| | deficiencies with respect to the condominium documents relating to the North Carolina Property and the parties entered into an amendment to the Purchase and Sale Agreement on November 21, 2018 extending our inspection period with respect to the North Carolina Property to within forty-five days of our acceptance and satisfaction of the corrective actions taken by the seller with respect to the deficiencies. We anticipate completing the acquisition of the condominium unit in October 2020. |

Distributions

From inception through the date of this prospectus, we have distributed approximately $510,271 to common stockholders. Because we have not yet generated a profit, distributions have been made from offering proceeds.

Results of Operations

On February 29, 2016, our initial offering was qualified by the SEC and subsequently the Company has spent the majority of its efforts on fundraising operations and implementing our business plan including by acquiring our six properties.

Three Months Ended March 31, 2020 Compared to the Three Months Ended March 31, 2019

Revenue

During the three-month period ended March 31, 2020, total revenues from operations were $880,638 as compared to $274,206 for the three-month period ended March 31, 2019. Revenues increased approximately $606,000 due to three additional properties generating revenue for the three months ended March 31, 2020.

Operating Expenses

During the three-month periods ended March 31, 2020 and 2019, we incurred total expenses of $1,231,826 and $378,746, respectively which included total general, administrative and organizational (“GAO”) of $241,364 for 2020 and $100,800 for 2019. The $140,564 increase in GAO expenses is due in part to costs associated with operating as a public company such as increased audit fees of approximately $84,000 and stock compensation of approximately $20,000.

During the three-month period ended March 31, 2020 and 2019, we incurred building expenses of $189,461 and $26,460, respectively. The increase is due to the three additional properties which were owned for the entire three months in 2020 of which two of the properties are office buildings for which we bear the costs of utilities, repairs, maintenance and other operating expenses.

During the three-month period ended March 31, 2020 and 2019, we incurred depreciation and amortization expense of $357,018 and $99,774, respectively. The increase is due to the additional three properties which were owned for the three months in 2020.

During the three-month period ended March 31, 2020 and 2019, we incurred interest expense on debt and the amortization of debt issuance costs of $376,290 and $124,421 respectively. The increase in interest expense incurred is the result of additional debt for the additional properties acquired in 2019.

During the three-month period ended March 31, 2020 and 2019, we incurred compensation costs of $67,693 and $27,291 respectively. The increase is reflective of additional personnel hires and their related compensation for the three-month period in 2020.

Income Tax Benefit

We did not record an income tax benefit for the three-months ended March 31, 2020 or 2019 because we have been in a net loss situation since inception and have recorded a valuation allowance to offset any tax benefits generated by the operating losses.

Net Loss

During the three-month period ended March 31, 2020 and 2019, we generated a net loss of $351,188 and $104,540, respectively. The increased loss was the result of increased GAO costs, interest expense and depreciation and amortization.

Net Income Attributable to Non-controlling Interests

During the three-month period ended March 31, 2020, we generated net income attributable to non-controlling interest of $142,844 as compared to $103,141 for the three months ended March 31, 2019. The variance is attributable to the increase in distributions paid to the redeemable non-controlling interests which includes $122,469 paid to the limited partnership interests held at the Operating Partnership.

Net Loss Attributable to Shareholders

During the three-month period ended March 31, 2020 and 2019, we generated a net loss attributable to our shareholders of $494,032 and $207,681, respectively.

Year Ended December 31, 2019 Compared to the Year Ended December 31, 2018

Revenue

During the years ended December 31, 2019 and 2018, we generated rental revenue of $1,730,871 and $341,538, respectively. The increase in rental revenue is due to the Company owning six properties in 2019 versus three properties in 2018 of which one was purchased in December 2018.

Operating Expenses

For the twelve months ended December 31, 2019 and 2018, we incurred general, administrative and organizational expenses of $1,039,755 and $396,832, respectively, which included professional fees, marketing expenses and other costs associated with running our business. The $642,923 increase in expenses is due in part to costs associated with applying to be quoted on the OTCQB Venture Market, increasing the number of properties, costs associated with being a public reporting company which includes approximately $306,000 non-cash expense (issuance of 61,193 shares to an underwriter) for consulting services.

During the twelve months ended December 31, 2019 and 2018, we incurred building expenses of $163,467 and $45,208, respectively. The increase is due to the additional properties which were owned for three months in 2019. The majority of these expenses are reimbursed by the tenant.

For the twelve months ended December 31, 2019 and 2018, we incurred depreciation and amortization expense of $665,675 and $153,569, respectively. For the twelve months ended December 31, 2019 and 2018, we incurred interest expense of $682,889 and $145,107, respectively. The increase in depreciation and interest expense is due to the purchase of three additional properties during 2019 and 12 months of depreciation for two properties purchased in 2018.

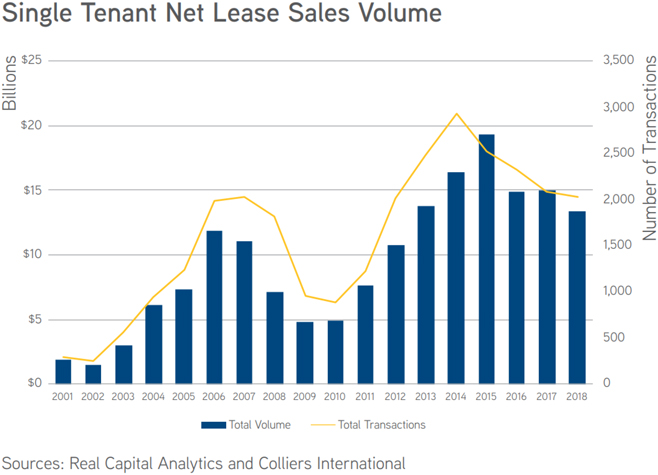

For the twelve months ended December 31, 2019, we agreed to pay a $85,000 settlement to a developer to terminate an agreement which had allowed for the opportunity to develop single tenant, net lease buildings throughout the U.S. over the next several years. The Company decided to terminate this agreement due to the inability to agree to terms on the development of individual locations.

For the twelve months ended December 31, 2019 and 2018, we incurred compensation expense of $108,430 and $81,377, respectively. The increase in compensation costs is due primarily to our President being paid annual compensation of $100,000 starting April 2018.

Income Tax Benefit

We did not record an income tax benefit for the year ended December 31, 2019 or 2018 because we have been in a net loss situation since inception and have recorded a valuation allowance to offset any tax benefits generated by the operating losses.

55