UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

July 2, 2018

(DATE OF REPORT)

ANDES 7 Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| Delaware | | 000-55491 | | 47-4683655 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | (COMMISSION FILE NO.) | | (IRS EMPLOYEE IDENTIFICATION NO.) |

424 Clay Street, Lower Level, San Francisco, CA 94111

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(415) 463 7827

(ISSUER TELEPHONE NUMBER)

N/A

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

FORWARD LOOKING STATEMENTS

There are statements in this registration statement that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Registration Statement carefully, especially the risks discussed under “Risk Factors.” Although management believes that the assumptions underlying the forward looking statements included in this Registration Statement are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Registration Statement will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

Factors that might cause or contribute to such differences include, but are not limited to, those discussed in “Risk Factors” contained in this report. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Except as required by law, we expressly disclaim any obligation to update publicly any forward-looking statements for any reason after the date of this report, to conform these statements to actual results, or to changes in our expectations. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC after the date of this report.

ANDES 7 Inc.

SECTION 1

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On July 2, 2018, ANDES 7 Inc. a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger between the Company, ANDES 7 Acquisition Corp, (“Merger Sub”) a Delaware corporation and Abina Co. Ltd. (the “Target”). The Target is a corporation organized under the Kingdom of Thailand and has operated under the name “Abina Co. Ltd.” since August 3, 2015. The Agreement and Plan of Merger provided for the acquisition by the Company of all the outstanding shares of the target through a reverse merger of merger sub into the target, the surviving corporation. We have filed our Agreement and Plan of Merger as exhibits 3.4 and 2.1 within this Current Report on Form 8-K and with the State of Delaware.

As part of the Agreement and Plan of Merger with Abina Co. Ltd. the parties agreed to an exchange of shares, in which all of the 100,000 issued and outstanding shares of Abina Co. Ltd were exchanged for 111,000,000 shares in the Company, additionally, shares of ANDES 7 which were held by Abina Co. Ltd were divided amongst the shareholders of Abina Co. Ltd and provided amounts according to their respective holding in Abina Co. Ltd. pursuant to the merger.

Prior to the exchange, Andrew Khor Poh Kiang (or “Mr. Khor”), Manichan Khor and Tantida Sae-tang were the owners of 100,000 shares of Abina Co. Ltd. which represented all of the outstanding shares of Abina Co. Ltd.

The Agreement and Plan of Merger was signed by Mr. Khor in his individual capacity and as President and Chief Executive Officer of the Company and as President and Chief Executive Officer of Abina Co. Ltd, and of the Merger Sub. The Cancellation Agreement was signed by Mr. Khor in his individual capacity and as President, and Chief Executive Officer of the Company and of Abina Co. Ltd. The Chief Financial Officer of each of the companies, Lee KokKeing, also signed on behalf of each of the companies. The remaining 9,100,000outstanding shares of ANDES 7, which are held by shareholders Abina Asean Co, Ltd, Dr. Ir. HM Itoc Tochija and Tech Associates Inc., were unaffected by the Cancellation Agreement.

DESCRIPTION OF BUSINESS

(a) Business of Issuer

ANDES 7 Inc. was incorporated in the State of Delaware on July 27, 2015. ANDES 7 Inc. was formed as a vehicle to pursue a business combination with an operating company that would have perceived benefits of becoming a publicly traded corporation. Abina Co. Ltd (“Abina”) was incorporated in Thailand on August 3, 2015 and has since then operated a diverse business involved in investments in hotels, resorts, and commercial property. The Company had directed its efforts by the end of 2015 to develop the tallest and largest flagpole in the world in the Chiang Saen District of Chiang Rai, Thailand with measurements of 42 meters in height and 63 meters in length. It was since awarded with the prestigious honor of being the largest flag in Thailand by the Guinness Book of World Records. The flag pole itself is pending development along with a park and concession area for tourists primarily from China.

Abina has secured the exclusive right and license with the local and state government of Thailand for the development of the “tallest flagpole and largest flag” in the world to be a landmark destination in Thailand and to attract, promote local and foreign tourism primarily from China. Having a long history of being ruled by kings, Abina believes that Thailand is a country deep rooted with patriotism and loyalty to their king and national flag. With this belief, under Abina’s license, the Thai government mandated that each citizen must purchase a flag and or souvenirs from the collection of ANDES 7 souvenirs. ANDES 7 intend to promote and sell its souvenir products and flags through souvenir shops and cafes in major cities throughout Thailand.

Following the merger, the Company is planning a full leisure and tourist destination in Chiang Rai, Thailand with agreements with the Thai government as its exclusive authorized merchandising, souvenir and collectables retailer for the Thai flag, and to offer religious merchandise, retail shops, cafes, and build other real estate projects. The Company is seeking to develop a fully integrated hotel and entertainment center in the Chiang Saen District of Chiang Rai, Thailand that will include souvenir shops, a hotel, office buildings, several malls, and a resort entertainment center catering to both local and foreign tourists primarily from China.

ANDES 7 Inc. is a smaller reporting company under SEC Rule 405 because it is currently not trading, has a public float of zero and annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available. As a smaller reporting company, pursuant to Rule 8-01 of Regulation S-X, the Company is only required to produce financial statements as follows: (a) audited balance sheet as of the end of each of the most recent two fiscal years, or as of a date within 135 days if the issuer has existed for a period of less than one fiscal year, (b) audited statements of income, cash flows and changes in stockholders' equity for each of the two fiscal years preceding the date of the most recent audited balance sheet (or such shorter period as the registrant has been in business), and (c) interim reviewed financial statements for the current period if the filing is more than 135 days after the end of your fiscal year. Any and all amendments shall include updated interim or audited financial statements if the financial statements in the prior filing are more than 135 days old.

The Project

The Company seeks to acquire full rights and ownership in 126 hectares of land in the Chiang Saen District of Chiang Rai, Thailand within a Free Trade Zone designated area to develop a leisure and tourist destination designed for both local and foreign tourists. The Company believes that this area holds beneficial value based on the “One Belt, One Road” initiative or “OBOR”. Announced by the Chinese government in 2013, OBOR is a development strategy by the Chinese government which focuses on connectivity and cooperation between Europe, Africa, China and Southeast Asia. The OBOR initiative is designed to increase the flow of trade, aimed at building new infrastructure, and increasing cultural exchanges.

The project and acquisition costs are expected to cost over an estimated $6 million USD, while the construction of the flagpole, mall, office building complex, hotel, spiritual center and shops are expected to cost$120 million USD.As of the date of this Current Report, the Company has paid 5 million Thai Baht, or $159,000 in US dollars and owes a balance of 195 million Thai Baht, or $6,228,300 in US dollars (at today’s exchange rates) for the land in Chiang Rai, Thailand due by December 15, 2018.The Company seeks to develop a destination site for locals and foreign tourists by establishing a “100 Years Café” coffee shop and souvenir shops that celebrate over 100 years of the Thai flag.

The Company has secured an exclusive license by the government of Thailand to promote, market, and sell souvenirs and collectable products based on the Thai largest flag in Chiang Rai, Thailand. Currently, the Company has created the flag portion of the tallest flagpole and largest flag project but not the flagpole itself. The flagpole is currently under production by an American company and expected to be delivered by 2019. The flag portion measuring 42 meters in height and 63 meters in length was given honors and recognition by the Guinness Book of World Records on November 30, 2016.

The Area

The Company is seeking to fully acquire and develop 126 hectares of land in the Chiang Saen District of Chiang Rai, Thailand. Chiang Rai is located in northern Thailand near the borders of Laos and Myanmar (formerly Burma). The area is known as a cultural center with attractions and parks with night bazaar markets and many Buddhist temples. In previous years, Chiang Rai has been known as the “Golden Triangle” which it is still called. The Golden Triangle is the area which meaning comes from the proximity to Laos, Myanmar and Thailand.

(Project land site view from road)

(Project land site and flag pole area)

(View of project and surrounding land area)

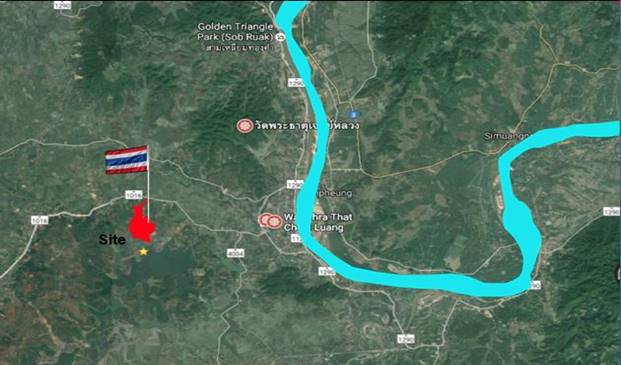

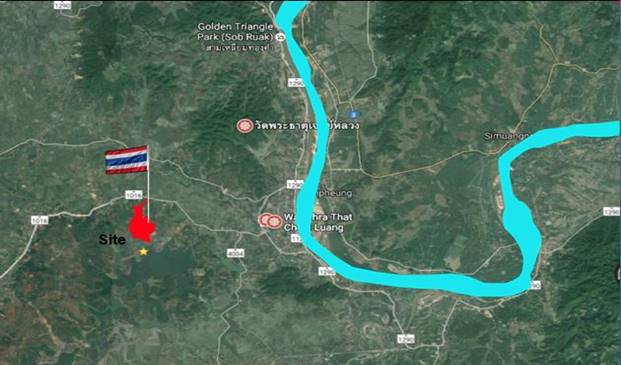

(Map of project site and proximity to the Mekong River)

Other notable tourist attractions in the area are royal temples that once housed the Emerald Buddha, a jade structure which was replaced with a replica. There are also 100 Khmer (Cambodian) style pillars and temples. In addition, there are historic museums and cultural parks in the area.

The Thai Flag

The Company had directed its efforts by the end of 2015 to develop the tallest and largest flagpole in the world in the Chiang Saen District of Chiang Rai, Thailand. It was since awarded with the prestigious honor of being the largest flag in Thailand by the Guinness Book of World Records. The flag pole itself is pending development along with a park and concession area for tourists primarily from China.

The flag of Thailand plays a significant role in the Company’s plans to expand its business plan. The flag of Thailand has been the same without change from September 28, 1917 to present, or for over 100 years. To celebrate this fact, the Company has merchandise with the “100 Years” labeling on t-shirts, banners, flags, and other collectables. The people of Thailand are strongly supportive and proud of their country and flag. The national flag is seen on display in many places within the country. The colors of the flag represent three important items to the Thai people, red is said to represent the people and the blood which was shed to keep the country independent, the white represents religion or the purity of Buddhism and the blue represents the monarchy in Thailand.

(ANDES 7 produced the largest Flag in Thailand in connection with the 100 Year’s Anniversary of the flag)

The Tourism Industry

According to the World Travel & Tourism Council, 20.6% of the GDP, (or $82.5 billion USD) of Thailand in 2016 was from tourism. The World Travel & Tourism Council anticipates that by 2027, 31.7% (or $169.9 billion USD) of GDP will be from tourism. The majority of tourists are from other South East Asian countries or ASEAN (Association of South East Nations), followed by China and Europe. The Company believes that with new infrastructure being commissioned and built by both the Thai government and China through its OBOR initiative, is likely to have an impact on tourism in Thailand. In early 2018, the Thai government approved a high speed rail project that would connect major cities in southern Thailand to the north. According to Reuters, in 2016, Thailand had 33 million foreign tourists visiting Thailand, and Bangkok in particular with Chinese tourists comprising over 26% of that figure. Additionally, according to Mastercard Index of Global Destination Cities, in 2016, Bangkok was the world’s top destination beating 132 cities worldwide, such as London, Paris and Dubai. Thailand earned $71.4 billion in 2017 from tourist revenue which was higher by 11% percent from 2015. The Tourism Authority of Thailand attributes the increase in travel to Thailand to the increased demand from short haul markets during school holidays, heavy interest from the China market, and continued development of long haul markets in Europe, the United States and Russia.

Employees

As of July 2, 2018, the Company employed a total of 6 persons of which were in management and administration. The Company considers its relationship with its employees to be favorable.

Facilities and Logistics

The Company maintains a virtual office in San Francisco, California, in the United States at 424 Clay Street, Lower Level, San Francisco, CA 94111. Its headquarters are located at 333, Village 6, Amphur Wiang Chiang, Chiang Rai, Thailand.

| | | |

| Location | Address | Size |

| San Francisco, California | 424 Clay Street, Lower Level | n/a (virtual office) |

| | San Francisco, CA 94111 | |

| Chiang Rai, Thailand | 333, Village 6, Amphur Wiang Chiang | 16,000 square meters |

| | Chiang Rai, Thailand 57150 | |

Involvement in Certain Legal Proceedings

None of our officers or directors, promoters or control persons have been involved in the past ten years of any of the following:

(1) Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

(2) Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

(3) Being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, or any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or

(4) Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated.

Patents

The Company has no patents and no intentions at this time to apply for any patents. The Company however, may choose to file for trademarks upon development of its project in Chiang Saen District of Chiang Raito protect its intellectual property.

SECTION 2 FINANCIAL INFORMATION

Item 2 Financial Information

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Company was incorporated in the State of Delaware on July 27, 2015 and filed its registration statement on Form 10 to register with the U.S. Securities and Exchange Commission as a public company on August 7, 2015. We were originally organized as a vehicle to investigate and, if such investigation warrants, to acquire a target company or business seeking the perceived advantages of being a publicly held corporation.

On February 12, 2016, the former control shareholder who was also our sole director agreed to a share redemption whereby the Company redeemed his stock certificate representing 10,000,000 shares and issued 100,000 shares of restricted common stock with the net result of the redemption the former control shareholder received $990 for the redeemed shares, and the issuance of new restricted stock totaling 100,000 shares. In addition, the Company entered into stock subscription agreements with Abina Asean Co. Ltd, Toh Kean Ban and Dr. Ir. H.M. Itoc Tochija. Each of these agreements were the result of privately negotiated transactions without the use of public dissemination of promotional or sales materials, further, each of the buyers represented they were “accredited investors”, and as such could bear the risk of such investment for an indefinite period of time and afford a complete loss thereof.

On July 2, 2018, ANDES 7 Inc. a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger between the Company, ANDES 7 Acquisition Corp, (“Merger Sub”) a Delaware corporation and Abina Co. Ltd. (the “Target”). Abina Co. Ltd (“Abina”) was incorporated in Thailand on August 3, 2015 and has since then operated a diverse business involved in investments in hotels, resorts, and commercial property.

The Company pursuant to the merger is planning a leisure and tourist destination in Thailand with interests in merchandising, souvenirs, retail and real estate projects. The Company is seeking to develop a fully integrated hotel and entertainment center in Chiang Rai, Thailand that will include souvenir shops, a hotel, office buildings, a shopping mall, and a resort entertainment center catering to both local and foreign tourists.

Item 2.01 Completion of Acquisition or Disposition of Assets

As described above under Item 1.01, the Company entered into an Agreement and Plan of Merger with Abina Co. Ltd, with the Company as the surviving corporation.

Pursuant to Item 2.01(f) of Form 8-K, the information that would be required if the Company were filing a general form for registration of securities on Form 10 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) upon consummation of the transaction follows. The information below corresponds to the item numbers of Form 10 under the Exchange Act.

Implications of Being an Emerging Growth Company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, as such amount is indexed for inflation every five years by the Securities and Exchange Commission to reflect the change in the Consumer Price Index for All Urban Consumers during its most recently completed fiscal year, (3) the last day of the fiscal year in which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our common stock held by non-affiliates exceeded $700.0 million as of the last business day of the second fiscal quarter of such fiscal year, or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| | • | we may present only two years of audited financial statements, plus unaudited condensed financial statements for any interim period, and related management’s discussion and analysis of financial condition and results of operations in our initial registration statement; |

| | • | we may avail ourselves of the exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley; |

| | • | we may provide reduced disclosure about our executive compensation arrangements; and |

| | • | we may not require stockholder non-binding advisory votes on executive compensation or golden parachute arrangements. |

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the date of this Current Report, there were 120,100,000 shares of common stock issued and outstanding. The following table sets forth certain information regarding the beneficial ownership of the outstanding shares as of the date of this Report, (i) each of our executive officers and directors; and (ii) all of our executive officers and directors as a group.

Except as otherwise indicated, each such person has investment and voting power with respect to such shares, subject to community property laws where applicable. The address of all individuals for whom an address is not otherwise indicated is 333,Village 6, Amphur Wiang Chiang, Chiang Rai, Thailand 57150.

| Name and Address of Beneficial Owner | Title of Class | Amount and Nature of Beneficial Ownership | Percent of Class |

| Andrew Khor Poh Kiang | Common Stock | 54,390,000 | | 45% |

| All Directors and Officers as a group, 1 person | | | | |

| Manichan Khor | Common Stock | 55,500,000 | | 46% |

| TantidaSae-Tang | Common Stock | 1,110,000 | | * |

| Abina Asean, Co. Ltd. (Republic of Seychelles) | Common Stock | 8,000,000 | | 7% |

| Dr. Ir. HM Itoc Tochija | Common Stock | 1,000,000 | | * |

| Tech Associates, Inc. | Common Stock | 100,000 | | * |

| Manichan Khor | Series A Preferred | 500,000 | | 100% |

(1) The above table is based upon information derived from our stock records. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable. Unless otherwise indicated, beneficial ownership is determined in accordance with the Rule 13d-3 promulgated under the Securities Exchange Act of 1934, as amended, and includes voting or investment power with respect to the shares beneficially owned. Applicable percentages are based upon 120,100,000 shares of common stock outstanding as of the date of this filing.

(2) The address for Tech Associates Inc. is 650 California Street, 7th Floor, San Francisco, CA 94108.

(3) Manichan Khor is the wife of our President, CEO and Chairman, Andrew Khor Poh Kiang, and both share mutual beneficial ownership of their shares.

(4) *Under 5%

DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Neither the Company, its property, nor any of its directors or officers is a party to any pending legal proceeding, nor have they been subject to a bankruptcy petition filed against them. None of its officers or directors have been convicted in, nor is subject to, any criminal proceeding.

The names and ages of the directors and executive officers of the Company and their positions with the Company are as follows:

| Name | | Age | | Position |

| Executive Officers | | | | | |

| Andrew KhorPohKiang | | | 52 | | President, Chief Executive Officer, Chairman |

| Lee KokKeing | | | 57 | | Chief Financial Officer |

| Dr. Eric Chin TekMun | | | 49 | | Chief Operations Officer |

| JannieGui Honey | | | 50 | | Secretary |

| Dr. Ng MooiEng | | | 52 | | Treasurer |

Officers and Directors

Andrew Khor Poh Kiang –President, Chief Executive Officer and Chairman:From 2000 to 2002, Mr. Khor was the assistant to Consul General Mr. Wan Jaafar Wan Noor from the Ministry of Foreign Affairs, Malaysia in Thailand. From 2002 to 2006, Mr. Khor was managing SAG Group Company Limited in Thailand, a mining company he controlled that supplied iron ore to China. From 2006 to present, Mr. Khor has been involved in the High Technology area through " The Super Conductivity Maglev System " of Japan Flagship Group " or known as FSG, as its South East Asia Representative, dealing with local governments in South East Asia for the " HIGH SPEED SURFACE TRAIN " and also appointed by STAR CRUISES, Berjaya Group and Tanjung Rhu Resorts as human resources trainer in hospitality and residential property development. Mr. Khor is the President of AbinaAsean Co., Ltd. Mr. Khor holds a Masters of Business Administration from ICS Singapore.

Lee Kok Keing --Chief Financial Officer:Mr. Lee began his career in banking and finance with RHB Bank Berhad from 1979 to 2006, he held various positions and served as branch manager for a few years. From 2006 to 2015, he joined RHB Investment Bank Berhad (formerly OSK Investment Bank) and served in several executive positions as head of branch.

Dr. Eric Chin Tek Mun --Chief Operations Officer: From 2005 to 2011 Dr. Chin was the founder of PDS Group Univision International, an investment and risk management consultancy to government owned entities and to private high net worth individuals. From 2011 to 2014, he became the Chief Operating Officer of Heyu Leisure Holidays Corporation and from 2014 to 2015, he maintains a position as the Chief Operating Officer of Abina Holding Co. Ltd.

Jannie Gui Honey --Secretary: Ms. Gui was employed by NBE Construction Sdn Bhd for 27 years as an Accounts Clerk; she worked as Sales Manager for Vanhoden Sdn Bhd from 2005 to 2010 and as its Operating Manager from 2010 to 2014. Most recently, she has held the position of Secretary for Abina Company Limited from 2015 to present.

Dr. Ng Mooi Eng—Treasurer:Dr. Ng has 25 years experience in business managing branding and franchising of women's wear apparel for V-Up Advance Sdn Bhd. Dr. Eng holds a master’s and doctorate in business administration from Ansted University.

Compliance with Section 16(A) of the Securities Exchange Act Of 1934

Section 16(a) of the Securities Exchange Act of 1934, as amended ("Section 16(a)"), requires our Directors and executive officers, and persons who beneficially own more than ten percent of a registered class of our equity securities (collectively, "Section 16 reporting persons"), to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Stock and other equity securities. Section 16 reporting persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of any such reports furnished to us, none of the Section 16 reporting persons failed to file on a timely basis reports required by Section 16(a) of the Exchange Act with respect to our most recent fiscal year, and through December 31, 2017.

Code of Ethics

We are in the process of establishing a Code of Ethics.

Procedures for Security Holders to Nominate Directors

Our bylaws do not provide a procedure for Stockholders to nominate directors. The Board of Directors does not currently have a standing nominating committee. The Board of Directors currently has the responsibility of selecting individuals to be nominated for election to the Board of Directors. Qualifications considered by the Directors in nominating an individual may include, without limitation, independence, integrity, business experience, education, accounting and financial expertise, reputation, civic, community and industry relationships and industry knowledge. In nominating an existing director for re-election to the Board of Directors, the Directors will consider and review an existing director’s Board and Committee attendance, performance and length of service.

Employment Agreements and Compensation

The Company does not presently have any employment agreements.

Equity Incentive Plan

As of the date of this Report, the Registrant has not entered into any Equity Incentive Plans.

Option Grants in the Last Fiscal Year

No Stock Appreciation Rights (“SARs”) or options to purchase our stock were granted to the Named Executive Officers during fiscal year ended December 31, 2017.

Retirement Plan

We do not currently have any retirement plan, but we expect to adopt one in the near term.

Compensation of Directors During Period Ended December 31, 2017.

During the period ended December 31, 2017, we did not compensate any director for service as such.

Audit Committee Financial Expert

The Company does not have an audit committee financial expert.

SECTION 3 SECURITIES AND TRADING MARKETS

Item 3.02 Recent Sales of Unregistered Securities

On January 20, 2017, Abina Co. Ltd. purchased 1,000,000 shares of restricted common stock from Toh Kean Ban, a private individual and 10% shareholder of the Issuer at $0.00225 per share in a privately negotiated transaction via Subscription Agreement. The Reporting Person used working capital to acquire the shares. The Reporting Person did not borrow funds for the purchase. The Subscription Agreement was the result of a privately negotiated transaction without the use of public dissemination of promotional or sales materials. The buyer represented they were an “accredited investor,” and as such could bear the risk of such investment for an indefinite period of time and to afford a complete loss thereof. Further, the buyer agreed that the Company would continue to keep the existing legend on the securities to indicate that they could not be resold without an exemption, and that the legend would indicate that the securities were “restricted securities” within the meaning of Rule 144(a)(iii). The buyer represented and warranted that she/he/it was purchasing the security for investment, and not for distribution, and that she understood the restrictions on transfer applicable to the securities, and that the Company would code the securities so that they could not be transferred without the transferor obtaining an opinion of counsel satisfactory to the Company.

On March 25, 2018, our Board of Directors approved the creation of our Series A preferred stock. On that day, we created 500,000 shares of Series A preferred stock to be designated with the State of Delaware. Each share of Series A preferred stock is convertible into 1,000 shares of common stock and each share of Series A preferred stock holds 1,000 votes per common share. We filed our Certificate of Designation on May 10 2018 along with a Stock Subscription Agreement from Manichan Khor who acquired the 500,000 shares of Series A preferred stock and filed our Form 8-K disclosure on June 1, 2018.

On July 2, 2018 as part of the Agreement and Plan of Merger with Abina Co. Ltd. the parties agreed to an exchange of shares, in which all of the 100,000 issued and outstanding shares of Abina Co. Ltd were exchanged for 111,000,000 shares in the Company, additionally, shares of ANDES 7 which were held by Abina Co. Ltd were divided amongst the shareholders of Abina Co. Ltd and provided amounts according to their respective holding in Abina Co. Ltd. pursuant to the merger.

The Registrant believes that the foregoing transactions were exempt from the registration requirements under the Securities Act of 1933, as amended (“the Act”), based on the following facts: there was no general solicitation, there was a limited number of purchasers, each of whom the Registrant believes was an “accredited investor” (within the meaning of Regulation D under the Securities Act of 1933, as amended) and was sophisticated about business and financial matters, and all shares issued were subject to restriction on transfer, so as to take reasonable steps to assure that the purchaser was not an underwriter within the meaning of Section 2(11) under the Act.

Description of Registrant’s Securities to be Registered

Authorized Capital Stock

Our authorized capital stock consists of (i) 1,000,000,000 (one billion) shares of common stock, and (ii) 5,000,000 shares of preferred stock, in each case with a par value of $.0001 per share. As of July 2, 2018, we had (i) 120,100,000 shares of common stock outstanding, held of record by 6 shareholders, and (ii) 500,000 shares of Series A preferred stock outstanding. The following summarized the important provisions of the Company’s capital stock.

Description of Capital Stock

The following is a summary of the rights of our capital stock and certain provisions of our articles of organization, as amended, and by-laws. For more detailed information, please see our articles of organization, as amended, and by-laws filed as exhibits to this Current Report on Form 8-K.Each holder of the Company’s Common Stock are entitled to one vote for each share held on all matters submitted to a vote of shareholders and do not have cumulative voting rights. An election of directors by our shareholders shall be determined by a plurality of the votes cast by the shareholders entitled to vote on the election. The holders of Common Stock are entitled to receive pro rata dividends, when and as declared by the Board of Directors in its discretion, out of funds legally available therefore, but only if all dividends on the Preferred Stock have been paid in accordance with the terms of such Preferred Stock and there exists no deficiency in any sinking fund for the Preferred Stock.

Dividends on the Common Stock are declared by the Board of Directors. The payment of dividends on the Common Stock in the future, if any, will be subordinate to the Preferred Stock and will be determined by the Board of Directors. In addition, the payment of such dividends will depend on the Company’s financial condition, results of operations, capital requirements and such other factors as the Board of Directors deems relevant. The Company has heretofore never paid any dividends and the Board has no plans for the payment of future dividends. The Board presently plans for any future surplus income to be reinvested into growing the Company through additional investment.

Preferred Stock

The Board of Directors is authorized to provide for the issuance of shares of preferred stock in series and, by filing a certificate pursuant to the applicable law of Delaware, to establish from time to time the number of shares to be included in each such series, and to fix the designation, powers, preferences and rights of the shares of each such series and the qualifications, limitations or restrictions thereof without any further vote or action by the shareholders. Any shares of preferred stock so issued would have priority over the common stock with respect to dividend or liquidation rights. Any future issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of our Company without further action by the shareholders and may adversely affect the voting and other rights of the holders of common stock. At present, we have no plans to neither issue any preferred stock nor adopt any series, preferences or other classification of preferred stock.

The issuance of shares of preferred stock, or the issuance of rights to purchase such shares, could be used to discourage an unsolicited acquisition proposal. For instance, the issuance of a series of preferred stock might impede a business combination by including class voting rights that would enable the holder to block such a transaction, or facilitate a business combination by including voting rights that would provide a required percentage vote of the stockholders. In addition, under certain circumstances, the issuance of preferred stock could adversely affect the voting power of the holders of the common stock. Although the Board of Directors is required to make any determination to issue such stock based on its judgment as to the best interests of our stockholders, the Board of Directors could act in a manner that would discourage an acquisition attempt or other transaction that some, or a majority, of the stockholders might believe to be in their best interests or in which stockholders might receive a premium for their stock over the then market price of such stock. The Board of Directors does not at present intend to seek stockholder approval prior to any issuance of currently authorized stock, unless otherwise required by law or stock exchange rules. We have 500,000 shares of Series A preferred stock currently issued and outstanding.

The description of certain matters relating to the securities of the Company is a summary and is qualified in its entirety by the provisions of the Company’s Certificate of Incorporation and By-Laws, copies of which have been filed as exhibits to the Company’s Form 10 filed with the Securities Exchange Commission on August 7, 2015.

Dividends

We have not paid any dividends on our common stock and do not presently intend to pay cash dividends prior to the consummation of a business combination. The payment of cash dividends in the future, if any, will be contingent upon our revenues and earnings, if any, capital requirements and general financial condition subsequent to consummation of a business combination, if any. The payment of any dividends subsequent to a business combination, if any, will be within the discretion of our then existing board of directors. It is the present intention of our board of directors to retain all earnings, if any, for use in our business operations and, accordingly, the board of directors does not anticipate paying any cash dividends in the foreseeable future.

Delaware Anti-Takeover Law

In general, we are subject to the provisions of section 203 of the DGCL. Section 203 prohibits certain publicly held Delaware corporations from engaging in a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder, unless the business combination is approved in a prescribed manner. A “business combination” includes mergers, asset sales and other transactions resulting in a financial benefit to the interested stockholder. Subject to certain exceptions, an “interested stockholder” is a person who, together with affiliates and associates, owns, or within three years did own, 15% or more of the corporation’s voting stock. These provisions could have the effect of delaying, deferring or preventing a change of control of us or reducing the price that certain investors might be willing to pay in the future for shares of our common stock.

Future Stock Issuances

Except as expressly set forth herein or pursuant to any equity incentive plan, we have no current plans to issue any additional shares of our capital stock. However, our authorized but unissued shares of common stock and preferred stock are available for future issuance without stockholder approval. These additional shares may be utilized for a variety of corporate purposes, including future public and private offerings to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued shares of common stock and preferred stock could render more difficult or discourage an attempt to obtain control of a majority of our common stock by means of a proxy contest, tender offer, merger or otherwise.

Trading Information

Our common stock is not currently eligible for trading on any national securities exchange or any over-the-counter markets, including the OTC Bulletin Board. We intend to apply to have our common stock quoted on the OTC Bulletin Board under a symbol to be determined by our Board of Directors.

Transfer Agent and Registrar

As of the date of this Current Report on Form 8-K, there were approximately 6 holders of record of the Company’s common stock and 1 holder of record for the Company’s Series A preferred stock. The Company currently engages Action Stock Transfer of Salt Lake City, Utah as its stock transfer agent.

Changes In and Disagreements with Accountants

None.

SECTION 5 CORPORATE GOVERNANCE AND MANAGEMENT

Item 5.01 Changes in Control of Registrant

Change in control of registrant occurred in connection with the consummation of Agreement and Plan of Merger, as set forth above and detailed in Section 2.01 of this Form 8-K.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On July 2, 2018, the Registrant filed its Agreement and Plan of Merger with the State of Delaware. We entered into an Agreement and Plan of Merger with Abina Co. Ltd., with the Company as the surviving corporation. We continue to hold our fiscal year ending as December 31.

Section 5.06 Change in Shell Company Status

Previously we were designated as a “shell company” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934. As a result of the Closing of the Agreement and Plan of Merger, the Registrant is an operating business and no longer a “shell company.” Information regarding our main operating business is in Item 2.01.

Item 6 Executive Compensation

Our President and Chief Executive Officer and Chief Financial Officer have not taken compensation for their services. Any compensation arrangement for our officers and directors will be approved and ratified by our Board of Directors. It is not anticipated at this date that our officers and directors will be compensated for serving in their positions.

The Company has no stock option, retirement, pension, or profit sharing programs for the benefit of directors, officers or other employees, but our officers and directors may recommend adoption of one or more such programs in the future.

We have no employment agreements with our officers, although we may enter into such agreements following our receipt of additional capital.

The Company does not have a standing compensation committee, audit committee, nomination committee, or committees performing similar functions. We anticipate that we will form such committees of the Board of Directors once we have a full Board of Directors.

The following table summarizes the compensation paid to our President and Chief Executive Officer and Chief Financial Officer, (collectively, the “Named Executive Officers”) during or with respect to the fiscal year ended December 31, 2017.

Summary Compensation Table

| Name and principal position | Year | Salary | Bonus | Non-Equity Incentive Plan (1) | All other compensation (2) | Total |

| Andrew Khor Poh Kiang (1) | 2017 | - | - | - | - | - |

| President, CEO and Chairman | 2016 | - | - | - | - | - |

| Lee Kok Keing (2) | 2017 | - | - | - | - | - |

| CFO | 2016 | - | - | - | - | - |

(1) Mr. Khor became our President and Chief Executive Officer and Chief Financial Officer on February 12, 2016, in connection with the change in control of our company from our former control shareholder. Mr. Khor did not receive any compensation with respect to the year ended December 31, 2017. Mr. Khor is not currently being paid an annual salary for serving as our President, Chief Executive Officer and Chairman. He will be eligible for additional bonus compensation, to be determined by the Board of Directors.

(2) Mr. Lee became our Chief Financial Officer and Secretary on February 12, 2016. Mr. Lee is not currently being paid an annual salary for serving as Chief Financial Officer. He will be eligible for additional bonus compensation, to be determined by the Board of Directors.

Director Independence

As of the date of this Current Report, we had no independent directors as defined by the rules of any securities exchange or inter-dealer quotation system. We anticipate that our Common Stock will eventually be traded on the OTC Bulletin Board, which does not impose standards relating to director independence or the makeup of committees with independent directors, or provide definitions of independence.

Indemnification of Officers and Directors

Subsection (a) of Section 145 of the General Corporation Law of the State of Delaware empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys' fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

Subsection (b) of Section 145 empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by right of the corporation to procure a judgment in its favor by reason of the fact that such person acted in any of the capacities set forth above, against expenses (including attorneys' fees) actually and reasonably incurred by him in connection with the defense or settlement of such action or suit if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification may be made in respect to any claim issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 145 further provides that to the extent a director or officer of a corporation has been successful on the merits or otherwise in the defense of any such action, suit or proceeding referred to in subsections (a) and (b) of Section 145 or in the defense of any claim, issue or matter therein, he shall be indemnified against expenses (including attorneys' fees) actually and reasonably incurred by him in connection therewith; that the indemnification provided for by Section 145 shall not be deemed exclusive of any other rights which the indemnified party may be entitled; that indemnification provided by Section 145 shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of such person's heirs, executors and administrators; and empowers the corporation to purchase and maintain insurance on behalf of a director or officer of the corporation against any liability asserted against him and incurred by him in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify him against such liabilities under Section 145.

Section 102(b)(7) of the General Corporation Law or the State of Delaware provides that a certificate of incorporation may contain a provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of the director (i) for any breach of the director's duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law, or (iv) for any transaction from which the director derived an improper personal benefit.

Article Tenth of the registrant's Charter provides that, “to the fullest extent permitted by the Delaware General Corporation Law, a director of this corporation shall not be liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director.”

Article XI, Section 1(c) of the registrant's Bylaws further provides that “Each person who was or is made a party or is threatened to be made a party or is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she, or a person of whom he or she is the legal representative, is or was a director or officer, of the Corporation shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the Delaware General Corporation Law, as the same exists or may hereafter be amended.”

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers, or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

RISK FACTORS

An investment in our Common Stock is highly speculative in nature, involves a high degree of risk, and is suitable only for persons who can afford to risk the loss of the entire amount invested. Before purchasing any of these securities, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the eventual trading price of our Common Stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

Our business is intensely competitive and our revenues are unpredictable as a small company.

We are a relatively new business having launched in 2015. We have derived our revenues from selling souvenirs, collectables and flag merchandise since our inception. We plan on acquiring land in northern Thailand and have signed agreements along with initial payment for the land but have not yet acquired full rights to the land. We compete with numerous entities that sell souvenirs in Thailand; however, we hold an exclusive right and license by the government of Thailand to sell souvenirs and collectables based on the “Largest Flag” of Thailand project.

We are subject to the risk that certain key personnel, including key employees named below, on whom we depend, in part, for our operations, will cease to be involved with us. The loss of any these individuals would adversely affect our financial condition and the results of our operations.

We are dependent on the experience, knowledge, skill and expertise of our President and CEO Andrew Khor Poh Kiang. We are also in large part dependent on current CFO, Lee Kok Keing. The loss of any of the key personnel listed above could materially and adversely affect our future business efforts. Our success depends in substantial part upon the services, efforts and abilities of Andrew Khor Poh Kiang, our Chairman and Chief Executive Officer, due to his experience, history and knowledge of the leisure and real estate industry in South East Asia and his overall insight into our business direction. The loss or our failure to retain Mr. Khor, or to attract and retain additional qualified personnel, could adversely affect our operations. We do not currently carry key-man life insurance on Mr. Khor or any of our officers and have no present plans to obtain this insurance. See “Management.”

The loss of any of our executive officers could adversely affect our business.

We depend to a large extent on the efforts and continued employment of our executive officers, two of these officers are employed at other companies, and their other responsibilities could take precedence over their duties to us. The time Lee Kok Keing plans to devote to our business will primarily be based upon the financial accounting duties as CFO. We do not carry key man life insurance on any of our executive officers.

We are seeking additional funding to acquire full rights and ownership to land in Chiang Rai, Thailand. We cannot make any assurances that we will be successful in raising the required funds to execute our business plan.

We are seeking to acquire 126 hectares of land in the Chiang Saen District of Chiang Rai, Thailand, within a Free Trade Zone designated area to develop a leisure and tourist destination designed for both local and foreign tourists. The land acquisition costs are expected to cost over an estimated $6 million USD, while the construction of the flagpole, mall, office building complex, hotel, spiritual center and shops are expected to cost $120 million USD. As of the date of this Current Report, the Company has paid 5 million Thai Baht, or $159,000 in US dollars and owes a balance of 195 million Thai Baht, or $6,228,300 in US dollars (at today’s exchange rates) for the land in Chiang Rai, Thailand due by December 15, 2018. We cannot make any assurances that we will be successful with our capital raising plans to execute our business plan. We have already extended our financial commitment by one year in late 2017 and may not be able to further extend this commitment, and if we do, may not be able to do so with favorable terms.

If we are successful in acquiring full rights to our proposed land, competition from other real estate or related leisure companies could result in a decrease our business and a decrease in our financial performance.

Once engaged in our operations, we will operate in the highly competitive industry. Many of our potential competitors will likely include larger multinational companies, domestic real estate companies with multiple leisure projects, hotels and attractions have existed longer and have larger customer bases, greater brand recognition and significantly greater financial, marketing, personnel, technical and other resources than we do. In addition, many of these competitors may be able to devote significantly greater resources to:

·research and development of new projects

·attracting and retaining key employees;

·maintaining a large budget for marketing and promotional expenses

Our business plan relies on certain actions and events to occur that we have no control over.

We are completely dependent on the continued actions and events from parties we have no control over. Our business plan relies heavily on the condition that China continues to move forward implementing its OBOR initiative and brings additional roads and highways through Thailand. In addition, we are also relying on the Thai government to continue to build out its own domestic high speed rail network to bring additional tourists to northern Thailand. We have no influence, power or ability to determine if these projects by the Chinese government or the Thai government will continue or be successful. If these projects are not completed and do not produce the desired results, our business plan may not be fully implemented and we will likely experience adverse results.

The risk of corruption in Thailand is high.

Our operations are located in Thailand and we have open communications and a favorable working relationship with the Thai government, however, risk of government corruption in Thailand is high. While Thailand has the legal framework and range of institutions to counter corruption, companies may regularly encounter bribery or other corrupt practices. Public services, land administration, the judicial system, tax administration, customs administration, public procurement, and natural resources are main points of government corruption. According to Transparency International, Thailand ranks 96 up from 101 in 2017 in its annual corruption index. Thailand improved its ranking as determined by its progress towards democracy and market freedom. We cannot assure you that we will not encounter corrupt practices in our dealings with the government and if we are met with disruption, our legal recourse may be limited against the government.

Our management does not presently draw an annual salary or bonus.

Our management has not taken an annual salary or bonus for work provided towards the Company’s effort to develop its business plan. We plan to initiate reasonable salary and bonuses for our officers and directors in the future when our financial conditions improve and we make successful milestones towards our business plan.

All of our revenues come from operations in Thailand which may affect financial results in U.S. dollar terms and could negatively impact our financial results.

All of our revenues come from Thailand and we are paid in Thai Baht. We expect this to continue as we execute our business plan to develop land in Thailand. We have no system in place to combat currency risk and may be affected negatively if the Thai Baht experiences any dramatic currency movements.

RISKS RELATED TO OUR COMMON STOCK

We are an “emerging growth company” and we have elected to comply with certain reduced reporting and disclosure requirements which could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, (the “JOBS Act”). For as long as we continue to be an emerging growth company, we have elected to take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including (1) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which we refer to as the Sarbanes-Oxley Act, (2) reduced disclosure obligations regarding executive compensation in this prospectus and our periodic reports and proxy statements and (3) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. In addition, as an emerging growth company, we are only required to provide two years of audited financial statements and two years of selected financial data in this prospectus. As a result of these reduced reporting and disclosure requirements our financial statements may not be comparable to SEC registrants not classified as emerging growth companies. We may be an emerging growth company for up to five years following the first sale of our equity securities in a public offering, although circumstances could cause us to lose that status earlier, including if the market value of our common stock held by non-affiliates exceeds $700.0 million before that time or if we have total annual gross revenue of $1.0 billion or more during any fiscal year before that time, in which cases we would no longer be an emerging growth company as of the following December 31 or, if we issue more than $1.0 billion in non-convertible debt during any three-year period before that time, we would immediately cease to be an emerging growth company. Even after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company” which would allow us to take advantage of many of the same exemptions from disclosure requirements, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until the later of our second annual report or the first annual report required to be filed with the SEC following the date we are no longer an “emerging growth company” as defined in the JOBS Act. We cannot assure you that there will not be material weaknesses or significant deficiencies in our internal controls in the future.

Under the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards and, therefore, will not be subject to the same new or revised accounting standards as other SEC registrants that are not emerging growth companies.

Investors may find our common stock less attractive as a result of our election to utilize these exemptions, which could result in a less active trading market for our common stock and/or the market price of our common stock may be more volatile.

Our stock price may be volatile or may decline regardless of our operating performance and the price of our common stock may fluctuate significantly.

If and when our shares begin trading, the market price of our shares is likely to be volatile, in part because our shares have not been traded publicly. Additionally, the market price for our shares may fluctuate significantly in response to a number of factors, most of which are beyond our control, including:

| · | Competition from other projects that may be similar to ours |

| · | Changes in government regulations in Thailand |

| · | The economic outlook for the tourism industry in Thailand |

| · | Changes in key management |

| · | Actions and announcements by us or our competitors |

| · | Changes in our operating performance and market valuation for other similar companies |

| · | Investor’s perceptions of our prospects and the prospects of the Thai tourist industry |

| · | The public’s response to press releases by us or other similar companies, including our filings with the SEC |

| · | Financial guidance to the extent we offer such |

| · | Changes in financial statements or ratings by independent third party securities analysts |

| · | The development of our stock over time |

| · | Future sales of our common stock by our officers, directors or significant stockholders |

| · | Changes in accounting principles affecting our financial reporting |

These and other unknown factors may lower the market price for our common stock, regardless of our actual operating performance. The stock markets and trading facilities, including the OTC Bulletin Board have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities in many companies. In the past, stockholders of some companies have instituted securities class action litigation following periods of intense market volatility. If we were involved in securities litigation, we could incur substantial costs and our resources and the attention of management could be diverted from our business operations.

Our common stock is subject to risks arising from restrictions on reliance on Rule 144 by former shell companies.

Under a regulation of the U.S. Securities and Exchange Commission (“SEC”) known as “Rule 144”, a person who has beneficially owned restricted shares of an issuer and who is not an affiliate of that issuer may sell them without registration under the Securities Act provided that certain conditions have been met. One of these conditions is that such a person has held the restricted shares for a prescribed period, which is 6 months or 1 year, depending on various factors. The SEC defines a shell company as a company that as (a) no or nominal operations and (b) either (i) no or nominal assets, (ii) assets consisting solely of cash and cash equivalents, or (iii) assets consisting of any amount of cash and cash equivalents and other nominal assets. Until the merger, we were a shell company.

| · | The SEC has provided an exemption to this unavailability if and for as long as the following conditions are met: |

| · | The issuer of the securities that was formerly a shell company, has ceased to be a shell company |

| · | The issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act |

| · | The issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than current reports on Form 8-K; and |

| · | At least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company known as “Form 10 Information.” |

The purpose of this filing on Form 8-K is to provide updated “Form 10 Information” about the plans of the Company going forward, stockholders who receive our restricted securities will be able to sell them pursuant to Rule 144 without registration for only as long as we continue to meet those requirements and are not a shell company. No assurance can be given that we will meet these requirements or that we will continue to do so, or that we will not again be a shell company. Furthermore, any non-registered securities we sell in the future or issue for acquisitions or to consultants or employees in consideration for services rendered, or for any other purpose will have limited or no liquidity until and unless such securities are registered with the SEC and/or until a year after we have complied with the requirements of Rule 144. As a result, it may be harder for us to fund our operations, to acquire assets and to pay our consultants with our securities instead of cash. Furthermore, it will be difficult for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the SEC, which could cause us to expend additional resources in the future. In addition, if we are unable to attract additional capital, it could have an adverse impact on our ability to implement our business plan and sustain our operations. Our status as a former “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions, which could cause the value of our securities, if any, to decline in value or become worthless.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our company, our stock price and trading volume could suffer.

The trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. We do not currently have and may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence coverage of our company, the trading price for our common stock would be negatively impacted. If we obtain securities or industry analyst coverage and if one or more of the analysts who cover us downgrades our common stock or publishes inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, demand for our common stock could decrease, which could cause our stock price and trading volume to decline.

Our internal controls over financial reporting may not be effective and our independent registered public accounting firm may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business and reputation.

As a public company, we will be required to evaluate our internal controls over financial reporting. We may identify material weaknesses that we may not be able to remediate in time to meet the applicable deadline imposed upon us for compliance with the requirements of Section 404. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. We cannot be certain as to the timing of completion of our evaluation, testing and any remediation actions or the impact of the same on our operations. If we are not able to implement the requirements of Section 404 in a timely manner or with adequate compliance, our independent registered public accounting firm may issue an adverse opinion due to ineffective internal controls over financial reporting and we may be subject to sanctions or investigation by regulatory authorities, such as the SEC. As a result, there could be a negative reaction in the financial markets due to a loss of confidence in the reliability of our financial statements. In addition, we may be required to incur costs in improving our internal control system and the hiring of additional personnel. Any such action could negatively affect our results of operations and cash flows.

Andrew Khor Poh Kiang, who serves as our President, CEO and Chairman and his wife, Manichan Khor control the majority of our company and holds additional control through Series A convertible preferred stock.

Mr. Khor and his wife, Manichan Khor are mutual beneficial owners of the majority of ANDES 7 Inc. Through their majority ownership, they are entitled to vote and exercise considerable influence over matters requiring approval by our stockholders, including the election of directors, and may not always act in the best interests of other stockholders. Such a concentration of ownership may have the effect of delaying or preventing a change in our control, including transactions in which our stockholders might otherwise receive a premium for their shares over then current market price.

The obligations associated with being a public company require significant resources and management attention, which may divert from our business operations.

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and The Sarbanes-Oxley Act of 2002 (“SOX”). The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition, proxy statement, and other information. SOX requires, among other things, that we establish and maintain effective internal controls and procedures for financial reporting. Our Chief Executive Officer and Chief Accounting Officer need to certify that our disclosure controls and procedures are effective in ensuring that material information we are required to disclose in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. We will need to hire additional financial reporting, internal controls and other financial personnel in order to develop and implement appropriate internal controls and reporting procedures. As a result, we will incur significant legal, accounting and other expenses. Furthermore, the need to establish the corporate infrastructure demanded of a public company may divert management’s attention from implementing our growth strategy, which could prevent us from improving our business, results of operations and financial condition. We have made, and will continue to make, changes to our internal controls and procedures for financial reporting and accounting systems to meet our reporting obligations as a public company. However, the measures we take may not be sufficient to satisfy our obligations as a public company. In addition, we cannot predict or estimate the amount of additional costs we may incur in order to comply with these requirements. We anticipate that these costs will materially increase our selling, general and administrative expenses.

Section 404 of SOX requires annual management assessments of the effectiveness of our internal control over financial reporting. In connection with the implementation of the necessary procedures and practices related to internal control over financial reporting, we may identify deficiencies. If we are unable to comply with the internal controls requirements of SOX, then we may not be able to obtain the independent account certifications required by that act, which may preclude us from keeping our filings with the SEC current, and interfere with the ability of investors to trade our securities and our shares to be quoted or our ability to list our shares on any national securities exchange.

Penny Stock Consideration

Our shares likely will be "penny stocks" as that term is generally defined in the Securities Exchange Act of 1934 to mean equity securities with a price of less than $5.00. Our shares thus will be subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving a penny stock.

Under the penny stock regulations, a broker-dealer selling a penny stock to anyone other than an established customer or accredited investor must make a special suitability determination regarding the purchaser and must receive the purchaser's written consent to the transaction prior to the sale. Generally, an individual with a net worth in excess of $1,000,000 or annual income exceeding $200,000 individually or $300,000 together with his or her spouse is considered an accredited investor. In addition, under the penny stock regulations the broker-dealer is required to:

| | · | Deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt; |

| | · | Disclose commissions payable to the broker-dealer and our registered representatives and current bid and offer quotations for the securities; |

| | · | Send monthly statements disclosing recent price information pertaining to the penny stock held in a customer's account, the account's value and information regarding the limited market in penny stocks; and |

| | · | Make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction, prior to conducting any penny stock transaction in the customer's account. |

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our business and operating results. In addition, current and potential stockholders could lose confidence in our financial reporting, which could have an adverse effect on our stock price.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed.