2017 Q2 Analyst Call The Bank of N.T. Butterfield & Son Limited July 26, 2017

2 Forward-Looking Statements Forward-Looking Statements: Certain of the statements made in this presentation are “forward-looking statements” within the meaning and protections of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our current beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions, and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance, capital, ownership or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Our performance may vary due to a variety of factors, including worldwide economic conditions, success in business retention and obtaining new business and other factors. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target” and other similar words and expressions of the future. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our Securities and Exchange Commission (“SEC”) reports and filings. Such reports are available upon request from the Bank, or from the SEC, including through the SEC’s Internet website at http:// www.sec.gov. We have no obligation and do not undertake to update, revise or correct any of the forward-looking statements after the date hereof, or after the respective dates on which any such statements otherwise are made. About Non-GAAP Financial Measures: This presentation contains non-GAAP financial measures including “core” net income and other financial measures presented on a “core” basis. We believe such measures provide useful information to investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however, our non-GAAP financial measures have a number of limitations. As such, investors should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use. Reconciliations of these non-GAAP measures to corresponding GAAP financial measures are provided in the Appendix of this presentation. All information in $millions and as of 31 March 2017 unless otherwise indicated . Conversion rate: 1 BMD$ = 1 US$.

3 Q2 2017 Earnings Call Presenters Agenda Six International Locations Butterfield Overview Michael Collins Chairman & Chief Executive Officer Michael Schrum Chief Financial Officer Dan Frumkin Chief Risk Officer • Leading Bank in Attractive Markets • Strong Capital Generation and Return • Efficient, Conservative Balance Sheet • Visible Earnings • Overview • Financials • Summary • Q&A Awards

4 Q2 2017 Highlights Q1 Q2 Q3 Q4 Q1 Q2 $36.0 $32.1 $33.4 $37.1 $38.5 $37.5 Core Net Income** Butterfield Peer average *** Q1 Q2 Q3 Q4 Q1 Q2 23.7% 20.1% 19.0% 19.3% 23.4% 21.6% 12.2% 12.6% 12.9% 12.9% 12.9% Core Return on Average Tangible Common Equity** vs. Q1 2017 vs. Q2 2016 Q2 2017 $ % $ % Net Interest Income 71.5 3.5 7.1 Non-Interest Income 38.7 0.2 0.8 Prov. for Credit Losses (0.5) (0.9) 4.8 Non-Interest Expenses* (75.6) (4.4) (8.6) Other Gains (Losses) 2.0 1.8 2.2 Net Income 36.1 0.2 0.5 % 6.3 21.1% Non-Core Items** 1.4 (1.2) (0.9) Core Net Income 37.5 (1.0) (2.7)% 5.4 16.8% 2016 2017 2016 2017 * Includes income taxes ** See the Appendix for a reconciliation of the non-GAAP measure. *** Includes US banks identified by management as a peer group. See the Appendix for a list of these banks. • NIM expansion to 2.66%, a 8 bps increase over Q1 2017, due to mortgage repricing and increased portfolio yields. • Stability of non-interest income supported by diversified financial services businesses. • Robust originations in UK mortgage business with continuing favourable credit environment. • Successfully hosted 35th America’s Cup in Bermuda with more than 800 clients attending Bank functions. • Core ROE** of 21.6%. • Core EPS** of $0.67 for the quarter supporting dividend of $0.32 per share.

Financials

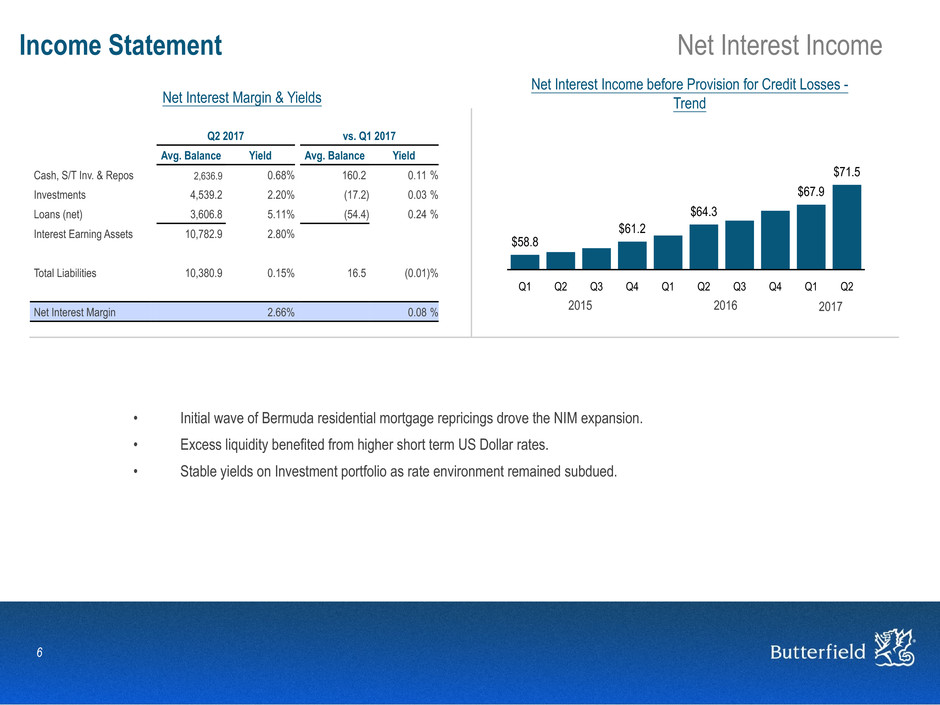

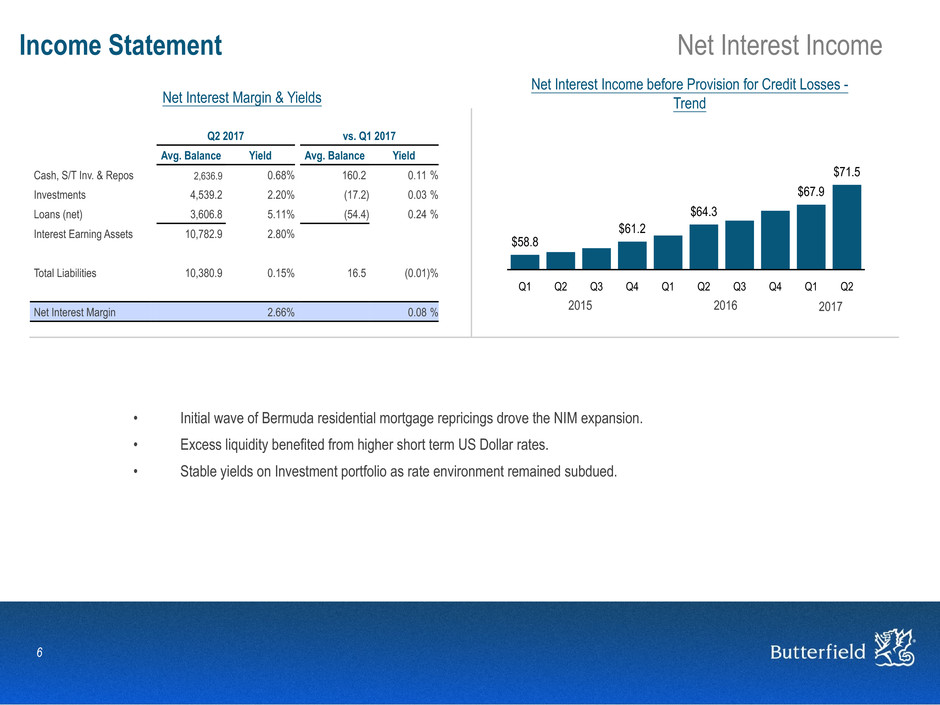

6 Income Statement Net Interest Income Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 $58.8 $61.2 $64.3 $67.9 $71.5 Net Interest Income before Provision for Credit Losses - Trend Q2 2017 vs. Q1 2017 Avg. Balance Yield Avg. Balance Yield Cash, S/T Inv. & Repos 2,636.9 0.68% 160.2 0.11 % Investments 4,539.2 2.20% (17.2) 0.03 % Loans (net) 3,606.8 5.11% (54.4) 0.24 % Interest Earning Assets 10,782.9 2.80% Total Liabilities 10,380.9 0.15% 16.5 (0.01)% Net Interest Margin 2.66% 0.08 % Net Interest Margin & Yields 2015 2016 2017 • Initial wave of Bermuda residential mortgage repricings drove the NIM expansion. • Excess liquidity benefited from higher short term US Dollar rates. • Stable yields on Investment portfolio as rate environment remained subdued.

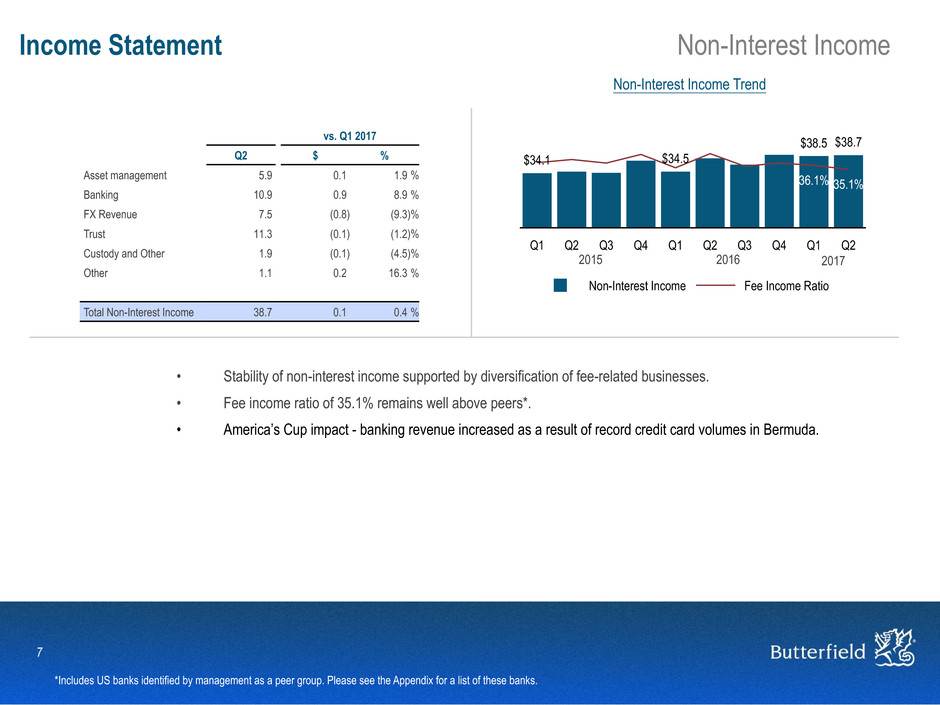

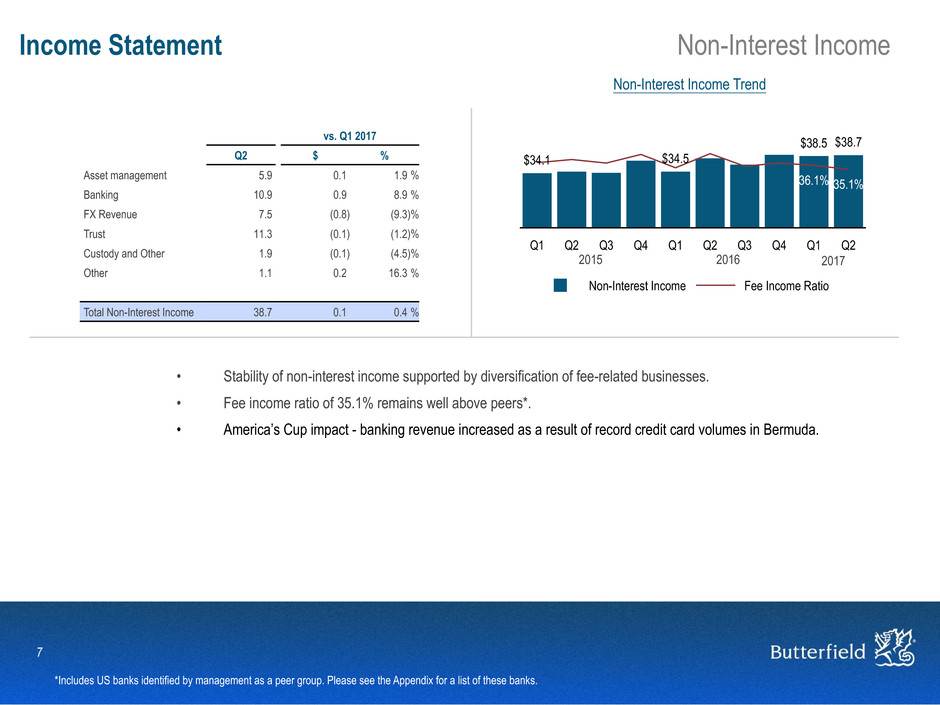

7 Income Statement Non-Interest Income Non-Interest Income Trend vs. Q1 2017 Q2 $ % Asset management 5.9 0.1 1.9 % Banking 10.9 0.9 8.9 % FX Revenue 7.5 (0.8) (9.3)% Trust 11.3 (0.1) (1.2)% Custody and Other 1.9 (0.1) (4.5)% Other 1.1 0.2 16.3 % Total Non-Interest Income 38.7 0.1 0.4 % Non-Interest Income Fee Income Ratio Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 $34.1 $34.5 $38.5 $38.7 36.1% 35.1% • Stability of non-interest income supported by diversification of fee-related businesses. • Fee income ratio of 35.1% remains well above peers*. • America’s Cup impact - banking revenue increased as a result of record credit card volumes in Bermuda. 2015 2016 2017 *Includes US banks identified by management as a peer group. Please see the Appendix for a list of these banks.

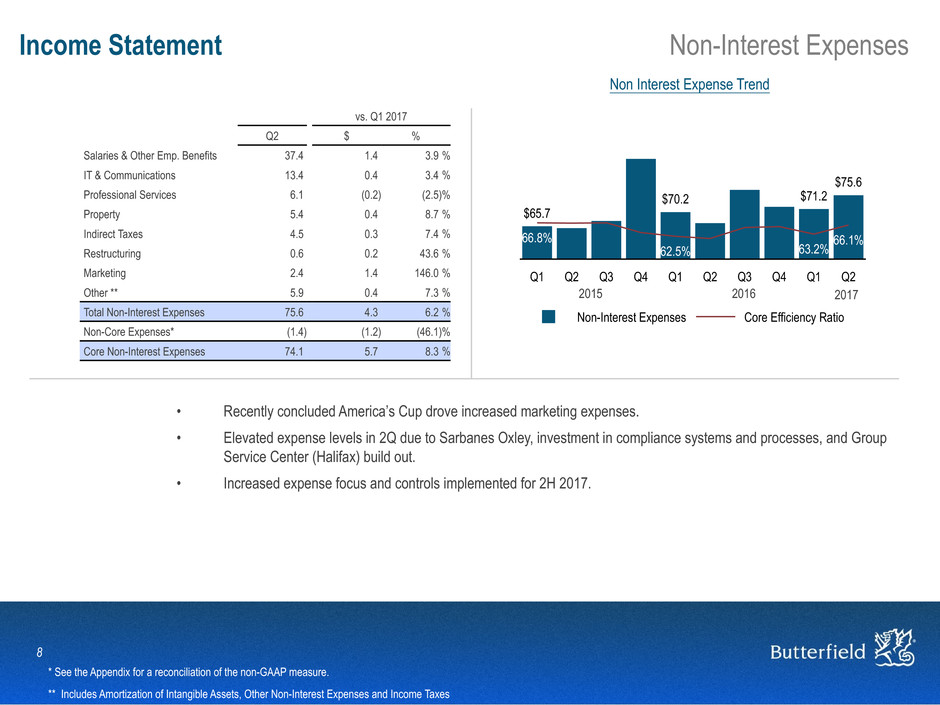

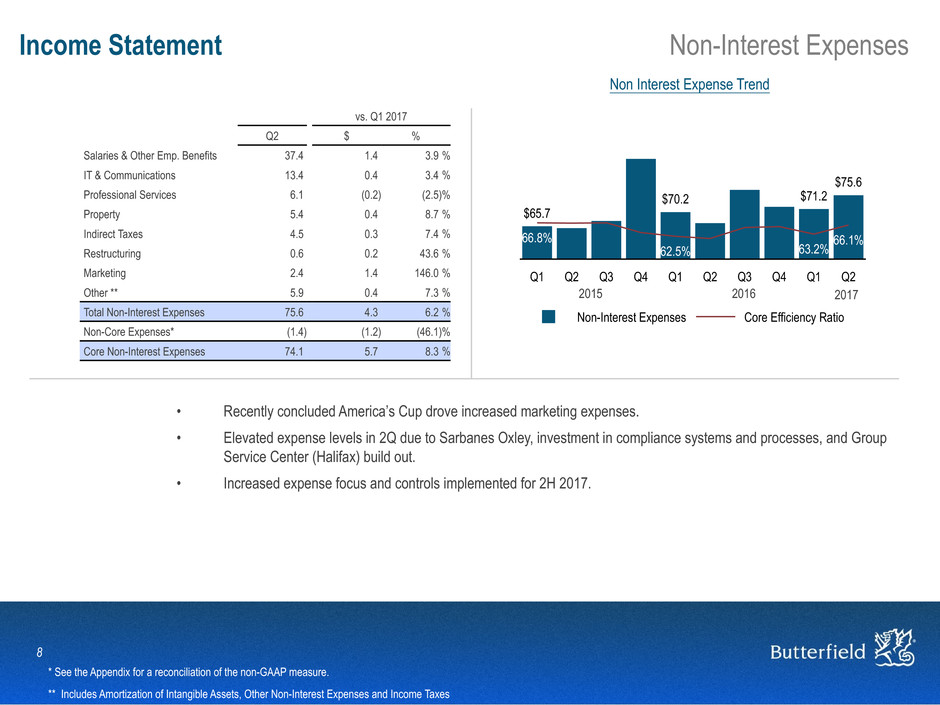

8 Income Statement Non-Interest Expenses Non Interest Expense Trend vs. Q1 2017 Q2 $ % Salaries & Other Emp. Benefits 37.4 1.4 3.9 % IT & Communications 13.4 0.4 3.4 % Professional Services 6.1 (0.2) (2.5)% Property 5.4 0.4 8.7 % Indirect Taxes 4.5 0.3 7.4 % Restructuring 0.6 0.2 43.6 % Marketing 2.4 1.4 146.0 % Other ** 5.9 0.4 7.3 % Total Non-Interest Expenses 75.6 4.3 6.2 % Non-Core Expenses* (1.4) (1.2) (46.1)% Core Non-Interest Expenses 74.1 5.7 8.3 % Non-Interest Expenses Core Efficiency Ratio Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 $65.7 $70.2 $71.2 $75.6 66.8% 62.5% 63.2% 66.1% • Recently concluded America’s Cup drove increased marketing expenses. • Elevated expense levels in 2Q due to Sarbanes Oxley, investment in compliance systems and processes, and Group Service Center (Halifax) build out. • Increased expense focus and controls implemented for 2H 2017. 2015 2016 2017 * See the Appendix for a reconciliation of the non-GAAP measure. ** Includes Amortization of Intangible Assets, Other Non-Interest Expenses and Income Taxes

9 Capital Requirements and Return Leverage Capital • Meeting current and anticipated regulatory capital requirements. • $0.32 per share dividend declared for 2nd quarter. • Leverage capital at the end of the 2nd quarter at high end of target capital range. Regulatory Capital (Basel III) - Total Capital Ratio Butterfield Current BMA 2017 Required US Peer Average * 19.1% 15.9% 15.1% * Includes US banks identified by management as a peer group. Please see the Appendix for a list of these banks. TCE/TA TCE/TA Ex Cash Butterfield - Pre IPO Butterfield - Current US Peer Median * Period Ending 5.0% 6.7% 8.2%1.6% 1.3% 0.8% 6.6% 8.0% 9.0%

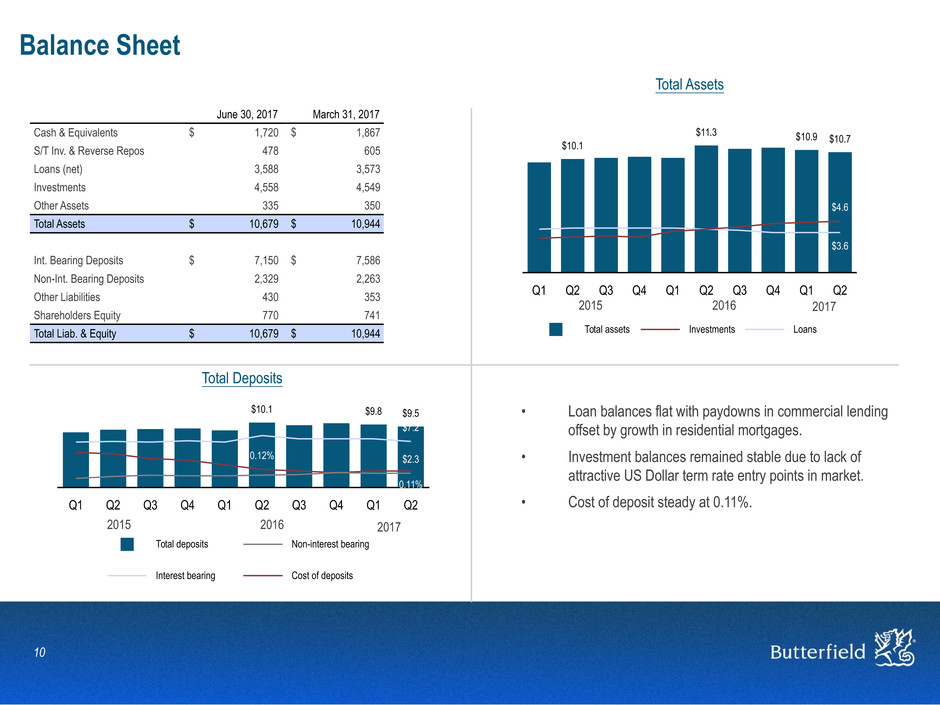

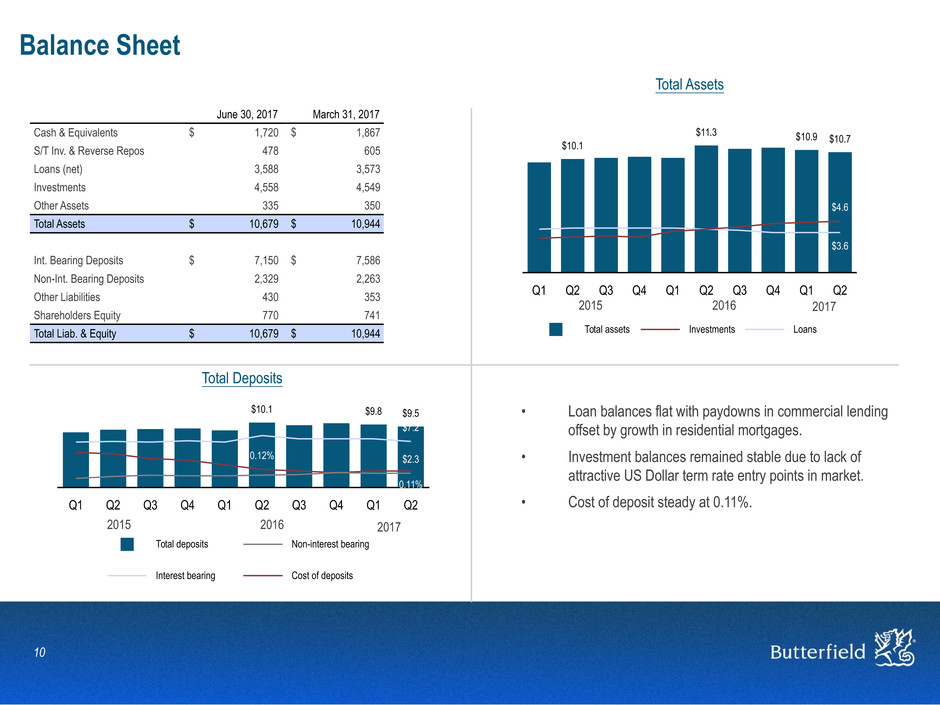

10 Balance Sheet Total Assets • Loan balances flat with paydowns in commercial lending offset by growth in residential mortgages. • Investment balances remained stable due to lack of attractive US Dollar term rate entry points in market. • Cost of deposit steady at 0.11%. June 30, 2017 March 31, 2017 Cash & Equivalents $ 1,720 $ 1,867 S/T Inv. & Reverse Repos 478 605 Loans (net) 3,588 3,573 Investments 4,558 4,549 Other Assets 335 350 Total Assets $ 10,679 $ 10,944 Int. Bearing Deposits $ 7,150 $ 7,586 Non-Int. Bearing Deposits 2,329 2,263 Other Liabilities 430 353 Shareholders Equity 770 741 Total Liab. & Equity $ 10,679 $ 10,944 Total assets Investments Loans Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 $10.1 $11.3 $10.9 $10.7 $4.6 $3.6 Total deposits Non-interest bearing Interest bearing Cost of deposits Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 $10.1 $9.8 $9.5 $2.3 $7.2 0.12% 0.11% 2015 2016 2017 2015 2016 2017 Total Deposits

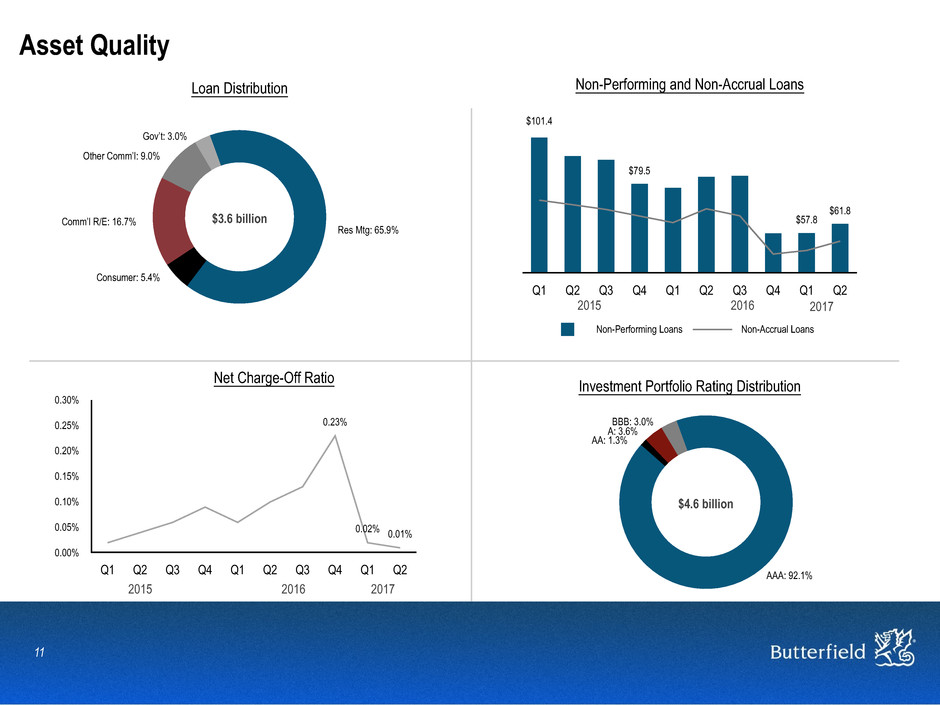

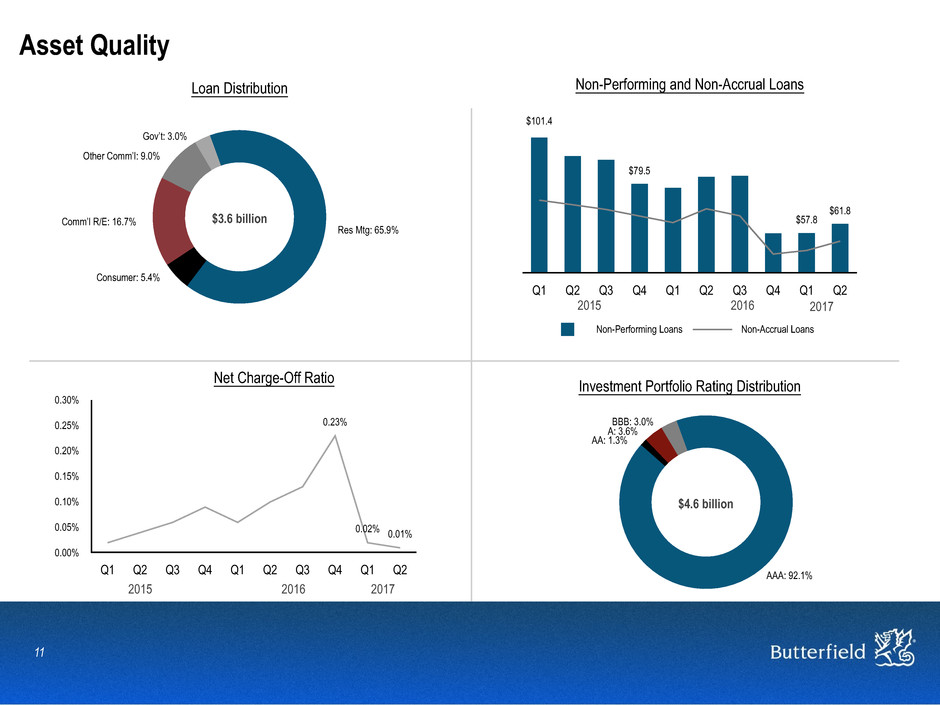

11 Asset Quality Non-Performing and Non-Accrual Loans Non-Performing Loans Non-Accrual Loans Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 $101.4 $79.5 $57.8 $61.8 Res Mtg: 65.9% Consumer: 5.4% Comm’l R/E: 16.7% Other Comm’l: 9.0% Gov’t: 3.0% Loan Distribution 2015 2016 2017 0.30% 0.25% 0.20% 0.15% 0.10% 0.05% 0.00% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 0.23% 0.02% 0.01% Net Charge-Off Ratio AAA: 92.1% AA: 1.3% A: 3.6% BBB: 3.0% $3.6 billion $4.6 billion Investment Portfolio Rating Distribution 2015 2016 2017

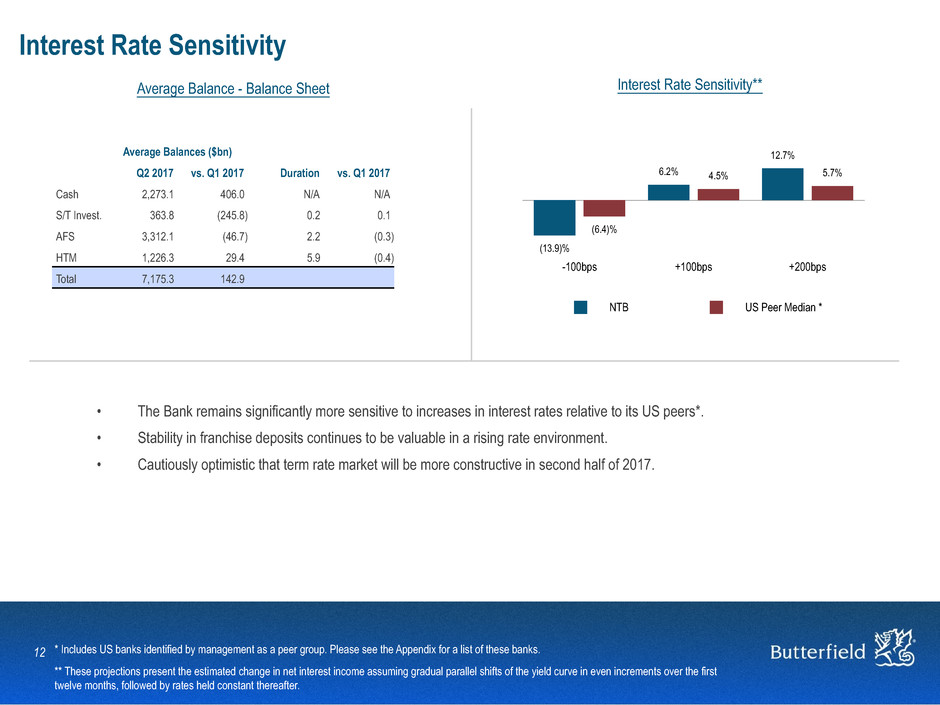

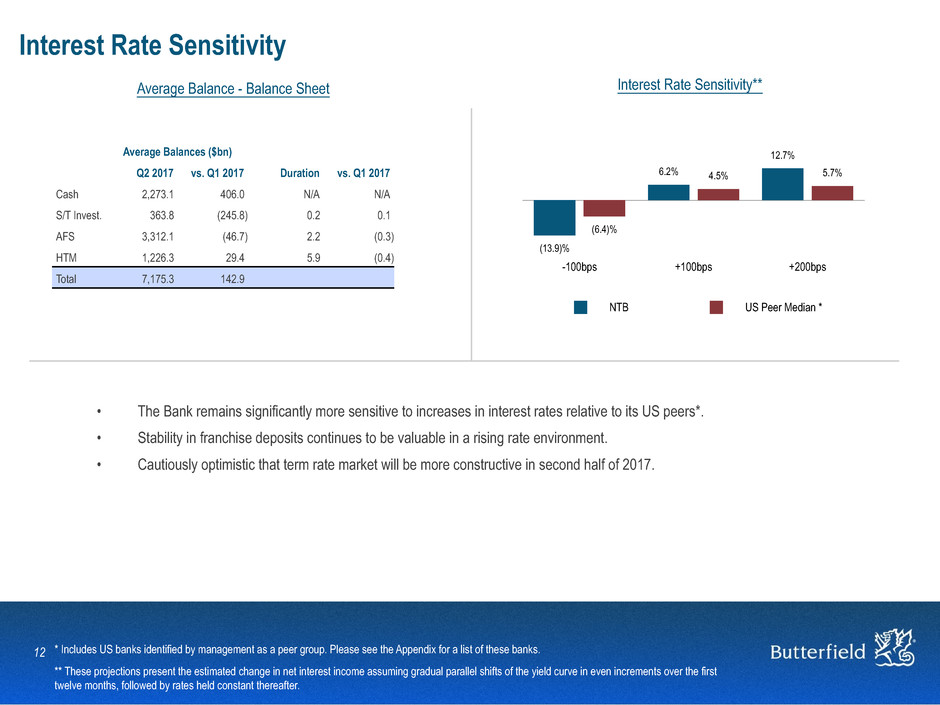

12 Interest Rate Sensitivity Interest Rate Sensitivity**Average Balance - Balance Sheet Average Balances ($bn) Q2 2017 vs. Q1 2017 Duration vs. Q1 2017 Cash 2,273.1 406.0 N/A N/A S/T Invest. 363.8 (245.8) 0.2 0.1 AFS 3,312.1 (46.7) 2.2 (0.3) HTM 1,226.3 29.4 5.9 (0.4) Total 7,175.3 142.9 NTB US Peer Median * -100bps +100bps +200bps (13.9)% 6.2% 12.7% (6.4)% 4.5% 5.7% • The Bank remains significantly more sensitive to increases in interest rates relative to its US peers*. • Stability in franchise deposits continues to be valuable in a rising rate environment. • Cautiously optimistic that term rate market will be more constructive in second half of 2017. * Includes US banks identified by management as a peer group. Please see the Appendix for a list of these banks. ** These projections present the estimated change in net interest income assuming gradual parallel shifts of the yield curve in even increments over the first twelve months, followed by rates held constant thereafter.

Summary Q&A Appendices

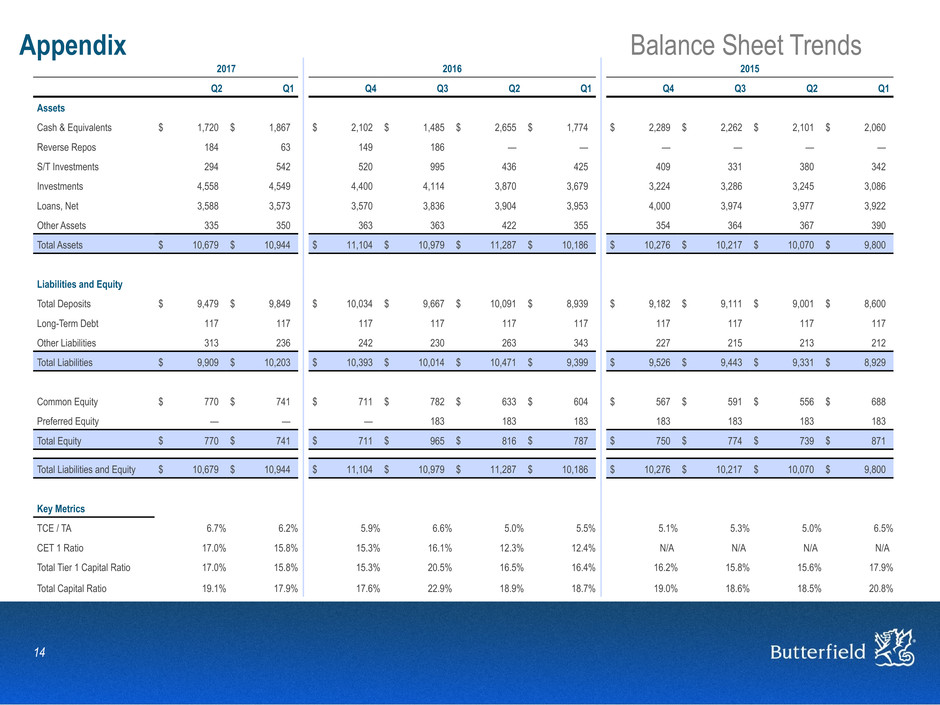

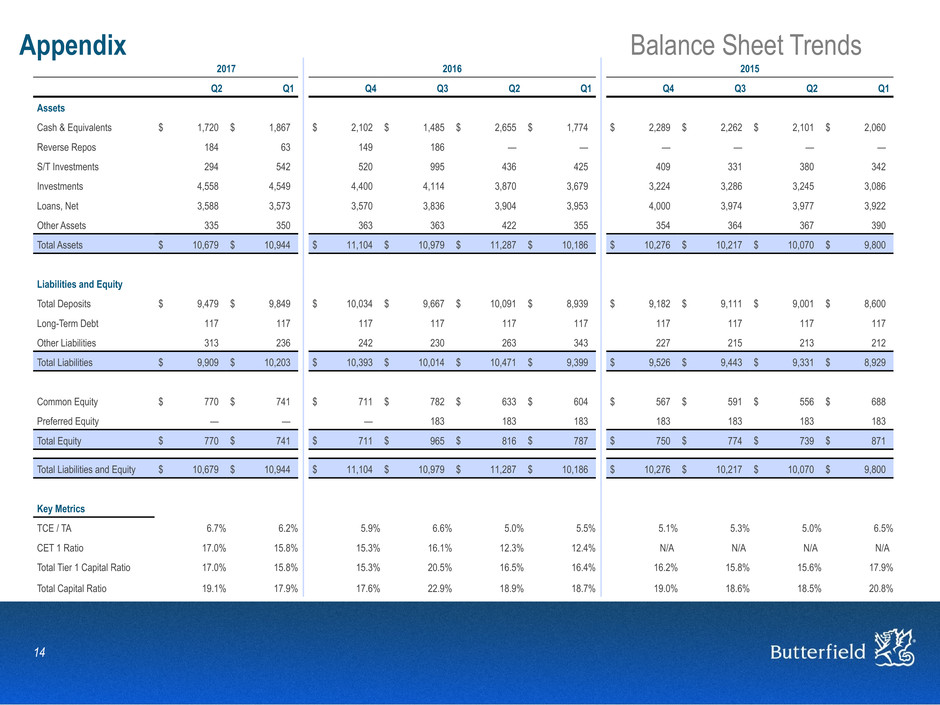

14 Appendix Balance Sheet Trends 2017 2016 2015 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Assets Cash & Equivalents $ 1,720 $ 1,867 $ 2,102 $ 1,485 $ 2,655 $ 1,774 $ 2,289 $ 2,262 $ 2,101 $ 2,060 Reverse Repos 184 63 149 186 — — — — — — S/T Investments 294 542 520 995 436 425 409 331 380 342 Investments 4,558 4,549 4,400 4,114 3,870 3,679 3,224 3,286 3,245 3,086 Loans, Net 3,588 3,573 3,570 3,836 3,904 3,953 4,000 3,974 3,977 3,922 Other Assets 335 350 363 363 422 355 354 364 367 390 Total Assets $ 10,679 $ 10,944 $ 11,104 $ 10,979 $ 11,287 $ 10,186 $ 10,276 $ 10,217 $ 10,070 $ 9,800 Liabilities and Equity Total Deposits $ 9,479 $ 9,849 $ 10,034 $ 9,667 $ 10,091 $ 8,939 $ 9,182 $ 9,111 $ 9,001 $ 8,600 Long-Term Debt 117 117 117 117 117 117 117 117 117 117 Other Liabilities 313 236 242 230 263 343 227 215 213 212 Total Liabilities $ 9,909 $ 10,203 $ 10,393 $ 10,014 $ 10,471 $ 9,399 $ 9,526 $ 9,443 $ 9,331 $ 8,929 Common Equity $ 770 $ 741 $ 711 $ 782 $ 633 $ 604 $ 567 $ 591 $ 556 $ 688 Preferred Equity — — — 183 183 183 183 183 183 183 Total Equity $ 770 $ 741 $ 711 $ 965 $ 816 $ 787 $ 750 $ 774 $ 739 $ 871 Total Liabilities and Equity $ 10,679 $ 10,944 $ 11,104 $ 10,979 $ 11,287 $ 10,186 $ 10,276 $ 10,217 $ 10,070 $ 9,800 Key Metrics TCE / TA 6.7% 6.2% 5.9% 6.6% 5.0% 5.5% 5.1% 5.3% 5.0% 6.5% CET 1 Ratio 17.0% 15.8% 15.3% 16.1% 12.3% 12.4% N/A N/A N/A N/A Total Tier 1 Capital Ratio 17.0% 15.8% 15.3% 20.5% 16.5% 16.4% 16.2% 15.8% 15.6% 17.9% Total Capital Ratio 19.1% 17.9% 17.6% 22.9% 18.9% 18.7% 19.0% 18.6% 18.5% 20.8%

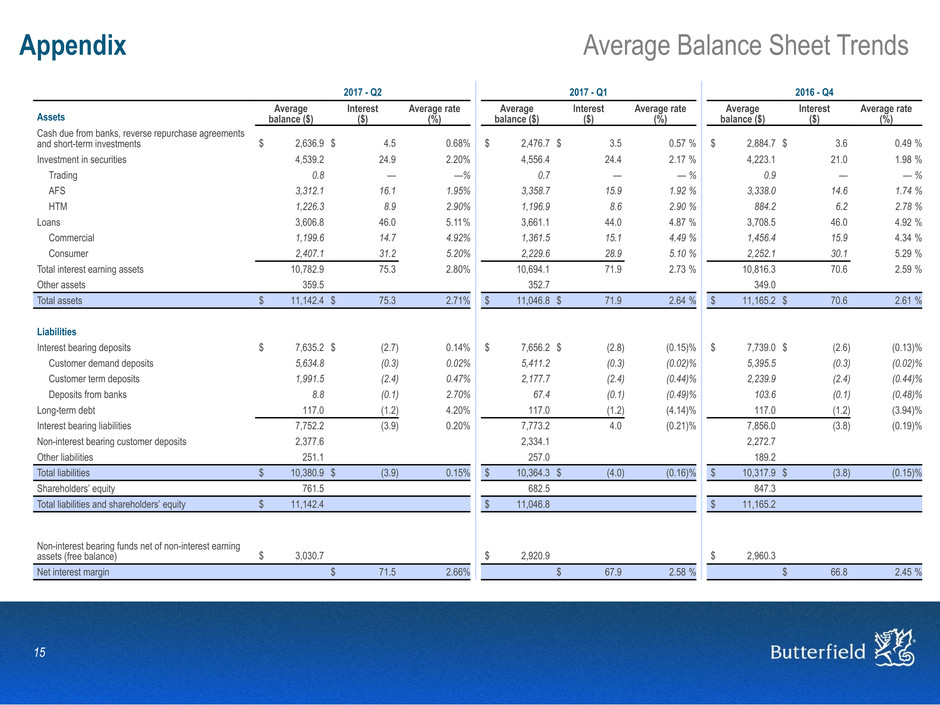

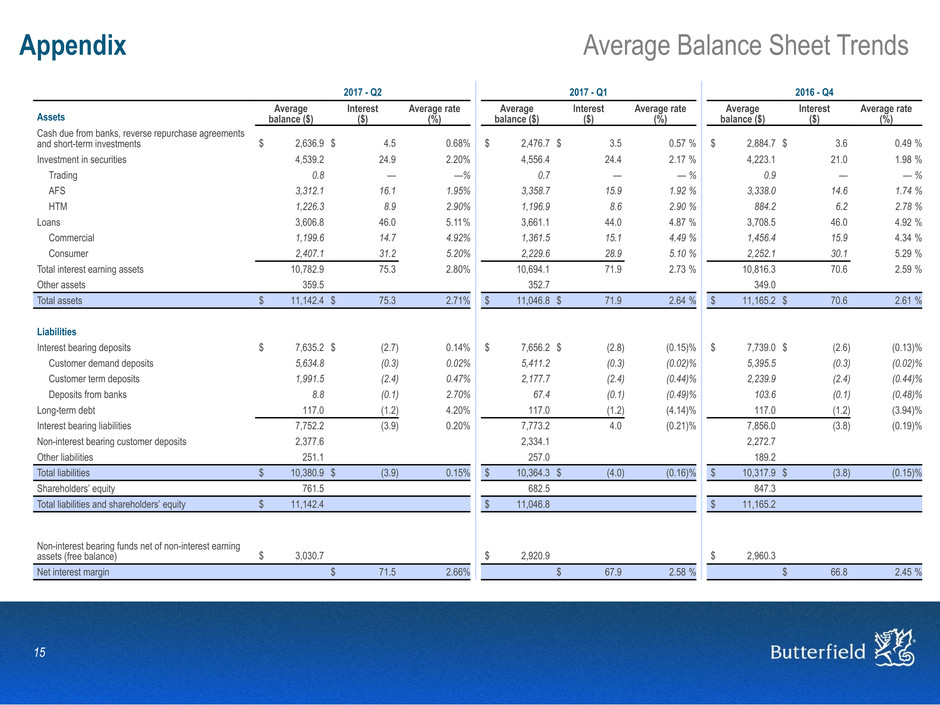

15 Appendix Average Balance Sheet Trends 2017 - Q2 2017 - Q1 2016 - Q4 Assets Average balance ($) Interest ($) Average rate (%) Average balance ($) Interest ($) Average rate (%) Average balance ($) Interest ($) Average rate (%) Cash due from banks, reverse repurchase agreements and short-term investments $ 2,636.9 $ 4.5 0.68% $ 2,476.7 $ 3.5 0.57 % $ 2,884.7 $ 3.6 0.49 % Investment in securities 4,539.2 24.9 2.20% 4,556.4 24.4 2.17 % 4,223.1 21.0 1.98 % Trading 0.8 — —% 0.7 — — % 0.9 — — % AFS 3,312.1 16.1 1.95% 3,358.7 15.9 1.92 % 3,338.0 14.6 1.74 % HTM 1,226.3 8.9 2.90% 1,196.9 8.6 2.90 % 884.2 6.2 2.78 % Loans 3,606.8 46.0 5.11% 3,661.1 44.0 4.87 % 3,708.5 46.0 4.92 % Commercial 1,199.6 14.7 4.92% 1,361.5 15.1 4.49 % 1,456.4 15.9 4.34 % Consumer 2,407.1 31.2 5.20% 2,229.6 28.9 5.10 % 2,252.1 30.1 5.29 % Total interest earning assets 10,782.9 75.3 2.80% 10,694.1 71.9 2.73 % 10,816.3 70.6 2.59 % Other assets 359.5 352.7 349.0 Total assets $ 11,142.4 $ 75.3 2.71% $ 11,046.8 $ 71.9 2.64 % $ 11,165.2 $ 70.6 2.61 % Liabilities Interest bearing deposits $ 7,635.2 $ (2.7) 0.14% $ 7,656.2 $ (2.8) (0.15)% $ 7,739.0 $ (2.6) (0.13)% Customer demand deposits 5,634.8 (0.3) 0.02% 5,411.2 (0.3) (0.02)% 5,395.5 (0.3) (0.02)% Customer term deposits 1,991.5 (2.4) 0.47% 2,177.7 (2.4) (0.44)% 2,239.9 (2.4) (0.44)% Deposits from banks 8.8 (0.1) 2.70% 67.4 (0.1) (0.49)% 103.6 (0.1) (0.48)% Long-term debt 117.0 (1.2) 4.20% 117.0 (1.2) (4.14)% 117.0 (1.2) (3.94)% Interest bearing liabilities 7,752.2 (3.9) 0.20% 7,773.2 4.0 (0.21)% 7,856.0 (3.8) (0.19)% Non-interest bearing customer deposits 2,377.6 2,334.1 2,272.7 Other liabilities 251.1 257.0 189.2 Total liabilities $ 10,380.9 $ (3.9) 0.15% $ 10,364.3 $ (4.0) (0.16)% $ 10,317.9 $ (3.8) (0.15)% Shareholders’ equity 761.5 682.5 847.3 Total liabilities and shareholders’ equity $ 11,142.4 $ 11,046.8 $ 11,165.2 Non-interest bearing funds net of non-interest earning assets (free balance) $ 3,030.7 $ 2,920.9 $ 2,960.3 Net interest margin $ 71.5 2.66% $ 67.9 2.58 % $ 66.8 2.45 %

16 Appendix Income Statement Trends 2017 2016 2015 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Net Interest Income $ 71.5 $ 67.9 $ 66.8 $ 65.0 $ 64.3 $ 62.3 $ 61.2 $ 60.0 $ 59.3 $ 58.8 Non-Interest Income 38.7 38.5 38.8 36.3 37.9 34.5 37.3 34.2 34.5 34.1 Prov. for Credit Losses (0.5) (0.3) (0.9) 0.3 5.3 (0.3) 2.6 0.9 2.0 0.2 Non-Interest Expenses 75.6 71.2 71.9 77.5 67.0 70.2 87.9 67.6 65.3 65.7 Other Gains (Losses) 2.0 0.2 0.8 0.6 (0.2) (0.2) (10.3) 3.1 (3.2) 1.0 Net Income $ 36.1 $ 35.9 $ 35.4 $ 24.0 $ 29.8 $ 26.8 $ (2.3) $ 28.8 $ 23.3 $ 28.0 Non-Core Items* $ 1.4 $ 2.6 $ 1.7 $ 9.4 $ 2.3 $ 9.2 $ 30.1 $ 0.5 $ 4.5 $ 1.0 Core Net Income $ 37.5 $ 38.5 $ 37.1 $ 33.4 $ 32.1 $ 36.0 $ 27.8 $ 29.3 $ 27.8 $ 29.0 Key Metrics Loan Yield 5.11% 4.87% 4.92% 4.75% 4.72% 4.74% 4.63% 4.61% 4.66% 4.63% Securities Yield 2.20 2.17 1.98 1.91 1.87 2.07 2.08 2.10 2.33 2.16 Interest Bearing Dep. Cost 0.14 0.15 0.13 0.11 0.12 0.15 0.18 0.19 0.22 0.23 Net Interest Margin 2.66 2.58 2.45 2.39 2.44 2.54 2.48 2.43 2.52 2.48 Core Efficiency Ratio* 66.1 63.2 65.6 65.3 61.8 62.5 63.7 66.8 66.7 66.8 Core ROATCE* 21.6 23.4 19.3 19.0 20.1 23.7 17.7 19.3 17.6 16.0 Fee Income Ratio 35.1 36.1 36.4 35.9 39.1 35.5 38.9 36.7 37.6 36.8 Fully Diluted Share Count (in millions of common shares) 55.6 55.2 54.7 49.0 47.4 47.4 47.3 47.4 49.9 55.7 * See the Appendix for a reconciliation of the non-GAAP measure.

17 Appendix Non-Interest Income & Expense Trends 2017 2016 2015 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Non-Interest Income Trust $ 11.3 $ 11.4 $ 11.5 $ 11.6 $ 10.8 $ 10.1 $ 10.3 $ 9.9 $ 10.2 $ 10.0 Asset Management 5.9 5.8 6.0 5.6 5.3 4.2 5.3 4.7 4.6 4.3 Banking 10.9 10.0 11.0 9.7 10.0 8.7 10.2 8.5 8.2 8.3 FX Revenue 7.5 8.3 7.4 6.5 8.4 8.3 8.3 7.6 8.0 7.9 Custody & Other Admin. 1.9 2.0 2.0 2.3 2.3 2.2 2.3 2.3 2.5 2.4 Other 1.1 0.9 0.9 0.6 1.0 1.0 0.9 1.2 1.0 1.2 Total Non-Interest Income $ 38.7 $ 38.5 $ 38.8 $ 36.3 $ 37.9 $ 34.5 $ 37.3 $ 34.2 $ 34.5 $ 34.1 Non-Interest Expense Salaries & Benefits $ 37.4 $ 36.0 $ 34.2 $ 42.4 $ 32.2 $ 31.2 $ 37.8 $ 32.1 $ 32.3 $ 32.7 Technology & Comm. 13.4 12.9 14.5 14.4 14.1 14.5 14.6 14.7 13.9 13.9 Property 5.4 4.9 5.5 5.4 5.1 5.0 5.5 5.7 5.2 5.2 Professional & O/S Services 6.1 6.2 5.4 4.1 5.4 4.1 13.7 5.8 4.1 4.1 Indirect Taxes 4.5 4.2 4.7 4.2 2.8 4.6 1.6 4.2 3.8 4.3 Intangible Amortization 1.1 1.0 1.0 1.2 1.3 1.1 1.1 1.1 1.1 1.1 Marketing 2.4 1.0 1.7 0.9 1.0 0.9 1.2 0.7 1.1 0.9 Restructuring 0.6 0.4 0.5 0.6 0.7 4.5 2.2 — — — Other 4.5 4.3 4.4 4.4 4.2 4.0 9.5 3.1 3.6 3.3 Total Non-Interest Expense $ 75.3 $ 71.0 $ 71.9 $ 77.3 $ 66.7 $ 69.9 $ 87.2 $ 67.4 $ 65.1 $ 65.5 Income Taxes 0.3 0.2 — 0.2 0.2 0.3 0.7 0.2 0.2 0.2 Total Expense incld. Taxes $ 75.6 $ 71.2 $ 71.9 $ 77.5 $ 67.0 $ 70.2 $ 87.9 $ 67.6 $ 65.3 $ 65.7

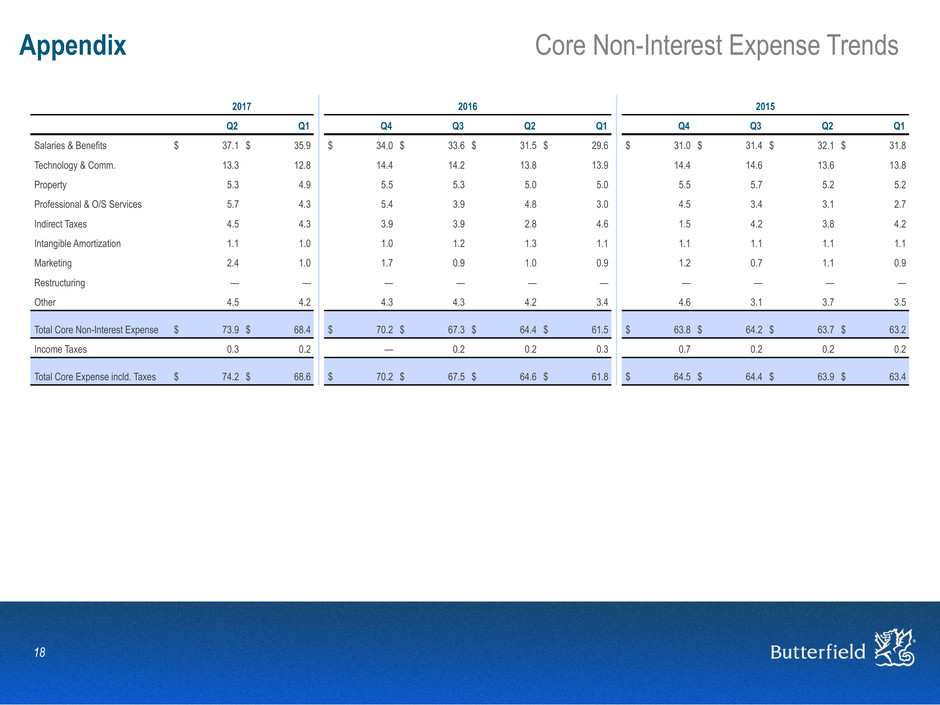

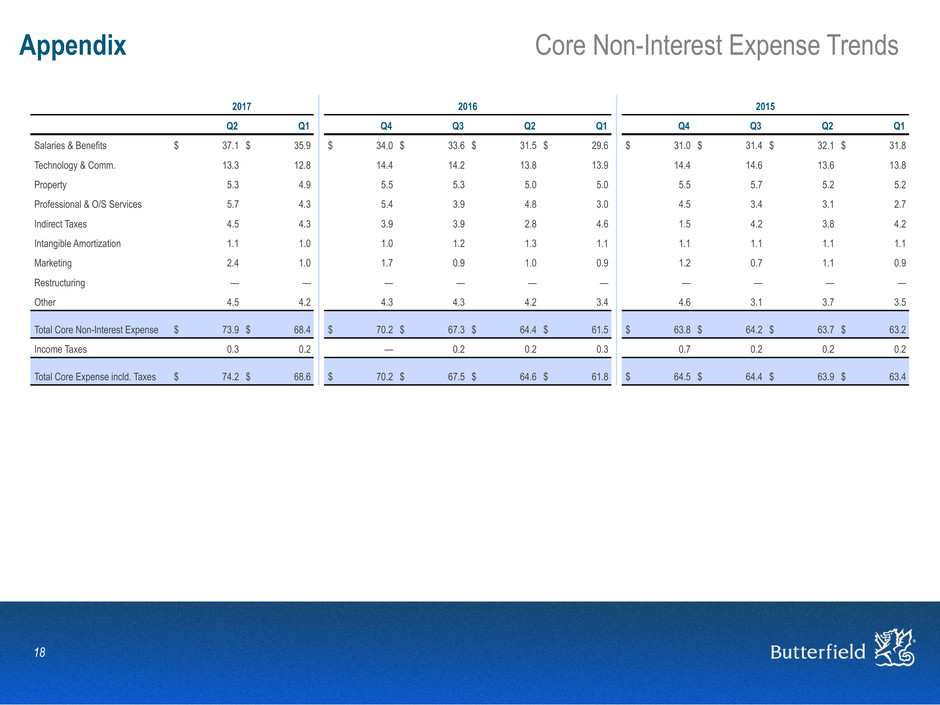

18 Appendix Core Non-Interest Expense Trends 2017 2016 2015 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Salaries & Benefits $ 37.1 $ 35.9 $ 34.0 $ 33.6 $ 31.5 $ 29.6 $ 31.0 $ 31.4 $ 32.1 $ 31.8 Technology & Comm. 13.3 12.8 14.4 14.2 13.8 13.9 14.4 14.6 13.6 13.8 Property 5.3 4.9 5.5 5.3 5.0 5.0 5.5 5.7 5.2 5.2 Professional & O/S Services 5.7 4.3 5.4 3.9 4.8 3.0 4.5 3.4 3.1 2.7 Indirect Taxes 4.5 4.3 3.9 3.9 2.8 4.6 1.5 4.2 3.8 4.2 Intangible Amortization 1.1 1.0 1.0 1.2 1.3 1.1 1.1 1.1 1.1 1.1 Marketing 2.4 1.0 1.7 0.9 1.0 0.9 1.2 0.7 1.1 0.9 Restructuring — — — — — — — — — — Other 4.5 4.2 4.3 4.3 4.2 3.4 4.6 3.1 3.7 3.5 Total Core Non-Interest Expense $ 73.9 $ 68.4 $ 70.2 $ 67.3 $ 64.4 $ 61.5 $ 63.8 $ 64.2 $ 63.7 $ 63.2 Income Taxes 0.3 0.2 — 0.2 0.2 0.3 0.7 0.2 0.2 0.2 Total Core Expense incld. Taxes $ 74.2 $ 68.6 $ 70.2 $ 67.5 $ 64.6 $ 61.8 $ 64.5 $ 64.4 $ 63.9 $ 63.4

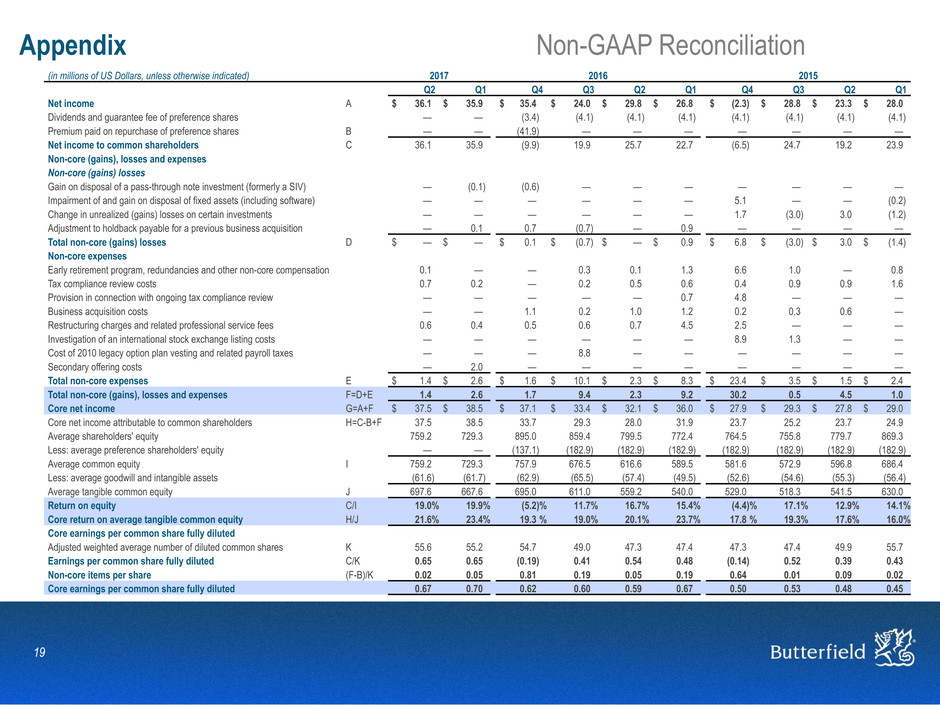

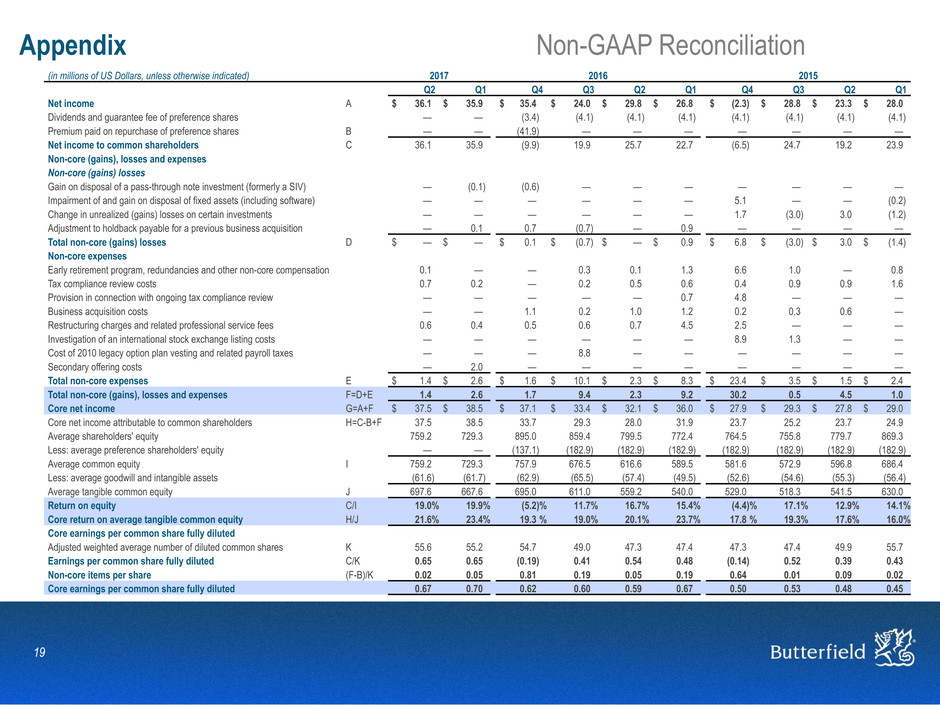

19 Appendix Non-GAAP Reconciliation (in millions of US Dollars, unless otherwise indicated) 2017 2016 2015 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Net income A $ 36.1 $ 35.9 $ 35.4 $ 24.0 $ 29.8 $ 26.8 $ (2.3) $ 28.8 $ 23.3 $ 28.0 Dividends and guarantee fee of preference shares — — (3.4) (4.1) (4.1) (4.1) (4.1) (4.1) (4.1) (4.1) Premium paid on repurchase of preference shares B — — (41.9) — — — — — — — Net income to common shareholders C 36.1 35.9 (9.9) 19.9 25.7 22.7 (6.5) 24.7 19.2 23.9 Non-core (gains), losses and expenses Non-core (gains) losses Gain on disposal of a pass-through note investment (formerly a SIV) — (0.1) (0.6) — — — — — — — Impairment of and gain on disposal of fixed assets (including software) — — — — — — 5.1 — — (0.2) Change in unrealized (gains) losses on certain investments — — — — — — 1.7 (3.0) 3.0 (1.2) Adjustment to holdback payable for a previous business acquisition — 0.1 0.7 (0.7) — 0.9 — — — — Total non-core (gains) losses D $ — $ — $ 0.1 $ (0.7) $ — $ 0.9 $ 6.8 $ (3.0) $ 3.0 $ (1.4) Non-core expenses Early retirement program, redundancies and other non-core compensation 0.1 — — 0.3 0.1 1.3 6.6 1.0 — 0.8 Tax compliance review costs 0.7 0.2 — 0.2 0.5 0.6 0.4 0.9 0.9 1.6 Provision in connection with ongoing tax compliance review — — — — — 0.7 4.8 — — — Business acquisition costs — — 1.1 0.2 1.0 1.2 0.2 0.3 0.6 — Restructuring charges and related professional service fees 0.6 0.4 0.5 0.6 0.7 4.5 2.5 — — — Investigation of an international stock exchange listing costs — — — — — — 8.9 1.3 — — Cost of 2010 legacy option plan vesting and related payroll taxes — — — 8.8 — — — — — — Secondary offering costs — 2.0 — — — — — — — — Total non-core expenses E $ 1.4 $ 2.6 $ 1.6 $ 10.1 $ 2.3 $ 8.3 $ 23.4 $ 3.5 $ 1.5 $ 2.4 Total non-core (gains), losses and expenses F=D+E 1.4 2.6 1.7 9.4 2.3 9.2 30.2 0.5 4.5 1.0 Core net income G=A+F $ 37.5 $ 38.5 $ 37.1 $ 33.4 $ 32.1 $ 36.0 $ 27.9 $ 29.3 $ 27.8 $ 29.0 Core net income attributable to common shareholders H=C-B+F 37.5 38.5 33.7 29.3 28.0 31.9 23.7 25.2 23.7 24.9 Average shareholders' equity 759.2 729.3 895.0 859.4 799.5 772.4 764.5 755.8 779.7 869.3 Less: average preference shareholders' equity — — (137.1) (182.9) (182.9) (182.9) (182.9) (182.9) (182.9) (182.9) Average common equity I 759.2 729.3 757.9 676.5 616.6 589.5 581.6 572.9 596.8 686.4 Less: average goodwill and intangible assets (61.6) (61.7) (62.9) (65.5) (57.4) (49.5) (52.6) (54.6) (55.3) (56.4) Average tangible common equity J 697.6 667.6 695.0 611.0 559.2 540.0 529.0 518.3 541.5 630.0 Return on equity C/I 19.0% 19.9% (5.2)% 11.7% 16.7% 15.4% (4.4)% 17.1% 12.9% 14.1% Core return on average tangible common equity H/J 21.6% 23.4% 19.3 % 19.0% 20.1% 23.7% 17.8 % 19.3% 17.6% 16.0% Core earnings per common share fully diluted Adjusted weighted average number of diluted common shares K 55.6 55.2 54.7 49.0 47.3 47.4 47.3 47.4 49.9 55.7 Earnings per common share fully diluted C/K 0.65 0.65 (0.19) 0.41 0.54 0.48 (0.14) 0.52 0.39 0.43 Non-core items per share (F-B)/K 0.02 0.05 0.81 0.19 0.05 0.19 0.64 0.01 0.09 0.02 Core earnings per common share fully diluted 0.67 0.70 0.62 0.60 0.59 0.67 0.50 0.53 0.48 0.45

20 Appendix Non-GAAP Reconciliation (cont’d) (in millions of US Dollars, unless otherwise indicated) 2017 2016 2015 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Core return on average tangible assets Total average assets L $ 10,981.8 $ 10,982.6 $ 11,106.3 $ 11,207.4 $ 10,794.8 $ 10,243.3 $10,083.5 $ 10,102.8 $ 9,870.8 $ 9,859.0 Less: average goodwill and intangible assets (61.6) (61.7) (62.9) (65.5) (57.4) (49.5) (52.6) (54.6) (55.3) (56.4) Average tangible assets M $ 10,920.2 $ 10,920.8 $ 11,043.4 $ 11,141.8 $ 10,737.3 $ 10,193.8 $10,030.8 $ 10,048.1 $ 9,815.4 $ 9,802.7 Return on average assets A/L 1.3% 1.3% 1.3% 0.9% 1.1% 1.0% (0.1)% 1.1% 1.0% 1.2% Core return on average tangible assets G/M 1.4% 1.5% 1.3% 1.2% 1.2% 1.4% 1.1 % 1.2% 1.1% 1.2% Tangible equity to tangible assets Shareholders' equity $ 769.9 $ 741.0 $ 710.7 $ 964.7 $ 815.9 $ 786.9 $ 750.4 $ 773.9 $ 739.0 $ 871.5 Less: goodwill and intangible assets (61.5) (61.4) (61.9) (64.6) (66.4) (49.1) (51.1) (53.3) (56.0) (54.7) Tangible total equity N 708.4 679.6 648.8 900.1 749.5 737.8 699.3 720.6 683.0 816.8 Less: preference shareholders' equity — — — (182.9) (182.9) (182.9) (182.9) (182.9) (182.9) (182.9) Tangible common equity O 708.4 679.6 648.8 717.2 566.6 554.9 516.4 537.7 500.1 633.9 Total assets 10,678.7 10,943.6 11,103.5 10,978.5 11,287.2 10,185.6 10,275.6 10,216.5 10,069.8 9,800.3 Less: goodwill and intangible assets (61.5) (61.4) (61.9) (64.6) (66.4) (49.1) (51.1) (53.3) (56.0) (54.7) Tangible assets P $ 10,617.2 $ 10,882.2 $ 11,041.6 $ 10,913.9 $ 11,220.8 $ 10,136.5 $10,224.5 $ 10,163.2 $ 10,013.8 $ 9,745.6 Tangible common equity to tangible assets O/P 6.7% 6.2% 5.9% 6.6% 5.0% 5.5% 5.1 % 5.3% 5.0% 6.5% Tangible total equity to tangible assets N/P 6.7% 6.2% 5.9% 8.2% 6.7% 7.3% 6.8 % 7.1% 6.8% 8.4% Efficiency ratio Non-interest expenses $ 75.3 $ 71.0 $ 71.9 $ 77.3 $ 66.7 $ 69.9 $ 87.2 $ 67.4 $ 65.1 $ 65.5 Less: Amortization of intangibles (1.1) (1.0) (1.0) (1.2) (1.3) (1.1) (1.1) (1.1) (1.1) (1.1) Non-interest expenses before amortization of intangibles Q 74.2 70.0 70.9 76.1 65.4 68.8 86.1 66.3 64.0 64.4 Non-interest income 38.7 38.5 38.8 36.3 37.9 34.5 37.3 34.2 34.5 34.1 Net interest income before provision for credit losses 71.5 67.9 66.8 65.0 64.3 62.3 61.2 60.0 59.3 58.8 Net revenue before provision for credit losses and other gains/losses R $ 110.2 $ 106.4 $ 105.6 $ 101.3 $ 102.2 $ 96.8 $ 98.5 $ 94.2 $ 93.8 $ 92.9 Efficiency ratio Q/R 67.4% 65.7% 67.1% 75.1% 64.0% 71.1% 87.4 % 70.4% 68.2% 69.3% Core efficiency ratio Non-interest expenses $ 75.3 $ 71.0 $ 71.9 $ 77.3 $ 66.7 $ 69.9 $ 87.2 $ 67.4 $ 65.1 $ 65.5 Less: non-core expenses (E) (1.4) (2.6) (1.6) (10.1) (2.3) (8.3) (23.3) (3.5) (1.5) (2.4) Less: amortization of intangibles (1.1) (1.0) (1.0) (1.2) (1.3) (1.1) (1.1) (1.1) (1.1) (1.1) Core non-interest expenses before amortization of intangibles S 72.8 67.4 69.3 66.0 63.1 60.5 64.3 62.8 62.5 62.0 Net revenue before provision for credit losses and other gains/losses T 110.2 — 105.6 101.3 102.2 96.8 98.5 94.2 93.8 92.9 Core efficiency ratio S/T 66.1% 63.2% 65.6% 65.3% 61.8% 62.5% 63.7 % 66.8% 66.7% 66.8%

21 Appendix Peer Group Our peer group includes the following banks, noted by their ticker symbols: • FRC • SIVB • EWBC • CFR • ASB • WTFC • CBSH • IBKC • UMBF • FHB • BOH • TRMK • IBOC • CBU • BPFH • FFIN • WABC