Shareholder Letter Q1 FY24 | November 2, 2023

Q1 FY24 Fellow shareholders, Over the past year, we’ve talked about playing offense in this challenging environment to strengthen our position and build an enduring 100+ year company. That’s exactly what we’ve done. You won’t find Atlassian sitting still, waiting for macro conditions to change. We continue to push hard on cloud, enterprise, and ITSM (covered in detail last quarter). Cloud momentum remains high, with the number of users migrated over the past year up nearly 50%. Customers are adopting Premium and Enterprise editions of our cloud products at a high rate in response to the steady stream of innovation and enterprise-grade capabilities we roll out each quarter. And more companies like Domino’s, Breville, and the NRMA are switching from legacy ITSM solutions to Jira Service Management so they can deliver outstanding service at scale. Those three big bets continue to pay off, but we’re doing much more than that. We’re also playing offense in the following four areas: 1. Shipping ever-more innovative new products 2. Delivering AI-powered capabilities that will transform how our customers get work done 3. Strengthening our position through strategic acquisitions, large and small 4. Building a championship team There’s a lot of exciting news. Let’s get cracking! Compass: a new and improved way to navigate the developer experience Just one quarter after launching Jira Product Discovery (which is off to a flyer with several thousand paying customers already), we launched our newest product, Compass, into general availability last month. The rise of microservice architecture has radically changed software development over the past decade. But until now, teams haven’t had a unified way of managing the myriad components they work with every day. Compass fills that gap. It improves the day-to-day experience for engineers and operators by giving them a comprehensive view of the ownership, dependencies, compliance, and overall health of the pieces comprising today’s SaaS products. With better visibility, teams can improve how they build and collaborate, unleashing more of their productivity – and ultimately, their potential. From the CEOs 2

Q1 FY24 3 Customers at hundreds of companies large and small participated in our early access program and, in their words, “love the hell out of it.” Feedback like this confirms that we’re addressing one of our customers’ biggest challenges: how to make development teams happier and more productive. Compass was built on our cloud platform so it benefits from the analytics, automation, and AI capabilities we’ve been building. And it also provides another compelling reason for customers to migrate to the cloud. Unleashing the power of AI across our platform Atlassian invests more in R&D than our peers, which gives us a huge competitive advantage. We’ve also designed our best-in-class cloud platform such that we can build a feature once, then surface it across multiple products. The combination of these two strategies means we have deep expertise across a wide range of engineering domains and can deliver new capabilities like AI to more customers faster (and better) than our peers. Case in point: virtual agents are now available to Jira Service Management customers, allowing teams from IT to HR to provide always-on, conversational support at scale. The built-in AI engine analyzes intent, sentiment, context, and profile information to personalize each interaction. It then dynamically generates answers from internal sources like knowledge base articles, onboarding guides, and FAQs. If necessary, the virtual agent can escalate the conversation to human experts, along with the context they need to get up to speed quickly. We’re also debuting additional AI capabilities powered by Atlassian Intelligence , that reduce manual tasks and cognitive load for support agents. When an issue transitions to a new agent, they’ll get a concise summary of all the conversations and recommendations from previous agents for a seamless hand-off. When it’s time to communicate with customers, AI will help them draft responses, adjust their tone, and summarize articles to provide concise instructions. Plus, intelligent assignment and routing capabilities based on the contents of the request help expedite a resolution. These powerful new features are currently available through our early access program.

Q1 FY24 4 But it’s not just Jira Service Management. Due to our “build once, run anywhere” platform, thousands of customers are already experiencing these powerful new Atlassian Intelligence features (also in early access) across our cloud portfolio: • When using the editor in Confluence, Jira Software, Jira Work Management, Trello, Atlas, and Bitbucket, AI helps customers create and improve content in seconds by generating summaries and titles, tightening up their wording, perfecting their tone, finding action items, and brainstorming new ideas. • Jira Software and Jira Service Management customers can search for issues using natural language instead of a structured query language. • Confluence customers can see explanations of unfamiliar terms and get answers to questions, drawn from the content they have access to. AI capabilities like these are already making customers more efficient and will keep drawing more teams to our cloud. ATLASSIAN + UNITED “How do we free people up to do the work that really makes them feel fulfilled? I truly believe with some of the AI capabilities that Atlassian introduced with Atlassian Intelligence, we will be able to do that. I imagine a world where we have cross-functional teams spending less time on the mundane tasks, we can instead focus on being creative, collaborative, and coming up with awesome new ideas.” Oxana Trotsenko Head of Agile Transformation, Digital Technology at United Airlines

Q1 FY24 Welcome, AirTrack and Loom! Building on our history of strategic acquisitions, we’re adding AirTrack and Loom to the Atlassian family to supercharge our capacity for innovation. AirTrack taps into an IT team’s various systems of record to help them find and fix bad data (think missing asset tags or broken workflow configurations). With a complete and accurate picture of all their systems, IT leaders can make smarter decisions, respond to incidents faster, and even prevent them entirely by reducing the risk associated with changes. Atlassian has a strong record of inspiring customers to think beyond IT when it comes to service management – over 60% of Jira Service Management customers also use it for non-IT support. Adding AirTrack builds on this momentum by giving enterprises a single place to manage data challenges around security and compliance, inventory and billing, forecasting and planning, and much more. Airtrack will be integrated with Jira Service Management, with connectors to 30+ systems that let teams aggregate and reconcile data across their entire IT landscape. But we didn’t stop there. Last month we announced a definitive agreement to acquire Loom, the asynchronous video messaging platform with over 200,000 customers, whose business users create nearly 5 million videos each month. The continuing rise of distributed work means a greater reliance on working asynchronously, which might happen across geographies and time zones, or just across the hallway. Compared to text or slide decks, video is a far more human means of communication and has become an indispensable part of how teams work today. It’s also the medium of the future, with video- loving Gen Z comprising a greater share of the workforce. 5

Q1 FY24 Trouble is, getting a “quick call” with your team on the books can be a scheduling nightmare. But with Loom, collaborating via video doesn’t have to happen in real time – it can happen at any time. And when we “weave” Loom into Atlassian, it can happen in just about any product. Customers will be able to transition seamlessly between video, transcripts, documents, tickets, and workflows. Engineers will file bug reports with embedded videos demonstrating the problem. HR teams will convert Looms into rich Confluence pages with a single click. Even better, AI will change the way we consume and create video, giving rise to more of both. No time to watch the full-length video? No worries – soon, AI will be able to generate shorter versions by identifying the most important segments and knitting them together. Alternatively, users who want to watch the full video will be able to search and jump ahead to the parts they’re interested in. On the creation side, AI takes the pain out of editing videos. Whereas traditional video involves multiple takes that are painstakingly stitched together, AI-powered video creation is as easy as editing a document. Just edit the transcript to say precisely what you want, and AI does the rest. With new ways to make, share, and watch, we expect teams will soon embed videos in nearly every aspect of work. And Atlassian products will be there to support them. 6 Assembling an all-star team Great people build great things. That’s why Atlassian is playing offense on talent, using a three-pronged strategy: • Retain and hire the best talent to compete (and win) at the highest level • Amplify our reputation as a top employer • Build a strong senior leadership team that people are excited to work for Atlassian is a “destination employer.” Compared to last year, we see nearly twice as many applications per role – a credit to our legendary culture, inspiring mission, meaningful values, and hyper-flexible approach to distributed work. This affords us the privilege of being incredibly selective, looking for people who have experience with the journey we are on (e.g., AI, platform, video) and can help us move faster. And employees stay with us, as evidenced by retention rates that are higher than our peers’ and a slew of workplace awards. “These are going straight to the pool room” Since our last letter, Atlassian has been recognized five more times as a top employer. Fortune Best Workplaces in Technology™ 2023 (#3!) India’s Best Workplaces for Women Fortune Best Workplaces for Women™ 2023 Fortune Best Workplaces for Millennials™ 2023 Australia’s Best Workplaces™ 2023

Q1 FY24 7 Running a good offense also means knowing how to adapt. With our Chief Revenue Officer, Cameron Deatsch, leaving at the end of the year, we’re using this opportunity to evolve our GTM org so we can continue to fuel both our self-serve flywheel and our growth in the enterprise segment. Atlassian has a strong track record for anticipating workplace trends and making bold moves to capitalize on them. We believe a ripper team, an expanding customer base, and our steady drumbeat of new innovations will drive long-term durable growth. We look forward to discussing all this and more during our call later today. Here’s to the road ahead, and to unleashing the potential of every team. Mike Cannon-Brookes Co-founder and co-CEO Scott Farquhar Co-founder and co-CEO MIKE & SCOT T First, we are delighted to announce that Zeynep Ozdemir joined our team last month as Chief Marketing Officer. With a PhD in machine learning and a broad marketing background, she brings the deep technical expertise and product marketing chops needed to lead a world-class marketing organization in the age of big data and AI. Welcome aboard, Zeynep! Zeynep Ozdemir On the sales side, we’ve been iterating on our approach to serving enterprise customers for a number of years, all without sacrificing our product-led roots and best- in-class GTM efficiency. To push our team forward and keep the momentum high, Kevin Egan has been promoted to Chief Sales Officer based on his record of effectively scaling our flywheel model to better serve larger customers. Congratulations, Kevin! Kevin Egan We also added star player Vikram Rao to our line-up, as Chief Trust Officer. Vikram’s rich experience spanning consumer, enterprise, and cloud customers will be instrumental in advancing our products' compliance, governance, and security in the cloud. We look forward to the fresh insights he’ll bring to the team as we further solidify Atlassian’s position as a trusted leader in our industry. Vikram Rao

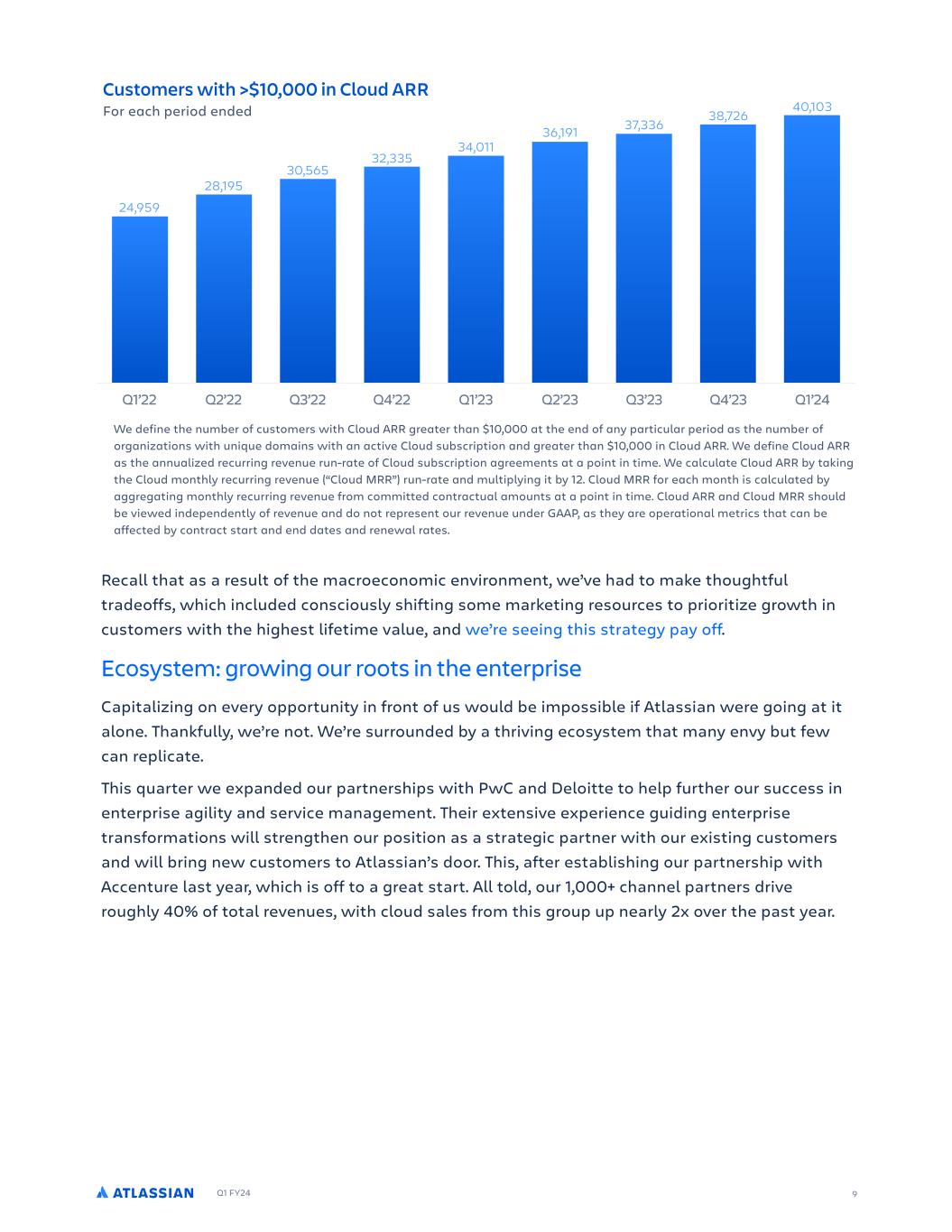

Q1 FY24 8 Taking care of business Updates from across Atlassian. Customers: a new perspective on our expanding base Atlassian exited Q1 with over 265,000 customers, including over 40,000 customers with more than $10,000 in Cloud annualized recurring revenue (“Cloud ARR”), representing companies of all sizes from nearly every industry. We continuously evolve our GTM approach to make deeper inroads with our largest and highest-potential customers while our self-serve flywheel brings in thousands of new organizations each quarter. Attracting new customers is critical as we seek to serve the “Fortune 500,000.” In concert, we're increasingly focused on moving existing customers to the cloud and driving expansion within our massive base. These two efforts go hand-in-hand. Our cloud platform strategy layers on additional expansion vectors like our full ladder of editions and unique product offerings – all of which are easier to try, adopt, and purchase in the cloud. To provide a transparent view into the health and trends of our business and enable investors to evaluate our progress against our strategic priorities, we’re sharing a new metric: the number of customers with more than $10,000 in Cloud ARR. This measures our ability to successfully shift customers to the cloud and expand within our existing customer base. Customers with >$10,000 in Cloud ARR represent over 75% of total cloud ARR and continue to grow as a proportion of our overall cloud business. In Q1, this cohort grew 18% year-over-year. ATLASSIAN + ZOOM “Almost everyone [at Zoom] uses Atlassian products now: tech support, system engineers, engineers, product teams, security, and more.” Gary Chan Head of IT Infrastructure and Employee Services at Zoom

Q1 FY24 For each period ended Customers with >$10,000 in Cloud ARR Q1’22 Q2’22 Q3’22 Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24 40,103 38,726 37,33636,191 34,011 32,335 30,565 28,195 24,959 We define the number of customers with Cloud ARR greater than $10,000 at the end of any particular period as the number of organizations with unique domains with an active Cloud subscription and greater than $10,000 in Cloud ARR. We define Cloud ARR as the annualized recurring revenue run-rate of Cloud subscription agreements at a point in time. We calculate Cloud ARR by taking the Cloud monthly recurring revenue (“Cloud MRR”) run-rate and multiplying it by 12. Cloud MRR for each month is calculated by aggregating monthly recurring revenue from committed contractual amounts at a point in time. Cloud ARR and Cloud MRR should be viewed independently of revenue and do not represent our revenue under GAAP, as they are operational metrics that can be affected by contract start and end dates and renewal rates. 9 Recall that as a result of the macroeconomic environment, we’ve had to make thoughtful tradeoffs, which included consciously shifting some marketing resources to prioritize growth in customers with the highest lifetime value, and we’re seeing this strategy pay off. Ecosystem: growing our roots in the enterprise Capitalizing on every opportunity in front of us would be impossible if Atlassian were going at it alone. Thankfully, we’re not. We’re surrounded by a thriving ecosystem that many envy but few can replicate. This quarter we expanded our partnerships with PwC and Deloitte to help further our success in enterprise agility and service management. Their extensive experience guiding enterprise transformations will strengthen our position as a strategic partner with our existing customers and will bring new customers to Atlassian’s door. This, after establishing our partnership with Accenture last year, which is off to a great start. All told, our 1,000+ channel partners drive roughly 40% of total revenues, with cloud sales from this group up nearly 2x over the past year.

Q1 FY24 10 Sustainability: learning from yesterday, building for tomorrow Part of building a 100-year company is taking sustainability just as seriously as our products; our long-term success as a business depends on both. As part of our sustainability program this year, we signed our first virtual power purchase agreement to match in-office electricity and work-from-home energy use in the United States. We also conducted a pay equity audit, which found no observable statistically significant gaps in salary or equity on the basis of gender (globally) or race/ethnicity (in the U.S.) and revealed insights that will inform our compensation programs going forward. Last, we published our Responsible Technology Principles detailing Atlassian’s commitment to putting privacy, security, and human rights at the center when we’re developing or deploying new technologies like AI. You can learn more about our efforts to foster stronger communities and a healthier planet in our 2023 Sustainability Report on our Investor Relations website. Ship it. Ship it good. In addition to everything mentioned above, we also delivered enhancements to our platform that unlock the cloud for millions of users, alongside crowd-pleasers that turn users into fans. Here’s a sample. Progress tracking in Jira Software’s release hub Navigation menus in Jira Align for faster access to users' work across Atlassian products Improved connector mappings for Jira Align that make onboarding new projects easier Support for migrating data from all on- prem Jira Software apps to cloud in one go 2-factor authentication for external users via a temporary one-time password Simple transfer of Confluence spaces from one instance to another Separate sandbox environments for each cloud product to ensure isolated testing and validation APIs for admins to archive and restore up to 100,000 Jira issues at a time Data residency options in Canada

Q1 FY24 11 First quarter fiscal year 2024 financial summary (U.S. $ in thousands, except percentages and per share data) First quarter fiscal year 2024 highlights Steady execution drove a good start to our fiscal year, with results across revenue, gross profit, and operating income exceeding our expectations. Revenue growth benefitted from stronger renewals, migrations, and paid seat expansion, while gross profit and operating income continued to benefit from our focus on cost management. Overall, we continue to deliver innovative value to customers with a strong operational focus and disciplined strategic investments in our unique opportunities to drive durable, long-term growth. Financial highlights Joe Binz Chief Financial Officer ,AIJ I I F AJ C % %' AE E A C J DD IP G PFL O O CTACMP MCN OF NC P MCNAC P ECO I 0FE J E G D I % % % %% - 3 I J C J CRC C -- -- . - ) ( 6NLOO MNLDGP - - , ,,. 6NLOO NEG % :MCN PG E LOO . ., ) (- :MCN PG E NEG % 9CP LOO ) ..) ) - 9CP LOO MCN OF NC $ G PC % ( % 2 OF D LS DNL LMCN PGL O ,, , ( ( 1FE - 3 I J C J 6NLOO MNLDGP .(( )) ,. ) 6NLOO NEG :MCN PG E G AL C (( ) - :MCN PG E NEG % 9CP G AL C ,. . ( - 9CP G AL C MCN OF NC $ G PC %, %), 5NCC A OF D LS ,) (.- - , A reconciliation of GAAP to non-GAAP measures is provided within the tables at the end of this letter as well as in our earnings press release, and on our Investor Relations website.

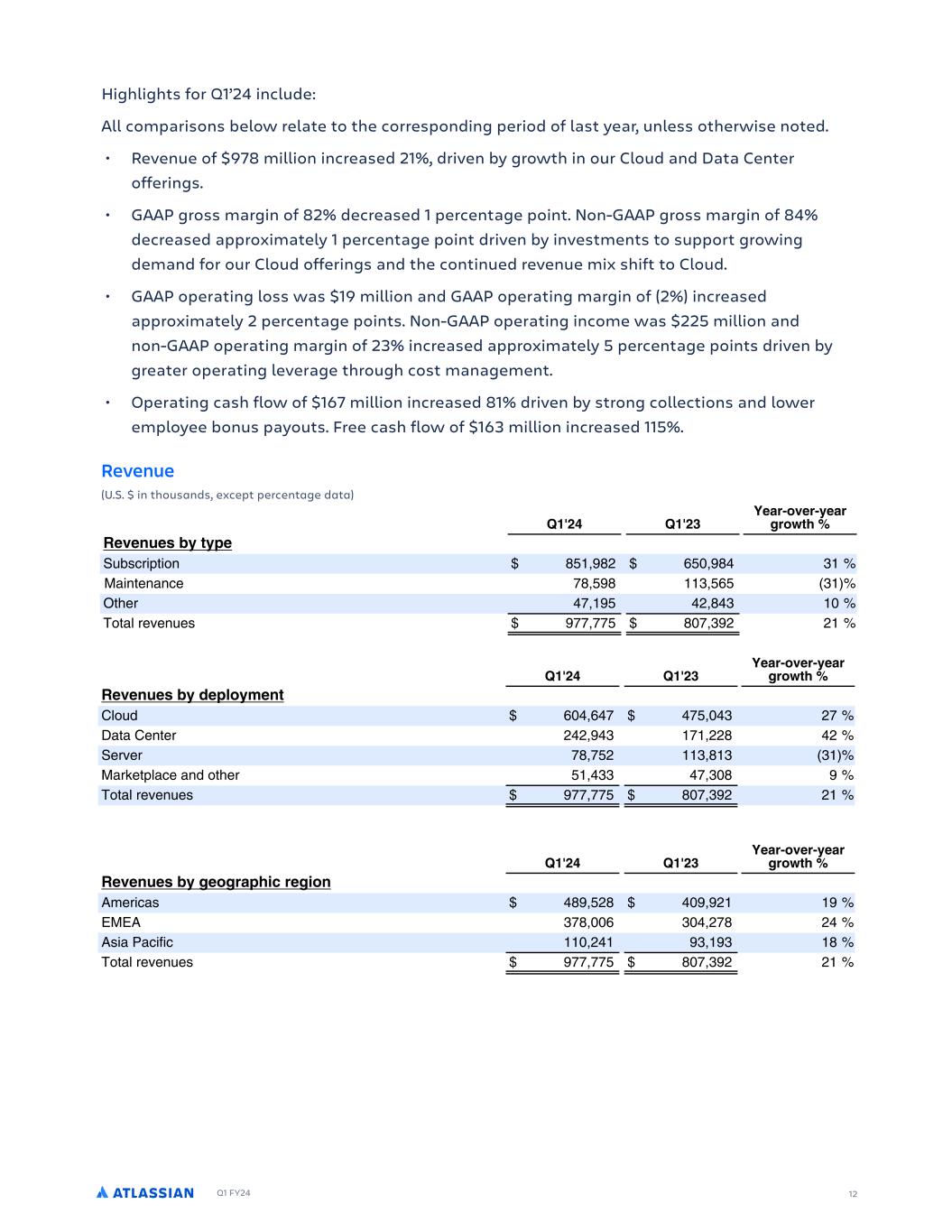

Q1 FY24 12 Highlights for Q1’24 include: All comparisons below relate to the corresponding period of last year, unless otherwise noted. • Revenue of $978 million increased 21%, driven by growth in our Cloud and Data Center offerings. • GAAP gross margin of 82% decreased 1 percentage point. Non-GAAP gross margin of 84% decreased approximately 1 percentage point driven by investments to support growing demand for our Cloud offerings and the continued revenue mix shift to Cloud. • GAAP operating loss was $19 million and GAAP operating margin of (2%) increased approximately 2 percentage points. Non-GAAP operating income was $225 million and non-GAAP operating margin of 23% increased approximately 5 percentage points driven by greater operating leverage through cost management. • Operating cash flow of $167 million increased 81% driven by strong collections and lower employee bonus payouts. Free cash flow of $163 million increased 115%. Revenue (U.S. $ in thousands, except percentage data) ,AIJ I I F AJ C % %' I M E I J C J G PFL O O CTACMP MCNAC P EC Q 4 %' 4 % I FM I P I IFN M E J P PG OANGMPGL . .( , . ) 8 G PC AC -. . ) , ) :PFCN - ( . ) LP NCRC CO -- -- . - ) ( ( 4 %' 4 % I FM I P I IFN M E J P GCFPD E 2 L , , - - ) (- 3 P 2C PCN ( ( ) - ((. ( CNRCN -. - ( ) . ) ) 8 N CPM AC LPFCN )) - ) . LP NCRC CO -- -- . - ) ( ( 4 %' 4 % I FM I P I IFN M E J P F I G A I AFE 1 CNGA O . (. ( 4841 )-. , ) (-. ( 1OG AGDGA ( ) ) . LP NCRC CO -- -- . - ) ( (

Q1 FY24 Revenue growth in Q1 was driven by subscription revenue, which grew 31%. Customers continue to turn to our products to help their teams track and deliver work, share knowledge, get help, and build high-performing teams. Overall, trends from the prior quarter continued with healthy migration activity from Server to both our Cloud and Data Center offerings. Cloud revenue growth of 27% was in line with our expectations driven by paid seat expansion within existing customers, healthy migrations, and cross-sell to additional products. Prior quarter macro headwinds on paid seat expansion and free-to-paid conversions persisted in Q1, although the rate of deceleration continued to moderate slightly. Upsell to Premium and Enterprise editions, customer retention, and monthly active usage across the business remain healthy, driven by the high-value, mission-critical nature of our products. Data Center revenue growth of 42% exceeded expectations driven by continued strength in renewals, migrations, and seat expansion within existing customers. Lastly, deferred revenue increased 28% year-over-year to $1.5 billion reflecting growth in annual and multi-year customer commitments to the Atlassian platform. 13 Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24 $977.8 $939.1$915.5 $872.7 $807.4 $759.8 Total revenue (U.S. $ in millions, year-over-year growth rate in %) 27%31% 24%36% 24% 21%

Q1 FY24 14 (U.S. $ in millions, except percentage data) Revenues by deployment $977.8 $939.1$915.5 $872.7 $807.4 $759.8 Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24 $78.8 $86.1$94.4 $106.2 $113.8 $117.6 $51.4 $57.5 $64.6 $59.9 $47.3 $49.3 $242.9 $232.2 $221.6 $194.3 $171.2 $158.9 $604.6$563.2$534.9$512.3$475.0$434.0 Cloud Data Center Marketplace and services Server (2) (1) Note: revenue totals may not foot due to rounding Year-over-year growth % Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24 Cloud 55% 49% 41% 34% 30% 27% Data Center 60% 54% 40% 47% 46% 42% Marketplace and services 24% 4% 20% 12% 17% 9% Server (16%) (18%) (22%) (29%) (27%) (31%) Total revenues 36% 31% 27% 24% 24% 21% Included in Server is perpetual license revenue. Perpetual license revenue is captured as other revenue on the Condensed Consolidated Statements of Operations. (1) Included in Marketplace and services is premier support revenue. Premier support is a subscription-based arrangement for a higher level of support across different deployment options. Premier support is recognized as subscription revenue on the Condensed Consolidated Statements of Operations as the services are delivered over the term of the arrangement. (2)

Q1 FY24 15 GAAP operating expenses increased 17% year-over-year driven by higher employment costs, including stock-based compensation. Headcount at the end of Q1'24 was 11,151, which was 14% higher than a year ago. Non-GAAP operating expenses increased 11% year-over-year and were lower than expected due to the timing of certain headcount investments that shifted to future quarters and our focus on driving efficiencies across the business. GAAP operating margin of (2%) and non-GAAP operating margin of 23% benefited year-over-year from moderation in the pace of hiring as well as our continued focus on disciplined cost management. Margins, operating expenses, and operating income (U.S. $ in thousands, except percentage data) ,AIJ I I F AJ C % %' D I AEJ E FG I AE OG EJ J DD IP G PFL O O CTACMP MCN OF NC P MCNAC P EC Q 4 %' 4 % -IFJJ D I AE 611 ENLOO NEG % 9L $611 ENLOO NEG F C FG I AE OG EJ J 611 LMCN PG E CTMC OCO . . , - ( (- 9L $611 LMCN PG E CTMC OCO - ) , ), J I E M CFGD E OG EJ J 611 NCOC NAF CRC LM C P CTMC OCO . -). ) , 9L $611 NCOC NAF CRC LM C P CTMC OCO )) . (.. -.) 2 525 0 3.7.16.4 ( 0 I AE E J C J OG EJ J 611 N CPG E O CO CTMC OCO ) ,- , (. 9L $611 N CPG E O CO CTMC OCO . ( ) (. 2 525 0 3.7.16.4 ) ) ) - E I C E DAEAJ I AM OG EJ J 611 EC CN G GOPN PGRC CTMC OCO ) ) ( . ) 9L $611 EC CN G GOPN PGRC CTMC OCO - (-- ) 2 525 0 3.7.16.4 2G I AE AE FD 611 LMCN PG E LOO . ., ) (- 9L $611 LMCN PG E G AL C (( ) - 2 525 0 3.7.16.4 % Net income (U.S. $ in thousands, except per share data) ,AIJ I I F AJ C % %' 1 E FD G PFL O O CTACMP MCN OF NC P 4 %' 4 % - 3 I J C J 9CP LOO ) ..) ) - 9CP LOO MCN OF NC $ G PC % ( % 1FE - 3 I J C J 9CP G AL C ,. . ( - 9CP G AL C MCN OF NC $ G PC %, %), ,AIJ I I F AJ C % %' ,I J ,CFN G PFL O O CTACMP MCNAC P EC 4 %' 4 % ,I J CFN 611 CP A OF MNLRG C LMCN PG E APGRGPGCO ,, , ( ( 7COO0 2 MGP CTMC GP NCO ) ,, , , 5NCC A OF D LS ,) (.- - , 2 525 0 3.7.16.4 )

Q1 FY24 As a reminder, we experience quarterly seasonality in our free cash flow results, with Q1 typically having the lowest free cash flow of the year due to employee bonus payments in the quarter. 16 Free cash flow (U.S. $ in thousands, except percentage data) ,AIJ I I F AJ C % %' 1 E FD G PFL O O CTACMP MCN OF NC P 4 %' 4 % - 3 I J C J 9CP LOO ) ..) ) - 9CP LOO MCN OF NC $ G PC % ( % 1FE - 3 I J C J 9CP G AL C ,. . ( - 9CP G AL C MCN OF NC $ G PC %, %), ,AIJ I I F AJ C % %' ,I J ,CFN G PFL O O CTACMP MCNAC P EC 4 %' 4 % ,I J CFN 611 CP A OF MNLRG C LMCN PG E APGRGPGCO ,, , ( ( 7COO0 2 MGP CTMC GP NCO ) ,, , , 5NCC A OF D LS ,) (.- - , 2 525 0 3.7.16.4 ) ,AE E A C I J - 3 Q I 0FE J E AE D I % % CRC C G GL PL ) G GL 2 L NCRC C ENLSPF C N$LRCN$ C N ( % PL (-% 3 P 2C PCN NCRC C ENLSPF C N$LRCN$ C N )) 6NLOO NEG . % :MCN PG E NEG -% 1FE - 3 Q I 0FE J E AE D I % % 6NLOO NEG .)% :MCN PG E NEG ( % - 3 Q ,AJ C I E AE E % %' 2 L NCRC C ENLSPF C N$LRCN$ C N ( PL ) 3 P 2C PCN NCRC C ENLSPF C N$LRCN$ C N ) 6NLOO NEG . % :MCN PG E NEG % 1FE - 3 Q ,AJ C I E AE E % %' 6NLOO NEG .)% :MCN PG E NEG ( % Financial targets (U.S. $) Q2’24 FY24 ,AE E A C I J - 3 Q I 0FE J E AE D I % % CRC C G GL PL ) G GL 2 L NCRC C ENLSPF C N$LRCN$ C N ( % PL (-% 3 P 2C PCN NCRC C ENLSPF C N$LRCN$ C N )) 6NLOO NEG . % :MCN PG E NEG -% 1FE - 3 Q I 0FE J E AE D I % % 6NLOO NEG .)% :MCN PG E NEG ( % - 3 Q ,AJ C I E AE E % %' 2 L NCRC C ENLSPF C N$LRCN$ C N ( PL ) 3 P 2C PCN NCRC C ENLSPF C N$LRCN$ C N ) 6NLOO NEG . % :MCN PG E NEG % 1FE - 3 Q ,AJ C I E AE E % %' 6NLOO NEG .)% :MCN PG E NEG ( %

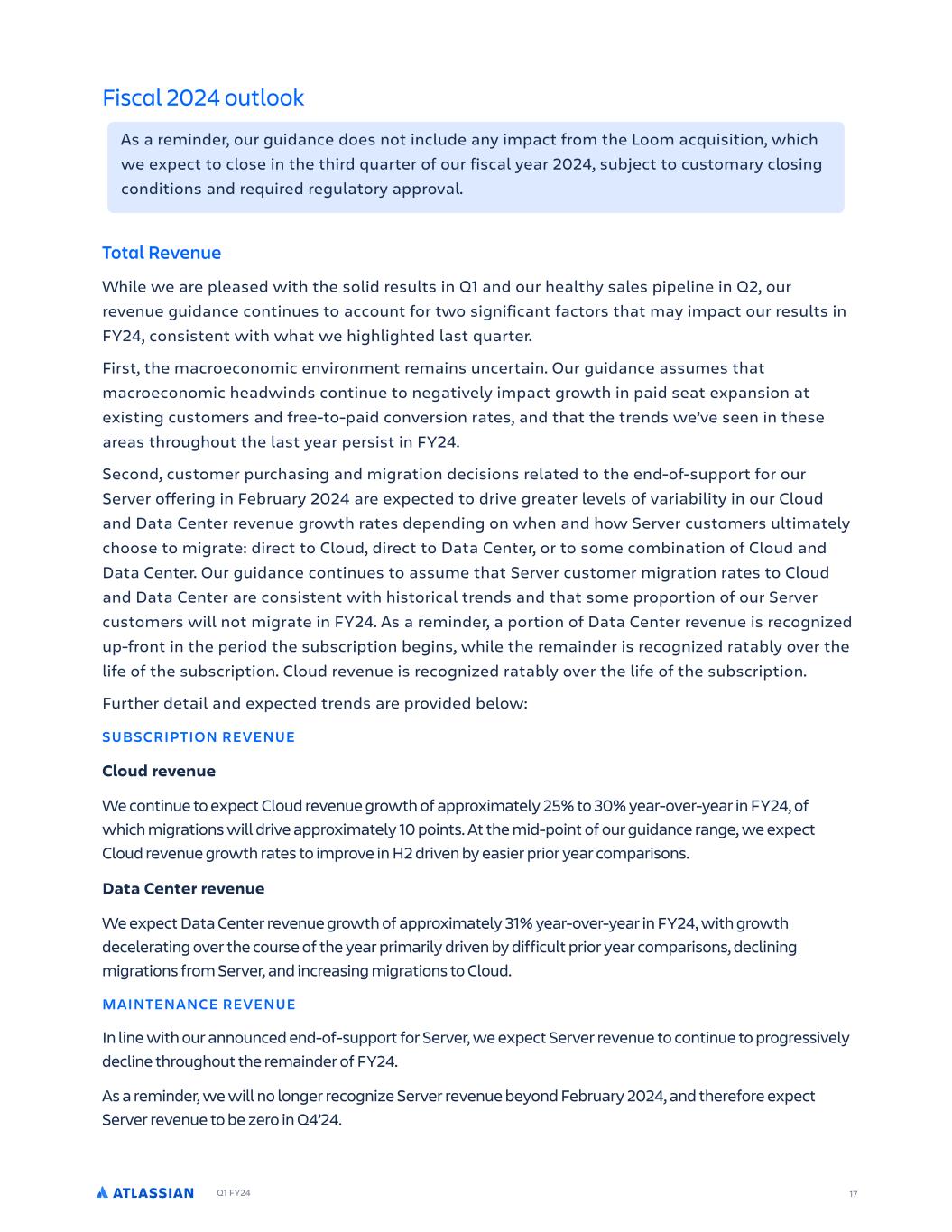

Q1 FY24 17 Fiscal 2024 outlook As a reminder, our guidance does not include any impact from the Loom acquisition, which we expect to close in the third quarter of our fiscal year 2024, subject to customary closing conditions and required regulatory approval. Total Revenue While we are pleased with the solid results in Q1 and our healthy sales pipeline in Q2, our revenue guidance continues to account for two significant factors that may impact our results in FY24, consistent with what we highlighted last quarter. First, the macroeconomic environment remains uncertain. Our guidance assumes that macroeconomic headwinds continue to negatively impact growth in paid seat expansion at existing customers and free-to-paid conversion rates, and that the trends we’ve seen in these areas throughout the last year persist in FY24. Second, customer purchasing and migration decisions related to the end-of-support for our Server offering in February 2024 are expected to drive greater levels of variability in our Cloud and Data Center revenue growth rates depending on when and how Server customers ultimately choose to migrate: direct to Cloud, direct to Data Center, or to some combination of Cloud and Data Center. Our guidance continues to assume that Server customer migration rates to Cloud and Data Center are consistent with historical trends and that some proportion of our Server customers will not migrate in FY24. As a reminder, a portion of Data Center revenue is recognized up-front in the period the subscription begins, while the remainder is recognized ratably over the life of the subscription. Cloud revenue is recognized ratably over the life of the subscription. Further detail and expected trends are provided below: SUBSCRIPTION REVENUE Cloud revenue We continue to expect Cloud revenue growth of approximately 25% to 30% year-over-year in FY24, of which migrations will drive approximately 10 points. At the mid-point of our guidance range, we expect Cloud revenue growth rates to improve in H2 driven by easier prior year comparisons. Data Center revenue We expect Data Center revenue growth of approximately 31% year-over-year in FY24, with growth decelerating over the course of the year primarily driven by difficult prior year comparisons, declining migrations from Server, and increasing migrations to Cloud. MAINTENANCE REVENUE In line with our announced end-of-support for Server, we expect Server revenue to continue to progressively decline throughout the remainder of FY24. As a reminder, we will no longer recognize Server revenue beyond February 2024, and therefore expect Server revenue to be zero in Q4’24.

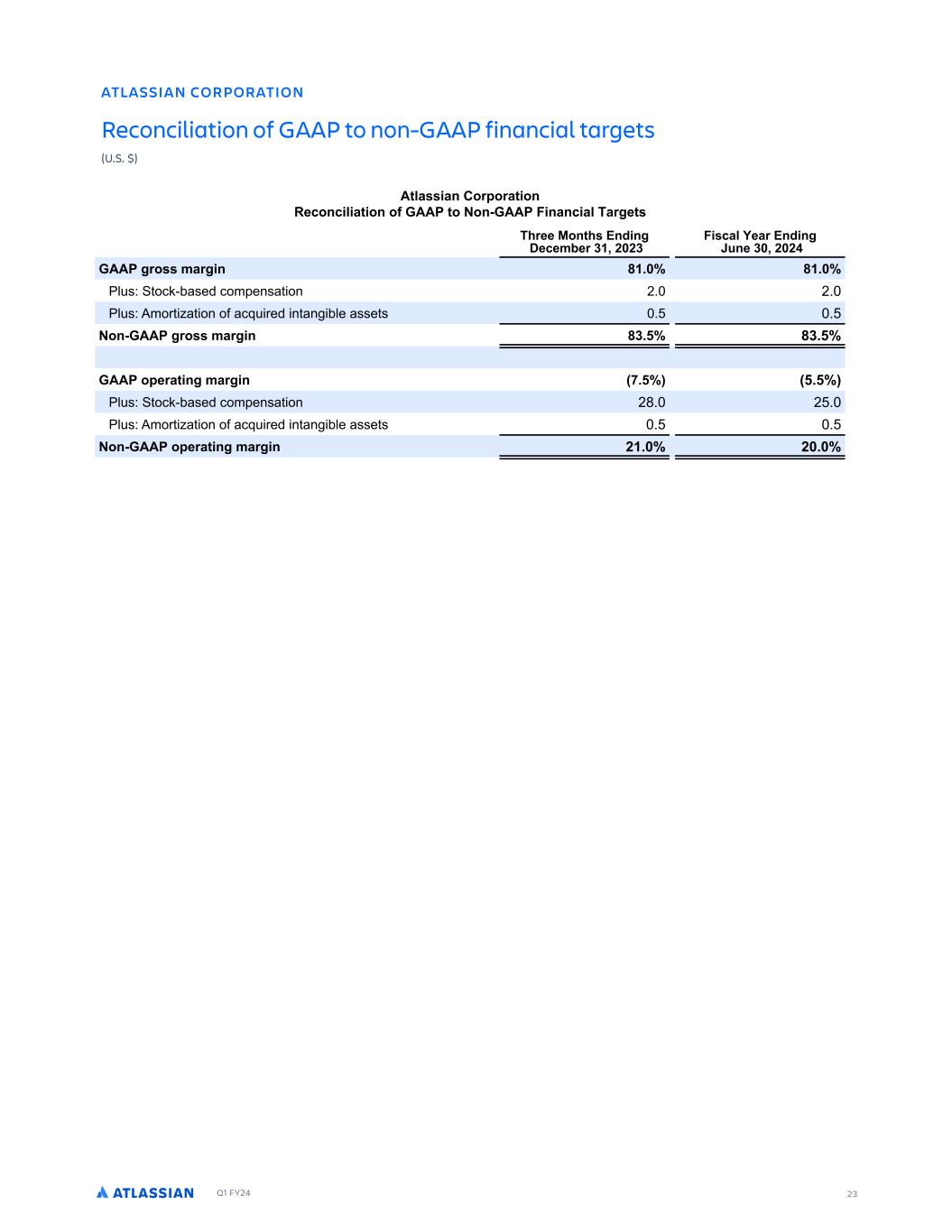

Q1 FY24 18 OTHER REVENUE We continue to expect Other revenue, which is primarily comprised of Marketplace revenue, to be roughly flat year-over-year in FY24, driven by continued sales mix shift to cloud apps. As a reminder, there is a lower Marketplace take rate on third-party cloud apps relative to Server and Data Center apps to incentivize further cloud app development, and Marketplace revenue is recognized in full in the period of the Marketplace sale. Gross margin We continue to expect GAAP gross margin to be approximately 81.0% and non-GAAP gross margin to be approximately 83.5% in FY24. We expect gross margins to decrease over the course of FY24 due to the continued revenue mix shift to Cloud. Operating and free cash flow margin We expect GAAP operating margin to be approximately (5.5%) and non-GAAP operating margin to be approximately 20.0% in FY24. Operating expense growth will continue to be driven by our investments in key strategic priorities that expand our opportunity to help our customers and drive durable, long-term growth. These priorities include cloud migrations, serving enterprise customers, AI, and delivering innovative customer value across our product portfolio. We expect free cash flow margin in Q2’24 to be impacted by a discrete tax payment of approximately $60 million related to transfer pricing. Share count We continue to expect diluted share count to increase by less than 2% in FY24.

Q1 FY24 19 ATLASSIAN CORPORATION Condensed consolidated statements of operations (U.S. $ and shares in thousands, except per share data) (unaudited) .S ARR AM 0N ON AS NM 0NMDEMRED 0NMRN DASED SASELEMSR NF OE AS NMR % % AMD R A ER M S NTRAMDR EWCEOS OE R A E DASA TMATD SED EE 7NMS R 2MDED EOSELBE ) ( () ( (( FWFO FT0 CTDS PO . .( , . :B O FOBODF -. . ) , IFS - ( . ) P BM SFWFO FT -- -- . - ) ( 3PT PG SFWFO FT ( -. ( ) ) ( 7SPTT SPG - - , ,,. FSB O F FOTFT0 FTFBSDI BOE EFWFMP NFO ( . -). ) , :BSLF O BOE TBMFT ( ) ,- , (. 7FOFSBM BOE BEN O T SB WF ) ) ( . ) P BM P FSB O F FOTFT . . , - ( (- FSB O MPTT . ., ) (- IFS ODPNF F FOTF OF . )) ( (. 8O FSFT ODPNF ( ((, ) 8O FSFT F FOTF . -, , ( 9PTT CFGPSF SPW T PO GPS ODPNF B FT - , SPW T PO GPS ODPNF B FT ( ( . ( F MPTT ) ..) ) - F MPTT FS TIBSF B S C BCMF P 3MBTT 1 BOE 3MBTT 2 DPNNPO T PDLIPMEFST0 2BT D % ( % 4 M FE % ( % AF I FE$BWFSB F TIBSFT TFE O DPN O OF MPTT FS TIBSF B S C BCMF P 3MBTT 1 BOE 3MBTT 2 DPNNPO T PDLIPMEFST0 2BT D ( - - ( ,- 4 M FE ( - - ( ,- 1NP O T ODM EF T PDL$CBTFE DPN FOTB PO BT GPMMP T0 EE 7NMS R 2MDED EOSELBE ) ( () ( (( 3PT PG SFWFO FT , .( , ) FTFBSDI BOE EFWFMP NFO , ( :BSLF O BOE TBMFT )( (. () 7FOFSBM BOE BEN O T SB WF ), )) ( , ( 1NP O T ODM EF BNPS B PO PG BDR SFE O BO CMF BTTF T BT GPMMP T0 EE 7NMS R 2MDED EOSELBE ) ( () ( (( 3PT PG SFWFO FT --( , - FTFBSDI BOE EFWFMP NFO :BSLF O BOE TBMFT ( ), (

Q1 FY24 20 ATLASSIAN CORPORATION Condensed consolidated balance sheets (U.S. $ in thousands) (unaudited) .S ARR AM 0N ON AS NM 0NMDEMRED 0NMRN DASED A AMCE EESR % % M S NTRAMDR TMATD SED EOSELBE ) ( () 5TME ) ( () .RRESR 3 SSFO BTTF T0 3BTI BOE DBTI FR WBMFO T ( ) ) ( ( :BSLF BCMF TFD S FT ( . 1DDP O T SFDF WBCMF OF ),. (, -- ,-. SF B E F FOTFT BOE P IFS D SSFO BTTF T ( , - , ), P BM D SSFO BTTF T ( -) - ( -), ), PO$D SSFO BTTF T0 SP FS BOE FR NFO OF - ,) . ( FSB O MFBTF S I $PG$ TF BTTF T . ) . SB F D OWFT NFO T (( )) (( ). 8O BO CMF BTTF T OF , . ( , -( 7PPE MM -(, -(- ( 4FGFSSFE B BTTF T , IFS OPO$D SSFO BTTF T , ()) -) ( NSA ARRESR - ,) , -- AB S ER AMD SNCJ N DE RY 2PT S 3 SSFO M BC M FT0 1DDP O T B BCMF (, ( ( ) 1DDS FE F FOTFT BOE P IFS D SSFO M BC M FT ),( ))- () ) 4FGFSSFE SFWFO F D SSFO PS PO )(, . ),( -), FSB O MFBTF M BC M FT D SSFO PS PO ( -)- ) FSN MPBO GBD M D SSFO PS PO )- P BM D SSFO M BC M FT - ).) ( (- PO$D SSFO M BC M FT0 4FGFSSFE SFWFO F OF PG D SSFO PS PO - -) .( - ) FSB O MFBTF M BC M FT OF PG D SSFO PS PO () - - ()- .) FSN MPBO GBD M OF PG D SSFO PS PO ,)- ,( ) 4FGFSSFE B M BC M FT ( ,, IFS OPO$D SSFO M BC M FT ( ) -- NSA AB S ER ) ) ) ( - SNCJ N DE RY EPT S 3PNNPO T PDL ) ) 1EE POBM B E$ O DB BM ) ),, ( ( ) ) ,) 1DD N MB FE P IFS DPN SFIFOT WF ODPNF . ) ( 1DD N MB FE EFG D ( , - .. ( , NSA RSNCJ N DE RY EPT S -- ,( , ,-( NSA AB S ER AMD RSNCJ N DE RY EPT S - ,) , -- (

Q1 FY24 21 ATLASSIAN CORPORATION Condensed consolidated statements of cash flows (U.S. $ in thousands) (unaudited) ( : AA ) ) A ) A : . A ) A : EA 0 . CA A C C , A . 2 $ $ $ ) A : EA 3 A 5 E ,, ( CN G G BE G E G : A OB : BG : BOB B 2 B: B G :G : BR: B G ) $,( ( $ 9 D : G : B G ) ), 2 BG :P ) ) 4:BG G : G G : A :E : G EEBG BG : N B B: , ( $- 5 E G : B BGO G (, ) 5 B G N G E :BG , ) 6 A , 1A:G BG : BG : :G EB: BEB B NG BO: E G $- (,, ( 7 :B P G :G A : $) NG : : E $ ) ( N P G :G A EB: BEB B $, (( 2 O GN (( -, - ,() 3 A 2F 3 A -) - (( ) A : EA A 3 A 0N BG BG: B G G : A : NB S $$ 7N A: :G NB G - (- 7N A: : B BGO G )$ , )$ 7N A: : D : E N B B :G A BGO G - $ $$$ 7 : N B B : D : E N B B S , -)$ 7 :E : D : E N B B :G : B BGO G - , - ), 3 A CA A 3 A ) -$ , ) A : EA 3 3 A 8 N A: 1E: 1 G 9 D ) , - S 7 A BG:G BG : :G G S - 3 A 2F CA 3 3 A ) , - - 3 B G P A:G : A:G G : A : A NBO:E G :G B : A ,$ ( - - 3 A 3 A 3 A C : A A 3 3 A ($ ,-( , ) A 3 A C : A A 3 3 A 2 $ - ) , , 5 : BG : A :G : A NBO:E G BG EN BG : A E :E S $ ) A 3 A C : A A 3 3 A (( ,$- ( - -(-

Q1 FY24 22 ATLASSIAN CORPORATION Reconciliation of GAAP to non-GAAP results (U.S. $ and shares in thousands, except per share data) (unaudited) (F EE A ) C F A A F A ,((0 F . A ,((0 EG FE $2$ A E E A F GE A E CF C AF A C E F GA G F 3 - AF E A 2 CF , EE C F 611: D LPP LCF - - , ,,. :I P0 L $ P A L P FL , .( , ) :I P0 1 L FW FL LC N F A F DF I PP P --( , - 9L $611: D LPP LCF .(( )) ,. ) C F A A 611: L F D ILPP . ., ) (- :I P0 L $ P A L P FL () . -) ,) :I P0 1 L FW FL LC N F A F DF I PP P . () . ( , 9L $611: L F D F L (( ) - C F A A 611: L F D DF ( :I P0 L $ P A L P FL ( ( :I P0 1 L FW FL LC N F A F DF I PP P 9L $611: L F D DF () . . F A 611: ILPP ) ..) ) - :I P0 L $ P A L P FL () . -) ,) :I P0 1 L FW FL LC N F A F DF I PP P . () . ( , 8 PP0 6 F L L $ PE P I LC L LIIF D F P LC P PFAF )-. ) 8 PP0 7 L AG P P - )( . 9L $611: F L ,. . ( - . F A C E 611: ILPP PE $ AFI A % ( % :I P0 L $ P A L P FL % %,. :I P0 1 L FW FL LC N F A F DF I PP P % ) % ) 8 PP0 6 F L L $ PE P I LC L LIIF D F P LC P PFAF % % - 8 PP0 7 L AG P P % , % ) 9L $611: F L PE $ AFI A %, %), F GF E E GFEF A A FDE A$ S D PE P P A F L F D AFI A 611: ILPP PE ( - - ( ,- :I P0 3FI FL C L AFI FS P F F P ( . FDE A$ S D PE P P A F L F D AFI A L $611: F L PE ( . ( , ( . E 611: PE LSFA A L F D FSF F P ,, , ( ( 8 PP0 2 F I AF P ) ,, , , 5 PE CILT ,) (.- - , 7 E CF P N LC CFP I ( ( T D L FIFW CF A IL D$ LG A L $611: F L L FL LC E L $611: F L AG P P F L A L LSFA L PFP LPP F F L F D FLAP% 7 LG F D EFP IL D$ L $611: T FIFW A E $ CF F I LG FL E I A P E AF A F AF F L CC P LC E L E L $ 611: AG P P CI A LS % 1AAF FL II T L PFA A L L F D P A L E C L P P E P L FP F D LPF FL P F S FL P G FPAF FL P A I DFPI FL F GL G FPAF FL P TE T L % 5L CFP I ( ( T A F A E LG A L $611: L (- % EFP CF A IL D$ LG A L $611: IF F P E CC P LC L $ F D A FLA P FCF F P TEF E S F PFW A C N % 4 I P LC E L $ F D A FLA P FCF F P F I A L IF F A L E D P F E S I FL IILT I A L A C A PP P CC P P I F D C L N FPF FL P A P I L F C N I L F D F P% TFII FLAF II $ S I EFP IL D$ P PP CL PFD FCF S P% E L IA P G L E D CL S F LC PL P CL I PFD FCF E D P F E D LD EF F DP F L C A I I T E D P F GL G FPAF FL P TE E L L P% ( E CC P LC E P AFI FS P F F P T L F I A A F E 611: I I FL LC AFI A ILPP PE CL E E L EP A A ) ( () A ( (( P E CC TL IA E S F$AFI FS %

Q1 FY24 23 ATLASSIAN CORPORATION Reconciliation of GAAP to non-GAAP financial targets (U.S. $) .S ARR AM 0N ON AS NM ECNMC AS NM NF 4.. SN 8NM$4.. 3 MAMC A A GESR EE 7NMS R 2MD MG 1ECELBE ) ( () 3 RCA EA 2MD MG 5TME ) ( ( 4.. G NRR LA G M - % - % M T0 PDL$CBTFE DPN FOTB PO (% (% M T0 1NPS B PO PG BDR SFE O BO CMF BTTF T % % 8NM$4.. G NRR LA G M -)% -)% 4.. NOE AS MG LA G M ,% % M T0 PDL$CBTFE DPN FOTB PO (.% ( % M T0 1NPS B PO PG BDR SFE O BO CMF BTTF T % % 8NM$4.. NOE AS MG LA G M ( % ( %

Q1 FY24 24 FORWARD-LOOKING STATEMENTS This shareholder letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. In some cases, you can identify these statements by forward-looking words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “should,” “estimate,” or “continue,” and similar expressions or variations, but these words are not the exclusive means for identifying such statements. All statements other than statements of historical fact could be deemed forward-looking, including risks and uncertainties related to statements about our products, product features, including AI and large language models, customers, channel partnerships, Atlassian Marketplace, Cloud and Data Center migrations, macroeconomic environment, anticipated growth, outlook, technology, potential benefits and synergies from acquisitions, hiring capabilities, sustainability strategy and progress, and other key strategic areas, and our financial targets such as total revenue, Cloud and Data Denter revenue and GAAP and non-GAAP financial measures including gross margin and operating margin. We undertake no obligation to update any forward-looking statements made in this shareholder letter to reflect events or circumstances after the date of this shareholder letter or to reflect new information or the occurrence of unanticipated events, except as required by law. The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made. Further information on these and other factors that could affect our financial results is included in filings we make with the Securities and Exchange Commission (the “SEC”) from time to time, including the section titled “Risk Factors” in our most recently filed Forms 10- K and 10-Q. These documents are available on the SEC Filings section of the Investor Relations section of our website at: https:// investors.atlassian.com. ABOUT NON-GAAP FINANCIAL MEASURES In addition to the measures presented in our consolidated financial statements, we regularly review other measures that are not presented in accordance with GAAP, defined as non-GAAP financial measures by the SEC, to evaluate our business, measure our performance, identify trends, prepare financial forecasts and make strategic decisions. The key measures we consider are non-GAAP gross profit, non-GAAP operating income and non-GAAP operating margin, non-GAAP net income, non-GAAP net income per diluted share and free cash flow (collectively, the “Non-GAAP Financial Measures”). These Non-GAAP Financial Measures, which may be different from similarly titled nonGAAP measures used by other companies, provide supplemental information regarding our operating performance on a non-GAAP basis that excludes certain gains, losses and charges of a non-cash nature or that occur relatively infrequently and/or that management considers to be unrelated to our core operations. Management believes that tracking and presenting these Non-GAAP Financial Measures provides management, our board of directors, investors and the analyst community with the ability to better evaluate matters such as: our ongoing core operations, including comparisons between periods and against other companies in our industry; our ability to generate cash to service our debt and fund our operations; and the underlying business trends that are affecting our performance. Our Non-GAAP Financial Measures include: • Non-GAAP gross profit. Excludes expenses related to stock-based compensation and amortization of acquired intangible assets. • Non-GAAP operating income and non-GAAP operating margin. Excludes expenses related to stock-based compensation and amortization of acquired intangible assets. • Non-GAAP net income and non-GAAP net income per diluted share. Excludes expenses related to stock-based compensation, amortization of acquired intangible assets, gain on a non-cash sale of a controlling interest of a subsidiary, and the related income tax adjustments. • Free cash flow. Free cash flow is defined as net cash provided by operating activities less capital expenditures, which consists of purchases of property and equipment. We understand that although these Non-GAAP Financial Measures are frequently used by investors and the analyst community in their evaluation of our financial performance, these measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. We compensate for such limitations by reconciling these Non-GAAP Financial Measures to the most comparable GAAP financial measures. We encourage you to review the tables in this shareholder letter titled “Reconciliation of GAAP to Non-GAAP Results” and “Reconciliation of GAAP to Non-GAAP Financial Targets” that present such reconciliations. ABOUT ATLASSIAN Atlassian unleashes the potential of every team. Our agile & DevOps, IT service management and work management software helps teams organize, discuss, and complete shared work. The majority of the Fortune 500 and over 265,000 companies of all sizes worldwide - including NASA, Audi, Kiva, Deutsche Bank and Dropbox - rely on our solutions to help their teams work better together and deliver quality results on time. Learn more about our products, including Jira Software, Confluence and Jira Service Management at https://atlassian.com. Investor relations contact: Martin Lam, IR@atlassian.com Media contact: M-C Maple, press@atlassian.com