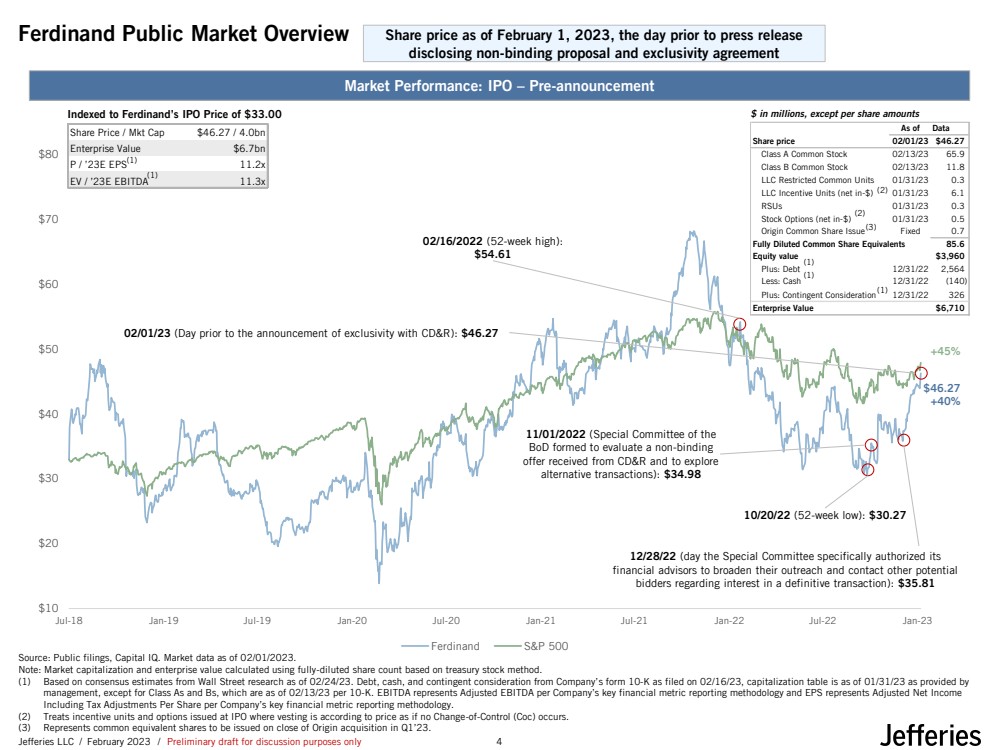

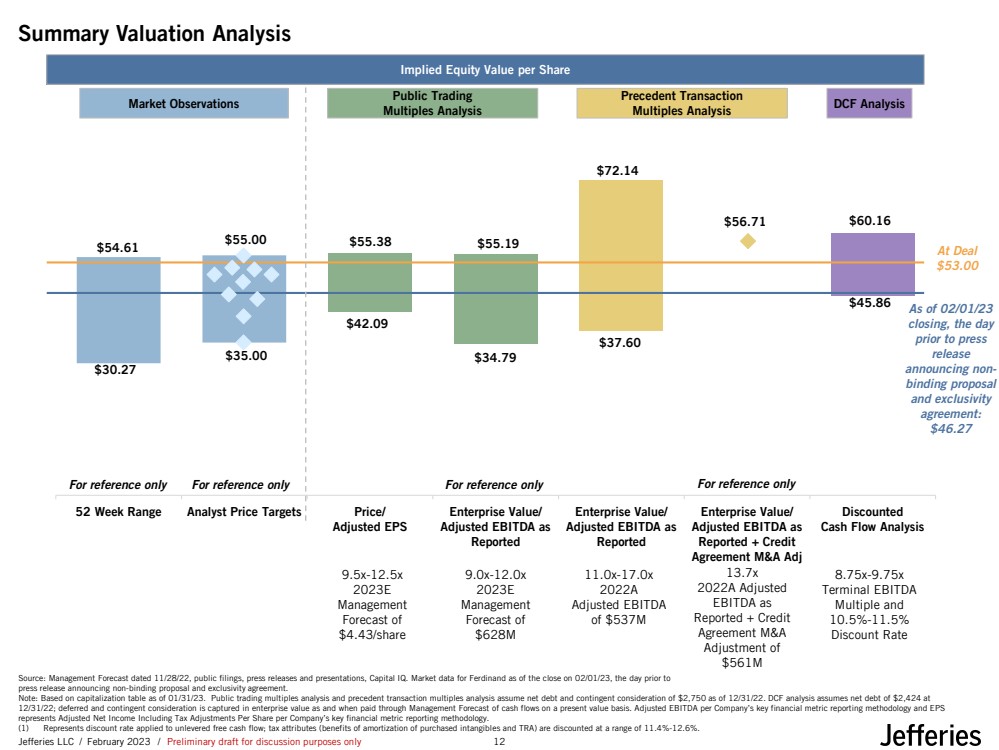

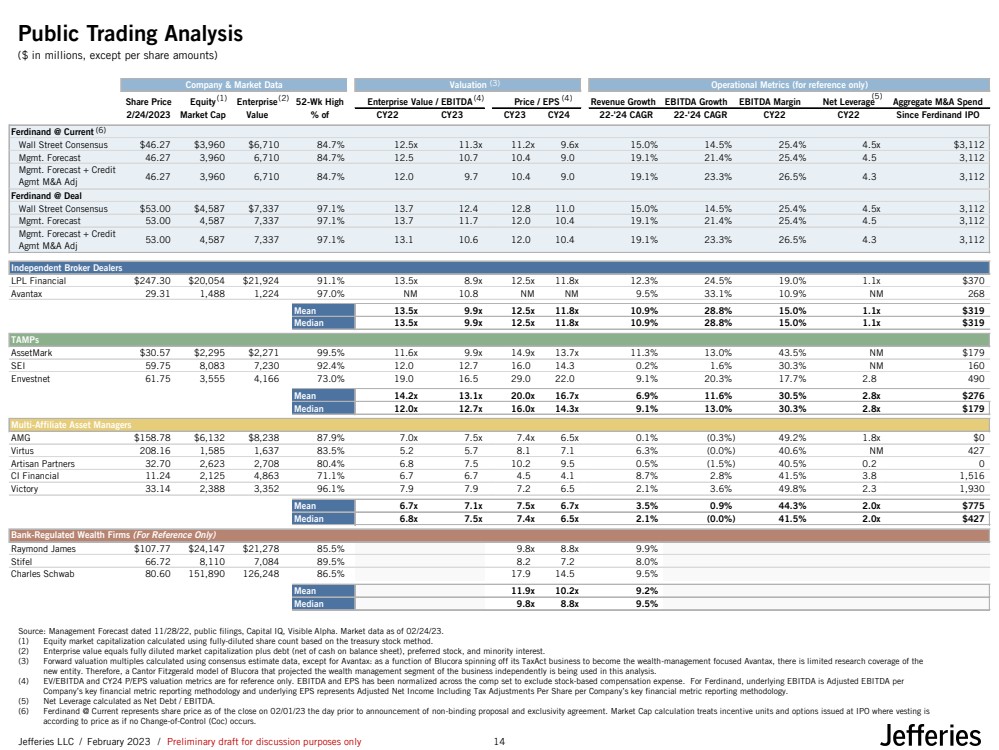

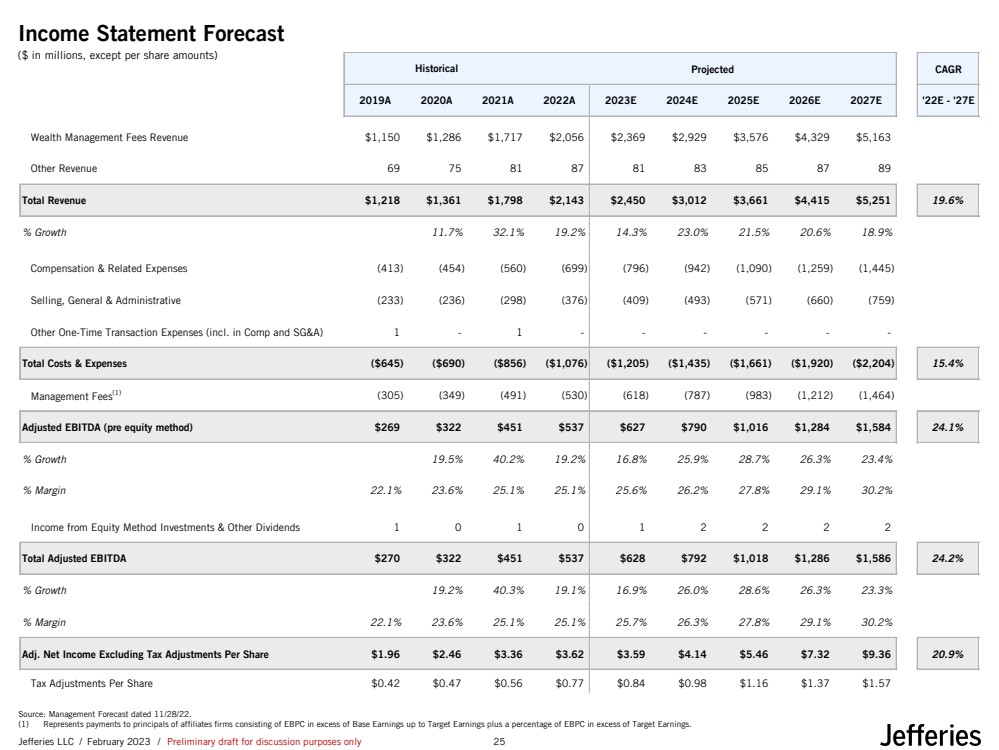

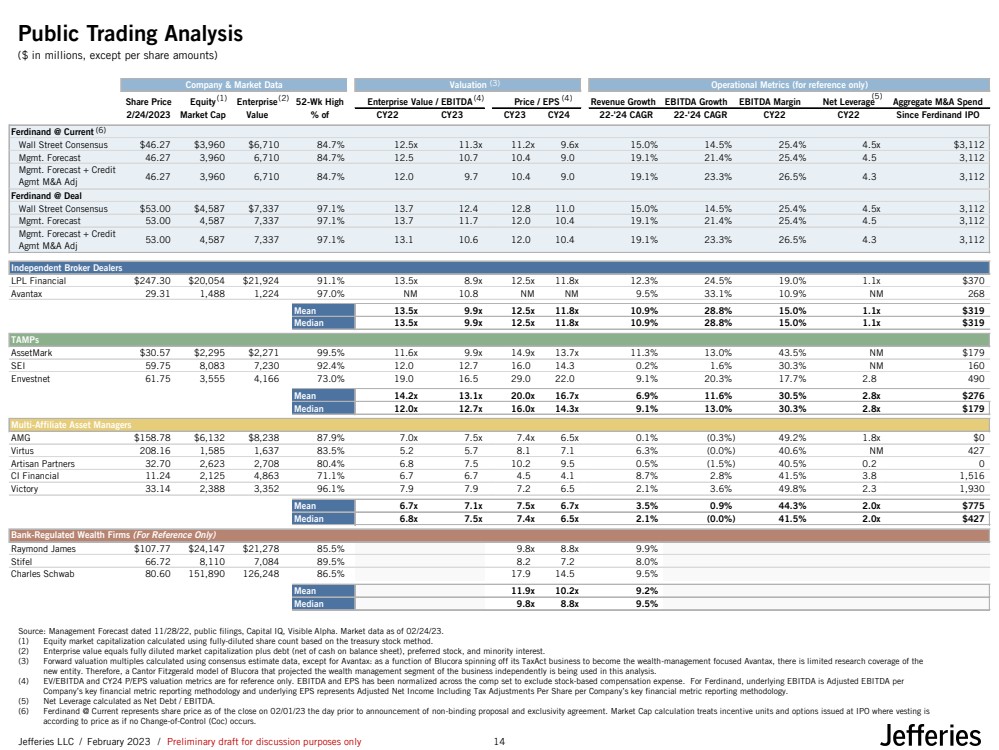

| Jefferies LLC / February 2023 / Preliminary draft for discussion purposes only Company & Market Data Valuation Operational Metrics (for reference only) Share Price Equity Enterprise 52-Wk High Enterprise Value / EBITDA Price / EPS Revenue Growth EBITDA Growth EBITDA Margin Net Leverage Aggregate M&A Spend 2/24/2023 Market Cap Value % of CY22 CY23 CY23 CY24 22-'24 CAGR 22-'24 CAGR CY22 CY22 Since Ferdinand IPO Ferdinand @ Current Wall Street Consensus $46.27 $3,960 $6,710 84.7% 12.5x 11.3x 11.2x 9.6x 15.0% 14.5% 25.4% 4.5x $3,112 Mgmt. Forecast 46.27 3,960 6,710 84.7% 12.5 10.7 10.4 9.0 19.1% 21.4% 25.4% 4.5 3,112 46.27 3,960 6,710 84.7% 12.0 9.7 10.4 9.0 19.1% 23.3% 26.5% 4.3 3,112 Ferdinand @ Deal Wall Street Consensus $53.00 $4,587 $7,337 97.1% 13.7 12.4 12.8 11.0 15.0% 14.5% 25.4% 4.5x 3,112 Mgmt. Forecast 53.00 4,587 7,337 97.1% 13.7 11.7 12.0 10.4 19.1% 21.4% 25.4% 4.5 3,112 53.00 4,587 7,337 97.1% 13.1 10.6 12.0 10.4 19.1% 23.3% 26.5% 4.3 3,112 Independent Broker Dealers LPL Financial $247.30 $20,054 $21,924 91.1% 13.5x 8.9x 12.5x 11.8x 12.3% 24.5% 19.0% 1.1x $370 Avantax 29.31 1,488 1,224 97.0% NM 10.8 NM NM 9.5% 33.1% 10.9% NM 268 Mean 13.5x 9.9x 12.5x 11.8x 10.9% 28.8% 15.0% 1.1x $319 Median 13.5x 9.9x 12.5x 11.8x 10.9% 28.8% 15.0% 1.1x $319 TAMPs AssetMark $30.57 $2,295 $2,271 99.5% 11.6x 9.9x 14.9x 13.7x 11.3% 13.0% 43.5% NM $179 SEI 59.75 8,083 7,230 92.4% 12.0 12.7 16.0 14.3 0.2% 1.6% 30.3% NM 160 Envestnet 61.75 3,555 4,166 73.0% 19.0 16.5 29.0 22.0 9.1% 20.3% 17.7% 2.8 490 Mean 14.2x 13.1x 20.0x 16.7x 6.9% 11.6% 30.5% 2.8x $276 Median 12.0x 12.7x 16.0x 14.3x 9.1% 13.0% 30.3% 2.8x $179 Multi-Affiliate Asset Managers AMG $158.78 $6,132 $8,238 87.9% 7.0x 7.5x 7.4x 6.5x 0.1% (0.3%) 49.2% 1.8x $0 Virtus 208.16 1,585 1,637 83.5% 5.2 5.7 8.1 7.1 6.3% (0.0%) 40.6% NM 427 Artisan Partners 32.70 2,623 2,708 80.4% 6.8 7.5 10.2 9.5 0.5% (1.5%) 40.5% 0.2 0 CI Financial 11.24 2,125 4,863 71.1% 6.7 6.7 4.5 4.1 8.7% 2.8% 41.5% 3.8 1,516 Victory 33.14 2,388 3,352 96.1% 7.9 7.9 7.2 6.5 2.1% 3.6% 49.8% 2.3 1,930 Mean 6.7x 7.1x 7.5x 6.7x 3.5% 0.9% 44.3% 2.0x $775 Median 6.8x 7.5x 7.4x 6.5x 2.1% (0.0%) 41.5% 2.0x $427 Bank-Regulated Wealth Firms (For Reference Only) Raymond James $107.77 $24,147 $21,278 85.5% 9.8x 8.8x 9.9% Stifel 66.72 8,110 7,084 89.5% 8.2 7.2 8.0% Charles Schwab 80.60 151,890 126,248 86.5% 17.9 14.5 9.5% Mean 11.9x 10.2x 9.2% Median 9.8x 8.8x 9.5% Mgmt. Forecast + Credit Agmt M&A Adj Mgmt. Forecast + Credit Agmt M&A Adj Public Trading Analysis Source: Management Forecast dated 11/28/22, public filings, Capital IQ, Visible Alpha. Market data as of 02/24/23. (1) Equity market capitalization calculated using fully-diluted share count based on the treasury stock method. (2) Enterprise value equals fully diluted market capitalization plus debt (net of cash on balance sheet), preferred stock, and minority interest. (3) Forward valuation multiples calculated using consensus estimate data, except for Avantax: as a function of Blucora spinning off its TaxAct business to become the wealth-management focused Avantax, there is limited research coverage of the new entity. Therefore, a Cantor Fitzgerald model of Blucora that projected the wealth management segment of the business independently is being used in this analysis. (4) EV/EBITDA and CY24 P/EPS valuation metrics are for reference only. EBITDA and EPS has been normalized across the comp set to exclude stock-based compensation expense. For Ferdinand, underlying EBITDA is Adjusted EBITDA per Company’s key financial metric reporting methodology and underlying EPS represents Adjusted Net Income Including Tax Adjustments Per Share per Company’s key financial metric reporting methodology. (5) Net Leverage calculated as Net Debt / EBITDA. (6) Ferdinand @ Current represents share price as of the close on 02/01/23 the day prior to announcement of non-binding proposal and exclusivity agreement. Market Cap calculation treats incentive units and options issued at IPO where vesting is according to price as if no Change-of-Control (Coc) occurs. (1) (2) (3) (4) ($ in millions, except per share amounts) (6) (4) (5) 14 |