May 6, 2022

By EDGAR Submission

| | |

U.S. Securities and Exchange Commission Division of Corporation Finance, Office of Life Sciences 100 F. Street, N.E. Washington, D.C. 20549 Attention: Mr. Michael Davis and Mr. Jason Drory |

Re: BeiGene, Ltd.

Form 10-K for the Fiscal Year Ended December 31, 2021

Filed February 28, 2022

File No. 001-37686

Dear Mr. Davis and Mr. Drory:

BeiGene, Ltd. (the “Company”) is transmitting this letter in response to the comments received from the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) with respect to the Company’s Form 10-K filed on February 28, 2022 (the “2021 Annual Report”), as set forth in your letter dated April 6, 2022 addressed to Mr. John Oyler, Chief Executive Officer and Chairman of the Company (the “Comment Letter”). For your convenience, the Staff’s comments are reproduced in bold type below, followed by the Company’s responses thereto. Capitalized terms used but not defined herein are defined in the 2021 Annual Report.

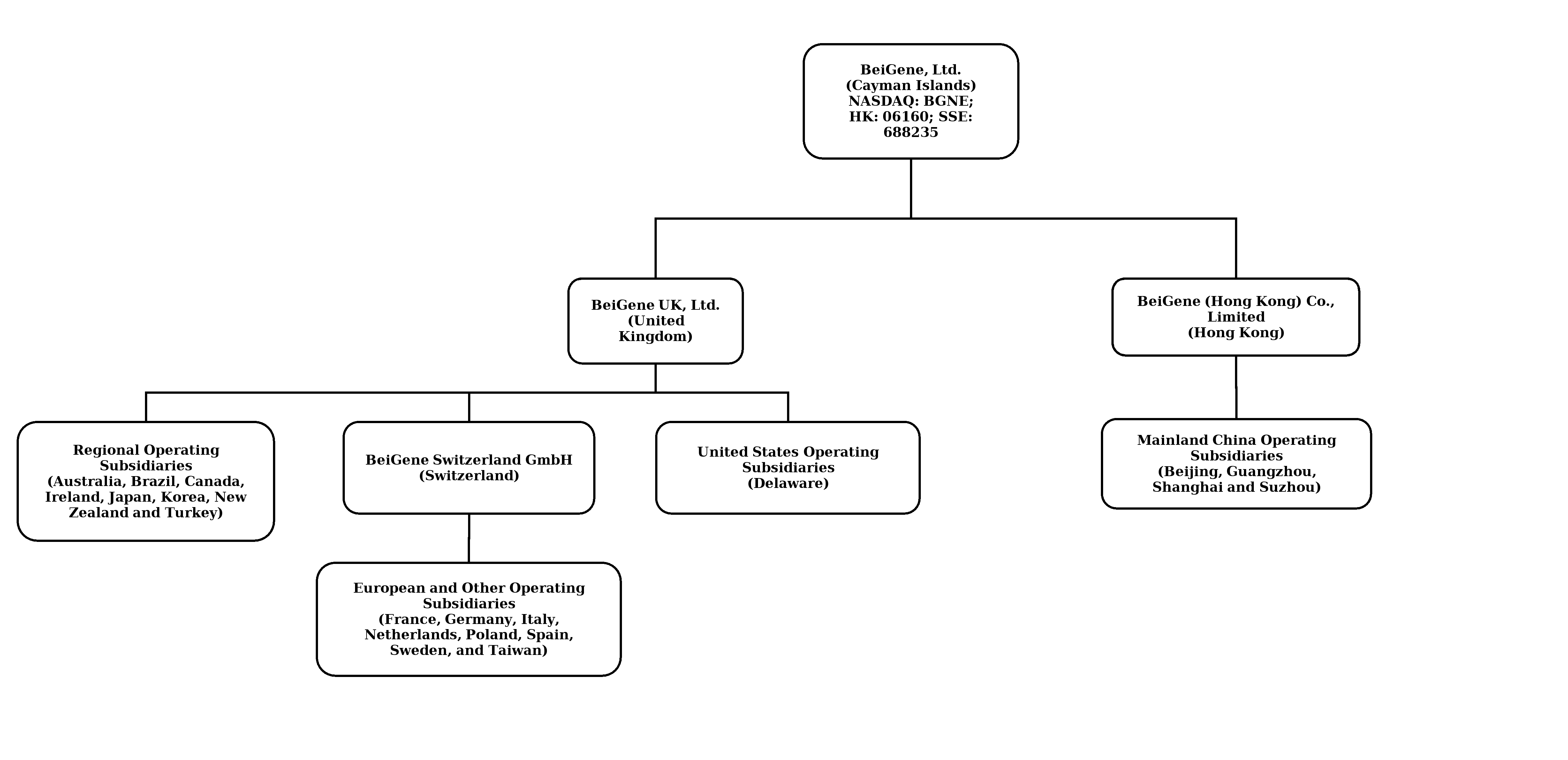

1.At the onset of Part I, please disclose prominently that you are not a Chinese operating company but a Cayman Islands holding company with operations conducted by your subsidiaries. In addition, please provide early in the Business section a diagram of your corporate structure.

RESPONSE: The Company acknowledges the Staff’s comment and respectively advises the Staff that on page 53 of the 2021 Annual Report, the Company discloses that “[w]e are an exempted company incorporated in the Cayman Islands with limited liability on October 28, 2010. Any company that is registered in the Cayman Islands but conducts business mainly outside of the Cayman Islands may apply to be registered as an exempted company.” However, in response to the Staff’s comments, in future annual reports on Form 10-K, the Company will disclose, at the onset of Part I, that it is not a Chinese operating company but a Cayman Islands holding company with operations conducted by its subsidiaries. The Company will also provide early in the Business section a diagram of its corporate structure. In this regard, please refer to Appendix A for a diagram of the Company’s corporate structure that will be provided in future annual reports on Form 10-K.

Additionally, the Company undertakes to update, at the onset of Part I Business section, in its future annual reports on Form 10-K as follows, with necessary updates:

“Our Holding Company Structure

We are a holding company incorporated in the Cayman Islands with operations primarily conducted through our subsidiaries in the United States, China, United Kingdom, Switzerland and Australia. The following diagram depicts a summary of our corporate structure. Currently, our corporate structure contains no variable interest entities.”

2.We note your disclosure beginning on page 94 regarding “Risks Related to Our Doing Business in the PRC.” Please provide a more prominent disclosure about the legal and operational risks associated with being based in or having the majority of the company’s operations in China. Your disclosure should make clear whether these risks could result in a material change in your operations and/or the value of your securities or could significantly limit or completely hinder your ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Your disclosure should address how recent statements and regulatory actions by China’s government, such as those related to data security or anti-monopoly concerns, have or may impact the company’s ability to conduct its business, accept foreign investments, or list on a U.S. or other foreign exchange.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in future relevant Exchange Act periodic reports to address the legal and operational risks of operating in China, the potential effects of such matters on our operations and/or value of our securities, and recent statements and regulatory actions by China’s government and their effect on the Company. Please refer to Appendix C for the risk factors the Company will include in future relevant Exchange Act periodic reports.

The Company undertakes to update the Business section in future annual reports on Form 10-K as follows, with necessary updates:

“Doing Business in the PRC

As a result of our operations in the PRC, the PRC government may intervene in or exert influence over our operations at any time with little or no advanced notice, which could result in a material change in our operations and/or the value of our ADSs, ordinary shares, or RMB Shares. For example, the PRC government has recently published new policies that significantly affected certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding any industry that could adversely affect the business, financial condition and results of operations of our company.

Furthermore, the PRC government has also recently indicated an intent to exert more oversight and control over securities offerings and other capital markets activities that are conducted outside of China and over foreign investment in China-based companies. Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including enforcement actions against illegal activities in the securities market, enhancing supervision over China-based companies listed outside of China using the variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on July 6, 2021, the relevant PRC government authorities made public the Opinions on Intensifying Crack-Down on Illegal Securities Activities. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies and proposed to take measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. On November 14, 2021, the Cyberspace Administration of China (the “CAC”) released the draft Administrative Regulations on Cyber Data Security (the “Draft Cyber Data Security Regulations”) for public comments, which requires, among others, that a prior cybersecurity review should be required for listing abroad of data processors which process over one million users’ personal information, and the listing of data processors in Hong Kong which affects or may affect national security.

The Chinese government may further promulgate relevant laws, rules and regulations that may impose additional and significant obligations and liabilities on overseas listed PRC companies regarding data security, cross-border data flow, anti-monopoly and unfair competition, and compliance with China’s securities laws. It is uncertain whether or how these new laws, rules and regulations and the interpretation and implementation thereof may affect us, but among other things, our ability to obtain external financing through the issuance of equity securities in the United States, Hong Kong or other markets could be negatively affected, and as a result, the trading prices of our ADSs, ordinary shares and RMB Shares could significantly decline or become worthless. For a detailed description of risks related to our doing business in China, see “Item 1A. Risk Factors—Risks Related to Our Doing Business in the PRC.””

3.We note your discussion of PCAOB inspections beginning on page 95. Please prominently disclose whether your auditor is subject to the determinations announced by the PCAOB on December 16, 2021 and whether and how the Holding Foreign Companies Accountable Act and related regulations will affect your company, including disclosing that you were identified by the Commission under the HFCAA. In addition, disclose that trading in your securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or investigate completely your auditor, and that as a result an exchange may determine to delist your securities.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in the Business section of future annual reports on Form 10-K to prominently disclose that its previous auditor is subject to the determinations announced by the PCAOB on December 16, 2021, including that the Company was identified by the Commission under the Holding Foreign Companies Accountable Act and related regulations. The Company also advises the Staff that it will include new risk factor disclosures in the next quarterly report on Form 10-Q that will be filed on May 9, 2022, which discusses the related risks. Please refer to Appendix D for the risk factors the Company will include in the next quarterly report on Form 10-Q.

The Company undertakes to update the Business section in future annual reports on Form 10-K as follows, with necessary updates:

“Status under Holding Foreign Companies Accountable Act

On December 2, 2021, the U.S. Securities and Exchange Commission (“SEC”) adopted rules (the “Final Rules”) to implement the Holding Foreign Companies Accountable Act (the “HFCAA”), which became law on December 18, 2020. The HFCAA includes requirements for the SEC to identify issuers who file annual reports with audit reports issued by independent registered public accounting firms located in foreign jurisdictions that the Public Company Accounting Oversight Board (“PCAOB”) is unable to inspect or investigate completely because of a position taken by a non-U.S. authority in the accounting firm’s jurisdiction (“Commission-Identified Issuers”). The HFCAA also requires that, to the extent that the PCAOB has been unable to inspect an issuer’s independent registered public accounting firm for three consecutive years since 2021, the SEC shall prohibit the issuer’s securities registered in the United States from being traded on any national securities exchange or over-the-counter markets in the United States.

Under the Final Rules, the SEC adopted submission and disclosure requirements by amending Form 10-K and other annual reporting forms and established procedures to identify issuers and prohibit the trading of the securities of certain registrants as required by the HFCAA. Specifically, the Final Rules require each Commission-Identified Issuer to submit documentation to the SEC annually on or before its annual report due date that establishes that it is not owned or controlled by a government entity in its public accounting firm’s foreign jurisdiction and require additional specified disclosures by “foreign issuers” as defined in Rule 3b-4 promulgated under the Securities Exchange Act of 1934, as amended. The SEC will identify an issuer as a Commission-Identified Issuer as early as possible after the issuer files its annual report and on a rolling basis, and will impose an initial trading prohibition on an issuer as soon as practicable after it has been conclusively identified as a Commission-Identified Issuer for three consecutive years. To end an initial or subsequent trading prohibition, a Commission-Identified Issuer must certify that it has retained a registered public accounting firm that the PCAOB has determined it is able to inspect or investigate. To make that certification, the Commission-Identified Issuer must file financial statements that include an audit report signed by such a registered public accounting firm.

On March 30, 2022, as expected following its adoption of the Final Rules, the SEC added BeiGene, Ltd. to its conclusive list of issuers identified under the HFCAA, after being provisionally named as a Commission-Identified Issuer on March 8, 2022, following the filing of its annual report on Form 10-K with the SEC on February 28, 2022. Ernst & Young Hua Ming LLP, located in the PRC, served as our independent registered public accounting firm from 2014 to 2021, including for our annual report on Form 10-K for the year ended December 31, 2021 filed on February 28, 2022. However, as our global business has expanded, we have evaluated, designed and implemented business processes and control changes and built substantial organizational capabilities outside of the PRC. Therefore, on March 23, 2022, following a review process carried out by our audit committee, Ernst & Young Hua Ming LLP resigned as our independent registered public accounting firm for the audits of our financial statements and internal control over financial reporting to be filed with the SEC. On the same day, our audit committee approved the engagement of Ernst & Young LLP, located in Boston, Massachusetts, United States, as the Company’s independent registered public accounting firm for the audits of our financial statements and internal control over financial reporting for the fiscal year ending December 31, 2022 to be filed with the SEC. No changes were made to the accounting firms who audit our financial statements filed with the Shanghai Stock Exchange and the Hong Kong Stock Exchange, which will remain Ernst & Young Hua Ming LLP, located in Beijing, PRC, and Ernst & Young, located in Hong Kong, PRC, respectively.

We have evaluated, designed and implemented additional business processes and internal control changes which have enabled us to engage Ernst & Young LLP (United States), which is subject to PCAOB inspection requirements. Given that Ernst and Young LLP (United States) will serve as the principal accountant to audit our consolidated financial statements for the fiscal year ending December 31, 2022, to be included in the 2022 Form 10-K, to be filed with the SEC, we expect to be able to comply with the HFCAA and certify following the filing of our 2022 Form 10-K that we have retained a registered public accounting firm that the PCAOB has determined it is able to inspect or investigate, Ernst & Young LLP (United States), which should preclude a further finding by the SEC that we are a Commission-Identified Issuer and therefore the delisting of our American Depositary Shares from the NASDAQ Global Select Market.

However, these efforts may not be sufficient and ultimately may not be successful. We may also be subject to enforcement under the HFCAA, the rules implementing the act that may be adopted by the SEC, and any other similar legislation that may be enacted into law or executive orders that may be adopted in the future. Although we are committed to complying with the rules and regulations applicable to listed companies in the United States, we are currently unable to predict the potential impact on our listed status by any rules that may be adopted by the SEC under the HFCAA in the future. If we failed to comply with those rules, it is possible that our ADSs would be delisted. The risk and uncertainty associated with a potential delisting would have a negative impact on the price of our ADSs, ordinary shares and RMB Shares. Failure to adopt effective contingency plans may also have a material adverse impact on our business and the price of our ADSs, ordinary shares and RMB Shares.”

4.Clearly disclose how you will refer to the holding company and subsidiaries when providing the disclosure throughout the document so that it is clear to investors which entity the disclosure is referencing and which subsidiaries or entities are conducting the business operations. For example, disclose, if true, that your subsidiaries conduct operations in China.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in future Exchange Act periodic reports to clearly disclose how the Company will refer to the holding company and subsidiaries when providing disclosure throughout the document so it is clear to investors which entity the disclosure is referencing and which subsidiaries or entities are conducting the business operations. In this regard, the Company respectfully refers the Staff to page 5 of the 2021 Annual Report where the Company discloses that “Unless the context requires otherwise, references in this report to “BeiGene,” the “Company,” “we,” “us,” and “our” refer to BeiGene, Ltd., and its subsidiaries, on a consolidated basis.” The Company will revise future Exchange Act periodic reports to indicate that BeiGene, Ltd., is a Cayman Islands holding company with operations conducted by its subsidiaries.

Further, as depicted in Appendix A, the organization structure chart that will be included in future annual reports on Form 10-K provides the name and domicile of the Company’s selected subsidiaries. Where the context requires disclosure for any of the subsidiaries, the Company will refer to the specific subsidiary and, if applicable, it will be clearly defined. For example, on pages 23 to 26 of the 2021 Annual Report, where there was disclosure related to BeiGene Switzerland GmbH (BeiGene Switzerland), the Company specifically named and defined the subsidiary. Similarly, the Company did the same for BeiGene (Hong Kong) Co., Ltd. (BeiGene HK) in the 2021 Annual Report. The Company will continue to do this in its future Exchange Act periodic reports, as applicable. For your reference, please see Appendix B for the names and domicile of selected subsidiaries and how the Company may refer to them in future Exchange Act periodic reports.

5.We note your discussion regarding dividends on page 99 and 111. Provide a clear description of how cash is transferred through your organization. Disclose your intentions to distribute earnings. Quantify any cash flows and transfers of other assets by type that have occurred between the holding company and its subsidiaries, and direction of transfer. Quantify any dividends or distributions that a subsidiary have made to the holding company and which entity made such transfer, and their tax consequences. Similarly quantify dividends or distributions made to U.S. investors, the source, and their tax consequences. Your disclosure should make clear if no transfers, dividends, or distributions have been made to date. Describe any restrictions on foreign exchange and your ability to transfer cash between entities, across borders, and to U.S. investors. Describe any restrictions and limitations on your ability to distribute earnings from the company, including your subsidiaries, to the parent company and U.S. investors.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in future annual reports on Form 10-K to describe how cash is transferred through the organization. In this regard, the Company undertakes to update the Business section in future annual reports on Form 10-K as follows, with necessary updates:

“Doing Business in the PRC

We are a holding company incorporated in the Cayman Islands with operations primarily conducted through subsidiaries in the United States, China, United Kingdom, Switzerland and Australia. The intercompany flow of funds within the organization is effected through capital contributions and intercompany loans. Since our formation in 2010, BeiGene, Ltd. has raised over $10.0 billion in various public and private stock offerings as of December 31, 2021. Of this amount, $1.2 billion and RMB 4.9 billion have been transferred as capital contributions to its operating subsidiaries; and $79 million and RMB 3.1 billion have been transferred as intercompany loans to its operating subsidiaries. BeiGene, Ltd., by itself or through its affiliates, is also the holder or licensee and developer of biopharmaceutical patents. Certain of these patents have been transferred to operating subsidiaries for further development and commercialization. BeiGene’s wholly owned subsidiaries compensate each other for the intercompany provision of goods and services on an arm’s length basis. As of December 31, 2021, BeiGene, Ltd. held $5.8 billion in cash, cash equivalents and short-term investments which are available for future investment in its programs and in our operating subsidiaries. To date, BeiGene, Ltd. has not received any dividends or distributions from its operating subsidiaries.

Further, our board of directors has adopted a dividend policy which provides that we currently intend to retain all available funds and earnings, if any, to fund the development and expansion of our business, and we do not anticipate paying any cash dividends in the foreseeable future. Subject to applicable law and our amended and restated articles of association, any future determination to pay dividends will be made at the discretion of our board of directors and may be based on a number of factors, including our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that our board of directors may deem relevant. This dividend policy reflects our board of directors’ current views on our financial and cash flow position. We intend to continue to review our dividend policy from time to time, and there can be no assurance that dividends will be paid in any particular amount, if at all, for any given period.

We have never declared or paid any dividends on our ordinary shares or any other securities. If we pay dividends in the future, in order for us to distribute dividends to our shareholders and holders of ADSs, we may rely to some extent on dividends distributed by our PRC subsidiaries. PRC regulations may restrict the ability of our PRC subsidiaries to pay dividends to us, and such distributions will be subject to PRC withholding tax. In addition, PRC regulations currently permit payment of dividends of a PRC company only out of accumulated distributable after-tax profits, as determined in accordance with our articles of association and the accounting standards and regulations in the PRC.

We may rely on dividends and other distributions on equity paid by our PRC subsidiaries for our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders or to service any debt we may incur. If any of our PRC subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us. Under PRC laws and regulations, our PRC subsidiaries may pay dividends only out of their respective accumulated profits as determined in accordance with PRC accounting standards and regulations. In addition, a wholly foreign-owned enterprise is required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund a certain statutory reserve fund, until the aggregate amount of such fund reaches 50% of its registered capital. Such reserve funds cannot be distributed to us as dividends. At its discretion, a wholly foreign-owned enterprise may allocate a portion of its after-tax profits based on PRC accounting standards to an enterprise expansion fund, or a staff welfare and bonus fund. In addition, registered share capital and capital reserve accounts are also restricted from withdrawal in the PRC, up to the amount of net assets held in each operating subsidiary. As of December 31, 2021, these restricted assets totaled $799.6 million.

Our PRC subsidiaries generate primarily all of their revenue in RMB, which is not freely convertible into other currencies. As a result, any restriction on currency exchange may limit the ability of our PRC subsidiaries to use their RMB revenues to pay dividends to us. However, conversion of RMB to other currencies are permitted for the purpose of dividends according to the PRC’s regulations on Foreign Exchange Control.

Further, in response to the persistent capital outflow in the PRC and RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China (PBOC) and China's State Administration of Foreign Exchange (SAFE) promulgated a series of capital control measures, including stricter vetting procedures for domestic companies to remit foreign currency for overseas investments, dividends payments and shareholder loan repayments. Such measures were relaxed in mid-2017 with the slowdown of the capital outflow and stabilizing of the RMB. However, the PRC government may revert to strengthen its capital controls, and more restrictions and substantial vetting process may be put forward by the SAFE for cross-border transactions falling under both the current account and the capital account. Any limitation on the ability of our PRC subsidiaries to pay dividends or make other kinds of payments to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

The PRC Enterprise Income Tax Law (the “EIT Law”) and its implementation rules provide that China-sourced income of foreign enterprises, such as dividends paid by a PRC subsidiary to its equity holders that are non-PRC resident enterprises, will normally be subject to PRC withholding tax at a rate of 10%, unless any such foreign investor’s jurisdiction of incorporation has a tax treaty with China that provides for a reduced withholding rate arrangement and such non-PRC resident enterprises constitute the beneficiary of such income.

Pursuant to an arrangement between Mainland China and the Hong Kong Special Administrative Region (the “Hong Kong Tax Treaty”) and relevant tax regulations of the PRC, subject to certain conditions, a reduced withholding tax rate of 5% will be available for dividends from PRC entities provided that the recipient can demonstrate it is a Hong Kong tax resident and it is the beneficial owner of the dividends. The government adopted regulations in 2018 which stipulate that in determining whether a non-resident enterprise has the status as a beneficial owner, comprehensive analysis shall be conducted based on the factors listed therein and the actual circumstances of the specific case shall be taken into consideration. Specifically, it expressly excludes an agent or a designated payee from being considered as a “beneficial owner.” We own the PRC subsidiaries through BeiGene HK. BeiGene HK currently does not hold a Hong Kong tax resident certificate from the Inland Revenue Department of Hong Kong, and there is no assurance that the reduced withholding tax rate will be available.”

6.We note your disclosure regarding potential PRC changes beginning on page 94. Disclose each permission or approval that you or your subsidiaries are required to obtain from Chinese authorities to operate your business and to offer securities to foreign investors. State whether you or your subsidiaries are covered by permissions requirements from the China Securities Regulatory Commission (CSRC), Cyberspace Administration of China (CAC) or any other governmental agency that is required to approve your operations, and state affirmatively whether you have received all requisite permissions or approvals and whether any permissions or approvals have been denied. Please also describe the consequences to you and your investors if you or your subsidiaries: (i) do not receive or maintain such permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, or (iii) applicable laws, regulations, or interpretations change and you are required to obtain such permissions or approvals in the future.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in the Business section of future annual reports on Form 10-K to disclose each permission or approval that the Company and its subsidiaries are required to obtain from Chinese authorities to operate our business and to offer securities to foreign investors, including whether the Company and its subsidiaries are covered by permissions requirements from the China Securities Regulatory Commission (CSRC), Cyberspace Administration of China (CAC) or any other governmental agency that is required to approve our operations. The Company will also describe the consequences to it and its investors if the Company and its subsidiaries: (i) do not receive or maintain such permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, or (iii) applicable laws, regulations, or interpretations change and the Company is required to obtain such permissions or approvals in the future. Please refer to Appendix C for the risk factors the Company will include in future Exchange Act periodic reports.

The Company undertakes to update the Business section in future annual reports on Form 10-K as follows, with necessary updates:

“Permissions Required from the PRC Authorities for Our Operations

We conduct our business in the PRC through our PRC subsidiaries. Our operations in the PRC are governed by PRC laws and regulations. As of the date of this annual report, our PRC subsidiaries have obtained all requisite licenses and permits from the PRC government authorities that are material for their business operations in the PRC, including, among others, business licenses issued by local counterparts of the SAMR, drug manufacturing licenses, drug trade license, CTAs, drug registration certificates, import and export business qualifications and filings, licenses for use of experimental animals, pollutant discharge licenses and permits for urban sewage discharge into drainage pipe network. However, given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by government authorities, we cannot assure you that we have obtained all the permits or licenses required for conducting our business in the PRC.

In connection with our previous issuance of securities to foreign investors in stock markets outside the PRC, under current PRC laws, regulations and regulatory rules, as of the date of this annual report, we and our PRC subsidiaries, (i) are not required to obtain permissions from the CSRC, (ii) are not required to go through cybersecurity review by the Cyberspace Administration of China, or the CAC, and (iii) have not received or were denied such requisite permissions by any PRC authority. However, the PRC government has recently indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers.

Further, as of the date of this annual report, we have not received any inquiry, notice, warning or sanction regarding obtaining approval, completing filing or other procedures in connection with offering our equity securities in overseas stock markets from the CSRC or any other Chinese regulatory authorities that have jurisdiction over our operations. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities, including the Draft Overseas Listing Regulations. If it is determined in the future that the approval of, filing or other procedure with the CSRC or any other regulatory authority is required for issuing our equity securities in overseas stock markets, it is uncertain whether we will be able to and how long it would take for us to obtain the approval or complete the filing or other procedure, despite our efforts. If we, for any reason, are unable to obtain or complete, or experience significant delays in obtaining or completing, the requisite relevant approval(s), filing or other procedure(s), we may face sanctions by the CSRC or other Chinese regulatory authorities as applicable. These regulatory authorities may impose fines and penalties on our operations in the PRC, limit our ability to pay dividends outside of China, limit our operations in the PRC, delay or restrict the repatriation of funds into the PRC or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our ADSs, ordinary shares and RMB Shares.”

Item 1A. Risk Factors, page 54

7.In your summary of risk factors, disclose the risks that your corporate structure and being based in or having the majority of the company’s operations in China poses to investors. In particular, describe the significant regulatory, liquidity, and enforcement risks. For example, specifically discuss risks arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice; and the risk that the Chinese government may intervene or influence your operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in your operations and/or the value of your securities. Acknowledge any risks that any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder your ability to offer or continue to offer securities to investors and cause the value of your securities to significantly decline or be worthless.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in future relevant Exchange Act periodic reports to disclose the risks related to the Company’s corporate structure and of having significant operations in China poses to investors. The Company will describe the significant regulatory, liquidity, and enforcement risks, including risks arising from the legal system in China; risks and uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice; and, the risk that the Chinese government may intervene or influence the Company’s operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in the Company’s operations and/or the value of the Company’s securities. Please refer to Appendix C for the risk factors the Company will include in future relevant Exchange Act periodic reports.

8.We note your disclosure about the Holding Foreign Companies Accountable Act on page 96. Please expand your risk factors to disclose that you were identified by the Commission under the HFCAA. In addition, please update your disclosure to reflect that the Commission adopted rules to implement the HFCAA and that, pursuant to the HFCAA, the PCAOB has issued its report notifying the Commission of its determination that it is unable to inspect or investigate completely accounting firms headquartered in mainland China or Hong Kong.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in future relevant Exchange Act periodic reports to disclose that the Company was identified by the Commission under the HFCAA. In addition, the Company will update its disclosure to reflect that the Commission adopted rules to implement the HFCAA and that, pursuant to the HFCAA, the PCAOB has issued its report notifying the Commission of its determination that it is unable to inspect or investigate completely accounting firms headquartered in mainland China or Hong Kong. The Company also advises the Staff that it plans to include new risk factor disclosures in the next quarterly report on Form 10-Q that will be filed on Monday, May 9, 2022, which discusses these risks, discloses that the Company was identified by the Commission under the HFCAA and the steps the Company has taken to address the HFCAA, including appointing Ernst & Young LLP (USA) as the Company’s independent registered public accounting firm for the year ending December 31, 2022 for its filings with the SEC. Please refer to Appendix D for the risk factors the Company will include in the next quarterly report on Form 10-Q.

9.Given the Chinese government’s significant oversight and discretion over the conduct of your business, please revise to highlight separately the risk that the Chinese government may intervene or influence your operations at any time, which could result in a material change in your operations and/or the value of your securities. Also, given recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China- based issuers, acknowledge the risk that any such action could significantly limit or completely hinder your ability to offer or continue to offer securities to investors and cause the value of your securities to significantly decline or be worthless.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in future relevant Exchange Act periodic reports to highlight the risk that the Chinese government may intervene or influence the Company’s operations at any time, which could result in a material change in our operations and/or the value of our securities. Also, given recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China- based issuers, the Company will acknowledge the risk that any such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. Please refer to Appendix C for the risk factors the Company will include in future Exchange Act periodic reports.

10.We note your discussion regarding the Cyberspace Administration of China on page 90. In light of recent events indicating greater oversight by the Cyberspace Administration of China (CAC) over data security, particularly for companies seeking to list on a foreign exchange, please revise your disclosure to explain how this oversight impacts your business and your securities and to what extent you believe that you are compliant with the regulations or policies that have been issued by the CAC to date. In addition, please update the disclosure in this risk factor to reflect that the final version of the revisions to the existing Measures for Cybersecurity Review came into effect on February 15, 2022.

RESPONSE: The Company respectfully acknowledges the Staff’s comment, and advises the Staff that the Company will revise its disclosure in future relevant Exchange Act periodic reports to explain how the Cyberspace Administration of China’s oversight impacts the Company’s business and its securities, including the extent to which the Company believes it has been compliant with the regulations and policies that have been issued by the CAC to date. Please refer to Appendix C for the risk factors the Company will include in future Exchange Act periodic reports.

***

If you or any other member of the Staff have any questions with regard to the foregoing responses, would like to discuss any of the matters covered in this letter, or otherwise require additional information, please contact the undersigned (scott.samuels@beigene.com or 857-327-8286).

Sincerely,

Scott A. Samuels

Senior Vice President, General Counsel

Enclosures

cc: Julia Wang, Chief Financial Officer, BeiGene, Ltd.

Edwin O’Connor, Goodwin Procter LLP

Folake Ayoola, Goodwin Procter LLP

Appendix A

Organizational Chart as of May 6, 2022

Appendix B

| | | | | |

| Subsidiary | Name and Domicile |

| |

| “BeiGene AUS” | BeiGene AUS Pty Ltd., a company incorporated under the laws of Australia on July 15, 2013 and an indirectly wholly owned subsidiary of the Company |

| |

| “BeiGene Beijing” | BeiGene (Beijing) Co., Ltd., a company incorporated under the laws of the PRC on January 24, 2011 and an indirectly wholly owned subsidiary of the Company |

| |

| “BeiGene Biologics” | BeiGene Biologics Co., Ltd., a company incorporated under the laws of the PRC on January 25, 2017 and an indirectly wholly owned subsidiary of the Company |

| |

| “BeiGene Guangzhou” | BeiGene (Guangzhou) Co., Ltd., a company incorporated under the laws of the PRC on July 11, 2017 and an indirectly wholly owned subsidiary of the Company |

| |

| “BeiGene Guangzhou Manufacturing” | BeiGene Guangzhou Biologics Manufacturing Co., Ltd., a company incorporated under the laws of the PRC on March 3, 2017 and a wholly owned subsidiary of BeiGene Biologics |

| |

| “BeiGene HK” | BeiGene (Hong Kong) Co., Limited, a company incorporated under the laws of Hong Kong on November 22, 2010 and a wholly owned subsidiary of the Company |

| |

| “BeiGene Pharmaceutical (Shanghai)” | BeiGene Pharmaceutical (Shanghai) Co., Ltd., formerly known as Baiji Pharmaceutical (Shanghai) Co., Ltd. and “Celgene Pharmaceutical (Shanghai) Co., Ltd.”, a company incorporated under the laws of the PRC on December 15, 2009 and an indirectly wholly owned subsidiary of the Company |

| |

| “BeiGene Shanghai” | BeiGene (Shanghai) Co., Ltd., a company incorporated under the laws of the PRC on September 11, 2015 and a wholly owned subsidiary of BeiGene Biologics |

| |

| “BeiGene Suzhou” | BeiGene (Suzhou) Co., Ltd., a company incorporated under the laws of the PRC on April 9, 2015 and an indirectly wholly owned subsidiary of the Company |

| |

| “BeiGene (USA)” | BeiGene USA, Inc., a company incorporated under the laws of Delaware, US, on July 8, 2015 and an indirectly wholly owned subsidiary of the Company |

| |

| “BeiGene Switzerland” | BeiGene Switzerland GmbH, a company established under the laws of Switzerland on September 1, 2017 and an indirectly wholly owned subsidiary of the Company |

Appendix C

The PRC government has significant oversight and discretion over the conduct of the business operations of our PRC subsidiaries or to exert control over any offering of securities conducted overseas and/or foreign investment in China-based issuers, and may intervene with or influence our operations, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the value of such securities to significantly decline or be worthless, as the government deems appropriate to further regulatory, political and societal goals.

The PRC government may intervene or influence the operations of our PRC subsidiaries at any time with little to no advanced notice, which could result in a material change in our operations and/or the value of our ADSs, ordinary shares, or RMB Shares. For example, the PRC government recently published new policies that significantly affected certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding any industry that could adversely affect the business, financial condition and results of operations of our company. For example, on December 28, 2021, the NDRC, the MIIT, and several other administrations jointly published the revised Measures for Cybersecurity Review, effective on February 15, 2022, which required that, among others, operators of “critical information infrastructure” purchasing network products and services or network platform operators carrying out data processing activities, that affect or may affect national security, shall apply with the Cybersecurity Review Office for a cybersecurity review. In addition, a network platform operator holding over one million users’ personal information shall apply with the Cybersecurity Review Office for a cybersecurity review before any public offering and listings outside of mainland PRC and Hong Kong.

Furthermore, the PRC government has also recently indicated an intent to exert more oversight and control over securities offerings and other capital markets activities that are conducted overseas and foreign investment in China-based companies. Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using the variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on July 6, 2021, the relevant PRC government authorities made public the Opinions on Intensifying Crack Down on Illegal Securities Activities. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. On November 14, 2021, the Cyberspace Administration of China (the “CAC”) released the draft Regulations on Network Data Security Management (the “Draft Cyber Data Security Regulations”) for public comments, which requires, among others, that a prior cybersecurity review should be required for listing abroad of data processors which process over one million users’ personal information, and the listing of data processors in Hong Kong which affects or may affect national security.

Since the Draft Cyber Data Security Regulations are in the process of being formulated and the Opinions on Intensifying Crack Down on Illegal Securities Activities remain unclear on how it will be interpreted, amended and implemented by the relevant PRC governmental authorities, it remains uncertain how PRC governmental authorities will regulate overseas listing in general and whether we are required to obtain any specific regulatory approvals from the CSRC, CAC or any other PRC governmental authorities for our offshore offerings. If the CSRC, CAC or other regulatory agencies later promulgate new rules or explanations requiring that we obtain their approvals for our future offshore offerings, we may be unable to obtain such approvals in a timely manner, or at all, and such approvals may be rescinded even if obtained. Any such circumstance could significantly limit or completely hinder our ability to continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. In addition, implementation of industry-wide regulations directly targeting our operations could cause the value of our securities to significantly decline. Therefore, investors of our company and our business face potential uncertainty from actions taken by the PRC government affecting our business.

The PRC government has significant oversight over the conduct of the business of our PRC subsidiaries; such oversight could result in a material change in our operations and/or the value of our ordinary shares or could significantly limit our ability to offer or continue to offer ordinary shares and/or other securities to investors and cause the value of such securities to significantly decline.

The PRC government has significant oversight over the conduct of the business of our PRC subsidiaries and may intervene or influence our operations in mainland China at any time as the PRC government deems appropriate to further regulatory, political and societal goals, which may potentially result in a material adverse effect on our operations. The PRC government has recently published new policies that significantly affect certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations.

On December 24, 2021, the CSRC released the Provisions of the State Council on the Administration of Domestic Companies Offering Securities for Overseas Listing (Revision Draft for Comments) (the Draft Provisions) and the Administrative Measures for the Filing of Domestic Companies Seeking Overseas Securities Offering and Listing (the Filing Measures, or collectively, the Draft Overseas Listing Regulations) for public comment. The Draft Provisions provide for a general filing regulatory framework, and the Filing Measures set out more detailed terms and procedures of the filing requirements. Pursuant to the Draft Overseas Listing Regulations, domestic companies that apply for direct offerings and listings in an overseas market or an indirect offerings and listings in the name of an offshore entity are required to, among others, file and report to the CSRC, if: (i) the total assets, net assets, revenues or profits of the PRC operating entity of the issuer in the most recent accounting year account for more than 50% of the corresponding figure in the issuer’s audited consolidated financial statements for the same period and (2) the senior managers in charge of business operation and management of the issuer are mostly PRC citizens or have habitual residence in the PRC, and its main places of business are located in the PRC or main business activities are conducted in the PRC. Based on our global assets, operations and management outside of the PRC, we do not believe that we satisfy test in the Draft Overseas Listing Regulations that would require us to file and report to the CSRC, but this could change in the future.

According to questions and answers published by the CSRC on December 24, 2021, the new rules, as drafted, would not be applied retrospectively, and would be applied to new listings and follow-on offerings by existing overseas listed Chinese companies. If we are deemed to be subject to the Draft Overseas Listing Regulations and we fail to complete the filing procedures with the CSRC for any of our follow-on offerings in the overseas stock market or fall within any of the circumstances where our follow-on offering is prohibited by the State Council, our offering application may be discontinued and we may be subject to penalties, sanctions and fines imposed by the CSRC and relevant departments of the State Council. In severe circumstances, the business of our PRC subsidiaries may be suspended and their business qualifications and licenses may be revoked. However, uncertainties exist regarding the interpretation of the Draft Overseas Listing Regulations, as well as interpretation of the final form of these regulations and implementation thereof after promulgation.

Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Intensifying Crack Down on Illegal Securities Activities, which call for strengthened regulation over illegal securities activities and supervision on overseas listings by China-based companies and propose to take effective measures, such as promoting the development of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. The PRC government has indicated that it may exert more control or influence over offerings of securities conducted overseas. If the PRC authorities attempt to exercise such control or influence through regulation over our PRC subsidiaries, we could be required to restructure our operations to comply with such regulations or potentially cease operations in the PRC entirely, which could adversely affect our business. results of operations and financial condition. Moreover, any such action could significantly limit our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline.

Currently, these statements and regulatory actions have had no impact on our daily business operations, the ability to accept foreign investments and list our securities on a U.S. or other foreign exchange. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operations, the ability to accept foreign investments and list our securities on a U.S., Hong Kong, or other stock exchange.

The approval of, or filing or other procedures with, the CSRC or other Chinese regulatory authorities may be required in connection with issuing our equity securities to foreign investors under Chinese law, and, if required, we cannot predict whether we will be able, or how long it will take us, to obtain such approval or complete such filing or other procedures. We are also required to obtain business licenses from Chinese authorities in connection with our general business activities currently conducted in China.

On July 6, 2021, the General Office of the Communist Party of China Central Committee and the State Council jointly promulgated the Opinions on Intensifying Crack Down on Illegal Securities Activities, pursuant to which Chinese regulators are required to accelerate rulemaking related to the overseas issuance and listing of securities, and update the existing laws and regulations related to data security, cross-border data flow, and administration of classified information. Numerous regulations, guidelines and other measures have been or are expected to be adopted under the umbrella of or in addition to the Cyber Security Law (as defined below) and Data Security Law (as defined below). As there are still uncertainties regarding the interpretation and implementation of such regulatory guidance, we cannot assure investors that we will be able to comply with new regulatory requirements relating to our future overseas capital-raising activities and we may become subject to more stringent requirements with respect to matters including data privacy and cross-border investigation and enforcement of legal claims.

Furthermore, on December 24, 2021, the CSRC promulgated the Draft Overseas Listing Rules, which, among others, require certain companies to fulfill a filing procedure in respect of its offering and listing in the stock markets outside of China if such companies meet the criteria set forth in the Draft Overseas Listing Rules. As the Draft Overseas Listing Rules were released only for public comment, the final version and the effective date thereof may be subject to change with substantial uncertainty.

As of the date of this report, we have not received any inquiry, notice, warning or sanction regarding obtaining approval, completing filing or other procedures in connection with offering our equity securities to foreign investors in foreign stock markets from the CSRC or any other Chinese regulatory authorities that have jurisdiction over our operations. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. If it is determined in the future that the approval of, filing or other procedure with the CSRC or any other regulatory authority is required for issuing our equity securities in foreign stock markets, it is uncertain whether we will be able to and how long it would take for us to obtain the approval or complete the filing or other procedure, despite our best efforts. If we, for any reason, are unable to obtain or complete, or experience significant delays in obtaining or completing, the requisite relevant approval(s), filing or other procedure(s), we may face sanctions by the CSRC or other Chinese regulatory authorities. These regulatory authorities may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or restrict the repatriation of funds into China or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our ADSs, ordinary shares, and RMB Shares. In addition, if the CSRC or other regulatory authorities later promulgate new rules requiring that we obtain their approvals or complete filing or other procedures for any future public offerings in foreign stock markets, we may be unable to obtain a waiver of such requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding such a requirement could have a material adverse effect on the trading price of our ADSs, ordinary shares, and RMB Shares.

To operate our general business activities currently conducted in China, each of our Chinese subsidiaries is required to obtain a business license from the local counterpart of the State Administration for Market Regulation (“SAMR”). Each of our Chinese subsidiaries has obtained a valid business license from the local counterpart of the SAMR, and no application for any such license has been denied. The pharmaceutical industry in which we operate is also highly regulated in China. Our Chinese subsidiaries are required to obtain applicable licenses from competent Chinese government authorities for our operations in China, including drug manufacturing licenses, drug trade license, CTAs, drug registration certificates, import and export business qualifications and filings, licenses for use of experimental animals, pollutant discharge licenses and permits for urban sewage discharge into drainage pipe network etc. Our PRC subsidiaries have obtained all applicable licenses and permits which are material to our business operations in China from competent Chinese government authorities.

PRC regulations establish complex procedures for some acquisitions conducted by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China.

PRC regulations and rules concerning mergers and acquisitions set forth additional procedures and requirements that could make merger and acquisition activities of PRC-based companies by foreign investors more time-consuming and complex. See also “—Risks Related to Our Industry, Business and Operations—We incur significant costs as a result of operating as a public company, and our management is required to devote substantial time to compliance requirements, including establishing and maintaining internal controls over financial reporting. We may be exposed to potential risks if we are unable to comply with these requirements.” These rules, among others, specify that mergers and acquisitions by foreign investors that raise “national defense and security” concerns and mergers and acquisitions through which foreign investors may acquire the de facto control over domestic enterprises that raise “national security” concerns are subject to strict review by the MOFCOM, and the rules prohibit any activities attempting to bypass a security review by structuring the transaction through, among other things, trusts, entrustment or contractual control arrangements. Although we believe that our business is not in an industry related to national security, we cannot preclude the possibility that the competent PRC government authorities may publish explanations contrary to our understanding or broaden the scope of such security reviews in the future, in which case our future acquisitions and investment in the PRC, including those by way of entering into contractual control arrangements with target entities, may be closely scrutinized or prohibited. Moreover, according to the Anti-Monopoly Law, the SAMR shall be notified in advance of any concentration of undertaking if certain filing thresholds are triggered. We may grow our business in part by acquiring complementary businesses in China. Complying with the requirements of the laws and regulations mentioned above and other PRC regulations to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the SAMR, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain or expand our market share. Our ability to expand our business or maintain or expand our market share through future acquisitions would as such be materially and adversely affected.

In December 2020, the NDRC and the MOFCOM promulgated the Foreign Investment Security Review Measures, which came into effect on January 18, 2021. Under the Foreign Investment Security Review Measures, investments in military, national defense-related areas or in locations in proximity to military facilities, or investments that would result in acquiring the actual control of assets in certain key sectors, such as critical agricultural products, energy and resources, equipment manufacturing, infrastructure, transport, cultural products and services, IT, Internet products and services, financial services and technology sectors, are required to be approved by designated governmental authorities in advance. As these measures are recently promulgated, official guidance has not been issued by the designated office in charge of such security review yet, therefore there are great uncertainties with respect to the interpretation and implementation of the Foreign Investment Security Review Measures. If any of our business operations were to fall under the foregoing categories, we would need to take further actions in order to comply with these laws, regulations and rules, which may materially and adversely affect our current corporate structure, business, financial condition and results of operations.

Our failure to comply with data protection laws and regulations could lead to government enforcement actions and significant penalties against us, and adversely impact our operating results.

The regulatory framework for the collection, use, safeguarding, sharing, transfer and other processing of personal information and other regulated data worldwide is complex and is rapidly evolving.

In the United States, we are subject to laws and regulations that address privacy, personal information protection and data security at both the federal and state levels. Numerous laws and regulations, including security breach notification laws, health information privacy laws, and consumer protection laws, govern the collection, use, disclosure and protection of health-related and other personal information. Given the variability and evolving state of these laws, we face uncertainty as to the exact interpretation of the new requirements, and we may be unsuccessful in implementing all measures required by regulators or courts in their interpretation.

Regulatory authorities in Europe have implemented and are considering a number of legislative and regulatory proposals concerning data protection. For example, the General Data Protection Regulation (EU) 2016/679 (GDPR), which became effective in 2018, imposes a broad range of strict requirements on companies subject to the GDPR. Because the GDPR specifically gives member states flexibility with respect to certain matters, national laws may partially deviate from the GDPR and impose different obligations from country to country, leading to additional complexity and uncertainty. Despite our best efforts to comply, there is a risk that we may be subject to fines and penalties, litigation, and reputational harm in connection with our European activities. The GDPR may increase our responsibility and liability in relation to personal data that we process where such processing is subject to the GDPR, and we may be required to put in place additional mechanisms to ensure compliance with the GDPR, including deviations implemented by individual countries.

In addition, further to the UK’s exit from the EU on January 31, 2020, the GDPR ceased to apply in the UK at the end of the transition period on December 31, 2020. However, as of January 1, 2021, the UK’s European Union (Withdrawal) Act 2018 incorporated the GDPR (as it existed on December 31, 2020 but subject to certain UK specific amendments) into UK law, referred to as the UK GDPR. Although the UK is regarded as a third country under the EU’s GDPR, the European Commission (EC) has now issued a decision recognizing the UK as providing adequate protection under the EU GDPR and, therefore, transfers of personal data originating in the EU to the UK remain unrestricted. The UK government has confirmed that personal data transfers from the UK to the EEA remain free flowing.

We expect that these data protection and transfer laws and regulations will continue to receive greater attention and focus from regulators going forward, and we will continue to face uncertainty as to whether our efforts to comply with evolving obligations under data protection, privacy and security laws will be sufficient. Any failure or perceived failure by us to comply with applicable laws and regulations could result in reputational damage or proceedings or actions against us by governmental entities, individuals or others. These proceedings or actions could subject us to significant administrative, civil or criminal penalties and negative publicity, result in the delayed or halted transfer or confiscation of certain personal information or scientific data (such as the results of our preclinical studies or clinical trials conducted within China), or other regulated data, result in the suspension of research and development of drug candidates, ongoing clinical trials or ban on initiation of new trials, require us to change our business practices, increase our costs, or materially harm our business, prospects, financial condition and results of operations. In addition, our current and future relationships with customers, vendors, pharmaceutical partners and other third parties could be negatively affected by any proceedings or actions against us or current or future data protection obligations imposed on them under applicable law. In addition, a data breach affecting personal information or other regulated data, including health information, or a failure to comply with applicable requirements could result in significant management resources, legal and financial exposure and reputational damage that could potentially have a material adverse effect on our business, results of operations, and financial condition.

Compliance with the Data Security Law of the People’s Republic of China (the “Data Security Law”), Cybersecurity Review Measures, Personal Information Protection Law of the People’s Republic of China (the “PIPL”), regulations and guidelines relating to the multi-level protection scheme (the “MLPS”) and any other future laws and regulations may entail significant expenses and could materially affect our business.

China has implemented rules or is expected to implement extensive data protection, privacy and information security rules and is considering a number of additional proposals relating to these subject areas. We face significant uncertainties and risks related to these laws, regulations and policies, some of which were only recently enacted, and the interpretation of these legal requirements by government regulators as applied to biotechnology companies like us. For example, we do not maintain, nor do we intend to maintain in the future, personally identifiable health information of patients in China. We do, however, collect and maintain de-identified or pseudonymized health data for clinical trials in compliance with local regulations. This data could be deemed “personal data” or “important data” by government regulators. With China’s growing emphasis of its sovereignty over data derived from China, the outbound transmission of de-identified or pseudonymized health data for clinical trials may be subject to the new national security legal regime, including the Data Security Law, the Cyber Security Law of the People’s Republic of China (the “Cyber Security Law”), the PIPL, and various implementing regulations and standards.

China’s Data Security Law took effect in September 2021. The Data Security Law provides that the data processing activities must be conducted based on “data classification and hierarchical protection system” for the purpose of data protection and prohibits entities in China from transferring data stored in China to foreign law enforcement agencies or judicial authorities without prior approval by the relevant PRC authority. The classification of data is based on its importance in economic and social development, as well as the degree of harm expected to be caused to national security, public interests, or the legitimate rights and interests of individuals or organizations if such data is tampered with, destroyed, leaked, or illegally acquired or used. The security assessment mechanism was also included in the PIPL, which was promulgated in August 2021 and became effective on November 1, 2021, for the Chinese government to supervise certain cross-border transfers of personal information.

Additionally, the Cyber Security Law, which became effective in 2017, requires companies to take certain organizational, technical and administrative measures and other necessary measures to ensure the security of their networks and data stored on their networks. Specifically, the Cyber Security Law provides that companies adopt an MLPS, under which network operators are required to perform obligations of security protection to ensure that the network is free from interference, disruption or unauthorized access, and prevent network data from being disclosed, stolen or tampered. Under the MLPS, entities operating information systems must have a thorough assessment of the risks and the conditions of their information and network systems to determine the level to which the entity’s information and network systems belong, from the lowest Level 1 to the highest Level 5 pursuant to a series of national standards on the grading and implementation of the classified protection of cybersecurity. The grading result will determine the set of security protection obligations that entities must comply with. Entities classified as Level 2 or above should report the grade to the relevant government authority for examination and approval.

Under the Cyber Security Law and Data Security Law, we are required to establish and maintain a comprehensive data and network security management system that will enable us to monitor and respond appropriately to data security and network security risks. We will need to classify and take appropriate measures to address risks created by our data processing activities and use of networks. We are obligated to notify affected individuals and appropriate Chinese regulators of and respond to any data security and network security incidents. Establishing and maintaining such systems takes substantial time, effort and cost, and we may not be able to establish and maintain such systems as fully as needed to ensure compliance with our legal obligations. Despite our investment, such systems may not adequately protect us or enable us to appropriately respond to or mitigate all data security and network security risks or incidents we may face.

Furthermore, under the Data Security Law, data categorized as “important data,” which will be determined by governmental authorities in the form of catalogs, is to be processed and handled with a higher level of protection. The notion of important data is not clearly defined by the Cyber Security Law or the Data Security Law. In order to comply with the statutory requirements, we will need to determine whether we possess important data, monitor the important data catalogs that are expected to be published by local governments and departments, perform risk assessments and ensure we are complying with reporting obligations to applicable regulators. We may also be required to disclose to regulators business-sensitive or network security-sensitive details regarding our processing of important data and may need to pass the government security review or obtain government approval in order to share important data with offshore recipients, can include foreign licensors, or share data stored in Mainland China with judicial and law enforcement authorities outside of Mainland China. If judicial and law enforcement authorities outside Mainland China require us to provide data stored in Mainland China, and we are not able to pass any required government security review or obtain any required government approval to do so, we may not be able to meet the foreign authorities’ requirements. The potential conflicts in legal obligations could have adverse impacts on our operations in and outside of Mainland China.

The CAC has taken action against several Chinese internet companies listed on U.S. securities exchanges for alleged national security risks and improper collection and use of the personal information of Chinese data subjects. According to the official announcement, the action was initiated based on the National Security Law of the People’s Republic of China (the “National Security Law”), the Cyber Security Law and the Cybersecurity Review Measures, which are aimed at “preventing national data security risks, maintaining national security and safeguarding public interests.” On December 28, 2021, the CAC, together with 12 other PRC governmental authorities, promulgated the Revised Cybersecurity Review Measures which took effect from February 15, 2022. Pursuant to the Revised Cybersecurity Review Measures, critical information infrastructure operators procuring network products and services and online platform operators carrying out data processing activities, which affect or may affect national security, shall conduct a cybersecurity review pursuant to the provisions therein. In addition, online platform operators possessing personal information of more than one million users seeking to be listed on foreign stock markets must apply for a cybersecurity review. The relevant competent governmental authorities may also initiate a cybersecurity review against the relevant operators if the authorities believe that the network product or service or data processing activities of such operators affect or may affect national security. There are still uncertainties as to the exact scope of network product or service or data processing activities that will or may affect national security, and the PRC government authorities may have discretion in the interpretation and enforcement of these measures.

On November 14, 2021, the CAC further published the Draft Cyber Data Security Regulations, under which data processors refer to individuals and organizations who determine the data processing activities in terms of the purpose and methods at their discretion. Pursuant to the Draft Cyber Data Security Regulations, data processors shall apply for cybersecurity review if they engage in (i) merger, reorganization or division of internet platform operators with significant data resources related to national security, economic development or public interests that affects or may affect national security; (ii) overseas listing while processing over one million users’ personal information; (iii) Hong Kong listing that affects or may affect national security; or (iv) other data processing activities that affect or may affect national security. The Draft Cyber Data Security Regulations further require data processors processing important data or going public overseas to conduct annual data security self-assessment, and submit the data security assessment report to their respective local branch of the Cyberspace Administration of China before January 31 each year. As the Draft Cyber Data Security Regulations were released only for public comment, the final version and the effective date thereof may be subject to change with substantial uncertainty.