UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23084

Series Portfolios Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ryan L. Roell, President

Series Portfolios Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Ave, 6th Fl

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1709

Registrant’s telephone number, including area code

Date of fiscal year end: November 30, 2024

Date of reporting period: November 30, 2024

Item 1. Reports to Stockholders.

| | |

| InfraCap Equity Income Fund ETF | |

| ICAP (Principal U.S. Listing Exchange: NYSE) | |

| Annual Shareholder Report | November 30, 2024 | |

This annual shareholder report contains important information about the InfraCap Equity Income Fund ETF for the period of December 1, 2023, to November 30, 2024. You can find additional information about the Fund at https://infracapfund.com/icap. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| InfraCap Equity Income Fund ETF | $373 | 3.19% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the fiscal year ended November 30, 2024, the Fund at NAV returned 33.85%. For the same period, the S&P 500 Index, a broad-based securities market index returned 33.89%, and the underlying Index, which serves as the style-specific index, returned 29.56%.

Select sector allocations were factors that positively contributed to ICAP’s relative outperformance to the Bloomberg US Large Cap Dividend Yield Total Return Index (“Benchmark”) for the 12-month period. Overweight exposure to the Financials and Communication Services sectors positively contributed to ICAP’s high income and total return, while underweight exposure to the Consumer Staples sector and smaller market capitalized companies detracted from performance.

| | |

| FACTOR | IMPACT | SUMMARY |

| Financials | Positive | Overweight exposure to the information technology sector relative to the benchmark contributed to outperformance. |

| Communication Services | Positive | Overweight exposure to the Communication Services sector relative to the Benchmark contributed to outperformance. |

| Consumer Staples | Negative | Underweight exposure to Consumer Staples sector relative to the Benchmark detracted from relative performance. |

| Company Market Capitalization | Negative | Overweight exposure to select small company issuers underperformed relative to their larger capitalized peers during the period. |

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, such as management fees, were deducted.

| InfraCap Equity Income Fund ETF | PAGE 1 | TSR-AR-81752T619 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(12/28/2021) |

InfraCap Equity Income Fund ETF NAV | 33.85 | 6.82 |

S&P 500 TR | 33.89 | 9.94 |

Bloomberg US Large Cap Dividend Yield Total Return Index | 29.56 | 11.50 |

Visit https://infracapfund.com/icap for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $60,814,638 |

Number of Holdings | 155 |

Net Advisory Fee | $429,563 |

Portfolio Turnover | 207% |

30-Day SEC Yield | 6.93% |

30-Day SEC Yield Unsubsidized | 6.93% |

Visit https://infracapfund.com/icap for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of November 30, 2024)

| |

Industry Breakdown | (% of investments) |

Banks | 14.5% |

Oil, Gas & Consumable Fuels | 12.4% |

Specialized REITs | 9.5% |

Capital Markets | 8.1% |

Office REITs | 7.1% |

Retail REITs | 4.5% |

Mortgage REITs | 3.9% |

Financial Services | 3.7% |

Software | 3.0% |

Cash & Other | 33.3% |

| |

Top 10 Issuers | (% of net assets) |

Goldman Sachs Group, Inc. | 4.5% |

Equinix, Inc. | 4.4% |

Chevron Corp. | 4.3% |

Kilroy Realty Corp. | 4.0% |

M&T Bank Corp. | 4.0% |

MPLX LP | 3.5% |

Citigroup, Inc. | 3.3% |

Oracle Corp. | 3.3% |

Citizens Financial Group, Inc. | 3.2% |

Apollo Global Management, Inc. | 3.1% |

| |

Security Type | (% of net assets) |

Common Stocks | 105.6% |

Preferred Stocks | 17.4% |

Convertible Preferred Stocks | 5.9% |

Written Options | -0.2% |

Cash & Other | -28.7% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://infracapfund.com/icap.

| InfraCap Equity Income Fund ETF | PAGE 2 | TSR-AR-81752T619 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Infrastructure Capital Advisors, LLC documents not be householded, please call toll-free at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt.

| InfraCap Equity Income Fund ETF | PAGE 3 | TSR-AR-81752T619 |

10000961690601212710000865498521319110000108961061113748

| | |

| InfraCap Small Cap Income ETF | |

| SCAP (Principal U.S. Listing Exchange: NYSE) | |

| Annual Shareholder Report | November 30, 2024 | |

This annual shareholder report contains important information about the InfraCap Small Cap Income ETF for the period of December 11, 2023, to November 30, 2024. You can find additional information about the Fund at https://infracapfund.com/scap. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE PAST PERIOD*? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| InfraCap Small Cap Income ETF | $219 | 1.94% |

| * | Period is inception date of December 11, 2023 through November 30, 2024. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the fiscal year ended November 30, 2024, the Fund at NAV returned 33.28%. For the same period, the S&P 500 Index, a broad-based securities market index returned 32.26%, and the underlying Index, which serves as the style-specific index, returned 27.75%.

Sector allocation and company market capitalization were factors that positively contributed to SCAP’s relative outperformance to the Bloomberg US 2000 Value Total Return Index (“Benchmark”) for the 12-month period. SCAP’s overweight exposure to the Information Technology sector positively contributed to performance while overweight exposure to the Energy and Real Estate sectors detracted from relative performance.

| | |

| FACTOR | IMPACT | SUMMARY |

| Information Technology | Positive | Overweight exposure to the information technology sector relative to the benchmark contributed to outperformance. |

| Company Market Capitalization | Positive | Overweight exposure to larger market capitalized companies within the small cap company sector contributed to outperformance. |

| Energy | Negative | The Fund’s overweight exposure to the energy sector relative to the benchmark detracted from relative performance. |

| Real Estate | Negative | The Fund’s overweight exposure to the real estate sector relative to the benchmark detracted from relative performance. |

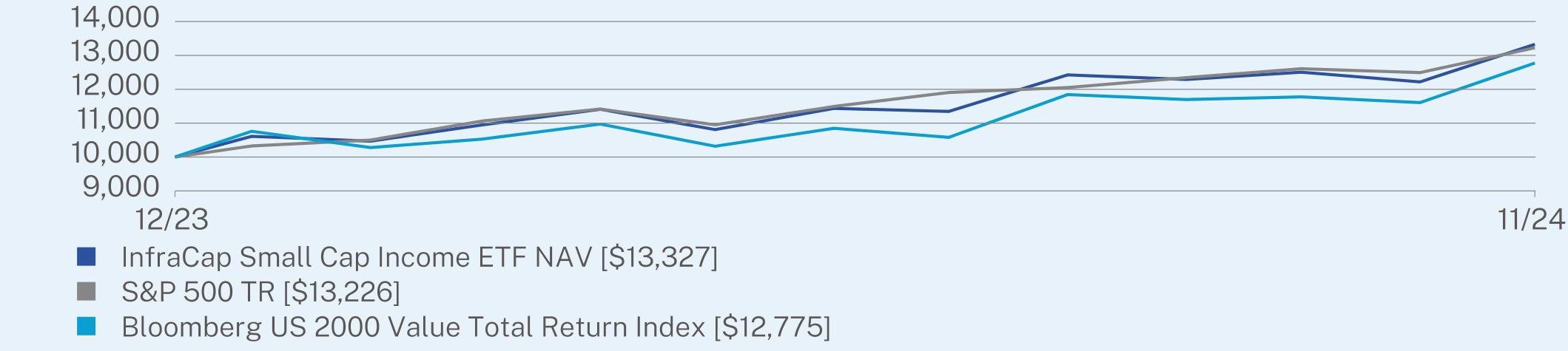

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, such as management fees, were deducted.

| InfraCap Small Cap Income ETF | PAGE 1 | TSR-AR-81752T445 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(12/11/2023) |

InfraCap Small Cap Income ETF NAV | 33.28 |

S&P 500 TR | 32.26 |

Bloomberg US 2000 Value Total Return Index | 27.75 |

Visit https://infracapfund.com/scap for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $12,476,230 |

Number of Holdings | 78 |

Net Advisory Fee | $52,889 |

Portfolio Turnover | 139% |

30-Day SEC Yield | 6.06% |

30-Day SEC Yield Unsubsidized | 6.06% |

Visit https://infracapfund.com/scap for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of November 30, 2024)

| |

Industry Breakdown | (% of investments) |

Banks | 18.1% |

Mortgage REITs | 10.3% |

Oil, Gas & Consumable Fuels | 9.8% |

Trading Companies & Distributors | 5.2% |

Chemicals | 5.1% |

Financial Services | 4.3% |

Capital Markets | 3.7% |

Office REITs | 3.2% |

Consumer Finance | 3.0% |

Cash & Other | 37.3% |

| |

Top 10 Issuers | (% of net assets) |

iShares Russell 2000 ETF | 8.0% |

Apollo Global Management, Inc. | 3.8% |

Chart Industries, Inc. | 3.8% |

Chimera Investment Corp. | 3.6% |

Herc Holdings, Inc. | 3.5% |

Rithm Capital Corp. | 3.5% |

AGNC Investment Corp. | 3.4% |

Casey’s General Stores, Inc. | 3.2% |

Tapestry, Inc. | 3.2% |

GATX Corp. | 3.1% |

| |

Security Type | (% of net assets) |

Common Stocks | 87.0% |

Preferred Stocks | 22.5% |

Convertible Preferred Stocks | 9.0% |

Exchange Traded Funds | 8.0% |

Written Options | 0.0% |

Cash & Other | -26.5% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://infracapfund.com/scap.

| InfraCap Small Cap Income ETF | PAGE 2 | TSR-AR-81752T445 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Infrastructure Capital Advisors, LLC documents not be householded, please call toll-free at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt.

| InfraCap Small Cap Income ETF | PAGE 3 | TSR-AR-81752T445 |

100001332710000132261000012775

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

File: A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Debra McGinty-Poteet is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those two fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning; including reviewing the Funds’ tax returns and distribution calculations. There were no “other services” provided by the principal accountant. For the fiscal years ended November 30, 2024 and November 30, 2023, the Funds’ principal accountant was Cohen & Company, Ltd. The following table details the aggregate fees billed or expected to be billed for each of the past two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 11/30/2024 | FYE 11/30/2023 |

| (a) Audit Fees | $37,000 | $17,500 |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $8,000 | $4,000 |

| (d) All Other Fees | $0 | $0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 11/30/2024 | FYE 11/30/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two fiscal years.

| Non-Audit Related Fees | FYE 11/30/2024 | FYE 11/30/2023 |

| Registrant | $0 | $0 |

| Registrant’s Investment Adviser | $0 | $0 |

(h) The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable

(j) Not applicable

Item 5. Audit Committee of Listed Registrants.

(a) The Registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The members of the audit committee, all Independent Trustees, are as follows: Koji Felton, Debra McGinty-Poteet and Daniel B. Willey.

(b) Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

Series Portfolios Trust

InfraCap Equity Income Fund ETF

Ticker Symbol: ICAP

InfraCap Small Cap Income ETF

Ticker Symbol: SCAP

Core Financial Statements

November 30, 2024

TABLE OF CONTENTS

InfraCap Equity Income Fund ETF

Schedule of Investments

as of November 30, 2024

| | | | | | | |

COMMON STOCKS - 105.6%

|

Aerospace & Defense - 1.0%

| | | | | | |

General Dynamics Corp. | | | 44 | | | $12,496 |

RTX Corp.(a)(b) | | | 5,072 | | | 617,922 |

| | | | | | 630,418 |

Banks - 17.2%

| | | | | | |

Bank of America Corp.(a)(c) | | | 29,124 | | | 1,383,681 |

Citigroup, Inc.(a)(c) | | | 28,533 | | | 2,022,134 |

Citizens Financial Group, Inc.(a)(c) | | | 39,838 | | | 1,917,801 |

Fifth Third Bancorp(a)(c) | | | 13,152 | | | 632,085 |

JPMorgan Chase & Company(c) | | | 927 | | | 231,491 |

M&T Bank Corp.(a)(c) | | | 10,930 | | | 2,404,491 |

Truist Financial Corp.(a)(c) | | | 26,106 | | | 1,244,734 |

U.S. Bancorp(c) | | | 12,017 | | | 640,386 |

| | | | | | 10,476,803 |

Beverages - 0.1%

| | | | | | |

Coca-Cola Co.(a) | | | 625 | | | 40,050 |

Broadline Retail - 3.0%

| | | | | | |

Amazon.com, Inc.(a)(b)(c)(d) | | | 8,790 | | | 1,827,353 |

Capital Markets - 10.3%

| | | | | | |

AllianceBernstein Holding LP(a)(c) | | | 37,740 | | | 1,368,830 |

Ares Management Corp. - Class A(a)(c) | | | 5,118 | | | 904,504 |

Goldman Sachs Group, Inc.(a)(c) | | | 4,474 | | | 2,722,742 |

Morgan Stanley | | | 9,806 | | | 1,290,568 |

| | | | | | 6,286,644 |

Chemicals - 1.1%

| | | | | | |

Dow, Inc.(a)(c) | | | 15,499 | | | 685,211 |

Communications Equipment - 0.5%

| | | | | | |

Cisco Systems, Inc.(b) | | | 5,077 | | | 300,609 |

Diversified Telecommunication Services - 0.6%

| | | | | | |

AT&T, Inc.(a)(c) | | | 4,867 | | | 112,720 |

Verizon Communications, Inc.(a)(c) | | | 5,251 | | | 232,829 |

| | | | | | 345,549 |

Electric Utilities - 3.5%

| | | | | | |

Duke Energy Corp. | | | 1,108 | | | 129,691 |

Edison International(a)(c) | | | 11,973 | | | 1,050,631 |

NextEra Energy, Inc.(b)(c) | | | 2,072 | | | 163,004 |

Southern Co.(b)(c) | | | 8,591 | | | 765,716 |

| | | | | | 2,109,042 |

Food Products - 1.8%

| | | | | | |

Kraft Heinz Co.(a)(b)(c) | | | 33,727 | | | 1,078,252 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Equity Income Fund ETF

Schedule of Investments

as of November 30, 2024 (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Gas Utilities - 3.1%

| | | | | | |

Northwest Natural Holding Co.(a)(c) | | | 10,750 | | | $471,065 |

UGI Corp.(a)(c) | | | 46,510 | | | 1,412,509 |

| | | | | | 1,883,574 |

Health Care Providers & Services - 0.0%(e)

| | | | | | |

UnitedHealth Group, Inc. | | | 11 | | | 6,712 |

Health Care REITs - 0.8%

| | | | | | |

Healthcare Realty Trust, Inc.(a)(c) | | | 25,747 | | | 471,685 |

Hotels, Restaurants & Leisure - 3.2%

| | | | | | |

Bloomin’ Brands, Inc.(a)(c) | | | 42,810 | | | 596,772 |

McDonald’s Corp.(b) | | | 4,116 | | | 1,218,377 |

Red Rock Resorts, Inc. - Class A(a)(c) | | | 3,035 | | | 152,023 |

| | | | | | 1,967,172 |

Industrial Conglomerates - 2.3%

| | | | | | |

3M Company(a)(c) | | | 2,558 | | | 341,570 |

Honeywell International, Inc.(a)(b) | | | 4,565 | | | 1,063,325 |

| | | | | | 1,404,895 |

Industrial REITs - 1.7%

| | | | | | |

Rexford Industrial Realty, Inc.(a)(c) | | | 24,049 | | | 1,011,982 |

Machinery - 0.7%

| | | | | | |

Caterpillar, Inc.(b) | | | 1,036 | | | 420,730 |

Multi-Utilities - 1.9%

| | | | | | |

Algonquin Power & Utilities Corp.(a)(c) | | | 229,174 | | | 1,134,412 |

Dominion Energy, Inc. | | | 99 | | | 5,816 |

| | | | | | 1,140,228 |

Office REITs - 9.1%

| | | | | | |

Alexandria Real Estate Equities, Inc.(a)(c) | | | 11,189 | | | 1,233,363 |

Boston Properties, Inc.(a)(c) | | | 23,195 | | | 1,901,758 |

Kilroy Realty Corp.(a)(c) | | | 58,460 | | | 2,427,844 |

| | | | | | 5,562,965 |

Oil, Gas & Consumable Fuels - 16.0%

| | | | | | |

Chevron Corp.(a)(b)(c) | | | 16,071 | | | 2,602,377 |

Diamondback Energy, Inc.(a)(b)(c) | | | 4,765 | | | 846,216 |

Enbridge, Inc.(a)(c) | | | 38,245 | | | 1,659,068 |

Energy Transfer LP(a) | | | 964 | | | 19,145 |

Exxon Mobil Corporation(a)(b)(c) | | | 12,631 | | | 1,489,953 |

Kinder Morgan, Inc.(a)(c) | | | 21,943 | | | 620,328 |

ONEOK, Inc.(a) | | | 1,011 | | | 114,850 |

MPLX LP(a)(c) | | | 41,482 | | | 2,142,960 |

Plains All American Pipeline LP(a)(c) | | | 10,360 | | | 193,421 |

South Bow Corp. | | | 97 | | | 2,527 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Equity Income Fund ETF

Schedule of Investments

as of November 30, 2024 (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Oil, Gas & Consumable Fuels - (Continued)

| | | | | | |

TC Energy Corp. | | | 76 | | | $3,719 |

Williams Cos., Inc. | | | 82 | | | 4,799 |

| | | | | | 9,699,363 |

Pharmaceuticals - 0.9%

| | | | | | |

Johnson & Johnson(a) | | | 327 | | | 50,688 |

Merck & Co., Inc.(a)(b)(c) | | | 5,095 | | | 517,856 |

| | | | | | 568,544 |

Retail REITs - 5.9%

| | | | | | |

Federal Realty Investment Trust(a)(c) | | | 15,115 | | | 1,763,165 |

Realty Income Corp.(a)(c) | | | 13,397 | | | 775,552 |

Simon Property Group, Inc.(a)(c) | | | 5,575 | | | 1,023,570 |

| | | | | | 3,562,287 |

Semiconductors & Semiconductor Equipment - 1.8%

| | | | | | |

Broadcom, Inc.(a)(b)(c) | | | 6,730 | | | 1,090,798 |

Software - 3.8%

| | | | | | |

Microsoft Corp. | | | 751 | | | 318,019 |

Oracle Corp.(a)(b)(c) | | | 10,912 | | | 2,016,974 |

| | | | | | 2,334,993 |

Specialized REITs - 11.8%

| | | | | | |

American Tower Corp.(a)(c) | | | 1,654 | | | 345,686 |

Crown Castle, Inc.(a)(c) | | | 6,150 | | | 653,437 |

Digital Realty Trust, Inc.(a)(c) | | | 9,166 | | | 1,793,695 |

EPR Properties(a)(c) | | | 4,071 | | | 184,701 |

Equinix, Inc.(a)(c) | | | 2,712 | | | 2,661,774 |

Iron Mountain, Inc.(a) | | | 3,288 | | | 406,627 |

Safehold, Inc.(a)(c) | | | 51,767 | | | 1,105,743 |

| | | | | | 7,151,663 |

Technology Hardware, Storage & Peripherals - 0.9%

| | | | | | |

Hewlett Packard Enterprise Co.(a)(c) | | | 27,138 | | | 575,868 |

Tobacco - 1.2%

| | | | | | |

Altria Group, Inc. | | | 704 | | | 40,649 |

Philip Morris International, Inc.(a)(b)(c) | | | 5,091 | | | 677,408 |

| | | | | | 718,057 |

Wireless Telecommunication Services - 1.4%

| | | | | | |

Vodafone Group PLC - ADR(a)(c) | | | 96,843 | | | 868,682 |

TOTAL COMMON STOCKS

(Cost $60,030,711) | | | | | | 64,220,129 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Equity Income Fund ETF

Schedule of Investments

as of November 30, 2024 (Continued)

| | | | | | | |

PREFERRED STOCKS - 17.4%

| | | | | | |

Banks - 1.5%

| | | | | | |

Bank of America Corp. Series 02, 5.43% (3 mo. Term SOFR + 0.91%), Perpetual Maturity(a)(c) | | | 10,158 | | | $234,243 |

Bank of Hawaii Corp. 8.00%, Perpetual Maturity(a)(c) | | | 1,173 | | | 31,202 |

Flagstar Financial, Inc., Series A., 6.38% to 03/17/2027 then 3 mo. SOFR + 3.82%, Perpetual Maturity(f) | | | 5,118 | | | 114,285 |

Valley National Bancorp, Series C, 8.25% to 09/30/2029 then 5 yr. CMT Rate + 4.18%, Perpetual Maturity(a)(c)(f) | | | 20,476 | | | 537,905 |

| | | | | | 917,635 |

Capital Markets - 0.1%

| | | | | | |

Trinity Capital, Inc. 7.88%, 03/30/2029(a) | | | 1,727 | | | 43,935 |

Commercial Services & Supplies - 0.2%

| | | | | | |

Pitney Bowes, Inc. 6.70%, 03/07/2043(a)(c) | | | 5,180 | | | 103,652 |

Consumer Finance - 2.8%

| | | | | | |

Atlanticus Holdings Corp. Series *, 9.25%, 01/31/2029 | | | 1,036 | | | 25,848 |

SLM Corp. Series B, 6.91% (3 mo. Term SOFR + 1.96%), Perpetual Maturity(a)(c)(f) | | | 22,104 | | | 1,658,242 |

| | | | | | 1,684,090 |

Diversified REITs - 0.9%

| | | | | | |

Global Net Lease, Inc. Series B, 6.88%, Perpetual Maturity(a)(c) | | | 24,255 | | | 537,248 |

Diversified Telecommunication Services - 0.3%

| | | | | | |

Qwest Corp.

| | | | | | |

6.75%, 06/15/2057 | | | 10,360 | | | 186,169 |

6.50%, 09/01/2056 | | | 5 | | | 88 |

| | | | | | 186,257 |

Electrical Equipment - 1.2%

| | | | | | |

Babcock & Wilcox Enterprises, Inc. Series A, 7.75%, Perpetual Maturity(a)(c) | | | 52,726 | | | 743,437 |

Financial Services - 1.6%

| | | | | | |

Corebridge Financial, Inc. 6.38%, 12/15/2064 | | | 40,000 | | | 995,520 |

Health Care REITs - 0.6%

| | | | | | |

Diversified Healthcare Trust

| | | | | | |

5.63%, 08/01/2042(a)(c) | | | 24,626 | | | 365,942 |

6.25%, 02/01/2046 | | | 641 | | | 9,878 |

| | | | | | 375,820 |

Hotel & Resort REITs - 1.9%

| | | | | | |

RLJ Lodging Trust Series A, 1.95%, Perpetual Maturity | | | 45,754 | | | 1,158,949 |

Insurance - 1.0%

| | | | | | |

Aspen Insurance Holdings Ltd. 7.00%, Perpetual Maturity | | | 24,000 | | | 598,080 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Equity Income Fund ETF

Schedule of Investments

as of November 30, 2024 (Continued)

| | | | | | | |

PREFERRED STOCKS - (Continued)

|

Mortgage REITs - 5.1%

| | | | | | |

AGNC Investment Corp., Series G, 7.75% to 10/15/2027 then 5 yr. CMT Rate + 4.39%, Perpetual Maturity(a)(c)(f) | | | 21,500 | | | $542,230 |

MFA Financial, Inc. 8.88%, 02/15/2029(a) | | | 12,761 | | | 324,002 |

New York Mortgage Trust, Inc., Series D, 8.00% to 10/15/2027 then 3 mo. SOFR + 5.70%, Perpetual Maturity(a)(c)(f) | | | 50,656 | | | 1,165,088 |

Redwood Trust, Inc. 9.00%, 09/01/2029(a)(c) | | | 40,952 | | | 1,036,085 |

| | | | | | 3,067,405 |

Real Estate Management & Development - 0.2%

| | | | | | |

DigitalBridge Group, Inc. Series H, 7.13%, Perpetual Maturity(c) | | | 4,993 | | | 125,824 |

Wireless Telecommunication Services - 0.0%(e)

| | | | | | |

United States Cellular Corp.

| | | | | | |

6.25%, 09/01/2069 | | | 319 | | | 7,474 |

5.50%, 03/01/2070 | | | 284 | | | 6,452 |

5.50%, 06/01/2070 | | | 206 | | | 4,693 |

| | | | | | 18,619 |

TOTAL PREFERRED STOCKS

(Cost $10,673,672) | | | | | | 10,556,471 |

| | | | | | |

CONVERTIBLE PREFERRED STOCKS - 5.9%

| | | | | | |

Electric Utilities - 0.3%

| | | | | | |

NextEra Energy, Inc. 6.93%, 09/01/2025(a)(c) | | | 3,795 | | | 164,741 |

Financial Services - 3.1%

| | | | | | |

Apollo Global Management, Inc. 6.75%, 07/31/2026 | | | 20,595 | | | 1,908,745 |

Machinery - 0.9%

| | | | | | |

Chart Industries, Inc. Series B, 6.75%, 12/15/2025(a)(c) | | | 7,832 | | | 563,591 |

Specialized REITs - 0.4%

| | | | | | |

EPR Properties Series E, 9.00%, Perpetual Maturity(a)(c) | | | 9,118 | | | 269,665 |

Technology Hardware, Storage & Peripherals - 1.2%

| | | | | | |

Hewlett Packard Enterprise Co. 7.63%, 09/01/2027(a)(c) | | | 11,261 | | | 696,605 |

TOTAL CONVERTIBLE PREFERRED STOCKS

(Cost $2,912,481) | | | | | | 3,603,347 |

TOTAL INVESTMENTS - 128.9%

(Cost $73,616,864) | | | | | | $78,379,947 |

Liabilities in Excess of Other Assets - (28.9)% | | | | | | (17,565,309) |

TOTAL NET ASSETS - 100.0% | | | | | | $60,814,638 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Equity Income Fund ETF

Schedule of Investments

as of November 30, 2024 (Continued)

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

ADR - American Depositary Receipt

CMT - Constant Maturity Treasury Rate

PLC - Public Limited Company

REIT - Real Estate Investment Trust

SOFR - Secured Overnight Financing Rate

(a)

| All or a portion of security has been committed as collateral for a borrowing facility. The total value of assets committed as collateral as of November 30, 2024 is $41,852,545. |

(b)

| Held in connection with written option contracts. See Schedule of Written Options for further information. |

(c)

| All or a portion of security has been committed as collateral for open written options contracts. The total value of assets committed as collateral as of November 30, 2024 is $11,444,782. |

(d)

| Non-income producing security. |

(e)

| Represents less than 0.05% of net assets. |

(f)

| This security represents a fixed to float/variable rate preferred stock. The coupon rate shown represents the fixed rate as of November 30, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

INFRACAP EQUITY INCOME FUND ETF

SCHEDULE OF WRITTEN OPTIONS

as of November 30, 2024

| | | | | | | | | | |

WRITTEN OPTIONS(b)

|

Call Options

| | | | | | | | | |

Amazon.com, Inc.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $220.00 | | | $(207,890) | | | (10) | | | $(290) |

Expiration: 12/13/2024; Exercise Price: $225.00 | | | (207,890) | | | (10) | | | (370) |

Expiration: 12/20/2024; Exercise Price: $225.00 | | | (207,890) | | | (10) | | | (730) |

Broadcom, Inc.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $205.00 | | | (810,400) | | | (50) | | | (25) |

Expiration: 12/13/2024; Exercise Price: $205.00 | | | (486,240) | | | (30) | | | (390) |

Expiration: 12/20/2024; Exercise Price: $205.00 | | | (162,080) | | | (10) | | | (260) |

Expiration: 12/27/2024; Exercise Price: $205.00 | | | (162,080) | | | (10) | | | (335) |

Chevron Corp.

| | | | | | | | | |

Expiration: 12/20/2024; Exercise Price: $170.00 | | | (1,619,300) | | | (100) | | | (4,200) |

Expiration: 01/17/2025; Exercise Price: $170.00 | | | (1,619,300) | | | (100) | | | (17,500) |

Cisco Systems, Inc.

| | | | | | | | | |

Expiration: 12/20/2024; Exercise Price: $61.00 | | | (177,630) | | | (30) | | | (900) |

Expiration: 12/27/2024; Exercise Price: $62.00 | | | (59,210) | | | (10) | | | (240) |

Expiration: 01/03/2025; Exercise Price: $62.00 | | | (118,420) | | | (20) | | | (600) |

Diamondback Energy, Inc.

| | | | | | | | | |

Expiration: 12/20/2024; Exercise Price: $200.00 | | | (355,180) | | | (20) | | | (600) |

Expiration: 12/27/2024; Exercise Price: $205.00 | | | (177,590) | | | (10) | | | (875) |

Expiration: 01/03/2025; Exercise Price: $195.00 | | | (177,590) | | | (10) | | | (1,900) |

Exxon Mobil Corp.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $126.00 | | | (117,960) | | | (10) | | | (30) |

Expiration: 12/13/2024; Exercise Price: $126.00 | | | (589,800) | | | (50) | | | (600) |

Expiration: 12/20/2024; Exercise Price: $126.00 | | | (353,880) | | | (30) | | | (810) |

Expiration: 12/27/2024; Exercise Price: $126.00 | | | (235,920) | | | (20) | | | (760) |

Expiration: 01/03/2025; Exercise Price: $126.00 | | | (235,920) | | | (20) | | | (1,070) |

Kraft Heinz Co.

| | | | | | | | | |

Expiration: 12/13/2024; Exercise Price: $33.00 | | | (351,670) | | | (110) | | | (1,540) |

Expiration: 12/20/2024; Exercise Price: $33.00 | | | (319,700) | | | (100) | | | (2,050) |

McDonald’s Corp.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $320.00 | | | (1,480,050) | | | (50) | | | (350) |

Expiration: 12/13/2024; Exercise Price: $320.00 | | | (1,480,050) | | | (50) | | | (500) |

Expiration: 12/20/2024; Exercise Price: $320.00 | | | (2,960,100) | | | (100) | | | (1,400) |

Expiration: 12/27/2024; Exercise Price: $315.00 | | | (2,960,100) | | | (100) | | | (3,200) |

Expiration: 12/27/2024; Exercise Price: $325.00 | | | (2,960,100) | | | (100) | | | (1,000) |

Expiration: 01/03/2025; Exercise Price: $315.00 | | | (2,960,100) | | | (100) | | | (6,900) |

Expiration: 01/17/2025; Exercise Price: $315.00 | | | (1,776,060) | | | (60) | | | (8,040) |

Merck & Co., Inc.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $115.00 | | | (254,100) | | | (25) | | | (388) |

Expiration: 12/20/2024; Exercise Price: $115.00 | | | (254,100) | | | (25) | | | (125) |

Expiration: 12/27/2024; Exercise Price: $110.00 | | | (406,560) | | | (40) | | | (840) |

Expiration: 01/17/2025; Exercise Price: $110.00 | | | (304,920) | | | (30) | | | (2,430) |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

INFRACAP EQUITY INCOME FUND ETF

SCHEDULE OF WRITTEN OPTIONS

as of November 30, 2024 (Continued)

| | | | | | | | | | |

WRITTEN OPTIONS - (Continued)

|

Call Options - (Continued)

|

NextEra Energy, Inc.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $80.00 | | | $(78,670) | | | (10) | | | $(490) |

Expiration: 12/13/2024; Exercise Price: $80.00 | | | (157,340) | | | (20) | | | (2,000) |

Expiration: 12/20/2024; Exercise Price: $82.50 | | | (78,670) | | | (10) | | | (580) |

Expiration: 01/17/2025; Exercise Price: $85.00 | | | (157,340) | | | (20) | | | (1,850) |

Oracle Corp., Expiration: 12/06/2024; Exercise Price: $192.50 | | | (369,680) | | | (20) | | | (780) |

RTX Corp., Expiration: 12/06/2024; Exercise Price: $123.00 | | | (243,660) | | | (20) | | | (1,540) |

Southern Co.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $91.00 | | | (445,650) | | | (50) | | | (450) |

Expiration: 12/13/2024; Exercise Price: $91.00 | | | (445,650) | | | (50) | | | (1,000) |

Expiration: 12/20/2024; Exercise Price: $91.00 | | | (445,650) | | | (50) | | | (6,250) |

Total Call Options | | | | | | | | | (76,188) |

Put Options

| | | | | | | | | |

Caterpillar, Inc., Expiration: 12/06/2024; Exercise Price: $380.00 | | | (406,110) | | | (10) | | | (190) |

Chevron Corp.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $160.00 | | | (809,650) | | | (50) | | | (3,350) |

Expiration: 12/13/2024; Exercise Price: $160.00 | | | (161,930) | | | (10) | | | (1,250) |

Exxon Mobil Corp., Expiration: 12/06/2024; Exercise Price: $120.00 | | | (294,900) | | | (25) | | | (5,925) |

Honeywell International, Inc., Expiration: 12/06/2024; Exercise Price: $230.00 | | | (465,860) | | | (20) | | | (2,600) |

Philip Morris International, Inc.

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $128.00 | | | (133,060) | | | (10) | | | (110) |

Expiration: 12/13/2024; Exercise Price: $126.00 | | | (133,060) | | | (10) | | | (575) |

Expiration: 12/13/2024; Exercise Price: $127.00 | | | (133,060) | | | (10) | | | (300) |

Expiration: 12/20/2024; Exercise Price: $126.00 | | | (133,060) | | | (10) | | | (450) |

Expiration: 12/20/2024; Exercise Price: $127.00 | | | (266,120) | | | (20) | | | (1,020) |

Expiration: 12/27/2024; Exercise Price: $127.00 | | | (266,120) | | | (20) | | | (2,450) |

Total Put Options | | | | | | | | | (18,220) |

TOTAL WRITTEN OPTIONS

(Premiums received $110,766) | | | | | | | | | $(94,408) |

| | | | | | | | | | |

Percentages are stated as a percent of net assets.

(a)

| 100 shares per contract. |

(b)

| Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Small Cap Income ETF

Schedule of Investments

as of November 30, 2024

| | | | | | | |

COMMON STOCKS - 87.0%

|

Aerospace & Defense - 1.8%

| | | | | | |

Woodward, Inc.(a) | | | 1,222 | | | $220,351 |

Banks - 17.9%

| | | | | | |

Bank of NT Butterfield & Son Ltd.(a)(c) | | | 7,535 | | | 285,802 |

BankUnited, Inc. | | | 1,900 | | | 79,933 |

East West Bancorp, Inc.(a)(c) | | | 3,522 | | | 386,293 |

ESSA Bancorp, Inc. | | | 3,800 | | | 78,546 |

First Horizon Corp. | | | 100 | | | 2,113 |

HarborOne Bancorp, Inc. | | | 5,950 | | | 76,636 |

Kearny Financial Corp./MD | | | 9,600 | | | 76,032 |

Metrocity Bankshares, Inc.(a) | | | 8,615 | | | 295,839 |

Pinnacle Financial Partners, Inc.(a) | | | 2,544 | | | 323,368 |

Popular, Inc.(a) | | | 1,336 | | | 132,745 |

Preferred Bank/Los Angeles CA(a) | | | 3,717 | | | 350,625 |

Western Alliance Bancorp(a) | | | 1,577 | | | 147,623 |

| | | | | | 2,235,555 |

Beverages - 0.0%(e)

| | | | | | |

Celsius Holdings, Inc.(d) | | | 120 | | | 3,414 |

Capital Markets - 4.7%

| | | | | | |

AllianceBernstein Holding LP(a)(c) | | | 5,265 | | | 190,962 |

Jefferies Financial Group, Inc.(a) | | | 2,641 | | | 209,009 |

Lazard, Inc.(a) | | | 3,250 | | | 188,727 |

| | | | | | 588,698 |

Chemicals - 6.4%

| | | | | | |

AdvanSix, Inc.(a) | | | 9,976 | | | 323,921 |

Avient Corp.(a)(c) | | | 5,389 | | | 276,186 |

Element Solutions, Inc.(a) | | | 7,098 | | | 203,571 |

| | | | | | 803,678 |

Consumer Finance - 1.6%

| | | | | | |

SLM Corp.(a)(c) | | | 7,161 | | | 196,068 |

Consumer Staples Distribution & Retail - 3.2%

| | | | | | |

Casey’s General Stores, Inc.(a) | | | 953 | | | 401,108 |

Diversified REITs - 1.5%

| | | | | | |

Essential Properties Realty Trust, Inc.(a) | | | 5,580 | | | 190,278 |

Electric Utilities - 1.9%

| | | | | | |

Portland General Electric Co.(a) | | | 5,009 | | | 240,031 |

Financial Services - 1.6%

| | | | | | |

Mr Cooper Group, Inc.(a)(d) | | | 1,248 | | | 123,140 |

Waterstone Financial, Inc. | | | 5,100 | | | 76,959 |

| | | | | | 200,099 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Small Cap Income ETF

Schedule of Investments

as of November 30, 2024 (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Health Care REITs - 1.1%

| | | | | | |

Community Healthcare Trust, Inc.(a) | | | 7,425 | | | $140,332 |

Hotel & Resort REITs - 1.4%

| | | | | | |

Park Hotels & Resorts, Inc.(a) | | | 10,825 | | | 168,329 |

Hotels, Restaurants & Leisure - 1.5%

| | | | | | |

Bloomin’ Brands, Inc.(a) | | | 13,108 | | | 182,726 |

Industrial REITs - 2.8%

| | | | | | |

Rexford Industrial Realty, Inc.(a) | | | 5,186 | | | 218,227 |

STAG Industrial, Inc.(a)(c) | | | 3,696 | | | 135,976 |

| | | | | | 354,203 |

Insurance - 0.0%(e)

| | | | | | |

Assurant, Inc. | | | 16 | | | 3,634 |

Media - 1.8%

| | | | | | |

New York Times Co. - Class A(a) | | | 4,105 | | | 222,737 |

Mortgage REITs - 3.6%

| | | | | | |

AGNC Investment Corp.(a) | | | 23,135 | | | 223,484 |

Rithm Capital Corp.(a) | | | 20,348 | | | 228,915 |

| | | | | | 452,399 |

Multi-Utilities - 1.1%

| | | | | | |

Algonquin Power & Utilities Corp.(a) | | | 26,375 | | | 130,556 |

Office REITs - 2.1%

| | | | | | |

Kilroy Realty Corp.(a)(c) | | | 6,237 | | | 259,023 |

Oil, Gas & Consumable Fuels - 12.4%

| | | | | | |

Chord Energy Corp.(a) | | | 2,437 | | | 310,766 |

Delek Logistics Partners LP(a) | | | 6,282 | | | 253,416 |

Murphy Oil Corp.(a) | | | 9,654 | | | 313,465 |

Plains GP Holdings LP(a)(c) | | | 16,587 | | | 332,072 |

SM Energy Co.(a) | | | 7,408 | | | 334,768 |

| | | | | | 1,544,487 |

Real Estate Management & Development - 1.1%

| | | | | | |

Marcus & Millichap, Inc.(a) | | | 3,250 | | | 135,233 |

Retail REITs - 3.5%

| | | | | | |

Brixmor Property Group, Inc.(a)(c) | | | 8,316 | | | 250,062 |

NETSTREIT Corp.(a)(c) | | | 11,758 | | | 190,597 |

| | | | | | 440,659 |

Semiconductors & Semiconductor Equipment - 3.0%

| | | | | | |

MKS Instruments, Inc.(a) | | | 3,289 | | | 373,762 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Small Cap Income ETF

Schedule of Investments

as of November 30, 2024 (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Specialized REITs - 1.2%

| | | | | | |

Safehold, Inc.(a) | | | 6,718 | | | $143,496 |

Textiles, Apparel & Luxury Goods - 3.2%

| | | | | | |

Tapestry, Inc. | | | 6,330 | | | 394,232 |

Trading Companies & Distributors - 6.6%

| | | | | | |

GATX Corp.(a) | | | 2,368 | | | 388,731 |

Herc Holdings, Inc.(a)(c) | | | 1,884 | | | 437,088 |

| | | | | | 825,819 |

TOTAL COMMON STOCKS

(Cost $9,853,895) | | | | | | 10,850,907 |

PREFERRED STOCKS - 22.5%

| | | | | | |

Banks - 5.0%

| | | | | | |

Banc of California, Inc., Series F, 7.75% to 09/01/2027 then 5 yr. CMT Rate + 4.82%, Perpetual Maturity(a)(c)(f) | | | 8,646 | | | 216,150 |

Flagstar Financial, Inc., Series A., 6.38% to 03/17/2027 then 3 mo. SOFR + 3.82%, Perpetual Maturity(f) | | | 15,626 | | | 348,928 |

Valley National Bancorp, Series A, 6.25% to 06/30/2025 then 3 mo. SOFR + 3.85%, Perpetual Maturity(a)(c)(f) | | | 2,226 | | | 56,051 |

| | | | | | 621,129 |

Commercial Services & Supplies - 0.9%

| | | | | | |

Pitney Bowes, Inc. 6.70%, 03/07/2043(a) | | | 5,409 | | | 108,234 |

Consumer Finance - 2.3%

| | | | | | |

Atlanticus Holdings Corp. Series *, 9.25%, 01/31/2029(a) | | | 11,376 | | | 283,831 |

Diversified REITs - 1.8%

| | | | | | |

Global Net Lease, Inc. Series A, 7.25%, Perpetual Maturity(a) | | | 9,438 | | | 218,962 |

Health Care REITs - 0.4%

| | | | | | |

Diversified Healthcare Trust 5.63%, 08/01/2042(a) | | | 3,458 | | | 51,386 |

Mortgage REITs - 9.3%

| | | | | | |

AG Mortgage Investment Trust, Inc. Series B, 8.00%, Perpetual Maturity(a) | | | 14,601 | | | 317,718 |

AGNC Investment Corp. Series D, 9.25% (3 mo. Term SOFR + 4.59%), Perpetual Maturity(a)(c)(f) | | | 7,821 | | | 199,122 |

Chimera Investment Corp.

| | | | | | |

Series A, 8.00%, Perpetual Maturity(a) | | | 9,380 | | | 225,026 |

Series B, 10.66% (3 mo. Term SOFR + 6.05%), Perpetual Maturity(a)(f) | | | 8,695 | | | 219,375 |

Rithm Capital Corp., Series D, 7.00% to 11/15/2026 then 5 yr. CMT Rate + 6.22%, Perpetual Maturity(a)(c)(f) | | | 8,514 | | | 203,570 |

| | | | | | 1,164,811 |

Office REITs - 2.0%

| | | | | | |

Vornado Realty Trust Series L, 5.40%, Perpetual Maturity(a) | | | 13,740 | | | 250,206 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Small Cap Income ETF

Schedule of Investments

as of November 30, 2024 (Continued)

| | | | | | | |

PREFERRED STOCKS - (Continued)

| | | | | | |

Trust, Fiduciary, and Custody Activities - 0.8%

| | | | | | |

SCE Trust IV, Series J, 5.38% to 09/15/2025 then 3 mo. Term SOFR + 3.39%, Perpetual Maturity(a)(c)(f) | | | 4,234 | | | $105,130 |

TOTAL PREFERRED STOCKS

(Cost $2,649,907) | | | | | | 2,803,689 |

CONVERTIBLE PREFERRED STOCKS - 9.0%

| | | | | | |

Financial Services - 3.8%

| | | | | | |

Apollo Global Management, Inc. 6.75%, 07/31/2026 | | | 5,103 | | | 472,946 |

Machinery - 3.8%

| | | | | | |

Chart Industries, Inc. Series B, 6.75%, 12/15/2025(a)(c) | | | 6,557 | | | 471,842 |

Technology Hardware, Storage & Peripherals - 1.4%

| | | | | | |

Hewlett Packard Enterprise Co. 7.63%, 09/01/2027(a) | | | 2,874 | | | 177,785 |

TOTAL CONVERTIBLE PREFERRED STOCKS

(Cost $847,787) | | | | | | 1,122,573 |

EXCHANGE TRADED FUNDS - 8.0%

| | | | | | |

iShares Russell 2000 ETF(a)(b) | | | 4,133 | | | 999,649 |

TOTAL EXCHANGE TRADED FUNDS

(Cost $905,006) | | | | | | 999,649 |

TOTAL INVESTMENTS - 126.5%

(Cost $14,256,595) | | | | | | $15,776,818 |

Liabilities in Excess of Other Assets - (26.5)% | | | | | | (3,300,588) |

TOTAL NET ASSETS - 100.0% | | | | | | $12,476,230 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

CMT - Constant Maturity Treasury Rate

ETF - Exchange Traded Fund

REIT - Real Estate Investment Trust

SOFR - Secured Overnight Financing Rate

(a)

| All or a portion of security has been committed as collateral for a borrowing facility. The total value of assets committed as collateral as of November 30, 2024 is $11,487,954. |

(b)

| Held in connection with written option contracts. See Schedule of Written Options for further information.

|

(c)

| All or a portion of security has been committed as collateral for open written options contracts. The total value of assets committed as collateral as of November 30, 2024 is $695,925.

|

(d)

| Non-income producing security.

|

(e)

| Represents less than 0.05% of net assets.

|

(f)

| This security represents a fixed to float/variable rate preferred stock. The coupon rate shown represents the fixed rate as of November 30, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

INFRACAP SMALL CAP INCOME ETF

SCHEDULE OF WRITTEN OPTIONS

as of November 30, 2024

| | | | | | | | | | |

WRITTEN OPTIONS(b)

| | | | | | | | | |

Call Options

| | | | | | | | | |

iShares Russell 2000 ETF

| | | | | | | | | |

Expiration: 12/06/2024; Exercise Price: $250.00 | | | $(241,870) | | | (10) | | | $(500) |

Expiration: 12/06/2024; Exercise Price: $255.00 | | | (241,870) | | | (10) | | | (110) |

Expiration: 12/13/2024; Exercise Price: $260.00 | | | (241,870) | | | (10) | | | (220) |

Expiration: 12/13/2024; Exercise Price: $262.00 | | | (362,805) | | | (15) | | | (225) |

Expiration: 12/20/2024; Exercise Price: $255.00 | | | (241,870) | | | (10) | | | (1,140) |

Expiration: 12/20/2024; Exercise Price: $265.00 | | | (362,805) | | | (15) | | | (450) |

Expiration: 12/27/2024; Exercise Price: $258.00 | | | (241,870) | | | (10) | | | (1,070) |

Expiration: 12/27/2024; Exercise Price: $270.00 | | | (362,805) | | | (15) | | | (345) |

Expiration: 01/03/2025; Exercise Price: $265.00 | | | (241,870) | | | (10) | | | (630) |

Expiration: 01/03/2025; Exercise Price: $270.00 | | | (241,870) | | | (10) | | | (400) |

Total Call Options | | | | | | | | | (5,090) |

TOTAL WRITTEN OPTIONS

(Premiums received $5,716) | | | | | | | | | $(5,090) |

| | | | | | | | | | |

Percentages are stated as a percent of net assets.

ETF - Exchange Traded Fund

(a)

| 100 shares per contract. |

(b)

| Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

iCAP ETFs

STATEMENTS OF ASSETS AND LIABILITIES

November 30, 2024

| | | | | | | |

ASSETS:

| | | | | | |

Investments, at value | | | $78,379,947 | | | $15,776,818 |

Cash | | | 1,782,967 | | | 178,684 |

Receivable for investments sold | | | 901,150 | | | — |

Dividends and interest receivable | | | 247,931 | | | 35,817 |

Deposit at broker for written option contracts | | | — | | | 5,712 |

Total assets | | | 81,311,995 | | | 15,997,031 |

LIABILITIES:

| | | | | | |

Written option contracts, at value | | | 94,408 | | | 5,090 |

Loans payable | | | 19,258,928 | | | 3,498,341 |

Payable for investments purchased | | | 812,800 | | | — |

Due to broker for written option contracts | | | 204,457 | | | — |

Accrued loan interest | | | 77,384 | | | 15,228 |

Payable to Adviser | | | 32,121 | | | 2,047 |

Accrued broker interest | | | 17,259 | | | 95 |

Total liabilities | | | 20,497,357 | | | 3,520,801 |

NET ASSETS | | | $60,814,638 | | | $12,476,230 |

Net Assets Consists of:

| | | | | | |

Paid-in capital | | | $57,100,519 | | | $10,893,585 |

Total distributable earnings | | | 3,714,119 | | | 1,582,645 |

Total net assets | | | $60,814,638 | | | $12,476,230 |

Shares issued and outstanding(a) | | | 2,150,000 | | | 330,000 |

Net asset value per share | | | $28.29 | | | $37.81 |

Cost:

| | | | | | |

Investments, at cost | | | $73,616,864 | | | $14,256,595 |

Proceeds:

| | | | | | |

Written options premium | | | $110,766 | | | $5,716 |

| | | | | | | |

(a)

| Unlimited shares authorized without par value. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

iCAP ETFs

Statements of Operations

For the Periods Ended November 30, 2024

| | | | | | | |

INVESTMENT INCOME:

| | | | | | |

Dividend income | | | $2,766,717 | | | $297,945 |

Less: Dividend withholding taxes | | | (36,877) | | | (2,198) |

Less: Issuance fees | | | (3,350) | | | — |

Interest income | | | 21,981 | | | 2,730 |

Total investment income | | | 2,748,471 | | | 298,477 |

EXPENSES:

| | | | | | |

Loan interest expense (See Note 8) | | | 1,039,626 | | | 74,138 |

Investment advisory fee (See Note 3) | | | 429,563 | | | 52,889 |

Broker interest expense | | | 245,152 | | | 1,327 |

Other expenses | | | 561 | | | — |

Total expenses | | | 1,714,902 | | | 128,354 |

Net investment income | | | 1,033,569 | | | 170,123 |

REALIZED AND change in unrealized gain/(loss) on investments:

| | | | | | |

Net realized gain/(loss) from:

| | | | | | |

Investments | | | 3,821,260 | | | 350,936 |

In-kind redemptions | | | 615,334 | | | 279,332 |

Written option contracts expired or closed | | | 666,141 | | | (27,390) |

Securities sold short | | | 13 | | | — |

Net realized gain | | | 5,102,748 | | | 602,878 |

Net change in unrealized appreciation/depreciation on:

| | | | | | |

Investments | | | 9,624,261 | | | 1,520,223 |

Written option contracts | | | 61,691 | | | 626 |

Net change in unrealized appreciation/depreciation | | | 9,685,952 | | | 1,520,849 |

Net realized and unrealized gain | | | 14,788,700 | | | 2,123,727 |

NET INCREASE IN NET ASSETS RESULTING FROM

OPERATIONS | | | $15,822,269 | | | $2,293,850 |

| | | | | | | |

(a)

| Commencement date of the Fund was December 11, 2023. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

iCAP ETFs

Statements of Changes in Net Assets

| | | | | | | |

OPERATIONS:

| | | | | | | | | |

Net investment income | | | $1,033,569 | | | $1,970,824 | | | $170,123 |

Net realized gain/(loss) | | | 5,102,748 | | | (3,039,304) | | | 602,878 |

Net change in unrealized appreciation/(depreciation) | | | 9,685,952 | | | (2,359,308) | | | 1,520,849 |

Net increase/(decrease) in net assets from operations | | | 15,822,269 | | | (3,427,788) | | | 2,293,850 |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | | | | |

From distributable earnings (See Note 4) | | | (3,140,035) | | | (2,221,837) | | | (428,525) |

From return of capital (See Note 4) | | | (1,467,965) | | | (1,956,746) | | | — |

Total distributions to shareholders | | | (4,608,000) | | | (4,178,583) | | | (428,525) |

CAPITAL TRANSACTIONS:

| | | | | | | | | |

Subscriptions | | | 5,150,723 | | | 28,822,965 | | | 14,195,960 |

Redemptions | | | (4,446,940) | | | (1,936,460) | | | (3,585,055) |

Net increase in net assets from capital transactions | | | 703,783 | | | 26,886,505 | | | 10,610,905 |

Net increase in net assets | | | 11,918,052 | | | 19,280,134 | | | 12,476,230 |

NET ASSETS:

| | | | | | | | | |

Beginning of the period | | | 48,896,586 | | | 29,616,452 | | | — |

End of the period | | | $60,814,638 | | | $48,896,586 | | | $12,476,230 |

SHARES TRANSACTIONS

| | | | | | | | | |

Subscriptions | | | 200,000 | | | 1,100,000 | | | 440,000 |

Redemptions | | | (175,000) | | | (75,000) | | | (110,000) |

Total increase in shares outstanding | | | 25,000 | | | 1,025,000 | | | 330,000 |

| | | | | | | | | | |

(a)

| Commencement date of the Fund was December 11, 2023. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

iCAP ETFs

Statements of Cash Flows

For the Periods Ended November 30, 2024

| | | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES:

| | | | | | |

Net increase in net assets resulting from operations | | | $15,822,269 | | | $2,293,850 |

Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities:

| | | | | | |

Purchases of investments | | | (149,864,123) | | | (28,907,848) |

Purchases of short-term investments, net | | | 367,302 | | | — |

Proceeds from sales of investments | | | 149,931,899 | | | 15,281,521 |

Increase in receivable for investments sold | | | (850,078) | | | — |

Increase in payable to Adviser | | | 4,839 | | | 2,047 |

(Increase) decrease in dividends and interest receivable | | | 167,132 | | | (35,817) |

Purchases to cover securities sold short | | | (2,462) | | | — |

Premiums received on written option contracts | | | 1,942,319 | | | 37,453 |

Written option contracts expired or closed | | | (1,004,468) | | | (59,127) |

Decrease in payable for investments purchased | | | (110,438) | | | — |

(Decrease) increase in accrued expenses and other liabilities | | | (14,812) | | | 15,323 |

Net realized gain on investments | | | (3,821,260) | | | (350,936) |

Net realized gain on securities sold short | | | (13) | | | — |

Net realized (gain) loss on written option contracts | | | (666,141) | | | 27,390 |

Net realized gain on redemptions in-kind | | | (615,334) | | | (279,332) |

Change in unrealized appreciation/depreciation on investments | | | (9,624,300) | | | (1,520,223) |

Change in unrealized appreciation/depreciation on written option contracts | | | (61,691) | | | (626) |

Net cash from operating activities | | | 1,600,640 | | | (13,496,325) |

CASH FLOWS FROM FINANCING ACTIVITIES:

| | | | | | |

Proceeds from shares sold, net of change in receivable for Fund shares sold | | | 5,150,723 | | | 14,195,960 |

Payment for shares redeemed | | | (4,446,940) | | | (3,585,055) |

Cash distributions paid to shareholders, net of reinvestments | | | (4,608,000) | | | (428,525) |

Loan borrowings | | | 52,295,138 | | | 7,740,299 |

Loan repayments | | | (48,499,999) | | | (4,241,958) |

Net cash provided by financing activities | | | (109,078) | | | 13,680,721 |

Net change in cash | | | 1,491,562 | | | 184,396 |

CASH AND RESTRICTED CASH:

| | | | | | |

Beginning Balance | | | 86,948 | | | — |

Ending Balance | | | $1,578,510 | | | $184,396 |

SUPPLEMENTAL DISCLOSURES:

| | | | | | |

Broker expense on written options | | | 260,452 | | | 1,232 |

Cash paid for loan interest expense | | | 1,039,138 | | | 58,910 |

RECONCILIATION OF RESTRICTED AND UNRESTRICTED CASH AT THE BEGINNING OF PERIOD TO THE STATEMENT OF ASSETS AND LIABILITIES

| | | | | | |

Cash | | | 30,978 | | | — |

Deposits at broker for written options contracts | | | 55,970 | | | — |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

iCAP ETFs

Statements of Cash Flows

For the Periods Ended November 30, 2024 (Continued)

| | | | | | | |

RECONCILIATION OF RESTRICTED AND UNRESTRICTED CASH AT THE END OF PERIOD TO THE STATEMENT OF ASSETS AND LIABILITIES

| | | | | | |

Cash | | | $ 1,782,967 | | | $ 178,684 |

Deposits at broker for written options contracts | | | — | | | 5,712 |

Due to broker for written options contracts | | | (204,457) | | | — |

| | | | | | | |

(a)

| Commencement date of the Fund was December 11, 2023. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Equity Income Fund ETF

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout the periods.

| | | | | | | |

PER SHARE DATA:

| | | | | | | | | |

Net asset value, beginning of period | | | $23.01 | | | $26.92 | | | $30.00 |

INVESTMENT OPERATIONS:

| | | | | | | | | |

Net investment income(b) | | | 0.49 | | | 1.08 | | | 1.25 |

Net realized and unrealized gain (loss) on investments | | | 6.97 | | | (2.68) | | | (2.41) |

Total from investment operations | | | 7.46 | | | (1.60) | | | (1.16) |

LESS DISTRIBUTIONS FROM:

| | | | | | | | | |

Net investment income | | | (1.48) | | | (1.07) | | | (1.92) |

Net realized gains | | | — | | | (0.16) | | | — |

Return of capital | | | (0.70) | | | (1.08) | | | — |

Total distributions | | | (2.18) | | | (2.31) | | | (1.92) |

Net asset value, end of period | | | $28.29 | | | $23.01 | | | $26.92 |

Total return, at NAV(c) | | | 33.85% | | | −5.78% | | | −3.84% |

Total return, at market(c) | | | 33.89% | | | −5.37% | | | −4.08% |

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | | | | |

Net assets, end of period (in thousands) | | | $60,815 | | | $48,897 | | | $29,616 |

Ratio of gross expenses to average net assets(d) | | | 3.19% | | | 2.96% | | | 1.71% |

Ratio of broker interest expense to average net assets(d) | | | 2.39% | | | 2.16% | | | 0.91% |

Ratio of operational expenses to average net assets excluding broker interest expense(d) | | | 0.80% | | | 0.80% | | | 0.80% |

Ratio of net investment income to average net assets(d) | | | 1.92% | | | 4.54% | | | 4.89% |

Portfolio turnover rate(c)(e)(f) | | | 207% | | | 144% | | | 87% |

| | | | | | | | | | |

(a)

| Commencement date of the Fund was December 28, 2021.

|

(b)

| Calculated based on average shares outstanding during the period.

|

(c)

| Not annualized for periods less than one year.

|

(d)

| Annualized for periods less than one year.

|

(e)

| Excludes in-kind transactions associated with creations of the Fund.

|

(f)

| The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short-term investments, written option contracts and in-kind transactions associated with the creation units and redemptions). The denominator includes the average fair value of long positions throughout the period. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

InfraCap Small Cap Income ETF

Financial Highlights

For a Fund share outstanding throughout the period.

| | | | |

PER SHARE DATA:

| | | |

Net asset value, beginning of period | | | $30.14 |

INVESTMENT OPERATIONS:

| | | |

Net investment income(b)(c) | | | 0.85 |

Net realized and unrealized gain on investments | | | 8.88 |

Total from investment operations | | | 9.73 |

LESS DISTRIBUTIONS FROM:

| | | |

Net investment income | | | (2.06) |

Total distributions | | | (2.06) |

Net asset value, end of period | | | $37.81 |

Total return, at NAV(d) | | | 33.28% |

Total return, at market(d) | | | 33.49% |

SUPPLEMENTAL DATA AND RATIOS:

| | | |

Net assets, end of period (in thousands) | | | $12,476 |

Ratio of expenses to average net assets(e)(f) | | | 1.94% |

Ratio of broker interest expense to average net assets(e)(f) | | | 1.14% |

Ratio of operational expenses to average net assets excluding broker interest expense (e)(f) | | | 0.80% |

Ratio of net investment income to average net assets(e)(f) | | | 2.57% |

Portfolio turnover rate(d)(g)(h) | | | 139% |

| | | | |

(a)

| Commencement date of the Fund was December 11, 2023.

|

(b)

| Calculated based on average shares outstanding during the period.

|

(c)

| Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. The ratio does not include net investment income of the exchange traded funds in which the Fund invests.

|

(f)

| These ratios exclude the impact of expenses of the underlying exchange traded funds as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the underlying exchange traded funds in which the Fund invests.

|

(g)

| Excludes in-kind transactions associated with creations of the Fund.

|

(h)

| The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short-term investments, written option contracts and in-kind transactions associated with the creation units and redemptions). The denominator includes the average fair value of long positions throughout the period. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

iCAP ETFs

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024

1. ORGANIZATION

Series Portfolios Trust (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust

dated July 27, 2015. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The InfraCap Equity Income Fund ETF and the InfraCap Small Cap Income ETF (each separately a “Fund” and collectively, the “Funds”) each have their own investment objectives and policies with the Trust. The InfraCap Equity Income Fund ETF commenced operations on December 28, 2021. The InfraCap Small Cap Income ETF commenced operations on December 11, 2023. The Funds’ investment adviser, Infrastructure Capital Advisors, LLC (the “Adviser”) is responsible for providing management oversight, investment advisory services, day- to-day management of the Funds’ assets, as well as compliance, sales, marketing, and operations services to the Funds. The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (the “Codification”) Topic 946, Financial Services – Investment Companies. The Funds do not hold themselves out as related to any other series of the Trust for purposes of investment and investor services, nor do they share the same investment adviser with any other series of the Trust. Organizational costs that were incurred to establish the Funds to enable them to legally do business were paid for by the Adviser. These payments are not recoupable by the Adviser.

The InfraCap Equity Income Fund ETF investment objective is to maximize income and pursue total return opportunities. The Fund, under normal conditions, will invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of companies that pay dividends during normal market conditions. The Fund’s investments in equity securities may include common stocks, preferred stocks and convertible securities. The Fund may invest in the equity securities of companies of any market capitalization. To assist the Adviser’s portfolio management process, the Adviser may purchase and write put and call options in an effort to (i) generate additional income and reduce volatility in the portfolio, (ii) remove or add securities from the portfolio (i.e., convertible securities), (iii) facilitate total return opportunities, and (iv) hedge against market risks or other risks in the Fund’s portfolio.

The InfraCap Small Cap Income ETF investment objective is to seek total return through a blended approach of capital appreciation and current income. The Fund, under normal conditions, invests at least 80% of its net assets (plus any borrowings for investment purposes) in securities of small-capitalization companies. The Fund defines small capitalization (“Small Cap”) companies as those companies with a market capitalization, at the time of initial investment, that is within or below the range of companies in the Russell 2000® Index. To assist the Adviser’s portfolio management process, the Adviser may purchase and write put and call options in an effort to (i) generate additional income and reduce volatility in the portfolio, (ii) remove or add securities from the portfolio (i.e., convertible securities), (iii) facilitate total return opportunities, and (iv) hedge against market risks or other risks in the Fund’s portfolio.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

A.

| Investment Valuation – The following is a summary of the Funds’ pricing procedures. It is intended to be a general discussion and may not necessarily reflect all the pricing procedures followed by the Funds. Equity securities, including common stocks, convertible preferred stocks, preferred stocks, and real estate investment trusts (“REITS”) that are traded on a national securities exchange, except those listed on the Nasdaq Global Market®, Nasdaq Global Select Market® and the Nasdaq Capital Market® exchanges (collectively “Nasdaq”), are valued at the last reported sale price on that exchange on which the security is principally traded. Securities traded on Nasdaq will be valued at the Nasdaq Official Closing Price (“NOCP”). If, on a particular day, an exchange traded or Nasdaq security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non-exchange traded |

TABLE OF CONTENTS

iCAP ETFs

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024 (Continued)

equity security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

In the case of foreign securities, the occurrence of events after the close of foreign markets, but prior to the time the Funds’ net asset values (“NAVs”) are calculated will result in an adjustment to the trading prices of foreign securities when foreign markets open on the following business day. The Funds will value foreign securities at fair value, taking into account such events in calculating the NAVs. In such cases, use of fair valuation can reduce an investor’s ability to seek profit by estimating the Funds’ NAVs in advance of the time the NAVs are calculated. These securities are categorized in Level 2 of the fair value hierarchy.

Exchange traded funds and closed-end funds are valued at the last reported sale price on the exchange on which the security is principally traded. If, on a particular day, an exchange-traded fund does not trade, then the mean between the most recent quoted bid and asked prices will be used. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Investments in registered open-end investment companies (including money market funds), other than exchange traded funds, are valued at their reported NAVs. To the extent these securities are valued at their NAVs per share, they are categorized in Level 1 of the fair value hierarchy.

Exchange traded options are valued at the last reported sale price on the exchange on which the security is principally traded. If the last sale price is not available the composite mean price can be used, which calculates the mean price of the highest bid price and the lowest ask price across the exchanges where the option is principally traded. For non-exchange traded options, models such as Black-Scholes can be used to value the options. On the last trading day prior to expiration, expiring options may be priced at intrinsic value. These securities are categorized in Level 2 of the fair value hierarchy.

The Board of Trustees (the “Board”) has adopted a pricing and valuation policy for use by the Funds and their Valuation Designee (as defined below) in calculating the Funds’ NAVs. Pursuant to Rule 2a-5 under the 1940 Act, the Funds have designated Infrastructure Capital Advisors, LLC (the “Adviser”) as their “Valuation Designee” to perform all of the fair value determinations as well as to perform all of the responsibilities that may be performed by the Valuation Designee in accordance with Rule 2a-5. The Valuation Designee is authorized to make all necessary determinations of the fair values of the portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are unreliable.

The Funds have adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation Levels for major security types. These inputs are summarized in the three broad Levels listed below:

Level 1 –

| Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

Level 2 –

| Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

Level 3 –

| Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

TABLE OF CONTENTS

iCAP ETFs

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024 (Continued)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Funds’ securities by Level within the fair value hierarchy as of November 30, 2024:

InfraCap Equity Income Fund ETF

| | | | | | | | | | | | | |

Assets:

| | | | | | | | | | | | |

Investments:

| | | | | | | | | | | | |

Common Stocks | | | $64,220,129 | | | $— | | | $— | | | $64,220,129 |

Preferred Stocks | | | 9,560,951 | | | 995,520 | | | — | | | 10,556,471 |

Convertible Preferred Stocks | | | 3,603,347 | | | — | | | — | | | 3,603,347 |

Total Investments | | | $77,384,427 | | | $995,520 | | | $— | | | $78,379,947 |

Liabilities:

| | | | | | | | | | | | |

Investments:

| | | | | | | | | | | | |

Written Options | | | $(64,370) | | | $(30,038) | | | $— | | | $(94,408) |

Total Investments | | | $(64,370) | | | $(30,038) | | | $— | | | $(94,408) |

| | | | | | | | | | | | | |

InfraCap Small Cap Income ETF

| | | | | | | | | | | | | |

Assets:

| | | | | | | | | | | | |

Investments:

| | | | | | | | | | | | |

Common Stocks | | | $10,850,907 | | | $— | | | $— | | | $10,850,907 |

Preferred Stocks | | | 2,803,689 | | | — | | | — | | | 2,803,689 |

Convertible Preferred Stocks | | | 1,122,573 | | | — | | | — | | | 1,122,573 |

Exchange Traded Funds | | | 999,649 | | | — | | | — | | | 999,649 |

Total Investments | | | $15,776,818 | | | $— | | | $— | | | $15,776,818 |

Liabilities:

| | | | | | | | | | | | |

Investments:

| | | | | | | | | | | | |

Written Options | | | $(4,865) | | | $(225) | | | $— | | | $(5,090) |

Total Investments | | | $(4,865) | | | $(225) | | | $— | | | $(5,090) |

| | | | | | | | | | | | | |

As of the year or period ended November 30, 2024, the Funds did not hold any Level 3 securities, nor were there any transfers into or out of Level 3.

Refer to each Fund’s Schedule of Investments for further information on the classification of investments.

B.

| Transactions with Brokers – The Funds’ written options contracts’ cash deposits are monitored daily by the Adviser and counterparty. Cash deposits by the Funds are presented as “deposits at broker for written option contracts” on the Statement of Assets and Liabilities. These transactions may involve market risk in excess of the assets or liabilities reflected on the Statement of Assets and Liabilities. |

C.

| Cash and Cash Equivalents – The Funds consider highly liquid short-term fixed income investments purchased with an original maturity of less than three months and money market funds to be cash equivalents. Cash equivalents are included in short term investments on the Schedule of Investments as well as in investments on the Statement of Assets and Liabilities. Any temporary cash overdrafts are reported as a payable to custodian. |

TABLE OF CONTENTS

iCAP ETFs

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2024 (Continued)

D.

| Foreign Securities and Currency Translation – Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Funds do not isolate the portion of the results of operations from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal year- end, resulting from changes in exchange rates. |

Investments in foreign securities entail certain risks. There may be a possibility of nationalization or expropriation of assets, confiscatory taxation, political or financial instability, and diplomatic developments that could affect the value of the Funds’ investments in certain foreign countries. Since foreign securities normally are denominated and traded in foreign currencies, the value of the Funds’ assets may be affected favorably or unfavorably by currency exchange rates, currency exchange control regulations, foreign withholding taxes, and restrictions or prohibitions on the repatriation of foreign currencies. There may be less information publicly available about a foreign issuer than about a U.S. issuer, and foreign issuers are not generally subject to accounting, auditing, and financial reporting standards and practices comparable to those in the United States. The securities of some foreign issuers are less liquid and at times more volatile than securities of comparable U.S. issuers.

E.