© 2018 Acacia Communications, Inc.1 © 2018 Acacia Communications, Inc. Investor Presentation February 27, 2018 CONNECTING AT THE SPEED OF LIGHT

© 2018 Acacia Communications, Inc.2 Safe Harbor Statement This presentation may contain forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward- looking statements we make. The forward-looking statements contained in this presentation reflect our current views with respect to future events, and we assume no obligation to update any forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this presentation, and our actual future results may be materially different from what we expect. We have included important factors in the cautionary statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and other documents we have filed with the SEC, particularly in the Risk Factors section, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Non-GAAP Financial Measures This presentation includes measures defined by the SEC as non-GAAP financial measures. We believe that these non-GAAP financial measures can provide useful supplemental information to investors when read in conjunction with our reported results. Reconciliations of these non-GAAP financial measures to their closest GAAP measures are available in the Appendix to this presentation and descriptions of these non-GAAP financial measures can be found in our earnings release with respect to our fourth quarter and full-year 2017 results.

© 2018 Acacia Communications, Inc.3 Acacia Highlights Mission: Deliver silicon-based interconnects that transform cloud and communication networks by simplifying these networks, digitizing numerous complex analog functions, and providing significant improvements in speed, capacity and power consumption Coherent Optical Interconnect Provider Addressing High Growth Markets Driving the Siliconization of Optical Interconnect First to Market, Award Winning Products Proven Management Team Strong Financials

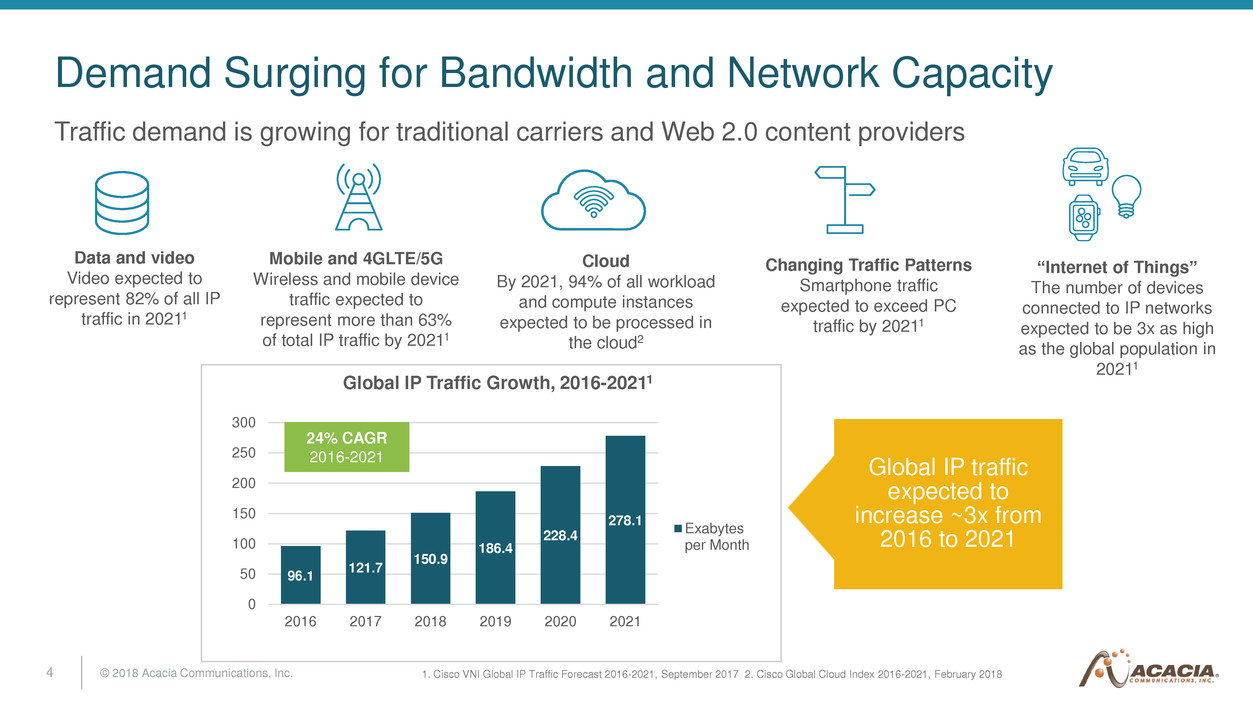

© 2018 Acacia Communications, Inc.4 Traffic demand is growing for traditional carriers and Web 2.0 content providers Demand Surging for Bandwidth and Network Capacity Data and video Video expected to represent 82% of all IP traffic in 20211 Mobile and 4GLTE/5G Wireless and mobile device traffic expected to represent more than 63% of total IP traffic by 20211 Cloud By 2021, 94% of all workload and compute instances expected to be processed in the cloud2 “Internet of Things” The number of devices connected to IP networks expected to be 3x as high as the global population in 20211 Changing Traffic Patterns Smartphone traffic expected to exceed PC traffic by 20211 Global IP Traffic Growth, 2016-20211 1. Cisco VNI Global IP Traffic Forecast 2016-2021, September 2017 2. Cisco Global Cloud Index 2016-2021, February 2018 96.1 121.7 150.9 186.4 228.4 278.1 0 50 100 150 200 250 300 2016 2017 2018 2019 2020 2021 Exabytes per Month 24% CAGR 2016-2021 Global IP traffic expected to increase ~3x from 2016 to 2021

© 2018 Acacia Communications, Inc.5 Acacia solutions significantly reduce complexity and cost of high speed networks Markets We Address DATA-CENTER INTERCONNECTMETROLONG-HAUL • Plug and play with a variety of network equipment • Simplifies optical link management eliminating complex manual calibration • Key characteristics: speed, industry leading density and power efficiency, automation and manageability Optical modules and components • High performance • Fiber constrained • Space and power constrained • Pay as you grow model • Shorter product life cycles • Cost and power sensitive Central Office Central Office Central Office City City

© 2018 Acacia Communications, Inc.6 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 100G p o rt e q u iv a le n ts (m il li o n s ) 100/200/400 Gbps port shipments1 Cloud (DCI) - 45% CAGR Telecom - 32% CAGR Enterprise - 42% CAGR 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Sale s ($ M ) DWDM - 100/200/400 Gbps DWDM - up to10 Gbps Key Market Segments According to LightCounting1, optical component spend is estimated to reach ~$12 billion globally by 2022 Three drivers for 100G+ market growth: DCI Low-power High density Low-cost per bit Metro Density Low-cost Plugability Interoperability China Low-power Easy to deploy DCOs Sales of Optics Components and Modules1 1. Reprinted with permission: LightCounting, Oct 2017 100G+ Module Sales Compared to the Rest of the WDM Market1 100G/200G/40 G The Rest of the DWDM market $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $ M IL L IO N All the rest China Cloud 2 2. CAGR calculated by 100G Port Equivalent growth (200G Port = 2 100G Eq., 400G Port = 4 100G Eq., etc.)

© 2018 Acacia Communications, Inc.7 Higher growth anticipated in coherent edge (<100km) applications • Driven by DCI requirements • In the edge market, preferred solutions are cost optimized and low power • Coherent expected to increase share in edge applications at higher data rate due to performance requirements 2 CAGR calculated by 100G Port Equivalent growth (200G Port = 2 100G Eq., 400G Port = 4 100G Eq., etc.) 0% 20% 40% 60% 80% 100% 2017 2018 2019 2020 2021 Edge 100G+ Port Share1 Edge Direct Detect Port Share Edge Coherent Port Share 78% CAGR2 38% CAGR2 19% CAGR2 Edge Direct Detect 100G+ Port Equivalents by Application1 Edge Coherent Metro Coherent Long Haul Coherent -31% CAGR2 2017 2021 1 Reprinted with permission: Cignal AI, Sept 2017

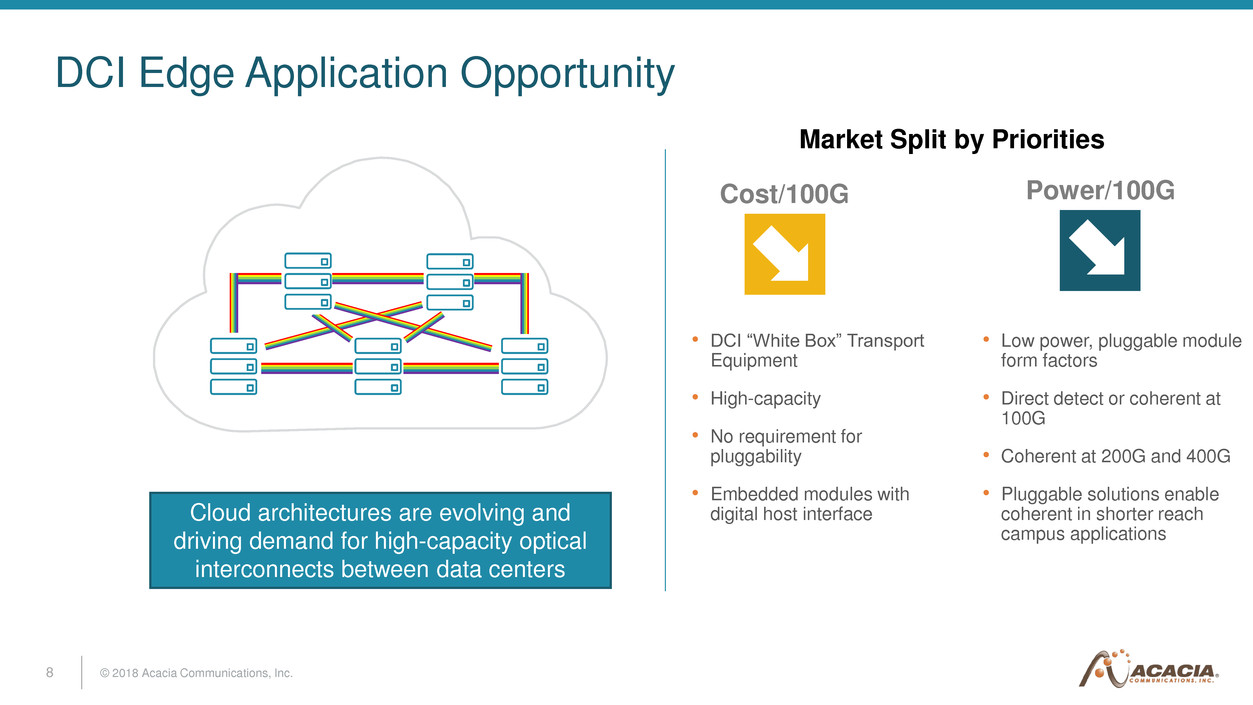

© 2018 Acacia Communications, Inc.8 DCI Edge Application Opportunity Cost/100G Power/100G Cloud architectures are evolving and driving demand for high-capacity optical interconnects between data centers Market Split by Priorities • DCI “White Box” Transport Equipment • High-capacity • No requirement for pluggability • Embedded modules with digital host interface • Low power, pluggable module form factors • Direct detect or coherent at 100G • Coherent at 200G and 400G • Pluggable solutions enable coherent in shorter reach campus applications

© 2018 Acacia Communications, Inc.9 Our Products: Rapid Pace of Innovation DSP ASICs Everest 100G LH BGA 0.4 Inch2 Many discrete components 1.5 Inch 2 SiPh PIC 0.4 Inch2 SiPh PIC 2011 2012 2013 2014 2015 2016 2017 Silicon PICs 2018 Modules 40nm 40nm 40nm 28nm 28nm 16nm 16nm AC100 AC100S AC40S CFP-DCO AC400 CFP2-ACO CFP2-DCO AC1200 Strong and diverse portfolio of patents and intellectual property Long-Haul DCI Metro Mouna Kea 100G LH K2 40G ULH Sky 100G Metro Denali 400G ULH/Metro Multi-core Meru 200G Metro Pico 1.2T DCI/Metro/LH Multi-core

© 2018 Acacia Communications, Inc.10 Acacia AC1200 Based on Acacia’s Pico DSP ASIC Sampling 1st half 2018 Rich feature set for exceptional performance in metro and long haul applications High data rate transmission offers the efficiency required for evolving cloud networks 50% higher capacity per wavelength than competitive 400G solutions 3x the capacity in 40% smaller footprint than 400G 5”x7” modules Lower power/bit based on Acacia’s proven DSP algorithms and enhanced TPC SD-FEC Tunable Baud Rate – enables continuous baud rate adjustment for optimal utilization of the available spectrum Patented Fractional QAM Modulation – provides users with the ability to select very fine resolution of QAM constellations for optimal capacity Enhanced Turbo Product Code SD-FEC - offers ultra- high net coding gain (NCG) and enables maximum reach, while maintaining low power consumption Bits/Symbol 2 3 4 5 6 30 40 60 70 50 Baud Rate

© 2018 Acacia Communications, Inc.11 Well Positioned to Deliver Highly Integrated Interconnects Diverse Set of Skills and Expertise Represents High Barrier to Entrance Acacia has all the pieces of the interconnect puzzle to deliver: • Superior performance • Higher density • Easy deployment and management • Lower cost • Lower power DSP Radio Frequency Software Optics Silicon Coherent PIC Dual-core DSP 100G MSA 100G CFP-DCO 400G Module 200G CFP2-DCO 1st 1st 1st We believe we were the first to introduce to the market:

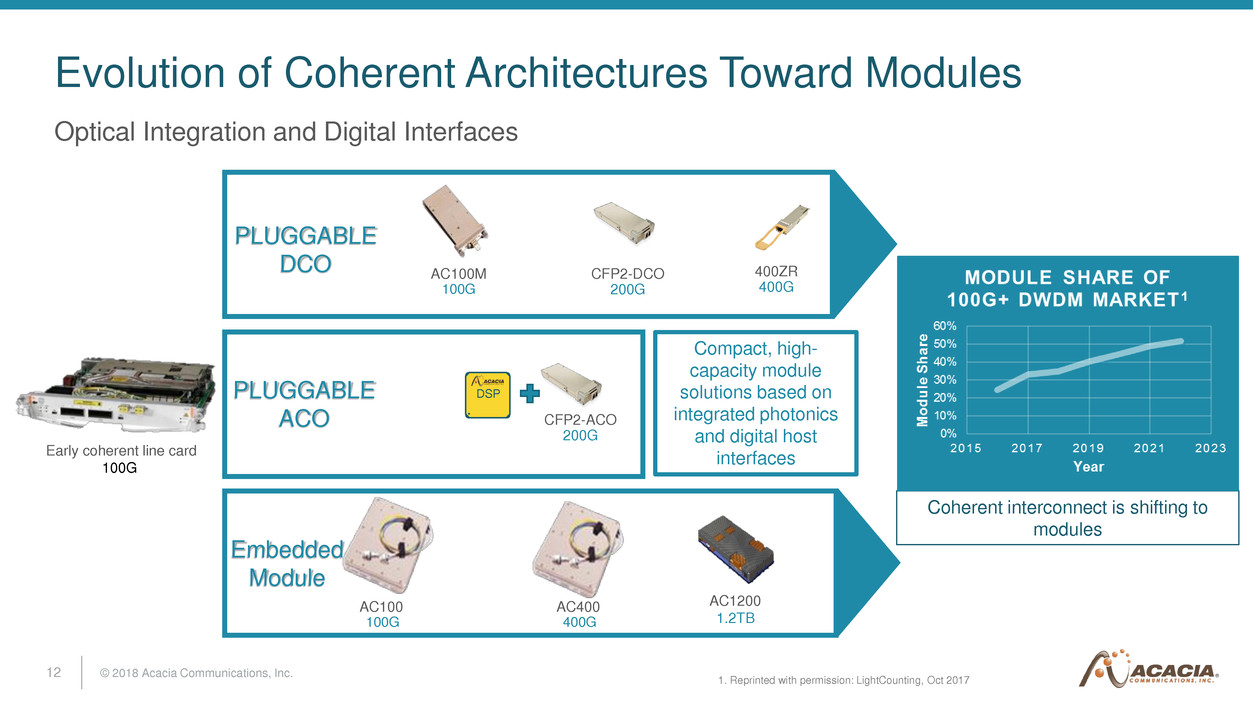

© 2018 Acacia Communications, Inc.12 Evolution of Coherent Architectures Toward Modules Optical Integration and Digital Interfaces AC100 100G CFP2-DCO 200G AC1200 1.2TB AC100M 100G Early coherent line card 100G 400ZR 400G CFP2-ACO 200G DSP AC400 400G PLUGGABLE DCO Embedded Module PLUGGABLE ACO Compact, high- capacity module solutions based on integrated photonics and digital host interfaces Coherent interconnect is shifting to modules 1. Reprinted with permission: LightCounting, Oct 2017

© 2018 Acacia Communications, Inc.13 400G ZR AC1200 CFP2-DCO AC400 Coherent Technology Trends – DCO and Shorter Reaches <0.5km0.5 – 2km2 – 10km10 – 80km80 – 500km500+km LREdgeMetroLH DR 400G FR Intra DCTransport AC100 CFP-DCO 1200G 200G 100G Move to higher data rates for lower cost per bit High density systems demand smaller modules and more optical integration At higher data rates, coherent is considered for shorter reach interfaces Industry Momentum for Pluggable DCO • OIF • Targets 400G client form factors • IEEE • 100G, 200G, & 400G beyond 10km reach • CableLabs • Coherent Access Standard

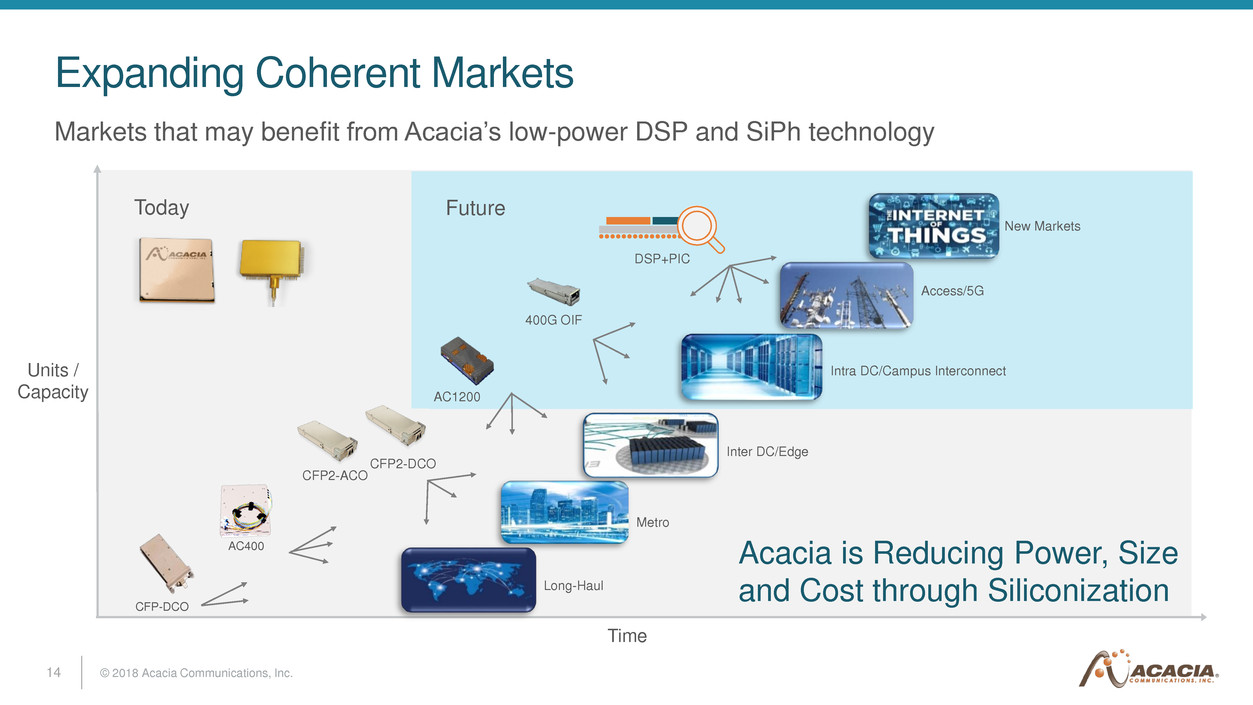

© 2018 Acacia Communications, Inc.14 Expanding Coherent Markets Markets that may benefit from Acacia’s low-power DSP and SiPh technology Time Units / Capacity Acacia is Reducing Power, Size and Cost through Siliconization 400G OIF AC1200 AC400 Today Future DSP+PIC CFP2-DCO CFP2-ACO Intra DC/Campus Interconnect Inter DC/Edge Metro New Markets Access/5G Long-Haul CFP-DCO

© 2018 Acacia Communications, Inc.15 Helping to ensure sustainability despite soaring bandwidth growth • Optimizing design of DSP ASIC and SiPh PIC • Developing power efficient algorithms •Helping our service provider and cloud customers dramatically reduce energy consumption Sustainable Optical Networking Acacia has been able to reduce the power consumed by its coherent optical interconnects by as much as 85% in the last 5 years.

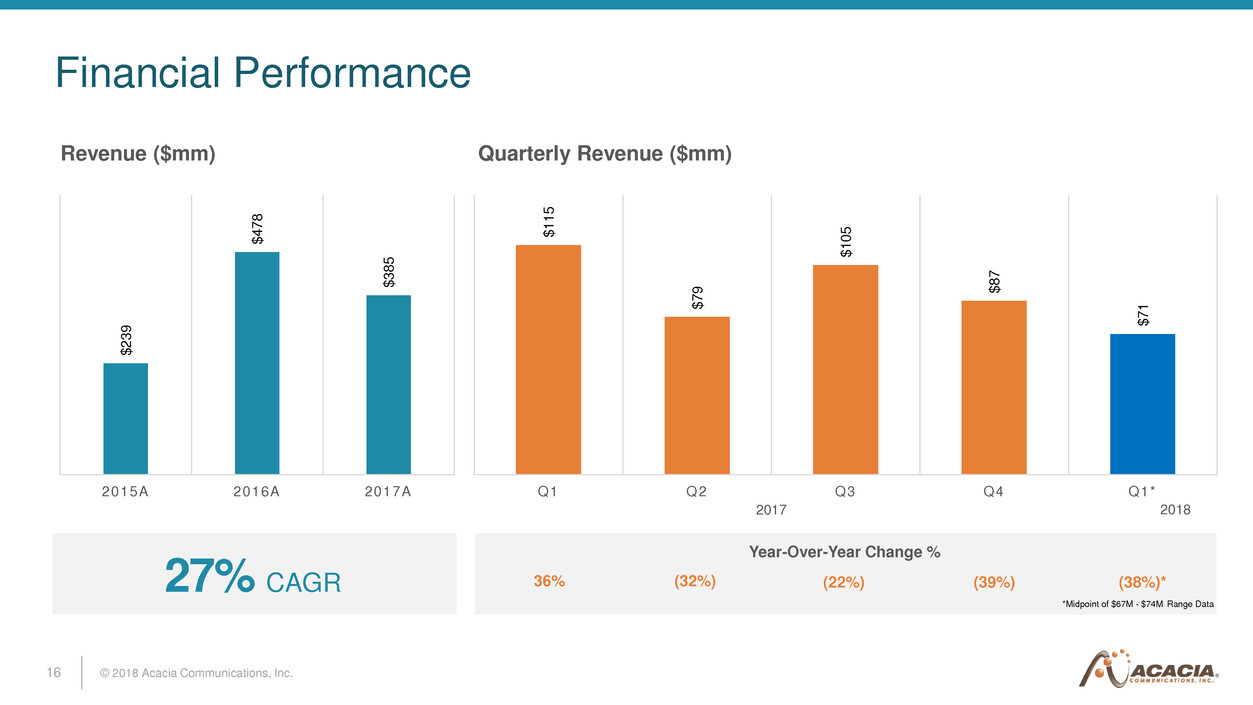

© 2018 Acacia Communications, Inc.16 Financial Performance Year-Over-Year Change % Revenue ($mm) Quarterly Revenue ($mm) $ 2 3 9 $ 4 7 8 $ 3 8 5 2015A 2016A 2017A *Midpoint of $67M - $74M Range Data $ 1 1 5 $ 7 9 $ 1 0 5 $ 8 7 $ 7 1 Q1 Q2 Q3 Q4 Q1* 20182017 27% CAGR 36% (32%) (22%) (39%) (38%)*

© 2018 Acacia Communications, Inc.17 Operating Leverage and Profitability Operational Scalability Leveraged Sales Model Capital Efficiency Efficient R&D Non-GAAP Net Income1 ($mm) Key Drivers *Midpoint of $0.3M - $4.3M Range Data 1 This is a “non-GAAP financial measure” as defined in Regulation G under the Securities Exchange Act of 1934, as amended, and reconciliation of such non-GAAP financial measure to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP is provided in the Appendix to this presentation. Descriptions of this non-GAAP financial measure can be found in the company’s earnings release with respect to its fourth quarter and full year 2017 results % of Revenue $32 $123 $73 $32 $11 $19 $11 $2 0 20 40 60 80 100 120 2015 2016 2017 Q117 Q217 Q317 Q417 Q118* 14% 26% 19% 28% 14% 18% 13% 3%*

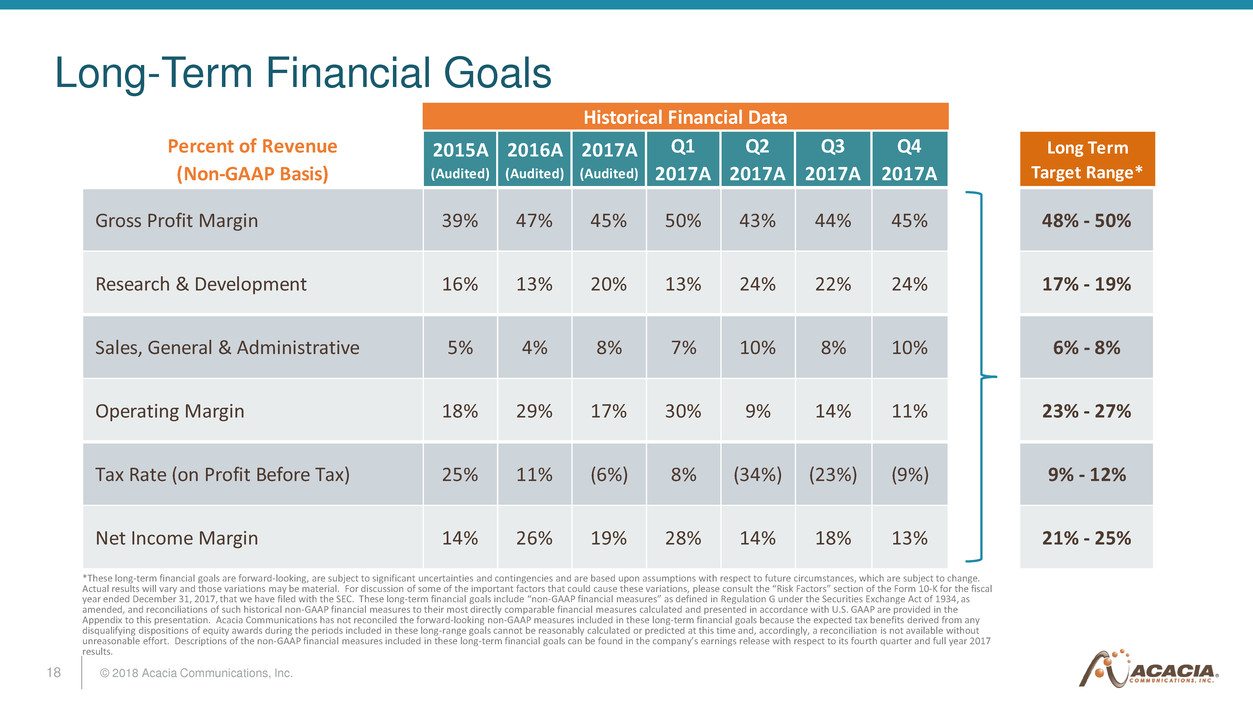

© 2018 Acacia Communications, Inc.18 Percent of Revenue (Non-GAAP Basis) Gross Profit Margin 39% 47% 45% 50% 43% 44% 45% 48% - 50% Research & Development 16% 13% 20% 13% 24% 22% 24% 17% - 19% Sales, General & Administrative 5% 4% 8% 7% 10% 8% 10% 6% - 8% Operating Margin 18% 29% 17% 30% 9% 14% 11% 23% - 27% Tax Rate (on Profit Before Tax) 25% 11% (6%) 8% (34%) (23%) (9%) 9% - 12% Net Income Margin 14% 26% 19% 28% 14% 18% 13% 21% - 25% Historical Financial Data Long Term Target Range* 2015A (Audited) 2017A (Audited) Q2 2017A Q1 2017A Q4 2017A 2016A (Audited) Q3 2017A Long-Term Financial Goals *These long-term financial goals are forward-looking, are subject to significant uncertainties and contingencies and are based upon assumptions with respect to future circumstances, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the Form 10-K for the fiscal year ended December 31, 2017, that we have filed with the SEC. These long-term financial goals include “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, as amended, and reconciliations of such historical non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP are provided in the Appendix to this presentation. Acacia Communications has not reconciled the forward-looking non-GAAP measures included in these long-term financial goals because the expected tax benefits derived from any disqualifying dispositions of equity awards during the periods included in these long-range goals cannot be reasonably calculated or predicted at this time and, accordingly, a reconciliation is not available without unreasonable effort. Descriptions of the non-GAAP financial measures included in these long-term financial goals can be found in the company’s earnings release with respect to its fourth quarter and full year 2017 results.

© 2018 Acacia Communications, Inc.19 Appendix

© 2018 Acacia Communications, Inc.20 Reconciliation of GAAP to Non-GAAP 2015 2016 2017 Non-GAAP Gross Profit;Non-GAAP Gross Profit Margin Gross profit $93,706 $220,987 $167,840 GAAP gross profit margin 39.2% 46.2% 43.6% Stock-based compensation 75 1,629 1,993 Warranty charges due to manufacturing quality issue - - 5,090 Non-GAAP gross profit $93,781 $222,616 $174,923 Non-GAAP gross profit margin 39.2% 46.5% 45.4% Non-GAAP R&D Expenses GAAP research and development expenses $38,645 $75,696 $92,027 Stock-based compensation 561 12,347 14,150 Non-GAAP research and development expenses $38,084 $63,349 $77,877 Non-GAAP SG&A Expenses GAAP selling, general and administrative expenses $13,124 $27,676 $38,807 Stock-based compensation 189 6,769 7,230 Non-GAAP selling, general and administrative expenses $12,935 $20,907 $31,577 Non-GAAP Operating Expenses GAAP operating expenses $51,769 $103,397 $130,787 Stock-based compensation 750 19,116 21,380 Non-GAAP operating expenses $51,019 $84,281 $109,407 Non-GAAP Income from Operations (Loss) income from operations $41,937 $117,590 $37,053 Stock-based compensation 825 20,745 23,373 Warranty charges due to manufacturing quality issue - - 5,090 Non-GAAP income from operations $42,762 $138,335 $65,516 (in thousands) Year Ended December 31,

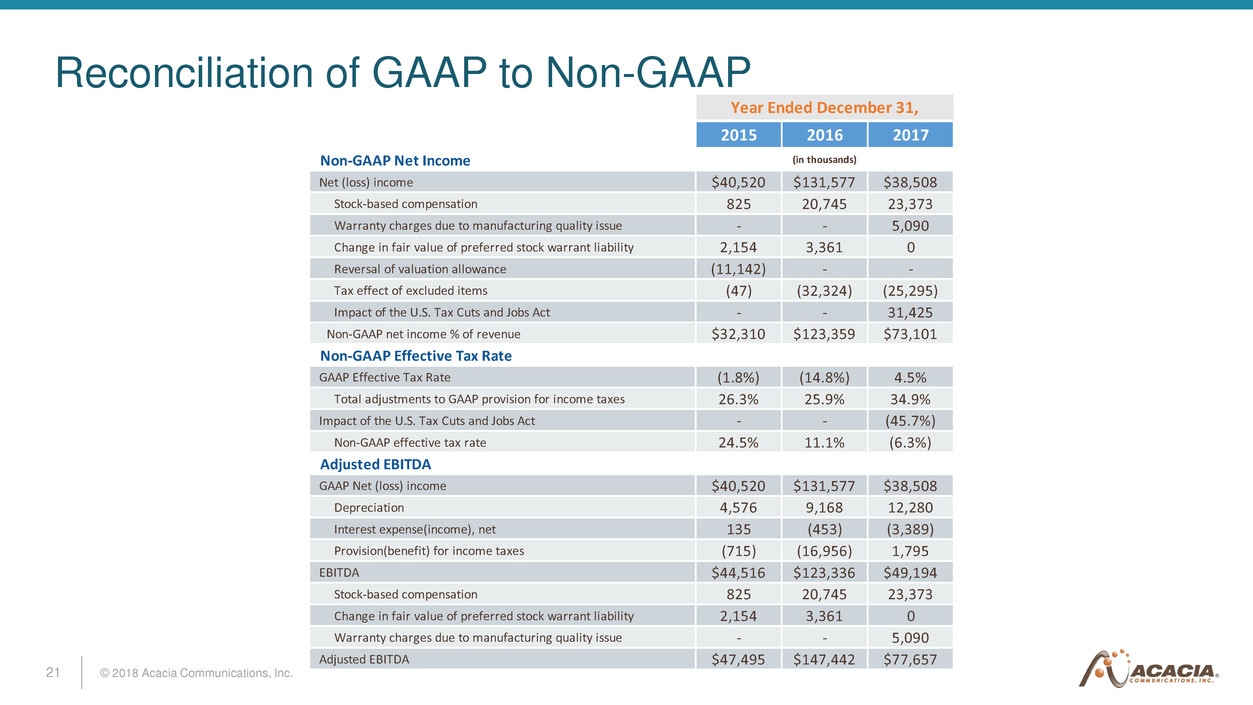

© 2018 Acacia Communications, Inc.21 Reconciliation of GAAP to Non-GAAP 2015 2016 2017 Non-GAAP Net Income Net (loss) income $40,520 $131,577 $38,508 Stock-based compensation 825 20,745 23,373 Warranty charges due to manufacturing quality issue - - 5,090 Change in fair value of preferred stock warrant liability 2,154 3,361 0 Reversal of valuation allowance (11,142) - - Tax effect of excluded items (47) (32,324) (25,295) Impact of the U.S. Tax Cuts and Jobs Act - - 31,425 Non-GAAP net income % of revenue $32,310 $123,359 $73,101 Non-GAAP Effective Tax Rate GAAP Effective Tax Rate (1.8%) (14.8%) 4.5% Total adjustments to GAAP provision for income taxes 26.3% 25.9% 34.9% Impact of the U.S. Tax Cuts and Jobs Act - - (45.7%) Non-GAAP effective tax rate 24.5% 11.1% (6.3%) Adjusted EBITDA GAAP Net (loss) income $40,520 $131,577 $38,508 Depreciation 4,576 9,168 12,280 Interest expense(income), net 135 (453) (3,389) Provision(benefit) for income taxes (715) (16,956) 1,795 EBITDA $44,516 $123,336 $49,194 Stock-based compensation 825 20,745 23,373 Change in fair value of preferred stock warrant liability 2,154 3,361 0 Warranty charges due to manufacturing quality issue - - 5,090 Adjusted EBITDA $47,495 $147,442 $77,657 Year Ended December 31, (in thousands)