William Charles LTD and William Charles Purchasing, Inc. Combined Financial Report December 31, 2017

Contents Independent Auditor’s Report 1 Combined Financial Statements Combined balance sheets 2-3 Combined statements of income 4 Combined statements of comprehensive income 5 Combined statements of changes in equity 6 Combined statements of cash flows 7-8 Notes to combined financial statements 9-22

Independent Auditor's Report Board of Directors William Charles LTD Report on the Financial Statements We have audited the accompanying combined financial statements of William Charles LTD and William Charles Purchasing, Inc. (together, the Company), which comprise the combined balance sheets as of December 31, 2017 and 2016, the combined statements of income, comprehensive income, changes in equity, and cash flows for the years ended December 31, 2017, 2016 and 2015, and the related notes to the combined financial statements (collectively, the financial statements). Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of William Charles LTD and William Charles Purchasing, Inc. as of December 31, 2017 and 2016, and the results of their operations and their cash flows for the years ended December 31, 2017, 2016 and 2015 in accordance with accounting principles generally accepted in the United States of America. Rockford, Illinois November 2, 2018 1

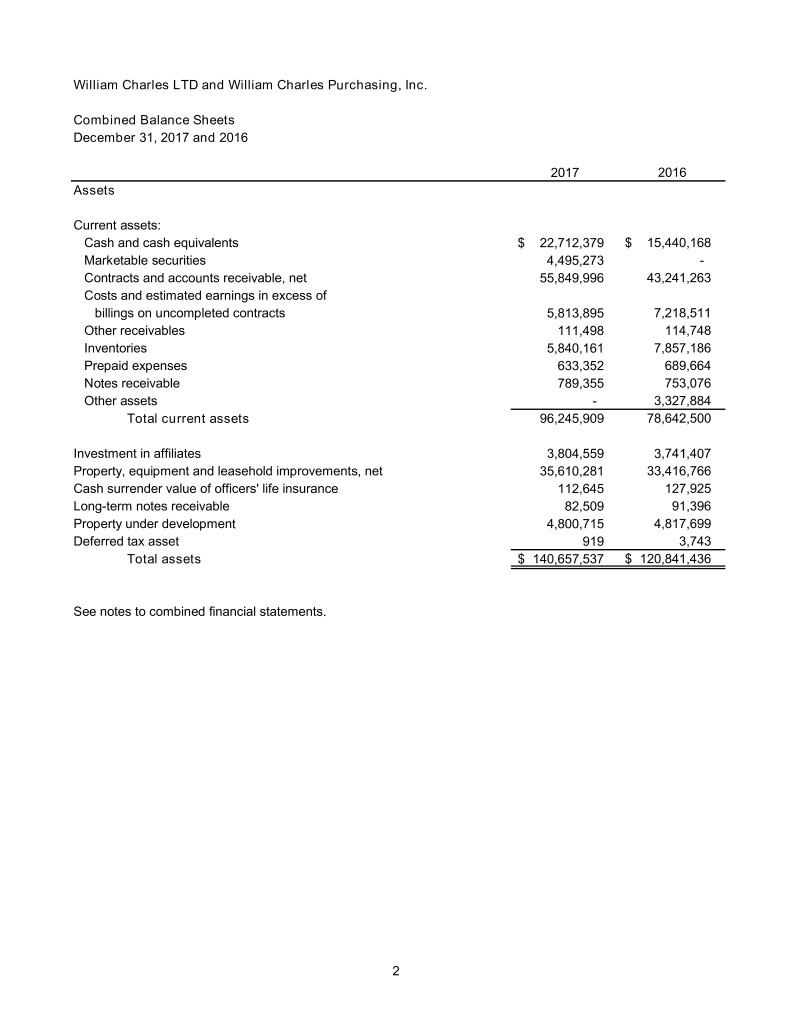

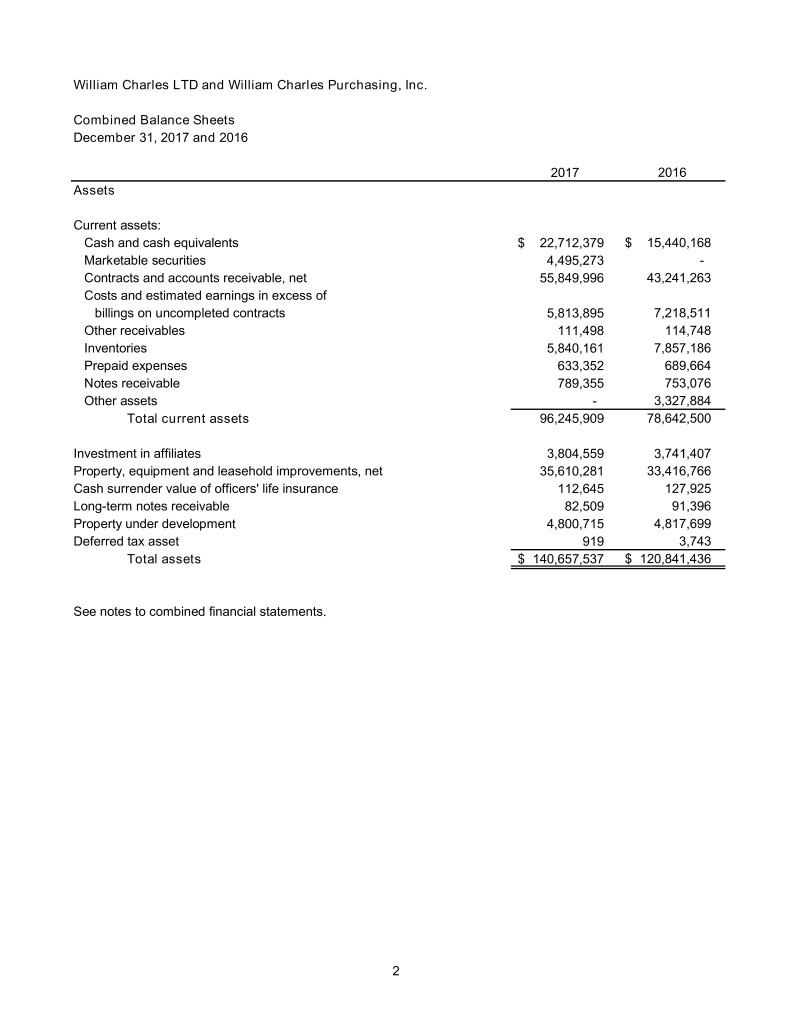

William Charles LTD and William Charles Purchasing, Inc. Combined Balance Sheets December 31, 2017 and 2016 2017 2016 Assets Current assets: Cash and cash equivalents $ 22,712,379 $ 15,440,168 Marketable securities 4,495,273 - Contracts and accounts receivable, net 55,849,996 43,241,263 Costs and estimated earnings in excess of billings on uncompleted contracts 5,813,895 7,218,511 Other receivables 111,498 114,748 Inventories 5,840,161 7,857,186 Prepaid expenses 633,352 689,664 Notes receivable 789,355 753,076 Other assets - 3,327,884 Total current assets 96,245,909 78,642,500 Investment in affiliates 3,804,559 3,741,407 Property, equipment and leasehold improvements, net 35,610,281 33,416,766 Cash surrender value of officers' life insurance 112,645 127,925 Long-term notes receivable 82,509 91,396 Property under development 4,800,715 4,817,699 Deferred tax asset 919 3,743 Total assets $ 140,657,537 $ 120,841,436 See notes to combined financial statements. 2

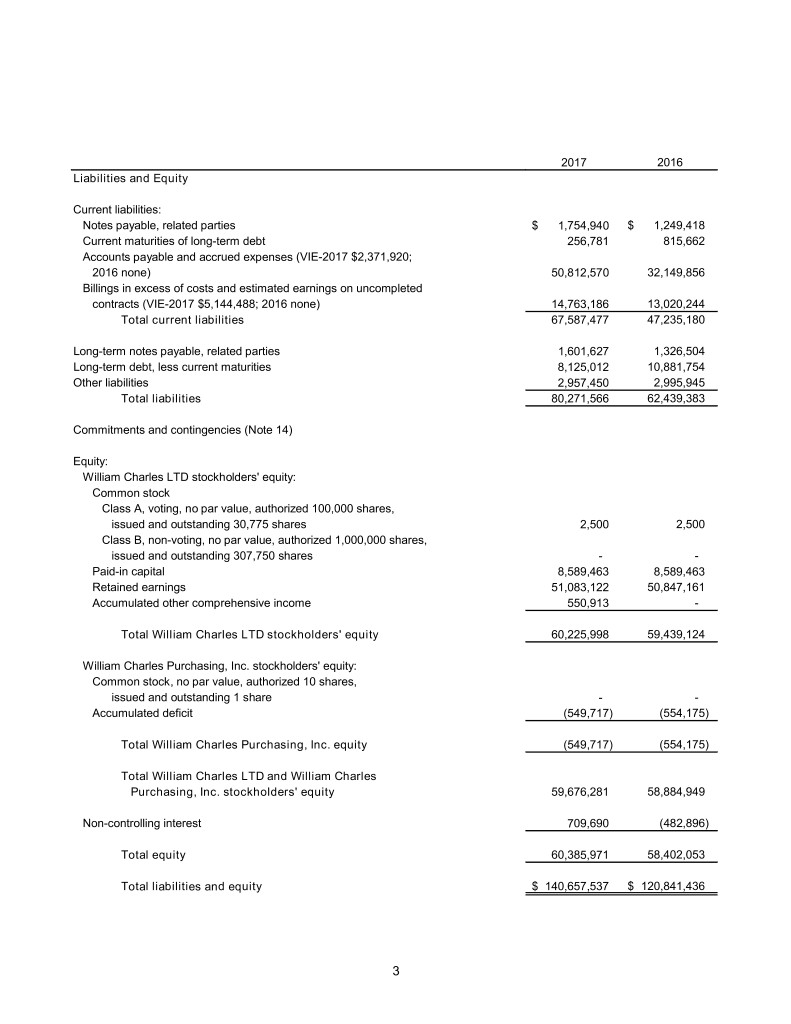

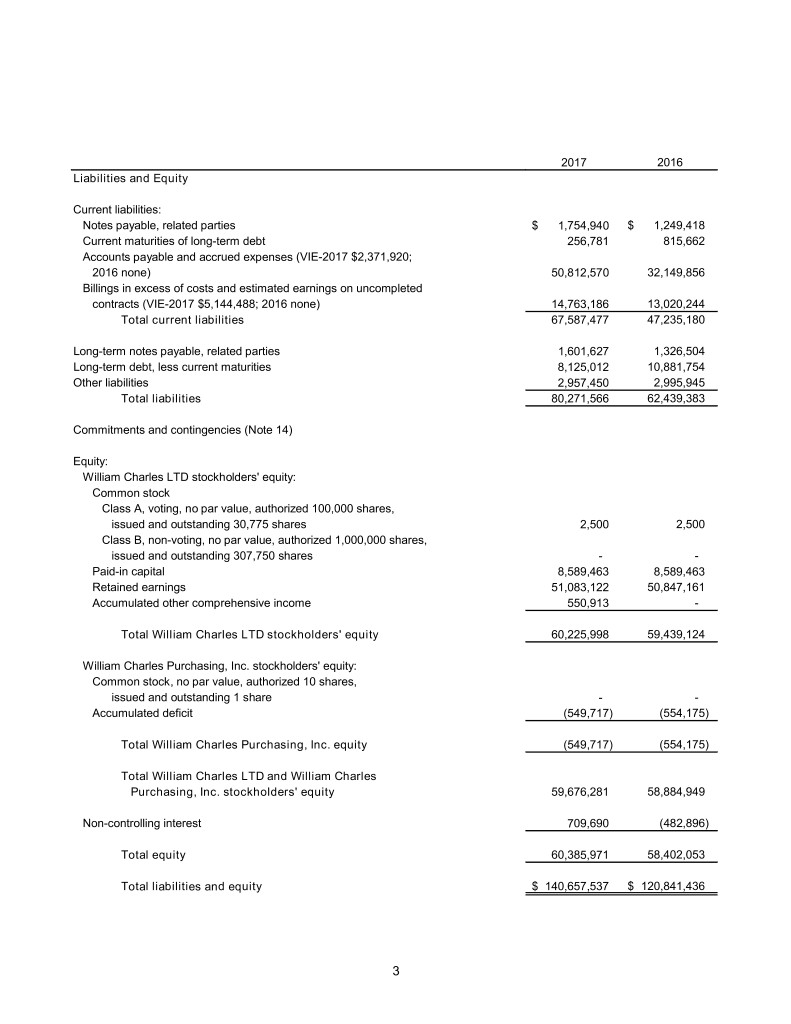

2017 2016 Liabilities and Equity Current liabilities: Notes payable, related parties $ 1,754,940 $ 1,249,418 Current maturities of long-term debt 256,781 815,662 Accounts payable and accrued expenses (VIE-2017 $2,371,920; 2016 none) 50,812,570 32,149,856 Billings in excess of costs and estimated earnings on uncompleted contracts (VIE-2017 $5,144,488; 2016 none) 14,763,186 13,020,244 Total current liabilities 67,587,477 47,235,180 Long-term notes payable, related parties 1,601,627 1,326,504 Long-term debt, less current maturities 8,125,012 10,881,754 Other liabilities 2,957,450 2,995,945 Total liabilities 80,271,566 62,439,383 Commitments and contingencies (Note 14) Equity: William Charles LTD stockholders' equity: Common stock Class A, voting, no par value, authorized 100,000 shares, issued and outstanding 30,775 shares 2,500 2,500 Class B, non-voting, no par value, authorized 1,000,000 shares, issued and outstanding 307,750 shares - - Paid-in capital 8,589,463 8,589,463 Retained earnings 51,083,122 50,847,161 Accumulated other comprehensive income 550,913 - Total William Charles LTD stockholders' equity 60,225,998 59,439,124 William Charles Purchasing, Inc. stockholders' equity: Common stock, no par value, authorized 10 shares, issued and outstanding 1 share - - Accumulated deficit (549,717) (554,175) Total William Charles Purchasing, Inc. equity (549,717) (554,175) Total William Charles LTD and William Charles Purchasing, Inc. stockholders' equity 59,676,281 58,884,949 Non-controlling interest 709,690 (482,896) Total equity 60,385,971 58,402,053 Total liabilities and equity $ 140,657,537 $ 120,841,436 3

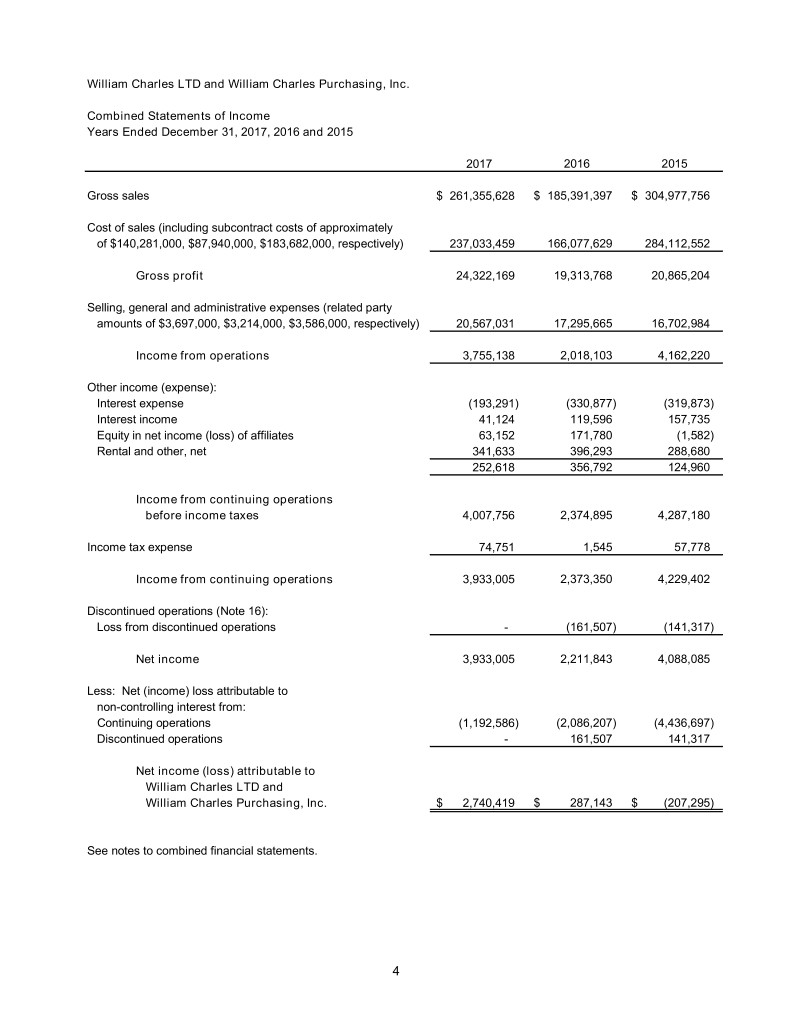

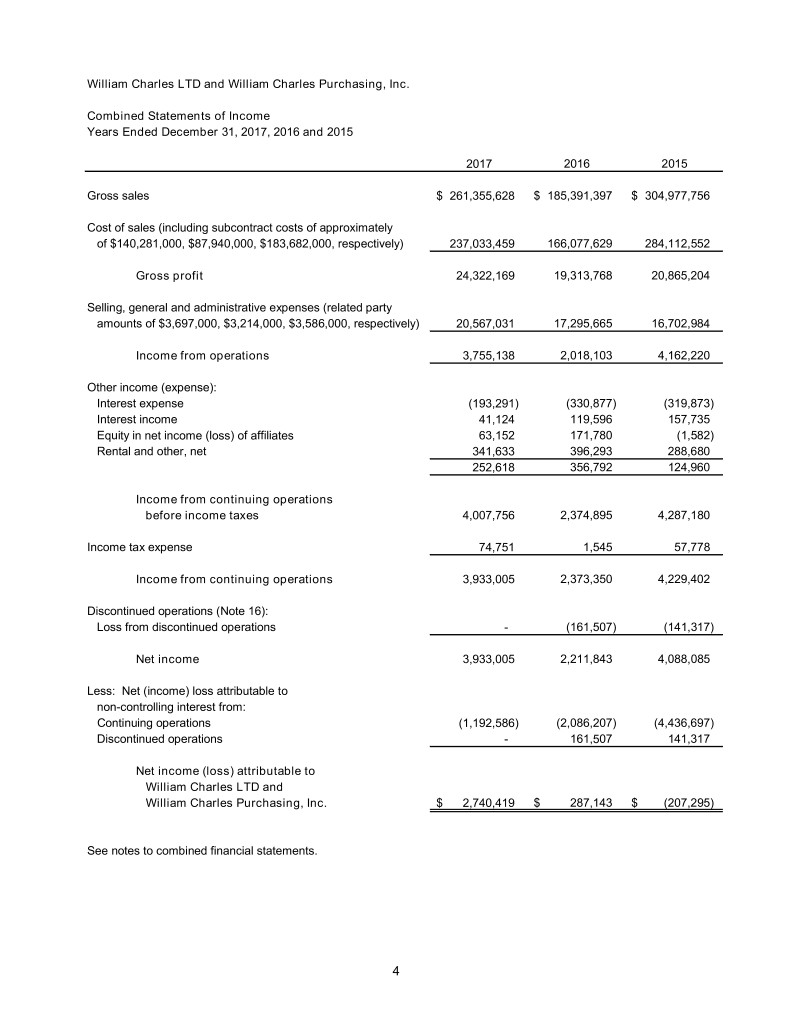

William Charles LTD and William Charles Purchasing, Inc. Combined Statements of Income Years Ended December 31, 2017, 2016 and 2015 2017 2016 2015 Gross sales $ 261,355,628 $ 185,391,397 $ 304,977,756 Cost of sales (including subcontract costs of approximately of $140,281,000, $87,940,000, $183,682,000, respectively) 237,033,459 166,077,629 284,112,552 Gross profit 24,322,169 19,313,768 20,865,204 Selling, general and administrative expenses (related party amounts of $3,697,000, $3,214,000, $3,586,000, respectively) 20,567,031 17,295,665 16,702,984 Income from operations 3,755,138 2,018,103 4,162,220 Other income (expense): Interest expense (193,291) (330,877) (319,873) Interest income 41,124 119,596 157,735 Equity in net income (loss) of affiliates 63,152 171,780 (1,582) Rental and other, net 341,633 396,293 288,680 252,618 356,792 124,960 Income from continuing operations before income taxes 4,007,756 2,374,895 4,287,180 Income tax expense 74,751 1,545 57,778 Income from continuing operations 3,933,005 2,373,350 4,229,402 Discontinued operations (Note 16): Loss from discontinued operations - (161,507) (141,317) Net income 3,933,005 2,211,843 4,088,085 Less: Net (income) loss attributable to non-controlling interest from: Continuing operations (1,192,586) (2,086,207) (4,436,697) Discontinued operations - 161,507 141,317 Net income (loss) attributable to William Charles LTD and William Charles Purchasing, Inc. $ 2,740,419 $ 287,143 $ (207,295) See notes to combined financial statements. 4

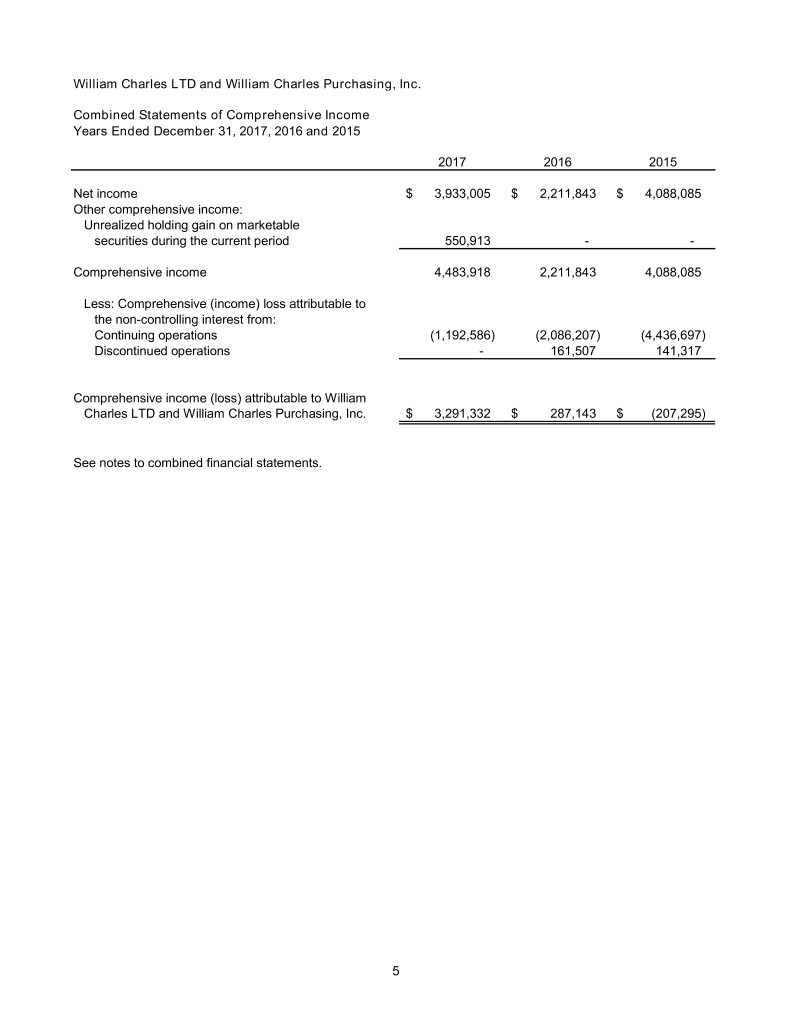

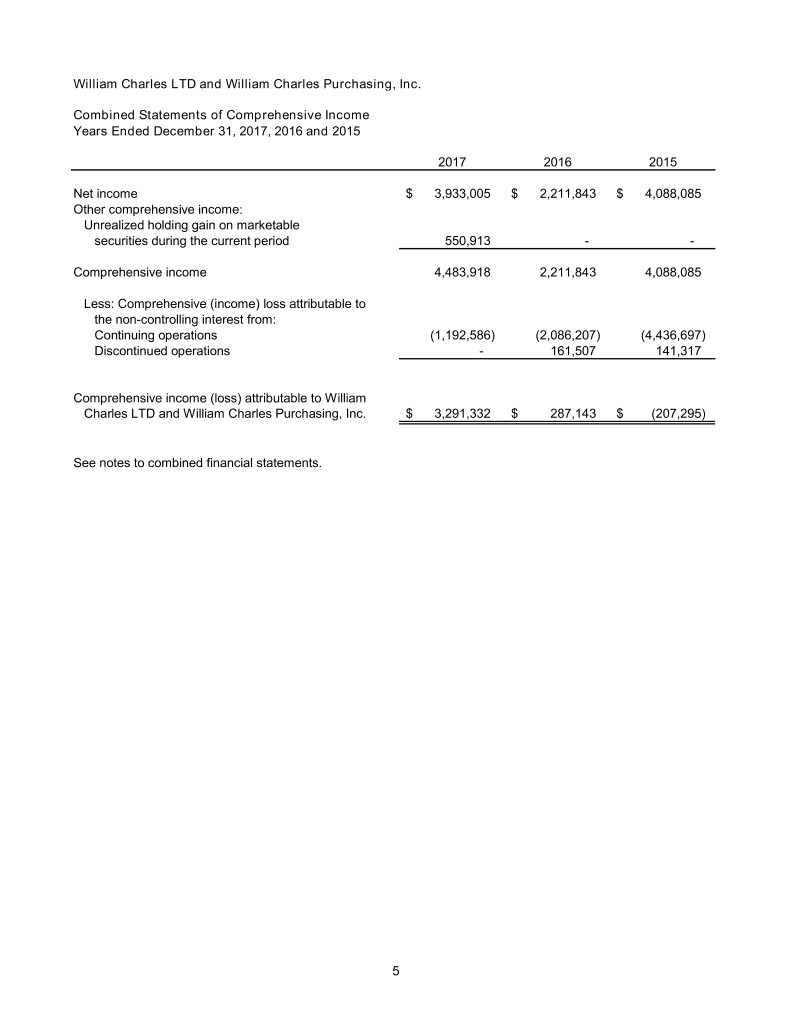

William Charles LTD and William Charles Purchasing, Inc. Combined Statements of Comprehensive Income Years Ended December 31, 2017, 2016 and 2015 2017 2016 2015 Net income $ 3,933,005 $ 2,211,843 $ 4,088,085 Other comprehensive income: Unrealized holding gain on marketable securities during the current period 550,913 - - Comprehensive income 4,483,918 2,211,843 4,088,085 Less: Comprehensive (income) loss attributable to the non-controlling interest from: Continuing operations (1,192,586) (2,086,207) (4,436,697) Discontinued operations - 161,507 141,317 Comprehensive income (loss) attributable to William Charles LTD and William Charles Purchasing, Inc. $ 3,291,332 $ 287,143 $ (207,295) See notes to combined financial statements. 5

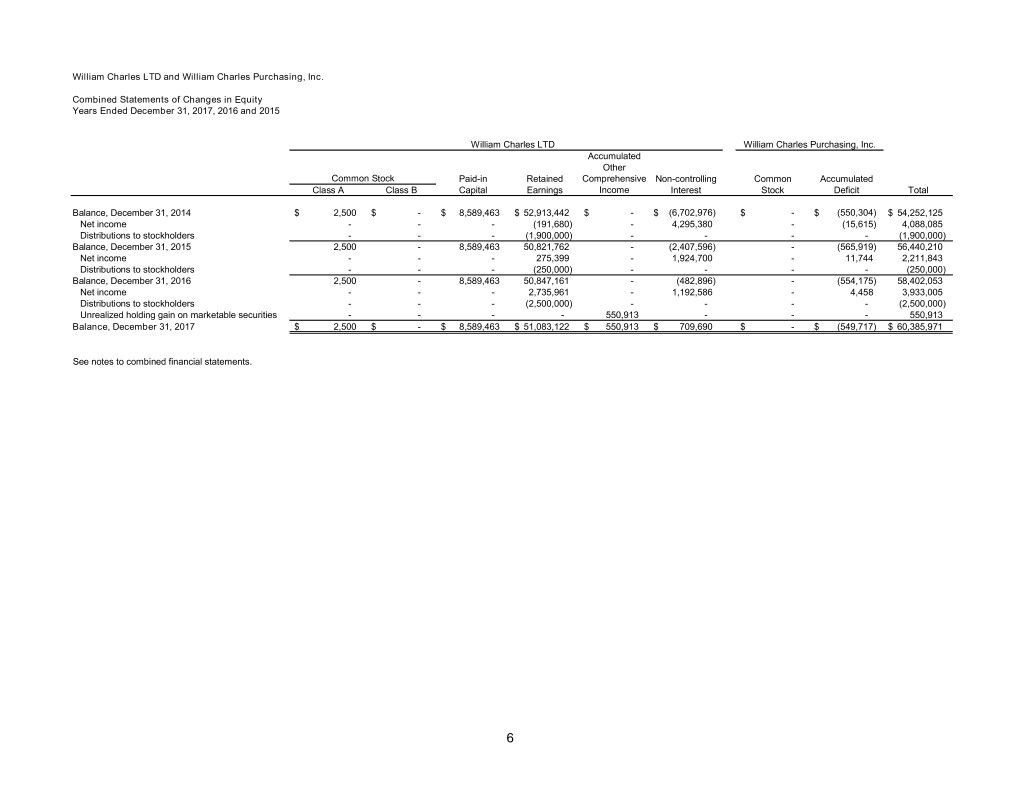

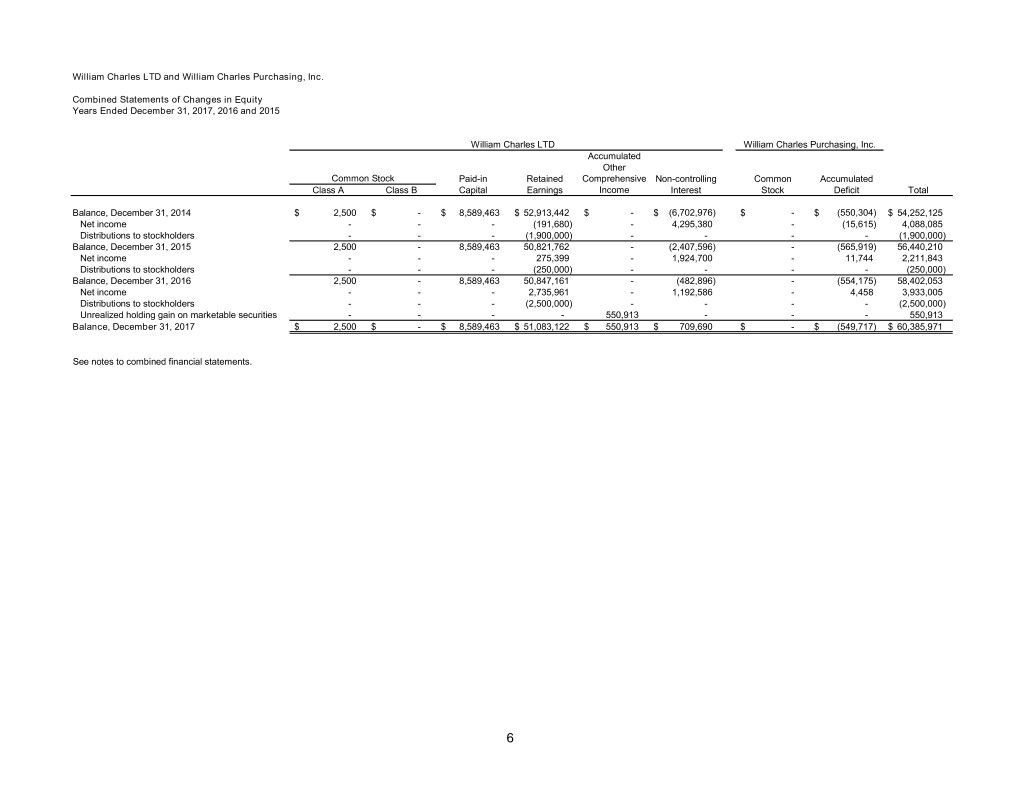

William Charles LTD and William Charles Purchasing, Inc. Combined Statements of Changes in Equity Years Ended December 31, 2017, 2016 and 2015 William Charles LTD William Charles Purchasing, Inc. Accumulated Other Common Stock Paid-in Retained Comprehensive Non-controlling Common Accumulated Class A Class B Capital Earnings Income Interest Stock Deficit Total Balance, December 31, 2014 $ 2,500 $ - $ 8,589,463 $ 52,913,442 $ - $ (6,702,976) $ - $ (550,304) $ 54,252,125 Net income - - - (191,680) - 4,295,380 - (15,615) 4,088,085 Distributions to stockholders - - - (1,900,000) - - - - (1,900,000) Balance, December 31, 2015 2,500 - 8,589,463 50,821,762 - (2,407,596) - (565,919) 56,440,210 Net income - - - 275,399 - 1,924,700 - 11,744 2,211,843 Distributions to stockholders - - - (250,000) - - - - (250,000) Balance, December 31, 2016 2,500 - 8,589,463 50,847,161 - (482,896) - (554,175) 58,402,053 Net income - - - 2,735,961 - 1,192,586 - 4,458 3,933,005 Distributions to stockholders - - - (2,500,000) - - - - (2,500,000) Unrealized holding gain on marketable securities - - - - 550,913 - - - 550,913 Balance, December 31, 2017 $ 2,500 $ - $ 8,589,463 $ 51,083,122 $ 550,913 $ 709,690 $ - $ (549,717) $ 60,385,971 See notes to combined financial statements. 6

William Charles LTD and William Charles Purchasing, Inc. Combined Statements of Cash Flows Years Ended December 31, 2017, 2016 and 2015 2017 2016 2015 Cash flows from operating activities: Net income $ 3,933,005 $ 2,211,843 $ 4,088,085 Adjustments to reconcile net income to net cash and cash equivalents provided by operating activities: Depreciation, depletion and amortization 4,541,936 4,241,773 4,206,589 Undistributed (income) loss of affiliates (63,152) (171,780) 7,425 Deferred income taxes 2,824 7,440 - Gain on sale of property and equipment (165,032) (250,814) (572,073) Impairment of property 700,000 - 200,000 Reinvested dividends (91,476) (58,386) - Unrealized gain on other assets - (108,673) - Change in cash surrender value recognized in earnings 15,280 35,228 43,023 Changes in operating assets and liabilities: Contracts and accounts receivable (12,608,733) 1,482,856 51,609,530 Costs and estimated earnings in excess of billings on uncompleted contracts 1,404,616 1,364,636 7,984,064 Other receivables 3,250 226,697 (263,557) Inventories 2,017,025 519,360 (130,229) Prepaid expenses 56,312 (76,671) 261,473 Property under development 16,984 147,593 - Accounts payable and accrued expenses 16,641,884 (4,964,939) (44,019,028) Billings in excess of costs and estimated earnings on uncompleted contracts 1,742,942 4,204,255 407,278 Other long-term liabilities (38,495) (97,257) (99,315) Net cash and cash equivalents provided by operating activities 18,109,170 8,713,161 23,723,265 Cash flows from investing activities: Purchases of property, equipment and leasehold improvements (7,121,672) (4,424,980) (7,341,883) Proceeds from sale of property and equipment 372,083 368,430 826,636 Advances on notes receivable (27,392) (651,487) (171,762) Purchase of other assets - (1,550,000) (1,536,671) Purchases of marketable securities (525,000) - - Net cash and cash equivalents used in investing activities (7,301,981) (6,258,037) (8,223,680) (Continued) 7

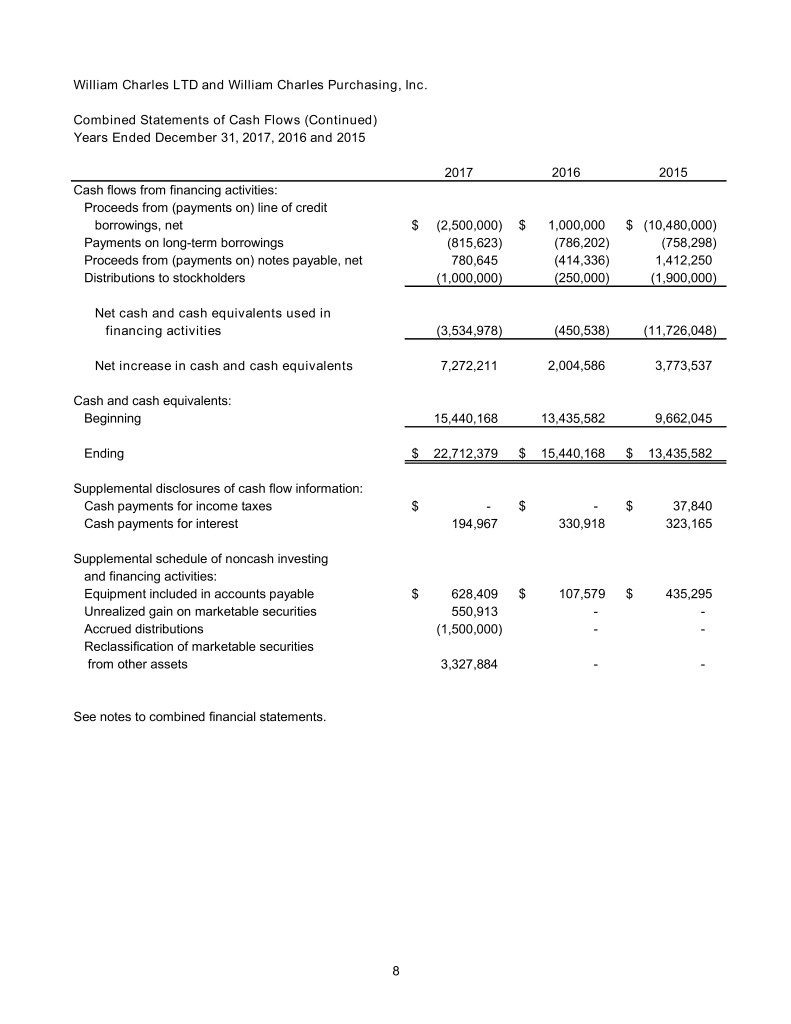

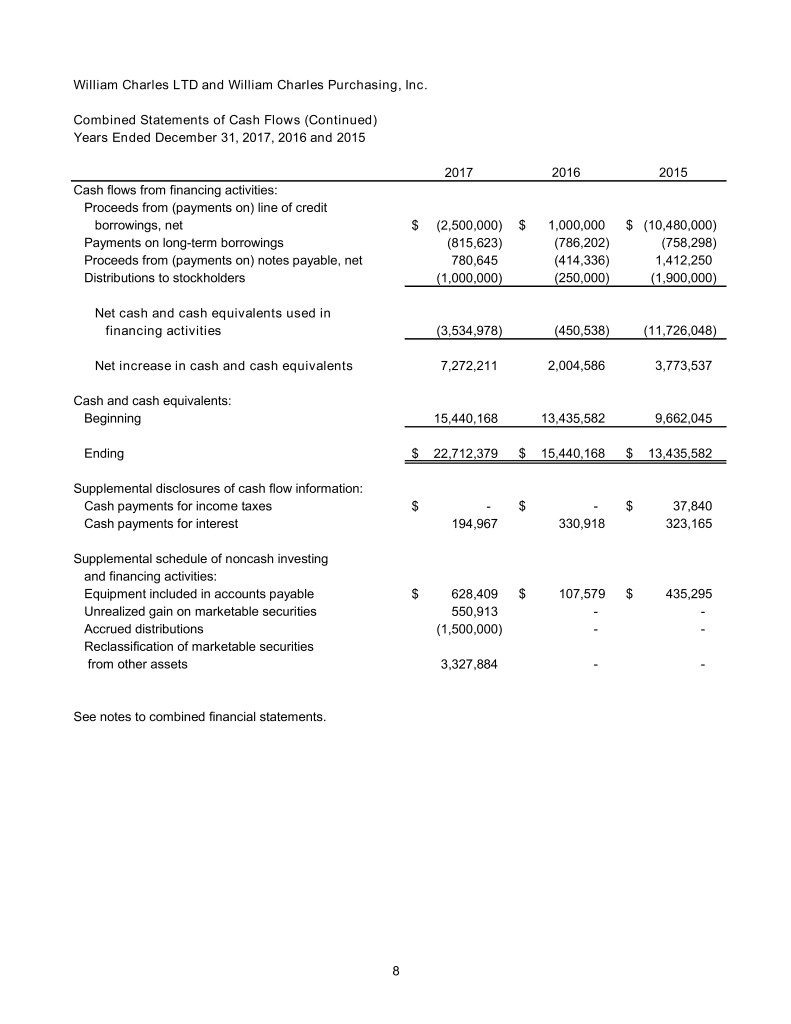

William Charles LTD and William Charles Purchasing, Inc. Combined Statements of Cash Flows (Continued) Years Ended December 31, 2017, 2016 and 2015 2017 2016 2015 Cash flows from financing activities: Proceeds from (payments on) line of credit borrowings, net $ (2,500,000) $ 1,000,000 $ (10,480,000) Payments on long-term borrowings (815,623) (786,202) (758,298) Proceeds from (payments on) notes payable, net 780,645 (414,336) 1,412,250 Distributions to stockholders (1,000,000) (250,000) (1,900,000) Net cash and cash equivalents used in financing activities (3,534,978) (450,538) (11,726,048) Net increase in cash and cash equivalents 7,272,211 2,004,586 3,773,537 Cash and cash equivalents: Beginning 15,440,168 13,435,582 9,662,045 Ending $ 22,712,379 $ 15,440,168 $ 13,435,582 Supplemental disclosures of cash flow information: Cash payments for income taxes $ - $ - $ 37,840 Cash payments for interest 194,967 330,918 323,165 Supplemental schedule of noncash investing and financing activities: Equipment included in accounts payable $ 628,409 $ 107,579 $ 435,295 Unrealized gain on marketable securities 550,913 - - Accrued distributions (1,500,000) - - Reclassification of marketable securities from other assets 3,327,884 - - See notes to combined financial statements. 8

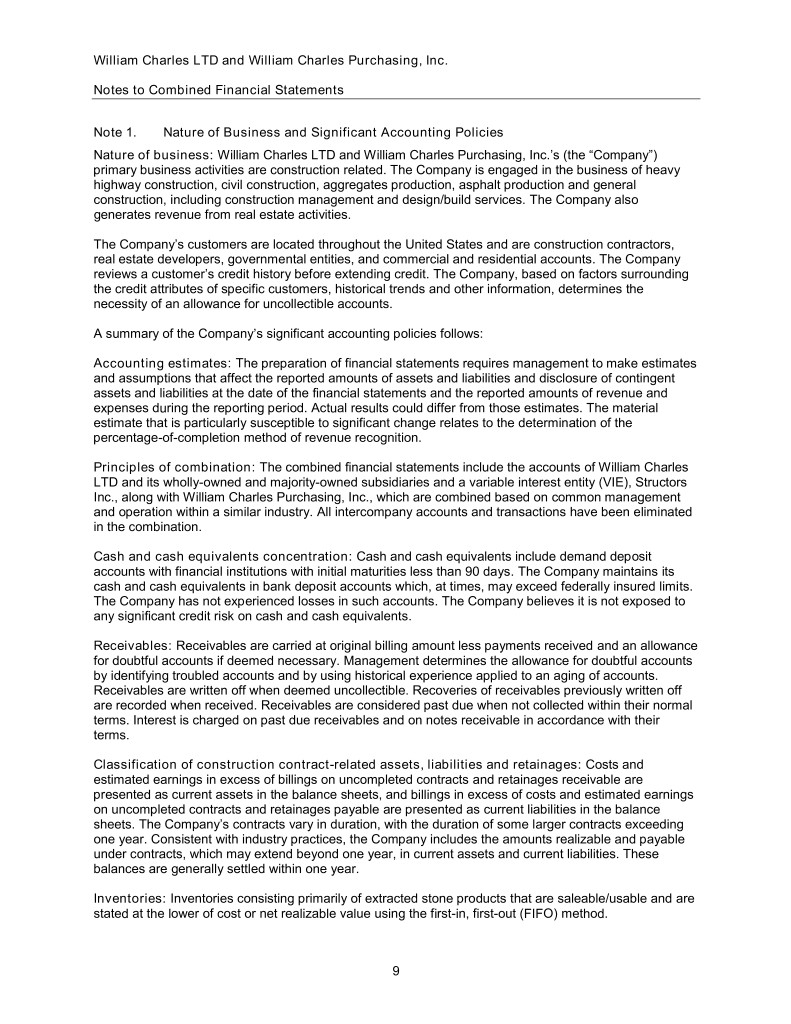

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 1. Nature of Business and Significant Accounting Policies Nature of business: William Charles LTD and William Charles Purchasing, Inc.’s (the “Company”) primary business activities are construction related. The Company is engaged in the business of heavy highway construction, civil construction, aggregates production, asphalt production and general construction, including construction management and design/build services. The Company also generates revenue from real estate activities. The Company’s customers are located throughout the United States and are construction contractors, real estate developers, governmental entities, and commercial and residential accounts. The Company reviews a customer’s credit history before extending credit. The Company, based on factors surrounding the credit attributes of specific customers, historical trends and other information, determines the necessity of an allowance for uncollectible accounts. A summary of the Company’s significant accounting policies follows: Accounting estimates: The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. The material estimate that is particularly susceptible to significant change relates to the determination of the percentage-of-completion method of revenue recognition. Principles of combination: The combined financial statements include the accounts of William Charles LTD and its wholly-owned and majority-owned subsidiaries and a variable interest entity (VIE), Structors Inc., along with William Charles Purchasing, Inc., which are combined based on common management and operation within a similar industry. All intercompany accounts and transactions have been eliminated in the combination. Cash and cash equivalents concentration: Cash and cash equivalents include demand deposit accounts with financial institutions with initial maturities less than 90 days. The Company maintains its cash and cash equivalents in bank deposit accounts which, at times, may exceed federally insured limits. The Company has not experienced losses in such accounts. The Company believes it is not exposed to any significant credit risk on cash and cash equivalents. Receivables: Receivables are carried at original billing amount less payments received and an allowance for doubtful accounts if deemed necessary. Management determines the allowance for doubtful accounts by identifying troubled accounts and by using historical experience applied to an aging of accounts. Receivables are written off when deemed uncollectible. Recoveries of receivables previously written off are recorded when received. Receivables are considered past due when not collected within their normal terms. Interest is charged on past due receivables and on notes receivable in accordance with their terms. Classification of construction contract-related assets, liabilities and retainages: Costs and estimated earnings in excess of billings on uncompleted contracts and retainages receivable are presented as current assets in the balance sheets, and billings in excess of costs and estimated earnings on uncompleted contracts and retainages payable are presented as current liabilities in the balance sheets. The Company’s contracts vary in duration, with the duration of some larger contracts exceeding one year. Consistent with industry practices, the Company includes the amounts realizable and payable under contracts, which may extend beyond one year, in current assets and current liabilities. These balances are generally settled within one year. Inventories: Inventories consisting primarily of extracted stone products that are saleable/usable and are stated at the lower of cost or net realizable value using the first-in, first-out (FIFO) method. 9

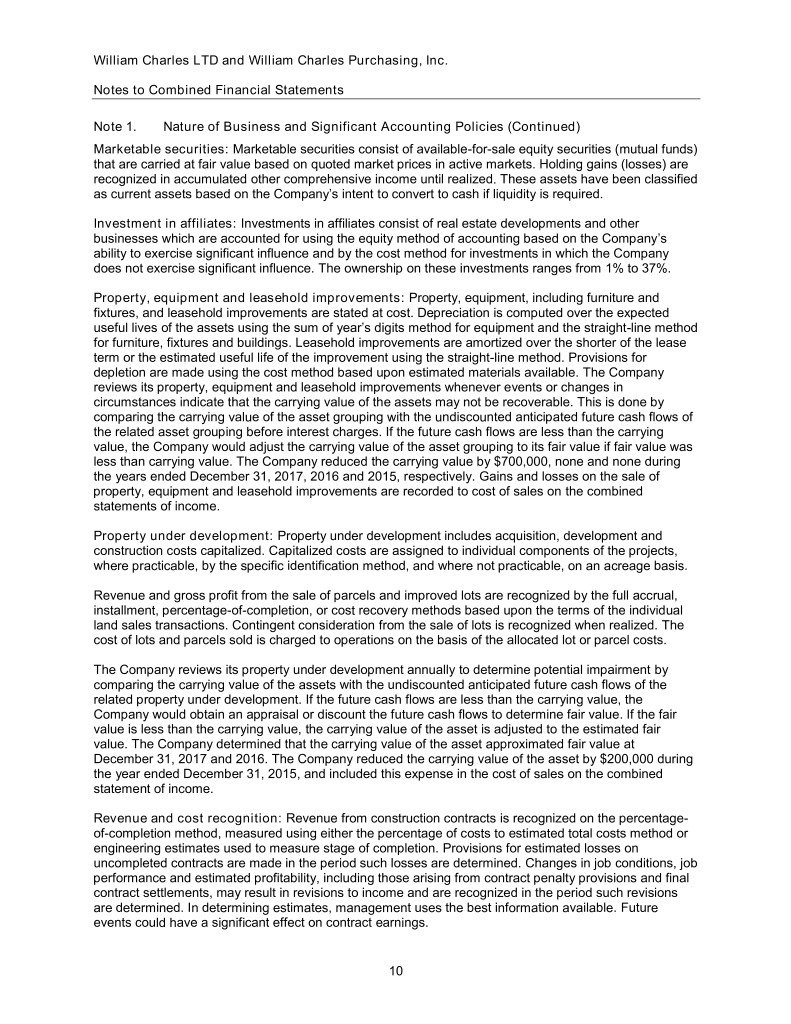

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 1. Nature of Business and Significant Accounting Policies (Continued) Marketable securities: Marketable securities consist of available-for-sale equity securities (mutual funds) that are carried at fair value based on quoted market prices in active markets. Holding gains (losses) are recognized in accumulated other comprehensive income until realized. These assets have been classified as current assets based on the Company’s intent to convert to cash if liquidity is required. Investment in affiliates: Investments in affiliates consist of real estate developments and other businesses which are accounted for using the equity method of accounting based on the Company’s ability to exercise significant influence and by the cost method for investments in which the Company does not exercise significant influence. The ownership on these investments ranges from 1% to 37%. Property, equipment and leasehold improvements: Property, equipment, including furniture and fixtures, and leasehold improvements are stated at cost. Depreciation is computed over the expected useful lives of the assets using the sum of year’s digits method for equipment and the straight-line method for furniture, fixtures and buildings. Leasehold improvements are amortized over the shorter of the lease term or the estimated useful life of the improvement using the straight-line method. Provisions for depletion are made using the cost method based upon estimated materials available. The Company reviews its property, equipment and leasehold improvements whenever events or changes in circumstances indicate that the carrying value of the assets may not be recoverable. This is done by comparing the carrying value of the asset grouping with the undiscounted anticipated future cash flows of the related asset grouping before interest charges. If the future cash flows are less than the carrying value, the Company would adjust the carrying value of the asset grouping to its fair value if fair value was less than carrying value. The Company reduced the carrying value by $700,000, none and none during the years ended December 31, 2017, 2016 and 2015, respectively. Gains and losses on the sale of property, equipment and leasehold improvements are recorded to cost of sales on the combined statements of income. Property under development: Property under development includes acquisition, development and construction costs capitalized. Capitalized costs are assigned to individual components of the projects, where practicable, by the specific identification method, and where not practicable, on an acreage basis. Revenue and gross profit from the sale of parcels and improved lots are recognized by the full accrual, installment, percentage-of-completion, or cost recovery methods based upon the terms of the individual land sales transactions. Contingent consideration from the sale of lots is recognized when realized. The cost of lots and parcels sold is charged to operations on the basis of the allocated lot or parcel costs. The Company reviews its property under development annually to determine potential impairment by comparing the carrying value of the assets with the undiscounted anticipated future cash flows of the related property under development. If the future cash flows are less than the carrying value, the Company would obtain an appraisal or discount the future cash flows to determine fair value. If the fair value is less than the carrying value, the carrying value of the asset is adjusted to the estimated fair value. The Company determined that the carrying value of the asset approximated fair value at December 31, 2017 and 2016. The Company reduced the carrying value of the asset by $200,000 during the year ended December 31, 2015, and included this expense in the cost of sales on the combined statement of income. Revenue and cost recognition: Revenue from construction contracts is recognized on the percentage- of-completion method, measured using either the percentage of costs to estimated total costs method or engineering estimates used to measure stage of completion. Provisions for estimated losses on uncompleted contracts are made in the period such losses are determined. Changes in job conditions, job performance and estimated profitability, including those arising from contract penalty provisions and final contract settlements, may result in revisions to income and are recognized in the period such revisions are determined. In determining estimates, management uses the best information available. Future events could have a significant effect on contract earnings. 10

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 1. Nature of Business and Significant Accounting Policies (Continued) Projects are completed under cost-plus-fee contracts and fixed-price contracts on credit terms that the Company establishes for individual customers. These contracts are undertaken by the Company or in partnership with other contractors through joint ventures. Progress billings are made at various stages of a job’s completion and are due within 30 days. Final billings are made upon completion of a job at which time all retainages are due. Contract costs include all direct material, subcontract and labor costs and those indirect costs related to contract performance, such as indirect labor, supplies, insurance, repairs, and depreciation costs. General and administrative costs are charged to expense as incurred. The asset, “Costs and estimated earnings in excess of billings on uncompleted contracts”, represents revenue recognized in excess of amounts billed. The liability, “Billings in excess of costs and estimated earnings on uncompleted contracts”, represents billings in excess of revenue recognized. The Company recognizes revenue for the sale of aggregates at the point of sale. Income taxes: William Charles LTD, with the consent of its stockholders, has elected to be taxed under sections of federal and state income tax laws, which provide that, in lieu of corporate income taxes, the stockholders separately account for their pro rata shares of the William Charles LTD’s items of income, deductions, losses and credits. As a result of this election, as it relates to William Charles LTD, no income taxes have been recognized in the financial statements except for certain state taxes that are assessed at the corporate level. The limited liability companies’ taxable income or loss is allocated to its members. Therefore, no provision or liability for federal income taxes has been included in the financial statements. The Company’s practice is to pay dividends which will assist the stockholders/members in meeting tax payments on the Company’s activities. For William Charles Purchasing, Inc., deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences, operating losses and tax credit carryforwards. Deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax basis. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. Management evaluated the Company’s tax positions and concluded that the Company had taken no uncertain tax positions that require recognition. Major customers: Due to the nature of the Company’s business, major customers accounting for more than 10% of gross sales or with contract receivables exceeding 10% of current assets may vary between years. Gross sales to two major customers for the year ended December 31, 2017, totaled $99,839,684. At December 31, 2017, the contract receivable for one major customer totaled $19,302,650. Gross sales to three major customers for the year ended December 31, 2016, totaled $85,542,848. At December 31, 2016, the contract receivable for one major customer totaled $12,461,978. Gross sales to four major customers for the year ended December 31, 2015, totaled approximately $200,044,300. 11

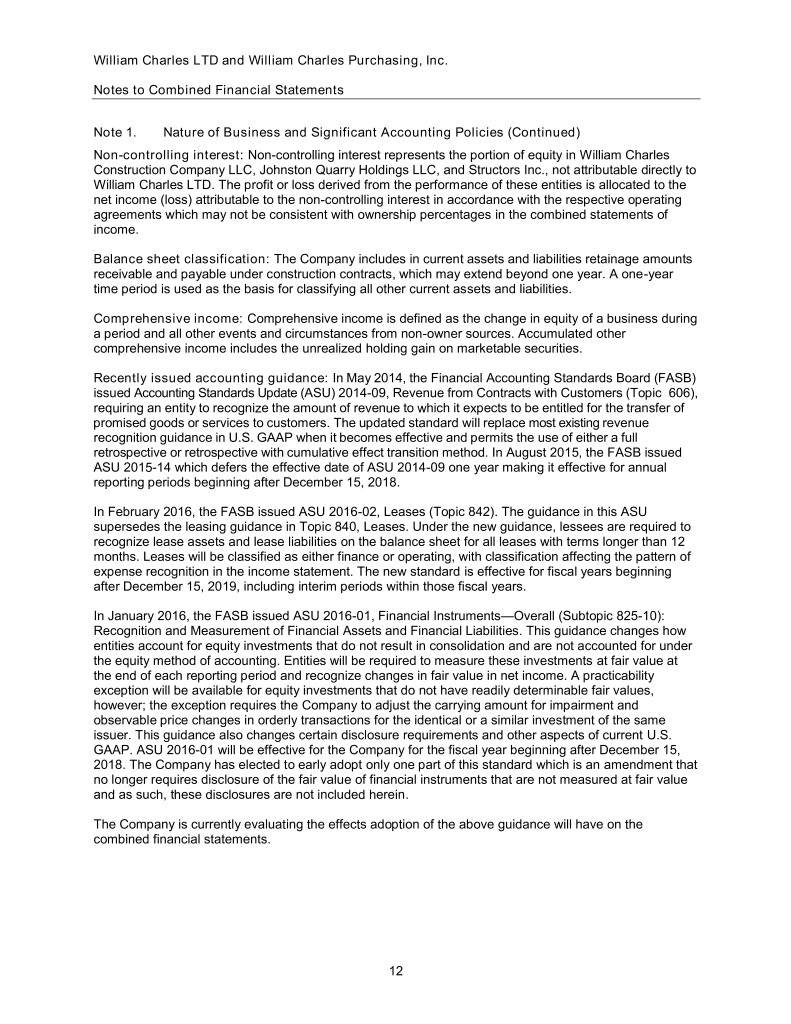

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 1. Nature of Business and Significant Accounting Policies (Continued) Non-controlling interest: Non-controlling interest represents the portion of equity in William Charles Construction Company LLC, Johnston Quarry Holdings LLC, and Structors Inc., not attributable directly to William Charles LTD. The profit or loss derived from the performance of these entities is allocated to the net income (loss) attributable to the non-controlling interest in accordance with the respective operating agreements which may not be consistent with ownership percentages in the combined statements of income. Balance sheet classification: The Company includes in current assets and liabilities retainage amounts receivable and payable under construction contracts, which may extend beyond one year. A one-year time period is used as the basis for classifying all other current assets and liabilities. Comprehensive income: Comprehensive income is defined as the change in equity of a business during a period and all other events and circumstances from non-owner sources. Accumulated other comprehensive income includes the unrealized holding gain on marketable securities. Recently issued accounting guidance: In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers (Topic 606), requiring an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. The updated standard will replace most existing revenue recognition guidance in U.S. GAAP when it becomes effective and permits the use of either a full retrospective or retrospective with cumulative effect transition method. In August 2015, the FASB issued ASU 2015-14 which defers the effective date of ASU 2014-09 one year making it effective for annual reporting periods beginning after December 15, 2018. In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The guidance in this ASU supersedes the leasing guidance in Topic 840, Leases. Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. In January 2016, the FASB issued ASU 2016-01, Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. This guidance changes how entities account for equity investments that do not result in consolidation and are not accounted for under the equity method of accounting. Entities will be required to measure these investments at fair value at the end of each reporting period and recognize changes in fair value in net income. A practicability exception will be available for equity investments that do not have readily determinable fair values, however; the exception requires the Company to adjust the carrying amount for impairment and observable price changes in orderly transactions for the identical or a similar investment of the same issuer. This guidance also changes certain disclosure requirements and other aspects of current U.S. GAAP. ASU 2016-01 will be effective for the Company for the fiscal year beginning after December 15, 2018. The Company has elected to early adopt only one part of this standard which is an amendment that no longer requires disclosure of the fair value of financial instruments that are not measured at fair value and as such, these disclosures are not included herein. The Company is currently evaluating the effects adoption of the above guidance will have on the combined financial statements. 12

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 1. Nature of Business and Significant Accounting Policies (Continued) Recently adopted accounting guidance: In July 2015, the FASB issued ASU 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory. The amendments in the ASU require entities that measure inventory using the first-in, first-out or average cost methods to measure inventory at the lower of cost and net realizable value. Net realizable value is defined as estimated selling price in the ordinary course of business less reasonably predictable costs of completion, disposal and transportation. The Company implemented this guidance on a prospective basis during the fiscal year ended December 31, 2017, which had no significant impact on the financial statements. Note 2. Contracts and Accounts Receivable Contracts and accounts receivable at December 31, 2017 and 2016, consisted of: 2017 2016 Contracts receivable: Completed contracts $ 3,997,368 $ 2,760,169 Contracts in progress 52,116,303 40,639,091 56,113,671 43,399,260 Accounts receivable 323,325 449,003 Less allowance for doubtful accounts (587,000) (607,000) $ 55,849,996 $ 43,241,263 Included in contracts receivable at December 31, 2017 and 2016, are retainage amounts of $14,071,169 and $11,847,043, respectively. Note 3. Costs and Estimated Earnings on Uncompleted Contracts Information with respect to uncompleted contracts as of December 31, 2017 and 2016, is as follows: 2017 2016 Costs incurred on uncompleted contracts $ 315,058,864 $ 514,369,064 Estimated earnings 38,269,455 38,497,607 Less: Billings to date (362,277,610) (558,668,404) $ (8,949,291) $ (5,801,733) 2017 2016 Costs and estimated earnings in excess of billings on uncompleted contracts $ 5,813,895 $ 7,218,511 Billings in excess of costs and estimated earnings on uncompleted contracts (14,763,186) (13,020,244) $ (8,949,291) $ (5,801,733) Contracts in progress total approximately $609,601,000 and $680,340,000 at December 31, 2017 and 2016, respectively. The Company, as a condition for entering into some of its construction contracts, had outstanding surety bonds as of December 31, 2017 and 2016. The surety bonds are collateralized by assets of the Company. 13

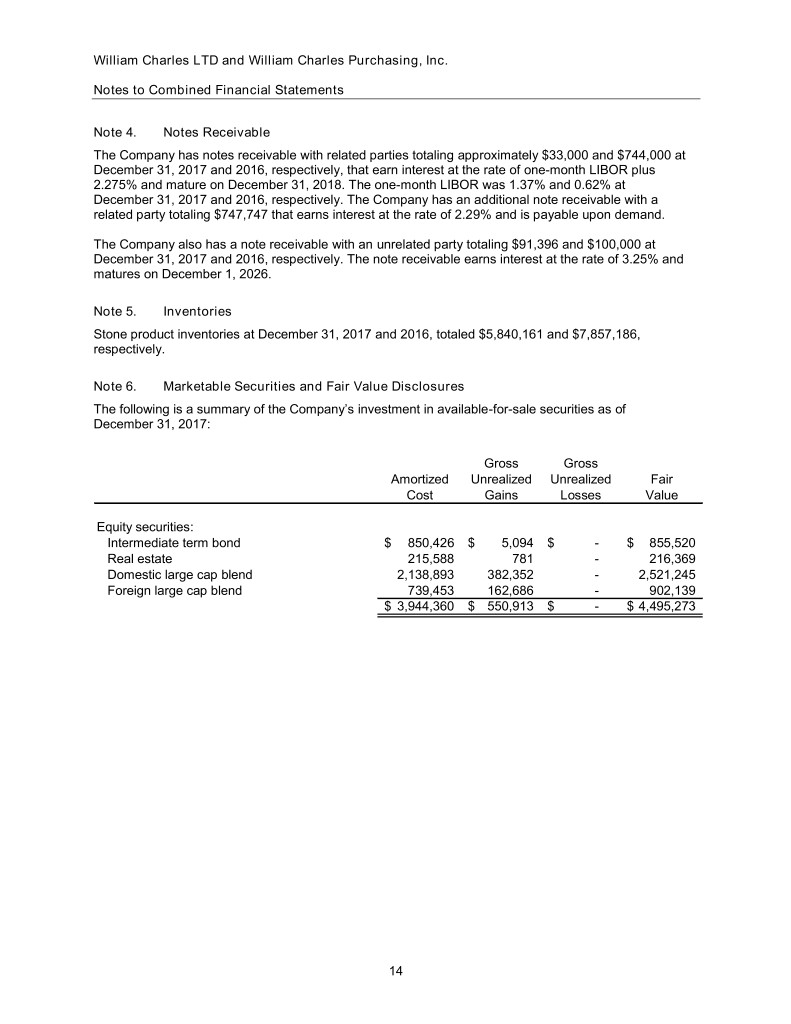

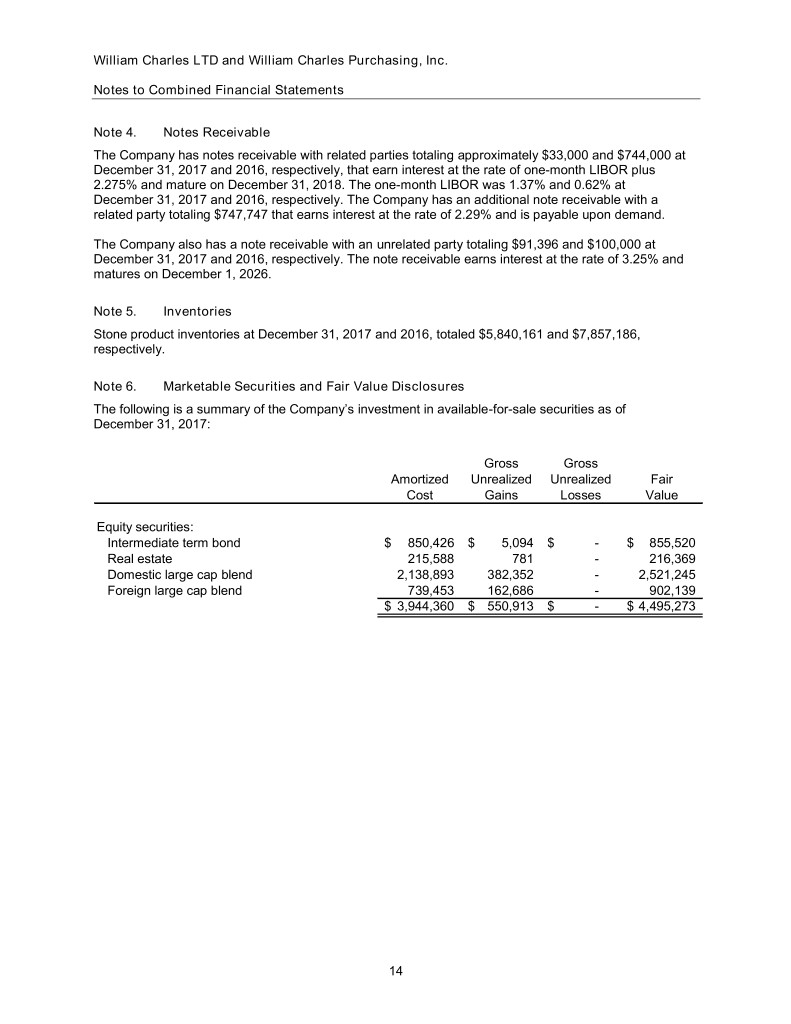

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 4. Notes Receivable The Company has notes receivable with related parties totaling approximately $33,000 and $744,000 at December 31, 2017 and 2016, respectively, that earn interest at the rate of one-month LIBOR plus 2.275% and mature on December 31, 2018. The one-month LIBOR was 1.37% and 0.62% at December 31, 2017 and 2016, respectively. The Company has an additional note receivable with a related party totaling $747,747 that earns interest at the rate of 2.29% and is payable upon demand. The Company also has a note receivable with an unrelated party totaling $91,396 and $100,000 at December 31, 2017 and 2016, respectively. The note receivable earns interest at the rate of 3.25% and matures on December 1, 2026. Note 5. Inventories Stone product inventories at December 31, 2017 and 2016, totaled $5,840,161 and $7,857,186, respectively. Note 6. Marketable Securities and Fair Value Disclosures The following is a summary of the Company’s investment in available-for-sale securities as of December 31, 2017: Gross Gross Amortized Unrealized Unrealized Fair Cost Gains Losses Value Equity securities: Intermediate term bond $ 850,426 $ 5,094 $ - $ 855,520 Real estate 215,588 781 - 216,369 Domestic large cap blend 2,138,893 382,352 - 2,521,245 Foreign large cap blend 739,453 162,686 - 902,139 $ 3,944,360 $ 550,913 $ - $ 4,495,273 14

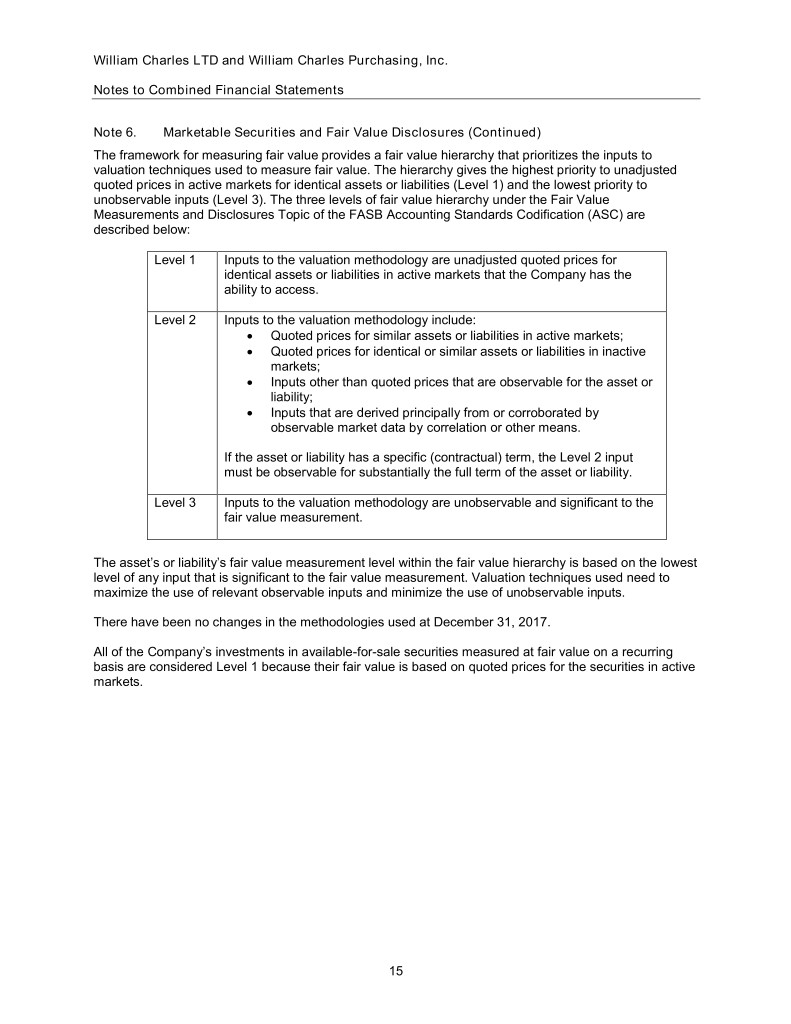

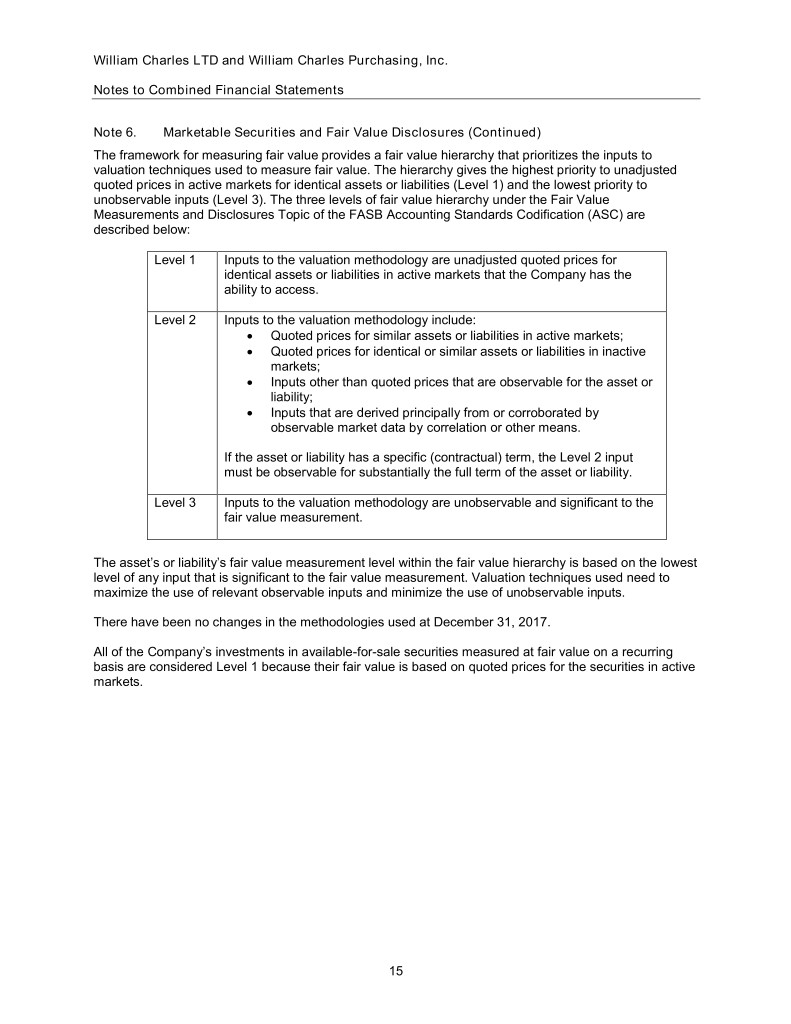

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 6. Marketable Securities and Fair Value Disclosures (Continued) The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of fair value hierarchy under the Fair Value Measurements and Disclosures Topic of the FASB Accounting Standards Codification (ASC) are described below: Level 1 Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Company has the ability to access. Level 2 Inputs to the valuation methodology include: Quoted prices for similar assets or liabilities in active markets; Quoted prices for identical or similar assets or liabilities in inactive markets; Inputs other than quoted prices that are observable for the asset or liability; Inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specific (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability. Level 3 Inputs to the valuation methodology are unobservable and significant to the fair value measurement. The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. There have been no changes in the methodologies used at December 31, 2017. All of the Company’s investments in available-for-sale securities measured at fair value on a recurring basis are considered Level 1 because their fair value is based on quoted prices for the securities in active markets. 15

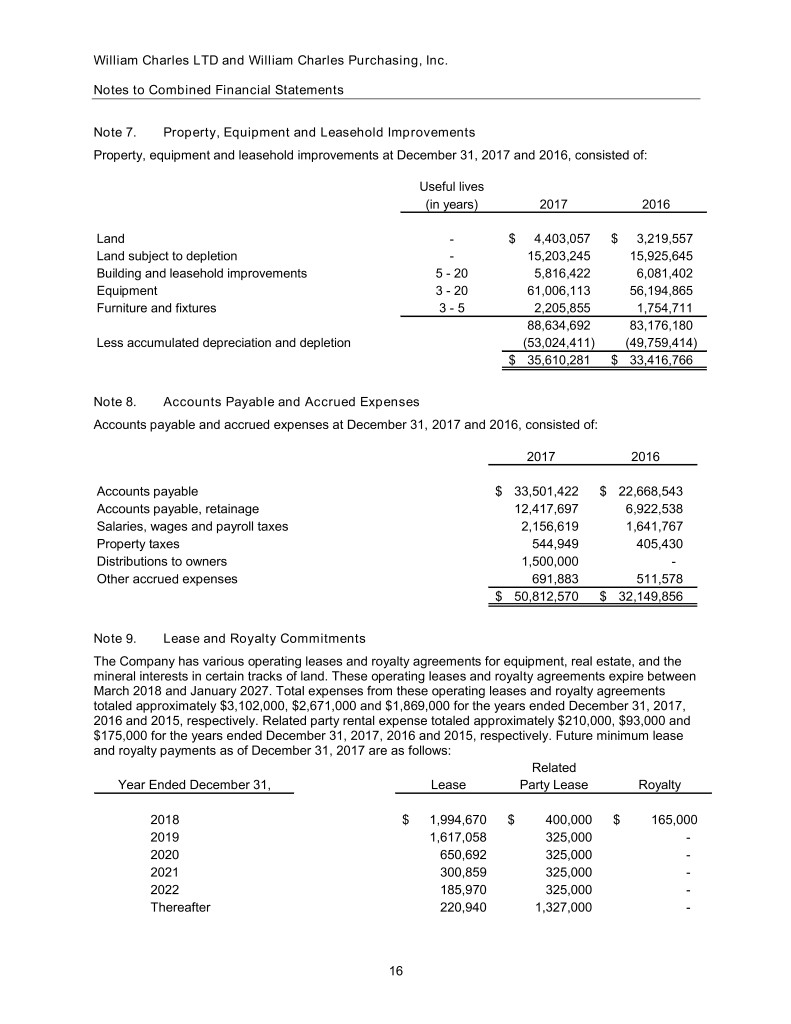

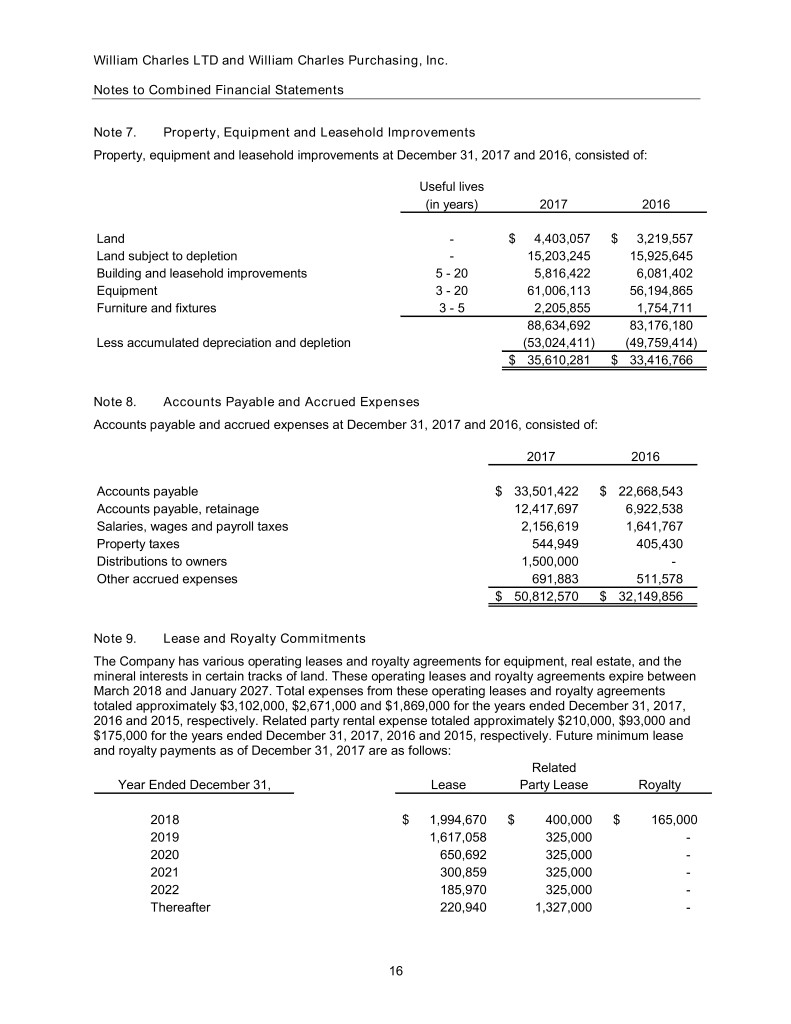

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 7. Property, Equipment and Leasehold Improvements Property, equipment and leasehold improvements at December 31, 2017 and 2016, consisted of: Useful lives (in years) 2017 2016 Land - $ 4,403,057 $ 3,219,557 Land subject to depletion - 15,203,245 15,925,645 Building and leasehold improvements 5 - 20 5,816,422 6,081,402 Equipment 3 - 20 61,006,113 56,194,865 Furniture and fixtures 3 - 5 2,205,855 1,754,711 88,634,692 83,176,180 Less accumulated depreciation and depletion (53,024,411) (49,759,414) $ 35,610,281 $ 33,416,766 Note 8. Accounts Payable and Accrued Expenses Accounts payable and accrued expenses at December 31, 2017 and 2016, consisted of: 2017 2016 Accounts payable $ 33,501,422 $ 22,668,543 Accounts payable, retainage 12,417,697 6,922,538 Salaries, wages and payroll taxes 2,156,619 1,641,767 Property taxes 544,949 405,430 Distributions to owners 1,500,000 - Other accrued expenses 691,883 511,578 $ 50,812,570 $ 32,149,856 Note 9. Lease and Royalty Commitments The Company has various operating leases and royalty agreements for equipment, real estate, and the mineral interests in certain tracks of land. These operating leases and royalty agreements expire between March 2018 and January 2027. Total expenses from these operating leases and royalty agreements totaled approximately $3,102,000, $2,671,000 and $1,869,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Related party rental expense totaled approximately $210,000, $93,000 and $175,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Future minimum lease and royalty payments as of December 31, 2017 are as follows: Related Year Ended December 31, Lease Party Lease Royalty 2018 $ 1,994,670 $ 400,000 $ 165,000 2019 1,617,058 325,000 - 2020 650,692 325,000 - 2021 300,859 325,000 - 2022 185,970 325,000 - Thereafter 220,940 1,327,000 - 16

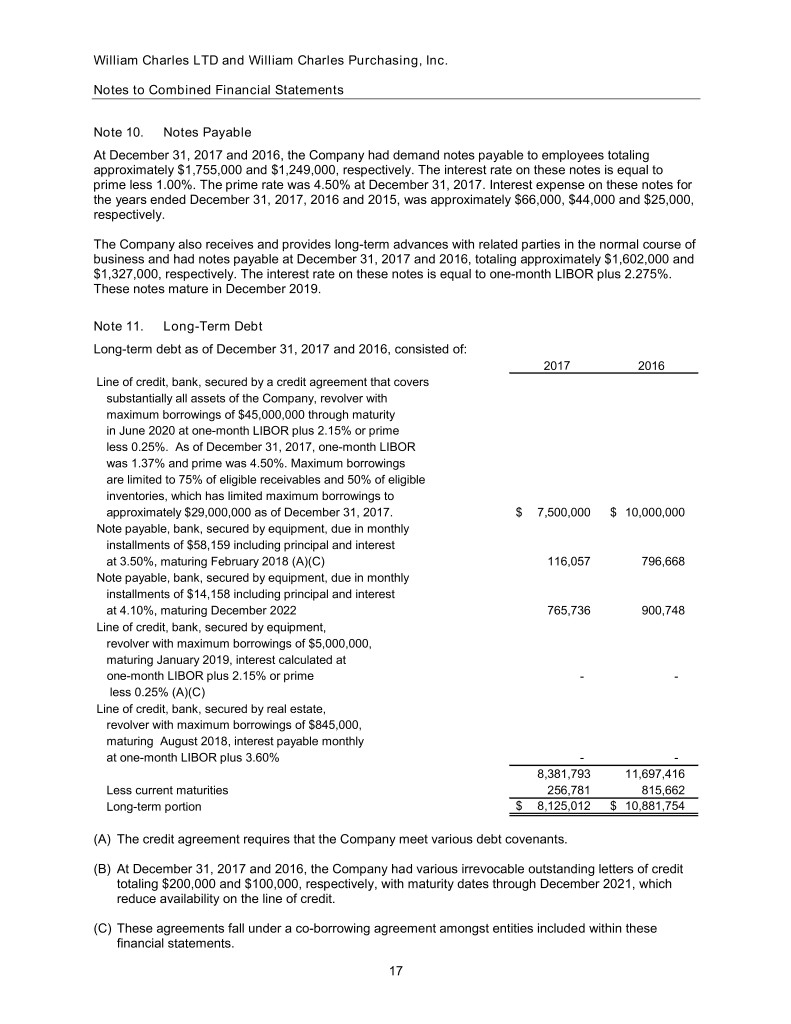

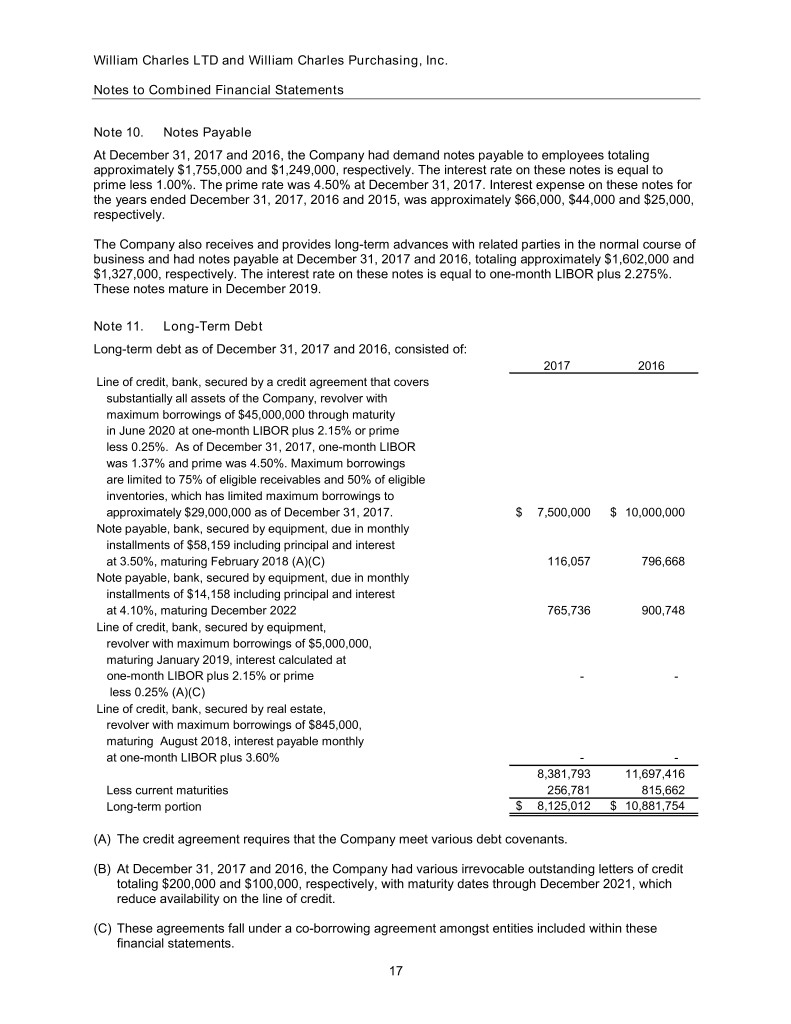

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 10. Notes Payable At December 31, 2017 and 2016, the Company had demand notes payable to employees totaling approximately $1,755,000 and $1,249,000, respectively. The interest rate on these notes is equal to prime less 1.00%. The prime rate was 4.50% at December 31, 2017. Interest expense on these notes for the years ended December 31, 2017, 2016 and 2015, was approximately $66,000, $44,000 and $25,000, respectively. The Company also receives and provides long-term advances with related parties in the normal course of business and had notes payable at December 31, 2017 and 2016, totaling approximately $1,602,000 and $1,327,000, respectively. The interest rate on these notes is equal to one-month LIBOR plus 2.275%. These notes mature in December 2019. Note 11. Long-Term Debt Long-term debt as of December 31, 2017 and 2016, consisted of: 2017 2016 Line of credit, bank, secured by a credit agreement that covers substantially all assets of the Company, revolver with maximum borrowings of $45,000,000 through maturity in June 2020 at one-month LIBOR plus 2.15% or prime less 0.25%. As of December 31, 2017, one-month LIBOR was 1.37% and prime was 4.50%. Maximum borrowings are limited to 75% of eligible receivables and 50% of eligible inventories, which has limited maximum borrowings to approximately $29,000,000 as of December 31, 2017. $ 7,500,000 $ 10,000,000 Note payable, bank, secured by equipment, due in monthly installments of $58,159 including principal and interest at 3.50%, maturing February 2018 (A)(C) 116,057 796,668 Note payable, bank, secured by equipment, due in monthly installments of $14,158 including principal and interest at 4.10%, maturing December 2022 765,736 900,748 Line of credit, bank, secured by equipment, revolver with maximum borrowings of $5,000,000, maturing January 2019, interest calculated at one-month LIBOR plus 2.15% or prime - - less 0.25% (A)(C) Line of credit, bank, secured by real estate, revolver with maximum borrowings of $845,000, maturing August 2018, interest payable monthly at one-month LIBOR plus 3.60% - - 8,381,793 11,697,416 Less current maturities 256,781 815,662 Long-term portion $ 8,125,012 $ 10,881,754 (A) The credit agreement requires that the Company meet various debt covenants. (B) At December 31, 2017 and 2016, the Company had various irrevocable outstanding letters of credit totaling $200,000 and $100,000, respectively, with maturity dates through December 2021, which reduce availability on the line of credit. (C) These agreements fall under a co-borrowing agreement amongst entities included within these financial statements. 17

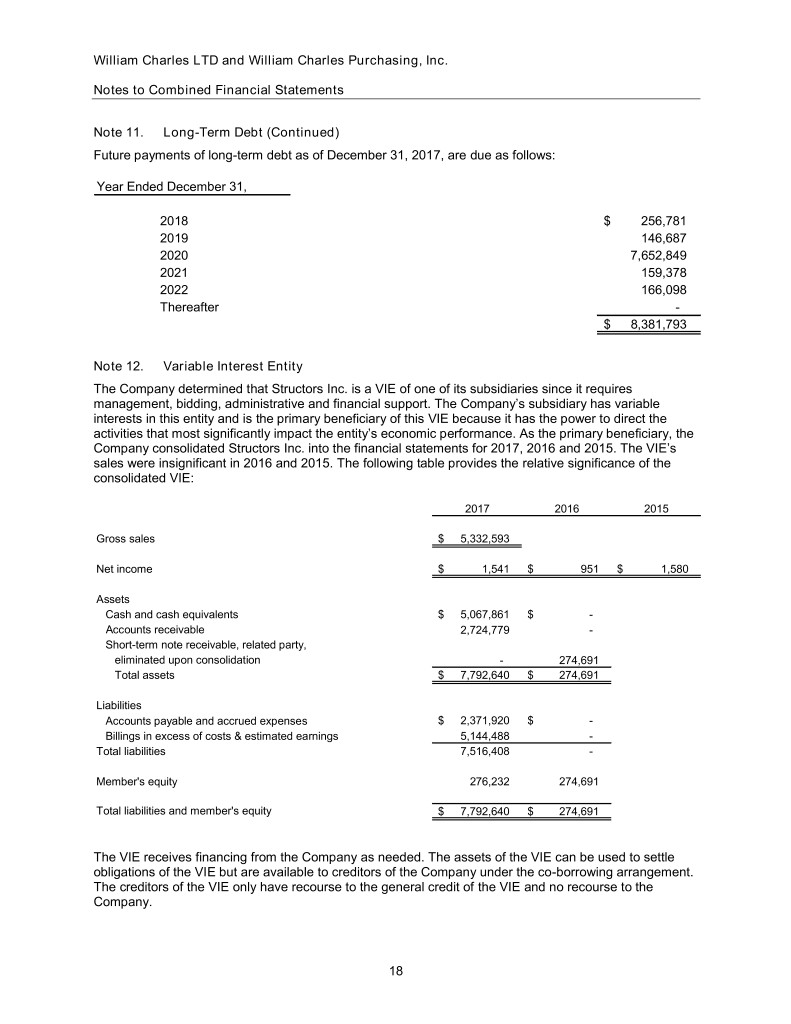

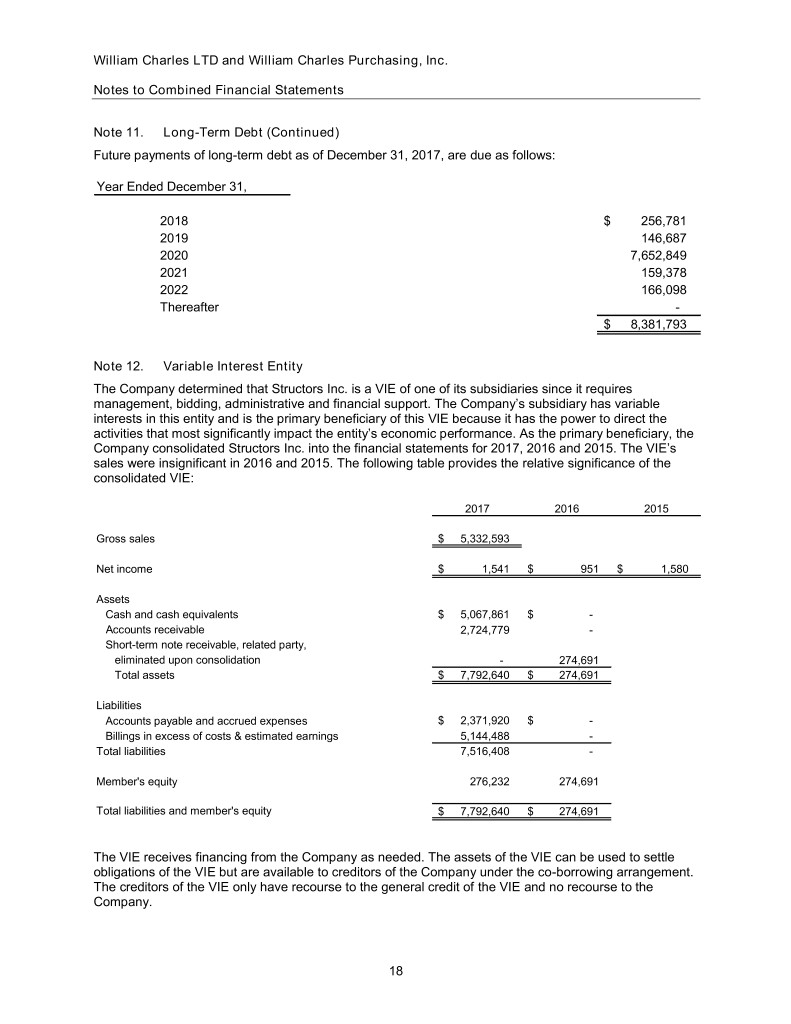

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 11. Long-Term Debt (Continued) Future payments of long-term debt as of December 31, 2017, are due as follows: Year Ended December 31, 2018 $ 256,781 2019 146,687 2020 7,652,849 2021 159,378 2022 166,098 Thereafter - $ 8,381,793 Note 12. Variable Interest Entity The Company determined that Structors Inc. is a VIE of one of its subsidiaries since it requires management, bidding, administrative and financial support. The Company’s subsidiary has variable interests in this entity and is the primary beneficiary of this VIE because it has the power to direct the activities that most significantly impact the entity’s economic performance. As the primary beneficiary, the Company consolidated Structors Inc. into the financial statements for 2017, 2016 and 2015. The VIE’s sales were insignificant in 2016 and 2015. The following table provides the relative significance of the consolidated VIE: 2017 2016 2015 Gross sales $ 5,332,593 Net income $ 1,541 $ 951 $ 1,580 Assets Cash and cash equivalents $ 5,067,861 $ - Accounts receivable 2,724,779 - Short-term note receivable, related party, eliminated upon consolidation - 274,691 Total assets $ 7,792,640 $ 274,691 Liabilities Accounts payable and accrued expenses $ 2,371,920 $ - Billings in excess of costs & estimated earnings 5,144,488 - Total liabilities 7,516,408 - Member's equity 276,232 274,691 Total liabilities and member's equity $ 7,792,640 $ 274,691 The VIE receives financing from the Company as needed. The assets of the VIE can be used to settle obligations of the VIE but are available to creditors of the Company under the co-borrowing arrangement. The creditors of the VIE only have recourse to the general credit of the VIE and no recourse to the Company. 18

William Charles LTD and William Charles Purchasing, Inc. Notes to Combined Financial Statements Note 13. Related Party Transactions The Company has contracts and accounts receivable with related parties totaling approximately $361,000 and $360,000 at December 31, 2017 and 2016, respectively. Sales to related parties totaled $81,253, none and none for the years ended December 31, 2017, 2016 and 2015, respectively. The Company receives management and consulting services from affiliates. Fees of $3,697,000, $3,214,000 and $3,586,000 for these services are included in selling, general and administrative expenses for the years ended December 31, 2017, 2016 and 2015, respectively. The Company receives and provides advances with related parties in the normal course of business. The Company had approximately $33,000, $114,000 and $149,000 of interest income and approximately $8,000, $136,000 and $91,000 of interest expense for the years ended December 31, 2017, 2016 and 2015, respectively, on these advances. Note 14. Commitments and Contingencies The Company is a defendant in various lawsuits arising in the ordinary course of business. Although the outcome of these lawsuits cannot be predicted with certainty, management believes the ultimate disposition of such matters will not have a material effect on the Company’s financial condition or operations. Note 15. Employee Benefits The Company sponsors a 401(k) profit sharing plan which covers all non-union employees of the Company. The Company also contributes to various trusteed pension plans under union-wide agreements. Total Company contributions to all of these plans were approximately $6,005,000, $4,838,600 and $5,680,300 in 2017, 2016 and 2015, respectively. The Company has established a deferred compensation plan for certain former members of management. The deferred compensation is payable upon the earlier of death, termination of employment after age 65, or 30 years of service with the Company. Payments of deferred compensation are made over a period of 20 years. Amounts totaling $397,122 and $2,871,822 are included in other accrued expenses and other long-term liabilities, respectively, at December 31, 2017. Amounts totaling $397,122 and $2,995,945 are included in other accruals and other long-term liabilities, respectively, at December 31, 2016. During 2017, 2016 and 2015, approximately 65%, 66% and 65%, respectively, of the employees of the Company were covered by union-sponsored, collectively bargained, multiemployer defined benefit pension plans. The risks of participating in these multiemployer plans are different from single employer plans in the following aspects: a. Assets contributed to a multiemployer plan by one participating employer may be used to provide benefits to employees of other participating employers. b. If a participating employer stops contributing to a plan, the unfunded obligations of the plan may be borne by the remaining participating employers. c. If a participating employer chooses to stop participating in a multiemployer plan, the withdrawing participating employer may be required to pay the plan an amount based on the underfunded status of the plan, referred to as a withdrawal liability. 19

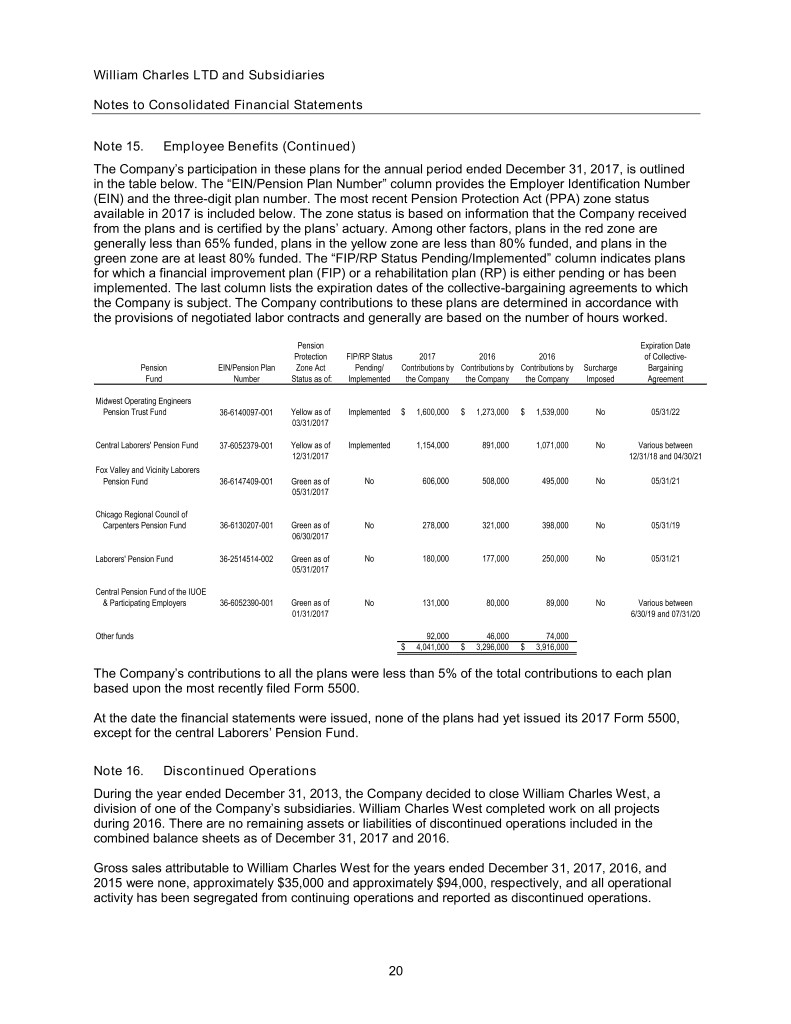

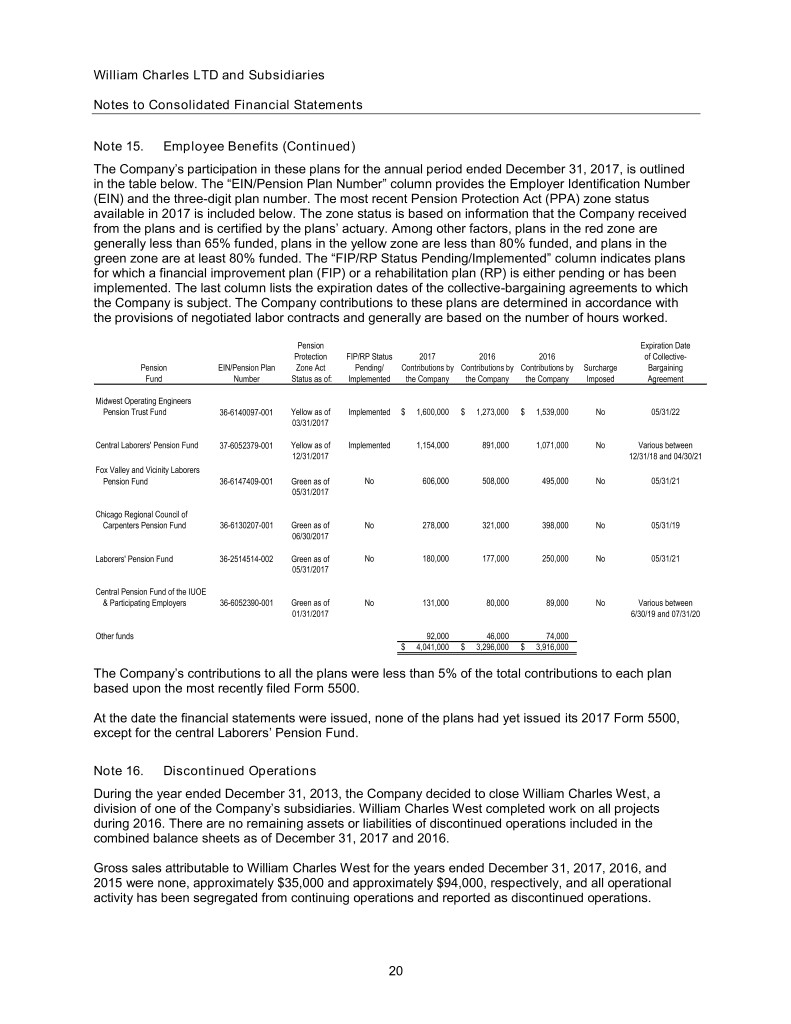

William Charles LTD and Subsidiaries Notes to Consolidated Financial Statements Note 15. Employee Benefits (Continued) The Company’s participation in these plans for the annual period ended December 31, 2017, is outlined in the table below. The “EIN/Pension Plan Number” column provides the Employer Identification Number (EIN) and the three-digit plan number. The most recent Pension Protection Act (PPA) zone status available in 2017 is included below. The zone status is based on information that the Company received from the plans and is certified by the plans’ actuary. Among other factors, plans in the red zone are generally less than 65% funded, plans in the yellow zone are less than 80% funded, and plans in the green zone are at least 80% funded. The “FIP/RP Status Pending/Implemented” column indicates plans for which a financial improvement plan (FIP) or a rehabilitation plan (RP) is either pending or has been implemented. The last column lists the expiration dates of the collective-bargaining agreements to which the Company is subject. The Company contributions to these plans are determined in accordance with the provisions of negotiated labor contracts and generally are based on the number of hours worked. Pension Expiration Date Protection FIP/RP Status 2017 2016 2016 of Collective- Pension EIN/Pension Plan Zone Act Pending/ Contributions by Contributions by Contributions by Surcharge Bargaining Fund Number Status as of: Implemented the Company the Company the Company Imposed Agreement Midwest Operating Engineers Pension Trust Fund 36-6140097-001 Yellow as of Implemented $ 1,600,000 $ 1,273,000 $ 1,539,000 No 05/31/22 03/31/2017 Central Laborers' Pension Fund 37-6052379-001 Yellow as of Implemented 1,154,000 891,000 1,071,000 No Various between 12/31/2017 12/31/18 and 04/30/21 Fox Valley and Vicinity Laborers Pension Fund 36-6147409-001 Green as of No 606,000 508,000 495,000 No 05/31/21 05/31/2017 Chicago Regional Council of Carpenters Pension Fund 36-6130207-001 Green as of No 278,000 321,000 398,000 No 05/31/19 06/30/2017 Laborers' Pension Fund 36-2514514-002 Green as of No 180,000 177,000 250,000 No 05/31/21 05/31/2017 Central Pension Fund of the IUOE & Participating Employers 36-6052390-001 Green as of No 131,000 80,000 89,000 No Various between 01/31/2017 6/30/19 and 07/31/20 Other funds 92,000 46,000 74,000 $ 4,041,000 $ 3,296,000 $ 3,916,000 The Company’s contributions to all the plans were less than 5% of the total contributions to each plan based upon the most recently filed Form 5500. At the date the financial statements were issued, none of the plans had yet issued its 2017 Form 5500, except for the central Laborers’ Pension Fund. Note 16. Discontinued Operations During the year ended December 31, 2013, the Company decided to close William Charles West, a division of one of the Company’s subsidiaries. William Charles West completed work on all projects during 2016. There are no remaining assets or liabilities of discontinued operations included in the combined balance sheets as of December 31, 2017 and 2016. Gross sales attributable to William Charles West for the years ended December 31, 2017, 2016, and 2015 were none, approximately $35,000 and approximately $94,000, respectively, and all operational activity has been segregated from continuing operations and reported as discontinued operations. 20

William Charles LTD and Subsidiaries Notes to Consolidated Financial Statements Note 17. Income Taxes Deferred tax assets consist of the following components as of December 31, 2017 and 2016: 2017 2016 Net operating loss carryforwards $ 159,427 $ 219,795 Less: Valuation allowance (158,508) (216,052) $ 919 $ 3,743 The total net deferred tax assets have been classified as a noncurrent asset on the combined balance sheets. Management has determined that based on expected future operating plans and tax planning strategies available to the Company, a portion of the deferred tax assets may not be utilized to offset future taxes. Therefore, a valuation allowance related to such deferred tax assets of approximately $158,000 and $216,000 was recorded at December 31, 2017 and 2016, respectively. During the years ended December 31, 2017, 2016 and 2015, the Company’s valuation allowance against deferred tax assets was increased (decreased) by approximately ($58,000), none and approximately $6,000, respectively. During the years ended December 31, 2017, 2016 and 2015, deferred income tax expense was approximately $3,000, approximately $7,000 and none, respectively, and is included with income tax expense on the combined statements of income. A reconciliation of income tax computed at the statutory federal income tax rate to the Company’s income tax expense for the years ended December 31, 2017, 2016 and 2015, is as follows: 2017 2016 2015 Percentage of Percentage of Percentage of Amount Pretax Income Amount Pretax Income Amount Pretax Income Tax expense at statutory rate $ 1,362,637 34.00 % $ 807,464 34.00 % $ 1,457,641 34.00 % State tax 72,275 2.20 (4,977) 0.06 57,031 1.78 Impact of income from nontaxable entities (1,360,161) (34.33) (800,942) (33.99) (1,462,950) (34.57) Change in tax rate 57,544 1.44 - - - - Change in valuation allowance (57,544) (1.44) - - 6,056 0.14 $ 74,751 1.87 % $ 1,545 0.07 % $ 57,778 1.35 % As of December 31, 2017 and 2016, the Company had federal operating loss carryforwards of approximately $560,000 and $567,000, respectively, and state operating loss carryforwards of approximately $559,000 and $566,000, respectively. The federal net operating loss carryforwards start to expire in 2031. The state net operating loss carryforwards start to expire in 2023. 21

William Charles LTD and Subsidiaries Notes to Consolidated Financial Statements Note 17. Income Taxes (Continued) In December 22, 2017, the President of the United States signed into law the Tax Cuts and Jobs Act tax reform legislation. This legislation makes significant change in U.S. tax law including a reduction in the federal corporate tax rates, changes to net operating loss carryforwards and carrybacks, and a repeal of the corporate alternative minimum tax. The legislation reduced the U.S. federal corporate tax rate from the current rate of 34% to 21% for years ending after December 31, 2017. As a result of the enacted law, the Company was required to revalue deferred tax assets and liabilities to the enacted rate. This revaluation resulted in a decrease in net deferred tax assets of approximately $58,000, a decrease in the valuation allowance of approximately $58,000, and no effect on income tax expense in continuing operations. The other provisions of the Tax Cuts and Jobs Act did not have a material impact on the financial statements. The Company files income tax returns in the U.S. federal jurisdiction and various states. Note 18. Subsequent Events The Company has evaluated subsequent events through November 2, 2018, which is the date the financial statements were available to be issued, for possible measurement and/or disclosure effects on the financial statements. On October 12, 2018, the Company entered into an Equity Purchase Agreement (the “Agreement”) with a wholly-owned subsidiary of Infrastructure and Energy Alternatives, Inc. (“IEA”). Pursuant to the terms of the Agreement, IEA acquired certain subsidiaries of William Charles LTD on November 2, 2018, which comprise the construction-related operations of the Company for approximately $90 million, including $85 million in cash and $5 million in equity, subject to certain adjustments. The construction-related operations represent approximately 89% of total Company assets as of December 31, 2017 and approximately 100% of gross sales for the years ended December 31, 207, 2016 and 2015. 22