UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

| |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240 14a-12 |

Infrastructure and Energy Alternatives, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| ý | No fee required |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

Infrastructure and Energy Alternatives, Inc.

6325 Digital Way, Suite 460

Indianapolis, Indiana 46278

November 2, 2018

To our shareholders:

On behalf of the Board of Directors and employees of Infrastructure and Energy Alternatives, Inc. (the “Company”), I cordially invite you to participate via webcast in the 2018 Annual Meeting of Shareholders (the “Annual Meeting”) of the Company to be held on Friday, December 14, 2018, beginning at 9:00 a.m., Eastern Standard Time. The Annual Meeting will be a virtual meeting of shareholders which means that you will be able to participate in the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/IEA2018. You will not be able to attend the Annual Meeting in person.

Details of the business to be conducted at the Annual General Meeting are provided in the accompanying Notice of 2018 Annual Meeting of Shareholders and Proxy Statement. If you participate in the Annual Meeting via the live webcast at www.virtualshareholdermeeting.com/IEA2018, you may revoke your proxy and vote during the Annual Meeting, even if you have previously submitted a proxy.

We have elected to take advantage of Securities and Exchange Commission (“SEC”) rules that allow us to furnish proxy materials to certain shareholders on the Internet. On or about the date of this letter, we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to shareholders of record at the close of business on October 16, 2018. At the same time, we provided those shareholders with access to our online proxy materials and filed our proxy materials with the SEC. We believe furnishing proxy materials to our shareholders on the Internet will allow us to provide our shareholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting. If you have received the Notice, you will not receive a printed copy of the proxy materials unless you request it by following the instructions for requesting such materials contained in the Notice.

It is important that your vote be represented at the Annual Meeting whether or not you are able to participate. Accordingly, after reading the accompanying proxy materials, please promptly submit your proxy by telephone, Internet or mail as described in the Proxy Statement or the Notice.

Your continuing interest in our Company is greatly appreciated.

Sincerely,

JP Roehm

President, Chief Executive Officer and Director

Infrastructure and Energy Alternatives, Inc.

6325 Digital Way, Suite 460

Indianapolis, Indiana 46278

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 14, 2018

Notice is hereby given that the 2018 Annual Meeting of Shareholders (the “Annual Meeting”) of Infrastructure and Energy Alternatives, Inc. (the “Company”) will be held on Friday, December 14, 2018 at 9:00 a.m., Eastern Standard Time. The Annual Meeting will be a virtual meeting of shareholders which means that you will be able to participate in the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/IEA2018. You will not be able to attend the Annual Meeting in person. At the Annual Meeting, you will be asked to vote on the following proposals:

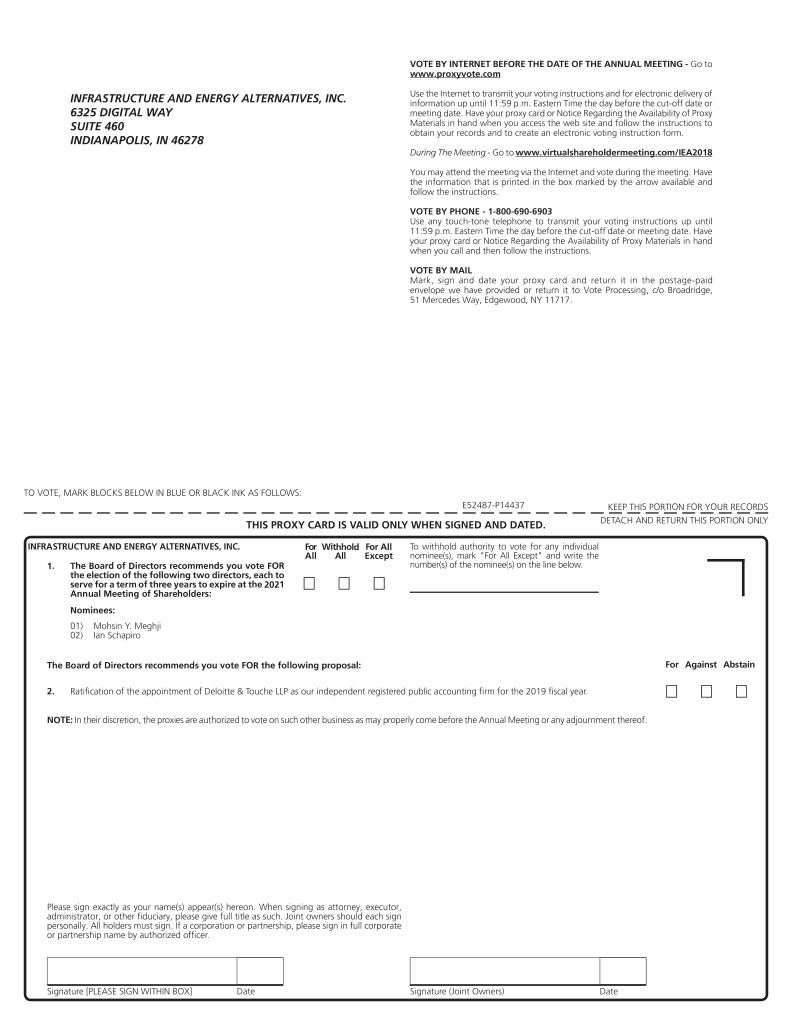

| |

| 1. | To elect Mohsin Y. Meghji and Ian Schapiro as Class I directors to serve for a term to expire at the 2021 Annual Meeting of Shareholders; |

| |

| 2. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2018 fiscal year; and |

| |

| 3. | To transact any other business properly brought before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing proposals are discussed more fully in the Proxy Statement accompanying this notice. Shareholders of record at the close of business on October 16, 2018 are entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements of the Annual Meeting.

Pursuant to the rules and regulations promulgated by the Securities and Exchange Commission, we are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials on or about November 2, 2018 to our shareholders of record on October 16, 2018. The Notice of Internet Availability of Proxy Materials contains instructions for accessing our Proxy Statement and Annual Report to Shareholders for the fiscal year ended December 31, 2017 (the “Annual Report”) and how to vote. In addition, the Notice of Internet Availability of Proxy Materials contains instructions on how you may (i) receive a paper copy of the Proxy Statement and Annual Report or (ii) elect to receive your Proxy Statement and Annual Report over the Internet.

We encourage you to view the virtual shareholder meeting through which you can vote on-line. It is important that your shares be represented and voted at the Annual Meeting. You may vote your shares over the Internet or by telephone. If you received a paper copy of the proxy card by mail, please mark, sign, date and promptly return the card in the self-addressed stamped envelope provided. Instructions regarding the methods of voting are contained in the proxy card. Voting over the Internet, by telephone or by mailing a proxy card will not limit your right to participate in the Annual Meeting and vote your shares during the live webcast.

By Order of the Board of Directors,

President, Chief Executive Officer and Director

Indianapolis, Indiana

November 2, 2018

TABLE OF CONTENTS

|

| |

| QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING | |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS | |

| INFORMATION AS TO NOMINEES AND OTHER DIRECTORS | |

| COMMITTEES AND CORPORATE GOVERNANCE | |

| PROPROSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| REPORT OF THE AUDIT COMMITTEE | |

| EXECUTIVE OFFICERS | |

| EXECUTIVE COMPENSATION | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |

| OTHER MATTERS | |

6325 Digital Way, Suite 460

Indianapolis, Indiana 46278

PROXY STATEMENT

The Board of Directors (the “Board”) of Infrastructure and Energy Alternatives, Inc. (the “Company,” “IEA,” “we,” “us” or “our”) is soliciting your proxy to vote at the 2018 Annual Meeting of Shareholders to be held on Friday, December 14, 2018 at 9:00 a.m., Eastern Standard Time, and any adjournment or postponement of that meeting (the “Annual Meeting”). The Annual Meeting will be a virtual meeting of shareholders which means that you will be able to participate in the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/IEA2018.

We are sending our proxy materials to shareholders on or about November 2, 2018, to our shareholders of record as of the close of business on October 16, 2018 (the “Record Date”). The Company’s principal executive offices are located at 6325 Digital Way, Suite 460, Indianapolis, Indiana 46278 and its telephone number is (765) 828-2580.

Introductory Note About the Company

We were incorporated in the State of Delaware on August 4, 2015 under the name M III Acquisition Corp. (“M III”) as a special purpose acquisition company (the “SPAC”) formed for the purposes of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

On March 26, 2018, M III consummated a business combination (the “Business Combination”) pursuant to an Agreement and Plan of Merger, dated as of November 3, 2017. As part of the Business Combination, the name of “M III Acquisition Corp.” was changed to “Infrastructure and Energy Alternatives, Inc.” Throughout this Proxy Statement, for periods prior to the Business Combination, we use the term “IEA” to refer to the target company of the Business Combination, IEA Energy Services, LLC (“IEA Services”) along with its subsidiaries, and the term “M III” to refer to the SPAC, pre-combination.

|

| | |

| HOW TO CAST YOUR VOTE: |

| Internet | Phone | Mail |

Go to www.proxyvote.com: You can use the Internet 24 hours a day to transmit your voting instructions. Have your proxy card or Notice of Internet Availability of Proxy Materials in hand when you access the web site and follow the instructions.

| Call 1-800-690-6903: You can use any touchtone telephone. Have your proxy card or Notice of Internet Availability of Proxy Materials in hand when you call and follow the instructions.

| If you received a printed copy of the proxy materials, you may submit your vote by completing, signing and dating your proxy card and returning it in the prepaid envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717.

|

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Why am I receiving these materials?

The Board of Directors is soliciting proxies for the Annual Meeting. The Notice of Internet Availability of Proxy Materials (the “Notice”), a proxy card, this Proxy Statement and our Annual Report to Shareholders for the fiscal year ended December 31, 2017 (the “Annual Report”) are being mailed on or about November 2, 2018 to shareholders as of the Record Date.

Where and When is the Annual Meeting?

We will hold the Annual Meeting via a live webcast on Friday, December 14, 2018 at 9:00 a.m., Eastern Standard Time, at www.virtualshareholdermeeting.com/IEA2018, where shareholders will be able to participate in the meeting live, submit questions and vote online. You will need the 16-digit control number provided on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

What am I being asked to vote on at the Annual Meeting?

We are asking our shareholders to consider the following proposals:

| |

| • | To elect the Class I directors, Mohsin Y. Meghji and Ian Schapiro, to serve until our annual meeting of shareholders to be held in 2021 or until their successors are duly elected and qualified; |

| |

| • | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

| |

| • | To transact any other business properly brought before the Annual Meeting or any adjournment or postponement thereof. |

How does the Board of Directors recommend I vote on these proposals?

The Board of Directors recommends a vote:

| |

| • | “FOR” the election of the Class I directors, Messrs. Meghji and Schapiro, to serve until our annual meeting of shareholders to be held in 2021 or until their successors are duly elected and qualified; and |

| |

| • | “FOR” the ratification of the appointment Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018. |

How can I attend the Annual Meeting?

The Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted through a live webcast. There will be no physical meeting location. You are entitled to participate in the Annual Meeting only if you were a shareholder as of the close of the business on the Record Date or if you hold a valid proxy. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/IEA2018. You also will be able to vote your shares online during the Annual Meeting.

To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice, on your proxy card, or on the instructions that accompanied your proxy materials. Instructions on how to attend and participate in our online meeting, including how to demonstrate proof of share ownership, are posted on the meeting website.

The meeting will begin promptly at 9:00 a.m., Eastern Standard Time. We encourage you to access the meeting prior to the start time. Online access to the meeting will open at 8:45 a.m., Easter Standard Time.

Why is the Annual Meeting virtual?

We are excited to embrace the latest technology to provide ease of access, real-time communication and cost savings for our shareholders and the Company. Hosting a virtual meeting will facilitate shareholder attendance and participation by enabling shareholders to participate from around the world.

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials?

We are taking advantage of the SEC rules that allow us to furnish our proxy materials over the Internet. As a result, most of our shareholders will be mailed a Notice of Internet Availability of Proxy Materials rather than a full paper set of the proxy materials. The Notice includes information on how to access the proxy materials via the Internet as well as how to vote via the Internet. We believe this method of delivery will decrease printing and shipping costs, expedite distribution of proxy materials to you and reduce our impact on the environment. Shareholders who receive the Notice but would like to receive a printed copy of the proxy materials in the mail should follow the instructions in the Notice for requesting such materials.

How many votes do I have?

You have and may cast one vote for each share of common stock of the Company, par value $0.0001 (“Common Stock”) that you owned at the close of business on the Record Date. These shares include:

| |

| • | Shares registered directly in your name with Continental Stock Transfer and Trust Company, Inc. (“Continental”), our transfer agent, for which you are considered the “shareholder of record”; and |

| |

| • | Shares held for you as the beneficial owner through a broker, bank or other nominee. |

As of the Record Date, the Company had 21,577,650 shares of Common Stock issued and outstanding.

What is the difference between holding shares as a “shareholder of record” and as a “beneficial owner”?

If your shares are registered directly in your name with Continental, you are considered the “shareholder of record” with respect to those shares. We have sent the notice and access materials for the Annual Meeting directly to you. As the shareholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card. Throughout this Proxy Statement, we refer to shareholders who hold their shares directly with Continental as “shareholders of record.”

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of the shares held in street name. Your broker, bank or other nominee who is considered the shareholder of record with respect to those shares has forwarded notice and access materials for the Annual Meeting to you. As the beneficial owner, you have the right to direct your broker or nominee on how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. If you request a printed copy of our proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use. Throughout this Proxy Statement, we refer to shareholders who hold their shares through a broker, bank or other nominee as “beneficial owners” or “street name shareholders.”

What is a proxy?

A proxy is your legal designation of another person to vote the shares of Common Stock you own. That other person is called your proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. We have designated two of our officers as proxy for the Annual Meeting to cast your vote. These officers are John Paul Roehm, our President and Chief Executive Officer and Andrew Layman, our Chief Financial Officer.

How do I vote?

Voting Methods for Shareholders of Record

If you are a shareholder of record, you may vote online during the Annual Meeting. Please follow the instructions provided on the Notice to log in to www.virtualshareholdermeeting.com/IEA2018 You will need the control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

If you are a shareholder of record, you may vote by one of the following methods without attending the Annual Meeting:

| |

| • | By Internet: you may vote over the Internet at www.proxyvote.com by following the instructions on the proxy card. Internet voting facilities will be available 24 hours a day and will close at 11:59 p.m., Eastern Standard Time, on December 13, 2018. |

| |

| • | By Telephone: you may vote by touch-tone telephone by calling 1-800-690-6903. Telephone voting facilities will be available 24 hours a day and will close at 11:59 p.m., Eastern Standard Time, on December 13, 2018. |

| |

| • | By Mail: you may authorize your proxy by completing, signing and dating your proxy card and returning it in the reply envelope or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

Voting Methods for Street Name Shareholders

If you are a street name shareholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Street name shareholders should generally be able to vote by returning an instruction card, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee.

Can I change my vote or revoke my proxy?

Yes. If you are a shareholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

| |

| • | providing written notice of revocation to the Secretary of the Company, in writing, at Infrastructure and Energy Alternatives, Inc., Attn: Secretary, 6325 Digital Way, Suite 460, Indianapolis Indiana 46278; |

| |

| • | delivering a valid, later-dated proxy or a later-dated vote on the Internet or by telephone; or |

| |

| • | attending the Annual Meeting and voting online during the meeting, which will automatically cancel any proxy previously given. |

Please note that your participation in the Annual Meeting alone will not cause your previously granted proxy to be revoked unless you vote online during the Annual Meeting. If you wish to revoke your proxy, you must do so in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the vote is taken. Shares held in street name may be voted by you online during the Annual Meeting only if you obtain a signed proxy from the record holder giving you the right to vote the shares.

What is a quorum?

A quorum of shareholders is necessary to hold a valid meeting. The presence in person or by proxy or, if a corporation or other non-natural person, by its duly authorized representative, of the shareholders holding in aggregate not less than a simple majority of our issued and outstanding Common Stock constitutes a quorum.

Your Common Stock will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement but will not count as votes for the purposes of the voting threshold. If there is no quorum, the meeting shall stand adjourned to the same day in the next week at the same time and place or to such other day, time and place as the directors may determine.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding Common Stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on our sole “routine” matter: the proposal to ratify the appointment of our independent registered public accounting firm. Your broker will not have discretion to vote on the election of directors, which is a “non-routine” matter, absent direction from you.

What vote is required to approve each proposal?

To be elected to our board of directors, the director nominees must receive a plurality of the votes cast by our shareholders present in person or by proxy and entitled to vote. The two director nominees who receive the greatest number of votes will be elected as directors. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

The appointment of our independent registered public accounting firm will be ratified by the affirmative vote of a majority of shares present or represented by proxy and entitled to vote at the Annual Meeting. Abstentions and broker non-votes will have the same effect as voting against this proposal.

Who will count the vote?

A representative of Broadridge will tabulate the votes.

Is my vote confidential?

Yes. The Company encourages shareholder participation in corporate governance by ensuring the confidentiality of shareholder votes. The Company has designated Broadridge, to receive and tabulate shareholder votes. Your vote on any particular proposal will be kept confidential and will not be disclosed to the Company or any of its officers or employees except (i) where disclosure is required by applicable law, (ii) where disclosure of your vote is expressly requested by you or (iii) where the Company concludes in good faith that a bona fide dispute exists as to the authenticity of one or more proxies, ballots or votes, or as to the accuracy of any tabulation of such proxies, ballots or votes. However, aggregate vote totals will be disclosed to the Company from time to time and publicly announced at the Annual Meeting.

Where can I find the voting results?

The Company will announce preliminary voting results at the Annual Meeting and publish preliminary results, or final results if available, in a Current Report on Form 8‑K filed with the SEC within four business days of the Annual Meeting.

Who pays for proxy solicitation?

We will pay the cost of soliciting proxies for the Annual Meeting. We will reimburse brokers, fiduciaries, custodians and other nominees for their costs in forwarding proxy materials to beneficial owners of our Common Stock. Other proxy solicitation expenses that we will pay include those for preparation, mailing, returning and tabulating the proxies.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Board has nominated Messrs. Meghji and Schapiro to stand for election as Class I Directors to hold office until the 2021 Annual Meeting of Shareholders and until their respective successors are elected and qualified. The Class I director nominees are incumbent directors.

The Board is composed of eight directors elected in three classes, with two Class I Directors, three Class II Directors and three Class III Directors, with only one class of directors being elected in each year. The terms of the classes are staggered so that the term of only one class terminates each year. The terms of the current Class I Directors expire at the Annual Meeting, the terms of the Class II Directors expire at the 2019 Annual Meeting of Shareholders and the terms of the Class III Directors expire at the 2020 Annual Meeting of Shareholders. If elected, the nominees for Class I Directors will serve until the 2021 Annual Meeting of Shareholders. Additional background information regarding the nominees for election is provided below. IEA has no reason to believe that any of these nominees will refuse or be unable to serve as a director if elected; however, if any of the nominees refuses or is unable to serve, each proxy that does not direct otherwise will be voted for a substitute nominee designated by the Board.

The Board recommends that you vote “FOR” the election of each of the nominees named above. Unless otherwise indicated, all proxies will be voted “FOR” the election of each of the nominees named above for election as a Class I Director.

Information as to Nominees and Other Directors

Class I Directors

Mohsin Y. Meghji, 52, our Chairman since inception and the Chairman and Chief Executive Officer of M III from its inception until the closing of the Business Combination, has also been the Managing Partner of M-III Partners, LP (or, M-III Partners, LLP, its predecessor) since February 2014. Mr. Meghji’s career of more than 25 years has focused primarily on identifying the financial, operational and strategic changes needed to maximize value in companies at inflection points in their growth trajectories and working with the relevant constituencies to implement those changes. Mr. Meghji has accomplished this through management and advisory roles in partnership with some of the world’s leading financial institutions, private equity funds and hedge funds. Mr. Meghji’s most recent corporate role was as Executive Vice President and Head of Strategy at Springleaf, as well as Chief Executive Officer of its captive insurance companies, from January 2012 to February 2014. Springleaf was listed on the NYSE in late 2013. Prior to Springleaf, Mr. Meghji served as a Senior Managing Director at C-III Capital Partners, LLC, a real-estate focused merchant banking firm, from October to December 2011. Mr. Meghji co-founded Loughlin Meghji + Company, a privately-held financial advisory firm which became one of the leading restructuring boutiques in the United States and serves as a Principal and Managing Director there from February 2002 to October 2011. Earlier in his career, Mr. Meghji was with Arthur Andersen & Co. from 1987 to 2002 in the firm’s London, Toronto and New York offices, ultimately serving as a Partner in the Global Corporate Finance group. In Mr. Meghji’s capacity as a restructuring and financial advisory professional, he has periodically served as Chief Restructuring Officer (or in an analogous position) of companies which elected to utilize bankruptcy proceedings as a part of their financial restructuring process and, as such, he served as an executive officer of various companies which filed bankruptcy petitions under federal law, including Real Alloy Intermediate Holding, LLC in 2017 and Sears Holdings Corporation in 2018. Mr. Meghji also has periodically served as an independent director of companies which have similarly elected to utilize bankruptcy proceedings, including Philadelphia Energy Solutions Refining and Marketing LLC from August 2017 through August 2018 and Toys “R” Us since September 2017. He also has served as an independent director of Specialty Retail Shops Holding Corp. since January 2018 and Full Beauty Brands since August 2018. Mr. Meghji is a director of the Equity Group International Foundation, which provides funding for underprivileged high potential students in Kenya. Previously, Mr. Meghji served on the Board of HealthRight International from 2004 to 2012 and the Children’s Museum of Manhattan from 2013 to 2018. Mr. Meghji is a graduate of the Schulich School of Business, York University, Canada and has taken executive courses at the INSEAD School of Business in France. Mr. Meghji has previously qualified as a U.K. and Canadian Chartered Accountant as well as a U.S. Certified Turnaround Professional. Mr. Meghji is well-qualified to serve as a member of the board of directors and as a member of the Board's investment committee, audit committee, compensation committee and nomination and governance committee due to his extensive experience in business, finance and operations.

Ian Schapiro, 61, has served as a director since the closing of the Business Combination, and is a managing director and the portfolio manager for Oaktree’s GFI Energy Group, which executes the Power Opportunities investment strategy. Additionally, he leads and is a co-portfolio manager of the firm’s Infrastructure Investing strategy following Oaktree’s acquisition of the Highstar Capital team. Mr. Schapiro co-founded GFI Energy Ventures, the predecessor to the GFI Energy Group, which became part of Oaktree in 2009. He presently serves on the boards of Footprint Power SH DevCo GP LLC, Sachs Electric

Company, Remedial Construction Services (RECON) and Infrastructure & Energy Alternatives LLC. Mr. Schapiro previously served on the boards of directors of Contract Land Staff; Solomon Holdings Corp.; Osmose Holdings, Inc.; Integrated Pipeline Services; Elgin National Industries, Inc.; NORESCO; Trans-Elect, Inc.; Smart Systems International, Inc.; LPPI Holdings LLC; UtiliQuest, LLC; Trace Technology; Xantrex Technology Inc.; InfraSource Inc.; Elgar Holdings, Inc. and Cherokee International Corporation. Prior to founding GFI Energy Ventures in 1995, Mr. Schapiro was a Partner of utility consulting firm Venture Associates and of Arthur Andersen & Co. following that firm’s acquisition of Venture Associates. Previously, Mr. Schapiro was the Chief Financial Officer of a technology company and a commercial banker focused on the energy sector. Mr. Schapiro received a Bachelor of Commerce degree from the University of Witwatersrand in South Africa and an M.B.A. from the University of Southern California. Mr. Schapiro is qualified to serve as a member of the board of directors and as a member of the compensation committee and bid review committee because of his extensive financial expertise and long-term experience investing in and serving on the boards of companies active in the energy sector.

Class II Directors

John Paul Roehm, 43, has served as a our director since the closing of the Business Combination and chief executive officer and president of IEA since February 2015, and has over 20 years of heavy civil and energy engineering and construction experience in IEA’s industry ranging from Project Superintendent, Project Engineer, Estimator, Project Manager, and VP of Business Development. He was employed for over twenty years at IEA’s present Op-co, White Construction, Inc, which IEA acquired in 2011. During the period 2011 through early 2015, he guided IEA’s Business Development and corporate growth strategy and also served on IEA’s previous M&A team developing targets, performing due diligence and participating in SPA negotiations. He served a leading role on the RMT-IEA integration team during the 2013 acquisition of RMT Inc. He pioneered IEA’s expansion into renewables, which has resulted in a ten-times growth of the company over nearly as many years. In his tenure as President and CEO, the business has performed at record levels of revenue and EBITDA as well as the business attaining an industry leading market share of the wind EPC market while producing safety performance superior to IEA’s industry peers and competitors. Mr. Roehm’s holds a B.S. in Civil Engineering from the Rose-Hulman Institute of Technology. Mr. Roehm’s prior long term, senior level experience with renewable energy and his experience in developing and implementing successful corporate growth strategies in the renewable sector will make him a valuable member of the board of directors.

Terence Montgomery, 55, has served as Director and Audit Committee Chairman since the closing of the Business Combination and also served as the interim CFO of IEA from September 2014 to April 2015. In addition to IEA, Mr. Montgomery currently serves as a Director and Audit Committee Chairman of NAPEC and Remedial Construction Services, L.P. (RECON) and the same position previously for Shermco Industries, Inc. His career of over 30 years has focused on leadership roles in energy, construction and manufacturing, primarily in a corporate finance capacity. Prior to joining IEA, Mr. Montgomery served as Chief Financial Officer at InfraSource Services, Inc., where he coordinated a private equity sponsored management buy-out in 2003, an initial public offering in 2004, and subsequent follow-on stock offerings and ultimately the sale of the company to Quanta Services. Previously, Mr. Montgomery served as Director and Audit Committee Chairman of RSH Energy Holdings, LLC and Integrated Pipeline Services, Inc. and Director of Goodcents Holdings, Inc. Earlier in his career, Mr. Montgomery served as the Director of Corporate Development at Exelon and as the Senior Vice President and Chief Financial Officer for Reading Energy. Mr. Montgomery began his career as an auditor at Ernst & Young. Mr. Montgomery holds a B.S. in Accounting from The Pennsylvania State University and is a certified public accountant and a certified information systems auditor. Mr. Montgomery is qualified to serve as a member of the board of directors and the bid review committee because of his extensive financial expertise and experience in energy, construction and manufacturing.

John Eber, 67, has served as a director since September 2018, and is a recognized leader in the renewable energy investment sector, ranked fourth on the global “Top 100 Power People of 2017” list. He recently retired from his 30-year career at JPM Capital Corporation as CEO/President and currently serves on the IEA board of directors and bid review committee. He also currently serves as a Senior Advisor to Blackstone and previously has served on the AWEA board of directors from 2007 to May of 2018 and the ACORE board of directors for a portion of 2018. Throughout his tenure at JPM, Mr. Eber gained immeasurable experience in all aspects of team management, financial controls, and the renewable energy industry—and more specifically, investment analysis, capital raising, deal origination, project financing, and project development. He brings a wealth of expertise in risk management, personnel performance and development, and tax equity investments, which enables a deep understanding of business opportunities that attract developers, financial investors, and their investment/credit committees. Mr. Eber holds a Bachelor of Science in Economics from Bradley University - Foster College of Business and an MBA in Finance from DePaul University - Charles H. Kellstadt Graduate School of Business.

Class III Directors

Peter Jonna, 33, has served as a director since the closing of the Business Combination, and serves as a Senior Vice President of Oaktree Capital’s GFI Energy Group, which he joined in April 2013, and is responsible for sourcing, executing and overseeing control investments in leading companies in the energy and utility sectors. Mr. Jonna currently serves on the boards of Shoals Technologies, MaxGen Energy Services, Sterling Lumber Company, Array Technologies, and IEA. Prior to joining Oaktree, he was an investment analyst in the Americas investment team of the UBS Infrastructure Asset Management strategy, investing directly in energy, power and transportation infrastructure assets. Mr. Jonna earned an M.S. in civil engineering from Stanford University and a B.S. in civil engineering from the University of California, Los Angeles. Mr. Jonna is qualified to serve as a member of the board of directors and as a member of the investment committee because of his broad business and financial background in sourcing and investing in the energy and utility sectors and his position as a board member on multiple other companies active in the energy and utility sectors.

Derek Glanvill, 57, has served as a director since the closing of the Business Combination. Mr Glanvill has been a Senior Advisor to Oaktree’s GFI Energy Group since April 2015 and he currently serves as the Executive Chairman of certain of its Engineering & Construction portfolio companies, including Remedial Construction Services, L.P. (RECON) and Sachs Electric, as well as consultant to IEA. Prior to joining Oaktree, Mr. Glanvill served as President and Chief Operating Officer of McCarthy Holdings, where he spent more than 20 years creating and expanding high-margin businesses. Mr. Glanvill currently serves on the boards of Black & Veatch, DPR Construction, Mestek Inc. and OmegaFlex. Previously, Mr. Glanvill was senior executive at Sverdrup (now Jacobs Engineering) as well as President of a subsidiary of an international construction conglomerate based in South Africa. Mr. Glanvill received a B.S. in civil and structural engineering from the University of Natal in South Africa. Mr. Glanvill is qualified to serve as a member of the board of directors and as a member of the investment committee and bid review committee because of his business strategy experience as a senior level executive and his service as a board member for other companies in the energy and construction sector.

Charles Garner, 55, has served as director since September 2018 (and from March 2018 to May 2018), and as Managing Director and General Counsel of M-III Partners, LP since April 2015. Previously, Mr. Garner was the founder and Managing Director of Long Mountain Advisers, LLC, a financial advisory firm, from April 2014 to April 2015. Prior to that, Mr. Garner served in an of counsel capacity with Duval & Stachenfeld LLP from May 2011 to May 2014. Mr. Garner began his career at Simpson Thacher & Bartlett LLP, where he remained through partnership in the Corporate/Banking group. Mr. Garner also has served as Executive Vice President or IDT Corp. (NYSE: IDT) and as Chief Executive Officer of its IDT Ventures division, as well as Executive Managing Director of Island Capital Group, LLC. Mr. Garner holds a B.A. in Urban Studies and Political Science from the University of Pennsylvania and a J.D. from the New York University School of Law. Mr. Garner’s extensive expertise in corporate strategy, investment and the legal sector will make him a valuable member of the board of directors and of the audit committee.

Committees and Corporate Governance

Director Independence

The Board of Directors is composed of a majority of directors who satisfy the criteria for independence within the meaning of Rule 5605(a)(2) of The NASDAQ Stock Market. In determining independence, the Board of Directors affirmatively determines, among other items, whether the directors have any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Applying these independence standards, the Board of Directors has determined that Messrs. Meghji, Schapiro, Montgomery, Eber, Jonna, Glanvill and Garner are all independent directors. All of the members of the Company's Audit Committee, Nominating and Governance Committee and Compensation Committee are independent.

Committees of the Board of Directors

The standing committees of our Board currently consist of an audit committee, compensation committee, nominating and governance committee, investment committee and bid review committee. Each of the committees report to the Board as they deem appropriate and as the Board may request. The composition, duties and responsibilities of these committees are set forth below.

Audit Committee

The audit committee of the Board (the “Audit Committee”) is responsible for, among other matters: (i) reviewing and discussing with management and the independent auditor the annual audited financial statements, and recommending to the

Board whether the audited financial statements should be included in our Form 10-K; (ii) discussing with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of our financial statements; (iii) discussing with management major risk assessment and risk management policies; (iv) monitoring the independence of the independent auditor; (v) verifying the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by law; (vi) reviewing and approving all related-party transactions; (vii) inquiring and discussing with management our compliance with applicable laws and regulations; (viii) pre-approving all audit services and permitted non-audit services to be performed by our independent auditor, including the fees and terms of the services to be performed; (ix) appointing or replacing the independent auditor; (x) determining the compensation and oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work; and (xi) establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or reports which raise material issues regarding our financial statements or accounting policies. The Audit Committee consists of Messrs. Montgomery (chair), Meghji, and Garner. Our Board has adopted a written charter for the Audit Committee, which is available on the Investors page of our corporate website at ir.iea.net/corporate-governance.

The Board has determined that Messrs. Montgomery, Meghji and Garner qualify as independent directors according to the rules and regulations of the SEC with respect to audit committee membership. The Board of Directors has also determined that Mr. Montgomery qualifies as an “audit committee financial expert,” as such term is defined in Item 401(h) of Regulation S‑K (“Regulation S-K”) promulgated under Securities Act.

Compensation Committee

The compensation committee of the Board (the “Compensation Committee”) is responsible for, among other matters: (i) reviewing key employee compensation goals, policies, plans and programs; (ii) reviewing and approving the compensation of our directors, Chief Executive Officer and other executive officers; (iii) reviewing and approving employment agreements and other similar arrangements between us and our executive officers; and (iv) administering our stock plans and other incentive compensation plans. The Compensation Committee consists of Messrs. Meghji (chair) and Schapiro. Our Board has adopted a written charter for the Compensation Committee, which is available on the Investors page of our corporate website at ir.iea.net/corporate-governance.

Compensation Committee Interlocks and Insider Participation

For fiscal 2017, our Board made all compensation decisions. None of our executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Nominating and Governance Committee

The nominating and governance committee is responsible for, among other matters: (i) identifying individuals qualified to become members of our Board, consistent with criteria approved by our Board; (ii) overseeing the organization of our Board to discharge the Board’s duties and responsibilities properly and efficiently; (iii) identifying best practices and recommending corporate governance principles; and (iv) developing and recommending to our Board a set of corporate governance guidelines and principles applicable to us. The nominating and governance committee has not identified specific minimum qualifications that must be met or specific qualities or skills that must be possessed for a person to be considered as a candidate for director; however, the nominating and governance committee will seek to ensure that the Board is composed of individuals with knowledge and experience in many substantive areas that impact our business. The nominating and governance committee review these factors, and diversity, in considering candidates for directorship. We believe that all of our currently anticipated board members possess the professional and personal qualifications necessary for board service, and have highlighted in the individual biographies above the specific experience, attributes and skills that led to the conclusion that each board member should serve as a director. The nomination and governance consists of Messrs. Schapiro (chair) and Meghji. Our Board has adopted a written charter for the nominating and corporate governance committee, which is available on the Investors page of our corporate website at ir.iea.net/corporate-governance.

Investment Committee

The investment committee is responsible for approving the purchase, rent, license, exchange or other acquisition of any assets (including securities or the stock of any entity) or the disposition or divestiture of any assets. The investment committee consists of Messrs. Meghji (chair), Glanvill, Jonna, and Garner.

Bid Review Committee

The bid review committee is responsible for reviewing and approving bids for engineering, construction, and procurement projects proposed by the Company to its customers, which are larger than an amount to be determined by the Board. The bid review committee consists of Messrs. Glanvill (chair), Eber, Garner, Montgomery and Schapiro.

The Board's Leadership Structure and Role in Risk Oversight

Pursuant to the Investor Rights Agreement, dated March 26, 2018, by and among the Company, M III Sponsor I LLC and the other parties thereto, the Company agreed with M III Sponsor I LLC that, (1) during Mr. Meghji’s term as a director (through the term ending at the 2021 Annual Meeting if he is re-elected), for so long as M III Sponsor I LLC and certain of its transferees, directly or indirectly, beneficially owns any common stock, and (ii) thereafter, for so long as the M III Sponsor I LLC has the right to designate any designees pursuant to the Investor Rights Agreement, Mr. Meghji shall be the Chairman of the Board. The Board believes that the separation of the roles of Chairman and Chief Executive Officer best serves the interests of shareholders because it allows our Chief Executive Officer to focus primarily on our business strategy and operations and most effectively leverages the experience of the Chairman. It also enhances the Board’s independent oversight of our senior management team and enables better communications and relations between the Board, the Chief Executive Officer and other senior management. In that regard, our independent Chairman presides over the executive sessions of the non-management and independent directors of the Board.

Consistent with its responsibility for oversight of the Company, the Board of Directors, among other things, oversees risk management of the Company’s business affairs directly and through the committee structure that it has established.

The Board’s role in the Company's risk oversight process includes regular reports from senior management on areas of material risk to the Company, including operational, financial, legal and regulatory, and strategic and reputational risks. The full Board (or the appropriate committee) receives these reports from management to identify and discuss such risks. The Board periodically reviews with management its strategies, techniques, policies and procedures designed to manage these risks. Under the overall supervision of the Board of Directors, management has implemented a variety of processes, procedures and controls to address these risks.

The Board requires management to report to the full Board on a variety of matters at regular meetings of the Board and on an as-needed basis, including the performance and operations of the Company and other matters relating to risk management. The Audit Committee also receives regular reports from the Company's independent registered public accounting firm on internal control and financial reporting matters. These reviews are conducted in conjunction with the Board’s risk oversight function and enable the Board to review and assess any material risks facing the Company.

Board Participation

Prior to the Business Combination, the board of directors of M III consisted of four directors: Mr. Meghji, Andrew L. Farkas, Osbert Hood and Philip Marber, each of whom (with the exception of Mr. Meghji) resigned upon the consummation of the Business Combination. The board of directors of M III held seven meetings in fiscal 2017. During fiscal 2017, each of the directors of M III attended at least a majority of the board meetings and of the committees on which he served.

Code of Ethics

We have adopted a Code of Ethics applicable to our directors, executive officers and employees that complies with the rules and regulations of the NASDAQ. The Code of Ethics codifies the business and ethical principles that govern all aspects of our business. Copies of the Code of Ethics is available on the Investors page of our corporate website at ir.iea.net/corporate-governance.

Communications with the Board of Directors

Interested parties wishing to communicate with the Board or with an individual member or members of the Board may do so by writing to the Board or to the particular member or members of the Board, and mailing the correspondence to Infrastructure and Energy Alternatives, Inc., 6325 Digital Way, Suite 460, Indianapolis, IN 46278. Each communication should set forth (i) the name and address of the shareholder as it appears in our register, and if the shares of Common Stock are held by a nominee, the name and address of the beneficial owner of such shares, and (ii) the number of shares of Common Stock that are owned of record by the record holder and beneficially by the beneficial owner.

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Deloitte & Touche LLP (“Deloitte”), an independent registered public accounting firm, to audit our consolidated financial statements for our fiscal year ending December 31, 2018, and recommends that shareholders vote in favor of the ratification of such appointment. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. We anticipate that representatives of Deloitte will participate in the Annual Meeting, will have the opportunity to make a statement if they desire, and will be available to respond to appropriate questions.

During fiscal 2017, Crowe Horwath LLP (“Crowe”) served as the independent registered public accounting firm of IEA, our accounting predecessor.

Notwithstanding the appointment of Deloitte and even if our shareholders ratify the appointment, the Audit Committee, in its discretion, may appoint another independent registered public accounting firm at any time if the Audit Committee believes that such a change would be in the best interests of the Company and its shareholders. At the Annual Meeting, our shareholders are being asked to ratify the appointment of Deloitte as our independent registered public accounting firm for fiscal 2018. The Audit Committee is submitting the appointment of Deloitte to our shareholders because we value our shareholders’ views on our independent registered public accounting firm and as a matter of good corporate governance.

The ratification of the appointment of Deloitte requires the affirmative vote of a majority of our Common Stock by proxy at the Annual Meeting and entitled to vote thereon. Abstentions and broker non-votes will have the effect of a vote AGAINST the proposal.

Audit and Related Fees

The following table presents fees for professional audit services and other services rendered to us by Crowe for fiscal 2017 and fiscal 2016:

|

| | | | | | |

| Type of Fees | Fiscal 2017 ($) | Fiscal 2016 ($) |

| Audit Fees (1) | $ | 583,220 |

| $ | 801,592 |

|

| Audit-Related Fees | — |

| — |

|

| Tax Fees | — |

| — |

|

| Other Fees | — |

| — |

|

| Total audit and related fees | $ | 583,220 |

| $ | 801,592 |

|

| |

| (1) | Audit fees include (i) fees associated with the audits of IEA’s consolidated financial statements prior to the Business Combination; (ii) reviews of IEA’s interim quarterly consolidated financial statements. |

Auditor Independence

The Audit Committee has considered whether the provision of the above-noted services is compatible with maintaining the auditor’s independence and has determined that the provision of such services has not adversely affected the auditor’s independence.

Policy and Audit Committee Pre-Approval of Audit and Permitted Non-Audit Services

The Audit Committee has established policies and procedures regarding the pre-approval of audit and other services that our independent auditor may perform for us, subject to the rules and regulations of the SEC, which provide that certain non-audit services accounting for less than five percent of the total fees paid to the independent auditor be approved by the Audit Committee retroactively. In accordance with the charter of the Audit Committee, approval can be made by the chairman of the Audit Committee (or any member of the Audit Committee if the chairman is not available) in between committee meetings and is required to disclose the pre-approved services to the Audit Committee at the next scheduled meeting.

On April 19, 2018, we dismissed Crowe as the Company’s independent registered public accounting firm and subsequently engaged Deloitte as the Company’s independent registered public accounting firm for the Company’s fiscal year ended December 31, 2018, effective immediately. The change in the Company’s independent auditor was approved by the Audit Committee.

Crowe’s audit reports on the IEA Energy Services, LLC consolidated financial statements as of and for the fiscal years ended December 31, 2017 and 2016 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2017, and 2016, and the subsequent interim periods through April 19, 2018, there were (i) no disagreements (as described in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and Crowe on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to Crowe’s satisfaction, would have caused Crowe to make reference thereto in their reports on the financial statements for such years, and (ii) no “reportable events” within the meaning of Item 304(a)(1)(v) of Regulation SK, except that Crowe advised the Company of the existence of material weaknesses as of December 31, 2017 and 2016, respectively, relating to the Company not yet developing an entity level and financial reporting control environment that is designed with appropriate precision, including (i) accounting personnel with an appropriate level of accounting knowledge, experience, and training commensurate with complex accounting issues and financial reporting requirements, (ii) adequate procedures to prepare, document and review areas of significant judgments and accounting estimates, revenue recognition, and accruals (iii) timely and systematic review by management of journal entries.

We have implemented a remediation plan, which included the hiring of an experienced Chief Accounting Officer and a Director of SEC Reporting, and engaged a big four accounting firm to assist in the implementation of effective internal controls over financial reporting and disclosure controls and procedures. There is no assurance that the measures We have taken to date, or any measures the combined company may take in the future, will be sufficient to remediate the material weaknesses described above or to avoid potential future material weaknesses.

During the fiscal years ended December 31, 2017 and 2016, and the subsequent interim periods through April 19, 2018, neither the Company nor anyone acting on its behalf has consulted with Deloitte regarding (i) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements or the effectiveness of internal control over financial reporting, and neither a written report or oral advice was provided to the Company that Deloitte concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, (ii) any matter that was the subject of a disagreement within the meaning of Item 304(a)(1)(iv) of Regulation S-K, or (iii) any reportable event within the meaning of Item 304(a)(1)(v) of Regulation S-K.

The Board of Directors recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee operates under a written charter approved by the Board of Directors, which is available on the Investors page of our corporate website at ir.iea.net/corporate-governance. The composition of the Audit Committee, the attributes of its members and the responsibilities of the Audit Committee, as reflected in its charter, are intended to be in accordance with applicable requirements for corporate audit committees. The Audit Committee reviews and assesses the adequacy of its charter and the Audit Committee’s performance on an annual basis.

With respect to the Company’s financial reporting process, the management of the Company is responsible for (1) establishing and maintaining internal controls and (2) preparing the Company’s consolidated financial statements. Our 2017 independent registered public accounting firm, Crowe, was responsible for auditing these financial statements. It is the responsibility of the Audit Committee to oversee these activities. It is not the responsibility of the Audit Committee to prepare our financial statements. These are the fundamental responsibilities of management. In the performance of its oversight function, the Audit Committee has:

| |

| • | reviewed and discussed the audited financial statements with management and previous auditor Crowe; |

| |

| • | discussed with Crowe the matters required to be discussed by the statement on Auditing Standards No. 1301, “Communications with Audit Committees” issued by the Public Company Accounting Oversight Board; and |

| |

| • | received the written disclosures and the letter from Crowe required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant's communications with the audit committee concerning independence, and has discussed with Crowe its independence. |

Based on the Audit Committee’s review and discussions with management and Crowe, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report.

Respectfully submitted by the members of the Audit Committee of the Board of Directors:

Terence Montgomery (Chair)

Mohsin Meghji

Charles Garner

This report of the Audit Committee is required by the SEC and, in accordance with the rules and regulations of the SEC, will not be deemed to be part of, or incorporated by reference by any general statement incorporating by reference to, this Proxy Statement into any filing under the Securities Act of 1933 as amended (the “Securities Act”), or under the Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed “soliciting material” or “filed” under either the Securities Act or the Exchange Act.

EXECUTIVE OFFICERS

Below is a list of names, ages and a brief overview of the business experience of our executive officers:

|

| | |

| Name | Age | Position/Title |

| John Paul Roehm | 42 | President and Chief Executive Officer |

| Andrew D. Layman | 50 | Chief Financial Officer |

| Chris Hanson | 49 | Executive Vice President of Wind Operations |

| Bharat Shah | 61 | Chief Accounting Officer |

John Paul (“JP”) Roehm. See “Information as to Nominees and Other Directors” for Mr. Roehm's biography.

Andrew D. Layman has served as Chief Financial Officer of IEA since April 2015. From December 2012 to April 2015, Mr. Layman served as CFO at Ferrovial, a “stand-alone” large, newly acquired, heavy construction and engineering services division for South America, located in Chile, which provides construction and mining services to the world’s largest mines. Mr. Layman brings over 28 years of experience in many industries, including construction, energy, mining, consumer products, manufacturing, bio-medical and automotive. As the Chief Financial Officer, he is responsible for overseeing the accounting, finance, human resource, and information technology departments of the Company. Mr. Layman began his career at PwC, where he earned his CPA. While at PwC, he managed multiple SEC reporting engagements, including the firm’s largest customer: the Ford Motor Company. He was the divisional CFO for Flextronics, overseeing a $6 billion dollar, high-growth product development and manufacturing division. He led the acquisition and integration of multiple companies in different parts of the world ranging in size from $50 million to $700 million dollars.

Chris Hanson has served as Executive Vice President of Wind Operations of IEA since March 2, 2015. Prior to that, Mr. Hanson served as the Senior Vice President of Operations of our White Construction division since joining the Company in 2004. Mr. Hanson has over 25 years of constructions and engineering experience in the heavy civil, energy and manufacturing markets. As the Executive Vice President of Wind Operations, he is responsible for establishing and maintaining clear business operations direction based on market research, backlog, client feedback, economic outlook, political climate, and company balance sheet vitality. Prior to joining IEA, Chris served as Chief Estimator and Business Development Manager for O’Neil Brothers Construction, as well as Project Engineer and Project Manager for Kokosing Construction Co., Inc. His experience with project execution and estimating provides a solid understanding of the importance of keeping safety, quality, and cost control at the forefront of management accountability in the field.

Bharat Shah has served as Chief Accounting Officer of IEA since November 2017. From April 2014 to October 2017, Mr. Shah served as the Corporate Controller of TerraForm Power, Inc. which owns and operates a diversified portfolio of solar and wind assets located in North America and Western Europe. Mr. Shah brings over 30 years of experiences in many industries, including energy and construction. As the Cheif Accounting Officer, he is responsible for overseeing the financial reporting, tax compliance, internal audit, project controls, payroll and day-to-day accounting functions. Mr. Shah also held various executive positions at NRG Energy, Inc., managerial positions at Mastercard, Inc., Exelon Corp. and Deloitte & Touche.

Family Relationships

There are no family relationships between any of our executive officers or directors.

EXECUTIVE COMPENSATION

The following section provides compensation information of IEA pursuant to the scaled disclosure rules applicable to “emerging growth companies” under the rules of the SEC and may contain statements regarding future individual and company performance targets and goals. These targets and goals are disclosed in the limited context of our executive compensation program and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts. For purposes of “Executive Compensation” “we,” “us,” and “our” refer to IEA Services and, following the Business Combination, the post-combination company.

Overview

Our “Named Executive Officers” for the year ended December 31, 2017 include John Paul Roehm, our Chief Executive Officer, and Chris Hanson and Andrew Layman, our two most highly compensated executive officers other than our current Chief Executive Officer who were serving as executive officers as of December 31, 2017 (collectively, the “Named Executive Officers”). Our compensation policies and philosophies are designed to align compensation with business objectives and the creation of shareholder value, while also enabling us to attract, motivate and retain individuals who contribute to our long-term success. We believe our executive compensation program must be competitive in order to attract and retain executive officers. We seek to implement compensation policies and philosophies by linking a significant portion of executive officers’ cash compensation to performance objectives and have historically provided a portion of their compensation as long-term incentive compensation in the form of equity awards in IEA.

For Fiscal 2017 and Fiscal 2016, the compensation of our Named Executive Officers has consisted of a base salary, an annual cash incentive bonus, equity compensation in IEA and health and welfare benefits. Pursuant to their employment agreements, the Named Executive Officers are also eligible to receive certain payments and benefits upon a termination of employment under certain circumstances. Each of our Named Executive Officers, along with certain other members of our management, have been given the opportunity to receive grants of equity in IEA pursuant to the Infrastructure and Energy Alternatives, LLC 2011 Profits Interest Unit Incentive Plan, as amended (the “Profits Interest Plan”), and the Fourth Amended and Restated Limited Liability Company Agreement of Infrastructure and Energy Alternatives, LLC, dated as of February 22, 2017, as amended from time to time (the “IEA LLC Agreement”) as further described below. IEA established the Profits Interest Plan to align the interests of our executive officers and management investors with those of its other equity investors and to encourage our executive officers and management investors to continue to operate the business in a manner that enhances our equity value. The board of managers of IEA, which was controlled by our principal shareholder, Oaktree Power Opportunities Fund III Delaware, L.P. (“Oaktree”), has historically determined all of the components of compensation of our executive officers.

The Company plans to undertake a re-evaluation of its compensation policies for fiscal 2019, which may, among other things, include hiring a third party compensation consultant to assist in determining market compensation at peer level companies.

Summary Compensation Table

The following table presents summary information regarding the total compensation for the years ended December 31, 2017 and 2016 for the Named Executive Officers.

|

| | | | | | | | | | | | | | | | |

| Name and Principal Position | Year | Salary | Stock Awards (1) | Non-Equity Plan Compensation | All Other Compensation (2) | Total |

| JP Roehm CEO | 2017 | $ | 364,167 |

| $ | — |

| $ | 410,478 |

| $ | 30,961 |

| $ | 805,606 |

|

| | 2016 | 310,100 |

| 22,640 |

| 1,713,330 |

| 34,787 |

| 2,080,857 |

|

| Andrew Layman CFO | 2017 | 298,333 |

| — |

| 207,602 |

| 32,906 |

| 538,841 |

|

| | 2016 | 275,000 |

| 16,465 |

| 1,214,490 |

| 35,502 |

| 1,541,457 |

|

| Chris Hanson EVP - Wind | 2017 | 298,333 |

| — |

| 268,202 |

| 29,210 |

| 595,745 |

|

| | 2016 | 275,000 |

| 16,465 |

| 1,236,240 |

| 27,390 |

| 1,555,095 |

|

| |

| (1) | Represents the grant date fair value of such awards as determined in accordance with ASC Topic 718 with respect to the 17,530,117.47, 12,749,176.34 and 12,749,176.34 Class B Profits Units granted to Messrs. Roehm, Hanson and |

Layman, respectively. The accounting assumptions were an exercise price of $0, risk free rate of interest of 1.19%, a term of 5 years and expected stock price volatility of 60%. These shares and the plan was cancelled and all shares forfeited as part of the Company going public.

| |

| (2) | Represents all other compensation paid to or earned by the Named Executive Officers, as provided in the chart below: |

|

| | | | | | | | | | | | | | | | | | |

| Name and Principal Position | 401K Company Match | Company Car (1) | Executive Life Insurance Imputed Income | 2017 Employer Costs of Insurance (Liability) | Company HSA Contribution | Total |

| JP Roehm CEO | $ | 10,800 |

| $ | 3,254 |

| $ | 424 |

| $ | 14,713 |

| $ | 1,500 |

| $ | 30,691 |

|

| Andrew Layman CFO | 10,800 |

| 5,082 |

| 811 |

| 14,713 |

| 1,500 |

| 32,906 |

|

| Chris Hanson EVP - Wind | 10,800 |

| 1,758 |

| 439 |

| 14,713 |

| 1,500 |

| 29,210 |

|

| |

| (1) | These amounts represents personal use of IEA's leased vehicles and car allowance. |

Salary

The Named Executive Officers receive a base salary to compensate them for services rendered to our company. The base salary payable to each Named Executive Officer is intended to provide a fixed component of compensation reflecting the executive’s skill set, experience, position and responsibilities.

Non-Equity Plan Compensation

Pursuant to the terms of their employment agreements, our Named Executive Officers are eligible to receive cash bonuses based the performance of IEA and its subsidiaries. Historically, the board of managers of IEA has set performance targets at the beginning of each fiscal year and has communicated these targets to our Named Executive Officers. Our performance bonus targets are based on the achievement of adjusted EBITDA targets. Pursuant to IEA’s 2017 annual cash incentive bonus plan (the “2017 Plan”), if adjusted EBITDA was less than $32 million, then no payout would be made, unless otherwise approved by the board of managers of Infrastructure and Energy Alternatives, LLC, the direct parent entity of IEA prior to the closing of the Business Combination (“IEA Parent”). If adjusted EBITDA was equal to $42.4 million, then the 2017 Plan would be funded at the maximum payout as set forth in the executives’ employment agreements. In addition, the board of managers of IEA Parent approved an additional pool whereby 10% of each dollar of adjusted EBITDA in excess of $42.4 million would be credited to the 2017 Plan (the “Incremental Pool”) and Messrs. Roehm, Layman and Hanson would be entitled to 27.5%, 20% and 20%, respectively, of the Incremental Pool. For 2017, IEA achieved adjusted EBITDA of $52,500,000 and Messrs. Roehm, Layman and Hanson received cash bonuses for 2017 of $410,478, $207,602 and $268,202, respectively. Adjusted EBITDA means earnings before income, taxes, depreciation and amortization excluding any restructuring charges related to IEA’s discontinued Canadian operations or Northern Power Industries and any board related fees, bonuses, expenses or charges, and adjusted by other gains or losses from extraordinary, unusual or nonrecurring items.

2017 Employment Agreements

IEA Management Services, Inc. (“IEA Management Services”), a subsidiary of IEA was party to employment agreements with our executives. JP Roehm entered into an employment agreement dated March 2, 2015 with IEA Management Services to provide services to IEA and its affiliates. Pursuant to the employment agreement, Mr. Roehm was employed on an at will basis and was initially employed as the President and Head of Business Development. Mr. Roehm was then promoted to Chief Executive Officer and has served in such role for the duration of fiscal year 2017. Pursuant to his employment agreement, Mr. Roehm’s annual base salary for fiscal year 2017 was $375,000 and his target annual bonus for 2017 was 130% of base salary with no maximum. Pursuant to his employment agreement, Mr. Roehm was also entitled to standard company benefits, vacation and reimbursement of expenses in connection with company policy.

If Mr. Roehm’s employment was terminated by IEA Management Services without “cause” or if he resigned for “good reason”, then he was eligible to receive severance equal to 12 months base salary plus $1,000 per month, payable over 12 months. The severance was conditioned on his execution of a release of claims in favor of IEA Management Services, as well as continuing to abide by his post-employment restrictive covenants including a 12 month non-compete, 12 month non-solicit and non-

disparagement. In addition, the severance payments would cease if he accepted employment or a similar relationship with compensation equal to at least 80% of his base salary.

Chris Hanson entered into an employment agreement dated March 2, 2015 with IEA Management Services. Pursuant to the employment agreement, Mr. Hanson was employed on at at-will basis and was initially employed as the Executive Vice President of IEA Wind. Mr. Hanson’s annual base salary was $300,000 and his target annual bonus for 2017 was 110% of base salary with no maximum. As noted above, IEA’s board of managers removed the cap on maximum bonus amounts. Pursuant to his employment agreement, Mr. Hanson was also entitled to standard company benefits, vacation and reimbursement of expenses in connection with company policy.

If Mr. Hanson’s employment was terminated by IEA Management Services without “cause” or if he resigned for “good reason”, then he was eligible to receive severance equal to 12 months base salary plus $1,000 per month, payable over 12 months. The severance was conditioned on his executing a release of claims in favor of IEA Management Services, as well as continuing to abide by his post-employment restrictive covenants including a 12 month non-compete, 12 month non-solicit and non-disparagement. In addition, the severance payments would cease if he accepted employment or a similar relationship with compensation equal to at least 80% of his base salary.

Andrew Layman entered into an employment agreement dated September 25, 2015 with IEA Management Services. Pursuant to the employment agreement, Mr. Layman was employed on an at-will basis and was initially employed as the Vice President and Chief Financial Officer. Mr. Layman’s annual base salary for 2017 was $300,000 and his target annual bonus was 60% of base salary. Pursuant to his employment agreement, he was entitled to standard company benefits, vacation and reimbursement

of expenses in connection with company policy. Mr. Layman was also entitled to receive a monthly vehicle allowance of $800.

If Mr. Layman’s employment was terminated by IEA Management Services without “cause” or if he resigns for “good reason”, then he would be eligible to receive severance equal to 12 months base salary, payable over 12 months. The severance was conditioned on his executing a release of claims in favor of IEA Management Services, as well as continuing to abide by his post-employment restrictive covenants, including a six month non-compete, six month non-solicit and non-disparagement.

For purposes of the employment agreements described above, “cause” means (i) the willful failure to perform executive’s duties with the company, (ii) the willful engaging in misconduct materially injurious to the company, (iii) executive’s commission of a crime involving any financial impropriety or which would materially interfere with executive’s ability to perform executive’s services for the company or otherwise be injurious to the company if known publicly; or (iv) executive’s material breach of his employment agreement.