CONNECTING AT THE SPEED OF LIGHT Investor Presentation November 1, 2018 © 2018 Acacia Communications, Inc. 1 © 2018 Acacia Communications, Inc.

Safe Harbor Statement This presentation contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “forecast,” “target,” “vision,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward- looking statements we make. The forward-looking statements contained in this presentation reflect our current views with respect to future events, and we assume no obligation to update any forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this presentation, and our actual future results may be materially different from what we expect. We have included important factors in the cautionary statements included in our Quarterly Report on Form 10-Q for the three month period ended September 30, 2018 and other documents we have filed with the SEC, particularly in the Risk Factors section, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Non-GAAP Financial Measures This presentation includes measures defined by the SEC as non-GAAP financial measures. We believe that these non-GAAP financial measures can provide useful supplemental information to investors when read in conjunction with our reported results. Reconciliations of these non-GAAP financial measures to their closest GAAP measures are available in the Appendix to this presentation and descriptions of these non-GAAP financial measures can be found in our earnings release with respect to our third quarter 2018 results. 2 © 2018 Acacia Communications, Inc.

Acacia Communications, Inc. Coherent Optical Interconnect First to Market, Provider & Innovator Award Winning Products Addressing Existing & Emerging Proven Management Coherent Markets Team Driving the Siliconization of Strong Balance Sheet Optical Interconnect Mission: Deliver silicon-based interconnects that transform cloud and communication networks by simplifying these networks, digitizing numerous complex analog functions, and providing significant improvements in speed, capacity and power consumption 3 © 2018 Acacia Communications, Inc.

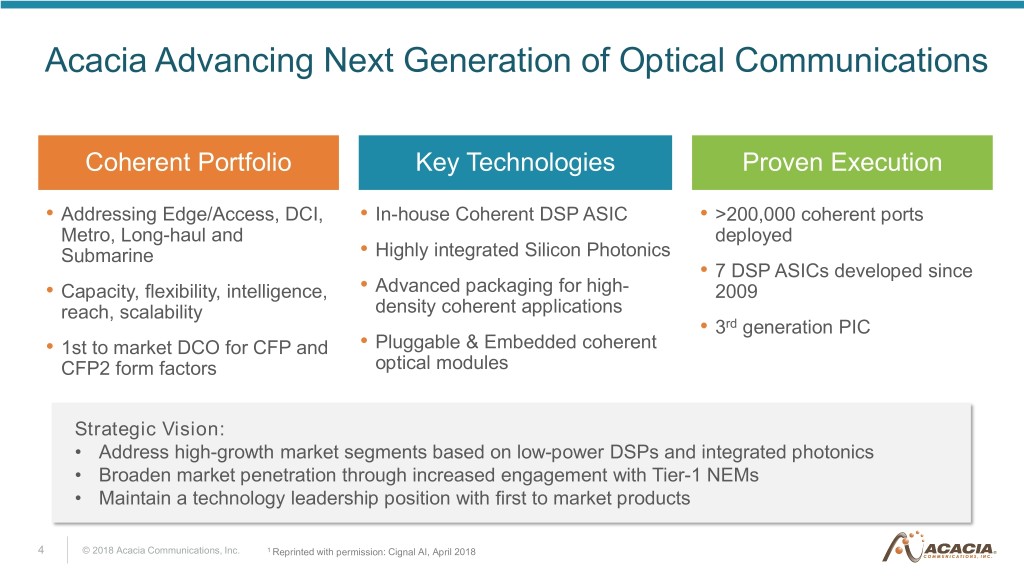

Acacia Advancing Next Generation of Optical Communications Coherent Portfolio Key Technologies Proven Execution • Addressing Edge/Access, DCI, • In-house Coherent DSP ASIC • >200,000 coherent ports Metro, Long-haul and deployed Submarine • Highly integrated Silicon Photonics • 7 DSP ASICs developed since • Capacity, flexibility, intelligence, • Advanced packaging for high- 2009 reach, scalability density coherent applications • 3rd generation PIC • 1st to market DCO for CFP and • Pluggable & Embedded coherent CFP2 form factors optical modules Strategic Vision: • Address high-growth market segments based on low-power DSPs and integrated photonics • Broaden market penetration through increased engagement with Tier-1 NEMs • Maintain a technology leadership position with first to market products 4 © 2018 Acacia Communications, Inc. 1 Reprinted with permission: Cignal AI, April 2018

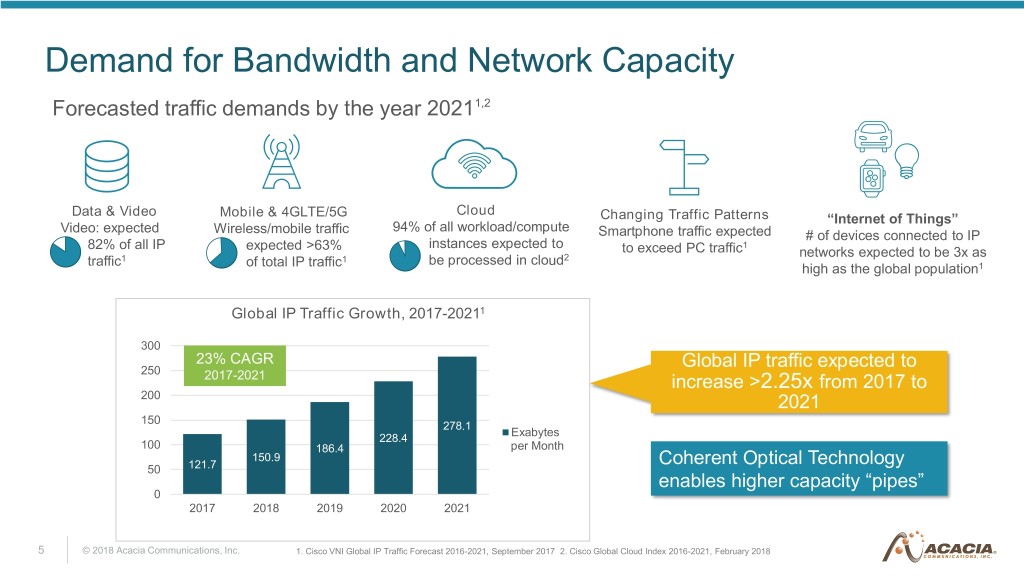

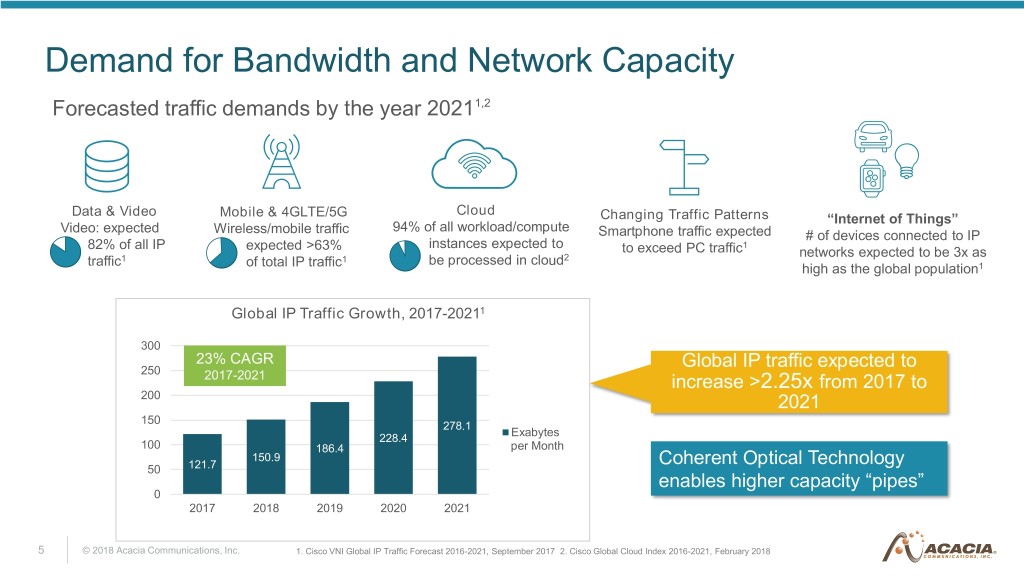

Demand for Bandwidth and Network Capacity Forecasted traffic demands by the year 20211,2 Data & Video Mobile & 4GLTE/5G Cloud Changing Traffic Patterns “Internet of Things” Video: expected Wireless/mobile traffic 94% of all workload/compute Smartphone traffic expected # of devices connected to IP 82% of all IP expected >63% instances expected to 1 to exceed PC traffic networks expected to be 3x as traffic1 of total IP traffic1 be processed in cloud2 high as the global population1 Global IP Traffic Growth, 2017-20211 300 23% CAGR Global IP traffic expected to 250 2017-2021 increase >2.25x from 2017 to 200 2021 150 278.1 228.4 Exabytes 100 186.4 per Month 150.9 Coherent Optical Technology 50 121.7 enables higher capacity “pipes” 0 2017 2018 2019 2020 2021 5 © 2018 Acacia Communications, Inc. 1. Cisco VNI Global IP Traffic Forecast 2016-2021, September 2017 2. Cisco Global Cloud Index 2016-2021, February 2018

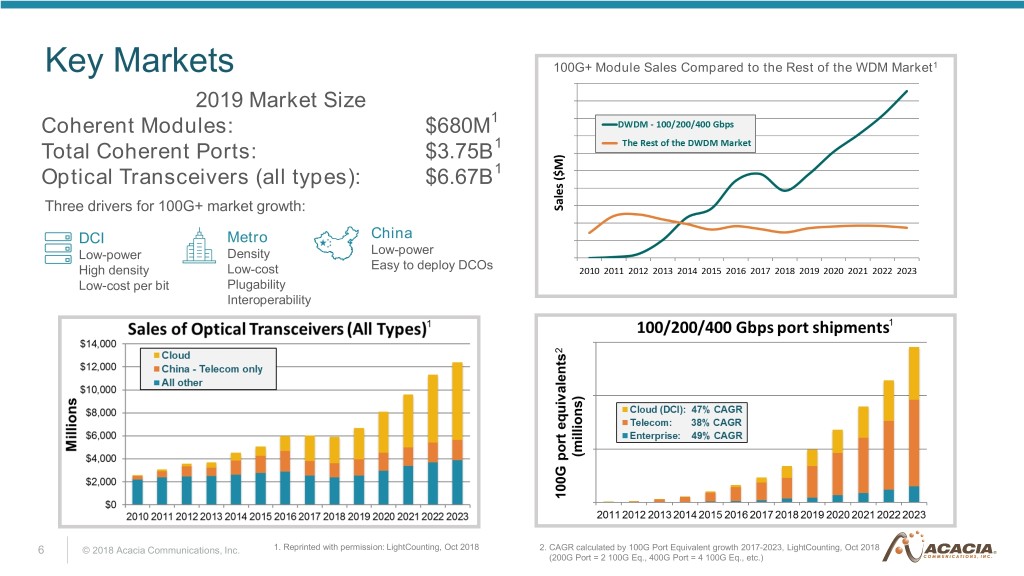

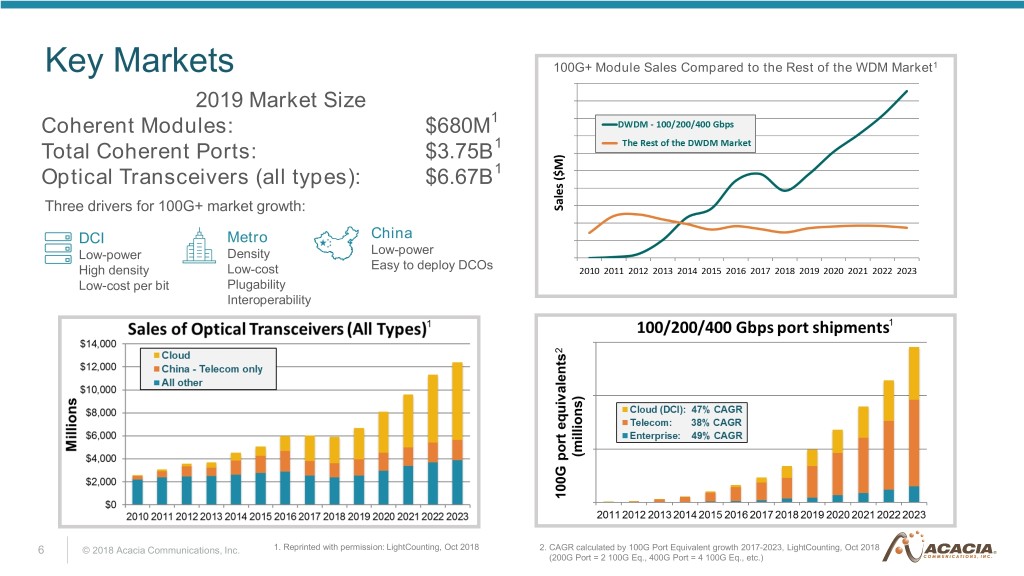

Key Markets 100G+ Module Sales Compared to the Rest of the WDM Market1 2019 Market Size Coherent Modules: $680M1 Total Coherent Ports: $3.75B1 Optical Transceivers (all types): $6.67B1 Three drivers for 100G+ market growth: DCI Metro China Low-power Density Low-power High density Low-cost Easy to deploy DCOs Low-cost per bit Plugability Interoperability 1 2 6 © 2018 Acacia Communications, Inc. 1. Reprinted with permission: LightCounting, Oct 2018 2. CAGR calculated by 100G Port Equivalent growth 2017-2023, LightCounting, Oct 2018 (200G Port = 2 100G Eq., 400G Port = 4 100G Eq., etc.)

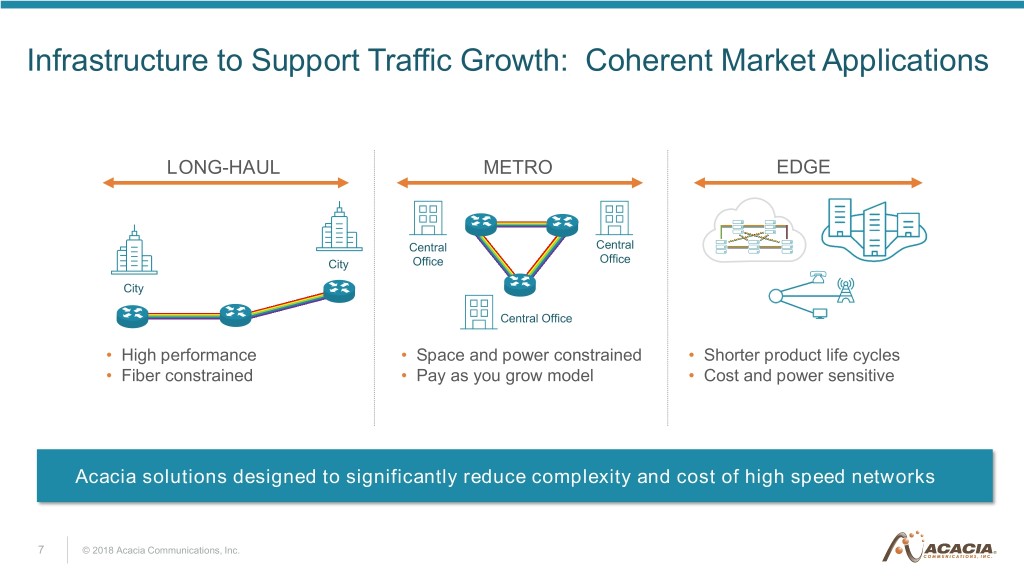

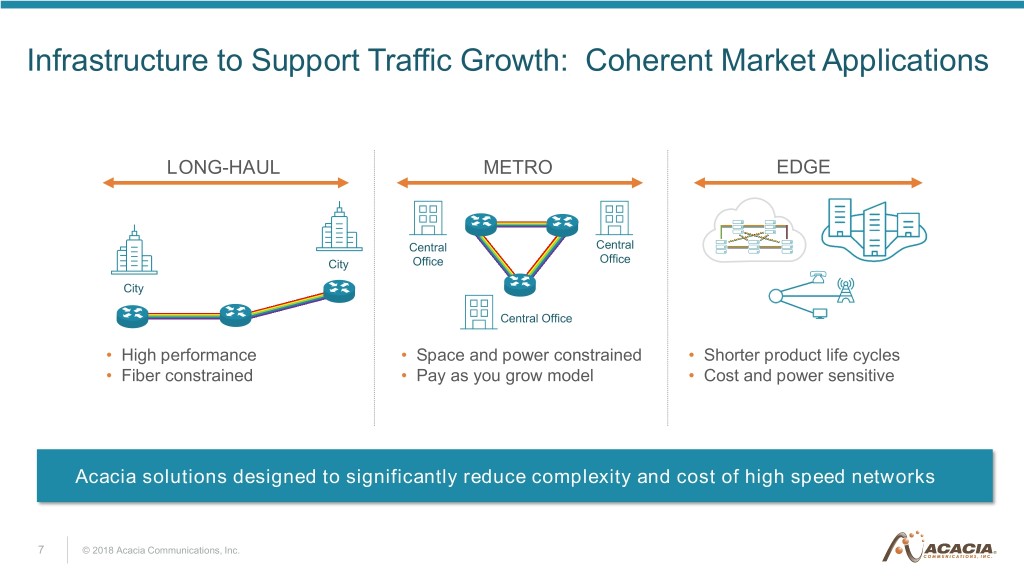

Infrastructure to Support Traffic Growth: Coherent Market Applications LONG-HAUL METRO EDGE Central Central City Office Office City Central Office • High performance • Space and power constrained • Shorter product life cycles • Fiber constrained • Pay as you grow model • Cost and power sensitive Acacia solutions designed to significantly reduce complexity and cost of high speed networks 7 © 2018 Acacia Communications, Inc.

Forecasted Demand Increase in Long Haul/Metro/Edge Deployed Bandwidth Growth1 Long Haul Metro Edge 2017 2022 Most significant growth anticipated from Edge (<100km) applications driven by DCI market 8 © 2018 Acacia Communications, Inc. 1 Reprinted with permission: Cignal AI, September 2018 2 CAGR calculated by 100G Port Equivalent growth, Cignal AI, Sept 2018

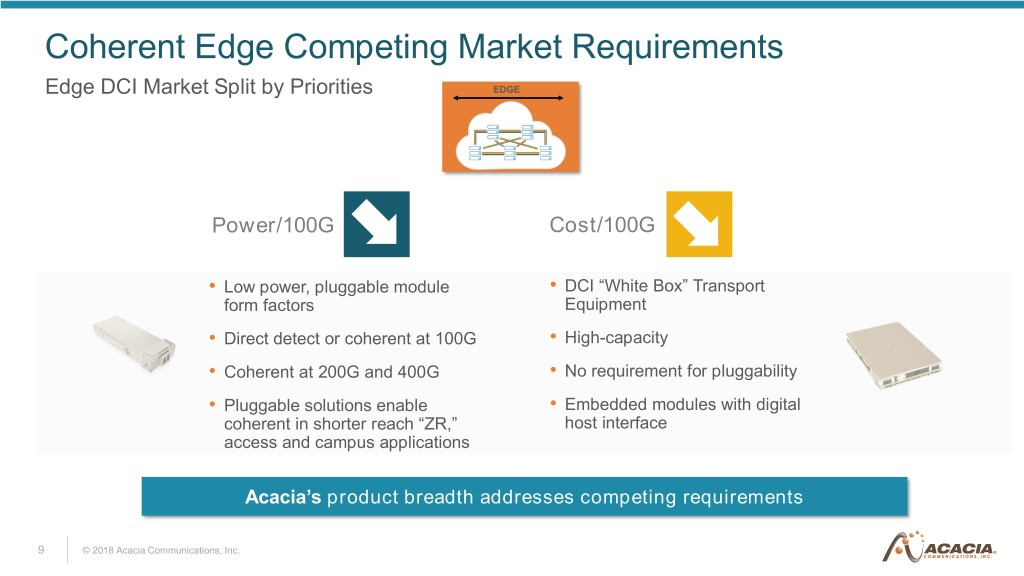

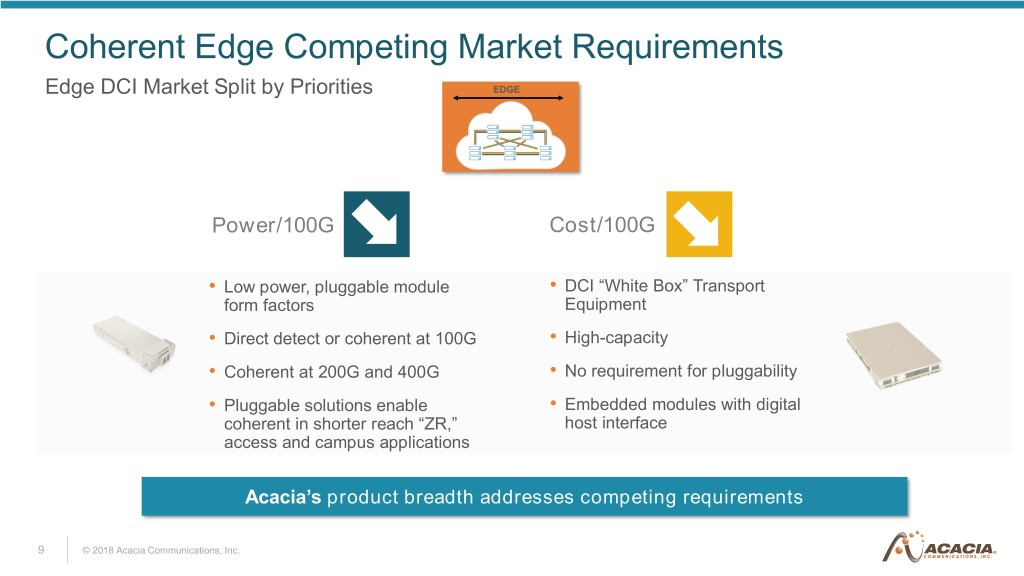

Coherent Edge Competing Market Requirements Edge DCI Market Split by Priorities Power/100G Cost/100G • Low power, pluggable module • DCI “White Box” Transport form factors Equipment • Direct detect or coherent at 100G • High-capacity • Coherent at 200G and 400G • No requirement for pluggability • Pluggable solutions enable • Embedded modules with digital coherent in shorter reach “ZR,” host interface access and campus applications Acacia’s product breadth addresses competing requirements 9 © 2018 Acacia Communications, Inc.

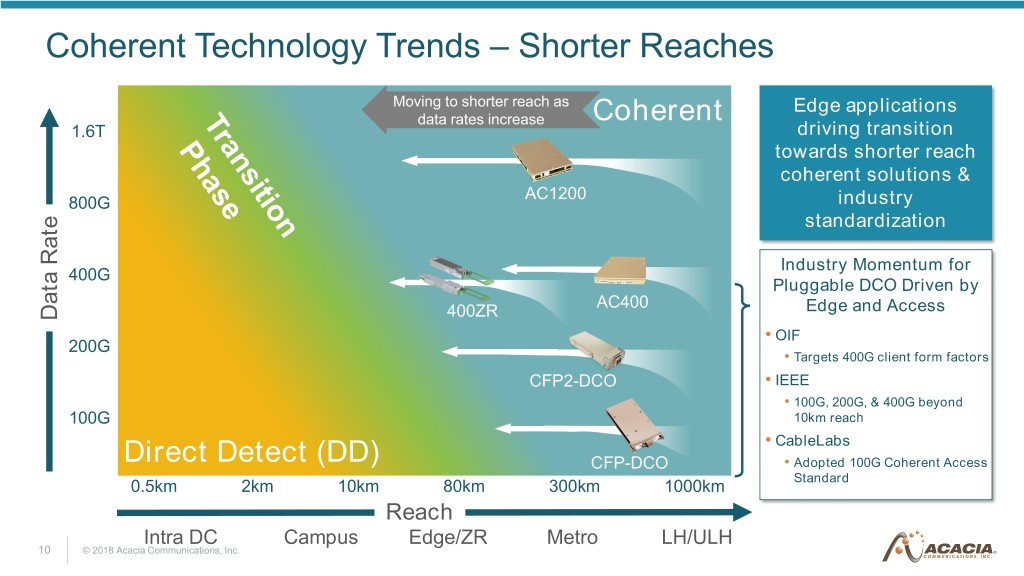

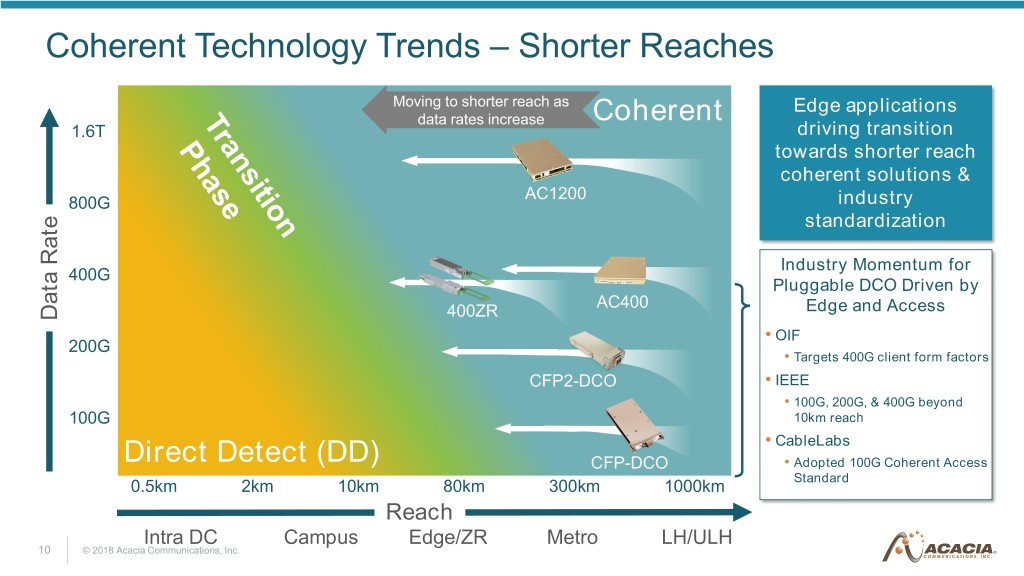

Coherent Technology Trends – Shorter Reaches Moving to shorter reach as Edge applications data rates increase Coherent 1.6T driving transition towards shorter reach coherent solutions & AC1200 800G industry standardization Industry Momentum for 400G Pluggable DCO Driven by AC400 400ZR Edge and Access Data Rate Data • OIF 200G • Targets 400G client form factors CFP2-DCO • IEEE • 100G, 200G, & 400G beyond 100G 10km reach • CableLabs Direct Detect (DD) CFP-DCO • Adopted 100G Coherent Access 0.5km 2km 10km 80km 300km 1000km Standard Reach Intra DC Campus Edge/ZR Metro LH/ULH 10 © 2018 Acacia Communications, Inc.

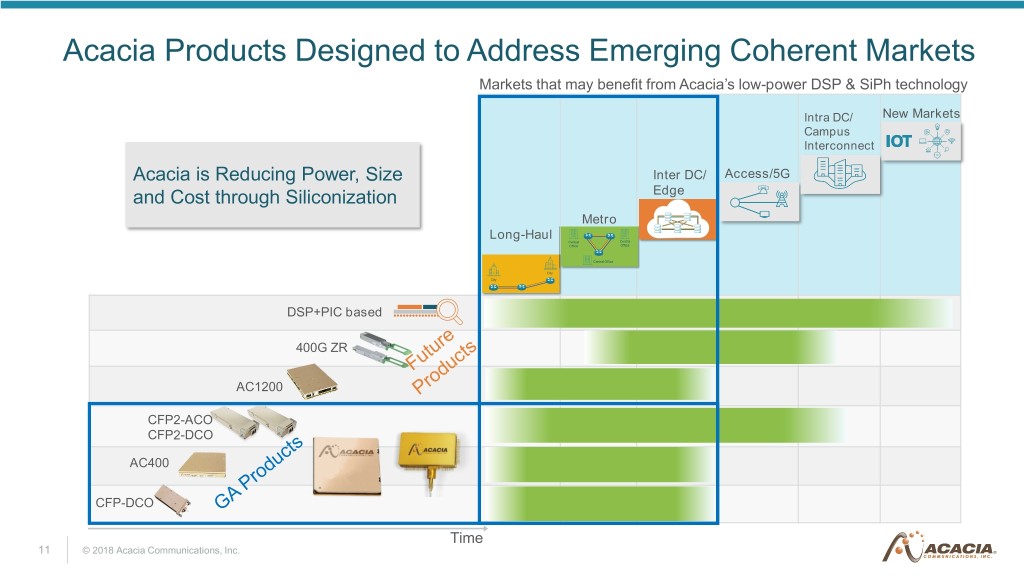

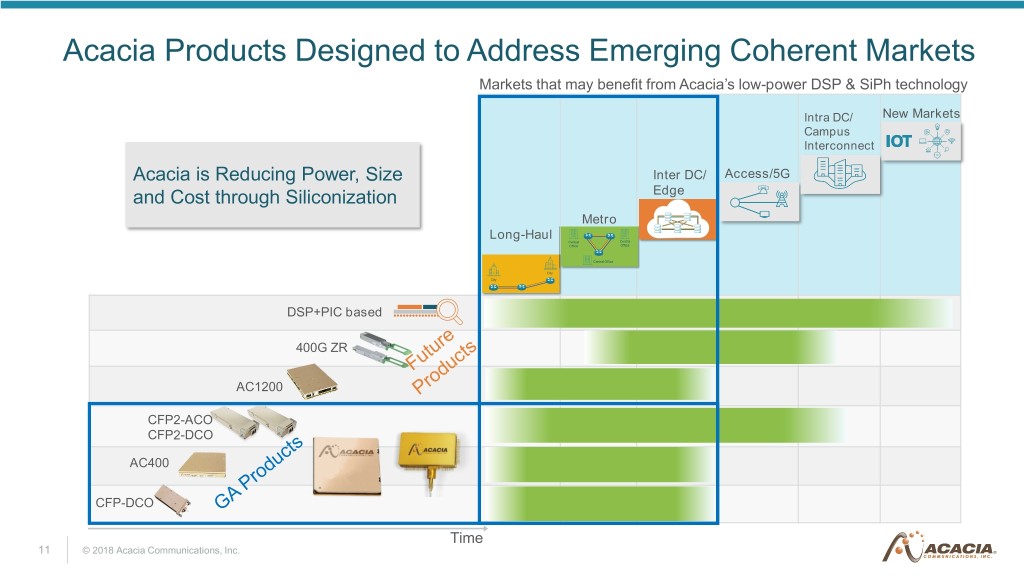

Acacia Products Designed to Address Emerging Coherent Markets Markets that may benefit from Acacia’s low-power DSP & SiPh technology Intra DC/ New Markets Campus Interconnect Acacia is Reducing Power, Size Inter DC/ Access/5G and Cost through Siliconization Edge Metro Long-Haul DSP+PIC based 400G ZR AC1200 CFP2-ACO CFP2-DCO AC400 CFP-DCO Time 11 © 2018 Acacia Communications, Inc.

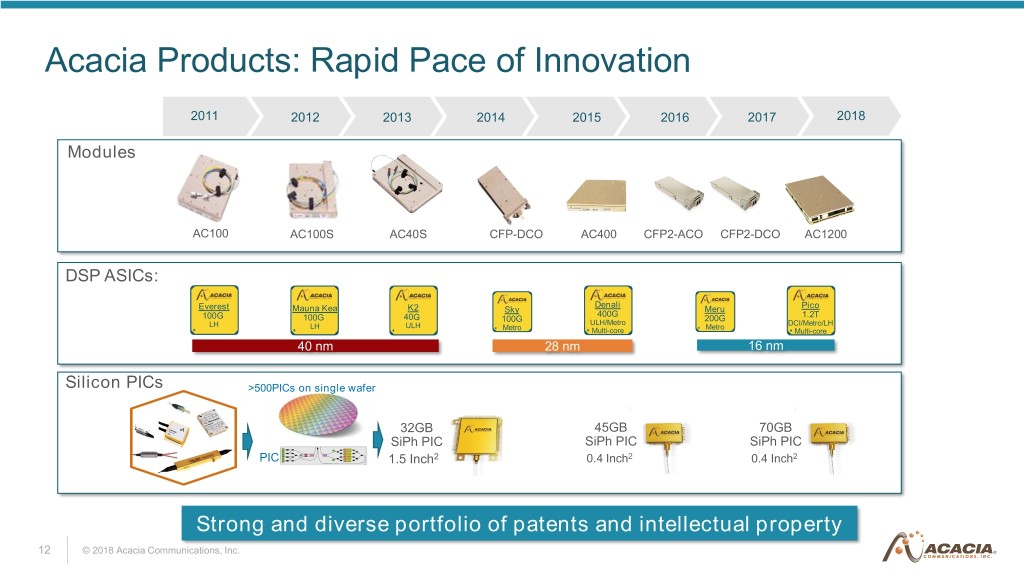

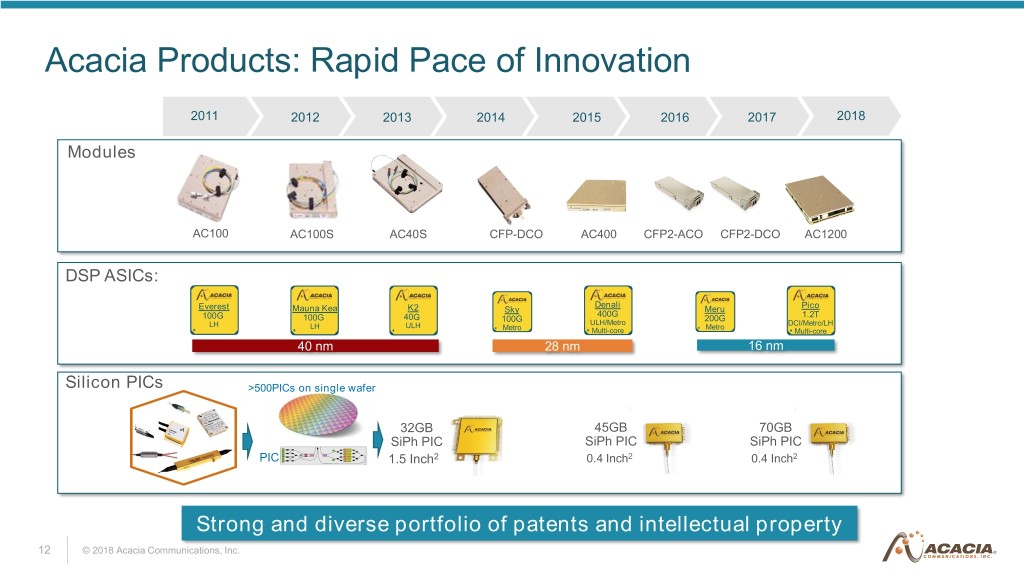

Acacia Products: Rapid Pace of Innovation 2011 2012 2013 2014 2015 2016 2017 2018 Modules AC100 AC100S AC40S CFP-DCO AC400 CFP2-ACO CFP2-DCO AC1200 DSP ASICs: Denali Everest Mauna Kea K2 Meru Pico Sky 400G 100G 100G 40G 200G 1.2T 100G ULH/Metro DCI/Metro/LH LH LH ULH Metro Metro Multi-core Multi-core 40 nm 28 nm 16 nm Silicon PICs >500PICs on single wafer 32GB 45GB 70GB SiPh PIC SiPh PIC SiPh PIC PIC 1.5 Inch2 0.4 Inch2 0.4 Inch2 Strong and diverse portfolio of patents and intellectual property 12 © 2018 Acacia Communications, Inc.

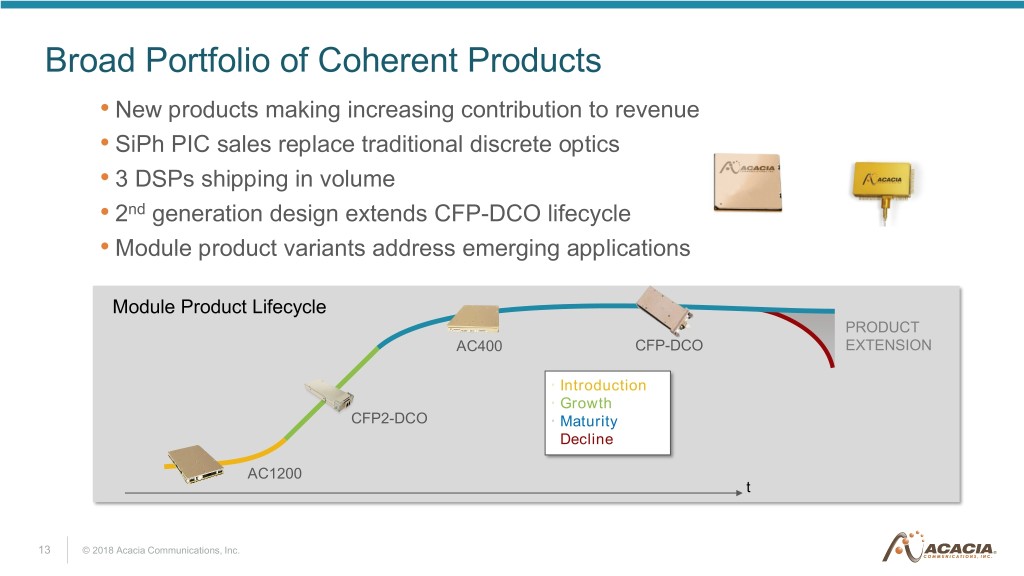

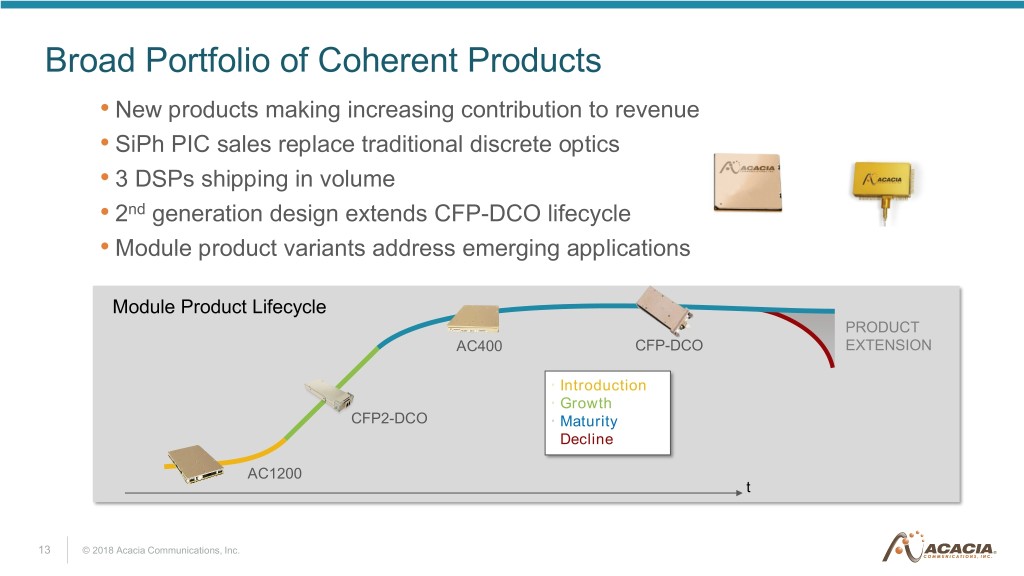

Broad Portfolio of Coherent Products • New products making increasing contribution to revenue • SiPh PIC sales replace traditional discrete optics • 3 DSPs shipping in volume • 2nd generation design extends CFP-DCO lifecycle • Module product variants address emerging applications Module Product Lifecycle PRODUCT AC400 CFP-DCO EXTENSION Introduction Growth CFP2-DCO Maturity Decline AC1200 t 13 © 2018 Acacia Communications, Inc.

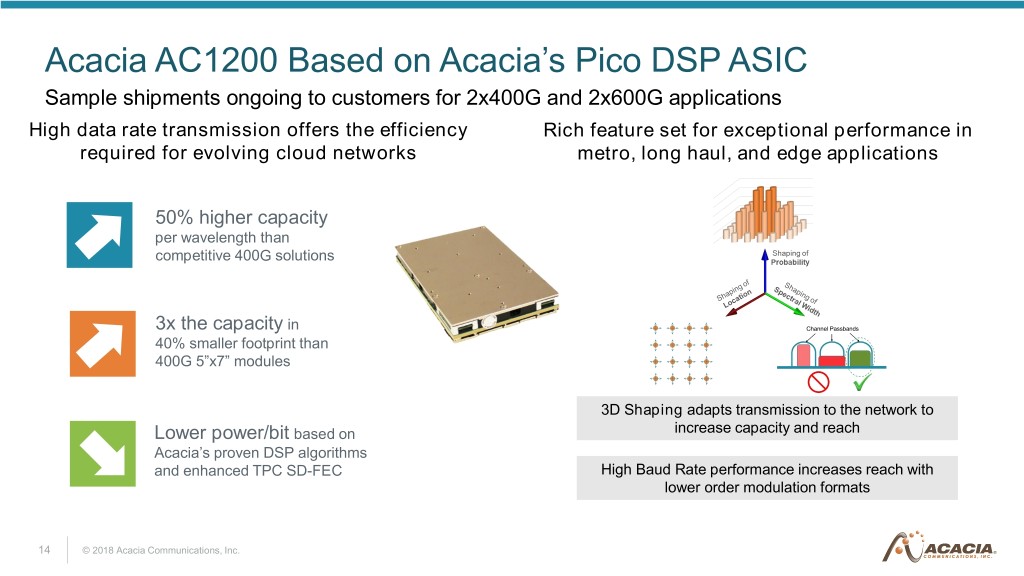

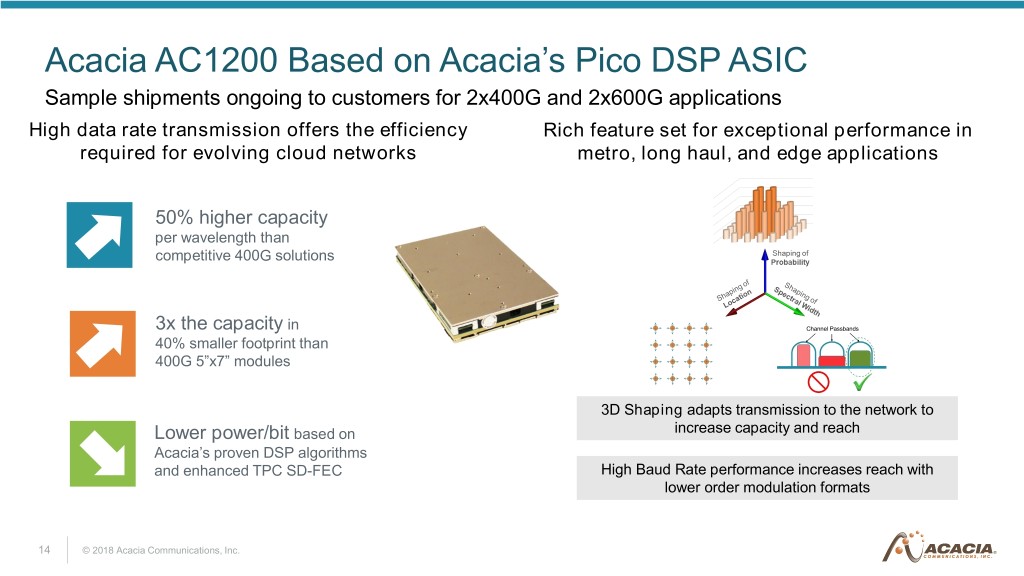

Acacia AC1200 Based on Acacia’s Pico DSP ASIC Sample shipments ongoing to customers for 2x400G and 2x600G applications High data rate transmission offers the efficiency Rich feature set for exceptional performance in required for evolving cloud networks metro, long haul, and edge applications 50% higher capacity per wavelength than competitive 400G solutions 3x the capacity in 40% smaller footprint than 400G 5”x7” modules 3D Shaping adapts transmission to the network to Lower power/bit based on increase capacity and reach Acacia’s proven DSP algorithms and enhanced TPC SD-FEC High Baud Rate performance increases reach with lower order modulation formats 14 © 2018 Acacia Communications, Inc.

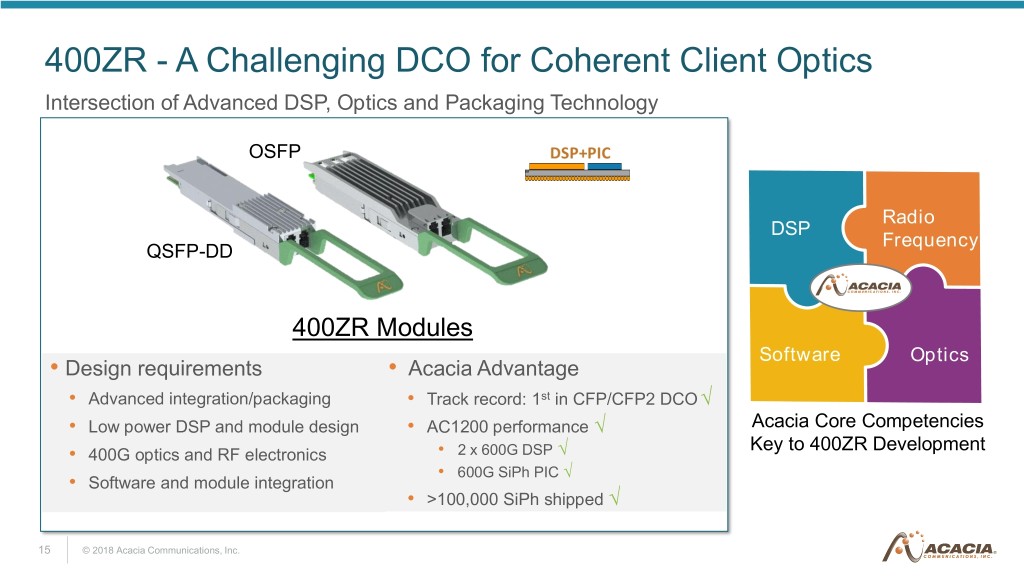

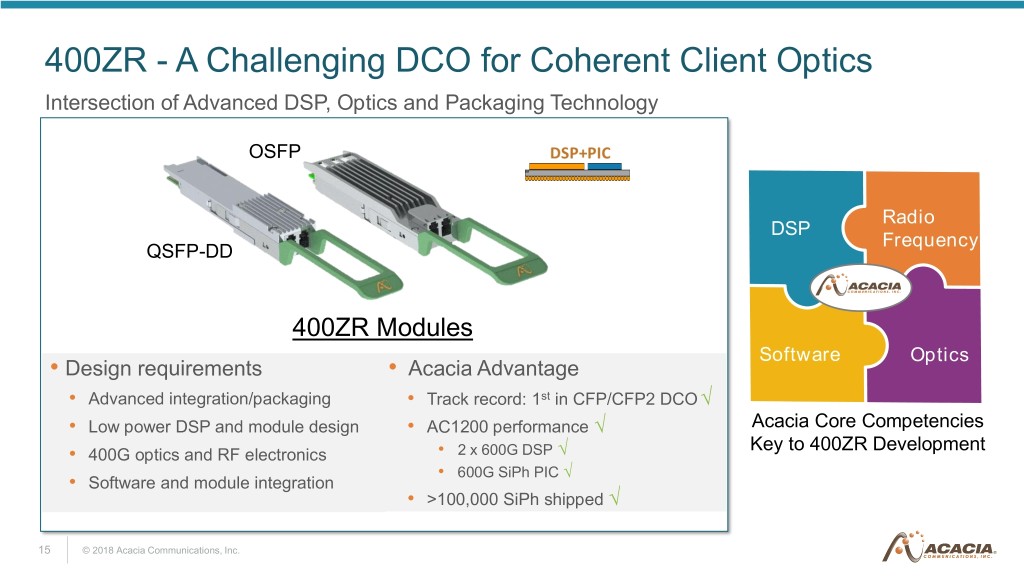

400ZR - A Challenging DCO for Coherent Client Optics Intersection of Advanced DSP, Optics and Packaging Technology OSFP Radio DSP Frequency QSFP-DD 400ZR Modules Software Optics • Design requirements • Acacia Advantage • Advanced integration/packaging • Track record: 1st in CFP/CFP2 DCO √ • Low power DSP and module design • AC1200 performance √ Acacia Core Competencies Key to 400ZR Development • 400G optics and RF electronics • 2 x 600G DSP √ • 600G SiPh PIC √ • Software and module integration • >100,000 SiPh shipped √ 15 © 2018 Acacia Communications, Inc.

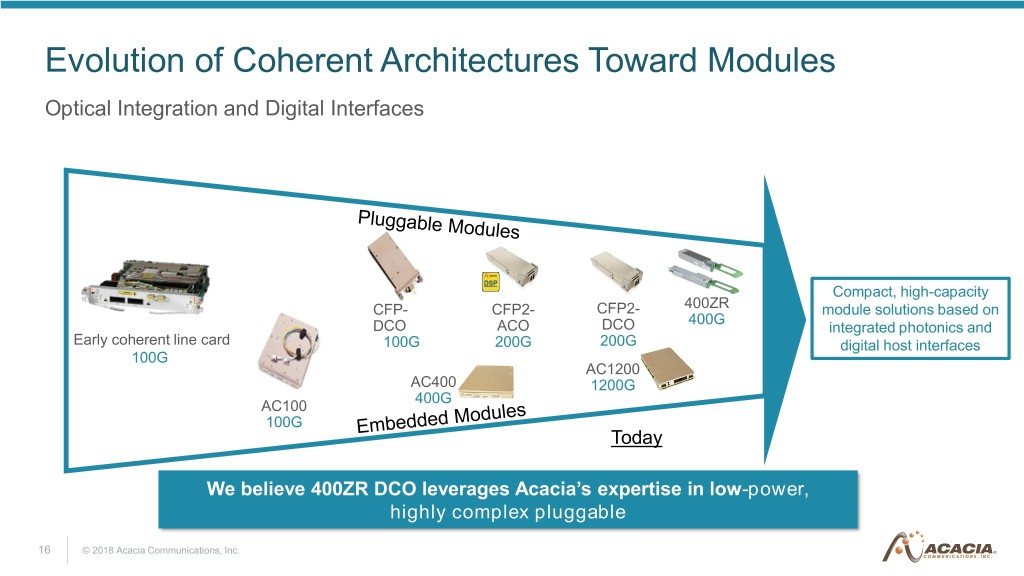

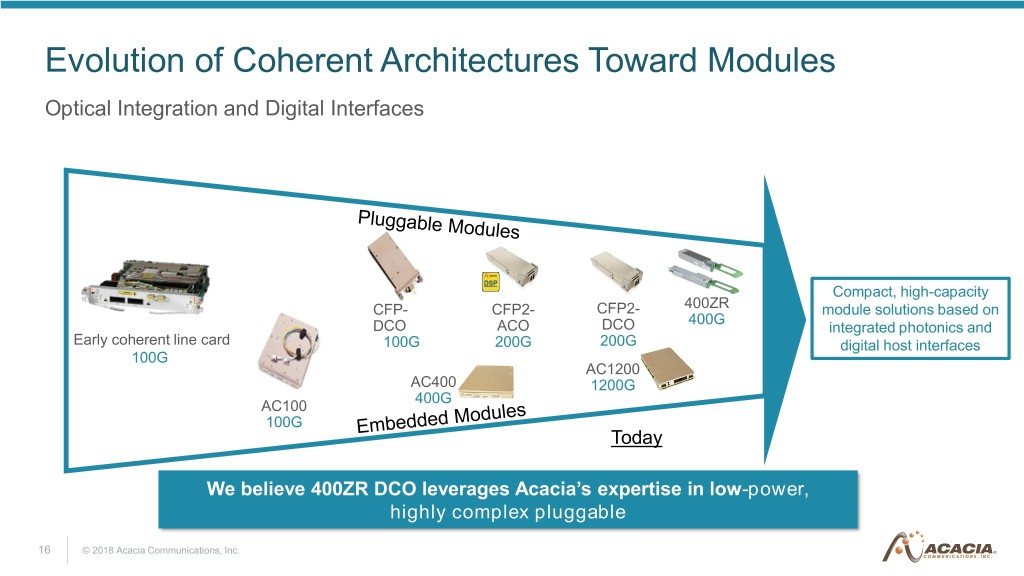

Evolution of Coherent Architectures Toward Modules Optical Integration and Digital Interfaces Compact, high-capacity CFP- CFP2- CFP2- 400ZR module solutions based on 400G DCO ACO DCO integrated photonics and Early coherent line card 100G 200G 200G digital host interfaces 100G AC1200 AC400 1200G 400G AC100 100G Today We believe 400ZR DCO leverages Acacia’s expertise in low-power, highly complex pluggable 16 © 2018 Acacia Communications, Inc.

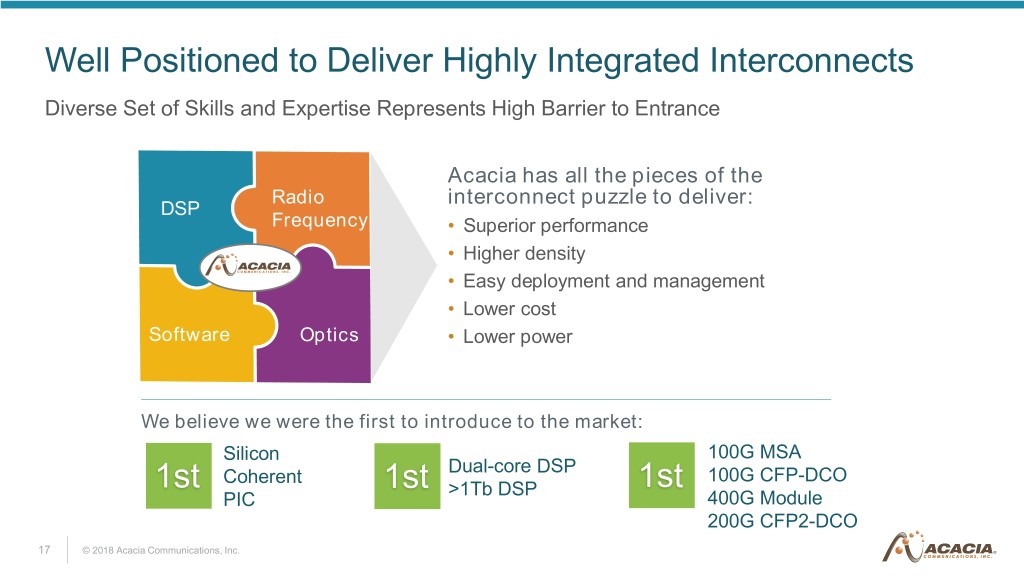

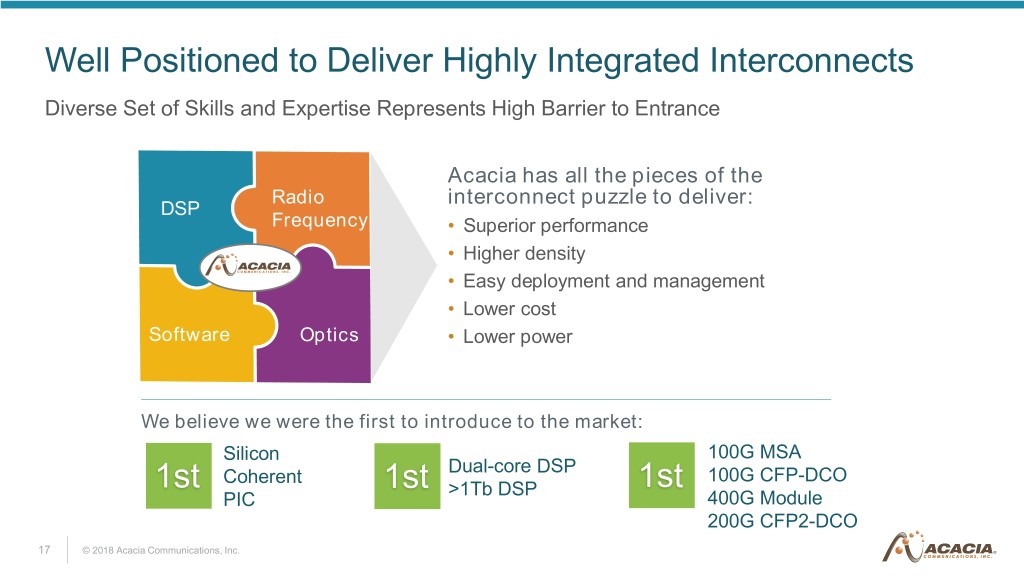

Well Positioned to Deliver Highly Integrated Interconnects Diverse Set of Skills and Expertise Represents High Barrier to Entrance Acacia has all the pieces of the Radio interconnect puzzle to deliver: DSP Frequency • Superior performance • Higher density • Easy deployment and management • Lower cost Software Optics • Lower power We believe we were the first to introduce to the market: Silicon 100G MSA Dual-core DSP Coherent 100G CFP-DCO 1st 1st >1Tb DSP 1st PIC 400G Module 200G CFP2-DCO 17 © 2018 Acacia Communications, Inc.

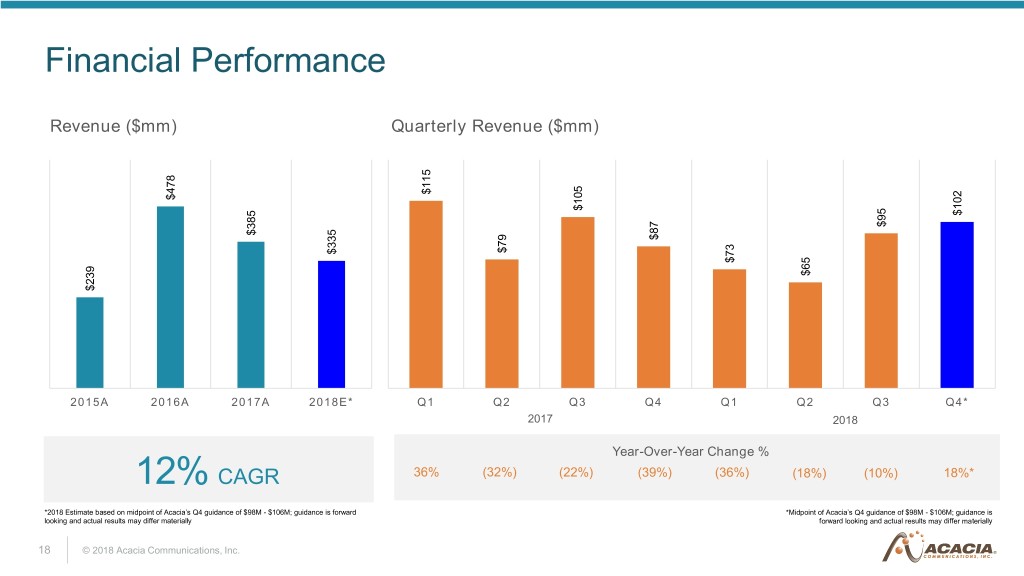

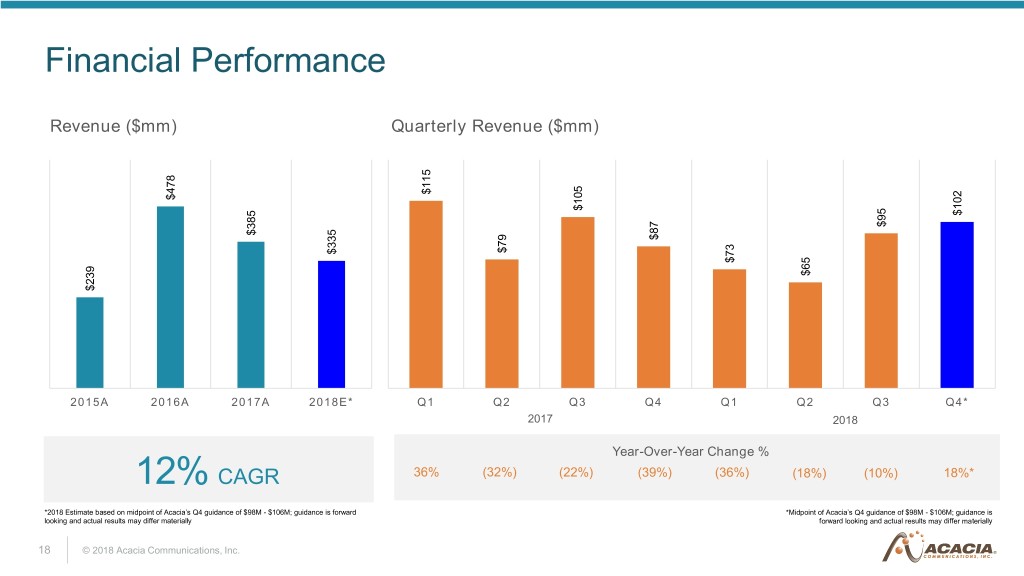

Financial Performance Revenue ($mm) Quarterly Revenue ($mm) $115 $478 $105 $105 $102 $95 $385 $385 $87 $79 $335 $335 $73 $65 $239 2015A 2016A 2017A 2018E* Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4* 2017 2018 Year-Over-Year Change % 12% CAGR 36% (32%) (22%) (39%) (36%) (18%) (10%) 18%* *2018 Estimate based on midpoint of Acacia’s Q4 guidance of $98M - $106M; guidance is forward *Midpoint of Acacia’s Q4 guidance of $98M - $106M; guidance is looking and actual results may differ materially forward looking and actual results may differ materially 18 © 2018 Acacia Communications, Inc.

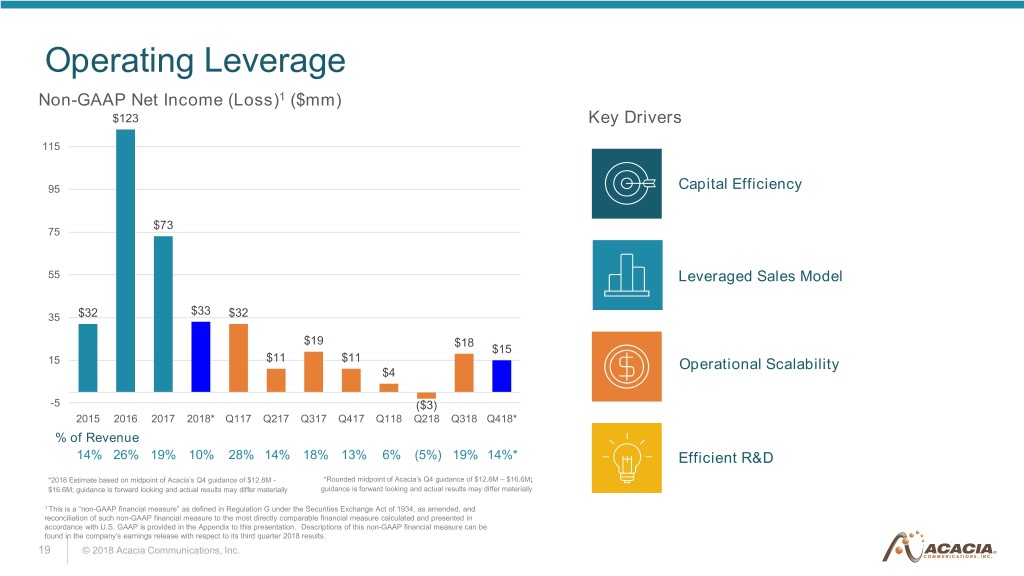

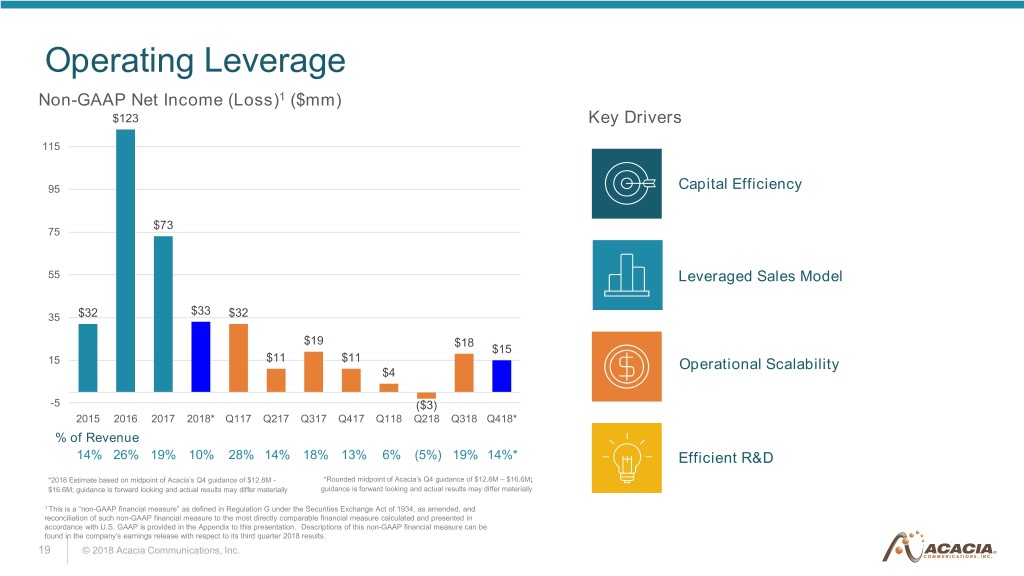

Operating Leverage Non-GAAP Net Income (Loss)1 ($mm) $123 Key Drivers 115 95 Capital Efficiency $73 75 55 Leveraged Sales Model $33 35 $32 $32 $19 $18 $15 15 $11 $11 Operational Scalability $4 -5 ($3) 2015 2016 2017 2018* Q117 Q217 Q317 Q417 Q118 Q218 Q318 Q418* % of Revenue 14% 26% 19% 10% 28% 14% 18% 13% 6% (5%) 19% 14%* Efficient R&D *2018 Estimate based on midpoint of Acacia’s Q4 guidance of $12.8M - *Rounded midpoint of Acacia’s Q4 guidance of $12.8M – $16.6M; $16.6M; guidance is forward looking and actual results may differ materially guidance is forward looking and actual results may differ materially 1 This is a “non-GAAP financial measure” as defined in Regulation G under the Securities Exchange Act of 1934, as amended, and reconciliation of such non-GAAP financial measure to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP is provided in the Appendix to this presentation. Descriptions of this non-GAAP financial measure can be found in the company’s earnings release with respect to its third quarter 2018 results. 19 © 2018 Acacia Communications, Inc.

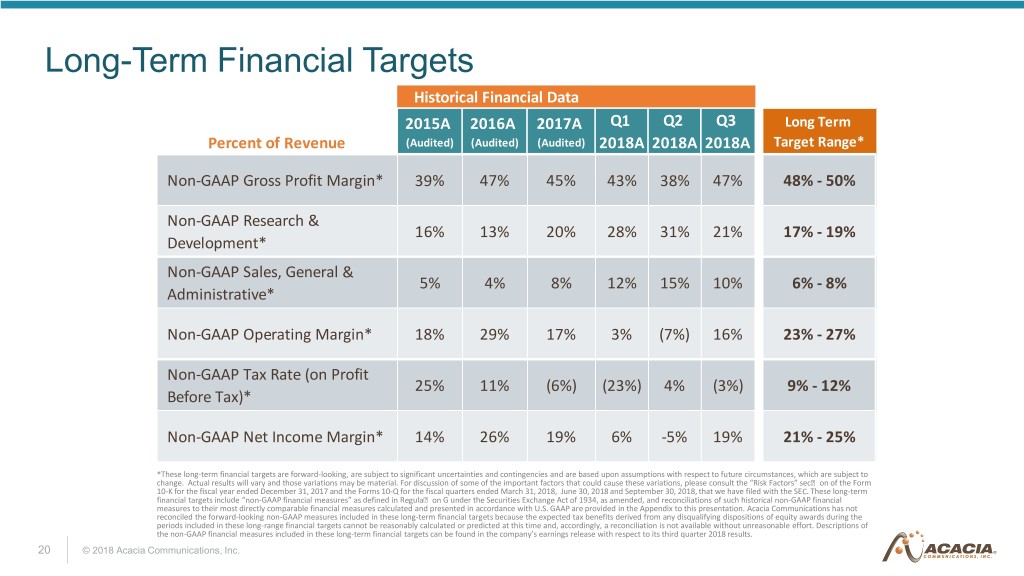

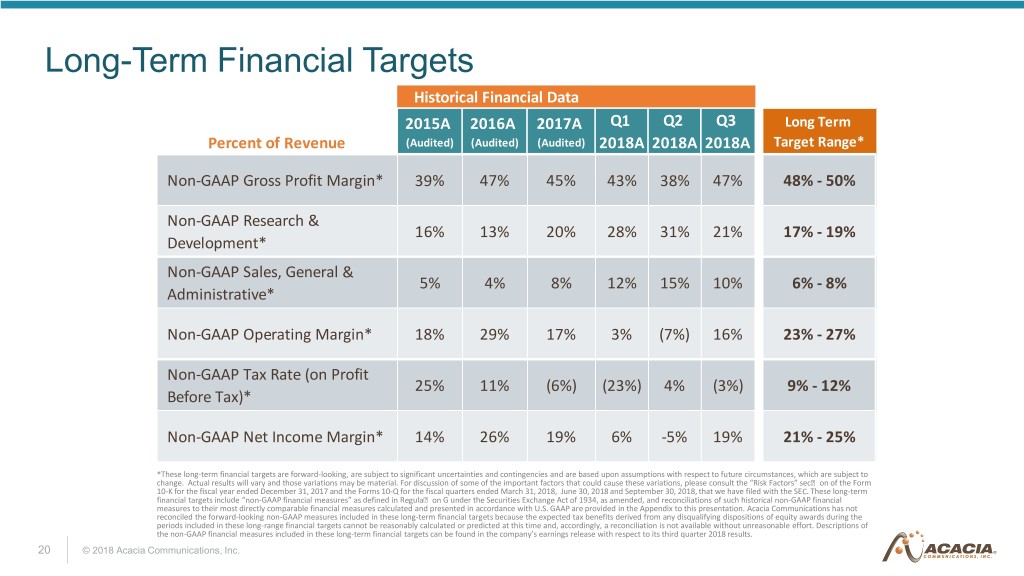

Long-Term Financial Targets Historical Financial Data 2015A 2016A 2017A Q1 Q2 Q3 Long Term Percent of Revenue (Audited) (Audited) (Audited) 2018A 2018A 2018A Target Range* Non-GAAP Gross Profit Margin* 39% 47% 45% 43% 38% 47% 48% - 50% Non-GAAP Research & 16% 13% 20% 28% 31% 21% 17% - 19% Development* Non-GAAP Sales, General & 5% 4% 8% 12% 15% 10% 6% - 8% Administrative* Non-GAAP Operating Margin* 18% 29% 17% 3% (7%) 16% 23% - 27% Non-GAAP Tax Rate (on Profit 25% 11% (6%) (23%) 4% (3%) 9% - 12% Before Tax)* Non-GAAP Net Income Margin* 14% 26% 19% 6% -5% 19% 21% - 25% *These long-term financial targets are forward-looking, are subject to significant uncertainties and contingencies and are based upon assumptions with respect to future circumstances, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” sec� on of the Form 10-K for the fiscal year ended December 31, 2017 and the Forms 10-Q for the fiscal quarters ended March 31, 2018, June 30, 2018 and September 30, 2018, that we have filed with the SEC. These long-term financial targets include “non-GAAP financial measures” as defined in Regula� on G under the Securities Exchange Act of 1934, as amended, and reconciliations of such historical non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP are provided in the Appendix to this presentation. Acacia Communications has not reconciled the forward-looking non-GAAP measures included in these long-term financial targets because the expected tax benefits derived from any disqualifying dispositions of equity awards during the periods included in these long-range financial targets cannot be reasonably calculated or predicted at this time and, accordingly, a reconciliation is not available without unreasonable effort. Descriptions of the non-GAAP financial measures included in these long-term financial targets can be found in the company’s earnings release with respect to its third quarter 2018 results. 20 © 2018 Acacia Communications, Inc.

Industry Awards & Accolades 2016 Finalist 2011 2014 2016 New England Region 2018 Outstanding Components Vendor 21 © 2018 Acacia Communications, Inc.

Sustainable Optical Networking Helping to ensure sustainability despite soaring bandwidth growth • Optimizing design of DSP ASIC and SiPh PIC • Developing power efficient algorithms • Helping our service provider and cloud customers dramatically reduce energy consumption Acacia has been able to reduce the power consumed by its coherent optical interconnects by as much as 85% in the last 5 years. 22 © 2018 Acacia Communications, Inc.

Appendix 23 © 2018 Acacia Communications, Inc.

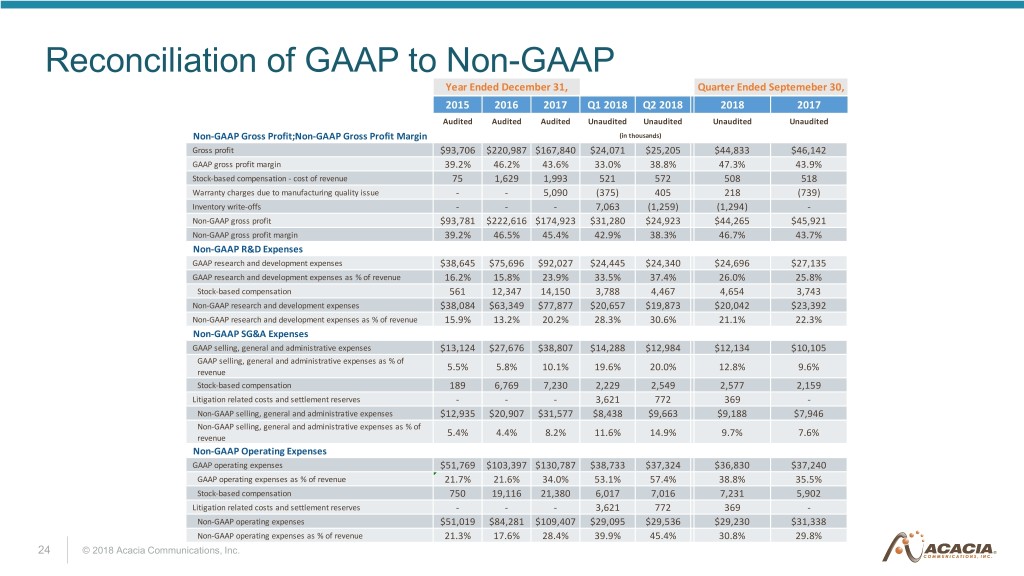

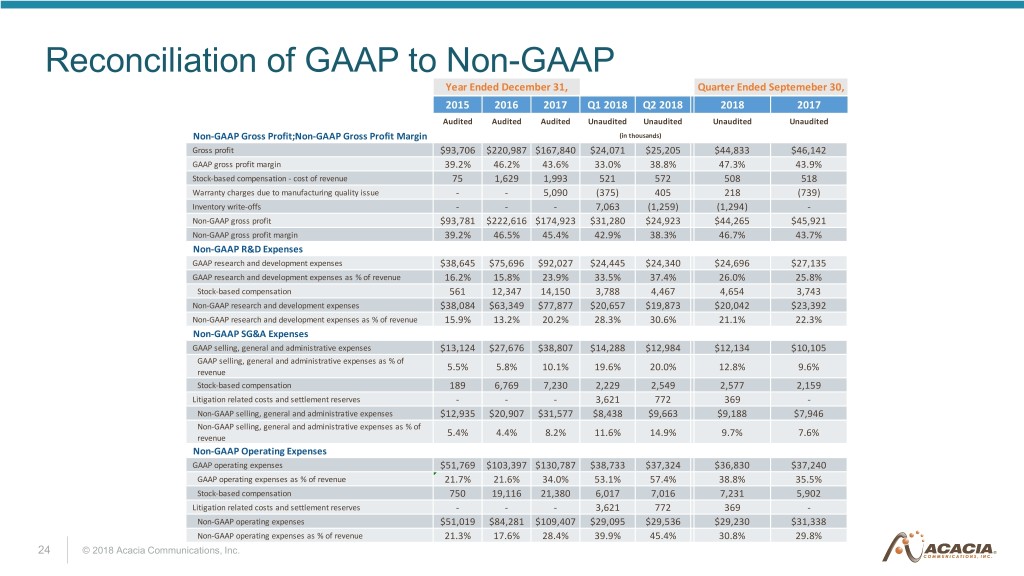

Reconciliation of GAAP to Non-GAAP Year Ended December 31, Quarter Ended Septemeber 30, 2015 2016 2017 Q1 2018 Q2 2018 2018 2017 Audited Audited Audited Unaudited Unaudited Unaudited Unaudited Non-GAAP Gross Profit;Non-GAAP Gross Profit Margin (in thousands) Gross profit $93,706 $220,987 $167,840 $24,071 $25,205 $44,833 $46,142 GAAP gross profit margin 39.2% 46.2% 43.6% 33.0% 38.8% 47.3% 43.9% Stock-based compensation - cost of revenue 75 1,629 1,993 521 572 508 518 Warranty charges due to manufacturing quality issue - - 5,090 (375) 405 218 (739) Inventory write-offs - - - 7,063 (1,259) (1,294) - Non-GAAP gross profit $93,781 $222,616 $174,923 $31,280 $24,923 $44,265 $45,921 Non-GAAP gross profit margin 39.2% 46.5% 45.4% 42.9% 38.3% 46.7% 43.7% Non-GAAP R&D Expenses GAAP research and development expenses $38,645 $75,696 $92,027 $24,445 $24,340 $24,696 $27,135 GAAP research and development expenses as % of revenue 16.2% 15.8% 23.9% 33.5% 37.4% 26.0% 25.8% Stock-based compensation 561 12,347 14,150 3,788 4,467 4,654 3,743 Non-GAAP research and development expenses $38,084 $63,349 $77,877 $20,657 $19,873 $20,042 $23,392 Non-GAAP research and development expenses as % of revenue 15.9% 13.2% 20.2% 28.3% 30.6% 21.1% 22.3% Non-GAAP SG&A Expenses GAAP selling, general and administrative expenses $13,124 $27,676 $38,807 $14,288 $12,984 $12,134 $10,105 GAAP selling, general and administrative expenses as % of 5.5% 5.8% 10.1% 19.6% 20.0% 12.8% 9.6% revenue Stock-based compensation 189 6,769 7,230 2,229 2,549 2,577 2,159 Litigation related costs and settlement reserves - - - 3,621 772 369 - Non-GAAP selling, general and administrative expenses $12,935 $20,907 $31,577 $8,438 $9,663 $9,188 $7,946 Non-GAAP selling, general and administrative expenses as % of 5.4% 4.4% 8.2% 11.6% 14.9% 9.7% 7.6% revenue Non-GAAP Operating Expenses GAAP operating expenses $51,769 $103,397 $130,787 $38,733 $37,324 $36,830 $37,240 GAAP operating expenses as % of revenue 21.7% 21.6% 34.0% 53.1% 57.4% 38.8% 35.5% Stock-based compensation 750 19,116 21,380 6,017 7,016 7,231 5,902 Litigation related costs and settlement reserves - - - 3,621 772 369 - Non-GAAP operating expenses $51,019 $84,281 $109,407 $29,095 $29,536 $29,230 $31,338 Non-GAAP operating expenses as % of revenue 21.3% 17.6% 28.4% 39.9% 45.4% 30.8% 29.8% 24 © 2018 Acacia Communications, Inc.

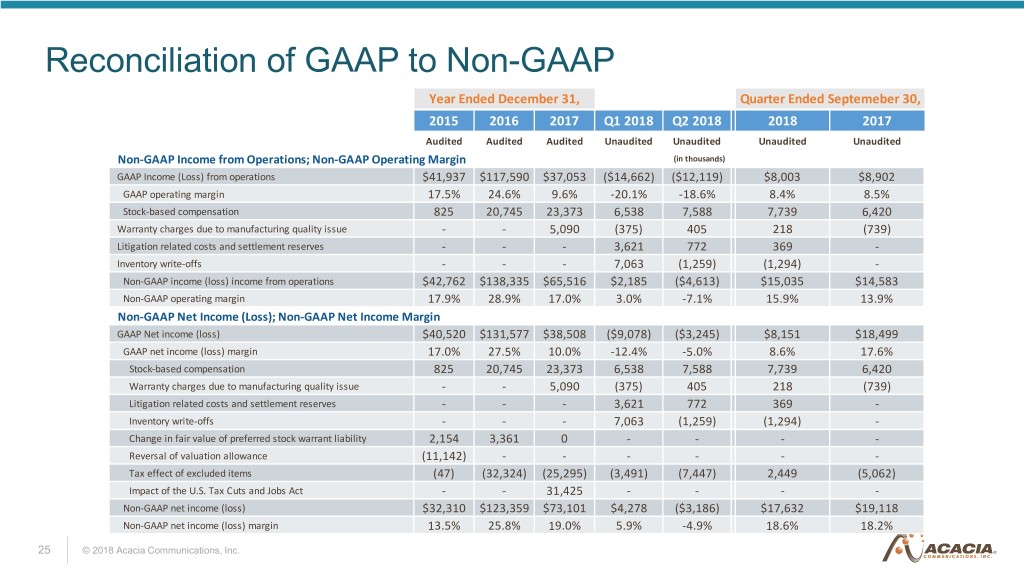

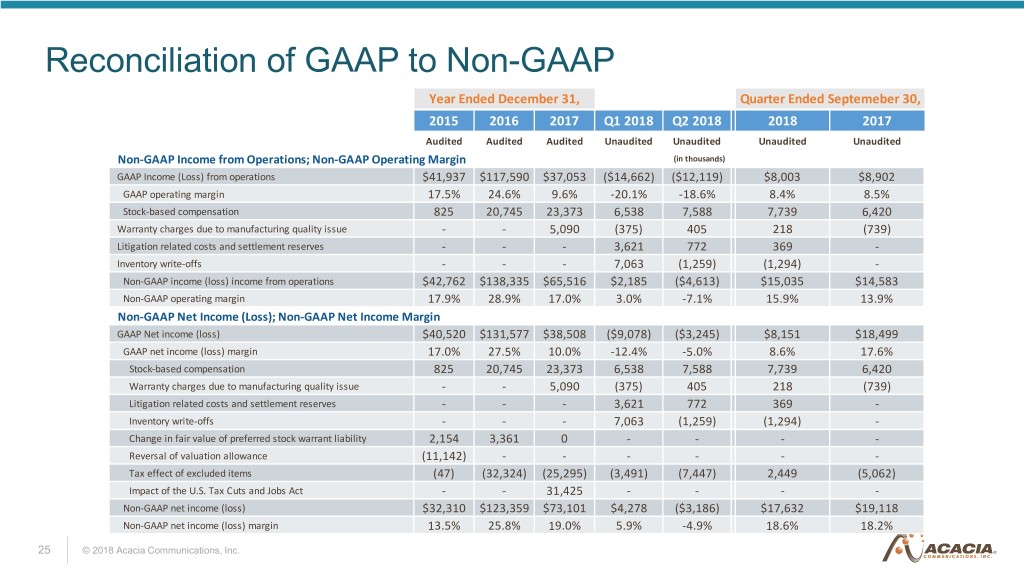

Reconciliation of GAAP to Non-GAAP Year Ended December 31, Quarter Ended Septemeber 30, 2015 2016 2017 Q1 2018 Q2 2018 2018 2017 Audited Audited Audited Unaudited Unaudited Unaudited Unaudited Non-GAAP Income from Operations; Non-GAAP Operating Margin (in thousands) GAAP Income (Loss) from operations $41,937 $117,590 $37,053 ($14,662) ($12,119) $8,003 $8,902 GAAP operating margin 17.5% 24.6% 9.6% -20.1% -18.6% 8.4% 8.5% Stock-based compensation 825 20,745 23,373 6,538 7,588 7,739 6,420 Warranty charges due to manufacturing quality issue - - 5,090 (375) 405 218 (739) Litigation related costs and settlement reserves - - - 3,621 772 369 - Inventory write-offs - - - 7,063 (1,259) (1,294) - Non-GAAP income (loss) income from operations $42,762 $138,335 $65,516 $2,185 ($4,613) $15,035 $14,583 Non-GAAP operating margin 17.9% 28.9% 17.0% 3.0% -7.1% 15.9% 13.9% Non-GAAP Net Income (Loss); Non-GAAP Net Income Margin GAAP Net income (loss) $40,520 $131,577 $38,508 ($9,078) ($3,245) $8,151 $18,499 GAAP net income (loss) margin 17.0% 27.5% 10.0% -12.4% -5.0% 8.6% 17.6% Stock-based compensation 825 20,745 23,373 6,538 7,588 7,739 6,420 Warranty charges due to manufacturing quality issue - - 5,090 (375) 405 218 (739) Litigation related costs and settlement reserves - - - 3,621 772 369 - Inventory write-offs - - - 7,063 (1,259) (1,294) - Change in fair value of preferred stock warrant liability 2,154 3,361 0 - - - - Reversal of valuation allowance (11,142) - - - - - - Tax effect of excluded items (47) (32,324) (25,295) (3,491) (7,447) 2,449 (5,062) Impact of the U.S. Tax Cuts and Jobs Act - - 31,425 - - - - Non-GAAP net income (loss) $32,310 $123,359 $73,101 $4,278 ($3,186) $17,632 $19,118 Non-GAAP net income (loss) margin 13.5% 25.8% 19.0% 5.9% -4.9% 18.6% 18.2% 25 © 2018 Acacia Communications, Inc.

Reconciliation of GAAP to Non-GAAP Year Ended December 31, Quarter Ended Septemeber 30, 2015 2016 2017 Q1 2018 Q2 2018 2018 2017 Audited Audited Audited Unaudited Unaudited Unaudited Unaudited Non-GAAP Effective Tax Rate (in thousands) GAAP Effective Tax Rate (1.8%) (14.8%) 4.5% 32.1% 70.0% 18.6% (87.4%) Total adjustments to GAAP provision for income taxes 26.3% 25.9% 34.9% (55.5%) (66.2%) (22.0%) 64.5% Impact of the U.S. Tax Cuts and Jobs Act - - (45.7%) - - - - Non-GAAP effective tax rate 24.5% 11.1% (6.3%) (23.4%) 3.8% (3.4%) (22.9%) Adjusted EBITDA GAAP Net income (loss) $40,520 $131,577 $38,508 ($9,078) ($3,245) $8,151 $18,499 Depreciation 4,576 9,168 12,280 3,266 3,368 3,498 3,260 Interest expense(income), net 135 (453) (3,389) (1,354) (1,491) (2,074) (990) Provision(benefit) for income taxes (715) (16,956) 1,795 (4,301) (7,574) 1,863 (8,628) Earnings (loss) before interest, taxes, depreciation and $44,516 $123,336 $49,194 ($11,467) ($8,942) $11,438 $12,141 amortization - EBITDA EBITDA as % of revenue 18.6% 25.8% 12.8% -15.7% -13.8% 12.1% 11.6% Stock-based compensation 825 20,745 23,373 6,538 7,588 7,739 6,420 Warranty charges due to manufacturing quality issue - - 5,090 (375) 405 218 (739) Litigation related costs and settlement reserves - - - 3,621 772 369 - Inventory write-offs - - - 7,063 (1,259) (1,294) - Change in fair value of preferred stock warrant liability 2,154 3,361 0 - - - - Adjusted EBITDA $47,495 $147,442 $77,657 $5,380 ($1,436) $18,470 $17,822 Adjusted EBITDA as % of revenue 19.9% 30.8% 20.2% 7.4% -2.2% 19.5% 17.0% 26 © 2018 Acacia Communications, Inc.