared with unaffiliated third parties.

(This Page Intentionally Left Blank.)

INVESTMENT ADVISER

Lido Advisors, LLC

1875 Century Park East, Suite 950

Los Angeles, CA 90067

DISTRIBUTOR

Quasar Distributors, LLC

3 Canal Plaza, Suite 100

Portland, ME 04101

CUSTODIAN

U.S. Bank N.A.

1555 North Rivercenter Drive, Suite 302

Milwaukee, WI 53212

ADMINISTRATOR, FUND ACCOUNTANT AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

342 North Water Street, Suite 830

Milwaukee, WI 53202

LEGAL COUNSEL

Kirkland & Ellis LLP

1301 Pennsylvania Avenue, N.W.

Washington, D.C. 20004

This report must be accompanied or preceded by a prospectus.

The Fund’s Statement of Additional Information contains additional information about the

Fund’s trustees and is available without charge upon request by calling 1-844-625-4778.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

File: A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Debra McGinty-Poteet is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N CSR.

Item 4. Principal Accountant Fees and Services.