Third Quarter 2017 Earnings Presentation November 2, 2017

Disclaimer: This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements generally include the words “may,” “could,” “should,” “believes,” “plans,” “intends,” “targets,” “will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues,” “forecast,” “prospect,” “potential” or similar expressions. Forward-looking statements may include, without limitation, expected financial positions, results of operations and cash flows; financing plans; business strategies and expectations; operating plans; synergies and the potential benefits of the acquisition of Georgia-Pacific’s pine chemicals business (the “acquisition”); the anticipated timing of the closing of the acquisition; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost-reduction initiatives, plans and objectives; and markets for securities. Like other businesses, Ingevity is subject to risks and uncertainties that could cause its actual results to differ materially from its expectations or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to materially differ from those contained in the forward-looking statements, or that could cause other forward-looking statements to prove incorrect, include, without limitation, risks related to the satisfaction of the conditions to closing the acquisition (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, risks that the expected benefits from the proposed acquisition will not be realized or will not be realized in the expected time period; the risk that the businesses will not be integrated successfully; significant transaction costs; unknown or understated liabilities; general economic and financial conditions; international sales and operations; currency exchange rates and currency devaluation; compliance with U.S. and foreign regulations; attracting and retaining key personnel; conditions in the automotive market or adoption of alternative technologies; worldwide air quality standards; government infrastructure spending; declining volumes in the printing inks market; the limited supply of crude tall oil (“CTO”); lack of access to sufficient CTO; access to and pricing of raw materials; competition from producers of substitute products and new technologies; a prolonged period of low energy prices; the provision of services by third parties at several facilities; natural disasters, such as hurricanes, winter or tropical storms, earthquakes, floods, fires; other unanticipated problems such as labor difficulties including renewal of collective bargaining agreements, equipment failure or unscheduled maintenance and repair; protection of intellectual property and proprietary information; information technology security risks; government policies and regulations, including, but not limited to, those affecting the environment, climate change, tax policies and the chemicals industry; and lawsuits arising out of environmental damage or personal injuries associated with chemical or other manufacturing processes. These and other important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document are and will be more particularly described in our filings with the U.S. Securities and Exchange Commission, including our Form 10-K for the year ended December 31, 2016 and our other periodic filings. Readers are cautioned not to place undue reliance on Ingevity’s projections and forward-looking statements, which speak only as the date thereof. Ingevity undertakes no obligation to publicly release any revision to the projections and forward-looking statements contained in this presentation, or to update them to reflect events or circumstances occurring after the date of this presentation. 2

Agenda •Third Quarter Highlights •Segment Performance •Financial Review •2017 Guidance •Q&A 3

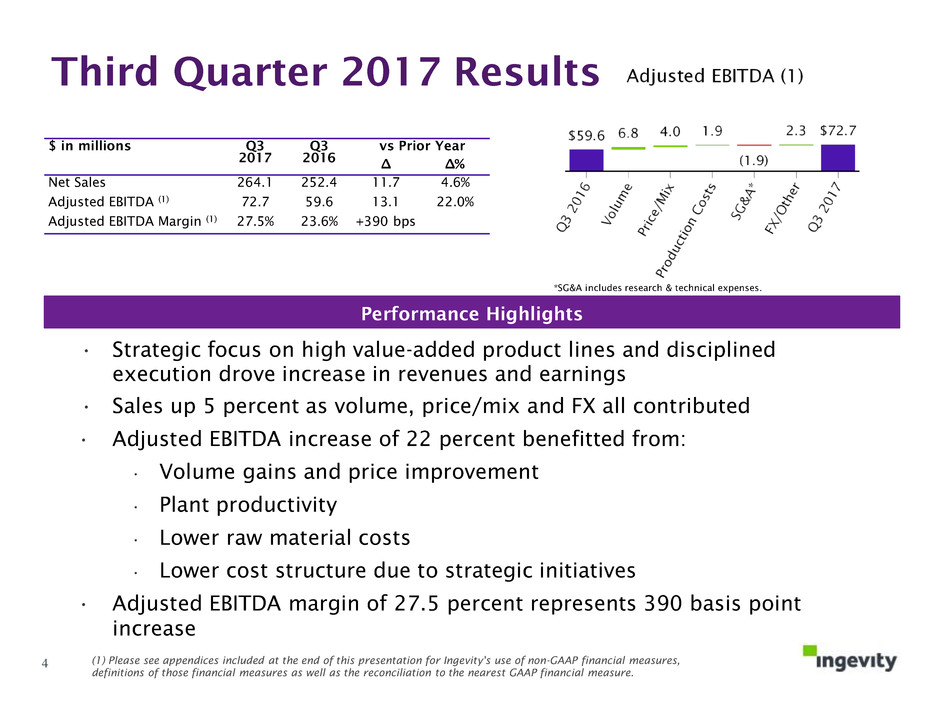

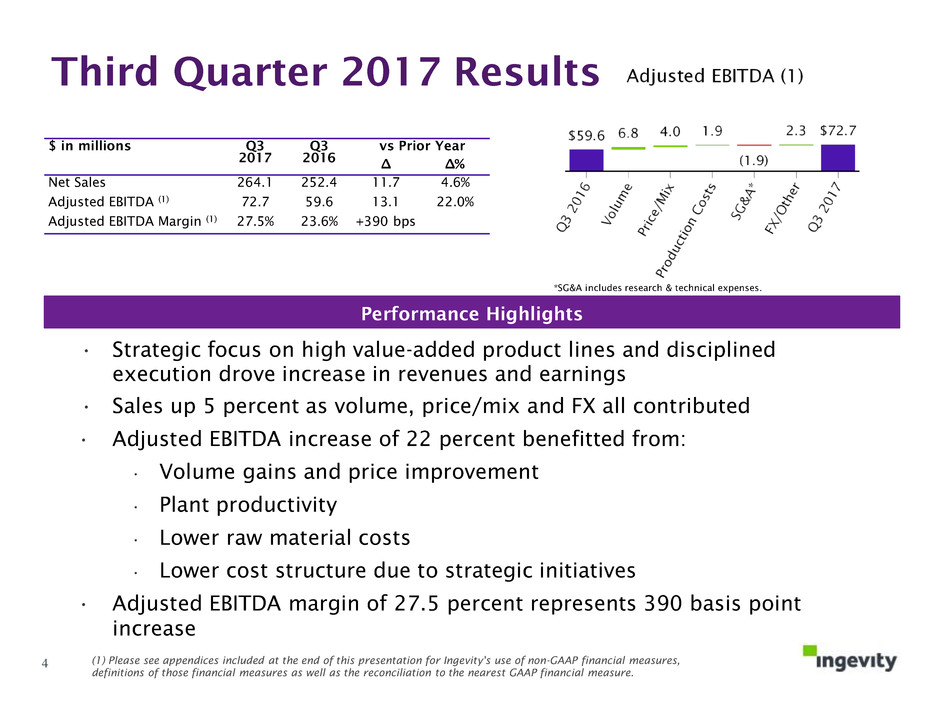

Third Quarter 2017 Results • Strategic focus on high value-added product lines and disciplined execution drove increase in revenues and earnings • Sales up 5 percent as volume, price/mix and FX all contributed • Adjusted EBITDA increase of 22 percent benefitted from: • Volume gains and price improvement • Plant productivity • Lower raw material costs • Lower cost structure due to strategic initiatives • Adjusted EBITDA margin of 27.5 percent represents 390 basis point increase Performance Highlights (1) Please see appendices included at the end of this presentation for Ingevity's use of non-GAAP financial measures, definitions of those financial measures as well as the reconciliation to the nearest GAAP financial measure. 4 *SG&A includes research & technical expenses. $ in millions Q3 2017 Q3 2016 vs Prior Year ∆ ∆% Net Sales 264.1 252.4 11.7 4.6% Adjusted EBITDA (1) 72.7 59.6 13.1 22.0% Adjusted EBITDA Margin (1) 27.5% 23.6% +390 bps

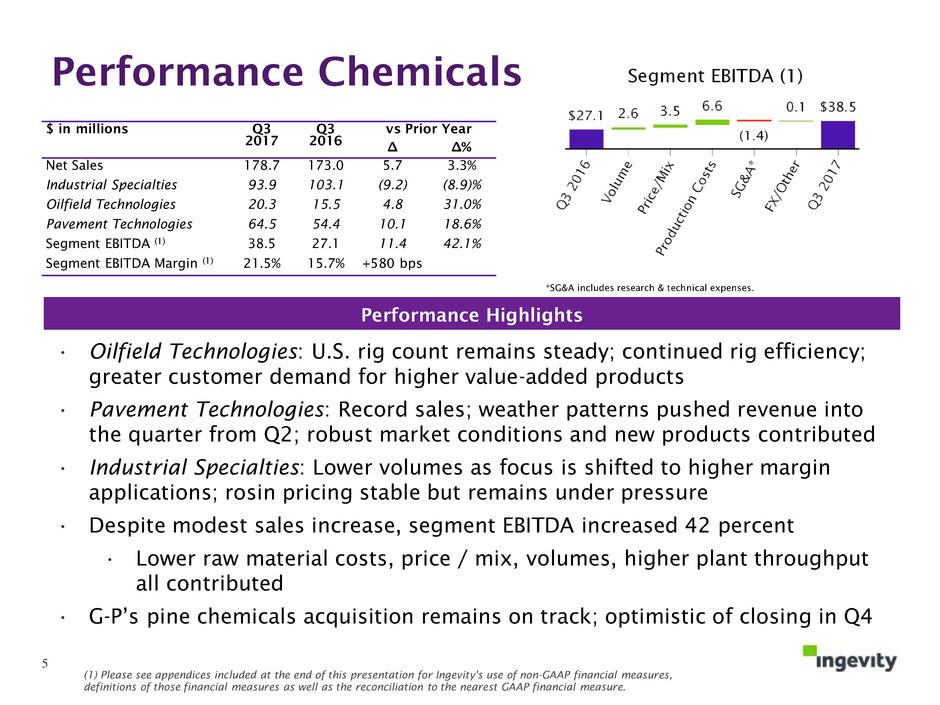

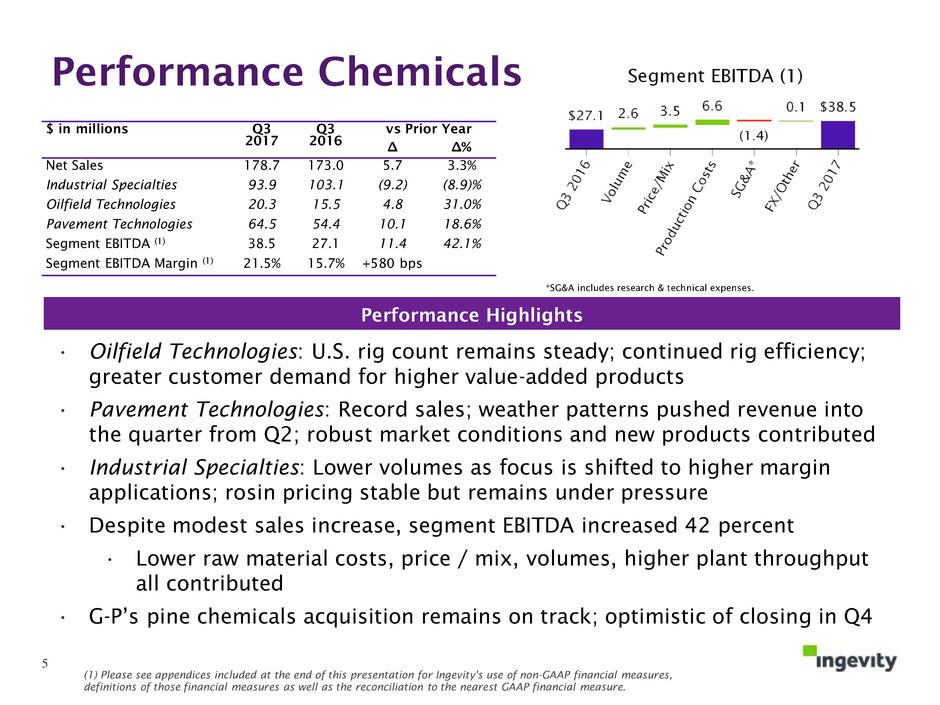

Performance Chemicals • Oilfield Technologies: U.S. rig count remains steady; continued rig efficiency; greater customer demand for higher value-added products • Pavement Technologies: Record sales; weather patterns pushed revenue into the quarter from Q2; robust market conditions and new products contributed • Industrial Specialties: Lower volumes as focus is shifted to higher margin applications; rosin pricing stable but remains under pressure • Despite modest sales increase, segment EBITDA increased 42 percent • Lower raw material costs, price / mix, volumes, higher plant throughput all contributed • G-P’s pine chemicals acquisition remains on track; optimistic of closing in Q4 Performance Highlights (1) Please see appendices included at the end of this presentation for Ingevity's use of non-GAAP financial measures, definitions of those financial measures as well as the reconciliation to the nearest GAAP financial measure. 5 *SG&A includes research & technical expenses. $ in millions Q3 2017 Q3 2016 vs Prior Year ∆ ∆% Net Sales 178.7 173.0 5.7 3.3% Industrial Specialties 93.9 103.1 (9.2) (8.9)% Oilfield Technologies 20.3 15.5 4.8 31.0% Pavement Technologies 64.5 54.4 10.1 18.6% Segment EBITDA (1) 38.5 27.1 11.4 42.1% Segment EBITDA Margin (1) 21.5% 15.7% +580 bps

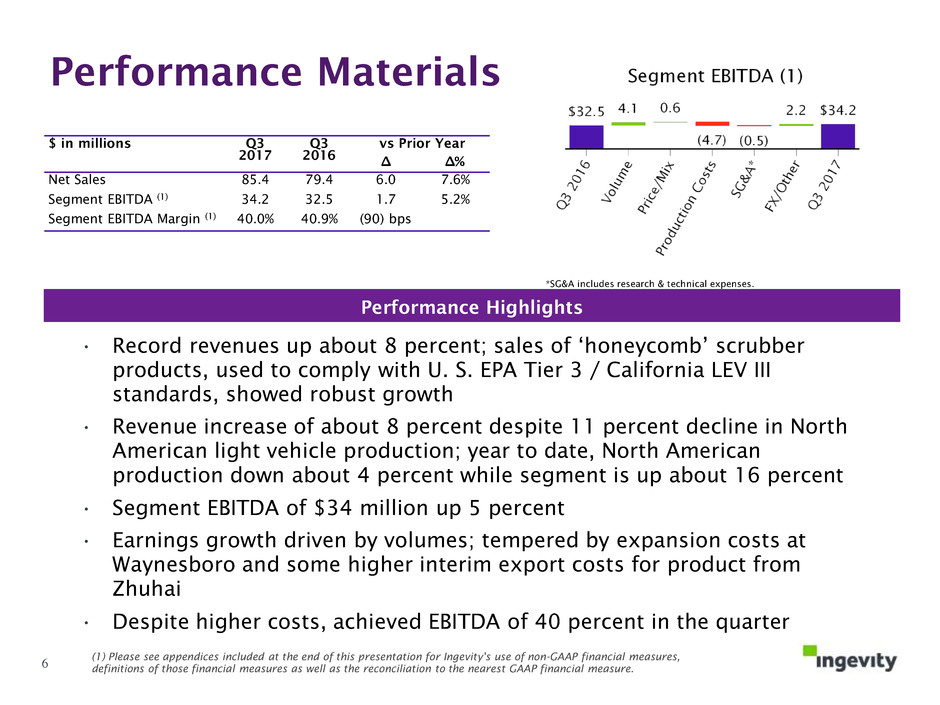

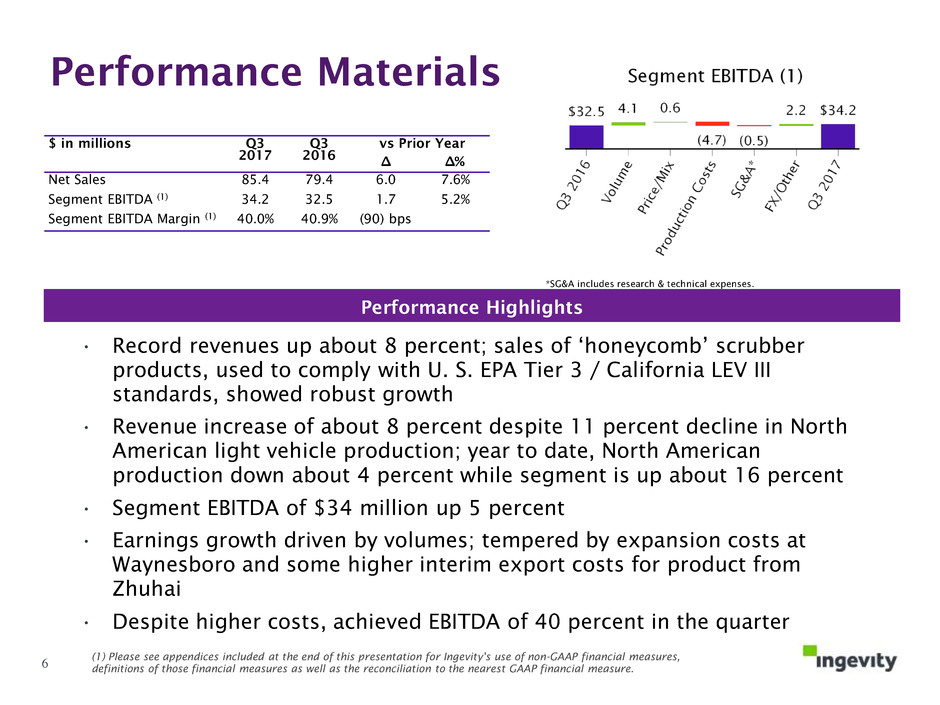

Performance Materials • Record revenues up about 8 percent; sales of ‘honeycomb’ scrubber products, used to comply with U. S. EPA Tier 3 / California LEV III standards, showed robust growth • Revenue increase of about 8 percent despite 11 percent decline in North American light vehicle production; year to date, North American production down about 4 percent while segment is up about 16 percent • Segment EBITDA of $34 million up 5 percent • Earnings growth driven by volumes; tempered by expansion costs at Waynesboro and some higher interim export costs for product from Zhuhai • Despite higher costs, achieved EBITDA of 40 percent in the quarter Performance Highlights (1) Please see appendices included at the end of this presentation for Ingevity's use of non-GAAP financial measures, definitions of those financial measures as well as the reconciliation to the nearest GAAP financial measure. 6 *SG&A includes research & technical expenses. $ in millions Q3 2017 Q3 2016 vs Prior Year ∆ ∆% Net Sales 85.4 79.4 6.0 7.6% Segment EBITDA (1) 34.2 32.5 1.7 5.2% Segment EBITDA Margin (1) 40.0% 40.9% (90) bps

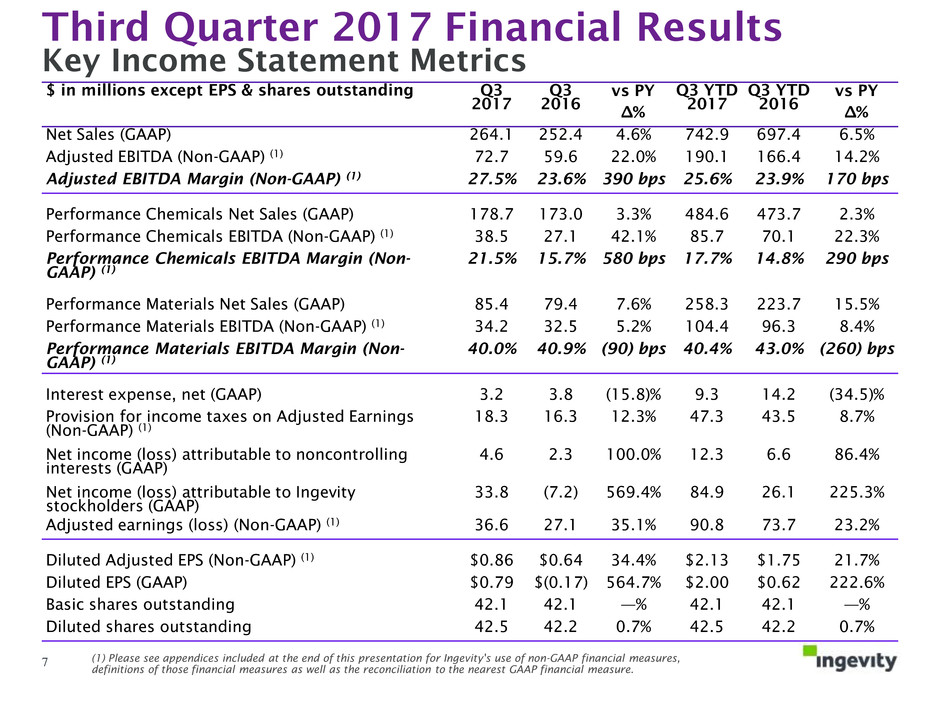

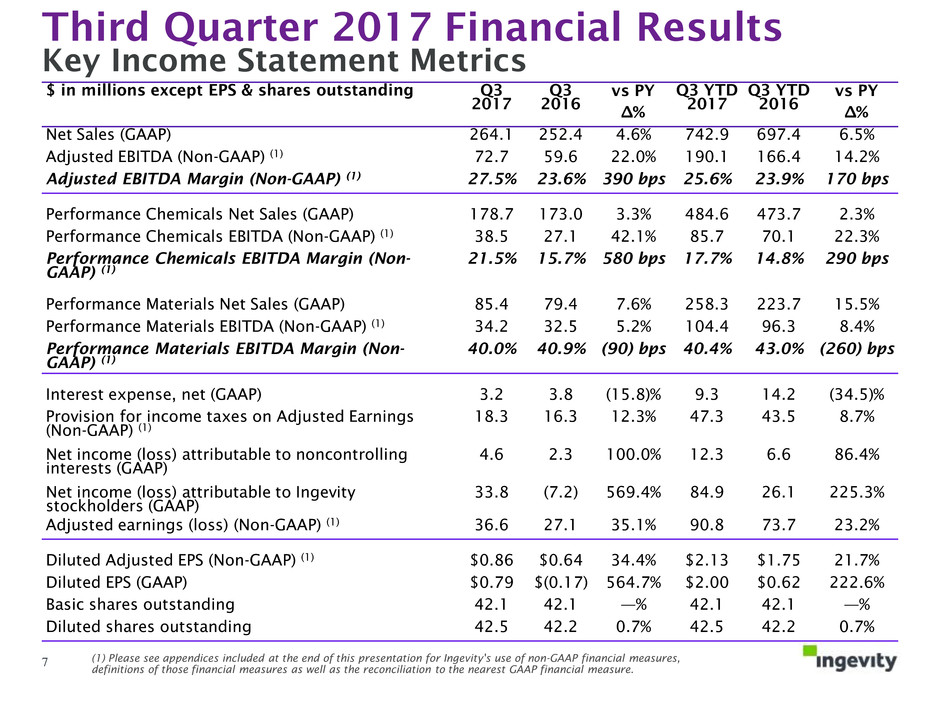

Third Quarter 2017 Financial Results Key Income Statement Metrics (1) Please see appendices included at the end of this presentation for Ingevity's use of non-GAAP financial measures, definitions of those financial measures as well as the reconciliation to the nearest GAAP financial measure. 7 $ in millions except EPS & shares outstanding Q3 2017 Q3 2016 vs PY Q3 YTD 2017 Q3 YTD 2016 vs PY ∆% ∆% Net Sales (GAAP) 264.1 252.4 4.6% 742.9 697.4 6.5% Adjusted EBITDA (Non-GAAP) (1) 72.7 59.6 22.0% 190.1 166.4 14.2% Adjusted EBITDA Margin (Non-GAAP) (1) 27.5% 23.6% 390 bps 25.6% 23.9% 170 bps Performance Chemicals Net Sales (GAAP) 178.7 173.0 3.3% 484.6 473.7 2.3% Performance Chemicals EBITDA (Non-GAAP) (1) 38.5 27.1 42.1% 85.7 70.1 22.3% Performance Chemicals EBITDA Margin (Non- GAAP) (1) 21.5% 15.7% 580 bps 17.7% 14.8% 290 bps Performance Materials Net Sales (GAAP) 85.4 79.4 7.6% 258.3 223.7 15.5% Performance Materials EBITDA (Non-GAAP) (1) 34.2 32.5 5.2% 104.4 96.3 8.4% Performance Materials EBITDA Margin (Non- GAAP) (1) 40.0% 40.9% (90) bps 40.4% 43.0% (260) bps Interest expense, net (GAAP) 3.2 3.8 (15.8)% 9.3 14.2 (34.5)% Provision for income taxes on Adjusted Earnings (Non-GAAP) (1) 18.3 16.3 12.3% 47.3 43.5 8.7% Net income (loss) attributable to noncontrolling interests (GAAP) 4.6 2.3 100.0% 12.3 6.6 86.4% Net income (loss) attributable to Ingevity stockholders (GAAP) 33.8 (7.2) 569.4% 84.9 26.1 225.3% Adjusted earnings (loss) (Non-GAAP) (1) 36.6 27.1 35.1% 90.8 73.7 23.2% Diluted Adjusted EPS (Non-GAAP) (1) $0.86 $0.64 34.4% $2.13 $1.75 21.7% Diluted EPS (GAAP) $0.79 $(0.17) 564.7% $2.00 $0.62 222.6% Basic shares outstanding 42.1 42.1 —% 42.1 42.1 —% Diluted shares outstanding 42.5 42.2 0.7% 42.5 42.2 0.7%

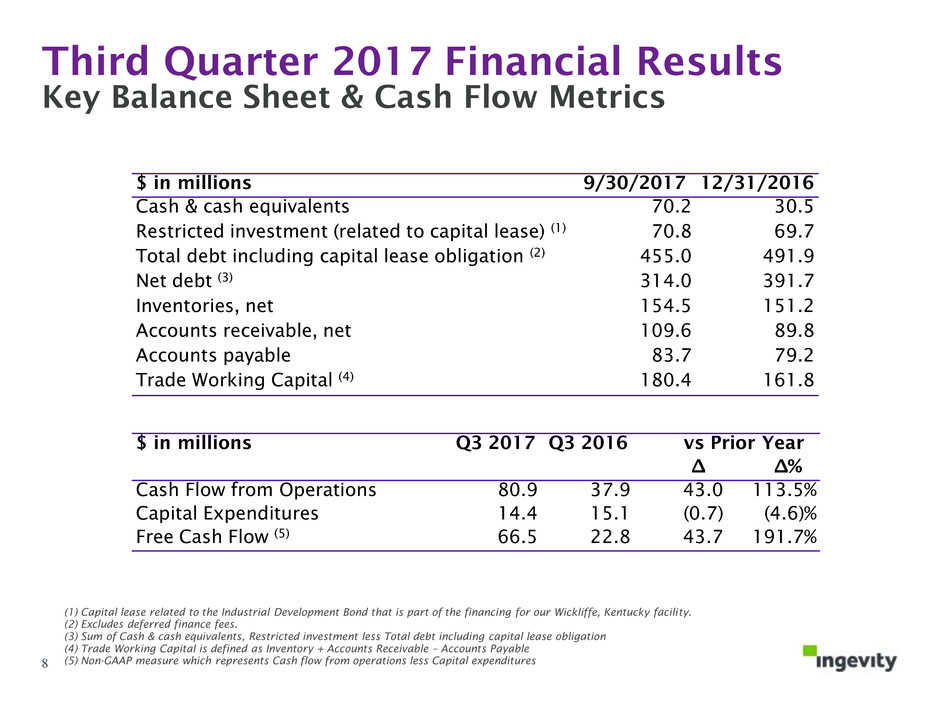

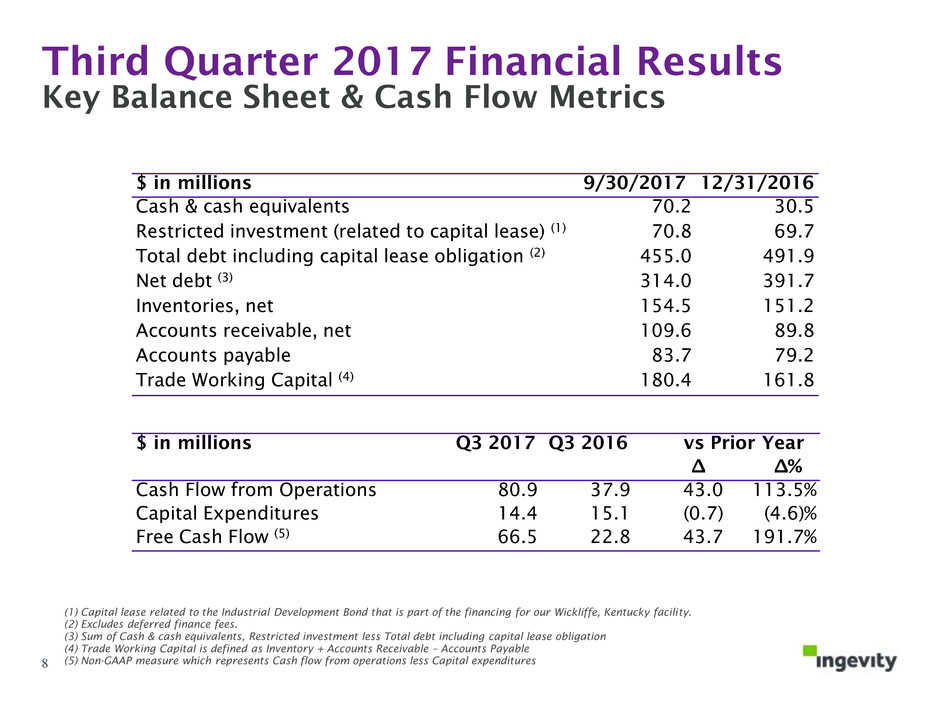

Third Quarter 2017 Financial Results Key Balance Sheet & Cash Flow Metrics (1) Capital lease related to the Industrial Development Bond that is part of the financing for our Wickliffe, Kentucky facility. (2) Excludes deferred finance fees. (3) Sum of Cash & cash equivalents, Restricted investment less Total debt including capital lease obligation (4) Trade Working Capital is defined as Inventory + Accounts Receivable – Accounts Payable (5) Non-GAAP measure which represents Cash flow from operations less Capital expenditures 8 $ in millions 9/30/2017 12/31/2016 Cash & cash equivalents 70.2 30.5 Restricted investment (related to capital lease) (1) 70.8 69.7 Total debt including capital lease obligation (2) 455.0 491.9 Net debt (3) 314.0 391.7 Inventories, net 154.5 151.2 Accounts receivable, net 109.6 89.8 Accounts payable 83.7 79.2 Trade Working Capital (4) 180.4 161.8 $ in millions Q3 2017 Q3 2016 vs Prior Year ∆ ∆% Cash Flow from Operations 80.9 37.9 43.0 113.5% Capital Expenditures 14.4 15.1 (0.7) (4.6)% Free Cash Flow (5) 66.5 22.8 43.7 191.7%

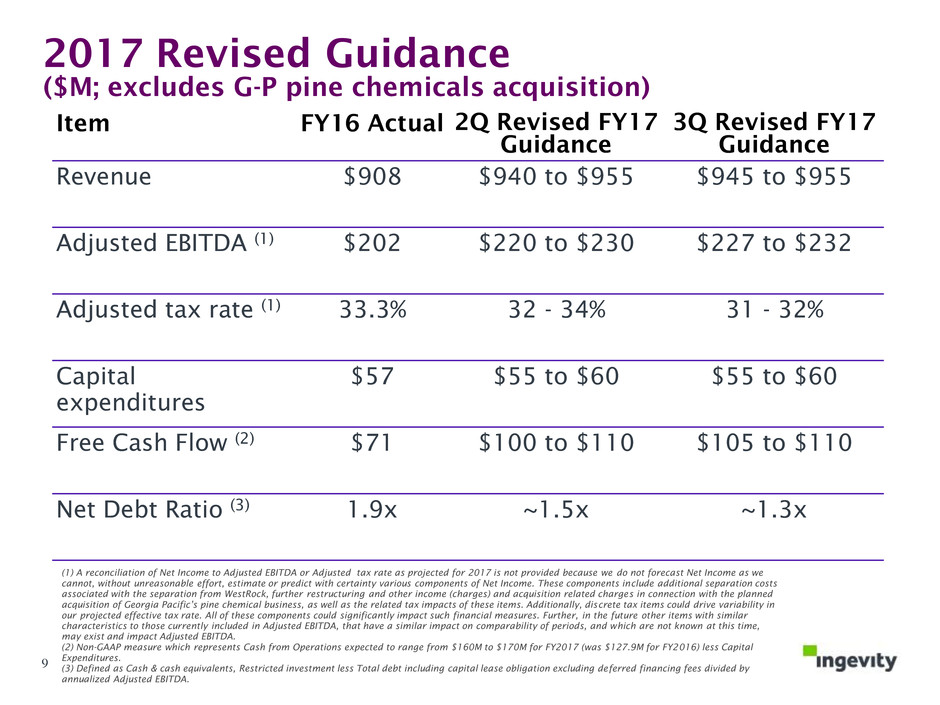

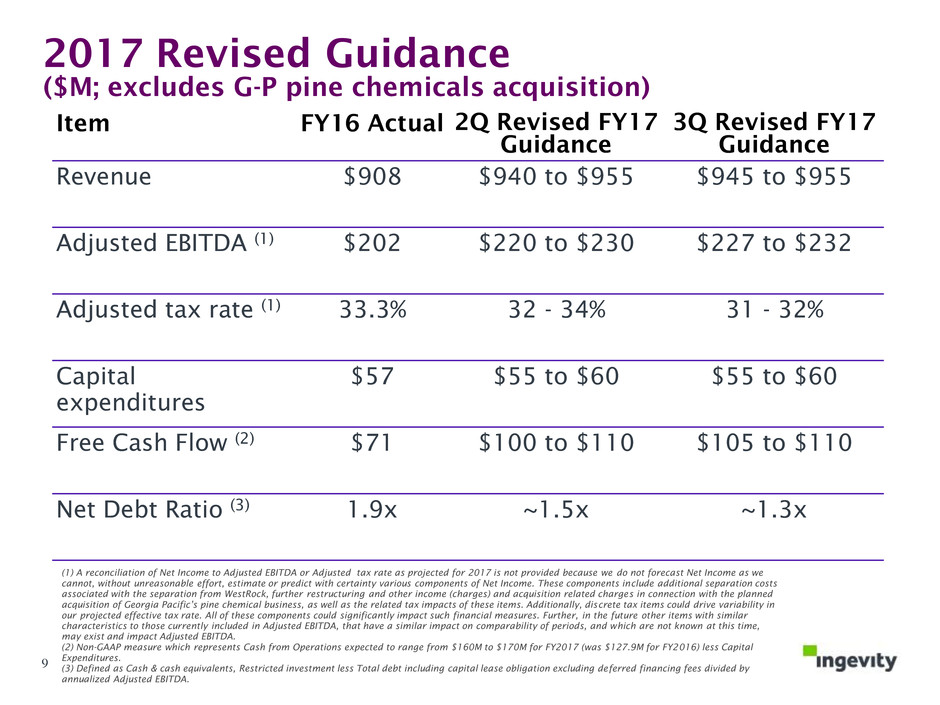

2017 Revised Guidance ($M; excludes G-P pine chemicals acquisition) Item FY16 Actual 2Q Revised FY17 Guidance 3Q Revised FY17 Guidance Revenue $908 $940 to $955 $945 to $955 Adjusted EBITDA (1) $202 $220 to $230 $227 to $232 Adjusted tax rate (1) 33.3% 32 - 34% 31 - 32% Capital expenditures $57 $55 to $60 $55 to $60 Free Cash Flow (2) $71 $100 to $110 $105 to $110 Net Debt Ratio (3) 1.9x ~1.5x ~1.3x (1) A reconciliation of Net Income to Adjusted EBITDA or Adjusted tax rate as projected for 2017 is not provided because we do not forecast Net Income as we cannot, without unreasonable effort, estimate or predict with certainty various components of Net Income. These components include additional separation costs associated with the separation from WestRock, further restructuring and other income (charges) and acquisition related charges in connection with the planned acquisition of Georgia Pacific’s pine chemical business, as well as the related tax impacts of these items. Additionally, discrete tax items could drive variability in our projected effective tax rate. All of these components could significantly impact such financial measures. Further, in the future other items with similar characteristics to those currently included in Adjusted EBITDA, that have a similar impact on comparability of periods, and which are not known at this time, may exist and impact Adjusted EBITDA. (2) Non-GAAP measure which represents Cash from Operations expected to range from $160M to $170M for FY2017 (was $127.9M for FY2016) less Capital Expenditures. (3) Defined as Cash & cash equivalents, Restricted investment less Total debt including capital lease obligation excluding deferred financing fees divided by annualized Adjusted EBITDA. 9

For More Information Thank you for your interest in Ingevity! Investors Dan Gallagher (843) 740-2126 Media Jack Maurer (843) 746-8242 10

Appendix 11

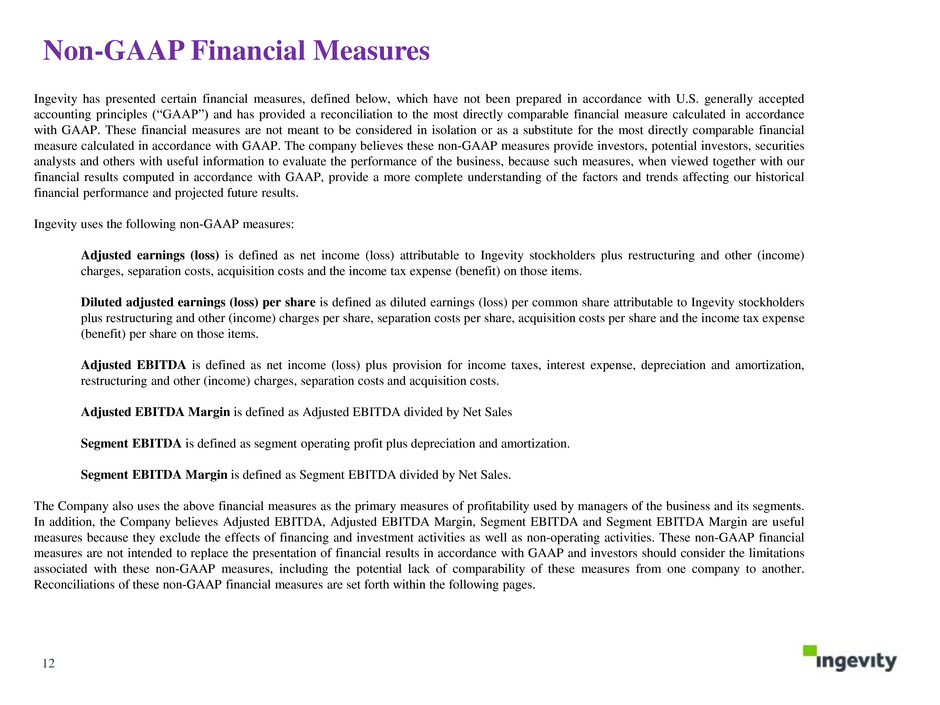

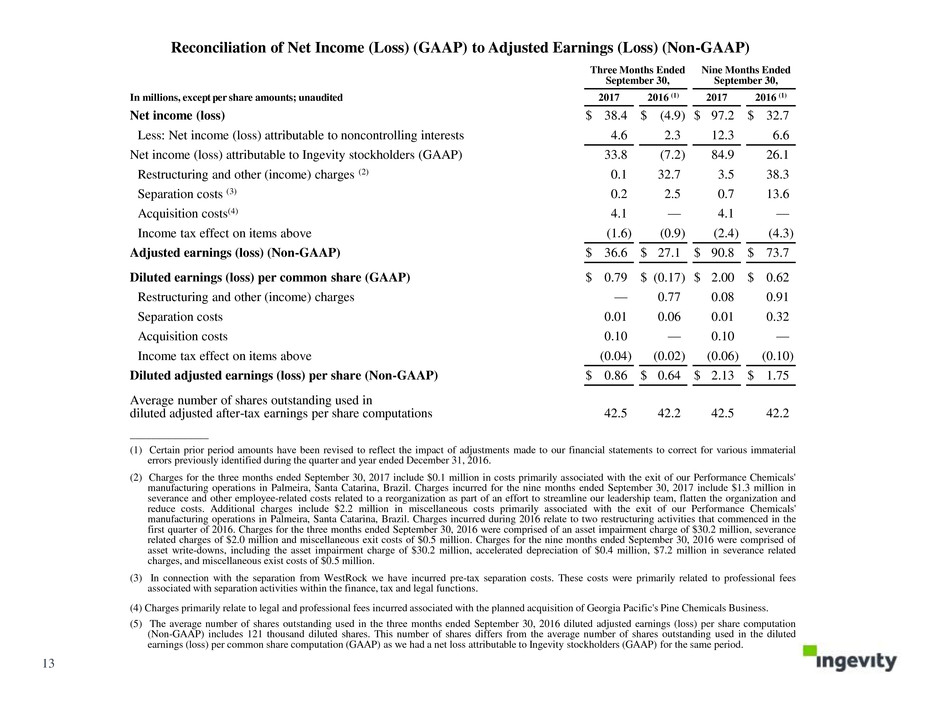

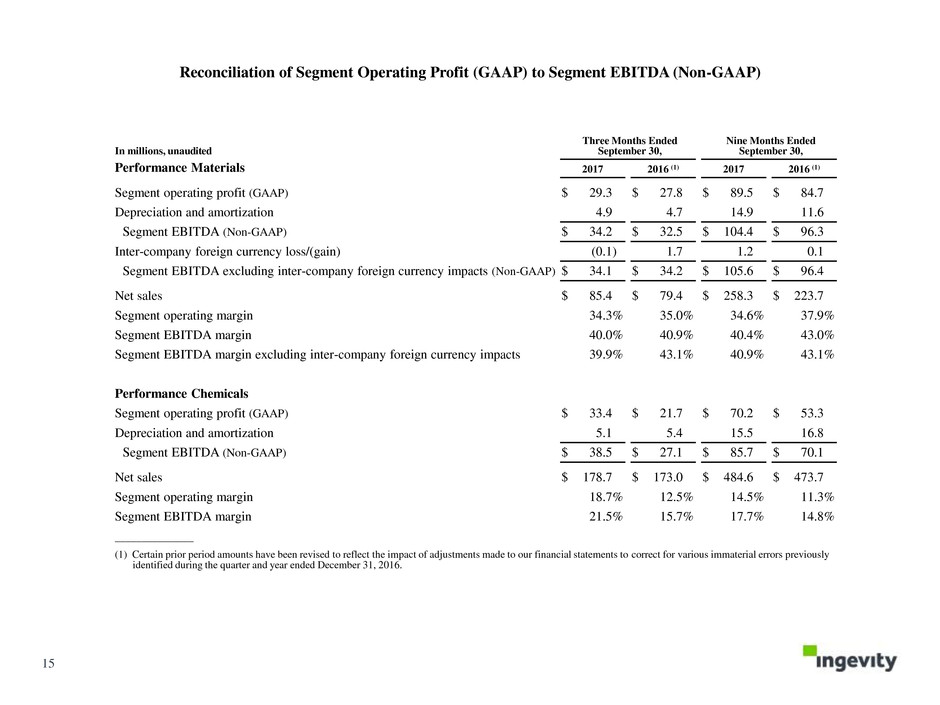

Non-GAAP Financial Measures 12 Ingevity has presented certain financial measures, defined below, which have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and has provided a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP. These financial measures are not meant to be considered in isolation or as a substitute for the most directly comparable financial measure calculated in accordance with GAAP. The company believes these non-GAAP measures provide investors, potential investors, securities analysts and others with useful information to evaluate the performance of the business, because such measures, when viewed together with our financial results computed in accordance with GAAP, provide a more complete understanding of the factors and trends affecting our historical financial performance and projected future results. Ingevity uses the following non-GAAP measures: Adjusted earnings (loss) is defined as net income (loss) attributable to Ingevity stockholders plus restructuring and other (income) charges, separation costs, acquisition costs and the income tax expense (benefit) on those items. Diluted adjusted earnings (loss) per share is defined as diluted earnings (loss) per common share attributable to Ingevity stockholders plus restructuring and other (income) charges per share, separation costs per share, acquisition costs per share and the income tax expense (benefit) per share on those items. Adjusted EBITDA is defined as net income (loss) plus provision for income taxes, interest expense, depreciation and amortization, restructuring and other (income) charges, separation costs and acquisition costs. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Net Sales Segment EBITDA is defined as segment operating profit plus depreciation and amortization. Segment EBITDA Margin is defined as Segment EBITDA divided by Net Sales. The Company also uses the above financial measures as the primary measures of profitability used by managers of the business and its segments. In addition, the Company believes Adjusted EBITDA, Adjusted EBITDA Margin, Segment EBITDA and Segment EBITDA Margin are useful measures because they exclude the effects of financing and investment activities as well as non-operating activities. These non-GAAP financial measures are not intended to replace the presentation of financial results in accordance with GAAP and investors should consider the limitations associated with these non-GAAP measures, including the potential lack of comparability of these measures from one company to another. Reconciliations of these non-GAAP financial measures are set forth within the following pages.

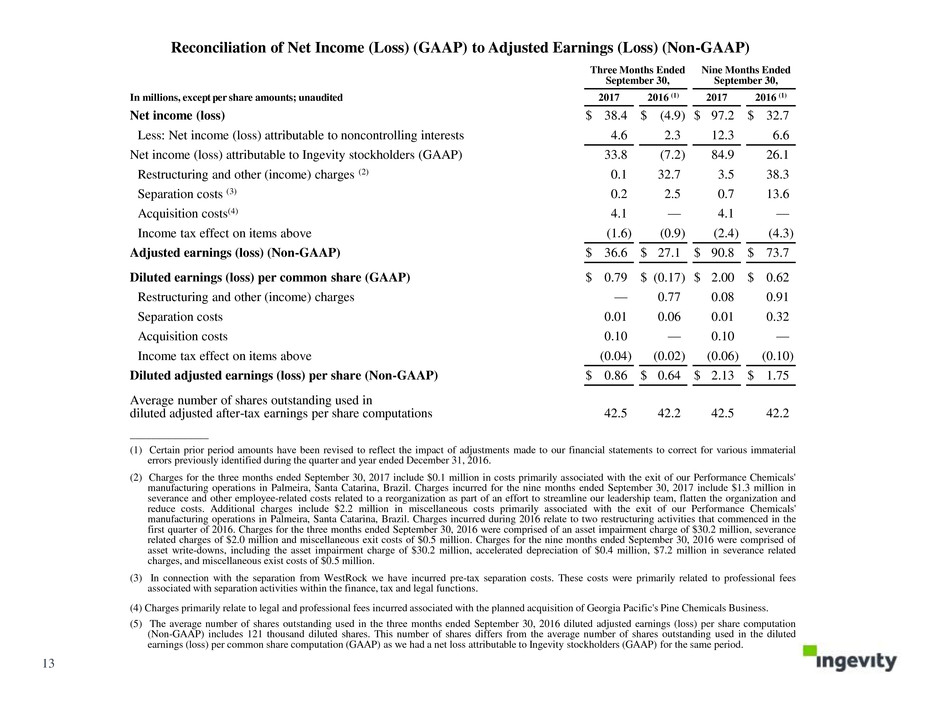

Reconciliation of Net Income (Loss) (GAAP) to Adjusted Earnings (Loss) (Non-GAAP) 13 Three Months Ended September 30, Nine Months Ended September 30, In millions, except per share amounts; unaudited 2017 2016 (1) 2017 2016 (1) Net income (loss) $ 38.4 $ (4.9 ) $ 97.2 $ 32.7 Less: Net income (loss) attributable to noncontrolling interests 4.6 2.3 12.3 6.6 Net income (loss) attributable to Ingevity stockholders (GAAP) 33.8 (7.2 ) 84.9 26.1 Restructuring and other (income) charges (2) 0.1 32.7 3.5 38.3 Separation costs (3) 0.2 2.5 0.7 13.6 Acquisition costs(4) 4.1 — 4.1 — Income tax effect on items above (1.6 ) (0.9 ) (2.4 ) (4.3 ) Adjusted earnings (loss) (Non-GAAP) $ 36.6 $ 27.1 $ 90.8 $ 73.7 Diluted earnings (loss) per common share (GAAP) $ 0.79 $ (0.17 ) $ 2.00 $ 0.62 Restructuring and other (income) charges — 0.77 0.08 0.91 Separation costs 0.01 0.06 0.01 0.32 Acquisition costs 0.10 — 0.10 — Income tax effect on items above (0.04 ) (0.02 ) (0.06 ) (0.10 ) Diluted adjusted earnings (loss) per share (Non-GAAP) $ 0.86 $ 0.64 $ 2.13 $ 1.75 Average number of shares outstanding used in diluted adjusted after-tax earnings per share computations 42.5 42.2 42.5 42.2 _______________ (1) Certain prior period amounts have been revised to reflect the impact of adjustments made to our financial statements to correct for various immaterial errors previously identified during the quarter and year ended December 31, 2016. (2) Charges for the three months ended September 30, 2017 include $0.1 million in costs primarily associated with the exit of our Performance Chemicals' manufacturing operations in Palmeira, Santa Catarina, Brazil. Charges incurred for the nine months ended September 30, 2017 include $1.3 million in severance and other employee-related costs related to a reorganization as part of an effort to streamline our leadership team, flatten the organization and reduce costs. Additional charges include $2.2 million in miscellaneous costs primarily associated with the exit of our Performance Chemicals' manufacturing operations in Palmeira, Santa Catarina, Brazil. Charges incurred during 2016 relate to two restructuring activities that commenced in the first quarter of 2016. Charges for the three months ended September 30, 2016 were comprised of an asset impairment charge of $30.2 million, severance related charges of $2.0 million and miscellaneous exit costs of $0.5 million. Charges for the nine months ended September 30, 2016 were comprised of asset write-downs, including the asset impairment charge of $30.2 million, accelerated depreciation of $0.4 million, $7.2 million in severance related charges, and miscellaneous exist costs of $0.5 million. (3) In connection with the separation from WestRock we have incurred pre-tax separation costs. These costs were primarily related to professional fees associated with separation activities within the finance, tax and legal functions. (4) Charges primarily relate to legal and professional fees incurred associated with the planned acquisition of Georgia Pacific's Pine Chemicals Business. (5) The average number of shares outstanding used in the three months ended September 30, 2016 diluted adjusted earnings (loss) per share computation (Non-GAAP) includes 121 thousand diluted shares. This number of shares differs from the average number of shares outstanding used in the diluted earnings (loss) per common share computation (GAAP) as we had a net loss attributable to Ingevity stockholders (GAAP) for the same period.

Reconciliation of Net Income (GAAP) to Adjusted EBITDA (Non-GAAP) 14 Reconciliation of Provision for Income Taxes (GAAP) to Provision for Income Taxes on Adjusted Earnings (Non-GAAP) Three Months Ended September 30, Nine Months Ended September 30, In millions, unaudited 2017 2016 (1) 2017 2016 (1) Net income (loss) (GAAP) $ 38.4 $ (4.9 ) $ 97.2 $ 32.7 Provision for income taxes 16.7 15.4 44.9 39.2 Interest expense, net 3.2 3.8 9.3 14.2 Separation costs 0.2 2.5 0.7 13.6 Depreciation and amortization 10.0 10.1 30.4 28.4 Restructuring and other (income) charges 0.1 32.7 3.5 38.3 Acquisition costs $ 4.1 $ — $ 4.1 $ — Adjusted EBITDA (Non-GAAP) $ 72.7 $ 59.6 $ 190.1 $ 166.4 Net sales $ 264.1 $ 252.4 $ 742.9 $ 697.4 Net income (loss) margin 14.5 % (1.9 )% 13.1 % 4.7 % Adjusted EBITDA margin 27.5 % 23.6 % 25.6 % 23.9 % _______________ (1) Certain prior period amounts have been revised to reflect the impact of adjustments made to our financial statements to correct for various immaterial errors previously identified during the quarter and year ended December 31, 2016. Three Months Ended September 30, Nine Months Ended September 30, In millions, unaudited 2017 2016 (1) 2017 2016 (1) Provision for Income Taxes (GAAP) $ 16.7 $ 15.4 $ 44.9 $ 39.2 Income tax effect on Special items 1.6 0.9 2.4 4.3 Provision for Income Taxes on Adjusted Earnings (Non-GAAP) $ 18.3 $ 16.3 $ 47.3 $ 43.5 _________________ (1) Certain prior period amounts have been revised to reflect the impact of adjustments made to our financial statements to correct the timing of previously recorded out-of-period adjustments.

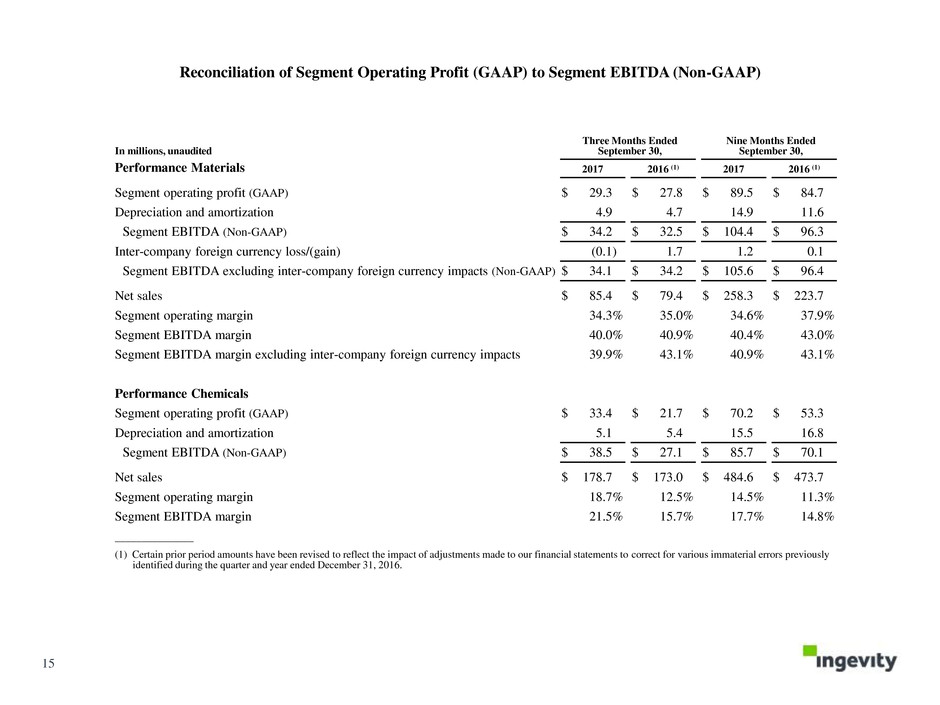

Reconciliation of Segment Operating Profit (GAAP) to Segment EBITDA (Non-GAAP) 15 In millions, unaudited Three Months Ended September 30, Nine Months Ended September 30, Performance Materials 2017 2016 (1) 2017 2016 (1) Segment operating profit (GAAP) $ 29.3 $ 27.8 $ 89.5 $ 84.7 Depreciation and amortization 4.9 4.7 14.9 11.6 Segment EBITDA (Non-GAAP) $ 34.2 $ 32.5 $ 104.4 $ 96.3 Inter-company foreign currency loss/(gain) (0.1 ) 1.7 1.2 0.1 Segment EBITDA excluding inter-company foreign currency impacts (Non-GAAP) $ 34.1 $ 34.2 $ 105.6 $ 96.4 Net sales $ 85.4 $ 79.4 $ 258.3 $ 223.7 Segment operating margin 34.3 % 35.0 % 34.6 % 37.9 % Segment EBITDA margin 40.0 % 40.9 % 40.4 % 43.0 % Segment EBITDA margin excluding inter-company foreign currency impacts 39.9 % 43.1 % 40.9 % 43.1 % Performance Chemicals Segment operating profit (GAAP) $ 33.4 $ 21.7 $ 70.2 $ 53.3 Depreciation and amortization 5.1 5.4 15.5 16.8 Segment EBITDA (Non-GAAP) $ 38.5 $ 27.1 $ 85.7 $ 70.1 Net sales $ 178.7 $ 173.0 $ 484.6 $ 473.7 Segment operating margin 18.7 % 12.5 % 14.5 % 11.3 % Segment EBITDA margin 21.5 % 15.7 % 17.7 % 14.8 % _______________ (1) Certain prior period amounts have been revised to reflect the impact of adjustments made to our financial statements to correct for various immaterial errors previously identified during the quarter and year ended December 31, 2016.