Certain statements in this Management's Discussion and Analysis ("MD&A"), other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "would," "expect," "intend," "could," "estimate," "should," "anticipate," or "believe," and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. Readers should carefully review the risk factors in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the Securities and Exchange Commission on April 14, 2022.

The following MD&A is intended to help readers understand the results of our operation and financial condition, and is provided as a supplement to, and should be read in conjunction with, our Interim Unaudited Financial Statements and the accompanying Notes to Interim Unaudited Financial Statements under Part 1, Item 1 of this Quarterly Report on Form 10-Q.

Growth and percentage comparisons made herein generally refer to the three-month period ended March 31, 2022 compared with the three-month period ended March 31, 2021 unless otherwise noted. Unless otherwise indicated or unless the context otherwise requires, all references in this document to "we, "us, "our," the "Company," and similar expressions refer to SusGlobal Energy Corp., and depending on the context, its subsidiaries.

SPECIAL NOTICE ABOUT GOING CONCERN AUDIT OPINION

OUR AUDITOR ISSUED AN OPINION EXPRESSING SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE IN BUSINESS AS A GOING CONCERN FOR THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019. YOU SHOULD READ THIS QUARTERLY REPORT ON FORM 10-Q WITH THE "GOING CONCERN" ISSUES IN MIND.

This Management's Discussion and Analysis should be read in conjunction with the unaudited interim condensed consolidated financial statements included in this Quarterly Report on Form 10-Q (the "Financial Statements"). The financial statements have been prepared in accordance with generally accepted accounting policies in the United States ("GAAP"). Except as otherwise disclosed, all dollar figures included therein and in the following management discussion and analysis are quoted in United States dollars.

OVERVIEW

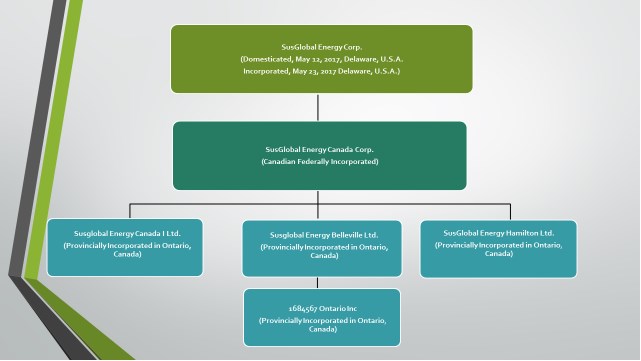

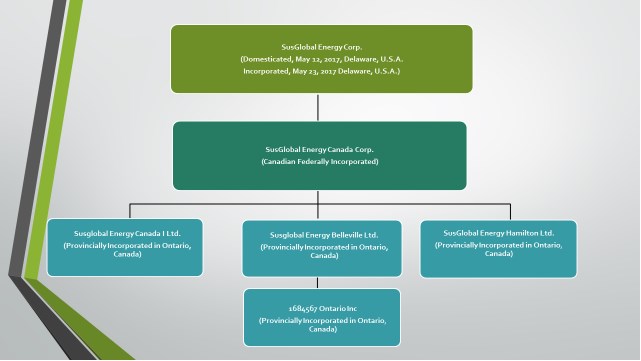

The following organization chart sets forth our wholly-owned subsidiaries:

|

| 33 |

SusGlobal Energy Corp. ("SusGlobal") was formed by articles of amalgamation on December 3, 2014, in the Province of Ontario, Canada and its executive office is in Toronto, Ontario, Canada, at 200 Davenport Road. Our telephone number is 416-223-8500. Our website address is www.susglobalenergy.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K are all available, free of charge, on our website as soon as practicable after we file the reports with the Securities and Exchange Commission (the "SEC"). SusGlobal Energy Corp., a company in the start-up stages and Commandcredit Corp. ("Commandcredit"), an inactive Canadian public company, amalgamated to continue business under the name of SusGlobal Energy Corp.

On May 23, 2017, SusGlobal filed an Application for Authorization to continue in another Jurisdiction with the Ministry of Government Services in Ontario and a certificate of corporate domestication and certificate of incorporation with the Secretary of State of the State of Delaware under which it changed its jurisdiction of incorporation from Ontario to the State of Delaware (the "Domestication"). In connection with the Domestication each of the currently issued and outstanding common shares were automatically converted on a one-for-one basis into common shares compliant with the laws of the state of Delaware (the "Shares"). As a result of the Domestication, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the "DGCL"), SusGlobal continued its existence under the DGCL as a corporation incorporated in the State of Delaware. The business, assets and liabilities of SusGlobal and its subsidiaries on a consolidated basis, as well as its principal location and fiscal year, were the same immediately after the Domestication as they were immediately prior to the Domestication. SusGlobal filed a Registration Statement on Form S-4 to register the Shares and this registration statement was declared effective by the Securities and Exchange Commission on May, 12, 2017.

SusGlobal is a renewables company focused on acquiring, developing and monetizing a global portfolio of proprietary technologies in the waste to energy and regenerative products application.

|

| 34 |

When the terms "the Company," "we," "us" or "our" are used in this document, those terms refer to SusGlobal Energy Corp., and its wholly-owned subsidiaries, SusGlobal Energy Canada Corp., SusGlobal Energy Canada I Ltd. and SusGlobal Energy Belleville Ltd., SusGlobal Energy Hamilton Ltd., and 1684567 Ontario Inc.

On December 11, 2018, the Company began trading on the OTCQB venture market exchange, under the ticker symbol SNRG.

As the global amount of organic waste continues to grow, a solution for sustainable global management of these wastes is paramount. SusGlobal through its proprietary technology and processes is equipped and confident to deliver this objective. Management believes renewable energy is the energy of the future. Sources of this type of energy are more evenly distributed over the earth's surface than finite energy sources, making it an attractive alternative to petroleum-based energy. Biomass, one of the renewable resources, is derived from organic material such as forestry, food, plant and animal residuals. SusGlobal can therefore help you turn what many consider waste into precious energy and regenerative products. The portfolio will be comprised of three distinct types of technologies: (a) Process Source Separated Organics ("SSO") in anaerobic digesters to divert from landfills and recover biogas. This biogas can be converted to gaseous fuel for industrial processes, electricity to the grid or cleaned for compressed renewable gas. (b) Maximizing the capacity of existing infrastructure (anaerobic digesters) to allow processing of SSO to increase biogas yield. (c) process SSO and digestate to produce an organic compost or a pathogen free organic liquid fertilizer. The convertibility of organic material into valuable end products such as biogas, liquid biofuels, organic fertilizers and compost shows the utility of renewables. These products can be converted into fuels, electricity and marketed to agricultural operations that are looking for an increase in crop yields, soil amendment and environmentally-sound practices. This practice also diverts these materials from landfills and reduces Greenhouse Gas Emissions ("GHG") that result from landfilling organic wastes. The Company can provide peace of mind that the full lifecycle of organic material is achieved, global benefits are realized and stewardship for total sustainability is upheld. It is management's objective to grow SusGlobal into a significant sustainable waste to energy and regenerative products provider, as Leaders in The Circular Economy®.

We believe the products and services offered can benefit both the public and private markets. The following includes some of our work managing organic waste streams: Anaerobic Digestion, Dry Digestion, Wastewater Treatment, In-Vessel Composting, SSO Treatment, Biosolids Heat Treatment, Leachate Management, Composting and Liquid Fertilizers.

The Company can provide a full range of services for handling organic residuals in a period where innovation and sustainability are paramount. From start to finish we offer in-depth knowledge, a wealth of experience and cutting-edge technology for handling organic waste.

The primary focus of the services SusGlobal provides includes integrating our technologies with capital investment to optimizing the processing of SSO. Our processes not only divert significant organic waste from landfills, but also result in methane avoidance, with significant GHG reductions from waste disposal. The processes produce regenerative products through the conversion of organic wastes into organic fertilizer, both dry compost and liquid.

Currently, the primary customers are municipalities in both rural and urban centers in Ontario, Canada. Where necessary, to be in compliance with provincial and local environmental laws and regulations, SusGlobal submits applications to the respective authorities for approval prior to any necessary engineering being carried out.

|

| 35 |

The Coronavirus Outbreak ("COVID-19") May Adversely Affect Our Business Operations and Financial Condition

In March 2020, the World Health Organization declared the outbreak of COVID-19 a pandemic which has resulted in substantial global economic disruption and uncertainty. In response to the COVID-19 pandemic, the measures implemented by various authorities have caused us to change the Company’s business practices, including those related to where employees work, the distance between employees in the Company’s facilities, limitations on in-person meetings between employees and with customers, suppliers, service providers and stakeholders, as well as restrictions on business travel to domestic and international locations.

The Company is fortunate that its operations have not been forced to close as we're considered an essential service. To date, there has been no material impact on the Company's workforce, operations, financial performance, liquidity, or supply chain as a result of COVID-19. However, the extent and continued impact of the COVID-19 pandemic on our business will depend on certain developments including the duration and spread of the outbreak and new variant strains of the virus; the availability and distribution of effective vaccines; the severity of the economic decline attributable to the pandemic and timing, nature and sustainability of economic recovery; and government responses, including vaccination or testing mandates, all of which are highly uncertain and unpredictable.

The Company will continue to monitor health orders issued by applicable governments to ensure compliance with evolving domestic and global COVID-19 guidelines.

|

| 36 |

Financings

(a) Securities Purchase Agreements

On March 3 and 7, 2022, the Company executed two unsecured convertible promissory notes with two investors (the "March 2022 Investors"), who purchased 25% original issue discount (the "OID") unsecured convertible promissory notes (the "The March 2022 Investor Notes") in the aggregate principal amount totaling $2,000,000 (the "Principal Amount") with such Principal Amount convertible into shares of the Company's common stock (the "Common Stock") from time to time triggered by the occurrence of certain events. The March 2022 Investor Notes carried an OID totaling $500,000 which is included in the principal balance of the Notes. The funds were received on March 7, 2022 and March 11, 2022 in the total amount of $1,425,000, net of the OID and professional fees. The Company used the with-and-without method to allocate the proceeds between the convertible promissory note and the common shares. As a result, all of the proceeds were allocated to the convertible promissory note and $nil to the common shares.

The maturity date of the Notes is the earlier of (i) June 3 and 7, 2022, and (ii) the occurrence of a Liquidity Event (as defined in the Notes) (the "Maturity Date"). The final payment of the Principal Amount (and default interest, if any) shall be paid by the Company to the Investors on the Maturity Date. On an event of default, the principal amount of the March 2020 Investor Notes will increase to 120% of their original principal amounts. The Investors are entitled to, following an event of default, (as defined in the March 2022 Investor Notes) to convert all or any amount of the Principal Amount and any interest accruing at the default interest rate of 24% per annum into Common Stock, at a conversion price (the "Conversion Price") equal to 70% (representing a 30% discount) multiplied by the price per share of the Common Stock at any national security exchange or over-the-counter marketplace for the five (5) trading days immediately prior to the March 2022 Investors' notice of conversion.

On May 11, 2022, the holder of the March 3, 2022 investor note, provided an amendment for an optional conversion of his investor note. The conversion price was amended to be the lower of (1) the product of the Liquidity Event price multiplied by the discount of 35% (previously 30%) or (2) the greater of (i) the product of the closing price per share of the Company’s Common Stock as reported by the applicable trading market on the trading day immediately prior to the conversion date multiplied by the discount (35%) or (ii) $1.70 multiplied by the discount (35%), provided that in the event of a conversion, of this investor note, at a time that a Liquidity Event shall not have previously occurred and be continuing, the conversion price for such conversion shall be as provided in (2)(i) above.

On May 13, 2022, the holder of the March 7, 2022 investor note, provided an amendment for an optional conversion of his investor note. The conversion price was amended to be the lower of (1) the product of the Liquidity Event price multiplied by the discount of 35% (previously 30%) or (2) the greater of (i) the product of the closing price per share of the Company’s Common Stock as reported by the applicable trading market on the trading day immediately prior to the conversion date multiplied by the discount (35%) or (ii) $1.70 multiplied by the discount (35%), provided that in the event of a conversion, of this investor note, at a time that a Liquidity Event shall not have previously occurred and be continuing, the conversion price for such conversion shall be as provided in (2)(i) above.

On December 2, 2021, the Company entered into a securities purchase agreement (the "December 2021 SPA") with one investor (the "December 2021 Investor") pursuant to which the Company issued to the December 2021 Investor one 10% unsecured convertible promissory note (the "December 2021 Investor Note") in the principal amount of $350,000. The December 2021 Investor Note included an OID of $35,000. In addition, the December 2021 Investor was issued 857,143 common shares of the Company. The Company used the with-and-without method to allocate the proceeds between the convertible promissory note and the common shares. As a result, all of the proceeds were allocated to the convertible promissory note and $nil to the common shares.

The maturity date of the December 2021 Investor Note is June 2, 2022. The December 2021 Investor Note bears interest at a rate of 10% per annum (the "December 2021 Interest Rate"), which shall be paid by the Company to the December 2021 Investor on a monthly basis, commencing on the first of the month following issuance. The December 2021 Investor may convert the principal amount and any accrued but unpaid interest into the Company's common stock from time to time following an event of default (as defined in the December 2021 Investor Note), with interest accruing at the default interest rate of 15% per annum from the event of default, at a conversion price (the "Conversion Price") equal to the lesser of 90% (representing a 10% discount) multiplied by the lowest trading price (i) during the previous twenty (20) trading day (as defined in the December 2021 Investor Note) period ending on the issuance date of the December 2021 Investor Note, or (ii) during the previous twenty (20) trading day period ending on date of conversion of the December 2021 Investor Note. The December 2021 Investor Note may be prepaid at any time in cash equal to the sum of (a) the then outstanding principal amount of the December 2021 Investor Note plus (b) accrued and unpaid interest on the unpaid principal balance of the December 2021 Investor Note plus (c) default interest (as defined in the December 2021 Investor Note) on the occurrence of an event of default), if any.

|

| 37 |

The Company initially reserved 5,000,000 of its authorized and unissued Common Stock (the "December 2021 Reserved Amount"), free from pre-emptive rights, to provide for the issuance of Common Stock upon the full conversion of the December 2021 Investor Note.

On October 28 and 29, 2021, the Company entered into two securities purchase agreement (the "October 2021 SPAs) with two investors (the "October 2021 Investors") pursuant to which the Company issued to the October 2021 Investors two 15% OID unsecured convertible promissory notes (the "October 2021 Investor Notes") in the principal amount of $1,765,118. The October 2021 Investor Notes are convertible, with accrued interest, from time to time on notice of a liquidity event (a "Liquidity Event"). A Liquidity Event is defined as a public offering of the Company's common stock resulting in the listing for trading of the common stock on any one of a number of exchanges. The October 2021 Investor Notes can be prepaid prior to maturity for an amount of 120% of the prepayment amount. The Company used the with-and-without method to allocate the proceeds between the convertible promissory note and the common shares. As a result, all of the proceeds were allocated to the convertible promissory note and $nil to the common shares.

The maturity date of the October 2021 Investor Notes is the earlier of (i) July 28 and 29, 2022 and (ii) the occurrence of a Liquidity Event, as described above (the "Maturity Date"). Upon the occurrence of a Liquidity Event, the October 2021 Investors are entitled to convert all or a portion of their October 2021 Investor Notes including any accrued and unpaid interest at a conversion price (the "Conversion Price") equal to 70% (representing a 30% discount) multiplied by the price per share of the Common Stock at the public offering associated with the Liquidity Event. Upon the occurrence of an event of default, the interest rate on the October 2021 Investor Notes will immediately accrue at 24% per annum and be paid in cash monthly to the October 2021 Investors, until the default is cured. And, the Conversion Price will be reset to 85% of the lowest volume weighted average price for the ten consecutive trading days ending on the trading day that is immediately prior to the applicable conversion date.

The Company initially reserved 1,585,000 of its authorized and unissued Common Stock (the "October 2021 Reserved Amount"), free from pre-emptive rights, to be issued upon conversion of the October 2021 Investor Notes.

On May 11, 2022, the holder of the October 29, 2021 investor note provided an amendment for an optional conversion of his investor note. The conversion price was amended to be the lower of (1) the product of the Liquidity Event price multiplied by the discount of 35% (previously 30%) or (2) the greater of (i) the product of the closing price per share of the Company’s Common Stock as reported by the applicable trading market on the trading day immediately prior to the conversion date multiplied by the discount (35%) or (ii) $1.70 multiplied by the discount (35%), provided that in the event of a conversion, of this investor note, at a time that a Liquidity Event shall not have previously occurred and be continuing, the conversion price for such conversion shall be as provided in (2)(i) above.

On August 26, 2021, the Company entered into a securities purchase agreement (the "August 2021 SPA") with one investor (the "August 2021 Investor") pursuant to which the Company issued to the August 2021 Investor one 10% unsecured convertible promissory note (the "August 2021 Investor Note") in the principal amount of $142,200. The August 2021 Investor Note included an OID of $13,450. In addition, the August 2021 Investor was issued 80,000 common shares of the Company. The Company used the with-and-without method to allocate the proceeds between the convertible promissory note and the common shares. As a result, all of the proceeds were allocated to the convertible promissory note and $nil to the common shares

The maturity date of the August 2021 Investor Note is August 26, 2022. The August 2021 Investor Note bears interest at a rate of 10% per annum (the "August 2021 Interest Rate"). The August 2021 Investor Note will include a one-time interest charge of $14,220, which shall be at repayable by the Company in 10 equal monthly amounts of $15,642 (including principal and interest) commencing October 15, 2021.

The August 2021 Investor may convert the principal amount and any accrued but unpaid interest into the Company's common stock from time to time following an event of default (as defined in the August 2021 Investor Note), with default interest accruing at the default interest rate of 22% per annum, at a conversion price (the "Conversion Price") equal to 75% (representing a 25% discount) multiplied by the lowest trading price (i) during the previous five (5) trading day (as defined in the August 2021 Investor Note), period prior to conversion. The Company has the right to accelerate the monthly payments or prepay the August 2021 Investor Note at any time without penalty.

|

| 38 |

The Company initially reserved 2,972,951 of its authorized and unissued Common Stock (the "August 2021 Reserved Amount"), free from pre-emptive rights, to provide for the issuance of Common Stock upon the full conversion of the August 2021 Investor Note.

The August 2021 Investor Note was converted on May 5, 2022 for 141,878 common shares of the Company.

On June 16, 2021, the Company entered into a securities purchase agreement (the "June 2021 SPA") with one investor (the "June 2021 Investor") pursuant to which the Company issued to the June 2021 Investor one 10% unsecured convertible promissory note (the "June 2021 Investor Note") in the principal amount of $450,000. The June 2021 Investor Note includes an OID of $35,000. In addition, the June 2021 Investor was issued 1,000,000 common shares of the Company. The Company used the with-and-without method to allocate the proceeds between the convertible promissory note and the common shares. As a result, all of the proceeds were allocated to the convertible promissory note and $nil to the common shares

The maturity date of the June 2021 Investor Note is June 16, 2022. The June 2021 Investor Note bears interest at a rate of 10% per annum (the "June 2021 Interest Rate"), which shall be paid by the Company to the June 2021 Investor on a monthly basis, commencing on the first of the month following issuance. The June 2021 Investor may convert the principal amount and any accrued but unpaid interest into the Company's common stock from time to time following an event of default (as defined in the June 2021 Investor Note), with interest accruing at the default interest rate of 15% per annum from an event of default, at a conversion price (the "Conversion Price") equal to the lesser of 90% (representing a 10% discount) multiplied by the lowest trading price (i) during the previous twenty (20) trading day (as defined in the June 2021 Investor Note) period ending on the issuance date of the June 2021 Investor Note, or (ii) during the previous twenty (20) trading day period ending on date of conversion of the June 2021 Investor Note. The June 2021 Investor Note may be prepaid at any time in cash equal to the sum of (a) the then outstanding principal amount of the June 2021 Investor Note plus (b) accrued and unpaid interest on the unpaid principal balance of the June 2021 Investor Note plus (c) default interest (as defined in the June 2021 Investor note on the occurrence of a default), if any.

The Company initially reserved 7,000,000 of its authorized and unissued Common Stock (the "June 2021 Reserved Amount"), free from pre-emptive rights, to provide for the issuance of Common Stock upon the full conversion of the June 2021 Investor Note.

On April 1, 2021, the Company entered into a securities purchase agreement (the "April 2021 SPA") with one investor (the "April 2021 Investor") pursuant to which the Company issued to the April 2021 Investor one 10% unsecured convertible promissory note (the "April 2021 Investor Note") in the principal amount of $275,000. The April 2021 Investor Note includes an OID of $25,000. In addition, the April 2021 Investor was issued 200,000 common shares immediately subsequent to the issue date. The Company used the with-and-without method to allocate the proceeds between the convertible promissory note and the common shares. As a result, all of the proceeds were allocated to the convertible promissory note and $nil to the common shares.

The maturity date of the April 2021 Investor Note was September 30, 2021. The April 2021 Investor Note bears interest at a rate of 10% per annum (the "April 2021 Interest Rate"). The April 2021 Investor is entitled to, at its option, at any time after issuance of the April 2021 Investor Note, convert all or any amount of the principal amount and any accrued but unpaid interest of the April 2021 Investor Note into Common Stock, at a conversion price of $0.20 per share. The original terms of the April 2021 Investor Note may be prepaid until 180 days from its issue date at a prepayment premium of 120%. Any portion of the April 2021 Investor Note which is not repaid by the maturity date will bear interest at the default interest rate of 18% per annum.

|

| 39 |

The Company initially reserved 5,000,000 of its authorized and unissued Common Stock (the "April 2021 Reserved Amount"), free from pre-emptive rights, to provide for the issuance of Common Stock upon the full conversion of the April 2021 Investor Note.

On December 9, 2021, the April 2021 Investor agreed to adjust the balance of the note, as it was past due, to $400,000. On January 4, 2022, the April 2021 Investor provided the Company with a request to convert April 2021 Investor Note into 2,000,000 common shares of the Company issued on January 17, 2022, at a conversion price of $0.20 per share, as stipulated in the April 2021 SPA.

On March 31, 2021, the Company entered into a securities purchase agreement (the "March 2021 SPA") with one investor (the "March 2021 Investor") pursuant to which the Company issued to the March 2021 Investor one 10% unsecured convertible promissory note (the "March 2021 Investor Note") in the principal amount of $275,000. The March 2021 Investor Note includes an original issue discount of (the "OID") of $25,000. In addition, the March 31, 2021 Investor was issued 200,000 common shares immediately subsequent to the issue date. The Company used the with-and-without method to allocate the proceeds between the convertible promissory note and the common shares. As a result, all of the proceeds were allocated to the convertible promissory note and $nil to the common shares.

The maturity date of the March 2021 Investor Note was September 30, 2021. The March 2021 Investor Note bears interest at a rate of 10% per annum (the "March 2021 Interest Rate"). The March 2021 Investor is entitled to, at its option, at any time after issuance of the March 2021 Investor Note, convert all or any amount of the principal amount and any accrued but unpaid interest of the March 2021 Investor Note into Common Stock, at a conversion price of $0.20 per share. Under the original terms of the March 2021 Investor Note may be prepaid until 180 days from its issue date at a prepayment premium of 120%. Any portion of the March 2021 Investor Note which is not repaid by the maturity date will bear interest at the default interest rate of 18% per annum.

On November 22, 2021, the March 2021 Investor extended the maturity date to March 31, 2022 in exchange for a payment of $486,474. On April 7, 2022, the March 2021 Investor extended the maturity date of the March 2021 Investor Note to April 30, 2022. And, on May 5, 2022, the March 2021 Investor converted a portion of the April 2021 Investor Note, $300,000, into 1,500,000 common shares of the Company at a conversion price of $0.20 per share as stipulated in the March 2021 SPA. The April 2021 Investor forgave the balance of the April 2021 Investor Note.

The Company initially reserved 5,000,000 of its authorized and unissued Common Stock (the "March 2021 Reserved Amount"), free from pre-emptive rights, to provide for the issuance of Common Stock upon the full conversion of the March 2021 Investor Note.

For the three-month period ended March 31, 2022, the Company issued 2,000,000 common shares on the conversion of a convertible promissory note, having a fair value on conversion in the amount of $463,862 at a conversion price of $0.20 per share. And, for the three-month period ended March 31, 2021, the Company issued 3,175,124 common shares on the conversion of convertible promissory notes, in the amount of $713,716, including accrued interest and related costs of $32,716. The share conversion prices ranged from $0.156 to $0.26 per share (on the 2019 convertible promissory notes).

For the three-month period ended March 31, 2022, the Company incurred interest of $nil (2021-$14,756 on the 2019 convertible promissory notes)

|

| 40 |

(b) Pace Savings & Credit Union Limited ("PACE")

On November 15, 2021, the Company paid all arrears to PACE and PACE agreed to allow the Company to continue payments to the end of the terms of each obligation, September 2022. Management continues discussions with equity investors to re-finance its remaining obligations to PACE and repay other creditors. In addition, the existing letter of credit, in the amount of $221,548 (C$276,831) was renewed by PACE to the termination of the Company's obligations to PACE, September 2022. The Company is in the process of obtaining a letter of credit for the new financial assurance with the MECP in the amount of $510,301 (C$637,637).

The remaining PACE long-term debt was initially payable as noted below:

| (i) | The credit facility bears interest at the PACE base rate of 7.00% plus 1.25% per annum, currently 8.25%, is payable in monthly blended installments of principal and interest of $7,014 (C$8,764) and matures on September 2, 2022. The first and only advance on the credit facility on February 2, 2017, in the amount of $1,280,480 (C$1,600,000), is secured by a business loan general security agreement, a $1,280,480 (C$1,600,000) personal guarantee from the CEO and a charge against the Haute leased premises. Also pledged as security are the shares of the wholly-owned subsidiaries, and a limited recourse guarantee against each of these parties. On April 3, 2020, the pledged shares were delivered by PACE and are currently held as security for the personal guarantee from the CEO and charge against the Haute leased premises. The credit facility is fully open for prepayment at any time without notice or bonus. |

| | |

| (ii) | The credit facility advanced on June 15, 2017, in the amount of $480,180 (C$600,000), bears interest at the PACE base of 7.00% plus 1.25% per annum, currently 8.25%, is payable in monthly blended installments of principal and interest of $3,922 (C$4,901), and matures on September 2, 2022. The credit facility is secured by a variable rate business loan agreement on the same terms, conditions and security as noted above. |

| | |

| (iii) | The corporate term loan advanced on September 13, 2017, in the amount of $2,980,435 (C$3,724,147), bears interest at PACE base rate of 7.00% plus 1.25% per annum, currently 8.25%, is payable in monthly blended installments of principal and interest of $23,778 (C$29,711), and matures September 13, 2022. The corporate term loan is secured by a business loan general security agreement representing a floating charge over the assets and undertakings of the Company, a first priority charge under a registered debenture and a lien registered under the Personal Property Security Act in the amount of $3,201,983 (C$4,000,978) against the assets including inventory, accounts receivable and equipment. The corporate term loan also included an assignment of existing contracts included in the asset purchase agreement. |

For the three-month period ended March 31, 2022, $75,525 (C$95,625) (2021-$77,265; C$97,816) in interest was incurred on the PACE long-term debt. As at March 31, 2022 $18,139 (C$22,967) (December 31, 2021-$42,686; C$53,680) in accrued interest is included in accrued liabilities in the interim condensed consolidated balance sheets

(c) Other Financings

On April 21, 2022, the Company received proceeds from an employee of $28,000 on a private placement for 70,708 common shares of the Company, at a price of $0.396 per share.

On May 5 and 6, 2022, the Company received proceeds of $700,000, on two private placements for 2,333,333 common shares of the Company, at a price of $0.30 per share.

| (i) | The Company obtained a 1st mortgage provided by private lenders to finance the acquisition of the shares of 1684567 and to provide funds for additional financing needs, including additional lands, received in four tranches totaling $4,161,560 (C$5,200,000) (December 31, 2021-$4,101,760; C$5,200,000). The fourth tranche was received on August 13, 2021 in the amount of $1,520,570 (C$1,900,000) and a portion of this fourth tranche, $1,483,703 (C$1,853,933), was used to fund a portion of the purchase of the Hamilton Property, described under long-lived assets, net (note 6). The 1st mortgage is repayable interest only on a monthly basis at an annual rate of the higher of the Royal Bank of Canada's prime rate plus 6.05% per annum (currently 8.50%) and 10% per annum with a maturity date of September 1, 2022. The 1st mortgage payable is secured by the shares held of 1684567, a 1st mortgage on the premises located at 704 Phillipston Road, Roslin, Ontario, Canada and a general assignment of rents. Financing fees on the 1st mortgage totaled $322,856 (C$403,419). As at March 31, 2022, $34,205 (C$42,740) (December 31, 2021-$33,713; C$42,740) of accrued interest is included in accrued liabilities in the consolidated balance sheets. In addition, as at March 31, 2022, there is $58,140 (C$72,648) (December 31, 2021-$90,794; C$115,104) of unamortized financing fees included in long-term debt in the consolidated balance sheets. |

|

| 41 |

(ii) On August 17, 2021, the Company obtained a vendor take-back 1st mortgage in the amount of $1,600,600 (C$2,000,000), on the purchase of the Hamilton Property. The 1st mortgage bears interest at an annual rate of 2% per annum, repayable monthly interest only with a maturity date of August 17, 2023, secured by the assets on the Hamilton Property.

For the three-month period ended March 31, 2022, $111,853 (C$141,622) (2021-$62,530; C$79,162) in interest was incurred on the 1st mortgages payable.

| (iii) | As a result of the COVID-19 virus, the Government of Canada launched the Canada Emergency Business Account (the "CEBA"), a program to ensure that small businesses have access to the capital they need to see them through the current challenges and better position them to quickly return to providing services to their communities and creating employment. The program is administered by Canadian chartered banks and credit unions.

The Company has received a total of $80,030 (C$100,000) under this program, from its Canadian chartered bank.

Under the initial term date of the loans, which is detailed in the CEBA term loan agreements, the amount is due on December 31, 2022 and is interest-free. If the loans are not repaid by December 31, 2022, the Company can make payments, interest only, on a monthly basis at an annual rate of 5%, under the extended term date, beginning January 1, 2023, maturing December 31, 2025.

The CEBA term loan agreements were amended by extending the interest free repayment date by one year to December 31, 2023. If paid by December 31, 2023, 33.33% ($26,676; C$33,333), previously 25%, of the loans would be forgiven. Repayment terms on the extended period are unchanged.

The CEBA term loan agreements contain a number of positive and negative covenants, for which the Company is not in full compliance. |

| | |

| (iv) | On April 8, 2021, the Company took delivery of a truck and hauling trailer for a total purchase price of $172,225 (C$218,338) plus applicable harmonized sales taxes. The purchase was financed by a bank term loan of $157,760 (C$200,000), over a forty-eight-month term, bearing interest at 4.95% per annum with monthly blended instalments of principal and interest payments of $3,866 (C$4,901) due April 7, 2025. |

| | |

| (v) | On August 4, 2020, the Company received an advance in the amount of $82,992 (C$110,700) from a private lender. The advance was repayable weekly at an amount of $4,881 (C$6,138). The amount was paid in full on January 26, 2021. For the three-month period ended March 31, 2022, the Company incurred interest charges of $nil (C$nil) (2021-$697 (C$883). |

| | |

| (vi) | During the three-month period ended March 31, 2021, Travellers International Inc. ("Travellers"), a company controlled by the president and chief executive officer (the "CEO") of the Company, who is also a director, loaned the Company $205,321 (C$261,620). The loans were converted along with of $80,323 (C$101,700) of accounts payable owing to Travellers into 1.005,728 common shares of the Company based on the closing trading price of the shares on conversion.

There are no written agreements evidencing the Travellers loans other than resolutions of the Board with attached loan schedules. |

|

| 42 |

(d) Financings Related to Obligations Under Capital Lease

There were no new capital leases entered into by the Company during the three-month period ended March 31, 2022.The original terms of the obligations under capital lease are noted below under paragraphs (i) and (ii).

| (i) | The lease agreement for certain equipment for the Company's organic composting facility at a cost of $198,034 (C$247,450 ), is payable in monthly blended installments of principal and interest of $4,096 (C$5,118), plus applicable harmonized sales taxes for a period of forty-six months plus the first two monthly blended installments of $8,003 (C$10,000) plus applicable harmonized sales taxes and an option to purchase the equipment for a final payment of $ 19,761 (C$24,680) plus applicable harmonized sales taxes on February 27, 2022. The leasing agreement bears interest at the rate of 6.15% annually, compounded monthly, due January 27, 2022. The Company is in the process of satisfying the final payment. |

| | |

| (ii) | The lease agreement for certain equipment for the Company's organic waste processing and composting facility at a cost of $311,837 (C$389,650), is payable in monthly blended installments of principal and interest of $5,484 (C$6,852), plus applicable harmonized sales taxes for a period of fifty-nine months plus an initial deposit of $15,566 (C$19,450) plus applicable harmonized sales taxes and an option to purchase the equipment for a final payment of a nominal amount of $80 (C$100) plus applicable harmonized sales taxes on February 27, 2025. The leasing agreement bears interest at the rate of 3.59% annually, compounded monthly, due February 27, 2025. |

For the three-month period ended March 31, 2022, $1,760 (C$2,229) (2021-$4,903; C$5,181) in interest was incurred.

Operations

The Company owns the Environmental Compliance Approvals (the "ECAs") issued by the MECP from the Province of Ontario, in place to accept up to 70,000 metric tonnes ("MT") of waste annually from the provinces of Ontario, Quebec and from New York state, and to operate a waste transfer station with the capacity to process up to an additional 50,000 MT of waste annually. Once built, the location of the waste transfer station will be alongside the organic waste processing and composting facility which is currently operating in Belleville, Ontario, Canada.

Waste Transfer Station- Access to the waste transfer station is critical to haulers who collect waste in areas not in close proximity to disposal facilities where such disposal continues to be permitted. Tipping fees charged to third parties at waste transfer stations are usually based on the type and volume or weight of the waste deposited at the waste transfer station, the distance to the disposal site, market rates for disposal costs and other general market factors.

Organic Composting Facility- As noted above, the Company's organic waste processing and composting facility, located in Belleville, Ontario Canada, has ECAs in place to accept up to 70,000 MT of waste annually and is currently in operation. Certain assets of the organic waste processing and composting facility, including the ECAs for the waste transfer station (not yet built), were acquired by the Company on September 15, 2017, from the Receiver for Astoria, under the APA. The Company charges tipping fees for the waste accepted at the organic waste composting facility based on arrangements in place with the customers and the type of waste accepted. Typical waste accepted includes, leaf and yard, biosolids, food, liquid, paper sludge and source separated organics. During three-month period ended March 31, 2022, tipping fees ranged from $55 (C$69) to $118 (C$150) per MT.

|

| 43 |

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2022, the Company had a bank balance of $36,058 (December 31, 2021-$36,033) and current debt obligations and other current liabilities in the amount of $17,365,862 (December 31, 2021-$13,944,507). As at March 31, 2022, the Company had a working capital deficit of $16,426,654 (December 31, 2021-$13,651,619). The Company does not currently have sufficient funds to satisfy the current debt obligations.

On November 15, 2021, the Company paid all arrears to PACE and PACE agreed to allow the Company to continue payments to the end of the terms of each obligation, September 2022. Management continues discussions with equity investors to re-finance its remaining obligations to PACE and repay other creditors. In addition, the existing letter of credit, in the amount of $221,548 (C$276,831) was renewed by PACE to the termination of the Company's obligations to PACE, September 2022. The Company is in the process of obtaining a letter of credit for the new financial assurance with the MECP in the amount of $510,301 (C$637,637).

On April 3, 2020, the shares previously pledged as security to PACE, were released and are currently held as security for the personal guarantee from the CEO and charge against the Haute leased premises.

The Company's total assets as at March 31, 2022 were $9,966,872 (December 31, 2021-$8,571,721) and total current liabilities were $17,365,862 (December 31, 2021-$13,944,507). Significant losses from operations have been incurred since inception and there is an accumulated deficit of $21,197,875 as at March 31, 2022 (December 31, 2021 -$18,334,649). Continuation as a going concern is dependent upon generating significant new revenue and generating external capital and securing debt to satisfy its creditors' demands and to achieve profitable operations while maintaining current fixed expense levels. The Company is also anticipating a successful underwritten offering in connection with its filed registration statement although there can be no assurance that the underwritten offering will be completed.

To pay current liabilities and to fund any future operations, the Company requires significant new funds, which the Company may not be able to obtain. In addition to the funds required to liquidate the $17,365,862 in current debt obligations and other current liabilities, the Company estimates that approximately $13,000,000 must be raised to fund capital requirements and general corporate expenses for the next 12 months.

In the normal course of business, we are exposed to market risks, including changes in interest rates, certain commodity prices and Canadian currency rates. The Company does not use derivatives to manage these risks.

During the three-month period ended March 31, 2022, the April 2021 Investor converted his unsecured convertible promissory notes having a stated amount of $400,000 and a fair value on conversion of $463,862 common shares of the Company.

As at March 31, 2022, the current and long-term portions of our debt obligations totaled $15,914,724 (December 31, 2021-$13,537,341).

In addition, as at March 31, 2022, the Company had an outstanding letter of credit provided by PACE, in the amount of $221,548 (C$276,831), in favor of the MECP. The letter of credit is a requirement of the MECP and is in connection with the financial assurance provided by the Company, for it to be in compliance with the MECPs environmental objectives. The MECP regularly evaluates the Company's organic waste processing and composting facility to ensure compliance is adhered to and the letter of credit is subject to change by the MECP. The Company is in the process of obtaining a letter of credit for the new financial assurance with the MECP in the amount of $510,301 (C$637,637).

|

| 44 |

CONSOLIDATED RESULTS OF OPERATIONS - FOR THE THREE-MONTH PERIOD ENDED MARCH 31, 2022 COMPARED TO THE THREE-MONTH PERIOD ENDED MARCH 31, 2021

| | | For the three-month periods ended | |

| | | March 31, 2022 | | | March 31, 2021 | |

| | | | | | | |

| Revenue | $ | 144,470 | | $ | 192,660 | |

| | | | | | | |

| Cost of Sales | | | | | | |

| Opening inventory | | 20,582 | | | 24,740 | |

| Depreciation | | 116,203 | | | 136,560 | |

| Direct wages and benefits | | 52,088 | | | 71,059 | |

| Equipment rental, delivery, fuel and repairs and maintenance | | 170,188 | | | 105,893 | |

| Utilities | | 38,812 | | | 18,263 | |

| Outside contractors | | 24,568 | | | - | |

| | | 422,441 | | | 356,515 | |

| Less: closing inventory | | (16,806 | ) | | (45,923 | ) |

| Total cost of sales | | 405,635 | | | 310,592 | |

| | | | | | | |

| Gross (loss) | | (261,165 | ) | | (117.932 | ) |

| | | | | | | |

| Operating expenses | | | | | | |

| Management compensation-stock-based compensation | | 60,113 | | | 54,259 | |

| Management compensation-fees | | 118,469 | | | 90,049 | |

| Marketing | | 376,488 | | | 45,727 | |

| Professional fees | | 261,652 | | | 69,402 | |

| Interest expense | | 191,243 | | | 163,874 | |

| Office and administration | | 60,577 | | | 75,215 | |

| Rent and occupancy | | 50,925 | | | 32,339 | |

| Insurance | | 28,838 | | | 15,002 | |

| Filing fees | | 54,175 | | | 18,959 | |

| Amortization of financing costs | | 33,532 | | | 13,578 | |

| Directors' compensation | | 14,809 | | | 10,664 | |

| Stock-based compensation | | 130,512 | | | 8.073 | |

| Repairs and maintenance | | 2,329 | | | 13,189 | |

| Foreign exchange (income) loss | | (77,749 | ) | | (12,118 | ) |

| Total operating expenses | | 1,305,913 | | | 598,212 | |

| | | | | | | |

| Net Loss Before Other (Loss) Income | | (1,567,078 | ) | | (716,114 | ) |

| Other (Expense) Income | | (1,296,148 | ) | | 323,612 | |

| Net Loss | $ | (2,863,226 | ) | $ | (392,532 | ) |

During the three-month period ended March 31, 2022, the Company generated $144,470 of revenue from its organic waste processing and composting facility and its garbage collection operations compared to $192,660 in the three-month period ended March 31, 2021. The reduction in revenue is primarily due to changes in the customer base including an expiring contract from September 2021 and a reduction of garbage collection revenue as the Company substantially ceased garbage collection at the end of February 2022. The majority of the revenue from the organic waste processing and composting facility relates to revenue from tipping fees charged for organic and other waste accepted and a lesser portion relating to the sale of compost processed.

|

| 45 |

In the operation of the organic waste processing and composting facility, the Company processes organic and other waste received and produces the end product, compost. The cost of producing the compost totaled $405,635 for the three-month period ended March 31, 2022 compared to $310,592 for the three-month period ended March 31, 2021. These costs include equipment rental, delivery, fuel, repairs and maintenance, direct wages and benefits, depreciation, utilities and outside contractors. The additional costs include an estimate for the clean-up of certain waste as ordered by the MECP. The significant increase in the disposing of unusable waste was the result of a price increase charged by the hauler of approximately 30% due to much higher than usual fuel costs.

Operating expenses increased by $707,701 from $598,212 in the three-month period ended March 31, 2021 to $1,305,913 in the three-month period ended March 31, 2022, explained further below.

Management compensation related to stock-based compensation increased by $5,854, in the three-month period ended March 31, 2022 compared to the three-month period ended March 31, 2021, as a result of the new common stock issued to the officers as stipulated in their executive consulting contracts, effective January 1, 2022. The total stock-based compensation valued at $240,450, based on the trading price of the shares on the effective date will be expensed over the year. And, the management compensation relating to fees increased by $28,420, from $90,049 in the three-month period ended March 31, 2021 to $118,469 in the three-month period ended March 31, 2022, the result of increased monthly fees, effective January 1, 2022.

Marketing expenses increased by $330,761, from $45,727 in the three-month period ended March 31, 2021 to $376,488 for the three-month period ended March 31, 2022, primarily the result of a new marketing campaign commencing in Q3 of 2021. This marketing campaign will be completed in Q2 of 2022.

Professional fees increased by $192,250, from $69,402 in the three-month period ended March 31, 2021 to $261,652 in the three-month period ended March 31, 2022. primarily due to increased estimated costs for the 2022 audit, review and tax related services. In addition, the Company engaged the services of a chartered professional accounting firm to assist management with various documentation and reporting matters. In addition, in 2021, the Company elected the fair value option to record its convertible promissory notes and as a result, any professional fees in connection with the issuance of convertible promissory notes were expenses, $75,000 in the current period and $5,000 in the prior period.

Interest expense increased by $27,369 from $163,874 in the three-month period ended March 31, 2021 to $191,243 in the three-month period ended March 31, 2022. This increase was primarily due to the increased 1st mortgage for the Company's waste processing and organic composting facility in the amount of $1,520,570 (C$1,900,000), partially offset by lowering interest rates on the Company's interest-bearing debt obligations.

Office and administration expenses reduced by $14,638, from $75,215 in the three-month period ended March 31, 2021 to $60,577 in the three-month period ended March 31, 2022, primarily from the absence of subscriptions and research publications.

Rent and occupancy increased by $18,586, from $32,339 in the three-month period ended March 31, 2021 to $50,925 in the three-month period ended March 31, 2022, primarily due to an increase in the monthly rent for the Company's Toronto, Ontario, Canada office and increased realty taxes for the Company's new facility under construction in Hamilton, Ontario, Canada.

Insurance increased by $13,836, from $15,002 in the three-month period ended March 31, 2021 to $28,838 in the three-month period ended March 31, 2022, primarily due to the new insurance on the Company's new facility under construction in Hamilton, Ontario, Canada.

|

| 46 |

Filing fees increased by $35,216, from $18,959 in the three-month period ended March 31, 2021 to $54,175 in the three-month period ended March 31, 2022, primarily due to costs associated with the special meeting of the shareholders on March 24, 2022, administrative costs incurred in the filing of the S-1 registration statement and an increase in investor relations activities.

The amortization of financing costs increased by $19,954, from $13,578 in the three-month period ended March 31, 2021 to $33,532 in the three-month period ended March 31, 2022, due to the additional filing fees incurred on the increased 1st mortgage noted above.

Directors' compensation increased nominally from $10,664 in the three-month period ended March 31, 2021 to $14,809 in the three-month period ended March 31, 2022, due to the full complement of independent directors in the current period.

Stock-based compensation increased by $122,439, from $8,073 in the three-month period ended March 31, 2021 to $130,512 in the three-month period ended March 31, 2022, as a result of significant new consulting services provided by several new service providers.

Repairs and maintenance decreased by $10,860, from $13,189 in the three-month period ended March 31, 2021 to $2,329 in the three-month period ended March 31, 2022, due to absence of necessary repairs at the Company's waste processing and organic composting facility.

The foreign exchange income increased by $65,631, from income of $12,118 in the three-month period ended March 31, 2022 to income of $77,749 in the three-month period ended March 31, 2022, due primarily to the translation of significant United States dollar denominated transactions and balances during the period including the convertible promissory notes, compared to the prior period, during a period of the strengthening Canadian dollar.

During the current three-month period ended March 31, 2022, the Company recorded an expense for the revaluation of the convertible promissory notes in the amount of $1,296,148 compared to $81,197 in the prior period ended March 31, 2021. In addition, during the three-month period ended March 31, 2021, the Company recorded a gain on disposal of long-lived assets in the amount of $45,349 and gains on forgiveness on convertible promissory notes in the amount of $359,460.

As at March 31, 2022, the Company had a working capital deficit of $16,426,654 (December 31, 2021-$13,651,619), incurred a net loss of $2,863,226 (March 31, 22021-$392,532) for the three months ended March 31, 2021 and had an accumulated deficit of $21,197,875 (December 31, 2021-$18,334,649) and expects to incur further losses in the development of its business.

These factors cast substantial doubt as to the Company's ability to continue as a going concern, which is dependent upon its ability to obtain the necessary financing to further the development of its business, satisfy its obligations to PACE and its other creditors and upon achieving profitable operations. There is no assurance of funding being available or available on acceptable terms. Realization values may be substantially different from carrying values as shown.

Beginning in March 2020 the Governments of Canada and Ontario, as well as foreign governments instituted emergency measures as a result of COVID-19. The virus has had a major impact on Canadian and international securities and currency markets and consumer activity which may impact the Company's financial position, its results of operations and its cash flows significantly. The situation is constantly evolving, however, so the extent to which the COVID-19 outbreak will impact businesses and the economy is highly uncertain and cannot be predicted. Accordingly, the Company cannot predict the extent to which its financial position, results of operations and cash flows will be affected in the future.

|

| 47 |

The interim condensed consolidated financial statements do not include any adjustments to reflect the future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result if the Company was unable to continue as a going concern.

CRITICAL ACCOUNTING ESTIMATES

Use of estimates

The preparation of the Company's consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates are based on management's best knowledge of current events and actions the Company may undertake in the future. The Company regularly evaluates estimates and assumptions. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgements about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. Areas involving significant estimates and assumptions include: the allowance for doubtful accounts, inventory valuation, useful lives of long-lived and intangible assets, impairment of long-lived assets and intangible assets, valuation of asset acquisition, accruals, fair value of convertible promissory notes, deferred income tax assets and related valuation allowance, environmental remediation costs, stock-based compensation and going concern. Actual results could differ from these estimates. These estimates are reviewed periodically and as adjustments become necessary, they are reported in earnings in the period in which they become available.

Stock-based compensation

The Company records compensation costs related to stock-based awards in accordance with ASC 718, Compensation-Stock Compensation, whereby the Company measures stock-based compensation cost at the grant date based on the estimated fair value of the award. Compensation cost is recognized on a straight-line basis over the requisite service period of the award. Where necessary, the Company utilizes the Black-Scholes option-pricing model to estimate the fair value of stock options granted, which requires the input of highly subjective assumptions including: the expected option life, the risk-free rate, the dividend yield, the volatility of the Company's stock price and an assumption for employee forfeitures. The risk-free rate is based on the U.S. Treasury bill rate at the date of the grant with maturity dates approximately equal to the expected term of the option. The Company has not historically issued any dividends and does not expect to in the near future. Changes in any of these subjective input assumptions can materially affect the fair value estimates and the resulting stock- based compensation recognized. The Company has not issued any stock options and has no stock options outstanding at December 31, 2021.

Indefinite Asset Impairments

The Company evaluates the intangible assets for impairment annually in the fourth quarter or when triggering events are identified and whether events and circumstances continue to support the indefinite useful life using Level 3 inputs.

|

| 48 |

Long-Lived Asset Impairments

In accordance with ASC 360, "Property, Plant and Equipment", long-lived assets to be held and used are analyzed for impairment whenever events or changes in circumstances indicate that the related carrying amounts may not be recoverable.

The Company evaluates at each balance sheet date whether events or circumstances have occurred that indicate possible impairment. If there are indications of impairment, the Company uses future undiscounted cash flows of the related asset or asset grouping over the remaining life in measuring whether the carrying amounts are recoverable. In the event that such cash flows are not expected to be sufficient to recover the recorded asset values, the assets are written down to their estimated fair value.

Convertible Promissory Notes

The Company has elected the fair value option to account for its convertible promissory notes issued during 2021 and 2022. In accordance with ASC 825, the convertible promissory notes are marked-to-market at each reporting date with changes in fair value recorded as a component of other income (expense), in the interim condensed consolidated statements of operations and comprehensive loss. The Company has elected to include interest expense in the changes in fair value. Transaction costs are incurred as expensed. The Company did not elect the fair value option for the convertible promissory notes issued in 2019. These notes are measured at amortized cost.

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

From time to time, new accounting pronouncements are issued by the financial accounting standards board (the "FASB") or other standard setting bodies and adopted by the Company as of the specified effective date or possibly early adopted, where permitted. Unless otherwise discussed, the impact of recently issued standards that are not yet effective are not expected to have a material impact on the Company's financial position, results of operations or cash flows.

There were no new accounting pronouncements adopted during the three months ended March 31, 2022.

EQUITY

As at March 31, 2022, the Company had 97,208,547 common shares issued and outstanding. As at May 20, 2022, the Company had 101,254,466 common shares issued and outstanding.

STOCK OPTIONS, WARRANTS AND RESTRICTED STOCK UNITS

The Company has no stock options, warrants or restricted stock units outstanding as at March 31, 2022 and as of the date of this filing.

RELATED PARTY TRANSACTIONS

For three-month period ended March 31, 2022, the Company incurred $94,776 (C$120,000) (2021-$71,091; C$90,000), in management fees expense with Travellers International Inc. ("Travellers"), an Ontario company controlled by a director and the president and chief executive officer (the "CEO"); and $23,693 (C$30,000) (2021-$18,958; C$24,000) in management fees expense with the Company's chief financial officer (the "CFO"). As at March 31, 2022, unpaid remuneration and unpaid expenses in the amount of $33,533 (C$41,901) (December 31, 2021-$14,755; C$18,706) is included in accounts payable in the interim condensed consolidated balance sheets.

|

| 49 |

For the three-month period ended March 31, 2022, the Company incurred $23,506 (C$29,762) (2021-$21,165; C$26,795) in rent expense paid under a lease agreement with Haute Inc. ("Haute"), an Ontario company controlled by the CEO.

For those independent directors providing their services throughout 2022, the Company accrued directors' compensation to each director in the amount of $4,936 (C$6,250), in total, $14,808 (C$18,750) (2021-$9,874; C$12,500). Also included in directors' compensation for the three-month period ended March 31, 2022, is the audit committee chairman's fees, in the amount of $nil (C$nil) (2021-$790; C$1,000). As at March 31, 2022, outstanding directors' compensation of $86,389 (C$107,946) (December 31, 2021-$70,358; C$89,196) is included in accrued liabilities, in the interim condensed consolidated balance sheets.

Furthermore, for the three-month period ended March 31, 2022, the Company recognized management stock-based compensation expense of $60,113 (2021-$54,259), on the common stock issued to the CEO and the CFO, 1,000,000 and 50,000 common stock, respectively, as stipulated in their executive consulting agreements, effective January 1, 2022. The total stock-based compensation on the issuance of the common stock totaled $240,450 (2021-$217,035). The portion to be expensed for the balance of the year, $180,337 (2021-$162,776 is included in prepaid expenses and deposits in the interim condensed consolidated balance sheets.

During the three-month period ended March 31, 2022, the director's company, Travellers, converted a total of $nil (C$nil) (December 31, 2021-$371,001 (C$461,620) of loans provided during the period and $nil (C$nil) (December 31, 2021-$80,323; C$101,700) of accounts payable owing to Travellers for nil common shares (December 31, 2021-1,726,076 common shares).

In addition, during the three-month period ended March 31, 2022, the Company paid the CFO interest of $504 (C$638) on loans totaling $29,211 (C$36,000) provided to the Company and repaid during the period.

There are no written agreements evidencing these loans from Travellers other than resolutions of the Board with attached loan schedules.

On December 17, 2020, the Company entered into an Executive Chairman Consulting Agreement (the "CEO's Consulting Agreement"), by and among the Company, Travellers International Inc. ("Travellers"), and the CEO, who is also a director, the Executive Chairman and President of the Company, effective January 1, 2021 (the "Effective Date"). The CEO's Consulting Agreement replaced the consulting agreement which expired on December 31, 2020.

Pursuant to the terms of the CEO's Consulting Agreement, for his services as the CEO, the compensation is at a rate of $24,009 (C$30,000) per month for twelve (12) months, beginning on the Effective Date, and at a rate of $32,012 (C$40,000) per month for twelve (12) months, beginning January 1, 2022. In addition, the Company agreed to grant the CEO 1,000,000 restricted shares of the Company's common stock, par value of $0.0001 per share (the "Common Stock") on the Effective Date, and 1,000,000 shares of Common Stock on January 1, 2022. The Company has also agreed to reimburse the CEO for certain out-of-pocket expenses incurred by the CEO.

The CEO's Consulting Agreement is for a term of twenty-four (24) months. Upon a Constructive Discharge (as defined in the CEO's Consulting Agreement) and subject to certain notification requirements and the Company's opportunity to cure the Constructive Discharge, the CEO will be entitled to a compensation of twelve (12) months' fees, as well as any bonus compensation owing.

|

| 50 |

On December 17, 2020, the Company entered into an Executive Consulting Agreement (the "CFO Consulting Agreement"), by and between the Company and the CFO of the Company, effective January 1, 2021. Pursuant to the terms of the CFO Consulting Agreement, the CFO is entitled to fees of $6,402 (C$8,000) per month for his services. In addition, the Company has also agreed to grant the CFO 50,000 restricted shares of the Company's Common Stock, par value of $0.0001 per share on the Effective Date. The Company has also agreed to reimburse the CFO for certain out-of-pocket expenses incurred by the CFO. The CFO's Consulting Agreement replaced the consulting agreement which expired on December 31, 2020. The CFO's Consulting Agreement is for a term of twelve (12) months. Upon a Constructive Discharge (as defined in the CFO's Consulting Agreement) and subject to certain notification requirements and the Company's opportunity to cure the Constructive Discharge, the CFO will be entitled to a compensation of two (2) months' fees, as well as any bonus compensation owing.

On January 26, 2022, SusGlobal Energy Corp. (the "Company") entered into a CFO Consulting Agreement (the "Makrimichalos Consulting Agreement"), by and between the Company and Ike Makrimichalos, Chief Financial Officer of the Company ("Makrimichalos "), effective January 1, 2022. Pursuant to the terms of the Makrimichalos Consulting Agreement, Makrimichalos will be entitled to fees of $8,003 C$10,000 per month, plus the applicable Harmonized Sales Tax, for his services as Chief Financial Officer of the Company. The Company has also agreed to reimburse Makrimichalos for certain out-of-pocket expenses incurred by Makrimichalos. In addition to the monthly fees, Makrimichalos was awarded 50,000 restricted shares of the Company's Common Stock, par value of $0.0001 per share on the Effective Date. The Makrimichalos Consulting Agreement will replace the consulting agreement currently in effect by and between the Company and Makrimichalos.

The Makrimichalos Consulting Agreement is for a term of twelve (12) months. Upon a Constructive Discharge (as defined in the Makrimichalos Consulting Agreements) and subject to certain notification requirements and the Company's opportunity to cure the Constructive Discharge, Makrimichalos will be entitled to a compensation of two (2) months' fees, as well as any bonus compensation owing.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that is material to investors.

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

As a smaller reporting company, as that term is defined in Item 10(f)(1) of Regulation S-K, we are not required to provide information required by this Item.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our CEO and CFO, evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act") as of the end of the period covered by this Quarterly Report on Form 10-Q.

|

| 51 |

Our disclosure controls and procedures are designed to provide reasonable, not absolute, assurance that the objectives of our disclosure control system are met. Due to inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within a company have been detected. Based on our evaluation, our CEO and CFO have concluded that, as of the end of the period covered by this report, our disclosure controls and procedures were not effective. The matters involving internal controls over financial reporting that may be considered material weaknesses included the small size of the Company and the resulting lack of a segregation of duties and the inability to initiate a proper assessment of the terms and conditions of the convertible promissory notes and their initial and subsequent measurement and a proper going concern assessment.

Notwithstanding these material weaknesses, management has concluded that the unaudited interim condensed consolidated financial statements included elsewhere in this Quarterly Report on Form 10-Q present fairly, in all material respects, the financial position, results of operations and cash flows in conformity with generally accepted accounting principles.

Changes in Internal Control over Financial Reporting

During the three-month period ended March 31, 2022, management made a change to its internal controls over financial reporting by engaging the services of specialists to assist with the proper assessment of the terms and conditions of the convertible promissory notes and their initial and subsequent measurements.

PART II: OTHER INFORMATION

Item 1A. Legal Proceedings.

From time to time, the Company may become involved in litigation relating to claims arising from the ordinary course of business. Management believes that there are currently no claims or actions pending against us, the ultimate disposition of which would have a material adverse effect on our results of operations, financial condition or cash flows.

The Company has a claim against it for unpaid legal fees in the amount $52,212 (C$65,241). The amount is included in accounts payable on the Company's interim condensed consolidated balance sheets.

Item 1A. Risk Factors.

As a smaller reporting company, we are not required to provide the information required by this item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

During the three-month period ended March 31, 2022, the Company issued:

| (i) | 230,000 common shares for proceeds previously received. |

| | |

| (ii) | 1,000,000 common shares issued to the CEO as stipulated in his 2021 executive consulting agreement and 50,000 common shares issued to the CFO as stipulated in his 2022 executive consulting agreement. |

|

| 52 |

| 2,000,000 common shares issued on the conversion of a convertible promissory notes to equity. |

| | |

| (iv) | 895,000 common shares were issued for professional services. |

| | |

| (v) | 10,000 common shares issued to an employee. |

| | |

| (vi) | The Company raised $16,560, net of share issue costs of $1,440, on a private placement for 40,000 common shares at an issue price of $0.45 per share. |

The securities above were offered and sold pursuant to an exemption from the registration requirements under Section 4(a)(2) of the Securities Act since, among other things, the transactions did not involve a public offering.

Item 3. Defaults upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not Applicable.

Item 5. Other Information.

Not Applicable.

Item 6. Exhibits.

The following exhibits are filed as part of this quarterly report on Form 10-Q:

| Exhibit No. | Description |

| | |

| 4.1 | Form of Convertible Promissory Note issued by SusGlobal Energy Corp. on March 8, 2022 (filed as Exhibit 4.1 to the Registrant's 8-K filed with the SEC on March 15, 2022 and incorporated by reference). |

| | |

| 10.1 | Form of Securities Purchase Agreement, effective March 8, 2022 (Filed as Exhibit 10.1 to the Registrant's Form 8-K filed with the SEC on March 15, 2022). |

| | |

| 10.2 | Form of Consulting Agreement between SusGlobal Energy Canada Corp., and Alchemy Advisors LLC. (Filed as Exhibit 10.2 to the Registrant's Form 8-K filed with the SEC on March 15, 2022). |

| | |

| 31.1* | Certification of Chief Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | |

| 31.2* | Certification of Chief Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | |

| 32.1+ | Certification of the Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350 (Section 906 of Sarbanes-Oxley Act of 2002). |

| | |

| 101.INS* | Inline XBRL Instance Document–the instance document does not appear in the Interactive Data File as its XBRL tags are embedded within the Inline XBRL document |

| 101.SCH* | Inline XBRL Taxonomy Extension Schema Document |

| 101.CAL* | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF* | Inline XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB* | Inline XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE* | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

| * | Filed herewith |

| + | In accordance with SEC Release 33-8238, Exhibit 32.1 is being furnished and not filed. |

|

| 53 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | SUSGLOBAL ENERGY CORP. |

| | | |

| May 20, 2022 | By: | /s/ Marc Hazout |

| | | Marc Hazout |

| | | Executive Chairman, President and Chief Executive Officer |

| | | |

| | | |

| May 20, 2022 | By: | /s/ Ike Makrimichalos |

| | | Ike Makrimichalos |

| | | Chief Financial Officer (Principal Financial and Accounting Officer) |

|

| 54 |