Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Certain statements in this Management's Discussion and Analysis ("MD&A"), other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "would," "expect," "intend," "could," "estimate," "should," "anticipate," or "believe," and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. Readers should carefully review the risk factors in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the Securities and Exchange Commission on April 17, 2023.

The following MD&A is intended to help readers understand the results of our operation and financial condition, and is provided as a supplement to, and should be read in conjunction with, our Interim Unaudited Financial Statements and the accompanying Notes to Interim Unaudited Financial Statements under Part 1, Item 1 of this Quarterly Report on Form 10-Q.

Growth and percentage comparisons made herein generally refer to the three and nine-month periods ended September 30, 2023 compared with the three and nine-month periods ended September 30, 2022 unless otherwise noted. Unless otherwise indicated or unless the context otherwise requires, all references in this document to "we, "us, "our," the "Company," and similar expressions refer to SusGlobal Energy Corp., and depending on the context, its subsidiaries.

SPECIAL NOTICE ABOUT GOING CONCERN AUDIT OPINION

OUR AUDITORS ISSUED OPINIONS EXPRESSING SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE IN BUSINESS AS A GOING CONCERN FOR THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021. YOU SHOULD READ THIS QUARTERLY REPORT ON FORM 10-Q WITH THE "GOING CONCERN" ISSUES IN MIND.

This Management's Discussion and Analysis should be read in conjunction with the unaudited interim condensed consolidated financial statements included in this Quarterly Report on Form 10-Q (the "Financial Statements"). The financial statements have been prepared in accordance with generally accepted accounting policies in the United States ("GAAP"). Except as otherwise disclosed, all dollar figures included therein and in the following management discussion and analysis are quoted in United States dollars.

OVERVIEW

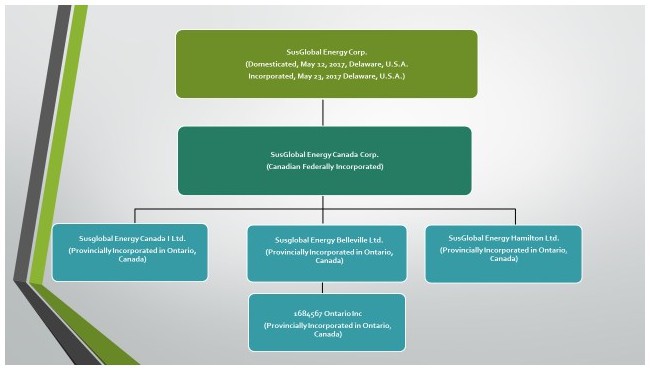

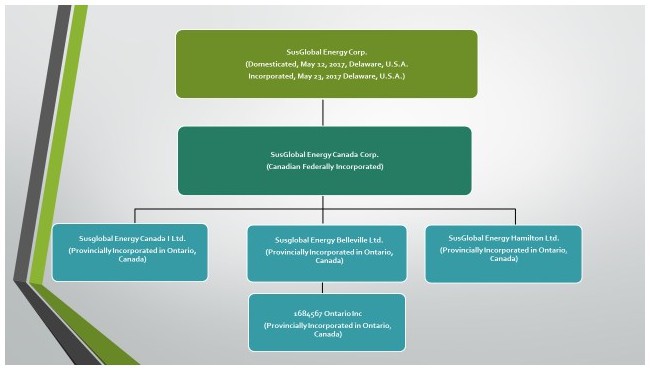

The following organization chart sets forth our wholly-owned subsidiaries:

27

On February 4, 2019, the Company registered its common stock, having a par value of $.0001 per share, pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and is effective pursuant to General Instruction A.(d).

SusGlobal Energy Corp. ("SusGlobal") was formed by articles of amalgamation on December 3, 2014, in the Province of Ontario, Canada and its executive office is in Toronto, Ontario, Canada, at 200 Davenport Road. Our telephone number is 416-223-8500. Our website address is www.susglobalenergy.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K are all available, free of charge, on our website as soon as practicable after we file the reports with the Securities and Exchange Commission (the "SEC"). SusGlobal Energy Corp., a company in the start-up stages and Commandcredit Corp. ("Commandcredit"), an inactive Canadian public company, amalgamated to continue business under the name of SusGlobal Energy Corp.

On May 23, 2017, SusGlobal filed an Application for Authorization to continue in another Jurisdiction with the Ministry of Government Services in Ontario and a certificate of corporate domestication and certificate of incorporation with the Secretary of State of the State of Delaware under which it changed its jurisdiction of incorporation from Ontario to the State of Delaware (the "Domestication"). In connection with the Domestication each of the currently issued and outstanding common shares were automatically converted on a one-for-one basis into common shares compliant with the laws of the state of Delaware (the "Shares"). As a result of the Domestication, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the "DGCL"), SusGlobal continued its existence under the DGCL as a corporation incorporated in the State of Delaware. The business, assets and liabilities of SusGlobal and its subsidiaries on a consolidated basis, as well as its principal location and fiscal year, were the same immediately after the Domestication as they were immediately prior to the Domestication. SusGlobal filed a Registration Statement on Form S-4 to register the Shares and this registration statement was declared effective by the Securities and Exchange Commission on May 12, 2017.

SusGlobal is a renewables company focused on acquiring, developing and monetizing a global portfolio of proprietary technologies in the waste to energy and regenerative products application.

When the terms "the Company," "we," "us" or "our" are used in this document, those terms refer to SusGlobal Energy Corp., and its wholly-owned subsidiaries, SusGlobal Energy Canada Corp., SusGlobal Energy Canada I Ltd., SusGlobal Energy Belleville Ltd., SusGlobal Energy Hamilton Ltd., and 1684567 Ontario Inc.

On December 11, 2018, the Company began trading on the OTCQB venture market exchange, under the ticker symbol SNRG.

As the global amount of organic waste continues to grow, a solution for sustainable global management of these wastes is paramount. SusGlobal through its proprietary technology and processes, is equipped and confident to deliver this objective. Management believes renewable energy is the energy of the future. Sources of this type of energy are more evenly distributed over the earth's surface than finite energy sources, making it an attractive alternative to petroleum-based energy. Biomass, one of the renewable resources, is derived from organic material such as forestry, food, plant and animal residuals. SusGlobal can therefore help turn what many consider waste into precious energy and regenerative products. The portfolio will be comprised of three distinct types of technologies: (a) Process Source Separated Organics ("SSO") in anaerobic digesters to divert from landfills and recover biogas. This biogas can be converted to gaseous fuel for industrial processes, electricity to the grid or cleaned for compressed renewable gas. (b) Maximizing the capacity of existing infrastructure (anaerobic digesters) to allow processing of SSO to increase biogas yield and (c) process SSO, digestate and leachate to produce an organic compost or a pathogen free organic liquid fertilizer. The convertibility of organic material into valuable end products such as biogas, liquid biofuels, organic fertilizers and compost shows the utility of renewables. These products can be converted into electricity, fuels and marketed to agricultural operations that are looking for an increase in crop yields, soil amendment and environmentally-sound practices. This practice also diverts these materials from landfills and reduces Greenhouse Gas Emissions ("GHG") that result from landfilling organic wastes. The Company can provide peace of mind that the full lifecycle of organic material is achieved, global benefits are realized and stewardship for total sustainability is upheld. It is management's objective to grow SusGlobal into a significant sustainable waste to energy and regenerative products provider, as Leaders in The Circular Economy®.

28

We believe the products and services offered can benefit both the public and private markets. The following includes some of our work managing organic waste streams: Anaerobic Digestion, Dry Digestion, Wastewater Treatment, In-Vessel Composting, SSO Treatment, Biosolids Heat Treatment, Leachate Management, Composting and Liquid Fertilizers.

The Company can provide a full range of services for handling organic residuals in a period where innovation and sustainability are paramount. From start to finish we offer in-depth knowledge, a wealth of experience and cutting-edge technology for handling organic waste.

The primary focus of the services SusGlobal provides includes integrating our technologies with capital investment to optimizing the processing of SSO. Our processes not only divert significant organic waste from landfills, but also result in methane avoidance, with significant GHG reductions from waste disposal. The processes produce regenerative products through the conversion of organic wastes into biogas, organic fertilizer, both dry compost and liquid.

Currently, the primary customers are municipalities in both rural and urban centers in Ontario, Canada. Where necessary, to be in compliance with provincial and local environmental laws and regulations, SusGlobal submits applications to the respective authorities for approval prior to any necessary engineering being carried out and has existing Environmental Compliance Approvals (ECAs) at its facilities.

We are a "smaller reporting company," as defined under SEC Regulation S-K. As such, we also are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and also are subject to less extensive disclosure requirements regarding executive compensation in our periodic reports and proxy statements. We will continue to be deemed a smaller reporting company until (i) our public float exceeds $250 million on the last day of our second fiscal quarter in our prior fiscal year (if our annual revenues exceeded $100 million in such prior fiscal year); or (ii) our public float exceeds $700 million on the last day of our second fiscal quarter in our prior fiscal year (if our annual revenues were less than $100 million in such prior fiscal year).

RECENT BUSINESS DEVELOPMENTS

On November 9, 2023, the Company received a Ministry of the Environment, Conservation and Parks (the "MECP") Provincial Officer’s Order issued to the Belleville, Ontario, Canada site for certain compliance items. The Company is requesting a review of the Order by the MECP Director.

On November 3, 2023, the funds held in escrow, in the amount of $924,500 (C$1,250,000), were released to Alterna and Alterna released all security it held back to the Company.

On November 2, 2023, the Company completed the purchase of additional land, consisting of a 2.03-acre site in Hamilton, Ontario, Canada for $2,292,760 (C$3,100,000). Prior to completing the purchase, the Company paid deposits of $229,276 (C$310,000) to the vendor, included under prepaid expenses and deposits on the interim condensed consolidated balance sheets. The balance of the purchase price was satisfied with a $1,479,200 (C$2,000,000) vendor take-back mortgage bearing interest at 7% annually, maturing in two years and the balance in cash financed by a second mortgage on the additional land bearing interest at 13% annually, maturing in one year and is secured by a third mortgage on the property in Belleville, Ontario, Canada.

On October 12, 2023, the Company announced that additional sales of Carbon Credits and Verified Emission Reductions and Renewals ("VERRs") generated from its Belleville Composting Offset Project in Ontario (the "Project"). The Company has generated an additional 12,500 VERRs and sold a further 9,000 carbon credits as part of the Anew™ Project. The Project has generated approximately 137,000 VERRS (generated from 2017 through 2022).

The Project and report are listed on the GHG CleanProjects® Registry, https://www.csaregistries.ca/GHG_VR_Listing/CleanProjectDetail?ProjectId=909, a business unit of the Standards Division of the Canadian Standards Association ("CSA") for developed and marketed greenhouse gas ("GHG") offset credits from the Company's 49-acre Organic & Non-Hazardous Waste Processing & Composting Facility in Belleville, Ontario. The Project was developed by Anew Climate, LLC formerly known as Blue Source Canada ULC ("Anew").

29

The Project has enabled an increase in the diversion of organic waste from landfills, thereby avoiding methane generation. Methane is a highly potent greenhouse gas which is 28 times more effective at trapping heat energy in our atmosphere than carbon dioxide. As organic waste decomposes in landfills, the methane builds up and must be released to prevent dangerous working conditions. By diverting waste that contributes to this problem, the Project benefits the community as well as the climate.

This initial sale of carbon credits expands the Company's ability to deliver on its mission to reduce organic wastes from wood, leaf and yard material, treated municipal sewage waste (biosolids), residential curbside green bin material or SSO and paper sludge otherwise destined for landfills.

On October 3, 2023, the Company announced that it signed commercial terms for a renewable natural gas Purchase and Sale Agreement Ten Year Offtake (the “Offtake Agreement”) valued at approximately US$138 Million. The Offtake Agreement will not take effect until after the signing of a Transaction Confirmation.

Highlights

- The Company will provide up to 674,184 GJs/year while meeting pipeline quality standards and have direct pipeline access to the largest integrated gas storage facility in North America.

- The forecasted commercial operation date for the RNG facilities is scheduled for the Company's Belleville Renewable Natural Gas ("RNG") Facility in September 2025, and the Hamilton RNG Facility for September 2026.

- The initial transaction term from the date of initial commercial operation of the RNG facilities will be 10 years. The buyer will pay a purchase price of over US$20 (C$27) per Metric Million British Thermal Unit ("MMbtu"), equivalent to approximately one Gigajoule ("GL") of RNG at the delivery point.

The Offtake Agreement is an industry standard summary of the commercial terms for the RNG purchase and sale which allows the parties to maintain confidentiality while finalizing the definitive Renewable Natural Gas Purchase and Sale Agreement ("RNGPA") in the form of a GasEDI Base Contract with special provisions and transaction confirmations. The RNGPA incorporates mutually agreeable and additional, more comprehensive terms, representations, warranties, and covenants customary to meet the local natural gas operating system standards, purchase offtake arrangements and required reporting.

Under the terms of the Offtake Agreement, the Company has committed to produce up to 674,184 GJs annually of RNG to be generated through the anaerobic digestion of organic matter at the Company's licensed facilities in Belleville and Hamilton, Ontario.

On August 1, 2023, the Company announced it has received a RNG Carbon Intensity ("CI") Report. This report uses the GHGenius model to calculate the CI of the produced RNG from Source Separated Organic ("SSO") Feedstock, analyzing the energy balance and emissions of contaminants associated with the production and use of traditional and alternative transportation fuels. Versions of the model are specified in renewable fuel regulations in the provinces of Ontario, Alberta and British Columbia. The GHGenius model is capable of estimating life cycle emissions of the primary greenhouse gases ("GHG") and the criteria pollutants from combustion and process sources. GHGenius can predict emissions for past, present and future years through 2050, using historical data or correlations for changes in energy and process parameters with time that are stored in the model.

The Report and Carbon Intensity Score allows the Company to proceed and enter into a long term and lucrative offtake agreement, leading to project and equity financing. The Company has the infrastructure, assets, licenses and capabilities to produce and distribute RNG which offers lower carbon options adjacent to our existing fertilizer production facilities, building a revolutionary circular economy model for sustainable change, utilizing transformative technology solutions to regenerate organic waste to energy and fertilizers at its strategically located facilities in western and eastern Ontario near the hub of the largest integrated gas storage facility in North America. A long-term offtake agreement can ensure that the Company will continue to lead the organic waste diversion and regenerative products program, helping to reduce the world's GHG emissions creating strong alignment with our ESG and uplisting goals, maximizing shareholder value.

The Company has received a -24.7 on the Report's Carbon Intensity Score. As this system uses a reversed scaled approach, in which lower a number denotes a better value in the RNG and sustainability, the Company is expected to continue to receive these opportunities in the future attracting seasoned offtake partners.

30

When organic waste decomposes, it naturally releases biogas, a GHG containing carbon dioxide and methane, into the atmosphere. Before this biogas can escape as GHGs it is captured and purified to create RNG. RNG is low carbon, meaning, that using RNG can reduce the amount of GHG emissions released into the atmosphere compared to conventional fossil fuels or natural gas. When added to the North American gas system, it can help reduce greenhouse gas emissions.

The RNG produced is then injected into the natural gas transmission and distribution system, providing for building space heat/hot water, industrial process heat, electricity generation and transportation, thereby reducing GHG emissions and generating additional carbon credits for the Company.

On July 17, 2023, the Company received notice from The Scotts Miracle-Gro Company that it was withdrawing its opposition to the Company's trademark SUSGRO (the "Mark") application in the U.S. and Canada. On July 27, 2023, the Mark was registered under Registration Number TMA1,192,300 with Innovation, Science and Economic Development Canada, Canadian Intellectual Property Office. This registration will be in effect for a period of ten years, expiring on July 27, 2033.

On July 14, 2023, the Company paid the final deposit of $159,306 (C$210,000) for an agreement of purchase and sale for 2.03 acres of land in Hamilton, Ontario, Canada, adjacent to the Company's current property. This deposit is in addition to the first deposit of $75,530 (C$100,000) paid on June 15, 2023.

New and Renewed Consulting Contracts

The Company entered into an Executive Chairman Consulting Agreement (the "CEO's Consulting Agreement"), by and among the Company, Travellers International Inc. ("Travellers"), and the CEO, who is also a director, the Executive Chairman and President of the Company, effective January 1, 2023 (the "Effective Date"). The CEO's Consulting Agreement replaced the consulting agreement which expired on December 31, 2022.

Pursuant to the terms of the CEO's Consulting Agreement, for his services as the CEO, the compensation is at a rate of $29,584 (C$40,000) per month for twelve (12) months, beginning on the Effective Date, and at a rate of $36,980 (C$50,000) per month for twelve (12) months, beginning January 1, 2024. In addition, the Company agreed to grant the CEO 3,000,000 restricted shares of the Company's common stock, par value of $0.0001 per share (the "Common Stock") on the Effective Date. This common stock was issued on January 3, 2023. The Company has also agreed to reimburse the CEO for certain out-of-pocket expenses incurred by the CEO.

The CEO's Consulting Agreement is for a term of twenty-four (24) months. Upon a Constructive Discharge (as defined in the CEO's Consulting Agreement) and subject to certain notification requirements and the Company's opportunity to cure the Constructive Discharge, the CEO will be entitled to a compensation of twelve (12) months' fees, as well as any bonus compensation owing.

The Company also entered into an Executive Consulting Agreement (the "CFO Consulting Agreement"), by and between the Company and the CFO of the Company, effective January 1, 2023. Pursuant to the terms of the CFO Consulting Agreement, the CFO is entitled to fees of $9,245 (C$12,500) per month for twelve (12). In addition, the Company has also agreed to grant the CFO 100,000 restricted shares of the Company's common stock, par value of $0.0001 per share on the Effective Date. The Company has also agreed to reimburse the CFO for certain out-of-pocket expenses incurred by the CFO. This common stock was issued on January 3, 2023. The CFO's Consulting Agreement replaced the consulting agreement which expired on December 31, 2022.

The CFO's Consulting Agreement is for a term of twelve (12) months. Upon a Constructive Discharge (as defined in the CFO's Consulting Agreement) and subject to certain notification requirements and the Company's opportunity to cure the Constructive Discharge, the CFO will be entitled to a compensation of two (2) months' fees, as well as any bonus compensation owing.

Financings

(a) Securities Purchase Agreements

As at September 30, 2023, the Company had and currently has 5 security purchase agreements outstanding with 4 investors. The outstanding principal balance, including accrued interest of $662,415, totaled $6,872,575 with a fair value of $9,756,700. The convertible promissory notes are currently in default and management has continued discussions with the investors.

Please refer to the interim condensed consolidated financial statements, convertible promissory notes, note 11 and fair value measurement, note 12 for details on the convertible promissory notes.

31

(b) Pace Savings & Credit Union Limited ("PACE")

On March 28, 2023, the Company and PACE finalized a full and final mutual release of all obligations owing to PACE, including accrued interest, in exchange for an amount of $924,500 (C$1,250,000). The funds were held in escrow by the Company's Canadian legal counsel until released to PACE (now Alterna) on November 3, 2023. Immediately prior to this full and final mutual release, the amounts owing to PACE, included in the interim condensed consolidated balance sheets, include $3,452,655 (C$4,668,274) disclosed under long-term debt and accrued interest of $391,785 (C$529,725) disclosed under accrued liabilities in the interim condensed consolidated balance sheets. The Company raised the funds by securing a 2nd mortgage on March 1, 2023 in the amount of $1,109,400 (C$1,500,000) prior to disbursements of $184,900 (C$250,000), on its Belleville, Ontario Canada property.

The remaining PACE long-term debt was initially payable as noted below:

(i) The credit facility bore interest at the PACE base rate of 7.00% plus 1.25% per annum, was payable in monthly blended installments of principal and interest of $6,482 (C$8,764) and matured on September 2, 2022. The first and only advance on the credit facility on February 2, 2017, in the amount of $1,183,360 (C$1,600,000), is secured by a business loan general security agreement, a $1,183,360 (C$1,600,000) personal guarantee from the CEO and a charge against the Haute leased premises. Also pledged as security are the shares of the wholly-owned subsidiaries, and a limited recourse guarantee against each of these parties. On April 3, 2020, the pledged shares were delivered by PACE and are currently held as security for the personal guarantee from the CEO and charge against the Haute leased premises. The credit facility is fully open for prepayment at any time without notice or bonus.

(ii) The credit facility advanced on June 15, 2017, in the amount of $443,760 (C$600,000), bore interest at the PACE base of 7.00% plus 1.25% per annum, was payable in monthly blended installments of principal and interest of $3,625 (C$4,901), and matured on September 2, 2022. The credit facility is secured by a variable rate business loan agreement on the same terms, conditions and security as noted above.

(iii) The corporate term loan advanced on September 13, 2017, in the amount of $2,754,379 (C$3,724,147), bore interest at PACE base rate of 7.00% plus 1.25% per annum, was payable in monthly blended installments of principal and interest of $21,974 (C$29,711), and matured September 13, 2022. The corporate term loan is secured by a business loan general security agreement representing a floating charge over the assets and undertakings of the Company, a first priority charge under a registered debenture and a lien registered under the Personal Property Security Act in the amount of $2,959,123 (C$4,000,978) against the assets including inventory, accounts receivable and equipment. The corporate term loan also included an assignment of existing contracts included in the asset purchase agreement.

For the three and nine-month periods ended September 30, 2023, $nil (C$nil) and $103,371 (C$139,089) (2022-$100,983; C$131,211 and $255,412; C$327,535) respectively, in interest was incurred on the PACE long-term debt. As at September 30, 2023 $391,785 (C$529,725) (December 31, 2022-$288,407; C$390,636) in accrued interest is included in accrued liabilities in the interim condensed consolidated balance sheets

(c) Other Financings

(i) The Company obtained a 1st mortgage provided by private lenders to finance the acquisition of the shares of 1684567 and to provide funds for additional financing needs, including additional lands, received in four tranches totaling $3,845,920 (C$5,200,000) (December 31, 2022-$3,839,160; C$5,200,000). The fourth tranche was received on August 13, 2021 in the amount of $1,405,240 (C$1,900,000) and a portion of this fourth tranche, $1,371,169 (C$1,853,933), was used to fund a portion of the purchase of the Hamilton Property, described under long-lived assets, net (note 7), to the interim condensed consolidated financial statements. The 1st mortgage is repayable interest only on a monthly basis at an annual rate of the higher of the Royal Bank of Canada's prime rate plus 6.05% per annum (currently 13.25%) and 10% per annum with a maturity date of December 1, 2023. The Company continues to be charged at the rate of 10% per annum. The 1st mortgage payable is secured by the shares held of 1684567, a 1st mortgage on the premises located at 704 Phillipston Road, Roslin, Ontario, Canada and a general assignment of rents.

Financing fees on the 1st mortgage totaled $298,369 (C$403,419). In addition, as at September 30, 2023 there is $10,458 (C$14,140) (December 31, 2022-$56,409; C$76,404) of unamortized financing fees included in long-term debt in the interim condensed consolidated balance sheets.

(ii) On August 17, 2021, the Company obtained a vendor take-back 1st mortgage in the amount of $1,479,200 (C$2,000,000), on the purchase of the Hamilton Property, described under long-lived assets, net (note 7) to the interim condensed consolidated financial statements. The 1st mortgage bears interest at an annual rate of 2% per annum, repayable monthly interest only with a maturity date of August 17, 2023, secured by the assets on the Hamilton Property. Management has been in discussions with the mortgagee to extend the maturity date.

32

(iii) On March 1, 2023, the Company obtained a 2nd mortgage in the amount of $1,109,400 (C$1,500,000) bearing interest at the annual rate of 12%, repayable monthly, interest only with a maturity date of March 1, 2024, secured as noted under (d) i) above. The Company incurred financing fees of $44,376 (C$60,0000). In addition, as at September 30, 2023 there is $18,480 (C$24,986) of unamortized financing fees included in long-term debt in the interim condensed consolidated balance sheets

For the three and nine-month periods ended September 30, 2023, $138,015 (C$185,000) and $388,605 (C$522,833) (2022-$104,681; C$136,682 and $324,937; C$416,692) respectively, in interest was incurred on the mortgages payable. As at September 30, 2023 $43,599 (C$58,950) (December 31, 2022- $31,555; C$42,740) in accrued interest is included in accrued liabilities in the interim condensed consolidated balance sheets.

(iv) As a result of the COVID-19 virus, the Government of Canada launched the Canada Emergency Business Account (the "CEBA"), a program to ensure that small businesses have access to the capital they need to see them through the current challenges and better position them to quickly return to providing services to their communities and creating employment. The program is administered by Canadian chartered banks and credit unions.

The Company has received a total of $73,960 (C$100,000) under this program, from its Canadian chartered bank.

Under the initial term date of the loans, which is detailed in the CEBA term loan agreements, the amount is due on December 31, 2022 and is interest-free. If the loans are not repaid by December 31, 2022, the Company can make payments, interest only, on a monthly basis at an annual rate of 5%, under the extended term date, beginning January 1, 2023, maturing December 31, 2025.

The CEBA term loan agreements were amended by extending the interest free repayment date by one year to December 31, 2023. (subsequently extended to January 18, 2024). If paid by December 31, 2023, 33.33% ($25,176; C$33,333), previously 25%, of the loans would be forgiven. Repayment terms on the extended period are unchanged.

The CEBA term loan agreements contain a number of positive and negative covenants, for which the Company is not in full compliance.

(v) On April 8, 2021, the Company took delivery of a truck and hauling trailer for a total purchase price of $161,483 (C$218,338) plus applicable harmonized sales taxes. The purchase was financed by a bank term loan of $147,920 (C$200,000), over a forty-eight-month term, bearing interest at 4.95% per annum with monthly blended instalments of principal and interest payments of $3,625 (C$4,901) due April 7, 2025.

For the three and nine-month periods ended September 30, 2023, $823 (C$1,103) and $2,794(C$3,760) (2022- $1,312; C$1,716 and $4,342; C$5,568) respectively, in interest was incurred.

(vi) During the three and nine-month periods ended September 30, 2023, the CEO converted $233,558 (C$316,400) and $233,558 (C$316,400) respectively, of outstanding accounts payable at prices ranging from $0.1678 to $0.261 per share, priced at the closing trading prices immediately prior to the conversion dates for 1,254,792 common shares of the Company. During the three and nine-month periods ended September 30, 2023, the CEO converted $nil (C$nil) and $278,845 (C$372,483) respectively, of outstanding loans at prices ranging from $nil to $nil and $0.2076 to $0.325 per share respectively, priced at the closing trading prices immediately prior to the conversion dates for nil and 1,167,371 common shares of the Company respectively.

(d) Financings Related to Obligations Under Capital Lease

There were no new capital leases entered into by the Company during the three and nine-month periods ended September 30, 2023.The original terms of the remaining obligation under capital lease outstanding at September 30, 2023 are noted below.

(i) The lease agreement for certain equipment for the Company's organic waste processing and composting facility at a cost of $288,185 (C$389,650), is payable in monthly blended installments of principal and interest of $5,068 (C$6,852), plus applicable harmonized sales taxes for a period of fifty-nine months plus an initial deposit of $14,385 (C$19,450) plus applicable harmonized sales taxes and an option to purchase the equipment for a final payment of a nominal amount of $74 (C$100) plus applicable harmonized sales taxes on February 27, 2025. The leasing agreement bears interest at the rate of 3.59% annually, compounded monthly, due February 27, 2025.

33

For the three and nine-month periods ended September 30, 2023, $785 (C$1,053) and $2,768 (C$3,725) (2022-$1,361; C$1,770 and $3,599; C$4,616) respectively, in interest was incurred.

Operations

The Company owns Environmental Compliance Approvals (the "ECAs") issued by the MECP from the Province of Ontario, in place to accept up to 70,000 metric tonnes ("MT") of waste annually from the provinces of Ontario, Quebec and from New York state, and to operate a waste transfer station with the capacity to process up to an additional 50,000 MT of waste annually. Once built, the location of the waste transfer station will be alongside the Organic and Non-Hazardous Waste Processing and Composting Facility which is currently operating in Belleville, Ontario, Canada.

Waste Transfer Station- Access to the waste transfer station is critical to haulers who collect waste in areas not in close proximity to disposal facilities where such disposal continues to be permitted. Tipping fees charged to third parties at waste transfer stations are usually based on the type and volume or weight of the waste deposited at the waste transfer station, the distance to the disposal site, market rates for disposal costs and other general market factors.

Organic Composting Facility- As noted above, the Company's organic waste processing and composting facility, located in Belleville, Ontario Canada, has ECAs in place to accept up to 70,000 MT of waste annually and is currently in operation. Certain assets of the organic waste processing and composting facility, including the ECAs for the waste transfer station (not yet built), were acquired by the Company on September 15, 2017, from the Receiver for Astoria, under the APA. The Company charges tipping fees for the waste accepted at the organic waste composting facility based on arrangements in place with the customers and the type of waste accepted. Typical waste accepted includes, SSO, leaf and yard, food, liquid, paper sludge and biosolids. During the nine-month period ended September 30, 2023, tipping fees ranged from $51 (C$69) to $118 (C$159) per MT.

The Company owns a 40,535 square foot facility on 5.29 acres in Hamilton, Ontario (the "Hamilton Facility"), which includes an Environmental Compliance Approval to process 65,884 MT per annum of organic waste, 24 hours per day 7 days a week. The facility will be designed to produce, distribute and warehouse the Company's SusGro™ organic liquid fertilizer and other products that are to be provided under private label and to be sold through big box retailers, consumer lawn and garden suppliers, and for end use to the wine, cannabis and agriculture industries. With the addition of a further 11,000 square feet of office space and R&D labs, the Hamilton facility will also house the continued development of SusGlobal's proprietary formulations and branded liquid and dry organic fertilizers.

LIQUIDITY AND CAPITAL RESOURCES

As of September 30, 2023, the Company had a bank balance of $6,431 (December 31, 2022-$42,900) and current debt obligations and other current liabilities in the amount of $26,203,416 (December 31, 2022-$22,339,175). As at September 30, 2023, the Company had a working capital deficit of $24,425,747 (December 31, 2022-$21,580,552). The Company does not currently have sufficient funds to satisfy the current debt obligations.

The Company's total assets as at September 30, 2023 were $10,599,934 (December 31, 2022-$9,865,775) and total current liabilities were $26,203,416 (December 31, 2022-$22,339,175). Significant losses from operations have been incurred since inception and there is an accumulated deficit of $35,520,256 as at September 30, 2023 (December 31, 2022 -$30,345,197). Continuation as a going concern is dependent upon generating significant new revenue and generating external capital and securing debt to satisfy its creditors' demands and to achieve profitable operations while maintaining current fixed expense levels.

To pay current liabilities and to fund any future operations, the Company requires significant new funds, which the Company may not be able to obtain. In addition to the funds required to liquidate the $26,203,416 in current debt obligations and other current liabilities, the Company estimates that approximately an additional $31,000,000 must be raised to fund capital requirements and general corporate expenses for the next 12 months.

In the normal course of business, we are exposed to market risks, including changes in interest rates, certain commodity prices and Canadian currency rates. The Company does not use derivatives to manage these risks.

During the three and nine-month periods ended September 30, 2023, the October 29, 2021 investor converted part of his unsecured convertible promissory note having a fair value of $nil and $374,000 respectively, for nil and 1,650,709 respectively, common shares of the Company.

As at September 30, 2023, the current and long-term portions of our debt obligations totaled $19,894,856 (December 31, 2022-$16,827,617).

34

In addition, as at September 30, 2023, the Company had an outstanding letter of credit provided by PACE, in the amount of $204,744 (C$276,831), in favor of the MECP. The letter of credit is a requirement of the MECP and is in connection with the financial assurance provided by the Company, for it to be in compliance with the MECPs environmental objectives. The MECP regularly evaluates the Company's organic waste processing and composting facility to ensure compliance is adhered to and the letter of credit is subject to change by the MECP. The MECP released the expired letter of credit provided by PACE subsequent to September 30, 2023. The Company is in the process of obtaining a letter of credit for the new financial assurance with the MECP in the amount of $471,596 (C$637,637).

CONSOLIDATED RESULTS OF OPERATIONS - FOR THE THREE-MONTH PERIOD ENDED SEPTEMBER 30, 2023 COMPARED TO THE THREE-MONTH PERIOD ENDED SEPTEMBER 30, 2022

| | | For the three-month periods ended | |

| | | September 30, 2023 | | | September 30, 2022 | |

| | | | | | | |

| Revenue | $ | 186,901 | | $ | 297,202 | |

| | | | | | | |

| Cost of Sales | | | | | | |

| Opening inventory | | 64,578 | | | 19,555 | |

| Depreciation | | 87,528 | | | 112,731 | |

| Direct wages and benefits | | 36,349 | | | 52,860 | |

| Equipment rental, delivery, fuel and repairs and maintenance | | 14,723 | | | 365,975 | |

| Utilities | | 32,721 | | | (7,760 | ) |

| Outside contractors | | - | | | 535 | |

| | | 236,009 | | | 543,896 | |

| Less: closing inventory | | (42,889 | ) | | (48,154 | ) |

| Total cost of sales | | 193,120 | | | 495,742 | |

| | | | | | | |

| Gross loss | | (6,219 | ) | | (198,540 | ) |

| | | | | | | |

| Operating expenses | | | | | | |

| Management compensation-stock-based compensation | | 57,600 | | | 60,113 | |

| Management compensation-fees | | 117,401 | | | 115,175 | |

| Marketing | | 923 | | | (250 | ) |

| Professional fees | | 103,930 | | | 190,653 | |

| Interest expense | | 140,161 | | | 208,537 | |

| Office and administration | | 56,567 | | | 67,377 | |

| Rent and occupancy | | 58,385 | | | 54,586 | |

| Insurance | | 10,974 | | | 12,867 | |

| Filing fees | | 8,562 | | | 9,699 | |

| Amortization of financing costs | | 26,901 | | | 27,752 | |

| Directors' compensation | | 18,631 | | | 14,366 | |

| Stock-based compensation | | 254,724 | | | 659,050 | |

| Repairs and maintenance | | 1,015 | | | 2,386 | |

| Foreign exchange loss | | 214,406 | | | 378,510 | |

| Total operating expenses | | 1,070,180 | | | 1,800,821 | |

| | | | | | | |

| Net Loss Before Other Expenses | | (1,076,399 | ) | | (1,999,361 | ) |

| Other Expenses | | (116,710 | ) | | (1,697,619 | ) |

| Net Loss | $ | (1,193,109 | ) | $ | (3,696,980 | ) |

During the three-month period ended September 30, 2023, the Company generated $186,901 of revenue from its organic waste processing and composting facility compared to $297,202 in the three-month period ended September 30, 2022. The decrease in revenue is primarily due to lower carbon credit revenue of approximately $83,000 and lower waste revenue of approximately $27,000. In the operation of the organic waste processing and composting facility, the Company processes organic and other waste received and produces the end product, compost. The cost of producing the compost totaled $193,120 for the three-month period ended September 30, 2023 compared to $495,742 for the three-month period ended September 30, 2022. These costs include equipment rental, delivery, fuel, repairs and maintenance, direct wages and benefits, depreciation, utilities and outside contractors. Included are the costs for the estimate of the clean-up of certain waste as ordered by the MECP, which decreased significantly from the prior period. In addition, with ceasing the garbage collection operation, the Company no longer requires the use of outside contractors.

35

Operating expenses reduced by $730,641 from $1,800,821 in the three-month period ended September 30, 2022 to $1,070,180 in the three-month period ended September 30, 2023, explained further below.

Management compensation related to stock-based compensation reduced by $2,513, in the three-month period ended September 30, 2023 compared to the three-month period ended September 30, 2022, as a result of the new common stock issued to the officers as stipulated in their executive consulting contracts, effective January 1, 2023. The total stock-based compensation valued at $446,400 (2022-$240,450), based on the trading price of the shares on the effective date will be expensed over the terms of the executive consulting contracts. And the management compensation relating to fees was relatively flat, with little change between the three-month period ended September 30, 2023 compared to the three-month period ended September 30, 2022.

Marketing increased by a nominal amount of $1,173, from $(250) in the three-month period ended September 30, 2022 to $923 for the three-month period ended September 30, 2023, primarily the result of a new and scaled back marketing program in 2023 compared to that in 2022.

Professional fees reduced by $86,723, from $190,653 in the three-month period ended September 30, 2022 to $103,930 in the three-month period ended September 30, 2023. The primary reasons for the decrease includes lower estimated and actual costs for various audit, review and tax services totaling approximately $66,500, lower consulting fees resulting from not re-engaging certain consultants totaling approximately $68,000 offset by higher legal fees of approximately $48,000.

Interest expense reduced by $68,376 from $208,537 in the three-month period September 30, 2022 to $140,161 in the three-month period ended September 30, 2023. The decrease is partially due to the absence of interest on the PACE debt, after the Company obtained a full and final mutual release on March 28, 2023, offset by additional interest on the new mortgage effective March 1, 2023, which bears interest at the rate of 12% per annum.

Office and administration expenses reduced by $10,810, from $67,377 in the three-month period ended September 30, 2022 to $56,567 in the three-month period ended September 30, 2023, primarily due to a reduction in various expenditures including lab testing and the state of Delaware franchise tax.

Rent and occupancy increased by $3,799, from $54,586 in the three-month period ended September 30, 2022 to $58,385 in the three-month period ended September 30, 2023 as a result of the effect of the translation rate for a weakening Canadian dollar quarter to quarter.

Insurance expense remained relatively flat with a nominal decrease of $1,893, from $12,867 in the three-month period ended September 30, 2022 to $10,974 in the three-month period ended September 30, 2023.

Filing fees expense remained relatively flat with a nominal decrease of $1,137, from $9,699 in the three-month period ended September 30, 2022 to $8,562 in the three-month period ended September 30, 2023.

The amortization of financing costs remained relatively flat with a nominal decrease of $851, from $27,752 in the three-month period ended September 30, 2022 to $26,901 in the three-month period ended September 30, 2023.

Directors' compensation increased by $4,265 from $14,366 in the three-month period ended September 30, 2022 to $18,631 in the three-month period ended September 30, due to the appointment of a new independent director during the during the three-month period ended March 31, 2023.

Stock-based compensation decreased by $404,326, from $659,050 in the three-month period ended September 30, 2022 to $254,724 in the three-month period ended September 30, 2023, due to the absence of multiple consultants providing services compared to the prior period.

Repairs and maintenance decreased nominally by $1,371, from $2,386 in the three-month period ended September 30, 2022 to $1,015 in the three-month period ended September 30, 2023.

The foreign exchange income decreased by $164,104, from $378,510 in the three-month period ended September 30, 2022 to $214,406 in the three-month period ended September 30, 2023, due primarily to the translation of significant United States dollar denominated transactions and balances during the period including the convertible promissory notes, compared to the prior period, during a period in which the Canadian dollar weakened but not as significantly as in the prior period.

During the current three-month period ended September 30, 2023, the Company recorded a loss on the revaluation of the convertible promissory notes in the amount of $116,710 compared to loss of $1,447,619 in the prior period ended September 30, 2022. In addition, in the prior period the Company recorded an amount of $250,000 for the accrued settlement payment for the release of services of a party for an underwriting offering dated March 23, 2022 and amended May 23, 2022. In total, the other expenses decreased by $1,580,909.

36

The interim condensed consolidated financial statements do not include any adjustments to reflect the future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result if the Company was unable to continue as a going concern.

CONSOLIDATED RESULTS OF OPERATIONS - FOR THE NINE-MONTH PERIOD ENDED SEPTEMBER 30, 2023 COMPARED TO THE NINE-MONTH PERIOD ENDED SEPTEMBER 30, 2022

| | | For the nine-month periods ended | |

| | | September 30, 2023 | | | September 30, 2022 | |

| | | | | | | |

| Revenue | $ | 505,075 | | $ | 551,815 | |

| | | | | | | |

| Cost of Sales | | | | | | |

| Opening inventory | | 58,695 | | | 20,582 | |

| Depreciation | | 301,467 | | | 344,196 | |

| Direct wages and benefits | | 111,984 | | | 158,356 | |

| Equipment rental, delivery, fuel and repairs and maintenance | | 55,569 | | | 477,128 | |

| Utilities | | 89,578 | | | 35,410 | |

| Outside contractors | | - | | | 26,018 | |

| | | 617,293 | | | 1,061,690 | |

| Less: closing inventory | | (42,889 | ) | | (48,154 | ) |

| Total cost of sales | | 574,404 | | | 1,013,536 | |

| | | | | | | |

| Gross loss | | (69,329 | ) | | (461,721 | ) |

| | | | | | | |

| Operating expenses | | | | | | |

| Management compensation-stock-based compensation | | 172,800 | | | 180,339 | |

| Management compensation-fees | | 351,162 | | | 350,910 | |

| Marketing | | 122,098 | | | 1,003,959 | |

| Professional fees | | 286,723 | | | 812,738 | |

| Interest expense | | 499,222 | | | 589,488 | |

| Office and administration | | 176,120 | | | 259,193 | |

| Rent and occupancy | | 161,127 | | | 171,177 | |

| Insurance | | 33,167 | | | 76,304 | |

| Filing fees | | 31,852 | | | 71,242 | |

| Amortization of financing costs | | 72,296 | | | 94,916 | |

| Directors' compensation | | 53,211 | | | 43,864 | |

| Stock-based compensation | | 785,149 | | | 955,837 | |

| Repairs and maintenance | | 22,636 | | | (8,773 | ) |

| Foreign exchange (income) loss | | (33,037 | ) | | 518,690 | |

| Total operating expenses | | 2,734,526 | | | 5,119,884 | |

| | | | | | | |

| Net Loss Before Other Expenses | | (2,803,855 | ) | | (5,581,605 | ) |

| Other Expenses | | (2,371,204 | ) | | (3,202,270 | ) |

| Net Loss | $ | (5,175,059 | ) | $ | (8,788,875 | ) |

During the nine-month period ended September 30, 2023, the Company generated $505,075 of revenue from its organic waste processing and composting facility compared to $551,815 in the nine-month period ended September 30, 2022, a decrease of $46,740. The decrease in revenue is due to the reduction in carbon credit revenue of approximately $72,000, the reduction in garbage collection revenue of approximately $27,000 after ceasing this operation in the prior period, offset by an increase in waste processing revenue in the form of tipping fees from new business from existing customers of approximately $52,000.

In the operation of the organic waste processing and composting facility, the Company processes organic and other waste received and produces the end product, compost. The cost of producing the compost totaled $574,404 for the nine-month period ended September 30, 2023 compared to $1,013,536 for the nine-month period ended September 30, 2022. These costs include equipment rental, delivery, fuel, repairs and maintenance, direct wages and benefits, depreciation, utilities and outside contractors. The reduction in costs of $439,132 is attributable to reduced depreciation as several of the Company's mobile equipment were fully depreciated in the current period, a reduction in direct labour and benefits from reduced overtime and one less staff member, offset by increased utilities costs as projected credits offered by the hydro utility expired. In addition, the equipment rental, delivery, fuel, repairs and maintenance include an estimate for the clean-up of certain waste as ordered by the MECP. The cost of this estimate has not increased significantly since the prior period's estimate.

37

Operating expenses reduced by $2,385,358 from $5,119,884 in the nine-month period ended September 30, 2022 to $2,734,526 in the nine-month period ended September 30, 2023, explained further below.

Management compensation related to stock-based compensation reduced by $7,539, in the nine-month period ended September 30, 2023 compared to the nine-month period ended September 30, 2022, as a result of the new common stock issued to the officers as stipulated in their executive consulting contracts, effective January 1, 2023. The total stock-based compensation valued at $446,400 (2022-$240,450), based on the trading price of the shares on the effective date is being expensed over the terms of the executive consulting contracts. And the management compensation relating to fees increased slightly by $252, from $350,910 in the nine-month period ended September 30, 2022 to $351,162 in the nine-month period ended September 30, 2023.

Marketing expenses decreased by $881,861, from $1,003,959 in the nine-month period ended September 30, 2022 to $122,098 for the nine-month period ended September 30, 2023, primarily the result of a new and scaled back marketing campaign in 2023 compared to that in 2022.

Professional fees reduced by $526,015, from $812,738 in the nine-month period ended September 30, 2022 to $286,723 in the nine-month period ended September 30, 2023. The primary reasons for the decrease included the absence of professional fees incurred on the issuance of convertible promissory notes in the current period whereas $75,000 in such professional fees was incurred in the prior period. In addition, the Company did not re-engage certain consultants who provided services in the prior period, a saving of approximately $296,000 and savings for various audit, review, tax and legal services, including the absence of fees in connection with its S-1/A registration statement, a total savings of approximately $155,000.

Interest expense decreased by $90,266 from $589,488 in the nine-month period ended September 30, 2022 to $499,222 in the nine-month period ended September 30, 2023. The decrease is partially due to the absence of interest on the PACE debt, after the Company obtained a full and final mutual release on March 28, 2023, offset by additional interest on the new mortgage effective March 1, 2023, which bears interest at the rate of 12% per annum.

Office and administration expenses reduced by $83,072, from $259,193 in the nine-month period ended September 30, 2022 to $176,121 in the nine-month period ended September 30, 2023. This is primarily due to the absence of certain expenditures including a claim from a municipality of approximately $29,000, website costs of approximately $16,000, a reduction in other expenditures including lab testing and security and the effect of the translation rate for a weakening Canadian dollar quarter to quarter.

Rent and occupancy reduced by $10,050, from $171,177 in the nine-month period ended September 30, 2022 to $161,127 in the nine-month period ended September 30, 2023, primarily due to the absence of additional rent expense for roof repairs in the prior period and the effect of the translation rate for a weakening Canadian dollar from 2022 to 2023.

Insurance reduced by $43,137, from $76,304 in the nine-month period ended September 30, 2022 to $33,167 in the nine-month period ended September 30, 2023, primarily due to the absence of insurance on the Company's new facility under construction in Hamilton, Ontario, Canada, whose construction had ceased temporarily and the Company self-insuring on certain other insurance.

Filing fees decreased by $39,390, from $71,242 in the nine-month period ended September 30, 2022 to $31,852 in the nine-month period ended September 30, 2023, primarily due to the absence of costs associated with the special meeting of the shareholders held last period on March 24, 2022 and the absence of administrative costs incurred in the filing of the S-1 (and S-1/A) registration statement and reduced investor relations activities.

The amortization of financing costs increased by $22,620, from $94,916 in the nine-month period ended September 30, 2022 to $72,296 in the nine-month period ended September 30, 2023, due to certain financing costs in connection with the mortgages payable having been fully amortized by the end of Q3-2022.

Directors' compensation increased nominally from $43,864 in the nine-month period ended September 30, 2022 to $53,211 in the nine-month period ended September 30, 2023, due to the appointment of a new independent director during the during the three-month period ended March 31, 2023.

Stock-based compensation decreased by $170,688, from $955,837 in the nine-month period ended September 30, 2022 to $785,149 in the nine-month period ended September 30, 2023, as a result of the absence new consulting services provided during the current period.

38

Repairs and maintenance increased by $31,409, from income of $8,773 in the nine-month period ended September 30, 2022 to an expense of $22,636 in the nine-month period ended September 30, 2023, due to the absence of a credit adjustment on a prior period expenditure.

The foreign exchange income decreased by $551,727, from a loss of $518,690 in the nine-month period ended September 30, 2022 to income of $33,037 in the nine-month period ended September 30, 2023, due primarily to the translation of significant United States dollar denominated transactions and balances during the period including the convertible promissory notes, compared to the prior period, during a period in which the Canadian dollar strengthened.

During the current nine-month period ended September 30, 2023, the Company recorded a loss on the revaluation of convertible promissory notes of in the amount of $2,296,845 compared to a loss of 2,957,270 (including net of the gain on extinguishment of convertible promissory notes) in the prior period ended September 30, 2022. The increase is primarily due to an increase in principal for certain convertible promissory notes due to an amendment and defaults along with the impact of default interest accruing at 24% per annum. In addition, during the nine-month period ended September 30, 2023, the Company recorded a loss of $74,359 on the conversions of a convertible promissory note. Also included in the prior period, the Company recorded an amount of $250,000 for the accrued settlement payment for the release of services of a party for an underwriting offering dated March 23, 2022 and amended May 23, 2022. Overall, the other expenses decreased by $831,066.

As at September 30, 2023, the Company had a working capital deficit of $24,425,747 (December 31, 2022-$21,580,552), incurred a net loss of $5,175,059 (September 30, 2022-$8,788,875) for the nine months ended September 30, 2023 and had an accumulated deficit of $35,520,256 (December 31, 2022-$30,345,197) and expects to incur further losses in the development of its business.

These factors cast substantial doubt as to the Company's ability to continue as a going concern, which is dependent upon its ability to obtain the necessary financing to further the development of its business, satisfy its obligations to its creditors and upon achieving profitable operations. There is no assurance of funding being available or available on acceptable terms. Realization values may be substantially different from carrying values as shown.

The interim condensed consolidated financial statements do not include any adjustments to reflect the future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result if the Company was unable to continue as a going concern.

CRITICAL ACCOUNTING ESTIMATES

Use of estimates

The preparation of the Company's consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates are based on management's best knowledge of current events and actions the Company may undertake in the future. The Company regularly evaluates estimates and assumptions. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgements about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. Areas involving significant estimates and assumptions include: the allowance for doubtful accounts, inventory valuation, useful lives of long-lived and intangible assets, impairment of long-lived assets and intangible assets, valuation of asset acquisition, accruals, fair value of convertible promissory notes, deferred income tax assets and related valuation allowance, environmental remediation costs, stock-based compensation and going concern. Actual results could differ from these estimates. These estimates are reviewed periodically and as adjustments become necessary, they are reported in earnings in the period in which they become available.

Stock-based compensation

The Company records compensation costs related to stock-based awards in accordance with ASC 718, Compensation-Stock Compensation, whereby the Company measures stock-based compensation cost at the grant date based on the estimated fair value of the award. Compensation cost is recognized on a straight-line basis over the requisite service period of the award. Where necessary, the Company utilizes the Black-Scholes option-pricing model to estimate the fair value of stock options granted, which requires the input of highly subjective assumptions including: the expected option life, the risk-free rate, the dividend yield, the volatility of the Company's stock price and an assumption for employee forfeitures. The risk-free rate is based on the U.S. Treasury bill rate at the date of the grant with maturity dates approximately equal to the expected term of the option. The Company has not historically issued any dividends and does not expect to in the near future. Changes in any of these subjective input assumptions can materially affect the fair value estimates and the resulting stock- based compensation recognized. The Company has not issued any stock options and has no stock options outstanding at September 30, 2023 and as of the date of the filing of this document.

39

Indefinite Asset Impairments

The Company evaluates the intangible assets for impairment annually in the fourth quarter or when triggering events are identified and whether events and circumstances continue to support the indefinite useful life using Level 3 inputs.

Long-Lived Asset Impairments

In accordance with ASC 360, "Property, Plant and Equipment", long-lived assets to be held and used are analyzed for impairment whenever events or changes in circumstances indicate that the related carrying amounts may not be recoverable.

The Company evaluates at each balance sheet date whether events or circumstances have occurred that indicate possible impairment. If there are indications of impairment, the Company uses future undiscounted cash flows of the related asset or asset grouping over the remaining life in measuring whether the carrying amounts are recoverable. In the event that such cash flows are not expected to be sufficient to recover the recorded asset values, the assets are written down to their estimated fair value.

Convertible Promissory Notes

The Company has elected the fair value option to account for its convertible promissory notes issued after December 31, 2020. In accordance with ASC 825, the convertible promissory notes are marked-to-market at each reporting date with changes in fair value recorded as a component of other income (expense), in the interim condensed consolidated statements of operations and comprehensive loss. The Company has elected to include interest expense in the changes in fair value. Transaction costs are incurred as expensed. The Company did not elect the fair value option for the convertible promissory notes issued in 2019. These notes are measured at amortized cost.

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

The following section provides a description of new accounting pronouncements ("Accounting Standard Update" or "ASU") issued by the Financial Accounting Standards Board ("FASB") that are applicable to the Company.

In March 2022, the FASB issued ASU No. 2022-02, Financial Instruments - Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures ("ASU 2022-02"), which requires enhanced disclosure of certain loan refinancings and restructurings by creditors when a borrower is experiencing financial difficulty while eliminating certain current recognition and measurement accounting guidance. This ASU also requires the disclosure of current-period gross write-offs by year of origination for financing receivables and net investments in leases. ASU No. 2022-02 became effective for the Company's annual and interim periods beginning on January 1, 2023. As a result, the adoption of ASU 2022-02 did not have any impact on the opening balances in the interim condensed consolidated financial statements.

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments ("ASU-2016-13"). ASU 2016-13 affects loans, debt securities, trade receivables, and any other financial assets that have the contractual right to receive cash. The ASU requires an entity to recognize expected credit losses rather than incurred losses for financial assets. ASU 2016-13 is effective for the fiscal year beginning after December 15, 2022, including interim periods within that fiscal year. The Company adopted this ASU on January 1, 2023. As a result, the adoption of ASU 2016-13 did not have any impact on the opening balances in the interim condensed consolidated financial statements.

EQUITY

As at September 30, 2023, the Company had 124,783,286 common shares issued and outstanding. As at November 14, 2023, the Company had 124,783,286 common shares issued and outstanding.

STOCK OPTIONS, WARRANTS AND RESTRICTED STOCK UNITS

The Company has no stock options, warrants or restricted stock units outstanding as at September 30, 2023 and as of the date of the filing of this document.

40

RELATED PARTY TRANSACTIONS

For three and nine-month periods ended September 30, 2023, the Company incurred $89,449 (C$120,000) and $267,552 (C$360,000) (2022-$92,189; C$120,000 and $280,728; C$360,000) respectively, in management fees expense with Travellers International Inc. ("Travellers"), an Ontario company controlled by a director and the president and chief executive officer (the "CEO"); and $27,952 (C$37,500) and $83,610 (C$112,500) (2022-$22,986; C$30,000 and $70,182; C$90,000) respectively, in management fees expense with the Company's chief financial officer (the "CFO"). As at September 30, 2023, unpaid remuneration and unpaid expenses in the amount of $204,728 (C$276,809) (December 31, 2022-$161,790; C$219,138) is included in accounts payable and $107,634 (C$145,530) (December 31, 2022-$22,705; C$30,753) is included in accrued liabilities in the interim condensed consolidated balance sheets.

During the three and nine-month periods ended September 30, 2023, Travellers converted $233,558 (C$316,400) and $512,403 (C$688,883) (2022-$nil; C$nil and $nil; C$nil) respectively, in outstanding loans and outstanding accounts payable for 1,254,792 and 2,422,163 (2022-nil and nil) respectively, common shares of the Company, based on closing trading prices on the day prior to each conversion.

For the three and nine-month periods ended September 30, 2023, the Company incurred $30,014 (C$40,046) and $80,452 (C$108,251) (2022-$27,728; C$36,244 and $89,530; C$114,812) respectively, in rent expense paid under a lease arrangement with Haute Inc. ("Haute"), an Ontario company controlled by the CEO.

In addition, during the three and nine-month periods ended September 30, 2023, the Company paid the CFO interest of $nil (C$nil) and $nil (C$nil) (2022-$nil; C$nil and $526; C$674) respectively, on loans totaling $nil (C$nil) (2022-$29,211 (C$36,000) respectively, provided to the Company and repaid during the three month period ended March 31, 2022.

For the independent directors, the Company recorded directors' compensation during the three and nine-month periods ended September 30, 2023 of $18,631 (C$25,000) and $53,211 (C$71,597) (2022-$14,366; C$18,750 and $43,864; C$56,250) respectively. In addition, on February 18, 2023 a new independent director was appointed and was awarded 100,000 common shares of the Company on March 1, 2023 valued at $21,000 based on the closing trading price on the appointed date and included under stock-based compensation in the interim condensed consolidated statements of operations and comprehensive loss. Further, the new independent director provided the Company funds of $101,039 (C$134,483) for a private placement in exchange for 310,888 common shares of the Company priced at $0.3250 per share.

As at September 30, 2023, outstanding directors' compensation of $174,393 (C$235,793) (December 31, 2022-$121,226; C$164,196) is included in accrued liabilities, in the interim condensed consolidated balance sheets.

During the three and nine-month periods ended September 30, 2023, $538 and $1,684 (2022-$548 and $679) respectively, in interest was incurred on the directors' loans. As at September 30, 2023, $2,839 (December 31, 2022-$1,088) of accrued interest is included in accrued liabilities in the interim condensed consolidated balance sheets.

Pursuant to the terms of the CEO's Consulting Agreement, for his services as the CEO, the compensation is at a rate of $29,728 (C$40,000) per month for twelve (12) months, beginning on the Effective Date, January 1, 2023, and at a rate of $37,160 (C$50,000) per month for twelve (12) months, beginning January 1, 2024. In addition, the Company agreed to grant the CEO 3,000,000 restricted shares of the Company's Common Stock, par value of $0.0001 per share (the "Common Stock") on the Effective Date. The Company has also agreed to reimburse the CEO for certain out-of-pocket expenses incurred by the CEO.

Pursuant to the terms of the CFO's Consulting Agreement for his services as the CFO, the compensation is at a rate of $9,290 (C$12,500) per month for twelve (12) months, beginning on the Effective Date, January 1, 2023. In addition, the Company agreed to grant the CFO 100,000 restricted shares of the Company's Common Stock, par value of $0.0001 per share (the "Common Stock") on the Effective Date. The Company has also agreed to reimburse the CFO for certain out-of-pocket expenses incurred by the CFO.

Furthermore, for the three and nine-month periods ended September 30, 2023, the Company recognized management stock-based compensation expense of $57,600 and $172,800 (2022-$60,113 and $180,339) respectively, on the common stock issued to the CEO and the CFO, 3,000,000 and 100,000 common stock, respectively, as stipulated in their executive consulting agreements, effective January 1, 2023 valued at the trading price on the Effective Date. The total stock-based compensation on the issuance of the common stock totaled $446,400 (2022-$240,450). The portion to be expensed for the balance of the consulting agreements, $273,600 (2022-$60,111) is included in prepaid expenses and deposits in the interim condensed consolidated balance sheets.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that is material to investors.

41

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

As a smaller reporting company, as that term is defined in Item 10(f)(1) of Regulation S-K, we are not required to provide information required by this Item.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our CEO and CFO, evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act") as of the end of the period covered by this Quarterly Report on Form 10-Q.

Our disclosure controls and procedures are designed to provide reasonable, not absolute, assurance that the objectives of our disclosure control system are met. Due to inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within a company have been detected. Based on our evaluation, our CEO and CFO have concluded that, as of the end of the period covered by this report, our disclosure controls and procedures were not effective. The matters involving internal controls over financial reporting that may be considered material weaknesses included the small size of the Company and the resulting lack of a segregation of duties.

Notwithstanding these material weaknesses, management has concluded that the unaudited interim condensed consolidated financial statements included elsewhere in this Quarterly Report on Form 10-Q present fairly, in all material respects, the financial position, results of operations and cash flows in conformity with generally accepted accounting principles.

Changes in Internal Control over Financial Reporting

During the nine-month period ended September, 2023, there were no changes made by management to its internal controls over financial reporting.

PART II: OTHER INFORMATION

Item 1. Legal Proceedings.

From time to time, the Company may become involved in litigation relating to claims arising from the ordinary course of business. Management believes that there are currently no claims or actions pending against us, the ultimate disposition of which would have a material adverse effect on our results of operations, financial condition or cash flows.

The Company has a claim against it for unpaid legal fees in the amount of $48,252 (C$65,241). The amount is included in accounts payable on the Company's interim condensed consolidated balance sheets.

Item 1A. Risk Factors.

As a smaller reporting company, we are not required to provide the information required by this item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

During the nine-month period ended September 30, 2023, the Company issued:

(i) 500,000 common shares for proceeds previously received.

(ii) 3,000,000 common shares issued to the CEO as stipulated in his 2023 executive consulting agreement and 100,000 common shares issued to the CFO as stipulated in his 2023 executive consulting agreement.

(iii) 1,650,709 common shares issued on the conversion of a convertible promissory note to equity.

(iv) 1,790,000 common shares were issued for professional services.

42

(v) 225,000 common shares issued for other services.

(vi) 20,000 common shares issued to an employee.

(vii) 100,000 common shares were issued to a new director.

(viii) 1,536,582 common shares issued on a private placement.

(ix) 2,422,163 of common shares issued on the conversion of related party debt and accounts payable.

The securities above were offered and sold pursuant to an exemption from the registration requirements under Section 4(a)(2) of the Securities Act since, among other things, the transactions did not involve a public offering.

Item 3. Defaults upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not Applicable.

Item 5. Other Information.

Not Applicable.

Item 6. Exhibits.

The following exhibits are filed as part of this quarterly report on Form 10-Q:

| Exhibit No. | Description |

| 10.1* | Purchase of land by and between Snave Holdings Ltd., (the vendor) and SusGlobal Energy Canada Corp., (the purchaser) on November 2, 2023. |

| 10.2* | Mortgage commitment by and between Snave Holdings Ltd, (the lender) and SusGlobal Energy Canada Corp., (the borrower) dated November 2, 2023. |

| 10.3* | Mortgage commitment by and between R. Williamson Consultants Limited, P.I.C.K.S. Inc., and 2654666 Ontario Inc., (the lenders) and 1684567 Ontario Inc., (the borrower) and SusGlobal Energy Canada Corp., (the guarantor) on November 2, 2023 for the land purchase. |

| 31.1* | Certification of Chief Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 31.2* | Certification of Chief Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 32.1+ | Certification of the Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350 (Section 906 of Sarbanes-Oxley Act of 2002). |

| 101.INS* | Inline XBRL Instance Document-the instance document does not appear in the Interactive Data File as its XBRL tags are embedded within the Inline XBRL document |

| 101.SCH* | Inline XBRL Taxonomy Extension Schema Document |

| 101.CAL* | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF* | Inline XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB* | Inline XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE* | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

| * | Filed herewith |

| ** | Management contract or compensatory plan or arrangement |

| + | In accordance with SEC Release 33-8238, Exhibit 32.1 is being furnished and not filed. |

43

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | SUSGLOBAL ENERGY CORP. |

| | | |

| November 14, 2023 | By: | /s/ Marc Hazout |

| | | Marc Hazout |

| | | Executive Chairman, President and Chief Executive Officer |

| | | |

| | | |

| November 14, 2023 | By: | /s/ Ike Makrimichalos |

| | | Ike Makrimichalos |

| | | Chief Financial Officer (Principal Financial and Accounting Officer) |

44