Exhibit 99.1

Investor Presentation

APRIL 14, 2016

0

Disclaimers

Except as otherwise indicated or unless the context otherwise requires, all references in this presentation to “we,” “our,” “us,” “QHC,” the “Company” or “Quorum Health” refer to Quorum Health Corporation and the combined business of the hospitals and related business operations, and Quorum Health Resources, LLC and its related business operations, that CHS will contribute to Quorum Health Corporation in connection with the proposed spin-off transaction. All references to “CHS“ refer to Community Health Systems, Inc. and its consolidated subsidiaries.

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 relating to, among other things, the proposed spin-off of Quorum Health by CHS and the future performance of Quorum Health. All statements in this presentation other than statements of historical fact, including statements regarding projections, expected operating results, expected timing of the completion of the spin-off transaction, the benefits of the spin-off transaction to either CHS or Quorum Health, the tax-free treatment of the spin-off transaction, the anticipated management of Quorum Health, the market position of Quorum Health and other events that depend upon or refer to future events or conditions or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “thinks,” and similar expressions, are forward looking statements. Although we believe that these forward looking statements are based on reasonable assumptions, these assumptions are inherently subject to significant risks, uncertainties and contingencies, which are difficult or impossible to predict accurately and are beyond our control. Accordingly, there can be no assurance that the proposed transaction or these future events will occur as anticipated, if at all, or that actual results will be as expected. A number of factors could affect the future results of Quorum Health or the healthcare industry generally and could cause Quorum Healths expected results to differ materially from those expressed in this presentation. In addition, as it relates to the proposed transaction, such differences may result from a number of factors, including but not limited to: the timing and completion of the proposed transaction; a failure to obtain necessary regulatory approvals; a failure to obtain assurances of anticipated tax treatment; a deterioration in the business or prospects of Quorum Healths or CHS business; adverse developments in Quorum Healths or CHS markets; our ability to improve the operations of acquired or existing hospitals; adverse developments in the U.S. or global capital markets, credit markets or economies generally; the risk that the benefits of the proposed transaction may not be fully realized or may take longer to realize than expected; the impact of the proposed transaction on our third-party relationships; risks associated with Quorum Healths substantial indebtedness, leverage and debt service obligations; Quorum Healths ability to successfully make acquisitions and to integrate such hospitals, or complete hospitals; and changes in regulatory, social and political conditions.

More information about these risks and other factors that may affect our operating results are set forth in Quorum Healths most recent Registration Statement on Form 10 under the captions “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements,” as well as CHS most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, copies of which may be obtained from the Investor Relations page of CHS website at www.chs.net or the Securities and Exchange Commission at www.sec.gov.

The combined operating results of Quorum Health for the year ended December 31, 2015, are not necessarily indicative of the results that may be experienced for any such future period or for any future year.

The forward-looking statements speak only as of the date of this presentation. Neither we nor CHS undertake any obligation to revise or update any of these statements, or to make any other forward looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

This presentation includes certain financial information defined as “non-GAAP financial measures” by the Securities and Exchange Commission. These measures may be different from non-GAAP financial measures used by other companies and should not be considered in isolation or as a substitute for net income, operating income, cash flows from operating, investing or financing activities or any other measure calculated in accordance with U.S. GAAP. A reconciliation of these non-GAAP measurements to the nearest comparable GAAP measure is available at the end of this presentation.

1

Spin-Off Overview

Community Health Systems (_CHS_) is spinning off a group of 38

hospitals and Quorum Health Resources, a leading hospital

management advisory and consulting services business (collectively,

_Quorum Health_ or _QHC_)

Transaction intended to qualify as a tax-free distribution to CHS and its

Proposed stockholders

Transaction

NYSE ticker: QHC

Spin-off expected to be completed April 29, 2016

When Issued Date: April 20, 2016

Record Date: April 22, 2016

1 QHC common share for each 4 CHS common shares via a special

distribution to CHS shareholders

Distribution Following the distribution, current CHS shareholders will own shares in

Process both CHS and QHC

[Graphic Appears Here]

Number of CHS shares owned by each shareholder will not change as a

result of this distribution

2

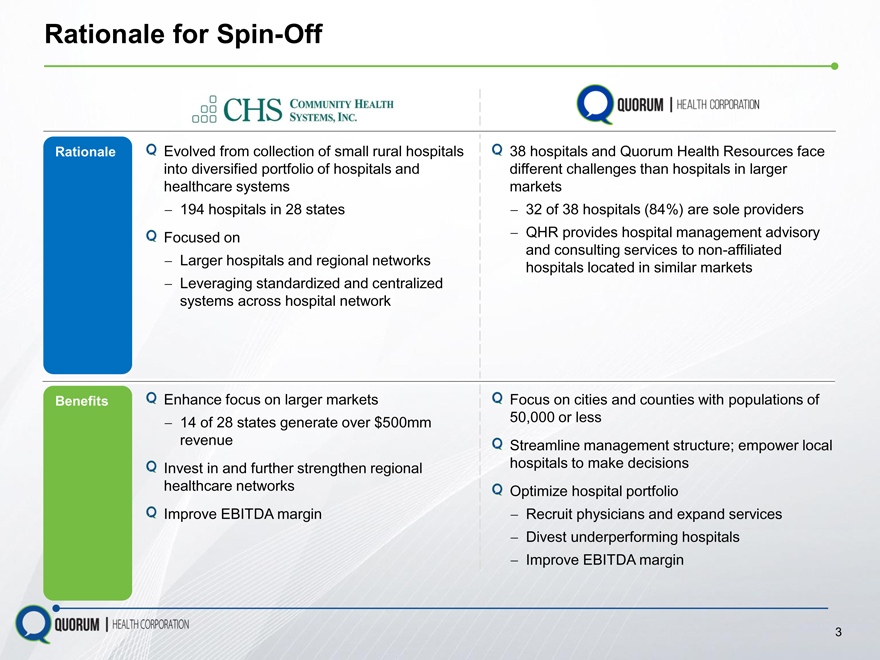

Rationale for Spin-Off

Rationale Evolved from collection of small rural hospitals 38 hospitals and Quorum Health Resources face

into diversified portfolio of hospitals and different challenges than hospitals in larger

healthcare systems markets

194 hospitals in 28 states 32 of 38 hospitals (84%) are sole providers

Focused on QHR provides hospital management advisory

and consulting services to non-affiliated

Larger hospitals and regional networks hospitals located in similar markets

Leveraging standardized and centralized

systems across hospital network

Benefits Enhance focus on larger markets Focus on cities and counties with populations of

14 of 28 states generate over $500mm 50,000 or less

revenue Streamline management structure; empower local

Invest in and further strengthen regional hospitals to make decisions

healthcare networks Optimize hospital portfolio

Improve EBITDA margin Recruit physicians and expand services

Divest underperforming hospitals

Improve EBITDA margin

3

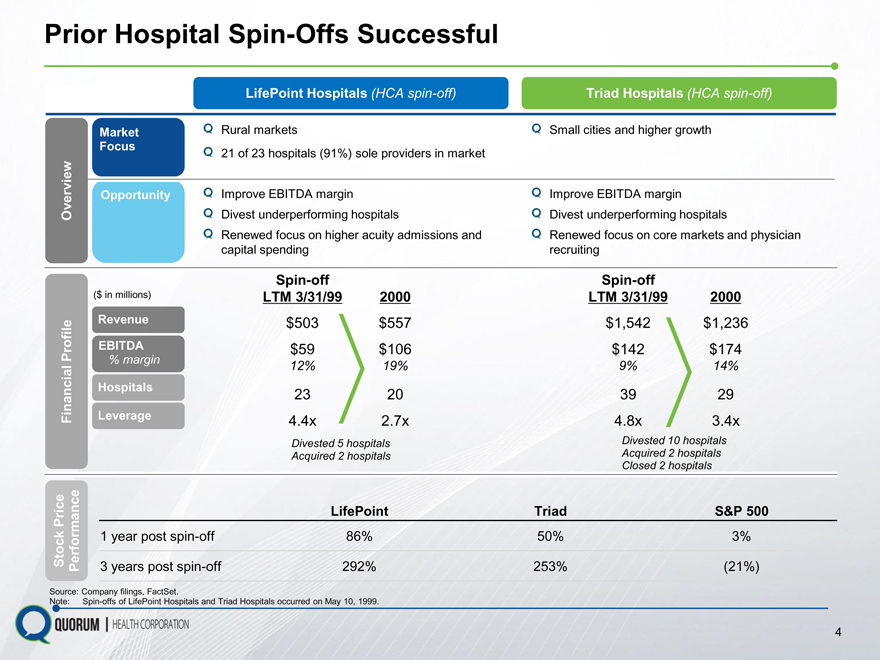

Prior Hospital Spin-Offs Successful

LifePoint Hospitals (HCA spin-off) Triad Hospitals (HCA spin-off)

Market Rural markets Small cities and higher growth

Focus 21 of 23 hospitals (91%) sole providers in market

Opportunity Improve EBITDA margin Improve EBITDA margin

Overview Divest underperforming hospitals Divest underperforming hospitals

Renewed focus on higher acuity admissions and Renewed focus on core markets and physician

capital spending recruiting

Spin-off Spin-off

($ in millions) LTM 3/31/99 2000 LTM 3/31/99 2000

Revenue $503 $ 557 $1,542 $1,236

EBITDA $59 $106 $142 $174

% margin 12% 19% 9% 14%

Hospitals 23 20 39 29

Financial Profile Leverage 4.4x 2.7x 4.8x 3.4x

Divested 5 hospitals Divested 10 hospitals

Acquired 2 hospitals Acquired 2 hospitals

Closed 2 hospitals

LifePoint Triad S&P 500

1 year post spin-off 86% 50% 3%

Stock Price Performance 3 years post spin-off 292% 253%(21%)

Source: Company filings, FactSet.

Note: Spin-offs of LifePoint Hospitals and Triad Hospitals occurred on May 10, 1999.

4

Company Overview

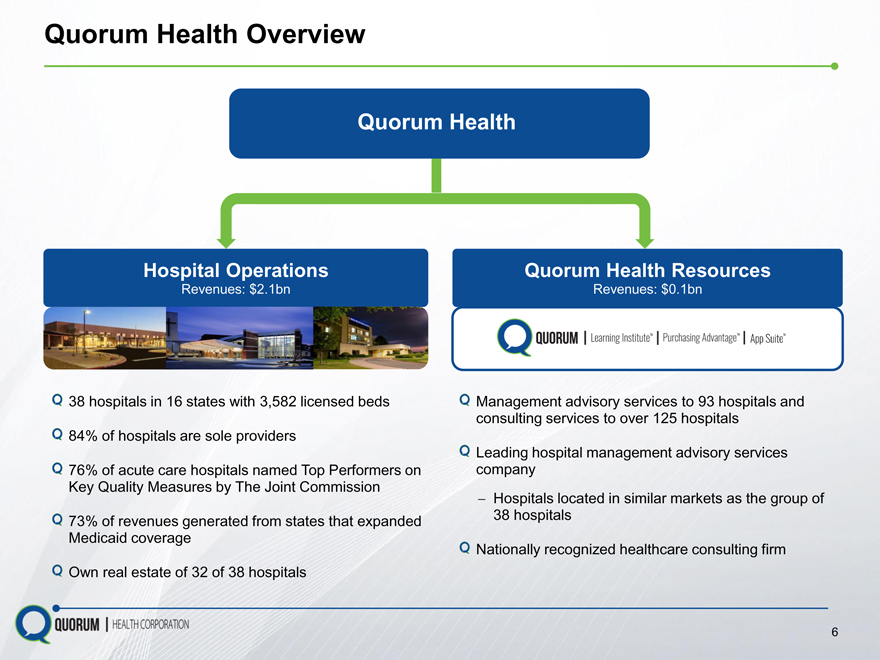

Quorum Health Overview

Quorum Health

Hospital Operations Quorum Health Resources

Revenues: $2.1bn Revenues: $0.1bn

38 hospitals in 16 states with 3,582 licensed beds Management advisory services to 93 hospitals and

consulting services to over 125 hospitals

84% of hospitals are sole providers

Leading hospital management advisory services

76% of acute care hospitals named Top Performers on company

Key Quality Measures by The Joint Commission

Hospitals located in similar markets as the group of

73% of revenues generated from states that expanded 38 hospitals

Medicaid coverage

Nationally recognized healthcare consulting firm

Own real estate of 32 of 38 hospitals

6

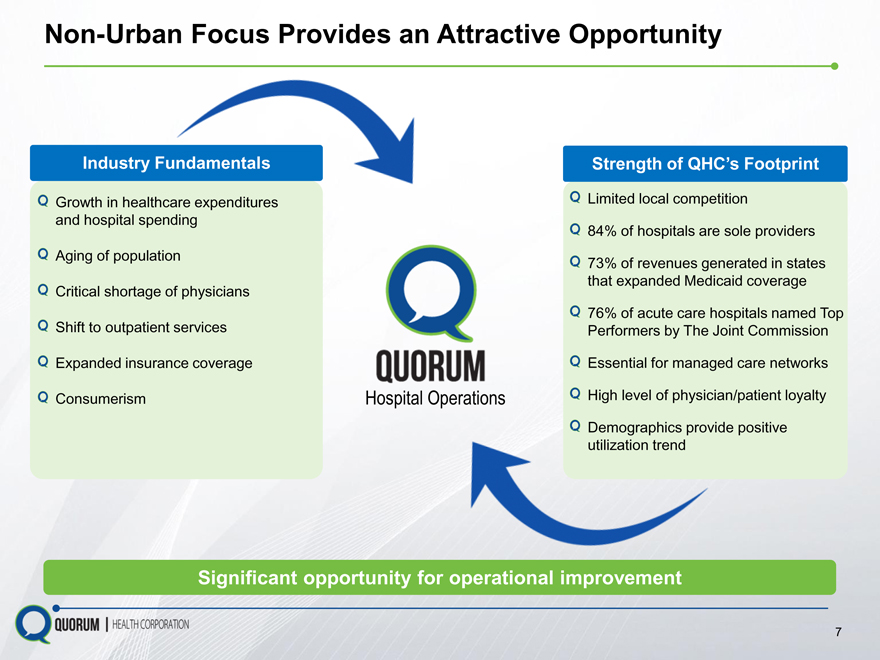

Non-Urban Focus Provides an Attractive Opportunity

Industry

Growth in health and hospital spending

Aging of population

Critical shortage of physicians Shift to outpatient services Expanded insurance coverage Consumerism

Strength of QHCs Footprint

Limited local competition

84% of hospitals are sole providers

73% of revenues generated in states

that expanded Medicaid coverage

76% of acute care hospitals named Top

Performers by The Joint Commission

Essential for managed care networks

Hospital Operations High level of physician/patient loyalty

positive

Significant opportunity for operational improvement

7

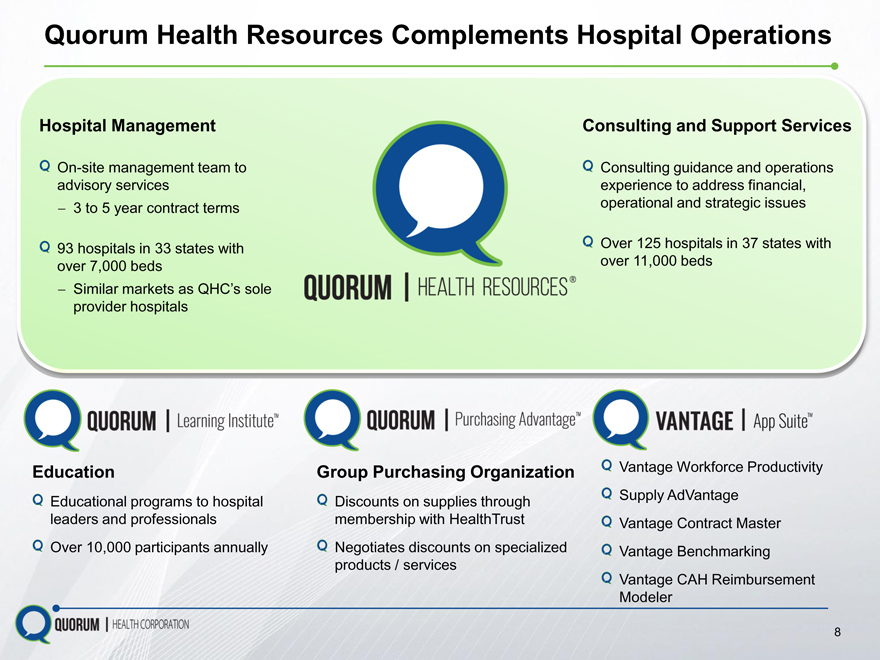

Quorum Health Resources Complements Hospital Operations

Hospital Management

On-site management team to advisory services 3 to 5 year contract terms

93 hospitals in 33 states with over 7,000 beds

Similar markets as QHCs sole

provider hospitals

Education

Educational programs to hospital leaders and professionals Over 10,000 participants annually

Consulting and Support Services

Consulting guidance and operations experience to address financial, operational and strategic issues

Over 125 hospitals in 37 states with over 11,000 beds

Group Purchasing Organization Vantage Workforce Productivity

Discounts on supplies through Supply AdVantage

membership with HealthTrust Vantage Contract Master

Negotiates discounts on specialized Vantage Benchmarking

products / services

Vantage CAH Reimbursement

Modeler

8

Our Competitive Strengths

Diversified Portfolio of

Leading Market Share Well-Positioned Assets

Track Record of Clinical Dedicated and

Experienced

Excellence Leadership Team

9

Leading Market Share

Cities and counties with populations

of 50,000 or less

Medically underserved communities 84% of

hospitals

Essential for managed care are sole

networks providers

Demographics drive demand for

outpatient services

10

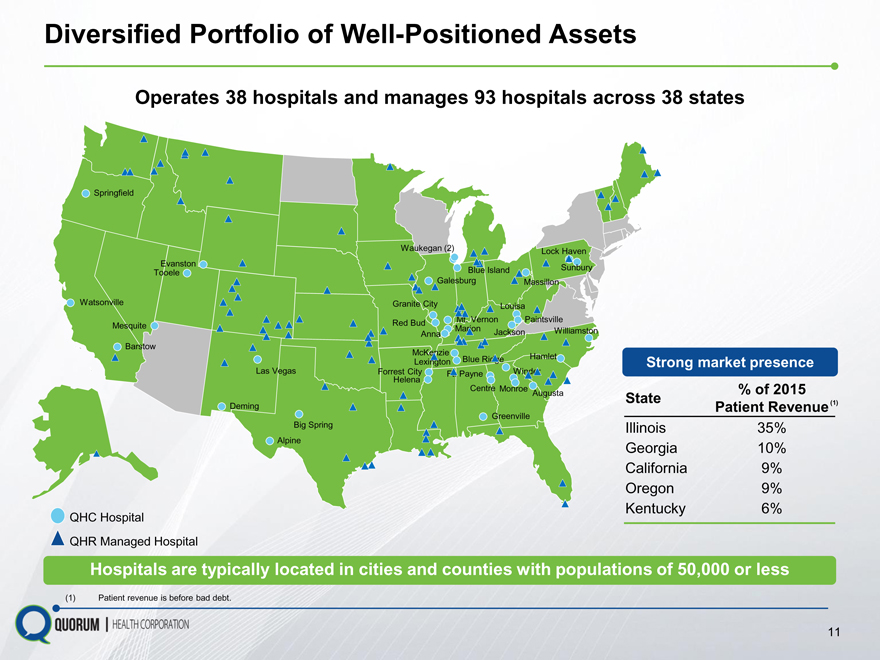

Diversified Portfolio of Well-Positioned Assets

Operates 38 hospitals and manages 93 hospitals across 38 states

Springfield

Waukegan (2) Lock Haven

Evanston

Tooele Blue Island Sunbury

Galesburg Massillon

Watsonville Granite City Louisa

Mt. Vernon Paintsville

Mesquite Red Bud Anna Marion Jackson Williamston

Barstow

McKenzie

Lexington Blue Ridge Hamlet Strong market presence

Las Vegas Forrest City Ft. Payne Winder

Helena

Centre Monroe% of 2015

Augusta State

Deming Patient Revenue (1)

Greenville

Big Spring Illinois 35%

Alpine

Georgia 10%

California 9%

Oregon 9%

Kentucky 6%

QHC Hospital

QHR Managed Hospital

Hospitals are typically located in cities and counties with populations of 50,000 or less

(1) Patient revenue is before bad debt.

11

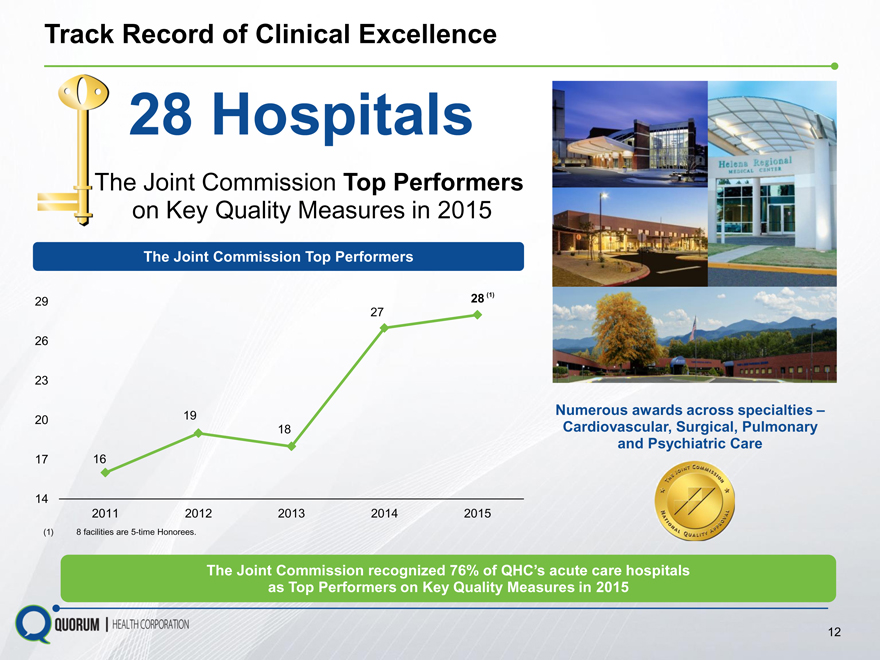

Track Record of Clinical Excellence

28 Hospitals

The Joint Commission Top Performers

on Key Quality Measures in 2015

The Joint Commission Top Performers

29 28 (1)

27

26

23

Numerous awards across specialties

20 19 18 Cardiovascular, Surgical, Pulmonary

and Psychiatric Care

17 16

14

2011 2012 2013 2014 2015

(1) 8 facilities are 5-time Honorees.

The Joint Commission recognized 76% of QHCs acute care hospitals

as Top Performers on Key Quality Measures in 2015

12

Experienced Leadership Team

Tom Miller Michael Culotta Martin Smith

Chief Executive Officer Chief Financial Officer EVP, Operations

President, Division V Operations, CHS Vice President, Investor Relations, CHS President, Division III Operations, CHS

President & CEO, Lutheran Health Network CFO, PharMerica (NYSE: PMC) and CEO, Pottstown Memorial Medical Center

LifePoint Hospitals (NYSE: LPNT)

34 years of experience 24 years of experience

39 years of experience

Proven track record successfully building and growing acute care hospital companies

13

Our Business Strategy

Build a portfolio of high- Expand breadth of

quality hospitals and services

related facilities

Improve patient safety and Improve operating and

quality of care financial performance

14

Build a Portfolio of High-Quality Hospitals and Facilities

Local community and management teams

Physician and clinical leadership groups

Facility-specific operating and marketing strategies

Sole provider in over 84% of our hospitals markets

76% of acute care hospitals named Top Performers by The Joint Commission

Focused on establishing strong community relationships and delivering high-quality healthcare services

15

Expand Breadth of Services

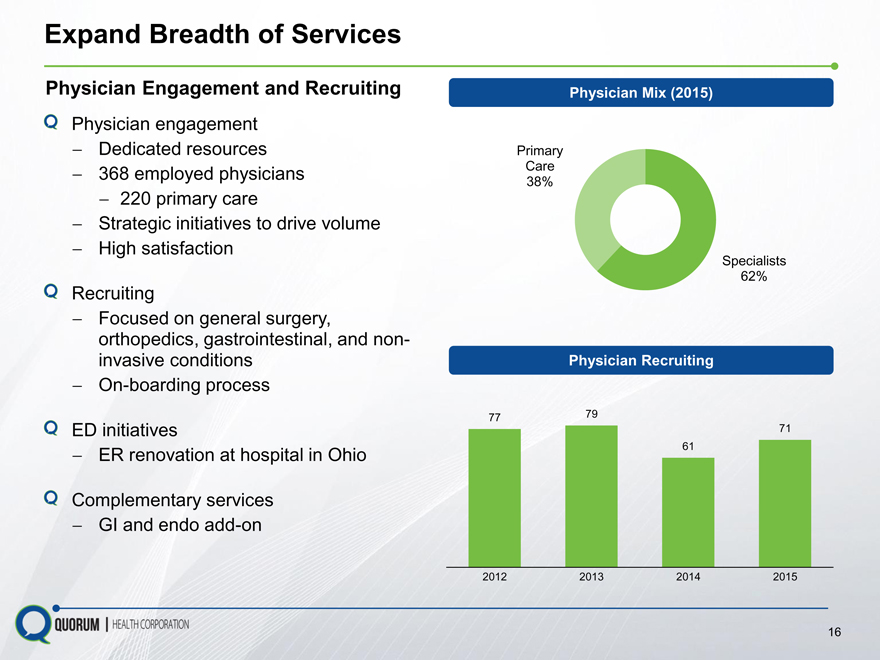

Physician Engagement and Recruiting

Physician engagement Dedicated resources 368 employed physicians

220 primary care

Strategic initiatives to drive volume

High satisfaction

Recruiting

Focused on general surgery, orthopedics, gastrointestinal, and non-invasive conditions On-boarding process

ED initiatives

ER renovation at hospital in Ohio

Complementary services GI and endo add-on

Physician Mix (2015)

Primary

Care

38%

Specialists

62%

Physician Recruiting

77 79

71

61

2012 2013 2014 2015

16

Expand Breadth of Services

Facility Expansion in Springfield, Oregon (Greater Eugene Area)

Building new patient tower

Increasing ADC by ~25%

All private rooms

Expanding surgical capacity

Cardiovascular services and vascular

surgery

Increase market share

Construction costs of ~$88 million

Completion expected in 2017

17

Disciplined Approach to Acquisitions and Divestitures

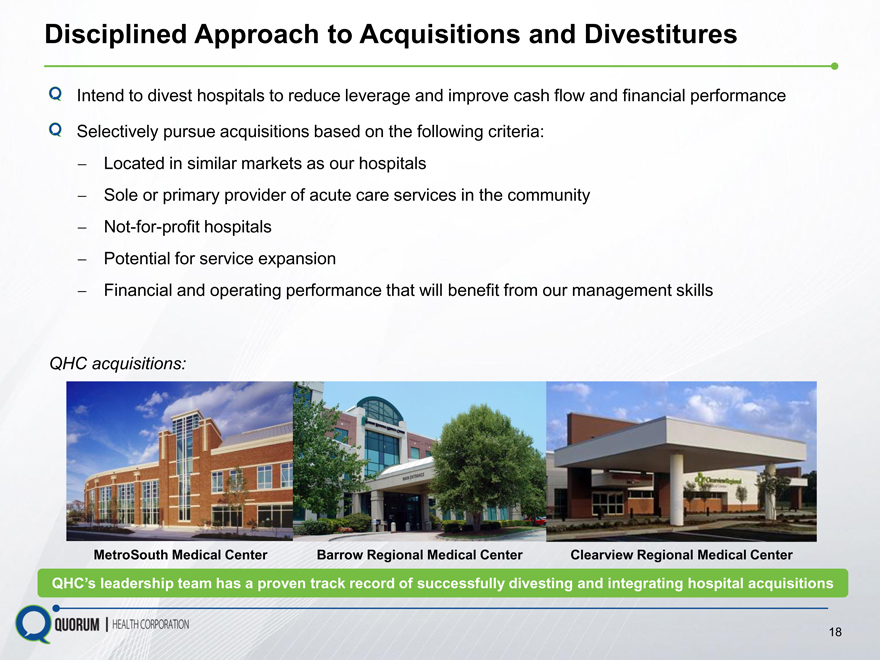

Intend to divest hospitals to reduce leverage and improve cash flow and financial performance

Selectively pursue acquisitions based on the following criteria:

Located in similar markets as our hospitals

Sole or primary provider of acute care services in the community

Not-for-profit hospitals

Potential for service expansion

Financial and operating performance that will benefit from our management skills

QHC acquisitions:

MetroSouth Medical Center

Barrow Regional Medical Center

Clearview Regional Medical Center

QHCs leadership team has a proven track record of successfully divesting and integrating hospital acquisitions

18

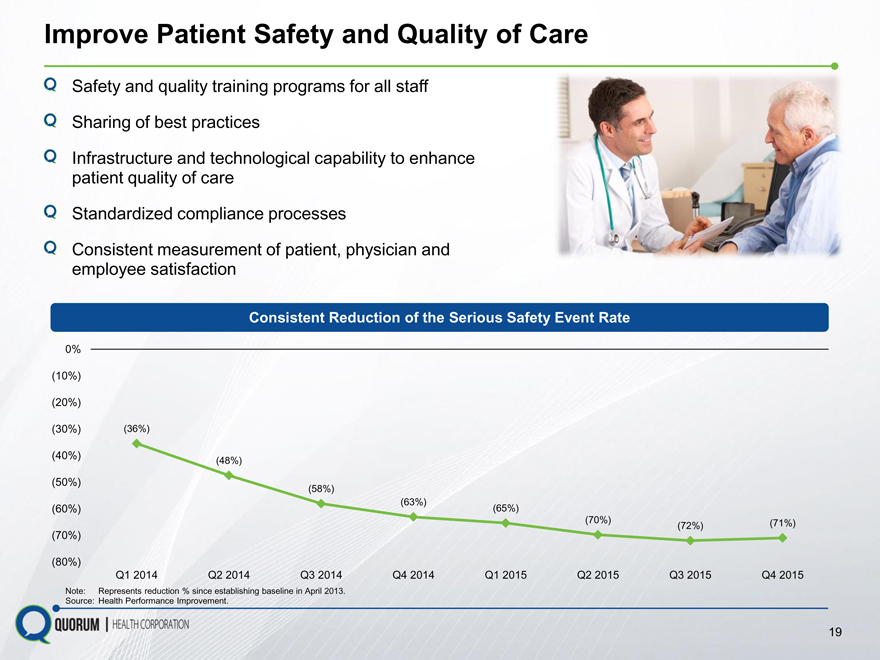

Improve Patient Safety and Quality of Care

Safety and quality training programs for all staff

Sharing of best practices

Infrastructure and technological capability to enhance patient quality of care

Standardized compliance processes

Consistent measurement of patient, physician and employee satisfaction

Consistent Reduction of the Serious Safety Event Rate

0%

(10%)

(20%)

(30%)(36%)

(40%)(48%)

(50%)(58%)

(63%)

(60%)(65%)

(70%)(72%)(71%)

(70%)

(80%)

Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015

Note: Represents reduction % since establishing baseline in April 2013.

Source: Health Performance Improvement.

19

Improve Operating and Financial Performance

Hospital-specific

strategic initiatives

Optimize hospital Growth in outpatient

portfolio services

Cost control

initiatives

Reducing operating costs and improving operations should generate increased cash flow

20

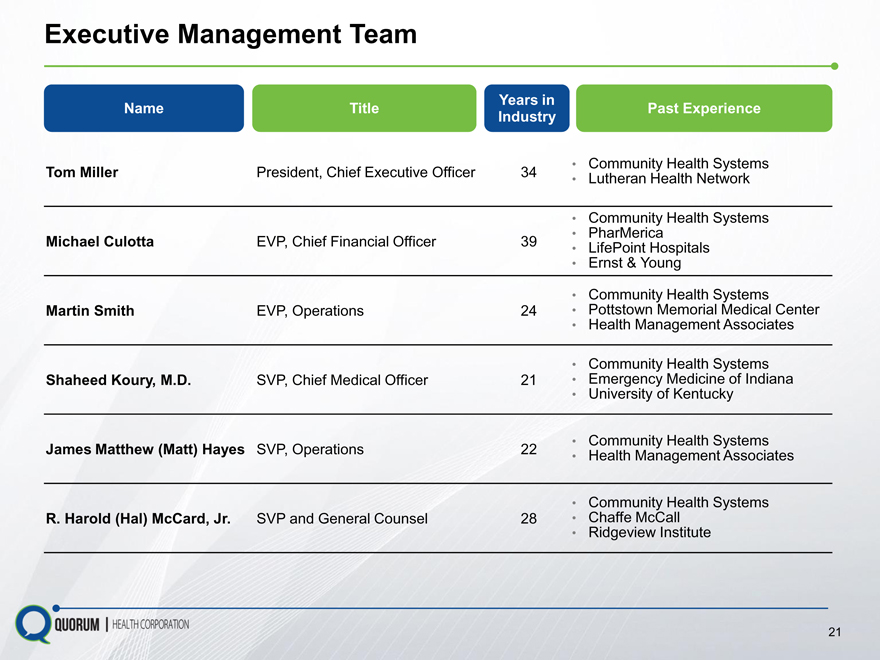

Executive Management Team

Years in

Name Title Past Experience Industry

Community Health Systems

Tom Miller President, Chief Executive Officer 34 Lutheran Health Network

Community Health Systems

PharMerica

Michael Culotta EVP, Chief Financial Officer 39 LifePoint Hospitals

Ernst & Young

Community Health Systems

Martin Smith EVP, Operations 24 Pottstown Memorial Medical Center

Health Management Associates

Community Health Systems

Shaheed Koury, M.D. SVP, Chief Medical Officer 21 Emergency Medicine of Indiana

University of Kentucky

Community Health Systems

James Matthew (Matt) Hayes SVP, Operations 22 Health Management Associates

Community Health Systems

R. Harold (Hal) McCard, Jr. SVP and General Counsel 28 Chaffe McCall

Ridgeview Institute

21

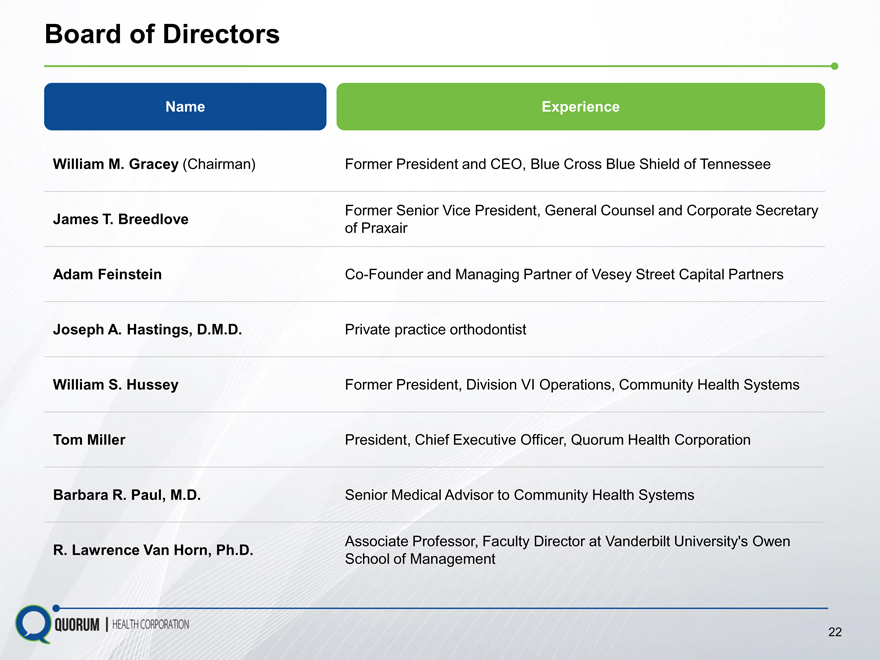

Board of Directors

Name Experience

William M. Gracey (Chairman) Former President and CEO, Blue Cross Blue Shield of Tennessee

James T. Breedlove Former Senior Vice President, General Counsel and Corporate Secretary

of Praxair

Adam Feinstein Co-Founder and Managing Partner of Vesey Street Capital Partners

Joseph A. Hastings, D.M.D. Private practice orthodontist

William S. Hussey Former President, Division VI Operations, Community Health Systems

Tom Miller President, Chief Executive Officer, Quorum Health Corporation

Barbara R. Paul, M.D. Senior Medical Advisor to Community Health Systems

Associate Professor, Faculty Director at Vanderbilt University’s Owen

R. Lawrence Van Horn, Ph.D. School of Management

22

Financial Summary

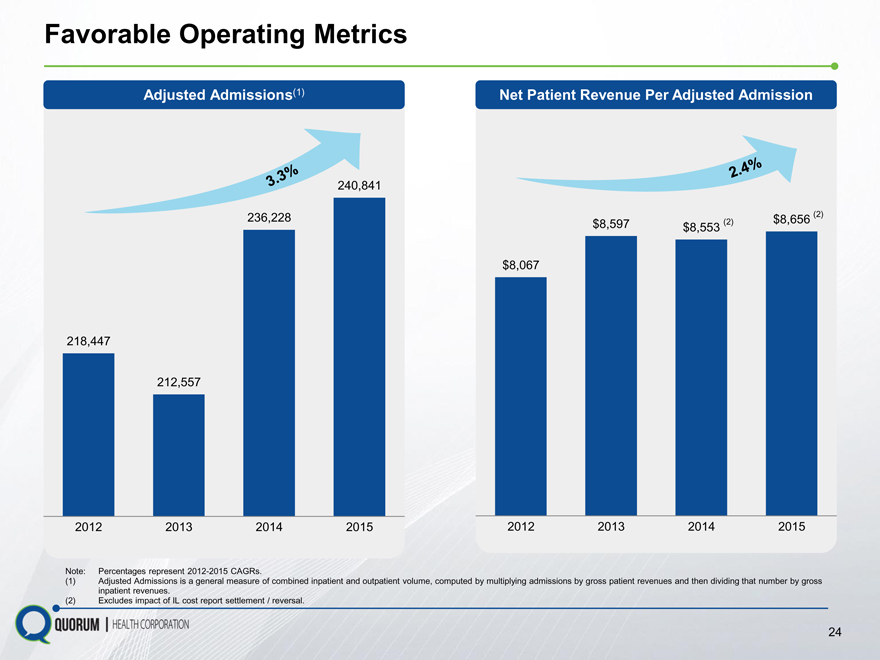

Favorable Operating Metrics

Adjusted Admissions(1)

Net Patient Revenue Per Adjusted Admission

240,841

236,228 $8,597 $8,553 (2) $8,656 (2)

$8,067

218,447

212,557

2012 2013 2014 2015 2012 2013 2014 2015

Note: Percentages represent 2012-2015 CAGRs.

Adjusted Admissions is a general measure of combined inpatient and outpatient volume, computed by multiplying admissions by gross patient revenues and then dividing that number by gross inpatient revenues.

Excludes impact of IL cost report settlement / reversal.

24

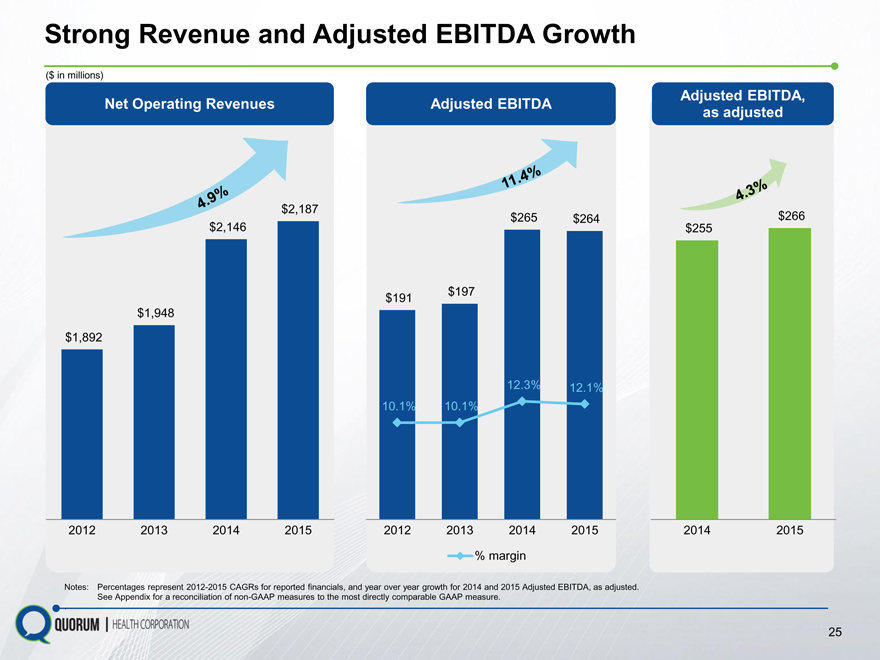

Strong Revenue and Adjusted EBITDA Growth

($ in millions)

Net Operating Revenues Adjusted EBITDA Adjusted EBITDA,

as adjusted

$2,187 $265 $264 $266

$2,146 $255

$191 $197

$1,948

$1,892

12.3% 12.1%

10.1% 10.1%

2012 2013 2014 2015 2012 2013 2014 2015 2014 2015

% margin

Notes: Percentages represent 2012-2015 CAGRs for reported financials, and year over year growth for 2014 and 2015 Adjusted EBITDA, as adjusted.

See Appendix for a reconciliation of non-GAAP measures to the most directly comparable GAAP measure.

.

25

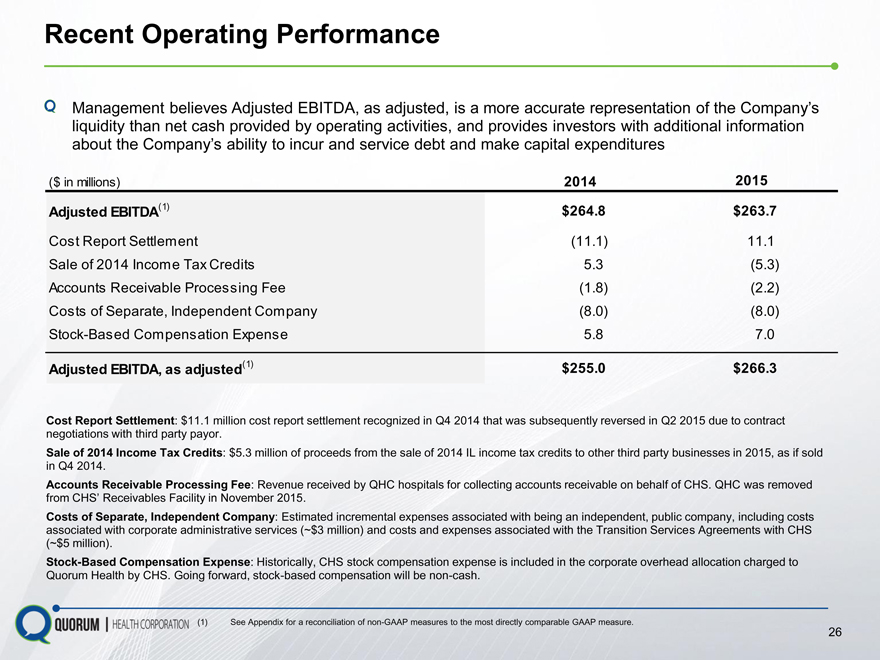

Recent Operating Performance

Management believes Adjusted EBITDA, as adjusted, is a more accurate representation of the Companys liquidity than net cash provided by operating activities, and provides investors with additional information about the Companys ability to incur and service debt and make capital expenditures

($ in millions) 2014 2015

Adjusted EBITDA(1) $ 264.8 $ 263.7

Cost Report Settlement(11.1) 11.1

Sale of 2014 Income Tax Credits 5.3(5.3)

Accounts Receivable Processing Fee(1.8)(2.2)

Costs of Separate, Independent Company(8.0)(8.0)

Stock-Based Compensation Expense 5.8 7.0

Adjusted EBITDA, as adjusted(1) $ 255.0 $ 266.3

Losses from Intended Hospital Divestitures 7.7

that was subsequently reversed in Q2 2015 due to contract

Adjusted EBITDA, as adjusted and after intended divestitures (1) $ 274.0

Sale of 2014 Income Tax Credits: $5.3 million of proceeds from the sale of 2014 IL income tax credits to other third party businesses in 2015, as if sold in Q4 2014.

Accounts Receivable Processing Fee: Revenue received by QHC hospitals for collecting accounts receivable on behalf of CHS. QHC was removed from CHS Receivables Facility in November 2015.

Costs of Separate, Independent Company: Estimated incremental expenses associated with being an independent, public company, including costs associated with corporate administrative services (~$3 million) and costs and expenses associated with the Transition Services Agreements with CHS (~$5 million).

Stock-Based Compensation Expense: Historically, CHS stock compensation expense is included in the corporate overhead allocation charged to Quorum Health by CHS. Going forward, stock-based compensation will be non-cash.

(1) See Appendix for a reconciliation of non-GAAP measures to the most directly comparable GAAP measure.

26

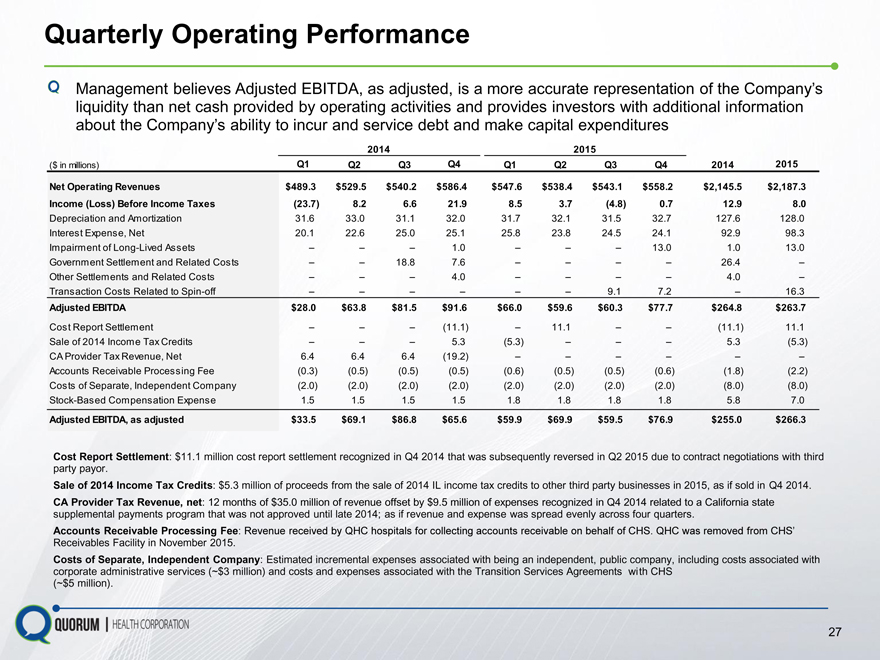

Quarterly Operating Performance

Management believes Adjusted EBITDA, as adjusted, is a more accurate representation of the Companys liquidity than net cash provided by operating activities and provides investors with additional information about the Companys ability to incur and service debt and make capital expenditures

2014 2015

($ in millions) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015

Net Operating Revenues $489.3 $529.5 $540.2 $586.4 $547.6 $538.4 $543.1 $558.2 $2,145.5 $2,187.3

Income (Loss) Before Income Taxes(23.7) 8.2 6.6 21.9 8.5 3.7(4.8) 0.7 12.9 8.0

Depreciation and Amortization 31.6 33.0 31.1 32.0 31.7 32.1 31.5 32.7 127.6 128.0

Interest Expense, Net 20.1 22.6 25.0 25.1 25.8 23.8 24.5 24.1 92.9 98.3

Impairment of Long-Lived Assets 1.0 13.0 1.0 13.0

Government Settlement and Related Costs 18.8 7.6 26.4

Other Settlements and Related Costs 4.0 4.0

Transaction Costs Related to Spin-off 9.1 7.2 16.3

Adjusted EBITDA $28.0 $63.8 $81.5 $91.6 $66.0 $59.6 $60.3 $77.7 $264.8 $263.7

Cost Report Settlement(11.1) 11.1(11.1) 11.1

Sale of 2014 Income Tax Credits 5.3(5.3) 5.3(5.3)

CA Provider Tax Revenue, Net 6.4 6.4 6.4(19.2)

Accounts Receivable Processing Fee(0.3)(0.5)(0.5)(0.5)(0.6)(0.5)(0.5)(0.6)(1.8)(2.2)

Costs of Separate, Independent Company(2.0)(2.0)(2.0)(2.0)(2.0)(2.0)(2.0)(2.0)(8.0)(8.0)

Stock-Based Compensation Expense 1.5 1.5 1.5 1.5 1.8 1.8 1.8 1.8 5.8 7.0

Adjusted EBITDA, as adjusted $33.5 $69.1 $86.8 $65.6 $59.9 $69.9 $59.5 $76.9 $255.0 $266.3

Cost Report Settlement: $11.1 million cost report settlement recognized in Q4 2014 that was subsequently reversed in Q2 2015 due to contract negotiations with third party payor.

Sale of 2014 Income Tax Credits: $5.3 million of proceeds from the sale of 2014 IL income tax credits to other third party businesses in 2015, as if sold in Q4 2014. CA Provider Tax Revenue, net: 12 months of $35.0 million of revenue offset by $9.5 million of expenses recognized in Q4 2014 related to a California state supplemental payments program that was not approved until late 2014; as if revenue and expense was spread evenly across four quarters.

Accounts Receivable Processing Fee: Revenue received by QHC hospitals for collecting accounts receivable on behalf of CHS. QHC was removed from CHS

Receivables Facility in November 2015.

Costs of Separate, Independent Company: Estimated incremental expenses associated with being an independent, public company, including costs associated with corporate administrative services (~$3 million) and costs and expenses associated with the Transition Services Agreements with CHS

(~$5 million).

27

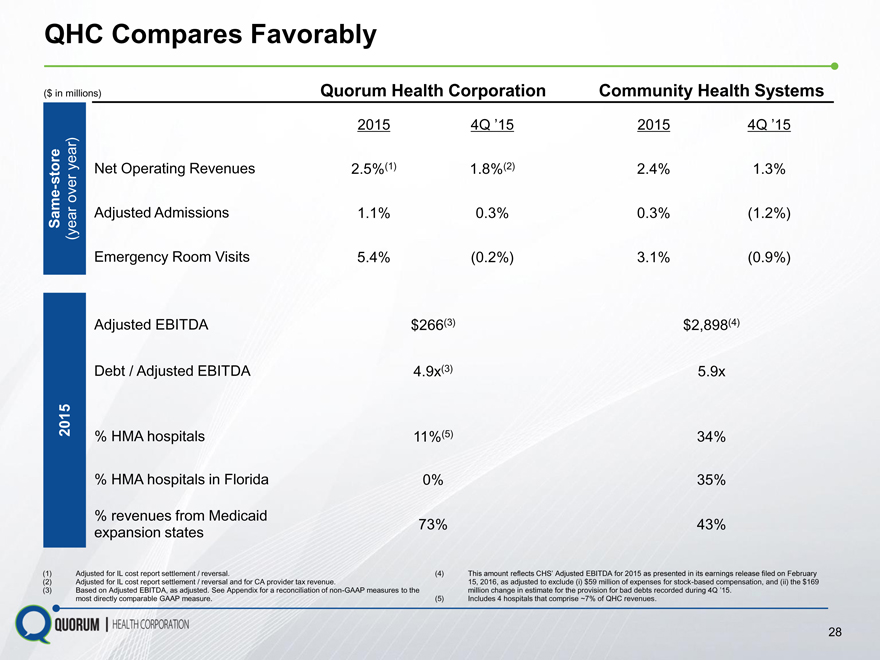

QHC Compares Favorably

($ in millions) Quorum Health Corporation Community Health Systems

2015 4Q 15 2015 4Q 15

Net Operating Revenues 2.5%(1) 1.8%(2) 2.4% 1.3%

Same—store (year over year) Adjusted Admissions 1.1% 0.3% 0.3%(1.2%)

Emergency Room Visits 5.4%(0.2%) 3.1%(0.9%)

Adjusted EBITDA $266(3) $2,898(4)

Debt / Adjusted EBITDA 4.9x(3) 5.9x

2015 % HMA hospitals 11%(5) 34%

% HMA hospitals in Florida 0% 35%

% revenues from Medicaid

expansion states 73% 43%

Adjusted for IL cost report settlement / reversal.

Adjusted for IL cost report settlement / reversal and for CA provider tax revenue.

Based on Adjusted EBITDA, as adjusted. See Appendix for a reconciliation of non-GAAP measures to the most directly comparable GAAP measure.

This amount reflects CHS Adjusted EBITDA for 2015 as presented in its earnings release filed on February

15, 2016, as adjusted to exclude (i) $59 million of expenses for stock-based compensation, and (ii) the $169 million change in estimate for the provision for bad debts recorded during 4Q 15.

Includes 4 hospitals that comprise ~7% of QHC revenues.

28

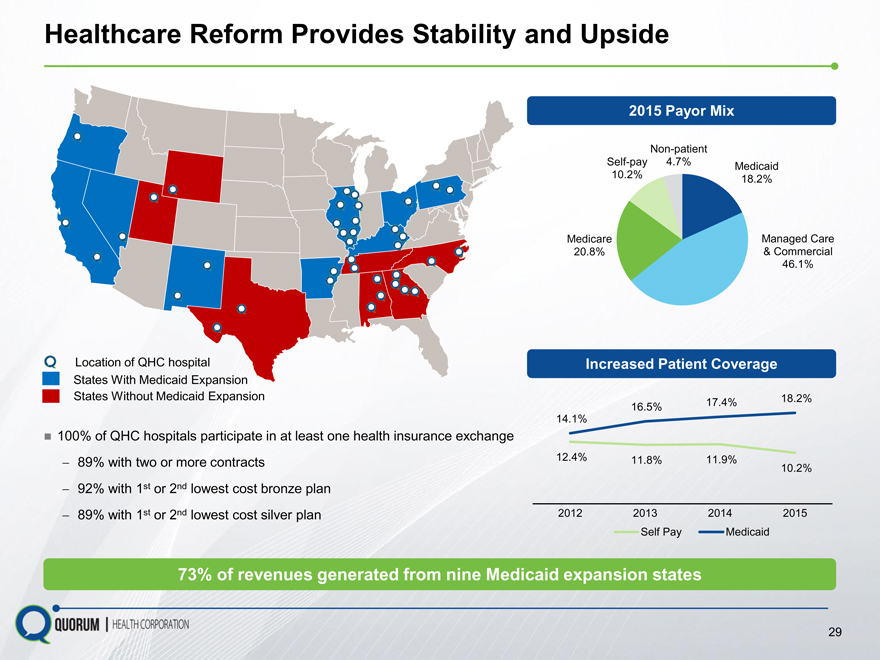

Healthcare Reform Provides Stability and Upside

Location of QHC hospital States With Medicaid Expansion States Without Medicaid Expansion

2015 Payor Mix

Non-patient

Self-pay 4.7% Medicaid

10.2% 18.2%

Medicare Managed Care

20.8% & Commercial

46.1%

100% of QHC hospitals participate in at least one health insurance exchange

89% with two or more contracts

92% with 1st or 2nd lowest cost bronze plan

89% with 1st or 2nd lowest cost silver plan

Increased Patient Coverage

17.4% 18.2%

16.5%

14.1%

12.4% 11.8% 11.9%

10.2%

2012 2013 2014 2015

Self Pay Medicaid

73% of revenues generated from nine Medicaid expansion states

29

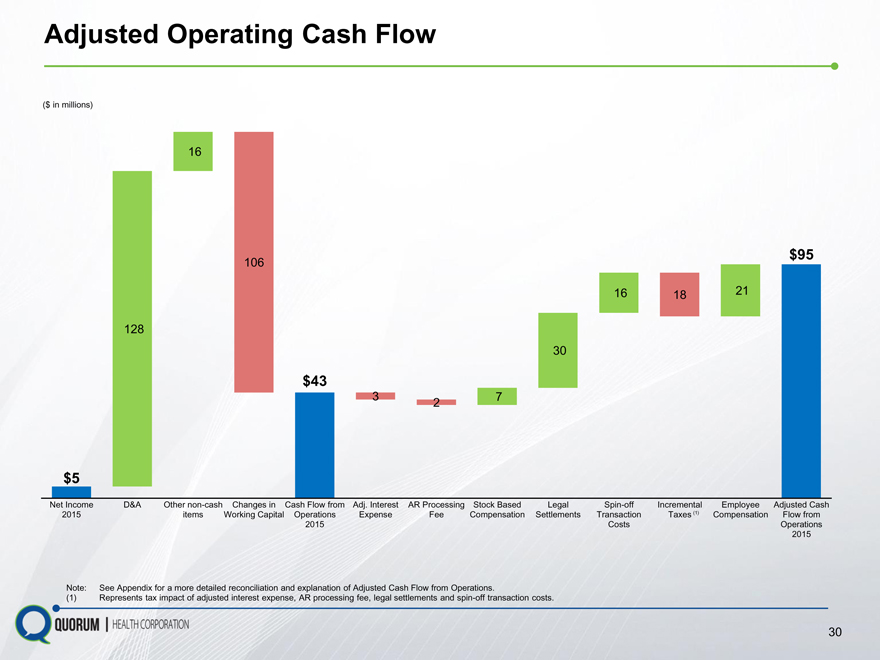

Adjusted Operating Cash Flow

($ in millions)

16

106 $95

16 18 21

128

30

$43

3 7

2

$5

Net Income D&A Other non-cash Changes in Cash Flow from Adj. Interest AR Processing Stock Based Legal Spin-off Incremental Employee Adjusted Cash

2015 items Working Capital Operations Expense Fee Compensation Settlements Transaction Taxes (1) Compensation Flow from

2015 Costs Operations

2015

Note: See Appendix for a more detailed reconciliation and explanation of Adjusted Cash Flow from Operations.

(1) Represents tax impact of adjusted interest expense, AR processing fee, legal settlements and spin-off transaction costs.

30

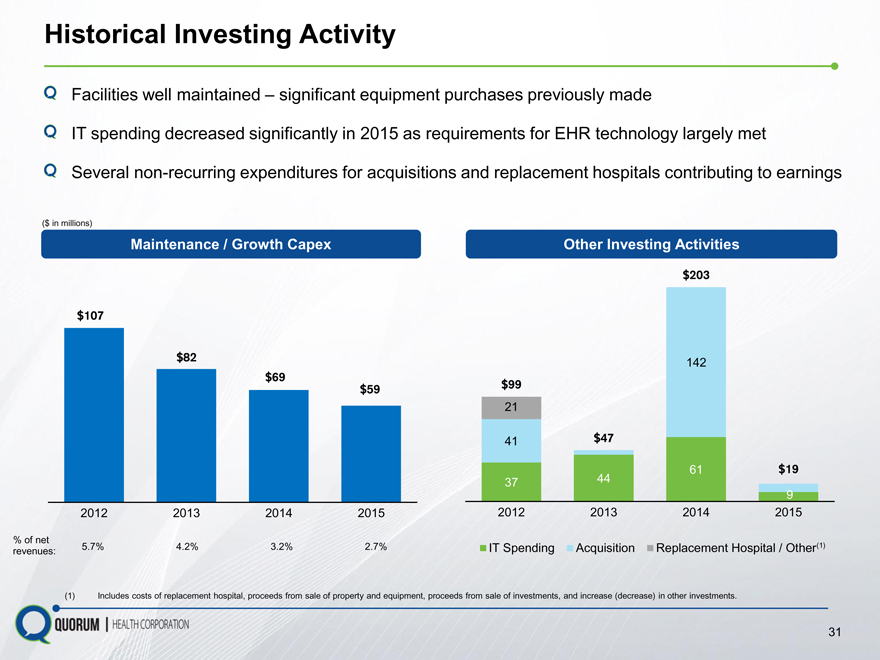

Historical Investing Activity

Facilities well maintained significant equipment purchases previously made

IT spending decreased significantly in 2015 as requirements for EHR technology largely met

Several non-recurring expenditures for acquisitions and replacement hospitals contributing to earnings

($ in millions)

Maintenance / Growth Capex

Other Investing Activities

$203

$107

$82 142

$69

$59 $99

21

41 $47

61 $19

37 44

9

2012 2013 2014 2015 2012 2013 2014 2015

% of net

revenues: 5.7% 4.2% 3.2% 2.7% IT Spending Acquisition Replacement Hospital / Other(1)

(1) Includes costs of replacement hospital, proceeds from sale of property and equipment, proceeds from sale of investments, and increase (decrease) in other investments.

31

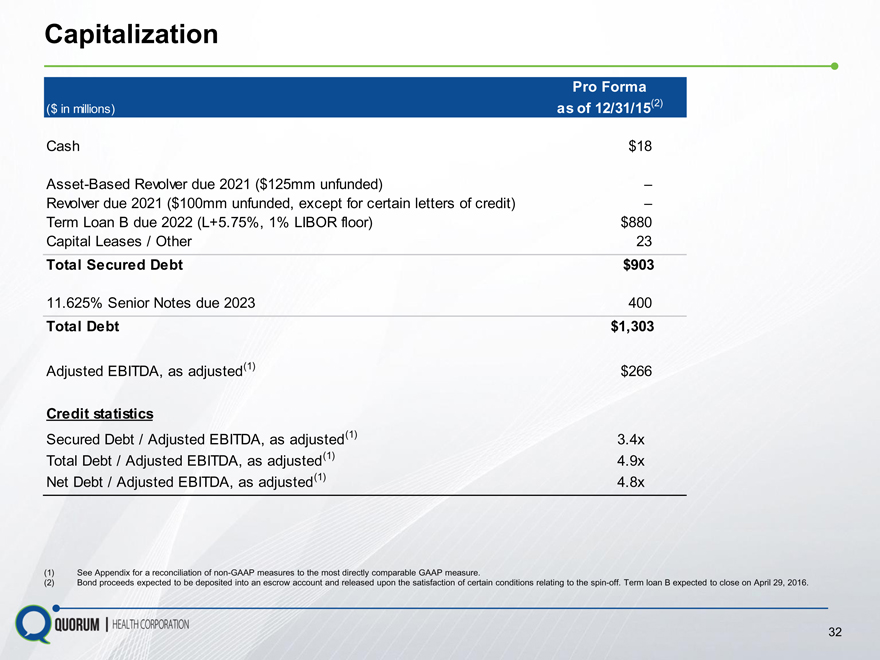

Capitalization

Pro Forma

($ in millions) as of 12/31/15(2)

Cash $18

Asset-Based Revolver due 2021 ($125mm unfunded)

Revolver due 2021 ($100mm unfunded, except for certain letters of credit)

Term Loan B due 2022 (L+5.75%, 1% LIBOR floor) $880

Capital Leases / Other 23

Total Secured Debt $903

11.625% Senior Notes due 2023 400

Total Debt $1,303

Adjusted EBITDA, as adjusted(1) $266

Credit statistics

Secured Debt / Adjusted EBITDA, as adjusted(1) 3.4x

Total Debt / Adjusted EBITDA, as adjusted(1) 4.9x

Net Debt / Adjusted EBITDA, as adjusted(1) 4.8x

See Appendix for a reconciliation of non-GAAP measures to the most directly comparable GAAP measure.

Bond proceeds expected to be deposited into an escrow account and released upon the satisfaction of certain conditions relating to the spin-off. Term loan B expected to close on April 29, 2016.

32

Separation Costs

QHC will enter into five year transition services agreements with CHS to provide administrative services for:

Information technology

Revenue cycle management for hospitals and physician practices

Payroll processing

Eligibility screening services

Collections

QHC is expected to incur administrative expenses commensurate to the cost of these services provided by CHS prior to the spin-off plus an additional ~$5 million of costs annually

QHC is expected to incur an additional ~$3 million of public company costs annually

33

Legal

As specified in the Separation and Distribution Agreement, QHC will be indemnified by CHS from all liabilities relating to

Any CHS liabilities that relate to the continuing CHS business or assets that will not be

contributed to QHC;

Any liabilities that are expressly reserved by CHS pursuant to the terms of the Separation

and Distribution Agreement, including certain legal proceedings currently outstanding or

that may arise in the future; and

Any third party claim relating to the conduct of any business, operation or activity of CHS

from and after the completion of the spin-off

QHC anticipates entering into a Corporate Integrity Agreement (CIA) with the OIG, with terms substantially similar to CHS August 2014 CIA

34

Investment Highlights

Leading market share

Experienced and Diversified portfolio of

proven management

team well-positioned assets

Opportunity to

improve operations Track record of

and financial clinical excellence

performance

35

Appendix

QHC Unaudited Supplemental Information

Non-GAAP Financial Measures

EBITDA consists of net income attributable to Quorum Health before interest, income taxes, depreciation and amortization. Adjusted EBITDA is EBITDA adjusted to exclude the impact of net income (loss) attributable to noncontrolling interests, expenses related to certain legal settlements and related costs, impairment of long-lived assets and transaction costs related to the spin-off. We have from time to time sold noncontrolling interests in certain of our subsidiaries or acquired subsidiaries with existing noncontrolling interest ownership positions. We believe that it is useful to present Adjusted EBITDA because it excludes the portion of EBITDA attributable to these third-party interests. We use Adjusted EBITDA as a measure of liquidity.

Adjusted EBITDA, as adjusted, is Adjusted EBITDA further adjusted to exclude the impacts of (i) a favorable cost report settlement that was subsequently reversed, (ii) revenue received by QHC hospitals for collecting accounts receivable on behalf of CHS in connection with CHS receivables facility prior to our termination of participation in November 2015, and (iii) stock-based compensation expense, which is a non-cash item, and include the impacts of (x) the proceeds from the sale of 2014 income tax credits to other third party businesses as if those credits were sold in 2014 and (y) estimated incremental expenses associated with being an independent, public company.

We have included these financial measures because we believe they provide investors with additional information about our ability to incur and service debt and make capital expenditures. In addition, we believe that analysts and rating agencies consider these measures useful. Our (i) Adjusted EBITDA and (ii) Adjusted EBITDA, as adjusted, are not measurements of financial performance or liquidity under GAAP. None of these measures should be considered in isolation or as a substitute for net income, operating income, cash flows from operating, investing or financing activities, or any other measure calculated in accordance with GAAP. The items excluded from (i) Adjusted EBITDA and (ii) Adjusted EBITDA, as adjusted, are significant components in understanding and evaluating our operating and financial performance and liquidity. Our calculation of (i) Adjusted EBITDA and (ii) Adjusted EBITDA, as adjusted, may not be comparable to similarly titled measures reported by other companies. A reconciliation of these non-GAAP measurements to the nearest GAAP measure is provided.

37

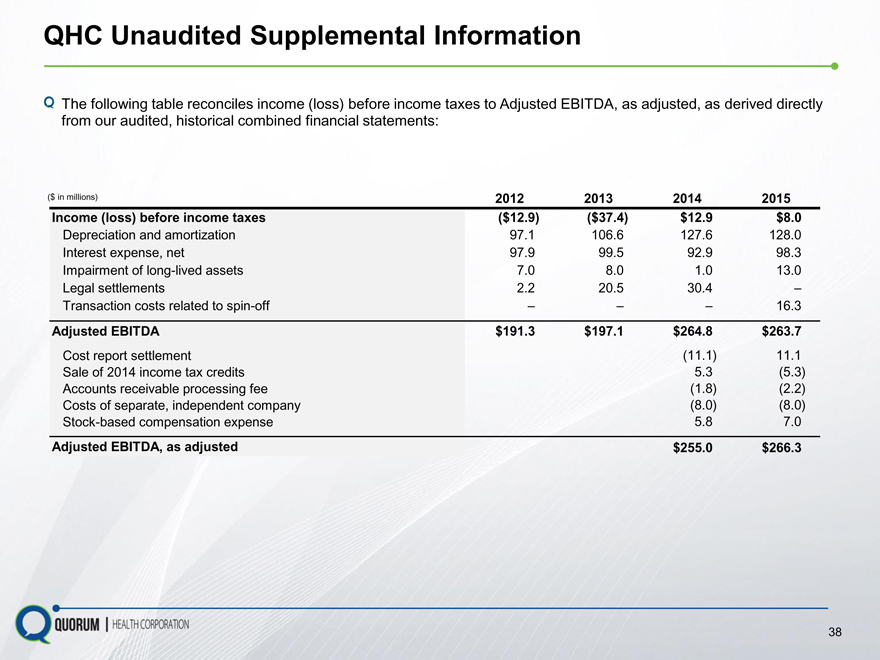

QHC Unaudited Supplemental Information

The following table reconciles income (loss) before income taxes to Adjusted EBITDA, as adjusted, as derived directly from our audited, historical combined financial statements:

($ in millions) 2012 2013 2014 2015

Income (loss) before income taxes($12.9)($37.4) $12.9 $8.0

Depreciation and amortization 97.1 106.6 127.6 128.0

Interest expense, net 97.9 99.5 92.9 98.3

Impairment of long-lived assets 7.0 8.0 1.0 13.0

Legal settlements 2.2 20.5 30.4

Transaction costs related to spin-off 16.3

Adjusted EBITDA $191.3 $197.1 $264.8 $263.7

Cost report settlement(11.1) 11.1

Sale of 2014 income tax credits 5.3(5.3)

Accounts receivable processing fee(1.8)(2.2)

Costs of separate, independent company(8.0)(8.0)

Stock-based compensation expense 5.8 7.0

Adjusted EBITDA, as adjusted $255.0 $266.3

38

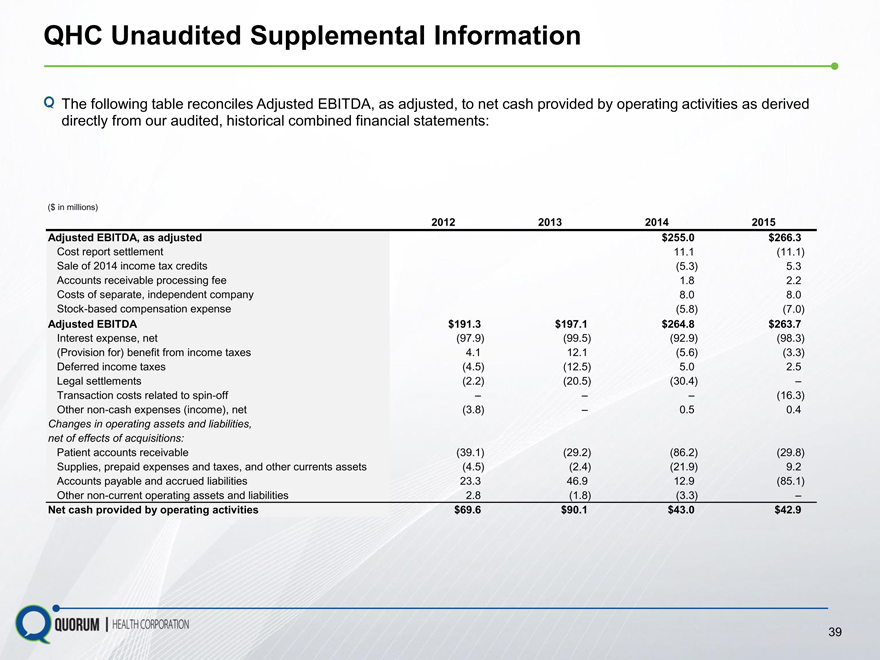

QHC Unaudited Supplemental Information

The following table reconciles Adjusted EBITDA, as adjusted, to net cash provided by operating activities as derived directly from our audited, historical combined financial statements:

($ in millions)

2012 2013 2014 2015

Adjusted EBITDA, as adjusted $255.0 $266.3

Cost report settlement 11.1(11.1)

Sale of 2014 income tax credits(5.3) 5.3

Accounts receivable processing fee 1.8 2.2

Costs of separate, independent company 8.0 8.0

Stock-based compensation expense(5.8)(7.0)

Adjusted EBITDA $191.3 $197.1 $264.8 $263.7

Interest expense, net(97.9)(99.5)(92.9)(98.3)

(Provision for) benefit from income taxes 4.1 12.1(5.6)(3.3)

Deferred income taxes(4.5)(12.5) 5.0 2.5

Legal settlements(2.2)(20.5)(30.4)

Transaction costs related to spin-off(16.3)

Other non-cash expenses (income), net(3.8) 0.5 0.4

Changes in operating assets and liabilities,

net of effects of acquisitions:

Patient accounts receivable(39.1)(29.2)(86.2)(29.8)

Supplies, prepaid expenses and taxes, and other currents assets(4.5)(2.4)(21.9) 9.2

Accounts payable and accrued liabilities 23.3 46.9 12.9(85.1)

Other non-current operating assets and liabilities 2.8(1.8)(3.3)

Net cash provided by operating activities $69.6 $90.1 $43.0 $42.9

39

Adjusted Cash Flow from Operations

($ in millions)

2012

2013

2014

2015

Net Cash Provided by Operating Activities

Adjusted Interest Expense, Net (1)

Accounts Receivable Processing Fee(1)

Stock-Based Compensation Expense

Baker Settlement Paid(1)

DOJ Settlement Paid(1)

QHR Legal Settlements Paid(1)

BNA & SSI Settlements Received(1)

Transaction Costs Related to Spin-off(1)

Employee Compensation

Adj. Net Cash Provided by Operating Activities

A. Adjusted Interest Expense, Net: Adjusted cash interest expense based on proposed capital structure and for the removal of CHS Receivables Facility in November 2015.

B. Accounts Receivable Processing Fee: Revenue received by QHC hospitals for collecting accounts receivable on behalf of

CHS. QHC was removed from CHS Receivables Facility in

November 2015.

C. Stock-Based Compensation Expense: Historically, CHS stock compensation expense is included in the corporate overhead allocation charged to Quorum Health by CHS. Going forward, stock-based compensation will be non-cash.

D. Baker Settlement Paid: CHS settled this matter in February 2015. The portion of the settlement allocated to QHC is $26.4.

(1) Represents amounts net of tax impact.

$69.6 $90.1 $43.0 $42.9

(2.0)(1.3)(4.5)(1.7)

(0.6)(0.7)(1.0)(1.3)

8.1 6.5 5.8 7.0

15.0

13.9

10.3 2.3

(8.8)

9.6

21.1

$76.6 $94.6 $57.2 $94.9

E. DOJ Settlement Paid: CHS settled this matter in August 2014. The portion of the settlement allocated to QHC is $20.5.

F. QHR Legal Settlements Paid: QHR-related legal settlements.

G. BNA & SSI Settlements Received: CHS received payment from industry-wide settlement with CMS in 2012. The portion of this settlement allocated to QHC was ($12.9) .

H. Transaction Costs Related to Spin-Off: Costs incurred related to the spin-off transaction.

I. Employee Compensation: Additional payroll period paid in 2015 compared to 2014 (27 pay periods vs. 26).

40

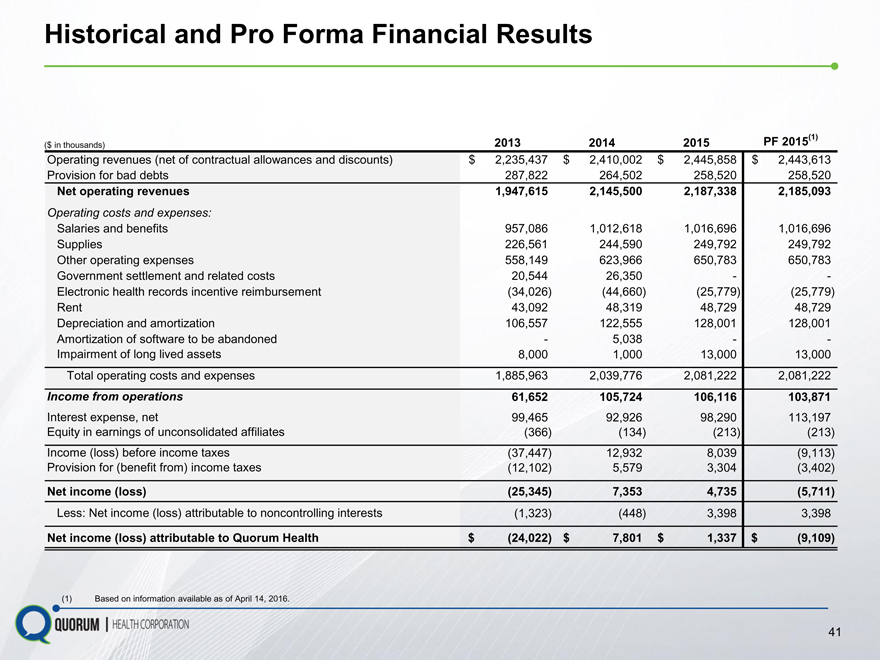

Historical and Pro Forma Financial Results

($ in thousands) 2013 2014 2015 PF 2015(1)

Operating revenues (net of contractual allowances and discounts) $ 2,235,437 $ 2,410,002 $ 2,445,858 $ 2,443,613

Provision for bad debts 287,822 264,502 258,520 258,520

Net operating revenues 1,947,615 2,145,500 2,187,338 2,185,093

Operating costs and expenses:

Salaries and benefits 957,086 1,012,618 1,016,696 1,016,696

Supplies 226,561 244,590 249,792 249,792

Other operating expenses 558,149 623,966 650,783 650,783

Government settlement and related costs 20,544 26,350 —

Electronic health records incentive reimbursement(34,026)(44,660)(25,779)(25,779)

Rent 43,092 48,319 48,729 48,729

Depreciation and amortization 106,557 122,555 128,001 128,001

Amortization of software to be abandoned—5,038 —

Impairment of long lived assets 8,000 1,000 13,000 13,000

Total operating costs and expenses 1,885,963 2,039,776 2,081,222 2,081,222

Income from operations 61,652 105,724 106,116 103,871

Interest expense, net 99,465 92,926 98,290 113,197

Equity in earnings of unconsolidated affiliates(366)(134)(213)(213)

Income (loss) before income taxes(37,447) 12,932 8,039(9,113)

Provision for (benefit from) income taxes(12,102) 5,579 3,304(3,402)

Net income (loss)(25,345) 7,353 4,735(5,711)

Less: Net income (loss) attributable to noncontrolling interests(1,323)(448) 3,398 3,398

Net income (loss) attributable to Quorum Health $(24,022) $ 7,801 $ 1,337 $(9,109)

(1) Based on information available as of April 14, 2016.

41

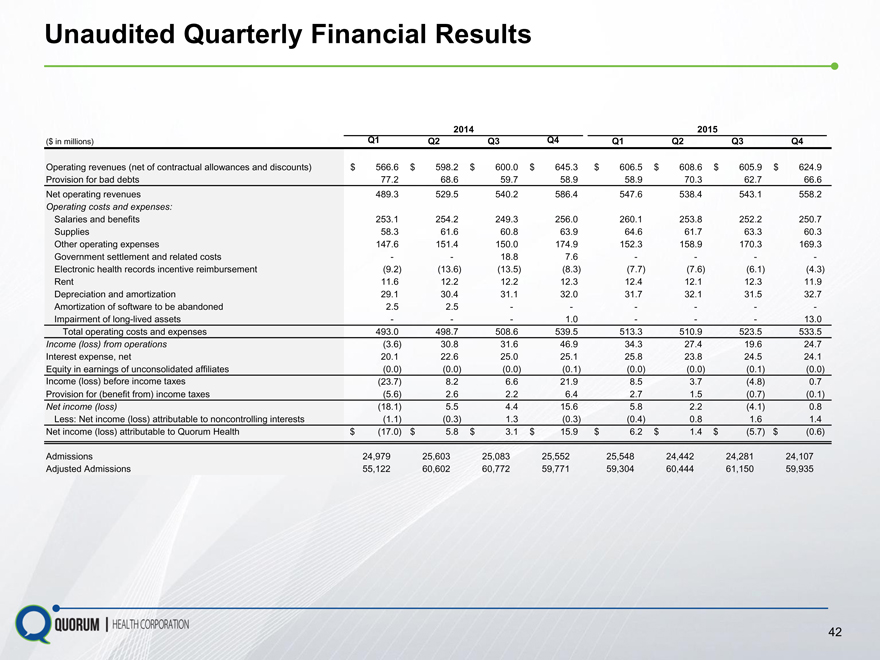

Unaudited Quarterly Financial Results

2014 2015

($ in millions) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Operating revenues (net of contractual allowances and discounts) $ 566.6 $ 598.2 $ 600.0 $ 645.3 $ 606.5 $ 608.6 $ 605.9 $ 624.9

Provision for bad debts 77.2 68.6 59.7 58.9 58.9 70.3 62.7 66.6

Net operating revenues 489.3 529.5 540.2 586.4 547.6 538.4 543.1 558.2

Operating costs and expenses:

Salaries and benefits 253.1 254.2 249.3 256.0 260.1 253.8 252.2 250.7

Supplies 58.3 61.6 60.8 63.9 64.6 61.7 63.3 60.3

Other operating expenses 147.6 151.4 150.0 174.9 152.3 158.9 170.3 169.3

Government settlement and related costs — 18.8 7.6 — —

Electronic health records incentive reimbursement(9.2)(13.6)(13.5)(8.3)(7.7)(7.6)(6.1)(4.3)

Rent 11.6 12.2 12.2 12.3 12.4 12.1 12.3 11.9

Depreciation and amortization 29.1 30.4 31.1 32.0 31.7 32.1 31.5 32.7

Amortization of software to be abandoned 2.5 2.5 — — —

Impairment of long-lived assets ——1.0 ——13.0

Total operating costs and expenses 493.0 498.7 508.6 539.5 513.3 510.9 523.5 533.5

Income (loss) from operations(3.6) 30.8 31.6 46.9 34.3 27.4 19.6 24.7

Interest expense, net 20.1 22.6 25.0 25.1 25.8 23.8 24.5 24.1

Equity in earnings of unconsolidated affiliates(0.0)(0.0)(0.0)(0.1)(0.0)(0.0)(0.1)(0.0)

Income (loss) before income taxes(23.7) 8.2 6.6 21.9 8.5 3.7(4.8) 0.7

Provision for (benefit from) income taxes(5.6) 2.6 2.2 6.4 2.7 1.5(0.7)(0.1)

Net income (loss)(18.1) 5.5 4.4 15.6 5.8 2.2(4.1) 0.8

Less: Net income (loss) attributable to noncontrolling interests(1.1)(0.3) 1.3(0.3)(0.4) 0.8 1.6 1.4

Net income (loss) attributable to Quorum Health $ (17.0) $ 5.8 $ 3.1 $ 15.9 $ 6.2 $ 1.4 $(5.7) $(0.6)

Admissions 24,979 25,603 25,083 25,552 25,548 24,442 24,281 24,107

Adjusted Admissions 55,122 60,602 60,772 59,771 59,304 60,444 61,150 59,935

42

Quorum Health Corporation