© 2021. IEA. All Rights Reserved. INVESTOR PRESENTATION MARCH 2021

© 2021. IEA. All Rights Reserved. 2 All statements, other than statements of historical fact, included in this presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements can be identified by the use of forward-looking terminology including “may,” “should,” “likely,” “will,” “believe,” “expect,” “anticipate,” “estimate,” “forecast,” “seek,” “target,” “continue,” “plan,” “intend,” “project,” or other similar words. All statements, other than statements of historical fact, included in this presentation regarding expectations for the impact of COVID-19, future financial performance, business strategies, expectations for our business, future operations, liquidity positions, availability of capital resources, financial position, estimated revenues and losses, projected costs, prospects, plans, objectives and beliefs of management are forward-looking statements. These forward-looking statements are based on information available as of the date of this presentation and our management’s current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot give any assurance that such expectations will prove correct. Forward-looking statements should not be relied upon as representing our views as of any subsequent date. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include: • potential risks and uncertainties relating to COVID-19, including the geographic spread, the severity of the disease, the scope and duration of the COVID-19 pandemic, actions that may be taken by governmental authorities to contain the COVID-19 pandemic or to treat its impact, and the potential negative impacts of COVID-19 on permitting and project construction cycles, the U.S. economy and financial markets; • availability of commercially reasonable and accessible sources of liquidity and bonding; • our ability to generate cash flow and liquidity to fund operations; • the timing and extent of fluctuations in geographic, weather and operational factors affecting our customers, projects and the industries in which we operate; • our ability to identify acquisition candidates and integrate acquired businesses; • our ability to grow and manage growth profitably; • the possibility that we may be adversely affected by economic, business, and/or competitive factors; • market conditions, technological developments, regulatory changes or other governmental policy uncertainty that affects us or our customers; • our ability to manage projects effectively and in accordance with management estimates, as well as the ability to accurately estimate the costs associated with our fixed price and other contracts, including any material changes in estimates for completion of projects; • the effect on demand for our services and changes in the amount of capital expenditures by customers due to, among other things, economic conditions, commodity price fluctuations, the availability and cost of financing, and customer consolidation; • the ability of customers to terminate or reduce the amount of work, or in some cases, the prices paid for services, on short or no notice; • customer disputes related to the performance of services; • disputes with, or failures of, subcontractors to deliver agreed-upon supplies or services in a timely fashion; • our ability to replace non-recurring projects with new projects; • the impact of U.S. federal, local, state, foreign or tax legislation and other regulations affecting the renewable energy industry and related projects and expenditures; • the effect of state and federal regulatory initiatives, including costs of compliance with existing and future safety and environmental requirements; • fluctuations in equipment, fuel, materials, labor and other costs; • our beliefs regarding the state of the renewable energy market generally; and • the “Risk Factors” described in this Annual Report on Form 10-K, and in our quarterly reports, other public filings and press releases. We do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. SAFE HARBOR STATEMENT

3 © 2021. IEA. All Rights Reserved. Who We Are Infrastructure & Energy Alternatives (Nasdaq “IEA”) Leading North American provider of infrastructure services 65% of revenues derived from renewable energy segment construction “Double-Breasted” workforce allows IEA to perform both union and non-union jobs © 2021. IEA. All Rights Reserved. 2020 Segment Revenues by End-market $1.8 Billion 65% 35% Renewables • Wind farm construction • Solar project construction Select ESG Index Memberships Atlas Clean Energy Index Specialty Civil • Environmental remediation • Rail construction • Bridge construction • Highway repair

4 © 2021. IEA. All Rights Reserved. LEADERSHIP POSITIONS ACROSS OUR CORE BUSINSSES Services Enabling the Energy Transition Services Improving Transportation Infrastructure Top 20 Rail Infrastructure(3) #2 Wind / Solar EPC(1) Top 3 Coal Ash Remediation(2) Top 20 Highway Construction(3) (1) Based on combined 2020 ENR rankings for wind and solar revenues. (2) Management estimate based on IEA and competitor revenues for 2019 and 2020. (3) Based on 2020 ENR ranking.

5 © 2021. IEA. All Rights Reserved. WE ARE A DIRECT BENEFICIARY OF GROWING INVESTMENT IN RENEWABLES Contribution to the Cost of a Wind Energy Project(2) Contribution to the Cost of a Solar Energy Project(1) (1) Wood Mackenzie H1 2020 U.S. Solar PV System Pricing, June 2020; estimate for 50 MW site using single-axis trackers. (2) Bloomberg New Energy Finance 2H 2020 Wind Turbine Price Index. (3) Includes permitting, logistics and taxes categories. (4) Includes marine transport and transport to site categories. (5) Includes labor, design & engineering, civil and overhead & margin categories. (6) Includes foundations, grid connection, crane installation, cabling and access roads categories. Approximately 30% of every dollar of investment in renewables goes to engineering, procurement and construction Equipment 60% Other(3) 8% Equipment 59% Other(4) 13% EPC(5) 32% EPC(6) 28%

6 © 2021. IEA. All Rights Reserved. RENEWABLES INVESTMENT IS GROWING FASTER THAN INVESTOR-OWNED UTILITY CAPEX U.S. Utility-Scale Wind and Solar Investment(2) ($ in Billions) U.S. Investor-Owned Utility Capital Expenditures(1) ($ in Billions) (1) EEI Industry Capital Expenditures with Functional Detail (October 2020). Represents total company spending of U.S. Investor-Owned Electric Utilities (“IOUs”), consolidated at the parent or appropriate holding company. (2) Bloomberg New Energy Finance Energy Transition Investment Database. Total capital spending for utility scale wind and solar as reported by BNEF as of January 19, 2021. Investment in renewable generation was equivalent to nearly 40% of IOU capex in 2019 $104 $113 $113 $119 $124 2015 2016 2017 2018 2019 $27 $29 $34 $33 $49 2015 2016 2017 2018 2019 2015-2019 CAGR 4.5% 2015-2019 CAGR 15.8%

7 © 2021. IEA. All Rights Reserved. A NEW CLEAN POWER PLAN COULD ACCELERATE UTILITY-SCALE WIND AND SOLAR DEPLOYMENTS Projected Fossil & Nuclear Generation Retirements Through 2025 (GW)(1) 1. U.S. Energy Information Administration (EIA), Annual Energy Outlook 2020, January 2020. Based on natural gas-fired power plants (combined cycle, combustion turbine, and steam turbine), coal-fired power plants and nuclear power plants. 2. The replaced GWs are estimated based on an average capacity factor of 55% for retired fossil generation (EIA Electric Power Monthly Capacity Factors), 20% for solar (EPA May 2019 AVERT) and 40% for wind (BNEF 2H 2020 US Renewable Energy Market Outlook). 3. Assumes EPC accounts for 28% of wind capex of $1.19/W and 32% of utility-scale solar capex of $0.91/W. Projected Fossil & Nuclear Generation Retirements Through 2025 Assuming Retirements After 2023 Accelerated One Year (GW) Just a one year acceleration in fossil and nuclear generation retirements could expand the renewables EPC opportunity more than 40% over the next three years 76 GW over next 3 years EPC Opportunity(3) 13 20 21 22 35 2021 2022 2023 2024 2025 54 GW over next 3 years 13 20 43 35 14 2021 2022 2023 2024 2025 $56B EPC Opportunity(3) Required Investment if 25% of retired capacity replaced with Solar and 25% replaced with Wind(2) $79B Required Investment if 25% of retired capacity replaced with Solar and 25% replaced with Wind(2) $17B $24B

8 © 2021. IEA. All Rights Reserved. U.S. electricity generation from selected fuels AEO2021 reference case Billion kilowatthours SUSTAINED RENEWABLE ENERGY GROWTH 0 1,000 2,000 3,000 4,000 5,000 6,000 2010 2020 2030 2040 2050 2020 history projections natural gas renewables nuclear coal 40% 21% 19% 19% 36% 42% 11% 11% Source: US Energy Information Administration, Annual Energy Outlook 2021 (AEO2021) Key Takeaways EIA – Annual Energy Outlook 2021 ▪ Wind and Solar are projected to contribute 42% of total US electricity generation by 2050, up from 21% in 2020 ▪ By 2030 Wind and Solar will collectively surpass Natural Gas to be the predominant source of power generation in the US ▪ EIA’s 2021 reference case assumes no further Wind PTC beyond 2024 and assumes ITC of 10% into perpetuity after 2023 ▪ Implies further upside with possible extension of PTC and ITC under the Biden Administration By 2030 Wind and Solar will collectively surpass Natural Gas to be the predominant source of power generation in the US

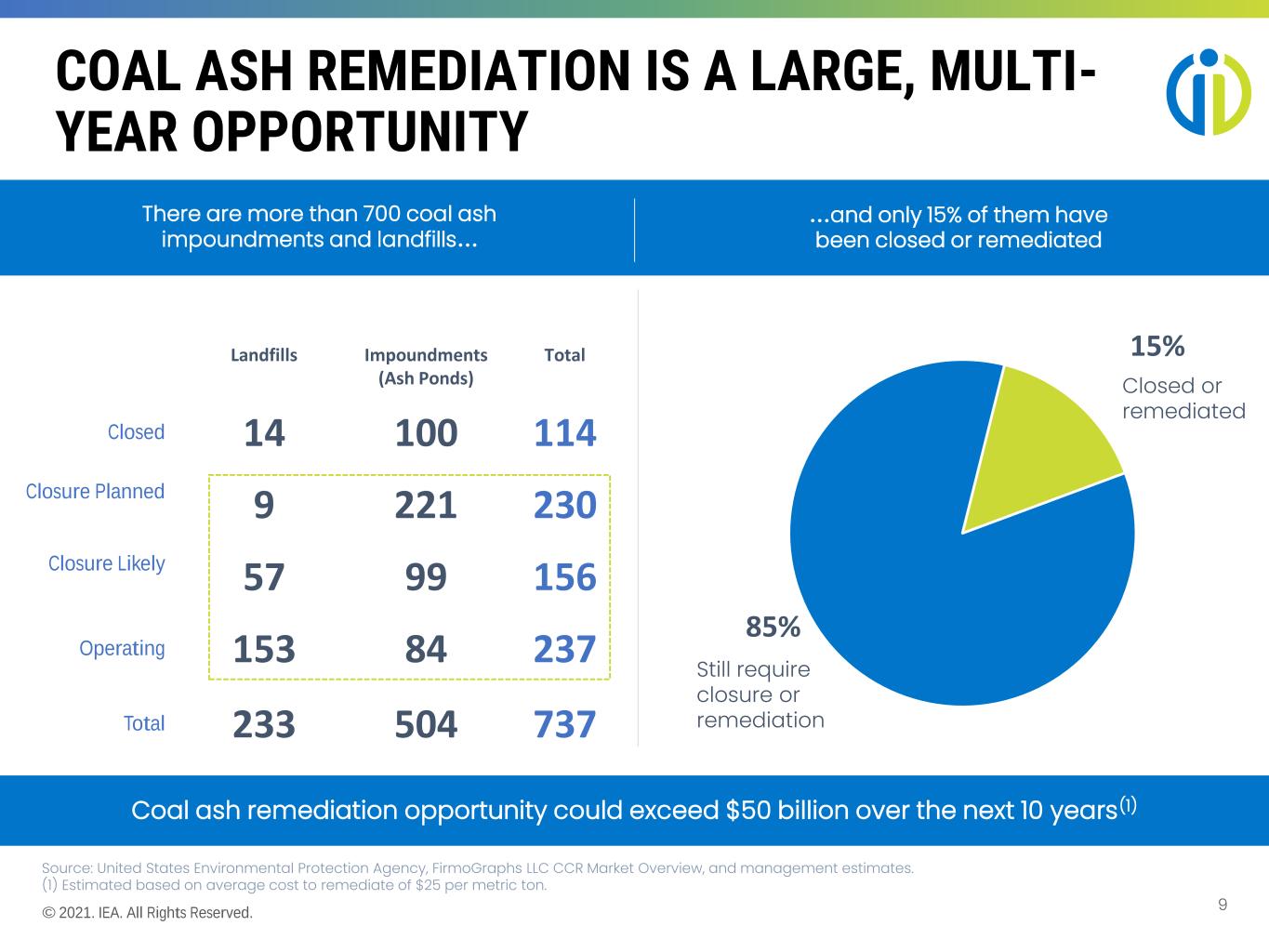

9 © 2021. IEA. All Rights Reserved. COAL ASH REMEDIATION IS A LARGE, MULTI- YEAR OPPORTUNITY There are more than 700 coal ash impoundments and landfills… …and only 15% of them have been closed or remediated Coal ash remediation opportunity could exceed $50 billion over the next 10 years(1) Landfills Impoundments (Ash Ponds) Total Closed 14 100 114 Closure Planned 9 221 230 Closure Likely 57 99 156 Operating 153 84 237 Total 233 504 737 15% 85% Closed or remediated Still require closure or remediation Source: United States Environmental Protection Agency, FirmoGraphs LLC CCR Market Overview, and management estimates. (1) Estimated based on average cost to remediate of $25 per metric ton.

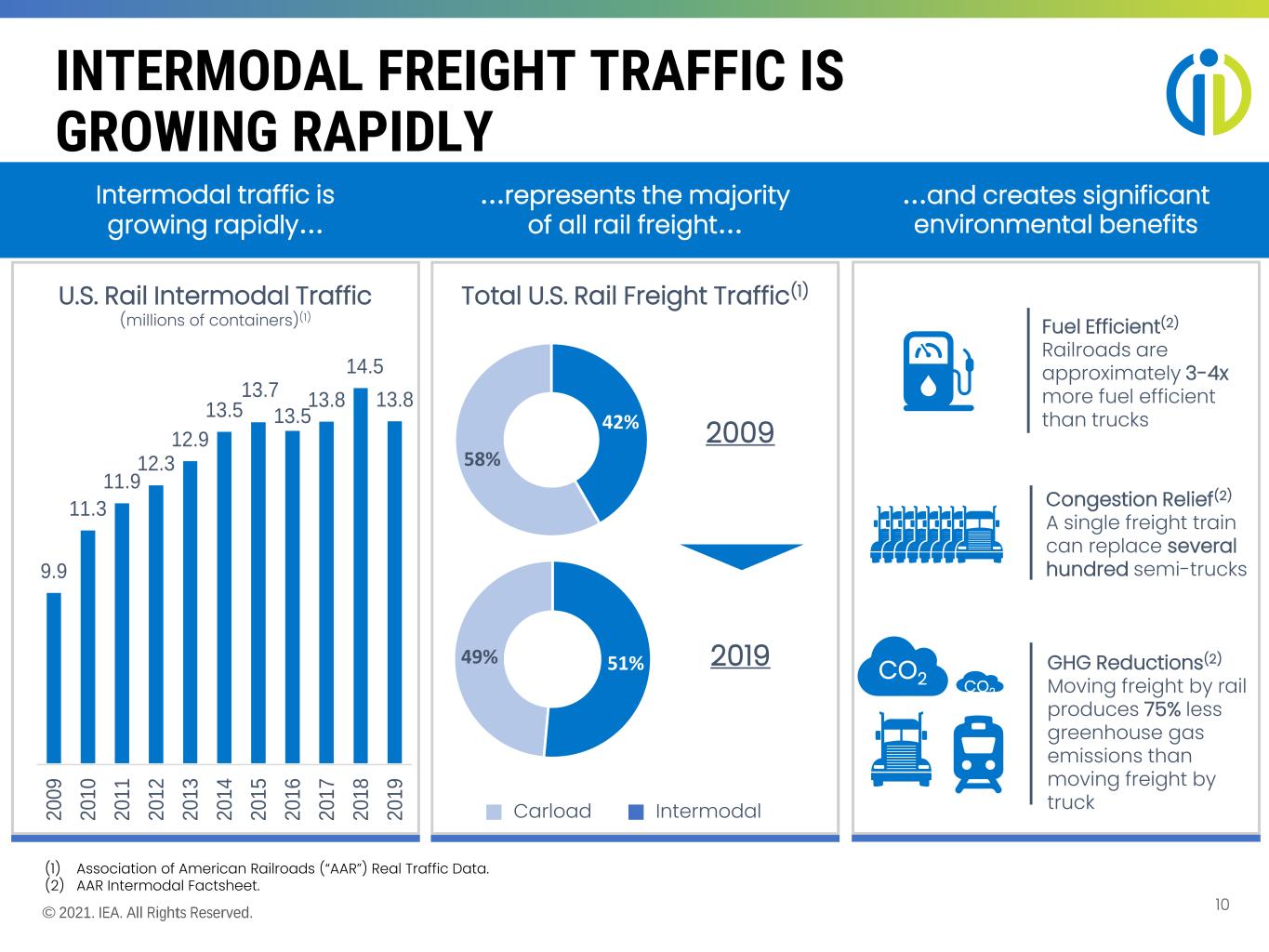

10 © 2021. IEA. All Rights Reserved. INTERMODAL FREIGHT TRAFFIC IS GROWING RAPIDLY Total U.S. Rail Freight Traffic(1)U.S. Rail Intermodal Traffic (millions of containers)(1) Intermodal traffic is growing rapidly… …represents the majority of all rail freight… …and creates significant environmental benefits GHG Reductions(2) Moving freight by rail produces 75% less greenhouse gas emissions than moving freight by truck Congestion Relief(2) A single freight train can replace several hundred semi-trucks Fuel Efficient(2) Railroads are approximately 3-4x more fuel efficient than trucks2009 2019 (1) Association of American Railroads (“AAR”) Real Traffic Data. (2) AAR Intermodal Factsheet. Carload Intermodal CO2 CO2 42% 58% 51% 49% 9.9 11.3 11.9 12.3 12.9 13.5 13.7 13.5 13.8 14.5 13.8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9

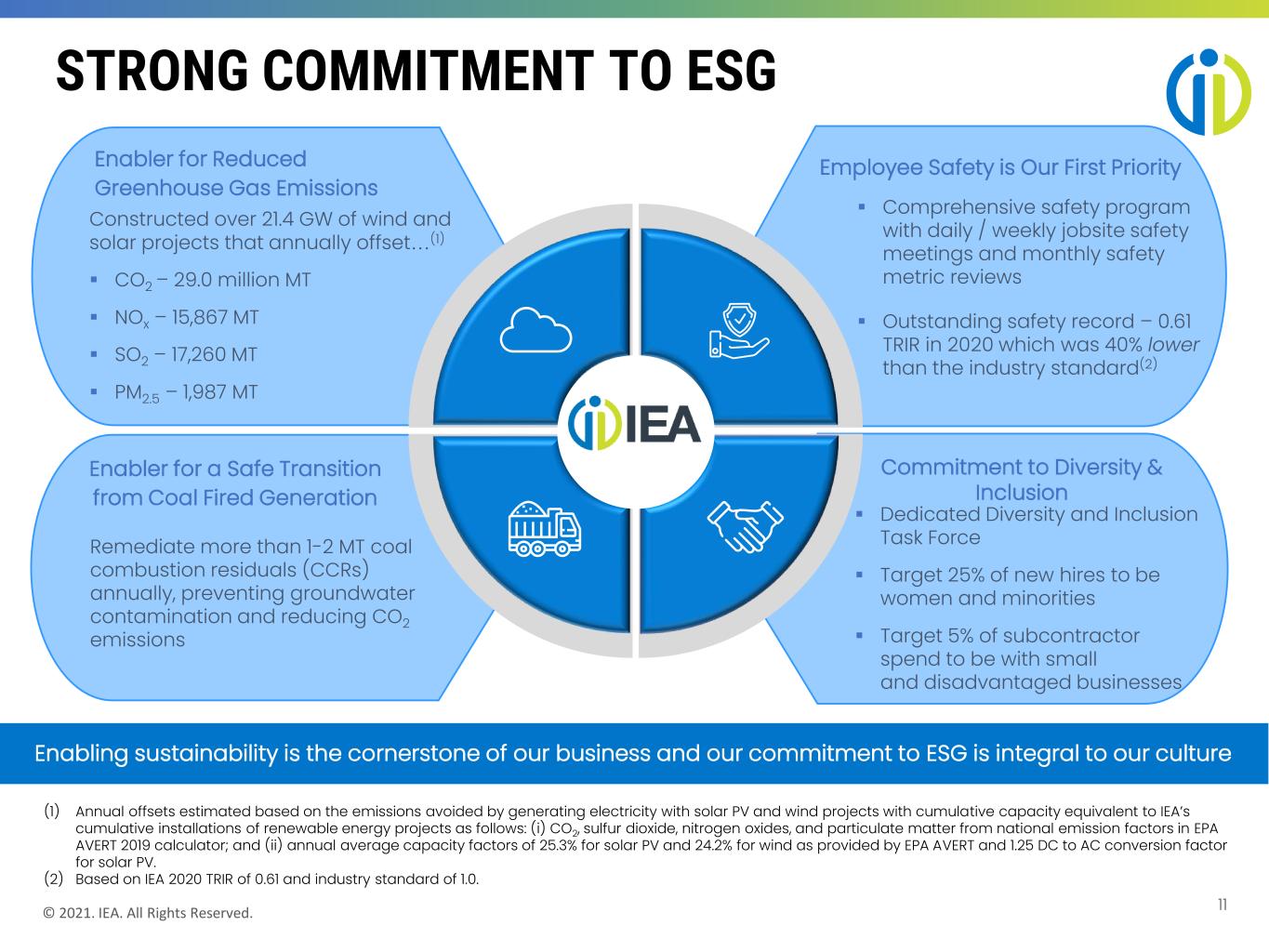

11 © 2021. IEA. All Rights Reserved. STRONG COMMITMENT TO ESG Constructed over 21.4 GW of wind and solar projects that annually offset…(1) ▪ CO2 – 29.0 million MT ▪ NOx – 15,867 MT ▪ SO2 – 17,260 MT ▪ PM2.5 – 1,987 MT Employee Safety is Our First PriorityEnabler for Reduced Greenhouse Gas Emissions Commitment to Diversity & Inclusion Enabler for a Safe Transition from Coal Fired Generation Remediate more than 1-2 MT coal combustion residuals (CCRs) annually, preventing groundwater contamination and reducing CO2 emissions ▪ Comprehensive safety program with daily / weekly jobsite safety meetings and monthly safety metric reviews ▪ Outstanding safety record – 0.61 TRIR in 2020 which was 40% lower than the industry standard(2) Enabling sustainability is the cornerstone of our business and our commitment to ESG is integral to our culture ▪ Dedicated Diversity and Inclusion Task Force ▪ Target 25% of new hires to be women and minorities ▪ Target 5% of subcontractor spend to be with small and disadvantaged businesses (1) Annual offsets estimated based on the emissions avoided by generating electricity with solar PV and wind projects with cumulative capacity equivalent to IEA’s cumulative installations of renewable energy projects as follows: (i) CO2, sulfur dioxide, nitrogen oxides, and particulate matter from national emission factors in EPA AVERT 2019 calculator; and (ii) annual average capacity factors of 25.3% for solar PV and 24.2% for wind as provided by EPA AVERT and 1.25 DC to AC conversion factor for solar PV. (2) Based on IEA 2020 TRIR of 0.61 and industry standard of 1.0.

© 2021. IEA. All Rights Reserved. 12 FINANCIAL & BUSINESS UPDATE

© 2021. IEA. All Rights Reserved. 13 FULL YEAR 2020 RESULTS SG&A Expense ($mm) Revenues ($mm) $1,460 $1,753 2019 2020 Adjusted EBITDA ($mm)(1) $101 $128 2019 2020 $120 $113 2019 2020 Key Themes ▪ Strong topline growth driven by renewables business • Record revenues in wind • Solar business ramping ▪ Stable gross margins despite COVID-19 costs ▪ Expanding EBITDA margins driven by SG&A leverage • Revenue growth combined with decreasing SG&A % Margin: 6.9% 7.3% (1) See appendix for a definition of Adjusted EBITDA and a reconciliation to net income. Gross Margin (%) 10.8% 10.8% 2019 2020

© 2021. IEA. All Rights Reserved. 14 FULL YEAR 2020 SEGMENT RESULTS Key Takeaways ▪ Wind revenues up YOY – new record ▪ Solar revenues up substantially YOY • Faster growing business going forward ▪ Modest increase in gross margins Key Takeaways ▪ Environmental down slightly YOY • Strong bidding environment impacted by increased time needed to obtain government approvals and environmental permitting ▪ Rail down slightly YOY • Continued demand for efficiency improvements offset by COVID-19 delays in public projects ▪ Transportation revenues up YOY Gross Margin %: 11.0% 10.1% Revenue Gross Margins Re n e w a b le s Sp e ci a lty C iv il $69 $62 2019 2020 ($mm) See Appendix for a reconciliation of non-GAAP measures. Gross Margin %: 10.6% 11.1% $834 $1,142 2019 2020 $88 $127 2019 2020 $626 $610 2019 2020

© 2021. IEA. All Rights Reserved. 15 STRONG BACKLOG VISIBILITY INTO 2021 Next Twelve-Month Backlog ($mm) Total Backlog ($mm) ▪ Slight decrease in 2020 resulting from delayed awards ▪ Strong Renewables business backlog • Record backlog in solar ▪ Growing Rail backlog ▪ Nearly doubled YoY $2,116 $2,171 $2,070 $0 $500 $1,000 $1,500 $2,000 $2,500 2018 2019 2020 $1,173 $1,412 $1,629 $0 $500 $1,000 $1,500 $2,000 2018 2019 2020

© 2021. IEA. All Rights Reserved. 16 FINANCIAL GUIDANCE

© 2021. IEA. All Rights Reserved. 17 ▪ $1.75B - $1.95B in Revenue ▪ $130M - $140M in Adjusted EBITDA 2021 GUIDANCE 2021 Guidance Range(1) ($ in Millions) Low High Revenue $1,750 $1,950 Net Income 5.0 14.0 Interest Expense, Net 61.0 61.0 Depreciation & Amortization 50.0 50.0 Expense for Income Taxes 10.0 11.0 EBITDA 126.0 136.0 Non-Cash Stock Compensation Expense 4.0 4.5 Series B Preferred warrant liability fair value adjustment 0.0 (0.5) Adjusted EBITDA $130.0 $140.0 (1) Guidance as of March 8, 2021

© 2021. IEA. All Rights Reserved. 18 APPENDIX

© 2021. IEA. All Rights Reserved. 19 Year Ended 12.31.2020 Year Ended 12.31.2019 Net income (loss) $ 728 $ 6,231 Interest expense 61,689 51,260 Provision (benefit) for income taxes 12,580 (1,621) Depreciation expense 47,682 48,220 EBITDA 122,679 104,090 Non-Cash Stock Comp Expenses 4,409 4,016 Acquisition Integration Costs(1) - 10,082 Contingent consideration fair value adjustment(2) - (23,082) Series B Preferred warrant liability fair value adjustment(3) 828 2,262 Project settlement legal fees(4) - - Other(5) 3,370 Adjusted EBITDA $ 127,916 $ 100,738 1) Acquisition integration costs related include legal, consulting, personnel and other costs associated with the acquisitions of Consolidated Construction Solutions I, LLC and William Charles Construction Group. 2) Reflects an adjustment for 2019 to the fair value of the Company’s contingent consideration incurred in connection with the Company's merger and initial public offering transactions in March 2018. The contingent consideration fair value adjustment is a mark-to-market adjustment based on the Company not anticipating reaching EBITDA requirements outlined in the original agreement. 3) Reflects an adjustment to the fair value of the Company’s Series B Preferred Stock warrant liabilities. The warrant liability fair value adjustment is a mark-to-market adjustment based on fluctuation in the Company's stock price. 4) Project settlement legal fees reflect fees incurred by the Company seeking additional recovery of settlements related to extreme weather-related events that occurred on projects at the end of 2018. 5) Other reflects unanticipated charges related to tax and warranty on solar projects that were previously disclosed as part of our Discontinued Operations in Canada in 2016 and gain/losses on asset sales. ADJUSTED EBITDA Dollars in millions

© 2021. IEA. All Rights Reserved. 20 THANK YOU I R C O N T A C T Addo Investor Relations Kimberly Esterkin, Managing Director iea@addoir.com 310.829.5400