- SITE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

SiteOne Landscape Supply (SITE) CORRESPCorrespondence with SEC

Filed: 14 Oct 15, 12:00am

October 14, 2015

J. Nolan McWilliams

Attorney-Advisor

U.S. Securities and Exchange Commission

Office of Transportation and Leisure

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-7010

| Re: | SiteOne Landscape Supply, Inc. |

Amendment No. 1 to Registration Statement on Form S-1

Filed September 24, 2015

File No. 333-206444

Dear Mr. McWilliams:

This letter sets forth the responses of SiteOne Landscape Supply, Inc. (the “Registrant” or the “Company”) to the comments contained in your letter, dated October 6, 2015, relating to Amendment No. 1 to the Registration Statement on Form S-1 Filed September 24, 2015 (“Amendment No. 1”). The comments of the staff of the U.S. Securities and Exchange Commission (the “Staff”) are set forth in bold italicized text below, and the Company’s responses are set forth in plain text immediately following each comment.

The Registrant is submitting, via EDGAR, Amendment No. 2 to the Registration Statement on Form S-1 Filed September 24, 2015 (“Amendment No. 2”). Enclosed with the paper copy of this letter are two copies of a clean version of Amendment No. 2, as well as two copies of a blacklined version of Amendment No. 2, marked to show changes from Amendment No.1.

Capitalized terms used but not defined herein have the meanings assigned to them in Amendment No. 2.

| J. Nolan McWilliams | 2 | October 14, 2015 |

Summary Financial Data, page 13

| 1. | We note from your response to our prior comment 6 that you included a “Pro Forma As Adjusted” placeholder in the “Summary Financial Data” section to reflect the Refinancing, Special Cash Dividend, offering, use of proceeds and planned conversion of the CD&R Investor’s Preferred Stock on a pro forma basis. Please revise footnote (2) to separately show the impacts of these items on the calculation of pro forma earnings per share. Also please confirm whether pro forma earnings per share will reflect the use of proceeds to repay the Amended Term Loan Facility and Amended ABL Facility as initially requested in our prior comment 6. |

The Registrant has revised footnote (2) to include placeholders in response to the Staff’s comment and confirms that pro forma earnings per share will reflect the use of proceeds to repay a portion of the indebtedness under the Amended Term Loan Facility and Amended ABL Facility.

Description of Certain

Indebtedness Amended

Credit Facilities, page 117

| 2. | We note that you intend to amend your credit facilities and describe the material terms of the future facilities here. Please also disclose the interest rate of the amended facilities. In addition, when the amendments are executed please file them as exhibits to your registration statement. |

The Registrant will provide a summary description of the amended facilities, including interest rates, and file the executed amendments as exhibits to the registration statement in a subsequent amendment.

Index to Consolidated and Combined Financial

Statements Note 1. Nature of Business and Significant

Accounting Policies Basis of Financial Statement

Presentation, page F-8

| 3. | We note your response to our prior comment 15. Please provide us a detailed analysis of how you determined that this transaction was not a reverse acquisition. In your response, specifically address each of the criteria listed in ASC805-10-55-12 through 14. |

To be responsive to the Staff’s request, the Registrant has included below an assessment of each of the criteria listed in ASC 805-10-55-12 through 14. The Registrant notes, however, that the guidance in those paragraphs does not appear to apply to the acquisition by an affiliate of Clayton Dubilier & Rice, LLC (“CD&R”) as such transaction was not the combination of two businesses effected primarily by the exchange of equity interests. This detailed response is an attempt to clarify why those provisions do not appear to apply.

| J. Nolan McWilliams | 3 | October 14, 2015 |

As previously noted in the Registrant’s response to prior comment 15, the Registrant, formerly known as CD&R Landscapes Parent, Inc., was incorporated by CD&R in Delaware on October 22, 2013 to effect the acquisition of JDA Holding LLC (“JDA”), and John Deere Landscapes LLC (“JDL”), from Deere & Company (“Deere”). Upon incorporation, all of the common stock of CD&R Landscapes Parent, Inc. was issued to CD&R Landscapes Holdings, L.P., a Cayman Islands exempted limited partnership whose limited partners are investment funds managed by CD&R (the “CD&R Investor”).

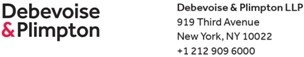

At or around the time of its initial incorporation, CD&R Landscapes Parent, Inc. also formed four wholly owned subsidiaries, CD&R Landscapes Bidco, Inc. (“Bidco”), CD&R Landscapes Midco, Inc. (“Midco”), CD&R Landscapes Merger Sub (“Merger Sub”) and CD&R Landscapes Merger Sub 2 (“Merger Sub 2”) for purposes of effecting the acquisition. At the time of formation, and at all times prior to the completion of the acquisition of JDA and JDL from Deere, each of CD&R Landscapes Parent, Inc., Bidco, Midco, Merger Sub and Merger Sub 2 was 100% indirectly owned by funds managed by the CD&R Investor; had no operations or employees of its own; and conducted no activities apart from the negotiation of financing arrangements in contemplation of the acquisition of JDA and JDL. Prior to the acquisition, Deere controlled 100% of JDA and JDL, and there was no relationship between Deere and CD&R.

| J. Nolan McWilliams | 4 | October 14, 2015 |

The respective structures of Deere and the CD&R Investor prior to the acquisition were as follows:

| J. Nolan McWilliams | 5 | October 14, 2015 |

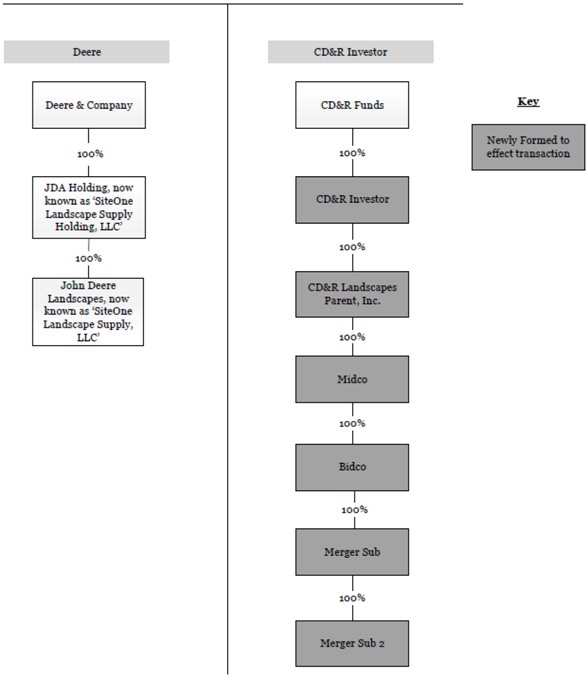

As a result of the acquisition, CD&R Landscapes Parent, Inc.’s wholly owned subsidiary BidCo acquired 100% of JDA, including its wholly-owned subsidiary JDL and affiliated company LESCO, Inc., from Deere in exchange for a combination of cash and shares of CD&R Landscapes Parent, Inc.’s common stock (the “Consideration”). The following simultaneous steps were taken to effect the acquisition:

| • | CD&R Landscapes Parent, Inc. issued to the CD&R Investor shares of its Preferred Stock, in exchange for (i) cancellation of the shares of its common stock issued to the CD&R Investor in connection with its incorporation on October 22, 2013 and (ii) $174 million in cash. |

| • | That cash was then contributed by CD&R Landscapes Parent, Inc. to MidCo, by MidCo to BidCo and by BidCo to Merger Sub. |

| • | CD&R Landscapes Parent, Inc. contributed 1,160,000 shares of its own common stock to MidCo. The common stock was then contributed by MidCo to BidCo and by BidCo to Merger Sub. |

| • | Merger Sub and Merger Sub 2 issued the ABL Facility and Term Loan for proceeds of $167 million, with BidCo as guarantor. |

| • | Merger Sub transferred the 1,160,000 shares of CD&R Landscapes Parent, Inc. common stock and $318 million in cash to Deere (comprised of $174 million from the CD&R Investor’s purchase of Preferred Stock plus $167 million from the ABL facility and the term loan facility less transaction costs incurred and paid out of these proceeds) in exchange for 100% of the interests of JDA, and subsequently merged into JDA, with JDA as the surviving entity. Merger Sub 2 then merged into JDL, with JDL as the surviving entity. |

| • | JDA and JDL assumed the role of primary obligors under the ABL Facility and Term Loan with BidCo remaining as guarantor. |

| J. Nolan McWilliams | 6 | October 14, 2015 |

The resulting ownership structure immediately following the CD&R Investor’s acquisition was as follows:

The Registrant concluded that the transaction described above met the definition of a business combination under accounting principles generally accepted in the United States (“GAAP”). The ASC Master Glossary defines a business combination as “a transaction or other event in which an acquirer obtains control of one or more businesses.” JDL met the definition of a business under ASC 805 and JDA was a holding company which owned 100% of JDL. JDL had inputs, processes and outputs; it was a substantive operating company with significant assets, liabilities, revenues, expenses and employees. Further, an acquirer obtained control of the business in the transaction. The Company concluded that Bidco was the acquirer as further detailed below.

| J. Nolan McWilliams | 7 | October 14, 2015 |

In accordance with ASC 805-10-55-10, the accounting acquirer in a business combination is the entity that obtains a controlling financial interest, as defined in ASC 810. The Registrant also considered the guidance in ASC 805-10-55-15, which states:

A new entity formed to effect a business combination is not necessarily the acquirer. If a new entity is formed to issue equity interests to effect a business combination, one of the combining entities that existed before the business combination shall be identified as the acquirer by applying the guidance in paragraphs 805-10-55-10 through 55-14. In contrast, a new entity that transfers cash or other assets or incurs liabilities as consideration may be the acquirer[emphasis added].

As discussed above, Merger Sub and Merger Sub 2 were the initial legal obligors on the debt incurred to finance a portion of the acquisition and directly transacted with Deere to transfer the Consideration, a portion of which (consisting of $174 million of the $318 million in cash and the 1,160,000 shares of CD&R Landscapes Parent, Inc. common stock) was passed through CD&R Landscapes Parent, Inc. to MidCo, by MidCo to BidCo and by BidCo to Merger Sub. Merger Sub and Merger Sub 2 did not survive the transaction and were formed solely to enable BidCo to complete its acquisition of a 100% ownership stake (a controlling interest) in JDA and JDL. As such, the Registrant concluded that BidCo was the accounting acquirer in the transaction. While SEC speeches are not authoritative under GAAP, the Registrant also considers this view to be consistent with remarks made by Pamela Schlosser, Professional Accounting Fellow, on Current SEC and PCAOB Developments in 2005, citing a scenario where a newly formed entity was deemed to be the accounting acquirer in a business combination. In arriving at this conclusion, the Registrant determined that Bidco was a substantive entity. It was determined to be substantive because Bidco survived the transaction and performed the following substantive activities: (i) it secured the commitment for, and its wholly owned subsidiary MidCo was the original obligor under, the term loan facility and ABL facility entered into contemporaneously with the closing of the acquisition, (ii) it directed the transfer of the Consideration to Deere in the acquisition, and (iii) subsequent to the acquisition, BidCo remained a guarantor of the term loan and ABL facility (which were assumed by JDA and JDL effective upon the closing of the acquisition).

Finally, as noted above, to be responsive to the Staff’s request, the Registrant has included an assessment of each of the criteria listed in ASC 805-10-55-12 through 14 below; however, it notes that the guidance in those paragraphs does not appear to apply to this transaction as it was not the combination of two businesses effected primarily by the exchange of equity interests:

| • | Under ASC 805-10-55-12, this transaction did not constitute a business combination effected primarily by exchanging equity interests. The Registrant notes that none of CD&R Landscapes Parent, Inc. nor its wholly owned subsidiaries met the definition of a “business” under ASC 805 prior to the |

| J. Nolan McWilliams | 8 | October 14, 2015 |

transaction. That is, prior to the transaction, those entities had no operations apart from the negotiation of financing arrangements in contemplation of the acquisition of JDA and JDL; no inputs, outputs or processes; and no employees. Further, the transaction was not effected primarily by exchanging equity interests. CD&R Landscapes Parent, Inc. transferred (via its newly formed wholly owned subsidiaries) cash totaling $318 million to Deere (comprised of $174 million from the CD&R Investor’s purchase of Preferred Stock plus $167 million from the ABL facility and the term loan facility less transaction costs incurred and paid out of these proceeds) in exchange for a controlling interest in JDA and JDL, and allowed Deere to retain a non-controlling interest in those businesses via common stock of CD&R Landscapes Parent, Inc. worth $78.2 million, representing 40% of the outstanding capital stock of CD&R Landscapes Parent, Inc. on an as converted basis. |

| • | With respect to ASC 805-10-55-12(a), the relative voting rights in CD&R Landscapes Parent, Inc. following the transaction were 60% held by the CD&R Investor in the form of the Preferred Stock (which is entitled to vote on all shareholder matters on an as-converted basis as a single class with the common stock) and 40% held by Deere in the form of common stock. |

| • | Given the CD&R Investor’s majority ownership position in CD&R Landscapes Parent, Inc., the Registrant concluded that ASC 805-10-55-12(b) was not applicable to this fact pattern. |

| • | With respect to ASC 805-10-55-12(c), immediately following the closing of the transaction, the CD&R Investor had the ability to designate or to remove three of the six members of the Board of Directors of CD&R Landscapes Parent, Inc. Deere had the ability to designate or to remove two members. The sixth member was designated to be the CEO, who is appointed or removed based on a majority vote of the CD&R Investor and Deere-designated members, of which the CD&R Investor has a majority (three of five such members). |

| • | With respect to ASC 805-10-55-12(d), the senior management team of CD&R Landscapes Parent, Inc. was initially comprised entirely of former employees of Deere who worked in the business units comprising the operations of JDA and JDL. The Board of Directors has the ability to appoint or remove management. Since the closing of the transaction, the Board of Directors, controlled by the CD&R Investor, has appointed a new senior management team, including a new CEO. |

| J. Nolan McWilliams | 9 | October 14, 2015 |

| • | With respect to ASC 805-10-55-12(e), the CD&R Investor and CD&R Landscapes Parent, Inc. did not receive any consideration in the transaction in exchange for the contribution of any businesses. Rather, they arranged for the transfer of both cash and equity to Deere in the transaction, which consideration exceeded the fair value of the net assets transferred by Deere (as indicated by the presence of goodwill in acquisition accounting reflected in the Registrant’s consolidated balance sheet). |

| • | Given that none of CD&R Landscapes Parent, Inc. nor its wholly owned subsidiaries met the definition of a business prior to the transaction, the Registrant concluded that ASC 805-10-55-13 and 55-14 were not applicable to this fact pattern, as the relative size indicators appear to be relevant only when two or more businesses with substantive operations combine. |

Based on the above analysis, the Registrant concluded that the transaction was not a reverse acquisition.

* * * * *

If you have any questions regarding this letter, please do not hesitate to call me at (212) 909-6375 or Lee Turnier Barnum at (212) 909-6431.

| Best Regards, |

| /s/ Peter J. Loughran |

| Peter J. Loughran |

| cc: | Aamira Chaudhry |

Melissa Raminpour

Tonya K. Aldave

U.S. Securities and Exchange Commission

Doug Black

John Guthrie

Briley Brisendine

SiteOne Landscape Supply, Inc.

Enclosures