- ICHR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DRS Filing

Ichor (ICHR) DRSDraft registration statement

Filed: 21 Sep 15, 12:00am

As submitted confidentially to the Securities and Exchange Commission on September 21, 2015

pursuant to the Jumpstart Our Business Startups Act

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ICHOR HOLDINGS, LTD.

(Exact name of registrant as specified in its charter)

| Cayman Islands | 3674 | Not Applicable | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

3185 Laurelview Ct.

Fremont, California 94538

(510) 897-5200

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

C T Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 590-9070

(Name, address, including zip code and telephone number, including area code, of agent for service)

Thomas M. Rohrs

Chairman and Chief Executive Officer

3185 Laurelview Ct.

Fremont, California 94538

(510) 897-5200

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Robert M. Hayward, P.C. Kirkland & Ellis LLP 300 North LaSalle Chicago, Illinois 60654 (312) 862-2000 | Tad J. Freese Latham & Watkins LLP 140 Scott Drive Menlo Park, California 94025 (650) 328-4600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated September , 2015

PROSPECTUS

Shares

ICHOR HOLDINGS, LTD.

Ordinary Shares

This is the initial public offering of ordinary shares of Ichor Holdings, Ltd. We are selling ordinary shares.

Prior to this offering, there has been no public market for our ordinary shares. The initial public offering price of our ordinary shares is expected to be between $ and $ per share. We have applied to list our ordinary shares on under the symbol “ ”.

Investing in our ordinary shares involves risks that are described in the “Risk Factors” section beginning on page 14 of this prospectus.

We are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933, as amended, or the Securities Act, and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. In addition, for so long as we remain an emerging growth company, we will qualify for certain limited exceptions from investor protection laws such as the Sarbanes-Oxley Act of 2002. Please read “Risk Factors—Risks Related to this Offering and Ownership of Our Ordinary Shares—We are an ‘emerging growth company’ and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our ordinary shares less attractive to investors.”

| Per Share | Total | |||||||

Public offering price | $ | $ | ||||||

Underwriting discounts(1) | $ | $ | ||||||

Proceeds, before expenses, to us | $ | $ | ||||||

| (1) | We refer you to “Underwriting” beginning on page 133 of this prospectus for additional information regarding underwriting compensation. |

The underwriters may also exercise their option to purchase up to additional ordinary shares from us at the initial public offering price, less the underwriting discount, for a period of 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The ordinary shares will be ready for delivery on or about , 2015.

| Deutsche Bank Securities | Stifel | RBC Capital Markets | ||

The date of this prospectus is , 2015.

| Page | ||||

| 1 | ||||

| 14 | ||||

| 38 | ||||

ENFORCEMENT OF CIVIL LIABILITIES UNDER U.S. FEDERAL SECURITIES LAWS | 39 | |||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 48 | |||

| 70 | ||||

| 85 | ||||

| 90 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 102 | |||

| 104 | ||||

| 107 | ||||

| 109 | ||||

| 125 | ||||

| 127 | ||||

| 134 | ||||

| 140 | ||||

| 140 | ||||

| 140 | ||||

| F-1 | ||||

We have not and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We are offering to sell, and seeking offers to buy, our ordinary shares only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of our ordinary shares. Our business, financial condition, results of operations and prospects may have changed since that date.

INDUSTRY AND MARKET DATA

We obtained the market and industry data and other statistical information used throughout this prospectus from our own research, surveys or studies conducted by third parties, independent industry or general publications and other published independent sources. In particular, we have based much of our discussion concerning the industry and market in which we operate on independent data, research opinions and viewpoints published by Gartner, Inc., or Gartner, and TechNavio. Industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we believe that each of these sources is reliable, neither we nor the underwriters have independently verified the accuracy or completeness of such data. Similarly, we believe our internal research is reliable, but it has not been verified by any independent sources.

i

TRADEMARKS AND TRADE NAMES

This prospectus includes our trademarks and service marks which are protected under applicable intellectual property laws and are the property of Ichor Holdings, Ltd. or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights, of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

ii

The following is a summary of material information discussed in this prospectus. This summary may not contain all the details concerning our business, our ordinary shares or other information that may be important to you. You should carefully review this entire prospectus, including the “Risk Factors” section and our financial statements and the notes thereto included elsewhere in this prospectus, before making an investment decision. As used in this prospectus, unless the context otherwise indicates, the references to “Ichor,” “our business,” “we,” “our,” or “us” or similar terms refer to Ichor Holdings, Ltd. and its consolidated subsidiaries. Unless otherwise indicated or the context otherwise requires, financial and operating data in this prospectus reflects the consolidated business and operations of Ichor Holdings, Ltd. and itswholly-owned subsidiaries.

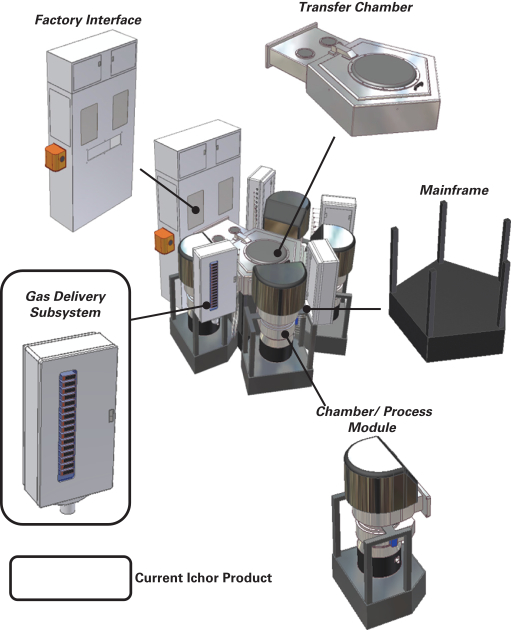

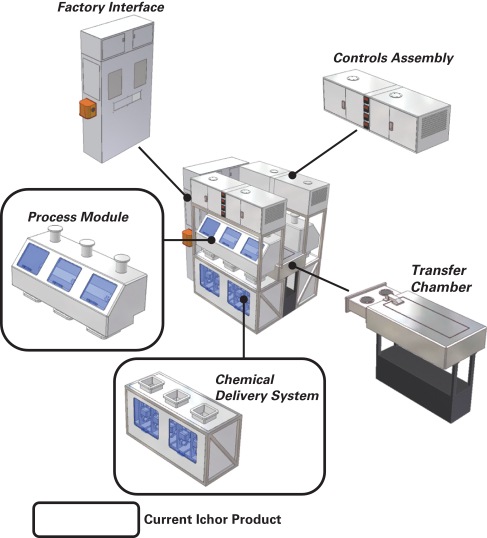

Company Overview

We are a leader in the design, engineering and manufacturing of critical fluid delivery subsystems for semiconductor capital equipment and equipment to manufacture light emitting diodes, or LEDs. Our primary offerings include gas and chemical delivery subsystems, collectively known as fluid delivery subsystems, which are key elements of the process tools used in the manufacturing of semiconductor devices and LEDs. Our gas delivery subsystems deliver, monitor and control precise quantities of the specialized gases used in semiconductor manufacturing processes such as etch and deposition and in metalorganic chemical vapor deposition, or MOCVD, for LED manufacturing. Our chemical delivery subsystems precisely blend and dispense the reactive liquid chemistries used in semiconductor manufacturing processes such as electroplating and cleaning. We also provide integration of process tools and sell refurbished process tools.

Fluid delivery subsystems ensure accurate measurement and uniform delivery of specialty gases and chemicals at critical steps in both semiconductor and LED manufacturing processes. Any malfunction or material degradation in fluid delivery reduces yields and increases the likelihood of manufacturing defects in these processes. Historically, semiconductor and LED equipment OEMs internally designed and manufactured the fluid delivery subsystems used in their process tools. Currently, most OEMs outsource the design, engineering and manufacturing of their gas delivery subsystems to a few specialized suppliers, including us. Additionally, many OEMs are also increasingly outsourcing the design, engineering and manufacturing of their chemical delivery subsystems due to the increased fluid expertise required to manufacture these subsystems. Outsourcing these subsystems has allowed OEMs to leverage the suppliers’ highly specialized engineering, design and production skills while focusing their internal resources on their own value-added processes. We believe that this outsourcing trend has enabled OEMs to reduce their fixed costs and development time, as well as provided significant growth opportunities for specialized subsystems suppliers like us.

Our goal is to be the premier supplier of outsourced subsystems to OEMs engaged in manufacturing capital equipment to produce semiconductors and LEDs and to leverage our technology into new markets. To achieve this goal, we engage with our customers early in their design and development processes and utilize our deep engineering resources and operating expertise to jointly create innovative and advanced solutions that meet the current and future needs of our customers. These collaborations frequently involve our engineers working at our customers’ sites and serving as an extension of our customers’ product design teams. We employ this approach with three of the largest manufacturers of semiconductor and LED capital

1

equipment in the world. We believe this approach enables us to design subsystems that meet the precise specifications our customers demand, allows us to often be the sole supplier of these subsystems during the initial production ramp, and positions us to be the preferred supplier for the full five to ten year lifespan of the process tool.

The broad technical expertise of our engineering team, coupled with our early customer engagement approach, enables us to offer innovative and reliable solutions to complex fluid delivery challenges. With two decades of experience developing complex fluid delivery subsystems and meeting the constantly-changing production requirements of leading semiconductor OEMs, we have developed expertise in fluid delivery that we offer to our OEM customers. In addition, our capital efficient model and the integration of our business systems with those of our customers provides us the flexibility to fulfill increased demand and meet changing customer requirements with minimum additional capital. With an aim to superior customer service, we have a global footprint with many facilities strategically located in close proximity to our customers. We have established long standing relationships with top tier OEM customers, including Applied Materials, Lam Research, Veeco and ASML, which were our largest customers by sales in fiscal 2014.

We grew our sales by 13.1% from $277.6 million in fiscal 2013 to $314.1 million in fiscal 2014, and by 17.8% from $166.1 million in the six months ended June 27, 2014 to $195.7 million in the six months ended June 26, 2015. We generated net income of $2.8 million in fiscal 2013, $6.2 million in fiscal 2014, $4.3 million in the six months ended June 27, 2014 and $9.4 million in the six months ended June 26, 2015. We generated adjusted net income of $8.2 million in fiscal 2013, $12.6 million in fiscal 2014, $7.4 million in the six months ended June 27, 2014 and $12.1 million in the six months ended June 26, 2015. Adjusted net income is a financial measure that is not calculated in accordance with generally accepted accounting principles in the United States, or GAAP. See note 3 to “Prospectus Summary—Summary Consolidated Financial Data” for a discussion of adjusted net income, an accompanying presentation of the most directly comparable GAAP financial measure, net income, and a reconciliation of the differences between adjusted net income and net income.

Our Industry

We design, engineer and manufacture critical fluid delivery subsystems for the semiconductor capital equipment, LED capital equipment and other related emerging markets described below.

The Semiconductor Device Industry is Large and Growing

Semiconductors are essential building blocks in all electronic systems. In recent years, semiconductor growth has been driven largely by increasing global demand for mobile devices and computer network systems. As consumers increasingly become accustomed to end products with higher functionality, better power management and smaller form factors, the demand for advanced semiconductor devices is expected to grow. Gartner estimates the semiconductor device market is expected to grow to $404 billion in 2019 from $340 billion in 2014.

Semiconductor Manufacturing Process is Complex and Constantly Evolving

Semiconductor manufacturing is complex and capital-intensive, requiring hundreds of process steps utilizing specialized manufacturing equipment. Technological advancements in

2

semiconductor manufacturing have traditionally led to a continual increase in the number of transistors in a given area of silicon, enabling smaller and more feature-rich devices. As a result, semiconductor device manufacturers must continuously refine their manufacturing processes and invest in next-generation manufacturing equipment that can produce semiconductors with a smaller chip size or an increasing number of features. Gartner estimates that the global spend on wafer fabrication equipment will grow to $37.8 billion in 2019 from $32.0 billion in 2014.

Changing Semiconductor Manufacturing Processes is Increasing the Need for Fluid Delivery Systems

A number of innovations in the design and manufacturing of semiconductors are being adopted in order to meet the continuing miniaturization and functionality demands, including multiple patterning, tri-gate, or FinFET transistors and three-dimensional, or 3D, semiconductors. Each of these innovations increases the number of process steps that a wafer must pass through during the manufacturing process, in particular, the number of etch and deposition steps. For example, according to Gartner, changes in the market for process requirements have driven a growth in etch spending by 29% and chemical vapor deposition spending by 12% from 2011 to 2014.

Semiconductor Capital Equipment Industry is Concentrated

The semiconductor capital equipment industry is dominated by a few large OEMs which focus on developing equipment specialized for many complex manufacturing process steps. As semiconductor manufacturing has become more technically advanced and capital intensive in recent years, the semiconductor equipment industry has experienced significant consolidation in order for the remaining OEMs to leverage economies of scale for delivering larger and more complex tools. As a result, most major semiconductor equipment markets are now typically supplied by a very limited number of major global suppliers. According to Gartner, the top five semiconductor equipment OEMs by sales in 2014 represented 67% of the total market for wafer fabrication equipment.

Semiconductor Capital Equipment OEMs Outsource Critical Subsytems including Fluid Delivery Subsystems

OEMs are increasingly outsourcing the development, design, prototyping, engineering, manufacturing, assembly, and testing of various critical subsystems to specialized independent suppliers. We believe that subsystem outsourcing has allowed OEMs to benefit from the highly specialized engineering, design and manufacturing skills of the subsystem suppliers while focusing internal resources on their own most critical value-added subsystems and processes. This outsourcing trend has been particularly applicable to the fluid delivery subsystem market. Over the past decade, as gas delivery subsystems have become more complex, most OEMs have increasingly outsourced the design, engineering and manufacturing of these subsystems to third party suppliers. OEMs are now also beginning to outsource chemical delivery subsystems, creating an additional opportunity for suppliers with fluid delivery expertise.

LED Manufacturing Equipment

LEDs are electronic components that emit light in a variety of brightness levels and colors and can act as highly efficient light sources. LEDs are used in a growing number of applications ranging from smartphone, tablet, laptop and television displays to general outdoor and indoor

3

lighting. LEDs are increasingly used in general lighting applications due to advantages over traditional light sources, such as lower energy consumption, longer durability, higher light quality and reduced form factor.

For vapor deposition, LED manufacturers employ a specialized technique called MOCVD to deposit very thin and precise layers of atoms onto an LED wafer. According to Gartner, total spending on MOCVD equipment from all manufacturing industries is forecast to grow from $414 million in 2014 to $831 million in 2019, representing a compound annual growth rate, or CAGR, of 15%.

Emerging and Other Markets

Similarly to semiconductor device and LED markets, manufacturing of products in flat panel display including organic LED, or OLED, displays, medical, scientific and other emerging markets require extremely precise and complex gas and liquid fluid delivery capabilities. Growth in these manufacturing equipment markets is driven by capacity expansion, facility upgrades, and adoption of complex deposition and etching manufacturing techniques. These sectors are evolving, but innovations in manufacturing are expected to drive demand for fluid management and control, some of which may be outsourced to suppliers like us.

In addition, we believe the market for systems integration of process tools in the semiconductor, LED and other equipment industries will continue to grow as OEMs in these industries look to dependable outsourced manufacturing partners like us to provide these services. Finally, we believe the market for refurbished production tools will continue to grow as OEMs choose to outsource the complete manufacturing of replacement parts and subsystems for their older generation products that continue to be used in various manufacturing processes.

Our Competitive Strengths

As a leader in the fluid delivery industry, we believe that our key competitive strengths include the following:

Deep Fluids Engineering Expertise

We believe that our engineering team, comprised of chemical engineers, mechanical engineers and software and systems engineers, has positioned us to expand the scope of our solutions, provide innovative subsystems and strengthen our incumbent position at our OEM customers. Our engineering team acts as an extension of our customers’ product development teams, providing our customers with technical expertise that is outside of their core competencies.

Early Engagement with Customers on Product Development

We seek to engage with our customers and potential customers very early in their process for new product development. We believe this approach enables us to collaborate on product design, qualification, manufacturing and testing in order to provide a comprehensive, customized solution. Through early engagement during the complex design stages, our engineering team gains early insight into our customers’ technology roadmaps which enables us to pioneer innovative and advanced solutions.

4

Long History and Strong Relationships with Top Tier Customers

We have established deep relationships with top tier OEMs such as Applied Materials, Lam Research, Veeco and ASML, each of whom has been our customer for more than 10 years. Our customers are global leaders by sales and are considered consolidators in the increasingly concentrated semiconductor and LED capital equipment industry. Our existing relationships with our customers have enabled us to effectively compete for new fluid delivery subsystems for our customers’ next generation products in development.

Operational Excellence with Scale to Support the Largest Customers

Over our 20 year history of designing and building gas delivery systems, we have developed deep capabilities in operations. We have strategically located our manufacturing facilities near our customers’ locations in Austin, Texas, Portland, Oregon and Kingston, New York in order to provide fast and efficient responses to new product introductions, and accommodate configuration or design changes late in the manufacturing process. We have also built significant capacity in Singapore to support high volume products. In addition to providing high quality and reliable fluid delivery subsystems, one of our principal focuses is delivering short lead times to allow our customers the maximum flexibility in their production processes.

Capital Efficient and Scalable Business Model

In general, our business is not capital intensive and we are able to grow sales with a low investment in factories and property, plant and equipment and working capital. In 2013 and 2014, our total capital expenditures were $2.3 million and $3.5 million, respectively. In particular, our close supplier relationships also enable us to scale production quickly without maintaining significant materials on hand. We have structured our business to minimize fixed manufacturing overhead and operating expenses to enable us to grow net income at a higher rate than sales during periods of growth. Conversely, our low fixed cost approach allows us to minimize the impact of cyclical downturns on our net income.

Our Growth Strategy

Our objective is to enhance our position as a leader in providing fluid delivery solutions, including subsystems, complete integration offerings, and tool refurbishment, to our customers by leveraging our core strengths. The key elements of our strategy are:

Grow Our Market Share within Existing Customer Base

We intend to grow our position with existing customers by continuing to leverage our specialized engineering talent and early collaboration approach with OEMs to foster long term relationships. Each of our customers produces many different process tools for various process steps. At each customer, we are the outsourced supplier of fluid delivery subsystems for a subset of their entire process tool offerings. We are constantly looking to expand our relationships and to capture additional share at our existing customers. We believe that our early collaborative approach with customers positions us to deliver innovative and dynamic solutions, offer timely deployment and meet competitive cost targets, further enhancing our brand reputation.

5

Grow Our Total Available Market at Existing Customers with Expanded Product Offerings

We continue to work with our existing core customers on additional opportunities, including chemical delivery, one of our important potential growth areas, as well as other extensions to our manufacturing services. We believe that wet processes, such as chemical-mechanical planarization, or CMP, clean and electro chemical deposition, that require precise chemical delivery are currently an underpenetrated market opportunity for us. By leveraging our existing customer relationships and strong reputation in fluid mechanics, we intend to increase our chemical delivery module market share as well as to introduce additional related products. In addition, we believe that as a larger number of leading edge tools are deployed and installed, our market opportunity for refurbishment of legacy systems grows.

Expand Our Total Customer Base within Fluid Delivery Market

We are actively in discussions with new customers that are considering outsourcing their gas and chemical delivery needs. For example, we recently acquired a new customer as the design and integration partner for the customer’s fluid delivery system for its next generation atomic layer deposition tool.

Expand Into Emerging Opportunities

We plan to leverage our existing manufacturing platform and engineering expertise to develop or acquire new products and solutions for attractive, high growth applications within new markets such as medical, research, oil and gas and energy. We believe these efforts will diversify our sales exposure while capitalizing on our current capabilities.

Continue to Improve Our Manufacturing Process Efficiency

We continually strive to improve our processes to reduce our manufacturing process cycle time, improve our ability to respond to last minute design or configuration changes, reduce our manufacturing costs and reduce our inventory requirements.

Recent Developments

On August 11, 2015, we entered into a new $55.0 million term loan facility and $20.0 million revolving credit facility and repaid all outstanding indebtedness under our prior $50.0 million term loan facility and $25.0 million revolving credit facility. Proceeds from borrowings under our new credit facilities, together with cash on hand, were used to pay a one-time approximately $22.1 million cash dividend on our outstanding preferred shares and an approximately $1.7 million cash bonus to certain members of management. Up to an additional approximately $1.4 million will become payable to certain members of management over the approximately four year period following the first bonus payments. For ease of reference, we refer to the foregoing transactions throughout this prospectus as the Refinancing Transaction.

Upon the closing of the Refinancing Transaction, we had $55.0 million of indebtedness outstanding under our new term loan facility and $10.0 million of indebtedness outstanding under our new revolving credit facility.

6

Risk Factors

There are a number of risks that you should understand before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary. These risks include, but are not limited to:

| • | Our business depends significantly on expenditures by manufacturers in the semiconductor capital equipment and LED capital equipment industries, which, in turn, are dependent upon the semiconductor and LED device industries. When those industries experience cyclical downturns, demand for our products and services is likely to decrease, which would likely result in decreased sales. We may also be forced to reduce our prices during cyclical downturns without being able to proportionally reduce costs. |

| • | We rely on a very small number of OEM customers for a significant portion of our sales. Any adverse change in our relationships with these customers could materially adversely affect our business, financial condition and results of operations. |

| • | Our customers exert a significant amount of negotiating leverage over us, which may require us to accept lower prices and gross margins or increased liability risk in order to retain or expand our market share with them. |

| • | The industries in which we participate are highly competitive and rapidly evolving, and if we are unable to compete effectively, our business, financial condition and results of operations could be materially adversely affected. |

| • | An active trading market for our ordinary shares may not develop, and you may not be able to sell your ordinary shares at or above the initial public offering price. |

| • | The price of our ordinary shares may fluctuate substantially. |

| • | We are a “controlled company” and, as a result, we are exempt from obligations to comply with certain corporate governance requirements. |

Corporate Information

Our principal executive offices are located at 3185 Laurelview Ct., Fremont, California, 94538, and our telephone number at that address is (510) 897-5200. Our website address iswww.ichorsystems.com. The reference to our website is a textual reference only. We do not incorporate the information on our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

JOBS Act

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earlier of the last day of the fiscal year following the fifth anniversary of the completion of this offering, the last day of the fiscal year in which we have total annual gross revenue of at least $1.0 billion, the date on which we are deemed to be a large accelerated filer (this means the market value of our ordinary shares that are held by non-affiliates exceeds $700 million as of the end of the second quarter of that fiscal year), or the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

7

An emerging growth company may also take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We have elected to take advantage of certain of the reduced disclosure obligations regarding financial statements and executive compensation in this prospectus and may elect to take advantage of other reduced burdens in future filings. As a result, the information that we provide to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, Section 107(b) of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected not to take advantage of such extended transition period under Section 107(b).

8

THE OFFERING

Ordinary shares offered by us | shares. |

Ordinary shares to be outstanding immediately after this offering | shares. |

Option to purchase additional shares | We have agreed to allow the underwriters to purchase up to an additional ordinary shares from us, at the public offering price, less the underwriting discount, within 30 days of the date of this prospectus. |

Use of proceeds | We estimate that the net proceeds from this offering to us will be approximately $ million, assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. The principal purposes of this offering are to obtain additional capital to fund our operations and growth, to create a public market for our ordinary shares and to facilitate our future access to the public equity markets. We expect to use approximately $ million of the net proceeds of this offering to repay outstanding borrowings under our credit facilities and the remainder for general corporate purposes, which we expect to include funding working capital, operating expenses and the selective pursuit of business development opportunities. At this time, we have not specifically identified a large single use for which we intend to use the net proceeds, and, accordingly, we are not able to allocate the net proceeds among any of these potential uses in light of the variety of factors that will impact how such net proceeds are ultimately utilized by us. |

Dividend policy | We do not anticipate declaring or paying any cash dividends on our ordinary shares for the foreseeable future. Any future determination relating to our dividend policy will be made at the discretion of our board of directors and will depend on then existing conditions, including our financial condition, results of operations, contractual restrictions (including in the credit agreements governing our credit facilities), capital requirements, business prospects, legal restrictions and other factors our board of directors may deem relevant. See “Dividend Policy.” |

Proposed symbol | We have applied to list our ordinary shares on under the symbol “ .” |

9

Unless otherwise indicated, all information in this prospectus relating to the number of ordinary shares to be outstanding immediately after this offering:

| • | assumes the effectiveness of our amended and restated memorandum and articles of association, the conversion of all outstanding Series A preferred shares into ordinary shares and the subsequent for reverse split of our ordinary shares, each of which will occur upon or prior to the completion of this offering; |

| • | excludes an aggregate of ordinary shares issuable upon the exercise of options that were issued to our employees under the Ichor Holdings, Ltd. 2012 Equity Incentive Plan (the “2012 Incentive Plan”); |

| • | excludes an aggregate of ordinary shares reserved for issuance under the equity compensation plan we intend to adopt in connection with this offering; |

| • | assumes an initial public offering price of $ per share, which is the midpoint of the initial public offering price range indicated on the cover of this prospectus; and |

| • | assumes no exercise of the underwriters’ option to purchase additional shares. |

10

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our historical consolidated financial data and should be read together with the sections in this prospectus entitled “Selected financial data” and “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

We have derived the consolidated statements of operations data for the years ended December 27, 2013 and December 26, 2014 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the consolidated statements of operations data for the six months ended June 27, 2014 and June 26, 2015 and the consolidated balance sheet data as of June 26, 2015, from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited interim consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments that are necessary for the fair statement of our unaudited interim consolidated financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future.

| Year Ended | Six Months Ended | |||||||||||||||

| December 27, 2013 | December 26, 2014 | June 27, 2014 | June 26, 2015 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| (In thousands, except share and per share amounts) | ||||||||||||||||

Consolidated Statement of Operations Data: | ||||||||||||||||

Net sales | $ | 277,637 | $ | 314,133 | $ | 166,141 | $ | 195,710 | ||||||||

Cost of sales(1) | 239,647 | 274,151 | 144,023 | 168,321 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Gross profit | 37,990 | 39,982 | 22,118 | 27,389 | ||||||||||||

Operating expenses: | ||||||||||||||||

Research and development(1) | 4,209 | 4,493 | 2,370 | 2,526 | ||||||||||||

Selling, general and administrative(1) | 22,491 | 24,557 | 12,760 | 12,271 | ||||||||||||

Restructuring charges | 700 | 414 | 148 | 63 | ||||||||||||

Amortization of intangible assets | 6,886 | 6,886 | 3,443 | 3,443 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total operating expenses | 34,286 | 36,350 | 18,721 | 18,303 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Income from operations | 3,704 | 3,632 | 3,397 | 9,086 | ||||||||||||

Interest expense | 3,350 | 3,115 | 1,598 | 1,474 | ||||||||||||

Other (income) expense, net | 145 | 207 | 83 | (22 | ) | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Income loss before income taxes | 209 | 310 | 1,716 | 7,634 | ||||||||||||

Income tax benefit(2) | (2,547 | ) | (5,858 | ) | (2,540 | ) | (1,757 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||

Net income | $ | 2,756 | $ | 6,168 | $ | 4,256 | $ | 9,391 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Other Financial Data: | ||||||||||||||||

Adjusted net income(3) | $ | 8,174 | $ | 12,620 | $ | 7,363 | $ | 12,092 | ||||||||

|

|

|

|

|

|

|

| |||||||||

11

| As of June 26, 2015 | ||||||||||||

| Actual | Pro Forma(4) | Pro Forma As Adjusted(5)(6) | ||||||||||

| (Unaudited) | ||||||||||||

| (In thousands) | ||||||||||||

Consolidated Balance Sheet Data: | ||||||||||||

Cash | $ | 20,286 | $ | $ | ||||||||

Working capital | 40,756 | |||||||||||

Total assets | 232,788 | |||||||||||

Total long-term debt(7) | 52,625 | |||||||||||

Preferred stock | 142,728 | |||||||||||

Total shareholders’ equity | 99,992 | |||||||||||

| (1) | Share-based compensation is included in the consolidated statement of operations data above was as follows: |

| Year Ended | Six Months Ended | |||||||||||||||

| December 27, 2013 | December 26, 2014 | June 27, 2014 | June 26, 2015 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| (In thousands) | ||||||||||||||||

Share-Based Compensation Expense: | ||||||||||||||||

Cost of sales | $ | 33 | $ | 33 | $ | 17 | $ | 17 | ||||||||

Research and development | 51 | 51 | 26 | 23 | ||||||||||||

Selling general and administrative | 412 | 927 | 487 | 500 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total share-based compensation expense | $ | 496 | $ | 1,011 | $ | 530 | $ | 540 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| (2) | Income tax benefit consists primarily of federal and state income tax benefits in the United States offset in part by income tax expense in certain foreign jurisdictions. Our income tax benefit results from losses recorded in the United States, where we incur the majority of our corporate expenses and which is being fully benefited as a result of acquired deferred tax liabilities, offset by income in Singapore, which has no tax expense as a result of a tax holiday through 2019. |

| (3) | Adjusted net income is a financial measure that is not calculated in accordance with GAAP. We define adjusted net income as net income adjusted to exclude amortization of intangible assets, share-based compensation expense, restructuring charges and other non-recurring expenses, net of the tax impact of such adjustments. Other non-recurring expenses include expenses incurred in connection with preparation for our initial public offering, expenses related to business acquisitions and consulting fees paid to Francisco Partners Consulting, LLC, an entity which is owned and controlled by individual operations executives who are associated with our principal shareholders but in which such shareholders hold no interest. We have provided below a reconciliation of adjusted net income to net income, the most directly comparable GAAP financial measure. Adjusted net income should not be considered as an alternative to net income or any other measure of financial performance calculated and presented in accordance with GAAP. In addition, our adjusted net income measure may not be comparable to similarly titled measures of other organizations as they may not calculate adjusted net income in the same manner as we calculate the measure. |

12

| The following table presents our adjusted net income and a reconciliation from net income, the most comparable GAAP measure, for the periods indicated: |

| Year Ended | Six Months Ended | |||||||||||||||

| December 27, 2013 | December 26, 2014 | June 27, 2014 | June 26, 2015 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| (In thousands) | ||||||||||||||||

Net income | $ | 2,756 | $ | 6,168 | $ | 4,256 | $ | 9,391 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Amortization of intangible assets | 6,886 | 6,886 | 3,443 | 3,443 | ||||||||||||

Share-based compensation | 496 | 1,011 | 530 | 540 | ||||||||||||

Restructuring charges | 700 | 414 | 148 | 63 | ||||||||||||

Other non-recurring expenses | 324 | 1,905 | 798 | 168 | ||||||||||||

Tax adjustment related to non-GAAP adjustments(a) | (2,988 | ) | (3,764 | ) | (1,812 | ) | (1,513 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted net income | $ | 8,174 | $ | 12,620 | $ | 7,363 | $ | 12,092 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| (a) | The difference between (i) the adjustments to our tax provision (benefit) made in connection with the other non-GAAP adjustments made to determine adjusted net income and (ii) the GAAP tax provision (benefit) for the years ended December 27, 2013 and December 26, 2014 and for the six months ended June 27, 2014 and June 26, 2015 is $440, $(2,094), $(728) and $(214), respectively. |

Adjusted net income has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for net income or any of our other operating results reported under GAAP. Adjusted net income excludes some costs, namely, non-cash share-based compensation, amortization of intangible assets and other non-recurring expenses, and therefore it does not reflect the non-cash impact of such expenses. Other companies may calculate adjusted net income differently or may use other measures to evaluate their performance, both of which could reduce the usefulness of our adjusted net income as a tool for comparison.

| Because of these limitations, you should consider adjusted net income alongside other financial performance measures, including net income and other financial results presented in accordance with GAAP. In addition, in evaluating adjusted net income, you should be aware that in the future we will incur expenses such as those that are the subject of adjustments in deriving adjusted net income and you should not infer from our presentation of adjusted net income that our future results will not be affected by these expenses or any unusual or non-recurring items. |

| (4) | Reflects (i) the Refinancing Transaction and (ii) the conversion of all outstanding shares of our preferred stock into ordinary shares and the subsequent for reverse split of our ordinary shares to be effective upon or prior to the completion of this offering. |

| (5) | Reflects: (i) all adjustments included in the pro forma column, and (ii) the sale by us of ordinary shares in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (6) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) our pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total shareholders’ equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (7) | Includes the current and long-term portion of our debt obligations (i) on an actual basis, our prior $50.0 million term loan facility and $25.0 million revolving credit facility and (ii) on a pro forma and pro forma adjusted basis, our new $55.0 million term loan facility and $20.0 million revolving credit facility. |

13

This offering and an investment in our ordinary shares involve a high degree of risk. You should carefully consider the risks described below, together with the financial and other information contained in this prospectus, before you decide to purchase our ordinary shares. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially adversely affected. As a result, the trading price of our ordinary shares could decline, and you could lose all or part of your investment in our ordinary shares.

Risks Related to Our Business

Our business depends significantly on expenditures by manufacturers in the semiconductor capital equipment and LED capital equipment industries, which, in turn, are dependent upon the semiconductor and LED device industries. When those industries experience cyclical downturns, demand for our products and services is likely to decrease, which would likely result in decreased sales. We may also be forced to reduce our prices during cyclical downturns without being able to proportionally reduce costs.

Our business, financial condition and results of operations depend significantly on expenditures by manufacturers in the semiconductor capital equipment and LED capital equipment industries. In turn, those industries depend upon the current and anticipated market demand for semiconductor and LED devices. The semiconductor and LED device industries are subject to cyclical and volatile fluctuations in supply and demand and in the past have periodically experienced significant downturns, which often occur in connection with declines in general economic conditions, and which have resulted in significant volatility in the semiconductor capital equipment and LED capital equipment industries. The semiconductor and LED device industries have also experienced recurring periods of over-supply of products that have had a severe negative effect on the demand for capital equipment used to manufacture such products. We have experienced, and anticipate that we will continue to experience, significant fluctuations in customer orders for our products and services as a result of such fluctuations and cycles. Any downturns in the semiconductor and LED device industries could have a material adverse effect on our business, financial condition and results of operations. For example, in fiscal 2012, we incurred a goodwill impairment charge of $42.9 million as a result of a significant downturn in the LED market.

In addition, we must be able to appropriately align our cost structure with prevailing market conditions, effectively manage our supply chain and motivate and retain employees, particularly during periods of decreasing demand for our products. We may be forced to reduce our prices during periods of decreasing demand. While we operate under a low fixed cost model, we may not be able to proportionally reduce all of our costs if we are required to reduce our prices. If we are not able to timely and appropriately adapt to the changes in our business environment, our business, financial condition and results of operations will be materially adversely affected. The cyclical and volatile nature of the semiconductor and LED industries and the absence of long-term fixed or minimum volume contracts make any effort to project a material reduction in future sales volume difficult.

We rely on a very small number of OEM customers for a significant portion of our sales. Any adverse change in our relationships with these customers could materially adversely affect our business, financial condition and results of operations.

The semiconductor capital equipment and LED capital equipment industries are highly concentrated and have experienced significant consolidation in recent years. As a result, a

14

relatively small number of OEM customers have historically accounted for a significant portion of our sales, and we expect this trend to continue for the foreseeable future. For fiscal 2014, our top three customers accounted for approximately 39.6%, 35.7% and 20.6%, respectively, of our total sales, and we expect that our sales will continue to be concentrated among a very small number of customers. We do not have any long-term contracts that require customers to place orders with us in fixed or minimum volumes. Accordingly, the success of our business depends on the success of our customers and those customers and other OEMs continuing to outsource the manufacturing of critical subsystems and process solutions to us. Because of the small number of OEMs in the markets we serve, a number of which are already our customers, it would be difficult to replace lost sales resulting from the loss of, or the reduction, cancellation or delay in purchase orders by, any one of these customers, whether due to a reduction in the amount of outsourcing they do, their giving orders to our competitors, their acquisition by an OEM who is not a customer or with whom we do less business, or otherwise. We have in the past lost business from customers for a number of these reasons. If we are unable to replace sales from customers who reduce the volume of products and services they purchase from us or terminate their relationship with us entirely, such events could have a material adverse impact on our business, financial condition and results of operations.

Additionally, if one or more of the largest OEMs were to decide to single- or sole-source all or a significant portion of manufacturing and assembly work to a single equipment manufacturer, such a development would heighten the risks discussed above.

Our customers exert a significant amount of negotiating leverage over us, which may require us to accept lower prices and gross margins or increased liability risk in order to retain or expand our market share with them.

By virtue of our largest customers’ size and the significant portion of our sales that is derived from them, as well as the competitive landscape, our customers are able to exert significant influence and pricing pressure in the negotiation of our commercial arrangements and the conduct of our business with them. Our customers often require reduced prices or other pricing, quality or delivery commitments as a condition to their purchasing from us in any given period or increasing their purchase volume, which can, among other things, result in reduced gross margins in order to maintain or expand our market share. Our customers’ negotiating leverage also can result in customer arrangements that may contain significant liability risk to us. For example, some of our customers require that we provide them indemnification against certain liabilities in our arrangements with them, including claims of losses by their customers caused by our products. Any increase in our customers’ negotiating leverage may expose us to increased liability risk in our arrangements with them, which, if realized, may have a material adverse effect on our business, financial condition and results of operations. In addition, new products often carry lower gross margins than existing products for several quarters following their introduction. If we are unable to retain and expand our business with our customers on favorable terms, or if we are unable to achieve gross margins on new products that are similar to or more favorable than the gross margins we have historically achieved, our business, financial condition and results of operations may be materially adversely affected.

The industries in which we participate are highly competitive and rapidly evolving, and if we are unable to compete effectively, our business, financial condition and results of operations could be materially adversely affected.

We face intense competition from other suppliers of gas or chemical delivery subsystems and suppliers of system integration, as well as the internal manufacturing groups of OEMs. Increased competition has in the past resulted, and could in the future result, in price

15

reductions, reduced gross margins or loss of market share, any of which would materially adversely affect our business, financial condition and results of operations. We are subject to significant pricing pressure as we attempt to maintain and increase market share with our existing customers. Our competitors may offer reduced prices or introduce new products or services for the markets currently served by our products and services. These products may have better performance, lower prices and achieve broader market acceptance than our products. OEMs also typically own the design rights to their products. Further, if our competitors obtain proprietary rights to these designs such that we are unable to obtain the designs necessary to manufacture products for our OEM customers, our business, financial condition and results of operations could be materially adversely affected.

Certain of our competitors may have or may develop greater financial, technical, manufacturing and marketing resources than we do. As a result, they may be able to respond more quickly to new or emerging technologies and changes in customer requirements, devote greater resources to the development, promotion, sale and support of their products and services, and reduce prices to increase market share. In addition to organic growth by our competitors, there may be merger and acquisition activity among our competitors and potential competitors that may provide our competitors and potential competitors with an advantage over us by enabling them to expand their product offerings and service capabilities to meet a broader range of customer needs. The introduction of new technologies and new market entrants may also increase competitive pressures.

We are exposed to risks associated with weakness in the global economy and geopolitical instability.

Our business is dependent upon manufacturers of semiconductor and LED capital equipment, whose businesses in turn ultimately depend largely on consumer spending on semiconductor and LED devices. Continuing uncertainty regarding the global economy continues to pose challenges to our business. Economic uncertainty and related factors, including current unemployment levels, uncertainty in European debt markets, geopolitical instability in various parts of the world, fiscal uncertainty in the U.S. economy, market volatility and the slow rate of recovery of many countries from recent recessions, exacerbate negative trends in business and consumer spending and may cause certain of our customers to push out, cancel or refrain from placing orders for products or services, which may reduce sales and materially adversely affect our business, financial condition and results of operations. Difficulties in obtaining capital, uncertain market conditions or reduced profitability may also cause some customers to scale back operations, exit businesses, merge with other manufacturers, or file for bankruptcy protection and potentially cease operations, leading to customers’ reduced research and development funding and/or capital expenditures and, in turn, lower orders from our customers and/or additional slow moving or obsolete inventory or bad debt expense for us. These conditions may also similarly affect our key suppliers, which could impair their ability to deliver parts and result in delays for our products or require us to either procure products from higher-cost suppliers, or if no additional suppliers exist, to reconfigure the design and manufacture of our products, and we may be unable to fulfill some customer orders. Any of these conditions or events could have a material adverse effect on our business, financial condition and results of operations.

If we do not keep pace with developments in the industries we serve and with technological innovation generally, our products and services may not be competitive.

Rapid technological innovation in the markets we serve requires us to anticipate and respond quickly to evolving customer requirements and could render our current product

16

offerings, services and technologies obsolete. In particular, the design and manufacturing of semiconductors and LED devices is constantly evolving and becoming more complex in order to achieve greater power, performance and efficiency with smaller devices. Capital equipment manufacturers need to keep pace with these changes by refining their existing products and developing new products.

We believe that our future success will depend upon our ability to design, engineer and manufacture products that meet the changing needs of our customers. This requires that we successfully anticipate and respond to technological changes in design, engineering and manufacturing processes in a cost-effective and timely manner. If we are unable to integrate new technical specifications into competitive product designs, develop the technical capabilities necessary to manufacture new products or make necessary modifications or enhancements to existing products, our business, financial condition and results of operations could be materially adversely affected.

The timely development of new or enhanced products is a complex and uncertain process which requires that we:

| • | design innovative and performance-enhancing features that differentiate our products from those of our competitors; |

| • | identify emerging technological trends in the industries we serve, including new standards for our products; |

| • | accurately identify and design new products to meet market needs; |

| • | collaborate with OEMs to design and develop products on a timely and cost-effective basis; |

| • | ramp-up production of new products, especially new subsystems, in a timely manner and with acceptable yields; |

| • | manage our costs of product development and the costs of producing the products that we sell; |

| • | successfully manage development production cycles; and |

| • | respond quickly and effectively to technological changes or product announcements by others. |

If we are unsuccessful in keeping pace with technological developments for the reasons above or other reasons, our business, financial condition and results of operations could be materially adversely affected.

We must design, develop and introduce new products that are accepted by OEMs in order to retain our existing customers and obtain new customers.

The introduction of new products is inherently risky because it is difficult to foresee the adoption of new standards, coordinate our technical personnel and strategic relationships and win acceptance of new products by OEMs. We attempt to mitigate this risk by collaborating with our customers during their design and development processes. We cannot, however, assure you that we will be able to successfully introduce, market and cost-effectively manufacture new products, or that we will be able to develop new or enhanced products and processes that satisfy customer needs. In addition, new capital equipment typically has a lifespan of five to ten years, and OEMs frequently specify which systems, subsystems, components and instruments are to be used in their equipment. Once a specific system, subsystem, component or instrument is incorporated into a piece of capital equipment, it will often continue to be purchased for that

17

piece of equipment on an exclusive basis for 18-24 months before the OEM generates enough sales volume to consider adding alternative suppliers. Accordingly, it is important that our products are designed into the new systems introduced by the OEMs. If any of the new products we develop are not launched or successful in the market, our business, financial condition and results of operations could be materially adversely affected.

The manufacturing of our products is highly complex, and if we are not able to manage our manufacturing and procurement process effectively, our business, financial condition and results of operations may be materially adversely affected.

The manufacturing of our products is a highly complex process that involves the integration of multiple components and requires effective management of our supply chain while meeting our customers’ design-to-delivery cycle time requirements. Through the course of the manufacturing process, our customers may modify design and system configurations in response to changes in their own customers’ requirements. In order to rapidly respond to these modifications and deliver our products to our customers in a timely manner, we must effectively manage our manufacturing and procurement process. If we fail to manage this process effectively, we risk losing customers and damaging our reputation. We may also be subject to liability under our agreements with our customers if we or our suppliers fail to re-configure manufacturing processes or components in response to these modifications. In addition, if we acquire inventory in excess of demand or that does not meet customer specifications, we could incur excess or obsolete inventory charges. We have from time to time experienced bottlenecks and production difficulties that have caused delivery delays and quality control problems. These risks are even greater as we seek to expand our business into new subsystems. In addition, certain of our suppliers have been, and may in the future be, forced out of business as a result of the economic environment. In such cases, we may be required to procure products from higher-cost suppliers or, if no additional suppliers exist, reconfigure the design and manufacture of our products. This could materially limit our growth, adversely impact our ability to win future business and have a material adverse effect on our business, financial condition and results of operations.

Defects in our products could damage our reputation, decrease market acceptance of our products and result in potentially costly litigation.

A number of factors, including design flaws, material and component failures, contamination in the manufacturing environment, impurities in the materials used and unknown sensitivities to process conditions, such as temperature and humidity, as well as equipment failures, may cause our products to contain undetected errors or defects. Errors, defects or other problems with our products may:

| • | cause delays in product introductions and shipments; |

| • | result in increased costs and diversion of development resources; |

| • | cause us to incur increased charges due to unusable inventory; |

| • | require design modifications; |

| • | result in liability for the unintended release of hazardous materials; |

| • | create claims for rework, replacement and/or damages under our contracts with customers, as well as indemnification claims from customers; |

| • | decrease market acceptance of, or customer satisfaction with, our products, which could result in decreased sales and increased product returns; or |

| • | result in lower yields for semiconductor manufacturers. |

18

If any of our products contain defects or have reliability, quality or compatibility problems, our reputation may be damaged and customers may be reluctant to buy our products. We may also face a higher rate of product defects as we increase our production levels in periods of significant growth. Product defects could result in warranty and indemnification liability or the loss of existing customers or impair our ability to attract new customers. In addition, we may not find defects or failures in our products until after they are installed in a manufacturer’s fabrication facility. We may have to invest significant capital and other resources to correct these problems. Our current or potential customers also might seek to recover from us any losses resulting from defects or failures in our products. In addition, hazardous materials flow through and are controlled by certain of our products and an unintended release of these materials could result in serious injury or death. Liability claims could require us to spend significant time and money in litigation or pay significant damages.

We may incur unexpected warranty and performance guarantee claims that could materially adversely affect our business, financial condition and results of operations.

In connection with our products and services, we provide various product warranties, performance guarantees and indemnification rights. Warranty or other performance guarantee or indemnification claims against us could cause us to incur significant expense to repair or replace defective products or indemnify the affected customer for losses. In addition, quality issues can have various other ramifications, including delays in the recognition of sales, loss of sales, loss of future sales opportunities, increased costs associated with repairing or replacing products, and a negative impact on our reputation, all of which could materially adversely affect our business, financial condition and results of operations.

Our dependence on a limited number of suppliers may harm our production output and increase our costs, and may prevent us from delivering acceptable products on a timely basis.

Our ability to meet our customers’ demand for our products depends upon obtaining adequate supplies of quality components and other raw materials on a timely basis. In addition, our customers often specify components from particular suppliers that we must incorporate into our products. We also use consignment and just-in-time stocking programs, which means we carry very little inventory of components or other raw materials, and we rely on our suppliers to deliver necessary components and raw materials in a timely manner. However, our suppliers are under no obligation to provide us with components or other raw materials. As a result, the loss of or failure to perform by any of our key suppliers could materially adversely affect our ability to deliver products on a timely basis. In addition, if a supplier were unable to provide the volume of components we require on a timely basis and at acceptable prices and quality, we would have to identify and qualify replacements from alternative sources of supply. However, the process of qualifying new suppliers for complex components is also lengthy and could delay our production. We may also experience difficulty in obtaining sufficient supplies of components and raw materials in times of significant growth in our business. If we are unable to procure sufficient quantities of components or raw materials from suppliers, our customers may elect to delay or cancel existing orders or not place future orders, which could have a material adverse effect on our business, financial condition and results of operations.

We are subject to order and shipment uncertainties, and any significant reductions, cancellations or delays in customer orders could have a material adverse effect on our business, financial condition and results of operations.

Our sales are difficult to forecast because we generally do not have a material backlog of unfilled orders and because of the short time frame within which we are often required to

19

manufacture and deliver products to our customers. Most of our sales for a particular quarter depend on customer orders placed during that quarter or shortly before it commences. Our contracts generally do not require our customers to commit to minimum purchase volumes. While most of our customers provide periodic rolling forecasts for product orders, those forecasts do not become binding until a formal purchase order is submitted, which generally occurs only a short time prior to shipment. As a result of the foregoing and the cyclicality and volatility of the industries we serve, it is difficult to predict future orders with precision. Occasionally, we order component inventory and build products in advance of the receipt of actual customer orders. Customers may cancel order forecasts, change production quantities from forecasted volumes or delay production for reasons beyond our control. Furthermore, reductions, cancellations or delays in customer order forecasts usually occur without penalty to, or compensation from, the customer. Reductions, cancellations or delays in forecasted orders could cause us to hold inventory longer than anticipated, which could reduce our gross profit, restrict our ability to fund our operations and result in unanticipated reductions or delays in sales. If we do not obtain orders as we anticipate, we could have excess components for a specific product and/or finished goods inventory that we would not be able to sell to another customer, likely resulting in inventory write-offs, which could have a material adverse effect on our business, financial condition and results of operations.

Because our customers generally require that they qualify our engineering, documentation, manufacturing and quality control procedures, our ability to add new customers quickly is limited.

We are generally required to qualify and maintain our status as a supplier for each of our customers. This is a time-consuming process that involves the inspection and approval by a customer of our engineering, documentation, manufacturing and quality control procedures before that customer will place orders with us. Our ability to lessen the adverse effect of any loss of, or reduction in sales to, an existing customer through the rapid addition of one or more new customers is limited in part because of these qualification requirements. Consequently, the risk that our business, financial condition and results of operations would be materially adversely affected by the loss of, or any reduction in orders by, any of our significant customers is increased. Moreover, if we lost our existing status as a qualified supplier to any of our customers, such customer could cancel its orders from us or otherwise terminate its relationship with us, which could have a material adverse effect on our business, financial condition and results of operations.

Restrictive covenants under our credit facilities may limit our current and future operations. If we fail to comply with those covenants, the lenders could cause outstanding amounts, which are currently substantial, to become immediately due and payable, and we might not have sufficient funds and assets to pay such loans.

As of June 26, 2015, we had $52.6 million of outstanding indebtedness, including $42.1 million of indebtedness under our term loan facility and $10.5 million of indebtedness under our revolving credit facility. Upon the closing of the Refinancing Transaction, we had $55.0 million of indebtedness outstanding under our new term loan facility and $10.0 million of indebtedness outstanding under our new revolving credit facility. We may incur additional indebtedness in the future. Our new credit facilities contain certain restrictive covenants and conditions, including limitations on our ability to, among other things:

| • | incur additional indebtedness or contingent obligations; |

| • | create or incur liens, negative pledges or guarantees; |

| • | make investments; |

20

| • | make loans; |

| • | sell or otherwise dispose of assets; |

| • | merge, consolidate or sell substantially all of our assets; |

| • | make certain payments on indebtedness; |

| • | pay dividends on or make distributions in respect of capital stock or make certain other restricted payments or investments; |

| • | enter into certain agreements that restrict distributions from restricted subsidiaries; |

| • | enter into transactions with affiliates; |

| • | change the nature of our business; and |

| • | amend the terms of our organizational documents. |

As a result of these covenants, we may be restricted in our ability to pursue new business opportunities or strategies or to respond quickly to changes in the industries that we serve. A violation of any of these covenants would be deemed an event of default under our credit facilities. In such event, upon the election of the lenders, the loan commitments under our credit facilities would terminate and the principal amount of the loans and accrued interest then outstanding would be due and payable immediately. A default may also result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In the event our lenders accelerate the repayment of our borrowings, we cannot assure you that we and our subsidiaries would have sufficient funds to repay such indebtedness or be able to obtain replacement financing on a timely basis or at all. These events could force us into bankruptcy or liquidation, which would a material adverse effect on our business, financial condition and results of operations.

We also may need to negotiate changes to the covenants in the agreements governing our credit facilities in the future if there are material changes in our business, financial condition or results of operations, but we cannot assure you that we will be able to do so on terms favorable to us or at all.

Certain of our customers require that we consult with them in connection with specified fundamental changes in our business, and address any concerns or requests such customer may have in connection with a fundamental change. While those customers do not have contractual approval or veto rights with respect to fundamental changes, our failure to consult with such customers or to satisfactorily respond to their requests in connection with any such fundamental change could constitute a breach of contract or otherwise be detrimental to our relationships with such customers.