- NGVT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ingevity (NGVT) DEF 14ADefinitive proxy

Filed: 10 Mar 23, 4:16pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549f

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

INGEVITY CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

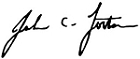

MESSAGE FROM OUR CEOJohn C. Fortson | March 10, 2023 |

Dear Ingevity Stockholders:

It is our pleasure to invite you to attend the 2023 annual meeting of stockholders (the “Annual Meeting”) of Ingevity Corporation (the “Company”). The Annual Meeting will be held virtually via live audio webcast on April 27, 2023, at 9:30 a.m. Eastern Time.

You can participate in the Annual Meeting, submit questions and vote your shares of the Company’s common stock (the “Common Stock”) by visiting www.virtualshareholdermeeting.com/NGVT2023. Further details regarding participation, voting and the business to be conducted at the Annual Meeting appear in the following notice of the Annual Meeting and this proxy statement.

Ingevity has much to be proud of in 2022. As a company, we delivered record performance over 2021, despite an environment that remained dynamic and challenging. Throughout it all, the Ingevity team remained nimble and aggressive. Our operations worked safely and remained flexible through market-driven continuous revisions to production schedules. The supply chain team diligently sourced the materials and vehicles needed to make and deliver our products. The commercial team worked with our customers through dramatically rising production costs. Our growth and innovation colleagues remained focused on identifying future avenues for growth.

Our segments performed well while dealing with the lingering effects of the COVID-19 pandemic, particularly in China, and global disruptions in our supply chains and logistics. Our Performance Chemicals business enjoyed an unprecedented year of record growth across all of its businesses. We saw strength in all our end markets – industrial specialties, pavement technologies and engineered polymers. Performance Materials revenue outperformed 2021, and I am proud of how the team worked continuously to adjust production and delivery schedules as auto production surged and then fell off in different global geographies.

In 2022, we made significant progress in evolving our business to meet future customer demands in all our businesses. Our Performance Chemicals team’s completion of our polyols expansion in our facility in DeRidder, Louisiana, increases volumes of our engineered polymers and provides shorter global lead times for our customers. The acquisition of Ozark Materials allows us to provide a full suite of product offerings to our road construction customers. We continue to enjoy success in the development of different alternative fatty acids, which both reduces our reliance on crude tall oil (“CTO”) and allows us to enter new markets where CTO based products aren’t competitive.

Across Ingevity, we continue to identify and invest in opportunities to increase our exposure to electric vehicles. In 2022, we made a strategic investment in Nexeon Limited, a company that is developing silicon-based anode technology that utilizes activated carbon. Our ability to manufacture carbon that is optimized for use in these anodes is an exciting opportunity for us. We continue to identify other opportunities to support the electric battery industry using our products and production and engineering capabilities.

We continue to be a leader in sustainability. In late 2022, Ingevity was recognized by Newsweek® magazine on their list of America’s Most Responsible Companies in 2023, placing 58th out of 500 public companies, ranking 10th in the materials and chemicals industry and number one in South Carolina. Additionally, we were awarded a Gold rating by EcoVadis, placing us in the top 3% of responding companies. We aim to continuously improve the sustainable nature of our company, and, as a result, we joined the United Nations Global Compact, committing ourselves to sustainable development.

We have a world class team that continues to develop and grow. We welcomed a new chief human resources officer, Christine Stunyo, to lead our people and talent efforts, and we bolstered the diversity of experience and perspectives of our board of directors by welcoming Shon Wright and Will Slocum in 2022, and Bruce Hoechner in 2023. At the start of 2022, we rolled out the “IngeviWay in Action” – an initiative that raises the bar on expectations to build, inspire and lead, and better aligns how we work and collaborate as a team to create the Ingevity of the future.

| INGEVITY | 2023 Proxy Statement | 1 |

Thank you for your interest and investment in Ingevity. We hope you share our enthusiasm for our Company. We are excited about the future and confident in our ability to continue to be a best-in-class specialty chemicals company that is a leader in sustainability and our markets.

A notice of internet availability of proxy materials or proxy card is being mailed, and the attached proxy statement is being made available, beginning on March 10, 2023, to each holder of record of Common Stock as of the record date, February 27, 2023. Please see “Questions and Answers about the Annual Meeting, Proxy Solicitation and Voting Information” for additional information about how to attend, vote, examine the list of stockholders and submit questions during the Annual Meeting.

Whether or not you plan to attend the Annual Meeting virtually, we urge you to vote and submit your proxy in advance of the Annual Meeting by one of the methods described in the proxy materials. Your vote will mean that you are represented at the Annual Meeting even if you do not attend virtually. Thank you for your ongoing support of Ingevity.

Best regards,

John C. Fortson

President and CEO

| INGEVITY | 2023 Proxy Statement | 2 |

NOTICE

of 2023 Annual Meeting of Stockholders of Ingevity Corporation

How to vote: | |

| Online Before the Annual Meeting, vote online at www.proxyvote.com |

| By phone Call 1-800-690-6903 |

| By mobile device Scan the QR code on your proxy card or Notice |

| By mail If you received a printed version of the proxy materials, you may vote by mail |

| During the virtual meeting See “Questions and Answers about the Annual Meeting, Proxy Solicitation, and Voting Information” for details on how to virtually attend and vote during the meeting |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on April 27, 2023. The Proxy Statement and our Annual Report are available at www.proxyvote.com. | |

DATE & TIME |  LIVE AUDIO WEBCAST LOCATION |  RECORD DATE |

Thursday, | www.virtualshareholder | February 27, 2023 |

9:30 a.m. | To be admitted, enter the control number found on your proxy card or Notice regarding the availability of proxy materials | Holders of record of our Common Stock at the close of business on the Record Date are entitled to receive notice of, virtually attend, and vote at the Annual Meeting |

To allow our stockholders greater access to the meeting and lower the barriers to stockholder participation, our Annual Meeting will be held in a virtual format only with no physical meeting location.

At the Annual Meeting, stockholders will be asked to act on the following items:

Elect the ten (10) director nominees named in the proxy statement;

Approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers;

Approve, on a non-binding, advisory basis, the frequency of advisory votes to approve the Company’s named executive officer compensation;

Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2023;

Approve the amendment and restatement of the 2017 Ingevity Corporation Employee Stock Purchase Plan to increase the number of shares of Common Stock available for issuance thereunder by an additional 300,000 shares; and

Consider any other business properly brought before the meeting.

Whether or not you plan to attend the Annual Meeting virtually, we urge you to review the proxy materials carefully and to vote in advance.

By Order of the Board of Directors,

Stacy L. Cozad

Secretary

| INGEVITY | 2023 Proxy Statement | 3 |

Table of Contents |

| INGEVITY | 2023 Proxy Statement | 5 |

Reconciliation of Net Income (Loss) Attributable to Ingevity Stockholders (GAAP) to NOPAT (Non-GAAP) |

| INGEVITY | 2023 Proxy Statement | 6 |

Proxy Statement Summary |

This summary highlights information about Ingevity Corporation and certain information contained elsewhere in this proxy statement (the “Proxy Statement”) for our 2023 Annual Meeting of Stockholders (the “Annual Meeting”). This summary does not contain all of the information that you should consider in deciding to vote. Please read the entire Proxy Statement carefully before voting.

Proposal | Board Vote Recommendation | Page |

Proposal 1: Election of Directors | FOR | 14 |

Proposal 2: Advisory Vote on compensation of our Named Executive Officers (Say-on-Pay) | FOR | 37 |

Proposal 3: Advisory Vote on the frequency of Named Executive Officer Compensation Advisory | EVERY ONE | 75 |

Proposal 4: Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s | FOR | 76 |

Proposal 5: Amendment and Restatement of 2017 Ingevity Corporation Employee Stock Purchase | FOR | 79 |

| INGEVITY | 2023 Proxy Statement | 7 |

| INGEVITY | 2023 Proxy Statement | 8 |

Published an environmental product declaration (EPD) for Evotherm® M1 Warm Mix Asphalt technology, establishing Ingevity as the first chemical additive supplier to be included in the National Asphalt Pavement Association’s (NAPA) Emerald Eco-Label Tool program that provides customers with quantifiable metrics of the sustainability and environmental impact of unique asphalt mixtures

Earned the elite OK biodegradable MARINE certification by TÜV Austria Bureau of Inspection and Certification, confirming Capa® thermoplastics fully biodegrade in a marine environment within four weeks, enabling a safer marine ecosystem than traditional plastics made with alternative chemistries

Completed additional lifecycle analysis showing the environmental benefits of our Polyfon®H dispersant for crop protection which completely offset the volume of greenhouse gas emissions associated with its manufacture, resulting in a carbon footprint 122% lower than fossil carbon-based alternatives(1)

Recognized on Newsweek® Magazine’s list of America’s Most Responsible Companies 2023, ranking 58 of 500 public companies overall, 10th in the materials and chemicals industry and number one among public companies based in South Carolina

Joined the United Nations (UN) Global Compact as a participant, affirming our alignment with the ten universally accepted principles for human rights, labor, environment and anti-corruption, and committing to responsible business actions that support the UN’s Sustainable Development Goals

Advanced our diversity, equity and inclusion priorities by piloting inclusive leadership training for people managers, implementing enhanced recruiting programs to attract talented diverse candidates and expanding programming for our employee resource groups (ERGs) to encourage community among employees, grow cultural awareness and foster allyship

Significantly improved our employee engagement scores, which were boosted by ongoing efforts to invest in our people and build a world-class work experience, both during and post-pandemic

Donated over $1.39 million through our IngeviCares philanthropy program in 2022 to make a positive impact in the communities where we operate and advance our goal of investing $6 million in the areas of health, education and environment between 2020 and 2025

(1) | According to a study conducted by Environmental Resources Management (ERM), London, U.K., a third party consulting firm |

| INGEVITY | 2023 Proxy Statement | 9 |

Achieved the Gold rating for sustainability by EcoVadis, an independent organization that provides evidence-based sustainability assessments for companies, placing Ingevity in the top 3% of all respondents and advancing the company to the 97th percentile overall

Submitted comprehensive data, risks and opportunities related to climate change to the CDP for the first time in 2022 as a means to help identify ways to manage climate risks and opportunities and provide vital information back to our customers, investors and the market

Bolstered the strength of our executive leadership by welcoming our new chief human resources officer, Christine Stunyo, to lead our talent and people efforts, and further expanded the diversity of experience and perspectives among our board of directors with the addition of Will Slocum and Shon Wright

| INGEVITY | 2023 Proxy Statement | 10 |

| Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships* | Other Public Company Boards |

| JEAN S. BLACKWELL (CHAIR) | 68 | 2016 | Retired; Former Senior Executive at Cummins Inc. |  | — LD&C — N&G — Executive (Chair) | 2 |

| LUIS FERNANDEZ-MORENO | 60 | 2016 | Sole Member and Manager, Strat and Praxis LLC; Former Senior Executive at Ashland Inc. |  | — N&G (Chair) — S&S — Executive | 1 |

| JOHN C. FORTSON | 55 | 2020 | President and CEO, Ingevity Corporation |

|

|

|

| DIANE H. GULYAS | 66 | 2019 | Retired; Former President, DuPont Performance Polymers, E.I. du Pont de Nemours |  | — LD&C (Chair) — N&G — Executive | 1 |

| BRUCE D. HOECHNER | 63 | 2023 | Retired; Former CEO, Rogers Corporation |  | — LD&C — N&G | 2 |

| FREDERICK J. LYNCH | 58 | 2016 | Operating Partner, AEA Investors LP; Interim CEO, Verdesian Life Sciences; Former President and CEO, Masonite International Corporation |  | — Audit — LD&C |

|

| KAREN G. NARWOLD | 63 | 2019 | EVP, Chief Administrative Officer, General Counsel and Corporate Secretary, Albemarle Corporation |  | — Audit — S&S (Chair) — Executive |

|

| DANIEL F. SANSONE | 70 | 2016 | Retired; Former EVP, Strategy and CFO, Vulcan Materials Company |  | — Audit (Chair) — LD&C — Executive | 1 |

| WILLIAM J. SLOCUM | 45 | 2022 | Partner, Inclusive Capital Partners |  | — Audit — S&S | 1 |

| BENJAMIN G. (SHON) WRIGHT | 48 | 2022 | Vice President, Cummins & President, Cummins Engine Components |  | — Audit — S&S |

|

* Audit – Audit Committee LD&C – Leadership Development and Compensation Committee N&G – Nominating and Governance Committee S&S – Sustainability and Safety Committee Executive – Executive Committee | |||||||

59.6 years | 3 years | 3 new | 3/10 | 2/10 | 3/5 | 9/10 |

AVERAGE AGE | MEDIAN TENURE | DIRECTORS ADDED IN THE LAST 12 MONTHS; ROTATION OF LD&C COMMITTEE CHAIR | DIRECTORS ARE WOMEN | DIRECTORS IDENTIFY AS RACIALLY OR ETHNICALLY DIVERSE | COMMITTEES AND BOARD CHAIRED BY WOMEN | DIRECTORS ARE INDEPENDENT |

| INGEVITY | 2023 Proxy Statement | 11 |

We recognize that strong corporate governance practices contribute to long-term stockholder value. We are committed to sound governance practices, including those described below.

Board Independence, Composition, and Accountability | ■ 9 of 10 directors are independent, including the Chair ■ Separate Chair and CEO ■ Five fully independent Board committees ■ Regular Board and committee executive sessions ■ Diverse Board in terms of gender, race, ethnicity, experience and skills ■ Director overboarding policy ■ Directors may not stand for re-election in the year in which they reach 72 years of age (unless waived by the Board on a case-by-case basis) |

Best Practices | ■ Active stockholder engagement program ■ Annual Board and committee self-evaluations ■ Board leadership role in CEO and executive succession planning ■ Robust risk management program that includes Board oversight of key risk areas, including cybersecurity ■ Board oversight of environmental and sustainability matters (primarily through the Sustainability and Safety Committee) ■ Annual Sustainability Report containing measurable sustainability goals ■ Comprehensive new director orientation ■ Policy prohibiting officers, directors and employees from hedging and pledging our Common Stock ■ Policy to include candidates identifying as gender-diverse and racially/ethnically-diverse among the pool of potential new director candidates ■ Significant Board refreshment, with three new directors added within the last twelve months ■ Robust stock ownership guidelines applicable to executives and directors ■ Recently updated comprehensive Code of Conduct and Ethics and Compliance Program |

Stockholder Rights | ■ Annual election of all directors ■ Majority voting with director resignation policy (plurality in contested elections) ■ Stockholder right to call special meetings ■ No poison pill or dual-class shares ■ One share, one vote standard ■ No supermajority voting requirements |

| INGEVITY | 2023 Proxy Statement | 12 |

The LD&C Committee continues to implement and maintain practices in our compensation programs and related areas that reflect responsible corporate governance and compensation policies. These practices include the following:

What We Do |

| What We Don’t Do | ||

| Use performance metrics to align pay with Company financial performance |

|  | No repricing, backdating or discounting of stock options |

| Balance short-term and long-term incentives through focused use of performance metrics |

|  | No hedging, pledging or short sales of Common Stock by any director, executive officer or other employee |

| Emphasize stock ownership with long-term incentives being paid in Common Stock and meaningful Common Stock ownership guidelines |

|  | No excise tax gross-ups for change of control payments |

| Cap incentive compensation at 200% of target performance |

|  | No excessive perquisites |

| Maintain a “clawback” policy for incentive compensation in cases where misconduct leads to restatement of financial results* |

|  | No tax gross-ups on perquisites other than in connection with relocation benefits |

| Use “double trigger” change of control (with respect to replacement awards) for severance and equity vesting provisions |

|

|

|

| Engage an independent consultant to advise the LD&C Committee |

|

|

|

| Discourage excessive risk taking by offering a balanced compensation program that uses multiple incentive metrics that balance focus on achievement of long- and short-term goals |

|

|

|

| Pay dividend equivalents only on stock unit awards that vest, if any |

|

|

|

| * | Clawback policy will be updated to apply regardless of misconduct in the event of a restatement as required by recent SEC rules. |

| INGEVITY | 2023 Proxy Statement | 13 |

PROPOSAL 1 | |

ELECTION OF DIRECTORS | |

| OUR BOARD RECOMMENDS A VOTE FOR EACH NOMINEE. |

Our Nominating & Governance Committee has recommended, and the Board of Directors has nominated for election as directors at the Annual Meeting, the ten nominees named below. Each nominee currently serves as a director of the Company.

Each director elected at the Annual Meeting will serve until the 2024 annual meeting of stockholders and until his or her successor has been elected and qualified. Each director nominee has consented to being named in this Proxy Statement and to serving as a director if elected. If any nominee is unable to stand for election for any reason, the Common Stock represented at our Annual Meeting by proxy may be voted for another candidate proposed by our Board, or our Board may choose to reduce its size.

The information below summarizes the particular experience, qualifications, attributes and skills of each nominee. The Nominating & Governance Committee and the Board believe that, as a group, these nominees provide our Board with a strong balance of experience, leadership, qualifications, attributes and skills, and that each individual nominee can make a significant contribution to the Board and should serve as a director of the Company.

At any meeting of stockholders for the election of directors at which a quorum is present, the election will be determined by a majority of the votes cast by the stockholders entitled to vote in the election, except that in the case of a contested election, the election will be determined by a plurality of the votes cast by the stockholders entitled to vote in the election. The election of directors is not contested at this Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the election of directors.

| THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES NAMED IN THIS PROXY STATEMENT. |

| INGEVITY | 2023 Proxy Statement | 14 |

| JEAN S. BLACKWELL | |

BOARD COMMITTEES | OTHER PUBLIC COMPANY DIRECTORSHIPS | |

■ LD&C ■ Nominating & Governance ■ Executive (Chair) | ■ Johnson Controls International plc (since 2018) ■ Celanese Corporation (since 2014) | |

Age: 68 Director since: Independent chair | SKILLS AND EXPERIENCE Ms. Blackwell has substantial experience in the areas of finance and law, and also as to matters of corporate responsibility, sustainability and human resources, having served both as a public company Chief Financial Officer and General Counsel, among other corporate leadership roles. She also has significant oversight and governance expertise as an experienced public company board member, having served in a number of committee chair roles.

ADDITIONAL INFORMATION Ms. Blackwell has served as a director on numerous non-profit boards. Ms. Blackwell holds a bachelor’s degree in economics from The College of William and Mary and a juris doctor degree from the University of Michigan. | PROFESSIONAL HIGHLIGHTS Chief Executive Officer of Cummins Foundation and Executive Vice President of Corporate Responsibility for Cummins Inc. (“Cummins”) from 2008 until her retirement in 2013. Previous positions with Cummins (joined in 1997) included Chief Financial Officer; Vice President, business services; Vice President, human resources; and General Counsel. Earlier experience includes Budget Director for the State of Indiana; Executive Director of the Indiana State Lottery Commission, and Partner at the law firm of Bose McKinney & Evans, LLC.

PRIOR PUBLIC COMPANY DIRECTORSHIPS |

■ Essendant Inc. (formerly, United Stationers Inc.) (former public company) (2007-2018) ■ The Nassau Companies of New York (formerly Phoenix Companies, Inc.) (former public company) (2004-2009) |

| INGEVITY | 2023 Proxy Statement | 15 |

| LUIS FERNANDEZ-MORENO | |

BOARD COMMITTEES | OTHER PUBLIC COMPANY DIRECTORSHIPS | |

■ Nominating & Governance (Chair) ■ Sustainability & Safety ■ Executive | ■ Select Energy Services, Inc. (since 2022) | |

Age: 60 Director since: | SKILLS AND EXPERIENCE Mr. Fernandez-Moreno has over thirty years of executive and operational experience in the performance materials, specialty chemicals and coatings industries. He has significant mergers and acquisitions (“M&A”) and international business experience, having held leadership roles in complex global business operations in the United States, Mexico, Brazil, France and the United Kingdom. Mr. Fernandez also has extensive expertise in the area of sustainability with a focus on integrating responsible environmental, social and governance principles and metrics into global business strategies to maximize stakeholder value.

ADDITIONAL INFORMATION Mr. Fernandez-Moreno has served as a member of several private and non-profit company boards including Hasa, Inc., a portfolio company of Wind Point Partners (commencing in 2023); Huber Engineered Materials, a portfolio company of J.M. Huber Corporation, since 2019; Ascensus Specialties International Company, a portfolio company of Wind Point Partners (2017-2021); and OQ Chemicals GmbH (formerly Oxea S.a.r.l.), a subsidiary of OQ, an integrated energy company, owned by the Oman government, since 2018. Mr. Fernandez-Moreno holds a bachelor’s degree in chemical engineering from Universidad Iberoamericana in Mexico City, Mexico, and is a graduate of the Wharton Management Certificate Program at the University of Pennsylvania. | PROFESSIONAL HIGHLIGHTS Sole Manager and Member of Strat and Praxis LLC, a consulting services company, since June 2018. Senior Vice President of Ashland Inc. (“Ashland”) (2012-2017), including serving as President of its Chemicals Group (2015-2017); President, Ashland specialty ingredients (2013-2015); and President, Ashland water technologies (2012-2013). Previous experience included 27 years at Rohm & Haas Company and, after its acquisition, with The Dow Chemical Company. He also served as Executive Vice President at Arch Chemicals until its acquisition by Lonza Group AG (2010-2011).

|

|

| INGEVITY | 2023 Proxy Statement | 16 |

| JOHN C. FORTSON | ||

SKILLS AND EXPERIENCE Mr. Fortson has served as our President and Chief Executive Officer since September 2020. From 2015 to April 2021, he served as the Company’s Chief Financial Officer, and from 2015 to February 2021, he served as the Company’s Treasurer. Mr. Fortson has more than 23 years of experience in executive, management, strategic planning, financial, M&A and sustainability matters and has held leadership positions in the chemicals, manufacturing, global aerospace and defense industries. ADDITIONAL INFORMATION Mr. Fortson has served as a member of non-profit company boards, including as a member of the Medical University of South Carolina Heart and Vascular Advisory Board (2017-present). Mr. Fortson has a bachelor’s degree from the United States Military Academy at West Point and a master’s degree in business administration from Duke University’s Fuqua School of Business. | PROFESSIONAL HIGHLIGHTS President and Chief Executive Officer of Ingevity since September 2020. Served as Chief Financial Officer and Treasurer of Ingevity from 2015-2021. Vice President, Chief Financial Officer, and Treasurer, AAR Corporation (2013–October 2015). Managing Director, Bank of America Merrill Lynch (2007–2013). | |

Age: 55 Director since: |

| DIANE H. GULYAS | |

BOARD COMMITTEES | OTHER PUBLIC COMPANY DIRECTORSHIPS | |

■ LD&C (chair) ■ Nominating & Governance ■ Executive | ■ Expeditors International of Washington, Inc. (since 2015) | |

Age: 66 Director since: | SKILLS AND EXPERIENCE Ms. Gulyas’ qualifications to serve as a director include her extensive executive experience at one of the world’s largest chemical companies, as well as her extensive experience in international operations, sustainability, global manufacturing and sales, including in the automotive parts industry. Ms. Gulyas also has significant oversight and governance expertise as an experienced public company board member.

ADDITIONAL INFORMATION Ms. Gulyas has served on the boards of several non-profit and private companies, including as chair of the board of directors of the Ladies Professional Golfing Association (2016-2022). Ms. Gulyas has a bachelor’s degree in chemical engineering from the University of Notre Dame. | PROFESSIONAL HIGHLIGHTS President, Performance Polymers business of E.I. du Pont de Nemours (“du Pont”) from 2009 until her retirement in 2014. Previous positions in her thirty-five year du Pont career include Global Chief Marketing and Sales Officer (2004-2006); Group Vice President of the electronic and communication technologies platform (2002-2004); and Vice President and General Manager of the advanced fiber business (1997-2001).

|

PRIOR PUBLIC COMPANY DIRECTORSHIPS ■ W.R. Grace & Co. (former public company) (2015-2021) ■ Mallinckrodt Pharmaceuticals (2013-2018) ■ Navistar International Corporation (2009-2012) ■ Viasystems (former public company) (2003-2009) |

| INGEVITY | 2023 Proxy Statement | 17 |

| BRUCE D. HOECHNER | |

BOARD COMMITTEES | OTHER PUBLIC COMPANY DIRECTORSHIPS | |

■ LD&C ■ Nominating & Governance | ■ Curtiss Wright Corp. (since 2017) ■ Rogers Corporation (since 2011)* | |

Age: 63 Director since: | SKILLS AND EXPERIENCE Mr. Hoechner was elected to the Board in February 2023. He has experience leading a publicly traded, global manufacturing company and has significant expertise in international marketing and business strategy development. Mr. Hoechner has significant oversight and governance expertise as an experienced public company board member, having served on governance and finance committees.

ADDITIONAL INFORMATION Mr. Hoechner has served on non-profit boards. He holds a Bachelor of Science degree in chemical engineering from Pennsylvania State University and is a graduate of the Wharton Management Certificate Program at the University of Pennsylvania. | PROFESSIONAL HIGHLIGHTS President & CEO of Rogers Corporation from 2011 until his retirement in 2022. Various positions of increasing responsibility with Rohm and Haas Company for whom he worked for 28 years and with The Dow Chemical Company (after its acquisition of Rohm and Haas), including over ten years spent living and working in Asia, culminating as President, Asia Pacific Region, Dow Advanced Materials Division (2009-2011). |

|

Mr. Hoechner’s service on the Rogers Corporation Board will terminate on March 31, 2023.

| FREDERICK J. LYNCH | |

BOARD COMMITTEES |

| |

■ LD&C ■ Audit |

| |

Age: 58 Director since: 2016 | SKILLS AND EXPERIENCE Mr. Lynch served as President and Chief Executive Officer of a public, global manufacturing company for twelve years until his retirement in 2019, also having served as a director for that organization. He also brings substantial prior executive experience in the chemicals industry, and in-depth knowledge of global business, manufacturing, supply chain management, sustainability and strategic planning. He is an “audit committee financial expert” under SEC rules.

ADDITIONAL INFORMATION Mr. Lynch has served on the board of several non-profit and private companies. Mr. Lynch has a bachelor’s degree in chemical engineering from Villanova University and a master’s degree in business administration from Temple University. | PROFESSIONAL HIGHLIGHTS Operating Partner, AEA Investors, LP, a global private investment firm (since 2020); Interim CEO, Verdesian Life Sciences (since 2023); Director of Traeger Grills (2020-2021), Process Sensing Technologies (since 2020), and Window Nation (since 2021) (portfolio companies of AEA Investors, LP). President and CEO of Masonite International Corporation, a global manufacturer of doors and door systems from 2006 until his retirement in 2019. Previous experience includes President of human generics division and Senior Vice President of global supply chain for Alpharma, Inc. (2003-2006), and eighteen years at Honeywell International, including Vice President and General Manager of its specialty chemicals business.

PRIOR PUBLIC COMPANY DIRECTORSHIPS |

■ Masonite International Corporation (2009-2019) |

| INGEVITY | 2023 Proxy Statement | 18 |

| KAREN G. NARWOLD | |

BOARD COMMITTEES |

| |

■ Audit ■ Sustainability & Safety (Chair) ■ Executive |

| |

Age: 63 Director since: | SKILLS AND EXPERIENCE Ms. Narwold has over thirty years of executive, management, legal and compliance experience in chemicals and manufacturing, including as Chief Administrative Officer and General Counsel of several public companies. Her areas of expertise include law, corporate governance, compliance, executive compensation, risk oversight, strategic planning, M&A and cybersecurity. Ms. Narwold also has expertise in the area of sustainability with a focus on leveraging best-in-class benchmarking to drive corporate accountability and reporting.

ADDITIONAL INFORMATION Ms. Narwold has bachelor’s degree in political science from the University of Connecticut and a juris doctor degree from the University of Connecticut School of Law. | PROFESSIONAL HIGHLIGHTS Executive Vice President, Chief Administrative Officer, General Counsel, and Corporate Secretary of Albemarle Corporation (“Albemarle”), a global specialty chemicals company, since 2010, including leadership of the legal, public affairs (government and regulatory affairs and communications) and compliance organizations. She is also a member of Albemarle’s Enterprise Risk Management and Disclosure Committees. Ms. Narwold will retire from Albemarle effective April 4, 2023. Previously held various leadership roles at Symmetry Holdings (2007-2010) and Barzel Industries (2008-2009), including for both as General Counsel, and at GrafTech International (1990-2006), a global graphite and carbon manufacturer and former subsidiary of Union Carbide, including serving as Vice President, human resources, General Counsel and Secretary. |

|

| DANIEL F. SANSONE | |

BOARD COMMITTEES | OTHER PUBLIC COMPANY DIRECTORSHIPS | |

■ Audit (Chair) ■ LD&C ■ Executive | ■ AdvanSix Inc. (since 2016) | |

Age: 70 Director since: | SKILLS AND EXPERIENCE Mr. Sansone has extensive executive and general management experience and substantial financial expertise, including service as Chief Financial Officer and Treasurer at a global manufacturing public company and is an “audit committee financial expert” under SEC rules. Given his level of financial expertise, Mr. Sansone is well qualified to chair the Company’s Audit Committee. He also brings expertise in the asphalt and paving markets.

ADDITIONAL INFORMATION Mr. Sansone has a bachelor’s degree in finance from John Carroll University and a master’s degree in business administration from the Illinois Institute of Technology. | PROFESSIONAL HIGHLIGHTS Executive Vice President and Chief Financial Officer at Vulcan Materials Company (“Vulcan”), an S&P 500 company and the largest U.S. producer of aggregate-based construction materials, including asphalt, from 2005 until his retirement in 2014. Other roles at Vulcan included President, southern and gulf coast division; President, Gulf Coast Materials; EVP, Strategy; Treasurer; and Corporate Controller. Before joining Vulcan, Mr. Sansone held positions domestically and internationally at Monroe Auto Equipment (now Tenneco Inc.), FMC Corporation (1978-1986), and Kraft Inc. (1976-1978). |

|

| INGEVITY | 2023 Proxy Statement | 19 |

| WILLIAM J. SLOCUM | |

BOARD COMMITTEES | OTHER PUBLIC COMPANY DIRECTORSHIPS | |

■ Audit ■ Sustainability & Safety | ■ Strategic Education, Inc. (since 2021) | |

Age: 45 Director since: | SKILLS AND EXPERIENCE Mr. Slocum has been a partner at Inclusive Capital Partners since its founding in 2020. He has experience developing and executing growth strategies for public and private companies solving environmental and social challenges. Mr. Slocum is an “audit committee financial expert” under SEC rules based on his education, experience and background. He also brings expertise in the area of sustainability.

ADDITIONAL INFORMATION Mr. Slocum earned a Bachelor of Arts degree in Economics from Williams College, where he graduated magna cum laude and was inducted into Phi Beta Kappa. He earned his Master of Business Administration degree, with distinction, from Harvard Business School. | PROFESSIONAL HIGHLIGHTS Partner, Inclusive Capital Partners since 2020. Portfolio manager at Golden Gate Capital, where he led public-equity investments for the Golden Gate Capital Opportunity Fund and the Emerald gate Equities Portfolio (2011-2020). Board of Managers and Compensation Committee Williston Financial Group (2017-2020). |

|

| BENJAMIN G. (SHON) WRIGHT | |

BOARD COMMITTEES |

| |

■ Audit ■ Sustainability & Safety |

| |

Age: 48 Director since: 2022 | SKILLS AND EXPERIENCE Mr. Wright is an executive with extensive international manufacturing experience with industrial and chemical companies. As President of Cummins Engine Components, he is responsible for approximately 7,000 employees and 14 manufacturing locations.

ADDITIONAL INFORMATION Mr. Wright has served on non-profit and private company boards, including as a member of the Board of Trustees at The Children’s Museum of Indianapolis (from 2019-2021). He holds a Bachelor of Science degree in chemical engineering from the University of South Carolina, and a Master of Business Administration degree from Harvard Business School. | PROFESSIONAL HIGHLIGHTS Vice President, Cummins Incorporated & President, Cummins Engine Components; various positions of increasing responsibility over a 19-year career at Cummins. Chemical Engineer, British Petroleum (1997-2002) |

|

| INGEVITY | 2023 Proxy Statement | 20 |

The Company’s Board consists of a diverse group of respected leaders who possess the requisite skills, experience and character to effectively oversee Ingevity’s evolving needs and strategy. The following chart summarizes the core competencies that the Board considers valuable for effective governance and oversight and illustrates how the current Board members individually and collectively represent these key competencies.

| Skill/Experience | Blackwell | Fernandez- Moreno | Fortson | Gulyas | Hoechner | Lynch | Narwold | Sansone | Slocum | Wright | |

| Industry or Market Experience |  |  |  |  |  |  |  |  | ||

| C-Suite Experience |  |  |  |  |  |  | ||||

| Other Public Company Board Experience |  |  |  |  |  |  |  | |||

| International Manufacturing Experience (P&L) |  |  |  |  |  |  |  |  | ||

| Executive Compensation/Human Capital Management |  |  |  |  |  |  |  |  | ||

| SEC Financial Expert* |  |  |  |  |  |  | ||||

| Enhances Diversity |  |  |  |  |  | |||||

| Substantial M&A/Joint Venture Experience |  |  |  |  |  |  |  |  |  |  |

| Compliance/Legal Experience |  |  | ||||||||

| Environmental, Safety & Sustainability Experience |  |  |  |  |  |  |  |  |  |  |

| Cybersecurity Experience |  | |||||||||

| Risk Management |  |  |  |  |  |  |  |  |  |  |

While each of Ms. Blackwell, Mr. Fortson, and Mr. Hoechner meet the qualifications of an audit committee financial expert under the SEC rules, none of them serve on the Audit Committee or are formally designated as an audit committee financial expert for the Company.

In addition, many of our directors have experience as members of non-profit, academic and philanthropic institutions, which adds additional perspective to their roles at Ingevity.

| INGEVITY | 2023 Proxy Statement | 21 |

The Board is responsible for overseeing and providing guidance on the Company’s strategy, business and performance, and protecting stockholder interests and value. In addition, the Board is responsible for appointing, overseeing and evaluating the executive officers who manage the Company’s day-to-day operations. The Board oversees management’s activities to ensure that the Company’s assets are properly safeguarded; that the Company maintains appropriate financial and other internal controls; and that the Company complies with responsible corporate governance practices, and applicable laws, regulations and ethical standards. One of the Board’s most important functions is oversight of risk management, including cybersecurity. This is discussed further below under the section titled “Board’s role in risk oversight.”

The Board actively oversees the development and execution of our strategies, including those related to business, operations and finance, as well as strategies focused on legal and regulatory matters, corporate responsibility and sustainability, stockholder engagement, innovation and protection of intellectual property, cybersecurity, talent development and executive succession.

In carrying out its responsibilities, the Board has created and delegated responsibilities to five committees:

The Audit Committee;

The Leadership Development and Compensation Committee (the “LD&C Committee”);

The Nominating and Governance Committee;

The Sustainability and Safety Committee; and

The Executive Committee.

Each committee’s responsibilities are described under “Committees of our Board of Directors.”

The Board is committed to sound corporate governance policies and practices that are designed to enable Ingevity to operate responsibly and with integrity, to compete effectively, to sustain its business and to build long-term stockholder value. Our Board-approved Corporate Governance Guidelines (the “Guidelines”) are available on our website at https://ir.ingevity.com/corporate-governance/corporate-governance-documents.

The Guidelines form a transparent framework for the effective governance of Ingevity, addressing matters such as the respective roles and responsibilities of the Board and management, the Board’s leadership structure, director independence and Board and committee membership criteria. The Guidelines are reviewed at least annually by the Nominating & Governance Committee in light of changing regulations, evolving best practices and other governance developments.

| INGEVITY | 2023 Proxy Statement | 22 |

Our Board regularly reviews its leadership structure, how the structure is functioning, and whether the structure continues to be in the best interest of our stockholders. The Company’s current Board leadership structure consists of the following:

INDEPENDENT CHAIR | JEAN S. BLACKWELL |

Main Responsibilities: ■ Presides over Board and stockholder meetings ■ Provides advice and counsel to CEO ■ Acts as liaison between independent directors and CEO ■ Provides input to the LD&C and Nominating & Governance Committees regarding the annual CEO performance evaluation, Board evaluation, and succession planning ■ Chairs the Executive Committee |

PRESIDENT & CEO | JOHN C. FORTSON |

Main Responsibilities: ■ Manages Ingevity’s day-to-day business and operations ■ Manages and develops Ingevity’s executive leadership team ■ Ensures proper execution of Ingevity’s corporate strategy |

Our Guidelines do not contain a firm policy regarding separation of the offices of CEO and Chair. Instead, the Guidelines give the Board flexibility to make the determination that is in the best interests of the stockholders based on applicable circumstances at the time of the decision. Except in connection with a leadership transition in 2020, the Company has always separated the roles of Chair and CEO. The Board believes that separating the positions of CEO and Chair allows for clear delineation of the role of the Chair and minimizes duplication of effort between the CEO and the Chair. The separation of roles also allows the CEO to focus on executing Ingevity’s strategic plan and managing its operations and performance, and facilitates effective oversight by the Chair and improved communications and relations between the Board, the CEO, and other senior leaders of the Company.

The Guidelines provide that if the Chair is not independent, the Board must appoint a Lead Independent Director. During the leadership transition in 2020, Mr. Lynch served as the Lead Independent Director.

Ms. Blackwell has served as Independent Chair of the Board since February 2021. Our Board Chair is elected to serve a two-year term, unless otherwise determined by the Board. Upon the recommendation of the Nominating & Governance Committee and following its own review, the Board elected Ms. Blackwell in February 2023 to continue her service as Board Chair for another two-year term. Because Ms. Blackwell is an independent director, the Board has not deemed it necessary to appoint a lead independent director.

Our Board has established five standing committees to help the Board fulfill its responsibilities. Committee members are elected annually by the Board based on the recommendations of the Nominating & Governance Committee. Each committee operates under a charter, all of which are available at https://ir.ingevity.com/corporate-governance/corporate-governance-documents.

In July 2022, on the recommendation of the Nominating & Governance Committee, the Board established the Sustainability and Safety Committee. The creation of this committee acknowledges that sustainability is core to Ingevity’s mission, underscores the importance of sustainability and safety to Ingevity, and enables more focused oversight of these important topics. At the same time, the Nominating & Governance Committee and the Board evaluated and made adjustments to other committee memberships and leadership roles.

The Board has determined that each member of its standing committees is independent under the relevant SEC and New York Stock Exchange (“NYSE”) standards, including the heightened independence standards required for members of audit and compensation committees. For more information on independence standards, see “Director independence.”

| INGEVITY | 2023 Proxy Statement | 23 |

AUDIT COMMITTEE | 2022 Meetings: 7 Average attendance in 2022: 92% | |

CHAIR | MEMBERS | PRIMARY RESPONSIBILITIES: |

Daniel F. Sansone* | Frederick J. Lynch* Karen G. Narwold William J. Slocum* Benjamin G. (Shon) Wright * Audit Committee Financial Expert

| 1. Assist the Board with overseeing the integrity of the Company’s financial statements; 2. Review management’s assessments and reports relating to the effectiveness of the Company’s internal control over financial reporting; 3. Appoint, oversee, and evaluate the qualifications, performance, and independence of the independent auditor; 4. Oversee and evaluate the effectiveness of the Company’s internal audit function; 5. Review the overall adequacy and effectiveness of the Company’s legal, regulatory, and ethics and compliance programs; 6. Review significant legal, compliance, or regulatory matters; and 7. Review the Company’s financial risk exposures and mitigating actions. |

ADDITIONAL GOVERNANCE MATTERS: | ||

The Board has determined that each member of the Audit Committee is independent in accordance with the heightened independence standards established by the Securities and Exchange Act of 1934 (the “Exchange Act”) and adopted by the NYSE for audit committee members. The Board has also determined that each Audit Committee member is financially literate, as such qualification is interpreted by the Board in its business judgement, and that each of Messrs. Lynch, Sansone and Slocum is an “audit committee financial expert” under SEC rules. No member of our Audit Committee serves on the audit committee of more than three public companies. The Audit Committee’s report for December 31, 2022, appears under “Audit Committee Report.” Mr. Fernandez-Moreno served on the Audit Committee until July 2022, when he stepped down to join the newly-created Sustainability & Safety Committee. | ||

LEADERSHIP DEVELOPMENT AND COMPENSATION COMMITTEE | 2022 Meetings: 6 Average attendance in 2022: 100% | |

CHAIR | MEMBERS | PRIMARY RESPONSIBILITIES: |

Diane H. Gulyas | Jean S. Blackwell Bruce D. Hoechner Frederick J. Lynch Daniel F. Sansone

| 1. Evaluate the CEO’s performance and determine the CEO’s compensation based on such evaluation; 2. Review and approve the compensation of other executive officers; 3. Review and recommend to the Board for its approval non-employee director compensation; 4. Administer the Company’s equity and other compensation plans and programs; 5. Review and make recommendations to the Board with respect to talent and succession planning, inclusion and diversity policies and programs, and employee engagement initiatives; and 6. Review incentive compensation arrangements to confirm that incentive pay aligns with Company goals and outcomes and does not encourage inappropriate risk-taking. |

ADDITIONAL GOVERNANCE MATTERS: | ||

The Board has determined that each member of the LD&C Committee is (i) an “outside director” under Section 162(m) of the Internal Revenue Code, as amended (the “Code”) and (ii) a “non-employee director” under Section 16b-3(b)(3)(i) promulgated under the Exchange Act. The LD&C Committee’s report for December 31, 2022, appears under “Leadership Development and Compensation Committee Report.” Following an evaluation by the Nominating & Governance Committee and the Board of committee leadership refreshment, Ms. Gulyas was appointed Chair of the LD&C Committee effective in July 2022. | ||

| INGEVITY | 2023 Proxy Statement | 24 |

NOMINATING AND GOVERNANCE COMMITTEE | 2022 Meetings: 6 Average attendance in 2022: 100% | |

CHAIR | MEMBERS | PRIMARY RESPONSIBILITIES: |

Luis | Jean S. Blackwell Diane H. Gulyas Bruce D. Hoechner | 1. Identify individuals qualified to become Board members and recommend nominees for election to the Board; 2. Make recommendations to our Board concerning Board and committee composition and needs; 3. Maintain a Board succession plan; 4. Advise our Board on corporate governance matters; 5. Oversee the annual Board and committee self-evaluation process; and 6. Review related party transactions. |

ADDITIONAL GOVERNANCE MATTERS: | ||

Ms. Narwold served on the Nominating & Governance Committee until July 2022, when she stepped down to serve on the newly-created Sustainability & Safety Committee. | ||

SUSTAINABILITY AND SAFETY COMMITTEE | 2022 Meetings: 2 Average attendance in 2022: 100% | |

CHAIR | MEMBERS | PRIMARY RESPONSIBILITIES: |

Karen G. Narwold | Luis Fernandez-Moreno William J. Slocum Benjamin G. (Shon) Wright | 1. Oversee and review Ingevity’s integration of economic, environmental, and social principles into its business strategy and decision making; 2. Oversee Ingevity’s policies, procedures and performance with respect to environmental and corporate responsibility and sustainability programs; 3. Review Ingevity’s annual Sustainability Report; 4. Review and monitor Ingevity’s policies, procedures, and performance relating to matters affecting employee, public, process, and product safety; and 5. Review and monitor the Company’s policies, procedures, and performance relating to matters affecting community engagement. |

| ||

EXECUTIVE COMMITTEE | 2022 Meetings: 0

| |

CHAIR | MEMBERS | PRIMARY RESPONSIBILITIES AND LIMITATIONS: |

Jean S. Blackwell | Luis Fernandez-Moreno Diane H. Gulyas Karen G. Narwold Daniel F. Sansone | The Executive Committee is authorized to exercise certain powers of the Board not otherwise prohibited by law or Ingevity’s Guidelines or governing documents between Board meetings when a meeting of the full Board is impractical or not warranted under the circumstances. |

Each of the Audit Committee, LD&C Committee, Nominating & Governance Committee, and Sustainability & Safety Committee is responsible for annually reviewing their charter and performance. The Nominating & Governance Committee further reviews each of the committee charters annually, including the Executive Committee charter.

The Board strives to select as director candidates a mix of individuals with experience at policy-making levels in substantive areas that are relevant to the Company’s activities, as well as other characteristics that will contribute to the overall ability of the Board to perform its duties and meet changing conditions.

| INGEVITY | 2023 Proxy Statement | 25 |

The Nominating & Governance Committee is responsible for evaluating and recommending qualified director candidates to the Board for its consideration. In evaluating potential director nominees, the Nominating & Governance Committee considers the following, among other things:

independence and other related requirements for service on committees;

the number of public company boards on which the nominee serves;

conflicts of interest and other legal and ethical issues that would interfere with the proper performance of the responsibilities of a director (recognizing that some directors may also be executive officers of the Company);

the nominee’s commitment to discharging the duties of a director in accordance with the Guidelines and applicable law and to serving on the Board for an extended period of time;

the nominee’s available time and energy to carry out his or her duties effectively;

experience that would enable the nominee to meaningfully participate in deliberations of the Board and committees and to otherwise fulfill his or her duties; and

whether the nominee will enhance the diversity of the Board based on his or her educational and professional background, experience, racial and ethnic makeup, gender, viewpoints or perspectives.

In addition, the Nominating & Governance Committee also considers character, financial literacy, and relevant skills in light of the Board’s needs.

The Nominating & Governance Committee considers recommendations for director candidates from Board members, stockholders, and other third parties, such as search firms that are engaged to identify candidates. The Nominating & Governance Committee evaluates candidates recommended by stockholders using the same criteria it uses for all other candidates. Any stockholder wishing to recommend a director candidate should provide the Nominating & Governance Committee with the information required by the Company’s Bylaws to be provided with respect to director nominees submitted by stockholders. For more information, see “Questions and Answers Regarding Stockholder Communications, Stockholder Proposals, and Company Documents.”

During 2022, the Board appointed two new directors (William J. Slocum and Benjamin G. (Shon) Wright) and during 2023, the Board appointed one new director (Bruce D. Hoechner). Mr. Wright and Mr. Hoechner were recommended by third-party search firms. Mr. Slocum was personally known to senior management of the Company through Inclusive Capital Partners’ investment in Ingevity.

Our Guidelines and the NYSE require that a majority of our directors be independent under the applicable rules and regulations of the SEC and the general listing standards of the NYSE. Our Board, with the assistance of the Nominating & Governance Committee, annually (or more frequently if circumstances require) assesses the independence of each director.

In conducting its independence assessment, the Board reviews all relevant facts and circumstances, including each director’s affiliations and relationships, potential conflicts of interest, and all specific criteria included in the NYSE’s general listing standards. An independent director is a director who our Board affirmatively determines has no material relationship with the Company (either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company) other than in connection with his or her role as a director.

In February 2023, the Nominating & Governance Committee and Board conducted their review of each director’s affiliations that are relevant to independence. These affiliations were provided by the directors in their responses to annual questionnaires distributed by the Company in December 2022. Once the Company received the list of affiliations, it conducted additional diligence on each relationship and ran searches against the Company’s books and records to determine whether any financial transactions existed with the affiliates. Results of the diligence and searches were reported to the Nominating & Governance Committee and the Board.

After reviewing the affiliations and report described above, upon the recommendation of the Nominating & Governance Committee, the Board affirmatively determined that all directors other than Mr. Fortson (Ingevity’s President and CEO) are independent, in accordance with applicable rules and regulations of the SEC and the general listing standards of the NYSE.

| INGEVITY | 2023 Proxy Statement | 26 |

The Nominating & Governance Committee assists the Board in annually assessing the effectiveness of the Board and its committees in carrying out their respective roles, as described below.

Format | Topics | Presentation of Findings | Feedback Incorporated |

The Nominating & Governance Committee determines the format of the evaluations, which may include interviews conducted by the Nominating & Governance Committee Chair, interviews conducted by an independent third party, or written surveys. The Nominating & Governance Committee annually considers the effectiveness of the evaluation process. | Evaluation topics generally include, among other matters: ■ Board composition and structure; ■ Board culture; ■ Information flow and processes; ■ Board oversight of risk management and strategic planning; ■ Compliance and ethics program effectiveness; ■ Succession planning; and ■ Access to management. | The Nominating & Governance Committee evaluates the findings and then presents to the Board and each committee chair the results of the evaluations. The Board and committees discuss the results to identify opportunities to enhance effectiveness. | The Board and/or committees implement enhancements and other modifications to their respective policies and procedures as appropriate. |

Examples of actions the Board has taken in recent years in response to the annual evaluation process include:

establishment of the Sustainability & Safety Committee;

assigning oversight of matters relating to the attraction, development, and retention of the Company’s leadership to the LD&C Committee;

rotating the Chair of the LD&C Committee;

running certain committee meetings concurrently to maximize Board time at regular meetings; and

modifying committee meeting content and length to reflect input from committee members.

Our Board meets on a regularly scheduled basis during the year to review significant developments affecting Ingevity and to act on matters requiring Board approval. The Board may hold special meetings between scheduled Board meetings when appropriate.

The Board met eight times during 2022. Each director attended at least 75% of the aggregate of (i) the number of meetings of the Board held during the period he or she was a director and (ii) the number of meetings of all committees of the Board held during the period he or she served on such committees. All directors then on the Board attended the 2022 Annual Meeting of Stockholders.

Our Guidelines require that the non-management members of our Board meet in executive session without management present at each regularly scheduled Board meeting. Likewise, our committees generally meet in executive session without management present at each regularly scheduled committee meeting.

| INGEVITY | 2023 Proxy Statement | 27 |

The Board, acting as a full Board and through its committees, oversees risk management on behalf of the Company. Our Board believes it has in place effective processes to identify and oversee the material risks facing the Company.

Ingevity’s enterprise risk management processes help management and the Board identify, prioritize and manage risks that have the potential to present the most significant obstacles to achieving the Company’s business objectives or that otherwise present significant risk to the Company. These risk management processes are regularly refreshed, including priorities and planned remediations. Management reports regularly to the Board on this process.

Set forth below are key areas of risk overseen by the Board, directly or through its committees.

Our Board, both directly and through the Audit Committee, receives regular updates on various legal, compliance and regulatory matters, such as developments in litigation, compliance risks and our compliance programs. In addition, regular updates provided to the Audit Committee by our General Counsel, Chief Compliance Officer, and internal audit function provide insight into our risk assessment and risk management policies and processes.

The Audit Committee oversees the management of financial, accounting, internal controls, and liquidity risks. This oversight includes interaction at Audit Committee meetings with the Chief Financial Officer; management from our financial, accounting, internal audit, and treasury functions; and representatives from our independent registered public accounting firm. The Audit Committee also discusses with management our major financial risk exposures and the steps management has taken to monitor, control and remediate such exposure.

The Nominating & Governance Committee oversees risks related to Board organization, Board membership (including director refreshment and succession), Board structure and other corporate governance matters.

The LD&C Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs and with respect to succession planning for management. For more information, see “Compensation Discussion and Analysis.”

The Sustainability & Safety Committee reviews and monitors our corporate responsibility and sustainability programs, including ESG matters and oversight of people, product and process safety risk. In addition to reporting to the Sustainability & Safety Committee, management’s practice is to periodically review corporate responsibility and sustainability matters, including ESG programs and policies, in joint session with the full Board. As shown below, although the Sustainability & Safety Committee has primary responsibility for these matters, other committees, and occasionally the full Board, oversee specific sustainability-related matters.

| INGEVITY | 2023 Proxy Statement | 28 |

Sustainability Report/ Other Area for Review | Item Description | Committee | ||||

BoD | S&S | N&G | Audit | LD&C | ||

Commitment to Sustainability | Sustainability Rating Agencies, Reporting and Sustainability Groups |

|  |

|

|

|

Sustainability Materiality Refresh |

|  |

|

|

| |

Goal Setting and Tracking Progress |

|  |

|

|

| |

Manufacture Responsibly | Responsible Care Policy/Program |

|  |

|

|

|

Prioritize People | Employee Experience |

|

|

|

|  |

Safety |

|  |

|

|

| |

Personal/Employee Safety |

|  |

|

|

| |

Process Safety |

|  |

|

|

| |

Public Safety/ Environmental Sustainability |

|  |

|

|

| |

Emergency Response and Crisis Communication Plans |

|  |

|

|

| |

Culture of Inclusion/Diversity, Equity & Inclusion |

|

|

|

|  | |

Talent Attraction |

|

|

|

|  | |

Compensation and Talent Management |

|

|

|

|  | |

Employee Development |

|

|

|

|  | |

Health and Wellness |

|

|

|

|  | |

Supporting our Communities/Community Engagement |

|  |

|

|

| |

Ingevicares/Philanthropic Giving |

|  |

|

|

| |

PAC/Political Giving/Political Advocacy |

|

|  |

|

| |

Pursue Excellence | Commitment to Integrity and Ethical Behavior |

|

|  |

|

|

Compliance & Ethics – Program Effectiveness, Complaints, Investigations, Financial Related Concerns, Compliance Program |

|

|

|  |

| |

Code of Conduct |

|

|  |  |

| |

Supplier Principles of Conduct, Diversity and Sustainability |

|  |

|

|

| |

Cybersecurity |  |

|

|

|

| |

Intellectual Property |  |

|

|

|

| |

Financial Performance |  |

|

|  |

| |

Governance |

|

|  |

|

| |

Embrace Innovation | Business and Segment Innovation |  |

|

|

|

|

Other | Emerging Issues, regulations in Sustainability and Safety |

|  |

|

|

|

Alignment of sustainability and safety programs to company strategy |

|  |

|

|

| |

Enterprise Risk Management |  |

|

|

|

| |

|

|

|

|

|

| |

| INGEVITY | 2023 Proxy Statement | 29 |

The Board oversees our cybersecurity program and management of the associated risks. The Board receives updates at least annually from management, including our Chief Information Officer, on cybersecurity matters and our risk management program. The Board also receives updates periodically from third-party cybersecurity experts on the risk landscape generally.

Under its charter, the Sustainability & Safety Committee has responsibility for overseeing and reviewing the Company’s integration of economic, environmental and social principles into its business strategy and decision making; reviewing and monitoring Ingevity’s policies, procedures and performance with respect to environmental, corporate responsibility and sustainability programs, matters affecting employee, public, process and product safety and matters affecting community engagement; reviewing the Company’s annual Sustainability Report; and making recommendations to the Board regarding the foregoing matters as the Sustainability & Safety Committee deems appropriate. In addition to the reviews completed by the Sustainability & Safety Committee, Ingevity’s management also presents on ESG matters to the full Board at least once annually.

Our latest Sustainability Report and other information regarding our ESG initiatives and progress are available on our website at https://www.ingevity.com/about/sustainability.

One of our Board’s most critical functions is executive succession planning, which is reviewed at least once annually and more often as needed. The LD&C Committee, which has the primary responsibility for overseeing the development of succession plans for all of our executive officers, regularly discusses succession in collaboration with our CEO and CHRO, and reports on the discussions to the Board.

Under its charter, the LD&C Committee is responsible for overseeing and reviewing Ingevity’s inclusion and diversity policies and programs and human capital matters, including employee engagement initiatives. The LD&C Committee receives periodic updates from management on, and discusses, the Company’s DEI vision and development strategy.

Additional information regarding DEI and human capital matters are available on our website at https://www.ingevity.com/diversity-equity-inclusion.

Each director receives educational information about the Company and expectations of their role as part of an orientation upon joining the Board. Once on the Board, directors participate in an ongoing education program that incorporates site visits; management presentations; presentations by the Company’s independent auditors, investment banks and internal and external legal counsel; third-party expert speakers on various topics; and the distribution of analyst reports and pertinent articles on the Company’s business and industry. The Nominating & Governance Committee annually reviews the Board education program and recommends changes that it deems appropriate.

In 2022, the Board revised our Guidelines to require directors to submit a letter of resignation in the year in which they turn 72 in the interest of facilitating Board refreshment. The Board will determine on a case-by-case basis whether to accept such a resignation. None of our current directors has attained or will attain the age of 72 in 2023.

The Board has not established a policy enforcing a term limit because it believes that, on balance, such a policy would sacrifice the contribution of directors who have been able to develop, over a period of time, extensive insight into the Company and its operations. The Board annually evaluates each director’s contributions during the Board and committee evaluation process.

| INGEVITY | 2023 Proxy Statement | 30 |

Our Guidelines require any director who has a significant change in his or her full-time job responsibilities to submit a resignation. The Board then considers whether to accept any such resignation taking into account all relevant factors. In 2022, Ms. Narwold and Mr. Wright submitted resignations as required by this policy. Ms. Narwold’s resignation stemmed from her announced retirement from Albemarle. The Board decided not to accept Ms. Narwold’s resignation for reasons including her significant contributions to the Board to date, her industry and legal expertise and her willingness to continue to serve as a director. Mr. Wright’s resignation stemmed from a promotion he received at Cummins that increased the scope of his duties significantly. The Board decided not to accept Mr. Wright’s resignation for reasons including Mr. Wright’s deep industry knowledge, significant management and operational experience and his willingness to continue to serve as a director.

The Guidelines provide that independent directors generally may not serve on more than five public company boards (including Ingevity’s Board). However, a director who is actively employed as a CEO of a public company may not serve on more than three public company boards (including Ingevity’s Board), and a director who serves as an officer (other than CEO) at another public company may not serve on more than four public company boards (including Ingevity’s Board).

We value and are committed to regular, meaningful engagement with our stockholders and other stakeholders, including customers, suppliers, employees and our communities. In 2022, we hosted 50 calls with stockholders and potential stockholders and discussed a variety of topics, including capital allocation, strategy, sustainability and financial results. Senior leadership participated in roughly half of the calls.

In 2022, we also attended 12 conferences/roadshows hosted by analysts resulting in 85 meetings with stockholders or potential stockholders.

| INGEVITY | 2023 Proxy Statement | 31 |

Interested parties, including stockholders, may communicate with all or selected members of the Board as follows:

|

|

|

|

| Via Email: corporatesecretary@ingevity.com | Via Mail: C/O Corporate Secretary Ingevity Corporation 4920 O’Hear Ave, Suite 400 N. Charleston, SC 29405 |

|

Correspondence should be addressed to the Board or any individual director(s) or group or committee of directors either by name or title (for example, “Chair of the Board,” “Chair of the Nominating & Governance Committee,” or “All Independent Directors”). All such correspondence will be forwarded as directed, except that we reserve the right not to forward any soliciting or advertising materials or any abusive, threatening, or otherwise inappropriate materials.

In 2022, the Board amended and restated Ingevity’s codes of conduct and ethics, combining its previous three separate codes into one, consolidated code. The new combined code is referred to as the “Code of Conduct.” The Code of Conduct results from actions taken by management in 2022 to strengthen and reinforce Ingevity’s ethics and compliance program and culture. It applies to all Ingevity-controlled entities and their respective employees, officers and directors, including the Board. The revised Code of Conduct emphasizes our commitment to doing things the right way to ensure our employees and others understand our “IngeviWay” value for integrity and ethical behavior. The revised Code of Conduct also contains new and expanded information to enable better decision making on topics such as employee and leader responsibilities, data privacy and protection, DEI and third-party interactions.

The Code of Conduct focuses the Board, management and our employees on areas of ethical risk, provides guidance and examples to help personnel recognize and deal with ethical issues, prominently features mechanisms to report unethical conduct, and helps to foster a culture of honesty and accountability. The Code of Conduct is available on our website at http://ir.ingevity.com/governance/codes-of-conduct. All employees, including executives, and all non-employee directors are required annually to review the Code of Conduct and to participate in Code of Conduct training.

Any waiver for directors or executive officers from the provisions of the Code of Conduct must be made by the Nominating & Governance Committee or by the Board at the recommendation of the Audit Committee or the Nominating & Governance Committee. Any such waiver will be disclosed within four business days of the waiver (or an implicit waiver) on our website at http://ir.ingevity.com/governance/codes-of-conduct, and will remain posted for a period of at least 12 months. Any amendment to the Code of Conduct (other than technical, administrative, or other non-substantive amendments) for which disclosure is required pursuant to Item 5.05 of Form 8-K under the Exchange Act will also be disclosed on that page of our website.

We have provided employees with a number of avenues to report ethics and compliance violations or similar concerns, including an anonymous telephone hotline, with options specific to the countries in which we operate to allow for reporting in local languages.

We maintain several governance documents on our website, which are listed below.

Our Code of Conduct is available at: https://ir.ingevity.com/corporate-governance/codes-of-conduct

The following materials are available at https://ir.ingevity.com/corporate-governance/corporate-governance-documents:

Certificate of Incorporation;

Bylaws;

Governance Guidelines;

Committee charters;

Anti-Hedging Policy; and

Stock Ownership Guidelines.

| INGEVITY | 2023 Proxy Statement | 32 |

The following materials are available at: https://www.ingevity.com/about/sustainability/:

Sustainability Reports;

Ingevity’s alignment with ten of the United Nations’ Sustainable Development Goals;

Human Rights Policy;

Modern Slavery Act – Transparency Statement 2020;

Quality Policy;

Responsible Care® Policy; and

Supplier Principles of Conduct.

These materials are also available in print at no charge to any stockholder who requests a copy by writing to Corporate Secretary, Ingevity Corporation, 4920 O’Hear Ave, Suite 400, N. Charleston, SC 29405, or by email to: corporatesecretary@ingevity.com.

The Board evaluates related party transactions consistent with Item 404 of Regulation S-K. Under its charter, the Nominating & Governance Committee is charged with reviewing all potential related party transactions and making recommendations to the Board regarding approval of any such transactions.

The Company solicited information from directors and director nominees regarding potential related party transactions beginning in December 2022. Based on a review of the reported affiliations and results from searches run against the Company’s books and records to determine whether any financial transactions existed with the affiliates, the Nominating & Governance Committee has advised the Board that it has not identified any related party transactions since the beginning of the fiscal year ended December 31, 2022, and none are currently proposed.

| INGEVITY | 2023 Proxy Statement | 33 |

The Board annually reviews and approves non-employee director compensation at the recommendation of the LD&C Committee. This review involves a survey of director compensation at peer companies and other similarly situated companies and a discussion with our independent compensation consultant, Pearl Meyer, regarding director compensation practices.

The 2022 non-employee director compensation program consisted of the following:

Standard Compensation | ||

Cash Retainer | $ | 90,000 |

Restricted Stock Unit Award | $ | 118,000 |

TOTAL | $ | 208,000 |

Additional Cash Retainers for Leadership | ||

Board Chair | $ | 100,000 |

Lead Independent Director* | $ | 25,000 |

Audit Committee Chair | $ | 20,000 |

LD&C Committee Chair | $ | 15,000 |

Nominating & Governance Committee Chair | $ | 12,000 |

Sustainability & Safety Committee Chair | $ | 12,000 |

* The Company did not have a Lead Independent Director in 2022. | ||

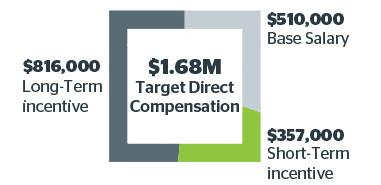

Cash retainers are paid to the non-employee directors quarterly in advance. Non-employee directors may elect to receive their annual cash retainer (both standard and leadership retainers) in the form of deferred stock units (“DSUs”) in lieu of cash under the 2016 Omnibus Incentive Plan, as amended, and the Non-Employee Director Deferred Compensation Plan (“Director DCP”). If a director makes such an election, the cash retainer is converted into an amount of DSUs using the closing price of the Company’s Common Stock on the business day that the cash retainer would have otherwise been paid to the director. DSUs representing cash retainers are fully vested upon grant and are settled when the director terminates his or her service with the Board. DSUs in lieu of cash retainers do not confer voting rights but are entitled to dividend-equivalents, which accrue from the grant date and are delivered in cash when the underlying DSUs are settled.