As filed with the Securities and Exchange Commission on February 8, 2016.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23093

The Cushing MLP Infrastructure Fund II

(Exact name of registrant as specified in charter)

8117 Preston Road, Suite 440, Dallas, TX 75225

(Address of principal executive offices) (Zip code)

Jerry V. Swank

8117 Preston Road, Suite 440, Dallas, TX 75225

(Name and address of agent for service)

214-692-6334

(Registrant's telephone number, including area code)

Date of fiscal year end: November 30, 2015

Date of reporting period: November 30, 2015

Item 1. Reports to Stockholders.

THE CUSHING® MLP INFRASTRUCTURE FUND II

ANNUAL REPORT

November 30, 2015

(INCLUDING THE FINANCIAL STATEMENTS AND

REPORT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF

THE CUSHING® MLP INFRASTRUCTURE MASTER FUND)

| | Section |

| | |

| I |

| Financial Statements and Report of the Independent Registered Public | |

| Accounting Firm as of November 30, 2015 and for the year then ended | |

| | |

| II |

| Financial Statements and Report of the Independent Registered Public | |

| Accounting Firm as of November 30, 2015 and for the period then ended | |

The Cushing® MLP Infrastructure Fund II | |

| TABLE OF CONTENTS | |

The Cushing® MLP Infrastructure Fund II | | |

| | |

| | November 30, 2015 |

| Assets | | | | |

| Investment in The Cushing MLP Infrastructure Master Fund | | $ | 41,936 | | |

| Short-term investments | | | 46,566 | | |

| Cash | | | 9,887 | | |

| Receivable from Adviser, net | | | 19,026 | | |

| Total assets | | | 117,415 | | |

| | | | | | |

| Liabilities | | | | | |

| Accrued expenses | | | 25,833 | | |

| Net assets | | $ | 91,582 | | |

| | | | | | |

| Net Assets Consisting of | | | | | |

| Additional paid-in capital | | $ | 100,000 | | |

| Accumulated net investment loss | | | (464 | ) | |

| Accumulated realized loss | | | (1,702 | ) | |

| Net unrealized depreciation on investments | | | (6,252 | ) | |

| Net assets | | $ | 91,582 | | |

| | | | | | |

| Net Asset Value, 100.00 units outstanding | | $ | 915.82 | | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Fund II | | |

| | |

| | | | | |

| | Period From |

| | September 1, 2015(1) |

| | Through |

| | November 30, 2015 |

| Investment Income and Expenses Allocated from The Cushing MLP Infrastructure Master Fund | | | | |

| Distributions and dividends received | | $ | 697 | | |

| Less: return of capital on distributions | | | (647 | ) | |

| Distribution and dividend income | | | 50 | | |

| Interest income | | | 1 | | |

| Professional fees | | | (116 | ) | |

| Management fees | | | (113 | ) | |

| Administrator fees | | | (22 | ) | |

| Trustees’ fees | | | (15 | ) | |

| Fund accounting fees | | | (12 | ) | |

| Custodian fees and expenses | | | (3 | ) | |

| Expense reimbursement by Adviser, net | | | 120 | | |

| Total Net Investment Loss Allocated from The Cushing MLP Infrastructure Master Fund | | | (110 | ) | |

| Fund Investment Income | | | | | |

| Interest income | | | 6 | | |

| Fund Expenses | | | | | |

| Professional fees | | | 20,000 | | |

| Administrator fees | | | 7,533 | | |

| Transfer agent fees | | | 1,250 | | |

| Registration fees | | | 490 | | |

| Total Fund Expenses | | | 29,273 | | |

| Less: expense reimbursement by Adviser, net | | | (28,913 | ) | |

| Net Expenses | | | 360 | | |

| Net Investment Loss | | | (464 | ) | |

| | | | | | |

| Realized and Unrealized Gain (Loss) on Investments | | | | | |

| Net realized loss allocated from The Cushing MLP Infrastructure Master Fund | | | (1,702 | ) | |

| Net change in unrealized depreciation of investments allocated from | | | | | |

| The Cushing MLP Infrastructure Master Fund | | | (6,252 | ) | |

| Net Realized and Unrealized Loss on Investments | | | (7,954 | ) | |

| Decrease in Net Assets Resulting from Operations | | $ | (8,418 | ) | |

| (1) | Commencement of Operations |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Fund II |

|

| | | | | |

| | Period From |

| | September 1, 2015(1) |

| | Through |

| | November 30, 2015 |

| Operations | | | | |

| Net investment loss | | $ | (464 | ) | |

| Net realized loss | | | (1,702 | ) | |

| Net change in unrealized depreciation | | | (6,252 | ) | |

| Net decrease in net assets resulting from operations | | | (8,418 | ) | |

| Capital Share Transactions (Note 7) | | | | | |

| Proceeds from unitholder subscriptions | | | 100,000 | | |

| Net increase in net assets from capital share transactions | | | 100,000 | | |

| Total increase in net assets | | | 91,582 | | |

| Net Assets | | | | | |

| Beginning of period | | | — | | |

| End of period | | $ | 91,582 | | |

| Accumulated net investment income at the end of the period | | $ | (464 | ) | |

| (1) | Commencement of Operations |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Fund II |

|

| | | Period From |

| | | September 1, 2015(1) |

| | | Through |

| | | November 30, 2015 |

| OPERATING ACTIVITIES | | | | | |

| | | | | | | |

| Decrease in Net Assets Resulting from Operations | | | $ | (8,418 | ) | |

| Adjustments to reconcile decrease in net assets resulting from operations to net cash used in operating activities | | | | | | |

| Net realized loss allocated from The Cushing MLP Infrastructure Master Fund | | | | 1,702 | | |

Net change in unrealized depreciation of investments allocated from The Cushing MLP Infrastructure Master Fund | | | | 6,252 | | |

| Net investment loss allocated from The Cushing MLP Infrastructure Master Fund | | | | 110 | | |

| Purchases of investment in The Cushing MLP Infrastructure Master Fund | | | | (50,000 | ) | |

| Purchases of short-term investments | | | | (46,566 | ) | |

| Changes in operating assets and liabilities | | | | | | |

| Receivable from Adviser | | | | (19,026 | ) | |

| Accrued expenses | | | | 25,833 | | |

| Net cash used in operating activities | | | | (90,113 | ) | |

| FINANCING ACTIVITIES | | | | | | |

| Proceeds from issuance of units, net of contributed securities | | | | 100,000 | | |

| INCREASE IN CASH | | | | 9,887 | | |

| | | | | | | |

| CASH: | | | | | | |

| Beginning of period | | | | — | | |

| End of period | | | $ | 9,887 | | |

| (1) | Commencement of Operations |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Fund II |

|

| | Period From |

| | September 1, 2015 |

| | (1) |

| | through |

| | November 30, |

| | | | | | |

Per Unit Data (2) | | | | | |

| Net Asset Value, beginning of period | | $ | 1,000.00 | | |

| Income from Investment Operations: | | | | | |

| Net investment loss | | | (4.64 | ) | |

| Net realized and unrealized loss on investments | | | (79.54 | ) | |

| Total increase from investment operations | | | (84.18 | ) | |

| Net Asset Value, end of period | | $ | 915.82 | | |

| | | | | | |

Total Investment Return (3) | | | (8.4 | )%(4) | |

| Supplemental Data and Ratios | | | | | |

| Net assets, end of period | | $ | 91,582 | | |

| | | | | | |

Ratio of expenses to average net assets before waiver (5) | | | 127.71 | % | |

| | | | | | |

Ratio of expenses to average net assets after waiver (5) | | | 2.25 | % | |

| | | | | | |

Ratio of net investment loss to average net assets before waiver (5) | | | (127.47 | )% | |

| | | | | | |

Ratio of net investment loss to average net assets after waiver (5) | | | (2.01 | )% | |

| (1) | Commencement of operations. |

| (2) | Information presented relates to a unit outstanding for the entire period. |

| (3) | Individual returns and ratios may vary based on the timing of capital transaction |

| (5) | All income and expenses are annualized for periods less than one full year . |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Fund II

NOTES TO FINANCIAL STATEMENTS November 30, 2015

The Cushing® MLP Infrastructure Fund II (the “Fund”), was organized as a Delaware statutory trust pursuant to an agreement and declaration of trust dated May 4, 2015 (the “Declaration of Trust”) and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940. The Fund commenced operations on September 1, 2015. The Fund’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders.

The Fund pursues its investment objective by investing all or substantially all of its investable assets in The Cushing® MLP Infrastructure Master Fund (the “Master Fund”), a non-diversified, closed-end management investment company under the Investment Company Act of 1940 and has the same investment objective as the Fund. The Fund and Master Fund are managed by Cushing® Asset Management, LP (the “Adviser”).

The financial statements of the Master Fund, including the Schedule of Investments, are attached to this report and should be read in conjunction with the Fund’s financial statements. The Fund owns 0.13% of the Master Fund as of November 30, 2015.

| 2. | Significant Accounting Policies |

A. Basis of Presentation

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) as detailed in the Financial Accounting Standards Board’s Accounting Standards Codification.

B. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

C. Investment Valuation

The Fund uses the following valuation methods to determine fair value as either fair value for investments for which market quotations are available, or if not available, the fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Fund’s Board of Trustees (“Board of Trustees” or “Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

(i) The market value of each security listed or traded on any recognized securities exchange or automated quotation system will be the last reported sale price at the relevant valuation date on the composite tape or on the principal exchange on which such security is traded except those listed on the NASDAQ Global Market®, NASDAQ Global Select Market® and the NASDAQ Capital Market® exchanges (collectively, “NASDAQ”). Securities traded on NASDAQ will be valued at the NASDAQ official closing price. If no sale is reported on that date, the closing price from the prior trading day may be used.

(ii) The Fund’s non-marketable investments will generally be valued in such manner as the Adviser determines in good faith to reflect their fair values under procedures established by, and under the general supervision and responsibility of, the Board of Trustees. The pricing of all assets that are fair valued in this manner will be subsequently reported to and ratified by the Board of Trustees.

The Fund records its investment in the Master Fund at fair value which is represented by the Fund’s proportionate indirect interest in the net assets of the Master Fund as of November 30, 2015. Valuation of securities and other investments held by the Master Fund is discussed in the notes to the Master Fund’s financial statements. The Fund records its pro rata share of the Master Fund’s income, expenses and realized and unrealized gains and losses. The performance of the Fund is directly affected by the performance of the Master Fund. The financial statements of the Master Fund, which are attached, are an integral part of these financial statements. Please refer to the accounting policies disclosed in the financial statements of the Master Fund for additional information regarding significant accounting policies that affect the Fund.

D. Security Transactions, Investment Income and Expenses

The Master Fund’s security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on an accrual basis. Distributions and dividends (collectively referred to as “Distributions”) are recorded on the ex-dividend date. Distributions received from the Master Fund’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income, capital gains and return of capital. For financial statement purposes, the Master Fund uses return of capital and income estimates to determine the dividend income received from MLP Distributions. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from the MLPs after their tax reporting periods are concluded, as the actual character of these Distributions is not known until after the fiscal year end of the Master Fund.

The Master Fund estimates the allocation of investment income and return of capital for the Distributions received from its portfolio investments within the Statement of Operations.

Expenses are recorded on an accrual basis. The Fund records its proportionate share of the Master Fund’s income, expenses, and realized and unrealized gains and losses. In addition, the Fund incurs and accrues its own expenses.

E. Valuation of Investment in Master Fund

The Fund records its investment in the Master Fund at its proportionate share of net assets. Valuation of investments held by the Master Fund, including, but not limited to, the valuation techniques used and categorization within the fair value hierarchy of investments are discussed in the notes to the Master Fund financial statements included elsewhere in this report.

F. Distributions to Unitholders

Distributions to unitholders are recorded on the ex-dividend date. The character of Distributions to unitholders are comprised of 100 percent return of capital.

G. Federal Income Taxation

The Fund is treated as a partnership for Federal income tax purposes. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements. The Fund does not record a provision for U.S. federal, state, or local income taxes because the unitholders report their share of the Fund’s income or loss on their income tax returns. The Fund files an income tax return in the U.S. federal jurisdiction, and may file income tax returns in various U.S. states. Generally, the Fund is subject to income tax examinations by major taxing authorities for all tax years since its inception.

In accordance with GAAP, the Fund is required to determine whether its tax positions are more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. The tax benefit recognized is measured as the largest amount of benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authorities. Based on its analysis, the Fund has determined that it has not incurred any liability for unrecognized tax benefits as of November 30, 2015. The Fund does not expect that its assessment regarding unrecognized tax benefits will materially change over the next twelve months. However, the Fund’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, questioning the timing and amount of deductions, the nexus of income among various tax jurisdictions, compliance with U.S. federal and U.S. state and foreign tax laws, and changes in the administrative practices and precedents of the relevant taxing authorities.

H. Cash Flow Information

The Fund intends to make Distributions from investments, which include the amount received as cash Distributions from MLPs, common stock dividends from the Master Fund. These activities are reported in the Statement of Changes in Net Assets, and additional information on cash receipts and payments is presented in the Statement of Cash Flows.

I. Indemnifications

Under the Fund’s organization documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under such indemnification arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred, and may not occur.

The Fund’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders. The Fund seeks to achieve its investment objective by investing, under normal market conditions, in the Master Fund, which invests in MLPs.

In the normal course of business, substantially all of the Fund and Master Fund’s securities transactions, money balances, and security positions are transacted with the Fund’s custodian, U.S. Bank, N.A. The Fund and Master Fund are subject to credit risk to the extent any broker with whom it conducts business is unable to fulfill contractual obligations on its behalf. The Adviser monitors the financial conditions of such brokers.

| 4. | Agreements and Related Party Transactions |

Each of the Fund and the Master Fund has entered into an Investment Management Agreement (the “Agreement”) with the Adviser. Under the terms of the Agreement, the Master Fund pays the Adviser a management fee, payable monthly in arrears, equal to 0.083% (1.0% per annum) of the net assets of the Master Fund determined as of the beginning of each calendar month for services and facilities provided by the Adviser to the Fund and the Master Fund. The Fund does, however, due to its investment in the Master Fund, bear its proportionate percentage of the management fee paid to the Adviser by the Master Fund.

The Adviser agreed to waive a portion of its management fee and reimburse Fund and Master Fund expenses such that the Fund’s operating expenses would not exceed 2.25% of the Fund’s net assets and the Master Fund’s operating expenses would not exceed 1.50% of the Master Fund’s net assets through September 1, 2016. For the fiscal period ended November 30, 2015, the Adviser waived fees and reimbursed Fund expenses in the amount of $28,913. For the fiscal period ended November 30, 2015, the Adviser earned $136,761 in management fees from the Master Fund and waived fees and reimbursed Master Fund expenses in the amount of $134,201. Under the waiver agreement, the Fund relies upon the Adviser to pay certain expenses. Should the Adviser not be able to perform under the waiver agreement, there is a risk the Fund would have to bear those expenses.

Waived fees and reimbursed Fund expenses, including prior year expenses, are subject to potential recovery by year of expiration. The Adviser’s waived fees and reimbursed expenses that are subject to potential recovery are as follows:

| | | | | | | | | Amount Subject | | |

| | | Amount | | | Amount | | | to Potential | | |

| Fiscal Year Incurred | | Reimbursed | | | Recouped | | | Recovery | | Expiration Date |

| November 30, 2015 | | $ | 28,913 | | | $ | — | | | $ | 28,913 | | November 30, 2018 |

Jerry V. Swank, the founder and managing partner of the Adviser, is Chairman of the Fund’s Board of Trustees.

U.S. Bancorp Fund Services, LLC serves as the Fund’s administrator and transfer agent. In addition to the fees it charges the Master Fund, the Fund pays the administrator a monthly fee computed at an annual rate of 0.035% of the first $50 million of the Fund’s net assets, 0.020% on the next $100 million of net assets and 0.010% on the balance of the Fund’s net assets above $150 million, with a minimum annual fee of $30,000.

U.S. Bank, N.A. serves as the Fund’s custodian. There is no fee directly attributable to the Fund other than its allocated portion of the Master Fund’s expenses.

Quasar Distributors, LLC, an affiliate of U.S. Bancorp Fund Services, LLC and U.S. Bank, N.A., serves as the Fund’s distributor.

Certain unitholders are affiliated with the Fund. The aggregate value of the affiliated unitholders’ share of net assets as of November 30, 2015 was approximately $91,500.

| 5. | Fair Value Measurements |

Various inputs that are used in determining the fair value of the Fund’s investments are summarized in the three broad levels listed below:

| | ● | Level 1 — quoted prices in active markets for identical securities |

| | ● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | ● | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of November 30, 2015, short-term investments valued at $46,566 were classified as Level 1 in the fair value hierarchy. The individual securities are listed in the table below. The Fund invests substantially all of its assets in the Master Fund.

| | | Shares | | | Fair Value | |

| AIM Short-Term Treasury Portfolio Fund - Institutional Class | | | 9,312 | | | $ | 9,312 | |

| Fidelity Government Portfolio Fund - Institutional Class | | | 9,312 | | | | 9,312 | |

| Fidelity Money Market Portfolio - Institutional Class | | | 9,312 | | | | 9,312 | |

| First American Government Obligations Fund - Class Z | | | 9,318 | | | | 9,318 | |

| Invesco STIC Prime Portfolio | | | 9,312 | | | | 9,312 | |

| | | | | | | $ | 46,566 | |

During the fiscal period ended November 30, 2015, the Fund did not have any transfers between any of the levels of the fair value hierarchy.

Units of beneficial interest (“Units”) of the Fund may be offered or sold in a private placement to persons who satisfy the suitability standards set forth in the Fund’s confidential offering memorandum. The Fund generally offers Units on the first business day of each month. As of November 30, 2015, the Fund had 100.00 Units outstanding.

The Fund generally intends to pay Distributions quarterly, in such amounts as may be determined from time to time by the Fund’s Board of Trustees. Unless a unitholder elects otherwise, Distributions, if any, will be automatically reinvested in additional Units in the Fund.

The financial statements were approved by the Board of Trustees and available for issuance on January 29, 2016. Subsequent events have been evaluated through this date.

On December 3, 2015, the Fund issued 0.91 units through its dividend reinvestment plan.

Report of Independent Registered Public Accounting Firm

To the Unitholders and Board of Trustees of

The Cushing® MLP Infrastructure Fund II:

We have audited the accompanying statement of assets and liabilities of The Cushing® MLP Infrastructure Fund II (the “Fund”) as of November 30, 2015, and the related statements of operations, changes in net assets, cash flows, and financial highlights for the period September 1, 2015 through November 30, 2015. The financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2015, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Cushing® MLP Infrastructure Fund II, as of November 30, 2015, the results of its operations, changes in net assets, cash flows, and financial highlights for the period September 1, 2015 through November 30, 2015, in conformity with accounting principles generally accepted in the United States of America.

Dallas, Texas

January 29, 2016

The Cushing® MLP Infrastructure Fund II

November 30, 2015

Investment Policies and Parameters

The Commodity Futures Trading Commission (“CFTC”) amended Rule 4.5 which permits investment advisers to registered investment companies to claim an exclusion from the definition of commodity pool operator with respect to a fund provided certain requirements are met. In order to permit the Adviser to continue to claim this exclusion with respect to the Fund under the amended rule, the Fund limits its transactions in futures, options of futures and swaps (excluding transactions entered into for “bona fide hedging purposes,” as defined under CFTC regulations) such that either: (i) the aggregate initial margin and premiums required to establish its futures, options on futures and swaps do not exceed 5% of the liquidation value of the Fund’s portfolio, after taking into account unrealized profits and losses on such positions; or (ii) the aggregate net notional value of its futures, options on futures and swaps does not exceed 100% of the liquidation value of the Fund’s portfolio, after taking into account unrealized profits and losses on such positions. The Fund and the Adviser do not believe that complying with the amended rule will limit the Fund’s ability to use futures, options and swaps to the extent that it has used them in the past.

Trustee and Officer Compensation

The Fund does not currently compensate any of its trustees who are interested persons nor any of its officers. The Master Fund is responsible for compensation of the Trustees. The Fund, through its investment in the Master Fund, bears its proportionate percentage of the Trustee fees paid by the Master Fund. The Fund did not pay any special compensation to any of its trustees or officers. The Fund continuously monitors standard industry practices and this policy is subject to change. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request by calling the Fund toll-free at (877) 653-1415 and on the SEC’s Web site at www.sec.gov.

Cautionary Note Regarding Forward-Looking Statements

This report contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Fund’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; MLP industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in the Fund’s filings with the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Fund undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Fund’s investment objectives will be attained.

Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities owned by the Fund and information regarding how the Fund voted proxies relating to the portfolio of securities during the 12-month period ended June 30 will be available to stockholders (i) without charge, upon request by calling the Fund toll-free at (877) 653-1415; and (ii) on the SEC’s Web site at www.sec.gov.

Form N-Q

The Fund will file its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q and statement of additional information are available without charge by visiting the SEC’s Web site at www.sec.gov. In addition, you may review and copy the Fund’s Form N-Q at the SEC’s Public Reference Room in Washington D.C. following its first filing You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Privacy Policy

In order to conduct its business, the Fund collects and maintains certain nonpublic personal information about its stockholders of record with respect to their transactions in shares of the Fund’s securities. This information includes the stockholder’s address, tax identification or Social Security number, share balances, and dividend elections. We do not collect or maintain personal information about stockholders whose share balances of our securities are held in “street name” by a financial institution such as a bank or broker.

We do not disclose any nonpublic personal information about you, the Fund’s other stockholders or the Fund’s former stockholders to third parties unless necessary to process a transaction, service an account, or as otherwise permitted by law.

To protect your personal information internally, we restrict access to nonpublic personal information about the Fund’s stockholders to those employees who need to know that information to provide services to our stockholders. We also maintain certain other safeguards to protect your nonpublic personal information.

Householding

In an effort to decrease costs, the Fund intends to reduce the number of duplicate annual and semi-annual reports, proxy statements and other similar documents you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please contact investor services at investorservices@usbank.com to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

The Cushing® MLP Infrastructure Fund II

Board Approval of Investment Management Agreement (Unaudited) November 30, 2015

On May 21, 2015, the Board of Trustees (the “Board”) of The Cushing® MLP Infrastructure Fund II (the “Fund”) (members of which are referred to collectively as the “Trustees”) met in person to discuss, among other things, the approval of the Investment Management Agreement (the “Agreement”) between the Fund and Cushing® Asset Management, LP (the “Adviser”).

Activities and Composition of the Board

The Board of Trustees is comprised of four Trustees, three of whom are not “interested persons,” as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Fund (the “Independent Trustees”). The Board of Trustees is responsible for the oversight of the operations of the Fund and performs the various duties imposed by the 1940 Act on the trustees of investment companies. The Independent Trustees have retained independent legal counsel to assist them in connection with their duties. Prior to its consideration of the Agreement, the Board of Trustees received and reviewed information provided by the Adviser. The Board of Trustees also received and reviewed information responsive to requests from independent counsel to assist it in its consideration of the Agreement. Before the Board of Trustees voted on the approval of the Agreement, the Independent Trustees met with independent legal counsel during executive session and discussed the Agreement and related information.

The Board considered that the Fund would be a “feeder fund” that will invest all or substantially all of its investable assets in The Cushing® MLP Infrastructure Master Fund (the “Master Fund”), which has the same investment objectives as the Fund.

Consideration of Nature, Extent and Quality of the Services

The Board of Trustees received and considered information regarding the nature, extent and quality of services proposed to be provided to the Fund under the Agreement. The Board of Trustees reviewed certain background materials supplied by the Adviser in its presentation, including the Adviser’s Form ADV.

The Board of Trustees reviewed and considered the Adviser’s investment advisory personnel, its history as an asset manager and its performance and the amount of assets currently under management by the Adviser. The Board of Trustees also reviewed the research and decision-making processes utilized by the Adviser, including the methods proposed to be used to seek to achieve compliance with the investment objectives, policies and restrictions of the Fund.

The Board of Trustees considered the background and experience of the Adviser’s management in connection with the Fund, including reviewing the qualifications, backgrounds and responsibilities of the management team that would be primarily responsible for the day-to-day portfolio management of the Fund (noting that the primary holdings of the Fund would be its investment in the Master Fund) and the extent of the resources proposed to be devoted to research and analysis of the Fund’s investments.

The Board of Trustees also reviewed, among other things, the Adviser’s conflict of interest policies, insider trading policies and procedures and the Adviser’s Code of Ethics. The Board of Trustees, including all of the Independent Trustees, concluded that the nature, extent and quality of services to be rendered by the Adviser under the Agreement were adequate.

Consideration of Advisory Fees and the Cost of the Services

The Board of Trustees reviewed and considered the contractual annual advisory fee proposed to be paid by the Master Fund to the Adviser in light of the extent, nature and quality of the advisory services to be provided by the Adviser to the Master Fund.

The Board of Trustees considered the information they received comparing the Fund’s contractual annual advisory fee and overall expenses with (a) a peer group of competitor closed-end funds determined by the Adviser; and (b) other accounts or vehicles managed by the Adviser. Given the small universe of managers and funds fitting within the criteria for the peer group, the Adviser did not believe that it would be beneficial to engage the services of an independent third-party to assist in the preparation of the peer group analysis, and the Independent Trustees concurred with this approach.

The Board of Trustees also noted that under the proposed master/feeder structure, the Fund would not pay a management fee to the Adviser.

Based on such information, the Board of Trustees determined that although the peer group was of limited utility because of the significant differences between the Master Fund and the other funds in the peer group, the Master Fund’s proposed management fee and total expense ratio were significantly below the peer group median, and the proposed management fee was identical to the current management fee for The Cushing® MLP Infrastructure Fund (“Feeder Fund I”), which was expected to be converted to a “feeder fund” that would invest substantially all of its investable assets in the Master Fund. The Board noted that under the proposed master/feeder structure, the Fund, as a feeder fund, would not pay a management fee to the Advisor, but would bear its pro rata share of the management fee paid by the Master Fund. The Board of Trustees also concluded that the fees charged by the Adviser to the Fund relative to comparable accounts of the Adviser employing similar strategies were reasonable in light of the differences between the types of clients, the kinds of costs incurred by the Adviser, and other considerations faced by the Adviser in competing for and servicing such clients.

Consideration of Investment Performance

The Board of Trustees regularly reviews the performance of the Fund throughout the year. The Board of Trustees reviewed performance information comparing the performance of Feeder Fund I, which has the same investment objectives as the Fund and was expected to be converted to a “feeder fund” that would invest substantially all of its investable assets in the Master Fund, against benchmark indices and its peer group. The Board of Trustees noted that Feeder Fund I had outperformed its benchmark index, with significant outperformance in the 1-year and 3-year periods, and the proposed strategy of the Fund would be identical to the current strategy of Feeder Fund I.

Other Considerations

The Board of Trustees received and considered a profitability analysis prepared by the Adviser based on the fees payable by Feeder Fund I. The Board noted that under the proposed master/feeder structure, the Fund would not pay a management fee to the Adviser. The Board of Trustees considered the profits that could be anticipated to be realized by the Adviser in connection with the operation of the Master Fund and concluded that the profit, if any, anticipated to be realized by the Adviser in connection with the operation of the Master Fund is not unreasonable to such Fund.

The Board of Trustees considered whether economies of scale in the provision of services to the Fund had been or would be passed along to the shareholders under the Agreement. The Board of Trustees reviewed and considered any other incidental benefits derived or to be derived by the Adviser from its relationship with the Fund, including soft dollar arrangements or other so called “fall-out benefits” with respect to the potential investments by the Master Fund. The Board of Trustees concluded there were no material economies of scale or other incidental benefits accruing to the Adviser in connection with its relationship with the Fund.

Conclusion

In approving the Agreement and the fees charged under the Agreement, the Board of Trustees concluded that no single factor reviewed by the Board of Trustees was identified by the Board of Trustees to be determinative as the principal factor in whether to approve the Agreement. The summary set out above describes the most important factors, but not all of the matters, considered by the Board of Trustees in coming to its decision regarding the Agreement. On the basis of such information as the Board of Trustees considered necessary to the exercise of its reasonable business judgment and its evaluation of all of the factors described above, and after much discussion, the Board of Trustees concluded that each factor they considered, in the context of all of the other factors they considered, favored approval of the Agreement. It was noted that it was the judgment of the Board of Trustees that approval of the Agreement was consistent with the best interests of the Fund and its shareholders. A majority of the Trustees and, voting separately, a majority of the Independent Trustees, approved the Agreement.

The Cushing® MLP Infrastructure Fund II

TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) November 30, 2015

Set forth below is information with respect to each of the Trustees and executive officers of the Fund and Master Fund, including their principal occupations during the past five years. The business address of the Fund and Master Fund, its Trustees and executive officers is 8117 Preston Road, Suite 440, Dallas, Texas 75225.

| | | | | | | | | | | |

Name and Year of Birth | | Position(s) Held with the Trust | | Term of Office and Length of Time Served | | Principal Occupations During Past Five Years | | Number of Portfolios in Fund Complex(1) Overseen by Trustee | | Other Directorships Held by Trustee During the Past Five Years |

| Independent Trustees | | | | | | | | | | |

Brian R. Bruce (1955) | | Trustee and Chairman of the Audit Committee | | Trustee since 2010 | | Chief Executive Officer, Hillcrest Asset Management, LLC (2008 to present) (registered investment adviser). Previously, Director of Southern Methodist University’s Encap Investment and LCM Group Alternative Asset Management Center (2006 to 2011). Chief Investment Officer of Panagora Asset Management, Inc. (1999 to 2007) (investment management company). | | 6 | | CM Advisers Family of Funds (2 series) (2003 to present) and Dreman Contrarian Funds (2 series) (2007 to present). |

| | | | | | | | | | | |

Edward N. McMillan (1947) | | Trustee and Lead Independent Trustee | | Trustee since 2010 | | Retired. Private Investor with over 35 years of experience in asset management, investment banking and general business matters. | | 6 | | None. |

| | | | | | | | | | | |

| Ronald P. Trout (1939) | | Trustee and Chairman of the Nominating, and Corporate Governance Committee | | Trustee since 2010 | | Retired. Previously, founding partner and Senior Vice President of Hourglass Capital Management, Inc. (1989 to 2002) (investment management company). | | 6 | | Dorchester Minerals LP (2008 - present) (acquisition, ownership and administration of natural gas and crude oil royalty, net profits and leasehold interests in the U.S.) |

| | | | | | | | | | | |

| Interested Trustees | | | | | | | | | | |

Jerry V. Swank (1951)(2) | | Trustee, Chairman of the Board, President and Chief Executive Officer | | Trustee since 2010 | | Managing Partner of the Adviser and founder Swank Capital, LLC of (2000 - present). | | 6 | | E-T Energy Ltd. (2008 - 2014) (developing, operating, producing and selling recoverable bitumen); Central Energy Partners, LP (2010-2013) (storage and transportation of refined petroleum products and petrochemicals). |

(1) | The “Fund Complex” includes the Fund, Master Fund and each other registered investment company for which the Adviser serves as investment adviser. As of the date hereof, there are six funds, including the Fund and Master Fund, in the Fund Complex. |

(2) | Mr. Swank is an “interested person” of the Fund and Master Fund, as defined under the Investment Company Act of 1940, as amended, by virtue of his position as Managing Partner of the Investment Adviser. |

Executive Officers

The following provides information regarding the executive officers of the Fund and Master Fund who are not Trustees. Officers serve at the pleasure of the Board of Trustees and until his or her successor is appointed and qualified or until his or her earlier resignation or removal.

| | | | | Term of Office | | |

| Name and | | Position(s) Held | | and Length of | | |

| Year of Birth | | with the Trust | | Time Served | | Principal Occupations During Past Five Years |

| | | | | | | |

John H. Alban (1963) | | Chief Financial Officer and Treasurer | | Officer since 2010 | | Chief Operating Officer (“COO”) and Chief Financial Officer of the Adviser (2010 - present). Previously, Chief Administrative Officer of NGP Energy Capital Management (2007 - 2009); COO of Spinnerhawk Capital Management, L.P. (2005 - 2007). |

| | | | | | | |

Barry Y. Greenberg (1963) | | Chief Compliance Officer and Secretary | | Officer since 2010 | | General Counsel and Chief Compliance Officer of the Adviser (2010-present); Partner at Akin Gump Strauss Hauer & Feld LLP (2005 - 2010); Vice President, Legal, Compliance and Administration at American Beacon Advisors (1995 - 2005); Attorney and Branch Chief at the U.S. Securities and Exchange Commission (1988 - 1995). |

| | | | | | | |

Elizabeth F. Toudouze (1962) | | Executive Vice President | | Officer since 2010 | | Portfolio manager of the Adviser (2005 – present). Previously, ran a family office. |

| | | | | | | |

John M. Musgrave (1982) | | Vice President | | Officer since 2013 | | Vice President and Senior Research Analyst of the Adviser (2007 – present). Previously an investment banker at Citigroup (2005 - 2007) and a research analyst at UBS Investment Bank (2004 – 2005). |

THE CUSHING® MLP INFRASTRUCTURE MASTER FUND

ANNUAL REPORT

November 30, 2015

The Cushing® MLP Infrastructure Master Fund |

| TABLE OF CONTENTS |

| | | |

| | 1 |

| | | |

| | 2 |

| | | |

| | 4 |

| | | |

| | 5 |

| | | |

| | 6 |

| | | |

| | 7 |

| | | |

| | 8 |

| | | |

| | 9 |

| | | |

| | 13 |

| | | |

| | 14 |

| | | |

| | 16 |

| | | |

| | 18 |

The Cushing® MLP Infrastructure Master Fund |

|

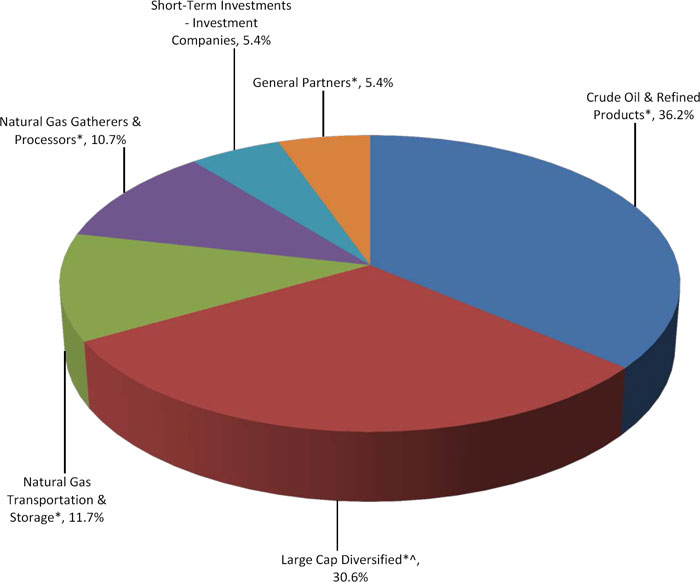

| November 30, 2015 |

| (Expressed as a Percentage of Total Investments) |

| (1) | Fund holdings and sector allocations are subject to change and there is no assurance that the Fund will continue to hold any particular security. |

| | |

| * | Master Limited Partnerships and Related Companies |

| ^ | Common Stock |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund |

|

| | | | | | | |

| | | November 30, 2015 | |

| | | | | | | |

| | | Shares | | | Fair Value | |

| Common Stock - 4.6% | | | | | | |

| Large Cap Diversified - 4.6% | | | | | | |

| United States - 4.6% | | | | | | |

| Kinder Morgan, Inc. | | | 60,600 | | | $ | 1,428,342 | |

| | | | | | | | | |

| Total Common Stock (Cost $2,194,766) | | | | | | $ | 1,428,342 | |

| | | | | | | | | |

| Master Limited Partnerships and Related Companies - 90.3% | | | | | | | | |

| Crude Oil & Refined Products - 36.3% | | | | | | | | |

| United States - 36.3% | | | | | | | | |

| Buckeye Partners, L.P. | | | 22,900 | | | $ | 1,550,101 | |

| Enbridge Energy Partners, L.P. | | | 26,700 | | | | 663,495 | |

| Genesis Energy, L.P. | | | 41,150 | | | | 1,619,253 | |

| MPLX, L.P. | | | 22,900 | | | | 983,326 | |

| NuStar Energy, L.P. | | | 10,900 | | | | 436,218 | |

| Phillips 66 Partners, L.P. | | | 20,200 | | | | 1,171,600 | |

| Rose Rock Midstream, L.P. | | | 37,100 | | | | 776,503 | |

| Shell Midstream Partners, L.P. | | | 41,450 | | | | 1,445,361 | |

| Sunoco Logistics Partners, L.P. | | | 54,550 | | | | 1,520,308 | |

| Tesoro Logistics, L.P. | | | 24,000 | | | | 1,198,800 | |

| | | | | | | | 11,364,965 | |

| General Partners - 5.4% | | | | | | | | |

| United States - 5.4% | | | | | | | | |

| Energy Transfer Equity, L.P. | | | 88,350 | | | | 1,673,349 | |

| | | | | | | | | |

| Large Cap Diversified - 26.1% | | | | | | | | |

| United States - 26.1% | | | | | | | | |

| Energy Transfer Partners, L.P. | | | 37,100 | | | | 1,417,591 | |

| Enterprise Products Partners, L.P. | | | 78,000 | | | | 1,980,420 | |

| Magellan Midstream Partners, L.P. | | | 30,450 | | | | 1,904,038 | |

| ONEOK Partners, L.P. | | | 21,800 | | | | 659,014 | |

| Plains All American Pipeline, L.P. | | | 50,150 | | | | 1,242,717 | |

| Williams Partners, L.P. | | | 35,450 | | | | 972,039 | |

| | | | | | | | 8,175,819 | |

| Natural Gas Gatherers & Processors - 10.8% | | | | | | | | |

| United States - 10.8% | | | | | | | | |

| MarkWest Energy Partners, L.P. | | | 28,100 | | | | 1,348,800 | |

| Targa Resources Partners, L.P. | | | 36,550 | | | | 834,802 | |

| Western Gas Partners, L.P. | | | 24,650 | | | | 1,183,693 | |

| | | | | | | | 3,367,295 | |

| Natural Gas Transportation & Storage - 11.7% | | | | | | | | |

| United States - 11.7% | | | | | | | | |

| Columbia Pipeline Partners, L.P. | | | 69,800 | | | | 1,049,792 | |

| EQT Midstream Partners, L.P. | | | 27,250 | | | | 1,843,463 | |

| TC Pipelines, L.P. | | | 15,800 | | | | 781,468 | |

| | | | | | | | 3,674,723 | |

| | | | | | | | | |

| Total Master Limited Partnerships and Related Companies (Cost $28,931,535) | | | | | | $ | 28,256,151 | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| | | | | | | |

| | | November 30, 2015 | |

| | | | | | | |

| | | Shares | | | Fair Value | |

| Short-Term Investments - Investment Companies - 5.4% | | | | | | |

| United States - 5.4% | | | | | | |

AIM Short-Term Treasury Portfolio Fund - Institutional Class, 0.02% (1) | | | 340,296 | | | $ | 340,296 | |

Fidelity Government Portfolio Fund - Institutional Class, 0.01% (1) | | | 329,040 | | | | 329,040 | |

Fidelity Money Market Portfolio - Institutional Class, 0.12% (1) | | | 340,296 | | | | 340,296 | |

First American Government Obligations Fund - Class Z, 0.07% (1) | | | 340,296 | | | | 340,296 | |

Invesco STIC Prime Portfolio, 0.08% (1) | | | 340,295 | | | | 340,295 | |

| Total Short-Term Investments (Cost $1,690,223) | | | | | | $ | 1,690,223 | |

| | | | | | | | | |

| Total Investments - 100.3% (Cost $32,816,524) | | | | | | $ | 31,374,716 | |

| Liabilities in Excess of Other Assets - (0.3)% | | | | | | | (84,341 | ) |

| Total Net Assets Applicable to Unitholders - 100.0% | | | | | | $ | 31,290,375 | |

Percentages are stated as a percent of net assets.

| (1) | Rate reported is the current yield as of November 30, 2015. |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund |

|

| | | | | | | |

| | | November 30, 2015 | |

| Assets | | | | | | |

| Investments at fair value (cost $32,816,524) | | | $ | 31,374,716 | | |

| Receivable from Adviser | | | | 31,229 | | |

| Total assets | | | | 31,405,945 | | |

| | | | | | | |

| Liabilities | | | | | | |

| Accrued expenses | | | | 115,570 | | |

| Net assets | | | $ | 31,290,375 | | |

| | | | | | | |

| Net Assets Consisting of | | | | | | |

| Additional paid-in capital | | | $ | 40,412,885 | | |

| Accumulated net investment loss | | | | (127,766 | ) | |

| Accumulated realized loss | | | | (953,472 | ) | |

| Net unrealized depreciation on investments | | | | (8,041,272 | ) | |

| Net assets | | | $ | 31,290,375 | | |

| | | | | | | |

| Net Asset Value, 42,034.94 units outstanding | | | $ | 744.39 | | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund |

|

| | | | | | | |

| | | Period From

July 1, 2015(1)

Through

November 30, 2015 | |

| Investment Income | | | | | | |

| Distributions and dividends received | | | $ | 920,914 | | |

| Less: return of capital on distributions | | | | (854,624 | ) | |

| Distribution and dividend income | | | | 66,290 | | |

| Interest income | | | | 226 | | |

| Total Investment Income | | | | 66,516 | | |

| | | | | | | |

| Expenses | | | | | | |

| Management fees | | | | 136,761 | | |

| Professional fees | | | | 109,378 | | |

| Administrator fees | | | | 22,948 | | |

| Organizational costs | | | | 20,150 | | |

| Trustees’ fees | | | | 18,000 | | |

| Fund accounting fees | | | | 14,122 | | |

| Custodian fees and expenses | | | | 4,378 | | |

| Registration fees | | | | 2,746 | | |

| Total Expenses | | | | 328,483 | | |

| Less: expense reimbursement by Adviser, net | | | | (134,201 | ) | |

| Net Expenses | | | | 194,282 | | |

| Net Investment Loss | | | | (127,766 | ) | |

| | | | | | | |

| Realized and Unrealized Loss on Investments | | | | | | |

| Net realized loss on investments | | | | (953,472 | ) | |

| Net change in unrealized depreciation of investments | | | | (8,041,272 | ) | |

| Net Realized and Unrealized Loss on Investments | | | | (8,994,744 | ) | |

| Decrease in Net Assets Resulting from Operations | | | $ | (9,122,510 | ) | |

| (1) | Commencement of Operations |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund |

|

| | | | | | | |

| | | Period From

July 1, 2015(1)

Through

November 30, 2015 | |

| | | | | | | |

| Operations | | | | | | |

| Net investment loss | | | $ | (127,766 | ) | |

| Net realized loss on investments | | | | (953,472 | ) | |

| Net change in unrealized depreciation of investments | | | | (8,041,272 | ) | |

| Net decrease in net assets resulting from operations | | | | (9,122,510 | ) | |

| Dividends and Distributions to Common Unitholders | | | | | | |

| Net investment income | | | | — | | |

| Return of capital | | | | (421,528 | ) | |

| Total dividends and distributions to common unitholders | | | | (421,528 | ) | |

| Capital Share Transactions (Note 7) | | | | | | |

| Proceeds from unitholder subscriptions | | | | 40,685,136 | | |

| Distribution reinvestments | | | | 149,277 | | |

| Net increase in net assets from capital share transactions | | | | 40,834,413 | | |

| Total increase in net assets | | | | 31,290,375 | | |

| Net Assets | | | | | | |

| Beginning of period | | | | — | | |

| End of period | | | $ | 31,290,375 | | |

| Accumulated net investment income at the end of the period | | | $ | (127,766 | ) | |

| (1) | Commencement of Operations |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund |

|

| | | | | | | |

| | | Period From

July 1, 2015(1)

Through

November 30, 2015 | |

| OPERATING ACTIVITIES | | | | | | |

| | | | | | | |

| Decrease in Net Assets Resulting from Operations | | | $ | (9,122,510 | ) | |

| Adjustments to reconcile decrease in net assets resulting from operations to net cash used in operating activities | | | | | | |

| Net realized loss on sales of investments | | | | 953,472 | | |

| Net change in unrealized depreciation of investments | | | | 8,041,272 | | |

| Return of capital on distributions | | | | 854,624 | | |

| Purchases of investments in securities | | | | (9,736,679 | ) | |

| Proceeds from sales of investments in securities | | | | 3,837,226 | | |

| Net purchases of short-term investments | | | | (1,690,223 | ) | |

| Changes in operating assets and liabilities | | | | | | |

| Receivable from Adviser | | | | (31,229 | ) | |

| Accrued expenses | | | | 115,570 | | |

| Net cash used in operating activities | | | | (6,778,477 | ) | |

| FINANCING ACTIVITIES | | | | | | |

| Proceeds from issuance of units, net of contributed securities | | | | 7,050,728 | | |

| Distributions paid | | | | (272,251 | ) | |

| Net cash provided by financing activities | | | | 6,778,477 | | |

| CHANGE IN CASH | | | | — | | |

| | | | | | | |

| CASH: | | | | | | |

| Beginning of period | | | | — | | |

| End of period | | | $ | — | | |

| | | | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW AND NON-CASH INFORMATION | | | | | | |

| Distribution reinvestment | | | $ | 149,277 | | |

| Contribution of securities, at fair value (cost $27,034,944) | | | $ | 33,634,408 | | |

| (1) | Commencement of Operations |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund |

|

| | | | | | | |

| | | Period From

July 1, 2015 (1)

through

November 30,

2015 | |

| | | | | | | |

Per Unit Data (2) | | | | | | |

| Net Asset Value, beginning of period | | | $ | 1,000.00 | | |

| Income from Investment Operations: | | | | | | |

| Net investment loss | | | | (3.38 | ) | |

| Net realized and unrealized loss on investments | | | | (240.06 | ) | |

| Total decrease from investment operations | | | | (243.44 | ) | |

| Less Distributions: | | | | | | |

| Net investment income | | | | — | | |

| Return of capital | | | | (12.17 | ) | |

| Total distributions to common stockholders | | | | (12.17 | ) | |

| Net Asset Value, end of period | | | $ | 744.39 | | |

Total Investment Return (3) | | | | (24.3 | )%(4) | |

| Supplemental Data and Ratios | | | | | | |

| Net assets, end of period | | | $ | 31,290,375 | | |

| | | | | | | |

Ratio of expenses to average net assets before waiver (5) | | | | 2.5 | % | |

| | | | | | | |

Ratio of expenses to average net assets after waiver (5) | | | | 1.5 | % | |

| | | | | | | |

Ratio of net investment loss to average net assets before waiver (5) | | | | (2.0 | )% | |

| | | | | | | |

Ratio of net investment loss to average net assets after waiver (5) | | | | (1.0 | )% | |

| | | | | | | |

| Portfolio turnover rate | | | | 12.63 | %(4) | |

| (1) | Commencement of operations. |

| (2) | Information presented relates to a unit outstanding for the entire period. |

| (3) | Individual returns and ratios may vary based on the timing of capital transaction |

| (4) | Not annualized. |

| (5) | All income and expenses are annualized for periods less than one full year. |

See Accompanying Notes to the Financial Statements.

November 30, 2015

The Cushing® MLP Infrastructure Master Fund (the “Master Fund”), was organized as a Delaware statutory trust pursuant to an agreement and declaration of trust dated May 4, 2015 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940. The Master Fund commenced operations on July 1, 2015. The Master Fund’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders.

The Cushing® MLP Infrastructure Fund I (the “Feeder Fund I”), was organized as a Delaware statutory trust and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940. Feeder Fund I commenced operations on March 1, 2010. The Feeder Fund I’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders and does so by investing substantially all of its investable assets in the Master Fund.

The Cushing® MLP Infrastructure Fund II (the “Feeder Fund II”, together with the “Feeder Fund I” the “Feeder Funds”), was organized as a Delaware statutory trust pursuant to an agreement and declaration of trust dated May 4, 2015 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940. The Feeder Fund II’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders and does so by investing substantially all of its assets in the Master Fund.

The Master Fund and Feeder Funds are managed by Cushing® Asset Management, LP (the “Adviser”).

| 2. | Significant Accounting Policies |

A. Basis of Presentation

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) as detailed in the Financial Accounting Standards Board’s Accounting Standards Codification.

B. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

C. Investment Valuation

The Master Fund uses the following valuation methods to determine fair value as either fair value for investments for which market quotations are available, or if not available, the fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Master Fund’s Board of Trustees (“Board of Trustees” or “Trustees”) from time to time. The valuation of the portfolio securities of the Master Fund currently includes the following processes:

(i) The market value of each security listed or traded on any recognized securities exchange or automated quotation system will be the last reported sale price at the relevant valuation date on the composite tape or on the principal exchange on which such security is traded except those listed on the NASDAQ Global Market®, NASDAQ Global Select Market® and the NASDAQ Capital Market® exchanges (collectively, “NASDAQ”). Securities traded on NASDAQ will be valued at the NASDAQ official closing price. If no sale is reported on that date, the closing price from the prior trading day may be used.

(ii) The Master Fund’s non-marketable investments will generally be valued in such manner as the Adviser determines in good faith to reflect their fair values under procedures established by, and under the general supervision and responsibility of, the Board of Trustees. The pricing of all assets that are fair valued in this manner will be subsequently reported to and ratified by the Board of Trustees.

D. Security Transactions, Investment Income and Expenses

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on an accrual basis. Distributions and dividends (collectively referred to as “Distributions”) are recorded on the ex-dividend date. Distributions received from the Master Fund’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income, capital gains and return of capital. For financial statement purposes, the Master Fund uses return of capital and income estimates to determine the dividend income received from MLP Distributions. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from the MLPs after their tax reporting periods are concluded, as the actual character of these Distributions is not known until after the fiscal year end of the Master Fund.

The Master Fund estimates the allocation of investment income and return of capital for the Distributions received from its portfolio investments within the Statement of Operations. For the fiscal period ended November 30, 2015, the Master Fund has estimated approximately 93% of the Distributions received from its portfolio investments to be return of capital.

Expenses are recorded on an accrual basis.

E. Distributions to Unitholders

Distributions to unitholders are recorded on the ex-dividend date. The character of Distributions to unitholders are comprised of 100 percent return of capital.

F. Federal Income Taxation

The Master Fund is treated as a partnership for Federal income tax purposes. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements. The Master Fund does not record a provision for U.S. federal, state, or local income taxes because the unitholders report their share of the Master Fund’s income or loss on their income tax returns. The Master Fund files an income tax return in the U.S. federal jurisdiction, and may file income tax returns in various U.S. states. Generally, the Master Fund is subject to income tax examinations by major taxing authorities for all tax years since its inception.

In accordance with GAAP, the Master Fund is required to determine whether its tax positions are more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. The tax benefit recognized is measured as the largest amount of benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authorities. Based on its analysis, the Master Fund has determined that it has not incurred any liability for unrecognized tax benefits as of November 30, 2015. The Master Fund does not expect that its assessment regarding unrecognized tax benefits will materially change over the next twelve months. However, the Master Fund’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, questioning the timing and amount of deductions, the nexus of income among various tax jurisdictions, compliance with U.S. federal and U.S. state and foreign tax laws, and changes in the administrative practices and precedents of the relevant taxing authorities.

The difference between book basis and tax basis is attributable primarily to net unrealized appreciation on investments. The tax basis of the Master Fund’s investments as of November 30, 2015 was $32,816,524 and net unrealized depreciation was $1,441,808 (gross unrealized appreciation $3,703,616; gross unrealized depreciation $5,145,424).

G. Cash Flow Information

The Master Fund makes Distributions from investments, which include the amount received as cash Distributions from MLPs. common stock dividends and the Master Fund. These activities are reported in the Statement of Changes in Net Assets, and additional information on cash receipts and payments is presented in the Statement of Cash Flows.

H. Indemnifications

Under the Master Fund’s organization documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Master Fund. In addition, in the normal course of business, the Master Fund may enter into contracts that provide general indemnification to other parties. The Master Fund’s maximum exposure under such indemnification arrangements is unknown, as this would involve future claims that may be made against the Master Fund that have not yet occurred, and may not occur.

The Master Fund’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders. The Master Fund seeks to achieve its investment objective by investing, under normal market conditions, in MLPs.

In the normal course of business, substantially all of the Master Fund’s securities transactions, money balances, and security positions are transacted with the Master Fund’s custodian, U.S. Bank, N.A. The Master Fund is subject to credit risk to the extent any broker with whom it conducts business is unable to fulfill contractual obligations on its behalf. The Adviser monitors the financial conditions of such brokers.

| 4. | Agreements and Related Party Transactions |

The Master Fund has entered into an Investment Management Agreement (the “Agreement”) with the Adviser. Under the terms of the Agreement, the Master Fund pays the Adviser a management fee, payable monthly in arrears, equal to 0.083% (1.0% per annum) of the net assets of the Master Fund determined as of the beginning of each calendar month for services and facilities provided by the Adviser to the Master Fund.

The Adviser agreed to waive a portion of its management fee and reimburse Master Fund expenses such that Master Fund operating expenses would not exceed 1.50% of the Master Fund’s net assets through September 1, 2016. For the fiscal period ended November 30, 2015, the Adviser earned $136,761 in advisory fees and waived fees and reimbursed Master Fund expenses in the amount of $134,201.

Waived fees and reimbursed Master Fund expenses, including prior year expenses, are subject to potential recovery by year of expiration. The Adviser’s waived fees and reimbursed expenses that are subject to potential recovery are as follows:

| | | | | | | | | | | Amount Subject | | |

| | | Amount | | | Amount | | | to Potential | | |

| Fiscal Year Incurred | | Reimbursed | | | Recouped | | | Recovery | | Expiration Date |

| November 30, 2015 | | $ | 134,201 | | | | $ | — | | | | $ | 134,201 | | | November 30, 2018 |

Jerry V. Swank, the founder and managing partner of the Adviser, is Chairman of the Master Fund’s Board of Trustees.

U.S. Bancorp Fund Services, LLC serves as the Master Fund’s administrator and transfer agent. The Master Fund pays the administrator a monthly fee computed at an annual rate of 0.07% of the first $100 million of the Master Fund’s net assets, 0.05% on the next $200 million of net assets and 0.04% on the balance of the Master Fund’s net assets above $300 million, with a minimum annual fee of $45,000.

U.S. Bank, N.A. serves as the Master Fund’s custodian. The Master Fund pays the custodian a monthly fee computed at an annual rate of 0.004% of the Master Fund’s average daily market value, with a minimum annual fee of $4,800.

Quasar Distributors, LLC, an affiliate of U.S. Bancorp Fund Services, LLC and U.S. Bank, N.A., serves as the Fund’s distributor.

| 5. | Fair Value Measurements |

Various inputs that are used in determining the fair value of the Master Fund’s investments are summarized in the three broad levels listed below:

| | ● | Level 1 — quoted prices in active markets for identical securities |

| | ● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | ● | Level 3 — significant unobservable inputs (including the Master Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| These inputs are summarized in the three broad levels listed below. |

| | | | | | Fair Value Measurements at Reporting Date Using | |

| | | | | | | | | Significant | | | | |

| | | | | | Quoted Prices in | | | Other | | | Significant | |

| | | | | | Active Markets for | | | Observable | | | Unobservable | |

| | | Fair Value as of | | | Identical Assets | | | Inputs | | | Inputs | |

| Description | | November 30, 2015 | | | (Level 1) | | | (Level 2) | | | (Level 3) | |

| Assets | | | | | | | | | | | | |

| Equity Securities | | | | | | | | | | | | |

| Common Stock | | $ | 1,428,342 | | | $ | 1,428,342 | | | $ | — | | | $ | — | |

| Master Limited | | | | | | | | | | | | | | | | |

Partnerships and Related Companies(a) | | | 28,256,151 | | | | 28,256,151 | | | | — | | | | — | |

| Total Equity Securities | | | 29,684,493 | | | | 29,684,493 | | | | — | | | | — | |

| Other | | | | | | | | | | | | | | | | |

| Short-Term | | | | | | | | | | | | | | | | |

| Investments | | | 1,690,223 | | | | 1,690,223 | | | | — | | | | — | |

| Total Other | | | 1,690,223 | | | | 1,690,223 | | | | — | | | | — | |

| Total Assets | | $ | 31,374,716 | | | $ | 31,374,716 | | | $ | — | | | $ | — | |

| (a) | All other industry classifications are identified in the Schedule of Investments. The Master Fund did not hold Level 3 investments at any time during the fiscal period ended November 30, 2015. |

During the fiscal period ended November 30, 2015, the Master Fund did not have any transfers between any of the levels of the fair value hierarchy.

| 6. | Investment Transactions |

For the fiscal period ended November 30, 2015, the Master Fund purchased (at cost) and sold securities (proceeds) in the amount of $9,736,679 and $3,837,226 (excluding short-term securities), respectively.

Units of beneficial interest (“Units”) of the Master Fund may be offered or sold in a private placement to persons who satisfy the suitability standards set forth in the Master Fund’s confidential offering memorandum. The Master Fund generally offers Units on the first business day of each month. As of November 30, 2015, the Master Fund had 42,034.94 Units outstanding.

The Master Fund generally intends to pay Distributions quarterly, in such amounts as may be determined from time to time by the Master Fund’s Board of Trustees. Unless a unitholder elects otherwise, Distributions, if any, will be automatically reinvested in additional Units in the Master Fund. For the fiscal period ended November 30, 2015, the Master Fund issued 168.20 units through its dividend reinvestment plan.

As of November 30, 2015, the Feeder Fund I and Feeder Fund II owned 99.87% and 0.13% of the outstanding shares of the Master Fund, respectively.

The financial statements were approved by the Board of Trustees and available for issuance on January 29, 2016. Subsequent events have been evaluated through this date.

From December 1, 2015 through January 29, 2016, the Master Fund accepted additional subscriptions of $1,670,000. On January 13, 2016, the Master Fund commenced a tender offer to repurchase up to 40% of the Master Fund’s outstanding units as of January 31, 2016.

On December 3, 2015, the Master Fund issued 220.59 units through its dividend reinvestment plan.

To the Unitholders and Board of Trustees of

The Cushing®MLP Infrastructure Master Fund :

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Cushing® MLP Infrastructure Master Fund (the “Master Fund”) as of November 30, 2015, and the related statements of operations, changes in net assets, cash flows, and financial highlights for the period July 1, 2015 through November 30, 2015. The financial statements are the responsibility of the Master Fund’s management. Our responsibility is to express an opinion on the financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2015, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Cushing® MLP Infrastructure Master Fund, as of November 30, 2015, the results of its operations, changes in net assets, cash flows, and financial highlights for the period July 1, 2015 through November 30, 2015, in conformity with accounting principles generally accepted in the United States of America.

Dallas, Texas

January 29, 2016

November 30, 2015

Investment Policies and Parameters

The Commodity Futures Trading Commission (“CFTC”) amended Rule 4.5 which permits investment advisers to registered investment companies to claim an exclusion from the definition of commodity pool operator with respect to a fund provided certain requirements are met. In order to permit the Adviser to continue to claim this exclusion with respect to the Master Fund under the amended rule, the Master Fund limits its transactions in futures, options of futures and swaps (excluding transactions entered into for “bona fide hedging purposes,” as defined under CFTC regulations) such that either: (i) the aggregate initial margin and premiums required to establish its futures, options on futures and swaps do not exceed 5% of the liquidation value of the Master Fund’s portfolio, after taking into account unrealized profits and losses on such positions; or (ii) the aggregate net notional value of its futures, options on futures and swaps does not exceed 100% of the liquidation value of the Master Fund’s portfolio, after taking into account unrealized profits and losses on such positions. The Master Fund and the Adviser do not believe that complying with the amended rule will limit the Master Fund’s ability to use futures, options and swaps to the extent that it has used them in the past.

Trustee and Officer Compensation