Exhibit 99.2

NASDAQ:WTRH Waitr Announces Agreement To Acquire Bite Squad December 12, 2018

2 Disclaimer Important Information This investor presentation (“Investor Presentation”) is for informational purposes only and does not constitute an offer to s ell , a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of Waitr Holdings Inc. (“ Waitr ”) or Bite Squad.com, LLC (“Bite Squad”) or any of Waitr’s or Bite Squad’s affiliates. The information contained herein does not purport to be all - inclusive. The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions mad e within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained her ein is not an indication as to future performance. Waitr and Bite Squad assume no obligation to update the information in this Investor Presentation. This press release includes forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 199 5. These forward - looking statements relate to expectations or forecasts for future events, including, without limitation, the pe nding acquisition of Bite Squad and the timing of the closing thereof, Waitr’s ability to successfully integrate Bite Squad, grow market share and achieve synergies from the acquisition. These statements ma y be preceded by, followed by or include the words “may,” “might,” “will,” “will likely result,” “should,” “estimate,” “plan, ” “ project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,” “target” or similar expressions. These forward - looking statements are based on information availa ble to Waitr as of the date they were made, and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Ac cordingly, forward - looking statements should not be relied upon as representing Waitr’s views as of any subsequent date, and Waitr does not undertake any obligation to update forward - looking statements to reflect events or circumstances after the date they w ere made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, Waitr’s actual results or performance may be materially different from those expressed or implied by these forward - looking statements. Some factors that could cause actual results to differ include: Waitr’s ability to obtain necessary regulatory approvals or to satisfy any of the other conditions to the transaction on a timely bas is or at all; a delay in the expected closing date of the transaction; a failure to close the transaction on the terms negotiate d; a failure to close the debt financing described herein; any delay or inability of the combined company to realize the expected benefits and synergies of the transaction; the issuance of st ock to consummate the acquisition and the dilution to Waitr’s existing stockholders relating thereto; the loss of management and other key employees; substantial non - recurring transaction, regulatory and integration costs and/or unknown liabilities; sales of Waitr’s stock in the future by shareholders of Bite Squad, which will hold a substantial portion of Waitr’s outstanding securities, and the resulting effect on the price of Waitr’s common stock; the risk that disruptions from the proposed transaction will harm Waitr’s or Bite Squad’s business, including customer retention risk; competitive responses to the proposed transaction; Waitr’s ability to effectively protect Bite Squad’s intellectual property rights; new market risks and operations in new geographies; a nd general economic and business conditions that affect the combined company following the transaction. A detailed discussion of risks related to Waitr’s business is included in the section entitled “Risk Factors” included in Waitr’s definitive proxy statement related its recently completed business combination with Waitr , Incorporated, which was filed with the Securities and Exchange Commission on November 1, 2018. No Offer or Solicitation This Investor Presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlaw fu l prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended. Industry and Market Data In this Investor Presentation, we rely on and refer to information and statistics regarding market participants in the sector s i n which Bite Squad competes and other industry data. We obtained this information and statistics from third - party sources, inclu ding reports by market research firms, and company filings. Trademarks As of the date of this Investor Presentation, Waitr had two trademarks registered in the United States, including “ Waitr .” This Investor Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are th e property of their respective owners. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Investor Presentation are listed without the TM, SM , © and ® symbols, but Waitr will assert, to the fullest extent under applicable law, its rights or the rights of the applicable owners, if any, to these tr ademarks, service marks, trade names and copyrights. Non - GAAP Financial Measures This Investor Presentation includes Adjusted EBITDA which is a measure not calculated in accordance with U.S. generally accep ted accounting principles (“GAAP”). Waitr believes that this non - GAAP measures is useful to investors for two principal reasons. First, Waitr believes this measure assist investors in comparing performance over various reporting periods on a consistent basis by removing from operating results the impact of i tem s that do not reflect core operating performance. Second, it is a key metrics used by management to assess financial performa nce and may (subject to the limitations described below) enable investors to compare the performance of Waitr to its competitors. Waitr believes that the use of this non - GAAP financial measure provides an additional tool for investors to use in evaluating ongoing operating results and trends. This non - GAAP measure should not be considered in isolation from, or as an alternative to, net income (loss) or other measures in accordance with GAAP. Other companies may calculate Adjusted EBITDA di ffe rently, and therefore the measure referenced herein may not be directly comparable to similarly titled measures of other comp ani es.

3 Our Mission Be the leading restaurant platform for online ordering and food delivery across underserved U.S. markets

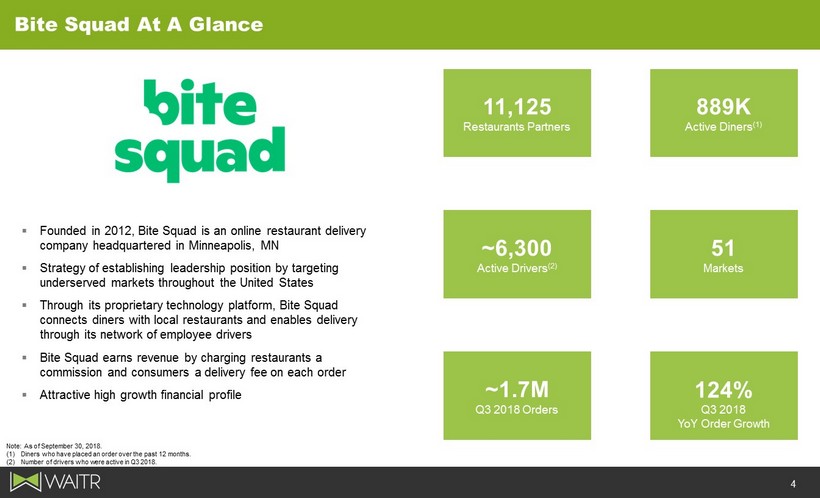

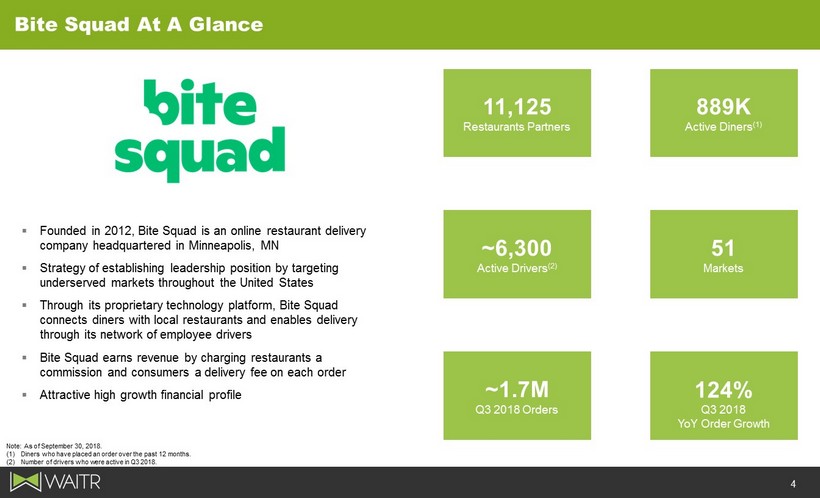

4 Bite Squad At A Glance 51 Markets 11,125 Restaurants Partners 889K Active Diners (1) ~6,300 Active Drivers (2) Note: As of September 30, 2018. (1) Diners who have placed an order over the past 12 months. (2) Number of drivers who were active in Q3 2018. ▪ Founded in 2012, Bite Squad is an online restaurant delivery company headquartered in Minneapolis, MN ▪ Strategy of establishing leadership position by targeting underserved markets throughout the United States ▪ Through its proprietary technology platform, Bite Squad connects diners with local restaurants and enables delivery through its network of employee drivers ▪ Bite Squad earns revenue by charging restaurants a commission and consumers a delivery fee on each order ▪ Attractive high growth financial profile ~1.7M Q3 2018 Orders 124% Q3 2018 YoY Order Growth

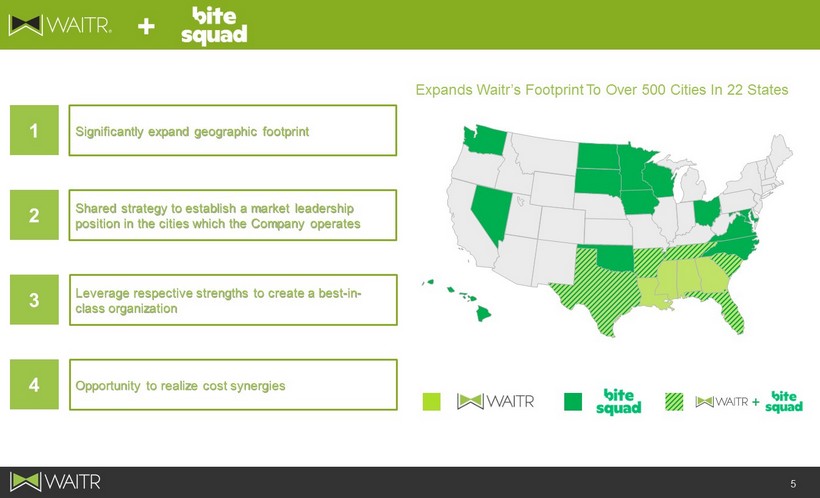

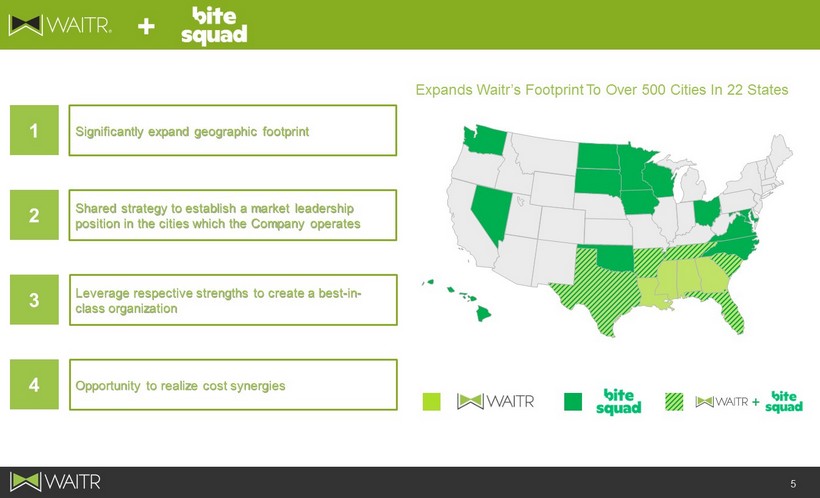

5 Expands Waitr’s Footprint To Over 500 Cities In 22 States + + Significantly expand geographic footprint 1 Shared strategy to establish a market leadership position in the cities which the Company operates 2 Leverage respective strengths to create a best - in - class organization 3 Opportunity to realize cost synergies 4

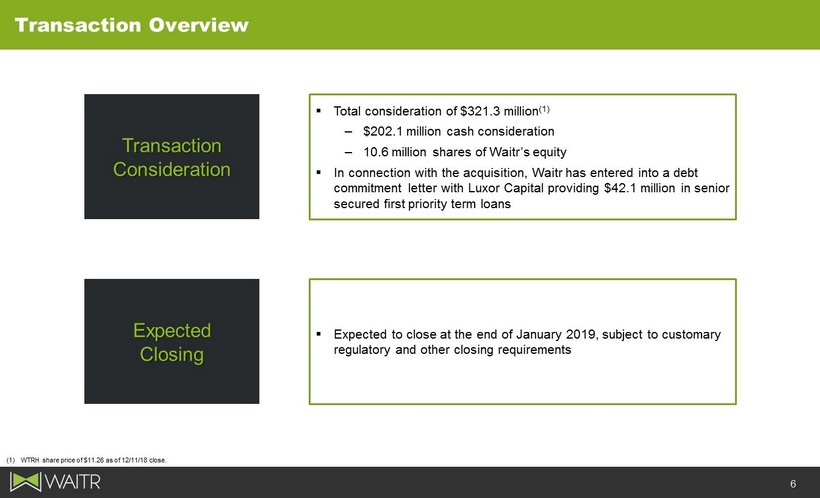

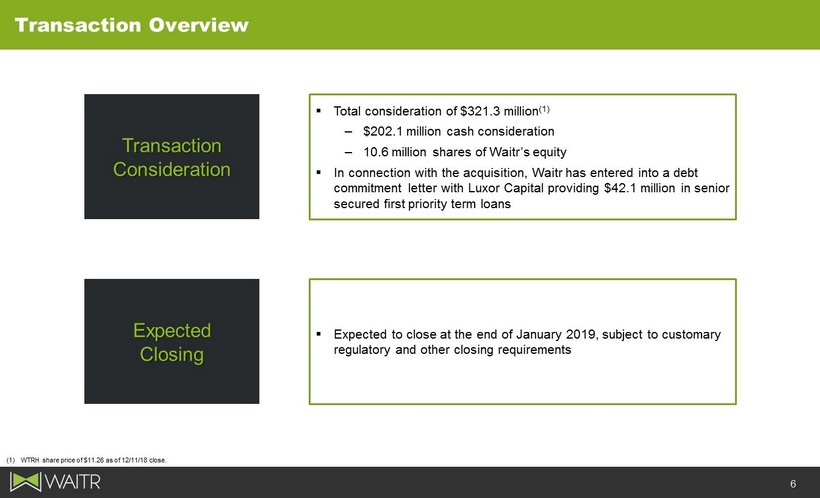

6 Transaction Overview (1) WTRH share price of $11.26 as of 12/11/18 close. Transaction Consideration ▪ Total consideration of $321.3 million (1) – $202.1 million cash consideration – 10.6 million shares of Waitr’s equity ▪ In connection with the acquisition, Waitr has entered into a debt commitment letter with Luxor Capital providing $42.1 million in senior secured first priority term loans Expected Closing ▪ Expected to close at the end of January 2019, subject to customary regulatory and other closing requirements

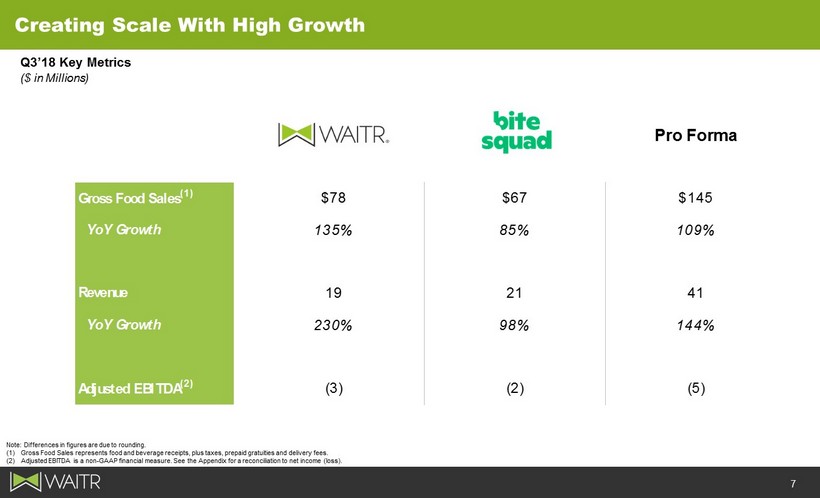

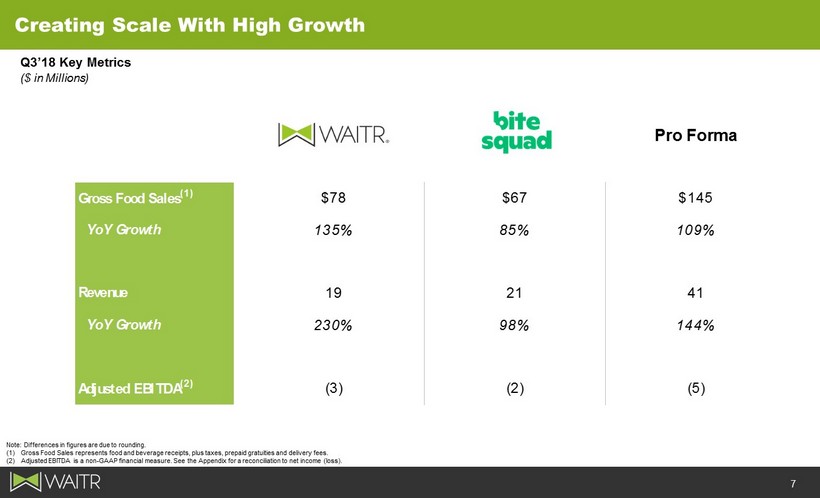

7 Creating Scale With High Growth Pro Forma Note: Differences in figures are due to rounding. (1) Gross Food Sales represents food and beverage receipts, plus taxes, prepaid gratuities and delivery fees. (2) Adjusted EBITDA is a non - GAAP financial measure. See the Appendix for a reconciliation to net income (loss). Q3’18 Key Metrics ($ in Millions) Gross Food Sales (1) $78 $67 $145 YoY Growth 135% 85% 109% Revenue 19 21 41 YoY Growth 230% 98% 144% Adjusted EBITDA (2) (3) (2) (5)

8 Q & A

9 Appendix

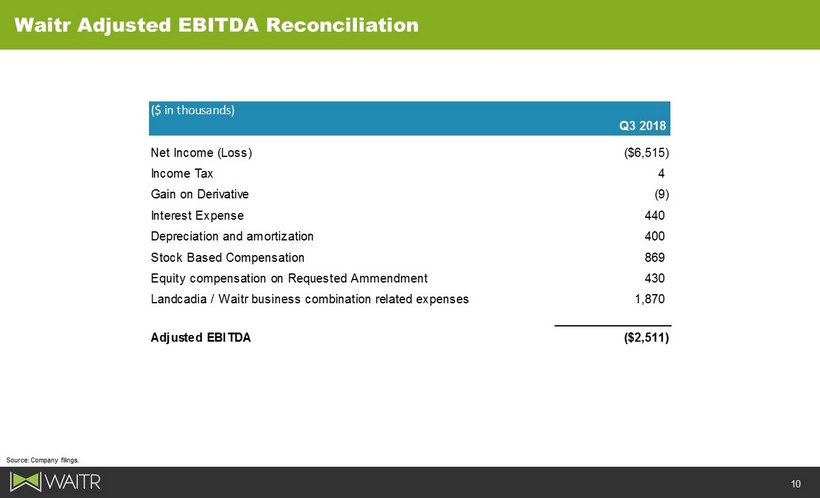

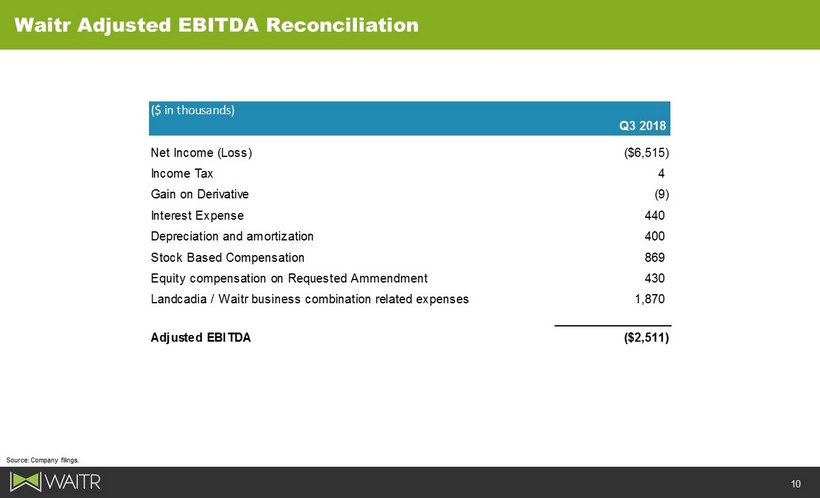

10 Waitr Adjusted EBITDA Reconciliation Source: Company filings. ($ in thousands) Q3 2018 Net Income (Loss) ($6,515) Income Tax 4 Gain on Derivative (9) Interest Expense 440 Depreciation and amortization 400 Stock Based Compensation 869 Equity compensation on Requested Ammendment 430 Landcadia / Waitr business combination related expenses 1,870 Adjusted EBITDA ($2,511)

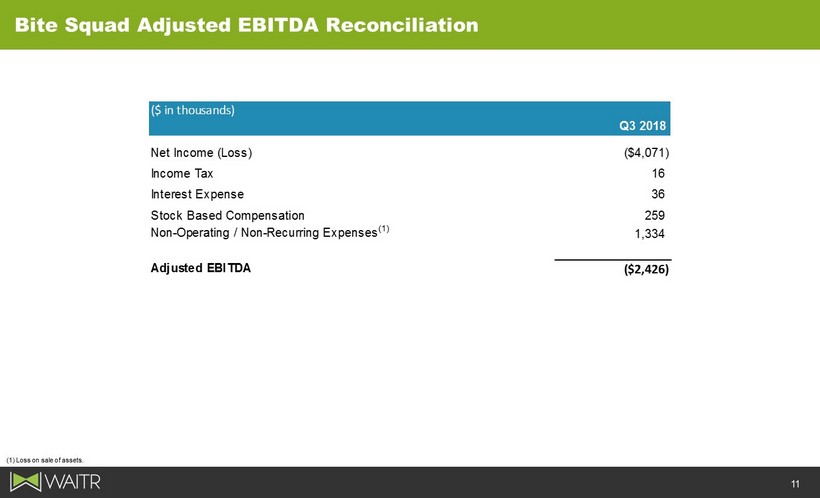

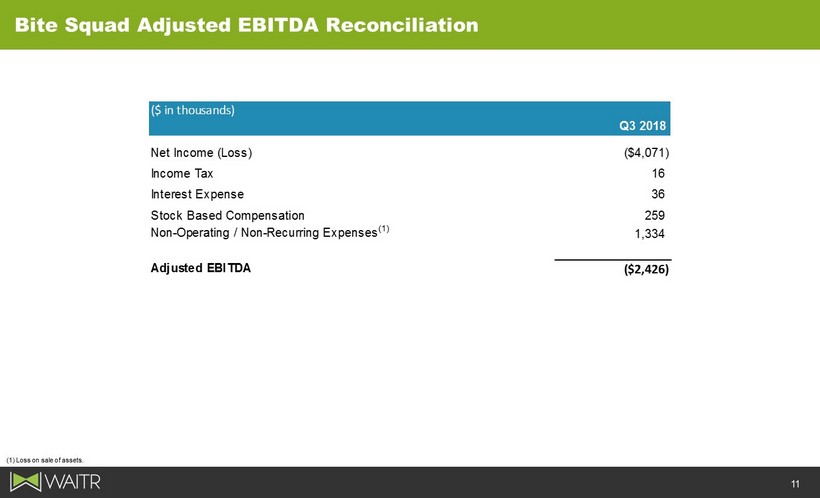

11 Bite Squad Adjusted EBITDA Reconciliation (1) Loss on sale of assets. ($ in thousands) Q3 2018 Net Income (Loss) ($4,071) Income Tax 16 Interest Expense 36 Stock Based Compensation 259 Non-Operating / Non-Recurring Expenses (1) 1,334 Adjusted EBITDA ($2,426)