CONSOLIDATED CONSTRUCTION SOLUTIONS I LLC AND SUBSIDIARIES dba THE ACC COMPANIES CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

CONSOLIDATED CONSTRUCTION SOLUTIONS I LLC AND SUBSIDIARIES dba THE ACC COMPANIES CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) CONTENTS Pages INDEPENDENT ACCOUNTANTS’ REVIEW REPORT 1 FINANCIAL STATEMENTS Condensed Consolidated Balance Sheets as of June 30, 2018 and December 31, 2017 2 Condensed Consolidated Statements of Income and Member’s Equity for the six-months ended June 30, 2018 and 2017 3 Condensed Consolidated Statements of Cash Flows for the six-months ended June 30, 2018 and 2017 4 Notes to Condensed Consolidated Financial Statements 5 - 19

4722 North 24th Street, Suite 300 ■ Phoenix, AZ 85016 Main: 602.264.6835 ■ Fax: 602.265.7631 ■ www.mhmcpa.com INDEPENDENT ACCOUNTANTS’ REVIEW REPORT To the Sole Member of CONSOLIDATED CONSTRUCTION SOLUTIONS I LLC AND SUBSIDIARIES dba THE ACC COMPANIES We have reviewed the accompanying condensed consolidated financial statements of Consolidated Construction Solutions I LLC and Subsidiaries dba The ACC Companies, which comprise the condensed consolidated balance sheets as of June 30, 2018 and December 31, 2017, and the condensed consolidated statements of income and member’s equity, and cash flows for the six-month periods ended June 30, 2018 and 2017, and the related notes to the condensed consolidated financial statements. A review includes primarily applying analytical procedures to management’s financial data and making inquiries of company management. A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole. Accordingly, we do not express such an opinion. Management’s Responsibility for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Accountants’ Responsibility Our responsibility is to conduct the review engagement in accordance with Statements on Standards for Accounting and Review Services promulgated by the Accounting and Review Services Committee of the AICPA. Those standards require us to perform procedures to obtain limited assurance as a basis for reporting whether we are aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting principles generally accepted in the United States of America. We believe that the results of our procedures provide a reasonable basis for our conclusion. Accountants’ Conclusion Based on our reviews, we are not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in accordance with accounting principles generally accepted in the United States of America. September 20, 2018 Member of Kreston International — a global network of independent accounting firms

CONSOLIDATED CONSTRUCTION SOLUTIONS I LLC AND SUBSIDIARIES dba THE ACC COMPANIES CONDENSED CONSOLIDATED BALANCE SHEETS ($ in thousands) (unaudited) A S S E T S June 30, December 31, 2018 2017 CURRENT ASSETS Cash and cash equivalents $ 20,961 $ 30,330 Contracts and other accounts receivable, net 57,961 50,891 Inventory 515 542 Prepaid insurance 1,201 1,649 Costs and estimated earnings in excess of billings on 7,613 3,827 uncompleted contracts Other current assets 1,341 1,170 TOTAL CURRENT ASSETS 89,592 88,409 Property and equipment, net 38,222 38,672 Assets held for sale 1,326 1,454 Other non-current assets 139 124 Due from affiliate 70 68 Intangible assets, net 1,494 1,611 Goodwill 715 715 Deferred tax asset, net 5,322 5,775 TOTAL ASSETS $ 136,880 $ 136,828 L I A B I L I T I E S A N D M E M B E R' S E Q U I T Y CURRENT LIABILITIES Accounts payable $ 20,113 $ 19,473 Accrued liabilities 6,323 8,223 Current maturities of capital lease obligations 538 618 Current maturities of property and equipment notes payable 2,494 2,288 Current maturities of notes payable 24,925 6,125 Billings in excess of costs and estimated earnings on uncompleted contracts 16,649 16,297 TOTAL CURRENT LIABILITIES 71,042 53,024 Capital lease obligations, net of current maturities 740 957 Property and equipment notes payable, net of current maturities 3,342 3,374 Notes payable, net of current maturities and unamortized discount and debt issuance costs 30,193 53,436 TOTAL LIABILITIES 105,317 110,791 COMMITMENTS AND CONTINGENCIES TOTAL MEMBER'S EQUITY 31,563 26,037 TOTAL LIABILITIES AND MEMBER'S EQUITY $ 136,880 $ 136,828 See Notes to Condensed Consolidated Financial Statements See Independent Accountants' Review Report - 2 -

CONSOLIDATED CONSTRUCTION SOLUTIONS I LLC AND SUBSIDIARIES dba THE ACC COMPANIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND MEMBER'S EQUITY ($ in thousands) (unaudited) June 30, June 30, 2018 2017 Contract revenue $ 139,020 $ 122,976 Cost of contract revenue 118,792 106,266 Gross profit 20,228 16,710 General and administrative expenses 10,209 9,532 Income from operations 10,019 7,178 Other income (expense): Interest income 5 1 Interest expense (3,565) (4,086) Other income 28 12 Other expense, net (3,532) (4,073) Income before income taxes 6,487 3,105 Income tax (expense) benefit (493) 1,307 Net income 5,994 4,412 Member's equity, beginning of period 26,037 17,624 Distribution to member (468) (313) Member's equity, June 30 $ 31,563 $ 21,723 See Notes to Condensed Consolidated Financial Statements See Independent Accountants' Review Report - 3 -

CONSOLIDATED CONSTRUCTION SOLUTIONS I LLC AND SUBSIDIARIES dba THE ACC COMPANIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS ($ in thousands) (unaudited) June 30, June 30, 2018 2017 CASH FLOWS FROM OPERATING ACTIVITIES Net income $ 5,994 $ 4,412 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 4,096 4,081 Amortization of debt issue costs and debt discount 366 581 Paid in kind interest expense 754 717 Gain on sale of property and equipment (97) (436) Gain on sale of assets held for sale (23) - Deferred income taxes, net 452 (1,336) Changes in operating assets and liabilities: (7,071) (951) Inventory 27 16 Prepaid insurance 448 2,671 Costs and estimated earnings in excess of billings on uncompleted contracts (3,786) (3,972) Other current assets (169) 1,289 Other non-current assets (14) - Accounts payable 639 (994) Accrued liabilities (1,899) (5,148) Billings in excess of costs and estimated earnings on uncompleted contracts 352 1,510 Net cash provided by operating activities 69 2,440 CASH FLOWS FROM INVESTING ACTIVITIES Paid to affiliates, net (2) - Purchase of property and equipment (3,057) (5,977) Proceeds from disposal of assets held for sale 151 - Proceeds from disposal of property and equipment 1,123 1,476 Net cash used in investing activities (1,785) (4,501) CASH FLOWS FROM FINANCING ACTIVITIES Repayment of property and equipment notes payable (1,271) (1,031) Repayment of capital lease obligations (351) (340) Repayment of notes payable (5,563) (6,153) Distributions to member (468) (313) Net cash used in financing activities (7,653) (7,837) NET INCREASE IN CASH AND CASH EQUIVALENTS (9,369) (9,898) CASH AND CASH EQUIVALENTS Beginning of period 30,330 29,427 End of period $ 20,961 $ 19,529 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid for interest $ 3,094 $ 3,351 Cash paid for income taxes $ 25 $ 29 SUPPLEMENTAL DISCLOSURE OF NONCASH INVESTING AND FINANCING ACTIVITIES: Equipment financed through capital lease obligations $ 53 $ 23 Equipment financed through long-term debt $ 1,445 $ 321 See Notes to Condensed Consolidated Financial Statements See Independent Accountants' Review Report - 4 -

CONSOLIDATED CONSTRUCTION SOLUTIONS I LLC AND SUBSIDIARIES dba THE ACC COMPANIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS ($ in thousands) (unaudited) (1) Summary of significant accounting policies and basis of presentation Basis of presentation – The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), and consequently may not include all disclosures normally required by accounting principles generally accepted in the United States of America. In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements contain all adjustments necessary, all of which are of a normal and recurring nature, to present fairly our financial position, results of operations and cash flows. Certain information and note disclosures normally included in financial statements may have been condensed or omitted pursuant to the rules and regulations of the SEC. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2017. Nature of the corporation – Consolidated Construction Solutions I LLC dba The ACC Companies (”CCSI”), a limited liability company, was formed under the laws of the State of Delaware in November 2014 as the wholly-owned subsidiary of Consolidated Construction Investment Holdings LLC (“CCIH”). As part of a merger transaction between companies under common control (the “Merger”) effective January 27, 2015, CCSI was established as the sole member of Consolidated Construction Solutions II LLC dba ACC Companies (“CCSII”), which is the sole member of Meadow Valley Parent Corp. dba American Civil Constructors (“MVPC”) and Saiia Holdings LLC (“Saiia Holdings”). The merger transaction was completed with entities under common control. Accordingly, the consolidated assets and liabilities were recorded at historical cost. MVPC was organized under the laws of the State of Delaware on July 3, 2008. MVPC purchased all of the common stock of Meadow Valley Corporation (“MVCO”) through a merger transaction that closed on February 2, 2009. MVCO is the parent company of Meadow Valley Contractors, Inc. dba ACC Southwest (“ACC SW”). MVPC is the parent company of Meadow Valley Trucking, Inc. (“MV Trucking”). MVPC is the sole member of American Civil Constructors LLC dba ACC Mountain West (“ACC MW”). ACC MW is the sole member of American Civil Constructors West Coast LLC dba ACC West Coast (“ACC WC”). ACC SW is predominantly a general contractor, primarily engaged in the construction of structural concrete highway bridges and overpasses, earthwork, various types of site-work, and the paving of highways and roadways for various governmental authorities, municipalities and developers in the states of Nevada, Utah, and Arizona. ACC MW and ACC WC are also predominantly general contractors and are primarily engaged in the performance of a variety of construction services including construction, maintenance and repair of bridges, roadways, tunnels, underground utilities, golf courses and parks. Additionally, ACC MW performs specialty landscape services such as the construction of athletic fields and reclamation work. ACC MW maintains offices in Colorado and ACC WC maintains offices in California. - 5 -

(1) Summary of significant accounting policies and basis of presentation (continued) Effective January 27, 2015, Saiia Holdings, an entity under common control, was merged into CCSII at historical cost. Saiia Holdings is the holding company for Saiia Construction Company LLC dba Saiia Construction Company LLC, an ACC Company (“Saiia”). Saiia is engaged in the business of providing contract site excavation/grading services, industrial site maintenance services, and contract mining services in the southeastern United States. Excavation and grading services involve the use of heavy equipment such as bulldozers, excavators, and scrapers for the purpose of grading or otherwise restricting the existing terrain. These services, which often also include installation of underground utilities as part of the site work, are primarily provided to industrial and commercial customers for site preparation prior to building construction by others. Excavation and grading services may also involve the construction of industrial settlement ponds, lagoons, levees, and landfills and may also include subsequent cleaning or remediation of those structures. Industrial site maintenance services include the provision of on-site services to landfill maintenance, waste handling and disposal, pond maintenance and cleanout, coal handling, road and ground maintenance. Mining services involve the use of heavy equipment to remove overburden and intra-burden material in and around quarry operations. The Mining division also provides services for green field sites from initial environmental pond construction to final reclamation. Saiia maintains an office in Alabama. Principles of consolidation – The accompanying condensed consolidated financial statements include the accounts of CCSI and its wholly-owned subsidiaries (collectively, the “Company”). Arrangements with joint ventures are included in the condensed consolidated balance sheets using the equity method and are included in the condensed consolidated statement of income based on the Company’s pro-rata share of the revenues and costs of the joint venture. Intercompany transactions and balances have been eliminated in consolidation. Operating cycle – Assets and liabilities related to long-term contracts are included in current assets and current liabilities in the accompanying condensed consolidated balance sheets as they will be liquidated in the normal course of contract completion, although this may require more than one year. Use of estimates – The preparation of condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ materially from those estimates. Significant estimates are used when accounting for the percentage-of-completion and the estimated gross profit on projects in progress, depreciation and amortization methods and useful lives of long-lived assets, valuation of intangible assets including goodwill impairment, taxes including deferred tax assets, and contingencies. Revenue and cost recognition – Revenues are earned under fixed price, unit price, time and material and stand-ready service type contracts. Revenues from fixed price construction contracts are recognized on the percentage-of-completion method, which is measured by the ratio of contract costs incurred to estimated total contract costs at completion. This method is used because management considers total costs to be the best available measure of progress on the contracts. Revenues from unit price contracts are recognized as units are fulfilled under the contract. Revenue from time and material and stand-ready service type contracts and related cost of revenue are recognized either on the accrual basis of accounting or as materials or services are provided depending on the nature of the contract. Contract costs include all direct material, transportation, direct labor costs, field labor, equipment rent, subcontractor and certain indirect costs related to contract performance such as indirect labor, supplies, insurance, equipment repairs, depreciation costs, tools and direct overhead. Contracts using self-owned equipment and trucks are charged an internal rental fee. Selling, general and administrative expenses are accounted for as period costs and are, therefore, not included in the calculation of the estimates to complete construction contracts in progress. - 6 -

(1) Summary of significant accounting policies and basis of presentation (continued) Project losses are provided for in their entirety in the period in which such estimated losses become evident, without reference to the percentage-of-completion. As contracts can extend over one or more accounting periods; changes in job performance, job conditions and estimated profitability, including those arising from contract penalty provisions and final contract settlements, may result in revisions to costs and income. The resulting adjustments are recognized in the period in which the revisions are determined. Costs related to change orders and claims are recognized when they are incurred. Change orders and claims are included in total estimated contract revenues when they can be reliably estimated and it is probable that the adjustment will be approved by the customer or realized. The accuracy of revenue and gross profit recognition in a given period is dependent on the accuracy of estimates of costs to complete each project. Cost estimates for all projects are detailed and originate in the bid process before a project is awarded. There are a number of factors that can contribute to changes in estimates of contract cost and profitability. The most significant of these include: the completeness and accuracy of the original bid; costs associated with added scope changes; extended overhead expenses due to counter party, weather and other delays; subcontractor performance issues; changes in productivity expectations; site conditions that are different from those assumed in the original bid; changes in the availability and proximity of equipment and materials, and project supervision and management. The foregoing factors as well as the stage of completion of contracts in process and the mix of contracts at different margins may cause fluctuations in gross profit between periods. Substantial changes in cost estimates have had, and in future periods may have, a significant effect on profitability. The asset, “Costs and estimated earnings in excess of billings on uncompleted contracts,” represents revenues recognized in excess of amounts billed. The liability, “Billings in excess of costs and estimated earnings on uncompleted contracts,” represents billings in excess of revenues recognized. Cash and cash equivalents – All cash, certificates of deposit and highly liquid investments with original maturities of three months or less when purchased are considered cash equivalents. Balances of cash and cash equivalents are periodically maintained with financial and other institutions in excess of insured limits. Contracts and other accounts receivable, net – Contracts and other accounts receivable include contract receivables, retention receivable, and other trade receivables. The majority of the Company’s work is performed on a contract basis but the Company does provide services to customers using credit terms customary in its industry. Contract receivables represent amounts billed but uncollected on completed construction contracts and construction contracts in progress. Generally, the terms of the contracts require monthly billings for work completed based on various measures of performance. Such progress billings may require customer or inspector approval prior to submission. Retention receivables include amounts that are held back until project completion and acceptance by the customer. Retention practices vary from contract to contract, but in general, retention (usually between 5% to 10% of the contract) is withheld from each progress payment by the owner. Allowance for doubtful accounts – The Company follows the allowance method of recognizing uncollectible contracts and other accounts receivable. The allowance method recognizes bad debt expense based on a review of the individual accounts outstanding, historic loss experience and current economic conditions. As part of the review of individual accounts, an allowance for doubtful accounts is also recorded for specifically identified accounts that are being disputed based on contract penalty provisions and/or final contract settlement after all attempts to collect have failed. The Company writes off uncollectable receivables to the allowance when management deems further collection efforts will not produce additional recoveries. - 7 -

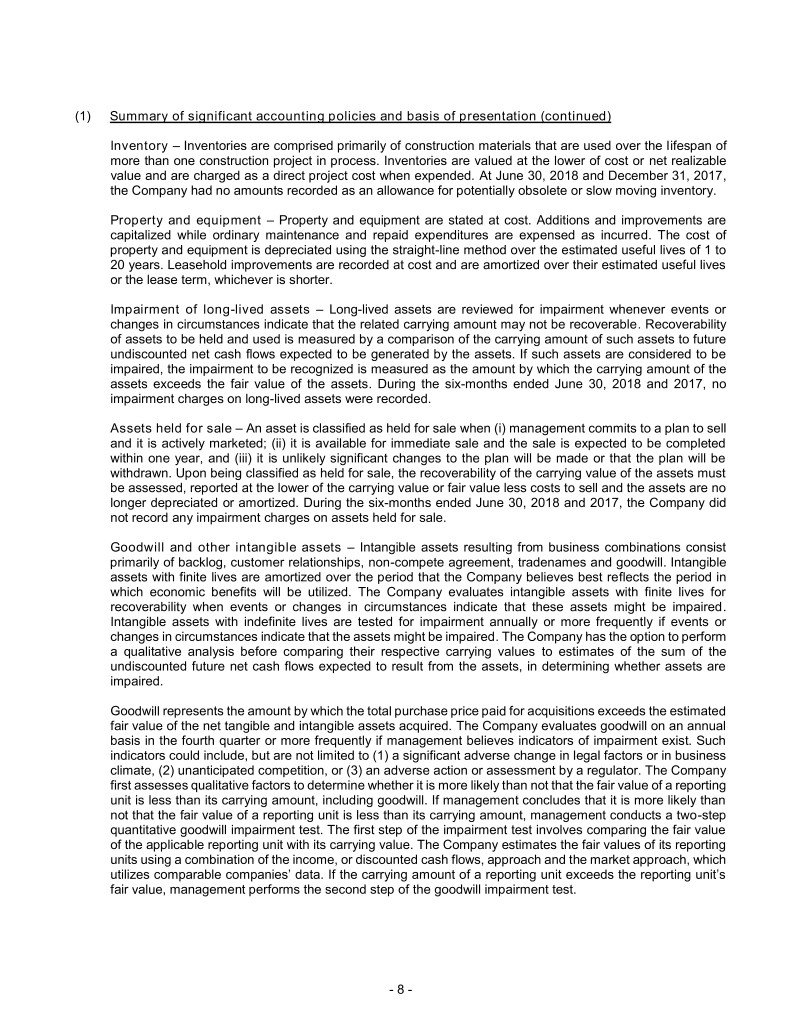

(1) Summary of significant accounting policies and basis of presentation (continued) Inventory – Inventories are comprised primarily of construction materials that are used over the lifespan of more than one construction project in process. Inventories are valued at the lower of cost or net realizable value and are charged as a direct project cost when expended. At June 30, 2018 and December 31, 2017, the Company had no amounts recorded as an allowance for potentially obsolete or slow moving inventory. Property and equipment – Property and equipment are stated at cost. Additions and improvements are capitalized while ordinary maintenance and repaid expenditures are expensed as incurred. The cost of property and equipment is depreciated using the straight-line method over the estimated useful lives of 1 to 20 years. Leasehold improvements are recorded at cost and are amortized over their estimated useful lives or the lease term, whichever is shorter. Impairment of long-lived assets – Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the related carrying amount may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of such assets to future undiscounted net cash flows expected to be generated by the assets. If such assets are considered to be impaired, the impairment to be recognized is measured as the amount by which the carrying amount of the assets exceeds the fair value of the assets. During the six-months ended June 30, 2018 and 2017, no impairment charges on long-lived assets were recorded. Assets held for sale – An asset is classified as held for sale when (i) management commits to a plan to sell and it is actively marketed; (ii) it is available for immediate sale and the sale is expected to be completed within one year, and (iii) it is unlikely significant changes to the plan will be made or that the plan will be withdrawn. Upon being classified as held for sale, the recoverability of the carrying value of the assets must be assessed, reported at the lower of the carrying value or fair value less costs to sell and the assets are no longer depreciated or amortized. During the six-months ended June 30, 2018 and 2017, the Company did not record any impairment charges on assets held for sale. Goodwill and other intangible assets – Intangible assets resulting from business combinations consist primarily of backlog, customer relationships, non-compete agreement, tradenames and goodwill. Intangible assets with finite lives are amortized over the period that the Company believes best reflects the period in which economic benefits will be utilized. The Company evaluates intangible assets with finite lives for recoverability when events or changes in circumstances indicate that these assets might be impaired. Intangible assets with indefinite lives are tested for impairment annually or more frequently if events or changes in circumstances indicate that the assets might be impaired. The Company has the option to perform a qualitative analysis before comparing their respective carrying values to estimates of the sum of the undiscounted future net cash flows expected to result from the assets, in determining whether assets are impaired. Goodwill represents the amount by which the total purchase price paid for acquisitions exceeds the estimated fair value of the net tangible and intangible assets acquired. The Company evaluates goodwill on an annual basis in the fourth quarter or more frequently if management believes indicators of impairment exist. Such indicators could include, but are not limited to (1) a significant adverse change in legal factors or in business climate, (2) unanticipated competition, or (3) an adverse action or assessment by a regulator. The Company first assesses qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount, including goodwill. If management concludes that it is more likely than not that the fair value of a reporting unit is less than its carrying amount, management conducts a two-step quantitative goodwill impairment test. The first step of the impairment test involves comparing the fair value of the applicable reporting unit with its carrying value. The Company estimates the fair values of its reporting units using a combination of the income, or discounted cash flows, approach and the market approach, which utilizes comparable companies’ data. If the carrying amount of a reporting unit exceeds the reporting unit’s fair value, management performs the second step of the goodwill impairment test. - 8 -

(1) Summary of significant accounting policies and basis of presentation (continued) The second step of the goodwill impairment test involves comparing the implied fair value of the affected reporting unit’s goodwill with the carrying value of that goodwill. The amount, by which the carrying value of the goodwill exceeds its implied fair value, if any, is recognized as an impairment loss. No impairment losses on goodwill were recognized during the six-months ended June 30, 2018 and 2017. Deferred financing fees and discount on debt – Deferred financing fees are being amortized using the effective interest method over the respective lives of the related debt obligations. In January 2015, the Company refinanced its debt as part of the Merger (Note 1) and recorded $2,814 as deferred financing fees and $1,008 as a discount on debt. Amortization expense of approximately $365 and $581 is included in interest expense for the six months ended June 30, 2018 and 2017, respectively. The aggregate amount of unamortized deferred financing fees and discount on debt is reported as a reduction of notes payable in the accompanying condensed consolidated balance sheets. Income taxes – CCSI is treated as a partnership for income tax purposes, however, certain subsidiaries file consolidated corporate tax returns with their subsidiaries on a consolidated basis. The Company accounts for income taxes by recognizing deferred tax assets and liabilities for the expected future tax consequences of events that have been recognized in the Company’s consolidated financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the difference between the consolidated financial statement carrying amounts and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. To the extent that the Company does not consider it more likely than not that a deferred tax asset will be recovered, it provides a valuation allowance. The Company absorbs the net income or loss of its applicable subsidiaries pursuant to a tax sharing agreement, which calls for any income tax receivable or payable normally to be remitted to, or paid by, the applicable subsidiary. If the Company is required to pay interest on the underpayment of income taxes, the Company recognizes interest expense in the first period the interest becomes due according to the provisions of the relevant tax law. If the Company is subject to payment of penalties, the Company recognizes an expense for the amount of the statutory penalty in the period when the position is taken on the income tax return. If the penalty was not recognized in the period when the position was initially taken, the expense is recognized in the period when the Company changes its judgment about meeting minimum statutory thresholds related to the initial position taken. Fiscal years ending on or after 2014 remain subject to examination by federal and state tax authorities. Newly issued accounting pronouncements – In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606) that will supersede most current revenue recognition guidance, including industry- specific guidance. The core principle of the new guidance is that an entity will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard provides a five-step analysis of transactions to determine when and how revenue is recognized. Other major provisions include the capitalization and amortization of certain contract costs, ensuring the time value of money is considered in the transaction price, and allowing estimates of variable consideration to be recognized before contingencies are resolved in certain circumstances. Additionally, the guidance requires disclosures related to the nature, amount, timing, and uncertainty of revenue that is recognized. In August 2015, the FASB issued ASU No. 2015-14, Revenue from Contracts with Customers (Topic 606), which changed the effective date of the provisions of ASU No. 2014-09. As a result, the amendments are required to be adopted for the Company’s December 31, 2019 consolidated financial statements. Early adoption is permitted. Transition to the new guidance may be done using either a full or modified retrospective method. - 9 -

(1) Summary of significant accounting policies and basis of presentation (continued) Management has not yet begun the process of implementing the new standard other than attending various seminars and trainings to develop an understanding of the new requirements. Management anticipates developing additional controls and procedures for identification of performance obligations and uninstalled materials as well as developing accounting policies for various types of variable consideration that are frequently incorporated into construction contract documents and pre-contract costs. Therefore, at this time management is unable to determine impact, if any, that adoption of the amendments provided in ASU 2014- 09 will have on the consolidated financial statements. In November 2015, the FASB issued ASU No. 2015-17, Balance Sheet Classification of Deferred Taxes (Topic 740). ASU 2015-17 requires entities to classify deferred tax liabilities and assets as noncurrent in a classified balance sheet and is effective for fiscal years beginning after December 15, 2016. For particular tax-paying components of an entity and within a particular tax jurisdiction, all deferred tax liabilities and assets, as well as any related valuation allowances, shall be offset and presented in a single noncurrent amount. The Company has applied the amendments provided in ASU 2015-17 to the accompanying condensed consolidated balance sheets. In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). ASU 2016-02 requires that a lease liability and related right-of-use-asset representing the lessee’s right to use or control the asset be recorded on the balance sheet upon the commencement of all leases except for short-term leases. Leases will be classified as either finance leases or operating leases, which are substantially similar to the classification criteria for distinguishing between capital leases and operating leases in existing lease accounting guidance. As a result, the effect of leases in the statement of income and the statement of cash flows will be substantially unchanged from the existing lease accounting guidance. ASU 2016-02 is effective for fiscal years beginning after December 15, 2019. Early adoption is permitted. The Company has estimated that if they were to adopt the amendments provided in ASU 2016-02 as of June 30, 2018, a non-current right of use asset of approximately $22,419 would be recorded and a corresponding current and non-current lease liability of approximately $9,726 and $12,693, respectively, would be recorded in the accompanying condensed consolidated balance sheet. The estimate was calculated using the minimum future lease payments (see Note 14) and a discount rate of 6% representing the Company’s expected incremental borrowing rate were it to seek operational financing. (2) Contracts and other accounts receivable, net Contracts and other accounts receivable, net consists of the following: June 30, December 31, 2018 2017 Contracts in progress $ 45,735 $ 38,600 Contracts in progress - retention 7,378 12,067 Completed contracts 2,990 11 Completed contracts - retention 1,658 69 Other receivables 225 169 57,986 50,916 Allowance for doubtful accounts (25) (25) $ 57,961 $ 50,891 The balances billed but not paid by customers pursuant to retainage provisions in construction contracts generally become due upon completion of the contracts and acceptance by the owners. Retainage amounts of $9,036 at June 30, 2018 are expected to be collected at the end of the contracts. - 10 -

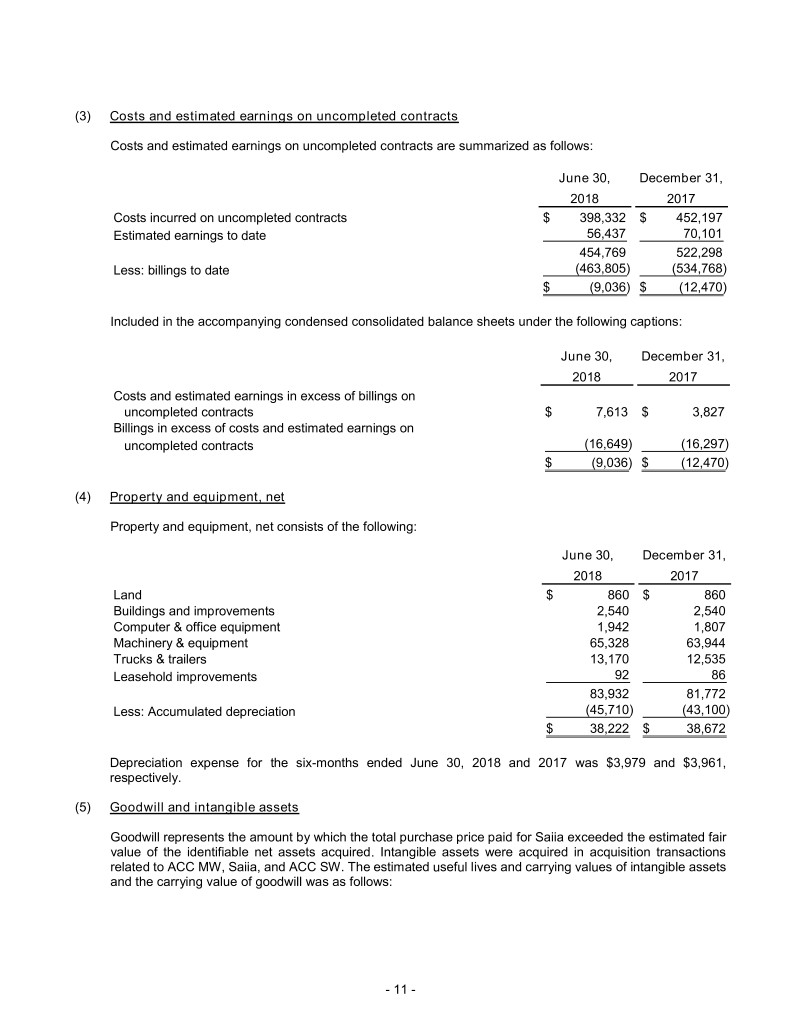

(3) Costs and estimated earnings on uncompleted contracts Costs and estimated earnings on uncompleted contracts are summarized as follows: June 30, December 31, 2018 2017 Costs incurred on uncompleted contracts $ 398,332 $ 452,197 Estimated earnings to date 56,437 70,101 454,769 522,298 Less: billings to date (463,805) (534,768) $ (9,036) $ (12,470) Included in the accompanying condensed consolidated balance sheets under the following captions: June 30, December 31, 2018 2017 Costs and estimated earnings in excess of billings on uncompleted contracts $ 7,613 $ 3,827 Billings in excess of costs and estimated earnings on uncompleted contracts (16,649) (16,297) $ (9,036) $ (12,470) (4) Property and equipment, net Property and equipment, net consists of the following: June 30, December 31, 2018 2017 Land $ 860 $ 860 Buildings and improvements 2,540 2,540 Computer & office equipment 1,942 1,807 Machinery & equipment 65,328 63,944 Trucks & trailers 13,170 12,535 Leasehold improvements 92 86 83,932 81,772 Less: Accumulated depreciation (45,710) (43,100) $ 38,222 $ 38,672 Depreciation expense for the six-months ended June 30, 2018 and 2017 was $3,979 and $3,961, respectively. (5) Goodwill and intangible assets Goodwill represents the amount by which the total purchase price paid for Saiia exceeded the estimated fair value of the identifiable net assets acquired. Intangible assets were acquired in acquisition transactions related to ACC MW, Saiia, and ACC SW. The estimated useful lives and carrying values of intangible assets and the carrying value of goodwill was as follows: - 11 -

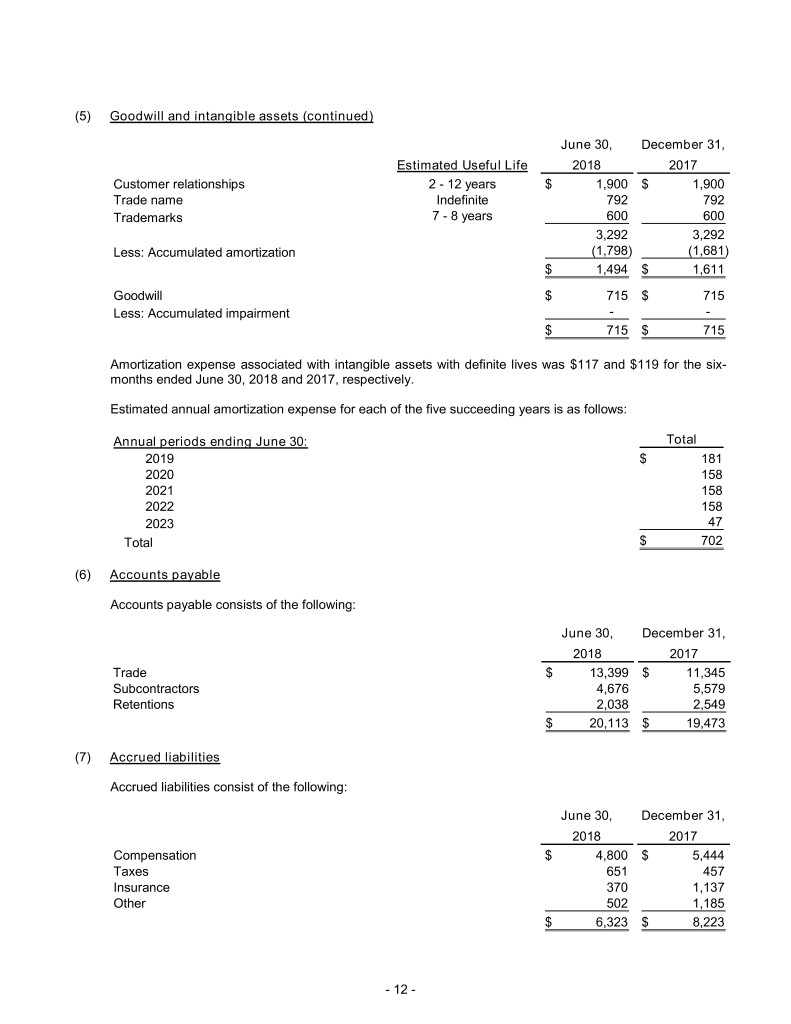

(5) Goodwill and intangible assets (continued) June 30, December 31, Estimated Useful Life 2018 2017 Customer relationships 2 - 12 years $ 1,900 $ 1,900 Trade name Indefinite 792 792 Trademarks 7 - 8 years 600 600 3,292 3,292 Less: Accumulated amortization (1,798) (1,681) $ 1,494 $ 1,611 Goodwill $ 715 $ 715 Less: Accumulated impairment - - $ 715 $ 715 Amortization expense associated with intangible assets with definite lives was $117 and $119 for the six- months ended June 30, 2018 and 2017, respectively. Estimated annual amortization expense for each of the five succeeding years is as follows: Annual periods ending June 30: Total 2019 $ 181 2020 158 2021 158 2022 158 2023 47 Total $ 702 (6) Accounts payable Accounts payable consists of the following: June 30, December 31, 2018 2017 Trade $ 13,399 $ 11,345 Subcontractors 4,676 5,579 Retentions 2,038 2,549 $ 20,113 $ 19,473 (7) Accrued liabilities Accrued liabilities consist of the following: June 30, December 31, 2018 2017 Compensation $ 4,800 $ 5,444 Taxes 651 457 Insurance 370 1,137 Other 502 1,185 $ 6,323 $ 8,223 - 12 -

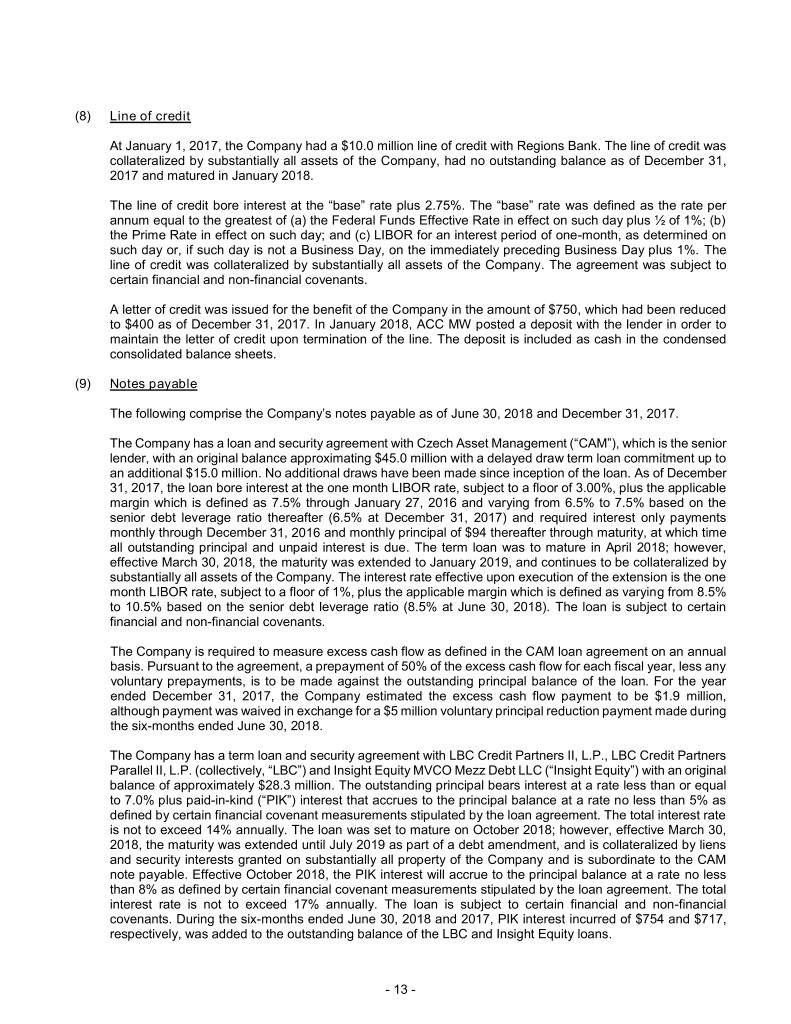

(8) Line of credit At January 1, 2017, the Company had a $10.0 million line of credit with Regions Bank. The line of credit was collateralized by substantially all assets of the Company, had no outstanding balance as of December 31, 2017 and matured in January 2018. The line of credit bore interest at the “base” rate plus 2.75%. The “base” rate was defined as the rate per annum equal to the greatest of (a) the Federal Funds Effective Rate in effect on such day plus ½ of 1%; (b) the Prime Rate in effect on such day; and (c) LIBOR for an interest period of one-month, as determined on such day or, if such day is not a Business Day, on the immediately preceding Business Day plus 1%. The line of credit was collateralized by substantially all assets of the Company. The agreement was subject to certain financial and non-financial covenants. A letter of credit was issued for the benefit of the Company in the amount of $750, which had been reduced to $400 as of December 31, 2017. In January 2018, ACC MW posted a deposit with the lender in order to maintain the letter of credit upon termination of the line. The deposit is included as cash in the condensed consolidated balance sheets. (9) Notes payable The following comprise the Company’s notes payable as of June 30, 2018 and December 31, 2017. The Company has a loan and security agreement with Czech Asset Management (“CAM”), which is the senior lender, with an original balance approximating $45.0 million with a delayed draw term loan commitment up to an additional $15.0 million. No additional draws have been made since inception of the loan. As of December 31, 2017, the loan bore interest at the one month LIBOR rate, subject to a floor of 3.00%, plus the applicable margin which is defined as 7.5% through January 27, 2016 and varying from 6.5% to 7.5% based on the senior debt leverage ratio thereafter (6.5% at December 31, 2017) and required interest only payments monthly through December 31, 2016 and monthly principal of $94 thereafter through maturity, at which time all outstanding principal and unpaid interest is due. The term loan was to mature in April 2018; however, effective March 30, 2018, the maturity was extended to January 2019, and continues to be collateralized by substantially all assets of the Company. The interest rate effective upon execution of the extension is the one month LIBOR rate, subject to a floor of 1%, plus the applicable margin which is defined as varying from 8.5% to 10.5% based on the senior debt leverage ratio (8.5% at June 30, 2018). The loan is subject to certain financial and non-financial covenants. The Company is required to measure excess cash flow as defined in the CAM loan agreement on an annual basis. Pursuant to the agreement, a prepayment of 50% of the excess cash flow for each fiscal year, less any voluntary prepayments, is to be made against the outstanding principal balance of the loan. For the year ended December 31, 2017, the Company estimated the excess cash flow payment to be $1.9 million, although payment was waived in exchange for a $5 million voluntary principal reduction payment made during the six-months ended June 30, 2018. The Company has a term loan and security agreement with LBC Credit Partners II, L.P., LBC Credit Partners Parallel II, L.P. (collectively, “LBC”) and Insight Equity MVCO Mezz Debt LLC (“Insight Equity”) with an original balance of approximately $28.3 million. The outstanding principal bears interest at a rate less than or equal to 7.0% plus paid-in-kind (“PIK”) interest that accrues to the principal balance at a rate no less than 5% as defined by certain financial covenant measurements stipulated by the loan agreement. The total interest rate is not to exceed 14% annually. The loan was set to mature on October 2018; however, effective March 30, 2018, the maturity was extended until July 2019 as part of a debt amendment, and is collateralized by liens and security interests granted on substantially all property of the Company and is subordinate to the CAM note payable. Effective October 2018, the PIK interest will accrue to the principal balance at a rate no less than 8% as defined by certain financial covenant measurements stipulated by the loan agreement. The total interest rate is not to exceed 17% annually. The loan is subject to certain financial and non-financial covenants. During the six-months ended June 30, 2018 and 2017, PIK interest incurred of $754 and $717, respectively, was added to the outstanding balance of the LBC and Insight Equity loans. - 13 -

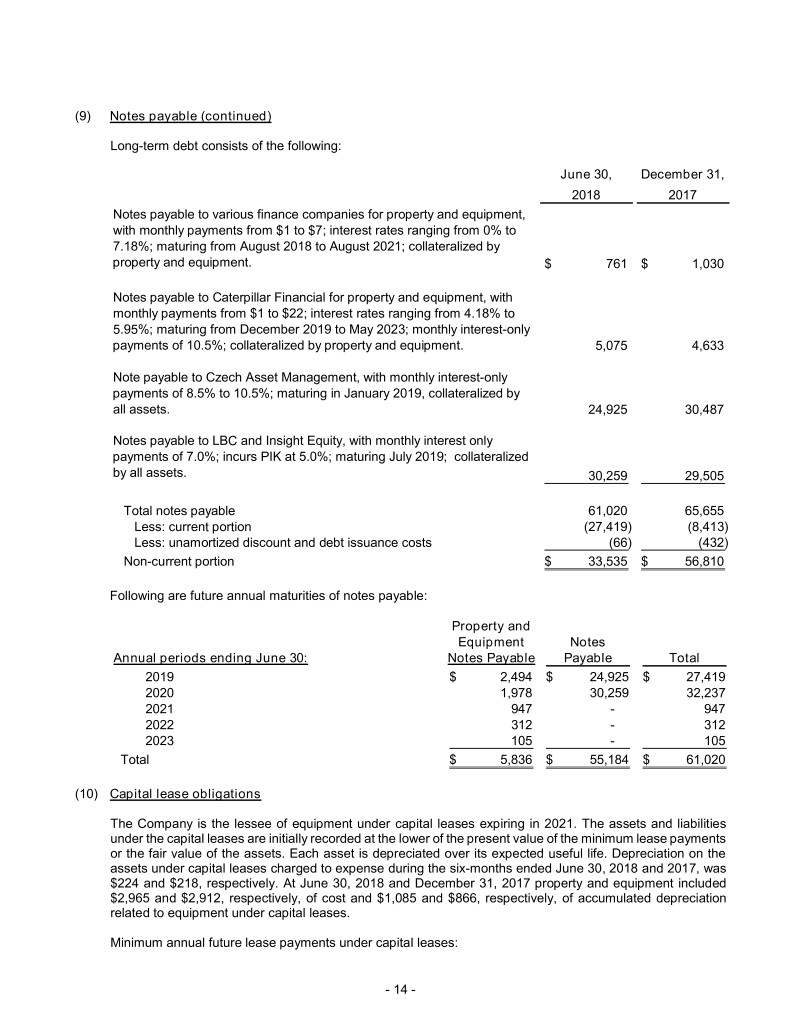

(9) Notes payable (continued) Long-term debt consists of the following: June 30, December 31, 2018 2017 Notes payable to various finance companies for property and equipment, with monthly payments from $1 to $7; interest rates ranging from 0% to 7.18%; maturing from August 2018 to August 2021; collateralized by property and equipment. $ 761 $ 1,030 Notes payable to Caterpillar Financial for property and equipment, with monthly payments from $1 to $22; interest rates ranging from 4.18% to 5.95%; maturing from December 2019 to May 2023; monthly interest-only payments of 10.5%; collateralized by property and equipment. 5,075 4,633 Note payable to Czech Asset Management, with monthly interest-only payments of 8.5% to 10.5%; maturing in January 2019, collateralized by all assets. 24,925 30,487 Notes payable to LBC and Insight Equity, with monthly interest only payments of 7.0%; incurs PIK at 5.0%; maturing July 2019; collateralized by all assets. 30,259 29,505 Total notes payable 61,020 65,655 Less: current portion (27,419) (8,413) Less: unamortized discount and debt issuance costs (66) (432) Non-current portion $ 33,535 $ 56,810 Following are future annual maturities of notes payable: Property and Equipment Notes Annual periods ending June 30: Notes Payable Payable Total 2019 $ 2,494 $ 24,925 $ 27,419 2020 1,978 30,259 32,237 2021 947 - 947 2022 312 - 312 2023 105 - 105 Total $ 5,836 $ 55,184 $ 61,020 (10) Capital lease obligations The Company is the lessee of equipment under capital leases expiring in 2021. The assets and liabilities under the capital leases are initially recorded at the lower of the present value of the minimum lease payments or the fair value of the assets. Each asset is depreciated over its expected useful life. Depreciation on the assets under capital leases charged to expense during the six-months ended June 30, 2018 and 2017, was $224 and $218, respectively. At June 30, 2018 and December 31, 2017 property and equipment included $2,965 and $2,912, respectively, of cost and $1,085 and $866, respectively, of accumulated depreciation related to equipment under capital leases. Minimum annual future lease payments under capital leases: - 14 -

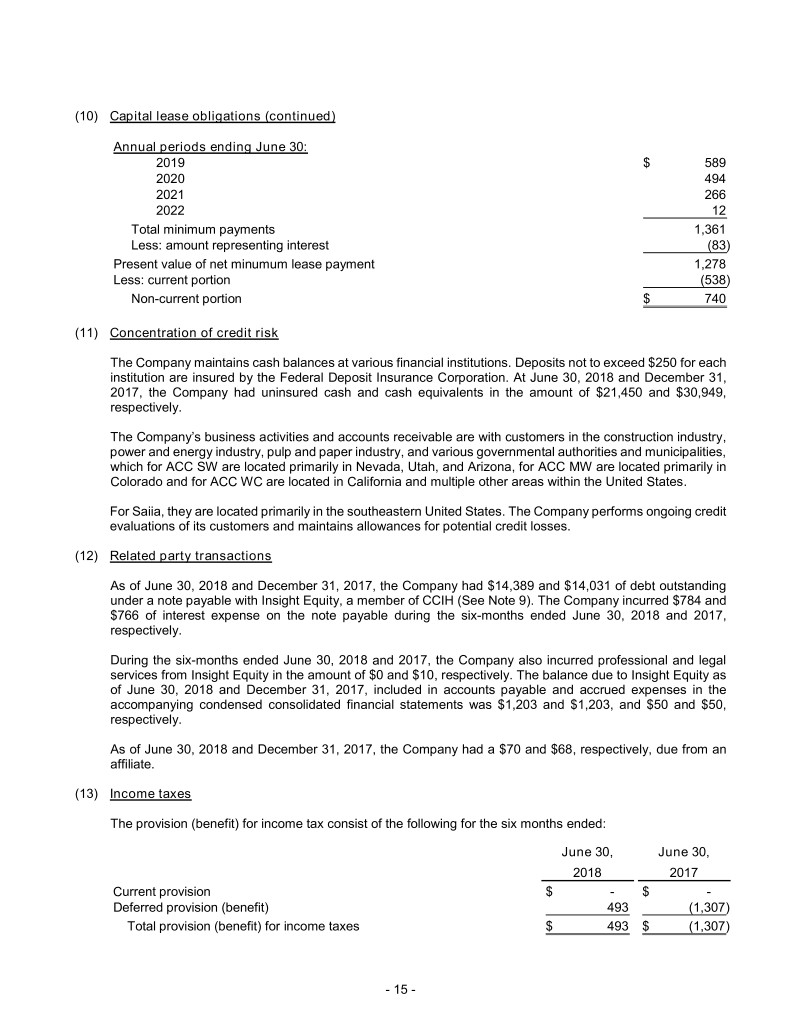

(10) Capital lease obligations (continued) Annual periods ending June 30: 2019 $ 589 2020 494 2021 266 2022 12 Total minimum payments 1,361 Less: amount representing interest (83) Present value of net minumum lease payment 1,278 Less: current portion (538) Non-current portion $ 740 (11) Concentration of credit risk The Company maintains cash balances at various financial institutions. Deposits not to exceed $250 for each institution are insured by the Federal Deposit Insurance Corporation. At June 30, 2018 and December 31, 2017, the Company had uninsured cash and cash equivalents in the amount of $21,450 and $30,949, respectively. The Company’s business activities and accounts receivable are with customers in the construction industry, power and energy industry, pulp and paper industry, and various governmental authorities and municipalities, which for ACC SW are located primarily in Nevada, Utah, and Arizona, for ACC MW are located primarily in Colorado and for ACC WC are located in California and multiple other areas within the United States. For Saiia, they are located primarily in the southeastern United States. The Company performs ongoing credit evaluations of its customers and maintains allowances for potential credit losses. (12) Related party transactions As of June 30, 2018 and December 31, 2017, the Company had $14,389 and $14,031 of debt outstanding under a note payable with Insight Equity, a member of CCIH (See Note 9). The Company incurred $784 and $766 of interest expense on the note payable during the six-months ended June 30, 2018 and 2017, respectively. During the six-months ended June 30, 2018 and 2017, the Company also incurred professional and legal services from Insight Equity in the amount of $0 and $10, respectively. The balance due to Insight Equity as of June 30, 2018 and December 31, 2017, included in accounts payable and accrued expenses in the accompanying condensed consolidated financial statements was $1,203 and $1,203, and $50 and $50, respectively. As of June 30, 2018 and December 31, 2017, the Company had a $70 and $68, respectively, due from an affiliate. (13) Income taxes The provision (benefit) for income tax consist of the following for the six months ended: June 30, June 30, 2018 2017 Current provision $ - $ - Deferred provision (benefit) 493 (1,307) Total provision (benefit) for income taxes $ 493 $ (1,307) - 15 -

(13) Income taxes (continued) A reconciliation of the provision (benefit) for income taxes with amounts determined by applying the statutory U.S. federal income tax rate to income before income taxes for the six months ended: June 30, June 30, 2018 2017 Computed tax at the federal statutory rate of 21% and 34% $ 356 $ (451) State taxes, net of federal benefit 67 (44) Effect of prior period true-up - (875) Permanent items 8 71 Other 62 (8) $ 493 $ (1,307) The Company’s net deferred tax asset consists of the following: June 30, December 31, 2018 2017 Deferred tax assets (liabilities): Other accrued expenses $ 57 $ 62 Deferred compensation 641 677 Other 27 27 Net operating loss carryforwards 5,432 5,836 Deferred financing costs 39 49 Depreciation and amortization (874) (876) Net deferred tax asset $ 5,322 $ 19 The Company’s effective tax rate differs from the federal statutory rate primarily due to the change in federal corporate tax rate, state income taxes and permanent differences related to nondeductible items. At June 30, 2018, the Company has federal net operating loss carryforwards in the amount of approximately $22.5 million, which may be available to offset federal and state taxable income and will expire through 2032. Pursuant to the Internal Revenue Code, utilization of the Company’s net operating loss carryforwards may be limited. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. The Tax Cuts and Jobs Act (“TCJA”) was signed into law on December 22, 2017, which decreased the federal enacted tax rate from an effective rate of 34% to a flat 21%. The Company re- measured the deferred taxes as of that date to reflect the reduced rate that will apply when these deferred taxes are settled or realized in future periods based on the enacted tax rates in the TCJA. (14) Commitments and contingencies The Company leases land, buildings, office space, automobiles and trucks, apartments, computer hardware/ software, and various machinery and equipment under operating leases. Future annual minimum payments under operating leases with initial terms in excess of one year as of June 30, 2018 are as follows: Annual periods ending June 30: 2019 $ 10,309 2020 8,706 2021 4,396 2022 1,393 2023 202 Total $ 25,006 - 16 -

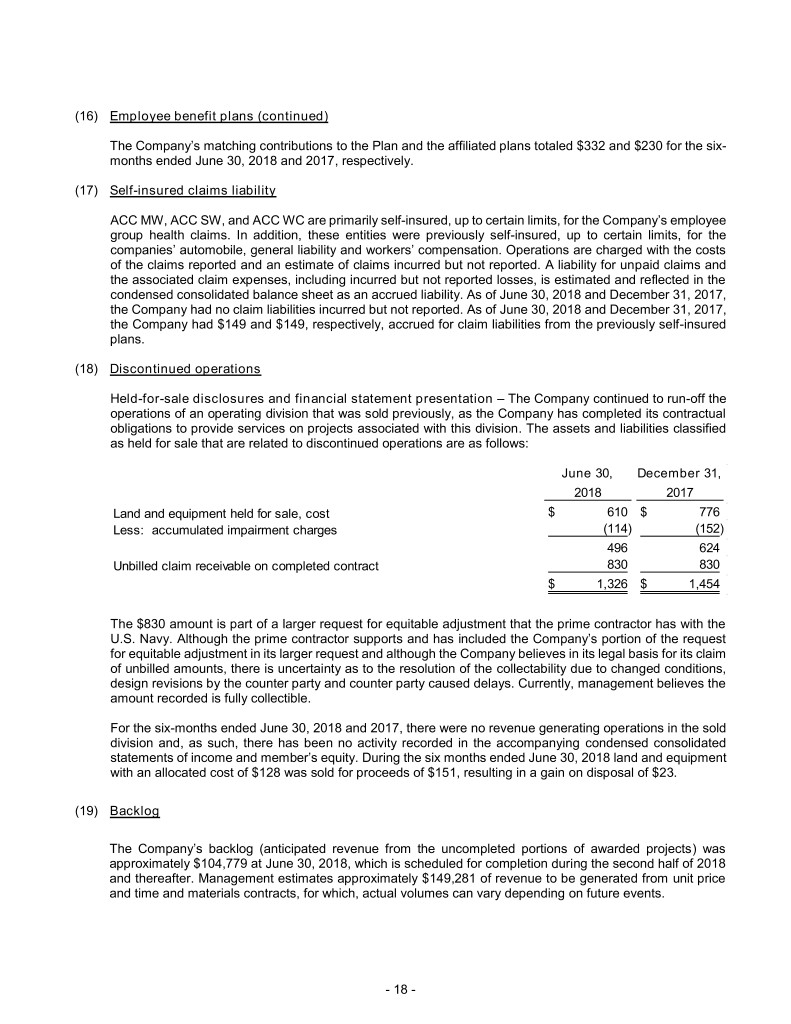

(14) Commitments and contingencies (continued) Rent expense under these agreements was $7,673 and $5,664 for the six-months ended June 30, 2018 and 2017, respectively. The Company recognizes step rent provisions and rent concessions of operating leases on a straight-line basis over the life of the lease, and records the difference between the average rental amount charged to expense and the amount payable under the lease as deferred rent. Each of the companies have agreed to provide indemnification for each other’s bid and performance bonds issued for projects awarded to either company. Further, the companies provide certain guarantees on each other’s leases and supplier transactions. The Company has agreed to indemnify its officers and directors for certain events or occurrences that may arise as a result of the officer or director serving in such capacity. The term of the indemnification period is for the officers’ or directors’ lifetime. The maximum potential amount of future payments the Company could be required to make under these indemnification agreements is unlimited. However, the Company maintains a directors and officers’ liability insurance policy that enables it to recover a portion of any future amounts paid. As a result of its insurance policy coverage and no current or expected litigation against its officers or directors, the Company believes the estimated fair value of these indemnification agreements is minimal and has no liabilities recorded for these agreements as of June 30, 2018 and December 31, 2017. The Company enters into indemnification provisions under its agreements with other companies in its ordinary course of business, typically with business partners, customers, landlords, lenders and lessors. Under these provisions the Company generally indemnifies and holds harmless the indemnified party for losses suffered or incurred by the indemnified party as a result of the Company’s activities or, in some cases, as a result of the indemnified party’s activities under the agreement. The maximum potential amount of future payments the Company could be required to make under these indemnification provisions is unlimited. The Company has not incurred material costs to defend lawsuits or settle claims related to these indemnification agreements. As a result, the Company believes the estimated fair value of these agreements is minimal. Accordingly, the Company has no liabilities recorded for these agreements as of June 30, 2018 and December 31, 2017. (15) Litigation and claim matters The Company is party to legal proceedings in the ordinary course of business. The Company believes that the nature of these proceedings (which generally relate to disputes between the Company and its subcontractors, material suppliers or customers regarding payment for work performed or materials supplied) are typical for a construction firm of its size and scope, and no other pending proceedings are deemed to be materially detrimental and some claims may prove beneficial to the Company’s financial condition. In the opinion of management, the outcome of such proceedings and litigation will not materially affect the Company’s consolidated financial position, results of operations, or cash flows. (16) Employee benefit plans On January 1, 2012, CCSI implemented a 409(b) deferred compensation plan (“CCSI 409(b) Plan”) for selected employees to participate. Under the terms of the CCSI 409(b) Plan, management may elect to make contributions to the CCSI 409(b) Plan. For the six-months ended June 30, 2018 and 2017, CCSI contributed $86 and $62, respectively, to the CCSI 409(b) Plan. CCSI and Saiia previously offered a qualified 401(k) retirement plan to their respective employees. Effective January 1, 2016, the Company restructured its 401(k) profit sharing plan resulting in the formation of The ACC Companies Retirement Savings Plan and Trust (the “Plan”). All assets of the affiliated plans were merged into the Plan in January 2016 and substantially all full-time employees are able to participate. The Company may make discretionary matching contributions but are subject to certain limitations. - 17 -

(16) Employee benefit plans (continued) The Company’s matching contributions to the Plan and the affiliated plans totaled $332 and $230 for the six- months ended June 30, 2018 and 2017, respectively. (17) Self-insured claims liability ACC MW, ACC SW, and ACC WC are primarily self-insured, up to certain limits, for the Company’s employee group health claims. In addition, these entities were previously self-insured, up to certain limits, for the companies’ automobile, general liability and workers’ compensation. Operations are charged with the costs of the claims reported and an estimate of claims incurred but not reported. A liability for unpaid claims and the associated claim expenses, including incurred but not reported losses, is estimated and reflected in the condensed consolidated balance sheet as an accrued liability. As of June 30, 2018 and December 31, 2017, the Company had no claim liabilities incurred but not reported. As of June 30, 2018 and December 31, 2017, the Company had $149 and $149, respectively, accrued for claim liabilities from the previously self-insured plans. (18) Discontinued operations Held-for-sale disclosures and financial statement presentation – The Company continued to run-off the operations of an operating division that was sold previously, as the Company has completed its contractual obligations to provide services on projects associated with this division. The assets and liabilities classified as held for sale that are related to discontinued operations are as follows: June 30, December 31, 2018 2017 Land and equipment held for sale, cost $ 610 $ 776 Less: accumulated impairment charges (114) (152) 496 624 Unbilled claim receivable on completed contract 830 830 $ 1,326 $ 1,454 The $830 amount is part of a larger request for equitable adjustment that the prime contractor has with the U.S. Navy. Although the prime contractor supports and has included the Company’s portion of the request for equitable adjustment in its larger request and although the Company believes in its legal basis for its claim of unbilled amounts, there is uncertainty as to the resolution of the collectability due to changed conditions, design revisions by the counter party and counter party caused delays. Currently, management believes the amount recorded is fully collectible. For the six-months ended June 30, 2018 and 2017, there were no revenue generating operations in the sold division and, as such, there has been no activity recorded in the accompanying condensed consolidated statements of income and member’s equity. During the six months ended June 30, 2018 land and equipment with an allocated cost of $128 was sold for proceeds of $151, resulting in a gain on disposal of $23. (19) Backlog The Company’s backlog (anticipated revenue from the uncompleted portions of awarded projects) was approximately $104,779 at June 30, 2018, which is scheduled for completion during the second half of 2018 and thereafter. Management estimates approximately $149,281 of revenue to be generated from unit price and time and materials contracts, for which, actual volumes can vary depending on future events. - 18 -

(20) Subsequent events Subsequent events have been evaluated through September 20, 2018, which is the date the condensed consolidated financial statements were available to be issued. On August 9, 2018, the Company and CCIH entered into a Purchase and Sale Agreement (the Agreement) with a wholly-owned subsidiary of Infrastructure and Energy Alternatives, Inc. (IEA). Pursuant to the terms of the Agreement, IEA acquired the Company for approximately $145 million in cash and new financing. The Company agreed to provide reasonable cooperation with IEA in IEA’s efforts to obtain the new financing although obtaining new financing is not a condition to the consummation of the acquisition. - 19 -