The Cushing® MLP Infrastructure Fund II

NOTES TO FINANCIAL STATEMENTS (Unaudited)

May 31, 2016

The Cushing® MLP Infrastructure Fund II (the “Fund”), was organized as a Delaware statutory trust pursuant to an agreement and declaration of trust dated May 4, 2015. The Fund is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940. The Fund commenced operations on September 1, 2015. The Fund’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders.

The Fund pursues its investment objective by investing all or substantially all of its investable assets in The Cushing® MLP Infrastructure Master Fund (the “Master Fund”), a non-diversified, closed-end management investment company under the Investment Company Act of 1940 and has the same investment objective as the Fund. The Fund and Master Fund are managed by Cushing® Asset Management, LP (the “Adviser”).

The financial statements of the Master Fund, including the Schedule of Investments, are attached to this report and should be read in conjunction with the Fund’s financial statements. The Fund owns 0.12% of the Master Fund as of May 31, 2016.

| 2. | Significant Accounting Policies |

A. Basis of Presentation

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) as detailed in the Financial Accounting Standards Board’s Accounting Standards Codification.

B. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

C. Investment Valuation

The Fund uses the following valuation methods to determine fair value as either fair value for investments for which market quotations are available, or if not available, the fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Fund’s Board of Trustees (“Board of Trustees” or “Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

(i) The market value of each security listed or traded on any recognized securities exchange or automated quotation system will be the last reported sale price at the relevant valuation date on the composite tape or on the principal exchange on which such security is traded except those listed on the NASDAQ Global Market®, NASDAQ Global Select Market® and the NASDAQ Capital Market® exchanges (collectively, “NASDAQ”). Securities traded on NASDAQ will be valued at the NASDAQ official closing price. If no sale is reported on that date, the closing price from the prior trading day may be used.

(ii) The Fund’s non-marketable investments will generally be valued in such manner as the Adviser determines in good faith to reflect their fair values under procedures established by, and under the general supervision and responsibility of, the Board of Trustees. The pricing of all assets that are fair valued in this manner will be subsequently reported to and ratified by the Board of Trustees.

The Fund records its investment in the Master Fund at fair value which is represented by the Fund’s proportionate indirect interest in the net assets of the Master Fund as of May 31, 2016. Valuation of securities and other investments held by the Master Fund is discussed in the notes to the Master Fund’s financial statements. The Fund records its pro rata share of the Master Fund’s income, expenses and realized and unrealized gains and losses. The performance of the Fund is directly affected by the performance of the Master Fund. The financial statements of the Master Fund, which are attached, are an integral part of these financial statements. Please refer to the accounting policies disclosed in the financial statements of the Master Fund for additional information regarding significant accounting policies that affect the Fund.

D. Security Transactions, Investment Income and Expenses

The Master Fund’s security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a first in, first out cost basis. Interest income is recognized on an accrual basis. Distributions and dividends (collectively referred to as “Distributions”) are recorded on the ex-dividend date. Distributions received from the Master Fund’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income, capital gains and return of capital. For financial statement purposes, the Master Fund uses return of capital and income estimates to determine the dividend income received from MLP Distributions. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from the MLPs after their tax reporting periods are concluded, as the actual character of these Distributions is not known until after the fiscal year end of the Master Fund.

The Master Fund estimates the allocation of investment income and return of capital for the Distributions received from its portfolio investments within the Master Fund’s Statement of Operations.

Expenses are recorded on an accrual basis. The Fund records its proportionate share of the Master Fund’s income, expenses, and realized and unrealized gains and losses. In addition, the Fund incurs and accrues its own expenses.

E. Valuation of Investment in Master Fund

The Fund records its investment in the Master Fund at its proportionate share of the Master Fund’s net assets. Valuation of investments held by the Master Fund, including, but not limited to, the valuation techniques used and categorization within the fair value hierarchy of investments are discussed in the notes to the Master Fund financial statements.

F. Distributions to Unitholders

Distributions to unitholders are recorded on the ex-dividend date. The character of Distributions to unitholders are comprised of 100 percent return of capital.

G. Federal Income Taxation

The Fund is treated as a partnership for Federal income tax purposes. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements. The Fund does not record a provision for U.S. federal, state, or local income taxes because the unitholders report their share of the Fund’s income or loss on their income tax returns. The Fund files an income tax return in the U.S. federal jurisdiction, and may file income tax returns in various U.S. states. Generally, the Fund is subject to income tax examinations by major taxing authorities for all tax years since its inception.

In accordance with GAAP, the Fund is required to determine whether its tax positions are more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. The tax benefit recognized is measured as the largest amount of benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authorities. Based on its analysis, the Fund has determined that it has not incurred any liability for unrecognized tax benefits as of December 31, 2015. The Fund does not expect that its assessment regarding unrecognized tax benefits will materially change over the next twelve months. However, the Fund’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, questioning the timing and amount of deductions, the nexus of income among various tax jurisdictions, compliance with U.S. federal and U.S. state and foreign tax laws, and changes in the administrative practices and precedents of the relevant taxing authorities.

H. Cash Flow Information

The Fund intends to make Distributions from investments, which include the amount received as cash Distributions from the Master Fund. These activities are reported in the Statement of Changes in Net Assets, and additional information on cash receipts and payments is presented in the Statement of Cash Flows.

I. Indemnification

Under the Fund’s organization documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under such indemnification arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred, and may not occur.

The Fund’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders. The Fund seeks to achieve its investment objective by investing, under normal market conditions, in the Master Fund, which invests in MLPs.

In the normal course of business, substantially all of the Fund’s and Master Fund’s securities transactions, money balances, and security positions are transacted with the Fund’s custodian, U.S. Bank, N.A. The Fund and Master Fund are subject to credit risk to the extent any broker with whom it conducts business is unable to fulfill contractual obligations on its behalf. The Adviser monitors the financial condition of such brokers.

| 4. | Agreements and Related Party Transactions |

Each of the Fund and the Master Fund has entered into an Investment Management Agreement (the “Agreement”) with the Adviser. Under the terms of the Agreement, the Master Fund pays the Adviser a management fee, payable monthly in arrears, equal to 0.083% (1.0% per annum) of the net assets of the Master Fund determined as of the beginning of each calendar month for services and facilities provided by the Adviser to the Fund and the Master Fund. The Fund does, however, due to its investment in the Master Fund, bear its proportionate percentage of the management fee paid to the Adviser by the Master Fund.

The Adviser agreed to waive a portion of its management fee and reimburse Fund and the Master Fund expenses such that the Fund’s operating expenses would not exceed 2.25% of the Fund’s net assets and the Master Fund’s operating expenses would not exceed 1.50% of the Master Fund’s net assets through May 31, 2017. For the period ended May 31, 2016, the Adviser waived fees and reimbursed Fund expenses in the amount of $28,559. For the period ended May 31, 2016, the Adviser earned $159,968 in management fees from the Master Fund and waived fees and reimbursed the Master Fund expenses in the amount of $33,350. Under the waiver agreement, the Fund relies upon the Adviser to pay certain expenses. Should the Adviser not be able to perform under the waiver agreement, there is a risk the Fund would have to bear those expenses.

Waived fees and reimbursed Fund expenses, including prior year expenses, are subject to potential recovery by year of expiration. The Adviser’s waived fees and reimbursed expenses that are subject to potential recovery are as follows:

| Fiscal Year Incurred | | Amount Waived/Reimbursed | | | Amount Recouped | | | Amount Subject to Potential Recovery | | Expiration Date |

| November 30, 2015 | | $ | 28,913 | | | $ | - | | | $ | 28,913 | | November 30, 2018 |

| November 30, 2016 | | | 28,559 | | | | - | | | | 28,559 | | November 30, 2019 |

| | | $ | 57,472 | | | $ | - | | | $ | 57,472 | | |

Jerry V. Swank, the founder and managing partner of the Adviser, is Chairman of the Fund’s Board of Trustees and President of the Fund.

U.S. Bancorp Fund Services, LLC serves as the Fund’s administrator and transfer agent. In addition to the fees it charges the Master Fund, the Fund pays the administrator a monthly fee computed at an annual rate of 0.035% of the first $50 million of the Fund’s net assets, 0.020% on the next $100 million of net assets and 0.010% on the balance of the Fund’s net assets above $150 million, with a minimum annual fee of $30,000.

U.S. Bank, N.A. serves as the Fund’s custodian. There is no fee directly attributable to the Fund other than its allocated portion of the Master Fund’s expenses.

Quasar Distributors, LLC, an affiliate of U.S. Bancorp Fund Services, LLC and U.S. Bank, N.A., serves as the Fund’s distributor.

Certain unitholders are affiliated with the Fund. The aggregate value of the affiliated unitholders’ share of net assets as of May 31, 2016 was approximately $93,800.

| 5. | Fair Value Measurements |

Various inputs that are used in determining the fair value of the Fund’s investments are summarized in the three broad levels listed below:

| · | Level 1 — quoted prices in active markets for identical securities |

| · | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of May 31, 2016, short-term investments valued at $51,772 were classified as Level 1 in the fair value hierarchy. The individual securities are listed in the table below. The Fund invests substantially all of its assets in the Master Fund.

| | Shares | | | Fair Value |

| AIM Short-Term Treasury Portfolio Fund - Institutional Class | 10,355 | | $ | 10,355 |

| Fidelity Government Portfolio Fund - Institutional Class | 10,355 | | | 10,355 |

| Fidelity Money Market Portfolio - Institutional Class | 10,354 | | | 10,354 |

| First American Government Obligations Fund - Class Z | 10,354 | | | 10,354 |

| Invesco STIC Prime Portfolio | 10,354 | | | 10,354 |

| | | | $ | 51,772 |

During the period ended May 31, 2016, the Fund did not have any transfers between any of the levels of the fair value hierarchy.

Units of beneficial interest (“Units”) of the Fund may be offered or sold in a private placement to persons who satisfy the suitability standards set forth in the Fund’s confidential offering memorandum. The Fund generally offers Units on the first business day of each month. As of May 31, 2016, the Fund had 101.61 Units outstanding.

The Fund generally intends to pay Distributions quarterly, in such amounts as may be determined from time to time by the Fund’s Board of Trustees. Unless a unitholder elects otherwise, Distributions, if any, will be automatically reinvested in additional Units in the Fund. For the period ended May 31, 2016, the Fund issued 1.62 units through its dividend reinvestment plan.

The Adviser has evaluated the impact of all subsequent events of the Fund.

On June 3, 2016, the Fund issued 0.84 units through its dividend reinvestment plan.

The Cushing® MLP Infrastructure Fund II

ADDITIONAL INFORMATION (Unaudited)

May 31, 2016

Investment Policies and Parameters

The Commodity Futures Trading Commission (“CFTC”) amended Rule 4.5 which permits investment advisers to registered investment companies to claim an exclusion from the definition of commodity pool operator with respect to a fund provided certain requirements are met. In order to permit the Adviser to continue to claim this exclusion with respect to the Fund under the amended rule, the Fund limits its transactions in futures, options of futures and swaps (excluding transactions entered into for “bona fide hedging purposes,” as defined under CFTC regulations) such that either: (i) the aggregate initial margin and premiums required to establish its futures, options on futures and swaps do not exceed 5% of the liquidation value of the Fund’s portfolio, after taking into account unrealized profits and losses on such positions; or (ii) the aggregate net notional value of its futures, options on futures and swaps does not exceed 100% of the liquidation value of the Fund’s portfolio, after taking into account unrealized profits and losses on such positions. The Fund and the Adviser do not believe that complying with the amended rule will limit the Fund’s ability to use futures, options and swaps to the extent that it has used them in the past.

Trustee and Officer Compensation

The Fund does not currently compensate any of its trustees who are interested persons nor any of its officers. The Master Fund is responsible for compensation of the Trustees. The Fund, through its investment in the Master Fund, bears its proportionate percentage of the Trustee fees paid by the Master Fund. The Fund did not pay any special compensation to any of its trustees or officers. The Fund continuously monitors standard industry practices and this policy is subject to change. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request by calling the Fund toll-free at (877) 653-1415 and on the SEC’s Web site at www.sec.gov.

Cautionary Note Regarding Forward-Looking Statements

This report contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Fund’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; MLP industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in the Fund’s filings with the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Fund undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Fund’s investment objectives will be attained.

Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities owned by the Fund and information regarding how the Fund voted proxies relating to the portfolio of securities during the 12-month period ended June 30 will be available to stockholders (i) without charge, upon request by calling the Fund toll-free at (877) 653-1415; and (ii) on the SEC’s Web site at www.sec.gov.

Form N-Q

The Fund files its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q and statement of additional information are available without charge by visiting the SEC’s Web site at www.sec.gov. In addition, you may review and copy the Fund’s Form N-Q at the SEC’s Public Reference Room in Washington D.C. following its first filing You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Privacy Policy

In order to conduct its business, the Fund collects and maintains certain nonpublic personal information about its stockholders of record with respect to their transactions in shares of the Fund’s securities. This information includes the stockholder’s address, tax identification or Social Security number, share balances, and dividend elections. We do not collect or maintain personal information about stockholders whose share balances of our securities are held in “street name” by a financial institution such as a bank or broker.

We do not disclose any nonpublic personal information about you, the Fund’s other stockholders or the Fund’s former stockholders to third parties unless necessary to process a transaction, service an account, or as otherwise permitted by law.

To protect your personal information internally, we restrict access to nonpublic personal information about the Fund’s stockholders to those employees who need to know that information to provide services to our stockholders. We also maintain certain other safeguards to protect your nonpublic personal information.

Householding

In an effort to decrease costs, the Fund intends to reduce the number of duplicate annual and semi-annual reports, proxy statements and other similar documents you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please contact investor services at investorservices@usbank.com to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

The Cushing® MLP Infrastructure Fund II

Board Approval of Investment Management Agreement (Unaudited)

May 31, 2016

On May 25, 2016, the Board of Trustees of the Fund (members of which are referred to collectively as the “Trustees”) met in person to discuss, among other things, the approval of the Investment Management Agreement (the “Agreement”) between the Fund and Cushing Asset Management, LP (the “Adviser”).

Activities and Composition of the Board

The Board of Trustees is comprised of four Trustees, three of whom are not “interested persons,” as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Fund (the “Independent Trustees”). The Board of Trustees is responsible for the oversight of the operations of the Fund and performs the various duties imposed by the 1940 Act on the trustees of investment companies. The Independent Trustees have retained independent legal counsel to assist them in connection with their duties. Prior to its consideration of the Agreement, the Board of Trustees received and reviewed information provided by the Adviser. The Board of Trustees also received and reviewed information responsive to requests from independent counsel to assist it in its consideration of the Agreement. Before the Board of Trustees voted on the approval of the Agreement, the Independent Trustees met with independent legal counsel during executive session and discussed the Agreement and related information.

Consideration of Nature, Extent and Quality of the Services

The Board of Trustees received and considered information regarding the nature, extent and quality of services provided to the Fund under the Agreement. The Board of Trustees reviewed certain background materials supplied by the Adviser in its presentation, including the Adviser’s Form ADV.

The Board of Trustees reviewed and considered the Adviser’s investment advisory personnel, its history and the amount of assets currently under management by the Adviser. The Board of Trustees also reviewed the research and decision-making processes utilized by the Adviser, including the methods adopted to seek to achieve compliance with the investment objectives, policies and restrictions of the Fund.

The Board of Trustees considered the background and experience of the Adviser’s management in connection with the Fund, including reviewing the qualifications, backgrounds and responsibilities of the management team members primarily responsible for the day-to-day portfolio management of the Fund and the extent of the resources devoted to research and analysis of the Fund’s actual and potential investments.

The Board of Trustees also reviewed, among other things, the Adviser’s conflict of interest policies, insider trading policies and procedures and its Code of Ethics. The Board of Trustees, including all of the Independent Trustees, concluded that the nature, extent and quality of services to be rendered by the Adviser under the Agreement were adequate.

Consideration of Advisory Fees and the Cost of the Services

The Board of Trustees reviewed and considered the contractual annual advisory fee to be paid by the Fund to the Adviser in light of the extent, nature and quality of the advisory services to be provided by the Adviser to the Fund.

The Board of Trustees considered the information they received comparing the Fund’s contractual annual advisory fee and overall expenses with (a) a peer group of competitor closed-end funds determined by the Adviser; and (b) other accounts or vehicles managed by the Adviser. Given the small universe of managers and funds fitting within the criteria for the peer group, the Adviser did not believe that it would be beneficial to engage the services of an independent third-party to prepare the peer group analysis, and the Independent Trustees concurred with this approach.

Based on such information, the Board of Trustees determined that the peer group was of limited utility because of differences between the Fund and the other funds in the peer group, the Fund’s management fee and total expense ratio were significantly below the peer group median. The Board of Trustees also discussed the expense waivers currently in place for the Fund (ending May 2017). The Board of Trustees concluded that the fee charged by the Adviser to the Fund relative to comparable accounts of the Adviser employing similar strategies was reasonable in light of the differences between the types of clients, the kinds of costs incurred by the Adviser and other considerations faced by the Adviser in competing for and servicing such clients.

The Board noted that the Fund is a feeder fund in a master/feeder structure, and a single management fee is paid at the master fund level and the Fund bears its pro rata portion of such fee, but does not incur a separate management fee for so long as the Fund invests through the master fund. Therefore, the Board’s consideration of the advisory fee with respect to the Fund included a consideration of such arrangement and the advisory fee paid by the master fund.

Consideration of Investment Performance

The Board of Trustees regularly reviews the performance of the Fund throughout the year. The Board of Trustees reviewed performance information comparing the performance of the Fund against its benchmark index and its peer group over several time horizons and using different performance metrics (e.g., stock price percent changes, total return percent changes and NAV total return percent changes). The Board of Trustees noted, among other things, that the Fund slightly lagged behind its benchmark index for the one-year period ending February 29, 2016, but continued to outperform its benchmark index in the three-year period and especially the period since inception (in each case considering the performance of the master fund and The Cushing MLP Infrastructure Fund, which converted to a master/feeder structure by investing in the master fund upon inception of the master fund and which, prior to such conversion, employed the same investment strategy as the Fund and the master fund).

Other Considerations

The Board of Trustees received and considered a profitability analysis prepared by the Adviser based on the fees payable by the Fund under the Agreement. The Board of Trustees considered the profits realized and anticipated to be realized by the Adviser in connection with the operation of the Fund and concluded that the profit, if any, anticipated to be realized by the Adviser in connection with the operation of the Fund is not unreasonable to the Fund.

The Board of Trustees considered whether economies of scale in the provision of services to the Fund had been or would be passed along to the shareholders under the Agreement. The Board of Trustees reviewed and considered any other incidental benefits derived or to be derived by the Adviser from its relationship with the Fund, including soft dollar arrangements or other so called “fall-out benefits.” The Board of Trustees concluded there were no material economies of scale or other incidental benefits accruing to the Adviser in connection with its relationship with the Fund.

Conclusion

In approving the Agreement and the fees charged under the Agreement, the Board of Trustees concluded that no single factor reviewed by the Board of Trustees was identified by the Board of Trustees to be determinative as the principal factor in whether to approve the Agreement. The summary set out above describes the most important factors, but not all of the matters, considered by the Board of Trustees in coming to its decision regarding the Agreement. On the basis of such information as the Board of Trustees considered necessary to the exercise of its reasonable business judgment and its evaluation of all of the factors described above, and after much discussion, the Board of Trustees concluded that each factor they considered, in the context of all of the other factors they considered, favored approval of the Agreement. It was noted that it was the judgment of the Board of Trustees that approval of the Agreement was consistent with the best interests of the Fund and its shareholders. A majority of the Trustees and, voting separately, a majority of the Independent Trustees, approved the Agreement.

THE CUSHING® MLP INFRASTRUCTURE MASTER FUND

SEMI-ANNUAL REPORT

May 31, 2016 (Unaudited)

The Cushing® MLP Infrastructure Master Fund |

TABLE OF CONTENTS |

| Allocation of Portfolio Assets | 1 |

| | |

| Schedule of Investments | 2 |

| | |

| Statement of Assets and Liabilities | 4 |

| | |

| Statement of Operations | 5 |

| | |

| Statement of Changes in Net Assets | 6 |

| | |

| Statement of Cash Flows | 7 |

| | | |

| | Financial Highlights | 8 |

| | | |

| | Notes to Financial Statements | 9 |

| | | |

| | Additional Information | 13 |

| | | |

| | Board Approval of Investment Management Agreement | 15 |

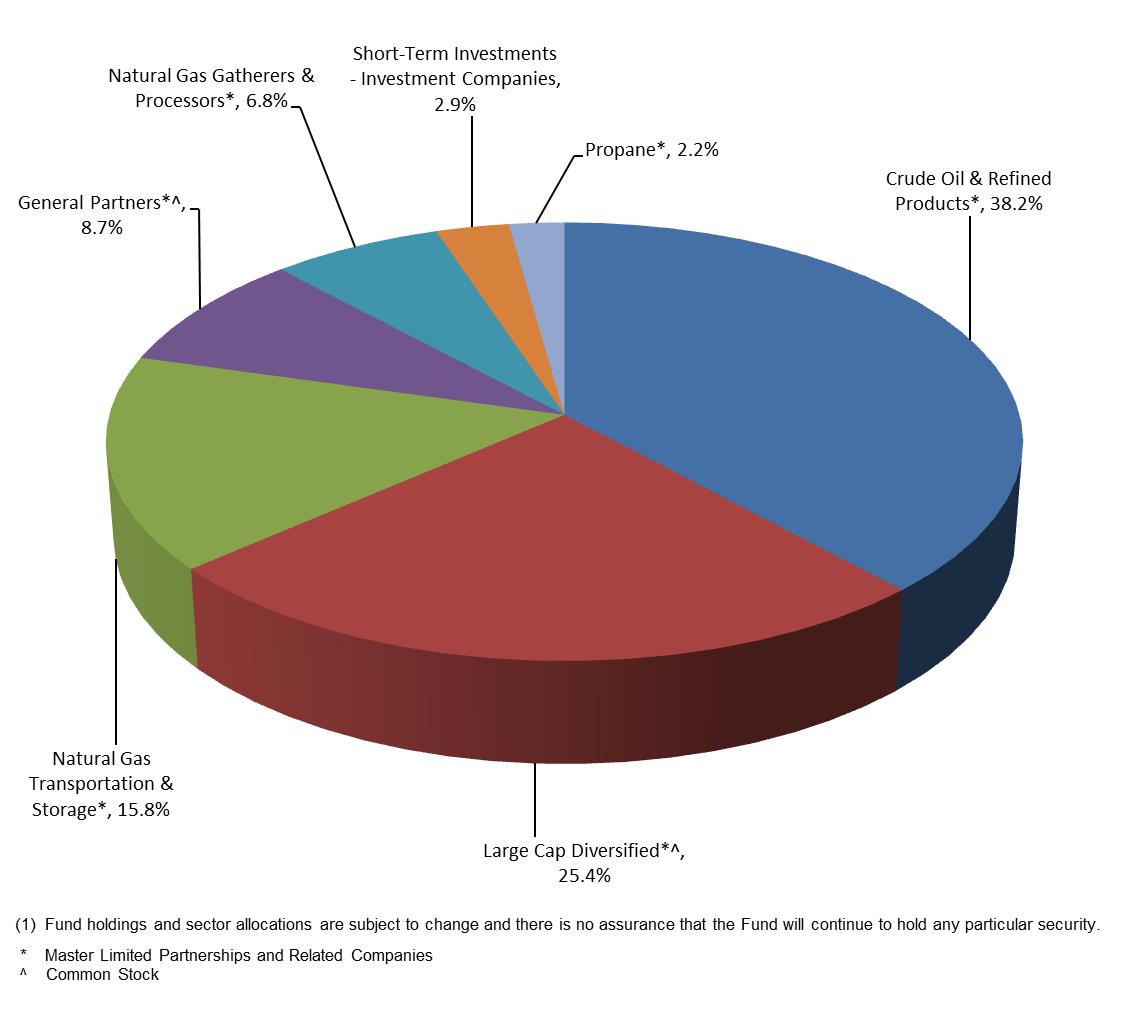

The Cushing® MLP Infrastructure Master Fund |

ALLOCATION OF PORTFOLIO ASSETS (1) |

| May 31, 2016 (Unaudited) |

| (Expressed as a Percentage of Total Investments) |

| |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund | | | | | | |

| SCHEDULE OF INVESTMENTS (Unaudited) | | | | | | |

| | | | |

| | | | May 31, 2016 | |

| | | | | | | | |

| | | | Shares | | | Fair Value | |

| Common Stock - 8.6% | | | | | | |

| General Partners - 4.3% | | | | | | |

| United States - 4.3% | | | | | | |

| Targa Resources Corporation | | | 38,500 | | | $ | 1,648,955 | |

| | | | | | | | | | |

| Large Cap Diversified - 4.3% | | | | | | | | |

| United States - 4.3% | | | | | | | | |

| Kinder Morgan, Inc. | | | 89,400 | | | | 1,616,352 | |

| | | | | | | | | | |

| Total Common Stock (Cost $2,512,157) | | | | | | $ | 3,265,307 | |

| | | | | | | | | | |

| Master Limited Partnerships and Related Companies - 89.0% | | | | | | | | |

| Crude Oil & Refined Products - 38.4% | | | | | | | | |

| United States - 38.4% | | | | | | | | |

| Buckeye Partners, L.P. | | | 25,700 | | | $ | 1,848,344 | |

| Enbridge Energy Partners, L.P. | | | 34,900 | | | | 758,726 | |

| Genesis Energy, L.P. | | | 46,200 | | | | 1,740,354 | |

| MPLX, L.P. | | | 54,300 | | | | 1,732,170 | |

| NuStar Energy, L.P. | | | 14,400 | | | | 708,048 | |

| Phillips 66 Partners, L.P. | | | 23,100 | | | | 1,268,883 | |

| Rose Rock Midstream, L.P. | | | 75,800 | | | | 1,955,640 | |

| Shell Midstream Partners, L.P. | | | 46,500 | | | | 1,569,375 | |

| Sunoco Logistics Partners, L.P. | | | 61,200 | | | | 1,679,940 | |

| Tesoro Logistics, L.P. | | | 26,900 | | | | 1,322,135 | |

| | | | | | | | 14,583,615 | |

| General Partners - 4.5% | | | | | | | | |

| United States - 4.5% | | | | | | | | |

| Energy Transfer Equity, L.P. | | | 133,900 | | | | 1,692,496 | |

| | | | | | | | | | |

| Large Cap Diversified - 21.2% | | | | | | | | |

| United States - 21.2% | | | | | | | | |

| Energy Transfer Partners, L.P. | | | 50,700 | | | | 1,838,382 | |

| Enterprise Products Partners, L.P. | | | 71,600 | | | | 1,987,616 | |

| Magellan Midstream Partners, L.P. | | | 15,900 | | | | 1,113,795 | |

| ONEOK Partners, L.P. | | | 29,000 | | | | 1,100,550 | |

| Plains All American Pipeline, L.P. | | | 31,400 | | | | 726,282 | |

| Williams Partners, L.P. | | | 41,000 | | | | 1,308,720 | |

| | | | | | | | 8,075,345 | |

| Natural Gas Gatherers & Processors - 6.8% | | | | | | | | |

| United States - 6.8% | | | | | | | | |

| Enlink Midstream Partners, L.P. | | | 77,000 | | | | 1,211,980 | |

| Western Gas Partners, L.P. | | | 27,700 | | | | 1,380,291 | |

| | | | | | | | 2,592,271 | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund | | | | | | | | |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) | | | | | | | | |

| | | | | | | | | |

| | | | May 31, 2016 | |

| | | | | | | | | | |

| | | | Shares | | | Fair Value | |

| Natural Gas Transportation & Storage - 15.9% | | | | | | | | |

| United States - 15.9% | | | | | | | | |

| Boardwalk Pipeline Partners, L.P. | | | 66,300 | | | $ | 1,170,858 | |

| Columbia Pipeline Partners, L.P. | | | 75,800 | | | | 1,116,534 | |

| EQT Midstream Partners, L.P. | | | 23,900 | | | | 1,801,343 | |

| Spectra Energy Partners, L.P. | | | 22,000 | | | | 988,680 | |

| TC Pipelines, L.P. | | | 17,700 | | | | 977,571 | |

| | | | | | | | | 6,054,986 | |

| Propane - 2.2% | | | | | | | | |

| United States - 2.2% | | | | | | | | |

| NGL Energy Partners, L.P. | | | 55,400 | | | | 832,108 | |

| | | | | | | | | | |

| Total Master Limited Partnerships and Related Companies (Cost $30,005,603) | | | | | | $ | 33,830,821 | |

| | | | | | | | | | |

| Short-Term Investments - Investment Companies - 2.9% | | | | | | | | |

| United States - 2.9% | | | | | | | | |

AIM Short-Term Treasury Portfolio Fund - Institutional Class, 0.22%(1) | | | 218,298 | | | $ | 218,298 | |

Fidelity Government Portfolio Fund - Institutional Class, 0.26%(1) | | | 218,298 | | | | 218,298 | |

Fidelity Money Market Portfolio - Institutional Class, 0.35%(1) | | | 218,298 | | | | 218,298 | |

First American Government Obligations Fund - Class Z, 0.29%(1) | | | 218,298 | | | | 218,298 | |

Invesco STIC Prime Portfolio, 0.32%(1) | | | 218,298 | | | | 218,298 | |

| Total Short-Term Investments (Cost $1,091,490) | | | | | | $ | 1,091,490 | |

| | | | | | | | | | |

| Total Investments - 100.5% (Cost $33,609,250) | | | | | | $ | 38,187,618 | |

| Liabilities in Excess of Other Assets - (0.5)% | | | | | | | (170,747 | ) |

| Total Net Assets Applicable to Unitholders - 100.0% | | | | | | $ | 38,016,871 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Percentages are stated as a percent of net assets. | | | | | | | | |

| (1) Rate reported is the current yield as of May 31, 2016. | | | | | | | | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund | | | |

| STATEMENT OF ASSETS & LIABILITIES (Unaudited) | | | |

| | | | |

| | | | |

| | | May 31, 2016 | |

| Assets | | | |

| Investments at fair value (cost $33,609,250) | | $ | 38,187,618 | |

| Total assets | | | 38,187,618 | |

| | | | | |

| Liabilities | | | | |

| Payable to Adviser, net of waiver | | | 95,389 | |

| Accrued expenses | | | 75,358 | |

| Total liabilities | | | 170,747 | |

| | | | | |

| Net assets | | $ | 38,016,871 | |

| | | | | |

| Net Assets Consisting of | | | | |

| Additional paid-in capital | | $ | 44,295,498 | |

| Accumulated net investment loss | | | (327,192 | ) |

| Accumulated realized loss | | | (3,930,339 | ) |

| Net unrealized depreciation on investments | | | (2,021,096 | ) |

| Net assets | | $ | 38,016,871 | |

| | | | | |

| Net Asset Value, 49,582.24 units outstanding | | $ | 766.74 | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund | |

| STATEMENT OF OPERATIONS (Unaudited) | |

| | Period From December 1, 2015 through May 31, 2016 |

| | | | | |

| Investment Income | | | | |

| Distributions and dividends received | | $ | 1,240,171 | |

| Less: return of capital on distributions | | | (1,197,724 | ) |

| Distribution and dividend income | | | 42,447 | |

| Interest income | | | 602 | |

| Total Investment Income | | | 43,049 | |

| | | | | |

| Expenses | | | | |

| Management fees | | | 159,968 | |

| Professional fees | | | 45,000 | |

| Administrator fees | | | 29,869 | |

| Fund accounting fees | | | 18,171 | |

| Trustees’ fees | | | 12,000 | |

| Custodian fees and expenses | | | 6,116 | |

| Other expenses | | | 4,701 | |

| Total Expenses | | | 275,825 | |

| Less: expense reimbursement by Adviser, net | | | (33,350 | ) |

| Net Expenses | | | 242,475 | |

| Net Investment Loss | | | (199,426 | ) |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments | | | | |

| Net realized loss on investments | | | (2,976,867 | ) |

| Net change in unrealized appreciation of investments | | | 6,020,176 | |

| Net Realized and Unrealized Gain on Investments | | | 3,043,309 | |

| Increase in Net Assets Resulting from Operations | | $ | 2,843,883 | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund | | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | | | | | |

| | | Period From

December 1, 2015

through

May 31, 2016 | | | Period From

July 1, 2015(1)

Through

November 30, 2015 | |

| | | (Unaudited) | | | | |

| Operations | | | | | | |

| Net investment loss | | $ | (199,426 | ) | | $ | (127,766 | ) |

Net realized loss on investments | | | (2,976,867 | ) | | | (953,472 | ) |

| Net change in unrealized appreciation (depreciation) | | | | | | | | |

| of investments | | | 6,020,176 | | | | (8,041,272 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 2,843,883 | | | | (9,122,510 | ) |

| Distributions and Dividends to Common Unitholders | | | | | | | | |

| Net investment income | | | - | | | | - | |

| Return of capital | | | (1,086,712 | ) | | | (421,528 | ) |

| Total distributions and dividends | | | | | | | | |

| to common unitholders | | | (1,086,712 | ) | | | (421,528 | ) |

| Capital Share Transactions (Note 7) | | | | | | | | |

| Proceeds from unitholder subscriptions | | | 4,607,803 | | | | 40,685,136 | |

| Distribution reinvestments | | | 361,522 | | | | 149,277 | |

| Net increase in net assets from | | | | | | | | |

| capital share transactions | | | 4,969,325 | | | | 40,834,413 | |

| Total increase in net assets | | | 6,726,496 | | | | 31,290,375 | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 31,290,375 | | | | - | |

| End of period | | $ | 38,016,871 | | | $ | 31,290,375 | |

| Accumulated net investment income | | | | | | | | |

| at the end of the period | | $ | (327,192 | ) | | $ | (127,766 | ) |

| | | | | | | | | |

(1) Commencement of Operations | | | | | | | | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund | |

| STATEMENT OF CASH FLOWS (Unaudited) | |

| | | | |

| | | Period From

December 1, 2015

through

May 31, 2016 | |

| OPERATING ACTIVITIES | | | |

| | | | |

| Increase in Net Assets Resulting from Operations | | $ | 2,843,883 | |

| Adjustments to reconcile increase in net assets resulting from operations | | | | |

| to net cash used in operating activities | | | | |

| Net realized loss on sales of investments | | | 2,976,867 | |

| Net change in unrealized appreciation of investments | | | (6,020,176 | ) |

| Return of capital on distributions | | | 1,197,724 | |

| Purchases of investments in securities | | | (16,634,132 | ) |

| Proceeds from sales of investments in securities | | | 11,068,082 | |

| Net purchases of short-term investments | | | 598,733 | |

| Changes in operating assets and liabilities | | | | |

| Receivable from Adviser | | | 31,229 | |

| Payable to Adviser, net of waiver | | | 95,389 | |

| Accrued expenses | | | (40,212 | ) |

| Net cash used in operating activities | | | (3,882,613 | ) |

| FINANCING ACTIVITIES | | | | |

| Proceeds from issuance of units | | | 4,607,803 | |

| Distributions paid | | | (725,190 | ) |

| Net cash provided by financing activities | | | 3,882,613 | |

| CHANGE IN CASH | | | - | |

| | | | | |

| CASH: | | | | |

| Beginning of period | | | - | |

| End of period | | $ | - | |

| | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW AND NON-CASH INFORMATION | |

| Distribution reinvestment | | $ | 361,522 | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund | | | | | | |

| FINANCIAL HIGHLIGHTS | | | | | | |

| | | Period From

December 1, 2015

through

May 31, 2016 | | | Period From

July 1, 2015 (1)

through

November 30, 2015 |

| | | | | | (Unaudited) | | | | | | | | | | | |

Per Unit Data (2) | | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of | | | | | | | | | | | | | | | | |

| period | | | | | $ | 744.39 | | | | | | | | | $ | 1,000.00 | | |

| Income from Investment Operations: | | | | | | | | | | | | | | | | | | |

| Net investment loss) | | | | | | (4.24 | ) | | | | | | | | | (3.38 | ) | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | | | | 51.51 | | | | | | | | | | (240.06 | ) | |

Total increase (decrease) from

investment operations | | | | | | 47.27 | | | | | | | | | | (243.44 | ) | |

| Less Distributions: | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | - | | | | | | | | | | - | | |

| Return of capital | | | | | | (24.92 | ) | | | | | | | | | (12.17 | ) | |

Total distributions to

common stockholders | | | | | | (24.92 | ) | | | | | | | | | (12.17 | ) | |

| Net Asset Value, end of period | | | | | $ | 766.74 | | | | | | | | | $ | 744.39 | | |

| | | | | | | | | | | | | | | | | | | |

| Total Investment Return (3) | | | | | | 6.4 | | % | (4) | | | | | | | (24.3 | ) | % (4) |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | $ | 38,016,871 | | | | | | | | | $ | 31,290,375 | | |

| | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average | | | | | | | | | | | | | | | | | | |

net assets before waiver (5) | | | | | | 1.7 | | % | | | | | | | | 2.5 | | % |

| | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average | | | | | | | | | | | | | | | | | | |

net assets after waiver (5) | | | | | | 1.5 | | % | | | | | | | | 1.5 | | % |

| | | | | | | | | | | | | | | | | | | |

| Ratio of net investment | | | | | | | | | | | | | | | | | | |

| loss to average net | | | | | | | | | | | | | | | | | | |

assets before waiver (5) | | | | | | (1.4 | ) | % | | | | | | | | (2.0 | ) | % |

| | | | | | | | | | | | | | | | | | | |

| Ratio of net investment | | | | | | | | | | | | | | | | | | |

| loss to average net | | | | | | | | | | | | | | | | | | |

assets after waiver (5) | | | | | | (1.2 | ) | % | | | | | | | | (1.0 | ) | % |

| | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | | | | 34.60 | | % | (4) | | | | | | | 12.63 | % | % (4) |

| (1) Commencement of operations. | | | | | | |

| (2) Information presented relates to a unit outstanding for the entire period. | | | | |

| (3) Individual returns and ratios may vary based on the timing of capital transactions. | |

| (4) Not annualized. | | | | | | |

| (5) All income and expenses are annualized for periods less than one full year. | | |

See Accompanying Notes to the Financial Statements.

The Cushing® MLP Infrastructure Master Fund

NOTES TO FINANCIAL STATEMENTS (Unaudited)

May 31, 2016

The Cushing® MLP Infrastructure Master Fund (the “Master Fund”), was organized as a Delaware statutory trust pursuant to an agreement and declaration of trust dated May 4, 2015 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940. The Master Fund commenced operations on July 1, 2015. The Master Fund’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders.

The Cushing® MLP Infrastructure Fund I (the “Feeder Fund I”), was organized as a Delaware statutory trust and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940. Feeder Fund I commenced operations on March 1, 2010. The Feeder Fund I’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders and does so by investing substantially all of its investable assets in the Master Fund.

The Cushing® MLP Infrastructure Fund II (the “Feeder Fund II”, together with the “Feeder Fund I” the “Feeder Funds”), was organized as a Delaware statutory trust pursuant to an agreement and declaration of trust dated May 4, 2015 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940. The Feeder Fund II’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders and does so by investing substantially all of its assets in the Master Fund.

The Master Fund and Feeder Funds are managed by Cushing® Asset Management, LP (the “Adviser”).

| 2. | Significant Accounting Policies |

A. Basis of Presentation

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) as detailed in the Financial Accounting Standards Board’s Accounting Standards Codification.

B. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

C. Investment Valuation

The Master Fund uses the following valuation methods to determine fair value as either fair value for investments for which market quotations are available, or if not available, the fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Master Fund’s Board of Trustees (“Board of Trustees” or “Trustees”) from time to time. The valuation of the portfolio securities of the Master Fund currently includes the following processes:

(i) The market value of each security listed or traded on any recognized securities exchange or automated quotation system will be the last reported sale price at the relevant valuation date on the composite tape or on the principal exchange on which such security is traded except those listed on the NASDAQ Global Market®, NASDAQ Global Select Market® and the NASDAQ Capital Market® exchanges (collectively, “NASDAQ”). Securities traded on NASDAQ will be valued at the NASDAQ official closing price. If no sale is reported on that date, the closing price from the prior trading day may be used.

(ii) The Master Fund’s non-marketable investments will generally be valued in such manner as the Adviser determines in good faith to reflect their fair values under procedures established by, and under the general supervision and responsibility of, the Board of Trustees. The pricing of all assets that are fair valued in this manner will be subsequently reported to and ratified by the Board of Trustees.

D. Security Transactions, Investment Income and Expenses

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a first in, first out cost basis. Interest income is recognized on an accrual basis. Distributions and dividends (collectively referred to as “Distributions”) are recorded on the ex-dividend date. Distributions received from the Master Fund’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income, capital gains and return of capital. For financial statement purposes, the Master Fund uses return of capital and income estimates to determine the dividend income received from MLP Distributions. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from the MLPs after their tax reporting periods are concluded, as the actual character of these Distributions is not known until after the fiscal year end of the Master Fund.

The Master Fund estimates the allocation of investment income and return of capital for the Distributions received from its portfolio investments within the Statement of Operations. For the period ended May 31, 2016, the Master Fund has estimated approximately 99% of the Distributions received from its portfolio investments to be return of capital.

Expenses are recorded on an accrual basis.

E. Distributions to Unitholders

Distributions to unitholders are recorded on the ex-dividend date. The character of Distributions to unitholders are comprised of 100 percent return of capital.

F. Federal Income Taxation

The Master Fund is treated as a partnership for Federal income tax purposes. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements. The Master Fund does not record a provision for U.S. federal, state, or local income taxes because the unitholders report their share of the Master Fund’s income or loss on their income tax returns. The Master Fund files an income tax return in the U.S. federal jurisdiction, and may file income tax returns in various U.S. states. Generally, the Master Fund is subject to income tax examinations by major taxing authorities for all tax years since its inception.

In accordance with GAAP, the Master Fund is required to determine whether its tax positions are more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. The tax benefit recognized is measured as the largest amount of benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authorities. Based on its analysis, the Master Fund has determined that it has not incurred any liability for unrecognized tax benefits as of December 31, 2015. The Master Fund does not expect that its assessment regarding unrecognized tax benefits will materially change over the next twelve months. However, the Master Fund’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, questioning the timing and amount of deductions, the nexus of income among various tax jurisdictions, compliance with U.S. federal and U.S. state and foreign tax laws, and changes in the administrative practices and precedents of the relevant taxing authorities.

The tax basis of the Master Fund’s investments as of May 31, 2016 was $33,609,250 and net unrealized appreciation was $4,578,368 (gross unrealized appreciation $6,917,702; gross unrealized depreciation $2,339,334). The difference between book basis and tax basis is attributable primarily to net unrealized appreciation on investments.

G. Cash Flow Information

The Master Fund makes Distributions from investments, which include the amount received as cash Distributions from MLPs and common stock dividends. These activities are reported in the Statement of Changes in Net Assets, and additional information on cash receipts and payments is presented in the Statement of Cash Flows.

H. Indemnification

Under the Master Fund’s organization documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Master Fund. In addition, in the normal course of business, the Master Fund may enter into contracts that provide general indemnification to other parties. The Master Fund’s maximum exposure under such indemnification arrangements is unknown, as this would involve future claims that may be made against the Master Fund that have not yet occurred, and may not occur.

The Master Fund’s investment objective is to seek a high level of after-tax total return, with an emphasis on current distributions paid to its unitholders. The Master Fund seeks to achieve its investment objective by investing, under normal market conditions, in MLPs.

In the normal course of business, substantially all of the Master Fund’s securities transactions, money balances, and security positions are transacted with the Master Fund’s custodian, U.S. Bank, N.A. The Master Fund is subject to credit risk to the extent any broker with whom it conducts business is unable to fulfill contractual obligations on its behalf. The Adviser monitors the financial condition of such brokers.

| 4. | Agreements and Related Party Transactions |

The Master Fund has entered into an Investment Management Agreement (the “Agreement”) with the Adviser. Under the terms of the Agreement, the Master Fund pays the Adviser a management fee, payable monthly in arrears, equal to 0.083% (1.0% per annum) of the net assets of the Master Fund determined as of the beginning of each calendar month for services and facilities provided by the Adviser to the Master Fund.

The Adviser agreed to waive a portion of its management fee and reimburse the Master Fund expenses such that the Master Fund operating expenses would not exceed 1.50% of the Master Fund’s net assets through May 31, 2017. For the period ended May 31, 2016, the Adviser earned $159,968 in advisory fees and waived fees and reimbursed the Master Fund expenses in the amount of $33,350.

Waived fees and reimbursed the Master Fund expenses, including prior year expenses, are subject to potential recovery by year of expiration. The Adviser’s waived fees and reimbursed expenses that are subject to potential recovery are as follows:

| Fiscal Year Incurred | | Amount Waived/Reimbursed | | | Amount Recouped | | | Amount Subject to Potential Recovery | | Expiration Date |

| November 30, 2015 | | $ | 134,201 | | | $ | - | | | $ | 134,201 | | November 30, 2018 |

| November 30, 2016 | | | 33,350 | | | | - | | | | 33,350 | | November 30, 2019 |

| | | $ | 167,551 | | | $ | - | | | $ | 167,551 | | |

Jerry V. Swank, the founder and managing partner of the Adviser, is Chairman of the Master Fund’s Board of Trustees and President of the Master Fund.

U.S. Bancorp Fund Services, LLC serves as the Master Fund’s administrator and transfer agent. The Master Fund pays the administrator a monthly fee computed at an annual rate of 0.07% of the first $100 million of the Master Fund’s net assets, 0.05% on the next $200 million of net assets and 0.04% on the balance of the Master Fund’s net assets above $300 million, with a minimum annual fee of $45,000.

U.S. Bank, N.A. serves as the Master Fund’s custodian. The Master Fund pays the custodian a monthly fee computed at an annual rate of 0.004% of the Master Fund’s average daily market value, with a minimum annual fee of $4,800.

| 5. | Fair Value Measurements |

Various inputs that are used in determining the fair value of the Master Fund’s investments are summarized in the three broad levels listed below:

| · | Level 1 — quoted prices in active markets for identical securities |

| · | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 — significant unobservable inputs (including the Master Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

These inputs are summarized in the three broad levels listed below.

| | | | Fair Value Measurements at Reporting Date Using | |

| | | Fair Value as of | | | Quoted Prices in Active Markets for Identical Assets | | | Significant Other Observable Inputs | | | Significant Unobservable Inputs | |

| Description | | May 31, 2016 | | | (Level 1) | | | (Level 2) | | | (Level 3) | |

Assets Equity Securities Common Stock | | $ | 3,265,307 | | | $ | 3,265,307 | | | $ | - | | | $ | - | |

Master Limited Partnerships and Related Companies (a) | | | 33,830,821 | | | | 33,830,821 | | | | - | | | | - | |

| Total Equity Securities | | | 37,096,128 | | | | 37,096,128 | | | | - | | | | - | |

Other Short-Term Investments | | | 1,091,490 | | | | 1,091,490 | | | | - | | | | - | |

| Total Other | | | 1,091,490 | | | | 1,091,490 | | | | - | | | | - | |

| Total Assets | | $ | 38,187,618 | | | $ | 38,187,618 | | | $ | - | | | $ | - | |

| (a) | All other industry classifications are identified in the Schedule of Investments. The Master Fund did not hold Level 3 investments at any time during the period ended May 31, 2016. |

During the period ended May 31, 2016, the Master Fund did not have any transfers between any of the levels of the fair value hierarchy.

| 6. | Investment Transactions |

For the period ended May 31, 2016, the Master Fund purchased (at cost) and sold securities (proceeds) in the amount of $16,634,132 and $11,068,082 (excluding short-term securities), respectively.

Units of beneficial interest (“Units”) of the Master Fund may be offered or sold in a private placement to persons who satisfy the suitability standards set forth in the Master Fund’s confidential offering memorandum. The Master Fund generally offers Units on the first business day of each month. As of May 31, 2016, the Master Fund had 49,582.24 Units outstanding.

The Master Fund generally intends to pay Distributions quarterly, in such amounts as may be determined from time to time by the Master Fund’s Board of Trustees. Unless a unitholder elects otherwise, Distributions, if any, will be automatically reinvested in additional Units in the Master Fund. For the period ended May 31, 2016, the Master Fund issued 542.76 units through its dividend reinvestment plan.

As of May 31, 2016, Feeder Fund I and Feeder Fund II owned 99.88% and 0.12% of the outstanding shares of the Master Fund, respectively.

The Adviser has evaluated the impact of all subsequent events on the Fund.

On July 18, 2016, the Master Fund commenced a tender offer to repurchase up to 40% of the Master Fund’s outstanding units as of July 31, 2016.

On June 3, 2016, the Master Fund issued 333.00 units through its dividend reinvestment plan.

The Cushing® MLP Infrastructure Master Fund

ADDITIONAL INFORMATION (Unaudited)

May 31, 2016

Investment Policies and Parameters

The Commodity Futures Trading Commission (“CFTC”) amended Rule 4.5 which permits investment advisers to registered investment companies to claim an exclusion from the definition of commodity pool operator with respect to a fund provided certain requirements are met. In order to permit the Adviser to continue to claim this exclusion with respect to the Master Fund under the amended rule, the Master Fund limits its transactions in futures, options of futures and swaps (excluding transactions entered into for “bona fide hedging purposes,” as defined under CFTC regulations) such that either: (i) the aggregate initial margin and premiums required to establish its futures, options on futures and swaps do not exceed 5% of the liquidation value of the Master Fund’s portfolio, after taking into account unrealized profits and losses on such positions; or (ii) the aggregate net notional value of its futures, options on futures and swaps does not exceed 100% of the liquidation value of the Master Fund’s portfolio, after taking into account unrealized profits and losses on such positions. The Master Fund and the Adviser do not believe that complying with the amended rule will limit the Master Fund’s ability to use futures, options and swaps to the extent that it has used them in the past.

Trustee and Officer Compensation

The Master Fund does not currently compensate any of its trustees who are interested persons nor any of its officers. During the period ended May 31, 2016, the aggregate compensation paid by the Master Fund to each independent trustee was $4,000. The Master Fund did not pay any special compensation to any of its trustees or officers. The Master Fund continuously monitors standard industry practices and this policy is subject to change. The Master Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request by calling the Master Fund toll-free at (877) 653-1415 and on the SEC’s Web site at www.sec.gov.

Cautionary Note Regarding Forward-Looking Statements

This report contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Master Fund’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; MLP industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in the Master Fund’s filings with the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Master Fund undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Master Fund’s investment objectives will be attained.

Proxy Voting Policies

A description of the policies and procedures that the Master Fund uses to determine how to vote proxies relating to portfolio securities owned by the Master Fund and information regarding how the Master Fund voted proxies relating to the portfolio of securities during the 12-month period ended June 30 will be available to stockholders (i) without charge, upon request by calling the Master Fund toll-free at (877) 653-1415; and (ii) on the SEC’s Web site at www.sec.gov.

Form N-Q

The Master Fund files its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Master Fund’s Form N-Q and statement of additional information will be available without charge by visiting the SEC’s Web site at www.sec.gov. In addition, you may review and copy the Master Fund’s Form N-Q at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Privacy Policy

In order to conduct its business, the Master Fund collects and maintains certain nonpublic personal information about its stockholders of record with respect to their transactions in shares of the Master Fund’s securities. This information includes the stockholder’s address, tax identification or Social Security number, share balances, and dividend elections. We do not collect or maintain personal information about stockholders whose share balances of our securities are held in “street name” by a financial institution such as a bank or broker.

We do not disclose any nonpublic personal information about you, the Master Fund’s other stockholders or the Master Fund’s former stockholders to third parties unless necessary to process a transaction, service an account, or as otherwise permitted by law.

To protect your personal information internally, we restrict access to nonpublic personal information about the Master Fund’s stockholders to those employees who need to know that information to provide services to our stockholders. We also maintain certain other safeguards to protect your nonpublic personal information.

Householding

In an effort to decrease costs, the Master Fund intends to reduce the number of duplicate annual and semi-annual reports, proxy statements and other similar documents you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders the Transfer Agent reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please contact investor services at investorservices@usbank.com to request individual copies of these documents. Once the Transfer Agent receives notice to stop householding, the Transfer Agent will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

The Cushing® MLP Infrastructure Master Fund

Board Approval of Investment Management Agreement (Unaudited)

May 31, 2016

On May 25, 2016, the Board of Trustees of the Master Fund (members of which are referred to collectively as the “Trustees”) met in person to discuss, among other things, the approval of the Investment Management Agreement (the “Agreement”) between the Master Fund and Cushing Asset Management, LP (the “Adviser”).

Activities and Composition of the Board

The Board of Trustees is comprised of four Trustees, three of whom are not “interested persons,” as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Master Fund (the “Independent Trustees”). The Board of Trustees is responsible for the oversight of the operations of the Master Fund and performs the various duties imposed by the 1940 Act on the trustees of investment companies. The Independent Trustees have retained independent legal counsel to assist them in connection with their duties. Prior to its consideration of the Agreement, the Board of Trustees received and reviewed information provided by the Adviser. The Board of Trustees also received and reviewed information responsive to requests from independent counsel to assist it in its consideration of the Agreement. Before the Board of Trustees voted on the approval of the Agreement, the Independent Trustees met with independent legal counsel during executive session and discussed the Agreement and related information.

Consideration of Nature, Extent and Quality of the Services

The Board of Trustees received and considered information regarding the nature, extent and quality of services provided to the Master Fund under the Agreement. The Board of Trustees reviewed certain background materials supplied by the Adviser in its presentation, including the Adviser’s Form ADV.

The Board of Trustees reviewed and considered the Adviser’s investment advisory personnel, its history and the amount of assets currently under management by the Adviser. The Board of Trustees also reviewed the research and decision-making processes utilized by the Adviser, including the methods adopted to seek to achieve compliance with the investment objectives, policies and restrictions of the Master Fund.

The Board of Trustees considered the background and experience of the Adviser’s management in connection with the Master Fund, including reviewing the qualifications, backgrounds and responsibilities of the management team members primarily responsible for the day-to-day portfolio management of the Master Fund and the extent of the resources devoted to research and analysis of the Master Fund’s actual and potential investments.

The Board of Trustees also reviewed, among other things, the Adviser’s conflict of interest policies, insider trading policies and procedures and its Code of Ethics. The Board of Trustees, including all of the Independent Trustees, concluded that the nature, extent and quality of services to be rendered by the Adviser under the Agreement were adequate.

Consideration of Advisory Fees and the Cost of the Services

The Board of Trustees reviewed and considered the contractual annual advisory fee to be paid by the Master Fund to the Adviser in light of the extent, nature and quality of the advisory services to be provided by the Adviser to the Master Fund.

The Board of Trustees considered the information they received comparing the Master Fund’s contractual annual advisory fee and overall expenses with (a) a peer group of competitor closed-end funds determined by the Adviser; and (b) other accounts or vehicles managed by the Adviser. Given the small universe of managers and funds fitting within the criteria for the peer group, the Adviser did not believe that it would be beneficial to engage the services of an independent third-party to prepare the peer group analysis, and the Independent Trustees concurred with this approach.

Based on such information, the Board of Trustees determined that the peer group was of limited utility because of differences between the Master Fund and the other funds in the peer group, but to the extent applicable, the Master Fund’s management fee and total expense ratio were significantly below the peer group median. The Board of Trustees also discussed the expense waivers currently in place for the Master Fund (ending May 2017). The Board of Trustees concluded that the fee charged by the Adviser to the Master Fund relative to comparable accounts of the Adviser employing similar strategies was reasonable in light of the differences between the types of clients, the kinds of costs incurred by the Adviser and other considerations faced by the Adviser in competing for and servicing such clients.

Consideration of Investment Performance

The Board of Trustees regularly reviews the performance of the Master Fund throughout the year. The Board of Trustees reviewed performance information comparing the performance of the Master Fund against its benchmark index and its peer group over several time horizons and using different performance metrics (e.g., stock price percent changes, total return percent changes and NAV total return percent changes). The Board of Trustees noted, among other things, that the Master Fund slightly lagged behind its benchmark index for the one-year period ending February 29, 2016, but continued to outperform its benchmark index in the three-year period and especially the period since inception (in each case considering the performance of The Cushing MLP Infrastructure Fund I, which converted to a master/feeder structure upon inception of the Master Fund).

Other Considerations

The Board of Trustees received and considered a profitability analysis prepared by the Adviser based on the fees payable by the Master Fund under the Agreement. The Board of Trustees considered the profits realized and anticipated to be realized by the Adviser in connection with the operation of the Master Fund and concluded that the profit, if any, anticipated to be realized by the Adviser in connection with the operation of the Master Fund is not unreasonable to the Master Fund.

The Board of Trustees considered whether economies of scale in the provision of services to the Master Fund had been or would be passed along to the shareholders under the Agreement. The Board of Trustees reviewed and considered any other incidental benefits derived or to be derived by the Adviser from its relationship with the Master Fund, including soft dollar arrangements or other so called “fall-out benefits.” The Board of Trustees concluded there were no material economies of scale or other incidental benefits accruing to the Adviser in connection with its relationship with the Master Fund.

Conclusion

In approving the Agreement and the fees charged under the Agreement, the Board of Trustees concluded that no single factor reviewed by the Board of Trustees was identified by the Board of Trustees to be determinative as the principal factor in whether to approve the Agreement. The summary set out above describes the most important factors, but not all of the matters, considered by the Board of Trustees in coming to its decision regarding the Agreement. On the basis of such information as the Board of Trustees considered necessary to the exercise of its reasonable business judgment and its evaluation of all of the factors described above, and after much discussion, the Board of Trustees concluded that each factor they considered, in the context of all of the other factors they considered, favored approval of the Agreement. It was noted that it was the judgment of the Board of Trustees that approval of the Agreement was consistent with the best interests of the Master Fund and its shareholders. A majority of the Trustees and, voting separately, a majority of the Independent Trustees, approved the Agreement.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not Applicable.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Jerry V. Swank, President & Chief Executive Officer

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Jerry V. Swank, President & Chief Executive Officer

John H. Alban, Treasurer & Chief Financial Officer